10/16/2017

Defense Travel Management Office 1

DEFENSE TRAVEL

MANAGEMENT OFFICE

Flat Rate Per Diem for Long Term TDY

Frequently Asked Questions

1. What is flat rate per diem and is it optional?

Flat rate per diem is a mandatory (it is not optional) and applies when a traveler is assigned on a long term

TDY at one location. If the TDY is 31-180 consecutive days at one location, the flat rate per diem allowance is

75% of the full locality per diem rate. If the TDY is 181 or more consecutive days at one location, the flat rate

per diem allowance is 55% of the full locality per diem rate. If travel orders erroneously authorize lodging or

meals and incidentals (M&IE) at the full locality rate the flat rate per diem still applies. There are exceptions

to receive a higher lodging per diem allowance in CONUS. There are exceptions to receive higher M&IE and

lodging per diem allowances when OCONUS.

Travelers and Authorizing Officials should reference Joint Travel Regulations para 020311 for specifics about

flat rate per diem during a TDY.

2. If the TDY ends on the 30th consecutive day of TDY, does the 75% flat rate per diem apply?

No. The 75% flat rate per diem only applies for “long-term TDY” that is 31 or more consecutive days.

3. Will DTS automatically change the per diem if the TDY is 31 or more consecutive days and 181 or more

consecutive days?

No. At this time DTS does not automatically calculate the flat rate per diem based on the length of the

TDY.

4. How could amendments to travel orders impact per diem rates?

Example 1: Initial TDY begins 1 November and is 31 or more consecutive days at one location.

TDY is scheduled from 1 November to 2 December and the traveler receives lodging and meals and

incidentals (M&IE) at 75% of the locality rate. The orders are amended on 15 November to extend the trip

until 31 May (an additional 197 days). Starting on 16 November (the day after the amendment is issued), the

traveler receives lodging and M&IE at 55% of the locality rate until 31 May (the revised end date for the TDY).

Example 2: Initial TDY begins 5 November and is 20 consecutive days at one location.

TDY is scheduled from 5 November to 25 November and the traveler receives actual lodging costs and

the full locality M&IE per diem rate. The orders are amended on 19 November to extend the trip an

additional 45 days (until 9 January) at the same location. Starting on 20 November (the day after the

amendment is issued), the traveler receives lodging and M&IE at 75% of the locality rate until the end

of the TDY.

Flat Rate Per Diem FAQs

10/16/2017

2

Defense Travel Management Office

5. The policy says “for each full day” so does that mean that the traveler receives full lodging per diem

on day 1, the travel day?

Maybe. On the travel day to the TDY location, the traveler receives 75% M&IE and the actual lodging

costs up to 100% of the locality per diem rate if the long-term lodging arrangement cannot begin on

that date. If long-term lodging can be occupied on the date of arrival, the traveler would receive 55%

or 75% of the lodging per diem rate.

6. Do travel days count when determining what constitutes 31 or more consecutive days?

Yes. If the traveler’s first day of travel results in arriving at the TDY location on the same day, that day

would count. If the traveler was authorized (and used) two days to get to the TDY location, then only

the date of arrival would count in the calculation to determine the duration of the TDY. Looked at

another way, count how many nights are spent at the TDY location. If the traveler spends 30 or more

nights at the TDY location, flat rate per diem applies.

7. How do you count days when the traveler crosses the International Date Line (IDL)?

The traveler needs to count the actual consecutive days at the TDY location. That is, count the day of

arrival and day of departure, using the day/time zone for the TDY location. Looked at another way,

count how many consecutive nights are spent at the TDY location. If the traveler spends 30 or more

consecutive nights at the TDY location, flat rate per diem applies.

8. Does the policy authorize a flat rate per diem when the TDY is 31 or more consecutive days at multiple

duty locations?

Yes. The traveler is paid flat rate when TDY to a single location for 31 or more consecutive days. If a

traveler is TDY for 31 or more consecutive days, but to multiple locations, the flat rate per diem only

applies for locations where the traveler is TDY for 31 or more consecutive days.

Example: If a traveler is TDY to two locations for a total of 46 consecutive days, but is at each location

for 23 consecutive days, flat rate per diem does not apply. However, if the traveler is TDY at location A

for 31 consecutive days and TDY at location B for 15 consecutive days, the traveler would receive 75%

flat rate per diem at location A and locality per diem at location B.

9. Will local level policy dictate when it is appropriate for the Authorizing Official to approve lodging

costs that exceed the 75% flat rate per diem?

