Scholarsedge529.com

Effective February 2, 2024

Scholar’s Edge

®

529

Plan Description and

Participation Agreement

Scholarsedge529.com

2

This Plan Description and Participation Agreement for Scholar’s Edge 529® (Scholar’s Edge or the

Plan) has been identified by the Plan as the Offering Materials intended to provide substantive

disclosure of the terms and conditions of an investment in the Plan. This Plan Description and

Participation Agreement does not constitute an offer to sell or the solicitation of an offer to buy any

security other than an investment in the Plan offered hereby, nor does it constitute an offer to sell or

the solicitation to any person in any jurisdiction or under any circumstances in which it would be

unlawful.

No security issued by the Plan has been registered with or approved by the United States Securities

and Exchange Commission or any state securities commission. Further, this Plan Description and

Participation Agreement is not subject to oversight by the Financial Industry Regulatory Authority

(FINRA) or the Municipal Securities Rulemaking Board (MSRB).

The information contained in this Plan Description and Participation Agreement is believed to be

accurate as of the date above and is subject to change without prior notice. Account Owners should

rely only on the information contained in the Plan Description and Participation Agreement. No one

is authorized to provide information about Scholar’s Edge that is different from the information

contained in the Plan Description and Participation Agreement. Please visit our website,

scholarsedge529.com, for the most current Plan Description and Participation Agreement.

If you are not a New Mexico taxpayer, you should consider before investing whether your or the

Beneficiary’s home state offers a 529 plan that provides its taxpayers with favorable state tax and

other benefits such as financial aid, scholarship funds, and protection from creditors that may only

be available through an investment in the home state’s 529 plan, and which are not available

through an investment in the Plan. Therefore, please consult your financial, tax, or other advisor to

learn more about how state-based benefits (or any limitations) would apply to your specific

circumstances. Keep in mind that state-based benefits should be one of the many appropriately

weighted factors to be considered when making an investment decision.

You should periodically access and, if appropriate, adjust your investment choices with your time

horizon, risk tolerance, and investment objectives in mind. Investing is an important decision. Please

read the Plan Description and Participation Agreement and the Enrollment Form in their entirety

before making an investment decision.

The Plan cannot and does not provide legal, financial, or tax advice and the following information

should not be construed as such with respect to the consequences for any particular individual as a

result of contributions to or distributions from a Plan account.

Section 529 plans are intended to be used only to save for qualified expenses. The Plan is not

intended to be used, nor should it be used, by any taxpayer for the purpose of evading U.S. federal or

state taxes or tax penalties. You may wish to seek tax advice from an independent tax advisor based

on your own particular circumstances.

Capitalized terms used in this Plan Description and Participation Agreement are defined throughout

the document and in the Glossary starting on page 10.

Scholarsedge529.com

3

This Plan Description and Participation Agreement describes the terms of your Account with

Scholar’s Edge. You should read it before you open your Account.

Getting Started ............................................................................................................................ 4

Summary ..................................................................................................................................... 5

Glossary .................................................................................................................................... 10

How You Participate ................................................................................................................. 17

How To Take a Distribution from Your Account ..................................................................... 27

Maintaining Your Account ....................................................................................................... 31

Fees and Charges ...................................................................................................................... 35

Important Risks You Should Consider ..................................................................................... 54

Investment Information ............................................................................................................. 59

Investment Performance ........................................................................................................... 73

Important Tax Information ....................................................................................................... 79

General Information .................................................................................................................. 84

Plan Governance ....................................................................................................................... 88

Participation Agreement ........................................................................................................... 90

Appendix A: Additional Underlying Investment Information .................................................. 96

What’s Inside

Scholarsedge529.com

4

Getting started with Scholar’s Edge is easy. Just follow these steps:

1. Read this Plan Description and Participation Agreement in its entirety and save it for future

reference. It contains important information you should review before opening an Account,

including information about the benefits and risks of investing.

2. Gather your personal information:

(a) Your Social Security Number or Tax Identification Number

(b) Your Permanent Address (not a post office box)

(c) Your Beneficiary’s Social Security Number or Tax Identification Number and date of birth

(d) Your email address

(e) Your checking or savings account number and your bank’s routing number (if you want to

contribute electronically with a bank transfer)

3. Work with your Financial Professional to complete your Enrollment Form.

4. Instruct your Financial Professional to submit your Enrollment Form to the Plan on your behalf.

Contact Us

Online: scholarsedge529.com

Phone: 1.866.529.SAVE (1.866.529.7283)

Monday through Friday, 8 a.m. to 7 p.m. Mountain Time

Regular Mail: Scholar’s Edge

P.O. Box 219798

Kansas City, MO 64121-9798

Priority Delivery: Scholar’s Edge

1001 E 101

st

Terrace, Suite 220

Kansas City, MO 64131

Getting Started

Scholarsedge529.com

5

About Scholar’s Edge

Scholar’s Edge is a Section 529 plan offered by The Education Trust Board of New Mexico

(the Board or Trustee). Scholar’s Edge is designed to help individuals and families save for

education goals in a tax-advantaged way and offers valuable advantages including tax-

deferred growth, generous contribution limits, attractive Investment Portfolios, and

professional investment management.

Ascensus College Savings Recordkeeping Services, LLC, as the Program Manager, is

responsible for the day-to- day operations of the Plan. Principal Global Investors, LLC (PGI

or Principal), as the investment advisor to the Plan, provides investment management

services to the Plan. Principal Funds Distributor, Inc. (PFD) serves as the distributor of the

Plan.

Effective June 16, 2023, due to recent legislation in New Mexico, which fully aligned New

Mexico with all Federal IRC Section 529 uses, residents of the state of New Mexico with an

in-state 529 plan can use the assets in their Account for the following, which will now be

considered a qualified use for New Mexico tax purposes:

1. Toward the costs of nearly any public or private, 2-year or 4-year college

nationwide, as long as the student (Beneficiary) is enrolled in a U.S.-accredited

college, university, graduate school, or technical school that is eligible to

participate in U.S. Department of Education student financial aid programs.

2. To pay tuition expenses at a public, private or religious elementary or

secondary school up to $10,000 per student per year.

3. To pay certain expenses required for a registered apprenticeship program.

4. For payments towards qualified education loans up to a $10,000 lifetime limit

per individual.

Deductions from State income taxes for contributions which are used for these purposes will

not be subject to recapture after June 16, 2023, as had previously been the case.

Scholar’s Edge is offered only through certain broker-dealers and properly licensed

investment advisers (Financial Advisers). If you do not wish to work with a Financial

Adviser, the Board also offers a direct-to-consumer Section 529 plan, The Education Plan.

Go to theeducationplan.com for more information about The Education Plan.

What’s Inside

Glossary

p. 10-16

This section provides definitions of terms contained in this Plan Description and Participation

Agreement. Note that terms defined in the glossary (other than you and your) appear with initial

capital letters when referenced in this document.

Summary

Scholarsedge529.com

6

How You Participate

p. 17-26

If you are interested in opening an Account in Scholar’s Edge, you must utilize the services

of a Financial Professional. Your Financial Professional can help you open an Account and

determine which Investment Portfolios best meet your savings goals.

Scholar’s Edge is open to U.S. citizens or resident aliens throughout the United States. You,

as the Account Owner, maintain complete control over the Account and can open Accounts

for any number of Beneficiaries, including yourself. This section will guide you through the

details of opening an Account in Scholar’s Edge, contributing to your Account, maintaining

your Account, using your savings to pay for Qualified Expenses, and closing your Account.

To open an Account, your Financial Professional will work with you to complete an

Enrollment Form, which is a contract between you, as the Account Owner, and the Board,

establishing the obligations of each.

This section also highlights the many ways you can contribute to your Account, including

Recurring Contributions, Electronic Funds Transfer, and rollovers from an account with

another Qualified Tuition Program. See pages 79-83 for information regarding the impact of

New Mexico state and U.S. federal tax considerations regarding rollovers into your Account.

How to Take a Distribution from Your Account

p. 27-30

This section discusses the different ways you can withdraw funds from your Account. You

can have a withdrawal paid directly to you, as the Account Owner, to the Beneficiary or to

an Eligible Educational Institution. A withdrawal to pay K-12 Tuition is only payable to the

Account Owner.

