1

April 16, 2020

Fiscal Stimulus Needed to Fight Recessions

Lessons From the Great Recession

By Chad Stone

The economy was in the longest expansion on record before the COVID-19 pandemic, but a

sharp decline in economic activity is now inevitable, with unemployment insurance claims

skyrocketing and many forecasters saying that the economy has already entered a recession. The last

recession — the Great Recession — was a stark reminder of the need to lessen the human hardship

and economic dislocation associated with a recession. It left key lessons for policymakers, who

should now use a wide array of available policy tools to keep this and future downturns as short and

shallow as possible.

Economists’ thinking about anti-recessionary policies has evolved in the last decade, informed in

part by the limits of conventional monetary policy that fighting the Great Recession revealed. This

experience generated renewed attention among policy economists to the importance of fiscal

stimulus (temporary increases in government spending and reductions in government revenues) in

supporting overall spending and employment when the economy weakens and preventing serious

and long-lasting damage when recessions do occur.

In March, lawmakers enacted three increasingly sizeable pieces of legislation to address the harm

that the pandemic and efforts to contain it are causing.

1

One of the most important lessons from the

Great Recession is that they should be prepared to do more. While the Great Recession measures

were substantial and prevented an even more severe recession, they ended prematurely and were

insufficient to promote a robust recovery. The protracted period of high unemployment and

underemployment after the economy stopped contracting and began to grow again in June 2009

continued to generate human hardship and hurt long-term growth. Because lawmakers did not

include provisions in the recently enacted coronavirus legislation to “trigger” additional stimulus

automatically, based on further deterioration in economic conditions, they must be prepared to

enact additional measures as conditions require and to ensure they remain in place until the recovery

is clearly underway.

The following account describes the importance of keeping recessions as short and shallow as

possible and how both the economy and economists’ views have changed since the Great Recession.

1

The Coronavirus Preparedness and Response Supplemental Appropriations Act, the Families First Coronavirus

Response Act, and the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

1275 First Street NE, Suite 1200

Washington, DC 20002

Tel: 202-408-1080

Fax: 202-408-1056

www.cbpp.org

2

It then provides a set of principles and policies for fiscal stimulus informed by lessons learned in the

Great Recession and its aftermath. (This analysis provides background and general policy principles;

CBPP has also released a number of analyses directly addressing the needs of families hit hard by

COVID-19 and the resulting economic fallout.

2

)

In brief:

• Recessions have profound human and economic costs. Prolonged unemployment harms not

only workers’ job prospects and lifetime earnings but also the health and well-being of them

and their families. Workers without a college degree and workers of color are the most

vulnerable to these adverse effects. Moreover, long unemployment spells and diminished

demand for goods and services in a recession erode job skills among unemployed workers and

reduce business investment, which can depress the economy’s productive capacity long past

the end of the recession.

• Interest rates are considerably lower now than they were in the two decades leading up to the

Great Recession. The Federal Reserve has already exhausted the room it had for its standard

approach of cutting short-term interest rates to offset an economic downturn and stimulate a

recovery in response to COVID-19. The Fed is proceeding with unconventional measures to

support economic activity similar to those used in the Great Recession and its aftermath, as

well as significant emergency measures to stabilize financial markets in the pandemic. Yet,

fiscal measures are still required.

• Fiscal policy has a greater role to play in fighting recessions and stimulating recoveries than

academic economists’ policy advice reflected prior to the Great Recession, especially in light

of the limits to conventional monetary policy. Strengthening the fiscal policy response to a

weakening economy requires more robust “automatic stabilizers” — the features of tax laws

and spending programs like unemployment insurance and the Supplemental Nutrition

Assistance Program (SNAP, formerly the Food Stamp Program) that automatically reduce

income losses and support consumer spending in a downturn — together with a willingness

of policymakers to enact additional temporary discretionary measures when the automatic

stabilizers alone are insufficient, as is the case now with the pandemic.

• Fiscal stimulus is most effective if: 1) it is implemented as early as possible in a recession; 2) it

is directed to individuals and entities who will spend any additional resources they receive

quickly; 3) it errs on the side of being larger than ultimately necessary rather than smaller; and

4) its size and duration respond to changing circumstances.

• Concerns that the United States does not have the “fiscal space” — due to high levels of

deficits and debt — to enact robust fiscal stimulus to minimize the human and economic

costs of a recession are misguided. The United States has a long-term fiscal challenge, not an

immediate debt crisis. Deficit and debt concerns should go on the back burner in a recession.

• The following are among the most important policies that meet the criteria for effective fiscal

stimulus:

o Providing additional weeks of unemployment insurance and raising the weekly benefit

level;

2

See “COVID-19: Responding to the Health and Economic Crisis,” Center on Budget and Policy Priorities,

https://www.cbpp.org/covid-19-responding-to-the-health-and-economic-crisis.

3

o Raising the maximum SNAP benefit level and ensuring that unemployed adults have

access to food assistance;

o Providing state fiscal relief by reducing the percentage of Medicaid spending for which

states are responsible (by increasing the federal matching rate) and giving states, tribes,

and localities temporary block grants or other flexible funding to maintain needed

services such as education;

o Providing cash assistance to people facing economic insecurity through monthly or

one-time cash payments that can help address both emergencies and ongoing basic

needs, as well as through expansions of refundable tax credits;

o Implementing a subsidized jobs program for low-income workers, although the special

circumstances of COVID-19 require waiting until after the health crisis diminishes and

such programs can be undertaken safely; and

o Increasing housing assistance to prevent a sharp rise in evictions and homelessness.

• A recession stemming from COVID-19 also requires additional measures to deal with unique

circumstances, but for many of the measures above, policymakers should design them not

only to provide robust immediate stimulus but also to permanently strengthen their function

as automatic stabilizers that trigger on early in future recessions, provide stimulus appropriate

to the magnitude of the downturn, and do not trigger off prematurely. Such trigger

mechanisms can ensure that needed stimulus measures are timely and that they neither end

prematurely nor remain in effect too long.

• As noted above, if a recession turns out to be deeper or last longer than initially anticipated,

policymakers should be prepared to increase the size and/or duration of their fiscal policy

response, including, if needed, following up with additional discretionary stimulus.

4

Keeping Recessions as Short and Shallow as Possible: Why It Matters

Pursuing and maintaining high employment and avoiding deep or long-lasting recessions are

critical for most Americans’ well-being, but they are especially important for people who face

greater hurdles finding good jobs and steady employment even in relatively good labor markets.

Victims of recessions experience serious and lasting harm, as the International Monetary Fund

found in its 2010 assessment of the human and social costs of recessions:

The human and social costs of unemployment are more far-reaching than the immediate

temporary loss of income. They include loss of human capital, loss of lifetime earnings,

worker discouragement, adverse health outcomes, and loss of social cohesion. Moreover,

parents’ unemployment can affect the health and education outcomes of their children. The

costs can be particularly high for certain groups, such as youth and the long-term

unemployed.

a

In the United States, racial disparities are particularly glaring. Black or African American and

Hispanic/Latino unemployment rates fell to historically low levels in the 2009-2020 expansion,

but they remained considerably higher than the white unemployment rate. Historically, black

unemployment in the best of times has been little better than white unemployment in the worst of

times (see chart).

Sustaining a high-employment economy is a necessary condition for making progress to close that

gap, and that requires robust automatic stabilizers and effective discretionary fiscal stimulus to

keep recessions as short and shallow as possible.

