Closing Costs, Refinancing, and Inefficiencies

in the Mortgage Market

David Zhang

∗

Rice University

(Click here for latest version)

February 3, 2023

Abstract

I use a structural model to quantify the cross-subsidization in the US mortgage

market due to heterogeneous borrower refinancing tendencies. Actively refinancing

borrowers gain up to 3% of their loan amount relative to non-refinancing borrowers in

expectation. In equilibrium, the presence of borrowers with high refinancing inertia

reduces mortgage interest rates particularly on lower upfront closing cost mortgages

which have more valuable refinancing options. As a result, actively refinancing bor-

rowers refinance excessively relative to a perfect information, no cross-subsidization

benchmark, an effect that accounts for around 28% of the overall refinancing volume

and generates significant deadweight losses due to administrative resource costs. Alter-

native contract designs can simultaneously reduce transfers and increase total welfare.

∗

I thank John Campbell, Ed Glaeser, Adi Sunderam, Ariel Pakes, and Robin Lee for continuous advice

on this paper. I also thank Jo˜ao Cocco, Matthew Curtis, Mark Egan, Xiang Fang, Jiacheng Feng, Xavier

Gabaix, Daniel Green, Shiyang Huang, Jun Ishii, Larry Katz, Amir Kermani, Alex Kopytov, David Laibson,

Doug McManus, Konstantin Milbradt, Fabrice Tourre, Pascal Noel, Henry Overman, Frank Pinter, David

Scharfstein, Jeremy Stein, Dragon Tang, Audrey Tiew, Fabrice Tourre, Boris Vallee, Nancy Wallace, Jeffrey

Wang, Paul Willen, Ron Yang, and seminar/conference participants at CityUHK, HKU, TAMU, SMU, BC,

UofT, Purdue, Rice, Fed Board, Minnesota, CU Boulder, 2022 Chicago Booth Household Finance Conference,

2022 NBER Summer Institute Real Estate, 2022 North American Summer Meeting of the Econometric

Society, 2022 Asian Meeting of the Econometric Society, and 2023 ASSA/AREUEA Meeting for valuable

comments which greatly improved the paper. All errors are my own. This research was conducted while the

author was a Visiting Fellow at the Federal Reserve Bank of Boston. The views expressed in this paper are

solely those of the author and not necessarily those of the Federal Reserve Bank of Boston nor the Federal

Reserve System.

1 Introduction

In the US, many borrowers are slow to refinance, or never refinance, their mortgages when

interest rates fall, while others are more quick at doing so. This heterogeneity in refinancing

inertia which has long been recognized as an important friction in household finance.

1

In

this paper, I use a structural model to quantify the distributional and efficiency implications

of the heterogeneous consumer refinancing inertia.

My model identifies two main channels through which heterogeneous consumer refinanc-

ing inertia affects on the US mortgage market. First, the existence of borrowers with refi-

nancing inertia implies that lenders can afford to charge lower interest rates upfront. This

interest rate reduction effect reflects a cross-subsidization from slow to refinance borrowers

to the more quick to refinance borrowers. Second, I identify a non-uniformity of the interest

rate reduction effect across upfront closing cost choices which distorts borrower contract

choice, further increases cross-subsidization, and generates economic inefficiencies. In par-

ticular, the interest rate reduction effect is particularly large for lower upfront closing cost

mortgages, which generates excessive refinancing by quick to refinance borrowers leading to

deadweight administrative costs.

By way of background, mortgage originating lenders must cover their costs. They can do

so in two ways. First, they can charge the borrower upfront, though upfront closing costs.

Second, they can raise the interest rate on the mortgage, holding fixed its principal balance

and then recovering their costs from the secondary market. Most lenders offer a menu of

rate and upfront closing cost options to prospective borrowers through a choice of how many

“points” to pay to or receive from the lender.

2

Borrowers therefore have a choice of getting

a lower rate, higher upfront closing cost mortgage, or a higher rate, lower upfront closing

1

See, e.g., Schwartz and Torous (1989), Archer and Ling (1993), McConnell and Singh (1994), Stanton

(1995), Green and LaCour-Little (1999), Campbell (2006), Agarwal, Rosen, and Yao (2016), Keys, Pope,

and Pope (2016), Johnson, Meier, and Toubia (2018), Andersen, Campbell, Nielsen, and Ramadorai (2018),

and Gerardi, Willen, and Zhang (2021).

2

In the industry, each mortgage point refers to 1% of the loan amount that borrowers pay upfront. Positive

points in the form of discount points increase the upfront closing cost while reducing the interest rate, while

negative points the form of lender credit to reduce upfront closing cost while increasing the interest rate.

1

cost mortgage.

Higher rate, lower upfront closing cost mortgages by construction carry a more valuable

refinancing option compared to lower rate, higher upfront closing cost mortgages, and I show

that their prices are more affected by the existence of borrowers with refinancing inertia in

equilibrium. This incentivizes actively refinancing borrowers to refinance more often than

they otherwise would, due to two mechanisms. First, actively refinancing borrowers become

less likely to pay points to reduce their rate, and end up with mortgages with a higher

refinancing incentive.

3

Second, actively refinancing borrowers are able to refinance more fre-

quently than they otherwise would by taking out a lower upfront closing cost mortgage when

they do refinance. Note that these mechanisms involve changes in the actively refinancing

borrowers’ upfront closing cost choices and expected refinancing activity, rather than their

levels. Because mortgage refinancing involves administrative resources that could have been

used for other economic activity, the extra refinancing that quick to refinance borrowers

undertake solely to receive transfers generates deadweight losses from a social perspective.

To quantify the size of the cross-subsidy by borrower refinancing tendencies and study

its efficiency consequences, I develop a structural equilibrium model that captures borrower

heterogeneity in refinancing and moving tendencies while endogenizing borrower choices

of upfront closing costs. To do so, I embed the time and state dependence of borrower

refinancing behavior described in Andersen, Campbell, Nielsen, and Ramadorai (2020) into

a life-cycle model that gives welfare estimates interpretable in dollar-equivalent terms. A

zero-profit condition with a Monte Carlo model of mortgage-backed securities pricing pins

down the supply side.

Borrowers in my model are heterogeneous in terms of their (i) refinancing costs, includ-

ing a time-varying ability to refinance and a hassle cost conditional on them being able to

3

This is consistent with Dave Ramsey’s financial advice, which says that: “most buyers won’t regain their

money on mortgage points because they usually refinance, pay off, or sell their homes before they reach their

break-even point.” Source: https://www.ramseysolutions.com/real-estate/what-are-mortgage-points. This

financial advice turns out to be correct for my benchmark optimally refinancing borrower, but only due to

the cross-subsidization from slow to refinance borrowers.

2

refinance, (ii) moving or exogenous prepayment probabilities, (iii) discount factors, and (iv)

liquid wealth and income. The time-varying ability to refinance and the refinancing has-

sle cost are separately identified from borrower delays in refinancing after their refinancing

thresholds has been reached (Andersen et al., 2020), and could reflect both demand-side dif-

ferences in preferences as well as any supply-side driven differential costs to refinance coming

from potential discrimination in the market. Moving or exogenous prepayment probabilities

are identified based on prepayment during periods of low interest rate incentives. Discount

factors are identified based on choices of upfront closing costs. Borrowers’ liquid wealth and

income are calibrated using data from the Survey of Consumer Finances (SCF).

I estimate the model using maximum likelihood on a novel data set linking borrower up-

front closing cost choices to their subsequent prepayment behavior. Three main conclusions

emerge from my empirical work. First, cross-subsidization from slow-to-refinance borrowers

significantly affects equilibrium prices and is larger on mortgages with lower upfront closing

costs. For a calibrated borrower who is always able to refinance at a hassle cost of $200, a

mortgage with a one percent upfront closing cost carries a 0.97% lower interest rate in the

existing market equilibrium relative to a world without cross-subsidization. For mortgages

with a four percent upfront closing cost, the difference is smaller at 0.21%. The intuitive

reason for the larger cross-subsidization of lower upfront closing cost mortgages is that, from

the perspective of the lender, slow to refinance refinance borrowers overpay for their mort-

gage closing costs when they pay it through the rate because they keep paying the higher

interest rate for longer.

A key advantage of my approach is that I am able to quantify the consequences of this

cross-subsidization. The economic consequences of this are significant. As my second con-

clusion, I find that the cross-subsidization of mortgage closing costs generates large transfers

between borrowers. Black and Hispanic borrowers are particularly worse off in the pooling

equilibrium. As my third conclusion, I show that the efficiency consequences of price distor-

tions are large. In particular, I estimate that around one quarter of all US refinancing would

3

not have occurred but for this cross-subsidization, leading to a welfare loss of around $3.5

billion per year relative to the no cross-subsidization benchmark.

Using the model, I conduct two counterfactual analyses. First, I investigate borrower

welfare under an alternative contract design where their closing costs have to be added to

the mortgage balance. I find a reduction in cross-subsidization from $1339/borrower to

$698/borrower, a decrease of 48%. Furthermore, I find an increase in average borrower

utility of $556/borrower in dollar terms. Second, I study the case of automatically refi-

nancing mortgages. This contract eliminates the cross-subsidization between borrowers with

different refinancing speeds, and leads to a bigger increase in average borrower utility of

$1215/borrower. My results suggests that the equity-efficiency trade-off is not binding in

the US mortgage context: it is possible to reduce inequality while increasing total welfare.

