Medicare Prescription Drug Benefit Manual

Chapter 13 - Premium and Cost-Sharing Subsidies for

Low-Income Individuals

(Rev. 14, 10-01-18)

Transmittals for Chapter 13

10 - Introduction

20 – Definitions

30 – Eligibility Requirements

30.1 - Full Subsidy Eligible Individuals

30.2 - Partial Subsidy Eligible Individuals

40 - Eligibility Determinations

40.1- Eligibility through Application

40.1.1- Financial Standards for Low-Income Subsidy (LIS) Applications

40.1.2 – Effective Date of Initial Determinations

40.1.3 – Changes in Subsidy Level within Established Span

40.1.4 – Deeming After Eligibility through Application

40.1.5 - Determining Agency Notification to Applicant

40.1.6 - Redetermination Process

40.1.7 – Appeals

40.2 – Eligibility through Deeming

40.2.1 – Source Data

40.2.2 - Effective Date of Initial Deemed Status

40.2.3 - Changes to Subsidy Status Within the Established Deemed Span

40.2.4 - CMS Notices to Deemed Individuals

40.2.5 - Redetermination of Deemed Status (“Redeeming”)

40.2.6 - CMS Notification to Beneficiaries Losing Deemed Status or Having a Copay Change

40.2.7 - Appeals

40.2.8 – Grace Period for Those Losing Deemed Status

50 – Premium Subsidy

50.1- Calculation of the Low-Income Subsidy Individual’s Premium Amount

50.2 - Calculation and Payment of the Premium Subsidy Amount for Full Subsidy Eligible

Individuals

50.2.1 - Calculation of the Regional Low-Income Premium Subsidy Amount

50.2.2 - Premiums Used to Calculate the Low – Income Benchmark Premium Amount

50.3 - Calculation of the Premium Subsidy for Partial Subsidy Eligible Individuals - Sliding

Scale Premium

50.4 - Waiver of Late Enrollment Penalty

60 – Cost-Sharing Subsidy

60.1 – Full Subsidy Eligible Individuals

60.1.1 – Application to Deductible

60.1.2 – Application to Cost- Sharing

60.2 – Full Benefit Dual Eligible Individuals Who are Institutionalized or Receiving Home

and Community Services-Based Services (HCBS)

60.2.1 – Institutionalized Individuals

60.2.2 - Individuals Receiving HCBS

60.3 – Partial Subsidy Eligible Individuals

60.3.1 - Application to Deductible

60.3.2 - Application to Cost-Sharing

60.4 – Administration of Cost-Sharing Subsidy

60.4.1 - Application to Generic and Multiple-Source Drugs

60.4.2 – Application to Months’/Days’ Supplies

60.4.3 – Application of Cost Sharing Subsidy When Individual Chooses Enhanced Alternative

Coverage

60.4.4 - Application of Lesser of Cost Sharing Amounts Test

60.4.5 - Cost Sharing When Claims for LIS Individuals Cross Multiple Benefit Phases

70 - Part D Sponsor Responsibilities When Administrating the Low – Income Subsidy

70.1 – Establishing Low – Income Subsidy Status

70.2 – Member Notifications

70.3 – Sponsor Requirements When Retroactive Changes to Subsidy Levels Occur

70.3.1– Refunds and Recoupments of Cost-Sharing and Premiums

70.3.2 - Adjustments to Prescription Drug Event Data

70.3.3 - Refunds of Overpaid Premiums

70.4 - Low-Income Subsidy and TrOOP Calculation

70.5 - Best Available Evidence (BAE)

70.5.1 - BAE Policy Communication and Oversight

70.5.2 - Required Documentation and Verification

70.5.3 - Part D Sponsors Responsibility When BAE is not Available

70.5.4 - Transmitting and Timing of Manual LIS Status Correction

70.5.5 - Evidence Retention Requirements

70.5.6 – CMS/SSA Documentation Supporting a Beneficiary’s LIS Cost Sharing Level

70.6 – Interpreting the Social Security Administration’s Low-Income Subsidy Letters

70.6.1 - Determining the Subsidy Effective Date

70.6.2 – Determining the Premium Subsidy Level, Deductible, and Co-payment amounts

from SSA Letters

80 - Application of Low-Income Subsidy to Employer Group Waivers Plans

90 - Enhanced Allotment for Low-Income Residents of the Territories

Appendices

Appendix A - Model Notice for Beneficiaries Whose Low-Income Subsidy is

Terminated (for PDPs, MA-PD Plans, and Cost Plans that offer Part D)

Appendix B - Model Notice of Removal of LIS Period(s) for PDPs, MA-PD

Plans, and Cost Plans that offer Part D

Appendix C - Model Notice of Error in Premiums and Cost Sharing

Appendix D - Model Notice “Determination of LIS Ineligibility”

Appendix E - Establishing Low-Income Subsidy Status

Appendix F - Important Information Sample

Note: This chapter is subject to both periodic and annual updates.

10 - Introduction

(Rev. 8, Issued: 10 -01-18; Effective/Implementation: 10-01-18)

This chapter establishes the Part D sponsor requirements and limitations for

payments made by and on behalf of low-income Medicare beneficiaries who

enroll in a Part D plan. The Medicare Prescription Drug Benefit provides extra

help with prescription drug costs for eligible individuals whose income and

resources are limited. This help takes the form of subsidies paid by the Federal

government to the Part D sponsor. The low-income subsidy (LIS) provides

assistance to certain low-income individuals to supplement the premium and cost-

sharing (including deductibles and cost-sharing during the coverage gap)

associated with the Part D benefit.

Except where specifically noted, these requirements apply to all Part D sponsors

offering Part D coverage. Other requirements related to beneficiary protections

are contained in other chapters of Pub. 100-18, Medicare Prescription Drug

Benefit Manual, which can be accessed at: https://www.cms.gov/Regulations-and-

Guidance/Guidance/Manuals/Downloads/Pub100_18.pdf

The current contract year low-income subsidy rates for premiums, deductibles

and cost sharing may be found in the current year’s Annual Call Letter available

on the CMS Web site.

20 - Definitions

(Rev. 14, Issued: 10-01-18, Effective Date: 10-01-18; Implementation Date:

10-01-18) Unless otherwise stated in this chapter, the following definitions apply:

Annual out-of-pocket threshold: The point in the Part D benefit when a

beneficiary enters the catastrophic coverage phase. Detailed description is found

in chapter 5, section 20.3.1 of this manual.

Applicant: The Part D eligible individual applying for the low- income subsidy with

either the Social Security Administration (SSA) or the State Medicaid agency.

Basic prescription drug coverage: Refer to chapter 5, section 20.1 of this

manual for the description of this term.

Best Available Evidence (BAE): Documentation used by the Part D sponsor to

support a favorable change to a low-income subsidy eligible beneficiary’s LIS

status.

Complaint Tracking Module (CTM): a module that is part of the Health Plan

Management System which provides Sponsors with a method for submitting BAE

assistance requests to CMS. (For more information see 70.5.3 - Part D Sponsors

Responsibility When BAE is not available).

Copayment Amounts: Applicable calendar year copayment/coinsurance amounts

are provided in the Annual Call Letter for full subsidy and partial subsidy eligible

individuals.

Coverage Gap: The Part D benefit phase above the initial coverage limit and at

or below the annual out-of-pocket threshold described at 42 CFR 423.104(d)(4)

(and in chapter 5, section 20.3.1 of this manual).

Covered Part D drugs: Refer to chapter 6, section 10.2 of this manual for the

description of this term.

Deductible Amounts: Applicable deductible amounts provided in the Annual

Call Letter for partial subsidy eligible individuals.

Deemed Eligible Individual: An individual who is deemed as meeting the

eligibility requirements for full subsidy eligible individuals if the individual is

entitled to Medicare and:

• A full benefit dual eligible individual (eligible for full Medicaid

benefits);

• A recipient of Supplemental Security Income (SSI) benefits; or

• Eligible for full Medicaid benefits, and/or the Medicare Savings Program

as a Qualified Medicare Beneficiary (QMB), Specified Low-Income

Medicare Beneficiary (SLMB), or Qualifying Individual (QI) under a

State’s Medicaid plan.

Dual Status: Entitlement to Medicare and concurrent eligibility for a Title XIX

benefit (i.e., Medicaid or a Medicare Savings Program).

Extra Help: The low-income subsidy (LIS) or subsidy.

Family Size: Includes the applicant, the spouse, if any, living in the same

household and the number of individuals, if any, related to the applicant(s) living

in the same household, and dependent on the applicant or the applicant’s spouse

for at least one-half of their financial support.