This section also describes the difference between Qualified Distributions, Non-Qualified

Distributions, and other types of withdrawals (for example, when the Beneficiary receives a

scholarship, or is unable to attend school due to a Disability). There can be U.S. federal and

state tax impacts of taking a withdrawal. It is important to discuss withdrawals with a tax

advisor to ensure you understand your particular situation.

Maintaining Your Account

p. 31-34

This section provides information on various Account maintenance issues such as your

Account statements, changing Beneficiaries, and changing your Investment Portfolios. You

can change Investment Portfolios up to two times per year and with a permissible change of

Beneficiary. The twice per year limitation applies in the aggregate across all of your accounts

for the same Beneficiary under all Qualified Tuition Programs sponsored by the State of New

Mexico.

Fees and Charges

p. 35-53

Scholar’s Edge currently offers three Unit Classes for each Investment Portfolio: Class A

Units, Class C Units, and Class R Units. Each Unit Class has its own Fee structure. You

should ask your Financial Professional to assist you in choosing the Unit Class that best

meets your goals. Class R Units may not be available to you. Class R Units are designed for

Scholarsedge529.com

7

use in fee-based accounts through qualified registered investment advisors or selling agents

who buy through a broker/dealer in advisory accounts. Class R Units may be sold by selling

agents that charge brokerage commissions and other transaction-related fees directly to their

clients.

Sales Charges –

• Class A: Class A Units are subject to a maximum initial sales charge of 3.50% of the

amount invested.

• Class C: Class C Units are subject to a contingent deferred sales charge (CDSC) of

1.00% if they are redeemed within one year of purchase.

• Class R: Class R Units are not subject to any sales charges.

Annual Account Maintenance Fee. All Unit Classes are subject to the Annual Account

Maintenance Fee of $20, which is waived if the Account balance is at least $25,000, if you

or your Beneficiary is a New Mexico Resident, or if you make Recurring Contributions of at

least $25 per month or $75 per quarter.

Total Annual Asset-Based Fee. Each Unit Class for each Investment Portfolio is subject to

certain annual asset- based Fees. The Total Annual Asset-Based Fee is the sum of Underlying

Investment Expenses, the Program Management Fee, and the Board Administrative Fee. For

Class A and Class C Units, the Total Annual Asset- Based Fee also includes the Distribution

and Service Fee. See Fees and Charges – Total Annual Asset-Based Fee beginning on page

35 for the range of Total Annual Asset-Based Fees for each Unit Class.

Automatic Conversion of Class C Units. Class C Units are automatically converted into

Class A Units five years after the date of purchase. The automatic conversions are not subject

to any initial sales charges or CDSCs.

Important Risks You Should Consider

p. 54-58

As with any investment, there are risks involved in investing in Scholar’s Edge, including

the risk of investment losses; the risk of changes in U.S. federal and state laws, including

U.S. federal and state tax laws; and the risk of Plan changes, as well as other risks. You

should be aware that the Board may change components of the Plan at any time. For

example, the Board may, without prior notice, change the Plan’s Fees, add or remove a

Portfolio, change a Portfolio’s Underlying Investment(s), close a Portfolio to new investors

and/or new contributions, or change the Program Manager or other Plan service provider.

To learn more about the risks, please thoroughly read and carefully consider the information

in this section and throughout this Plan Description and Participation Agreement, and ask your

tax, legal, and investment advisors about these risks.

Investment Information

p. 59-72

When you enroll in Scholar’s Edge, you choose to invest using at least one of three different

investment approaches, based upon your investing preferences and risk tolerance. You can

choose between the Year of Enrollment Portfolios, the Target Risk Portfolios, the Individual

Portfolios, or a mix of all three. Your investment returns will vary depending upon the

performance of the Portfolios you choose. Depending on market conditions and other factors,

you could lose all or a portion of your investment.

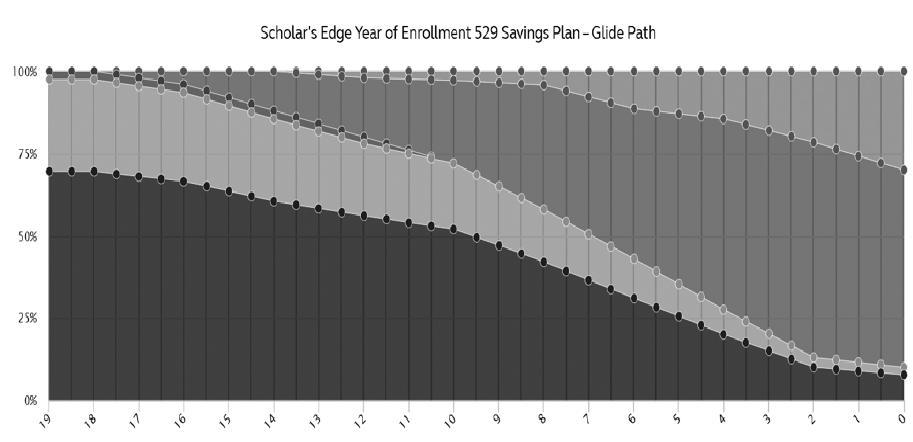

Year of Enrollment Portfolios

Scholarsedge529.com

8

This option includes Portfolios that automatically move to progressively more conservative

investments as the Portfolios approach their target enrollment dates. There are eleven (11)

Year of Enrollment Portfolios. These Portfolios invest in certain Underlying Funds currently

managed by Principal, BlackRock, Vanguard, and JPMorgan. These Portfolios also invest in

the Scholar’s Edge Guaranteed Contract, which is a funding agreement issued by Principal

Life.

Target Risk Portfolios

This option includes four (4) Portfolios, each with an investment objective and strategy

based on a target risk level and asset allocation that remains fixed over time. Each Portfolio

may invest in certain Underlying Funds currently managed by Principal, BlackRock,

Vanguard, or JPMorgan. Certain of these Portfolios also invest in the Scholar’s Edge

Guaranteed Contract which is a funding agreement issued by Principal Life.

Individual Portfolios

This option includes fifteen (15) Portfolios. Each Portfolio, except one, invests in an

Underlying Fund that primarily invests in U.S. equity, international equity, real estate, or

fixed income investments. The Underlying Funds are currently managed by Principal,

BlackRock, Vanguard, JPMorgan, and New York Life. The other Portfolio in this option

invests in the Scholar’s Edge Guaranteed Contract issued by Principal Life.

The Portfolios’ Underlying Investments are subject to change. There is no guarantee that the

current Investment Managers will manage any Underlying Fund of any Portfolio in the

future, or that any Portfolio will invest in a funding agreement issued by Principal Life.