My model generates cross-sectional in borrower refinancing behavior through hetero-

geneous refinancing costs that could come from either the demand or supply side and is

consistent with all borrowers being rational. Nevertheless, if one instead views the slow to

refinance borrowers as behavioral agents who do not understand the true cost of a higher

interest rate, it can also be interpreted as an empirical model of a shrouded equilibrium as

in Gabaix and Laibson (2006) where the quick to refinance borrowers select against the slow

to refinance borrowers. Since I focus on the dollar value consequences of heterogeneous refi-

nancing behavior and the value of alternative contract designs, my conclusions are invariant

to either interpretation.

My paper is related to the literature on borrower heterogeneity in mortgage refinancing

behavior. Many papers document large borrower heterogeneity in refinancing behavior con-

ditional on the interest rate savings available, including Archer and Ling (1993), McConnell

and Singh (1994), Stanton (1995), Deng, Quigley, and Van Order (2000), Agarwal, Rosen,

and Yao (2016), Keys, Pope, and Pope (2016), Johnson, Meier, and Toubia (2018), Andersen

et al. (2018), Beraja, Fuster, Hurst, and Vavra (2018), Ambokar and Samaee (2019), Bel-

gibayeva, Bono, Bracke, Cocco, and Majer (2020), and Gerardi, Willen, and Zhang (2021).

4

Most of this literature has studied this heterogeneity in the reduced form, and none quanti-

fies the cross-subsidization across borrowers with different refinancing tendencies in market

equilibrium and studies its efficiency implications.

More closely related to my paper are Fisher, Gavazza, Liu, Ramadorai, and Tripathy

(2022) and Berger, Milbradt, Tourre, and Vavra (2023), which uses structural models to

study refinancing heterogeneity and cross-subsidization in the UK and US mortgage mar-

ket, respectively. Neither studies the inefficiencies generated by this cross-subsidization due

to distortions in the choices of quick to refinance borrowers, which is the main conceptual

contribution of this paper. I show that these inefficiencies are economically important and

presents a reason to consider alternative contract designs beyond redistribution. Further-

more, I compute results by race and ethnicity and show that their expected loss under the

current US system relative to a no cross-subsidization benchmark is sizable even in an ex

ante sense.

My paper also contributes to the literature on life-cycle models of mortgage choice. This

includes Campbell and Cocco (2003), Mayer, Piskorski, and Tchistyi (2013), Corbae and

Quintin (2015), Campbell and Cocco (2015) Eichenbaum, Rebelo, and Wong (2018), Chen,

Michaux, and Roussanov (2020), Campbell, Clara, and Cocco (2021), Guren, Krishnamurthy,

and McQuade (2021) and MacGee and Yao (2022). My model builds in both state and time

dependence in refinancing costs in a life-cycle model of mortgage choice with endogenous

mortgage premia. Of these papers, only Eichenbaum, Rebelo, and Wong (2018) incorporate

equilibrium cross-sectional heterogeneity in refinancing behavior, which they use to model the

state-dependent behavior of monetary policy, but they do not endogenize the mortgage pre-

mia and subsequently do not study its implications in terms of borrower cross-subsidization

and efficiency.

In terms of institutions, my paper is related to a growing literature on choices of mortgage

upfront closing costs, which are also called points. In this literature, Brueckner (1994) LeRoy

(1996), and Stanton and Wallace (2003) present theories of mortgage points that emphasize

5

the role of selection on borrowers’ expected prepayment speeds. My empirical work takes the

selection effect explored in these theories seriously and evaluates their welfare implications

under heterogeneous refinancing tendencies. Chari and Jagannathan (1989) studies the role

of insurance to income shocks for the institution of mortgage points, which I also incorporate

in my quantitative model. Empirical work on consumer behavior with mortgage points

includes Woodward and Hall (2012) who document how points may lead to sub-optimal

shopping, Agarwal, Ben-David, and Yao (2017) who show that many borrowers make the

“mistake” of paying too much in points given their predicted refinancing propensities, and

Benetton, Gavazza, and Surico (2020) who look at the UK context and finds that lenders

may exploit heterogeneity in demand elasticities between rates and points to increase profits.

Another strand of literature on mortgage points focuses its role in mortgage discrimination,

including Bhutta and Hizmo (2019), Bartlett, Morse, Stanton, and Wallace (2019), and

Willen and Zhang (2023).

The rest of this paper is structured as follows. Section 2 presents the background about

the upfront closing cost and interest rate trade off. Section 3 describes the data used in

the study. Section 4 presents motivating facts. Section 5 presents my model and simulation

results. Section 6 presents estimation results. Section 7 describes the counterfactual analyses.

Section 8 concludes.

2 Background

US borrowers face a choice between a mortgage with a higher interest and a lower upfront

closing cost or a mortgage with a lower interest rate and a higher upfront closing cost. I

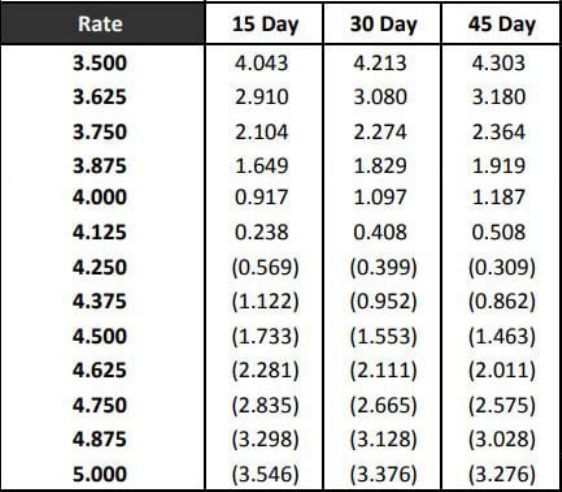

illustrate this choice in Figure 1, which shows a series of options for rates and upfront closing

costs from a lender ratesheet. The first column of the table in Figure 1 shows the choices of

interest rates that are available to a borrower, while the 15 Day, 30 Day, and 45 Day columns

show the corresponding upfront closing costs, quoted in percentages of the loan amount, that

6

borrowers would have to pay in order to receive the rate once the loan is originated within the

given lock period. A rate is “locked” when a lender commits to originating a mortgage with

the given terms within the stated lock period of, e.g., 15, 30, or 45 days. The quoted upfront

payment to the lender which vary by lock period are also called “points.” In particular,

Figure 1 shows how borrowers might choose a mortgage with a lower interest rate by paying

more points, or a mortgage with a higher interest rate by paying fewer (or, even, negative)

points.

4

Appendix Figure A.1 shows an example of how borrowers were shown a series of

rate and upfront closing cost choices from a price comparison website.

In this paper, I characterize mortgages with low or negative upfront closing costs as

mortgages with their price of mortgage origination added to the rate. To be more precise

about the definition of the price of mortgage origination added to the rate, focusing on the

setting where lenders are selling the mortgages they originate on the secondary market,

5

I

decompose lenders’ total origination revenue from making a loan as:

lender origination revenue

| {z }

price of mortgage origination

= upfront closing costs

| {z }

paid upfront

+ secondary marketing income(c)

| {z }

added into rate

(1)

where secondary marketing income(c) refers to the net income lenders derive from selling

a loan with interest rate c on the secondary market. The secondary marketing income can

be alternatively described as the premium of the mortgage relative to par. Mortgages with

higher interest rates tend to be more valuable on the secondary market and that originating

a mortgage with a high enough interest rate generates positive secondary marketing income.

To illustrate what the secondary marketing income as a function of interest rates might look

like on a given day, Figure A.2 plots the secondary market value of mortgages based on MBS

TBA prices as a percentage of the loan amount at various interest rates on January 2, 2014.

The TBA market is a highly liquid market where most MBS are traded, and is described in

4

Negative points are possible to cover the other upfront closing costs borrowers may have to pay, such as

transfer taxes and application fees.

5

Or, equivalently, where lenders are evaluating the value of their portfolio based on their potential sec-

ondary market value.

7

more detail in Vickery and Wright (2013).

3 Data

For my loan-level analyses, I use a combination of three data sets. The first data set is the

2013–2019 data from Optimal Blue on rate locks. Optimal Blue is a rate-locking platform

used by lenders constituting about 40% of all U.S. mortgage originations. Mortgage lenders

use rate-locking platforms such as Optimal Blue to assist their loan originators and mortgage

brokers in identifying options for rate and upfront closing costs for their clients. It contains

information about interest rates, points paid or received by the borrower, and time of the

lock. Second, I use the 2013–2021 CRISM (Equifax Credit Risk Insight Servicing McDash

Database) data, which is an anonymous credit file match from Equifax consumer credit

database to Black Knight’s McDash loan-level mortgage data set. It contains information

on loan performance and a time-varying borrower characteristic in terms of their Equifax

Risk Score. The CRISM data also allows me to classify prepayments as moves or refinances.

6

It has been frequently used to study borrower refinancing behavior.

7

Third, I use the 2013–

2019 Home Mortgage Disclosure Act (HMDA) data to capture borrower demographics.

For my main empirical analysis, I construct a match of these data sets, leading to 2013–

2021 Optimal Blue-HMDA-CRISM match. I present some summary statistics of this 2013–

2021 Optimal Blue-HMDA-CRISM match in Table 1. I focus on 30-year, conforming, fixed-

rate mortgages for my study due to their status as the most commonly chosen form of

mortgage contract in the US.

8

Further details of the matching procedure as well as additional

summary statistics can be found in the Appendix A.2.1 and A.2.

