CONDO 1 OctOber 1, 2011

Important Notice to Agents/Producers:

Boards of directors of condominium associations typically are responsible under their by-laws for maintaining all

forms of property insurance necessary to protect the common property of the association against all hazards

to which that property is exposed for the insurable value/replacement cost of those common elements. This

responsibility would typically include providing adequate flood insurance protection for all common property

located in Special Flood Hazard Areas (SFHAs). Such by-law requirements could make the individual members of

the boards of directors of such associations personally liable for insurance errors or omissions, including those

relating to flood insurance.

CONDOMINIUMS

I. METHODS OF INSURING CONDOMINIUMS

There are 4 methods of insuring condominiums

under the National Flood Insurance Program (NFIP).

Each method has its own eligibility requirements for

condominium type. Only residential buildings having

a condominium form of ownership are eligible for

the Residential Condominium Building Association

Policy (RCBAP).

A. Residential Condominium: Association Coverage

on Building and Contents

A condominium association is the corporate entity

responsible for the management and operation of

a condominium. Membership is made up of the

condominium unit owners. A condominium association

may purchase insurance coverage on a residential

building and its contents under the RCBAP. The

RCBAP covers only a residential condominium building

in a Regular Program community. If the named insured

is listed as other than a condominium association,

the agent/producer must provide legal documentation

to confirm that the insured is a condominium

association. (See the Eligibility Requirements

subsection in this section.)

B. Residential Condominium: Unit Owner’s

Coverage on Building and Contents

A residential condominium unit in a high-rise or low-

rise building, including a townhouse or rowhouse,

is considered to be a single-family residence. An

individual dwelling unit in a condominium building may

be insured in any 1 of the following 4 ways:

1. An individual unit and its contents may be

separately insured under the Dwelling Form, in the

name of the unit owner, at the limits of insurance

for a single-family dwelling.

2. An individual unit may be separately insured under

the Dwelling Form, if purchased by the association

in the name of the unit owner and the association

as their interests may appear, up to the limits of

insurance for a single-family dwelling.

3. An individual unit owned by the association may

be separately insured under the Dwelling Form, if

purchased by the condominium association. The

single-family limits of insurance apply.

4. An individual non-residential unit owner may not

purchase building coverage. However, contents-

only coverage can be purchased either under

the General Property Form or the Dwelling Form,

depending on the type of contents.

A policy on a condominium unit will be issued naming

the unit owner and the association, as their interests

may appear. Coverage under a unit owner’s policy

applies first to the individually owned building elements

and improvements to the unit and then to the damage

of the building’s common elements that are the unit

owner’s responsibility.

In the event of a loss, the claim payment to an individual

unit owner may not exceed the maximum allowable in

the Program.

C. Non-Residential (Commercial) Condominium:

Building and Contents

Non-residential (commercial) condominium buildings

and their commonly owned contents may be insured

in the name of the association under the General

Property Form. The “non-residential” limits apply.

D. Non-Residential (Commercial) Condominium:

Unit Owner’s Coverage (Contents)

The owner of a non-residential or residential

condominium unit within a non-residential condominium

building may purchase only contents coverage for that

unit. Building coverage may not be purchased in the

name of the unit owner.

In the event of a loss, up to 10% of the stated amount

of contents coverage can be applied to losses to

condominium interior walls, floors, and ceilings. The

10% is not an additional amount of insurance.

Previous Section

Next Section

Table of Contents

Previous Section

Next Section

Table of Contents

CONDO 2 OctOber 1, 2011

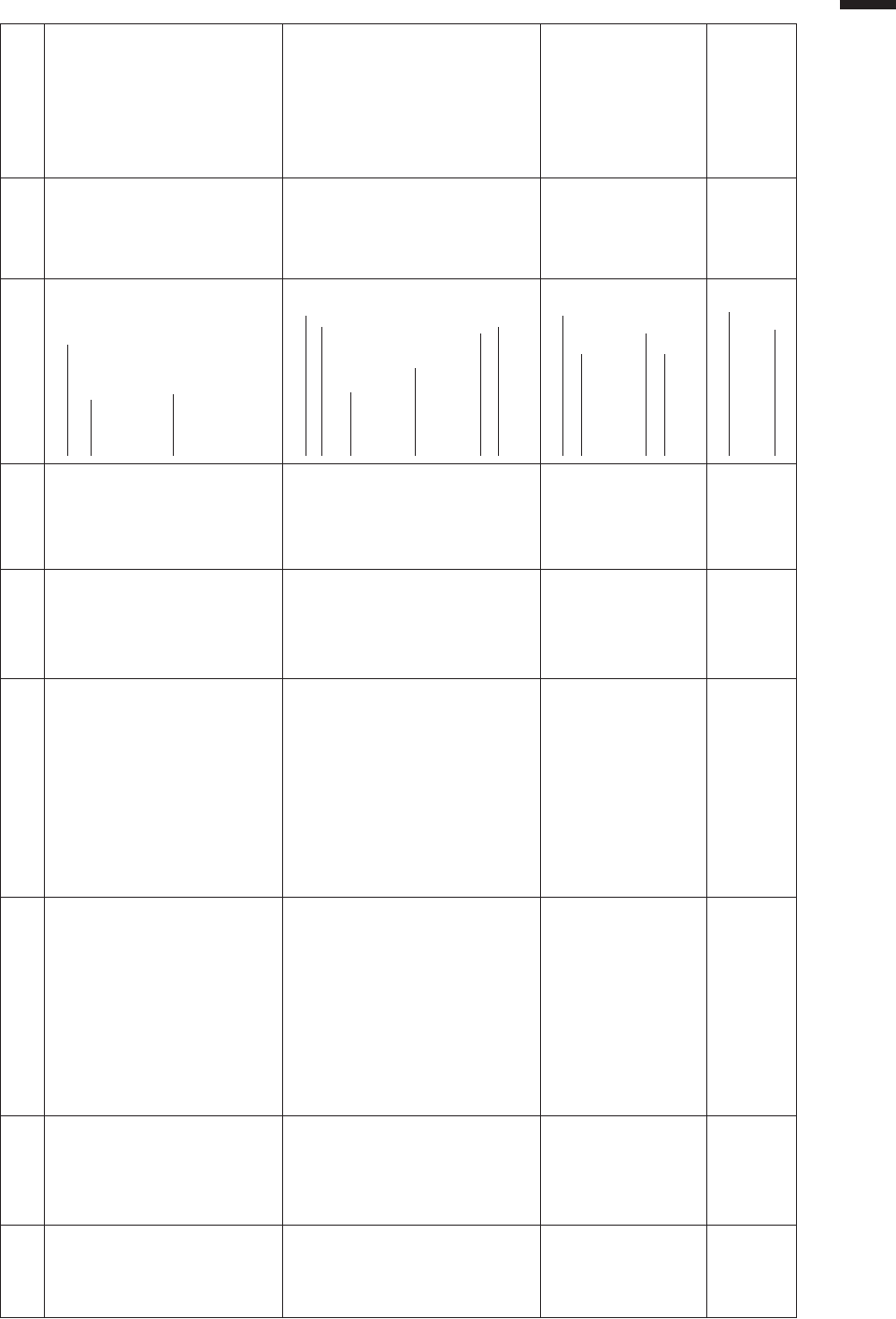

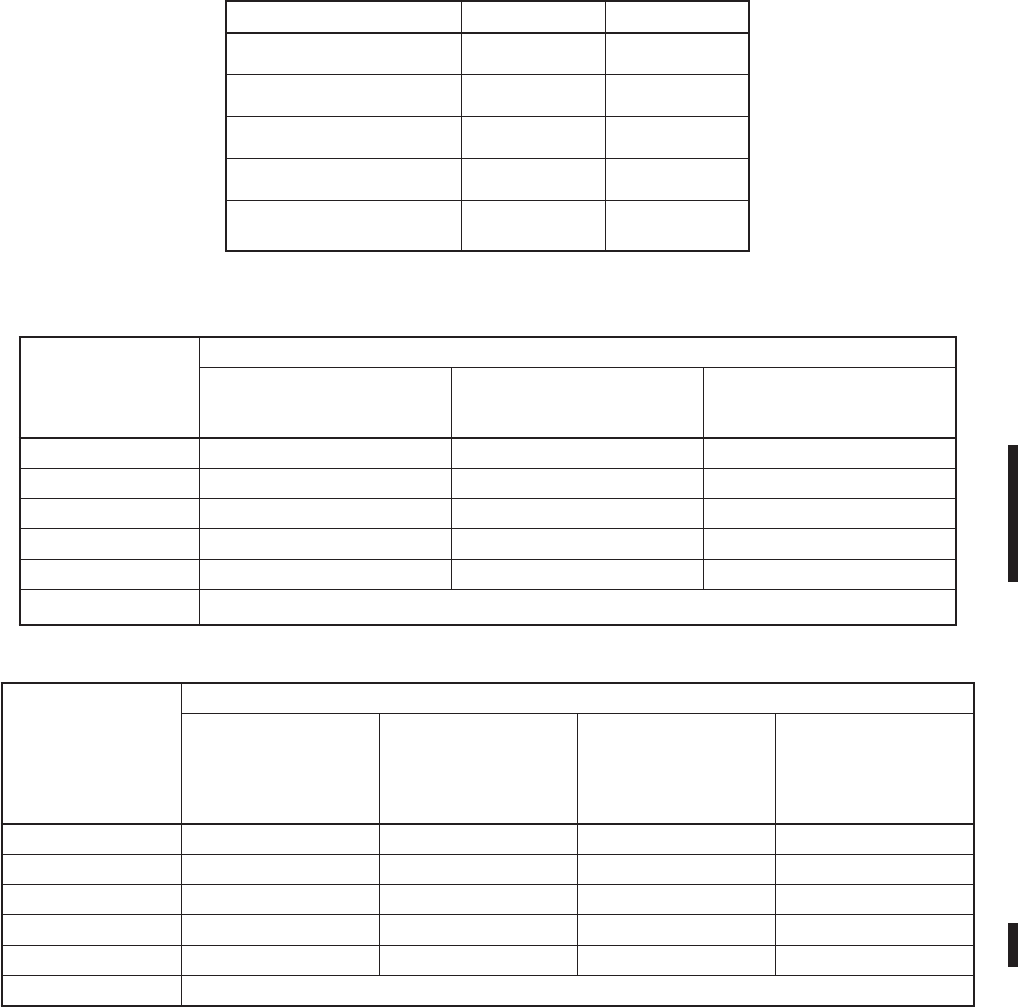

TABLE 1. CONDOMINIUM UNDERWRITING GUIDELINES

1

POLICY

FORM

INSURED

PROPERTY

COVERED

ELIGIBILITY

REQUIREMENTS

REPLACEMENT

COVERAGE

ICC

2

COVERAGE

LIMITS

ASSESSMENT

COVERAGE

FEDERAL

POLICY FEE

RCBAP

Residential

condominium

association

•Condominium building

•Individually owned units within the

building

•Improvements within unit

•Additions and extensions attached

or connected to the insured

building

•Fixtures, machinery, and

equipment within building

•Contents owned by the

association

•Community must be in regular

program

•Residential condominium

buildings including homeowner

associations (HOAs) and

timeshares in the condominium

form of ownership

•At least 75% of floor area must

be residential

•Buildings include townhouses,

rowhouses, low-rise, high-rise,

and detached single-family

condominium buildings

Yes

3

Yes MAXIMUM LIMITS:

BUILDING

•Replacement cost, or the

total number of units ×

$250,000, whichever is less

CONTENTS

•Actual cash value (ACV) of

commonly owned contents

to a maximum of $100,000

per building

No NUMBER OF UNITS:

1 – $40/POLICY

2–4 – $80/POLICY

5–10 – $200/POLICY

11–20 – $440/POLICY

21 + – $840/POLICY

GENERAL

PROPERTY

FORM

Condominium

association

•Condominium building

•Individually owned units within the

building

•Improvements within unit

•Additions and extensions attached

or connected to the insured

building

•Fixtures, machinery, and

equipment within building

•Contents owned by the

association

•Non-residential common building

elements and their contents

•Condominium building in a

regular program community with

less than 75% of its floor area in

residential use

•Residential condominium

building in an emergency

program community

No Yes

EMERGENCY PROGRAM

(ACV maximum limits):

Residential

Building $100,000

Contents $10,000

Non-residential

Building $100,000

Contents $100,000

REGULAR PROGRAM

(ACV maximum limits):

Building $500,000

Contents $500,000

No $40

DWELLING

FORM

Condominium

association,

residential

condominium

unit owners

•Building elements

•Individually owned contents

•Residential condominium units

•Emergency and regular programs

are eligible

Yes

3

No EMERGENCY PROGRAM

(maximum limits):

Building $35,000

Contents $10,000

REGULAR PROGRAM

(maximum limits):

Building $250,000

Contents $100,000

Yes $40

GENERAL

PROPERTY

FORM

Individual unit

owners and

tenants

•Non-residential condo units (only

contents coverage is available)

•Commercial Contents only

•Emergency and regular programs

are eligible

No No

EMERGENCY PROGRAM:

$100,000 maximum

REGULAR PROGRAM:

$500,000 maximum

No $40

1 These are basic guidelines for condominium associations and unit owners. Please refer to appropriate section of this manual for specific details.