Federal Poverty Level (FPL): The income standard for poverty that is updated

annually by the

U.S. Department of Health and Human Services and generally used as the basis

for determining the low-income subsidy level. For more information regarding

specific FPLs, see section 40.1.1.

Full Benefit Dual Eligible (FBDE) Individual: An individual who is entitled to

Medicare and is eligible for comprehensive Medicaid benefits and meets the

requirements of the definition at 42 CFR 423.772.

Full Subsidy: The amount of reductions to a full subsidy eligible individual’s

costs under a Part D plan, including:

• 100% subsidy of the monthly premium for basic prescription drug

coverage up to the regional low-income premium subsidy amount;

• Elimination of the annual deductible;

• Reduced cost-sharing if the copayment under the basic or enhanced

portion of the plan's benefit package is more than the applicable LIS

copayment amounts provided in the annual Call Letter for Part D covered

drugs (further explained in section 60.4);

• Elimination of the coverage gap;

• Elimination of cost-sharing above the annual out-of-pocket threshold; and,

• Waiver of late enrollment penalty.

Full Subsidy Eligible Individual:

• A subsidy eligible individual whose income is below 135 percent of the

FPL applicable to the individual’s family size and whose resources do not

exceed the resources described in 42 CFR 423.773(b)(2)(ii). For current

year resource limits see; and

• An individual deemed eligible as a full subsidy eligible individual.

Generic: A drug for which an application under section 505(j) of the Federal

Food, Drug, and Cosmetic Act (21 USC 355(j)) is approved.

Income: Money received in cash or in-kind by the applicant or a spouse who is

living with the applicant that can be used to meet their needs for food and shelter.

This definition includes the income of the applicant and spouse who is living in

the same household, if any, regardless of whether the spouse is also an applicant.

Income for support and maintenance in kind is not counted as income to the

applicant.

Individual Receiving Home and Community-Based Services (HCBS): A full-

benefit dual eligible individual who is receiving services under a home and

community-based waiver authorized for a State under section 1115 or subsection

(c) or (d) of section 1915 of the Social Security Act or under a State plan

amendment under subsection (i) of such section or if such services are provided

through enrollment in a Medicaid managed care organization with a contract

under section 1903(m) or under section 1932 of the Social Security Act.

Institutionalized Individual: A full-benefit dual eligible individual who is an

inpatient in a medical institution or nursing facility for which payment is made

under Medicaid throughout a calendar month, as defined in section 1902(q)(1)(B)

of the Social Security Act.

Low-Income Subsidy (LIS) Individual’s Premium Amount: The premium paid

by the low- income subsidy beneficiary for basic prescription drug coverage after

the premium subsidy amount is applied.

MA-PD plan: A plan offered by a Medicare Advantage (MA) organization that

provides qualified prescription drug coverage.

Medicare Savings Program (MSP): For purposes of the Medicare Part D full

subsidy eligibility, the Qualified Medicare Beneficiary (QMB) benefit, the

Specified Low Income Medicare Beneficiary (SLMB) benefit, or the Qualifying

Individual (QI) benefit under title XIX of the Social Security Act.

Multiple source or multi-source drug: A drug defined in section

1927(k)(7)(A)(i) of the Social Security Act.

Part D sponsor: A prescription drug plan (PDP) sponsor, MA organization

offering an MA-PD plan, a Program for All-inclusive Care for the Elderly

(PACE) organization offering a PACE plan including qualified prescription drug

coverage, and a cost plan offering qualified prescription drug coverage.

Partial Subsidy: Partial reductions in a beneficiary’s costs imposed under a Part

D plan, including:

• Reduction to the deductible when the deductible is greater than the

maximum deductible amounts for partial subsidy eligible individuals (See

Annual Call Letter https://www.cms.gov/Medicare/Health-

Plans/MedicareAdvtgSpecRateStats/Downloads/Announcement2018.pdf

)

• 25% to 100% subsidy of the monthly premium for basic prescription drug

coverage up to the regional low-income premium subsidy amount;

• Reduction to 15% coinsurance per prescription for covered Part D drugs,

up to the annual out-of-pocket threshold, and copayments of not more

than the maximum copayments for Partial subsidy eligible individuals

above the annual out-of-pocket threshold (See Annual Call Letter

https://www.cms.gov/Medicare/Health-

Plans/MedicareAdvtgSpecRateStats/Downloads/Announcement2018.pdf

);

• Elimination of the coverage gap; and,

• Waiver of late enrollment penalty (LEP).

Partial subsidy eligible individual: Referred to as other low-income subsidy

eligible individuals at 42 CFR 423.773, or a subsidy eligible individual who has:

• Income less than 150% of the Federal Poverty Level (FPL) applicable to

the individual’s family size; and

• Resources that do not exceed the amounts described in section 30.2. of

this chapter (see current year resource limitations).

Personal representative: For purposes of this chapter, (1) an individual who is

authorized to act on behalf of the applicant; (2) if the applicant is incapacitated; or

incompetent, someone acting responsibly on their behalf, or (3) an individual of

the applicant’s choice who is requested by the applicant to act as his or her

representative in the application process.

Preferred drug: A covered Part D drug on a Part D sponsor’s formulary for

which beneficiary cost-sharing is lower than for a non-preferred drug on the

sponsor’s formulary.

Preferred multiple source drugs: A drug that is both a preferred drug and a

multiple source drug, meaning that one version of that drug is placed on the

sponsor’s formulary with lower cost sharing than for a non-preferred drug.

Prescription Drug Plan (PDP): Prescription drug coverage that is approved

under 42 CFR 423.272 and that is offered by a PDP sponsor that has a contract

with CMS.

Reference Month: The month in the previous calendar year as identified by CMS

for the calculation of the low-income benchmark premium amount. See

423.780(b)(2), 422.258(c)(1).

Resources: With the exception of the value of the individual’s life insurance

policy, the liquid resources of an LIS applicant (and, if married, his or her spouse

who is living in the same household), such as checking and savings accounts,

stocks, bonds, and other resources that can be readily converted to cash within 20

days, that are not excluded from resources in section 1613 of the Act, and real

estate that is not the applicant’s primary residence or the land on which the

primary residence is located. The value of any life insurance policy is not counted

as a resource to the applicant.

Regional low-income premium subsidy amount: The greater of the PDP

region’s low-income benchmark premium amount or the lowest monthly

beneficiary premium for a PDP that offers basic prescription drug coverage in the

PDP region as defined in section 50.2.1.

State: Each of the 50 States and the District of Columbia.

Subsidy: The low-income subsidy.

Supplemental drugs: Drugs that would be covered Part D drugs but for the fact

that they are specifically excluded as Part D drugs under 42 CFR 423.100, and as

described in chapter 6, section 20.1 of this manual. Because such drugs must have

otherwise qualified as covered Part D drugs (as defined in chapter 6, section 10.2

of this manual) in order to be covered as a supplemental benefit, and because only

prescription drugs are included in the definition of a Part D drug, over-the-counter

drugs cannot be supplemental drugs, as discussed in chapter 6, section

10.10. Supplemental drugs may be included as a supplemental benefit under

enhanced alternative coverage, as described in chapter 5, section 20.4.2 of this

manual.

Transaction Reply Report (TRR): A report that CMS provides to Part D

sponsors containing details of the rejected and accepted enrollment transactions

that CMS has processed for a Part D sponsor’s contract(s) over a specified time

period. There are two types of TRRs: the Weekly TRR that covers the processing

week (typically Sunday through Saturday) and the Monthly TRR that covers the

payment processing month.

True Out-Of-Pocket costs (TrOOP) – See chapter 5, section 30 of this manual

for the description of this term.

30

- Eligibility Requirements

(Rev. 8, Issued: 10-01-18; Effective/Implementation: 10-01-18)

This section describes the requirements for Medicare beneficiaries with limited

income and resources to qualify for the Part D LIS. Specifically, it discusses

eligibility for the two categories of the LIS: the full subsidy and the partial

subsidy.

The LIS described in this chapter is limited to Medicare beneficiaries who reside

in the 50 States and the District of Columbia. U.S. Territories receive a Federal

grant to operate their own programs to assist dual Medicare/Medicaid

beneficiaries with the costs of the Part D benefit. Full time U.S. residents visiting

the Territories will be afforded LIS copay rates for in-network drug purchases.

Discussion of the U.S. Territories enhanced allotment program is described in

section 90 of this chapter.

