ANNUAL COMPREHENSIVE

FINANCIAL REPORT

For the year ended June 30, 2022

RENO-TAHOE AIRPORT AUTHORITY

Reno, Nevada

ANNUAL COMPREHENSIVE

FINANCIAL REPORT

FOR THE YEAR ENDED JUNE 30, 2022

Prepared by

Finance Department

Randall O. Carlton

Chief Finance & Administration Officer

RENO-TAHOE AIRPORT AUTHORITY

ANNUAL COMPREHENSIVE FINANCIAL REPORT

FOR THE YEAR ENDED JUNE 30, 2022

Table of Contents

I. Introductory Section (Unaudited) Page(s)

Letter of Transmittal ...................................................................................................... 1-13

Board of Trustees and Senior Management…………………………………… ............. 14

Organization Chart............................................................................................................ 15

Certificate of Achievement for Excellence in Financial Reporting .................................. 16

II. Financial Section

Independent Auditor’s Report ................................................................................... 17-19

Management’s Discussion and Analysis ................................................................... 20-31

Basic Financial Statements:

Statement of Net Position ............................................................................... 32-33

Statement of Revenues, Expenses and Changes in Net Position ......................... 34

Statement of Cash Flows ................................................................................ 35-36

Notes to Financial Statements ........................................................................ 37-65

Required Supplementary Information:

Schedule of Changes in the RTAA’s Total OPEB Liability

and Related Ratios ............................................................................................... 66

Schedule of RTAA’s Proportionate Share of the Net Pension Liability ............. 67

Schedule of Pension Plan Contributions .............................................................. 68

Supplementary Information:

Schedule of Revenues and Expenses, Comparison of Budget to Actual ............. 69

III. Statistical Section (Unaudited)

Statistical Section Explanations ........................................................................................ 70

Financial Trends

Net Position and Changes in Net Position ...................................................... 71-72

Summary of Operating Results ....................................................................... 73-74

Revenue Capacity

Principal Revenue Payers ............................................................................... 75-76

Principal Revenue Sources ............................................................................. 77-78

Revenue Rates and Cost per Enplanements ......................................................... 79

Debt Capacity

Schedule of Debt and Obligation Coverages ....................................................... 80

Rate Maintenance Covenant Performance ...................................................... 81-82

Ratios of Outstanding Debt and Debt Service ................................................ 83-84

Demographic and Economic Information

Population in Air Trade Area .............................................................................. 85

Principal Employers ............................................................................................ 86

Operating Information

Employees ........................................................................................................... 87

Operational Statistical Summary ......................................................................... 88

Enplanements and Market Share by Scheduled Airline ................................. 89-91

Landed Weights and Market Share by Scheduled Airline .............................. 92-94

Capital Asset Information ............................................................................... 95-96

IV. Compliance Section

Independent Auditor’s Report on Internal Control over Financial Reporting and on

Compliance and Other Matters Based on an Audit of Financial Statements

Performed in Accordance with Government Auditing Standards ....................... 97-98

Independent Auditor’s Report on Compliance for Each Major Federal Program and

Report on Internal Control Over Compliance ..................................................... 99-101

Schedule of Expenditures of Federal Awards ................................................................. 102

Notes to Schedule of Expenditures of Federal Awards .................................................. 103

Schedule of Findings and Questioned Costs ................................................................... 104

Independent Auditor’s Report on Compliance with Requirements Applicable to

The Passenger Facility Charge (PFC) Program and on Internal Control Over

Compliance and the Schedule of Passenger Facility Charges Collected and

Expended ....................................................................................................... .....105-107

Sched

ule of Passenger Facility Charges Collected and Expended ................................. 108

Schedule of Passenger Facility Charges Findings and Questio

ned Costs ...................... 109

Introductory

Section

November 30, 2022

Board of Trustees

Reno-Tahoe Airport Authority

Reno, Nevada

This report is the Annual Comprehensive Financial Report (ACFR) of the Reno-Tahoe Airport Authority

(“RTAA” or “Authority”) for the fiscal year July 1, 2021, through June 30, 2022. The staff of the RTAA

prepared this report and is responsible for the information it contains. The purpose of this report is to

present fully and fairly RTAA’s financial position, operating results, and cash flows.

Management assumes full responsibility for the accuracy, completeness and reliability of the information

contained in this report, based upon a comprehensive framework of internal controls that it has established

for this purpose. The design of the internal accounting controls employed by RTAA is to provide

reasonable assurance that assets will be safeguarded against loss and that financial records will be reliable

for use in preparing financial statements that are free of any material misstatements.

