2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

Q3 2023

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

2

Highlights

∙ The European residential markets continue to experience increased supply/demand

imbalances putting further upward pressure on rents across our markets. The like-for-

like rental growth was at 4.2% (5.7%) and real economic occupancy continued to stay

high at 98.1% (98.2%) in Q3

∙ The strong operational performance is driven by both rental income at SEK 3.9 billion

(3.8) and prudent cost efficiency measures. The NOI margin was 69.5% (69.0%).

∙ Fair value change was -1.4% (-2.1%) and had an impact on profit of SEK -4.9 billion

(-7.4). After five quarters of declining property values, valuations are now showing

signs of stabilisation

∙ Heimstaden Bostad’s Board approved to scale up the privatisation plan initiated earlier

in 2023. Proceeds will be prioritised for debt service and liability management to

support the key credit metrics

∙ Heimstaden continued its strategic deleveraging efforts by buying back 2024 and

2025 senior unsecured bonds, amounting to SEK 563 million. The sale of our Icelandic

portfolio, which has generated an annualised ROI of appr. 18%, was announced in

October. The proceeds will be used for liability management purposes and cover

upcoming debt maturities

∙ Fitch lowered Heimstaden’s rating to ‘BB’ and revised the Outlook to Rating Watch

Negative. The downgrade reflects a forecasted weaking of the interest coverage ratio

339 billion

Investment Properties, SEK

57.9%

Net loan-to-value

2.7 billion

Net operating income, SEK

1.8x

Interest coverage ratio

Key Figures

Q3 2023 Q2 2023 Q3 2022 YTD 2023 YTD 2022

Financials

Rental income SEK m 3,905 3,800 3,283 11 403 9,729

Growth y-o-y % 18.9 15.5 42.4 17,2 50.0

Net operating income SEK m 2,714 2,623 2,260 7,738 6,350

Net operating income margin % 69.5 69.0 68.8 67.9 65.3

Total comprehensive income/loss SEK m -5,812 244 -2,390 -18,135 12,759

Capital expenditures SEK m 2,043 2,026 2,436 6,113 6,967

Portfolio Metrics

Fair value of investment properties SEK m 338,754 346,629 343,456 338,754 343,456

Homes Units 163,157 162,166 155,822 163,157 155,822

Real economic occupancy, residential % 98.1 98.2 98.4 98.2 98.5

Like-for-like rental income growth % 4.2 5.7 5.5 5.0 5.5

Credit Metrics

Net loan-to-value % 57.9 57.2 52.2 57.9 52.2

Net debt / Total assets % 51.4 50.3 46.3 51.4 46.3

Interest Coverage Ratio (ICR) Multiple 1.8 2.0 2.6 1.8 2.6

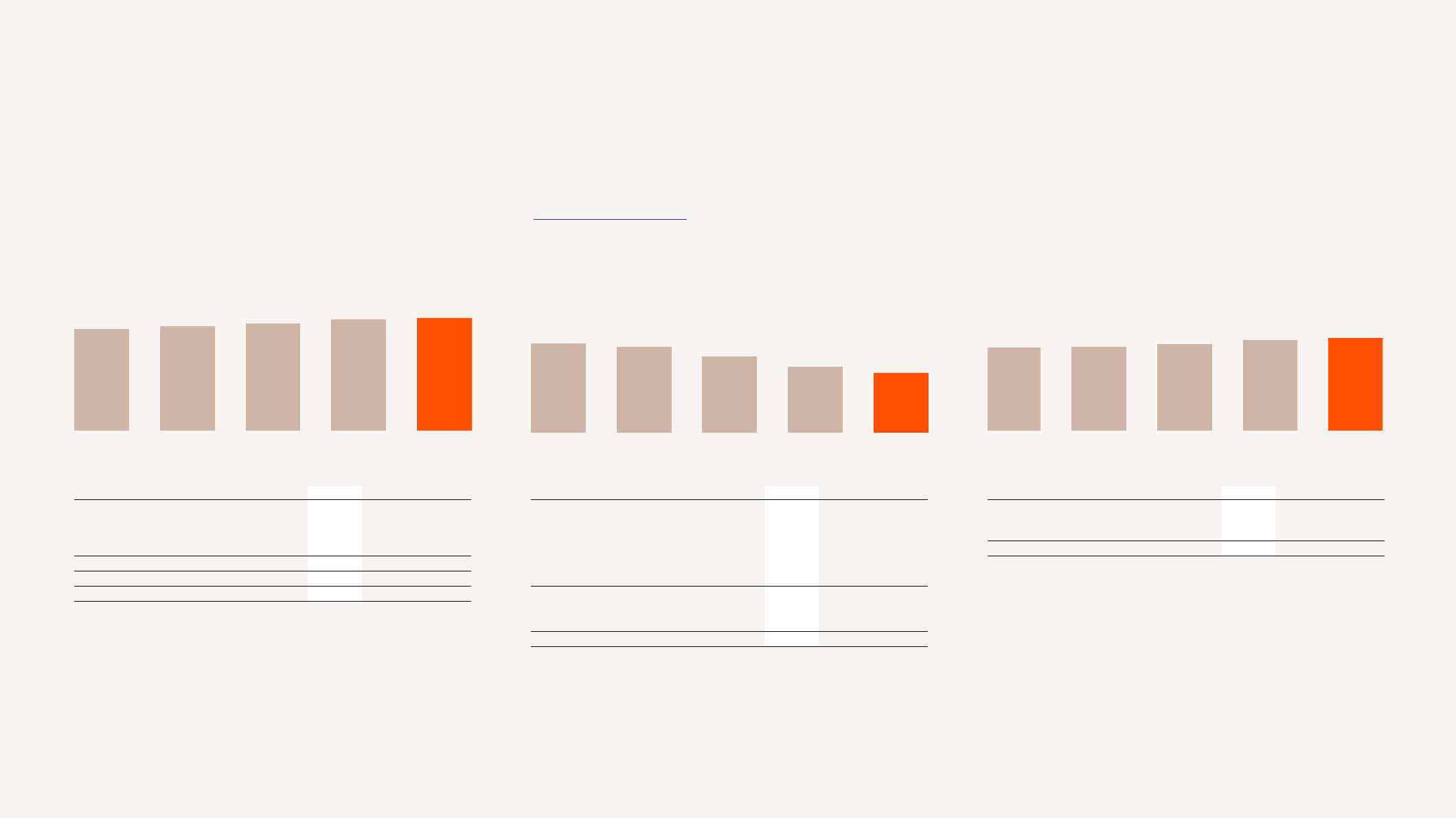

Rental Income

SEK million

Real Economic Occupancy

%

Net Loan-to-Value (LTV)

%

Q3 23Q2 23Q1 23Q4 22Q3 22

3,283

3,474

3,698

3,800

3,905

Q3 23Q2 23Q1 23Q4 22Q3 22

Real Occupancy Ratio

98.4 98.3 98.2 98.2

98.1

Q3 22Q2 23Q1 23Q4 22Q3 22

52.2

53.6

54.9

57.2

57.9

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

3

CEO letter

Favourable market fundamentals continue to benefit us. As an owner and manager of Heimstaden Bostad, we are pleased to

see that the company consistently achieves a strong operational performance and that the Net Operating Income margin has

organically improved. To further support the Heimstaden’s financial position, we completed a bond buyback for a total of SEK

563 million and a sale of the Icelandic portfolio. In addition, Heimstaden Bostad’s Board has announced a Privatisation Plan.

Heimstaden Bostad announced the Privatisation Plan

Following last quarter’s commitment to defending the ‘BBB’ rating, Heimstaden

Bostad’s Board has approved a Privatisation Plan which includes establishing a new

business line, where the company target to sell a part of the portfolio to the private

home-owner market. The plan will be ramped up over the coming quarters and ul-

timately is expected to deliver SEK 20 billion by the end of 2025. We see this as an

exciting new strategy that will support the company’s deleveraging program while

crystallising premiums to book values as a key support to the credit metrics.

Continue to reduce leverage

The last months, we have continued to deliver on our strategic plan to reduce lev-

erage.

In September, we completed a bond buyback of 2024 and 2025 senior unsecured

bonds for a total consideration of SEK 563 million. Additionally, we announced in

October the sale of our Icelandic portfolio, which has given us an annualised return

on investment of appr. 18% post-acquisition. The transaction offers an attractive

opportunity to accelerate our exit from the Icelandic market, advance our deleverag-

ing, and capture a significant portion of the ongoing exit strategy’s upside.

The proceeds from the buyback and the Icelandic transaction will be used for liabil-

ity management purposes and cover outstanding debt maturities until 2025.

Heimstaden Bostad continues to address upcoming maturities with strong bank

partnerships across the portfolio. In the third quarter, Heimstaden Bostad obtained

SEK 13 billion in secured bank financing and have in total signed SEK 50 billion in

funding the past 18 months.

As expected, Fitch lowered our rating to ‘BB’ and revised the Outlook to Rating

Watch Negative. The downgrade reflects a forecasted weaking of the interest cov-

erage ratio.

Attention from the media

Lately, certain media articles have incorrectly described Heimstaden and Heim-

staden Bostad as companies in crisis. During the last month, we have proactively

countered the allegations in several interviews, highlighting that both companies

have for many years delivered great annually returns to shareholders, continue to

achieve strong operational results, and are well-prepared for upcoming maturities.

Continued momentum in reaching our sustainability goals

Our sustainability efforts are made with purpose and passion and continue to re-

ceive external validation on our sustainability reporting, which confirms we are on

the right track. This quarter, Morningstar Sustainalytics and Danske Bank’s annual

ESG report gave Heimstaden Bostad top scores, spotlighting key achievements,

ambitious climate roadmap, and sustainability-linked financing framework.

Welcoming Christian to his new role

In September, I was especially pleased to welcome Chief Investment Officer

Christian Fladeland as Deputy CEO, a natural progression considering his substan-

tial contributions to Heimstaden’s positive development.

Helge Krogsbøl

CEO Heimstaden

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

4

Market update

The investment market faces low transaction volumes and uncertain residential value stability. Residential values are linked to yield

spreads and inflation-linked income, with real interest rates as a key determinant. Investors and operators must now prove their

operational excellence and deep understanding of residential real estate fundamentals. Privatising part of our portfolio will showcase

the resilience of our high-quality assets.

More to residential values than yields

I often hear concerns about how residential yields are too low to be sustainable and that

they fall short of covering funding costs. Accordingly, this occasionally prompt questions

about the potential impact on property valuations if yields were to increase significantly,

creating a positive spread over funding costs. Based on pure math, a 100-200 bps yield

expansion would result in 25-50% decline in values overnight.

Interestingly, during the past decade of declining interest rates, there was limited ex-

amination of why residential yields didn’t decrease to a comparable extent. This period

illustrates that residential values are influenced by many factors beyond nominal interest

rates. The same obvious explanations remain relevant today, as we observe values de-

clining less than can be explained by the observed yield expansion.

The difference between nominal and real yields

Over the past decade, lower interest rates and low inflation, coupled with increased

global productivity, balanced the impact of lenient monetary policies on inflation. During

this period, moderate construction cost increases and low funding costs kept rental

growth from soaring. Consequently, rental growth prospects, which contribute to the

total return for residential real estate, have shifted along with rising interest rates and

inflation. This shift should be factored in when comparing nominal funding costs and the

actual returns in residential real estate, as the total return outlook for residential real es-

tate has significantly improved.

