1

U.S. Energy Drink Industry Report

Reaching Uncapitalized Markets

Winter 2022

Presented by Morgan Presson

Industry Overview

2

Energy drinks claim to increase energy while enhancing mental

alertness and physical performance by providing consumers

with 70 to 250 milligrams of caffeine per container.

Energy Drink Industry BackgroundKey Industry Statistics

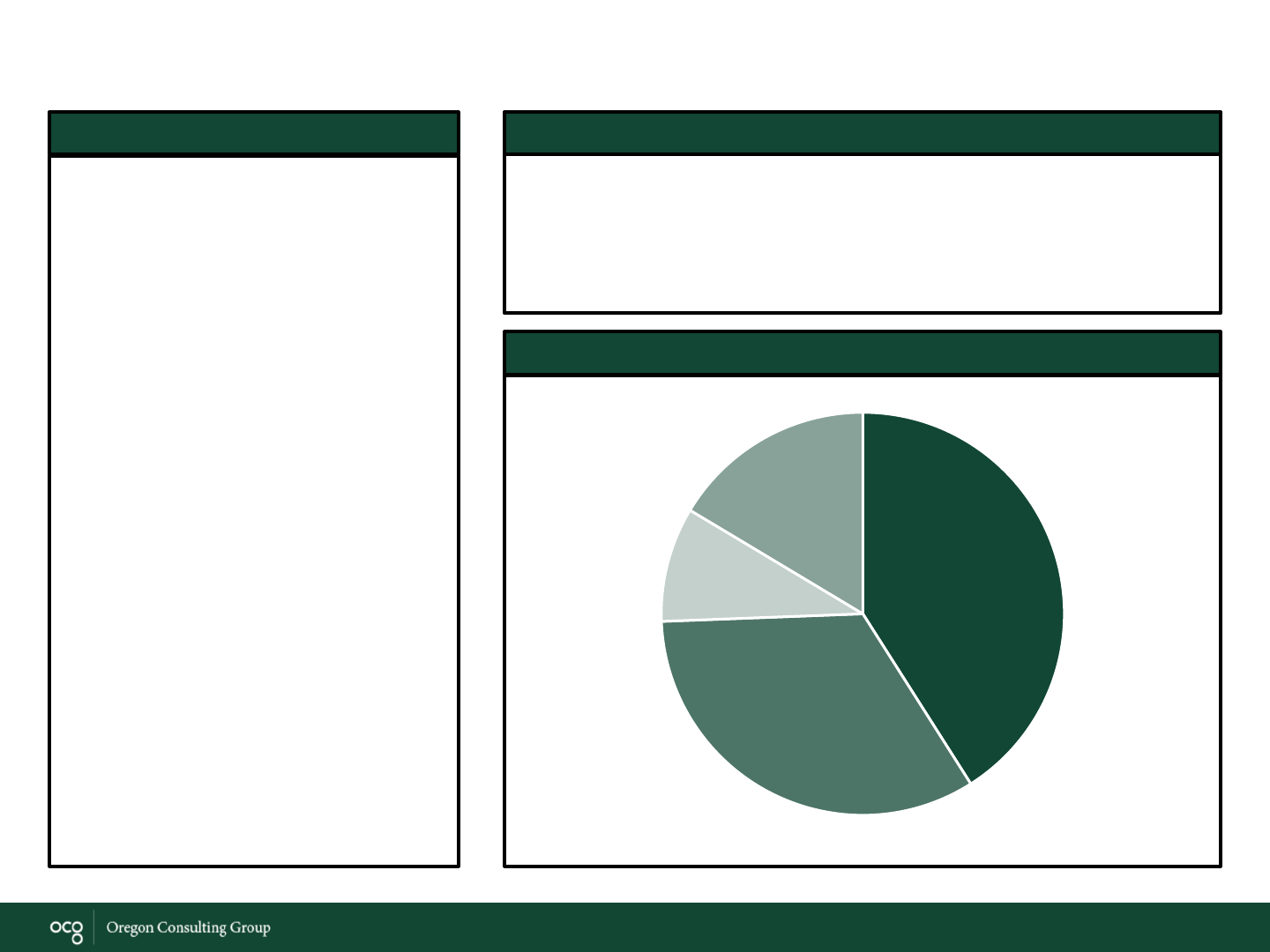

Market Share Distribution

Red Bull

44%

Monster

33.4%

PepsiCo.