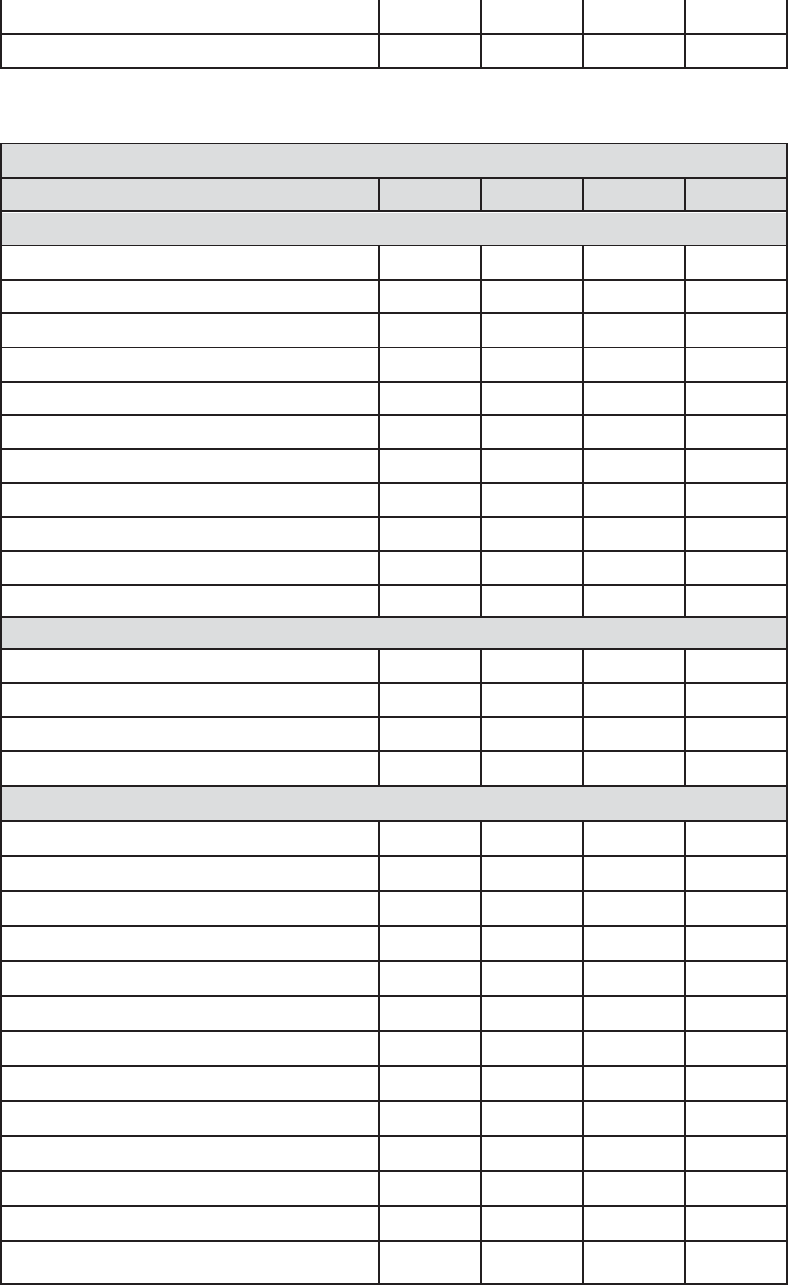

Investment Performance

p. 73-78

This section discusses the performance of the Investment Portfolios in the Plan. Performance

data represents past performance, which is not a guarantee of future results. Investment

returns and principal value will fluctuate, so your Units, when sold, may be worth more or

less than their original cost. For up-to-date price and performance information, go to

scholarsedge529.com or call us at 1.866.529.7283.

Important Tax Information

p. 79-83

This section discusses both the New Mexico state and U.S. federal tax benefits for an

investment in Scholar’s Edge.

Contributions to your Account are eligible for a New Mexico income tax deduction if you

are a New Mexico taxpayer (resident or non-resident) filing a single or joint return. You (as

the Account Owner) may be subject to a recapture of this New Mexico tax deduction in

certain situations.

General Information

p. 84-87

In this section, you will learn about the rights and obligations associated with your Account;

considerations related to changes to your Account, this document, and state and federal laws;

and claims against your Account.

Plan Governance

p. 88-89

Scholarsedge529.com

9

This section summarizes the administration of Scholar’s Edge.

Participation Agreement

p. 90-94

This section reviews your rights and responsibilities in connection with your enrollment in

Scholar’s Edge. You must review this agreement in detail prior to completing an Enrollment

in the Plan. You will be required to sign an acknowledgement of your understanding of and

agreement with the terms, conditions, and information contained in the Plan Description and

Participation Agreement.

Appendix A: Additional Underlying Investment Information

p. 96-125

The information in the Appendix provides additional information about the Portfolios’

Underlying Investments. The Appendix includes information about the Underlying Funds’

investment objectives, principal investment strategies, and principal risks. The Appendix

also includes information about the Scholar’s Edge Guaranteed Contract.

Scholarsedge529.com

10

Defined terms used in this Plan Description and Participation Agreement have the following

meanings:

ABLE Rollover Distribution: A distribution to an account in a Qualified ABLE Program for the

same Beneficiary or a Member of the Family of the Beneficiary. Any distribution must be made

before January 1, 2026, and cannot exceed the annual contribution limit prescribed by Section

529A(b)(2)(B)(i) of the Code, $18,000 for 2024, subject to adjustment by the IRS.

Account: An account in Scholar’s Edge established by an Account Owner for a Beneficiary.

Account Owner or you: An individual 18 years or older, an emancipated minor (as determined by

New Mexico law), a trust, an estate, a partnership, an association, a company, a corporation, or a

qualified custodian under the UGMA/UTMA, who signs an Enrollment Form establishing an

Account. In certain cases, the Account Owner and Beneficiary may be the same person. An

individual seeking to open an Account as an emancipated minor must submit a court order as well

as any other documentation that we request, establishing that he or she is empowered to enter into a

contract without the ability to revoke a contract based on age. Without such documentation, we will

not open an Account for an emancipated minor.

Annual Account Maintenance Fee: An annual fee charged to each Account. The fee is waived if the

Account balance is at least $25,000, if you or your Beneficiary is a New Mexico Resident, or if you

make Recurring Contributions of at least $25 per month or $75 per quarter.

Apprenticeship Expenses: Expenses for fees, books, supplies, and equipment required for the

participation of a Designated Beneficiary in an apprenticeship program registered and certified with

the Secretary of Labor under section 1 of the National Apprenticeship Act.

Beneficiary: The individual designated by an Account Owner, or as otherwise provided in writing to

Scholar’s Edge, to receive the benefit of an Account.

BlackRock: BlackRock Fund Advisors, the Investment Manager of the iShares Underlying Funds.

Board: The Education Trust Board of New Mexico.

Code: Internal Revenue Code of 1986, as amended. There are references to various Sections of the

Code throughout this Plan Description and Participation Agreement, including Section 529 as it

currently exists and as it may subsequently be amended, and any regulations adopted under it.

Custodian: The individual who opens an Account on behalf of a minor Beneficiary with assets from

an UGMA/ UTMA account. Generally, the Custodian will be required to perform all duties of the

Account Owner with regard to the Account until the Account Owner attains the age at which the

custodianship terminates under the applicable UGMA/UTMA law (usually 18 or 21), is otherwise

emancipated, or the Custodian is released or replaced by a valid court order. The Custodian of an

Account funded from an UGMA/UTMA account may not change the Account Owner or

Beneficiary.

Glossary

Scholarsedge529.com

11

Dealer: A distributor of Scholar’s Edge who is registered as a broker-dealer under the Securities

Exchange Act of 1934, as amended, and a member of both FINRA and the MSRB.

Declaration of Trust: The Declaration of Trust establishing the Trust as may be amended from time

to time by the Board.

Distribution and Service Fee: A fee charged to support the distribution and marketing of the Plan. A

portion of this Fee may be redistributed to Dealers.

Distribution Tax: A U.S. federal surtax required by the Code that is equal to 10% of the earnings

portion of a Non- Qualified Distribution.

Disabled or Disability: Condition of a Beneficiary who is unable to do any substantial gainful

activity because of any medically determinable physical or mental impairment which can be

expected to result in death or to be of long-continued and indefinite duration. We will require

medical documentation to verify this condition. See IRS Publication 970 available at

https://www.irs.gov/forms-pubs/about-publication-970 for further details.

Educational Assistance: Educational Assistance generally refers to the tax-free portion of any

scholarships or fellowships, Pell Grants, employer provided educational assistance, veterans

education assistance, and other tax-free educational assistance. See IRS Publication 970 online at

https://www.irs.gov/forms-pubs/about-publication-970 for more information.

EFT or Electronic Funds Transfer: A service in which an Account Owner authorizes Scholar’s Edge

to transfer money from a bank or other financial institution to an Account in Scholar’s Edge.

Eligible Educational Institution: An institution as defined in Section 529(e) of the Code. Generally,

the term includes accredited post-secondary educational institutions or vocational schools in the

United States and some accredited post-secondary educational institutions or vocational schools

abroad offering credit toward a bachelor’s degree, an associate’s degree, a graduate level or

professional degree, or another recognized post-secondary credential. The institution must be

eligible to participate in a student financial aid program under Title IV of the Higher Education Act

of 1965 (20 U.S.C. § 1088). You can generally determine if a school is an Eligible Education

Institution by searching for its Federal School Code (identification number for schools eligible for

Title IV financial aid programs) at: https://studentaid.gov/sa/fafsa.

