The Purple

Book 2022

DB pensions universe

risk profile

Contents

Introduction 01

Overview 02

Chapter 1 Executive summary 03

Chapter 2 The data 05

Chapter 3 Scheme demographics 06

Chapter 4 Scheme funding 11

Chapter 5 Funding sensitivities 17

Chapter 6 Insolvency risk 20

Chapter 7 Asset allocation 21

Chapter 8 Risk reduction 27

Chapter 9 PPF levy 2021/22 31

Chapter 10 Claims and schemes in assessment 37

Chapter 11 PPF compensation 2021/22 40

Chapter 12 PPF risk developments 43

Appendix 45

Glossary 46

Charts and tables 48

The Purple Book 2022

The data

Scheme

demographics

Scheme

funding

Funding

sensitivities

Insolvency

risk

Asset

allocation

Risk

reduction

PPF levy

2021/22

Claims and

schemes in

assessment

Glossary

PPF

compensation

2021/22

Charts and tables

PPF risk

developments

Appendix

Overview

Executive

summary

Introduction

Introduction

The Purple Book, also known as The Pensions Universe Risk Profile, is now

in its 17th edition. We’ve published The Purple Book annually since 2006,

giving the most comprehensive data and analysis of the UK defined benefit

pension landscape. This publication tracks trends in DB scheme funding,

demographics, asset allocation and more. It also gives us, the PPF, an in-

depth understanding of the risks we face from the universe of schemes

we protect. Understanding this information helps us to model the level

of claims we may need to absorb in years to come, and helps inform

decisions on our funding strategy.

The Purple Book 2022

01

The data

Scheme

demographics

Scheme

funding

Funding

sensitivities

Insolvency

risk

Asset

allocation

Risk

reduction

PPF levy

2021/22

Claims and

schemes in

assessment

Glossary

PPF

compensation

2021/22

Charts and tables

PPF risk

developments

Appendix

Overview

Executive

summary

Introduction

Overview

Number of eligible schemes

7,751

2006

5,220

2021

5,131

2022

Number of members

2006

14.0m

2021

9.7m

2022

9.6m

Proportion of schemes closed to all

benefit accrual

2021

48%

2022

51%

Bonds trend

2006

28%

2021

72%

2022

72%

Equities trend

61%

2006

19%

2021

20%

2022

Scheme funding

2006

97. 1%

2021

102.8%

2022

113.1%

Surplus/deficit of schemes in surplus/deficit

2021

Deficit

£129bn

Surplus

£175bn

2022

Deficit

£61bn

Surplus

£245bn

Number and liabilities of schemes

in PPF assessment

2021

£9.4bn

87

schemes

2022

£6.4bn

63

schemes

The Purple Book 2022

02

The data

Scheme

demographics

Scheme

funding

Funding

sensitivities

Insolvency

risk

Asset

allocation

Risk

reduction

PPF levy

2021/22

Claims and

schemes in

assessment

Glossary

PPF

compensation

2021/22

Charts and tables

PPF risk

developments

Appendix

Overview

Executive

summary

Introduction

01

Executive summary

Highlights and key trends

from this year’s Purple Book.

Data

There are estimated

1

to be 5,131 schemes in the Pension Protection Fund (PPF) eligible universe

as at 31 March 2022, a reduction from 5,220 as at 31 March 2021. The declining universe reflects

schemes winding up, scheme mergers, and schemes entering PPF assessment. This year,

The Purple Book dataset covers all 5,131 schemes that are eligible for PPF compensation.

Schemes with more than 5,000 members make up almost 75 per cent of each of total assets,

liabilities, and members, while only forming seven per cent of the total number of schemes in

The Purple Book 2022 dataset. Conversely, schemes with fewer than 1,000 members make up

80 per cent of the total number of schemes but only around 10 per cent of total assets, liabilities

and members.

Scheme demographics

The Purple Book 2022 dataset includes 9.6 million DB scheme members, down from 9.7 million

last year. Of these:

• 43 per cent are pensioner members;

• 47 per cent are deferred members; and

• 10 per cent are active members.

Whilst the proportions are the same as last year, the number of active members in The Purple Book

2022 dataset who are members of a scheme still open to new benefit accrual and who continue

to accrue benefits has reduced by five per cent over the year. This is significantly higher than the

percentage reduction in the universe of schemes (two per cent) and the reduction in total

membership (one per cent) over the year and will reflect the fact that some members will have

retired as well as the continuing trend of schemes that had previously closed to new members

now closing to new benefit accrual.

The proportion of schemes that are closed to new benefit accrual has increased from 48 per cent

in 2021 to 51 per cent in 2022. This now means that for the first time we have more schemes that

provide no form of accrual of benefits than those that do.

Schemes that remain open tend to be larger in terms of membership. 21 per cent of members were

in open schemes with a further 41 per cent in schemes that are closed to new members but open

to new benefit accrual.

Scheme funding

Universe scheme funding improved in the year to 31 March 2022. The net funding position on

a section 179 (s179) basis as shown in the PPF 7800 index improved to a surplus of £193.0 billion

compared to a surplus of £46.9 billion the year before, while the aggregate funding ratio increased

to 113.1 per cent from 102.8 per cent.

The increase in the aggregate funding ratio is mainly the result of market movements, primarily the

result of higher gilt yields driving down liability values by more than the corresponding decrease in

asset values, together with large increases in equity values.

There was a further increase in the aggregate funding ratio from the new s179 basis that came into

force on 1 May 2021 as well as up-to-date valuations and the latest eligible universe available by

updating to the new Purple Book 2022 dataset.

Over the year we have seen the total section 179 liabilities fall by almost 12 per cent, this being the

largest annual fall observed.

On an estimated full buy-out basis, the net funding position improved to a deficit of £438.4 billion

from a deficit of £615.3 billion the year before and the funding ratio improved from 73.7 per cent

to 79.2 per cent.

Asset allocation

The aggregate proportion of schemes’ assets invested in equities and bonds were broadly

unchanged from those recorded two years ago. The proportion in equities rose slightly from

19.0 per cent to 19.5 per cent while the proportion in bonds fell slightly from 72.0 per cent to

71.6 per cent.

Within bonds, the index-linked bonds proportion increased from 47.2 per cent to 47.8 per cent.

The corporate bonds proportion increased from 28.2 per cent to 30.2 per cent, while the

government fixed interest bonds proportion fell from 24.6 per cent to 22.0 per cent.

Within equities, the UK-quoted proportion fell from 11.6 per cent to 9.9 per cent, falling below

10 per cent for the first time. The overseas-quoted proportion increased slightly from 68.3 per cent

to 68.6 per cent, while the proportion of unquoted/private equities increased from 20.1 per cent to

21.5 per cent.

Risk reduction

DB pension schemes have continued to close to new benefit accrual. Although there has been little

change in the proportion of assets in bonds and equities over the last year, schemes continued to

invest a large proportion (over 70 per cent) of their assets in bonds and the proportion of assets

invested in equities is less than 20 per cent.

Based only on current recovery plans in place, total annual recovery plan payments are indicated to

decrease by around 88 per cent over the next 10 years, from around £12.3 billion in 2022 to around

£1.4 billion in 2032, as schemes increasingly become fully funded on a Technical Provisions basis.

However, this only shows the current position so changes may be made to existing recovery plans

and new recovery plans may be put in place in the future if experience is dierent from what has

currently been assumed by schemes.

Analysis of The Pensions Regulator’s latest Technical Provisions and recovery plan data shows that

in Tranche 15

2

, the average recovery plan length was 6.4 years, a year less than that of Tranche 12

(comparable given the three-year valuation cycle). Assets as a percentage of Technical Provisions

was 88.8 per cent in both Tranche 12 and Tranche 15.

For the first time we

have more schemes

that provide no form

of accrual of benefits

than those that do.

1 The number of schemes in the PPF eligible universe as at 31 March 2022 could be dierent from 5,131 if any of these schemes are discovered to

be ineligible for PPF protection or if any other schemes are discovered to be eligible for PPF protection as at 31 March 2022.

2 Tranche 15 covers schemes with valuation dates between 22 September 2019 and 21 September 2020. https://www.thepensionsregulator.gov.uk/

en/document-library/research-and-analysis/scheme-funding-analysis-2022/scheme-funding-analysis-2022-annex

The Purple Book 2022

03

The data

Scheme

demographics

Scheme

funding

Funding

sensitivities

Insolvency

risk

Asset

allocation

Risk

reduction

PPF levy

2021/22

Claims and

schemes in

assessment

Glossary

PPF

compensation

2021/22

Charts and tables

PPF risk

developments

Appendix

Overview

Executive

summary

Introduction

Executive summary continued

The total number of contingent assets submitted to the PPF for the 2022/23 levy year was 303,

compared with 317 in 2021/22.

There were £43 billion worth of risk transfer deals (buy-ins, buy-outs and longevity swaps) in 2021,

down from £56 billion the previous year. This is a relatively small amount in the context of the

whole universe of schemes.

PPF levy, claims, and compensation

• In 2021/22, the levy totalled £476 million, down from £630 million the previous year.

• The top 100 levy payers accounted for 58 per cent of the total levy, up from 55 per cent last year.

• 34 per cent of schemes had no risk-based levy while 3.3 per cent of schemes saw the cap of 0.25

per cent of smoothed liabilities apply to their risk-based levy.

• 84 per cent of the total levy came from schemes sponsored by employers categorised as

‘Non-Subsidiaries £30 million+ and Large Subsidiaries’, ‘Credit Rated’ or ’Group £50m+’ for

D&B scorecard purposes.