Yes. The JTR states that if a traveler is unable to find suitable commercial lodging at the reduced per

diem rate, they should contact their Travel Management Company (TMC) for assistance. If both the

traveler and the TMC determine that lodging is not available at the flat rate per diem, the Authorizing

Official may then authorize actual lodging. The actual lodging costs must not exceed the full locality

lodging per diem rate.

When authorized lodging costs that exceed the flat rate per diem, the traveler must still receive 75% or

55% flat rate per diem for M&IE.

10. Are lodging taxes reimbursed when flat rate per diem is authorized?

Maybe. The traveler should request tax exemption from the lodging provider before paying any

lodging taxes. In many states, tax is not charged for lodging that is acquired for a long term TDY

(usually 30, 60, or 90 consecutive days).

When TDY to CONUS and non-foreign locations, lodging tax reimbursement only applies when the

Flat Rate Per Diem FAQs

10/16/2017

3

Defense Travel Management Office

lodging taxes plus the lodging costs exceed the lodging portion of the flat rate per diem. If taxes are

authorized to be reimbursed separately, the traveler must submit a lodging receipt. When TDY to

OCONUS locations lodging taxes are not authorized to be reimbursed separately because taxes are

automatically calculated into the location’s per diem rate.

The traveler is TDY for 31 consecutive days. The flat rate lodging per diem allowance is $80 per night

($2,480 total). The nightly hotel rate is $70 per night ($2,170 total). The nightly hotel tax is $15 per

night ($465 total). Because the nightly rate plus the taxes ($2,170 + $465 = $2,635) exceed $2,480, the

traveler is authorized to be separately reimbursed an additional $155 ($2,635 - $2,480 = $155).

Example 2: If the lodging taxes plus the actual lodging cost is less than the flat rate allowance, the

lodging taxes are not separately reimbursed.

The traveler is TDY for 31 consecutive days. The flat rate lodging per diem allowance is $80 per night

($2,480 total). The nightly hotel rate is $70 per night ($2,170 total). The night hotel tax is $5 per night

($155 total). Because the nightly rate plus the taxes ($2,170 + $155 = $2,325) does not exceed $2,480,

the traveler is not authorized to be separately reimbursed for the taxes.

11. Are travelers required to itemize daily lodging expenses when leave is taken during TDY?

Yes. Lodging expenses during leave days must be itemized to determine the actual daily costs of

lodging. This includes the daily costs of the lodging, lodging taxes, electric, cable, phone, etc. Receipts

are required for all lodging expenses that are incurred during leave periods.

Example: The traveler is TDY for 45 consecutive days. The flat rate lodging per diem allowance is $80

per night but the actual nightly rental rate is $50 per night. The electric bill is $90 for the 45 days.

During this TDY the traveler takes 3 days of leave. The traveler is authorized to be reimbursed $50 per

night and an additional $2 per night ($90 electric bill / 45 days = $2 per day) during the three days of

leave. The traveler is not authorized to be reimbursed the flat rate lodging per diem allowance of $80

per night during the 3 days of leave.

12. Will DTS automatically change the per diem rates if the TDY is 31 or more consecutive days and 181 or

more consecutive days?

No. At this time DTS does not automatically calculate the flat rate per diem based on the length of the

TDY.

13. Is the traveler required to submit a receipt for lodging when flat rate per diem is authorized?

No. When authorized flat rate per diem, travelers are not required to submit a lodging receipt but may

be required to validate to their Authorizing Official that they did incur lodging costs. Receipts are

required when actual lodging is reimbursed during leave periods, dual lodging is authorized, and when

claiming lodging taxes separately (see FAQ #10 for more information about lodging tax

reimbursement).

14. When authorized flat rate per diem are military members mandated to stay in government quarters

when they are available?

Yes. Military members are still required to use government quarters when they are available. When

government quarters are available or if a traveler chooses to stay in government quarters, the flat rate

lodging per diem does not apply and the traveler is reimbursed for actual lodging costs. If meals are

not directed or available, the flat rate M&IE per diem still applies. If meals are directed and available

flat rate M&IE per diem does not apply and the traveler is reimbursed PMR or GMR.

Flat Rate Per Diem FAQs

10/16/2017

4

Defense Travel Management Office

15. If a traveler does not pay for lodging (lodging is made available at no cost) is the traveler paid

flat rate lodging per diem?

No. If the traveler is lodging in a contracted facility, at family or friend’s residence, or at a personally owed

residence, the traveler is not authorized a lodging payment. The traveler must incur a lodging cost to be

eligible to receive flat rate lodging per diem.