Recessions, of course, have immediate economic costs from unrecoverable output and income

losses. The Congressional Budget Office estimates that in the half century before the Great

Recession, net output and employment losses in recessions that outweighed increases in output

above potential during booms caused actual gross domestic product to fall short of the output the

economy was capable of producing by an average of about half a percentage point a year.

b

Moreover, protracted unemployment spells can erode workers’ job skills or lead them to leave the

labor force. And lower demand for their products can discourage businesses from investing in

5

maintaining or expanding their capital stock of machines, factories, offices, and stores or from

making other productivity improvements. The net result is slower growth in the economy’s long-run

capacity to supply goods and services and slower income growth.

c

a

Mai Dao and Prakash Loungani, “The Human Cost of Recessions: Assessing It, Reducing It,” International Monetary

Fund, November 11, 2010, https://www.imf.org/en/Publications/IMF-Staff-Position-Notes/Issues/2016/12/31/The-

Human-Cost-of-Recessions-Assessing-It-Reducing-It-24221.

b

Congressional Budget Office, “Why CBO Projects That Actual Output Will Be Below Potential Output on Average,”

February 2015, https://www.cbo.gov/sites/default/files/114th-congress-2015-2016/reports/49890-gdp-

projections.pdf.

c

Laurence Ball, “The Great Recession’s long-term damage,” Vox, July 1, 2014, https://voxeu.org/article/great-

recession-s-long-term-damage.

Monetary and Fiscal Policy Before the Great Recession

Before the Great Recession, the prevailing view among academic economists was that monetary

policy should bear the primary responsibility for stabilizing economic activity, inflation, and

employment. Fiscal policy’s role was largely confined to the automatic stabilizers built into existing

tax laws and spending programs, such as progressive tax rates, unemployment insurance (UI), and

SNAP.

That view reflected experience during the two-decade-long period prior to the Great Recession in

which business-cycle fluctuations were significantly less volatile than in the previous four decades of

the post-World War II era due to what economists perceived to be better monetary policy.

3

It also

reflected a skepticism about policymakers’ ability to implement discretionary fiscal stimulus

measures in a timely manner, even among economists who believed prompt enactment of well-

designed measures could be effective in fighting recessions. (See box, “The Great Moderation,” for

more about this period.)

Consistent with that view, when signs began to emerge in late 2007 that the expansion following

the 2001 recession was threatened by weakness in the housing market and brewing turmoil in

financial markets stemming from problems in the subprime mortgage market, economists generally

emphasized that monetary policy should be the first line of defense. They argued that the Fed, which

had gradually raised its short-term interest rate target from 1 percent in mid-2004 to 5.25 percent in

June 2006, had ample room to cut interest rates to provide stimulus.

Economists who did not reject out of hand that fiscal policy could be helpful argued that any

discretionary stimulus measures should be timely (i.e., stimulate new spending early in the recession),

targeted (i.e., go to individuals and entities that would quickly spend any new resources they received),

and temporary (i.e., expire when stimulus was no longer needed, so as not to add unnecessarily to

budget deficits and debt without providing effective stimulus — or possibly even lead to

overheating if they provide stimulus for too long).

3

Craig S. Hakkio, “The Great Moderation,” Federal Reserve Bank of Kansas City, November 22, 2013,

https://www.federalreservehistory.org/essays/great_moderation.

6

The Great Moderation

The two decades preceding the Great Recession didn’t prepare policymakers for the challenges

they would face in 2008-09. To the contrary, this period, known as the Great Moderation, was one

in which inflation was relatively tame, recessions were relatively mild, and the then record-length

1990s expansion produced strong growth and very low unemployment. That experience stood in

marked contrast to the preceding period from the late 1960s to the early 1980s, which included

the stagflation of the early-to-mid 1970s — when inflation and unemployment coexisted and

growth slowed — and the double-digit inflation of the late 1970s followed by the double-digit

unemployment of the 1981-82 recession.

The 1990-1991 and 2001 recessions were both relatively short and mild (although the

expansions coming out of each began sluggishly and unemployment continued to rise, peaking 15

and 19 months after the formal end of the recessions, respectively). The Fed had begun to cut its

target interest rate prior to both of these recessions (the first steps toward interest-rate cuts

totaling 5.8 and 4.5 percentage points, respectively) and did not begin to raise interest rates again

until after unemployment began to fall. In both recessions, policymakers enacted additional weeks

of emergency unemployment insurance (UI) payments for workers who exhausted their 26 weeks

of regular UI benefits after the formal end of the recession but before unemployment peaked.

The 2001 recession ended what was then the longest economic expansion on record. As that

expansion showed signs of faltering early that year, President Bush re-branded his campaign

proposal for large permanent tax cuts as stimulus, but the only deliberate stimulus measure was a

one-time (modest and non-refundable) tax rebate.

With unemployment still rising in early 2003, President Bush signed a second large tax cut that

accelerated but did not expand some previously enacted tax cuts, expanded the child credit and

included an advance payment mechanism for 2003, and increased certain business tax cuts. The

2003 package also included $20 billion in state fiscal relief

For the most part, however, the two Bush tax cuts provided limited stimulus while primarily

benefiting high-income households and significantly increasing current and projected future

budget deficits by lowering the path of future revenues substantially.

These positions were echoed in early 2008 by then-Fed Chairman Ben Bernanke, who testified

that the Fed had responded proactively by cutting its short-term interest rate target by a full

percentage point to 4.25 percent between September and December 2007. Bernanke said that

further cuts could be appropriate, and he agreed that well-designed fiscal measures could be helpful

but poorly designed measures would be counterproductive.

4

Economists Jason Furman and Douglas

Elmendorf similarly endorsed the priority of monetary policy and cautioned about the dangers of

fiscal measures that were poorly timed, badly targeted, or permanently increased the deficit. They

observed, however, that “if a sharp economic downturn appears imminent, and well-designed tax or

spending changes could be implemented quickly, such fiscal stimulus could boost economic activity

more quickly than monetary stimulus.”

5

A CBPP analysis added the recommendation that, to avoid

the costs of not being ready if the economy did fall into a recession, policymakers should

4

Ben S. Bernanke, “The economic outlook,” testimony before the House Budget Committee, January 17, 2008,

https://www.federalreserve.gov/newsevents/testimony/bernanke20080117a.htm.

5

Douglas W. Elmendorf and Jason Furman, “If, When, How: A Primer on Fiscal Stimulus,” Hamilton Project, January

2008, https://www.brookings.edu/wp-content/uploads/2016/06/0110_fiscal_stimulus_elmendorf_furman.pdf.

7

immediately assemble a stimulus package but wait for it to be triggered on by a specific indicator of

further deterioration in economic conditions.

6

Federal policymakers took reasonably timely steps early that year in response to evidence of a

rising risk of recession.

7

In February 2008, President Bush and the Democratic Congress enacted a

$152 billion package of individual income tax rebates, incentives to stimulate business investment,

and steps to address the subprime mortgage crisis. In a series of steps from January to May, the Fed

cut its interest rate target to 2 percent and adopted measures to contain the turmoil in financial

markets. In July, with unemployment about a percentage point higher than a year earlier, the

President and Congress enacted additional weeks of UI benefits.

In the second half of 2008, however, a meltdown in financial markets turned what might have

been only a mild downturn into the Great Recession.

Fiscal Policy Played a Prominent Role in the Great Recession

Unsustainable increases in bond and housing prices and excessive borrowing to purchase risky

assets led to the financial market meltdown in the summer and fall of 2008, which in turn further

weakened economic activity. As former Fed chair Janet Yellen, then President of the Federal

Reserve Bank of San Francisco, explained in early 2009:

Once this massive credit crunch hit, it didn’t take long before we were in a recession. The

recession, in turn, deepened the credit crunch as demand and employment fell, and credit

losses of financial institutions surged. . . . Consumers [pulled] back on purchases, especially

on durable goods, to build their savings. Businesses [canceled] planned investments and

[laid] off workers to preserve cash. And, financial institutions [shrank] assets to bolster

capital and improve their chances of weathering the current storm.

8

The first step of re-establishing financial market stability fell largely to the Fed and the Federal

Deposit Insurance Corp., which acted to restore liquidity that had evaporated in the crisis due to

falling asset prices and the failure or near-failure of major financial institutions. Most notably,

Congress eventually agreed to the controversial Troubled Asset Relief Program (TARP), which

established a $700 billion fund to give banks the capital they needed to continue to make loans.