In the year to 31 March 2022, 14 new schemes entered PPF assessment. This is lower than last

year when there were 30 new schemes. The total value of the year’s claims was £12 million

(as measured on an s179 basis), which is lower than last year’s claims of around £200 million.

In the year to 31 March 2022, the PPF made compensation payments of £1,115 million compared

with £1,006 million in the previous year. As at 31 March 2022, there were 193,983 records in respect

of members receiving compensation

1

, up from 184,844 a year earlier. The average annual payment

per record to members receiving compensation was £4,825, which is comparable to the 31 March

2021 average of £4,829.

PPF risk developments

We published our funding strategy review in September 2022, which explains our approach to

financial risk management as we move into a new phase of our funding journey. We enter this

new stage in a strong financial position, and our strategic aim will shift from growing our reserves

to ‘Maintaining our Financial Resilience’, which is our revised funding objective.

We defined a set of funding priorities to monitor our financial resilience. The strategic decisions

on our future investment and levy strategies will be guided by how our reserves compare to these

priorities. We therefore need to understand how our own funding and that of the schemes we

protect may change over time. For that, we use the Long-Term Risk Model (LTRM), a stochastic

model that runs a million dierent scenarios to project what the future may look like, allowing for

future claims, levies, investment returns and changes in economic conditions.

Like any complex modelling exercise, LTRM projections are subject to significant uncertainty.

They depend crucially on modelling assumptions, which we continually refine to reflect how

experience and expectations develop over time. We carried out sensitivity testing to understand

the key financial risks to which we are exposed. Under each of these tests, we are comfortable

that our current strategic decisions would be unchanged. We also continue to monitor, and seek

to understand, the impacts of the key risks we face, including climate change risk, macro-economic

changes and the COVID-19 pandemic.

Over the last year, there has been a material improvement in our funding position and in that of the

schemes we protect. This has increased the likelihood of us ‘Maintaining our Financial Resilience’.

The general economic environment remains volatile, but our modelling indicates that we are well

placed to cope with the uncertainty.

Economy and market background

The following table sets out how some key market indicators in the assessment of universe scheme

assets and s179 liabilities have changed over the year:

Market indicator

Change over the year to

31 March 2022

10-year fixed interest gilt yield 0.72pp

15-year fixed interest gilt yield 0.58pp

20-year fixed interest gilt yield 0.47pp

5–15 year index-linked gilt yield -0.06pp

FTSE All-Share Index (TR) 13.03%

FTSE All-World Ex-UK Index (TR) 12.62%

pp = percentage point(s)

TR = Total Return

Our strategic aim will shift from

growing our reserves to ‘Maintaining

our Financial Resilience’, which is

our revised funding objective.

1 Some members have more than one record in the data.

The Purple Book 2022

04

The data

Scheme

demographics

Scheme

funding

Funding

sensitivities

Insolvency

risk

Asset

allocation

Risk

reduction

PPF levy

2021/22

Claims and

schemes in

assessment

Glossary

PPF

compensation

2021/22

Charts and tables

PPF risk

developments

Appendix

Overview

Executive

summary

Introduction

02

The data

An overview of the dataset

used in this edition of

The Purple Book.

Summary

• This chapter contains information on the number and distribution of

schemes in The Purple Book 2022 dataset and the estimated universe

of PPF-eligible schemes.

• The main analysis in The Purple Book 2022 is based on the

most recent scheme returns submitted to TPR by 31 March 2022.

This covered a dataset of 5,131 DB schemes, covering 9.6 million

members

1

. This represents all PPF-eligible schemes and universe

liabilities. A full description of the data used is set out in the appendix.

• It is estimated that the eligible universe of schemes was 5,131 as

at 31 March 2022, a reduction from 5,220 as at 31 March 2021. The

declining universe reflects schemes winding up, scheme mergers,

and schemes entering PPF assessment.

• As in previous editions of The Purple Book, the bulk of the analysis

uses funding with pension scheme liability values measured on an

s179 basis. This is, broadly speaking, what would have to be paid

to an insurance company to take on the payment of PPF levels

of compensation.

Figure 2.1 | Distribution of schemes excluding those in assessment by size of

scheme membership

The reduction in the eligible universe from 5,220 schemes at 31 March 2021 to 5,131

schemes at 31 March 2022 is mainly due to schemes with fewer than 1,000 members

leaving the eligible universe.

Number of members 2–99 100–999

1,000–

4,999

5,000–

9,999 10,000+ Total

The Purple Book 2021 dataset

(number of schemes) 1,874 2,280 720 160 186 5,220

The Purple Book 2022 dataset

(number of schemes) 1,836 2,248 706 159 182 5,131

Dierence in number of schemes -2.0% -1.4% -1.9% -0.1% -2.2% -1.7%

Source: PPF

Figure 2.2 | Distribution of assets, s179 liabilities and members in The Purple Book 2022

dataset as at 31 March 2022

Large schemes with over 5,000 members make up seven per cent of schemes in The Purple

Book 2022 dataset but almost 75 per cent of each of total assets, liabilities and members.

Number of members 2–99 100–999

1,000–

4,999

5,000–

9,999 10,000+ Total

Assets (£bn) 17.4 145.6 265.9 208.8 1,029.3 1,666.9

s179 liabilities (£bn) 14.6 131.3 244.3 187. 3 896.4 1,473.9

Number of members (000’s) 81 786 1,604 1,110 6,067 9,648

Source: PPF

Note: the components may not sum to the total because of rounding.

Figure 2.3 | The Purple Book datasets

The universe has declined by two per cent over the year, similar to previous years. This

reflects schemes winding up, scheme mergers and schemes transferring into the PPF.

Estimated universe Purple Book dataset Number of members (m)

2006 7,751 5,772 14.0

2007 7,542 5,892 12.7

2008 7,400 6,898 12.4

2009 7,098 6,885 12.4

2010 6,850 6,596 12.0

2011 6,550 6,432 12.0

2012 6,460 6,316 11.7

2013 6,225 6,150 11.4

2014 6,070 6,057 11.1

2015 5,967 5,945 11.0

2016 5,886 5,794 10.9

2017 5,671 5,588 10.5

2018 5,524 5,450 10.4

2019 5,436 5,422 10.1

2020 5,327 5,318 9.9

2021 5,220 5,215 9.7

2022 5,131 5,131 9.6

Source: PPF

Note: the reason for the increase in The Purple Book dataset from 2006 to 2008 is mainly a result of improvements to

the design of the scheme return intended to permit better PPF validation procedures.

1 One individual can have multiple memberships (for example of dierent pension schemes). Hence the number of members exceeds the number of individuals.

The Purple Book 2022

05

The data

Scheme

demographics

Scheme

funding

Funding

sensitivities

Insolvency

risk

Asset

allocation

Risk

reduction

PPF levy

2021/22

Claims and

schemes in

assessment

Glossary

PPF

compensation

2021/22

Charts and tables

PPF risk

developments

Appendix

Overview

Executive

summary

Introduction

03

Scheme demographics

This chapter looks at trends

in scheme status and member

status. Schemes can be open

to new members, closed to

new members but open to new

benefit accrual, closed to new

members and benefit accrual,

or winding up. Members may

be actively accruing benefits,

deferred, or retired.

Summary

This chapter describes the dataset used for this year’s edition of The Purple Book and includes

some comparisons with data from previous years. Figures for the total number of schemes and

total scheme membership are included, with breakdowns by scheme size, scheme status, and

member status.

How we categorise schemes has varied in earlier editions of The Purple Book as more informative

breakdowns became available although the method of categorisation has been unchanged since

2013. For more detailed information, see the appendix.

Some statistics from this chapter are summarised in the following table:

Date of The Purple Book

31 March 2022 31 March 2021

Number of schemes in The Purple Book dataset 5,131 5,215

Proportion of schemes that are:

open to new members 10% 11%

closed to new members (but open to new benefit accrual) 38% 39%

closed to new benefit accrual 51% 48%

winding up 2% 2%

Number of members covered by schemes in

The Purple Book dataset, of which: 9.6m 9.7m

pensioner members 43% 43%

deferred members 47% 47%

active members (still accruing benefits) 10% 10%

Note: the percentages may not sum to 100 per cent because of rounding.

• The number of active members has continued to fall and is now around 0.9 million. This is around a quarter of those

found in the first Purple Book dataset in 2006.

• The gradual trend of schemes closing to both new members and new benefit accrual has continued and now

accounts for more than half of all schemes for the first time (51 per cent). This compares with 12 per cent in

The Purple Book dataset in 2006.

• 73 per cent of schemes have assets of less than £100 million.

Scheme status

Figure 3.1 | Distribution of schemes by scheme status

Over 50 per cent of schemes don’t provide any new benefit accrual.

Winding up (90 schemes, 2%)

Open (488 schemes, 10%)

Closed to new members (1,949 schemes, 38%)

Closed to new benefit accrual (2,604 schemes, 51%)

Open Closed to new members Closed to new benefit accrual Winding up

Source: PPF

Note: the percentages may not sum to 100 per cent because of rounding.

Figure 3.2 | Distribution of schemes by scheme status and member group

Large schemes are more likely to be open to new members or new benefit accrual.

Open Closed to new members Closed to new benefit accrual Winding up

Percentage

Number of members

0

20

40

60

80

100

2–99

12%

36%

48%

100–999

6%

37%

56%

1,000–4,999

10%

41%

48%

5,000–9,999

18%

44%

38%

10,000

and over

17%

48%

35%

Source: PPF

Note: the percentages may not sum to 100 per cent because of rounding.