16. When TDY to a government installation where government quarters and meals are directed and

available, does flat rate per diem apply?

No. If government quarters and meals are available and directed, the traveler is reimbursed for the

actual lodging costs of government quarters and M&IE is paid at the government meal rate (GMR) or

proportional meal rate (PMR).

17. If travel is to a government installation where government quarters and meals are directed and

available and the dining facility is closed on weekends and holidays, does flat rate per diem apply on

those days?

No, the full meal rate would apply to those days, unless the dining facility was closed for a period of 31

consecutive days or more due to circumstances such as renovation.

18. If government quarters and meals are provided, does flat rate per diem apply?

No. If government quarters and meals are provided, such as when deployed to the CENTCOM AOR or

when Essential Unit Messing is declared, travelers are paid the incidental expense portion of per diem

and are not paid flat rate per diem.

19. If a traveler voluntarily uses government quarters, does flat rate per diem apply?

If government quarters are used, the traveler is reimbursed the actual cost for government quarters. If

the government meal rate (GMR) or proportional meal rate (PMR) is not appropriate, M&IE is paid at

the flat per diem rate (75% or 55%, as applicable).

20. What is considered adequate and suitable lodging?

When determining the adequacy or suitability of lodging, the TMC and Authorizing Official should

consider:

a. Must be well maintained and structurally sound (shall not pose a health, safety or fire hazard). All

public lodging used by federal travelers must be approved by FEMA as meeting the requirements of the

Hotel and Motel Fire Safety Act of 1990.

b. Should have a private entrance (interior door) when possible and must have at least one full

bathroom (with tub or shower).

c. If required due to climate conditions, must have air conditioning or a similar cooling system and a

permanently installed, adequately vented heating system.

d. Must have adequate utility systems and services (e.g. electrical, gas, potable water, sewer, trash

collection, television, and telephone as required).

e. Must meet the requirements of the Americans with Disabilities Act of 1990 as amended (ADA), if

applicable.

f. Must have adequate parking facilities within the confines of the lodging establishment.

g. Must provide adequate hallway lighting when interior doors are available and adequate exterior lighting

if exterior doors are required.

Flat Rate Per Diem FAQs

10/16/2017

5

Defense Travel Management Office

h. Must meet local force protection requirements.

i. Commuting costs and commuting time from the lodging establishment to the place of duty.

21. Does flat rate per diem apply in a COCOM or JTF Commander’s Area of Responsibility (AOR)?

Maybe. When meals or quarters are not available or are not provided for 31 or more consecutive days,

then flat rate per diem applies. If the traveler is TDY in support of the COCOM or Joint Task Force (JTF)

Commander in a designated AOR where an alternate per diem rate has been established and meals and

quarters are provided, the traveler is paid the per diem rate that is established by the COCOM or JTF

Commander. If government quarters and meals are provided, such as when deployed to the CENTCOM

AOR, travelers are paid the incidental expense portion of per diem ($3.50 per day).

22. Does the OCONUS incidental expense rate ($3.50 per day) apply when calculating flat rate per diem

for travelers TDY to an OCONUS location, including a government installation OCONUS?

No. The flat rate per diem is calculated as a percentage, 75% or 55%, of the full locality per diem rate

(which includes the locality incidental rate).

23. If a traveler is TDY to one location for 40 consecutive days and is authorized the flat rate per diem,

what should the traveler be paid if the traveler unexpectedly returns to the PDS after 20 consecutive

days? Does the traveler receive the full locality per diem since the TDY was only for 20 consecutive days?

No. The traveler must be paid flat rate per diem. Because the original TDY order’s length was 31 or

more consecutive days, per diem may not be increased or decreased. If the TDY is curtailed and the

lodging establishment charges an early checkout fee or a penalty, the checkout fee or a penalty is paid

as a separate reimbursable expense.

24. If a traveler is ordered TDY to one location for 31 or more consecutive days and performs multiple

concurrent TDY trips to other locations (whether lodging is retained at the original location or not), does

the flat rate per diem still apply for the original location the traveler was ordered to initially?

Yes. The flat rate per diem would still apply at the original location upon return.

Example 1: The traveler is TDY for 90 consecutive days at Location A, with interim trips to locations B and C.

The traveler is paid the flat rate per diem at location A, but is paid the locality per diem rate while at locations

B and C. Dual Lodging for location A would be paid as a separate reimbursable expense. Lodging receipts are

required for Dual Lodging that is claimed.