6

I follow the procedure of Lambie-Hanson and Reid (2018) and Gerardi, Willen, and Zhang (2021) to

identify moving by classifying a prepayment as a move if the borrower’s address changed within a 6-month

window surrounding the prepayment date.

7

See, e.g., Beraja et al. (2018), Lambie-Hanson and Reid (2018), Di Maggio, Kermani, and Palmer (2020),

Cunningham, Gerardi, and Shen (2021), Abel and Fuster (2021), and Gerardi, Willen, and Zhang (2021).

8

Complex mortgage contracts used to be more common before the financial crisis, but have largely

vanished by the start of my sample period (Amromin, Huang, Sialm, and Zhong, 2018).

8

Finally, I obtain actual data on the rate and upfront closing cost menus from LoanSifter.

9

Summary statistics and more detailed descriptions of the LoanSifter data are shown in

Appendix A.2.3. I show that the rate and upfront closing cost trade-off from LoanSifter on

average closely matches the rate and secondary marketing income relationship as implied by

MBS TBA prices from Morgan Markets in Appendix A.3.

4 Motivating facts

In this section, I present some stylized facts that motivate my model. First, I show that bor-

rowers have heterogeneous refinancing tendencies in Section 4.1. Second, I explore evidence

on the selection of borrowers with different prepayment tendencies into upfront closing cost

choices in Section 4.2.

4.1 Heterogeneous refinancing tendencies

It is well-known that some borrowers are slow to refinance, while others are more quick to

refinance when interest rates fall.

10

This is also true in my Optimal Blue-HMDA-CRISM

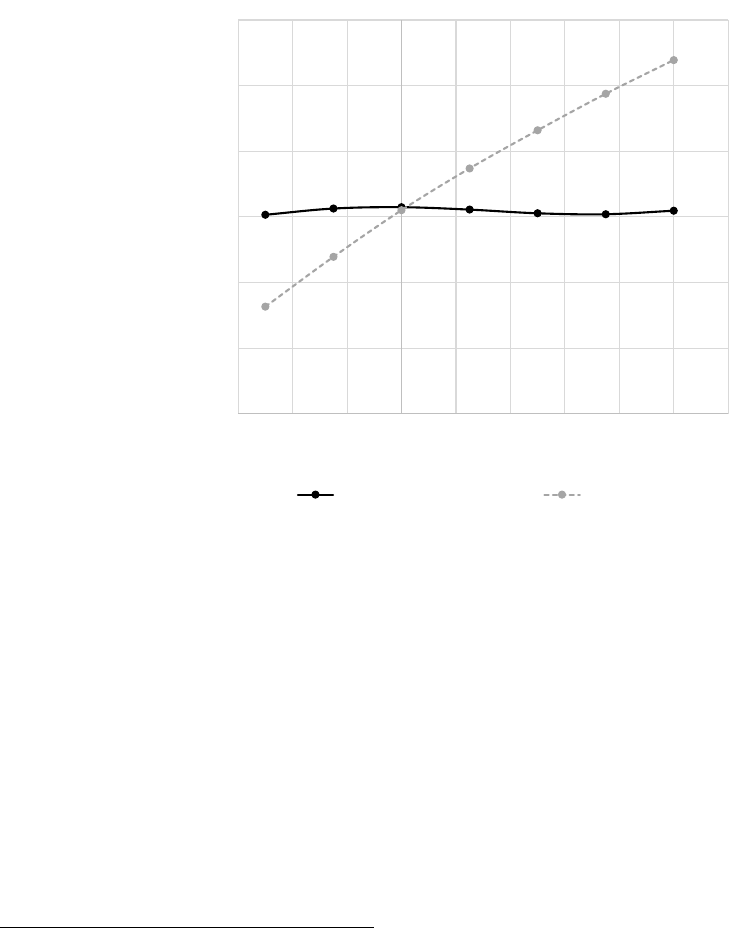

sample. In particular, Figure 2 plots the Kaplan-Meier survival hazards of prepayment

following months where the interest rate incentive for refinancing, here defined as the decrease

in the 30-year Freddie Mac survey rate, is greater than 1.2%, which is larger than the optimal

refinancing threshold in typical calibrations of both the Agarwal, Driscoll, and Laibson (2013)

model and my model as presented in Section 5.

Specifically, the Kaplan-Meier estimates are calculated as follows. Let the number of

terminations due to prepayment at time t be p

t

, and the number of loans remaining at time

t be n

t

, where t is monthly. Then, the Kaplan-Meier hazard function is:

ˆ

λ

p

(t) =

p

t

n

t

. The

Kaplan-Meier survival function is then the cumulative effect of the Kaplan-Meier hazard

9

These two data sets have also been used in Fuster, Lo, and Willen (2017) to study the time-varying price

of mortgage intermediation.

10

See, e.g., Archer and Ling (1993), McConnell and Singh (1994), Stanton (1995), Agarwal, Rosen, and

Yao (2016), Keys, Pope, and Pope (2016), Johnson, Meier, and Toubia (2018), and Andersen et al. (2018).

9

function, or

ˆ

S

p

(t) =

Q

t

0

<t

p

t

0

n

t

0

.

Figure 2 shows the results. In particular, more than half of mortgages are not prepaid

after 10 months of a relatively high refinancing incentive. While this could be due to supply-

side constraints, it also shows that the same pattern holds among a group of borrowers who

maintained an Equifax Risk Score of greater than or equal to 700 and an LTV of less than or

equal to 80% throughout the sample and are hence unlikely to be unable to refinance due to

unemployment, eligibility, or cash flow constraints. Even among this group of borrowers, I

find that more half are not prepaid after 10 months of a relatively high refinancing incentive.

4.2 Selection in choices of upfront closing costs

Second, I examine borrower choices of upfront closing costs in my Optimal Blue-HMDA-

CRISM data, paying particular attention to selection by borrower type. If borrowers all

know their prepayment types and choose upfront closing costs solely based on their expected

prepayment propensities, then there would be no cross-subsidization between borrowers de-

spite heterogeneity in prepayment propensities. The choice of upfront closing costs would

serve as a screening device that separates borrowers by type, as described in the models of

Brueckner (1994), LeRoy (1996), and Stanton and Wallace (2003). While I find some selec-

tion in the data, I also find evidence of within-choice heterogeneity in ex-post prepayment

and refinancing behavior, which leaves room for cross-subsidization.

In this section, I measure borrower upfront closing costs in terms of “points,” where each

point is customarily one percent of the loan amount used to reduce the interest rate. Upfront

closing costs consist of points plus an application fee. Negative points, also called “lender

credit,” that reduce the total upfront closing costs paid are also possible. The reason I use

points rather than upfront closing costs in this analysis is that, unlike the 2018–2019 Optimal

Blue-HMDA data used to analyze upfront closing cost choices in Appendix Section A.4, the

2013–2021 Optimal Blue-HMDA-CRISM data contains only information on points and not

any other application fees the lender may charge. To the extent that these application fees

10

are constant within lender and loan type, my lender by county by year fixed effects within the

sample of 30-year, fixed rate mortgages alleviates the effects of the potential measurement

error.

First, I examine the extent to which borrowers with different prepayment behavior choose

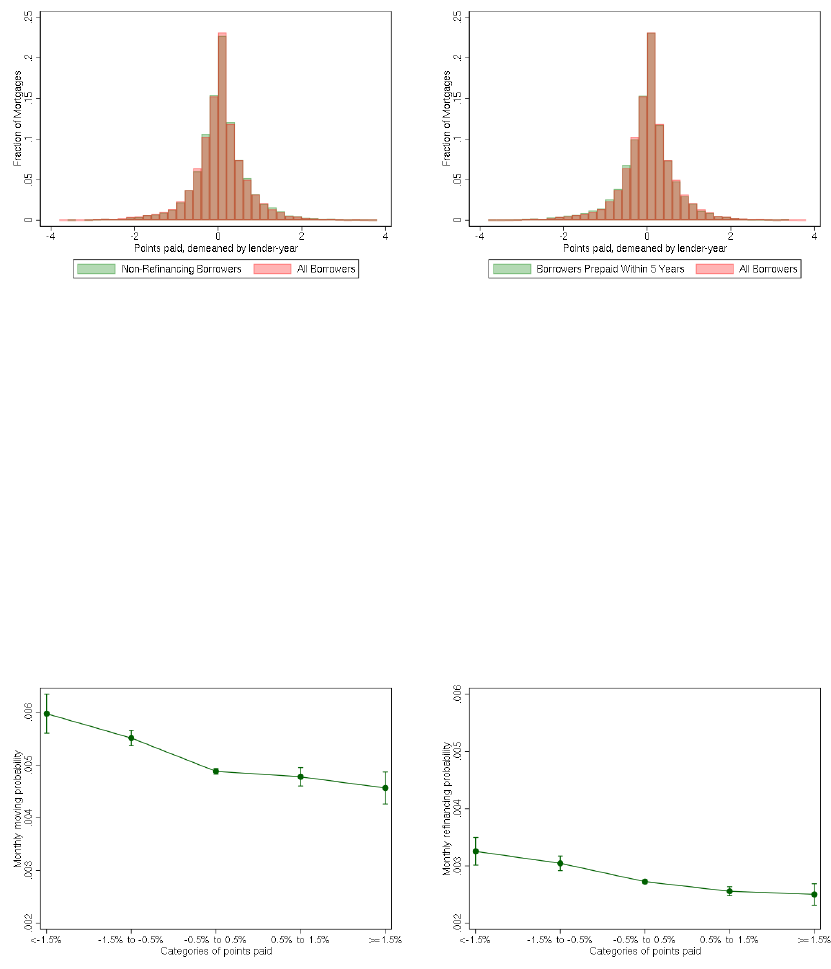

different levels of upfront closing costs measured in terms of points. Figure 3 plots the distri-

bution of borrower choices of points by their eventual refinancing or prepayment behavior.