To address the faltering economy, the Federal Reserve cut its target interest rate essentially to zero

between October and December 2008, when it adopted a target range of 0 to 0.25 percent, which it

6

Chad Stone and Kris Cox, “Economic Policy in a Weakening Economy,” Center on Budget and Policy Priorities,

January 11, 2008, https://www.cbpp.org/research/principles-for-fiscal-stimulus-economic-policy-in-a-weakening-

economy.

7

The Business Cycle Dating Committee of the National Bureau of Economic Research, a private organization, is the

recognized arbiter of business-cycle dating. In December 2008, the committee identified December 2007 as the starting

month of the recession, determining that the subsequent decline in economic activity was large enough to qualify as a

recession. National Bureau of Economic Research, “Determination of the December 2007 Peak in Economic Activity,”

December 11, 2008, https://www.nber.org/cycles/dec2008.html.

8

Janet L. Yellen, “A Minsky Meltdown: Lessons for Central Bankers,” presentation at the 18

th

Annual Hyman P. Minsky

Conference on the State of the U.S. and World Economies, April 16, 2009, https://www.frbsf.org/our-

district/press/presidents-speeches/yellen-speeches/2009/april/yellen-minsky-meltdown-central-bankers/.

8

maintained for the next five years. With no room for further conventional monetary stimulus via

cuts in short-term interest rates, the Fed turned to unconventional measures, notably what would

eventually be three rounds of large-scale purchases of longer-term assets — a policy known as

quantitative easing — to try to lower longer-term interest rates and continue to provide needed

stimulus.

On the fiscal policy front, President Obama and Congress enacted the American Recovery and

Reinvestment Act (ARRA) in February 2009. ARRA’s roughly $830 billion of tax cuts and spending

measures were at the time by far the largest package of “Keynesian stimulus” in the post-World War

II era. The Congressional Budget Office (CBO), in its 2015 assessment of the impact of ARRA on

employment and output, grouped the various provisions into the following four broad categories:

9

• Providing funds to states and localities — for example, by raising the federal government’s

share of Medicaid costs, providing funding for education costs, and increasing financial

support for some transportation projects;

• Supporting people in need — such as by extending and expanding unemployment benefits

and increasing benefits under SNAP;

• Purchasing goods and services — for instance, by funding construction and other investment

activities that could take several years to complete; and

• Providing temporary tax relief for individuals and businesses — ranging from expansions of

the Earned Income and Child Tax Credits and a new Making Work Pay tax credit to creating

enhanced deductions for depreciation of business equipment and raising exemption amounts

for the alternative minimum tax (AMT).

Success of the Fiscal Response to the Great Recession

Economists Alan Blinder and Mark Zandi describe policymakers’ response to these developments

as a major reason why the Great Recession did not become the United States’ “Great Depression

2.0,” and why the United States fared much better than many other countries in the global economic

and financial crisis:

The policy responses to the financial crisis and the Great Recession were massive and

multifaceted. . . . Not only did they include the aggressive use of standard monetary and

fiscal policy tools, but new tools were invented and implemented on the fly in late 2008 and

early 2009. Some aspects of the response worked splendidly, while others fell far short of

hopes, and many were controversial — both in real time and even in retrospect. In total,

however, we firmly believe that the policies must be judged a success.

10

Neither TARP nor ARRA was successful politically, and not all of ARRA’s provisions — such as

AMT relief — satisfied the criteria for sound stimulus. But their positive effect on financial markets

9

Congressional Budget Office, “Estimated Impact of the American Recovery and Reinvestment Act on Employment

and Economic Output in 2014,” February 2015, https://www.cbo.gov/sites/default/files/114th-congress-2015-

2016/reports/49958-ARRA.pdf.

10

Alan S. Blinder and Mark Zandi, “The Financial Crisis: Lessons for the Next One,” Center on Budget and Policy

Priorities, October 15, 2015, https://www.cbpp.org/research/economy/the-financial-crisis-lessons-for-the-next-one.

9

and the economy was crucial to turning the economy around in 2009. Output and employment

would have been significantly lower in the recession and early stages of the recovery without ARRA,

according to CBO’s analysis.

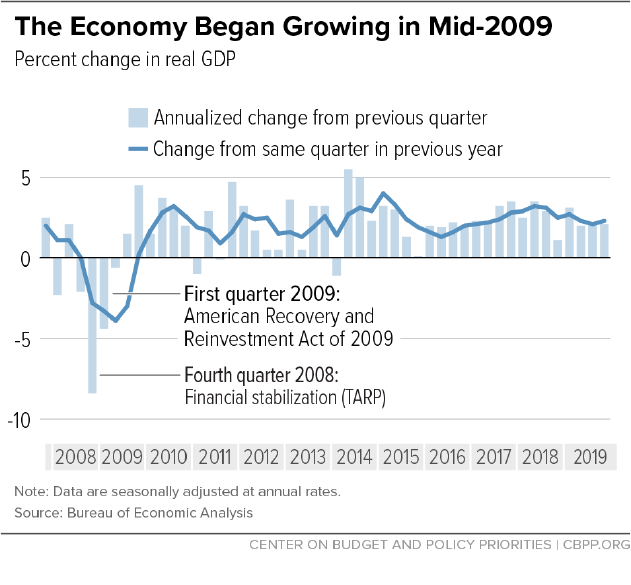

Economic activity as measured by real (inflation-adjusted) gross domestic product (GDP) was

contracting sharply when policymakers enacted TARP and ARRA (see Figure 1). The economy

stopped shrinking and began growing in mid-2009, and the expansion lasted more than a decade.

Job losses, which reached over three-quarters of a million a month in late 2008, began to shrink in

the spring of 2009, and private-sector job growth began an unbroken string of monthly job gains

from March 2010 through February 2020.

FIGURE 1

ARRA was designed to boost the demand for goods and services in order to stimulate growth and

preserve jobs in the recession and to create them in the early stages of the recovery. (See box, “How

ARRA Increased Output and Employment.”) GDP was higher and the unemployment rate lower

each year between 2009 and 2012 than they would have been without ARRA, with the largest impact

in 2010, CBO found.

GDP was between 0.7 and 4.1 percent higher in 2010 than it otherwise would have been, CBO

estimated (see Figure 2). The impact faded after 2010, as ARRA stimulus wound down, but CBO

estimated that even at the end of 2012, GDP was between 0.1 and 0.6 percent larger than it would

have been without ARRA.

10

FIGURE 2

Similarly, while CBO estimated that ARRA had the greatest effect on the unemployment rate in

2010 (see Figure 3), even in the fourth quarter of 2012, the unemployment rate was 0.1 to 0.4

percentage points lower than it otherwise would have been, and employment was between roughly

100,000 and 800,000 jobs greater than it otherwise would have been.

FIGURE 3

11

How ARRA Increased Output and Employment

Effective economic stimulus and recovery measures work by increasing the demand for goods and

services at a time when there is economic “slack” — insufficient demand to keep businesses

operating at full capacity and to generate full employment. Measures that increase demand stop

the destruction of jobs and begin to put people back to work during times when business and

consumer confidence is low and economic activity is declining. They continue to do so in the early

stages of a recovery from a recession if there is still substantial economic slack.

For the most part, ARRA was well-designed to produce stimulus as quickly as could be done. It

included fast-spending, high “bang-for-the-buck”

*

items such as expansions in SNAP and UI —

provisions that a broad range of economists and CBO rate as some of the most highly stimulative

types of spending per dollar of cost. Its state fiscal relief was essential to moderate the drag on

the economy from the even larger budget cuts and tax increases that states otherwise would have

had to impose. The package also included infrastructure investments, which are highly stimulative

once projects are underway but sometimes require significant lead time. Finally, some of the

package’s tax provisions were targeted on low- and moderate-income households, such as

expansions of the Earned Income Tax Credit and Child Tax Credit, making them effective as

stimulus. Various other ARRA tax provisions were less well-targeted and, according to CBO, had a

far smaller stimulative effect.