Residential rents have consistently tracked or outperformed inflation

Rental growth in our markets has matched or outperformed inflation over the past few

decades. While regulations may limit rental increases to match inflation, the real increase

in wages is enhancing affordability and enabling unregulated markets to experience

surplus growth. Currently, we are witnessing like-for-like rental growth matching core

inflation, and we anticipate that the growth will surpass core inflation in the near future,

making up for the shortfall observed over the past year.

Privatisations are accretive to shareholders and support credit metrics

We are initiating a 5–8-year plan to streamline our portfolio through selective mar-

ket-based privatisation. This will generate profits and optimise capital allocation as we

transition units to the home-ownership market when tenants move out.

Based on a detailed analysis, we have identified appr. 25% of our portfolio, or about SEK

85 billion in book value, suitable for privatisation. This assessment considered achievable

profits, operational fit, future returns, and existing funding. Consequently, we’ve selected

five of our nine markets for inclusion and expect profits to exceed 20% of book value

based on recent sales and market data. Our multi-year plan aims to begin accelerated ex-

ecution in Q1 2024, targeting sale of SEK 20 billion in book value by the end of 2025.

Heimstaden Bostad’s Board directive is clear: prioritise all proceeds for debt servicing

and liability management. These sale proceeds and expected profits will support our

essential credit metrics, playing a key role in stabilising the ICR as we aim to defend our

‘BBB’ rating.

The era of using real estate as a pure fixed income substitute has ended

The heavy focus on spreads between residential yields and nominal rates reflects the

financial engineering of real estate in the recent decade. In a zero-interest rate environ-

ment, fundamentals took a back seat, but now it’s time to remember what truly drives

successful real estate investments: inflation protection.

Residential real estate has seen its fundamentals strengthened. As we navigate this tran-

sitional period, the primary emphasis is on adjusting for higher interest rates. However, it’s

hard to imagine that an undersupplied, non-cyclical asset like residential real estate won’t

rebound from initial declines in nominal prices in a higher inflationary environment.

Christian Fladeland

Deputy CEO Heimstaden

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

5

Sustainability Highlights

We have improved our ESG risk rating with leading voices in European sus-

tainability analysis.

Morningstar Sustainalytics’ ESG now rates Heimstaden Bostad as “Negligible

Risk” (from “Low Risk” last year), with full scores in 23 out of 50 categories in

addition to a “Strong” rating of our ESG risk management – the highest pos-

sible score.

Danske Bank’s annual ESG report for the real estate sector upgraded our

ESG reporting from “Good” to “Excellent,” spotlighting our key achievements,

ambitious climate roadmap, and sustainability-linked financing framework.

In response to the Ukraine war, we provided 750 emergency apartments for

Ukrainian refugees in the Czech Republic.

As the government adjusted the programme this summer, Heimstaden pro-

actively engaged Ukrainian tenants, holding meetings to explain legislative

changes and offer alternative long-tern solutions. As a consequence, 73% of

the Ukrainian refugees have chosen to continue to lease with us.

Environmental Social Governance

This quarter, the CEO approved the following updated policies:

• Corporate Communications Policy and Manual

• Risk Policy and Manual

• Financial Policy

We have executed training on the new Group Authorisation Matrix and on the

Insider Framework, in addition to launching Anti Bribery and Corruption training

for all employees through our employee portal Workday.

“External validation from

research, ratings, and analytics

firms affirms our purposeful

and passionate sustainability

endeavors, confirming we’re on

the right track”

Katarina Skalare.

Chief Sustainability Officer

“Our Czech team has met

the Ukrainian refugees with

compassion, understanding, and a

solution-oriented mindset. We are

pleased to report that 73% of our

Ukrainian tenants have transitioned

from social contracts to regular

lease agreements—a crucial

step towards successful refugee

integration into local communities”

Anette Konar Riple

Group Director Social Sustainability

“Improving and streamlining our

policy framework, supports a

robust governance structure that

creates value throughout the

entire organisation”

Kristian Berentsen

Chief Legal Officer

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

6

1

Heimstaden Bostad/Allianz partnership owning part of the Swedish and German portfolios. Consolidated as Group companies.

Property & Country management

Management

Agreement

Direct

Real Estate

Investments

Largest Institutional Investors

Alecta

Folksam Group

Swedish Pensions Agency

Ericsson Pension Fund

Fredensborg AS

holding ordinary shares

Preference shares listed on Nasdaq First North

Growth Market under the ticker HEIM PREF

Institutional partner

Allianz

1

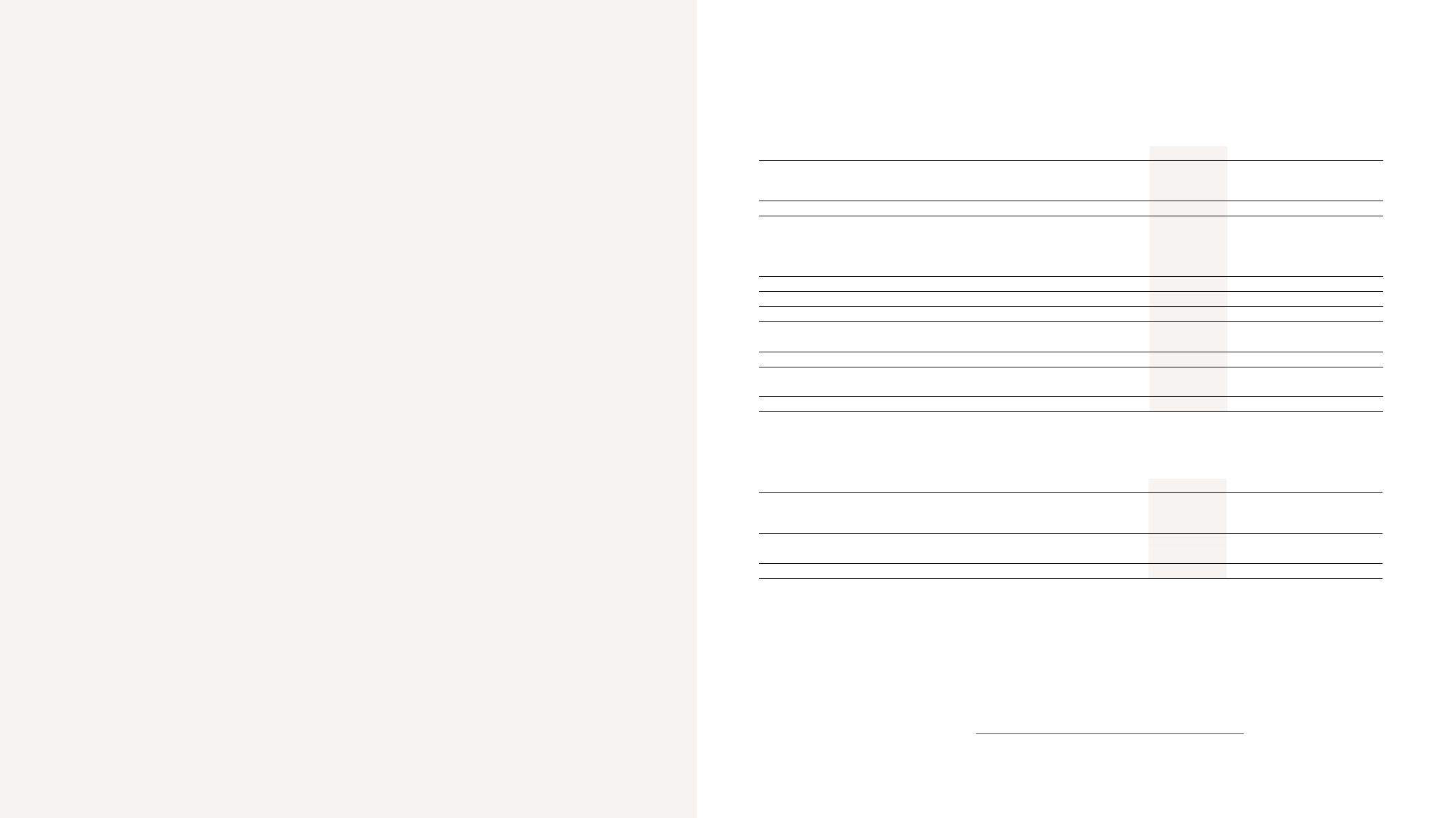

Owners

Simplified

Company Structure

Heimstaden is an industrial investor and owns

Heimstaden Bostad together with long-term

institutional investors who share Heimstaden’s

philosophy for evergreen and sustainable

investments. Heimstaden is also the Manager of

Heimstaden Bostad. The property companies are

fully owned by Heimstaden Bostad, except for

Iceland, which is owned by Heimstaden.

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

7

Quarterly Review

This report is presented on a consolidated basis. For information

on Heimstaden’s standalone financials, see pages 44-46.

Figures in brackets refer to the previous quarter.

Income

Rental income increased by 2.7% to SEK 3,905 million (3,800), driven primarily by

incrased income from standing assets and favourable exchange rate developments.

Service charges paid by tenants decreased to SEK 389 million (414), mainly due to

lower heating consumption.

Like-for-like rental income growth was 4.2% (5.7%). The comparable portfolio made

up 88% (90%) of rental income.

Residential real economic occupancy was stable of 98.1% (98.2%), excluding 2.4%

(2.2%) in vacancy due to refurbishments and other non-market related vacancies.

Operating expenses

Utility expenses decreased to SEK 458 million (494), mainly related to seasonal varie-

ties. Due to different rental regimes between markets, these costs impact net operat-

ing income margins differently. See Note 3 for more details.

Repair and maintenance was stable and amounted to SEK181 million (196). Costs

for facility and property management increased to SEK 667 million (623).

Capital expenditures and Repair & Maintenance

Total expenditure in standing assets was SEK 1,412 million (1,506), corresponding

to 0.42% of fair value (0.43%), while investments in properties under construction,

excluding forward purchase contracts, amounted to SEK 851 million (758) as the

number of homes under constrution was reduced from 3,539 to 3,484 at the end of

second quarter. More details on page 10.

SEK million Q3 2023 Q2 2023 YTD 2023 YTD 2022

Income statement items

Expenses for repair & maintenance

1

220 237 688 708

Balance sheet items

Capitalised cost on standing assets excluding

tenant improvements 761 724 2,086 2,805

Tenant improvements 431 545 1,452 942

Balance sheet expenditure 1,192 1,269 3,539 3,748

Expenditure on standing assets 1,412 1,506 4,226 4,456

Investment properties under construction 851 758 2,574 3,219

Capital expenditures 2,042 2,026 6,113 6,967

1

Excluding group eliminations, see Note 3

Rental Economic Occupancy

%

Property Expenses

SEK million

Rental Income Development

Q3 2023Foreign

currency effect

Standing

assets

Acquisitions

and divestments

Q2 2023

3,800

15

25

63

3,905

Property Cost Development

Q3 2023Foreign

currency effect

Standing

assets

Acquisitions

and divestments

Q2 2023

1,592

10

-46

23

1,579

Rental Income

SEK million

Real Economic Occupancy

Q3 23Q2 23Q1 23Q4 22Q3 22

1.9

98.4

96.5

1.9

98.2

96.3

1.9

98.2

96.3

2.2

98.2

96.0

2.4

98.1

95.8

Economic occupancy Non-market vacancy adjustments

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

8

Net operating income

Net operating income grew by 3.5% to SEK 2,714 million (2,623), resulting in a net

operating income margin of 69.5% (69.0%), mainly driven by rental growth, lower

utility costs, and delivery of new builds.