2 ICC coverage does not apply to the Emergency Program, individually owned condominium units located within a multi-unit building and insured under the Dwelling Form, contents-only policies,

and Group Flood Insurance Policies.

3 Subject to replacement cost provisions in policy.

CONDO 3 OctOber 1, 2011

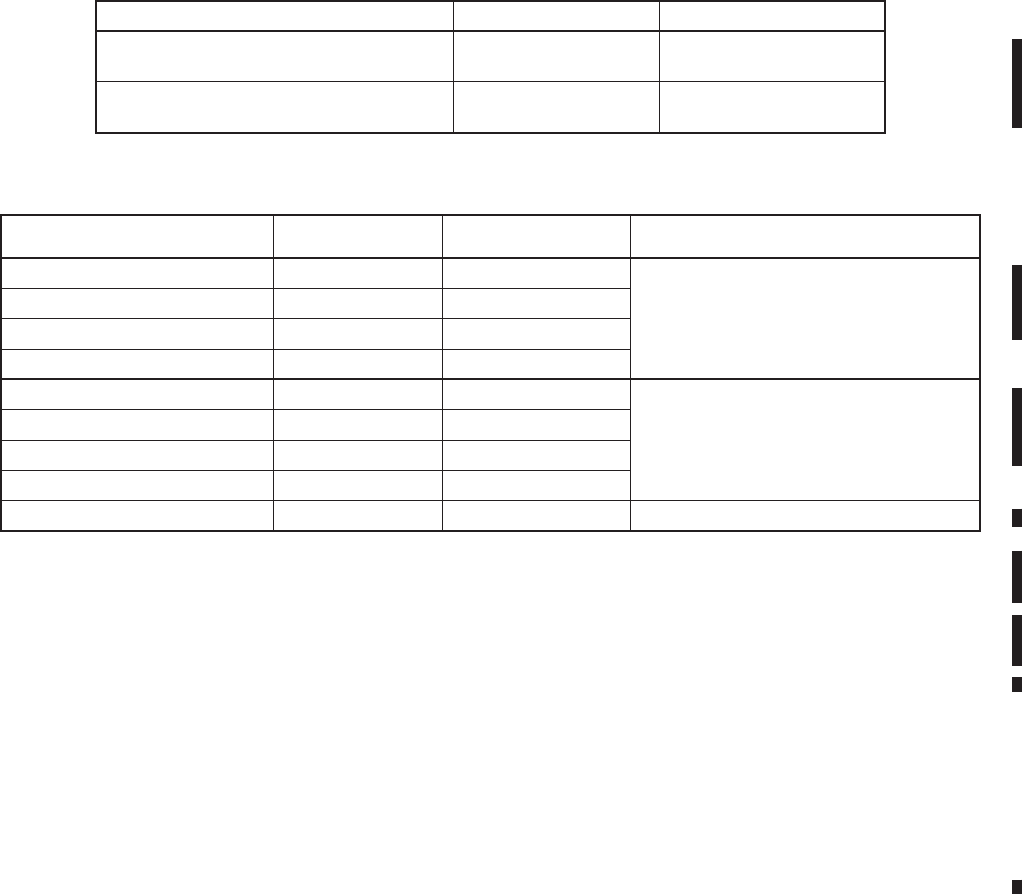

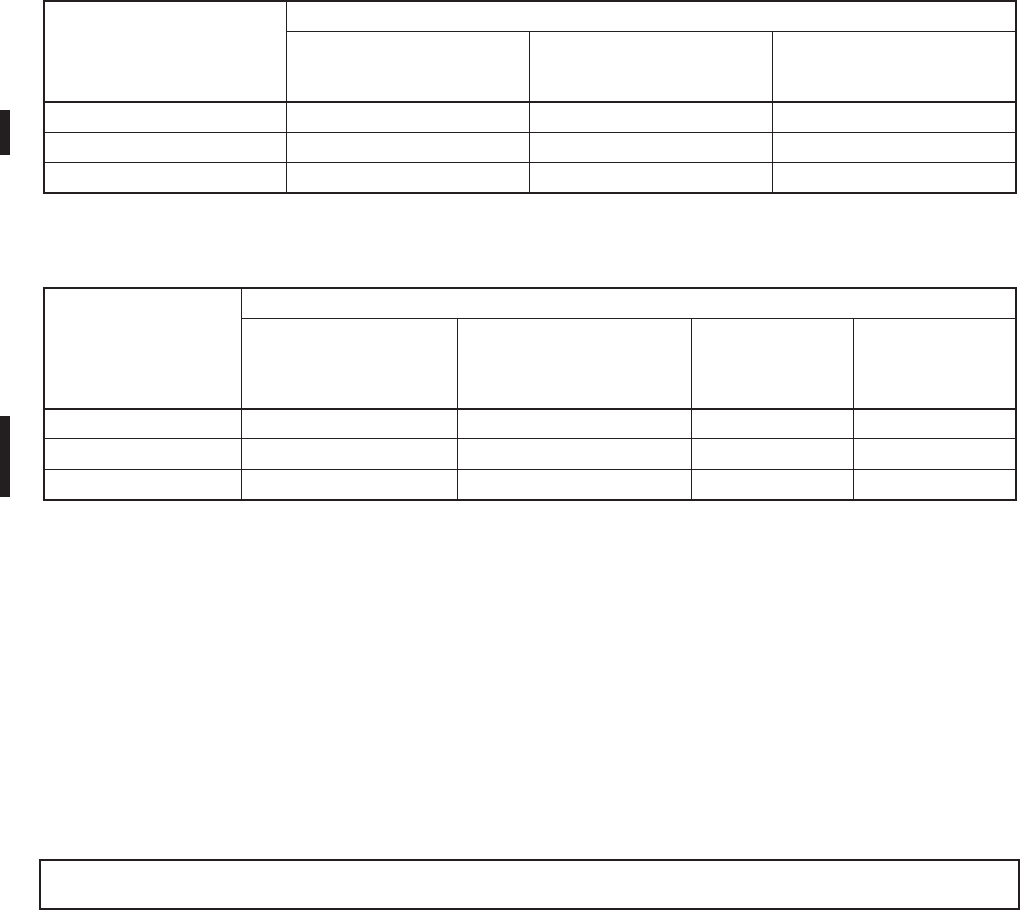

TABLE 2. CONDOMINIUM RATING CHART

LOW-RISE RESIDENTIAL CONDOMINIUMS

SINGLE-UNIT BUILDING OR TOWNHOUSE/ROWHOUSE TYPE – BUILDING WITH SEPARATE ENTRANCE FOR EACH UNIT

PURCHASER OF

POLICY

BUILDING

OCCUPANCY

1

BUILDING

INDICATOR

1

CONTENTS

INDICATOR

2

TYPE OF

COVERAGE

RATING

CLASSIFICATION POLICY FORM

3

UNIT OWNER Single family Single unit Household RC

4

Single family Dwelling

ASSOCIATION

(ASSOCIATION-

OWNED SINGLE UNIT

ONLY)

Single family Single unit Household RC

4

Single family Dwelling

ASSOCIATION

(ENTIRE BUILDING)

Determined by the

number of units, i.e.,

single family, 2–4 family,

other residential

Low-rise Household RC RCBAP Low-rise RCBAP

MULTI-UNIT BUILDING

2–4 UNITS PER BUILDING — REGARDLESS OF NUMBER OF FLOORS (NON-TOWNHOUSE)

PURCHASER OF

POLICY

BUILDING

OCCUPANCY

1

BUILDING

INDICATOR

1

CONTENTS

INDICATOR

2

TYPE OF

COVERAGE

RATING

CLASSIFICATION POLICY FORM

3

UNIT OWNER 2–4 Single unit Household RC

4

Single family for building;

2–4 family for contents

Dwelling

ASSOCIATION

(ASSOCIATION-OWNED

SINGLE UNIT ONLY)

2–4 Single unit Household RC

4

Single family for building;

2–4 family for contents

Dwelling

ASSOCIATION

(ENTIRE BUILDING)

2–4 Low-rise Household RC RCBAP Low-rise RCBAP

OWNER OF NON-

RESIDENTIAL CONTENTS

Non-residential

Single unit

(Building coverage

not available)

Other than

household

ACV Non-residential General Property

MULTI-UNIT BUILDING

5 OR MORE UNITS PER BUILDING – FEWER THAN 3 FLOORS

PURCHASER OF

POLICY

BUILDING

OCCUPANCY

1

BUILDING

INDICATOR

1

CONTENTS

INDICATOR

2

TYPE OF

COVERAGE

RATING

CLASSIFICATION POLICY FORM

3

UNIT OWNER

Other

residential

Single unit Household RC

4

Single family for building;

other residential for

contents

Dwelling

ASSOCIATION

(ASSOCIATION-OWNED

SINGLE UNIT ONLY)

Other

residential

Single unit Household RC

4

Single family for building;

other residential for

contents

Dwelling

ASSOCIATION

(ENTIRE BUILDING)

Other

residential

Low-rise Household RC RCBAP low-rise RCBAP

OWNER OF NON-

RESIDENTIAL CONTENTS

Non-residential

Single unit

(Building coverage

not available)

Other than

household

ACV Non-residential General Property

1 When there is a mixture of residential and commercial usage within a single building, refer to the General Rules section of this manual.

2 In determining the contents location, refer to the Rating section of this manual.

3 RCBAP must be used to insure residential condominium buildings owned by the association that are in a Regular Program

community and in which at least 75% of the total floor area within the building is residential. Use the General Property Form

if ineligible under RCBAP.