CBO’s range of estimates of the percentage boost to GDP from ARRA is based on low and high

estimates of the bang for the buck of the various ARRA measures. Among major provisions, these

were 0.5 to 2.5 for federal purchases of goods and services, 0.4 to 2.1 for transfer payments to

individuals such as SNAP and UI, and 0.3 to 1.5 for tax cuts for lower- and middle-income people.

In contrast, CBO’s estimates of bang for the buck were 0.1 to 0.6 for alternative minimum tax

relief for higher-income people, and 0 to 0.4 for the corporate tax provisions in ARRA, suggesting

that the latter two provided little or no stimulus.

*Dollars of net new aggregate demand for goods and services stimulated per dollar of budget cost. A value above 1

means that for every dollar of cost to the Treasury, the demand for private sector goods and services increased by more

than a dollar.

As discussed in the box “Keeping Recessions as Short and Shallow as Possible: Why It Matters,”

the human, social, and economic costs of recessions go well beyond the value of the goods and

services not produced and the income not earned, though these immediate economic losses were

quite large in the Great Recession. The cumulative gap between actual GDP and CBO’s high

estimate of how much lower GDP would have been without ARRA (the cumulative gap between

the blue line and the red dotted line in Figure 2) was about $1.3 trillion (in 2009 dollars). By reducing

job losses, ARRA saved the equivalent of 11 million full-time years of work, CBO estimated.

11

As large, timely, and reasonably well-targeted and effective as ARRA was, a rapid and robust

recovery from the Great Recession proved elusive. The output losses and jobs hole created by the

Great Recession were so large that an even larger stimulus package would have been required to

climb out more quickly. Indeed, the incoming Chair of the Council of Economic Advisers (CEA),

11

A full-time-equivalent employment year is 40 hours a week for a year. This measure treats two 20-hour-per week jobs

held for a full year as equivalent to a single 40-hour-per-week job held for a full year.

12

Christina Romer, suggested a larger package, but it was judged to be politically impractical.

12

President Obama proposed additional stimulus in subsequent budgets, but Congress agreed to only

modestly more stimulus.

In a 2012 assessment of ARRA, Romer acknowledged that it was too small and could have been

more effective but stated that over time, “the fiscal stimulus will be viewed as an important step at a

bleak moment in our history. Not the knockout punch the administration had hoped for, but a

valuable effort that improved the lives of many.”

13

Policymakers Must Use Fiscal Stimulus in a Recession

The CBO and Blinder-Zandi analyses bear out Romer’s belief that ARRA moderated the Great

Recession. Jason Furman, who served as CEA chair in the second Obama term, argues based on

recent fiscal stimulus research that “the tide of expert opinion” among policy-oriented economists

and international institutions such as the International Monetary Fund and the Organisation for

Economic Co-operation and Development was already shifting prior to the COVID-19 pandemic.

The “new view” of fiscal policy reverses most of the “old view” that prevailed leading up to the

Great Recession — and still may prevail among some policymakers, notwithstanding the bipartisan

and near-unanimous support for the CARES Act as a COVID-19 emergency measure.

14

Several policy shifts distinguish this new perspective, which features the following four principles:

1. Fiscal policy shouldn’t be subordinate to monetary policy. Furman argues that fiscal policy is

an essential tool to support aggregate demand and should not be subordinate to monetary policy, as

many considered it to be before the Great Recession. In response to COVID-19, the Fed has cut its

target interest-rate range from one that was already substantially lower than before the Great

Recession essentially to zero,

15

eliminating its room for conventional interest rate cuts to stimulate

aggregate demand in a weakening economy. Notwithstanding the significant quantitative easing and

financial-market stabilization measures the Fed is now taking, the CARES Act and other fiscal policy

measures are critical for fighting a COVID-19 recession, and fiscal policy will be a necessary

complement to monetary policy in any future recession.

16

12

Brad DeLong, “Romer Advised Obama To Push $1.8 Trillion Stimulus,” Economist’s View, February 16, 2012,

https://economistsview.typepad.com/economistsview/2012/02/romer-advised-obama-to-push-18-trillion-

stimulus.html.

13

Christina D. Romer, “The Fiscal Stimulus, Flawed but Valuable,” New York Times, October 20, 2012,

https://www.nytimes.com/2012/10/21/business/how-the-fiscal-stimulus-helped-and-could-have-done-more.html.

14

Jason Furman, “The New View of Fiscal Policy and Its Application,” remarks delivered at the conference Global

Implications of Europe’s Redesign, October 5, 2016,

https://obamawhitehouse.archives.gov/sites/default/files/page/files/20161005_furman_suerf_fiscal_policy_cea.pdf.

15

In late 2008, when it had run out of room for further cuts in its target short-term interest rate, the Fed switched to a

quarter-point target range.

16

Before the pandemic, former Federal Reserve chair Ben Bernanke wrote that the new monetary policy tools used in

the Great Recession would be effective and could provide the equivalent of about 3 additional percentage points of

short-term rate cuts as long as interest rates are not too low, but he conceded that with very low interest rates, fiscal

policy would likely be necessary as well. Ben Bernanke, “The new tools of monetary policy,” 2020 American Economic

Association presidential address, January 4, 2020, https://www.brookings.edu/blog/ben-bernanke/2020/01/04/the-

new-tools-of-monetary-policy/.

13

2. Fiscal policy stimulates demand in a recession. Furman argues that evidence from the Great

Recession shows that discretionary fiscal policy can be highly effective at stimulating aggregate

demand when the Fed does not counter it by tightening. By stimulating economic growth while

interest rates are low, well-targeted, deficit-financed stimulus measures may even encourage new

investment despite increasing the deficit. This suggests that CBO’s high-end estimates of ARRA’s

effect on output and employment, described in the box above, are likely to be much closer to the

likely stimulus effects of those measures in a recession than its low-end estimates.

Recovery from the Great Recession was slowed by a premature turn toward budget austerity

beginning in 2010, when concerns about budget deficits and debt prevented policymakers from

adopting further needed stimulus. Instead, the winding down of ARRA spending became a drag on

growth in 2010-11, as Figure 1 shows. Congressional opposition to continuing fiscal stimulus in

order to promote a stronger recovery was fueled by the emergence of small-government populist

Tea Party sentiments and since-discredited academic evidence purporting to show that levels of debt

beyond a 90-percent-of-GDP-threshold were damaging to growth

17

and that cutting government

spending in a recession could increase growth

18

— contrary to the overwhelming evidence that

cutting spending or raising taxes in a recession is contractionary.

3. Fiscal space constrains stimulus less than previously thought. Furman rejects the idea that

the United States now faces a debt crisis that requires immediate austerity, noting that “fiscal

stimulus is less constrained by fiscal space than previously appreciated.” Fiscal space is the amount

of room a country has to increase deficits and debt without debt holders losing confidence and

provoking a debt crisis with spiking interest rates, falling government bond prices, and the risk of a

sharp contraction in economic activity. Furman does not call for abandoning fiscal responsibility,

but even before COVID-19 created the need for an urgent and robust response, he rejected the idea

that we - have, or are near to having, a debt crisis that precludes borrowing for stimulus in a

recession.

Both former CBO Director Douglas Elmendorf and current CBO Director Phillip Swagel agree

with that position, with Swagel stating last summer, “when there’s a financial crisis and a recession . .

. countries that respond with expansionary policy do better. And it looks like the United States has

the fiscal space to do that. . . . Interest rates are low. The federal government is able to borrow. So

[the debt situation] is not an immediate crisis. . . . It’s a long-term challenge.”