Enabling Legislation: The law that established the Trust and its Board (The Education Trust Act,

Chapter 21, Article 21K NMSA 1978).

Enrollment Form: A participation agreement between an Account Owner and the Trust, establishing

the obligations of each and prepared in accordance with the provisions of Scholar’s Edge. The term

“Enrollment Form” also includes any application used by a selling agent to establish an Account in

the Plan for an Account Owner.

Fees: Fees, costs, expenses, and charges associated with Scholar’s Edge.

Financial Professional: Certain broker-dealers, financial professional, or properly licensed

investment advisors that offer Scholar’s Edge to investors.

IRS: Internal Revenue Service.

Scholarsedge529.com

12

Investment Portfolio: Each Scholar’s Edge Year of Enrollment Portfolio, Scholar’s Edge Target

Risk, Portfolio, and Individual Portfolio in Scholar’s Edge.

Investment Managers: The investment managers of the Underlying Investment options, which may

change from time to time, and currently include Principal, BlackRock, Vanguard, JPMorgan, and

New York Life, who are the investment managers of their respective Underlying Investments. The

Portfolios’ Underlying Investments are subject to change. There is no guarantee that the current

Investment Managers will manage any Underlying Fund of any Portfolio in the future.

JPMorgan: J.P. Morgan Investment Management Inc., the Investment Manager of the JPMorgan

Underlying Fund.

K-12 Tuition: Expenses for tuition in connection with enrollment or attendance at an elementary or

secondary public, private. or religious school, up to $10,000 per student per taxable year.

Management Agreement: An agreement between the Board and the Program Manager to provide

Scholar’s Edge with program management, investment advisory, recordkeeping, administrative, and

marketing services. The Management Agreement between the Board and Ascensus College Savings

Recordkeeping Services LLC (ACSR) is now effective and will terminate in 2026, unless extended

or earlier terminated as provided in the Management Agreement.

Maximum Account Balance: The maximum aggregate balance of all accounts for the same

Beneficiary in Qualified Tuition Programs sponsored by the State of New Mexico, as established by

the Board from time to time, which will limit the amount of contributions that may be made to

Accounts for any one Beneficiary, as required by Section 529. The current Maximum Account

Balance is $500,000.

Member of the Family: An individual as defined in Section 529(e)(2) of the Code. Generally, this

definition includes a Beneficiary’s immediate family members. A Member of the Family means an

individual who is related to the Beneficiary as follows:

1. A child, a descendent of a child (e.g., grandchildren), or a stepchild;

2. A sibling, stepsibling, or half-sibling;

3. A parent (or ancestor of a parent, e.g., grandparent), or a stepparent;

4. A niece or nephew;

5. An aunt or uncle;

6. A first cousin;

7. A mother- or father-in-law, son- or daughter-in-law, brother- or sister-in-law; or

8. A spouse of any individual listed (except a first cousin).

For purposes of determining who is a Member of the Family, a legally adopted child or a foster child

of an individual is treated as the child of that individual by blood. The terms “brother” and “sister”

include half- brothers and half-sisters.

Scholarsedge529.com

13

New Mexico Resident: An Account Owner or Beneficiary who has registered a New Mexico

address with the Plan.

New York Life: New York Life Investment Management LLC, the Investment Manager of the

Mainstay Underlying Fund.

Non-Qualified Distributions: A distribution from an Account that is not used to pay for Qualified

Expenses.

Omnibus Account: An account with the Plan held in the name of an Omnibus Service Provider for

the benefit of its customers or the customers of the applicable Dealer.

Omnibus Service Provider: A Dealer or third-party recordkeeping agent that has entered into an

agreement with the Program Manager to perform certain services for Omnibus Accounts.

PFD: Principal Funds Distributor, Inc., the distributor of the Plan.

PGI or Principal: Principal Global Investors, LLC, the investment advisor to the Plan, as well as the

Investment Manager of the Principal Underlying Funds.

Plan Description and Participation Agreement: This document, intended to provide substantive

disclosure of the terms and conditions of an investment in Scholar’s Edge, including any other

Supplements distributed from time to time.

Plan Officials: The State, Scholar’s Edge, the Board, the Trustee, the Trust, any other agency of the

State, the Program Manager (and its affiliates), PGI and PFD (and their affiliates), the Investment

Managers (and their respective affiliates), and any other counsel, advisor, or consultant retained by,

or on behalf of, those entities and any employee, officer, official, or agent of those entities.

Principal Life: Principal Life Insurance Company, the issuer of the Scholar’s Edge Guaranteed

Contract.

Principal Services Agreement: The agreement between the Program Manager and PGI and PFD,

and approved by the Board, pursuant to which PGI and PFD provide investment management and

distribution services, respectively, to Scholar’s Edge. The Principal Services Agreement is now

effective and will terminate in 2026, unless extended or earlier terminated as provided in the

Principal Services Agreement.

Program Management Fee: The annual asset-based Fee paid to the Program Manager for services

provided to the Plan.

Program Manager or Ascensus: Ascensus College Savings Recordkeeping Services, LLC has been

engaged by the Board to provide the program management services, including program

management, investment advisory, recordkeeping, administrative, and marketing services, as an

independent contractor, on behalf of Scholar’s Edge, the Trust, and the Board (as Trustee of the

Trust and administrator of the Plan).

Qualified ABLE Program: A program designed to allow individuals with disabilities to save for

qualified disability expenses. Qualified ABLE Programs are sponsored by states or state agencies

and are authorized by Section 529A of the Code.

Scholarsedge529.com

14

Qualified Distribution: A distribution from an Account that is used to pay Qualified Expenses of the

Beneficiary.

Qualified Expenses: Qualified education expenses as defined in the Code and as may be further

limited by Scholar’s Edge. Generally, these include the following:

1. Tuition, fees, and the costs of textbooks, supplies, and equipment required for the enrollment

or attendance of a Beneficiary at an Eligible Educational Institution;

2. Certain costs of the room and board of a Beneficiary for any academic period during which

the student is enrolled at least half-time at an Eligible Educational Institution;

3. Expenses for special needs Beneficiaries that are necessary in connection with their

enrollment or attendance at an Eligible Educational Institution;

4. Expenses for the purchase of computer or peripheral equipment (as defined in Section

168(i)(2)(B) of the Code), computer software (as defined in Section 197(e)(3)(B) of the

Code), or Internet access and related services, if the equipment, software, or services are to be

used primarily by the Beneficiary during any of the years the Beneficiary is enrolled at an

Eligible Educational Institution;

5. K-12 Tuition;

6. Apprenticeship Expenses; and

7. Student Loan Payments.

Qualified Tuition Program or 529 plan: A qualified tuition program under Section 529.

Recurring Contribution: Also known as AIP or Automatic Investment Plan. A service in which an

Account Owner authorizes Scholar’s Edge to transfer money, on a regular and predetermined basis,

from a bank or other financial institution to an Account in Scholar’s Edge.

Refunded Distribution: A distribution taken for Qualified Expenses which is later refunded by the

Eligible Educational Institution and recontributed to a Qualified Tuition Program that meets the

following requirements:

1. The recontribution must not exceed the amount of the refund from the Eligible Educational

Institution;

2. The recontribution must not exceed the amount of distributions previously taken to pay the

Qualified Expenses of the Beneficiary;

3. The recontribution must be made to an account in a Qualified Tuition Program of the same

Beneficiary to whom the refund was made; and

4. The funds must be recontributed to a Qualified Tuition Program within 60 days of the date

of the refund from the Eligible Educational Institution.

A Refunded Distribution will not be subject to U.S. federal or New Mexico state income tax,

recapture of the New Mexico state income tax deduction, or the Distribution Tax.

Scholarsedge529.com

15

Rollover Distribution: A distribution resulting from a change of Beneficiary to another Beneficiary

who is a Member of the Family, either within Scholar’s Edge or between Qualified Tuition

Programs, or a rollover or transfer of assets between Qualified Tuition Programs for the same

Beneficiary, provided another rollover or transfer for the same Beneficiary has not occurred in the

previous twelve (12) months.