4 Replacement Cost if the RC eligibility requirements are met (building only).

CONDO 4 OctOber 1, 2011

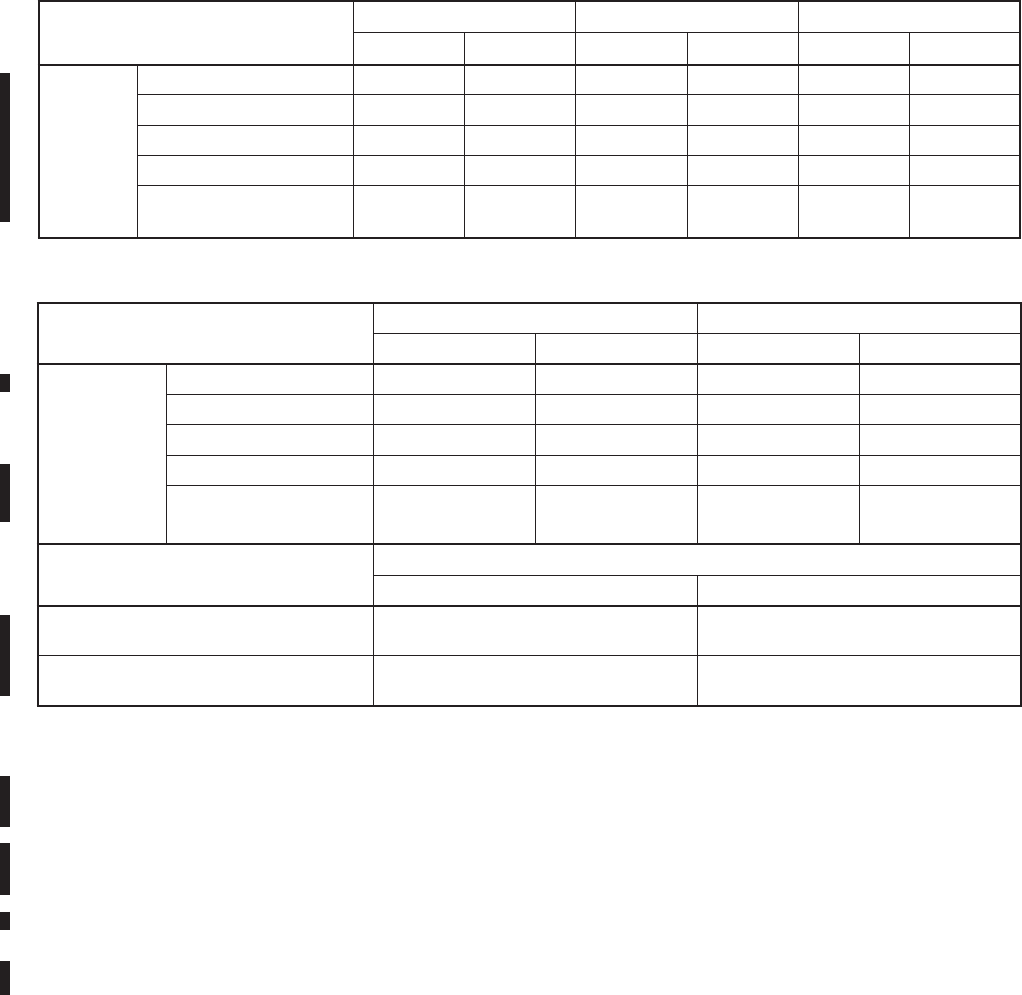

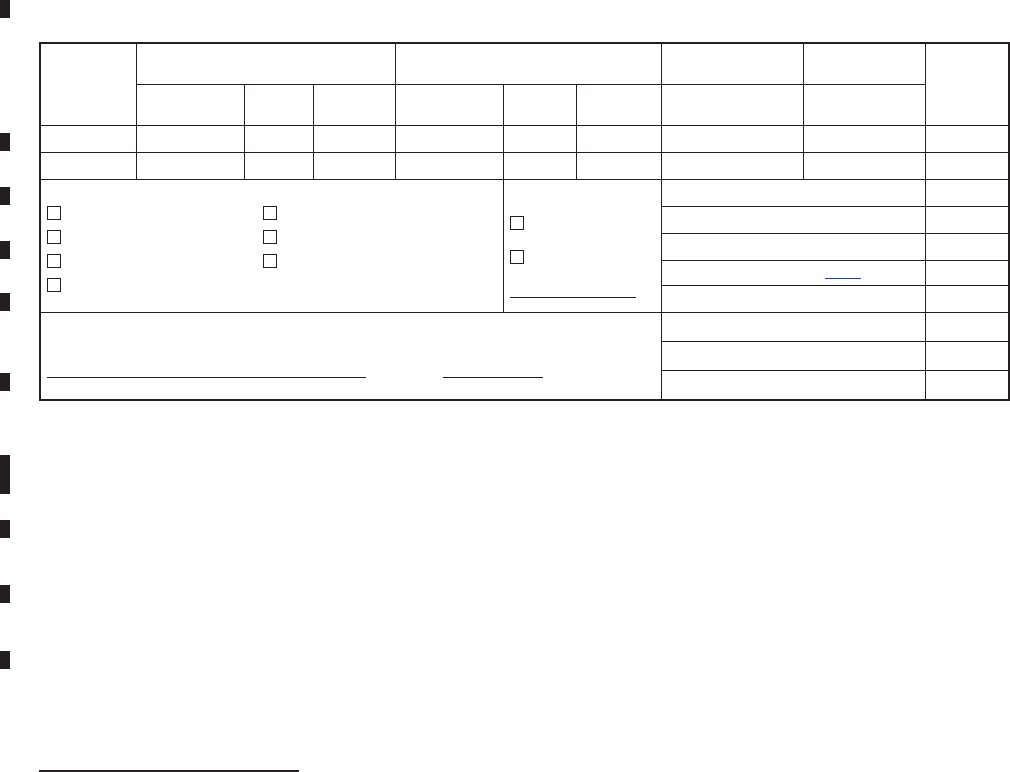

TABLE 2. CONDOMINIUM RATING CHART (continued)

HIGH-RISE RESIDENTIAL CONDOMINIUMS

MULTI-UNIT BUILDING – 5 OR MORE UNITS PER BUILDING – 3 OR MORE FLOORS

1

PURCHASER OF

POLICY

BUILDING

OCCUPANCY

2

BUILDING

INDICATOR

2

CONTENTS

INDICATOR

3

TYPE OF

COVERAGE

RATING

CLASSIFICATION

POLICY

FORM

4

UNIT OWNER Other residential Single unit Household RC

5

Single family for

building; other

residential for

contents

Dwelling

ASSOCIATION

(ASSOCIATION-OWNED

SINGLE UNIT ONLY)

Other residential Single unit Household RC

5

Single family for

building; other

residential for

contents

Dwelling

ASSOCIATION

(ENTIRE BUILDING)

Other residential High-rise Household RC RCBAP High-rise RCBAP

NON-RESIDENTIAL CONDOMINIUMS

PURCHASER OF

POLICY

BUILDING

OCCUPANCY

2

BUILDING

INDICATOR

2

CONTENTS

INDICATOR

3

TYPE OF

COVERAGE

RATING

CLASSIFICATION

POLICY

FORM

4

OWNER OF NON-

RESIDENTIAL

CONTENTS

Non-residential

Single unit

(Building

coverage not

available)

Other than

household

ACV Non-residential

General

property

OWNER OF

RESIDENTIAL

CONTENTS

Single family

(In a 2–4 unit building)

Single unit

(Building

coverage not

available)

Household ACV Single family Dwelling

OWNER OF

RESIDENTIAL

CONTENTS

Other residential

(In a 5-or-more-unit

building)

Single unit

(Building

coverage not

available)

Household ACV Single family Dwelling

ASSOCIATION Non-residential

Low-rise or

high-rise

Other than

household

ACV Non-residential

General

property

1 Enclosure/crawlspace, even if it is the lowest floor for rating, cannot be counted as a floor for the purpose of classifying the building as

a high-rise.

2 When there is a mixture of residential and commercial usage within a single building, refer to subsection D. Determination of Building

Occupancy in the General Rules section of this manual.

3 In determining the contents location, refer to the Rating section of this manual.

4 RCBAP must be used to insure residential condominium buildings owned by the association that are in a Regular Program

community and in which at least 75% of the total floor area within the building is residential. Use the General Property Form

if ineligible under RCBAP.

5 Replacement Cost if the RC eligibility requirements are met (building only).

CONDO 5 OctOber 1, 2011

II. RESIDENTIAL CONDOMINIUM BUILDING

ASSOCIATION POLICY (RCBAP) FORM

The policy form used for the residential condominium

buildings owned by a condominium association is

the RCBAP.

III. ELIGIBILITY REQUIREMENTS

A. General Building Eligibility

In order for a condominium building to be eligible under

the RCBAP form, the building must be owned by a

condominium association, which the NFIP defines as

the entity made up of the unit owners responsible for

the maintenance and operation of:

1. common elements owned in undivided shares by

unit owners; and

2. other real property in which the unit owners have

use rights

where membership in the entity is a required condition

of unit ownership.

The RCBAP is required for all buildings owned by a

condominium association containing 1 or more

residential units and in which at least 75% of the

total floor area within the building is residential

without regard to the number of units or number of

floors. The RCBAP is available for high-rise and low-

rise residential condominium buildings, including

townhouse/rowhouse and detached single-family

condominium buildings in the Regular Program only.

(See pages CONDO 3 and 4.)

Residential condominium buildings that are being used

as a hotel or motel, or are being rented (either short or

long term), must be insured under the RCBAP.

Only buildings having a condominium form of ownership

are eligible for the RCBAP. If the named insured is listed

as other than a condominium association, the agent/

producer must provide legal documentation to confirm

that the insured is a condominium association before

the RCBAP can be written. This documentation may be

a copy of the condominium association by-laws or a

statement signed by an officer or representative of the

condominium association confirming that the building

is in a condominium form of ownership. In the event of

a loss, RCBAPs written for buildings found not to be in a

condominium form of ownership will be rewritten under

the correct policy form for up to the maximum amount

of building coverage allowed under the program for the

type of building insured, not to exceed the coverage

purchased under the RCBAP.

A homeowners association (HOA) may differ from a

condominium association and is ineligible for the RCBAP,

unless the HOA meets the definition of a condominium

association as defined in the policy. Cooperative

ownership buildings are not eligible. Timeshare buildings

in a condominium form of ownership in jurisdictions

where title is vested in individual unit owners are eligible

provided that all other criteria are met.

If, during a policy term, the risk fails to meet the

eligibility requirements due to a change in the form

of ownership, it will be ineligible for coverage under

the RCBAP. The policy will be canceled and rewritten

using the correct Standard Flood Insurance Policy

(SFIP) form. The effective date of cancellation will

be the date on which the change in the form of

ownership occurred.

If an RCBAP was issued for a risk that was ineligible for

the RCBAP, the policy is void and the coverage must

be written under the correct form. The provisions of

the correct SFIP form apply. The coverage limits must

be reformed according to the provisions of the correct

SFIP form and cannot exceed the coverage limits

originally issued under the incorrect policy.

The NFIP has grouped condominium buildings into 2

different types, low-rise and high-rise, because of the

difference in the exposures to the risk that typically

exists. Low-rise buildings generally have a greater

percentage of the value of the building at risk than high-

rise buildings, thus requiring higher premiums for the

first dollars of coverage. The availability of the optional

deductibles for the low-rise buildings, however, allows

the association to buy back some of the risk, thereby

reducing the overall cost of the coverage.

For rating purposes:

• High-rise buildings contain 5 or more units and at

least 3 floors excluding enclosure, even if it is the

lowest floor for rating.

• Low-rise buildings have fewer than 5 units regardless

of the number of floors, or 5 or more units with fewer

than 3 floors, including the basement.

• Townhouse/rowhouse buildings are always considered

low-rise buildings for rating purposes, no matter how

many units or floors they have.

See the Definitions section in this manual for complete

definitions of high-rise and low-rise buildings.

Individual unit owners continue to have an option to

purchase an SFIP Dwelling Form.

B. Condominium Building in the Course of

Construction

The NFIP rules allow the issuance of an SFIP to cover a

building in the course of construction before the building

is walled and roofed. These rules provide lenders an

CONDO 6 May 1, 2011

option to require flood insurance coverage at the time

that the development loan is made to comply with the

mandatory purchase requirement outlined in the Flood

Disaster Protection Act of 1973, as amended. The

policy is issued and rated based on the construction

designs and intended use of the building.

In order for a condominium building in the course of

construction to be eligible under the RCBAP form, the

building must be owned by a condominium association.

As noted in the General Rules section, buildings in the

course of construction that have yet to be walled and

roofed are eligible for coverage except when construction

has been halted for more than 90 days and/or if the

lowest floor used for rating purposes is below the Base

Flood Elevation (BFE). Materials or supplies intended

for use in such construction, alteration, or repair are not

insurable unless they are contained within an enclosed

building on the premises or adjacent to the premises.

IV. COVERAGE

A. Property Covered

The entire building is covered under 1 policy, including

both the common as well as individually owned building

elements within the units, improvements within the

units, and contents owned in common. Contents

owned by individual unit owners should be insured

under an individual unit owner’s Dwelling Form.

B. Coverage Limits

Building coverage purchased under the RCBAP will be

on a Replacement Cost basis.

The maximum amount of building coverage that can

be purchased on a high-rise or low-rise condominium

is the Replacement Cost Value (RCV) of the building or

the total number of units in the condominium building

times $250,000, whichever is less.

The maximum allowable contents coverage is the Actual

Cash Value (ACV) of the commonly owned contents up

to a maximum of $100,000 per building.

Basic Limit Amount:

1. The building basic limit amount of insurance

for a detached building housing a single-family

unit owned by the condominium association is

$60,000.

2. For residential townhouse/rowhouse and low-rise

condominiums, the building basic limit amount of

insurance is $60,000 multiplied by the number of

units in the building.

3. For high-rise condominiums, the building basic

amount of insurance is $175,000.

4. The contents basic limit amount of insurance is

$25,000.

5. For condominium unit owners who have insured

their personal property under the Dwelling Form

or General Property Form, coverage extends to

interior walls, floor, and ceiling (if not covered

under the condominium association’s insurance)

up to 10% of the personal property limit of

liability. Use of this coverage is at the option of

the insured and reduces the personal property

limit of liability.

C. Replacement Cost

The RCBAP’s building coverage is on a Replacement

Cost valuation basis. RCV means the cost to replace

property with the same kind of material and construction

without deduction for depreciation. A condominium unit

owner’s Dwelling Form policy provides Replacement

Cost coverage on the building if eligibility requirements

are met.

D. Coinsurance

The RCBAP’s coinsurance penalty is applied to building

coverage only. To the extent that the insured has

not purchased insurance in an amount equal to the

lesser of 80% or more of the full replacement cost

of the building at the time of loss or the maximum

amount of insurance under the NFIP, the insured will

not be reimbursed fully for a loss. Building coverage

purchased under individual Dwelling Forms cannot

be added to RCBAP coverage in order to avoid the

coinsurance penalty. The amount of loss in this case

will be determined by using the following formula:

Insurance Carried

Insurance Required

× Amount of Loss = Limit of Recovery

Where the penalty applies, building loss under the

RCBAP will be adjusted based on the Replacement

Cost Coverage with a coinsurance penalty. Building

loss under the Dwelling Form will be adjusted on an

ACV basis if the Replacement Cost provision is not

met. The cost of bringing the building into compliance

with local codes (law and ordinance) is not included in

the calculation of replacement cost.

E. Assessment Coverage

The RCBAP Form and General Property Form do not

provide assessment coverage.

Assessment coverage is available only under the

Dwelling Form subject to the conditions and exclusions

found in Section III. Property Covered, Coverage C,

CONDO 7 May 1, 2011

paragraph 3 – Condominium Loss Assessments.

The Dwelling Form will respond, up to the building

coverage limit, to assessments against unit owners for

damages to common areas of any building owned by

the condominium association, even if the building is

not insured, provided that: (1) each of the unit owners

comprising the membership of the association is

assessed by reason of the same cause; and (2) the

assessment arises out of a direct physical loss by or

from flood to the condominium building at the time of

the loss.