The Purple Book 2022

06

The data

Scheme

demographics

Scheme

funding

Funding

sensitivities

Insolvency

risk

Asset

allocation

Risk

reduction

PPF levy

2021/22

Claims and

schemes in

assessment

Glossary

PPF

compensation

2021/22

Charts and tables

PPF risk

developments

Appendix

Overview

Executive

summary

Introduction

Scheme demographics continued

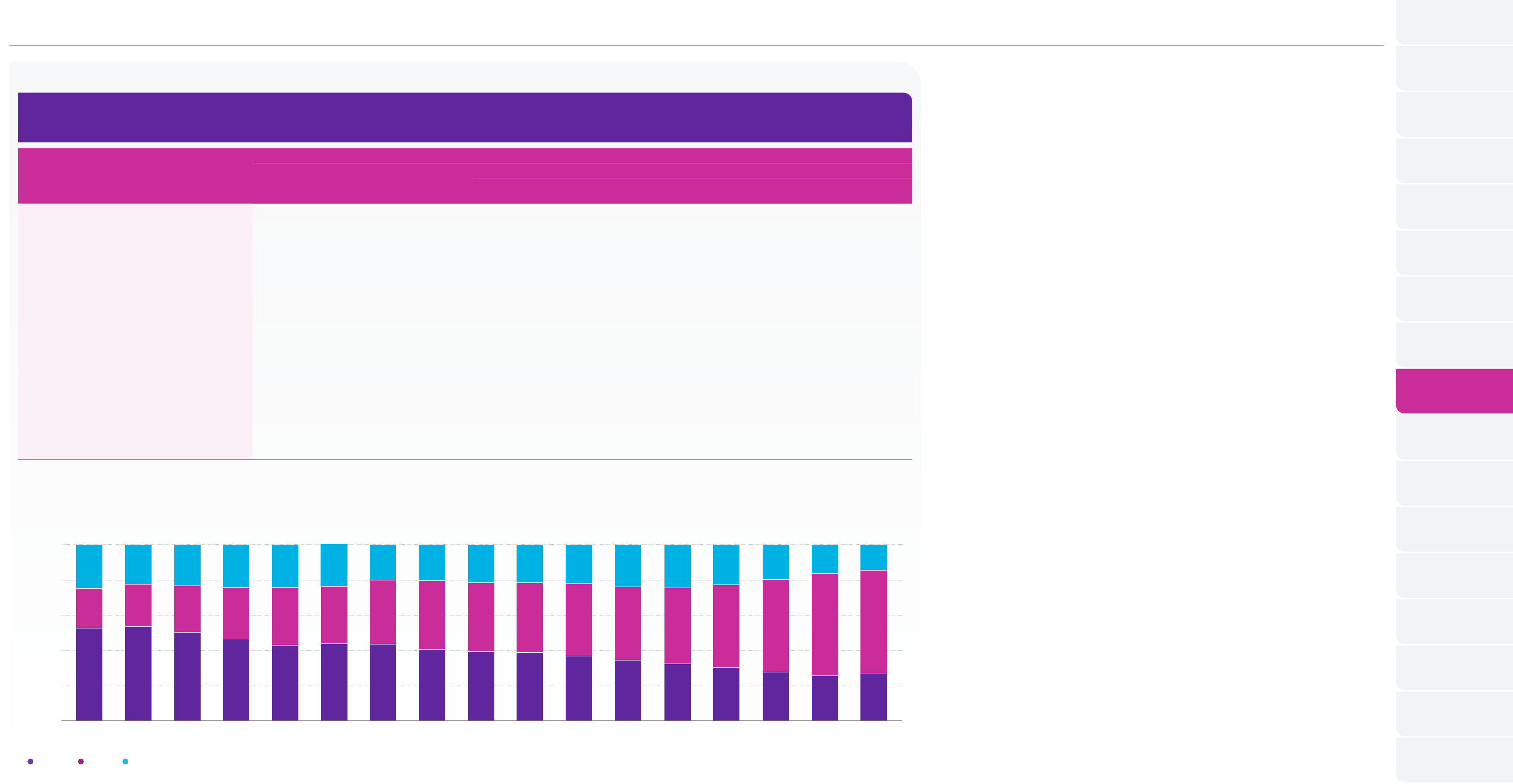

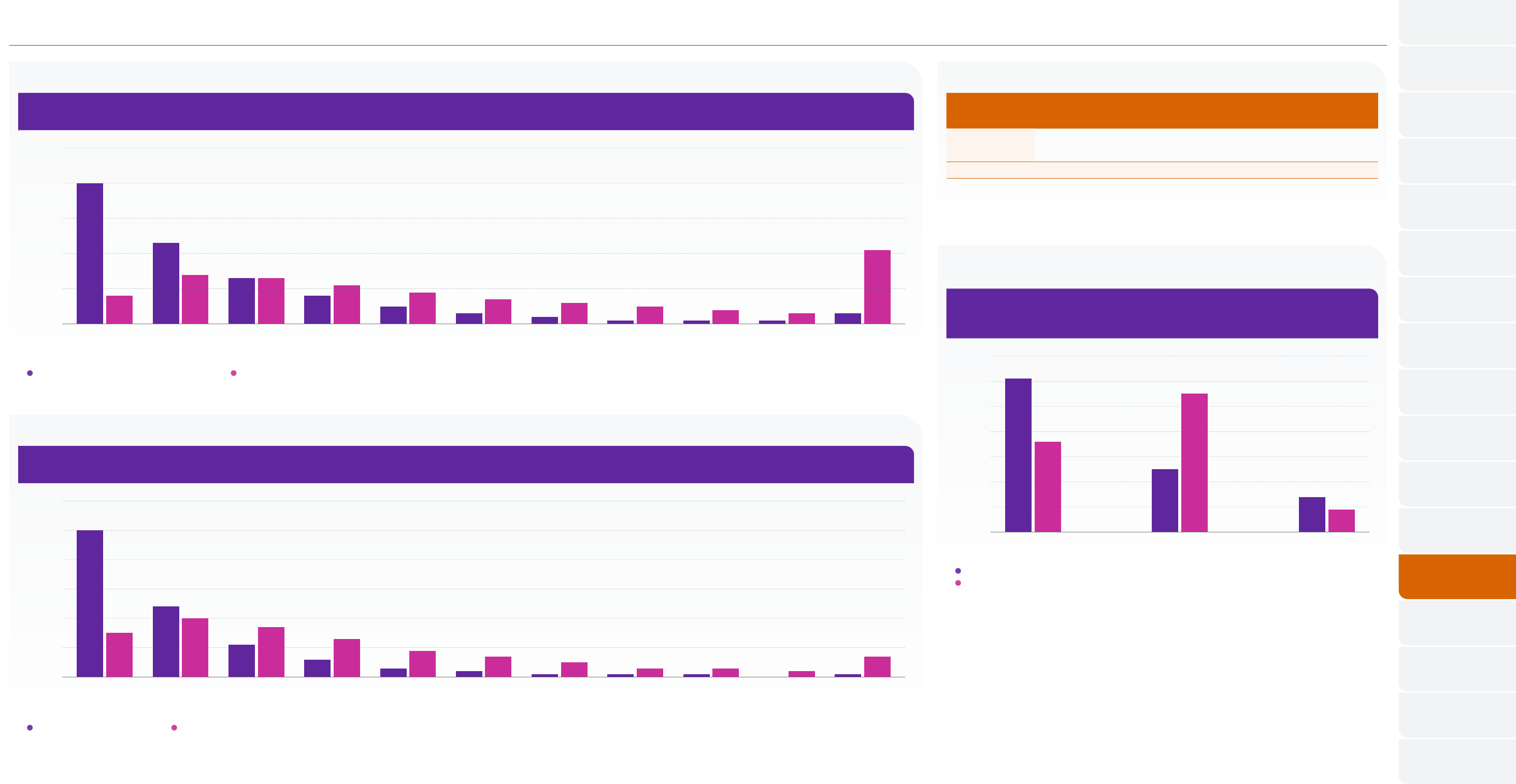

Figure 3.3 | Distribution of schemes by scheme status and year

The gradual trend of schemes already closed to new members also closing to accrual has continued, with this status now covering more than 50 per cent of schemes for the first time

(51 per cent).

Open Closed to new members Closed to new benefit accrual Winding up

Percentage

Year

0

20

40

60

80

100

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

43%

44%

12%

36%

45%

16%

31%

50%

17%

27%

52%

19%

18%

58%

21%

16%

58%

24%

14%

57%

26%

14%

54%

30%

13%

53%

32%

13%

51%

34%

13%

50%

35%

12%

47%

39%

12%

46%

41%

11%

44%

44%

11%

41%

46%

11%

39%

48%

10%

38%

51%

Source: PPF

Note: the percentages may not sum to 100 per cent because of rounding.

Figure 3.4 | Distribution of schemes by scheme status and year (excluding hybrid schemes

1

)

The distribution of schemes by scheme status in The Purple Book 2022 dataset is similar whether or not hybrid schemes are excluded.

Source: PPF

Note: the percentages may not sum to 100 per cent because of rounding.

1 A hybrid scheme is one that provides defined benefit (DB) and defined contribution (DC) benefits. The treatment of

such schemes has varied in past editions of The Purple Book as better data has become available (see the appendix

for a detailed explanation). At present we define a scheme as closed if the DB section is closed, even if the DC section

remains open.

Scheme status and scheme members

Figure 3.5 | Distribution of members by scheme status

Around 62 per cent of members are in schemes that have some form of new benefit accrual.

Winding up (0%)

Closed to new benefit accrual (37%)

Closed to new members (41%)

Open (21%)

Open Closed to new members Closed to new benefit accrual Winding up

Source: PPF

Note: the percentages may not sum to 100 per cent because of rounding.