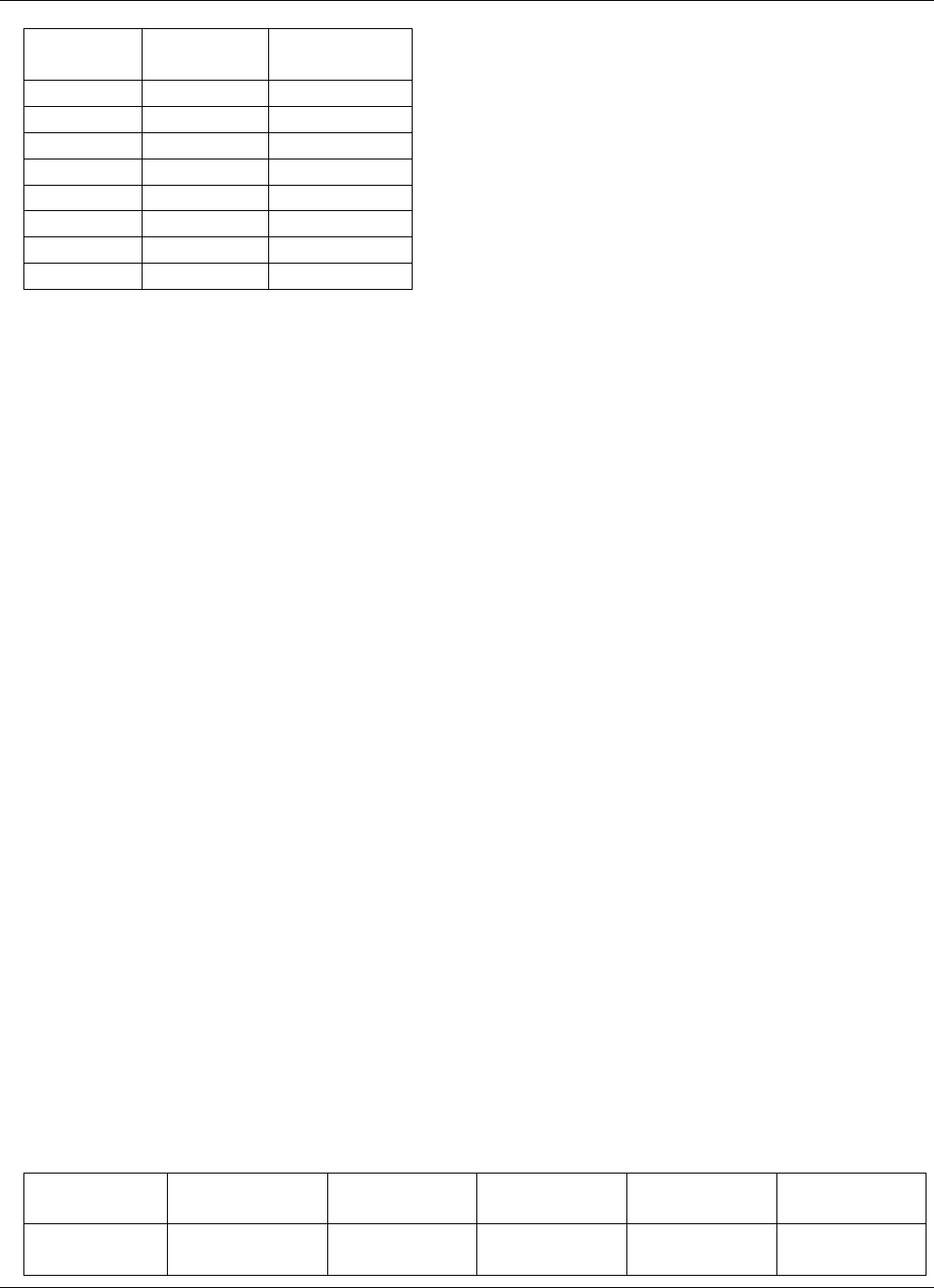

Days

Location

Per Diem

Rate

1-35

A

75%

36-40

B

100%

41-60

A

75%

61-75

C

100%

76-90

A

75%

Example 2: The traveler is TDY for 90 consecutive days to Location A and is being paid flat rate per diem of

75%. After arrival, the traveler is informed of travel to other locations (B, C, D, & E) with returns to the

original location. The per diem at locations B, C, D, and E are based on the number of consecutive days at

each location; however, the traveler is always limited to 75% while at Location A. The traveler receives up to

full locality per diem while at Locations B, C, D and E, but only 75% while at Location A. If the traveler retains

lodging at location A, dual lodging would be paid as a separate reimbursable expense.