Assessment coverage cannot be used to meet the

80% coinsurance provision of the RCBAP, and does

not apply to ICC coverage or to coverage for closed

basin lakes.

In addition, assessment coverage cannot be used to

pay a loss assessment resulting from a deductible

under the RCBAP.

For more information on this topic, see “E. Loss

Assessments” in the General Rules section and

Section III. C.3. of the Dwelling Form, “Condominium

Loss Assessments,” in the Policy section.

V. DEDUCTIBLES AND FEES

A. Deductibles

The loss deductible shall apply separately to each

building and personal property covered loss, including

any appurtenant structure loss. The Standard Deductible

is $2,000 for a residential condominium building, located

in a Regular Program community in SFHAs, i.e., zones A,

AO, AH, A1–A30, AE, AR, AR dual zones (AR/AE, AR/AH,

AR/AO, AR/A1–A30, AR/A), V, V1–V30, or VE, where the

rates available for buildings built before the effective

date of the initial Flood Insurance Rate Map (FIRM), Pre-

FIRM rates, are used to compute the premium.

For all policies rated other than those described above,

e.g., those rated as Post-FIRM and those rated in zones

A99, B, C, D, or X, the Standard Deductible is $1,000.

Optional deductible amounts are available under the

RCBAP; see Table 7 in this section.

B. Federal Policy Fee

The Federal Policy Fees for the RCBAP are:

1 unit . . . . . . . . . . . . . $40 per policy

2–4 units . . . . . . . . . . $80 per policy

5–10 units . . . . . . . . $200 per policy

11–20 units . . . . . . . . $440 per policy

21 or more units . . . . $840 per policy

VI. TENTATIVE RATES AND SCHEDULED

BUILDINGS

Tentative Rates cannot be applied to the RCBAP.

The Scheduled Building Policy is not available for

the RCBAP.

VII. COMMISSIONS (DIRECT BUSINESS ONLY)

The commission, 15%, will be reduced to 5% on only

that portion of the premium that exceeds the figure

resulting from multiplying the total number of units

times $2,000.

VIII. CANCELLATION OR ENDORSEMENT OF UNIT

OWNERS’ DWELLING POLICIES

Unit owners’ policies written under the Dwelling Form

may be canceled mid-term for the reasons mentioned

in the Cancellation/Nullification section of this manual.

To cancel building coverage while retaining contents

coverage on a unit owner’s policy, submit a general

change request. In the event of a cancellation:

• The commission on a unit owner’s policy will be

retained, in full, by the agent/producer;

• The Federal Policy Fee and Probation Surcharge will

be refunded on a pro-rata basis; and

• The premium refund will be calculated on a

pro-rata basis.

An existing policy written under the Dwelling Form or

RCBAP Form may be endorsed to increase amounts of

coverage in accordance with Endorsement rules. They

may not be endorsed mid-term to reduce coverage.

IX. APPLICATION FORM

The agent/producer should complete the entire Flood

Insurance Application according to the directions in the

Application section of this manual and attach 2 new

photographs of the building, 1 of which clearly shows

the location of the lowest floor used for rating the risk.

A. Type of Building

For an RCBAP, the “Building” section of the Flood

Insurance Application must indicate the total number

of units in the building and whether the building is a

high-rise or low-rise.

High-rise (vertical) condominium buildings are defined

as containing at least 5 units and having at least 3

floors. Note that an enclosure below an elevated floor

building, even if it is the lowest floor for rating purposes,

cannot be counted as a floor to classify the building as

a high-rise condominium building.

CONDO 8 OctOber 1, 2011

Low-rise condominium buildings are defined as having

fewer than 5 units and/or fewer than 3 floors. Low-rise

also includes all townhouses/rowhouses regardless of

the number of floors or units, and all detached single-

family buildings.

For a Dwelling Form used to insure a condominium unit,

see the Application section of this manual.

B. Replacement Cost Value

For an RCBAP, use normal company practice to

estimate the RCV and enter the value in the “Building”

section of the Application. Include the cost of the

building foundation when determining the RCV. Attach

the appropriate valuation to the Application.

Acceptable documentation of a building’s RCV is a

recent property valuation report that states the value of

the building, including its foundation, on an RCV basis.

The cost of bringing the building into compliance with

local codes (law and ordinance) is not to be included

in the calculation of the building’s replacement cost.

To maintain reasonable accuracy of the RCV for

the building, the agent/producer must update this

information and provide it to the insurer at least every

3 years. (See sample notification letter regarding

updating RCV on page CONDO 9.)

C. Coverage

Ensure that the “Coverage and Rating” section of the

Application accurately reflects the desired amount of

building and contents coverage.

If only building insurance is to be purchased, inform the

applicant of the availability of contents insurance for

contents that are commonly owned. It is recommended

that the applicant initial the contents coverage section

if no contents insurance is requested. (This will make

the applicant aware that the policy will not provide

payment for contents losses.)

1. Building

Enter the amount of insurance for building, Basic

and Additional Limits. Enter full Basic Limits before

entering any Additional Limits.

The building Basic Limit amount of insurance

for high-rise condominium buildings is up to a

maximum of $175,000.

The building Basic Limit amount of insurance for low-

rise condominium buildings is $60,000 multiplied

by the number of units in the building. The total

amount of coverage desired on the entire building

must not exceed $250,000 (Regular Program limit)

times the total number of units (residential and

non-residential) in the building.

2. Contents

Since the Program type must be Regular, enter

the amount of insurance for contents, Basic and

Additional Limits. Enter full Basic Limits before any

Additional Limits. Contents coverage purchased by

the association is for only those contents items that

are commonly owned. For the Basic Limits amount

of insurance, up to a maximum of $25,000 may

be filled in. For the Additional Limits, up to a total

of $75,000 may be filled in. The total amount of

insurance available for contents coverage cannot

exceed $100,000.

D. Rates and Fees

1. To determine rates, see the RCBAP Rate Tables

on the following pages. Enter the rate for building

and for contents and compute the annual

premium. If an optional deductible has been

selected for building and/or contents, see Table

7 in this section.

2. Enter the total premium for building and contents,

adjusted for any premium change because of

an optional deductible being selected. The total

premium will be calculated as if the building were

1 unit.

3. Add the total premium for building and contents

and enter the Annual Subtotal.

4. Add the Increased Cost of Compliance

(ICC) Premium.

5. Calculate the Community Rating System (CRS)

discount, if applicable.

6. Subtract the CRS discount, if applicable.

7. Add the $50 Probation Surcharge, if applicable.

8. Add the Federal Policy Fee to determine the Total

Prepaid Amount.

CONDO 9 May 1, 2011

Sample RCV Notification Letter

IMPORTANT FLOOD INSURANCE POLICY INFORMATION

Agent’s Name:

Agent’s Address:

Re: Insured’s Name:

Property Address:

Policy Number:

Dear Agent:

The letter is to inform you that the Replacement Cost Value (RCV) on file for the building referenced above,

insured under the Residential Condominium Building Association Policy (RCBAP), must now be updated. The

National Flood Insurance Program (NFIP) requires that the RCV be evaluated every 3 years; it has been at least

3 years since the RCV for the building has been updated.

The RCV as currently listed on the above-referenced policy is <INSERT CURRENT RCV>. The amount of

building coverage on the policy is <INSERT CURRENT BUILDING COVERAGE>.

If the RCV indicated above needs to be revised, you must provide new documentation showing the revised RCV.

Acceptable documentation of the building’s RCV is a recent property valuation report that states the building’s

value, including the foundation, on an RCV basis.

If the RCV has not changed, you must provide either new RCV documentation or a statement signed by an officer

or a representative of the Condominium Association confirming that the RCV is still valid.

Please be aware that to the extent that the amount of building coverage on the policy is not in an amount equal to

the lesser of 80 percent or more of the full replacement cost of the building at the time of a loss or the maximum

amount of insurance available under the NFIP, the Condominium Association may not be fully reimbursed

for the loss.

If you have any questions about the information in this letter, please contact < INSERT CONTACT NAME AND

TELEPHONE NUMBER>.

cc: Insured, Lender

CONDO 10 OctOber 1, 2011

TABLE 3A. RCBAP HIGH-RISE CONDOMINIUM RATES

ANNUAL RATES PER $100 OF COVERAGE (Basic/Additional)

BUILDING

BUILDING TYPE

REGULAR PROGRAM PRE-FIRM

1

REGULAR PROGRAM POST-FIRM

A, A1–A30,

AE, AO, AH, D V, VE A99, B, C, X A99, B, C, X D

NO BASEMENT/ENCLOSURE .85 / .24 1.08 / .59 1.17 / .05 1.17 / .05 1.17 / .24

WITH BASEMENT .90 / .33 1.15 / 1.25 1.42 / .07 1.42 / .07

SUBMIT

FOR

RATE

WITH ENCLOSURE .90 / .24 1.15 / .61 1.23 / .05 1.23 / .05

ELEVATED ON CRAWLSPACE .85 / .24 1.08 / .59 1.17 / .05 1.17 / .05

NON-ELEVATED WITH

SUBGRADE CRAWLSPACE

.85 / .24 1.08 / .59 1.17 / .05 1.17 / .05

CONTENTS

CONTENTS LOCATION

REGULAR PROGRAM PRE-FIRM

1

REGULAR PROGRAM POST-FIRM

A, A1–A30,

AE, AO, AH, D V, VE A99, B, C, X A99, B, C, X D

BASEMENT/SUBGRADE

CRAWLSPACE AND ABOVE

.96 / .99 1.23 / 2.46 1.77 / .65 1.77 / .65

SUBMIT

FOR

RATE

ENCLOSURE/CRAWLSPACE

AND ABOVE

.96 / 1.18 1.23 / 2.90 1.77 / .75 1.77 / .75

LOWEST FLOOR ONLY – ABOVE

GROUND LEVEL

.96 / 1.18 1.23 / 2.90 1.39 / .69 1.39 / .69 1.11 / .60

LOWEST FLOOR ABOVE GROUND

LEVEL AND HIGHER FLOORS

.96 / .82 1.23 / 2.55 1.39 / .37 1.39 / .37 1.11 / .40

ABOVE GROUND LEVEL MORE

THAN 1 FULL FLOOR

.35 / .16 .47 / .38 .41 / .14 .38 / .13 .35 / .12

BUILDING — A1–A30, AE · POST-FIRM

ELEVATION

DIFFERENCE

3 OR MORE FLOORS

NO BASEMENT/ENCLOSURE/CRAWLSPACE

2

3 OR MORE FLOORS

WITH BASEMENT/ENCLOSURE/CRAWLSPACE

2

+4 .33 /.03 .33 /.03

+3 .35 /.03 .34 /.03

+2 .45 /.03 .40 /.03

+1 .81 /.04 .56 /.04

0 1.61 /.05 1.44 /.05

-1

3

6.10 /.15 3.48 /.12

-2 SUBMIT FOR RATE

CONTENTS — A1–A30, AE · POST-FIRM

ELEVATION

DIFFERENCE

LOWEST FLOOR ONLY – ABOVE

GROUND LEVEL (NO BASEMENT/

ENCLOSURE/CRAWLSPACE

2

)

LOWEST FLOOR ABOVE

GROUND LEVEL AND HIGHER

(NO BASEMENT/ENCLOSURE/

CRAWLSPACE

2

)

BASEMENT/ENCLOSURE/

CRAWLSPACE

2

AND ABOVE

ABOVE GROUND

LEVEL MORE THAN

1 FULL FLOOR

+4 .38 /.12 .38 /.12 .38 /.12 .35 /.12

+3 .38 /.12 .38 /.12 .38 /.12 .35 /.12

+2 .38 /.12 .38 /.12 .38 /.12 .35 /.12

+1 .53 /.12 .38 /.12 .38 /.12 .35 /.12

0 1.16 /.12 .68 /.12 .45 /.12 .35 /.12

-1

3

3.10 /.63 1.90 /.42 .72 /.15 .35 /.12

-2 SUBMIT FOR RATE .35 /.12

1 Pre-FIRM construction refers to a building that has a start of construction date or substantial improvement date on or before 12/31/74,

or before the effective date of the initial FIRM. If FIRM zone is unknown, use rates for zones A, AE, AO, AH, D.

2 Includes subgrade crawlspace.

3 Use Submit-for-Rate procedures if either the enclosure below the lowest elevated floor of an elevated building or the crawlspace (under-

floor space) that has its interior floor within 2 feet below grade on all sides, which is used for rating, is 1 or more feet below the BFE.