Low-income individuals must be enrolled in a Part D plan to have their premium,

deductible, coverage gap, and cost-sharing subsidized by the LIS. Individuals

who receive prescription drug coverage through plans other than Part D plans,

including those for whom employers are claiming a retiree drug subsidy, do not

receive LIS benefits.

30.1 - Full Subsidy Eligible Individuals

(Rev. 7, Issued: 11-21-08; Effective/Implementation: 11-21-08)

An individual can qualify for the full subsidy in two ways. If he or she applies and

is determined to have:

1. Annual income below 135 percent of the FPL as applicable to the individual’s

family size; and

2. Resources that do not exceed the resource limitations specified at

https://secure.ssa.gov/apps10/poms.nsf/lnx/0603030025 for the plan year. For

subsequent years, the amount of resources allowed for the previous year will

be increased by the annual percentage increase set forth by the U.S. consumer

price index (all items, U.S. cities). The annual percentage increase will be

determined by September of the previous year and will be rounded to the

nearest multiple of $10. The nearest multiple will be rounded up if it is equal

to or greater than $5 and rounded down if it is less than $5.

The following individuals are deemed automatically eligible for the full

subsidy based on their qualification for other Federal programs:

a. Full-benefit dual eligible individuals;

b. Recipients of Supplemental Security Income (SSI) benefits under title XVI of the Act or;

c. Individuals eligible for Medicare Savings Programs as a qualified Medicare Beneficiary

(QMB), Specified Low Income Medicare Beneficiary (SMB), or a Qualifying individual

(QI) under a State’s plan.

30.1- Partial Subsidy Eligible Individuals

(Rev. 7, Issued: 11-21-08; Effective/Implementation: 11-21-08)

An individual is eligible for the partial subsidy if she/he applies and is determined

to have:

1. An annual income below 150 percent of the FPL as applicable to the individual’s

family size; and

2. Resources that do not exceed the resource limitations specified at

https://secure.ssa.gov/apps10/poms.nsf/lnx/0603030025 (including the assets and

resources of the individual’s spouse). For subsequent years, the amount of

resources allowed for the previous year is increased by the annual percentage

increase set forth by the U.S. consumer price index (all items, U.S. cities). The

annual percentage increase is determined by September of the previous year and

will be rounded to the nearest multiple of $10. The nearest multiple will be

rounded up if it is equal to or greater than $5 and rounded down if it is less than

$5.

40 - Eligibility Determinations, Redeterminations, and Applications

(Rev. 7, Issued: 11-21-08; Effective/Implementation: 11-21-08)

This section describes the process for determining eligibility for a full or partial

subsidy, and for deeming eligibility for a full subsidy. “Determining” describes

the process by which an individual must apply and be found eligible in order to

qualify for the full subsidy. “Deeming” is the term used to describe the process in

which an individual automatically qualifies for the full subsidy without applying,

by virtue of having applied and been found qualified for certain other Federal

programs. An individual's LIS status cannot begin earlier than his or her Part D

eligibility.

For details on the eligibility determination processes discussed in the following

sections, see 20 CFR Part 418 and the SSA Program Operations Manual System

[POMS], available at http://policy.ssa.gov/poms.nsf/aboutpoms under Health

Insurance (HI) 030.

40.1 - Eligibility Through Application

(Rev. 14, Issued: 10-01-18, Effective Date: 10-01-18; Implementation

Date: 10-01-18)

This section describes the application process to determine eligibility for the LIS.

A beneficiary who believes he or she may be eligible for the LIS--and is not

deemed eligible by virtue of being Medicaid, MSP, or SSI eligible---may apply

for the subsidy through the Social Security Administration (SSA) or his/her State

Medicaid agency. The agency (SSA or State Medicaid agency) that makes the

subsidy decision is responsible for on-going case activity, including notices,

redeterminations of subsidy eligibility, and appeals. If an application is filed with

the State Medicaid agency, that agency is responsible for screening the applicant

for eligibility for a Medicare Saving Program (MSP) and offering to enroll any

applicant who qualifies. If a State Medicaid agency determines LIS eligibility, the

applicant would be subject to state reporting requirements, which might result in

different timeframes for reduction or termination of eligibility than under the

process administered by SSA.

State Medicaid agencies, at the request of the applicant, must make subsidy

eligibility determinations using the same financial rules used by SSA but apply the

case processing standards (including time frames for making decisions and

notifying applicants) that the State uses for its Medicaid cases. State LIS

applications are available at State Medicaid agencies.

The Guidance to States on the Low-Income Subsidy may be found at:

https://www.cms.gov/Medicare/Eligibility-and-

Enrollment/LowIncSubMedicarePresCov/EligibilityforLowIncomeSubsidy.html

For effective CY2019 SEP enrollment Guidance

https://www.cms.gov/Medicare/Eligibility-and-

Enrollment/MedicarePresDrugEligEnrol/index.html

Eligibility determinations made by SSA are made in accordance with

requirements set forth by the Commissioner of Social Security (see 42 CFR §

423.774). SSA and the states notify CMS of individuals whom they have

determined to be eligible for the LIS and CMS in turn provides the subsidy

information, including effective date and level of subsidy, to the Part D plan in

which the beneficiary enrolls. (For details on how CMS communicates LIS

eligibility to Part D sponsors, see section 70 of this chapter.) The agency (SSA or

State Medicaid agency) that makes the subsidy determination is responsible for all

on-going case activity, including notices, redeterminations of subsidy eligibility,

and appeals.

The surviving spouse of a subsidy-eligible couple receive an extension of the

effective period for a determination or redetermination through the date that is

one (1) year after the date on which the next redetermination after the death of a

spouse would have occurred. Subsequently, the subsidy eligible widow/widower is

to be determined or redetermined, as appropriate, for the subsidy on the same

basis as other subsidy-eligible beneficiaries. States must, therefore, adjust their

redetermination schedule when the death of a spouse is reported.

For LIS subsidy applications under this section to be considered complete,

applicants (or personal representatives applying on the individual’s behalf) are

required to:

• Complete all required elements of the application;

• Provide any requested statements from financial institutions to

support information in the application; and

• Certify, under penalty of perjury or similar sanction for false

statements, as to the accuracy of the information provided on the

application form.

SSA verifies most information through data matches with existing SSA, Internal

Revenue Service and other government files. The agency (SSA or State Medicaid

agency) that makes the subsidy decision may request additional documentation if

there are discrepancies between the data matches and the attestations on the

application. If the individual, or his or her personal representative, files an

application with the State or SSA seeking subsidy eligibility for any portion of an

eligibility period covered by an earlier application, the later application is void if

the individual has received a subsidy approval on that earlier application from the

State or SSA.

The current open-ended Special Election Period for dual-eligible and Low

Income Subsidy (LIS) beneficiaries is being limited beginning with CY2019. As

long as the beneficiary has not been flagged as “at-risk” by pharmacy

management programs, such individuals will be eligible to change plans once per

quarter in each of the first three quarters.

• Calling 1-800-MEDICARE;

• Filing a request with the On-Line Enrollment Center at www.medicare.gov ; or

• Calling the Part D sponsor directly.

40.1.1- Financial Standards for Low-Income Subsidy (LIS) Applications

(Rev. 7, Issued: 11-21-08; Effective/Implementation: 11-21-08)

To qualify for the LIS, beneficiaries must have resources and income no greater

than the resource and income limits established by the Medicare Modernization

Act (MMA). The financial standards applicable to LIS applications are those in

effect on the date of application. When determining whether a beneficiary

qualifies for LIS, $1,500 in resources per person (applicant and spouse) are

excluded from consideration if the beneficiary indicates that they expect to use

some of their resources for burial expenses.

CMS is required by law to update the Part D income and resource limits each

year. Resource limits for the next calendar year are updated based on the

September Consumer Price Index (CPI) Resource limits (see

https://secure.ssa.gov/apps10/poms.nsf/lnx/0603030025 for the current year

resource limits). Early each year, the U.S. Department of Health and Human

Services updates that income level equivalent to 100% of the Federal Poverty

Level (FPL) for that same calendar year (see https://aspe.hhs.gov/poverty-

guidelines ) . CMS calculates the corresponding FPL (income) levels necessary

for qualifying for the LIS benefit, i.e., 135%, 140%, 145% and 150%, and notifies

Part D sponsors of the updated levels via an HPMS memo by the end of January

or early February. The new FPL guidelines are retroactive to January 1 of that

year.