This ACFR contains financial statements and statistical data that fully disclose all the material financial

operations of RTAA. A narrative overview and analysis of RTAA’s financial activities that occurred

during the fiscal year ended June 30, 2022, are presented in the Management’s Discussion and Analysis

(MD&A) found at the beginning of the Financial Section.

This ACFR reflects guidelines recommended by the Government Finance Officers Association of the

United States and Canada (GFOA). The GFOA awards a Certificate of Achievement to those entities

whose annual financial reports conform to the high standards of public financial reporting, including

generally accepted accounting principles issued by the Governmental Accounting Standards Board. It is

our belief that the accompanying ACFR also meets these program standards and will be submitted to the

GFOA for review.

REPORTING ENTITY

The RTAA is a quasi-municipal corporation created by the Nevada State Legislature and began operation

on July 1, 1977. The act creating RTAA provides that it will serve a public use and will facilitate safe and

convenient air travel and transport to and from the Reno-Tahoe area. RTAA is an independent entity that

is not part of any other unit of local government and does not use local property or sales tax revenue to

fund its operation.

1

The City of Reno, City of Sparks, Washoe County, and the Reno-Sparks Convention & Visitors Authority

(RSCVA) appoint the nine-member Board of Trustees that governs RTAA. Four members appointed by

the City of Reno, two by the City of Sparks, two by Washoe County, and a ninth board member by the

RSCVA. The Board of Trustees serve a four-year term, and terms are staggered to ensure the continued

presence of experienced members.

RTAA owns and operates the Reno-Tahoe International Airport (RNO) and the Reno-Stead Airport

(RTS). RTS is a general aviation facility that is home to approximately 200-based aircraft, as well as the

famous Reno National Championship Air Races. According to the latest available Federal Aviation

Administration (FAA) statistics, RNO is the 63

rd

busiest commercial passenger airport in the nation. RNO

also has substantial cargo activity and a vibrant general aviation community.

The geographical, or catchment area, served by RNO primarily encompasses the seven northern Nevada

counties of Churchill, Douglas, Humboldt, Lyon, Pershing, Storey, and Washoe and the major cities of

Reno, Sparks, and Carson City (the capital of the State of Nevada). The total catchment area for RNO

also includes the Lake Tahoe area and several communities in northeastern California.

As defined by the FAA, RNO is a medium hub commercial airport which served over 1.8 million

passengers in calendar year 2021. RNO is located four miles southeast of Reno’s central business district.

RTS is a general aviation airport located 11 miles northwest of the central business district. Carson City,

the capital of Nevada, is 30 miles south of Reno. The closest competing commercial airport is 115 miles

away in Sacramento, California. Commercial air service for the public is provided by Alaska Airlines,

Allegiant, American Airlines, Delta Airlines, Frontier Airlines, JetBlue, Southwest Airlines, Spirit

Airlines, Sun Country, United Airlines, and Volaris. Commercial cargo carriers include FedEx, United

Parcel Service (UPS), and DHL. In calendar year 2022, more than 147 million pounds of air cargo was

transported through RNO. Air cargo operations occupy about 25 acres north of the RNO passenger

terminal with two buildings used for air cargo activities that consist of approximately 67,300 square feet.

The ramp facilities can handle 14 aircraft. These facilities serve air cargo carriers including DHL, FedEx,

and UPS and accommodate all types of cargo aircraft.

ECONOMIC CONDITION AND OUTLOOK

The U.S. economy has faced some recent challenges brought on by high inflation, gas prices, and labor

force shortages. After a strong rebound of stock markets last year, 2022 has been a year of high volatility.

The Dow Jones Industrial average hit 36,800 on January 4, 2022, a new record, and 29,900 on June 16,

2022. S&P 500 recorded 4,800 and 3,700 on the same days.

The Bureau of Labor Statistics’ July report mentions the average unemployment rate of 3.5%, the lowest

level since February 2020, pre-pandemic. Total nonfarm payroll employment rose by 528,000 in July,

larger than the average monthly gain over the prior four months. The labor force participation rate of

62.1% has declined in recent months but exceeds the 61.7% recorded in July 2021.