19

Similarly, Elmendorf wrote in the Washington Post last year, “Yes, we have a serious long-term debt

problem, but no, that problem does not make anti-recessionary budget policy impossible or

17

Chad Stone, “After Reinhart-Rogoff, Reflections on the Relationship Between U.S. Debt and Economic Growth,”

Center on Budget and Policy Priorities, May 6, 2013, https://www.cbpp.org/blog/after-reinhart-rogoff-reflections-on-

the-relationship-between-us-debt-and-economic-growth.

18

Chad Stone, “Spend Less, Owe Less, Grow the Economy,” testimony before the Joint Economic Committee, June 21,

2011, https://www.cbpp.org/blog/chad-stone-on-the-fallacy-of-spend-less-owe-less-grow-the-economy.

19

NPR, “CBO Predicts Budget Deficit Will Reach Nearly $1 Trillion This Year,” August 22, 2019,

https://www.npr.org/2019/08/22/753355117/cbo-predicts-budget-deficit-will-reach-nearly-1-trillion-this-year.

14

unwise.”

20

The fact that interest rates were at a historically low level and expected to remain so for

many years even at the time he was writing last summer led Elmendorf to the following conclusion,

which is even more true now:

Federal borrowing is thus less costly and creates less risk for the federal government than

many of us predicted several years ago — and, according to economic analyses, does less

harm to the economy even in the long run. In addition, the funds used as stimulus do not

disappear: They support government spending for public goods and services, or they lower

taxes so that households have more resources for their private activities.

In sum, we have plenty of capacity in the federal budget to undertake vigorous

countercyclical tax and spending policies when the next recession arrives. Given the economic

and social costs of recessions, we should undertake such policies (emphasis added).

4. Sustained fiscal expansion could be necessary. The low-interest-rate environment and the

experience with sluggish recoveries from the Great Recession and the milder recessions in 1990-

1991 and 2001 lead to the fourth principle in the new view of fiscal policy: it may be desirable to

pursue sustained fiscal expansion.

Before the Great Recession, economists who were sympathetic to fiscal stimulus in principle were

hesitant to recommend it in practice due to concerns that delays in recognizing the need and

enacting the necessary legislation would delay the stimulus from taking effect until monetary

stimulus had already kicked in and the economy was recovering at a reasonable pace. That could

potentially be destabilizing and lead the Fed to raise interest rates to prevent overheating, largely

offsetting the stimulus. The net result would simply be an unnecessary increase in debt to finance

stimulus that was no longer needed and the Fed had largely offset.

In today’s low-interest-rate global economy, however, the case for more sustained stimulus in the

face of deficient aggregate demand is much stronger, especially if the stimulus takes the form of

productive investment.

21

The Great Recession wreaked long-lasting damage on the economy’s

productive capacity, as a result of the sharp contraction in productive investment and the effects of

long-term unemployment on workers’ skills, employment prospects, labor force participation, and

earnings, as described earlier. Stronger and more sustained fiscal stimulus could have attenuated

these effects substantially. Avoiding additional damage due to COVID-19 is now essential.

22

20

Douglas Elmendorf, “Yes, we still have the fiscal capacity to deal with a recession,” Washington Post, September 3,

2019, https://www.washingtonpost.com/opinions/yes-we-still-have-the-fiscal-capacity-to-deal-with-a-

recession/2019/09/03/2f5081b4-c8f0-11e9-a4f3-c081a126de70_story.html.

21

Brad DeLong, Larry Summers, and Laurence Ball, “Fiscal Policy and Full Employment,” Center on Budget and Policy

Priorities, April 2, 2014, https://www.cbpp.org/sites/default/files/atoms/files/4-2-14fe-delong.pdf.

22

See Heather Boushey, Washington Center for Equitable Growth; Robert Greenstein, Center on Budget and Policy

Priorities; Neera Tanden, Center for American Progress; and Felicia Wong, Roosevelt Institute, “Commentary: Deficit

and Debt Shouldn’t Factor Into Coronavirus Recession Response,” March 19, 2020,

https://www.cbpp.org/research/economy/commentary-deficit-and-debt-shouldnt-factor-into-coronavirus-recession-

response: “We face a once-in-a-generation — hopefully once-in-a-lifetime — crisis, with the risk of tens of millions of

infections and mounting numbers of deaths, an overwhelmed hospital system that can’t respond adequately, large

numbers of businesses closing or cutting back, millions of workers losing their jobs or having their hours slashed, and

15

Designing Effective Stimulus

Stimulus measures must be well-designed to stimulate aggregate demand in a cost-effective way.

The principles for designing effective stimulus under the new view of fiscal policy are similar in

many ways to those captured in the “timely, targeted, and temporary” catch-phrase prevalent in

2008, but they should be updated to reflect changed circumstances — including COVID-19 — and

lessons learned from the Great Recession.

23

To be most effective stimulus should be:

Implemented early. Fiscal stimulus should be implemented as early as possible in a recession.

Measures like cash or SNAP payments for those in the greatest need delivered early in a recession

stimulate new spending quickly, lessening the extent to which businesses cut back on production or

lay off workers due to weak demand. Tax cuts that will be saved in large part rather than spent

quickly, in contrast, do little to bolster demand. Increased outlays in government investment

programs that spend out slowly don’t immediately boost aggregate demand, but they can be helpful

in getting back to full employment more quickly, thereby reducing the human costs and preventing

the harm to future growth a sluggish recovery could cause.

Well targeted. Measures targeted on individuals and entities that will quickly spend the bulk of

any new resources they receive have a high bang for the buck in stimulating aggregate demand (see

box, “How ARRA Increased Output and Employment”). Such individuals include unemployed

workers and people of modest means, in contrast to higher-income individuals and households, who

will save a large portion of any additional income.

Fiscal relief for state governments is another well-targeted form of stimulus. Faced with declining

tax receipts and looming deficits when the economy slows, states respond by raising taxes and

cutting back on spending, especially for health care, education, and aid to local governments. States

have little alternative, since almost all are required to balance their operating budgets in bad

economic years as well as good ones. But such actions further reduce demand in the economy and

deepen the recession. Federal fiscal relief that enables states to minimize such spending cuts and tax

increases thus helps prop up the economy in a time of weakness.

Bold in size and scope and responsive to changing conditions. Fiscal stimulus is a response

to temporary weakness in the economy. The country should not be stuck with permanent, deficit-

increasing tax cuts or spending increases because of a temporary economic downturn — but neither

should stimulus measures be terminated prematurely, as happened with ARRA. When the economy weakens,

avoiding a serious recession and its attendant social and economic costs should be policymakers’ top

priority, and recent slow recoveries suggest that the costs of erring on the side of providing too

much stimulus are less than the costs of providing too little — especially in today’s low-interest-rate

environment.

serious hardship all across our land. Deficits and debt pose no comparable risk. Policymakers should set aside their

concerns about red ink and deliver the response the crisis demands.”

23

See Jason Furman, “The Case for a Big Coronavirus Stimulus,” Wall Street Journal, March 5, 2020,

https://www.wsj.com/articles/the-case-for-a-big-coronavirus-stimulus-11583448500.

16

A more robust set of automatic stabilizers would vary the size and duration of stimulus

automatically in response to changing economic conditions. In a recession, however, policymakers

also should be prepared to provide additional discretionary stimulus as needed.

The temporary measures enacted to fight the Great Recession added to the debt, and interest on

that higher debt added modestly to future deficits, but economic stimulus played only a minor role

in the rise in deficits and debt since 2001.

24

While it might be ideal in a non-crisis atmosphere to pair

stimulus measures with other measures that pay for the stimulus once the economy is strong

enough, the search for the latter in a politically fraught or crisis environment should not stand in the

way of enacting needed stimulus to keep a recession as short and shallow as possible.