40.1.2 Effective Date of Initial Determinations

(Rev. 14, Issued: 10-01-18, Effective Date: 10-01-18; Implementation Date:

10-01-18)

An individual who applies and is determined eligible for the LIS is eligible

effective the first day of the month in which the individual submitted an

application. In most cases, LIS applicant status is effective retroactively. The

majority of new LIS applicants are entitled to Medicare when they apply for LIS.

For individuals who are entitled to Medicare at the point in time they submit an

application, their LIS effective date will be retroactive to the first day of the

month the application was filed. If a beneficiary is already enrolled in a Part D

plan, the Part D sponsor must take steps to ensure that the beneficiary is made

whole with respect to any premium or cost- sharing the member has paid that

should have been covered by the subsidy (see section 70 for details on Part D

sponsor obligations). This applies to both current and former members.

For individuals who are not yet entitled to Medicare, the LIS effective date is the

first day of the month in which their Medicare Part D eligibility starts.

Example 1: An individual who is already Medicare eligible applies

at SSA for the LIS on April 22, 2017. SSA makes a determination

on May 19, 2017, that the person qualifies for the subsidy. Their LIS

is effective retroactive to April 1, 2017.

Example 2: An individual who is not yet Medicare eligible applies

at SSA for the LIS on April 22, 2017. SSA makes a determination

on May 19, 2017, that the person qualifies for the subsidy. The

person’s Medicare eligibility starts June 1, 2017, so the subsidy

effective date is also June 1, 2017.

Initial LIS determinations are made for a period not to exceed 12 months.

Thereafter, if the individual is found ineligible, the subsequent end date would be

established by the agency that made the decision. The end date is always the last

day of a calendar month but may occur in any month of the year, depending on

the requirements of the agency (either the State or SSA) making the decision. On-

going LIS eligibility will appear in the Medicare Beneficiary Database (MBD) as

a span without an end date.

40.1.3 - Changes in Subsidy Level Within Established Span

(Rev. 14, Issued: 10-01-18, Effective Date: 10-01-18; Implementation Date: 10-01-18)

For cases in which eligibility is established through application with SSA, report

of a subsidy- changing event will trigger a redetermination of subsidy eligibility

during the calendar year. This can result in changes to the individual’s deductible,

premium subsidy, cost-sharing subsidy, or even termination of their LIS. Subsidy

changing events are:

• Marriage;

• Divorce

• Death of a Spouse

• Separation

• Reunion after separation

• Annulment

When SSA receives a report of a subsidy-changing event, the beneficiary is

mailed a redetermination form to complete and return within 90 days. Any change

(i.e., increase, decrease, or termination) in the subsidy as indicated by the

completed redetermination form will take effect the first day of the month

following the month of the initial report of the change.

The surviving spouse of a subsidy-eligible couple receive an extension of the

effective period for a determination or redetermination through the date that is 1

year after the date on which the next redetermination after the death of a spouse

would have occurred. Subsequently, the subsidy- eligible widow/widower is to be

determined or redetermined, as appropriate, for the subsidy on the same basis as

other subsidy eligible beneficiaries.

Example: An individual who is subsidy-eligible reports to SSA on April 10,

2017, that her husband died on March 25, 2017. SSA mails a 1026-SCE (subsidy

changing event) form to the widow.

• If the report data would increase the subsidy or provide a more

favorable resources level, the change will be effective the month

following the month of the report. In the above example, the change

would be effective May 1, 2017.

• If the report data result in no change, SSA will not send the widow

a redetermination form in the following year unless the widow

belongs to a category of individuals that is designated for frequent

review.

• If the report data would decrease the subsidy, or provide a less

favorable resources level, SSA will not add the widow to the

August redetermination selection for 2017, but rather will add her to

the August redetermination selection in the next year (2018), with

any change being effective January 1, 2019.

Part D sponsors are obligated to make the beneficiary whole with respect to

overpaid premiums and cost-sharing or to collect any underpaid premiums and

cost-sharing due from the beneficiary as discussed in section 70.3 of this chapter.

This applies to both former and current members.

40.1.4 - Deeming After Eligibility through Application

(Rev. 14, Issued: 10-01-18, Effective Date: 10-01-18; Implementation Date: 10-01-18)

If, after establishing LIS eligibility through application, an individual is reported

by his or her State Medicaid agency as Medicaid or MSP-eligible, or by SSA as

SSI-eligible, deemed status is established for the individual. When this occurs, the

LIS determination is terminated. The deemed status prevails over the application

status and provides a subsidy benefit that is at least as good as the subsidy

established through application.

Example: Beneficiary applies for the LIS with SSA on October 9, 2017, and is

approved for a partial subsidy, effective October 1, 2017. In March, 2018, he is

reported by his State as being eligible for Medicaid effective March 1, 2018. His

eligibility as an LIS applicant for a partial subsidy is terminated effective

February 29, 2018. His deemed status (and thus qualification for full subsidy) is

effective March 1, 2018 through December 31, 2018.

When an individual previously approved for the subsidy through application is

deemed for a short period (less than 1 year), SSA will restore its subsidy

determination when deeming ceases if the subsidy eligibility was determined or

redetermined in the last 2 years.

Refer to section 70.3 regarding the Part D sponsor’s obligation to make the

member whole with respect to overpaid premiums and cost-sharing or to recoup

any underpaid premiums and cost- sharing due from the beneficiary. This applies

to both former and current members.

40.1.5 - Determining Agency Notification to Applicant

(Rev. 7, Issued: 11-21-08; Effective/Implementation: 11-21-08)

Individuals who applied for LIS will be notified of the results of the eligibility

determination, redetermination, or impact of subsidy-changing events by the

agency (SSA or State Medicaid agency) that made the initial LIS determination.

40.1.6 - Redetermination Process

(Rev. 7, Issued: 11-21-08; Effective/Implementation: 11-21-08)

The agency (SSA or State Medicaid agency) that makes the subsidy decision is

responsible for on-going case activity, including redeterminations of LIS

eligibility. CMS and the Part D sponsor may not be notified of an appeal decision

until after the effective date in case of an appeal.

40.1.7- Appeals

(Rev. 9, Issued: 02-05-10, Effective/Implementation Date: January 1,

2010)

When an individual disagrees with a determination of his or her subsidy

eligibility, subsidy level, or subsidy termination, the individual may appeal the

decision with either SSA or the State Medicaid agency, whichever agency made

the initial determination. Beneficiary information regarding the appeals process

for subsidy determinations are further described in the determination letter sent by

SSA or the Medicaid agency. Instructions regarding SSA appeals within the SSA

Program Operations Manual System are found at:

https://secure.ssa.gov/apps10/poms.nsf/lnx/0603040000 .

40.2- Eligibility through Deeming

(Rev. 7, Issued: 11-21-08; Effective/Implementation: 11-21-08)

This section describes how individuals are deemed automatically eligible for the

full subsidy. Individuals are never deemed eligible for the partial subsidy.

40.2.1 – Source Data

(Rev. 14, Issued: 10-01-18, Effective Date: 10-01-18; Implementation

Date: 10-01-18)

CMS deems individuals automatically eligible for the full subsidy, based on data

from State Medicaid Agencies and the Social Security Administration.

SSA sends a monthly file of SSI-eligible beneficiaries to CMS.

Similarly, the State Medicaid agencies submit MMA files to CMS that identify

beneficiaries who are:

• Eligible for full Medicaid benefits (full benefit dual eligible), or

• Eligible for a Medicare Savings Program (QMB, SLMB, or QI).

Data from States are also submitted to CMS in two additional ways:

1.

From CMS’ Contractor for the Limited Income NET Program (LI NET) the

contractor provides immediate coverage at point of sale for subsidy eligible

individuals who are not enrolled in a Part D plan. The eligibility verification

contractor checks State eligibility data to confirm the individuals are full

benefit or partial dual eligible individuals, and submits those data to CMS for

the purpose of subsidy deeming).

2.

From Part D sponsor-submitted data indicating best available evidence (BAE),

which documents the individual’s LIS eligibility (see section 70.5).

An individual needs to be reported eligible by SSA or the State for only 1 month

in a calendar year to be deemed eligible from that month through the end of the

year.

Example: An individual is reported by her State as Medicaid-eligible in March,

2017. She will be deemed eligible from March 1, 2017 through December 31,

2017.

40.2.2 - Effective Date of Initial Deemed Status

(Rev. 15, Issued: 10-01-18, Effective Date: 10-01-18; Implementation

Date: 10-01-18)

CMS deems individuals automatically eligible for LIS effective as of the first day

of the month that the individual attains the qualifying status (i.e., when a

Medicare beneficiary becomes eligible for Medicaid, QMB, SLMB, QI, or SSI).