9.2%

Other

16.4%

Market Size (2020)

$9.4 billion

Annual Growth Rate (2015-2020)

+2.7%

Average Profit Margin

14.1%

Annual Growth Rate (2020-2025)

+1.4%

Market Concentration

High

Industry Lifecycle

Growth, approaching maturity

Total Businesses

83

Identified Threats

3

Legislation and Bans on CaffeineExternal Competition

▸ Coffee is the central source of caffeine in the

U.S.

▸ The coffee industry is projected to continue

to grow at 0.9% annually

▸ Caffeine consumption increases with age,

although the energy drink industry only

maintains young consumers

▸ The FDA only has laws on caffeine in soda

beverages

▸ Energy drinks are marketed as dietary

supplements

▸ Rising hospitalizations from misuse of

caffeine and excessive caffeine consumption

▸ The U.K. banned the sale of energy drinks to

children under the age of 16 in 2019

▸ The U.S. has no current information on

potential regulations or bans, although this

would drastically alter the industry

Reaching New Consumers

4

x

Expanding Targeted

Consumers

Curated social

media campaigns

Targeted product

launches

Sponsored

Events

Platforms with

unreached

demographics

Posts

marketed

towards new

demographics

Older taste

profiles

Subtle,

professiona

l packaging

Events with

new

targeted

consumers

as

attendees

Tasting at

sponsored

events

Reaching New Consumers

5

▸

Energy drinks are currently only marketed towards younger demographics

▸

Current marketing has been successful with these consumers

▸

Expand marketing more heavily into other social media platforms based on target

demographics

▸

Use current social media algorithms to place advertisements on posts already

marketed towards these consumers

Expanding Targeted

Consumers

Curated social

media campaigns

Targeted product

launches

Sponsored

Events

Platforms with

unreached

demographics

Posts

marketed

towards new

demographics

Older taste

profiles

Subtle,

professional

packaging

Events with

new

targeted

consumers

as

attendees

Tasting at

sponsored

events

Reaching New Consumers

6

▸

Current energy drinks appeal to children, young adults, and athletes

▸

Bold flavors and bright packaging can be seen as unprofessional

▸

New products that account for older taste profiles

▸

Subtle, professional packaging that adults and professionals feel comfortable bringing to

everyday events and not only the gym

Expanding Targeted

Consumers

Curated social

media campaigns

Targeted product

launches

Sponsored

Events

Platforms with

unreached

demographics

Posts

marketed

towards new

demographics

Older taste

profiles

Subtle,

professional

packaging

Events with

new

targeted

consumers

as

attendees

Tasting at

sponsored

events

Reaching New Consumers

7

▸

Energy drinks brands have had success with marketing through sponsorships

▸

Most sponsorships are currently through athletic events (Red Bull)

▸

Expand sponsorships into new events with different consumer profiles

▸

Concerts, corporate events, fashion shows, etc.

▸

Allow attendees to sample or leave with a product

Expanding Targeted

Consumers

Curated social

media campaigns

Targeted product

launches

Sponsored

Events

Platforms with

unreached

demographics

Posts

marketed

towards new

demographics

Older taste

profiles

Subtle,

professiona

l packaging

Events with

new

targeted

consumers

as

attendees

Tasting at

sponsored

events

U.S. Energy Drink Industry

1

The Oregon Consulting Group

Further Stimulating Energy Drink Growth

Background

While coffee has powered Americans for the last 400 years, their source of

caffeination has recently shifted with the millennial preference towards energy drinks

rather than a cup of joe. Energy drinks claim to increase energy while enhancing mental

alertness and physical performance by providing consumers with 70 to 250 milligrams

of caffeine per container, allowing Americans to work harder and longer than their

noncaffeinated counterparts (U.S. Department of Health and Human Services, 2018).

With coffee only providing roughly 100 mg and soda roughly 35 mg of caffeine per 12

ounce serving (U.S. Department of Health and Human Services, 2018), the unmatched

caffeine content in energy drinks has stimulated industry growth to $9.4B in revenue in

2020 (Holcomb, 2021).