Change in fair value of investment properties

1

Net loss from fair value adjustments on investment properties was SEK 4,946 million

(7,349) corresponding to -1.4% of fair value. The yield requirement in the valuation

amounted to an average 3.50%, up from 3.42% at the end of the previous quarter

mainly driven by sentiment-based yield increase.

Q3 2023 YTD 2023

SEK million % SEK million % SEK million

Sweden -2.5 -2,319 -8.0 -8,018

Germany -2.5 -2,130 -12.4 -11,975

Denmark -0.5 -373 -5.2 -4,083

Netherlands -0.5 -143 -10.8 -3,403

Czech Republic 1.6 400 4.2 1,026

Norway -2.5 -464 1.4 243

Iceland 0.6 38 4.1 240

Finland -2.7 -106 -6.1 -250

United Kingdom 2.3 97 9.9 385

Poland 3.7 54 5.4 77

Total -1.4 -4,946 -7.1 -25,758

1

For more information regarding fair value assessments, see Note 7.

Interest expenses

Interest expenses was SEK 1,561 million (1,422) and the average interest rate

was 3.0% (2.7%). At the balance sheet date the interest rate hedge ratio was

76%(78%). The interest coverage ratio for the last 12 months was 1.8 (2.0).

Foreign currency

Heimstaden has holdings and operations in SEK, EUR, DKK, NOK, CZK, PLN, GBP

and ISK. Exchange differences on translation of foreign operations gave other com-

prehensive loss of SEK3,331 million (income 7,402), which was partially offset by

SEK 1,500 million in foreign exchange gain (loss 3,678), the latter mainly related to

bonds issued in EUR. For more details, see Note 13.

Cash Flow

SEK million Q3 2023 Q2 2023 YTD 2023 YTD 2022

Operating activities 631 57 703 2,072

Investing activities -1,203 -1,970 -4,352 -18,960

Financing activities -1,758 -1,243 -578 3,197

Currency effects 3 268 246 528

Change -2,331 -2,887 -4,227 -13,162

Period opening balance - Cash and cash

equivalents 9,670 12,556 11,323 20,488

Closing balance - Cash and cash equivalents 7,342 9,669 7,343 7,325

Cash generated from operation was SEK 2,719 million (1,162). Interest and taxes

paid in period was SEK –2,088 million (1,105) resulting in a net cash flow from oper-

ating activities of SEK 631 million (57). The main difference between operating profit

and cash flow from operations is fair value adjustments on investment properties of

SEK -4,946 million (-7,339).

Cash flow from investing activities was SEK -1,203 million (-1,970) and included

Capex on investment properties of SEK 2,061million (2,043), and divestments of in-

vestment property of SEK 437 million (259).

Cash flow from financing activities was negative SEK 1,758 million (1,243), where

repayments of loans exceeded proceeds from new financing, with a net effect of

SEK -1,686 million (608).

Earnings per share

Heimstaden will no longer report earnings per share (EPS), a financial metric rele-

vant only to companies where the shareholders do not have defined shareholdings

across several share classes.

Like-for-Like Rental Income Growth

Q3 23Q2 23Q1 23Q4 22Q3 22

5.5

5.4

5.0

4.2

5.7

Net Operating Income and Margin

Q3 23Q2 23Q1 23Q4 22Q3 22

63.4

7,783

64.4

8,497

64.9

8,925

66.2

9,432

66.4

9,885

Q3 23Q2 23Q1 23Q4 22Q3 22

Net Operating Income and Margin

Last twelve months, SEK million / %

Like-for-Like Rental Income Growth

year-on-year, %

LTM Net operating income LTM Net operating income margin

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

9

30 Sep 2023Fair value lossForeign currencyCapexDivestmentsAcquisitions30 Jun 2023

192

2,043

-4,946

338,754

-4,529

346,629

-635

Fair Value Development

SEK million

Investment Properties

Fair Value Development

Fair value of investment properties increased to SEK 339

billion, down from SEK 347 billion at 30 June 2023, mainly

through a foreign currency loss of SEK 4.5 billion, and an

unrealised fair value loss of SEK 4.9 billion and capital ex-

penditures of SEK 2.0 billion. The portfolio includes 163,157

(162,166) homes across ten markets. Residential units made

up 92.6% of fair value and 55.8% of residential in- come

comes from regulated units.

The decrease in fair value in Q3 2023 was primarily driven

by negative valuation movements in Sweden, Germany and

Finland where sentiment-based yield increases (in some

cases supported by a limited number of individual compa-

rable transactions) outweighed the positive effects of rental

increases. Norway and Iceland also saw values decrease

driven by negative owner-occupier price developments.

Denmark and The Netherlands saw values stabilise as rental

performance and owner-occupier price developments (and

outlook) mitigated the effects of increasing yields. Strong

rent roll performance saw increasing values in the Czech Re-

public, United Kingdom and Poland.

The elevated economic volatility in recent months has in-

creased forward looking uncertainty. Assuming it moderates

and based on Heimstaden’s expected portfolio operational

performance and external valuer forward looking sentiment,

on a like-for-like basis we expect the aggregate portfolio

value to continue to trend towards stabilisation over the next

1-2 quarters (with some variance shown between individual

country portfolios).

Methodology

Heimstaden’s investment properties are valued externally

on a quarterly basis, or with interim indexation applied to

the latest annual valuation (Norway residential only). For all

external valuations the Group instructs a real estate advisory

company with appropriate qualifications, experience, and

the capacity to carry out the valuation in accordance with

the required standards.

In addition, Heimstaden uses a dedicated in-house valua-

tion team to ensure quality control of all external valuations

and the execution of standardised structures and processes

across its markets.

The valuation methodologies the external valuers adopt are

based on best market practice in each respective country,

typically an explicit income, implicit income, or direct own-

er-occupier sales comparison approach. In general, val-

uations are based on a “highest-and-best-use” principle,

adopting the highest value given by a re-letting scenario

(assuming a re-letting of units at market terms upon tenant

churn) and a divestment scenario (assuming a sale of each

unit upon tenant churn). For properties under construction,

external valuers provide a market value on the special as-

sumption the proposed development works have been com-

pleted and occupancy is stabilised, from which Heimstaden

deducts remaining costs to complete and appropriate devel-

opment risk premia to arrive at a fair value.

For more details, see Note 3.1 on page 58 in the 2022 An-

nual Report

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

10

Capital Expenditures

Four pillars of capital expenditures

Heimstaden allocates Capex across two main segments: value

preserving and value increasing. These non-recurring projects aim

to upgrade, extend or improve the quality and lifetime of an exist-

ing asset with little mandatory commitment while maintaining high

optionality.

Those segments are built upon four categories. Value preserving

segment holds all maintenance Capex while the value increasing

segment is comprised of Sustainability Capex, Tenant Improve-

ments, and Value add Capex.

Maintenance

Maintenance Capex projects preserve the value of an asset or im-

prove tenant quality and satisfaction. All spend is measured in-

dividually and alternative investment calculations are carried out

considering when to repair versus replace.

Sustainability

Sustainability Capex projects contribute to the Company’s ESG tar-

gets and Climate Roadmap by reducing either energy consumption

through efficiency measures or CO

2

emissions through fuel shifts.

Projects are evaluated from both an emission reduction perspective

as well as a financial.

Tenant improvements

Unit refurbishments are carried out at churn when deemed eco-

nomically viable. Primarily made up of residential units, but can in-

clude improvements on the commercial leases as well. All spend is

optional and viewed on a case-by-case basis where accretive to the

business plan.

Value add Capex

Value add projects carried out opportunistically within standing

assets to increase the value and grow NOI. Projects include exten-

sions adding rentable square meters, attic apartment conversions,

infill buildings, and income producing property upgrades. All pro-

jects evaluated and approved on case-by-case basis as per group

authority matrix.

Capital Expenditures

1

Q3 2023 YTD 2023 Q3 2022 YTD 2022

SEK million %

2

SEK million %

2

SEK million %

2

SEK million %

2

SEK million

Sweden 0.49 454 1.28 1,246 0.52 530 1.76 1,723

Germany 0.17 148 0.59 548 0.37 302 0.77 546

Denmark 0.16 124 0.49 366 0.15 108 0.51 340

Netherlands 0.65 188 2.15 647 0.64 198 1.94 530

Czech Republic 0.80 210 2.28 534 0.95 201 2.48 445

Norway 0.06 11 0.20 41 0.15 32 0.55 105

Iceland 0.11 7 0.88 49 0.27 15 0.76 34

Finland 1.22 48 2,79 107 0.28 10 2.39 24

Total 0.34 1,192 1.01 3,539 0.41 1,395 1.23 3,748

1

Capital expenditure on standing assets

2

Capital expenditure on standing assets in relation to investment properties

Signed Acquisitions

Heimstaden expands and improves its portfolio through acquisitions of standing assets and newbuilds.

No new signed acquisitions have been made during the quarter.

Newbuild investments are structured either as forward purchase or forward funding. In a forward pur-

chase transaction, Heimstaden commits to buying new turnkey investment properties, which are not

recognised on the balance sheet until delivery.

In a forward funding transaction, Heimstaden incurs Capex throughout the development phase based on

construction milestones, but do not take on direct development risk. To mitigate counterparty risk, Heim-

staden performs thorough due diligence and only partners with robust and experienced counterparties.

In Q3 2023, Heimstaden Bostad reached agreements with developers on two turn-key projects whereby

the developers have bought themselves out of their turnkey obligations via payment to Heimstaden

Bostad. As a result of the agreement, Heimstaden Bostad also reduces future commitments by SEK

1,222 million.

Heimstaden has forward funding contracts with a total capital expenditure commitment of SEK 2.7

billion. The total pipeline of signed acquisitions, including standing assets and newbuilds, amounts to

SEK3.2 billion. For more details, see Note 14.