The end date is, at a minimum, through the end of the calendar year. Individuals

who are deemed LIS eligible for any month during the period of July through

December of a year are deemed eligible through the end of the following

calendar year.

A beneficiary deemed eligible through the end of a given calendar year remains

deemed even if no longer reported by his or her Medicaid agency as a full benefit

dual eligible individual or partial dual eligible individual, or by SSA as an SSI

recipient, due to loss of eligibility.

In most cases, LIS deemed status is effective retroactively. The majority of

newly deemed individuals are already entitled to Medicare and apply for

Medicaid/QMB/SLMB/QI/SSI. When eligibility for these programs is

retroactive, eligibility for LIS deemed status is also retroactive. If a beneficiary is

already enrolled in a Part D plan, Part D sponsors must take steps to ensure that

the beneficiary is made whole with respect to any premiums and cost-sharing the

member has paid that should have been covered by the subsidy (see section 70 of

this chapter for details on Part D sponsor obligations). This applies to current and

former members.

Example 1: An individual becomes a full-benefit dual eligible individual

March 1, 2017. The effective date of deemed status is March 1, 2017

through December 31, 2017.

Example 2: A Medicare individual becomes SSI eligible effective

October 1, 2017. The effective date of deemed status is October 1, 2017

through December 31, 2018.

For individuals who are initially entitled to Medicaid or SSI-only, and are about to

become entitled to Medicare, States and SSA will attempt to submit the data for

these individuals prior to the start of their Medicare eligibility to help ensure that

LIS deemed status is established the first day of their Medicare entitlement.

40.2.3 - Changes to Subsidy Status within the Established Deemed Span

(Rev. 13, Issued: 07-29-11, Effective Date: 01-01-11; Implementation Date:

01-01-11)

Within a given calendar year, an individual’s deemed status may change based on

data received from States or SSA subsequent to the initial deeming process. CMS

uses any such data from States or SSA to determine whether the beneficiary may

qualify for a lower copayment obligation. Thus, CMS changes an individual’s

deemed status mid-year only when such a change qualifies the beneficiary for

a lower copayment obligation. The other benefits of their LIS full subsidy –

premium subsidy and elimination of deductible and coverage gap – remain

unchanged.

40.2.4 - CMS Notices to Deemed Individuals

(Rev. 7, Issued: 11-21-08; Effective/Implementation: 11-21-08)

CMS provides notices to each individual when they are initially deemed eligible

for the LIS informing them that they are full subsidy eligible individuals and they

automatically qualify for the LIS.

40.2.5 - Redetermination of Deemed Status (“Redeeming”)

(Rev. 14, Issued: 10-01-11, Effective Date: 10-01-18; Implementation

Date: 10-01-18)

In July of each year CMS begins daily runs of its re-deeming process. During the

re-deeming process, CMS identifies individuals who qualify for the full subsidy in

the current year. Individuals who are eligible for Medicaid/QMB/SLMB/QI at any

point during the period of July through December of the current year qualify to be

re-deemed for the following calendar year, as do SSI recipients who are eligible in

any month from July through December of the current year. For the deemed

population, only favorable changes may occur mid-year.

The re-deemed date will appear in plans’ weekly transaction reply reports (TRRs)

beginning in July each year. Since 95% of the re-deemed population is re-

deemed in July, Part D sponsors should expect to see large numbers of re-

deemed records on their weekly TRRs that month. Transaction Reply Codes

(TRC) 121 identifies individuals who have been re-deemed. (See Appendix E.)

For individuals who do not qualify automatically for the next year, their LIS

deemed status ends on December 31 of the current year. However, Part D sponsors

should encourage individuals to apply for the LIS, since they may re-qualify for the

LIS through the application process.

Example 1: An individual loses deemed status and on October 15, applies

with SSA to reestablish LIS eligibility for the next year. The application is

approved and the individual's subsidy eligibility continues into the next

calendar year.

Example 2: An individual loses deemed status and on January 5 of

the next year applies with SSA to reestablish LIS eligibility. If the

Part D plan offers a grace period for individuals who have proof of

application for LIS, collection of premiums and cost sharing may

be delayed, pending a decision on the application. The application

is approved and the individual’s subsidy eligibility is retroactively

effective January 1 and continues through the end of the calendar

year.

Example 3: An individual loses deemed status but does not apply

with SSA to reestablish LIS eligibility until February 5 of the next

year. The application is approved and LIS eligibility is

retroactively effective February 1, creating a 1-month gap between

the prior year’s benefit that ended on December 31 and the newly

approved benefit.

40.2.6 - CMS Notification to Beneficiaries Losing Deemed Status or having a

Copay Change

(Rev. 13 Issued: 07-29-11, Effective Date: 01-01-11; Implementation

Date: 01-01- 11)

Each September CMS sends a gray notice to those beneficiaries who will lose

deemed status effective the next calendar year. This notice includes an SSA

subsidy application, along with a postage-paid return envelope. Also in September

of each year, CMS sends Part D sponsors and State Medicaid agencies files of

members who received notice of loss of deemed status. This file is informational

only and should be used for outreach to the affected beneficiaries. Plan sponsors

should not update their systems until the December loss-of-subsidy file is

received.

In October, CMS sends an orange notice to individuals who qualify automatically

for LIS in the next calendar year and will have a change in their co-payment level

triggered by a change in their Medicaid eligibility. CMS does not send a special

file to Part D sponsors, but sponsors are encouraged to use the weekly TRR to

identify those enrollees whose copayment level is changing in the following year.

40.2.7 - Appeals

(Rev. 7, Issued: 11-21-08; Effective/Implementation: 11-21-08)

If a Part D enrolled beneficiary disagrees with the level of premium subsidy, or

cost-sharing subsidy, the beneficiary should follow the appeals procedures of the

agency (SSA or State Medicaid Agency) that provided the data on which deemed

status is based.

40.2.8 - Grace Period for Those Losing Deemed Status

(Rev. 14, Issued: 10-01-18, Effective Date: 10-01-18; Implementation Date: 10-01-18)

Part D sponsors may choose to offer up to a 3-month grace period for the

collection of premiums and cost-sharing to individuals who have lost their LIS

deemed status and are able to demonstrate that they have applied for the LIS,

provided this option is offered to all such individuals. If, after the expiration of the

grace period, the member still does not appear to be LIS eligible according to the

CMS’ records or has not submitted BAE documentation to the Part D sponsor,

sponsors must attempt to recoup unpaid premiums and cost-sharing amounts

consistent with guidance provided in section 70.3 of this chapter. See section 70.2

of this chapter for details on the model notice.

Sponsors must confirm, either verbally or in writing that an individual has applied

for LIS prior to invoking the grace period. In other words, the grace period may

not be applied automatically to all individuals losing LIS; instead, sponsors may

apply the grace period only if an LIS application has been submitted. For

example, sponsors could send a letter to affected members instructing them to call

the sponsor if they are interested in the grace period. Any communication with the

members should advise them of the potential for retroactive liability for higher

premiums and cost sharing as of January 1 of the current year. The

communication should also include information regarding the special enrollment

period (SEP) for loss of deemed status and the need to take action by March 31 of

that year if they do not regain LIS status and wish to change plans. Sponsors

should submit these notices or scripts to CMS for review and approval according

to Medicare marketing guidelines.

50 - Premium Subsidy

(Rev. 7, Issued: 11-21-08; Effective/Implementation: 11-21-07)

Individuals who qualify for the LIS will be eligible for a premium subsidy, which

may or may not cover their plan’s entire Part D premium for basic prescription

drug coverage. The premium subsidy will vary based upon the subsidy level for

which the beneficiary qualifies.

50.1 - Calculation of the Low-Income Subsidy Individual’s Premium

Amount

(Rev. 13, Issued: 07-29-11, Effective Date: 01-01-11; Implementation

Date: 01-01-11)

The LIS individual’s premium amount is the monthly premium attributable to

basic prescription drug coverage after the premium subsidy, as calculated in

accordance with sections 50.2 and 50.3 below. The premium subsidy is rounded

to the nearest 10 cents before the premium subsidy is applied to the individual’s

monthly premium attributable to basic prescription drug coverage. Any

supplemental, enhanced, or MA premiums are then added to come to the final

premium amount.