Despite significant growth, the energy drink industry has maintained a high

market share concentration with 86.6% of the market being consumed by three major

players. Smaller companies have attempted to outcompete their larger counterparts, yet

Red Bull, Monster, and PepsiCo. have steadily maintained 44%, 33.4%, and 9.2% of

the market, respectively (Holcomb, 2021). Red Bull dominates the industry with their 8.4

oz cans in an array of flavors and varieties, including sugar free and total zero

(Fontinelle, 2021). Red Bull's leading competitor, Monster, markets a handful of various

energy drink names in addition to the Monster drink itself, including NOS, Full Throttle,

Burn, and Predator (Thomson, 2021). Monster’s strategic partnership with Coca-Cola

company in 2015 has provided both a distribution advantage and decreased competitive

pressure, as Monster and Coca-Cola entered into an agreement to avoid competition

U.S. Energy Drink Industry

2

The Oregon Consulting Group

with one another’s brands (Pysh, 2017). In third place, far behind both Red Bull and

Monster, PepsiCo. claims nearly half of the remaining market. PepsiCo. continues to

grow as it starts to acquire additional energy drink names, including Rockstar, AMP

energy, Bang, and Mountain Dew Kickstart (Fontinelle, 2021). Despite the domination

by these companies, approaching maturity and recent events pose a threat to the

industry as a whole.

Recent Market Trends

Prior to 2020, which was marked by global shutdown in the wake of COVID-19,

the energy drink market grew exponentially. With rising incomes, increased American

interest in sports activities, and urbanization, the industry was able to capitalize on

these marketing outlets (Research and Markets, 2021). Red Bull, for example, has

utilized a sports-based marketing strategy (Bush, 2021). By sponsoring large athletic

teams in a wide range of sports, from football to surfing to Formula 1 teams, the brand

has effectively become associated with athletics and athletes. Additionally, as people

have moved into larger cities with the rise of urbanization, convenience stores,

supermarkets, and online markets have become more readily available. The increased

availability of energy drinks in these outlets coupled by rising per capita disposable

income has helped to drive impulse purchases, and therefore the demand for

discretionary packaged beverages such as energy drinks (Holcomb, 2021). These

trends have led to low market volatility and high profit margins, up to 14.1% of revenue

in 2020, which have been of great benefit to major players (Holcomb, 2021). Despite

these advantages, the market still grinded to a halt with the abrupt challenges presented

with COVID-19.

U.S. Energy Drink Industry

3

The Oregon Consulting Group

Just as the industry began approaching its peak, COVID-19 struck, and the world

was sent into lockdown. As athletics and other activities were restricted in the heat of

the pandemic, which made up a large sector of the industry’s consumers, sales quickly

took a turn (United States Energy Drink Market: 2021-26). As Americans were confined

to their houses in 2020, consumer spending declined a steep 7.3% (Holcomb, 2021).

Additionally, industries shut down production for the health and safety of their workers,

creating low inventory. With both decreased demand and low inventory, the energy

drink industry recorded a 2.2% decrease in revenue over the course of 2020 (Holcomb,

2021).

Risk Factors in Maturity

As the world continues to experience and recover from the impacts of COVID-19,

the energy drink industry is expected to continue to experience growth, yet at a slower

rate than before the pandemic. The industry has a projected CAGR of 1.4% between

2020 and 2025 and is forecast to reach a revenue of $10.1B in 2025 (Holcomb, 2021).

While the United States slowly emerges from lockdown, stimulating sales once again,

the energy drink industry emerges alongside the rapidly developing coffee industry and

growing concern regarding the health and safety of caffeine.

U.S. Energy Drink Industry

4

The Oregon Consulting Group

Caffeine Competition

While caffeinated beverage

consumption increases with age, from 43% of

children under the age of five to nearly 100%

of those older than 65 (Verster, 2017), the

energy drink industry only successfully

maintains teens aged 12-17, men aged

18-34, and the nightlife crowd as regular

consumers (U.S. Department of Health and Human Services, 2018). The industry has

exploded in these select markets previously, although it has struggled to expand into

other sectors of consumers. Further, regardless of age, coffee is the central source of

caffeine in the U.S. (Verster, 2017). With per capita coffee consumption anticipated to

grow at 0.9% annually over the next five years (Ross, 2020), the energy drink industry

will likely feel the effects of coffee industry growth.