According to the Congressional Budget Office’s (CBO) projections in July 2022, the current and

future economic impact of the COVID-19 pandemic can be summarized as follows:

The federal budget deficit is expected to reach $1 trillion in 2022, $1.8 trillion less than 2021. At

3.9% of gross domestic product (GDP), the projected deficit in 2022 is much smaller than those

recorded in 2020 and 2021, as federal spending in response to the coronavirus pandemic has

tempered and revenues have risen sharply. Based on CBO’s projections, federal deficits over the

2022–2052 period will average 7.3% of GDP, more than double the average over the past half-

century. This is primarily due to the increase in interest cost.

2

Federal spending in 2022 is expected to represent 23.5% of GDP, a reduction from 2021 and

continuing a declining trend in 2023 and 2024 as federal spending in response to the COVID-19

pandemic diminishes.

Federal debt held by the public is projected to reach 98% of GDP. According to the CBO debt

begins to rise in 2024, surpasses its historical high in 2031 (107%), and continues to climb

thereafter, rising to 185% of GDP in 2052.

Real, inflation adjusted GDP is expected to grow by 3.1% in 2022. After 2022, economic growth

is expected to slow and inflationary pressures ease.

The greater Reno area’s economic picture has become far more diversified and the growth in recent years

has been significant. The Reno-Tahoe regional area economy is no longer relying solely on tourism and

gaming, as it was at the time of the 2008 great recession. Northern Nevada’s business friendly

environment, proximity to customers, availability of skilled workforce and logistics continues to attract a

diverse group of businesses to the area. Companies like Tesla, Panasonic, Switch, Microsoft, Apple,

Rackspace, Amazon, Zulily, Patagonia, Urban Outfitters, Thrive Market, and Petco all call Northern

Nevada home for critical business functions.

The diversity of industry in Northern Nevada is expected to provide a solid foundation for recovery and

long-term growth following the COVID-19 pandemic. It will also help soften the effects of a potential

recession. Nevada’s June unemployment rate dropped to 4.7% compared to the 29.5% reached at the

height of the pandemic in April 2020 according to the Nevada Department of Employment, Training and

Rehabilitation (DETR). Of the three Metropolitan Statistical Areas (MSA) in Nevada, Reno’s

unemployment rate was the lowest at 3.3%, while the Las Vegas area was at 5.7% and Carson at 3.7% in

June 2022.

Reno MSA industry trends for the month of June, as published by Ekay Consulting:

Business Activity Index – provides historical and current trends for business activity in the Reno

MSA region. It includes data on employment, gaming revenue, taxable sales, and airline activity

at RNO (passengers and cargo). The Index shows a 3.19% increase between May and June 2022,

and a 2.22% decline from the same period last year (June 2021).

Construction Index – provides historical and current trends for the construction industry in the

Reno MSA region. It includes data on construction employment, commercial permits,

commercial permit valuation, residential permit units, and residential permit valuation. The index

shows a decrease of 7.53% between May and June 2022, and 26.52% compared to the same month

in the previous year (June 2022). Construction employment has increased both month over month

and year over year. Commercial and residential permit values, and the number of commercial and

residential permits have declined compared to the previous month and the previous year when

adjusted for inflation and seasonality.

Housing Affordability Index – based on a ratio of median family income to qualifying family

income, or the income necessary to purchase a median priced home in Washoe County. Includes

data on median price of new and existing homes in Washoe County, median family income, US

30-year fixed mortgage rate. A ratio of 100 indicates that median family income is sufficient to

purchase a median-priced home. The second quarter (2Q) 2022 index of 61.83 indicates median

family income is 38.17% below the income necessary to qualify for median priced home. The

index declined by 14.51% between 2Q 2022 and 1Q 2022, making homes in the region less

affordable.

3

AIR SERVICE MARKET UPDATE

Passenger Airlines

U.S. scheduled passenger airlines reported a 2021 after-tax net loss of $2.8 billion, declining for the

second straight year after seven consecutive annual after-tax profits and a pre-tax operating loss of $17.3

billion, declining for the second straight year after 11 consecutive annual pre-tax profit. In 2020, the

airlines reported after-tax net loss of $35.0 billion.

The airlines reported a $17.3 billion pre-tax operating loss in 2021, improved results when compared to

the $46.5 billion loss in 2020. Total 2021 operating revenue was $130.0 billion. The airlines collected

$86.7 billion from fares, 66.7% of total operating revenue, $5.3 billion from baggage fees, 4.1% of total

operating revenues. Reservation change fees were $698 million, or 0.5% of total operating revenues.