A Part D sponsor may volunteer to waive the portion of the monthly adjusted

basic beneficiary premium that is a de minimis amount above the LIS benchmark

for a subsidy eligible individual. The de minimis amount is determined and

announced by CMS each year. The de minimis amount for 2017 is $2.00. LIS

individuals who enroll in plans that volunteer to waive the de minimis premium

amount will be charged a monthly beneficiary premium for basic prescription

drug coverage that is equal to the premium subsidy amount.

50.2 - Calculation and Payment of the Premium Subsidy Amount for

Full Subsidy Eligible Individuals

(Rev. 7, Issued: 11-21-08; Effective/Implementation: 11-21-08)

Full subsidy eligible individuals are entitled to a premium subsidy equal to 100

percent of the premium subsidy amount. The calculated premium subsidy amount

is equal to the lesser of the plan’s premium for basic prescription drug coverage or

the regional low-income premium subsidy amount calculated.

50.2.1 - Calculation of the Regional Low-Income Premium Subsidy Amount

(Rev. 7, Issued: 11-21-08; Effective/Implementation: 11-21-08)

The regional low-income premium subsidy amount is the greater of the PDP

region’s low- income benchmark premium amount or the lowest monthly

beneficiary premium for a PDP that offers basic prescription drug coverage in the

PDP region. CMS performs this “greater of” test before it releases the regional

low-income premium subsidy amounts for the PDP region.

The low-income benchmark premium amount for a PDP region is a weighted

average of the premium amounts described below. The weight for each PDP and

MA-PD plans is equal to a percentage, the numerator is equal to the number of

Part D LIS eligible individuals enrolled in the plan in the reference month. The

denominator is equal to the total number of Part D LIS eligible individuals

enrolled in all PDP and MA-PD plans (but not including PACE, private fee- for-

service plans or 1876 cost plans) in a PDP region in the reference month.

50.2.2- Premiums Used to Calculate the Low-Income Benchmark

Premium Amount

(Rev. 13, Issued: 07-29-11, Effective Date: 01-01-01; Implementation

Date: 01-01-11)

The premium amounts used to calculate the low-income benchmark

premium amount include:

• Basic PDP - the monthly beneficiary premium.

• Enhanced PDP - the portion of the monthly beneficiary premiums

not attributable to basic prescription drug coverage.

• MA-PD - the monthly prescription drug beneficiary premium (as

defined under section 1854(b)(2)(B) of the Social Security Act).

Note: The weighted average premium amounts described above are calculated

using the Part D premiums for MA-PD plans before they have been reduced by

any applicable MA A/B rebates. The calculation does not include bids submitted

by MA private fee-for-service plans, PACE programs under section 1894 of the

Act, “800 series” plans, and contracts under reasonable cost reimbursement

contracts under section 1876(h) of the Act (“Cost Plans”).

50.3 - Calculation of the Premium Subsidy for Partial Subsidy Eligible

Individuals - Sliding Scale Premium

(Rev. 7, Issued: 11-21-08; Effective/Implementation: 11-21-08)

Partial subsidy eligible individuals will be eligible for a premium subsidy based

upon a linear sliding scale ranging from 100 percent to 25 percent of the premium

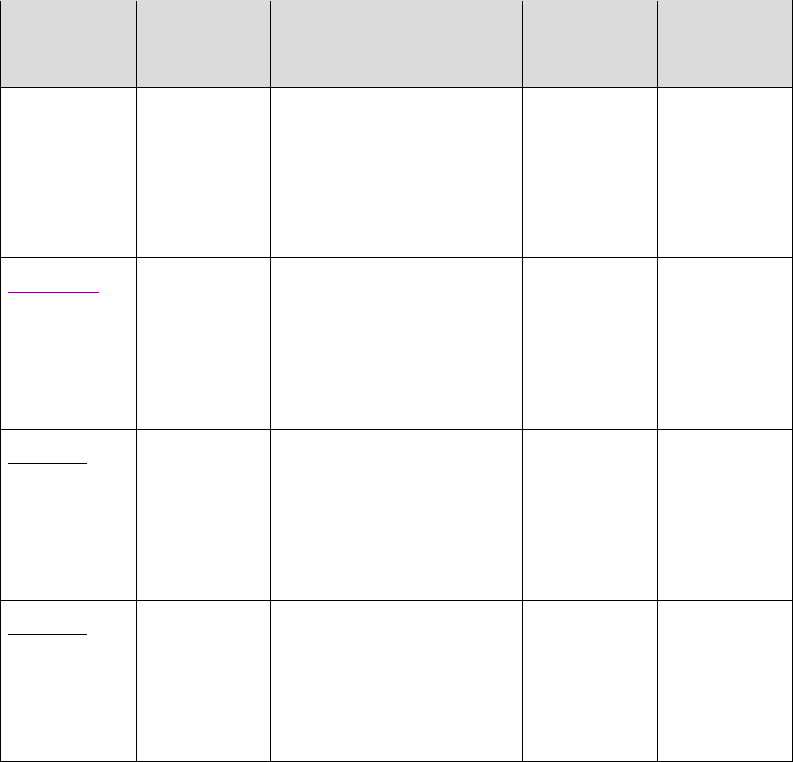

subsidy amount as specified in section 50.2 and upon the following chart:

FPL & Assets Percentage of

Premium

Subsidy

Amount

Income up to 135% FPL, and with assets that do not exceed the

calendar year resource limits* for Individuals or couples

100%

Income above 135% FPL but at or below 140% FPL, and with assets

that do not exceed the calendar year resource limits for Individuals or

couples.

75%

Income above 140% FPL but at or below 145% FPL, and with assets

that do not exceed the calendar year resource limits for individuals or

couples.

50%

Income above 145% FPL but below 150% FPL, and with assets that do

not exceed the calendar year resource limits for individuals or couples.

25%

*See https://secure.ssa.gov/apps10/poms.nsf/lnx/0603030025 for the calendar year resource limits.

50.4 - Waiver of Late Enrollment Penalty

(Rev. 9, Issued: 02-05-10, Effective/Implementation Date: January 1,

2010)

Depending upon when a beneficiary enrolls in a plan, s/he may be subject to late

enrollment penalties. However, LIS eligible individuals are not subject to a late

enrollment penalty as of the effective date of LIS eligibility. As long as these

individuals stay continuously enrolled in a PDP or MA-PD, they will not be

assessed an LEP, even if they lose their LIS eligibility. If LIS individuals

disenroll and do not have creditable coverage for a continuous period of 63 days

or longer, they will incur an LEP upon re-enrollment into a Part D plan if they are

not LIS eligible; however, their uncovered months prior to LIS eligibility will not

be a factor in the calculation of their LEP. Chapter 4 of this manual describes the

late enrollment penalty in detail and how plans should administer this policy.

60 - Cost-Sharing Subsidy

(Rev. 10, Issued: 10-01-18, Effective/Implementation Date: 10-01-18)

The following section describes the application of the cost-sharing subsidy to full

subsidy eligible and partial subsidy eligible individuals. The specific cost-sharing

and deductible amounts are referenced in the current Annual Call Letter.

60.1- Full Subsidy Eligible Individuals

(Rev. 7, Issued: 11-21-08; Effective/Implementation: 11-21-08)

60.1.1 - Application to Deductible

(Rev. 7, Issued: 11-21-08; Effective/Implementation: 11-21-08)

Full subsidy eligible individuals as defined in section 30.1 will not be

subject to any deductible under a Part D plan's basic prescription drug

coverage. Refer to chapter 5 of this manual for a description of Part D

plans’ deductible.

60.1.2 - Application to Cost-Sharing

(Rev. 8, Issued: 10-01-18; Effective/Implementation: 10-01-18)

Full subsidy eligible individuals will receive a reduction in cost-sharing for all

covered Part D drugs under the PDP or MA-PD plan to the copayment amounts

for full subsidy eligible individuals as provided in the Annual Call Letter.

The copayment amounts for full benefit dual eligible individuals with income at

or below 100% of the FPL are increased annually by the annual percentage

increase in the Consumer Price Index, All Urban Consumers (all item, U.S. city

average) as of September of the previous year and rounded to the nearest multiple

of 5 cents or 10 cents respectively.

The copayment amounts for non-institutionalized full subsidy eligible individuals

with income above 100% of the FPL are increased annually. The annual

percentage increase is based on the in average per capita aggregate expenditures

for covered Part D drugs in the United States for Part D eligible individuals as of

July of the prior year rounded to the nearest multiple of 5 cents.