Caffeine Bans and Legislation

In recent years, the United States has experienced a trend towards an organic

diet, creating increasing concern surrounding energy drink consumption (Holcomb,

2021). U.S. health and safety committees have also recognized these concerns and are

currently in the process of enacting legislation to place regulations on the sale of

caffeine (Pysh, 2017). While caffeine is currently nationally recognized as safe for use in

soda beverages only up to 200 parts per million (roughly 71 mg per 12 oz serving)

(Pysh, 2017), energy drinks have historically been marketed as part of the dietary

supplement category. By marketing under dietary supplements, energy drink containers

U.S. Energy Drink Industry

5

The Oregon Consulting Group

have no requirement to be labeled with their caffeine content or to cap the caffeine

content at 200 ppm (C.M.T., 2021). However, the Food and Drug Administration has

slowly begun placing stricter regulations on caffeinated goods. While the United States

currently has overly relaxed laws regarding the sale of caffeine, the U.K. took action to

ban sales of energy drinks to children under the age of 16 in 2019 (Aurthur, 2019).

Currently, the FDA has not made any official decisions surrounding the sale of

caffeinated non-Cola goods in the U.S., although they have numerous options as to

enacting regulations or education surrounding caffeine. Given that Europe tends to have

stricter regulations surrounding food production than the United States, it is safe to

assume that any ban or regulation on caffeine sales will be more relaxed than the ban

enacted in the U.K. in 2019.

Expanding into Uncapitalized Markets

While the growth of the coffee industry and potential caffeine regulation appear to

be very different issues for the energy drink industry, expansion of the industry into

uncapitalized markets would be a natural solution to both challenges. Energy drinks

have been marketed heavily towards young consumers through targeted advertising,

although they have not reached into other demographics. After college graduation,

many adults no longer have time or interest to participate in athletics or nightlife, making

energy drink consumption appear unprofessional or unnecessary. However, target

marketing towards older consumers, including busy mothers, the corporate workforce,

and retirees with declining energy, will help to diversify the industry. Specifically, moving

marketing more heavily into different social media platforms will help to grasp the

attention of these underreached classes. While only 8% of people over 65 use

U.S. Energy Drink Industry

6

The Oregon Consulting Group

Instagram, 35% of the same age group use Facebook and 58% use YouTube (The

2021 Social Media Users Demographics Guide, 2021). By shifting advertising towards

these mediums, and specifically onto posts and videos targeted towards working

generations, the industry can expand their market share.

Further, as U.S. consumers exhibit a preference for coffee over energy drinks,

the energy drink industry should use these taste preferences when launching new

products. While adolescents prefer the bold, fruity tastes and bright containers often

present in current energy drinks such as Bang energy, older generations often prefer

more mild tastes and subtle packaging. As some flavors, such as ginger and mint,

attract older consumers over adolescents, integrating these taste preferences into new

products will help to diversify the energy drink consumer profile (Michail, 2016). Further,

although children and millennials are often attracted to the bold, bright containers of

current energy drinks, this packaging may often be associated with immaturity and

adolescence, given the energy drink industry’s current consumer profile. A business

executive would not feel comfortable in a meeting with C-suite professionals holding a

bright red can of Rockstar energy but would naturally hold a paper coffee cup. By

launching products with more subtle containers and neutral colors that consumers can

naturally bring to work, a get together, or to a child’s playdate, similar to a cup of coffee,

the industry can draw the attention of more diverse consumers and pull from the coffee

industry’s consumers.

Finally, the energy drink industry should sponsor events made for these new

targeted age demographics. As Red Bull has clearly displayed through its athlete

sponsorships which attract athletic consumers, further expanding into concerts,

U.S. Energy Drink Industry

7

The Oregon Consulting Group

corporate business events, or even fashion events would help to translate this success

into other populations. These sponsorships would also give energy drink companies an

opportunity to provide attendees with a sample of their product, allowing consumers in

attendance to depart the event with an entirely new understanding of the company.

Given that regulations on caffeine sales will likely impact older age groups far less than

adolescents and children, moving into these markets will help to minimize the effects of

any actions by the FDA as well as creating an edge on external competition from the

coffee industry.

U.S. Energy Drink Industry

8

The Oregon Consulting Group

Works Cited

Arthur, R. (2019, July 23). UK bans sale of energy drinks to U16s. beveragedaily.com.