The CARES Act and other measures policymakers have taken thus far in the pandemic largely

satisfy these criteria. CARES includes essential measures to respond to the public health and

economic crises, though more will be needed. The CARES Act measures are in effect only for

temporary periods, such as through the end of the year, and lack provisions for extending them as

economic conditions warrant. They also lack key elements such as a SNAP benefit increase and an

emergency fund modeled after the successful TANF Emergency Fund in place during the Great

Recession. Furthermore, the increase in the federal share of state Medicaid costs provided in the

previous COVID-19 response legislation is smaller than the increase provided in the Great

Recession and ends at the end of the public health emergency, neither continuing nor increasing if

the economy worsens.

25

Plan to Use Triggers to Turn Stimulus On and Off

Well-designed stimulus measures should “trigger on” as early as possible and “trigger off” once a

robust recovery is clearly underway. The National Bureau of Economic Research (NBER), the

recognized arbiter of business-cycle dating, does not provide a determination of when a recession

started until well after that date, and only after examining and comparing several measures of

economic activity over many months. And, as discussed above, in recent business cycles, the formal

end of a recession has been followed by an extended period of sluggish growth and persistent slack

during which fiscal stimulus would still be beneficial, rather than the sharp rebound and robust

recovery characteristic of most earlier post–World War II recessions.

Thus, the NBER’s dating of business-cycle peaks and troughs is not a reliable real-time indicator

of when to start or end stimulus. Economist Claudia Sahm has shown, however, that a reliable early

indicator that the economy is in a recession is when the three-month average unemployment rate is

0.5 percentage points higher than its level in any of the previous 12 months. That indicator has

occurred early in every recession back to the 1970s and has never given a false reading indicating a

recession when none has followed.

24

Kathy Ruffing and Joel Friedman, “Economic Downturn and Legacy of Bush Policies Continue to Drive Large

Deficits,” Center on Budget and Policy Priorities, February 28, 2013, https://www.cbpp.org/research/economic-

downturn-and-legacy-of-bush-policies-continue-to-drive-large-deficits?fa=view&id=3849.

25

Sharon Parrott et al., “CARES Act Includes Essential Measures to Respond to Public Health, Economic Crises, But

More Will Be Needed,” Center on Budget and Policy Priorities, March 27, 2020,

https://www.cbpp.org/research/economy/cares-act-includes-essential-measures-to-respond-to-public-health-

economic-crises.

17

In more typical circumstances,

26

this indicator, now known as the “Sahm rule,”

27

is a good

indicator for triggering on a package of stimulus measures that ideally has already been enacted and

is ready to go. There also should be a trigger for turning off or phasing out such stimulus measures

when, but only when, a robust recovery is underway. That trigger may be different for particular

stimulus measures. In many cases, however, meeting all three of the following conditions would be a

reasonable triggering off criterion:

• the three-month average unemployment rate has fallen for two straight months (in order to

guard against cutting off stimulus before unemployment has peaked);

• the three-month average unemployment rate is below a specified threshold level for two

straight months (so as not to cut off stimulus when unemployment is still highly elevated); and

• the three-month average unemployment rate is less than 1.5 percentage points higher than its

rate when the measure was triggered on.

In the case of the CARES Act, where measures are already in place but expire by the end of the

year, it is important that policymakers avoid prematurely withdrawing needed support for the

economy and those facing hardship. Triggers based on economic conditions, not arbitrary calendar

dates, should determine the extent and duration of stimulus measures.

To prepare for future recessions, policymakers could strengthen the existing automatic stabilizers

by embedding the Sahm rule in the statutes that provide such benefits, such as by providing

additional federally funded weeks of unemployment insurance, a bump in SNAP benefit levels, and

an increase in the federal matching rate for state Medicaid expenditure when the Sahm-rule trigger

signals that the economy is in a recession.

Effective Stimulus Measures

A core set of measures would provide effective fiscal stimulus to bolster aggregate demand and

reduce economic hardship in recessions. The following discussion offers general principles for

designing effective stimulus in those core areas.

One caveat: Puerto Rico participates fully in the unemployment insurance system, but instead of

receiving federal funding for its nutrition assistance program sufficient to serve all eligible people

who apply and having a fixed percentage of its Medicaid costs covered by the federal government, as

a state would, Puerto Rico instead gets capped block grants for Medicaid and nutrition assistance

that don’t rise automatically when need increases in a recession. ARRA and the CARES Act

included provisions to increase assistance for Puerto Rico in the troubled periods these pieces of

26

The sharp drop in economic activity due to the pandemic is unprecedented and will show up in economic indicators

with a lag, but policymakers’ early actions render the question of when the pandemic-induced recession started moot.

The pandemic experience does not invalidate the value of the Sahm rule as an indicator of future recessions.

27

Claudia Sahm, “Roundtable Discussion: Providing Direct Payments to Households as Fiscal Stimulus,” remarks at the

forum Preparing for the Next Recession: Policies to Reduce the Impact on the U.S. Economy, May 16, 2019,

https://www.hamiltonproject.org/events/preparing_for_the_next_recession_policies_to_reduce_the_impact_on_the_u

.s; and Heather Boushey, Ryan Nunn, and Jay Shambaugh, “Recession ready: Fiscal policies to stabilize the American

economy,” Brookings Institution, May 16, 2019, https://www.brookings.edu/multi-chapter-report/recession-ready-

fiscal-policies-to-stabilize-the-american-economy/.

18

legislation cover, and so should subsequent stimulus packages that Congress is likely to work on in

the months ahead. But Puerto Rico, whose economy has been struggling for years, has undergone

the largest municipal bankruptcy in U.S. history, and has been devastated further by recent natural

disasters, ultimately needs stronger safety net programs on an ongoing basis,

28

not just

accommodations in stimulus packages.

Additional measures are also likely to be needed to address challenging idiosyncratic problems

associated with particular crises, such as distressed homeowners in the mortgage crisis and Great

Recession

29

and, most vividly, the health care costs and income losses due to quarantines and

business shutdowns in the pandemic.

Unemployment Insurance

Unemployment insurance provides well-targeted fiscal stimulus and scores high in bang for the

buck. Substantial reforms to the UI program, however, would improve its coverage and make it a

stronger fiscal stimulus measure.

States run the basic UI program, while the U.S. Department of Labor oversees the system. The

basic program in most states provides up to 26 weeks of benefits to unemployed workers, replacing

about half of their previous wages, up to a maximum benefit amount that each state sets. States

provide most of the funding for those benefits through taxes paid by employers; the federal

government pays only the administrative costs.

Although states are subject to a few federal requirements, they are generally able to set their own

eligibility criteria and benefit levels. In recent years, for example, a handful of states have reduced

their maximum number of weeks of regular UI benefits below 26 weeks. This has weakened the

protections UI provides workers experiencing long unemployment spells and has reduced UI’s

effectiveness as stimulus when the economy is weak.

UI was established in 1935 and has not adapted adequately to subsequent changes in the labor

market. When UI was designed, the typical job loser was a married male breadwinner laid off from a

full-time job to which he could expect to return when business picked up. But in the 21

st

-century

labor market, the program’s outdated eligibility requirements often exclude people such as part-time

workers and those who must leave work for compelling family reasons, like caring for an ill family

member. This prevents large numbers of unemployed workers, many of whom are women and

people of color, from receiving UI benefits.

28

See Brynne Keith-Jennings and Elizabeth Wolkomir, “How Does Household Food Assistance in Puerto Rico

Compare to the Rest of the United States?” Center on Budget and Policy Priorities, January 15, 2020,

https://www.cbpp.org/research/food-assistance/how-is-food-assistance-different-in-puerto-rico-than-in-the-rest-of-

the; and Judith Solomon, “Puerto Rico’s Medicaid Program Needs an Ongoing Commitment of Federal Funds,” Center

on Budget and Policy Priorities, April 22, 2019, https://www.cbpp.org/research/health/puerto-ricos-medicaid-

program-needs-an-ongoing-commitment-of-federal-funds.