0

20

40

60

80

100

Percentage

Year

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

35%

49%

15%

33%

49%

17%

26%

52%

19%

22%

55%

20%

21%

54%

23%

18%

54%

26%

17%

53%

29%

16%

51%

31%

15%

50%

33%

14%

49%

35%

14%

47%

37%

13%

45%

40%

13%

44%

42%

12%

41%

46%

10%

40%

48%

10%

38%

50%

10%

37%

51%

Open Closed to new members Closed to new benefit accrual Winding up

The Purple Book 2022

07

The data

Scheme

demographics

Scheme

funding

Funding

sensitivities

Insolvency

risk

Asset

allocation

Risk

reduction

PPF levy

2021/22

Claims and

schemes in

assessment

Glossary

PPF

compensation

2021/22

Charts and tables

PPF risk

developments

Appendix

Overview

Executive

summary

Introduction

Scheme demographics continued

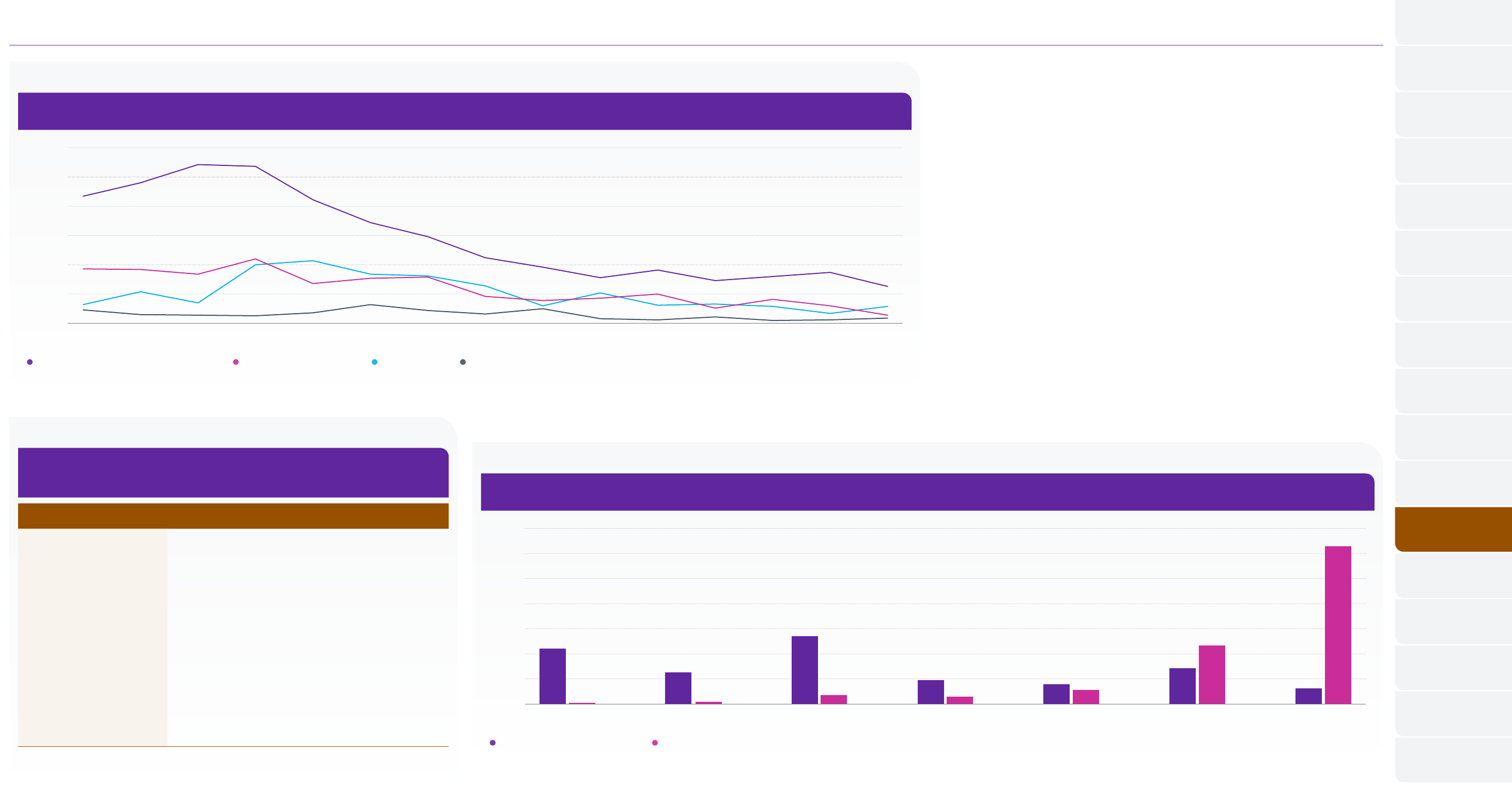

Figure 3.6 | Distribution of members by scheme status and year

The change in membership by scheme status has followed a similar trend over time to the number of schemes by scheme status. However, just under 40 per cent of members are in schemes

that don’t provide any new benefit accrual compared with over 50 per cent of schemes not providing any new benefit accrual.

0

20

40

60

80

100

Percentage

Year

2006 2007 2008

2009

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

66%

32%

50%

46%

44%

52%

4%

37%

59%

4%

34%

60%

5%

31%

62%

6%

28%

64%

8%

23%

65%

12%

22%

62%

15%

22%

62%

16%

19%

60%

20%

21%

55%

24%

21%

53%

25%

21%

52%

27%

24%

45%

30%

21%

41%

37%

23%

43%

33%

Open Closed to new members Closed to new benefit accrual Winding up

Source: PPF

Note: the percentages may not sum to 100 per cent because of rounding.

Figure 3.7 | Distribution of members by scheme status and year (excluding hybrid schemes)

Excluding hybrid schemes has a notable eect on the distribution of members by scheme status in The Purple Book 2022 dataset. This is partly due to one very large open scheme having a

hybrid status.

0

20

40

60

80

100

Percentage

Year

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

35%

49%

15%

55%

41%

3%

46%

49%

4%

38%

57%

5%

38%

56%

6%

34%

58%

8%

30%

61%

9%

27%

61%

11%

25%

60%

14%

24%

59%

16%

19%

56%

24%

19%

53%

27%

14%

54%

32%

13%

52%

34%

14%

49%

35%

14%

45%

39%

13%

44%

42%

Open Closed to new members Closed to new benefit accrual Winding up

Source: PPF

Note: the percentages may not sum to 100 per cent because of rounding.

Scheme membership

Figure 3.8 | Number and distribution of members by member type and scheme status

as at 31 March 2022

The total number of active members reduced by five per cent in the year to 31 March 2022

and is the main reason for the reduction in total membership. The total number of pensioners

reduced by one per cent while the total number of deferreds was almost unchanged.

Number (000’s) / % Open

Closed

to new

members

Closed to

new benefit

accrual Winding up All

Active members

628.5 302.2 – – 930.7

7% 3% 0% 0% 10%

Deferred members

743.5 1,784.4 2,026.6 20.7 4,575.3

8% 18% 21% 0% 47%

Pensioner members

657.7 1,908.4 1,555.2 20.3 4,141.6

7% 20% 16% 0% 43%

Total

2,029.8 3,995.0 3,581.8 41.0 9,647.6

21% 41% 37% 0% 100%

Note: the percentages may not sum to 100 per cent and the components may not sum to their totals because

of rounding.

Open

Closed to new members Closed to new benefit accrual Winding up

Type of member

Number of members (m)

0

1

2

3

4

5

Pensioner

7%

20%

16%

Deferred

8%

18%

21%

Active

7%

3%

Source: PPF

The Purple Book 2022

08

The data

Scheme

demographics

Scheme

funding

Funding

sensitivities

Insolvency

risk

Asset

allocation

Risk

reduction

PPF levy

2021/22

Claims and

schemes in

assessment

Glossary

PPF

compensation

2021/22

Charts and tables

PPF risk

developments

Appendix

Overview

Executive

summary

Introduction

Scheme demographics continued

Figure 3.9 | Active members in The Purple Book datasets

The number of active members has decreased to around 0.9 million and is around a

quarter of those found in the first Purple Book dataset in 2006.

Active members (m)

Year

0

1

2

3

4

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Source: PPF

Figure 3.10 | Distribution of member type, by scheme membership size

The proportion of active members increases as scheme membership size increases.

Active members

Percentage

Number of members

0

20

40

60

80

100

2 to 99

6%

51%

43%

42%

50%

9%

43%

46%

10%

43%

44%

13%

6%

45%

49%

100 to 999 1,000 to 4,999 5,000 to 9,999 10,000

and over

Deferred members Pensioner members

Source: PPF

Note: the percentages may not sum to 100 per cent because of rounding.

Figure 3.11 | Proportion of schemes by scheme membership size, by year

The distribution of schemes by scheme membership size has remained relatively stable over time, suggesting that there is little correlation between scheme size and removal from the

eligible universe.

0

20

40

60

80

100

Percentage

Year

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

36%

37%

36%

35%

36% 35% 36% 36% 36% 36%

35% 36% 35% 36% 36% 36% 36%

46%

45%

45%

46%

46% 45% 45% 45% 44%

44%

44% 44% 44% 44% 44% 44% 44%

12% 12%

13% 13% 13% 13% 13% 13% 13%

13%

14% 14% 14% 13% 14% 14% 14%

2–99 100–999 1,000–4,999 5,000–9,999 10,000 and over

Source: PPF

Note: the percentages may not sum to 100 per cent because of rounding.

Asset size

Figure 3.12 | Distribution of schemes by asset size

72 per cent of schemes have assets of less than £100 million.