Scholar’s Edge or Plan: Scholar’s Edge 529, the 529 plan described in this Plan Description and

Participation Agreement.

Section 529: Section 529 of the Code.

Standing Investment Instruction: The selection made by an Account Owner indicating how

contributions are allocated among Investment Portfolios.

State: The State of New Mexico.

Student Loan Payments: Amounts paid as principal or interest on any qualified education loan of

either the Beneficiary or a sibling of the Beneficiary up to a lifetime limit of $10,000 per individual.

Successor Account Owner: The person named in the Enrollment Form or otherwise in writing to

Scholar’s Edge by the Account Owner, who may exercise the rights of the Account Owner under

Scholar’s Edge if the Account Owner of a funded Account dies. The Successor Account Owner may

be the Beneficiary if the Beneficiary is 18 years or older.

Supplement: An addendum to the Plan Description and Participation Agreement, issued from time

to time.

Trust: The Education Plan Trust of New Mexico created by the Declaration of Trust.

Trusted Contact Person: The person you designate as a contact to address possible financial

exploitation, to confirm the specifics of your current contact information, health status, or the

identity of any legal guardian, executor, trustee, or holder of a power of attorney; or as otherwise

permitted by Financial Industry Regulatory Authority (FINRA) Rule 2165.

Trustee: The Board in its capacity as trustee of the Trust.

UGMA/UTMA: Uniform Gifts to Minors Act / Uniform Transfers to Minors Act.

Underlying Funds or Funds: The mutual funds and exchange-traded funds (ETFs) that are

Underlying Investments of the Portfolios.

Underlying Investments: The Underlying Funds and other assets in which the Portfolios are

invested, including any funding agreements.

Unit or Units: The measurement of your interest in a Portfolio.

Unit Class: A class of Units offered for a Portfolio, either Class A, Class C, or Class R, each having

a different Fee structure.

Unit Value: The value per Unit for a Portfolio.

Scholarsedge529.com

16

Upromise: A loyalty program offered by Upromise, LLC which enables Account Owners who are

members of Upromise to earn rewards from participating merchants and have those rewards

transferred from a Upromise account to a Plan Account, subject to minimum transfer amounts.

Upromise is a separate program from the Plan. Upromise, LLC is not affiliated with the State, the

Trust, the Board, the Program Manager, or any Plan Official.

Vanguard: The Vanguard Group, Inc., the Investment Manager of the Vanguard Underlying Funds.

We or our: Scholar’s Edge, the Board (as the Trustee of the Trust and administrator of the Plan), the

Program Manager, PGI, PFD, and/or the Investment Managers, as the case may be.

Scholarsedge529.com

17

Account Basics

To participate in Scholar’s Edge, you must complete, sign, and have your Financial Professional

submit an Enrollment Form. You must be 18 years or older and a U.S. citizen (or a resident alien),

or an entity that is organized in the U.S. and have a valid permanent U.S. Street address. By signing

the Enrollment Form, you irrevocably consent and agree that the Account is subject to the terms and

conditions of the Enrollment Form and this Plan Description and Participation Agreement. You also

consent and agree to authorize your Financial Professional to access your Account and perform

certain transactions on your behalf as explained on the Enrollment Form or separately on the

appropriate power of attorney or agent authorization form.

If you do not wish to work with a Financial Professional, the Board also offers a direct-to-consumer

529 plan, The Education Plan. The Education Plan offers lower cost investment options compared

to Scholar’s Edge. Go to theeeducationplan.com for more information about The Education Plan.

Investing through Omnibus Accounts. When you invest through a Financial Professional who works

for a Dealer that maintains your Account directly on its recordkeeping platform or where the Dealer

has an arrangement with a third-party recordkeeping agent that has entered into an agreement with

the Program Manager to perform certain services for Omnibus Accounts, the Omnibus Service

Provider will perform certain Account recordkeeping services such as accepting and processing

initial and subsequent contributions, accepting and processing requests for distributions, and

delivering confirmations and statements and other information. Usually, in such a case, the

Omnibus Service Provider maintains one single account held with the Plan in the institution’s name

for the benefit of its customers or the customers of the applicable Dealer. In an Omnibus Account

arrangement, Account Owner information is held on the Omnibus Service Provider’s platform and

trades are usually aggregated for transmission to the Plan. Different and/or additional fees than

those disclosed in this Plan Description and Participation Agreement may apply. You should

determine whether your Financial Professional’s Dealer holds Accounts in the Plan on behalf of its

customers under an Omnibus Account arrangement and if so, understand the details of such

arrangement, including the fees and expenses charged by such firm that are not disclosed in this

Plan Description and Participation Agreement.

In addition, guidelines, conditions, services, and restrictions may apply that vary from those

discussed in this Plan Description. Depending on a particular Omnibus Service Provider’s policies,

these differences may include but are not limited to: (i) eligibility standards to purchase, exchange,

and sell Units; (ii) availability of sales charge waivers and fees; (iii) minimum initial and subsequent

purchase amounts; (iv) conversion periods for Class C Units; (v) availability of Letter of Intent

Account Basics: You must work with a Financial Professional to open an Account, and you must

be 18 years or older and a U.S. citizen (or a resident alien), or an entity that is organized in the

U.S., and have a valid permanent U.S. Street address. If you have an open Account and you no

longer have a permanent U.S. Street address, your Account will not be eligible to receive

contributions.

How To Participate

Scholarsedge529.com

18

privileges; and (vi) availability of certain Plan features, such as the Upromise Program and Ugift.

Additionally, if you invest through a Financial Professional that maintains an Omnibus Account and

have one or more other Accounts with the Plan or eligible Principal mutual fund accounts, you must

notify your Financial Professional and the Plan in advance about your other Accounts or other

eligible Principal mutual fund accounts to help ensure that sales charge waivers, rights of

accumulation privileges, and/or other Plan features are properly applied to your Accounts. You may

be asked to provide additional information.

By establishing and/or contributing to an Account through an Omnibus Service Provider that holds

your Account directly on its recordkeeping platform, you will be deemed to have agreed that your

Account and its assets are subject to the terms and conditions of this Plan Description, including the

Participation Agreement, to the same extent as if you had executed the Participation Agreement.

Notwithstanding the foregoing, in the event of conflicts (as discussed above) between your financial

institution’s fees, guidelines, conditions, or policies and the Plan Description or Participation

Agreement, the fees, policies, or procedures of your financial institution will prevail as they relate to

any Accounts held in an omnibus capacity at your Omnibus Service Provider.

Successor Account Owner. You may designate a Successor Account Owner that is 18 years or older

(to the extent permissible under the laws that apply to your situation) to succeed to all of your right,

title, and interest in your Account upon your death. You can make this designation online, on the

Enrollment Form, over the phone, or in writing. We must receive and process your request before

the Successor Account Owner designation can be effective. You may change or terminate your

Successor Account Owner at any time by submitting the appropriate form. Forms may be obtained

from our website at scholarsedge529.com or by calling us at 1.866.529.7283.

Beneficiary. You can set up an Account for anyone, including yourself or your child, grandchild,

spouse, or other relative or even someone not related to you. Each Account can have only one

Beneficiary at any time. However, you may have multiple Accounts for different Beneficiaries.

Also, different Account Owners may have an Account for the same Beneficiary within the Plan, but

contributions to an Account will be limited if the total assets held in all Accounts for that

Beneficiary under all 529 plans offered by New Mexico equal or exceed the Maximum Account

Balance. See Maximum Account Balance on page 12. Your Beneficiary may be of any age;

however, the Beneficiary must be an individual.

Identity Verification. U.S. federal law requires all financial institutions to obtain, verify, and record

information that identifies each person who opens an Account. When completing your Enrollment

Form, we will ask for your name, street address, date of birth, and Social Security or Tax

Identification Number. If you are a trust or other entity, we require a Tax Identification Number and

information for any person(s) opening your Account, such as a Custodian, agent under power of

attorney, trustee, or corporate officer. Further information about identification verification

requirements can be found in the General Information section beginning on page 84.