Remaining Commitments

SEK million

2026202520242023

1,654

3,347

313

627

Forward funding

Own development

Forward purchase

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

11

Portfolio Overview

85

75

4

28

18

26

6

4

92

2

Fair Value

339

SEK billion

Country

Fair Value,

SEK million

Fair Value

/sqm, SEK

Homes,

units

Residen-

tial,%

Regulated

Income,

1

%

Real Economic

Occupancy, %

Sweden 91,656 27,319 46,236 90.0 100.0 99.0

Germany 84,595 42,329 29,708 91.0 100.0 99.2

Denmark 74,900 36,866 20,793 94.5 14.4 97.2

Netherlands 28,180 26,756 13,351 98.1 59.2 99.7

Czech Republic 25,509 9,787 42,547 95.9 25.1 96.4

Norway 18,170 86,760 4,004 86.8 0.0 99.6

Iceland

2

6,109 41,799 1,625 100.0 0.0 99.9

United Kingdom 4,268 56,580 949 99.7 0.0 83.2

Finland 3,853 20,698 3,167 95.6 0.0 93.6

Poland 1,515 40,468 777 88.8 0.0. 97.1

Total 338,754 28,936 163,157 92.6 55.8 98.1

1

Residential income

2

Properties in Iceland are owned 100% by Heimstaden

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

12

Q3 2023 Q2 2023 Q3 2022 YTD 2023 YTD 2022

Rental income SEK m 1,115 1,115 997 3 319 3,156

Net operating income SEK m 725 674 571 1 949 1,709

Net operating income margin % 65.1 60.5 57.3 58,7% 54.2

Like-for-like rental income growth % 4.8 5.4 3.2 4,5% 3.0

Real economic occupancy % 99.0 99.3 99.1 99,1% 99.0

Fair value of investment properties SEK m 91,656 93,219 100,395 91,656 100,395

Fair value change SEK m -2,319 -2,527 -2,955 -8,018 -2,101

Capital expenditures SEK m 755 718 1,057 2,239 3,247

Average valuation yield requirement

1

% 3.3 3.2 2.8 3.3 2.8

Acquisitions SEK m – – 154 24 1,987

Divestments SEK m – – -18 -33 -471

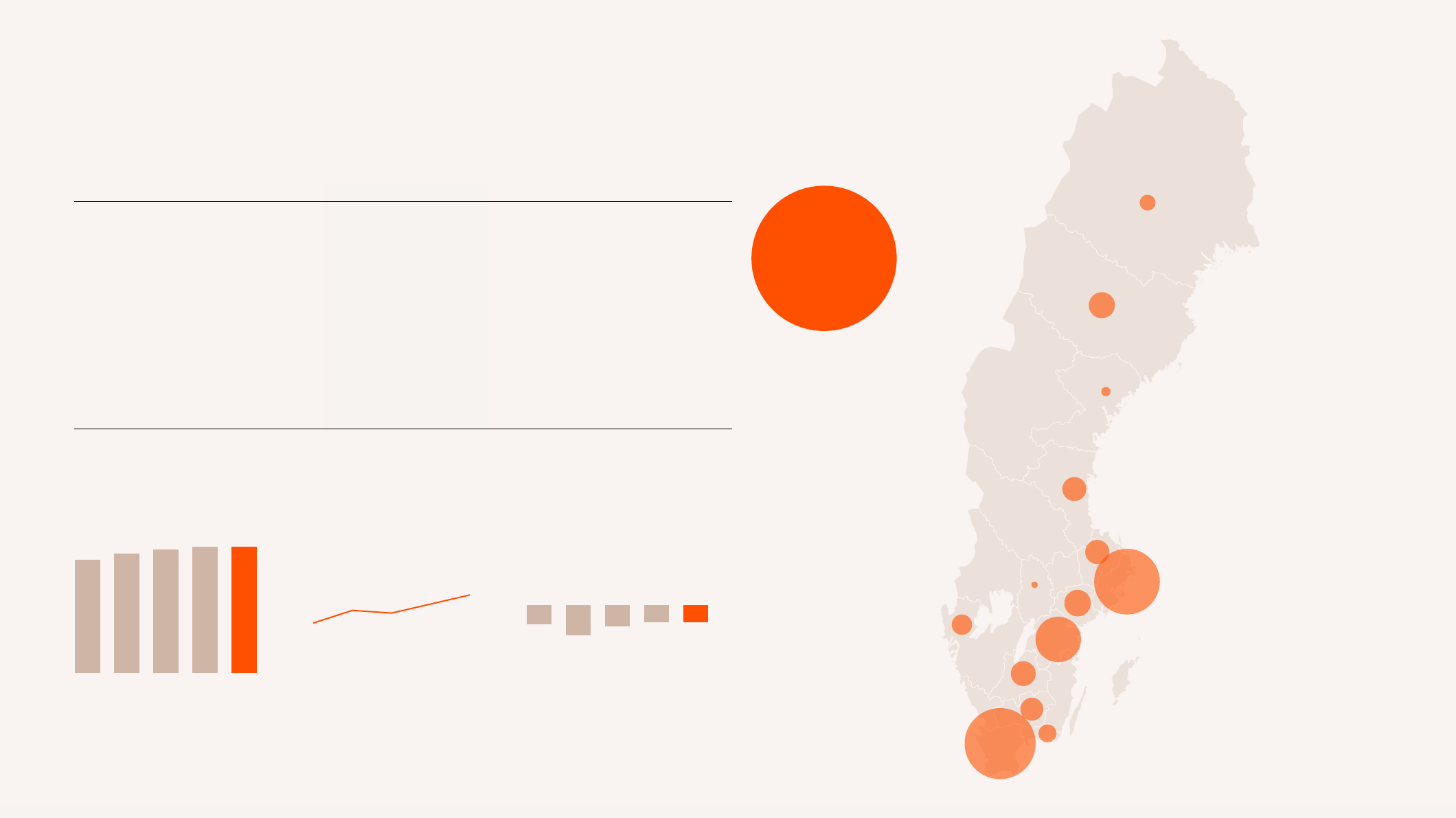

Q3 23Q2 23Q1 23Q4 22Q3 22

997

1,052

1,089

1,115 1,115

Q3 23Q2 23Q1 23Q4 22

Q3 22

51.0

53.8

53.2

55.2

57.2

Q3 23Q2 23Q1 23Q4 22Q3 22

-2.9 -4.6

-3.2 -2.6 -2.5

Rental Income

SEK million

Fair Value Change

%

Net Operating Income Margin

Last twelve months, %

Sweden

Fair Value

92

SEK billion

Skåne County

Stockholm County

Östergötland County

Västerbotten County

Södermanland County

Uppsala County

Gävleborg County

Jönköping County

Kronoberg County

Nordbotten County

Västra Götaland County

Blekinge County

1

The yield applied on the valuation-assumed property-generated cashflow to determine the valuation of said property. The yield corresponds to the valuers market

assumptions in each region.

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

13

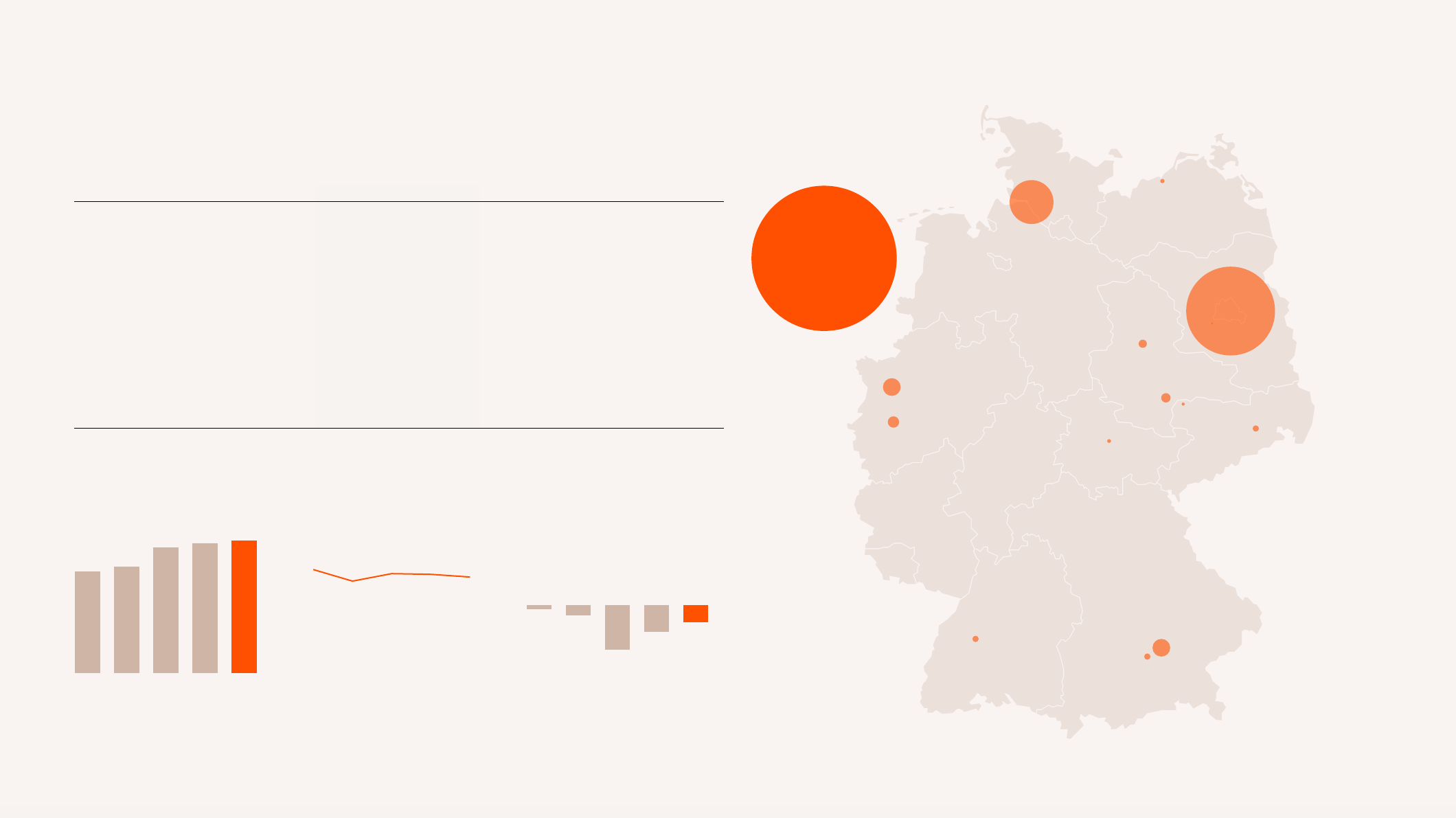

Q3 2023 Q2 2023 Q3 2022 YTD 2023 YTD 2022

Rental income SEK m 683 666 523 1,994 1,517

Net operating income SEK m 500 507 390 1,510 1,142

Net operating income margin % 73.3 76.0 74.6 75.7 75.3

Like-for-like rental income growth % 3.6 5.3 5.3 4.8 11.6

Real economic occupancy % 99.2 98.8 98.5 99.1 98.4

Fair value of investment properties SEK m 84,595 88,102 83,101 84,595 83,101

Fair value change SEK m -2,130 -3,656 -498 -11,975 4,534

Capital expenditures SEK m 149 198 256 549 546

Average valuation yield requirement

1

% 2.7 2.6 2.3 2.7 2.3

Acquisitions SEK m – – -2 – 2,618

Divestments SEK m – – -21 – -25

Rental Income

SEK million

Fair Value Change

%

Net Operating Income Margin

Last twelve months, %

Q3 23Q2 23Q1 23Q4 22Q3 22

523

548

645

666

683

Q3 23Q2 23Q1 23Q4 22

Q3 22

75.2

73.5

74.6 74.5

74.1

Q3 23Q2 23Q1 23Q4 22Q3 22

-0.6 -1.5 -6.6 -4.0 -2.5

Germany

Berlin

Hamburg

Düsseldorf

Bonn

Munich

Garching

Stuttgart

Halle

Magdeburg

Rostock

Dresden

Erfurt

Fair Value

85

SEK billion

1

The yield applied on the valuation-assumed property-generated cashflow to determine the valuation of said property. The yield corresponds to the valuers market

assumptions in each region.