Under £5m £5m to £10m £10m to £100m £100m to £1bn Over £1bn

Under £5m (846 schemes, 16%)

£5m to £10m (616 schemes, 12%)

£10m to £100m (2,261 schemes, 44%)

£100m to £1bn (1,111 schemes, 22%)

Over £1bn (297 schemes, 6%)

Source: PPF

The Purple Book 2022

09

The data

Scheme

demographics

Scheme

funding

Funding

sensitivities

Insolvency

risk

Asset

allocation

Risk

reduction

PPF levy

2021/22

Claims and

schemes in

assessment

Glossary

PPF

compensation

2021/22

Charts and tables

PPF risk

developments

Appendix

Overview

Executive

summary

Introduction

Scheme demographics continued

Pension indexation types

Figure 3.13 | Pension indexation types for scheme benefits accrued before 6 April 1997

More than three quarters of schemes provide indexation on scheme benefits accrued

before 6 April 1997.

None/fixed CPI-linked RPI-linked

Percentage

Pension indexation type

0

10

20

30

40

50

None Fixed Capped

inflation

Uncapped

inflation

Other

6%

5%

4%

26%

32%

22%

4%

1%

Source: PPF

Figure 3.14 | Pension indexation types for scheme benefits accrued after 5 April 1997

Around two thirds of schemes provide indexation of capped inflation on scheme benefits

accrued after 5 April 1997. For the vast majority of these schemes, the inflation cap is five

per cent a year.

None/fixed CPI-linked RPI-linked

Percentage

Pension indexation type

0

20

40

60

80

None Fixed Capped

inflation

Uncapped

inflation

Other

13%

4%

5%

15%

53%

4%

2%

4%

Source: PPF

Note: this is based on scheme return data provided by schemes, where the scheme return specifies that in cases

where there is more than one rate of indexation, the rate applying to the largest proportion of protected liabilities

should be submitted.

Note: most of the schemes with no pension indexation don’t have any scheme benefits that were accrued after

5 April 1997 or are cash balance schemes.

The Purple Book 2022

10

The data

Scheme

demographics

Scheme

funding

Funding

sensitivities

Insolvency

risk

Asset

allocation

Risk

reduction

PPF levy

2021/22

Claims and

schemes in

assessment

Glossary

PPF

compensation

2021/22

Charts and tables

PPF risk

developments

Appendix

Overview

Executive

summary

Introduction

04

Scheme funding

This chapter looks at how well

funded schemes are, and trends

and scheme funding by scheme

size, status and maturity.

Summary

This chapter covers funding on an s179 basis as at 31 March 2022, which is based on version A10 of

the s179 assumptions. Funding information supplied in scheme returns submitted to The Pensions

Regulator (TPR) is processed so that the funding ratios can be estimated at a common date, allowing

consistent totals to be used. In The Purple Book Deficit-Reduction Contributions (DRCs), as submitted

for levy purposes, have been added to the asset values submitted in s179 valuations. More detail on

how assets and s179 liabilities have been calculated at 31 March 2022 can be found in the appendix.

A scheme that is 100 per cent funded on an s179 basis has broadly enough assets to pay an insurance

company to take on the scheme with PPF levels of compensation.

In addition, this chapter considers estimated full buy-out funding information. This has been

calculated using the same valuation assumptions and underlying data as for the s179 calculations.

An approximate allowance is then made for the dierence between the PPF level of compensation

and full scheme benefits. Some of the statistics summarising these calculations are shown below:

Item

The Purple Book

31 March 2022 31 March 2021

1

Net s179 funding position (£bn) 193.0 surplus 46.9 surplus

s179 liabilities (£bn) 1,473.9 1,673.8

Assets (£bn) 1,666.9 1,720.7

Funding ratio:

s179 basis 113.1% 102.8%

Estimated full buy-out basis 79.2% 73.7%

1 The 31 March 2021 figures are based on version A9 of the s179 assumptions, which was in force at the eective date of last

year’s Purple Book.

The following table sets out how some of the market indicators used to assess and roll forward

pension scheme assets and s179 liabilities have changed over the year:

Market indicator

Change over the year to

31 March 2022

10-year fixed interest gilt yield 0.72pp

15-year fixed interest gilt yield 0.58pp

20-year fixed interest gilt yield 0.47pp

5–15 year index-linked gilt yield -0.06pp

FTSE All-Share Index (TR) 13.03%

FTSE All-World Ex-UK Index (TR) 12.62%

pp = percentage point(s)

TR = Total Return

The change in the aggregate s179 funding ratio over the year is a result of market movements, new

assumptions and new data, as shown in the following chart.

s179 funding

ratio as at

31 March 2021

Market

movements

Move to version

A10 of s179

assumptions

Up-to-date valuations

and the latest

eligible universe

s179 funding

ratio as at

31 March 2022

Percentage

0

20

40

60

80

120

100

1.7% 113.1%

2.6%

102.8%

6.0%

• The 10.3 percentage point increase in the s179 funding ratio over the year to 31 March 2022 can

be broken down as follows:

– The impact of market movements has resulted in a 6.0 percentage point increase in the s179

funding ratio. This was due to large increases in equity values and gilt yields over the year,

which caused total assets to increase while total liabilities decreased.

– The impact of moving to the A10 version of the s179 assumptions was an increase of 2.6

percentage points in the s179 funding ratio. This was due to a reduction in scheme liabilities.

– Additionally, an increase of 1.7 percentage points in the s179 funding ratio was observed from

adopting the new Purple Book 2022 dataset, which includes more up-to-date scheme valuations.

• The s179 funding ratio at 31 March 2022 is 16 percentage points higher than that disclosed in the

first Purple Book as at 31 March 2006. However, total assets and liability values have more than

doubled over this period for the following reasons:

– The significant increase in assets has arisen from increases in equity values (returns of around

143 per cent and 350 per cent on UK and global equities respectively), increases in bond

values and DRCs, oset to some extent by schemes that have left the PPF universe.

– The significant increase in liabilities has arisen from lower gilt yields and longer life

expectancies driving up liability values, again oset to some extent by schemes that have

left the PPF universe.

• Funding ratios are higher among:

– More mature schemes (i.e. those with a higher proportion of liabilities that relate to

pensioners); and

– The smallest and largest schemes (compared to mid-size schemes).

• In the last 12 years, the proportion of liabilities that relates to pensioner members has remained

relatively stable at around 40 per cent, although there are recent signs this is increasing as the

proportion increased by 3 percentage points to 44 per cent over the last year. The proportion

relating to active members has reduced significantly over the same period and has reduced by

15 percentage points to 17 per cent.

Overall funding

Figure 4.1 | Key funding statistics as at 31 March 2022

The net s179 funding position of the schemes in The Purple Book 2022 dataset at 31 March

2022 was a surplus of £193.0 billion, corresponding to a funding ratio of 113.1 per cent.

Number of members s179

Estimated full

buy-out

Total number of schemes 5,131 5,131

Total assets (£bn) 1,666.9 1,666.9

Total liabilities (£bn) 1,473.9 2,105.3

Net funding position (£bn) 193.0 -438.4

Aggregate funding ratio 113.1% 79.2%

Number of schemes in deficit 1,752 4,515

Number of schemes in surplus 3,379 616

Net funding position for schemes in deficit (£bn) -61.1 -454.4

Net funding position for schemes in surplus (£bn) 254.1 16.0

Source: PPF

Note: the component figures may not sum to the total because of rounding.

The Purple Book 2022

11

The data

Scheme

demographics

Scheme

funding

Funding

sensitivities

Insolvency

risk

Asset

allocation

Risk

reduction

PPF levy

2021/22

Claims and

schemes in

assessment

Glossary

PPF

compensation

2021/22

Charts and tables

PPF risk

developments

Appendix

Overview

Executive

summary

Introduction

Scheme funding continued

Figure 4.2 | Current and historical funding figures on an s179 basis

The aggregate s179 funding ratio improved by 10.3 percentage points over the year to 31 March 2022 to a record high of 113.1 per cent. The deficit of schemes in deficit improved from

£128.5 billion to £61.1 billion over the year to 31 March 2022.

Year

Number

of schemes

Total

assets

(£bn)

s179 liabilities

Liabilities

(£bn)

Net funding

position

(£bn)

Aggregate

funding ratio

Deficit of

schemes

in deficit

(£bn)

Surplus

of schemes

in surplus

(£bn)

2006 7,751 769.5 792.2 -22.7 97.1% -76.3 53.5

2007 7,542 837.7 769.9 67.8 108.8% -38.5 106.2

2008 6,897 837. 2 842.3 -5.1 99.4% -67.7 62.6

2009 6,885 780.4 981.0 -200.6 79.6% -216.7 16.0

2010 6,596 926.2 8 87.9 38.3 104.3% -49.1 87.4

2011 6,432 968.5 969.7 -1.2 99.9% -78.3 7 7.1

2012 6,316 1,026.8 1,231.0 -204.2 83.4% -231.3 27.1

2013 6,150 1,118.5 1,329.2 -210.8 84.1% -245.8 35.0

2014 6,057 1,137. 5 1,176.8 -39.3 96.7% -119.0 79.7

Year

Number

of schemes

Total

assets

(£bn)

s179 liabilities

Liabilities

(£bn)

Net funding

position

(£bn)

Aggregate

funding ratio

Deficit of

schemes

in deficit

(£bn)

Surplus

of schemes

in surplus

(£bn)

2015 5,945 1,298.3 1,542.5 -244.2 84.2% -285.3 41.1

2016 5,794 1,341.4 1,563.1 -221.7 85.8% -273.5 51.8

2017 5,588 1,541.1 1,702.9 -161.8 90.5% -246.7 84.9

2018 5,450 1,573.3 1,643.8 -70.5 95.7% -187.6 117.1

2019 5,422 1,615.3 1,628.0 -12.7 99.2% -159.8 147.1

2020 5,318 1,700.6 1,791.3 -90.7 94.9% -229.1 138.4

2021 5,215 1,720.7 1,673.8 46.9 102.8% -128.5 175.3

2022 5,131 1,666.9 1,473.9 193.0 113.1% -61.1 254.1

Note: the component figures may not sum to the total because of rounding.