60.2 - Full Benefit Dual Eligible Individuals Who are Institutionalized

or Receiving Home and Community-Based Services (HCBS)

(Rev. 13, Issued: 07-29-11, Effective Date: 01-01-11; Implementation

Date: 01-01-11)

This section describes the elimination of cost sharing for full benefit dual eligible

individuals who are either institutionalized or receiving home and community-

based services (HCBS).

60.2.1 - Institutionalized Individuals

(Rev. 14, Issued: 10-01-18 Effective Date: 10-01-18; Implementation Date: 10-01-18 )

Institutionalized full benefit dual eligible individuals will not pay any cost-sharing

(deductibles or copayments) towards the costs of their covered Part D drugs. For

the purpose of this section, those individuals who are an inpatient in a medical

institution or nursing facility for which payment is made under Medicaid

throughout a month, as defined under section 1902(q)(1)(B) of the Act, are

considered institutionalized.

Specifically, a full benefit dual eligible beneficiary must be an inpatient in a

medical institution or nursing facility in order to receive the zero cost-sharing

exemption. The definition of medical institution and nursing facility are defined in

regulation under Medicaid. The term “medical institution” for this portion of the

Medicaid statute is further defined in Medicaid regulation at section 42 CFR

435.1010. These definitions do not include: assisted living facilities, residential

care homes and boarding homes.

The Medicaid definition also provides that a person is not considered

institutionalized until the person is an inpatient in a medical institution or nursing

facility for which payments are made under Medicaid throughout a month. (See

section 1902(q)(1)(B) of the Act). This being the case, a full benefit dual eligible

individual who enters a nursing home or medical institution does not qualify for

the zero copayment immediately.

Example: If a full benefit dual eligible person enters an institution in the

middle of January, the individual will not be eligible for zero copayment

in January, as he/she was not in the institution for that full calendar month.

If the beneficiary stays at least until the end of February, and Medicaid has

paid for the beneficiary’s stay in the institution for the entire month of

February, the “Medicaid payment throughout a month" requirement would

be met for February. The individual will be deemed eligible for the zero

copayment from February 1 through the end of the calendar year.

Institutional status is only interrupted by a discharge to a community

setting such as the home or an assisted living facility, and not by transfers

between medical institutions or bed hold days.

Though the beneficiary may be discharged to a community setting, the

individual remains deemed for zero co-pay throughout the remainder of

the calendar year.

Not all Medicaid beneficiaries residing in nursing facilities or medical institutions

are eligible for the zero cost-sharing. Beneficiaries with Medicaid coverage of

premiums and/or cost sharing only (i.e., Medicare Savings Program

beneficiaries), and who are not entitled to the entire Medicaid benefit, will not be

eligible for the zero cost-sharing. It is likely, however, the majority of these

beneficiaries will eventually “spend-down” to the full benefit dual eligible status

when they enter a nursing facility and eventually receive the zero cost-sharing.

The State, as the Medicaid payer, reports to CMS the full benefit dual eligible

individuals and the institutionalized individuals in their State. CMS in turn reports

this information to the Part D sponsor. The Part D sponsor uses this information

to set the beneficiary’s co-payments to zero. In the example above, the State will

acknowledge the beneficiary’s institutionalized status in either late February or

early March when the facility bills the state for the beneficiary’s stay, the State

must then report this individual to CMS. Given the time lags inherent in the

reporting, the Part D sponsor may not receive this information from CMS until

April or May. In the interim, however, a Part D sponsor must accept and use BAE

(see section 70.5 on BAE policy) to substantiate the beneficiary’s correct LIS

cost-sharing level and correct the cost-sharing level in its own systems.

In a month in which co-pays are charged to the resident, these costs are the

resident’s liability. Under Medicaid, these costs are treated as a deduction from

income when calculating the individual’s contribution to the cost of institutional

care, as are other medical and remedial services that remain the individual’s

responsibility. This deduction reduces the amount of income the resident is

considered to have available to contribute toward the facility rate, and allows the

resident to retain an amount necessary to satisfy the copayment liability. Because

the income available to contribute toward the facility rate is less, the State

payment under Medicaid to the facility will increase by the amount of the

deduction. By contrast, the personal needs allowance (PNA) is a separate

deduction for incidental or personal expenses, and is not for medical expenses

such as co-pays. If the individual has insufficient income to cover the full cost of

the co-pays in a given month, the difference may be carried over to the following

month(s) until the liability is satisfied.

60.2.2- Individuals Receiving HCBS

(Rev. 13, Issued: 07-29-11, Effective Date: 01-01-11; Implementation Date: 01-01-11)

The Affordable Care Act extended the elimination of cost sharing to individuals

who would be an institutionalized individual (or couple) as described in 60.2.1 of

this chapter, if the full benefit dual eligible individual was not receiving HCBS

under title XIX of the Act. The effective date of this change will be no earlier than

January 1, 2012. Plans will receive an indicator of “3” to the institutional

indicator on the daily TRR when a beneficiary begins receiving HCBS under

Medicaid.

60.3 - Partial Subsidy Eligible Individuals

(Rev. 7, Issued: 11-21-08; Effective/Implementation: 11-21-08)

60.3.1- Application to Deductible

(Rev. 8, Issued: 10-01-18; Effective/Implementation: 10-01-18)

Partial subsidy eligible individuals will be subject to a reduction in the annual

deductible to the deductible amount specified in the Annual Call Letter for the

current calendar year, unless the Part D plan benefit package has a deductible that

is less than the deductible amount.

The deductible amount increases each year by the annual percentage increase in

average per capita aggregate expenditures for Part D drugs in the United States

for Part D eligible individuals, rounded to the nearest multiple of $1. If a plan’s

benefit package contains a deductible that is less than the deductible amount, the

full deductible under the plan's benefit package is applied to the partial subsidy

eligible individual’s covered Part D prescription drug costs.

60.3.2- Application to Cost-Sharing

(Rev. 7, Issued: 11-21-08; Effective/Implementation: 11-21-08)

Partial subsidy eligible individuals will be subject to a reduction in cost-sharing to

15% coinsurance after any deductible described in section 60.3.1 has been met. If

the Part D plan charges cost-sharing that is less than 15% coinsurance, no further

reduction is taken.

60.4 - Administration of Cost-Sharing Subsidy

(Rev. 7, Issued: 11-21-08; Effective/Implementation: 11-21-08)

60.4.1 - Application to Generic and Multiple-Source Drugs

(Rev. 10, Issued: 10-01-18, Effective/Implementation Date: 10-01-18 )

When imposing cost sharing on LIS eligible individuals, sponsors are required to

apply specific copayments for generic drugs as defined by regulation and in

section 10 of this chapter. Specifically, 42 CFR 423.4 defines generic drugs as

those drug products for which there is an approved application under section

505(j) of the Federal Food, Drug, and Cosmetic Act (21 USC 355(j)). For

purposes of Part D, what determines whether a drug is a generic drug is the type

of application on file for that drug product with the Food and Drug

Administration (FDA). If a drug product approval is based upon an abbreviated

new drug application (ANDA), that drug is a generic drug.

This definition applies regardless of whether the brand-name drug is no longer

manufactured and there is only one remaining ANDA-approved drug product on

the market, whether the sponsor’s formulary includes the drug on its generic cost-

sharing tier or on a higher tier, or how a particular drug product is identified by

the major drug listing services. Consequently, when sponsors by statute are

required to apply specific copayments for generic drugs (that is, for generic drugs

obtained by LIS eligible enrollees and enrollees with spending above the out-of-

pocket threshold), they must ensure that the appropriate cost-sharing is applied to

the generic drug as defined under CMS regulations and reflected in this manual.

For example, in accordance with 42 CFR 423.782(a)(2)(iii)(A), non-

institutionalized full- benefit dual eligible individuals with incomes that do not

exceed 100 percent of the Federal poverty level for their family size will pay no

more than the amount listed in the current year’s Call Letter for generic drugs.

Consequently, the sponsor must ensure that these individuals pay no more than

the copayment for generic drugs as listed in the current year’s Annual Call

Letter. This holds true for all drug products approved under an ANDA, even if a

Part D sponsor places such a drug product in its preferred cost-sharing tier rather

than its generic cost-sharing tier.

A multiple-source drug includes the branded product when the same drug is also

available as a generic. A prescription may be filled with the generic version of a

drug, or the pharmacy may choose to dispense a branded, multiple- source drug

because the pharmacy purchased the branded, multiple-source drug at a better

price. Under this scenario, the beneficiary pays the lower copayment for the

generic/preferred multiple-source copayment (provided in the Annual Call Letter)

regardless of whether they received the generic or branded multiple-source drug.