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

14

Q3 2023 Q2 2023 Q3 2022 YTD 2023 YTD 2022

Rental income SEK m 912 873 762 2,644 2,224

Net operating income SEK m 649 605 534 1,822 1,548

Net operating income margin % 71.2 69.3 70.1 68.9 69.6

Like-for-like rental income growth % 0.5 1.0 5.2 1.0 6.1

Real economic occupancy % 97.2 96.9 97.6 96.9 98.4

Fair value of investment properties SEK m 74,900 76,286 74,711 74,900 74,711

Fair value change SEK m -373 -528 -1,859 -4,097 -54

Capital expenditures SEK m 330 300 292 873 937

Average valuation yield requirement

1

% 4.1 4.1 3.6 4.1 3.6

Acquisitions SEK m 5.7 38 1,219 1.696 2,846

Divestments SEK m -19 – -10 -19 -16

Rental Income

SEK million

Fair Value Change

%

Net Operating Income Margin

Last twelve months, %

Q3 23Q2 23Q1 23Q4 22Q3 22

762

802

859 873

912

Q3 23Q2 23Q1 23Q4 22

Q3 22

69.1

68.3

67.4 67.5

68.0

Q3 23Q2 23Q1 23Q4 22Q3 22

-2.4 -3.7 -4.2 -0.7 -0.5

Denmark

København

Østjylland

Fyn

Sydjylland

Københavns omegn

Vestjylland

Nordjylland

Vest- og Sydsjælland

Østsjælland

Nordsjælland

Jylland

Fair Value

75

SEK billion

1

The yield applied on the valuation-assumed property-generated cashflow to determine the valuation of said property. The yield corresponds to the valuers market

assumptions in each region.

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

15

Q3 2023 Q2 2023 Q3 2022 YTD 2023 YTD 2022

Rental income SEK m 366 346 315 1,050 914

Net operating income SEK m 278 272 210 797 591

Net operating income margin % 76.0 78.5 66.9 75.9 64.7

Like-for-like rental income growth % 4.1 4.8 4.1 4.6 3.3

Real economic occupancy % 99.7 99.7 99.7 99.7 99.7

Fair value of investment properties SEK m 28,180 28,714 30,444 28,180 30,444

Fair value change SEK m -143 -862 -985 -3,403 634

Capital expenditures SEK m 188 229 198 647 530

Average valuation yield requirement

1

% 3.7 3.7 2.9 3.7 2.9

Acquisitions SEK m – – – – 196

Divestments SEK m -82 -55 -11 -152 -14

Rental Income

SEK million

Fair Value Change

%

Net Operating Income Margin

Last twelve months, %

Q3 23Q2 23Q1 23Q4 22Q3 22

315

328

338

346

366

Q3 23Q2 23Q1 23Q4 22

Q3 22

62.8

65.2

68.4

71.4

73.7

Q3 23Q2 23Q1 23Q4 22Q3 22

-3.1 -1.4 -7.8 -2.9 -0.5

Netherlands

Fair Value

28

SEK billion

1

The yield applied on the valuation-assumed property-generated cashflow to determine the valuation of said property. The yield corresponds to the valuers market

assumptions in each region.

Groningen

Rotterdam

Arnhem

Utrecht

Heerlen

Den Haag

Amsterdam

Alkmaar

Schiedam

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

16

Q3 2023 Q2 2023 Q3 2022 YTD 2023 YTD 2022

Rental income SEK m 434 443 344 1,292 994

Net operating income SEK m 307 324 249 932 703

Net operating income margin % 70.9 73.0 72.3 72.1 70.8

Like-for-like rental income growth % 10.1 15.8 9.6 13.8 8.0

Real economic occupancy % 96.4 96.8 97.0 96.8 96.8

Fair value of investment properties SEK m 25,509 26,121 22,209 25,509 22,209

Fair value change SEK m 400 240 337 1,026 2,321

Capital expenditures SEK m 210 189 201 534 471

Average valuation yield requirement

1

% 4.7 4.6 4.4 4.7 4.4

Acquisitions SEK m – – – – –

Divestments SEK m -19 -5 – -24 -1

Rental Income

SEK million

Fair Value Change

%

Net Operating Income Margin

Last twelve months, %

Q3 23Q2 23Q1 23Q4 22Q3 22

344

414

443

388

434

Q3 23Q2 23Q1 23Q4 22

Q3 22

68.7

69.2

70.0

70.9 70.6

Q3 23Q2 23Q1 23Q4 22Q3 22

1.5

0.2

1.6

0.9

1.6

Czech Republic

Fair Value

26

SEK billion

1

The yield applied on the valuation-assumed property-generated cashflow to determine the valuation of said property. The yield corresponds to the valuers market

assumptions in each region.

Ostrava

Pilsen

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

17

Q3 2023 Q2 2023 Q3 2022 YTD 2023 YTD 2022

Rental income SEK m 189 176 193 561 559

Net operating income SEK m 142 136 131 429 374

Net operating income margin % 74.9 77.3 67.9 76.5 66.8

Like-for-like rental income growth % 6.3 8.0 10.5 7.2 8.1

Real economic occupancy % 99.6 99.2 98.7 99.4 97.6

Fair value of investment properties SEK m 18,170 18,667 20,417 18,170 20,417

Fair value change SEK m -464 -10 -348 243 977

Capital expenditures SEK m 31 64 60 141 262

Average valuation yield requirement

1

% 3.2 3.0 2.9 3.2 2.9

Acquisitions SEK m – – 1 – 125

Divestments SEK m -189 24 – -1,522 -6

Rental Income

SEK million

Fair Value Change

%

Net Operating Income Margin

Last twelve months, %

Q3 23Q2 23Q1 23Q4 22Q3 22

193

195

176

198

189

Q3 23Q2 23Q1 23Q4 22

Q3 22

64.1

68.4

72.9

73.8

75.6

Q3 23Q2 23Q1 23Q4 22Q3 22

-1.7 -3.4

4.1

-0.1 -2.5

Norway

Fair Value

18

SEK billion

Oslo

1

The yield applied on the valuation-assumed property-generated cashflow to determine the valuation of said property. The yield corresponds to the valuers market

assumptions in each region.

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

Reykjavík

South Peninsula

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

18

Q3 2023 Q2 2023 Q3 2022 YTD 2023 YTD 2022

Rental income SEK m 87 83 77 249 220

Net operating income SEK m 58 58 54 167 145

Net operating income margin % 66.5 69.2 69.2 67.1 66.0

Like-for-like rental income growth % 4.9 11.0 N/A 9.6 N/A

Real economic occupancy % 99.9 99.9 99.7 99.9 99.4

Fair value of investment properties SEK m 6,109 6,013 5,624 6,109 5,624

Fair value change SEK m 38 52 18 240 573

Capital expenditures SEK m 7 21 15 49 34

Average valuation yield requirement

1

% 4.6 4.2 4.6 4.6 4.6

Acquisitions SEK m 181 – – 181 –

Divestments SEK m -154 -225 -3 -379 -3

Rental Income

SEK million

Fair Value Change

%

Net Operating Income Margin

Last twelve months, %

77 78

Q3 23Q2 23Q1 23Q4 22Q3 22

78

83

87

Q3 23Q2 23Q1 23Q4 22

Q3 22

64.3

65.7

66.4

67.2

66.6

Q3 23Q2 23Q1 23Q4 22Q3 22

0.3

4.2

2.6

0,9

0.6

Iceland

Fair Value

6

SEK billion

1

The yield applied on the valuation-assumed property-generated cashflow to determine the valuation of said property. The yield corresponds to the valuers market

assumptions in each region.

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

19

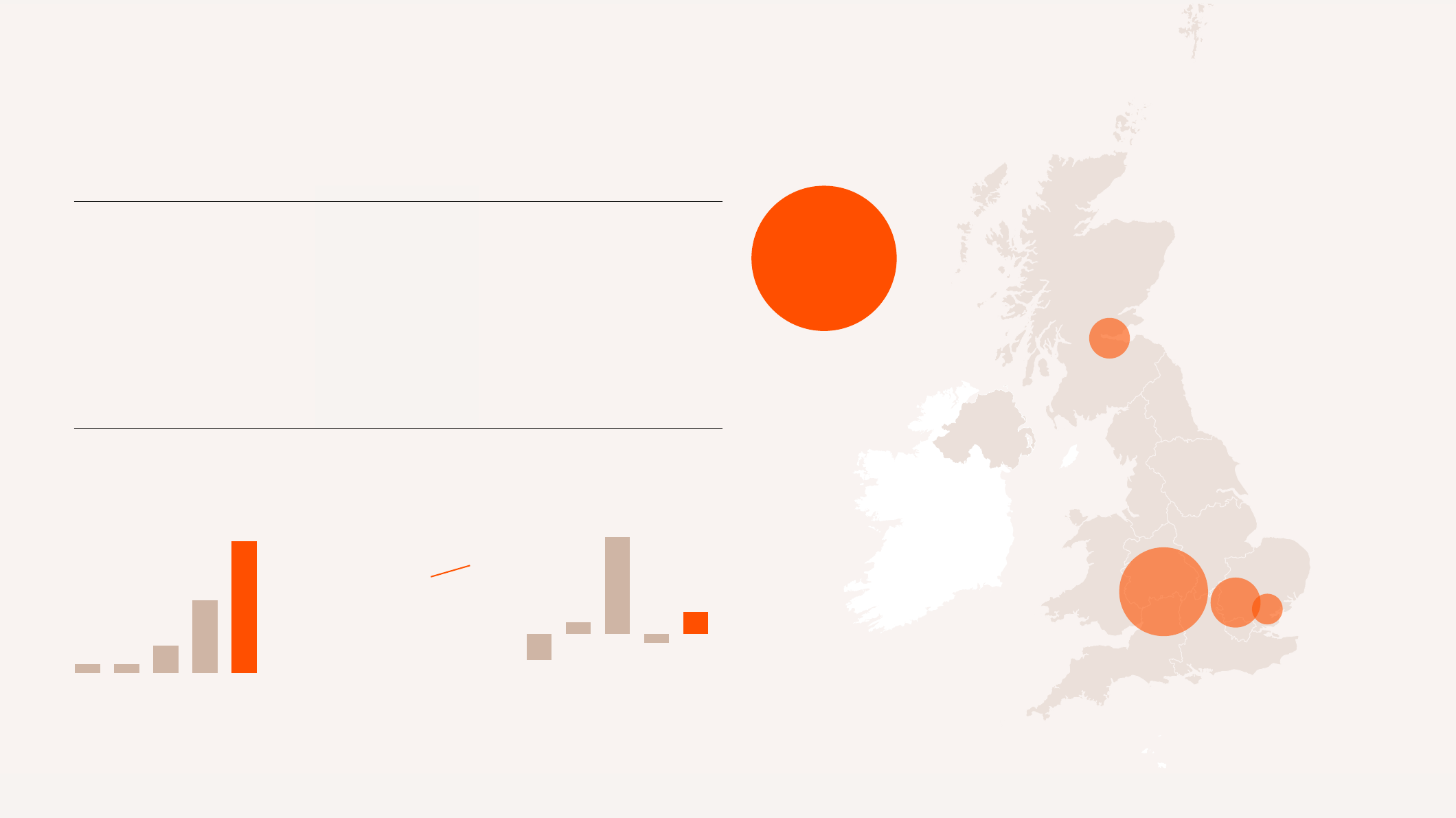

Q3 2023 Q2 2023 Q3 2022 YTD 2023 YTD 2022

Rental income SEK m 29 16 2 52 6

Net operating income SEK m 7 6 1 13 1

Net operating income margin % 23.7 38.5 N/A 24.9 N/A

Like-for-like rental income growth % 5.1 3.0 N/A 3.0 N/A

Real economic occupancy % 83.2 83.8 99.6 83.4 99.2

Fair value of investment properties SEK m 4,268 4,008 2,370 4,268 2,370

Fair value change SEK m 97 -37 -66 385 164

Capital expenditures SEK m 293 233 348 860 916

Average valuation yield requirement

1

% 4.4 4.3 4.5 4.4 4.5

Acquisitions SEK m – – – – 268

Divestments SEK m – – – – –

United Kingdom

Fair Value

4

SEK billion

Birmingham

City of Edinburgh

Barnet

Essex

1

The yield applied on the valuation-assumed property-generated cashflow to determine the valuation of said property. The yield corresponds to the valuers market

assumptions in each region.