Reservation change fees as a percentage of total operating revenues have declined, while the other

categories improved over the prior year. Total operating expenses in 2021 were $147.3 billion, of which

fuel costs accounted for $23.0 billion, or 15.6% of total expenses, and labor costs accounted for $52.6

billion, or 35.7%. In 2020, the operating expense share for fuel was 9.8%, and labor was 39.7%.

Annual Net Income 2017-2021, Systemwide U.S. Scheduled Passenger Airlines

Billions of Dollars ($)

Source: Bureau of Transportation Statistics

4

Passenger Activity

Since its emergence as a global pandemic in February of 2020, COVID-19 has been an unprecedented

shock to the airline and travel industries. As vaccines were made available to all willing to be vaccinated

and domestic travel restrictions were lifted, pent-up demand for travel brought back strong passenger

numbers especially at domestic destination airports such as RNO.

U.S. airlines carried 801.3 million systemwide (domestic and international) scheduled service passengers

for the fiscal year ended June 30, 2022, seasonally adjusted, according to the Bureau of Transportation

Statistics’ (BTS), up 86% from the previous year. The airlines carried 16.7% more passengers, seasonally

adjusted, in June of this year than June 2021.

U.S. airlines carried 717.9 million scheduled domestic service passengers, up 81.6% in in the year ended

June 30, 2022, from the previous year, seasonally adjusted, according to the BTS. International passenger

enplanements increased by 137.2% to 83.4 million in the year ended June 30, 2022.

Monthly Passengers on U.S. Scheduled Airlines (Domestic & International)

Seasonally Adjusted, June 2019-June 2022

Source: Bureau of Transportation Statistics

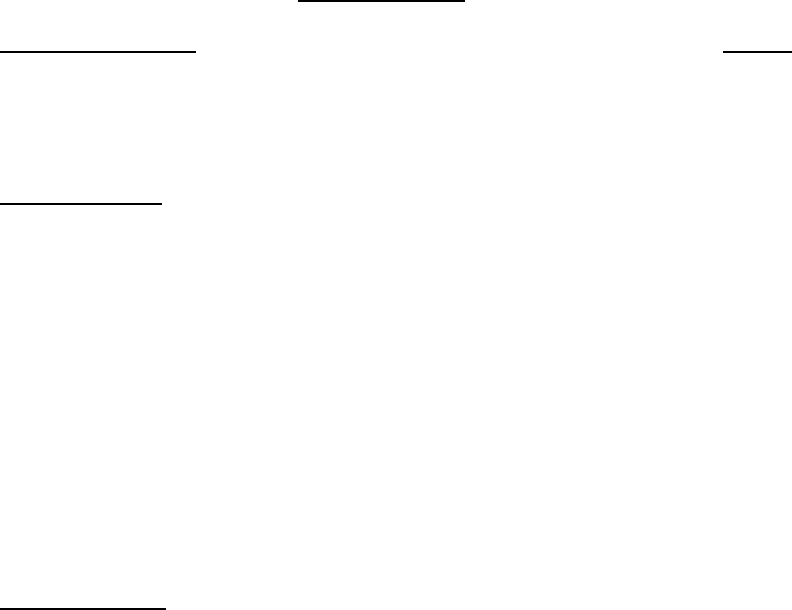

RNO Passengers

RNO served a total of 384,429 passengers in June 2022, a decrease of 3.4% from June 2021. The local

market was served by 11 airlines to 30 non-stop destinations. The total seat capacity decreased 10.5% and

flights decreased 14.8% when compared to June 2021. The average enplaned load factor was 85.7% in

June, an increase of 6.6% from the prior year. RNO served 4,155,405 total passengers during fiscal year

2021-22, a 68.0% increase when compared to fiscal year 2020-21.

On August 10, 2022, Spirit Airlines, RNO’s newest airline started service to Harry Reid International

Airport (LAS) in Las Vegas, Nevada.

5

RNO Enplaned Passengers

Cargo Airlines

Nevada has become a major west coast distribution hub due to its strategic location with the Reno/Sparks

area providing next-day ground service to almost every major U.S. city in the western United States. This

sector of the region’s economy includes the presence of major warehousing, pharmaceutical, e-commerce

and distribution facilities including such companies as Amazon, Walmart, Petco, Urban Outfitters, eBay,

Zulily and 1-800-Flowers.com. This sector of the economy, along with growth in industrial development

areas such as the Tahoe-Reno Industrial Center, has played a key role in cargo growth at RNO in recent

years.