Alternatively, the plan may have identified a specific branded multiple-source

drug as a preferred product to be used whenever a generic could be dispensed

and, therefore, the beneficiary would pay the lower cost sharing in this instance,

as well. However, if the pharmacy is required to dispense a branded multiple-

source drug (for instance, if a physician requires dispense as written), and that

drug is not cheaper for the pharmacy nor identified by the plan as a preferred

multiple-source drug, the beneficiary would be required to pay the higher

copayment.

60.4.2- Application to Months’ / Days’ Supplies

(Rev.

10

, Issued:

10-01-18

, Effective/Implementation Date:

10-01-

18

)

For month’s supplies and supplies over a month’s supply, Part D sponsors must

apply the equivalent of one copayment for LIS eligible beneficiaries to each

pharmacy transaction irrespective of days’ supply. For example, in 2018, a full

subsidy eligible individual with incomes over 100% of the FPL who uses mail

order to purchase his/her prescription medications may not be charged more than

$3.35 for a 90 day supply of a generic or preferred multiple source drug and more

than $8.35 for a 90 day supply of any other drug. This same policy applies to fills

during the catastrophic coverage period.

Supplies less than a month’s supply are subject to the daily cost-sharing rule at

42 CFR 423.100 and 423.153 (b)(4). Under this rule, a beneficiary who receives

less than the approved month’s supply of a solid oral dose drug (except

antibiotics and pre-packaged drugs) that is subject to a copayment pays a

copayment that is adjusted for the reduced days’ supply dispensed. The adjusted

amount is calculated by first calculating a daily cost-sharing rate, which is done

by taking the applicable monthly copayment under the enrollee's Part D plan and

dividing it by the number of days in the plan’s applicable approved month's

supply and rounding it to the nearest cent. To calculate the adjusted copayment,

the calculated daily cost-sharing rate is then multiplied by the number of days of

drug actually dispensed.

LIS individuals are not excluded from the daily cost-sharing rule; however, they

must also not pay more than the applicable statutory maximum copayments. We

provide the following example for a full subsidy eligible LIS individual with

income over 100%: First, the plan must determine what the reduced supply

would cost under the plan’s applicable copayment. The plan has a $60 copay for

a brand drug in question and has a 30 day approved month’s supply. A 10 day

supply of the brand drug would cost $20 ($60 / 30 = 2.00 x 10 days = $20). This

LIS individual would pay the statutory copay of $8.35 in this scenario. However,

if the plan has a $5 copay for a generic drug, a 10 day supply would cost $1.70

($5 / 30 = .17 (rounded to nearest cent) x 10 = $1.70). In such a case, the LIS

individual would pay $1.70. The LIS beneficiary pays the lesser of the sponsor’s

calculated daily cost share amount or the applicable LIS copay.

60.4.3 - Application of Cost Sharing Subsidy When Individual

Chooses Enhanced Alternative Coverage

(Rev. 14, Issued: 10-01-18; Effective Date: 10-01-18; Implementation

Date: 10-01-18)

Although the cost-sharing subsidy only applies to basic prescription drug

coverage, it applies equally to beneficiaries enrolled in both basic and enhanced

alternative plans. When a Part D sponsor provides enhanced alternative coverage,

thus reducing the cost sharing on a covered Part D drug, the cost-sharing subsidy

applies to the beneficiary liability after the plan's supplemental benefit is applied.

Supplemental benefits provided under the plan are always applied before

beneficiary liability and LIS amounts are calculated. Therefore, the plan should

determine the cost-sharing due under the enhanced alternative coverage after the

supplemental benefit is provided, then apply the LIS amount to further reduce the

LIS beneficiary’s cost-sharing liability.

For example, if the beneficiary qualifies for full subsidy benefits he/she is only

required to pay a nominal maximum. If a drug cost $100, for example, under the

plan’s basic benefit package, the cost sharing for a non-LIS beneficiary would be

25% of $100, or $25. Since the beneficiary qualifies for LIS, the Part D sponsor

would receive $21.70 in low-income-cost-sharing subsidy (LICS) payments ($25

minus $3.30) under the basic benefit package. Under the enhanced alternative

plan, the cost sharing is supplemented by the plan with an additional $10 resulting

in a cost share of $15. The Part D sponsor would receive $11.70 in LICS for the

LIS beneficiary ($15 minus $3.30).

The LIS only applies to covered Part D drugs. For supplemental drugs

covered by a Part D plan, the LIS beneficiary pays the same amount of

cost-sharing as any other beneficiary under their benefit package.

60.4.4 -Application of Lesser of Cost Sharing Amounts Test

(Rev. 9, Issued: 02-05-10-10, Effective/Implementation Date: 01-01-10

Since the cost sharing subsidy is a reduction in beneficiary liability at the point-

of-sale (POS), Part D sponsors must perform a calculation that compares the

amount due from a non-low income subsidy (non-LIS) individual under the plan,

to the statutory cost sharing provisions described in the Annual Call Letter. For

each dispensing event, the Part D sponsor must compare the amount of cost-

sharing due from a non-LIS beneficiary under the plan’s benefit package to the

maximum cost-sharing and deductible amounts due from a LIS eligible

beneficiary. The LIS beneficiary should be charged the lesser of the two amounts.

60.4.5 - Cost Sharing: When Claims for LIS Individuals Cross

Multiple Benefit Phases

(Rev. 14, Issued: 10-01-18, Effective Date: 10-01-18; Implementation

Date: 10-01-18)

When a claim crosses multiple phases of the prescription drug benefit that all

have co-payments, Part D sponsors must charge beneficiaries only one co-

payment per prescription. Part D sponsors are specifically required to charge all

beneficiaries the co-payment applicable to the phase of the benefit in which the

claim began. For example, a beneficiary is enrolled in an enhanced alternative

plan that has a generic co-payment of $5 in the initial coverage period and a

generic co-payment of $15 in the coverage gap. If the beneficiary purchases a

generic drug and that purchase moves the beneficiary from the initial coverage

period to the coverage gap phase of their prescription drug benefit, the plan must

charge the beneficiary a $5 co-payment because the claim started in the initial

coverage period. Note that this policy does not apply to claims that cross multiple

benefit phases in which any of the benefit phases have coinsurance.

If a claim crosses multiple benefit phases in which any of the benefit phases have

coinsurance, the beneficiary is responsible for the applicable cost sharing in each

phase that the claim crosses. However, when a claim crosses from the coverage

gap to the catastrophic phase of the benefit, Part D sponsors are required to charge

the cost sharing applicable to the portion of the claim below the out-of-pocket

threshold only. For the purpose of an example, a partial subsidy LIS beneficiary is

enrolled in a defined standard plan in 2018 and has $5,000 in true out-of pocket

costs (TrOOP). If the beneficiary purchases a covered Part D brand drug that has

a total cost of $150, the plan must charge the beneficiary $2.25 in coinsurance

(15%) for the $15 in gross covered drug cost applicable to the coverage gap

phase. The plan would not charge the LIS beneficiary the additional $5.60 co-

payment for the portion of the drug cost applicable to the catastrophic phase.

70-Part D Sponsor Responsibilities When Administering the Low-Income Subsidy

(Rev. 7, Issued: 11-21-08; Effective/Implementation: 11-21-08)

Part D sponsors are responsible for charging LIS beneficiaries the correct

premium, deductible, copayments and/or coinsurance for the correct effective

dates. To do so, Part D sponsors must update their systems based on CMS file

notifications, as well as establish procedures to react promptly to evidence

indicating that beneficiaries should have a more advantageous cost-sharing than

indicated by CMS data. Sponsors are responsible for notifying members when

they become LIS eligible, when their LIS levels change, and when their LIS

eligibility terminates. Since LIS changes are frequently effective retroactively,

sponsors must establish procedures to reimburse current and former members for

cost-sharing (including deductible and copayments) and premiums paid before

notification of LIS eligibility. The following subsections describe these

requirements in detail, as well as the LIS notification requirements that are the

responsibility of the Part D sponsor.

70.1 - Establishing Low-Income Subsidy Status

(Rev. 13, Issued: 07-29-11, Effective Date: 01-01-11; Implementation

Date: 01-01-11)

In order to establish the correct premium, cost sharing and deductible levels with

the correct effective dates for current, prior, and prospective enrollees, Part D

sponsors should refer to the Weekly/Monthly Transaction Reply Report (TRR).

Part D sponsors will receive data indicating new or modified LIS eligibility status