Rental Income

SEK million

Fair Value Change

%

Net Operating Income Margin

Last twelve months, %

16

6

22

Q3 23Q2 23Q1 23Q4 22Q3 22

29

21.2

Q3 23Q2 23Q1 23Q4 22

Q3 22

23.7

-0.9

10.0

1.2

-2.7

Q3 23Q2 23Q1 23Q4 22Q3 22

2.3

1

The yield applied on the valuation-assumed property-generated cashflow to determine the valuation of said property. The yield corresponds to the valuers market

assumptions in each region.

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

20

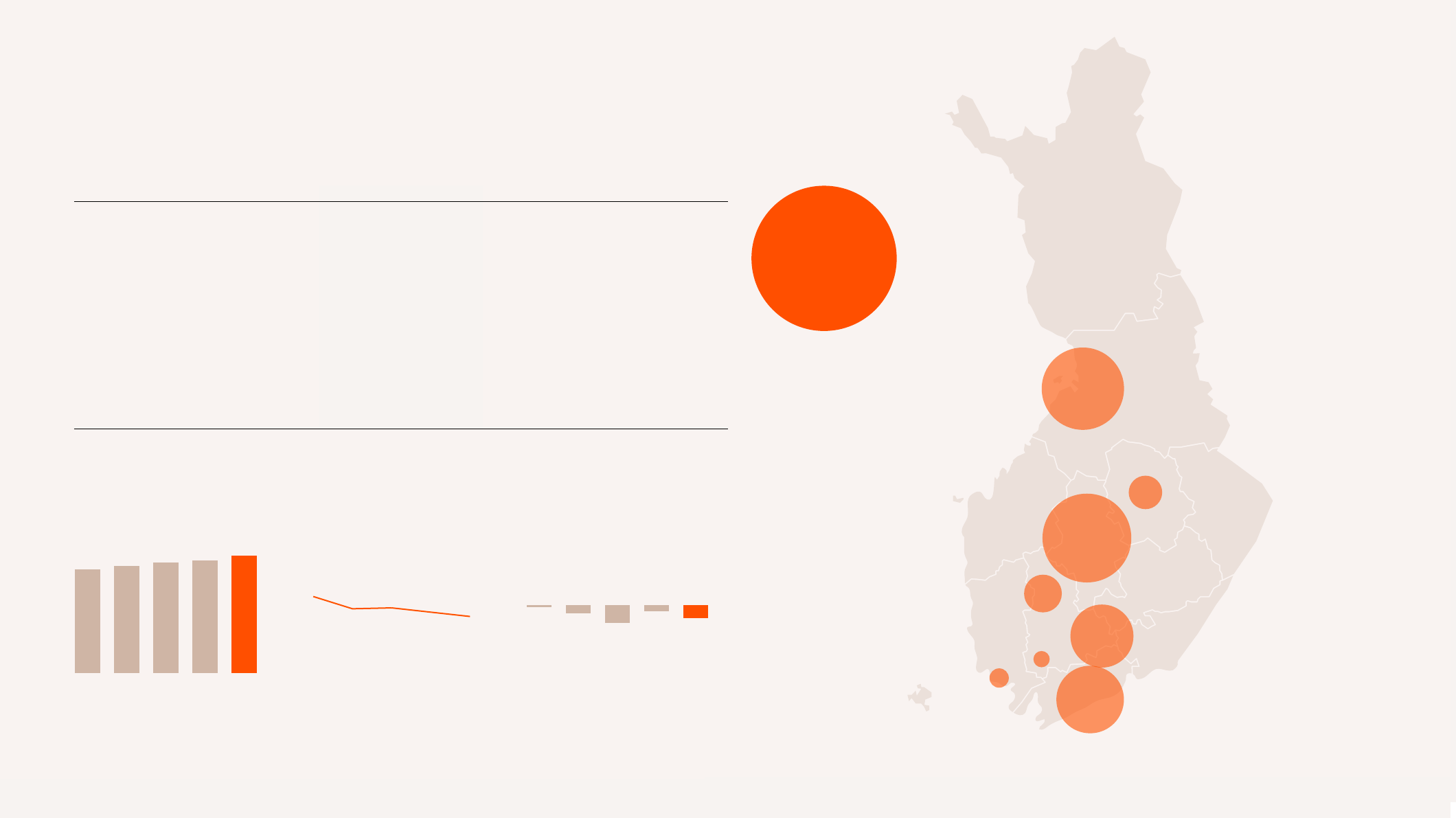

Q3 2023 Q2 2023 Q3 2022 YTD 2023 YTD 2022

Rental income SEK m 69 66 61 199 130

Net operating income SEK m 34 31 36 94 69

Net operating income margin % 50.3 46.9 58.9 47.1 53.3

Like-for-like rental income growth % 3.5 0.8 N/A 1.6 N/A

Real economic occupancy % 93.6 93.3 95.5 93.6 95.6

Fair value of investment properties SEK m 3,853 3,976 3,711 3,853 3,711

Fair value change SEK m -106 -38 -10 -250 200

Capital expenditures SEK m 48 41 10 106 24

Average valuation yield requirement

1

% 4.4 4.3 5.3 4.4 5.3

Acquisitions SEK m – – – – 1,962

Divestments SEK m – – – – –

Rental Income

SEK million

Fair Value Change

%

Net Operating Income Margin

Last twelve months, %

61

63

65

Q3 23Q2 23Q1 23Q4 22Q3 22

66

69

Q3 23Q2 23Q1 23Q4 22

Q3 22

53.7

48.3

48.7

46.8

44.9

Q3 23Q2 23Q1 23Q4 22Q3 22

-2.7 -0.9 -2.7-0.3 -1.2

Finland

Fair Value

4

SEK billion

Central Finland

North Ostrobothnia

Helsinki-Uusimaa

Päijät-Häme

North Savo

Pirkanmaa

1

The yield applied on the valuation-assumed property-generated cashflow to determine the valuation of said property. The yield corresponds to the valuers market

assumptions in each region.

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

21

Q3 2023 Q2 2023 Q3 2022 YTD 2023 YTD 2022

Rental income SEK m 21 15 1 45 1

Net operating income SEK m 12 10 -3 26 -6

Net operating income margin % 59.1 65.1 N/A 58.1 N/A

Like-for-like rental income growth % N/A N/A N/A N/A N/A

Real economic occupancy % 97.1 92.4 94.6 95.3 94.6

Fair value of investment properties SEK m 1,515 1,522 474 1,515 474

Fair value change SEK m 54 17 14 77 14

Capital expenditures SEK m 32 33 – 115 –

Average valuation yield requirement

1

% 5.4 5.6 5.0 5.4 5

Acquisitions SEK m 5 117 462 249 462

Divestments SEK m – – – – –

Poland

Fair Value

2

SEK billion

Warsaw

1

The yield applied on the valuation-assumed property-generated cashflow to determine the valuation of said property. The yield corresponds to the valuers market

assumptions in each region.

Rental Income

SEK million

Fair Value Change

%

Net Operating Income Margin

Last twelve months, %

Q3 23Q2 23Q1 23Q4 22Q3 22

15

9

5

1

21

Q3 23Q2 23Q1 23Q4 22

Q3 22

50.5

Q3 23Q2 23Q1 23Q4 22Q3 22

1.1

0.5

6.6

3.0

3.7

1

The yield applied on the valuation-assumed property-generated cashflow to determine the valuation of said property. The yield corresponds to the valuers market

assumptions in each region.

Krakow

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

22

2032+203120302029202820272026202520242023

1,178

23,772

39,026

21,639

43,318

14.244

17,782

14,651

21,591

6,827

Financing Overview

Owning and operating residential real estate requires stable access to capital at favoura-

ble terms. In line with announced strategy Heimstaden’s primary focus on a standalone

basis is to further reduce leverage to obtain a financial structure that creates resilience

in a macro environment associated with increasing risk of refinancing. As part of that

strategy Heimstaden successfully completed a bond buyback to proactively improve the

company’s debt maturity profile and strengthen the balance sheet.

Funding strategy

Heimstaden is through available sources of funding building a cash position that will

serve to meet upcoming debt maturities and refinancing needs and support the de-

leveraging strategy to create a more robust balance sheet and conservative financial

structure.

During the quarter, Heimstaden tendered a total consideration of SEK 530 million

senior unsecured bonds under its EMTN programme with a maturity in 2024 and

2025. At the end of the period, Heimstaden had SEK 12,088 million in senior unse-

cured bonds and a SEK 7,925 million hybrid bond outstanding, all listed on Nasdaq

Stockholm.

Rating

Fitch lowered Heimstaden’s rating by one notch to ‘BB’ and revised the Outlook to

Rating Watch Negative. The downgrade reflects a forecasted weaking of the interest

coverage ratio.

See pages 46-49 for more information on Heimstaden’s debt instruments and stan-

dalone financials.