Trusts, Corporations, and Other Entities as Account Owners. If you are a trust, partnership,

corporation, association, estate, or another acceptable type of entity, you must submit

documentation to Scholar’s Edge to verify the existence of the entity and identify the individuals

who are eligible to act on the entity’s behalf. Examples of appropriate documentation include a trust

agreement, partnership agreement, corporate resolution, articles of incorporation, bylaws, or letters

appointing an executor or personal representative. This documentation must be submitted when an

Account is established. We will not be able to open your Account until we receive all of the

information required on the Enrollment Form and any other information we may require, including

the documentation that verifies the identity and existence of the Account Owner. A Beneficiary does

Scholarsedge529.com

19

not have to be named during enrollment when the Account Owner is a tax-exempt organization, as

defined in the Code, and the Account has been established as a general scholarship fund.

How to Open and Fund Your Account

Minimum Contributions. You can make your initial and any additional contributions by check,

Recurring Contributions (also known as Automatic Investment Plan (AIP)), payroll direct deposit,

Electronic Funds Transfer (EFT), dollar-cost averaging, rolling over assets from another Qualified

Tuition Program, moving assets from an UGMA/UTMA account or Coverdell Education Savings

Account, or by redeeming U.S. Savings Bonds. Each of your contributions will be subject to

applicable Fees.

We will not accept contributions made by cash, money order, travelers checks, checks drawn on

foreign banks, contributions not in U.S. dollars, checks dated more than 180 days from the date of

receipt, checks post-dated more than seven days in advance, checks with unclear instructions, starter

or counter checks, credit card or bank courtesy checks, third-party personal checks over $10,000,

instant loan checks, or any other check we deem unacceptable. We will also not accept stocks,

securities, or other noncash assets as contributions to your Account.

You can allocate each contribution among any of the Investment Portfolios; however, the minimum

percentage per selected Investment Portfolio is 1% of the contribution amount. Your additional

contributions can be made to different Investment Portfolios than the selection(s) you make during

enrollment as long as investments in those different Investment Portfolios are permissible.

Contribution Date. We will credit any money contributed to your Account on the same business day

if the contribution is received in good order and prior to the close of the New York Stock Exchange

(NYSE), normally 4:00 p.m. Eastern Time. The contribution will be credited on the next succeeding

business day that the NYSE is open if it is received after its close.

In the event of Force Majeure, we may experience processing delays, which may affect your trade

date. In those instances, your actual trade date may be after the trade date you would have received,

which may negatively affect the value of your Account. For the definition of “Force Majeure,” see

“Market Uncertainties and other events” in the Section entitled “Important Risks You Should

Consider” on page 54.

We will generally treat contributions sent by U.S. mail as having been made in a given year if

checks are received in a mailing postmarked on or before December 31 of the applicable year, and

provided the checks are subsequently paid. With respect to EFT contributions, for tax purposes we

will generally treat contributions received by us in a given year as having been made in that year if

you initiate them on or before December 31 of such year, provided the funds are successfully

deducted from your checking or savings account at another financial institution. Your contributions

made by Recurring Contribution will generally be considered received by us in the year the

Recurring Contribution debit has been deducted from your checking or savings account at another

financial institution. See Funding Methods – Recurring Contribution beginning on page 20.

Future Contributions. At the time you enroll, you must choose how you want your contributions

invested, which will serve as the standing investment instruction for future contributions (Standing

Investment Instruction). We will invest all additional contributions according to your Standing

Investment Instruction, unless you provide us with different instructions, and investments in

different Investment Portfolios are permissible. You may view or change your Standing Investment

Instruction at any time by logging onto our website at scholarsedge529.com. You may also change

Scholarsedge529.com

20

your Standing Investment Instruction by downloading and submitting the appropriate

exchange/future contribution form from our website at scholarsedge529.com.

Changing Investment Portfolios. You may change the Investment Portfolios for your Account twice

per calendar year, and with a permissible change in the Beneficiary. The twice per calendar year

limitation on reallocations applies in the aggregate across all of your accounts for the same

Beneficiary under all Qualified Tuition Programs sponsored by the State of New Mexico. You may

exchange Units in a Portfolio only for Units of the same Unit Class in another Portfolio. You can

initiate this transaction online, over the telephone by contacting a Client Service Representative at

1.866.529.7283, or by downloading and submitting the appropriate exchange/future contribution

form from our website at scholarsedge529.com.

Control over Your Account. Although any individual or entity may make contributions to your

Account, you, as Account Owner, retain control of all contributions made as well as all earnings

credited to your Account up to the date they are directed for distribution. A Beneficiary who is not

the Account Owner has no control over any of the Account assets. You may also grant another

person the ability to take certain actions with respect to your Account by completing appropriate

form(s).

By signing the Enrollment Form, you consent and agree to authorize your Financial Professional to

access your Account and perform certain transactions on your behalf as explained on the Enrollment

Form or separately on the appropriate power of attorney or agent authorization form.

Trusted Contact. You can choose to authorize us to contact a Trusted Contact Person and disclose to

that person information about your Account to address possible financial exploitation; to confirm

the specifics of your current contact information, health status, or the identity of any legal guardian,

executor, trustee, or holder of a power of attorney; or as otherwise permitted by law. You can

choose to designate a Trusted Contact Person by completing the appropriate form or the Trusted

Contact Person section of the Enrollment Form. A Trusted Contact Person must be at least eighteen

(18) years of age.

Funding Methods:

Recurring Contribution. You may contribute to your Account by authorizing us to receive periodic

automated debits from a checking or savings account at your bank if your bank is a member of the

Automated Clearing House, subject to certain processing restrictions. You may elect to authorize an

annual increase to your Recurring Contribution. You can initiate a Recurring Contribution either

when you enroll by completing the Recurring Contribution section during enrollment or after your

Account has been opened, either online, over the phone (provided you have previously submitted

certain information about the bank account from which the money will be withdrawn), or in writing

by submitting the appropriate form. Your Recurring Contribution authorization will remain in effect

until we have received notification of its termination from you and we have had a reasonable

amount of time to act on it.

Recurring Contribution deposits can be set up for as little as $1. However, if you do not otherwise

qualify for a waiver, you may need to schedule Recurring Contributions of at least $25 per month or

$75 per quarter in order for the Annual Account Maintenance Fee to be waived. See Fees and

Charges – Annual Account Maintenance Fee on page 35.

Scholarsedge529.com

21

You may terminate your Recurring Contribution at any time. To be effective, a change to, or

termination of, a Recurring Contribution must be received at least five (5) business days before the

next Recurring Contribution debit is scheduled to be deducted from your bank account, and it is not

effective until processed by us. If your Recurring Contribution cannot be processed because the

bank account on which it is drawn lacks sufficient funds, if you provide incomplete or inaccurate

banking information, or if the transaction would violate processing restrictions, we reserve the right

to suspend processing of future Recurring Contributions.

There is no charge for making Recurring Contributions. Recurring Contribution debits from your

bank account will occur on the day you indicate, provided the day is a regular business day. If the

day you indicate falls on a weekend or a holiday, the Recurring Contribution debit will occur on the

next business day. You will receive a trade date of the same business day the bank debit occurs.

Quarterly Recurring Contribution debits will be made on the day you indicate (or the next business

day, if applicable) every three (3) months, not on a calendar quarter basis. If you do not designate a

date, your bank account will be debited on the 20th day of the applicable month.

The start date for a Recurring Contribution must be at least three (3) business days from the date

you submit the Recurring Contribution request. If a start date for a Recurring Contribution is less

than three (3) business days from the date you submit the Recurring Contribution request, the

Recurring Contribution will start on the requested day in the next succeeding month.

Electronic Funds Transfer (EFT). You may also contribute by EFT subject to certain processing

restrictions. Each contribution must be in an amount of at least $1. You may authorize us to

withdraw funds by EFT from a checking or savings account for both initial and additional

contributions to your Account, provided you have submitted certain information about the bank

account from which the money will be withdrawn. EFT transactions can be completed through the

following means: (i) by providing EFT instructions on the Enrollment Form; (ii) by submitting EFT

instructions online after enrollment at scholarsedge529.com; or (iii) by contacting a Client Service

Representative at 1.866.529.7283. We do not charge a Fee for contributing by EFT.