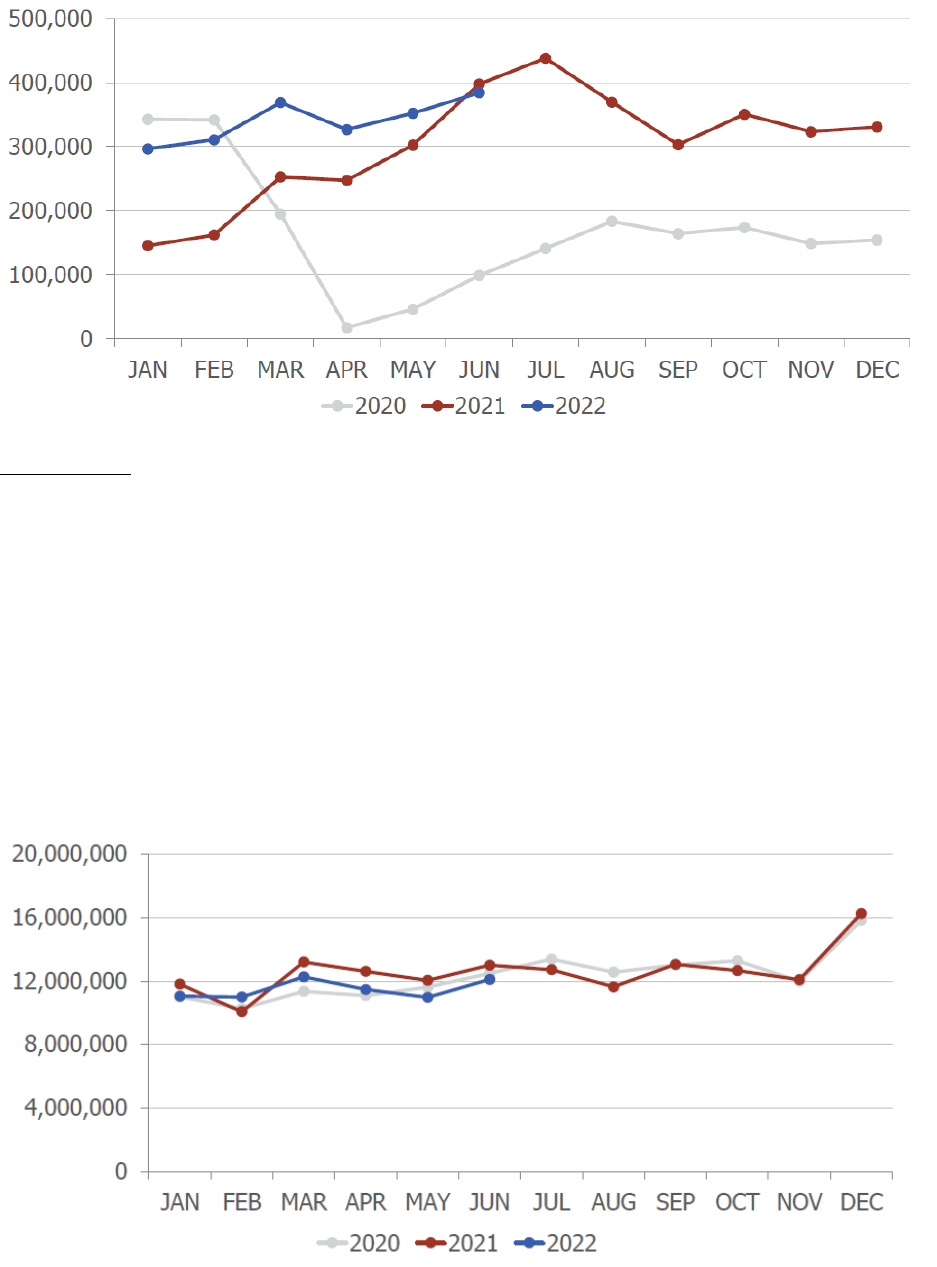

RNO handled 12,105,721 pounds of air cargo in June 2022, a decrease of 6.9% when compared to June

2021. RNO handled 147,276,696 pounds of air cargo in Fiscal Year 2021-22, a decrease of 3.6% when

compared to Fiscal Year 2020-21.