Retrieved December 17, 2021, from

https://www.beveragedaily.com/Article/2019/07/23/UK-government-bans-sale-of-

energy-drinks-to-U16s#

Bush, T. (2021, April 26). SWOT analysis of Red Bull. PESTLE Analysis. Retrieved

December 11, 2021, from https://pestleanalysis.com/swot-analysis-of-red-bull/.

Fontinelle, A. (2021, September 28). The Energy Drinks Industry. Investopedia.

Retrieved December 11, 2021, from

https://www.investopedia.com/articles/investing/022315/energy-drinks-

industry.asp#citation-1.

Gilsenan, K. (2018, October 8). How is the regulation of Energy Drinks Impacting

Consumer Choice? GWI. Retrieved December 17, 2021, from

https://blog.gwi.com/trends/energy-drink-regulations/

Holcomb, G. (2021, January). Energy Drink Production. IBIS World. Retrieved

December 11, 2021, from https://my-ibisworld-

com.libproxy.uoregon.edu/us/en/industry-specialized/od4205/competitive-

landscape#market-share-concentration.

Michail, N. (2016, January 21). Don't ignore different flavour preferences of older

consumers: Study. foodnavigator.com. Retrieved December 17, 2021, from

https://www.foodnavigator.com/Article/2016/01/21/Don-t-ignore-different-flavour-

preferences-of-older-consumers-Study#

U.S. Energy Drink Industry

9

The Oregon Consulting Group

Pysh, P. (2017, November 11). The intrinsic value of monster beverage. Forbes.

Retrieved December 11, 2021, from

https://www.forbes.com/sites/prestonpysh/2017/11/10/intrinsic-value-monster-

energy-drink/?sh=174f5b3316f0.

Research and Markets. (2021, October). United States energy drink market forecast

2021-2027, industry trends, share, insight, growth, impact of covid-19, Opportunity

Company analysis. Research and Markets - Market Research Reports -. Retrieved

December 11, 2021, from

https://www.researchandmarkets.com/reports/5459149/united-states-energy-drink-

market-forecast-

2021?utm_source=CI&utm_medium=PressRelease&utm_code=tgv3lw&utm_camp

aign=1623664%2B-

%2BUS%2BEnergy%2BDrink%2BMarket%2BReport%2B2021%3A%2BA%2BUS

%24%2B28.25%2BBillion%2BMarket%2Bby%2B2027&utm_exec=cari18prd.

Rosenfeld, L. S., Mihalov, J. J., Carlson, S. J., & Mattia, A. (2014, October

7). Regulatory status of caffeine in the United States. Wiley Online Library.

Retrieved December 11, 2021, from

https://onlinelibrary.wiley.com/doi/full/10.1111/nure.12136.

Ross, G. (2020, September). Coffee Store Franchises. IBIS World. Retrieved December

2021, from https://my-ibisworld-com.libproxy.uoregon.edu/us/en/industry-

specialized/od5552/industry-at-a-glance.

Talpos 06.26.2019, S., McCullom 05.05.2021, R., & Moyer 04.14.2021, M. W. (2019,

December 20). In the energy drink market, it's ads vs. science. Undark Magazine.

U.S. Energy Drink Industry

10

The Oregon Consulting Group

Retrieved December 17, 2021, from https://undark.org/2019/06/26/kids-energy-

drinks/

The 2021 Social Media Users Demographics Guide. Khoros. (n.d.). Retrieved

December 17, 2021, from https://khoros.com/resources/social-media-

demographics-guide

Thomson Reuters. (n.d.). MNST.O - Monster Beverage Corp Profile. Reuters. Retrieved

December 11, 2021, from https://www.reuters.com/companies/MNST.O.

U.S. Department of Health and Human Services. (2018, July). Energy drinks. National

Center for Complementary and Integrative Health. Retrieved December 11, 2021,

from https://www.nccih.nih.gov/health/energy-drinks.

United States Energy Drink Market: 2021 - 26: Industry share, size, growth

- mordor intelligence. United States Energy Drink Market | 2021 - 26 | Industry

Share, Size, Growth - Mordor Intelligence. (2021). Retrieved December 11, 2021,

from https://www.mordorintelligence.com/industry-reports/united-states-energy-

drink-market.

Verster, J. C., & Koenig, J. (2017). Caffeine intake and its sources: A Review of

National Representative Studies. Critical Reviews in Food Science and Nutrition,

58(8), 1250–1259. https://doi.org/10.1080/10408398.2016.1247252