Contributions by Check. You may make your initial contribution by check. Checks must be made

payable to Scholar’s Edge. Third-party personal checks must be equal to or less than ten-thousand

dollars ($10,000) and be properly endorsed or made payable to Scholar’s Edge.

Limitations on Recurring Contributions and EFT Contributions. We may place a limit on the total

dollar amount per day you may contribute to an Account by EFT. Contributions in excess of this

limit will be rejected. If you plan to contribute a large dollar amount to your Account by EFT, you

may want to contact a Client Service Representative at 1.866.529.7283 to inquire about the current

limit prior to making your contribution.

An EFT or Recurring Contribution may fail because the bank account on which it is drawn lacks

sufficient funds or because the Account Owner has failed to provide correct and complete banking

instructions (Failed Contributions). If you have a Failed Contribution, we reserve the right to

suspend processing of future Recurring Contributions and EFT contributions. See Failed

Contributions on page 25.

Direct Deposits from Payroll. You may be eligible to make automatic, periodic contributions to

your Account by payroll direct deposit (if your employer offers this service). You may make your

initial investment by payroll direct deposit or set up payroll direct deposit for additional

contributions to your Account. The minimum payroll direct deposit contribution is $1 per paycheck.

Scholarsedge529.com

22

Contributions by payroll direct deposit will only be permitted from employers able to meet our

operational and administrative requirements. You must complete payroll direct deposit instructions

by logging into your Account at scholarsedge529.com, selecting the payroll direct deposit option,

and designating the contribution amount in the instructions. You will need to print these instructions

and submit them to your employer. Alternatively, you may submit the appropriate payroll direct

deposit form directly to us to initiate the payroll direct deposit process.

Employer-sponsored investment plan: Termination of Employment. If you terminate employment with

your employer, please notify the Plan. If you terminate employment with your employer, you may

continue to make contributions to your Account using a Check or Recurring Contributions. Any

additional purchases of Class A Units will be made with the appropriate sales charges applied. If you

make Recurring Contributions of at least $25 per month or $75 per quarter, your Annual Account

Maintenance Fee will be waived.

Rollover Contributions. You can make your initial investment by rolling over assets from another

Qualified Tuition Program to Scholar’s Edge for the benefit of the same Beneficiary. You can also

roll over assets from your Account or another Qualified Tuition Program to a Beneficiary who is a

Member of the Family of your current Beneficiary. See Maintaining Your Account – Options for

Unused Contributions, Changing a Beneficiary, Transferring Assets to Another of Your Accounts on

page 31. A rollover for the same Beneficiary is restricted to once per 12-month period. Incoming

rollovers can be direct or indirect.

A direct rollover is the transfer of money from one Qualified Tuition Program directly to another.

An indirect rollover is the transfer to you of money from an account in another state’s Qualified

Tuition Program; you then contribute the money to your Account. To avoid U.S. federal income tax

consequences and the Distribution Tax, you must contribute an indirect rollover within 60 days of

the distribution.

You should also be aware that some states may not permit direct rollovers from Qualified Tuition

Programs. In addition, there may be state income tax consequences (and in some cases state-

imposed penalties) resulting from a rollover out of a state’s Qualified Tuition Program. See

Important Tax Information – State Tax Issues beginning on page 79.

Moving Assets from an UGMA/UTMA Account. If you are the Custodian of an UGMA/UTMA

account, you may be able to open an Account in your custodial capacity, depending on the laws of

the state where you opened the UGMA/UTMA account. These types of accounts involve additional

restrictions that do not apply to regular Section 529 accounts. The Plan Officials are not liable for

any consequences related to your improper use, transfer, or characterization of custodial funds.

In general, your UGMA/UTMA custodial account is subject to the following additional requirements

and restrictions:

1. You must indicate that the Account is an UGMA/ UTMA account and the state in which the

UGMA/ UTMA account was opened by checking the appropriate box on the Enrollment Form;

2. You must establish an Account in your custodial capacity separate from any Accounts you may

hold in your individual capacity;

3. You will be permitted to make distributions in accordance with the rules regarding distributions

under applicable UGMA/UTMA law;

Scholarsedge529.com

23

4. You will not be able to change the Beneficiary of the Account (directly or by means of a

Rollover Distribution), except as may be permitted by applicable UGMA/UTMA law;

5. You will not be able to change the Account Owner to anyone other than a successor Custodian

during the term of the custodial account under applicable UGMA/UTMA law;

6. You must notify us when the custodianship terminates and your Beneficiary is legally entitled

to take control of the Account. At that time, the Beneficiary will become the Account Owner

and will become subject to the provisions of the Plan applicable to non-UGMA/UTMA

Account Owners. If you fail to direct the Plan to transfer ownership of the UGMA/ UTMA

Account when the Beneficiary is legally entitled to take control of the Account assets, the Plan

may freeze the Account and/or refuse to allow you to transact on the Account. Some

UGMA/UTMA laws allow for more than one age at which the custodianship terminates (“Age

of Termination”). The Plan may freeze an Account based on the youngest allowable Age of

Termination of the custodianship according to the UGMA/UTMA laws where the custodianship

account was established, based on the Plan’s records. You may be required to provide

documentation to the Plan if the Age of Termination of the custodianship account is other than

the youngest allowable age under the applicable UGMA/ UTMA law or if the applicable

UGMA/UTMA law differs from Plan records;

7. We may require you to provide documentation evidencing compliance with the applicable

UGMA/ UTMA law; and

8. In addition, certain tax consequences described under Important Tax Information starting on

page 79, may not be applicable in the case of Accounts opened by a Custodian under

UGMA/UTMA. Moreover, because only contributions made in “cash form” may be used to

open an Account in Scholar’s Edge, the liquidation of non-cash assets held by an

UGMA/UTMA account would be required and may be considered a taxable event. Please

contact a tax advisor to determine how to transfer assets held in an existing UGMA/UTMA

account to Scholar’s Edge and what the implications of that transfer may be for your specific

situation.

Moving Assets from a Coverdell Education Savings Account. You may fund your Account by

moving assets from a Coverdell Education Savings Account (ESA). Please indicate that the assets

were liquidated from the ESA on the Enrollment Form or with any additional investments. Unlike

UGMA/UTMA accounts, the Beneficiary may be changed to a Member of the Family of the

beneficiary of the ESA. Making distributions from an ESA to fund an Account for the same

Beneficiary may not be considered a taxable transaction. Consult your tax advisor for more

information.

Redeeming U.S. Savings Bonds. You may fund your Account with proceeds from the redemption of

certain U.S. Savings Bonds. In certain cases, you may redeem U.S. Savings Bonds under the

education tax exclusion. Please visit savingsbonds.gov to determine if you are eligible for this

exclusion.

Refunded Distributions. In the event the Beneficiary receives a refund from an Eligible Educational

Institution, those funds will be eligible for recontribution to your Account if:

• The Beneficiary of your Account is the same Beneficiary receiving the refund; and

• The recontribution is made within 60 days of the date of the refund.

Scholarsedge529.com

24

The recontributed amount will not be subject to U.S. federal or New Mexico state income tax or the

Distribution Tax. For tax purposes, please maintain proper documentation evidencing the refund

from the Eligible Educational Institution.

Additional Form Requirements for Rollovers, ESAs, and Series EE or Series I Bonds

Rollover contributions and other transfers to your Account must be accompanied by the appropriate

incoming rollover form as well as any other information we may require, including the information

required for certain contributions described below. To roll over assets for a current Beneficiary into

an Account in Scholar’s Edge, you must complete the appropriate incoming rollover form and an

Enrollment Form.

When making a contribution to your Account with assets previously invested in an ESA, a

redemption of Series EE and Series I bonds or a rollover, you must indicate the source of the

contribution and provide us with the following documentation, as applicable:

1. In the case of a contribution from an ESA, an accurate account statement issued by the

financial institution that acted as custodian of the account that reflects in full both the

principal and earnings attributable to the rollover amount.