CONDO 11 OctOber 1, 2011

TABLE 3B. RCBAP HIGH-RISE CONDOMINIUM RATES

ANNUAL RATES PER $100 OF COVERAGE (Basic/Additional)

AO, AH POST-FIRM

NO BASEMENT/ENCLOSURE/CRAWLSPACE/SUBGRADE CRAWLSPACE BUILDINGS

1

BUILDING CONTENTS

WITH CERTIFICATION OF COMPLIANCE OR

ELEVATION CERTIFICATE

2

.48 /.04 .38 /.13

WITHOUT CERTIFICATION OF COMPLIANCE OR

ELEVATION CERTIFICATE

3, 8

1.11 /.09 1.05 /.19

POST-FIRM UNNUMBERED A ZONE

WITHOUT BASEMENT/ENCLOSURE/CRAWLSPACE/SUBGRADE CRAWLSPACE

1,4

ELEVATION DIFFERENCE BUILDING CONTENTS

5

TYPE OF ELEVATION CERTIFICATE

+5 OR MORE .88 /.05 .44 /.12

NO BASE

FLOOD ELEVATION

6

+2 TO +4 1.69 /.06 .74 /.13

+1 2.76 /.14 1.52 /.22

0 OR BELOW *** ***

+2 OR MORE .75 /.04 .38 /.12

WITH BASE

FLOOD ELEVATION

7

0 TO +1 1.50 /.06 1.06 /.14

-1 5.90 /.18 2.70 /.33

-2 OR BELOW *** ***

NO ELEVATION CERTIFICATE

8

7.90 /1.26 3.33 /.80 NO ELEVATION CERTIFICATE

1 Zones A, AO, or AH buildings with basement/enclosure/crawlspace/subgrade crawlspace – follow Submit-for-Rate procedures. Pre-FIRM

buildings in AO or AH Zones with basement/enclosure/crawlspace/subgrade crawlspace at or above the BFE or Base Flood Depth are to

use the “With Certification of Compliance or Elevation Certificate” rates and would not have to follow Submit-for-Rate procedures.

2 “With Certification of Compliance or Elevation Certificate” rates are to be used when the Elevation Certificate shows that the

lowest floor elevation used for rating is equal to or greater than the community’s elevation requirement, or when there is a Letter of

Compliance. This rule applies to all building types, including buildings with basement/enclosure/crawlspace/subgrade crawlspace.

3 “Without Certification of Compliance or Elevation Certificate” rates are to be used only on Post-FIRM buildings when the Elevation

Certificate shows that the lowest floor elevation is less than the community’s elevation requirement.

4 Pre-FIRM buildings with basement/enclosure/crawlspace/subgrade crawlspace may use this table if the rates are more

favorable to the insured.

5 For elevation-rated policies, when contents are located 1 floor or more above the lowest floor used for rating, use .35/.12.

6 NO BASE FLOOD ELEVATION: Elevation difference is the measured distance between the lowest floor of the building and the highest

adjacent grade next to the building.

7 WITH BASE FLOOD ELEVATION: Elevation difference is the measured distance between the lowest floor of the building and the BFE

provided by the community or registered professional engineer, surveyor, or architect.

8 For policies with effective dates on or after October 1, 2011, the No Elevation Certificate rates apply only to renewals and transfers.

***SUBMIT FOR RATING

CONDO 12 OctOber 1, 2011

TABLE 3C. RCBAP HIGH-RISE CONDOMINIUM RATES

ANNUAL RATES PER $100 OF COVERAGE (Basic/Additional)

AR AND AR DUAL ZONES

BUILDING – PRE-FIRM

1,2

AND POST-FIRM

3

NOT ELEVATION-RATED

BUILDING TYPE RATES

No Basement/Enclosure 1.17 /.05

With Basement 1.42 /.07

With Enclosure 1.23 /.05

Elevated on Crawlspace 1.17 /.05

Non-Elevated with Subgrade Crawlspace 1.17 /.05

CONTENTS – PRE-FIRM

1,2

AND POST-FIRM

3

NOT ELEVATION-RATED

CONTENTS LOCATION RATES

Basement/Subgrade Crawlspace and above

1.77 /.65

Enclosure/Crawlspace and above 1.77 /.75

Lowest floor only – above ground level

1.39 /.69

Lowest floor above ground level and higher floors

1.39 /.37

Above ground level more than 1 full floor

.38 /.13

BUILDING – PRE-FIRM AND POST-FIRM ELEVATION-RATED

ELEVATION

DIFFERENCE

3 OR MORE FLOORS

NO BASEMENT/ENCLOSURE/CRAWLSPACE

4

3 OR MORE FLOORS

WITH BASEMENT/ENCLOSURE/CRAWLSPACE

4

+4 .33 /.03 .33 /.03

+3 .35 /.03 .34 /.03

+2 .45 /.03 .40 /.03

+1 .81 /.04 .56 /.04

0 1.17 /.05 1.44 /.05

-1

5

SEE FOOTNOTE

CONTENTS – PRE-FIRM AND POST-FIRM ELEVATION-RATED

ELEVATION

DIFFERENCE

LOWEST FLOOR ONLY –

ABOVE GROUND LEVEL (NO

BASEMENT/ENCLOSURE/

CRAWLSPACE

4

)

LOWEST FLOOR ABOVE

GROUND LEVEL AND HIGHER

(NO BASEMENT/ENCLOSURE/

CRAWLSPACE

4

)

BASEMENT/ENCLOSURE/

CRAWLSPACE

4

AND ABOVE

ABOVE GROUND LEVEL –

MORE THAN 1

FULL FLOOR

+4 .38 /.12 .38 /.12 .38 /.12 .35 /.12

+3 .38 /.12 .38 /.12 .38 /.12 .35 /.12

+2 .38 /.12 .38 /.12 .38 /.12 .35 /.12

+1 .53 /.12 .38 /.12 .38 /.12 .35 /.12

0 1.16 /.12 .68 /.12 .45 /.12 .35 /.12

-1

5

SEE FOOTNOTE

1 Pre-FIRM construction refers to a building that has a start of construction date or substantial improvement date on or before

12/31/74, or before the effective date of the initial FIRM. If FIRM zone is unknown, use rates for zones A, AE, AO, AH, D.

2 Base deductible is $2,000.

3 Base deductible is $1,000.

4 Includes subgrade crawlspace.

5 Use Pre-FIRM Not Elevation-Rated AR and AR Dual Zones Rate Table above.

CONDO 13 OctOber 1, 2011

TABLE 3D. RCBAP HIGH-RISE CONDOMINIUM RATES

ANNUAL RATES PER $100 OF COVERAGE (Basic/Additional)

REGULAR PROGRAM — 1975–1981

1

POST-FIRM CONSTRUCTION

2

FIRM ZONES V1–V30, VE — BUILDING RATES

ELEVATION OF LOWEST FLOOR ABOVE

OR BELOW THE BFE

BUILDING TYPE

3 OR MORE FLOORS NO BASEMENT/

ENCLOSURE/CRAWLSPACE

3

3 OR MORE FLOORS WITH BASEMENT/

ENCLOSURE/CRAWLSPACE

3

0

4

3.30 /.18 3.15 /.18

-1

5

9.79 /.71 5.15 /.53

-2 *** ***

1975–1981 POST-FIRM CONSTRUCTION

FIRM ZONES V1–V30, VE — CONTENTS RATES

ELEVATION OF

LOWEST FLOOR

ABOVE OR

BELOW THE BFE

CONTENTS LOCATION

LOWEST FLOOR ONLY −

ABOVE GROUND LEVEL

(NO BASEMENT/

ENCLOSURE/CRAWLSPACE

3

)

LOWEST FLOOR ABOVE

GROUND LEVEL AND HIGHER

FLOORS (NO BASEMENT/

ENCLOSURE/CRAWLSPACE

3

)

BASEMENT/

ENCLOSURE/

CRAWLSPACE

3

AND ABOVE

ABOVE GROUND

LEVEL − MORE

THAN 1 FULL FLOOR

0

4

4.36 / .92 2.83 / .91 1.60 / .78 .56 / .25

-1

5

9.55 / 5.81 5.63 / 4.42 1.88 / .80 .56 / .25

-2 *** *** *** ***

1 Policies for 1975 through 1981 Post-FIRM and Pre-FIRM buildings in zones VE and V1–V30 will be allowed to use the Post-’81 V-Zone

rate table if the rates are more favorable to the insured. See instructions in the Rating section for V-Zone Optional Rating.

2 For 1981 Post-FIRM construction rating, refer to Tables 5A and 5B.

3 Includes subgrade crawlspace.

4 These rates are to be used if the lowest floor of the building is at or above the BFE.

5 Use Submit-for-Rate procedures if the enclosure below the lowest floor of an elevated building, which is used for rating, is 1 or more

feet below the BFE.

***SUBMIT FOR RATING

REGULAR PROGRAM 1975–1981 POST-FIRM CONSTRUCTION

UNNUMBERED V ZONE — ELEVATED BUILDINGS

SUbMIt FOr ratING

CONDO 14 OctOber 1, 2011

TABLE 4A. RCBAP LOW-RISE CONDOMINIUM RATES

(Including Townhouse/Rowhouse)

ANNUAL RATES PER $100 OF COVERAGE (Basic/Additional)

REGULAR PROGRAM – PRE-FIRM CONSTRUCTION RATES

1

FIRM ZONES: A, A1–A30, AE, AO, AH, D V,

VE

A99, B, C, X

BUILDING CONTENTS BUILDING CONTENTS BUILDING CONTENTS

BUILDING

TYPE

NO BASEMENT/ENCLOSURE .70 /.63 .96 / 1.17 .93 /1.66 1.23 /3.05 .74 /.21 1.20 /.37

WITH BASEMENT .75 /.77 .96 / .98 1.00 /2.88 1.23 /2.87 .81 /.30 1.36 /.46

WITH ENCLOSURE .75 /.92 .96 / 1.01 1.00 /3.14 1.23 /3.13 .81 /.34 1.36 /.54

ELEVATED ON CRAWLSPACE .70 /.63 .96 / 1.17 .93 /1.66 1.23 /3.05 .74 /.21 1.20 /.37

NON-ELEVATED

WITH

SUBGRADE CRAWLSPACE

.70 /.63 .96 / 1.17 .93 /1.66 1.23 /3.05 .74 /.21 1.20 /.37

REGULAR PROGRAM – POST-FIRM CONSTRUCTION RATES

FIRM ZONES: A99, B, C,

X

D

BUILDING CONTENTS BUILDING CONTENTS

BUILDING TYPE

NO BASEMENT/ENCLOSURE .74 /.21 1.20 /.37 1.12 /.39 1.11 /.60

WITH BASEMENT .81 /.30 1.36 /.46 *** ***

WITH ENCLOSURE .81 /.34 1.36 /.54 *** ***

ELEVATED ON CRAWLSPACE .74 /.21 1.20 /.37 1.12 /.39 1.11 /.60

NON-ELEVATED WITH

SUBGRADE CRAWLSPACE

.74 /.21 1.20 /.37 1.12 /.39 1.11 /.60

FIRM ZONES:

AO, AH (NO BASEMENT/ENCLOSURE/CRAWLSPACE BUILDINGS ONLY

2

)

BUILDING CONTENTS

WITH CERTIFICATION OF COMPLIANCE OR

ELEVATION CERTIFICATE

3

.24 /.08 .38 /.13

WITHOUT CERTIFICATION OF COMPLIANCE OR

ELEVATION CERTIFICATE

4, 5

1.04 /.21 1.05 /.19

1 Pre-FIRM construction refers to a building that has a start of construction date or substantial improvement date on or before 12/31/74,

or before the effective date of the initial FIRM. If FIRM zone is unknown, use rates for zones A, AE, AO, AH, D.

2 Zones AO, AH Buildings with basement/enclosure/crawlspace/subgrade crawlspace: follow Submit-for-Rate procedures. Pre-FIRM

buildings in AO or AH Zones with basement/enclosure/crawlspace/subgrade crawlspace at or above the BFE or Base Flood Depth are to

use the “With Certification of Compliance or Elevation Certificate” rates and would not have to follow Submit-for-Rate procedures.

3 “With Certification of Compliance or Elevation Certificate” rates are to be used when the Elevation Certificate shows that the

lowest floor elevation used for rating is equal to or greater than the community’s elevation requirement, or when there is a Letter of

Compliance. This rule applies to all building types, including buildings with basement/enclosure/crawlspace/subgrade crawlspace.

4 “Without Certification of Compliance or Elevation Certificate” rates are to be used only on Post-FIRM buildings when the Elevation

Certificate shows that the lowest floor elevation is less than the community’s elevation requirement.

5 For transfers and renewals of existing business where there is no Letter of Compliance or Elevation Certificate in the company’s file,

these rates can continue to be used. For new business effective on or after October 1, 2011, the provisions of footnote 4 apply.