I define a non-refinancing borrower as one who did not refinance or otherwise prepay within

five years despite facing a Freddie Mac Survey Rate decrease of at least 1.2%. As the figure

shows, although non-refinancing borrowers on average pay more points, and borrowers who

prepay within five years on average pay fewer points, the difference is small in terms of the

overall distribution.

To make sure that the result of Figure 3 holds even after controlling for underwriting

variables, I run an OLS regression of the number of points paid with (1) an indicator function

for whether the borrower is a non-refinancing borrower, and (2) an indicator function for

whether the borrower prepaid within five years. Results are shown in Table A.3. Indeed,

while I find a statistically significant positive correlation between non-refinancing borrowers

and their payment of points, and a statistically significant negative correlation between

borrowers who prepay within five years and their choices of points, the magnitude of the

difference in points paid is small at no more than 13 basis points. This analysis suggests

that most of the heterogeneity between borrower prepayment behavior remains conditional

on choices of upfront closing costs.

Next, I present regression estimates of how borrower choices of points correlate with their

prepayment behavior with choices of points and prepayment as the dependent variable. The

regressions are of the form:

i,t

= βX

i

+ γZ

i

+ ξ

l

i,t

×c

i,t

×t

+

i,t

(2)

11

where as before X

i

is a set of demographic and credit utilization variables including race

(Black and Hispanic), gender (male and female), credit card revolver status, and quartiles

of education; Z

i

is a set of underwriting variables including categories of credit scores at

origination, LTV, DTI, and log loan amount; ξ

l

i,t

×c

i,t

×t

is the lender by county by year fixed

effects. I run three regressions of this form with the indicator variable

i,t

being equal to the

amount of points paid, whether the mortgage was prepaid within five years, and whether

the mortgage was originated by a borrower who failed to refinance despite facing a greater

than or equal to 1.2% refinancing rate incentive.

Results are shown in Table 3. First, in terms of points, I find that borrowers with a larger

loan amount pay more points, and that the correlation is small in terms of other borrower

characteristics. The correlation between point choices and predicted prepayment behavior is

also weak. For example, Black and Hispanic borrowers are significantly less likely to prepay

their mortgage and more likely to be a non-refinancing borrower, but their choices of points

are not statistically significantly different from zero compared to the other borrowers.

11

Another way to examine selection is to look at how borrower choices of points relate to

their moving and refinancing behavior. Points do predict moving and prepayment behavior

in a statistically significant manner, which is indicative of some selection being important

in this market. To do so, I run the the linear probability model on an indicator variable for

moving or refinancing:

i,t

(move/refi) =

N

X

j=1

β

j

(ψ

i

= j) + γZ

i

+ ξ

l

i,t

×c

i,t

×t

+

i,t

(3)

where

i,t

(move/refi) is an indicator variable that is equal to either moving or refinancing; β

j

are a set of coefficients on categories of points choices as represented by the indicator function

(ψ

i

= j), and Z

i

is a set of controls including the call option value of refinancing from Deng,

11

Bhutta and Hizmo (2019) finds that minority borrowers tend to pay fewer points. The discrepancy in

results can be explained by the fact that we focus on conforming mortgages rather than FHA mortgages

used in Bhutta and Hizmo (2019), and is explored in more detail in Willen and Zhang (2023).

12

Quigley, and Van Order (2000), the spread of the mortgage interest rate at origination to

the Freddie Mac Primary Market Survey Rate (spread at origination, or SATO) as well as

its square, and the standard set of loan amount, credit score at origination (credit score),

loan-to-value ratio (LTV), and debt-to-income ratio (DTI) controls. In particular, the call

option value of refinancing is defined as:

Call Option

i,k

=

V

i,m

− V

i,r

V

i,m

(4)

where

V

i,m

=

T M

i

−k

i

X

s=1

P

i

(1 + m

it

)

s

(5)

V

i,r

=

T M

i

−k

i

X

s=1

P

i

(1 + c

i

)

s

(6)

and c

i

is borrower i’s mortgage rate at origination, T M

i

is the mortgage term, k

i

is the

number of months already past, m

it

is the Freddie Mac Primary Market Survey Rate, and

P

i

is the size of the current mortgage payment. The Call Option variable represents the

potential interest rate savings from refinancing, which is positively correlated with refinancing

behavior. Finally, ξ

l

i,t

×c

i,t

×t

represents lender by county by year fixed effects, and

i,t

is the

error term.

Figure 4 present the results. In particular, Figure 4a plots the predicted probabilities of

moving by categories of points paid in intervals of width 1. It shows that, all else equal,

the borrowers’ moving hazard is decreasing in the amount of points that they pay, which is

consistent with a selection story. Figure 4b shows the same pattern but for refinancing.

Table 2 shows the regression coefficients that underlie these results. The regression

coefficients show a negative, monotone, and statistically significant relationship between

the level of points paid and moving and refinancing probabilities. In terms of additional

covariates, the Call Option, spread at origination SATO, and log of the loan amount are

13

positively correlated with moving and refinancing.

The earlier analysis has focused on the differences between upfront closing cost choices

among borrowers. A question remains about the level of upfront closing cost choices, which

determines the extent to which borrowers pay their price of origination via the interest rate

or upfront, and how much of the price of origination may be susceptible to cross-subsidization

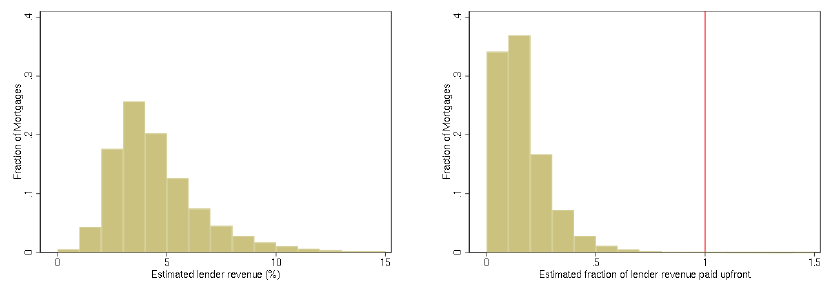

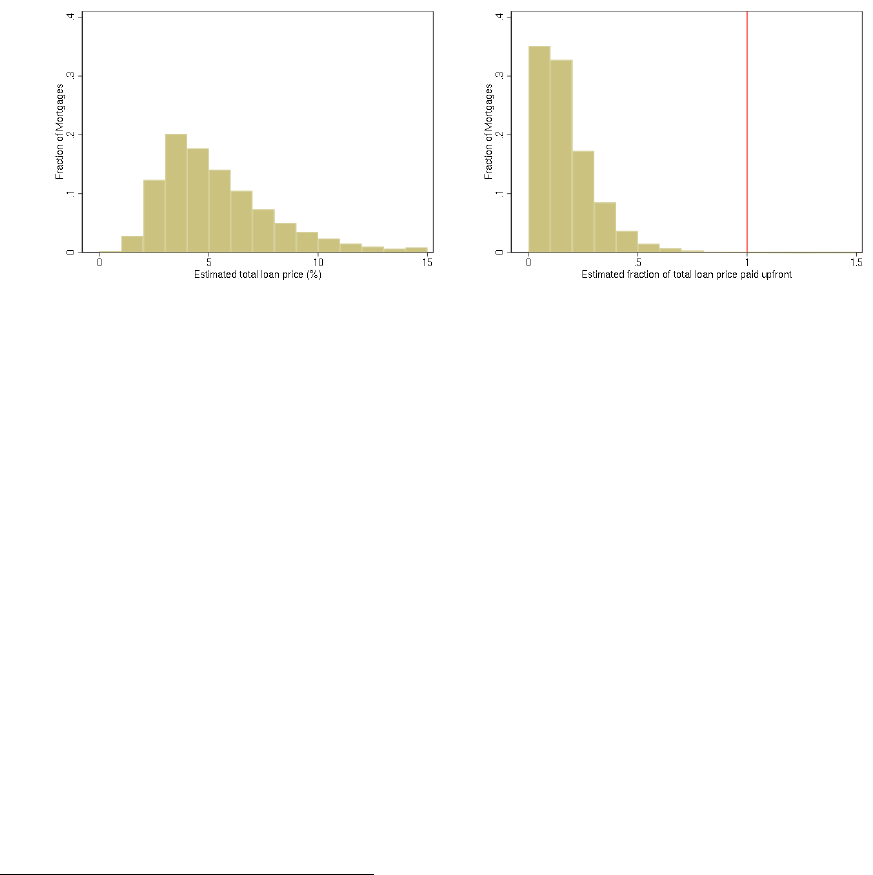

by borrower refinancing tendencies. I show that almost all borrowers pay for most of their

mortgage closing costs through a higher interest rate on their mortgage relative to mortgage-

backed securities yields, rather than upfront in Appendix Section A.4.

Overall, my motivating facts imply that a model of cross-subsidization by prepayment

type has to take into account both the within-choice heterogeneity in prepayment behavior as

well as the selection of borrowers into point choices by their ex ante prepayment expectation.