Interest bearing liabilities maturity

SEK million

Bank debt Mortgage debt Senior unsecured bonds Commercial paper

BBB

S&P and Fitch credit ratings

of Heimstaden Bostad

BB

Fitch credit rating

of Heimstaden

2032+

203120302029202820272026202520242023

0

4,460

0

3,446

000 00 0

Hybrid bonds reset dates

SEK million

Hybrid bonds

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

23

Credit Metrics

Q3 23Q2 23Q1 23Q4 22Q3 22

52.2

53.6

54.9

57.2 57.9

Q3 23Q2 23Q1 23Q4 22Q3 22

15

18

48

19

1

14

17

45

23

1

14

18

41

28

1

15

18

40

27

0

15

18

38

29

0

Q3 23Q2 23Q1 23Q4 22Q3 22

1.6

2.1

2.5

2.7

3.0

Q3 23Q2 23Q1 23Q4 22Q3 22

Average loan tenor

8.3

8.0

8.1

8.0 8.0

Q3 23Q2 23Q1 23Q4 22Q2 22

76

78

77 76

76

Q3 23Q2 23Q1 23Q4 22Q3 22

2.7

2.6

2.3

2.0

1.8

Net Loan-to-Value (LTV)

%

Average Interest Rate

%

Funding Distribution

%

Average Loan Tenor

%

Interest Rate Hedge Ratio

%

ICR

multiple

Bank debt Senior unsecured bonds Commercial paper

Hybrid bonds Mortgage debt

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

24

Condensed Consolidated Financial Statements and Notes

Condensed Consolidated FinancialStatements

Condensed Consolidated Statement of Comprehensive Income

25

Condensed Consolidated Statement of Financial Position

26

Condensed Consolidated Statement of Changes in Equity

27

Condensed Consolidated Cash Flow Statement

28

Notes to the Condensed Consolidated Financial Statements

29

1. Accounting Principles

29

2. Related Parties

29

3. Segment Reporting

30

4. Rental Income

32

5. Other Operating Expenses

32

6. Realised Gains/losses from Divestment of Properties

32

7. Investment Properties

33

8. Intangible Assets

34

9. Investments in Associated companies and Joint Ventures

34

10. Inventory Properties

34

11. Financial Assets and Liabilities

35

12. Fair Value Measurements of Financial Instruments

36

13. Equity

37

14. Commitments and Contingencies

37

15. Subsequent Events

37

Condensed Parent Company Financial Statements

Parent Company Income Statement

38

Parent Company Statement of Comprehensive Income

38

Parent Company Statement of Financial Position

39

Parent Company Statement of Changes in Equity

40

Parent Company Statement of Cash Flows

41

Auditor’s review report

42

Earnings Capacity

43

Alternative Performance Measures

44

Heimstaden AB Standalone

46

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

25

Condensed Consolidated Statement of Comprehensive Income

SEK million Note Q3 2023 Q3 2022

2

YTD 2023 YTD 2022

2

FY 2022

2

Rental income 3, 4 3,905 3,283 11,403 9,729 13,204

Service charges paid by tenants 3, 4 389 271 1,319 843 1,229

Property expenses 3 -1,579 -1,294 -4,984 -4,222 -5,935

Net operating income

1

2,714 2,260 7,738 6,350 8,497

Corporate administrative expenses -196 -170 -492 -498 -724

Other operating income 57 27 262 244 285

Other operating expenses 5 -97 -88 -278 -245 -282

Realised gains/losses from divestment of properties 6 34 -7 54 -10 9

Profit before unrealised fair value adjustment 2,513 2,023 7,285 5,841 7,786

Fair value adjustment of investment properties 7 -4,946 -6,351 -25,758 7,261 -4,232

Value adjustment of inventory properties 10 18 -16 32 -35 402

Operating profit/loss -2,415 -4,345 -18,441 13,067 3,955

Share of net profits/losses of associated companies and joint ventures 9 -1,195 1,553 -1,530 1,383 409

Impairment of intangible assets 8 - - -1,058 - -

Interest income 97 54 207 122 342

Interest expenses -1,561 -816 -4,231 -2,174 -3,253

Net currency translation gains/losses 1,500 -1,539 -2,870 -4,859 -7,257

Fair value adjustment of derivative financial instruments -19 80 -210 964 1,115

Other financial items -29 -751 474 -2,407 -2,307

Profit/loss before tax -3,622 -5,764 -27,658 6,095 -6,995

Current tax expense -219 -254 -725 -860 -842

Deferred tax income/expense 1,360 1,336 5,320 -1,357 2,028

Profit/loss for the period -2,481 -4,681 -23,064 3,879 -5,809

Other comprehensive income/loss 13 -3,331 2,291 4,929 8,880 13,866

Total comprehensive income -5,812 -2,390 -18,135 12,759 8,056

Profit/loss for the period attributable to:

The Parent Company’s shareholders -1,480 -3,159 -13,696 967 -4,628

Non-controlling interests -1,001 -1,523 -9,368 2,912 -1,182

Total comprehensive income for the period attributable to:

Parent Company’s ordinary shareholders -3,419 -1,909 -10,858 6,234 3,477

Parent Company’s preference shareholders 29 29 88 88 117

Non-controlling interests -2,422 -511 -7,364 6,437 4,462

1

Excludes income from inventory properties.

2

Comparables restated, see note 1

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

26

Condensed Consolidated Statement of Financial Position

SEK million Note 30 September 2023 31 December 2022 30 September 2022

ASSETS

Investment properties 7 338,754 351,337 343,456

Intangible assets 8 16,244 16,915 17,297

Machinery and equipment 389 358 350

Investments in associated companies and joint ventures 9 8,336 9,758 10,384

Derivative financial instruments 11, 12 509 836 1,018

Deferred tax assets 1,529 1,297 −

Other financial assets 12 3,219 3,885 3,515

Total non-current assets 368,980 384,387 376,021

Inventory properties 10 538 573 826

Rent and trade receivables 524 403 252

Other financial assets 2,608 5,011 1,522

Derivative financial instruments 11, 12 541 645 312

Prepayments 1,385 1,763 1,032

Cash and cash equivalents 7,342 11,322 7,325

Total current assets 12,936 19,716 11,269

Total assets 381,917 404,103 387,289

SEK million Note 30 September 2023 31 December 2022 30 September 2022

EQUITY AND LIABILITIES

Equity 13 148,796 168,808 164,573

Interest-bearing liabilities 11 190,469 185,082 174,905

Lease liabilities 11 1,215 1,405 1,366

Derivative financial instruments 11, 12 46 51 139

Deferred tax liabilities 19,899 24,463 26,128

Other financial liabilities 1,682 1,100 1,046

Total non-current liabilities 213,311 212,101 203,584

Interest-bearing liabilities 11 13,136 14,418 11,712

Lease liabilities 11 96 90 79

Trade payables 452 928 561

Other liabilities 3,270 4,737 4,204

Derivative financial instruments 11, 12 15 75 2

Accrued expenses and prepaid income 2,839 2,946 2,574

Total current liabilities 19,809 23,195 19,132

Total equity and liabilities 381,917 404,103 387,289

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

27

Condensed Consolidated Statement of Changes in Equity

SEK million

Share

capital

Other capital

contributions

Hybrid

bonds

Currency translation

reserve Retained earnings

Attributable

to Parent Company

shareholders

Non‑controlling

interests

Total

equity

Opening balance, 1 January 2022 95 7,540 7,374 -221 27,013 41,801 105,294 147,093

Profit for the period - - 251 - 716 967 2 912 3 879

Other comprehensive income - - - 5 355 - 5 355 3 526 8 880

Total comprehensive income - - 251 5 355 716 6 322 6 437 12 759

New share issue - - - - - - 14 211 14 211

Costs of issuance - -36 - - - -36 - -36

Buy-back of hybrid bonds - - - - - - -7 274 -7 274

Dividends - - -251 - -88 -339 -12 454 -12 793

Contributions from non-controlling interests - - - - - - 2 918 2 918

Transactions with non-controlling interests - - - - -441 -441 8 135 7 694

Total transactions with the Company’s shareholders – -36 -251 – -529 -816 5 536 4 720

Equity, 30 September 2022 95 7 504 7 374 5 133 27 200 47 306 117 268 164 573

Profit for the period - - 78 - -5 673 -5 595 -4 094 -9 689

Other comprehensive income - - - 2 868 - 2 868 2 118 4 986

Total comprehensive income - - 78 2 868 -5 673 -2 727 -1 976 -4 703

New share issue - - - - - - 435 435

Costs of issuance - - - - - - - -

Buyback of hybrid bonds - - - - - - -370 -370

Dividends - - -78 - -29 -107 -10 -117

Contributions from non-controlling interests - - - - -374 -374 689 315

Transactions with non-controlling interests - - - - - - 8 674 8 674

Total transactions with the Company’s shareholders - - -78 - -403 -481 9 418 8 937

Equity, 31 December 2022 95 7 504 7 374 8 001 21 123 44 098 124 710 168,808

Opening balance, 1 January 2023 95 7,504 7,374 8,001 21,124 44,098 124,711 168,808

Profit for the period – – 516 – -15,053 -14,537 -8,527 -23,064

Other comprehensive income – – – 2,925 – 2,925 2,004 4,929

Total comprehensive income – – 516 2,925 -15,053 -11,611 -6,523 -18,135

New share issue – – – – – – 1,942 1,942

Buyback of hybrid bonds – – – – – – -82 -83

Cost of issuance – – – – – – -6 -6

Dividends – – -516 – -1,588 -2,104 -4,198 -6,302

Contributions from non-controlling interests – – – – -264 -264 2,837 2,573

Transactions with non-controlling interests – – – – 1,376 1,376 -1,376 –

Total transactions with the Company’s shareholders – – -516 – -476 -992 -884 -1,877

Equity, 30 September 2023 95 7,504 7,374 10,926 5,595 31,495 117,303 148,796

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

28

Condensed Consolidated Cash Flow Statement

SEK million Note Q3 2023 Q3 2022 YTD 2023 YTD 2022

Operating activities

Profit/loss income tax -3,622 -5,764 -27,658 6,095

Adjustments to reconcile profit before tax to net cash flows:

Fair value adjustment on investment properties 7 4,942 6,365 25,758 -7,226

Fair value adjustment of derivative financial instruments 19 150 210 -733

Finance expenses – net 1,536 629 4,095 2,092

Share of profit of an associate and a joint venture 1,195 4 1,530 174

Other adjustments -1,591 688 2,988 5,590

Working capital changes

Increase/decrease(+) in rent and other receivables 258 225 -876 -276

Increase/decrease(-) in trade and other payables -18 -103 -234 -1,013

Cash generated from operations 2,719 2,194 5,813 4,704

Interest paid -1,729 -876 -4,302 -1,911

Interest received 158 -21 207 −

Paid income tax -517 -57 -1,015 -721

Net cash flows from operating activities 613 1,240 703 2,072

SEK million Note Q3 2023 Q3 2022 YTD 2023 YTD 2022

Investing activities

Purchase of investment and inventory properties -20 -547 -1,273 -6,861

Capital expenditure on investment and inventory properties 7,10 -2,061 -2,910 -6,168 -7,441

Divestments of investment properties 6 437 57 2 183 535

Deposits paid for signed acquisitions − -1 − -548

Purchase of machinery and equipment -11 -14 -50 -50

Investments in associated companies and joint ventures 178 125 663 -121

Purchase of quoted equity investments − -775 − -4,474

Other cash flows from investing activities 273 − 293 −

Net cash flows from investing activities -1,203 -4,065 -4,352 -18,960

Financing activities

Proceeds from interest-bearing liabilities 11 8,176 5,527 24,212 32,932

Repayment of interest-bearing liabilities 11 -9,681 -4,028 -25,553 -35,121

Dividends paid 13 − − -1,500 −

Dividends paid to preference shares -29 -29 -88 -88

Dividends paid to non-controlling interest − − -1,951 -1,010

Proceeds from non-controlling interests -11 6,643 6,647 14,338

Buyback of hybrid bonds 13 − -6,783 -58 -6,783

Repayments on hybrid bonds -105 -181 -1,357 -1,201

Transaction costs on issue of shares and hybrid capital − − -6 -36

Settlement of deriviative financial instruments − − 176 230

Other cash flows from financing activities 73 -22 -1,099 -62

Net cash flows from financing activities -1,758 1,126 -578 3,198

Net change in cash and cash equivalents -2,331 -1,699 -4,227 -13,690

Cash and cash equivalents at the beginning of the period 9,670 9,165 11,323 20,488

Net currency exchange effect in cash and cash equivalents 3 -141 246 528

Cash and cash equivalents at the end of the period 7,342 7,325 7 343 7,325

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

29

Notes to the Condensed Consolidated Financial Statements

1. Accounting Principles

Corporate information

Heimstaden AB (publ), Corp. ID No. 556670-0455, is a limited liability company registered in Sweden with its registered office at Östra

Promenaden 7A, SE-211 28, Malmö, Sweden. Heimstaden’s operations consist of owning, developing and managing residential properties.