Total s179 liabilities fell by almost 12 per cent over the year to 31 March 2022, which is the largest fall recorded. This was primarily a result of rising gilt yields.

0 0

300 15

600

45

30

900

60

1,800

1,500

1,200

90

75

2,400

2,100

120

105

Amount (£bn)

Percentage

Year

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Total assets (LHS) Liabilities (LHS) Funding ratio (RHS)

Source: PPF

The Purple Book 2022

12

The data

Scheme

demographics

Scheme

funding

Funding

sensitivities

Insolvency

risk

Asset

allocation

Risk

reduction

PPF levy

2021/22

Claims and

schemes in

assessment

Glossary

PPF

compensation

2021/22

Charts and tables

PPF risk

developments

Appendix

Overview

Executive

summary

Introduction

Scheme funding continued

Figure 4.3 | Current and historical funding figures on an estimated full buy-out basis

The aggregate full buy-out funding ratio increased from 73.7 per cent to 79.2 per cent over the year to 31 March 2022, which is smaller than the increase in the aggregate s179 funding ratio.

This is because of an increase in inflation expectations over the year, which is more significant for buy-out liabilities than for s179 liabilities.

Year

Total

assets

(£bn)

Estimated full buy-out

Liabilities

(£bn)

Net funding

position

(£bn)

Aggregate

funding ratio

2006 769.5 1,376.7 -607. 2 55.9%

2007 837.7 1,393.7 -556.0 60.1%

2008 837. 2 1,465.8 -628.6 57.1%

2009 780.4 1,461.1 -680.7 53.4%

2010 926.2 1,469.3 -543.1 63.0%

2011 968.5 1,551.8 -583.3 62.4%

2012 1,026.8 1,840.5 -813.7 55.8%

2013 1,118.5 1,974.7 -856.2 56.6%

2014 1,137.5 1, 827. 2 -689.7 62.3%

Year

Total

assets

(£bn)

Estimated full buy-out

Liabilities

(£bn)

Net funding

position

(£bn)

Aggregate

funding ratio

2015 1,298.3 2,269.2 -970.9 57. 2%

2016 1,341.4 2,293.1 -951.7 58.5%

2017 1,541.1 2,461.7 -920.6 62.6%

2018 1,573.3 2,332.0 -758.7 67.5%

2019 1,615.3 2,260.3 -644.9 71.5%

2020 1,700.6 2,369.1 -668.5 71.8%

2021 1,720.7 2,335.9 -615.3 73.7%

2022 1,666.9 2,105.3 -438.4 79.2%

Note: the component figures may not sum to the total because of rounding.

Since 2006, there has been a significant increase in the aggregate full buy-out funding ratio, from 55.9 per cent to 79.2 per cent at 31 March 2022.

0 0

300 15

600

45

30

900

60

1,800

1,500

1,200

90

75

2,700

2,400

2,100

135

120

105

Total assets (LHS) Liabilities (LHS) Funding ratio (RHS)

Amount (£bn)

Percentage

Year

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Source: PPF

The s179 funding ratio has increased significantly over time due to improvements in the last two years, from 97.1 per cent at 31 March 2006 to 113.1 per cent at 31 March 2022. The estimated full buy-out funding ratio has also increased significantly over the same period mainly due to

improvements in the last seven years, from 55.9 per cent at 31 March 2006 to 79.2 per cent at 31 March 2022.

The Purple Book 2022

13

The data

Scheme

demographics

Scheme

funding

Funding

sensitivities

Insolvency

risk

Asset

allocation

Risk

reduction

PPF levy

2021/22

Claims and

schemes in

assessment

Glossary

PPF

compensation

2021/22

Charts and tables

PPF risk

developments

Appendix

Overview

Executive

summary

Introduction

Scheme funding continued

Analysis of funding by scheme membership size

Figure 4.4 | s179 funding ratios by size of scheme membership as at

31 March 2022

The best funded schemes were the smallest, with an aggregate s179 funding ratio

of 119.2 per cent for schemes with fewer than 100 members.

Scheme size

(members)

Number of

schemes

Total assets

(£bn)

Liabilities

(£bn)

Net funding

position

(£bn)

Aggregate

funding ratio

Simple

average

funding

ratio*

2 to 99 1,836 17.4 14.6 2.8 119.2% 114.8%

100 to 999 2,248 145.6 131.3 14.4 110.9% 108.5%

1,000 to 4,999 706 265.9 244.3 21.6 108.8% 107.7%

5,000 to 9,999 159 208.8 187. 3 21.4 111.4% 110.4%

10,000 and over 182 1,029.3 896.4 132.8 114.8% 115.4%

Total 5,131 1,666.9 1,473.9 193.0 113.1% 110.9%

Source: PPF

Note: the component figures may not sum to the total because of rounding.

* Whereas aggregate funding ratios are determined by comparing the total assets and liabilities for all schemes, the

simple average funding ratio is the average of all of the schemes’ individual funding ratios. Note that 12 schemes

with funding ratios over 200 per cent (on an estimated full buy-out measure) were excluded from the simple

averages to avoid distortions. All of these schemes were small, with total assets of £0.1 billion.

Figure 4.5 | Distribution of s179 funding ratios by size of scheme membership as at

31 March 2022

Schemes with at least 5,000 members are the most well funded on an s179 basis.

0% to 50%

Percentage

Number of members

0

20

40

60

80

100

2 to 99

9%

28%

62%

65%

28%

7%

74%

17%

9%

80%

16%

4%

7%

23%

68%

100 to 999 1,000 to 4,999 5,000 to 9,999 10,000

and over

50% to 75% 75% to 100% Over 100%

Source: PPF

Note: the percentages in each column may not sum to 100 per cent because of rounding.

Figure 4.6 | Estimated full buy-out levels by size of scheme membership as at

31 March 2022

The smallest schemes are the most well funded on a full buy-out measure.

Members

(number)

Number of

schemes

Total assets

(£bn)

Liabilities

(£bn)

Net funding

position

(£bn)

Aggregate

funding ratio

Simple

average

funding

ratio*

2 to 99 1,836 17.4 20.6 -3.2 84.6% 83.3%

100 to 999 2,248 145.6 186.2 -40.5 78.2% 77.7%

1,000 to 4,999 706 265.9 342.1 -76.2 7 7.7% 7 7.7%

5,000 to 9,999 159 208.8 264.7 -55.9 78.9% 79.5%

10,000 and over 182 1,029.3 1,291.8 -262.5 79.7% 79.8%

Total 5,131 1,666.9 2,105.3 -438.4 79.2% 79.8%

Source: PPF

* 12 schemes with funding ratios over 200 per cent (on an estimated full buy-out measure) were excluded from

the simple averages to avoid distortions. All of these schemes were small, with total assets of £0.1 billion.

Figure 4.7 | Distribution of estimated full buy-out funding ratios by size of scheme

membership as at 31 March 2022

95 per cent or more of all scheme sizes have an estimated full buy-out funding

ratio higher than 50 per cent.

Percentage of schemes in membership group

Number of members

0

20

40

60

80

100

2 to 99

5%

38%

47%

9%

49%

7%

41%

4%

53%

34%

9%

60%

7%

31%

4%

30%

48%

18%

100 to 999 1,000 to 4,999 5,000 to 9,999 10,000

and over

0% to 50% 50% to 75% 75% to 100% Over 100%

Source: PPF

Note: the percentages in each column may not sum to 100 per cent because of rounding.

Analysis of funding by scheme maturity

Maturity is measured here as the percentage of the scheme liabilities relating to pensioners.

Figure 4.8 | Analysis of s179 funding ratios by scheme maturity as at 31 March 2022

The most mature schemes have an aggregate s179 funding ratio that is around

40 percentage points higher than the least mature schemes.

Proportion of s179

liabilities relating

to pensioners

Number of

schemes

Total assets

(£bn)

Liabilities

(£bn)

Net funding

position

(£bn)

Aggregate

funding ratio

Simple

average

funding

ratio*

25% and less 879 141.8 145.3 -3.4 97.6% 100.2%

Between 25%

and 50% 2,468 908.3 838.8 69.5 108.3% 106.4%

Between 50%

and 75% 1,457 569.1 454.7 114.5 125.2% 120.0%

Between 75%

and 100% 327 47.7 35.2 12.5 135.7% 134.0%

Total 5,131 1,666.9 1,473.9 193.0 113.1% 110.9%

Source: PPF

* 12 schemes with funding ratios over 200 per cent (on an estimated full buy-out measure) were excluded from the

simple averages to avoid distortions. All of these schemes were small, with total assets of £0.1 billion.

Figure 4.9 | Distribution of funding ratios on an s179 basis by scheme maturity as at

31 March 2022

Funding ratios improve with scheme maturity, with 88 per cent of the most mature

schemes being overfunded on an s179 basis.

0% to 50% 50% to 75% 75% to 100% Over 100%

Percentage

Percentage of scheme liability that relates to current pensioners

0

20

40

60

80

100

25% and less

8%

30%

61%

80%

17%

88%

9%

17%

33%

48%

Between

25% and 50%

Between

50% and 75%

Between

75% and 100%

Source: PPF

Note: the percentages in each column may not sum to 100 per cent because of rounding.