My model accomplishes both of these tasks. In particular, by estimating a distribution of ex

ante moving and refinancing types and how they correlate through borrower choices of points,

it simultaneously incorporates both selection and within-choice borrower heterogeneity.

5 Model

The motivating facts in Section 4 show that the existence of significant refinancing inertia in

the US mortgage market as well as selection of mortgage contracts by borrower prepayment

types. Because borrower refinancing behavior is an important determinant of mortgage inter-

est rates, an equilibrium model that incorporates the supply side (ie. mortgage interest rate)

response to heterogeneity in refinancing behavior is needed to get at the welfare questions.

I build such an equilibrium of mortgage choice that captures the heterogeneity in borrower

refinancing behavior and allows me to assess its welfare implications in dollar terms.

On the demand side, following the state-of-the-art from Andersen et al. (2018), I estimate

a distribution of borrower refinancing costs with two components: a fixed refinancing hassle

cost and a time varying ability to refinance. In addition, borrowers differ by their moving

14

probabilities and discount factors. These decisions are then embedded in a workhorse life-

cycle model of mortgage choice from Campbell and Cocco (2015) and Chen, Michaux, and

Roussanov (2020). A competitive supply side pins down mortgage interest rates at various

levels of upfront closing costs and closes the model.

Calibration of the model shows evidence of large cross-subsidization of low upfront clos-

ing cost mortgages from slow to refinance borrowers. In addition, the fully estimated model

allows me to measure the welfare implications of heterogeneity in borrower refinancing ten-

dencies in equilibrium.

5.1 Setup

5.1.1 Demand side

On the demand side, households maximize non-housing consumption with time-separable

utility with bequest motive for terminal wealth taking housing choice as exogenous:

max

1

T

X

t=1

β

t−1

i

(C

it

)

1−γ

i

1 − γ

i

+ β

T

i

b

i

W

1−γ

i,T +1

1 − γ

, (7)

where T is the terminal age, β

i

the time discount factor, C

it

the non-durable consumption,

γ

i

the coefficient of relative risk aversion, and W

i,T +1

the real terminal wealth.

In terms of exogenous state transitions, I assume that the risk-free rate r

1t

follows the

model of Cox, Ingersoll, and Ross (1985), which has a natural zero lower bound. I take

inflation π = 1.68% as a constant equal to the average in my sample.

12

Real (log)labor

income L

it

, house price H

it

, and changes in the mortgage interest rate at an average level of

upfront closing costs ∆¯c

t

are modelled as a vector auto-regression (VAR) with the risk-free

rate r

1t

as an exogenous covariate, the details of which are described in Appendix A.6.1.

Finally, moving is treated as an exogenous mortgage refinance at an average level of upfront

12

Inflation expectations were stable over my sample period, and a constant term for inflation allows me

to easily convert the nominal mortgage payment from the amortization table to real terms.

15

closing costs.

Mortgage payments follow a standard 30 year amortization schedule. In particular, the

real mortgage payment under constant inflation is P

M

it

=

1

(1+π)

t

M

i

c

it

/12(1+c

it

/12)

n

(1+c

it

/12)

n

−1

. Note that

the amortization is based on the current rate rather than the full history of rates, which

increases the computational tractability of the model. I add a correction for the difference in

amortization as an additional upfront payment to be made by the borrower during refinancing

so as to be more numerically correct, but the error resulting from this issue is likely to be

small for minor differences in rates.

In each period, households make a decision of whether to refinance along with a con-

sumption and savings decision. In doing so, they face financial constraints in the sense that

their savings S

it

≥ 0. They make a real mortgage payment P

M

it

and earn interest r

1t

on

savings minus inflation π

t

, and so in non-refinancing periods their non-durable consumption

C

it

in real terms can be written as:

C

it

= exp(L

it

) − P

M

it

+ (r

1,t−1

− π

t

)S

it−1

− ∆S

it

(8)

Where ∆S

it

= S

it

− S

it−1

is the change in the borrower’s savings. In order to refinance,

borrowers need to pay a cost ˜κ

it

. I model the borrowers’ refinancing cost ˜κ

it

as:

˜κ

it

=

∞, with probability 1 − p

a

i

κ

i

, with probability p

a

i

(9)

where p

a

i

is the probability that a borrower is able to refinance in a particular time period.

The inclusion of time- and state-varying refinancing costs is necessary to fit the data where

borrowers do not immediately refinance when facing their cut-off, as described in Andersen

et al. (2018) which uses a similar setup for capturing refinancing costs.

Furthermore, I require that the refinance must leave the borrower a loan-to-value (LTV)

16

ratio of at most 95%, which is required by Freddie Mac

13

and captures the constraints to

refinancing in periods of house price decline as described in Hurst, Keys, Seru, and Vavra

(2016).

The full value function V

it

(c

it

, S

i,t−1

, ¯c

t

, r

1,t−1

, H

it

, H

i,t−1

, L

it

) is a function of the state vari-

ables interest rate on the mortgage c

it

, last period savings S

i,t−1

, the current market interest

rate ¯c

t

, last period’s risk-free rate r

1,t−1

, house price H

it

, lagged house prices H

i,t−1

, labor

income L

it

. Of these variables, c

it

, S

it

are endogencous in that they are influenced by the deci-

sion to refinance and borrower’s consumption decision, while the other states are exogenous.

In what follows I write the value function

˜

V

it

(c

it

, S

it

) = V

it

(c

it

, S

it

, ¯c

t

, r

1,t−1

, H

it

, H

i,t−1

, L

it

)

as a function of the endogenous variables only for brevity.

When first getting a mortgage, borrowers make a choice of mortgage interest rate c along

with their associated upfront closing cost ψ

it

(c) to maximize their expected utility in the

first period:

1

U

i1

= max

∆S

i2

,c

(exp(L

i1

) − (˜κ

i1

+ ψ

it

(c)M) − ∆S

i1

)

1−γ

i

1 − γ

i

+ β

1

˜

V

i2

(c, S

i1

) (10)

In the following periods, borrowers make a mortgage payment P

M

(c

it

). And in periods

where the borrower is able to refinance, their utility can be written as the maximum of what

can be obtained by refinancing and not refinancing:

t

U

a

it

= max

max

∆S

it

(exp(L

it

)−P

M

(c

it

)+(r

1,t−1

−π

t

)S

it−1

−∆S

it

)

1−γ

i

1−γ

i

+ β

t

˜

V

i,t+1

(c

it

, S

it

)

max

∆S

it

,c

(exp(L

it

)−P

M

(c

it

)−(˜κ

it

+ψ

it

(c)M)+(r

1,t−1

−π

t

)S

it−1

−∆S

it

)

1−γ

i

1−γ

i

+ β

t

˜

V

i,t+1

(c, S

it

)

(11)

where the first line of Equation (11) corresponds to the borrower’s utility from not refinancing

and continuing to get the interest rate c

it

, while the second line corresponds to the borrower’s

13

Freddie Mac’s requirements for refinancing are described in https://sf.freddiemac.com/general/maximum-

ltv-tltv-htltv-ratio-requirements-for-conforming-and-super-conforming-mortgages. Fannie Mae has a slightly

looser LTV requirement of at most 97%: https://singlefamily.fanniemae.com/media/20786/display.

17

utility from refinancing to the rate c which affects the upfront closing cost they pay ψ

it

(c).

Similarly, the borrower’s utility given that they are not able to refinance is:

t

U

na

it

= max

∆S

it

(exp(L

it

) − P

M

it

− (r

1t

− π

t

)S

i,t−1

− ∆S

it

)

1−γ

i

1 − γ

i

+ β

t

˜

V

i,t+1

(c

it

, S

it

). (12)

Finally, I model moving as an exogenous costless refinance to the new mortgage with an

interest rate ¯c

t

that is associated with an average level of closing costs, which occurs with

probability p

m

i

for borrower i. Therefore, the borrower’s utility upon moving is:

t

U

m

it

= max

∆S

it

(exp(L

it

) − P

M

it

− (r

1t

− π

t

)S

i,t−1

− ∆S

it

)

1−γ

i

1 − γ

i

+ β

t

˜

V

i,t+1

(¯c

t

, S

it

). (13)

Combined, the value function of the borrower can be written as:

t

V

it

= (1 − p

m

i

)(p

a

i

t

U

a

it

+ (1 − p

a

i

)

t

U

na

it

) + p

m

i

t

U

m

it

. (14)

5.1.2 Supply side

A supply side to the model is needed compute mortgage premia with counterfactual mortgage

contract designs. I assume that the supply side is perfectly competitive and that lenders

set the rate and upfront closing cost/points trade-off based on the MBS value of mortgages.

That is, in equilibrium the relationship between the upfront closing costs paid as a fraction

of the loan amount ψ

it

for borrower i at time t and the mortgage interest rate c is pinned

down by a zero profit condition:

π

l

it

= ψ

it

M + φ

t

(c)M − ¯m

l

t

− m

l

i

(M) = 0 (15)

where π

l

it

is lender profit from a originating loan to borrower i at time t, φ

t

(c) is the MBS

premium of the mortgage as a percent of the loan amount at the time of origination, and ¯m

l

t

is average marginal cost incurred by the lender for originating the loan, and m

l

i

(M) is the

18

borrower and loan amount specific marginal cost incurred by the lender for originating the

loan. Assuming that the marginal cost of loan origination ¯m

l

t

+ m

l

i

(M) does not vary by the

borrower’s choice of points, we have by re-arranging:

ψ

it

(c) =

¯m

l

t

+ m

l

i

(M)

M

− φ

t

(c). (16)

So that, all else equal, a mortgage with a higher interest rate c and MBS value φ

t

(c)

would require fewer upfront points ψ

it

. In particular, my model implies that the MBS value

of mortgages with a higher interest rate will be passed-through to borrowers in terms of

lower upfront closing costs. This pass-through implication is approximately true in reality,

as I show in Figure A.3.