Basis for preparation

Heimstaden’s interim condensed consolidated accounts have been prepared in accordance with IAS 34 Interim Financial Reporting. The

Parent Company applies RFR 2 Accounting for Legal Entities and the Swedish Annual Accounts Act. The financial statements do not in-

clude all the information and disclosures required in the annual financial statements, and should be read in conjunction with the 2022 annual

financial statements. The accounting policies and methods of computation followed are consistent with those of the previous financial year,

except for items specified below.

Due to rounding, numbers presented in these financial statements may not add up precisely to the totals provided.

Recently issued accounting standards, interpretations and amendments

At the balance sheet date, there were no new or amended standards or interpretations published by IASB that are expected to have a ma-

terial impact on the financial statements of the Group or the Parent Company.

Associated companies and joint ventures

Effective 1 January 2023, the Condensed Statement of Comprehensive Income has been revised to provide the user of the consolidated

financial statements with more relevant information, including relevant and comparable subtotals. Share of net profits/losses of associated

companies and joint ventures are now excluded from the operating profit. The revised presentation did not have any impact on any financial

statement line item, the group’s profit/loss before tax, the financial position or equity. The comparative financial data has been reclassified

accordingly.

Realised Gains/losses from

divestment of properties

The Board of Directors have approved a Privatisation Plan that that represents a new line of business that works across all segments. The

goal of this plan it to sell a significant part of our portfolio to the private home-owner market. In response to the new strategy the accounting

policy for divestment of properties has been revised. The new policy separates realised gains/losses form unrealised change in value. Gains/

losses from divestments, both from Privatisation and other divestments, are realised and shown on a new financial statement line, “Realised

gains/losses from divestment of properties”. This also includes realised gain/losses from inventory properties. Gain/loss is calculated based

on the valuation in the latest interim financial statement and net of direct transactions cost.

To clarify the distinction of realised gains/losses and unrealised value change the following line items have been changed:

- “Profit before inventory properties and fair value adjustments” renamed to “Profit before unrealised fair value adjustments”

- “Change in value and gains/losses from sale of inventory properties” renamed to “Value adjustment of inventory properties”

The revised presentation did not have any impact on the group’s profit/loss before tax for the year, the financial position or equity. Compa-

rable figures in the Condensed Consolidated Statement of Comprehensive Income statement of have been changed accordingly.

2. Related Parties

During 2023 transactions with Fredensborg amounted to the net amout of SEK 48 million in management services expenses. No other re-

lated party transactions other than salaries and board fees have been paid to management and the board as of Q3 2023.

Heimstaden’s subsidiary Heimstaden Bostad AB received an investment guarantee from Fredensborg AS in 2018, recognised in other cur-

rent assets. The investment guarantee increased with SEK 9 million to SEK 715 million during Q3 2023, see note 10 for more information.

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

30

3. Segment Reporting

Heimstaden organises and governs its activities based on geographical areas. These geographical areas form the basis of the reportable segments. Senior management monitors net operating income and changes in the value of investment properties in the identified segments; other profit

and loss items are not distributed per segment. Heimstaden has identified ten reportable segments consisting of the geographical areas of Sweden, Germany, Denmark, Netherlands, Czech Republic, Norway, Finland, Iceland, United Kingdom and Poland.

1

The eliminations of the consolidated financials mainly consist of reclassifications due to internal services provided within countries. The rental income from the portfolio in Sweden reflects all-inclusive rents, meaning that majority of property expenses is not recoverable towards the tenants.

2

Other property costs consist of Property insurance, Property security, Running costs for broadband/TV, recurring inspections and similar items.

Q3 2023

SEK million Sweden Germany Denmark Netherlands Czech Republic Norway Iceland United Kingdom Finland Poland Eliminations Group in total

Statement of Comprehensive Income

Rental income

1

1,115 683 912 366 434 189 87 29 69 21 – 3,905

Service charges paid by tenants 20 267 1 – 89 4 0 0 3 5 – 389

Total income 1,135 950 913 366 523 193 87 29 72 26 – 4,293

Utilities -147 -172 -31 – -85 -9 -4 -2 -9 -2 1 -458

Repair and maintenance -46 -47 -40 -24 -42 -10 -4 -2 -5 – 39 -181

Property tax -26 -26 -52 -16 -2 -1 -6 -2 -2 -1 – -135

Other

2

-34 -34 -27 -15 -22 – -3 1 -5 -1 2 -137

Property management -157 -170 -113 -33 -64 -32 -13 -19 -16 -9 -42 -667

Total property expenses -409 -449 -264 -88 -215 -51 -29 -22 -37 -14 – -1,579

Net operating income 725 500 649 278 307 142 58 7 34 12 – 2,714

Net operating income margin, % 65.1 73.3 71.2 76.0 70.9 74.9 66.5 23.7 50.3 59.1 − 69.5

Q3 2022

SEK million Sweden Germany Denmark Netherlands Czech Republic Norway Iceland United Kingdom Finland Poland Eliminations Group in total

INCOME STATEMENT

Rental income

1

997 523 762 315 344 193 77 2 61 1 -1 3,283

Service charges paid by tenants 21 166 − − 71 10 − − 4 − − 271

Total income 1,017 689 762 315 415 203 77 2 65 1 -1 3,554

Utilities -166 -99 -29 − -68 -12 -3 − -9 − -1 -386

Repair and maintenance -44 -35 -36 -29 -33 -23 -5 − -4 − 109 -100

Property tax -30 -14 -40 -28 -2 -3 -5 − -1 − − -125

Other

2

-102 -48 -32 -14 -14 3 -2 5 -4 − 3 -212

Property management -105 -103 -91 -33 -49 -36 -8 -7 -11 -3 -24 -472

Total property expenses -446 -299 -228 -104 -166 -72 -24 -2 -29 -4 87 -1,294

Net operating income 571 390 534 210 249 131 54 1 36 -3 86 2,260

Net operating margin, % 57.3 74.6 70.1 66.9 72.3 67.9 69.2 - 58.9 − − 68.8

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

31

YTD 2023

1

The eliminations of the consolidated financials mainly consist of reclassifications due to internal services provided within countries. The rental income from the portfolio in Sweden reflects all-inclusive rents, meaning that majority of property expenses is not recoverable towards the tenants.

2

Other property costs consist of Property insurance, Property security, Running costs for broadband/TV, recurring inspections and similar items.

SEK million Sweden Germany Denmark Netherlands Czech Republic Norway Iceland United Kingdom Finland Poland Eliminations Group in total

Statement of Comprehensive Income

Rental income

1

3,319 1,994 2,644 1,050 1,292 561 249 52 199 45 -1 11,403

Service charges paid by tenants 62 748 4 – 460 26 – – 9 10 – 1,319

Total income 3,381 2,742 2,648 1,050 1,751 587 249 52 208 55 -1 12,723

Utilities -563 -476 -96 – -447 -43 -11 -3 -35 -4 3 -1 674

Repair and maintenance -145 -153 -137 -68 -128 -28 -11 -2 -15 -1 112 -576

Property tax -80 -71 -148 -45 -7 -3 -18 -2 -7 -3 – -384

Other

2

-109 -112 -95 -45 -71 -22 -8 -2 -14 -2 7 -474

Property management -534 -421 -350 -94 -167 -62 -34 -30 -44 -19 -120 -1,876

Total property expenses -1,432 -1,232 -826 -253 -819 -158 -82 -39 -114 -29 1 -4,984

Net operating income 1,949 1,510 1,822 797 932 429 167 13 94 26 – 7,738

Net operating income margin, % 58.7 75.7 68.9 75.9 72.1 76.5 67.0 24.9 47.1 58.1 − 67.9

YTD 2022

SEK million Sweden Germany Denmark Netherlands Czech Republic Norway Iceland United Kingdom Finland Poland Eliminations Group in total

INCOME STATEMENT

Rental income

1

3,156 1,517 2,224 914 994 559 220 6 130 1 -1 9,729

Service charges paid by tenants 51 447 1 − 317 20 − − 6 − − 843

Total income 3,207 1,964 2,225 914 1,312 579 220 6 136 1 -1 10,572

Utilities -552 -253 -75 − -312 -32 -9 − -20 − 2 -1,251

Repair and maintenance -216 -105 -106 -92 -102 -67 -15 − -6 − 162 -547

Property tax -78 -42 -115 -81 -6 -10 -16 − -4 − − -351

Other

2

-255 -137 -89 -45 -46 8 -8 5 -10 -1 5 -581

Property management -397 -285 -292 -105 -142 -105 -28 -9 -27 -7 -95 -1,492

Total property expenses -1,498 -822 -677 -323 -608 -206 -75 -5 -67 -9 74 -4,222

Net operating income 1,709 1,142 1,548 591 703 374 145 1 69 -8 73 6,350

Net operating margin, % 54.2 75.3 69.6 64.7 70.8 66.8 66.0 - 53.3 − − 65.3%

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

32

4. Rental Income

Rental income distributed by property category

SEK million Q3 2023 Q3 2022 YTD 2023 YTD 2022

Residential 3,590 3,004 10,465 8,907

Commercial premises 262 234 785 691

Garage and parking spaces 53 45 153 131

Total rental income 3,905 3,283 11,403 9,729

Service charges paid by tenants distributed by property category

SEK million Q3 2023 Q3 2022 YTD 2023 YTD 2022

Residential 366

249 1,245 799

Commercial premises 23 22 74 44

Total service charges paid by tenants 389 271 1,319 843

5. Other Operating Expenses

During 2023, SEK 109 million was expensed, of which SEK 43 million in the quarter, as donations to SOS Children’s Villages. See page 19

in the 2022 Annual Report for more information regarding the partnership A Home for a Home.

6. Realised Gains/losses from Divestment of Properties

Realised gains/losses from divestment of investment properties and inventory properties

SEK million Q3 2023 Q3 2022 YTD 2023 YTD 2022

Net proceeds from divestments of properties 497 53 2,183 528

Book value of divestments of properties -463 -60 -2,129 -538

Realised gain/loss on divestments of properties 34 -7 54 -10

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

2021 ARTBOX REPORT TEMPLATE ALL RIGHTS RESERVED © ARTBOX AS 2021

HEIMSTADEN THIRD QUARTER 2023HEIMSTADEN THIRD QUARTER 2023

33

7. Investment Properties

Total properties value per segment

The value of investment properties, as of 30 September 2023 was SEK 338,754 million (351,337). The fair value decreased by SEK million 25,758 (increase 7,261) during the first nine months. In percentage, the decrease in value was 7.1 (increase 2.2) of fair value of investment properties.

The decrease in fair value during the first nine months was primarily driven by sentiment-based yield increases (in some cases supported by a limited number of individual comparable transactions) outweighing the positive effects of rent increases and outlook in Heimstaden Bostad’s larger

markets (Sweden, Germany, Denmark, Netherlands, and Finland). In addition, in the Netherlands, an increase in Real Estate Transfer Tax (RETT) combined with negative owner-occupier house price development earlier in the year further negatively impacted values. These negative move-