The Purple Book 2022

14

The data

Scheme

demographics

Scheme

funding

Funding

sensitivities

Insolvency

risk

Asset

allocation

Risk

reduction

PPF levy

2021/22

Claims and

schemes in

assessment

Glossary

PPF

compensation

2021/22

Charts and tables

PPF risk

developments

Appendix

Overview

Executive

summary

Introduction

Scheme funding continued

Analysis of funding by scheme status

Figure 4.10 | Analysis of s179 funding ratios by scheme status as at

31 March 2022

Open schemes are around 20 percentage points worse funded than closed schemes,

as measured by the aggregate s179 funding ratio.

Status

Number

of schemes

Total assets

(£bn)

Liabilities

(£bn)

Net funding

position

(£bn)

Aggregate

funding ratio

Simple

average

funding

ratio*

Open 488 307.9 315.3 -7.4 97.6% 105.8%

Closed to

new members 1,949 818.9 690.8 128.1 118.5% 112.9%

Closed to new

benefit accrual 2,604 533.0 462.1 70.9 115.4% 110.1%

Winding up 90 7.1 5.7 1.4 125.4% 119.3%

Total 5,131 1,666.9 1,473.9 193.0 113.1% 110.9%

Source: PPF

Note: the components may not sum to the totals because of rounding.

* 12 schemes with funding ratios over 200 per cent (on an estimated full buy-out measure) were excluded from the

simple averages to avoid distortions. All of these schemes were small, with total assets of £0.1 billion.

Figure 4.11 | Distribution of schemes by s179 funding ratios within scheme status

groups as at 31 March 2022

Although on average open schemes are less well funded than schemes of other statuses,

almost 60 per cent of open schemes are more than 100 per cent funded on an s179 basis.

Scheme status

Percentage

0

20

40

60

80

100

Closed to new

benefit accrual

8%

27%

65%

Closed to new members

6%

1%2%

25%

26%

13%

59%

68%

Open

0% to 50% 50% to 75% 75% to 100% Over 100%

Source: PPF

Note: the percentages may not sum to 100 per cent because of rounding.

Figure 4.12 | Analysis of estimated full buy-out funding ratios by scheme status as at

31 March 2022

Open schemes are around 10 percentage points worse funded than closed schemes,

as measured by the aggregate buy-out funding ratio.

Status

Number of

schemes

Total assets

(£bn)

Liabilities

(£bn)

Net funding

position

(£bn)

Aggregate

funding ratio

Simple

average

funding

ratio*

Open 488 307.9 434.3 -126.5 70.9% 78.0%

Closed to

new members 1,949 818.9 1,010.2 -191.4 81.1% 80.8%

Closed to new

benefit accrual 2,604 533.0 652.7 -119.7 81.7% 79.1%

Winding up 90 7.1 8.0 -0.9 89.2% 88.7%

Total 5,131 1,666.9 2,105.3 -438.4 79.2% 79.8%

Source: PPF

Note: the components may not sum to the totals because of rounding.

* 12 schemes with funding ratios over 200 per cent (on a full buy-out measure) were excluded from the simple

averages to avoid distortions. All of these schemes were small, with total assets of £0.1 billion.

Figure 4.13 | Distribution of schemes by estimated full buy-out funding ratios within

scheme status groups as at 31 March 2022

The proportion of open schemes that are more than 100 per cent funded on an estimated

full buy-out basis is similar to schemes of other statuses.

Scheme status

Percentage

0

20

40

60

80

100

Closed to new

benefit accrual

5%

36%

49%

10%

Closed to new members

4%

35%

34%

9%

45%

12%

48%

13%

Open

0% to 50% 50% to 75% 75% to 100% Over 100%

Source: PPF

Note: the percentages may not sum to 100 per cent because of rounding.

The Purple Book 2022

15

The data

Scheme

demographics

Scheme

funding

Funding

sensitivities

Insolvency

risk

Asset

allocation

Risk

reduction

PPF levy

2021/22

Claims and

schemes in

assessment

Glossary

PPF

compensation

2021/22

Charts and tables

PPF risk

developments

Appendix

Overview

Executive

summary

Introduction

Scheme funding continued

Figure 4.14 | s179 liabilities by member status in current and historical Purple Book datasets

The proportion of liabilities that relates to pensioners increased to 44 per cent, which is the highest proportion recorded.

0

20

40

60

80

100

Active Deferred Pensioner

Percentage

Year

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

32%

27%

41%

28%

31%

42%

30%

31%

39%

29%

32%

39%

26%

33%

41%

26%

35%

39%

24%

36%

40%

25%

38%

37%

23%

39%

38%

21%

40%

39%

21%

40%

40%

19%

41%

41%

17%

40%

44%

Source: PPF

Note: the percentages in each column may not sum to 100 per cent because of rounding.

The Purple Book 2022

16

The data

Scheme

demographics

Scheme

funding

Funding

sensitivities

Insolvency

risk

Asset

allocation

Risk

reduction

PPF levy

2021/22

Claims and

schemes in

assessment

Glossary

PPF

compensation

2021/22

Charts and tables

PPF risk

developments

Appendix

Overview

Executive

summary

Introduction

05

Funding sensitivities

This chapter looks at factors

aecting scheme funding

levels, including changes

in equity prices, gilt yields

and life expectancy.

Summary

• This chapter shows how the funding of DB schemes and markets has changed since 2006, and

how the funding of DB schemes at 31 March 2022 would change as a result of plausible changes

in markets and longevity.

The following sections cover:

• The historical changes in s179 scheme funding since 2006. The series in this section take the

estimated funding position at 31 March in previous years’ editions of The Purple Book.

• Various funding sensitivities. All of these are on an s179 basis, taking the funding position as at

31 March 2022

1

as the base and using The Purple Book 2022 dataset.

Change in s179 funding position over time

• Both the historical net funding position and funding ratio had been broadly trending downwards

between March 2006 and August 2016. This trend has subsequently reversed and both

measures are now higher than the levels they were at on 31 March 2006, with the net funding

position reaching an all-time high of £193 billion at 31 March 2022.

• The proportion of schemes in deficit on an s179 basis reached an all-time low of 34 per cent in

March 2022. This is 15 percentage points lower than the previous historical low of 49 per cent

in March 2021.

Funding sensitivities as at 31 March 2022

• A 0.1 percentage point (10 basis point) rise in both nominal and real gilt yields increases the

31 March 2022 net funding position by £11.1 billion from £193.0 billion to £204.1 billion.

A 2.5 per cent rise in equity prices would improve the net funding position by £9.3 billion.

• A 0.1 percentage point (10 basis point) reduction in both nominal and real gilt yields raises

aggregate scheme liabilities by 1.7 per cent and raises aggregate scheme assets by 0.9 per cent.

A 2.5 per cent increase in equity markets increases scheme assets by 0.6 per cent.

• If individuals live two years longer than expected, s179 liabilities would increase by £110.9 billion,

or 7.5 per cent.

Historical changes in s179 scheme funding since 2006

The estimated funding position of the universe of schemes can change over time owing to a

number of factors including financial markets, actuarial assumptions, the decline in the number

of DB schemes, and sponsoring employers’ special contributions. The historical series in this

section take the estimated funding position at 31 March from previous editions of The Purple Book.

The monthly profiles between end-March of one year and end-February of the next are obtained

by rolling forward the assets and liabilities using movements in nominal and real gilt yields and

equity markets.

1 Using the valuation guidance as in Chapter 4. For more information, see the PPF website.

Figure 5.1 | Historical s179 aggregate funding ratio and net funding position of pension

schemes in The Purple Book datasets

The net funding position has reached a record high of £193 billion while the

aggregate s179 funding ratio is close to the highest historical level.

Net funding position (£bn) (LHS) Funding ratio (%) (RHS)

Net funding position (£bn)

Year

130%

200

120%

300

0

100%

100

110%

-100

90%

-200 80%

-300

70%

-500

50%

-400 60%

-600 40%

Aggregate s179 funding ratio (%)

Mar

2006

Mar

2007

Mar

2010

Mar

2009

Mar

2008

Mar

2012

Mar

2011

Mar

2013

Mar

2015

Mar

2014

Mar

2016

Mar

2017

Mar

2018

Mar

2020

Mar

2019

Mar

2021

Mar

2022

Source: PPF

The net funding position of

schemes reached an all time high

of £193 billion at 31 March 2022.

The Purple Book 2022

17

The data

Scheme

demographics

Scheme

funding

Funding

sensitivities

Insolvency

risk

Asset

allocation

Risk

reduction

PPF levy

2021/22

Claims and

schemes in

assessment

Glossary

PPF

compensation

2021/22

Charts and tables

PPF risk

developments

Appendix

Overview

Executive

summary

Introduction

Funding sensitivities continued

Figure 5.2 | Historical movements in assets and s179 liabilities of schemes

in The Purple Book datasets

Liabilities have fallen significantly by £317 billion over the last two years, although prior to

this there had been a general upward trend since 2006.

Assets

Value (£bn)

Year

2,200

2,000

1,600

1,800

1,400

1,200

1,000

800

600

Mar

2006

Mar

2007

Mar

2010

Mar

2009

Mar

2008

Mar

2012

Mar

2011

Mar

2013

Mar

2015

Mar

2014

Mar

2016

Mar

2017

Mar

2018

Mar

2019

Mar

2020

Mar

2021

Mar

2022

Liabilities

Source: PPF

Figure 5.3 | Historical aggregate funding position for schemes in deficit and surplus

The deficit of schemes in deficit was at its largest in August 2016 at £451 billion.