The zero profit condition in Equation (16) requires an estimate of MBS prices φ

t

(c).

These prices incorporate heterogeneous borrower refinancing behavior in the current world,

but not in counterfactuals without cross-subsidization between borrower refinancing types.

Estimation of these counterfactual prices is therefore key to establishing the interest rate

effect of heterogeneous borrower refinancing behavior.

I estimate the MBS value of mortgages φ

t

(c) based on an standard expected NPV method

where the cashflows from MBS are assumed to be discounted using the risk-free rate r

1t

plus an option-adjusted spread (OAS) term that compensates for the the liquidity and

prepayment risk. The OAS has been used and evaluated as a proxy for expected MBS returns

in Gabaix, Krishnamurthy, and Vigneron (2007), Song and Zhu (2018), and Boyarchenko,

Fuster, and Lucca (2019), and Diep, Eisfeldt, and Richardson (2021).

14

Under this setup,

the MBS value of mortgages may be written as:

φ

t

(c)M = E

t

t+T

X

t

0

=t

δ

t

0

q

t

0

[(1 − p

t

0

)P

M

(c) + ˆp

t

0

B

M

t

0

] − M (17)

14

Another method of valuing MBS is via multivariate density estimation, as in Boudoukh, Whitelaw,

Richardson, and Stanton (1997), but that does not allow me to get counterfactual prices under alternative

prepayment behavior or with alternative mortgage contract designs.

19

where p

t

0

is the prepayment probability of the borrower at time t

0

, q

t

0

=

Q

t

0

−1

j=t

(1 −p

j

) is the

remaining proportion of borrowers who have not prepaid, B

M

t

0

is the remaining principal the

lender gets when a borrower prepays, the lender gets remaining principal B

M

t

0

, and P

M

(c) is

the regular mortgage payment. The discount factor is based on the cumulative risk-free rate

in period j, r

jf

, plus an estimated OAS term that compensates for liquidity and prepayment

risk:

δ

t

0

=

1

Q

t

0

j=t

(1 + r

jf

+ OAS)

. (18)

Based on Equations 17 and (18), an estimate of the OAS combined with borrower refi-

nancing behavior allows me to arrive at counterfactual MBS prices. To estimate the OAS,

I use actual MBS prices combined with an empirical prepayment hazard function ˆp

t

0

and

its implied empirical cumulative remaining balance ˆq

t

0

=

Q

t

0

−1

j=t

(1 − ˆp

j

). Details of the OAS

estimation is shown in Appendix A.6.2.

The no cross-subsidization counterfactual, or the equilibrium without pooling of borrower

prepayment types, is computed by: (i) computing the required lender payoff in each state

as implied by the estimated OAS and ˆp, conditional on ¯c

t

and r

ft

as state variables, and

then (ii) finding the rate-point trade-off in separating equilibrium in each period via joint

iteration, where each period represents one quarter of calendar time. The joint iteration is

conducted as follows. In the last period, borrowers cannot refinance. In the second to last

period, the lender creates a rate-and-upfront closing costs schedule based on the borrower’s

expected behavior in the last period and the required lender payoff, and then the borrower

makes a refinancing decision conditional on their state and the lender’s schedule, and so on.

Combined with the demand side, my model can be viewed as an equilibrium model of

mortgage premia, in line with Campbell and Cocco (2015) and Campbell, Clara, and Cocco

(2021), but with the addition of heterogenous borrower refinancing costs and endogenous

upfront closing costs. A key assumption in these models is the perfectly competitive supply

20

side. If the supply side were not perfectly competitive as is assumed here, my pricing results

would still hold if lenders charged a constant markup across loans (i.e. so that constant

revenue per loan in the counterfactual still holds).

5.2 Cross-subsidization by upfront closing cost choice: a calibra-

tion

Using the model, I illustrate the cross-subsidization of low upfront closing cost mortgages

from the perspective of a quick to refinance borrower through a calibration. All of the

analysis in this section is conducted for a calibrated borrower with parameters described in

Table 4, where β, M, p

m

are the median of the estimates from Section 6, and p

a

i

= 1, κ

i

= 200

are chosen to represent the behavior of an optimally refinancing borrower who is always able

to refinance with a hassle cost of $200.

Figure 5 illustrates this pricing impact of cross-subsidization by plotting the implied

interest rates from the joint iteration of borrower and lender values in the dashed line. The

market rate and upfront closing cost rate-off as implied by the model is shown in the solid

line, and the empirical rate and upfront closing cost trade-off is presented in the dotted line.

The close match between the two suggests that the supply side of the model, which is the

previously described OAS model of MBS valuation, matches the average empirical rate and

upfront closing cost well.

As Figure 5 shows, the interest rate trade-off is higher, and steeper, for the calibrated

quick to refinance borrower in the no cross-subsidization counterfactual. This suggests that

the market interest rate for low upfront closing cost mortgages is especially lower than in

the no cross-subsidization case due to the presence of slow to refinance borrowers. In terms

of numbers, I find that a mortgage with a one percent upfront closing cost would carry a

0.97% higher interest rate in the no cross-subsidization case relative to the existing market

equilibrium, whereas the difference is only 0.21% for a mortgage with a four percent upfront

closing cost.

21

Figure 6 presents the welfare implications of this calibration for the borrower, lender, and

society. The calibrated quick to refinance borrower benefits from cross-subsidization, and

would have to be paid 2.4% of the loan amount in liquid assets in the no cross-subsidization

counterfactual in order to be indifferent from the current world. The lender, on the other

land, loses 5.5% of the loan amount in profit in the current world relative to the no cross-

subsidization counterfactual. Since the lender loses more than the borrower gains, cross-

subsidization led to a social loss of 3.0% of the loan amount. This social loss comes from the

excessive refinancing that the quick to refinance borrowers undertake at the expense of the

slow to refinance borrowers in the market, which in the calibration is 1.74 times as frequent

in expectation relative to the no cross-subsidization counterfactual.

6 Estimation

To estimate the model, I allow p

a

i

, κ

i

, β

i

, p

m

i

, M

i

to vary by individual, where p

a

i

is the prob-

ability that an individual is available to refinance in a particular time period, κ

i

is the

individual’s refinancing hassle cost when they do refinance, β

i

is the discount factor, p

m

i

is

the individual’s moving probability, and M

i

is the individual’s mortgage size. I fix the coef-

ficient of risk aversion γ = 2, liquid savings at origination to $50k, and a bequest motive of

b = 200 in accordance with Campbell and Cocco (2015). To maintain comparability to the

TBA market, I further restrict my analysis to 30 year purchase mortgages with a balance

above $150k, FICO above 680, and LTV below 85% following Fusari, Li, Liu, and Song

(2020).

I first present the identification argument in Section 6.1, then estimation procedure in

Section 6.2, then results in Section 6.3, some calibration based on my estimates in Section 5.2,

and finally the implications of my estimates for transfers and welfare in Section 6.4.

22

6.1 Identification

Of the unknown parameters, the distribution of M

i

is observed. I discuss the identification

for the distribution of p

a

i

, κ

i

, β

i

, p

m

i

as follows. First, the time-varying ability to refinance

p

a

i

and hassle costs κ

i

are separately identified from borrower responses to the time series

movement of the interest rate incentive. More specifically, if the only heterogeneity in bor-

rower refinancing behavior were due to hassle costs, borrowers would refinance immediately

when their refinancing cutoff is reached. This is rejected in the data as many borrowers wait

long after the interest rate has fallen to their eventual refinancing rate, suggesting that a

time-varying refinancing cost is at play. This line of reasoning is also used in Andersen et al.

(2020).

Of the other parameters, ex ante moving probabilities p

m

i

are identified from the inter-

action between the interest rate incentive and borrower refinancing behavior. In particular,

borrowers who do not refinance when faced with a large interest rate incentive are more

likely to subsequently move. This suggests that moving is not just an ex post shock and that

there is heterogeneity in moving expectations ex ante. Finally, conditional on refinancing

and moving probabilities, discount factors β

i

are identified from borrower choices of upfront

closing costs. In general, because upfront closing costs involve an initial outlay, they are

more attractive to borrowers with a higher discount factor. The choices of borrowers who

choose low upfront closing cost mortgages despite being unlikely to refinance or move are

rationalized with a lower discount factor.

6.2 Parametrization

I estimate the distribution of the borrower types using mortgage performance data. More

specifically, I use a Logit-Normal distribution

15

to model p

a

i

, β

i

, p

m

i

, a Log-Normal distribution

to model κ

i

, and allow p

a

i

, β

i

to be correlated via a coefficient ρ. The precise parametrization

15

The Logit-Normal distribution is the distribution generated by Y =

exp(X)

1+exp(X)

with a normally distributed

X. This formulation allows me to model observations that are between zero and one, as well as correlations

between them, in closed form.