29

Blinder and Zandi conclude that the policy responses to the mortgage crisis involving loan modifications and

refinancings were “underfinanced, under-promoted, and not effectively managed,” and hence, “While the program

helped some, it fell well short of both expectations and needs.” Blinder and Zandi, op. cit.

19

Nor does UI respond as effectively as it could to provide additional weeks of benefits in an

economic downturn, when unemployed workers are more likely to exhaust their regular state UI

benefits. UI’s Extended Benefits (EB) program provides an additional 13 or 20 weeks of benefits to

jobless workers who have exhausted their regular UI benefits in states where the unemployment

situation has worsened dramatically (regardless of whether the national economy is in recession).

The total number of weeks of EB available in a state depends on the severity of unemployment in

the state and its unemployment insurance laws. Normally, the federal government and the states split

the cost of EB.

When a state’s economy weakens, regular state UI caseloads expand and at some point EB may

kick in, supporting unemployed workers’ and their families’ incomes and spending. In practice,

however, the criteria for EB to trigger on are so stringent that federal policymakers have had to

enact temporary programs providing additional weeks of UI benefits on an ad hoc basis in national

recessions since the late 1970s. The temporary discretionary measures enacted in the Great

Recession, for example, included extra weeks of benefits and full federal funding of EB from mid-

2008 through 2013, as well as a federally funded $25 increase in weekly UI benefits in 2009-10.

As discussed earlier, the stimulus to demand from an expanding UI caseload and additional weeks

of UI benefits helped prevent an even sharper drop in spending during the Great Recession and its

immediate aftermath. However, temporary federal UI stimulus needed to be reauthorized

periodically — which became increasingly contentious politically — and it expired at the end of

2013, even though there was still considerable unemployment and underemployment at the time and

economic activity was recovering relatively slowly. In addition, out-of-date eligibility criteria and the

reduction in the maximum number of weeks of regular UI benefits in some states limited the

expansion of caseloads in the Great Recession and hence the amount of stimulus UI could provide.

To strengthen UI as a stimulus measure — as well as to meet UI’s primary purpose of supporting

eligible workers (and their families) who’ve lost their jobs through no fault of their own — the

criteria for receiving UI benefits should be modernized to reflect 21

st

-century labor market

conditions, which would result in a larger share of the jobless receiving benefits and hence boost the

total amount of automatic stimulus in a recession.

The Obama Administration’s 2017 budget proposal

30

and a collaboration among the Center for

American Progress, the National Employment Law Project, and the Georgetown Law Center on

Poverty and Inequality

31

both provide blueprints for comprehensive reform of the UI system,

including modernizing eligibility and reforming EB not only to improve protections for workers but

also to strengthen the fiscal stimulus UI can provide. (These proposals also include UI solvency

reforms to ensure that states build up reserves during good economic times and are better prepared

to fund regular benefits when unemployment rises.)

The CARES Act provides robust changes to UI that temporarily expand eligibility and, for four

months, raise benefit levels substantially, but new legislation will be required to extend these

30

Chad Stone, “Obama Budget Modernizes Policies for Unemployed Workers,” Center on Budget and Policy Priorities,

February 11, 2016, https://www.cbpp.org/blog/obama-budget-modernizes-policies-for-unemployed-workers.

31

Rachel West et al., “Strengthening Unemployment Protections in America,” Center for American Progress, June 2016,

https://cdn.americanprogress.org/wp-content/uploads/2016/05/31134245/UI_JSAreport.pdf.

20

provisions beyond the current year.

32

Comprehensive UI reform that broadens eligibility and

strengthens UI’s role as an automatic stabilizer is necessary to be better prepared for future

recessions.

SNAP

SNAP provides nutritional support for low-wage working families and unemployed individuals,

low-income seniors, and people with disabilities living on fixed incomes. The federal government

pays the full cost of SNAP benefits and splits the cost of administering the program with the states,

which operate the program. SNAP eligibility rules and benefit levels are, for the most part, set at the

federal level and uniform across the nation, though states have flexibility to tailor aspects of the

program.

Like UI, SNAP benefits are spent quickly and therefore provide high bang-for-the-buck stimulus

in a weak economy. SNAP caseloads also expand and contract with the level of economic activity as

more people’s income falls below the income threshold for eligibility in a recession and more

people’s income rises above it in an expansion.

The SNAP benefit formula targets food assistance according to need: very poor households

receive larger payments than households with somewhat more income since they need more help

affording an adequate diet. The benefit formula assumes that families will spend 30 percent of their

disposable income for food; SNAP makes up the difference between that 30 percent contribution

and the SNAP “maximum benefit,” which is set at the cost of the Thrifty Food Plan, the Agriculture

Department’s estimate of a very low-cost but nutritionally adequate diet. In 2018 the typical family

with children received $387 a month in SNAP benefits; a typical one-person household received

$130 a month.

Some people are not eligible for SNAP regardless of how small their income and assets may be,

such as striking workers, many college students, and certain immigrants with lawful immigration

status. Immigrants with undocumented status also are ineligible for SNAP.

In addition, adults without a disability who are aged 18 through 49 and aren’t employed at least 20

hours a week or participating in a qualifying workfare or job training program (and don’t have

dependents in the home) are limited to three months of benefits in a 36-month period. States can

waive this rule in areas with high unemployment. During the Great Recession and its aftermath, that

time limit was either suspended (for 2009 and 2010 under a provision of ARRA) or waived in most

states due to high unemployment.

Until recently, states qualified for waivers during and immediately after a recession when UI

Extended Benefits were triggered on in the state. In late 2019, however, the Trump Administration

32

See the section on UI in Sharon Parrott et al., “Immediate and Robust Policy Response Needed in Face of Grave Risks

to the Economy,” Center on Budget and Policy Priorities, March 19, 2020,

https://www.cbpp.org/research/economy/immediate-and-robust-policy-response-needed-in-face-of-grave-risks-to-the-

economy.

21

finalized an administrative rule that sharply limits such waivers, even in a recession.

33

If the new

policy goes into effect, the EB criterion will no longer be allowed as a qualification for state waivers,

and very few areas will qualify during economic downturns.

34

SNAP experienced large growth during and after the Great Recession. Caseloads expanded

significantly between 2007 and 2011 as the recession and sluggish economic recovery dramatically

increased the number of low-income households that qualified and applied for help. In addition to

the automatic stimulus from caseload growth, ARRA raised the level of maximum SNAP benefits by

13.6 percent beginning in April 2009, with the intention of keeping benefits at that new level until

the value of the Thrifty Food Plan caught up through normal food-price inflation. Because of very

low food price inflation (in fact, deflation in some years), the cost of the plan grew more slowly than

expected and policymakers ended the supplement to benefits in November 2013. While they were in

effect, these payments delivered $40 billion in high bang-for-the-buck economic stimulus on top of

the increase in SNAP outlays due to the growth in caseloads.

Both a provision allowing states to seek waivers to raise SNAP benefits for some households and

a suspension of the three-month time limit for unemployed adults not raising minor children are in

the Families First Coronavirus Response Act, but last only through the pandemic emergency

period.

35

A measure to raise the maximum SNAP benefit, comparable to the ARRA provision, is still

needed and should be designed to remain in effect while the economy remains weak and

unemployment remains elevated. In addition, to be ready for future recessions, policymakers should

enact legislation that provides for an increase in maximum SNAP benefits and suspension of the

three-month time limit that would be triggered on automatically when the economy slides and then

triggered off automatically when the economy recovers.

State Fiscal Relief

In a recession, state budget receipts fall, and rising unemployment and poverty increase the

demands on state-provided services that assist people in need, including the state share of Medicaid

costs. Many of the actions that states must take to achieve budget balance in the face of falling

revenues — cutting services, laying off workers, and raising taxes — further weaken the economy.

33

Chad Stone, “Trump Rule Weakens SNAP’s Recession-Fighting Power,” Center on Budget and Policy Priorities,

December 11, 2019, https://www.cbpp.org/blog/trump-rule-weakens-snaps-recession-fighting-power.