At 31 March 2022 this deficit was £61 billion, down £67 billion from the £128 billion

experienced at 31 March 2021.

Schemes in surplus Schemes in deficit

Net funding position (£bn)

Year

200

300

0

100

-100

-200

-300

-500

-400

Mar

2006

Mar

2007

Mar

2008

Mar

2009

Mar

2010

Mar

2011

Mar

2012

Mar

2013

Mar

2014

Mar

2015

Mar

2016

Mar

2017

Mar

2018

Mar

2019

Mar

2020

Mar

2021

Mar

2022

Source: PPF

The funding position of schemes in surplus has been more stable over time than

the funding position of schemes in deficit.

Figure 5.4 | Historical percentage of schemes in deficit each month

in The Purple Book datasets

In March 2022, the percentage of schemes in deficit reached an all-time low of 34 per cent, which is 15 percentage points lower than the previous all-time low of 49 per cent last year.

Percentage of schemes

80

90

100

60

70

40

50

30

20

0

10

Mar 2006

Mar 2007 Mar 2008 Mar 2009 Mar 2010 Mar 2011 Mar 2012 Mar 2013 Mar 2014 Mar 2015 Mar 2016 Mar 2017 Mar 2018 Mar 2019 Mar 2020 Mar 2021 Mar 2022

Year

Source: PPF

The pink lines indicate months in which changes were made to the assumptions used to value schemes on an s179 measure. The changes to assumptions in March 2008 and October 2009

reduced the number of schemes in deficit by 412 and 566 respectively, while the changes to assumptions in April 2011 and May 2014 raised the number of schemes in deficit by 107 and 259

respectively. The changes to assumptions in November 2016, November 2018 and May 2021 reduced the number of schemes in deficit by 157, 437 and 210 respectively.

Figure 5.5 | Movements in gilt yields

Gilt yields have increased since their all-time lows in March 2020.

10-year gilt yield

Gilt yield (% pa)

Year

6

5

4

3

2

1

0

Mar

2006

Mar

2007

Mar

2008

Mar

2009

Mar

2010

Mar

2011

Mar

2012

Mar

2013

Mar

2014

Mar

2015

Mar

2016

Mar

2017

Mar

2018

Mar

2019

Mar

2020

Mar

2021

Mar

2022

15-year gilt yield 20-year gilt yield

Source: Bloomberg

Figure 5.6 | Movements in equity indices

The FTSE All-Share and All-World Ex-UK Total Return Indices have recovered from their

sharp declines in March 2020 and have reached historical highs over the last year.

FTSE All-Share Total Return Index (LHS)

Mar

2006

Mar

2007

Mar

2008

Mar

2009

Mar

2010

Mar

2011

Mar

2012

Mar

2013

Mar

2014

Mar

2015

Mar

2016

Mar

2017

Mar

2018

Mar

2019

Mar

2020

Mar

2021

Mar

2022

FTSE All-Share Total Return Index

Year

10,000 1,000

8,000 800

9,000 900

6,000 600

7,000 700

5,000 500

4,000 400

3,000 300

1,000 100

2,000 200

0 0

FTSE All-World Ex-UK Total Return Index

FTSE All-World Ex-UK Total Return Index (RHS)

Source: Bloomberg

The Purple Book 2022

18

The data

Scheme

demographics

Scheme

funding

Funding

sensitivities

Insolvency

risk

Asset

allocation

Risk

reduction

PPF levy

2021/22

Claims and

schemes in

assessment

Glossary

PPF

compensation

2021/22

Charts and tables

PPF risk

developments

Appendix

Overview

Executive

summary

Introduction

Funding sensitivities continued

Funding sensitivities: rules of thumb

Funding ratios are sensitive to movements in financial markets, with equity and gilt prices in

particular having a major impact upon scheme assets, and gilt yields aecting liability values.

This section shows the eect on scheme funding positions of changes in equity and gilt markets.

The impact of a change of a 7.5 per cent rise in equity prices and a 0.3 percentage point increase

in gilt yields have been accurately calculated and then the rest of the results have been calculated

by pro-rating these two impacts.

The sensitivities do not take into account the use of derivative instruments to hedge changes in

interest rates, inflation, equity levels or life expectancy.

Figure 5.7 | Impact of changes in gilt yields and equity prices on s179 funding positions

from a base net funding position of £193.0 billion as at 31 March 2022

Small changes in gilt yields have a slightly larger impact on s179 funding positions than

small changes in equity prices.

Assets less s179 liabilities (£bn)

Movement in

equity prices

Movement in gilt yields

-0.3pp -0.2pp -0.1pp 0.0pp 0.1pp 0.2pp 0.3pp

7.5% 188.3 199.0 209.7 220.7 231.8 243.0 254.4

5.0% 179.1 189.7 200.5 211.5 222.6 233.8 245.2

2.5% 169.9 180.5 191.3 202.3 213.4 224.6 236.0

0.0% 160.7 171.3 182.1 193.0 204.1 215.4 226.8

-2.5% 151.5 162.1 172.9 183.8 194.9 206.2 217.6

-5.0% 142.3 152.9 163.7 174.6 185.7 197.0 208.4

-7.5% 133.0 143.7 154.5 165.4 176.5 187.7 199.1

Source: PPF

A 0.1 percentage point rise in both nominal and real gilt yields would have improved the

end-March 2022 s179 net funding position by £11.1 billion from £193.0 billion (bold) to

£204.1 billion (shaded). That’s more than the £9.3 billion impact of a 2.5 per cent increase

in equity prices (shaded).

Figure 5.8 | Impact of changes in gilt yields and equity prices on assets from a base of

100 as at 31 March 2022

Small changes in gilt yields have a slightly larger impact on assets than small changes in

equity prices.

Assets relative to a base of 100

Movement in

equity prices

Movement in gilt yields

-0.3pp -0.2pp -0.1pp 0.0pp 0.1pp 0.2pp 0.3pp

7.5% 104.3 103.4 102.5 101.7 100.8 99.9 99.1

5.0% 103.8 102.9 102.0 101.1 100.2 99.4 98.5

2.5% 103.2 102.3 101.4 100.6 99.7 98.8 98.0

0.0% 102.7 101.8 100.9 100.0 99.1 98.3 97.4

-2.5% 102.1 101.2 100.3 99.4 98.6 97.7 96.9

-5.0% 101.6 100.7 99.8 98.9 98.0 97. 2 96.3

-7.5% 101.0 100.1 99.2 98.3 97.5 96.6 95.8

Source: PPF

A 2.5 per cent increase in equity prices would raise scheme assets by 0.6 per cent (shaded). A 0.3

percentage point decrease in gilt yields would increase scheme assets by 2.7 per cent (shaded).

Figure 5.9 | Impact of changes in gilt yields on s179 liabilities as at 31 March 2022

A 0.1 percentage point movement in gilt yields would impact s179 liabilities by 1.7 per cent.

Impact on s179 liabilities

Movement in both nominal and real gilt yields

-0.3pp -0.2pp -0.1pp 0.1pp 0.2pp 0.3pp

Percentage change 5.2% 3.5% 1.7% -1.7% -3.5% -5.2%

Source: PPF

Figure 5.10 | Impact of changes in nominal or real gilt yields on s179 liabilities as at

31 March 2022 (base = £1,473.9 billion)

As at 31 March 2022, the s179 liabilities were almost three times as sensitive to changes in

nominal yields as to changes in real yields.

Impact on s179 liabilities

Change in nominal yields Change in real yields

-0.1pp 0.1pp -0.1pp 0.1pp

£ billions 1,493.6 1,454.2 1,480.6 1 ,467. 2

Percentage change 1.3% -1.3% 0.5% -0.5%

Source: PPF

Note: s179 liabilities are assessed using a combination of various nominal and real gilt yields. Whereas figure 5.9

shows the impact of universal stresses across both nominal and real yields, figure 5.10 stresses the nominal and

real gilt yields separately.

Figure 5.11 | Impact of changes in life expectancy assumptions on s179 liabilities as at

31 March 2022 (base = £1,473.9 billion)

If individuals live two years longer than expected, s179 liabilities would increase by around

£111 billion, or 7.5 per cent. Conversely, if individuals live two years shorter than expected,

s179 liabilities would decrease by around £109 billion, or 7.4 per cent.

s179 liabilities

(£bn)

% change

from base

Age rating +2 years 1,364.8 -7.4%

Age rating -2 years 1,584.8 7.5%

Source: PPF

Note: the impact of increased length of life has been approximated by age rating down by two years – that is, replacing

the life expectancy assumptions for each individual by an individual currently two years younger.

The Purple Book 2022

19

The data

Scheme

demographics

Scheme

funding

Funding

sensitivities

Insolvency

risk

Asset

allocation

Risk

reduction

PPF levy

2021/22

Claims and

schemes in

assessment

Glossary

PPF

compensation

2021/22

Charts and tables

PPF risk

developments

Appendix

Overview

Executive

summary

Introduction

06

Insolvency risk

This chapter looks at the rate

of insolvencies in DB scheme

sponsors, compared to the

overall company insolvency

rate in England and Wales, and

insolvencies by scheme size.

Summary

• This chapter shows the annual insolvency rate for employers in the PPF universe and companies

in England and Wales. It also shows the number of England and Wales company insolvencies

compared with the rate of UK real GDP growth. Finally, it shows a proxy for insolvency risk over

the next year, for dierent scheme sizes.

• The average insolvency rate in the PPF universe has decreased by 0.43 percentage points to

0.24 per cent at 31 March 2022.

• Conversely, the average annual insolvency rate of companies in England and Wales increased

by 0.23 percentage points to 0.67 per cent at 31 March 2022. This was caused by an increase of