23

is as follows:

p

a

i

β

i

∼ Logit

MultivariateNormal

µ

p

a

(b, h)

µ

β

,

σ

2

p

a

ρσ

p

a

σ

β

ρσ

p

a

σ

β

σ

2

β

(19)

p

m

i

∼ Logit(Normal(µ

p

m

(b, h), σ

p

m

)) (20)

κ

i

∼ LogNormal(µ

κ

(b, h), σ

κ

) (21)

where µ

p

a

(b, h), µ

p

m

(b, h), µ

κ

(b, h) can depend on a Black and Hispanic dummy represented

by b and h, respectively. This gives me 15 parameters:

θ = (µ

p

a

(0, 0), µ

p

a

(1, 0), µ

p

a

(0, 1), σ

p

a

, µ

p

m

(0, 0), µ

p

m

(1, 0),

µ

p

m

(0, 1), σ

p

m

, µ

κ

(0, 0), µ

κ

(1, 0), µ

κ

(0, 1), σ

κ

, µ

β

, σ

β

, ρ)

to estimate. I focus on the correlation ρ between a borrower’s probability of being able

to refinance and their discount factor because variation in the distribution of κ is small.

Intuitively, this is because when borrowers do refinance, they tend to do so for relatively

low interest rate savings (ie. in the range of 1%), which would not be reconcilable with

a high refinancing hassle cost κ. Therefore, time-varying ability to refinance appears more

important in the data, and I also estimate its correlation with the borrowers’ discount factors.

In the data, I observe borrowers’ prepayment decisions which combines moving and refi-

nancing.

16

I construct the likelihood based on prepayment decisions, which implicitly treats

all non-model implied refinancing as a move. Therefore, the moving probability p

m

i

in my

model captures all exogenous prepayment. The likelihood function for a prepayment decision

y

jt

for loan j at time t given a set of parameters x

i

= {p

a

i

, κ

i

, β

i

, p

m

i

, M

i

} is then:

l

jt

(x

i

) = (1 − y

jt

)

1−p

jt

(x

i

)

y

p

jt

(x

i

)

jt

. (22)

16

I also separately observe moving and refinancing decisions for a subset of prepayments.

24

Furthermore, at time t = 0, the likelihood of observing the borrower with ’s choice of

upfront closing costs ψ

i0

that is equal to the optimal choice implied by the model of ψ

∗

0

(x

i

):

17

l

0

j

(x

i

) = (ψ

i0

= ψ

∗

0

(x

i

)). (23)

To estimate the model, I simulate individuals with a grid for x

i

= {p

a

i

, κ

i

, β

i

, p

m

i

, M

i

}

based on a set of parameters θ, with x

i

∼ F(θ) where F(θ) is the distribution of types from

Equations (19) to (21). I then get their model implied optimal point choices (ψ

∗

(x

i

), in whole

numbers from -2 to 2) and time-varying prepayment (i.e., refinancing and moving) decisions

for each loan-time observation p

jt

(x

i

), and search for the set of parameters that maximizes

the likelihood of the data following the standard maximum likelihood formulation:

L ∝

X

j

log

nsim

X

i=1

l

0

j

(x

i

)

T

j

Y

t=1

l

j,t

(x

i

)

, x

i

∼ F(θ), (24)

where nsim = 2000 is the number of simulations used to compute the likelihood function.

6.3 Results

In this section I present my estimates for the distribution of borrower types in the population.

The parameters and their standard errors are shown in Appendix Table 5, and I plot their

distributions in the rest of this section.

Figure 7 presents the estimates on the distribution of refinancing types in the population.

In the left panel in Figure 7a, results show that most borrowers have a low probability of

being able to refinance in a particular month, with some variance. Mean able-to-refinance

probability is 6.0% monthly, or 52% annualized. This is consistent with my stylized fact in

Section 4.1 showing that around half of all borrowers fail to refinance following ten months

of a relatively high refinancing incentive. In the right panel in Figure 7b, the results show

17

Since I only observe points and not application fees prior to 2018, I assume a real application fee of

$2000 following Agarwal, Driscoll, and Laibson (2013).

25

that the implied hassle cost of refinancing for most borrowers is low. Taken together, the

results suggest that most of the inaction in refinancing is due to a Calvo-style time-varying

ability to refinance rather than hassle costs. The identification in the data is that borrowers

who eventually refinance tend to do so at relatively low interest rate savings (for example,

at around 1%), which implies a low hassle cost for refinancing for most borrowers despite a

time-varying inability to do so.

Figure 8 presents my estimates for borrower discount factors and their correlation with

their time-varying ability to refinance. Figure 8a plots the distribution of discount factors,

which is above 0.9 for most borrowers, but there is a small group of borrowers with discount

factors closer to 0.0. The discount factors are identified from borrower choices of upfront

closing costs, and the existence of many borrowers with low refinancing/moving probabilities

but nevertheless get higher interest rate, lower closing cost mortgages is rationalized in the

model via borrower myopia. Figure 8b shows a strong correlation between the likelihood of

being able to refinance and the discount factor. It is a scatterplot drawn from the multivariate

Logit-Normal distribution of Equation (19). It shows that many borrowers with a probability

of being able to refinance in a particular month of less than 5% also have a discount factor

significantly lower than 0.9. On the other hand, borrowers with a probability of being able

to refinance in a particular month of greater than or equal to 5% tend to have a discount

factor above 0.95.

Finally, Figure 9 presents my estimates of the distribution of moving probabilities by

borrower. Ex ante expectations of probabilities are identified from the joint interaction

of refinancing hazards and the interest rate incentive to refinance. As Figure 9 shows,

annualized moving probabilities are centered around 11% per year, with some groups of

borrowers having a lower moving probability. Appendix Figure A.16 plots these distributions

by the racial group of the borrower.

26

6.4 Implications for transfers and welfare

In this section I use my empirical estimates to examine the deviation of borrower behavior

from the perfect information benchmark. Doing so allows me to reveal the transfers and

efficiency consequences of heterogeneity in borrower refinancing behavior when interacted

with the financial contract design of adding closing costs to the rate of the mortgage.

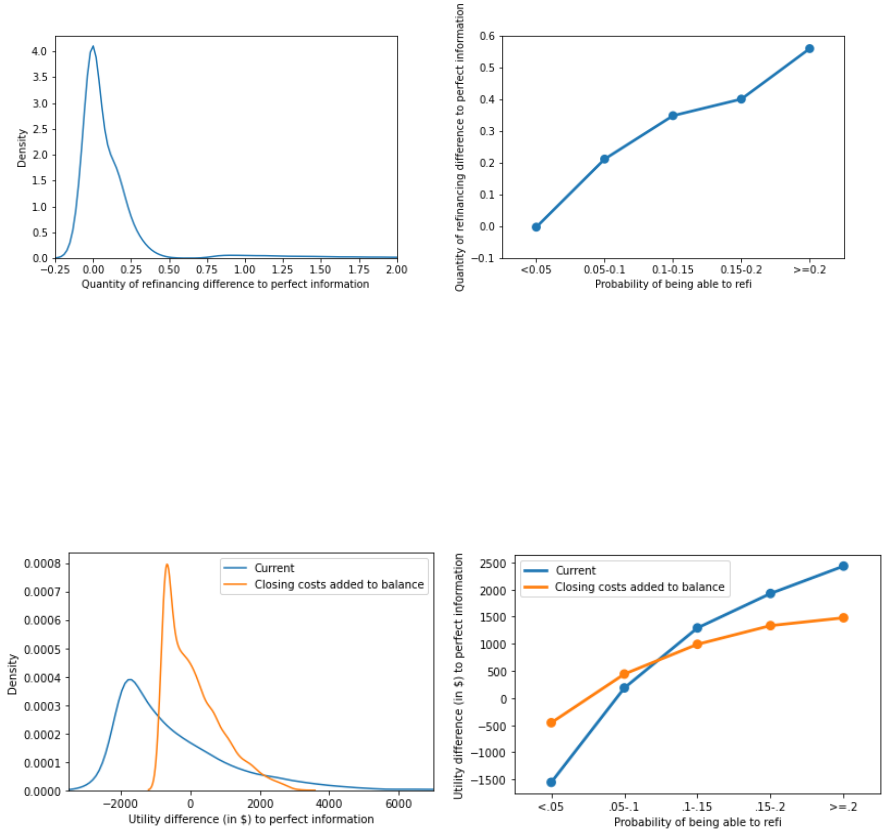

Figure 10 plots the differences in utility in the actual world versus the no perfect informa-

tion, no cross-subsidization benchmark. I find an average welfare loss of $445 per mortgage,

most of it borne by borrowers with a probability of being able to refinance of less than

5%. Given that there are around 8 million new mortgages being originated per year, the

welfare loss from the closing cost channel of cross subsidization is around $3.6 billion per

year. In addition, the average utility difference to the perfect information benchmark, in

absolute dollar value terms, is $1339/borrower, suggesting an average difference in utility of

1% of the loan amount from slow to refinance borrowers to quick to refinance borrowers.

18

By comparison, the difference in utility from comparing the benchmark quick to refinance

borrower as calibrated in Section 5.2 to a non-refinancing borrower that has p

a

i

= 0 but are

otherwise similar for a mortgage with zero upfront closing costs is 3.5% of the loan amount.

Figure 11 plots the welfare effects of the cross-subsidization by racial group. The welfare

effects are -$1776 per households for Black borrowers, -$1448 per households for Hispanic

borrowers, and -$366/borrower for other households. The welfare impact is negative for

all racial groups in part due to the deadweight loss generated by the cross-subsidization of

mortgage closing costs, but it is particularly strong for minorities.