2. In the case of a contribution from the redemption of Series EE or Series I U.S. Savings

Bonds, an accurate account statement or IRS Form 1099-INT issued by the financial

institution that redeemed the bond showing interest from the redemption of the bond.

3. In the case of a rollover, either you or the previous Qualified Tuition Program must provide

us with an accurate statement issued by the distributing program which reflects in full both

the principal and earnings attributable to the rollover amounts.

Please visit the Scholar’s Edge website at scholarsedge529.com or contact a Client Service

Representative at 1.866.529.7283 for any of the forms you may need. Until we receive the

documentation described above, as applicable, we will treat the entire amount of the rollover

contribution as earnings in the Account receiving the transfer, which would subject the entire

amount of the rollover contribution to taxation in the case of a Non- Qualified Distribution.

Dollar-Cost Averaging. The Plan allows Account Owners to take advantage of dollar cost averaging

via periodic systematic exchanges. Account Owners may choose an originating Portfolio and a

Portfolio into which specified dollar amounts (a minimum of $25 per Portfolio) will be transferred

on a monthly or quarterly basis. Account Owners must have at least $1,000 in the originating

Portfolio to begin dollar-cost averaging. Dollar-cost averaging does not eliminate the risks of

investing in financial markets and may not be appropriate for everyone. It does not ensure a profit or

protect you against a loss in declining markets.

If you elect to begin dollar-cost averaging assets that are currently in your Account, such election

will count as a transfer for purposes of the twice per calendar year limitation on reallocations. In

addition, changing your standing dollar-cost averaging instructions, or canceling them, will also be

considered a transfer for purposes of the same limitation. The twice per calendar year limitation on

reallocations applies in the aggregate across all of your accounts for the same Beneficiary under all

Qualified Tuition Programs sponsored by the State of New Mexico.

Maximum Account Balance. You can contribute up to a Maximum Account Balance of $500,000

for each Beneficiary. The aggregate market value of all accounts for the same Beneficiary under all

Scholarsedge529.com

25

Qualified Tuition Programs sponsored by the State of New Mexico is counted toward the Maximum

Account Balance regardless of the Account Owner. Earnings may cause the Account balances for

your Beneficiary to exceed $500,000 and no further contributions will be allowed at that point. If,

however, the market value of your Account falls below the Maximum Account Balance, we will

then accept additional contributions.

Should the Board decide to increase the Maximum Account Balance, which it may in its sole

discretion, additional contributions up to the new Maximum Account Balance will be accepted.

Excess Contributions. The excess portion of any contributions received that would cause your

Account balance to exceed the Maximum Account Balance (as determined by the close of business

on the day prior to our receipt of your contribution) will be rejected or returned to you, without

adjustment for gains or losses. If you are enrolled in a Recurring Contribution, the Recurring

Contribution may be discontinued. Also, if a contribution is applied to an Account and we later

determine the contribution to have caused the aggregate market value of the account(s) for a

Beneficiary in all Qualified Tuition Programs sponsored by the State of New Mexico to exceed the

Maximum Account Balance, we will refund the excess contributions and any earnings thereon to the

contributor. Any refund of an excess contribution may be treated as a Non-Qualified Distribution.

Failed Contributions. If you make a contribution by check, EFT, or Recurring Contribution that is

returned unpaid by the bank upon which it is drawn, you will be responsible for any losses or

expenses incurred by the Portfolios or the Plan and we may charge your Account a reasonable Fee.

Your obligation to cover the loss may be waived if you make payment in good order within ten (10)

calendar days. We have the right to reject or cancel any contribution due to nonpayment.

Confirmation of Contributions and Transactions. We will send you a confirmation for each

contribution and transaction to your Account(s), except for Recurring Contributions, payroll direct

deposits transactions, exchanges due to dollar-cost averaging, and automatic transfers from a

Upromise account to your Account. Each confirmation statement will indicate the number of Units

you own in each Investment Portfolio. If an error has been made in the amount of the contribution

or the Investment Portfolio in which a particular contribution is invested, you must notify us of the

error within the required time period See Maintaining Your Account – Correction of Errors on page

32. We use reasonable procedures to confirm that transaction requests are genuine. You may be

responsible for losses resulting from fraudulent or unauthorized instructions received by us,

provided we reasonably believe the instructions are genuine. To safeguard your Account, please

keep your information confidential. Contact us immediately at 1.866.529.7283 if you believe there

is a discrepancy between a transaction you requested and the confirmation statement you received,

or if you believe someone has obtained unauthorized access to your Account. Contributions may be

refused if they appear to be an abuse of the Plan.

Ugift. You may invite family and friends to contribute to your Account through Ugift, either in

connection with a special event or just to provide a gift to the Account Owner’s Beneficiary. Family

and friends can either contribute online through an electronic bank transfer or by mailing in a gift

contribution coupon with a check made payable to Ugift—Scholar’s Edge. The minimum gift

contribution through Ugift is $1.

Gift contributions received in good order will be held for approximately five (5) business days

before being transferred into your Account. Gift contributions through Ugift are subject to the

Maximum Account Balance. Gift contributions will be invested according to the Standing

Investment Instruction on file for your Account at the time the gift contribution is transferred. There

may be potential tax consequences of gift contributions invested in your Account. You and the gift

Scholarsedge529.com

26

giver should consult a tax advisor for more information. Ugift is an optional service, is separate

from Scholar’s Edge, and is not affiliated with the State of New Mexico, the Board, or the Trust.

For more information, please see our website at scholarsedge529.com.

Upromise

®

. If you are enrolled in Upromise, you can link your Account so that amounts on deposit

in your Upromise account are automatically transferred to your Account on a periodic basis.

Transfers from a Upromise account may be subject to a minimum amount that is subject to change

at any time.

This Plan Description and Participation Agreement is not intended to provide detailed information

concerning Upromise. Upromise is administered in accordance with the terms and procedures set

forth in the Upromise Member Agreement (as amended from time to time), which is available at

upromise.com. Participating companies, contribution levels, and terms and conditions are subject to

change at any time without notice. Upromise is an optional program, is separate from Scholar’s

Edge, and is not affiliated with the State of New Mexico, the Board, or the Trust.

Scholarsedge529.com

27

General. You can take a distribution from your Account or close your Account at any time by

notifying us. We will not send any proceeds from your distribution request until all the money has

been collected, meaning the money’s availability in your Account is confirmed.

Distributions from your Account are either Qualified Distributions or Non-Qualified Distributions

as determined under IRS requirements. As the Account Owner, you are responsible for satisfying

the IRS requirements for proof of Qualified Distributions, which includes retaining any paperwork

and receipts necessary to verify the type of distribution you received. We are not required to provide

information to the IRS regarding the type (qualified or non-qualified) of distribution you request.

Distributions may be subject to U.S. federal and/or state tax withholding. For purposes of

determining that a distribution is not taxable or subject to the Distribution Tax, you must determine

whether the distribution is made in connection with the payment of Qualified Expenses, as defined

under the Code and discussed under Qualified Distributions on page 28, or fits within one of the

exceptions for treatment as a Non-Qualified Distribution as discussed under Other Distributions on

page 28.

Procedures for Distributions. Only the Account Owner may direct distributions from your Account.

Qualified Distributions made payable to the Account Owner, the Beneficiary, or an Eligible

Educational Institution may be requested online, by phone, or by completing the appropriate

distribution request form. In order for us to process a distribution request, the distribution request

must be in good order, and we must be provided with such other information or documentation as

we may require.

We will generally process a distribution from an Account within three (3) business days of

accepting the request. During periods of market volatility and at year-end, distribution requests may

take up to five (5) business days to process. Please allow ten (10) business days for the proceeds to

reach the Account Owner, the Beneficiary, or the Eligible Educational Institution. We may also

establish a minimum distribution amount and/or charge a Fee for distributions made by federal wire.

Distributions for Account Owners that are Trusts, Corporations and Other Entities. If the individuals

who are authorized to act on behalf of your entity have changed since your Account was

established, then additional documentation showing these changes must be submitted with any

distribution request.