***SUBMIT FOR RATING

CONDO 15 OctOber 1, 2011

TABLE 4B. RCBAP LOW-RISE CONDOMINIUM RATES

(Including Townhouse/Rowhouse)

ANNUAL RATES PER $100 OF COVERAGE (Basic/Additional)

REGULAR PROGRAM – POST-FIRM CONSTRUCTION

FIRM ZONES A1–A30, AE — BUILDING RATES

ELEVATION

OF

LOWEST

FLOOR

ABOVE OR

BELOW THE BFE

1

BUILDING TYPE

1 FLOOR NO BASEMENT/

ENCLOSURE/CRAWLSPACE

2

MORE THAN 1 FLOOR NO

BASEMENT/ENCLOSURE

CRAWLSPACE

2

MORE THAN 1 FLOOR WITH

BASEMENT/ENCLOSURE/

CRAWLSPACE

2

+4 .20 /.08 .18 /.08 .20 /.08

+3 .22 /.08 .20 /.08 .20 /.08

+2 .30 /.08 .22 /.08 .22 /.08

+1 .54 /.09 .32 /.08 .26 /.09

0 1.36 /.11 .88 /.11 .69 /.10

-1

3

3.47 /.84 2.61 /.70 1.52 /.60

-2 *** *** ***

FIRM ZONES A1–A30, AE — CONTENTS RATES

ELEVATION

OF

LOWEST

FLOOR

ABOVE OR

BELOW THE BFE

1

CONTENTS LOCATION

LOWEST FLOOR ONLY –

ABOVE GROUND LEVEL

(NO BASEMENT/ENCLOSURE/

CRAWLSPACE

2

)

LOWEST FLOOR ABOVE

GROUND LEVEL AND HIGHER

FLOORS (NO BASEMENT/

ENCLOSURE/CRAWLSPACE

2

)

BASEMENT/

ENCLOSURE/

CRAWLSPACE

2

AND ABOVE

ABOVE GROUND

LEVEL – MORE THAN 1

FULL FLOOR

+4 .38 /.12 .38 /.12 .38 /.12 .35 /.12

+3 .38 /.12 .38 /.12 .38 /.12 .35 /.12

+2 .38 /.12 .38 /.12 .38 /.12 .35 /.12

+1 .53 /.12 .38 /.12 .38 /.12 .35 /.12

0 1.16 /.12 .68 /.12 .45 /.12 .35 /.12

-1

3

3.10 /.63 1.90 /.42 .72 /.15 .35 /.12

-2 *** *** *** .35 /.12

1 If the Lowest Floor is -1 or lower because of an attached garage and the building is described and rated as a single-family dwelling, see

the Lowest Floor Determination subsection in the Lowest Floor Guide section of this manual or contact the insurer for rating guidance;

rate may be lower.

2 Includes subgrade crawlspace.

3 Use Submit-for-Rate procedures if either the enclosure below the lowest floor of an elevated building or the crawlspace (under-floor

space) that has its interior floor within 2 feet below grade on all sides, which is used for rating, is 1 or more feet below the BFE.

***SUBMIT FOR RATING

CONDO 16 OctOber 1, 2011

TABLE 4C. RCBAP LOW-RISE CONDOMINIUM RATES

(Including Townhouse/Rowhouse)

ANNUAL RATES PER $100 OF COVERAGE (Basic/Additional)

UNNUMBERED ZONE A – WITHOUT BASEMENT/ENCLOSURE/CRAWLSPACE

1,2

ELEVATION DIFFERENCE BUILDING CONTENTS

3

TYPE OF ELEVATION CERTIFICATE

+5 OR MORE .41 /.09 .44 /.12

NO BASE FLOOD ELEVATION

4

+2 TO +4 1.11 /.12 .74 /.13

+1 2.25 /.57 1.52 /.22

0 OR BELOW *** ***

+2 OR MORE .37 /.08 .38 /.12

WITH BASE FLOOD ELEVATION

5

0 TO +1 .87 /.12 1.06 /.14

-1 3.30 /.83 2.70 /.33

-2 OR BELOW *** ***

NO ELEVATION CERTIFICATE

6

4.16 /1.44 3.33 /.80 NO ELEVATION CERTIFICATE

1 Zone A buildings with basement/enclosure without proper openings/crawlspace without proper openings/subgrade crawlspace: follow

Submit-for-Rate procedures in the Rating section.

2 Pre-FIRM buildings with basement/enclosure/crawlspace/subgrade crawlspace may use this table if the rates are more favorable to the

insured. For optional rating, follow the Submit-for-Rate procedures in the Rating section.

3 For elevation-rated policies, when contents are located 1 floor or more above lowest floor used for rating, use .35/.12.

4 NO BASE FLOOD ELEVATION: Elevation difference is the measured distance between the lowest floor of the building

and the highest adjacent grade next to the building.

5 WITH BASE FLOOD ELEVATION: Elevation difference is the measured distance between the lowest floor of the building and the BFE

provided by the community or registered professional engineer, surveyor, or architect.

6 For policies with effective dates on or after October 1, 2011, the No Elevation Certificate rates apply only to renewals and transfers.

***SUBMIT FOR RATING

CONDO 17 OctOber 1, 2011

TABLE 4D. RCBAP LOW-RISE CONDOMINIUM RATES

(Including Townhouse/Rowhouse)

ANNUAL RATES PER $100 OF COVERAGE (Basic/Additional)

AR AND AR DUAL ZONES

REGULAR PROGRAM – PRE-FIRM

1,2

AND POST-FIRM

3

NOT ELEVATION-RATED RATES

BUILDING

TYPE BUILDING CONTENTS

NO BASEMENT/ENCLOSURE .74 /.21 1.20 /.37

WITH BASEMENT .81 /.30 1.36 /.46

WITH ENCLOSURE .81 /.34 1.36 /.54

ELEVATED ON CRAWLSPACE .74 /.21 1.20 /.37

NON-ELEVATED

WITH SUBGRADE

CRAWLSPACE

.74 /.21 1.20 /.37

REGULAR PROGRAM – PRE-FIRM AND POST-FIRM ELEVATION-RATED RATES

BUILDING RATES

ELEVATION OF

LOWEST

FLOOR ABOVE

OR

BELOW

THE BFE

BUILDING

TYPE

1 FLOOR NO BASEMENT/

ENCLOSURE/CRAWLSPACE

4

MORE THAN 1 FLOOR NO

BASEMENT/ENCLOSURE/

CRAWLSPACE

4

MORE THAN 1 FLOOR WITH

BASEMENT/ENCLOSURE/

CRAWLSPACE

4

+4 .20 /.08 .18 /.08 .20 /.08

+3 .22 /.08 .20 /.08 .20 /.08

+2 .30 /.08 .22 /.08 .22 /.08

+1 .54 /.09 .32 /.08 .26 /.09

0 .74 /.21 .88 /.11 .69 /.10

-1

5

SEE FOOTNOTE

CONTENTS RATES

ELEVATION OF LOWEST

FLOOR ABOVE OR

BELOW THE BFE

CONTENTS LOCATION

LOWEST FLOOR ONLY

– ABOVE GROUND

LEVEL (NO BASEMENT/

ENCLOSURE/

CRAWLSPACE

4

)

LOWEST FLOOR ABOVE

GROUND LEVEL AND

HIGHER FLOORS (NO

BASEMENT/ENCLOSURE/

CRAWLSPACE

4

)

BASEMENT/ENCLOSURE/

CRAWLSPACE

4

AND

ABOVE

ABOVE GROUND

LEVEL – MORE THAN 1

FULL FLOOR

+4 .38 /.12 .38 /.12 .38 /.12 .35 /.12

+3 .38 /.12 .38 /.12 .38 /.12 .35 /.12

+2 .38 /.12 .38 /.12 .38 /.12 .35 /.12

+1 .53 /.12 .38 /.12 .38 /.12 .35 /.12

0 1.16 /.12 .68 /.12 .45 /.12 .35 /.12

-1

5

SEE FOOTNOTE

1 Pre-FIRM construction refers to a building that has a start of construction date or substantial improvement date on or before 12/31/74,

or before the effective date of the initial FIRM.

2 Standard deductible is $2,000.

3 Standard deductible is $1,000.

4 Includes subgrade crawlspace.

5 Use Pre-FIRM Not Elevation-Rated AR and AR Dual Zones Rate Table above.

CONDO 18 OctOber 1, 2011

TABLE 4E. RCBAP LOW-RISE CONDOMINIUM RATES

(Including Townhouse/Rowhouse)

ANNUAL RATES PER $100 OF COVERAGE (Basic/Additional)

REGULAR PROGRAM — 1975–1981

1

POST-FIRM CONSTRUCTION

2

FIRM ZONES V1–V30, VE — BUILDING RATES

ELEVATION OF LOWEST

FLOOR ABOVE OR

BELOW THE BFE

BUILDING TYPE

1 FLOOR NO BASEMENT/

ENCLOSURE/CRAWLSPACE

3

MORE THAN 1 FLOOR NO

BASEMENT/ENCLOSURE/

CRAWLSPACE

3

MORE THAN 1 FLOOR WITH

BASEMENT/ENCLOSURE/

CRAWLSPACE

3

0

4

3.01 / .56 2.41 / .56 2.08 / .56

-1

5

6.58 / 3.43 6.02 / 3.43 4.30 / 3.12

-2 *** *** ***

REGULAR PROGRAM — 1975–1981

1

POST-FIRM CONSTRUCTION

2

FIRM ZONES V1–V30, VE — CONTENTS RATES

ELEVATION OF

LOWEST

FLOOR ABOVE

OR

BELOW

THE BFE

CONTENTS

LOCATION

LOWEST FLOOR ONLY –

ABOVE GROUND LEVEL (NO

BASEMENT/ENCLOSURE/

CRAWLSPACE

3

)

LOWEST FLOOR ABOVE

GROUND LEVEL AND HIGHER

FLOORS (NO BASEMENT/

ENCLOSURE/CRAWLSPACE

3

)

BASEMENT/

ENCLOSURE/

CRAWLSPACE

3

AND ABOVE

ABOVE GROUND

LEVEL – MORE THAN

1 FULL FLOOR

0

4

4.36 / .92 2.83 / .91 1.60 / .78 .56 / .25

-1

5

9.55 / 5.81 5.63 / 4.42 1.88 / .80 .56 / .25

-2 *** *** *** .56 / .25

1 Policies for 1975 through 1981 Post-FIRM and Pre-FIRM buildings in zones VE and V1–V30 will be allowed to use the Post-’81 V Zone

rate table if the rates are more favorable to the insured. See instructions in the Rating section for V-Zone Optional Rating.

2 For 1981 Post-FIRM construction rating, refer to Tables 5A and 5B.

3 Includes subgrade crawlspace.

4 These rates are to be used if the lowest floor of the building is at or above the BFE.

5 Use Submit-for-Rate procedures if the enclosure below the lowest floor of an elevated building, which is used for rating, is 1 or more

feet below the BFE.

***SUBMIT FOR RATING

REGULAR PROGRAM — 1975–1981 POST-FIRM CONSTRUCTION

UNNUMBERED V ZONE — ELEVATED BUILDINGS

SUBMIT FOR RATING

CONDO 19 OctOber 1, 2011

TABLE 5A. RCBAP HIGH-RISE AND LOW-RISE CONDOMINIUM RATES

(Including Townhouse/Rowhouse)

ANNUAL RATES PER $100 OF COVERAGE

1981 POST-FIRM V1–V30, VE ZONE RATES

1

ELEVATED BUILDINGS FREE OF OBSTRUCTION

2

BELOW THE

BEAM SUPPORTING THE BUILDING’S LOWEST FLOOR

ELEVATION OF THE BOTTOM OF THE FLOOR

BEAM OF THE LOWEST FLOOR ABOVE OR

BELOW THE BFE ADJUSTED FOR

WAVE HEIGHT AT BUILDING SITE

3

BUILDING RATE CONTENTS RATE

+4 or more .73 .53

+3 .84 .54

+2 1.15 .73

+1 1.67 1.25

0 2.63 2.04

- 1 3.58 2.93

- 2 4.57 4.19

- 3 5.48 5.48

- 4 or lower *** ***

Rates above are only for elevated buildings. Use the Specific Rating Guidelines

for non-elevated buildings.

1 Policies for 1975 through 1981 Post-FIRM and Pre-FIRM buildings in zones VE and V1–V30 will be allowed to use the Post-’81 V-Zone

rate table if the rates are more favorable to the insured. See instructions in the Rating section for V-Zone Optional Rating.

2 Free of Obstruction – The space below the lowest elevated floor must be completely free of obstructions or any attachment to the

building, or may have:

(1) Insect screening, provided that no additional supports are required for the screening; or

(2) Wooden or plastic lattice with at least 40% of its area open and made of material no thicker than ½ inch; or

(3) Wooden or plastic slats or shutters with at least 40% of their area open and made of material no thicker than 1 inch.

(4) One solid breakaway wall or a garage door, with the remaining sides of the enclosure constructed of insect screening, wooden or

plastic lattice, slats, or shutters.

Any of these systems must be designed and installed to collapse under stress without jeopardizing the structural support of the

building, so that the impact on the building of abnormally high tides or wind-driven water is minimized. Any machinery or equipment

below the lowest elevated floor must be at or above the BFE.

3 Wave height adjustment is not required in those cases where the Flood Insurance Rate Map indicates that the map

includes wave height.