To get at the excessive refinancing incentives generated by the cross-subsidization of

mortgage closing costs, Figure 12 plots the differences in the expected number of refinances

per new origination in the actual world versus the perfect information, no cross-subsidization

benchmark. I find an average increase of 0.13 refinances per new purchase origination. My

18

This difference in utility is approximated by doubling the average utility difference to the perfect infor-

mation benchmark, or $2678/borrower, and dividing by the average loan size of $252,000.

27

model implies an average number of refinances per new purchase origination of 0.47. There-

fore, it implies that 27.5% of the total US mortgage refinancing volume may be considered

excessive relative to the perfect information benchmark.

7 Counterfactuals

I conduct two counterfactual analyses. First, I consider an alternative mortgage contract

design where closing costs have to be added to the balance of the loan. The advantage

of this design is that it eliminates the cross-subsidization of mortgage closing costs: all

borrowers have to pay for their own price of mortgage origination. Second, I consider the

case of automatically refinancing mortgages, which is a mortgage whose interest rate resets

downwards automatically to a lower rate when the market rates falls by more than 1%.

This contract has been discussed in Campbell (2006). In both of these cases, I compute

the updated borrower and lender value functions, and I re-estimate the equilibrium using

the same zero profit condition on the supply side. To avoid complications with multiple

equilibria, I restrict myself to counterfactuals where upfront closing cost choices are fixed.

7.1 Adding closing cost to balance

First, I consider the utility changes of borrowers when they add their closing cost to the

balance of the loan. That is, their new mortgage balance becomes M

0

= M(1 + c

l

(M)), and

their mortgage payment becomes:

P

it

(M

0

) = M

0

c

it

/12(1 + c

it

/12)

n

(1 + c

it

/12)

n

− 1

. (25)

In periods where borrowers are able to refinance, their utility can still be written as the

maximum of what can be obtained by refinancing and not refinancing, except that refinancing

increases the balance of the loan from M to M

0

. Hence, M becomes an endogenous state

variable that we add to the model which affects the size of the mortgage payment P

it

(M

0

).

28

The expected utility in periods where borrowers are able to refinance,

˜

U

a

i,t

, is then:

t

˜

U

a

i,t

= max

max

∆S

it

(exp(L

it

)−P

it

(M)−(r

1,t−1

−π

t

)S

i,t−1

−∆S

it

)

1−γ

i

1−γ

i

+ β

t

˜

V

i,t+1

(c

it

, S

it

, M), if no move/refi

max

∆S

it

(exp(L

it

)−P

it

(M

0

)−˜κ

it

−(r

1,t−1

−π

t

)S

i,t−1

−∆S

it

)

1−γ

i

1−γ

i

+ β

t

˜

V

i,t+1

(c

it

, S

it

, M

0

), if refi

.

(26)

I simulate borrower utility and prepayment behavior under this counterfactual with bor-

rower utility when they are able to refinance being described by Equation (26) instead of

Equation (11). I then obtain the implied aggregate borrower behavior and lender values

based on my estimated distribution of borrower types in Table 5, conditional on the paths of

interest rates as estimated in Section A.6.1. Finally, I decrease the initial mortgage interest

rate for all borrowers, holding fixed their prepayment behavior, until the zero profit condition

in Equation (16) is satisfied on average, which is an equilibrium effect of this contract design

that increases in borrower utility.

Results are shown in Figure 13a, with a significantly narrower range of utility differences

relative to the perfect information benchmark. When closing costs are added to the balance

of the mortgage, there are still gains from actively refinancing relative to not refinancing,

albeit less than in the current world. This reduces the cross-subsidization between borrower

types. In particular, the average utility difference to the perfect information benchmark, in

absolute dollar value terms, falls by around half from $1339/borrower in the current world to

$698/borrower in this counterfactual world. The same reduction in cross-subsidization can

be inferred from Figure 13b, which plots the mean utility difference to the perfect information

case, in dollar terms, by buckets of borrower refinancing ability.

In terms of total welfare, I find that on average consumer welfare relative to the perfect

information benchmark rises from -$446/borrower to $110/borrower. Not only is the negative

welfare impact of excessive refinancing eliminated in this contract design, but there is also

a welfare gain due to the relaxation of financial constraints as closing costs can be added

to the balance. In the current world, actively refinancing borrowers can only pre-commit to

29

not undertaking costly refinancing activity by paying more in upfront closing costs, which is

itself costly due to financial constraints. Otherwise, they would have to take a higher initial

interest rate and refinance more which carries administrative resource costs. The addition

of mortgage closing costs to the balance both eliminates the cross-subsidization of mortgage

closing costs and resolves this commitment problem. As a result, it is able to simulatenously

reduce transfers by borrowers with different refinancing tendencies and also increase total

welfare.

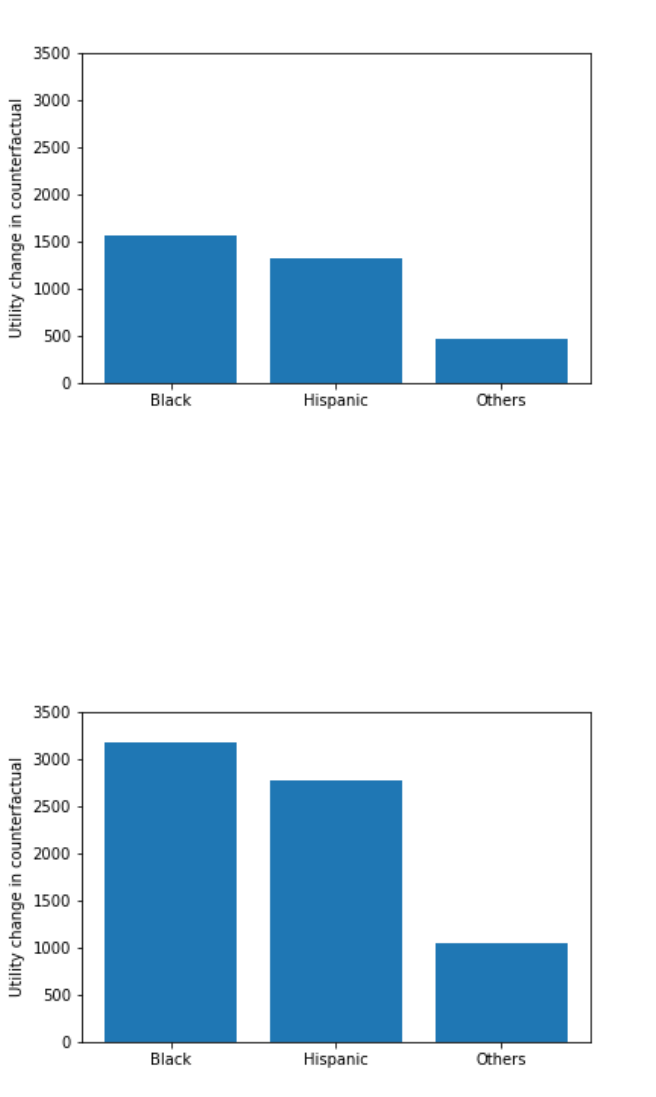

Appendix Figure A.17 plots the counterfactual change in utility by racial group under

the alternative contract design of adding all closing costs to the balance of the loan. All

racial groups gain from this counterfactual, with Black borrowers gaining on average $1566,

Hispanic borrowers gaining $1325, and other borrowers gaining $472. The average welfare

gain under this counterfactual is $556.

7.2 Making mortgages automatically refinancing

Second, I consider a counterfactual where mortgages are automatically refinancing and are

originated with zero upfront closing costs. In this case, I keep the same demand as in

Section 5 but automatically change the mortgage interest rate from c to r whenever c−r > 1

conditional on the paths of interest rates as estimated in Section A.6.1. Furthermore, I

eliminate the possibility of refinancing as that is no longer relevant. Finally, I increase

the initial mortgage premia over the risk-free rate for all borrowers until the zero profit

condition in Equation (16) is satisfied in the counterfactual, which is an equilibrium effect

of this contract design that decreases borrower utility.

Results are shown in Figure 14. I terms of distribution, automatically refinancing mort-

gages also feature lower average utility difference to the perfect information benchmark com-

pared to the current world. In particular, I find that this statistic falls from $1339/mortgage

to $773/mortgage. Furthermore, the automatically refinancing mortgages counterfactual fea-

ture a greater welfare improvement relative to the current world compared to adding closing

30

costs to the balance of the loan, at $1216/mortgage. This significant improvement is due to

the resource cost savings of refinancing, and is concentrated among the actively refinancing

borrowers as shown in Figure 14b. Appendix Figure A.18 plots the counterfactual change

in utility by racial group under the alternative contract design of automatically refinanc-

ing mortgages, showing that all racial groups would on average increase their utility in this

counterfactual.

Conceptually, there are two main channels through which automatically refinancing mort-

gages can increase total welfare. First, they can eliminate the excessive refinancing incentives

from the cross-subsidization of mortgage closing costs. Second, they also generate resource

savings by eliminating the administrative and hassle costs of refinancing. To the extent that

automatically refinancing mortgages present real resource savings to the economy and enable

a more efficient pass-through of monetary policy not modelled here, it may be an attractive

contract design for policymakers to consider.

8 Conclusion

The broad lesson of my paper is that in markets for consumer financial products, seemingly

small contractual details can have significant equity and efficiency implications. I illustrate

this lesson quantitatively in the US mortgage market where borrowers typically choose to

finance their closing costs through the rate. I show that this contractual feature exacerbates