Flat Rate Per Diem FAQs

10/16/2017

6

Defense Travel Management Office

Days

Location

Per Diem

Rate

1-20

A

75%

21-25

B

100%

26-40

A

75%

41-45

C

100%

46-60

A

75%

61-71

D

100%

72-75

E

100%

76-90

A

75%

NOTE: Because the original orders were 31 or more consecutive days at Location A, the entitlement at

Location A is always 75%, regardless of the actual number of days at this location.

25. If a traveler is TDY to one location, but is not expected to physically be at that location for 31 or more

consecutive days, should the traveler receive the flat rate per diem?

Maybe. The Authorizing Official must determine if the costs of paying actual lodging and full locality

M&IE per diem while at that location is less than paying flat rate per diem for lodging and M&IE plus

dual lodging. The traveler’s orders must state that the traveler is expected to be on one or more TDY

missions away from the original TDY location for a large part of the ordered duration and paying actual

lodging and full locality M&IE per diem is less than paying flat rate per diem for lodging and M&IE plus

dual lodging. This situation could apply to an air crew that is ordered to an installation to begin flying

multiple missions away from the original TDY location and a large portion of the TDY is spent away

from the original TDY location. Another example is when traveler is TDY to CENTCOM HQ at MacDill

AFB, FL for 180 consecutive days when after two weeks at MacDill AFB the traveler is ordered to deploy

TDY to Afghanistan. The traveler is in Afghanistan for most of the TDY period and returns to MacDill

AFB for the last week. See FAQ #26 for calculation examples.

26. How would an Authorizing Official determine if the flat rate is more advantageous for a specific TDY

assignment when the traveler is not expected to be physically at that location for 31 or more consecutive

days?

A traveler is TDY to Washington, DC for 70 consecutive days with a known concurrent TDY requirement that

will be at Norfolk, VA. The Authorizing Official must determine the costs based on the time that is anticipated

at each TDY location. Note that the TDY locations and the anticipated time periods at each location should be

stated in the authorization prior to travel.

Example: The traveler is TDY at Washington, DC for 70 consecutive days with a known concurrent TDY to

Norfolk, VA for 20 consecutive days and both requirements are stated in the orders. The itinerary places the

traveler in Washington, DC for 20 consecutive days, Norfolk, VA for 20 consecutive days, and the remainder

of the TDY period in Washington, DC. The per diem rate for Washington, DC is $179 for lodging and $69 for

M&IE. The flat rate per diem for Washington D.C. is $134.25 for lodging and $51.75 for M&IE. The per diem

rate for Norfolk, VA is $89 for lodging and $51 for M&IE.

Chart 1 - The traveler is authorized the flat rate of per diem and dual lodging at the initial TDY location.

Dates

Location

Lodging

M&IE

Dual

Lodging

Total

1 June

Washington,

DC

$134.25

$69 x 75%

= $51.75

0

$186.00

Flat Rate Per Diem FAQs

10/16/2017

7

Defense Travel Management Office

(travel

day)

2-20 June

(19 days)

$134.25 x

19 =

$2,550.75

$51.75 x

19 =

$983.25

0

$3,534.00

21 June-

10 July (20

days)

Norfolk, VA

$89 x 20 =

$1,780

$51 x 20 =

$1,020

$134.25 x

20 =

$2,685

$5,485.00

11 July-8

Aug (29

days)

Washington,

DC

$134.25 x

29 =

$3,893.25

$51.75 x

29 =

$1,500.75

0

$5,394.00

9 Aug

(travel

day)

0

$69 x 75%

= $51.75

$51.75

Total

$14,650.75

Chart 2 – The traveler is authorized actual lodging costs and full locality M&IE per diem.

Dates

Location

Lodging

M&IE

Dual

Lodging

Total

1 June

(travel

day)

Washington,

DC

$179

$69 x75%

= $51.75

0

$230.75

2-20 June

(19 days)

$179 x 19

= $3,401

$69 x 19 =

$1,311

0

$4,712.00

21 June-10

July (20

days)

Norfolk, VA

$89 x 20 =

$1780

$51 x 20 =

$1,020

0

$2,800.00

11 July-8

Aug (29

days)

Washington,

DC

$179 x 29

= $5,191

$69 x 29 =

$2,001

0

$7,192.00

9 Aug

(travel

day)

0

$69 x75%=

$51.75

$51.75

Total

$14,986.50

In this example, it would be more advantageous to the Government for the Authorizing Official to

authorize the flat rate per diem for Washington, DC and incur the dual lodging costs, rather than

authorizing actual lodging costs and full locality M&IE per diem at all locations for the entire TDY

period.