34

The Families First Coronavirus Response Act suspends the time limit, but only during the public health emergency

period of the pandemic and not through the duration of the recession. However, a federal district court on March 13,

2020 issued a nationwide injunction blocking the new rule from taking effect until the court decides whether the

rule restricts state flexibility beyond what the law allows. The Trump Administration has indicated that it plans to appeal

the court ruling. See Ed Bolen, “Unemployed Workers Can Get SNAP During Health Emergency,” Center on Budget

and Policy Priorities, April 2, 2020, https://www.cbpp.org/blog/unemployed-workers-can-get-snap-during-health-

emergency.

35

See the section on SNAP in Parrott et al., “CARES Act Includes Essential Measures to Respond to Public Health,

Economic Crises, But More Will Be Needed” and Dottie Rosenbaum et al., “USDA, States Must Act Swiftly to Deliver

Food Assistance Allowed by Families First Act,” Center on Budget and Policy Priorities, updated April 7, 2020,

https://www.cbpp.org/research/food-assistance/usda-states-must-act-swiftly-to-deliver-food-assistance-allowed-by-

families.

22

Federal financial assistance to states can mitigate these effects. Direct federal grants to states can

provide fiscal relief in a recession that helps states meet their balanced budget requirements without

having to go as far in enacting contractionary policies that lengthen and deepen the recession. The

approach taken in the last two recessions included, as one of the key fiscal relief measures,

temporarily increasing the federal government’s share of the costs that states incur in operating

Medicaid, the public insurance program that provides health coverage to low-income families and

individuals.

Medicaid is funded jointly by the federal government and the states. Each state operates its own

Medicaid program within federal guidelines. Because the federal guidelines are broad, states have a

great deal of flexibility in designing and administering their programs. As a result, Medicaid eligibility

and benefits can and often do vary widely from state to state. States are guaranteed federal Medicaid

matching funds for the costs of covered services furnished to eligible individuals, but states have

relatively broad discretion to determine who is eligible, what services they will cover, and what they

will pay for covered services.

The federal government contributes at least a dollar in matching funds for every dollar a state

spends on Medicaid. The fixed percentage that the federal government pays, known as the Federal

Medical Assistance Percentage (FMAP), varies by state, with the federal government shouldering a

larger share of the costs in poorer states than in wealthier ones. In the poorest state, the federal

government pays well over 70 percent of Medicaid service costs. In addition, the federal government

pays 90 percent of the costs for care provided under the Medicaid expansion provision of the

Affordable Care Act in states that have adopted the expansion. The federal share of Medicaid

expenses used to be about 57 percent overall in a typical year but has increased to over 60 percent

with the expansion.

36

In the 2001 downturn, Congress gave $20 billion in fiscal relief to the states, half in the form of

enhanced Medicaid matching rates and half in a block grant distributed among the states on a per-

capita basis. That relief was not enacted until May 2003, however, more than two years after the start

of the recession, by which time virtually all states were experiencing budget deficits. That delay

reduced the effectiveness of the fiscal relief in averting cuts in vital programs such as Medicaid and

education and in lessening the adverse effects that such state budget actions were having on the

economy.

State fiscal relief in the Great Recession was enacted more quickly as part of ARRA. That relief

included an increase in the Medicaid FMAP and a “State Fiscal Stabilization Fund” that provided

two block grants for states — a $39.5-billion grant earmarked for education and an $8.8-billion grant

to help fund other key services. States could use the flexible block grants to avert budget cuts in

education or other basic state services, such as public safety and law enforcement, services for the

elderly and people with disabilities, and child care. Those funds could also be used for school

modernization, renovation, or repair.

36

Alison Mitchell, “Medicaid’s Federal Medical Assistance Percentage (FMAP),” Congressional Research Service, April

25, 2018, https://fas.org/sgp/crs/misc/R43847.pdf, p.11.

23

The CARES Act contains significant new resources to help states address massive budget

problems due to COVID-19, though states will need more aid in coming months.

37

The FMAP

increase in the Families First Coronavirus Response Act lasts only through the health emergency

period. A larger increase in the FMAP of longer duration, as well as a more robust stabilization fund,

are necessary.

38

In addition, to be ready for future recessions, policymakers should enact legislation

that provides for an increase in the FMAP and a stabilization fund that would be triggered on

automatically in a national recession and for states experiencing high unemployment when there is

not a national recession.

Stimulus Payments to Individuals and Families

Direct cash assistance to low- and moderate-income households is one of the most well targeted

stimulus measures because it goes to people who will quickly spend almost all of any additional

income they receive, generating high bang for the buck. Either one-time, lump-sum payments or a

refundable tax credit (under which taxpayers whose tax liability is less than the amount of the credit

receive a cash payment for the difference) are suitable delivery mechanisms for a large share of the

population. Low-income people not required to file a tax return can be identified if they are

receiving benefits such as Social Security, Supplemental Security Income, or veterans’ benefits that

are administered by the federal government, and likely also if they receive benefits administered

through state social service agencies. In addition to its role in providing stimulus, direct cash

assistance for low- and moderate-income households directly addresses the human costs of

recessions by helping ensure that individuals and families have enough income to meet basic needs

in particularly tough times.

In theory, temporary middle-class tax cuts are less stimulative because recipients are less cash

constrained and are not likely to change their consumption dramatically in response to a temporary

increase in income, although some evidence suggests one-time cash rebates may stimulate one-time

purchases of, or be used as a down payment for, big-ticket items such as new appliances or a car.

Temporary tax cuts for high-income taxpayers have little bang for the buck because high-income

taxpayers are least likely to increase their spending substantially in response to a temporary boost to

their income.

The Economic Stimulus Act, enacted in February 2008, delivered one-time income tax rebates

and payments to tax filers who had at least $3,000 in earnings in 2007 or 2008, and to people who

received Social Security benefits or veterans’ payments. These rebates were phased out for high-

income taxpayers. ARRA then followed with a “Making Work Pay” refundable tax credit for the

2009 and 2010 tax years, in the form of reduced income-tax withholding over the course of the year,

although the saliency of the tax cut to many taxpayers seems to have been less than if they had

received it as a lump sum payment. The Making Work Pay tax credit was replaced in 2011 and 2012

by a 2-percentage-point cut in the payroll tax, which delivers stimulus in a less well targeted way than

does a refundable credit.

37

“How Will States and Localities Divide the Fiscal Relief in the Coronavirus Relief Fund?” Center on Budget and

Policy Priorities, March 27, 2020, https://www.cbpp.org/research/state-budget-and-tax/how-will-states-and-localities-

divide-the-fiscal-relief-in-the.

38

See the section on strengthening health care and providing states with needed fiscal relief in Parrott et al., “CARES Act

Includes Essential Measures to Respond to Public Health, Economic Crises, But More Will Be Needed.”

24

ARRA also made temporary changes to the Child Tax Credit and the Earned Income Tax Credit

(EITC), both refundable credits.

39

The changes lowered the earnings threshold for the Child Tax

Credit from $12,550 to $3,000, which enabled families with earnings in that range to receive a partial

credit and many other low-income families to receive a larger credit. This change was well targeted at

families with low earnings who were most likely to spend the additional funds. The EITC is

designed to reach individuals of modest means, so expansions of it during a recession generate high

bang for the buck. ARRA increased the EITC for families with three or more children and provided

a larger tax credit to married couples, which lessened marriage penalties.

Expansions of the Child Tax Credit and EITC to respond to an economic downturn can be

further tailored to reach the lowest-income individuals, enhancing these measures’ effectiveness as

stimulus. Making the full $2,000-per-child Child Tax Credit available to families without requiring

them to meet a minimum earnings threshold would enable the credit to reach families with very low

or no earnings, who have the highest likelihood of spending the funds quickly but who currently

receive only a partial Child Tax Credit or no credit at all, due to their very low income. In addition,