***SUBMIT FOR RATING

CONDO 20 OctOber 1, 2011

TABLE 5B. RCBAP HIGH-RISE AND LOW-RISE CONDOMINIUM RATES

(Including Townhouse/Rowhouse)

ANNUAL RATES PER $100 OF COVERAGE

1981 POST-FIRM V1–V30, VE ZONE RATES

1,2

ELEVATED BUILDINGS WITH OBSTRUCTION

3

BELOW THE

BEAM SUPPORTING THE BUILDING’S LOWEST FLOOR

ELEVATION OF THE BOTTOM OF THE FLOOR

BEAM OF THE LOWEST FLOOR ABOVE OR

BELOW THE BFE ADJUSTED FOR WAVE

HEIGHT AT BUILDING SITE

4

BUILDING RATE CONTENTS RATE

+4 or more 1.31 .67

+3 1.40 .68

+2 1.73 .86

+1 2.17 1.38

0 3.29 2.20

-1

5

4.12 3.02

-2

5

5.14 4.31

-3

5

6.03 5.62

- 4 or lower

5

*** ***

1 Policies for 1975 through 1981 Post-FIRM and Pre-FIRM buildings in zones VE and V1–V30 will be allowed to use the Post-’81 V-Zone

rate table if the rates are more favorable to the insured. See instructions in the Rating section for V-Zone Optional Rating.

2 Rates provided are only for elevated buildings, except those elevated on solid perimeter foundation walls. For buildings elevated on solid

perimeter foundation walls, and for non-elevated buildings, use the Specific Rating Guidelines document.

3 With Obstruction – The space below has an area of less than 300 square feet with breakaway solid walls or contains equipment below

the BFE. If the space below has an area of 300 square feet or more, or if any portion of the space below the elevated floor is enclosed

with non-breakaway walls, submit for rating. If the enclosure is at or above the BFE, use the “Free of Obstruction” rate table on the

preceding page. The elevation of the bottom enclosure floor is the lowest floor for rating (LFE). See the Rating section for details.

4 Wave height adjustment is not required in those cases where the Flood Insurance Rate Map indicates that the map includes

wave height.

5 For buildings with obstruction, use Submit-for-Rate procedures if the enclosure below the lowest elevated floor of an elevated building,

which is used for rating, is 1 or more feet below the BFE.

***SUBMIT FOR RATING

TABLE 5C. RCBAP HIGH-RISE AND LOW-RISE BUILDING RATES

(Including Townhouse/Rowhouse)

ANNUAL RATES PER $100 OF COVERAGE

1981 POST-FIRM V-ZONE RATES

SUBMIT FOR RATING

CONDO 21 May 1, 2011

TABLE 6. RCBAP HIGH-RISE AND LOW-RISE CONDOMINIUM RATES

(Including Townhouse/Rowhouse)

INCREASED COST OF COMPLIANCE (ICC) COVERAGE

All Except Submit-for-Rate Policies

1

Premiums for $30,000 ICC Coverage

FIRM

2

ZONE PREMIUM

POST-FIRM

A, AE, A1–A30, AO, AH $ 5

AR, AR DUAL ZONES $ 5

Post-’81 V1–V30, VE $ 18

’75–’81 V1–V30, VE $ 30

A99, B, C, X, D $ 5

PRE-FIRM

A, AE, A1–A30, AO, AH $ 70

AR, AR DUAL ZONES $ 5

V, VE, V1–V30 $ 70

A99, B, C, X, D $ 5

1 Use the ICC Premium Table contained in the Specific Rating Guidelines.

2 Elevation-rated Pre-FIRM buildings should use Post-FIRM ICC Premiums.

CONDO 22 May 1, 2011

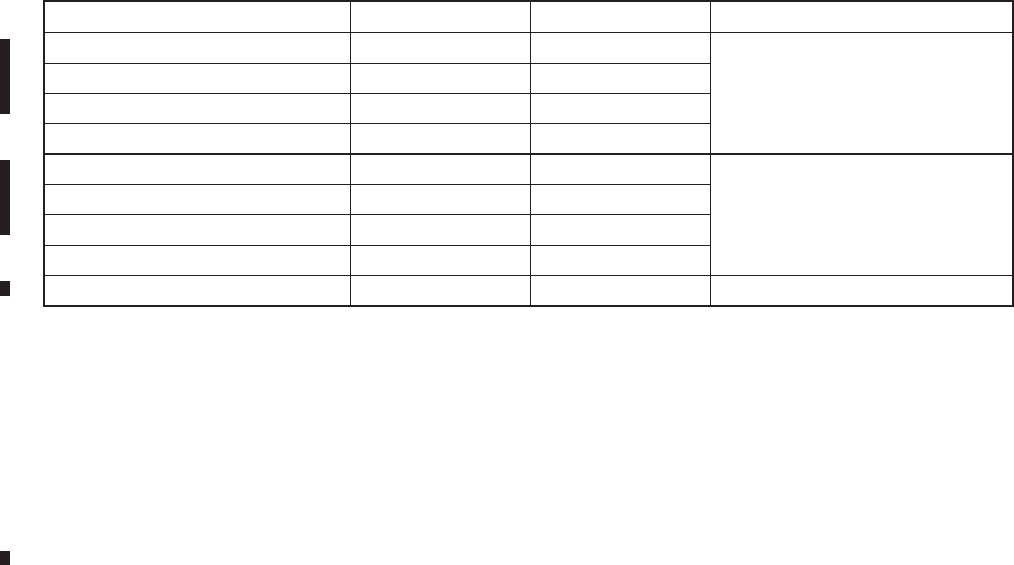

TABLE 7. RCBAP DEDUCTIBLE FACTORS – ALL ZONES

CATEGORY

1

–

LOW-RISE

CONDOMINIUM

BUILDING-AND-CONTENTS

POLICIES

DEDUCTIBLE OPTIONS

DEDUCTIBLE FACTOR

SINGLE FAMILY 2–4 UNITS 5 OR MORE UNITS

BUILDING/CONTENTS

POST-FIRM

$1,000 DED.

PRE-FIRM

$2,000 DED.

POST-FIRM

$1,000 DED.

PRE-FIRM

$2,000 DED.

POST-FIRM

$1,000 DED.

PRE-FIRM

$2,000 DED.

$1,000/$1,000 1.000 1.100 1.000 1.050 1.000 1.050

$2,000/$2,000 .925 1.000 .960 1.000 .975 1.000

$3,000/$3,000 .850 .925 .930 .965 .950 .975

$4,000/$4,000 .775 .850 .900 .930 .925 .950

$5,000/$5,000 .750 .810 .880 .910 .915 .930

$10,000/$10,000 .635 .675 .735 .765 .840 .860

$25,000/$25,000 .535 .570 .635 .665 .740 .760

CATEGORY 2 – LOW-RISE CONDOMINIUM BUILDING-ONLY POLICIES

DEDUCTIBLE OPTIONS

DEDUCTIBLE FACTOR

SINGLE FAMILY 2–4 UNITS 5 OR MORE UNITS

POST-FIRM

$1,000 DED.

PRE-FIRM

$2,000 DED.

POST-FIRM

$1,000 DED.

PRE-FIRM

$2,000 DED.

POST-FIRM

$1,000 DED.

PRE-FIRM

$2,000 DED.

$1,000 1.000 1.100 1.000 1.075 1.000 1.050

$2,000 .925 1.000 .950 1.000 .970 1.000

$3,000 .865 .935 .910 .960 .940 .970

$4,000 .815 .880 .870 .920 .920 .950

$5,000 .765 .830 .835 .880 .900 .930

$10,000 .630 .685 .650 .690 .830 .860

$25,000 .530 .580 .550 .585 .730 .760

CATEGORY 3 – HIGH-RISE CONDOMINIUM POLICIES, Building-and-Contents

and

Building-Only

The deductible factors are multipliers, and total deductible amounts are subject

to a maximum dollar discount per annual premium.

BUILDING/CONTENTS BUILDING

ONLY

DEDUCTIBLE

OPTIONS

DEDUCTIBLE FACTOR

MAXIMUM

DISCOUNT

POST-FIRM

$1,000

DEDUCTIBLE

PRE-FIRM

$2,000

DEDUCTIBLE

$1,000/ $1,000 1.000 1.050 N/A

$2,000/ $2,000 .980 1.000 $56

$3,000/ $3,000 .960 .980 $111

$4,000/ $4,000 .940 .960 $166

$5,000/ $5,000 .920 .940 $221

$10,000/ $10,000 .840 .860 $476

$25,000/ $25,000 .740 .760 $1,001

DEDUCTIBLE

OPTIONS

DEDUCTIBLE FACTOR

MAXIMUM

DISCOUNT

POST-FIRM

$1,000

DEDUCTIBLE

PRE-FIRM

$2,000

DEDUCTIBLE

$1,000 1.000 1.050 N/A

$2,000 .970 1.000 $55

$3,000 .940 .970 $110

$4,000 .920 .950 $165

$5,000 .900 .930 $220

$10,000 .830 .860 $475

$25,000 .730 .760 $1,000

CONDO 23 May 1, 2011

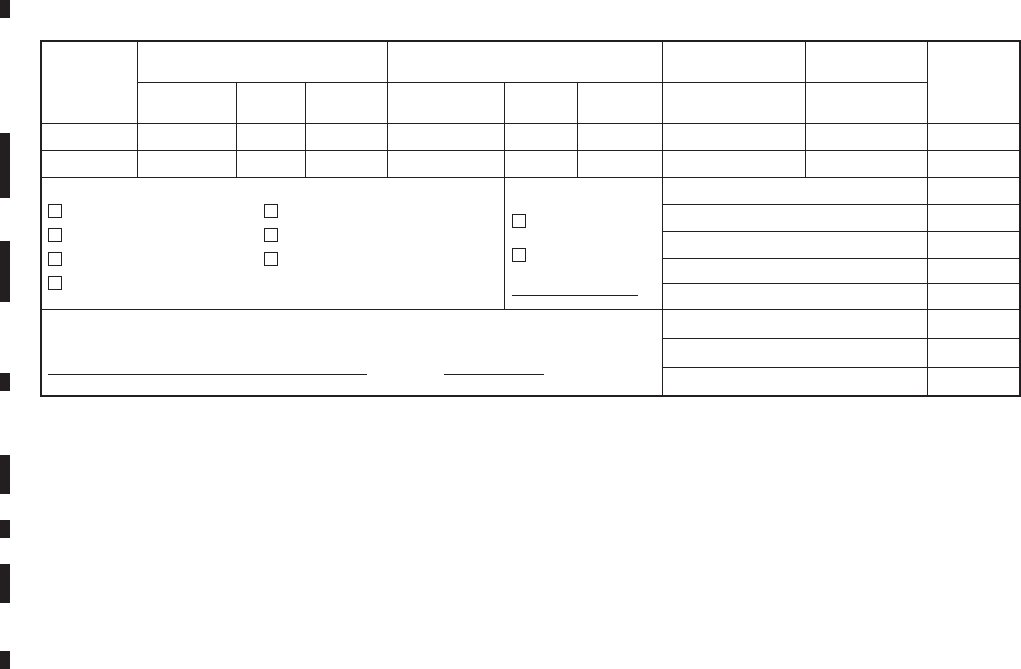

X. CONDOMINIUM RATING EXAMPLES

TABLE OF CONTENTS

eXaMPLe PaGe

Example 1 Pre-FIRM, Low-rise, with Enclosure, Coinsurance Penalty, Zone A . . . . . . . . . . . CONDO 24

Example 2 Pre-FIRM, Low-rise, No Basement/Enclosure, Zone AE . . . . . . . . . . . . . . . . . . . CONDO 25

Example 3 Post-FIRM, Low-rise, Coinsurance Penalty, Zone AE . . . . . . . . . . . . . . . . . . . . . CONDO 26

Example 4 Post-FIRM, Low-rise, Standard Deductible, Zone AE . . . . . . . . . . . . . . . . . . . . . CONDO 27

Example 5 Pre-FIRM, High-rise, Standard Deductible, Coinsurance Penalty, Zone A . . . . . . CONDO 28

Example 6 Pre-FIRM, High-rise, Basement, Maximum Discount, Zone AE . . . . . . . . . . . . . . CONDO 29

Example 7 Post-FIRM, High-rise, Standard Deductible, Zone AE . . . . . . . . . . . . . . . . . . . . CONDO 30

Example 8 Pre-FIRM, High-rise, Enclosure, Maximum Discount,

Coinsurance Penalty, Zone AE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . CONDO 31

CONDO 24 OctOber 1, 2011

CONDOMINIUM RATING EXAMPLE 1

PRE-FIRM, LOW-RISE, WITH ENCLOSURE, COINSURANCE PENALTY, ZONE A

REGULAR PROGRAM:

• Building Coverage: $140,000

• Contents Coverage: $100,000

• Condominium Type: Low-rise

• Flood Zone: A

• Occupancy: Other Residential

• Number of Units: 6

• Date of Construction: Pre-FIRM

• Building Type: 3 Floors Including Enclosure

• Deductible: $2,000/$2,000

• Deductible Factor: 1.000

• Replacement Cost: $600,000

• Elevation Difference: N/A

• 80% Coinsurance Amount: $480,000

• ICC Premium: $70 ($30,000 Coverage)

• CRS Rating: N/A

• CRS Discount: N/A

DETERMINED RATES:

Building: .75/.92 Contents: .96/1.01

BASIC LIMITS

ADDITIONAL LIMITS

(REGULAR PROGRAM ONLY) DEDUCTIBLE

BASIC AND

ADDITIONAL

TOTAL

PREMIUMCOVERAGE

AMOUNT OF

INSURANCE RATE

ANNUAL

PREMIUM

AMOUNT OF

INSURANCE RATE

ANNUAL

PREMIUM

PREM. REDUCTION/

INCREASE

TOTAL AMOUNT

OF INSURANCE

BUILDING

$140,000 .75 $1,050 $0 .92 $0 $0 $140,000 $1,050

CONTENTS

$ 25,000 .96 $ 240 $75,000 1.01 $758 $0 $100,000 $ 998

RATE TYPE (ONE BUILDING PER POLICY — BLANKET COVERAGE NOT PERMITTED):

MANUAL SUBMIT FOR RATING

ALTERNATIVE V-ZONE RISK RATING FORM

PROVISIONAL RATING LEASED FEDERAL PROPERTY

MORTGAGE PORTFOLIO PROTECTION PROGRAM

PAYMENT OPTION:

CREDIT CARD

OTHER:

ANNUAL SUBTOTAL $2,048

ICC PREMIUM $ 70

SUBTOTAL $2,118

CRS PREMIUM DISCOUNT

% —

SUBTOTAL $2,118

THE ABOVE STATEMENTS ARE CORRECT TO THE BEST OF MY KNOWLEDGE. I UNDERSTAND THAT ANY FALSE

STATEMENTS MAY BE PUNISHABLE BY FINE OR IMPRISONMENT UNDER APPLICABLE FEDERAL LAW.

SIGNATURE OF INSURANCE AGENT/BROKER

DATE (MM/DD/YY)

PROBATION SURCHARGE —

FEDERAL POLICY FEE

$ 200

TOTAL PREPAID AMOUNT

$2,318

PREMIUM CALCULATION:

1. Multiply Rate × $100 of Coverage: Building: $1,050 / Contents: $998

2. Apply Deductible Factor: Building: 1.000 × $1,050 = $1,050 / Contents: 1.000 × $998 = $998

3. Premium Reduction: Building: $0 / Contents: $0

4. Subtotal: $2,048

5. Add ICC Premium: $70

6. Subtract CRS Discount: N/A

7. Subtotal: $2,118

8. Probation Surcharge: N/A

9. Add Federal Policy Fee: $200

10. Total Prepaid Amount: $2,318

CLAIMS ADJUSTMENT WITH COINSURANCE PROVISION:

Claim Payment is determined as follows:

(Insurance Carried) $140,000

(Insurance Required) $480,000

× (Amount of Loss) $100,000 = (Limit of Recovery) $29,167 – Less Deductible

(Coinsurance Penalty applies because minimum insurance amount of $480,000 was not met.)

CONDO 25 OctOber 1, 2011

CONDOMINIUM RATING EXAMPLE 2

PRE-FIRM, LOW-RISE, NO BASEMENT/ENCLOSURE, ZONE AE

REGULAR PROGRAM:

• Building Coverage: $480,000

• Contents Coverage: $50,000

• Condominium Type: Low-rise

• Flood Zone: AE

• Occupancy: Other Residential

• Number of Units: 6

• Date of Construction: Pre-FIRM

• Building Type: 1 Floor, No Basement

• Deductible: $2,000/$2,000

• Deductible Factor: 1.000

• Replacement Cost: $600,000

• Elevation Difference: N/A

• 80% Coinsurance Amount: $480,000

• ICC Premium: $70 ($30,000 Coverage)

• CRS Rating: N/A

• CRS Discount: N/A

DETERMINED RATES:

Building: .70/.63 Contents: .96/1.17

BASIC LIMITS

ADDITIONAL LIMITS

(REGULAR PROGRAM ONLY) DEDUCTIBLE

BASIC AND

ADDITIONAL

TOTAL

PREMIUMCOVERAGE

AMOUNT OF

INSURANCE RATE

ANNUAL

PREMIUM

AMOUNT OF

INSURANCE RATE

ANNUAL

PREMIUM

PREM. REDUCTION/

INCREASE

TOTAL AMOUNT

OF INSURANCE

BUILDING

$360,000 .70 $2,520 $120,000 .63 $756 $0 $480,000 $3,276

CONTENTS

$ 25,000 .96 $ 240 $ 25,000 1.17 $293 $0 $ 50,000 $ 533

RATE TYPE (ONE BUILDING PER POLICY — BLANKET COVERAGE NOT PERMITTED):

MANUAL SUBMIT FOR RATING

ALTERNATIVE V-ZONE RISK RATING FORM

PROVISIONAL RATING LEASED FEDERAL PROPERTY

MORTGAGE PORTFOLIO PROTECTION PROGRAM

PAYMENT OPTION:

CREDIT CARD

OTHER:

ANNUAL SUBTOTAL $3,809

ICC PREMIUM $ 70

SUBTOTAL $3,879

CRS PREMIUM DISCOUNT

% —

SUBTOTAL $3,879

THE ABOVE STATEMENTS ARE CORRECT TO THE BEST OF MY KNOWLEDGE. I UNDERSTAND THAT ANY FALSE

STATEMENTS MAY BE PUNISHABLE BY FINE OR IMPRISONMENT UNDER APPLICABLE FEDERAL LAW.

SIGNATURE OF INSURANCE AGENT/BROKER

DATE (MM/DD/YY)

PROBATION SURCHARGE —

FEDERAL POLICY FEE

$ 200

TOTAL PREPAID AMOUNT

$4,079

PREMIUM CALCULATION:

1. Multiply Rate × $100 of Coverage: Building: $3,276 / Contents: $533

2. Apply Deductible Factor: Building: 1.00 × $3,276 = $3,276 / Contents: 1.00 × $533 = $533

3. Premium Reduction: Building: $0 / Contents: $0

4. Subtotal: $3,809

5. Add ICC Premium: $70

6. Subtract CRS Discount: N/A

7. Subtotal: $3,879

8. Probation Surcharge: N/A

9. Add Federal Policy Fee: $200

10. Total Prepaid Amount: $4,079

CLAIMS ADJUSTMENT WITH COINSURANCE PROVISION:

Coinsurance Penalty does not apply since minimum insurance amount of 80% was met.

CONDO 26 OctOber 1, 2011

CONDOMINIUM RATING EXAMPLE 3

POST-FIRM, LOW-RISE, COINSURANCE PENALTY, ZONE AE

REGULAR PROGRAM:

• Building Coverage: $750,000

• Contents Coverage: $100,000

• Condominium Type: Low-rise

• Flood Zone: AE

• Occupancy: Other Residential

• Number of Units: 14

• Date of Construction: Post-FIRM

• Building Type: 2 Floors, No Basement/Enclosure

• Deductible: $1,000/$1,000

• Deductible Factor: 1.000

• Replacement Cost: $1,120,000

• Elevation Difference: +1

• 80% Coinsurance Amount: $896,000

• ICC Premium: $5 ($30,000 Coverage)

• CRS Rating: N/A

• CRS Discount: N/A

DETERMINED RATES:

Building: .32/.08 Contents: .38/.12

BASIC LIMITS

ADDITIONAL LIMITS

(REGULAR PROGRAM ONLY) DEDUCTIBLE

BASIC AND

ADDITIONAL

TOTAL

PREMIUMCOVERAGE

AMOUNT OF

INSURANCE RATE

ANNUAL

PREMIUM

AMOUNT OF

INSURANCE RATE

ANNUAL

PREMIUM

PREM. REDUCTION/

INCREASE

TOTAL AMOUNT

OF INSURANCE

BUILDING

$750,000 .32 $2,400 $0 .08 $0 $0 $750,000 $2,400

CONTENTS

$ 25,000 .38 $ 95 $75,000 .12 $90 $0 $100,000 $ 185

RATE TYPE (ONE BUILDING PER POLICY — BLANKET COVERAGE NOT PERMITTED):

MANUAL SUBMIT FOR RATING

ALTERNATIVE V-ZONE RISK RATING FORM

PROVISIONAL RATING LEASED FEDERAL PROPERTY

MORTGAGE PORTFOLIO PROTECTION PROGRAM

PAYMENT OPTION:

CREDIT CARD

OTHER:

ANNUAL SUBTOTAL $2,585

ICC PREMIUM $ 5

SUBTOTAL $2,590

CRS PREMIUM DISCOUNT

% —

SUBTOTAL $2,590

THE ABOVE STATEMENTS ARE CORRECT TO THE BEST OF MY KNOWLEDGE. I UNDERSTAND THAT ANY FALSE

STATEMENTS MAY BE PUNISHABLE BY FINE OR IMPRISONMENT UNDER APPLICABLE FEDERAL LAW.

SIGNATURE OF INSURANCE AGENT/BROKER

DATE (MM/DD/YY)

PROBATION SURCHARGE —

FEDERAL POLICY FEE

$ 440

TOTAL PREPAID AMOUNT

$3,030

PREMIUM CALCULATION:

1. Multiply Rate × $100 of Coverage: Building: $2,400 / Contents: $185

2. Apply Deductible Factor: Building: 1.000 × $2,400 = $2,400 / Contents: 1.000 × $185 = $185

3. Premium Reduction/Increase: Building: $0 / Contents: $0

4. Subtotal: $2,585

5. Add ICC Premium: $5

6. Subtract CRS Discount: N/A

7. Subtotal: $2,590

8. Probation Surcharge: N/A

9. Add Federal Policy Fee: $440

10. Total Prepaid Amount: $3,030

CLAIMS ADJUSTMENT WITH COINSURANCE PROVISION:

Claim Payment is determined as follows:

(Insurance Carried) $750,000

(Insurance Required) $896,000

× (Amount of Loss) $300,000 = (Limit of Recovery) $251,116 – Less Deductible

(Coinsurance Penalty applies because minimum insurance amount of $896,000 was not met.)

CONDO 27 OctOber 1, 2011

CONDOMINIUM RATING EXAMPLE 4

POST-FIRM, LOW-RISE, STANDARD DEDUCTIBLE, ZONE AE

REGULAR PROGRAM:

• Building Coverage: $600,000

• Contents Coverage: $15,000

• Condominium Type: Low-rise

• Flood Zone: AE

• Occupancy: Other Residential

• Number of Units: 6

• Date of Construction: Post-FIRM

• Building Type: 3 Floors, Townhouse, No Basement/Enclosure

• Deductible: $1,000/$1,000

• Deductible Factor: 1.000

• Replacement Cost: $600,000

• Elevation Difference: +2

• 80% Coinsurance Amount: $480,000

• ICC Premium: $5 ($30,000 Coverage)

• CRS Rating: N/A

• CRS Discount: N/A

DETERMINED RATES:

Building: .22/.08 Contents: .38/.12

BASIC LIMITS

ADDITIONAL LIMITS

(REGULAR PROGRAM ONLY) DEDUCTIBLE

BASIC AND

ADDITIONAL

TOTAL

PREMIUMCOVERAGE

AMOUNT OF

INSURANCE RATE

ANNUAL

PREMIUM

AMOUNT OF

INSURANCE RATE

ANNUAL

PREMIUM

PREM. REDUCTION/

INCREASE

TOTAL AMOUNT

OF INSURANCE

BUILDING

$360,000 .22 $792 $240,000 .08 $192 $0 $600,000 $ 984

CONTENTS

$ 15,000 .38 $ 57 $0 .12 $0 $0 $ 15,000 $ 57

RATE TYPE (ONE BUILDING PER POLICY — BLANKET COVERAGE NOT PERMITTED):

MANUAL SUBMIT FOR RATING

ALTERNATIVE V-ZONE RISK RATING FORM

PROVISIONAL RATING LEASED FEDERAL PROPERTY

MORTGAGE PORTFOLIO PROTECTION PROGRAM

PAYMENT OPTION:

CREDIT CARD

OTHER:

ANNUAL SUBTOTAL $1,041

ICC PREMIUM $ 5

SUBTOTAL $1,046

CRS PREMIUM DISCOUNT

% —

SUBTOTAL $1,046

THE ABOVE STATEMENTS ARE CORRECT TO THE BEST OF MY KNOWLEDGE. I UNDERSTAND THAT ANY FALSE

STATEMENTS MAY BE PUNISHABLE BY FINE OR IMPRISONMENT UNDER APPLICABLE FEDERAL LAW.

SIGNATURE OF INSURANCE AGENT/BROKER

DATE (MM/DD/YY)

PROBATION SURCHARGE —

FEDERAL POLICY FEE