RNO Total Cargo Volume in Pounds

6

MAJOR INITIATIVES

Strategic Initiatives

On June 14, 2018, the Board of Trustees approved a Strategic Plan for the fiscal years 2018-19 through

2022-23, as amended December 12, 2019. The Strategic Plan reflects extensive input from the Board,

RTAA employees, the public and interested stakeholders. The purpose and desired outcomes of the

updated plan include the following:

Shared Vision: A strategic vision for the organization that is shared by staff and the Board of

Trustees.

Strategic Direction: Core strategies that will help guide RTAA over the next 5 years.

Roadmap: A high-level plan to guide priority setting and serve as a helpful road map for staff

and the Board of Trustees.

Planning Structure: Long-term goals and performance measures that support the strategic

priorities and provide a planning structure for objectives setting and annual action plans.

Agility/Flexibility: A living plan that provides direction but is also flexible and broad enough to

incorporate constant change in the aviation industry.

The Strategic Plan consists of the following components, beginning with the broadest, long-term elements

to the more specific, short-range and tactical activities: (1) Vision Statement; (2) Mission Statement; (3)

Strategic Priorities and Support Strategies; (4) Long-Term Goals; (5) Key Performance Indicators; and

(6) Short-Term/Annual Objectives. The Vision Statement aims to provide modern, safe, convenient

facilities and deliver customer satisfaction that is a source of community pride and serves as a significant

contributor to regional economic health.

Our Mission Statement of We Move You! We Bring the World to Reno-Tahoe and Reno-Tahoe to the

World is directed by the following eight (8) adopted Strategic Priorities:

1. Passenger and Air Cargo Service: Enhance air service by retaining and increasing passenger and

air cargo service.

2. Safety and Security: Safety and security of all is our priority 24/7, 365.

3. General Aviation: Foster an atmosphere to encourage general aviation growth at both airports.

4. Customer Experience: Enhance services and provide a positive and convenient environment for

all.

5. People: With our employees being the current and future strength of our organization, our focus

is on development, succession planning and making RTAA the employer of choice.

6. Financial Diversification and Growth: Grow and diversify non-airline revenues at both Airports.

7. Facilities for the Future: Optimize infrastructure to address market demand.

8. Sustainability: Operate and manage with a holistic approach reflecting sustainability and

environmental stewardship.

7

On December 12, 2019, the Board approved an update to the Strategic Plan to incorporate input from the

Board and RTAA staff and adjust direction of Facilities for the Future from “substantively” to

“transformative” to accommodate the increasing demands and dynamics of the airport and customer

experience. A second adjustment in this update elevated Safety & Security from “sustain” to

“transformative” to address interests in upgrading public safety and security for all airport stakeholders.

Air Service Development

The success in expanding service by existing carriers reflects the combined efforts of RTAA and a

regional partnership with the Regional Air Service Corporation (RASC), comprised of convention and

visitor bureaus, hotels, casinos, ski resorts, and various business groups. In addition, the community

partnerships with RSCVA, EDAWN, Reno Sparks Chamber of Commerce, and associations have all

played an important role in the recent success. Staff is committed to building on this success by continuing

the following:

(a) Support of existing air service through awareness efforts, such as:

Airport website

Airline celebrations (inaugurals, anniversaries, etc.)

In-terminal assets (Lamar print and digital signage opportunities)

Local publications (i.e., Planners – North Tahoe, South Tahoe, RSCVA)

Advertorials in industry publications (i.e., anna.aero & Air Service One)

Community events (i.e., Chamber Alliance, etc.)

Community and partner presentations (i.e., RASC partner opportunities, RSCVA

convention and sales webinars, etc.)

(b) Continue to work with the RASC and the local community to bring new air service to RNO.

With the FAA policy restricting the use of RTAA funds in support of new air service, the RASC

and its partners have historically been able to provide the following:

Promotion through partner databases (locally and out of market)

Promotion through partner digital marketing efforts

Promotion through partner traditional marketing efforts

Air carrier marketing cooperative programs

Promotion through public relations programs

Air carrier risk mitigation efforts

RASC offers a marketing resource that no other community can match - a consortium that

spreads across multiple industries and counties to promote air service and the region.

(c) Host airline representatives to the Reno-Tahoe region as guests to highlight the area by private

invitations, Familiarization Tours promoting leisure and business, special event attendance, and

more.

(d) Continue on-going efforts to attract new, as well as expand and maintain existing air service

through headquarter meetings, industry conferences, and periodic check-in calls.

(e) Continue funding for an additional Customs and Border Protection (CBP) officer to reduce

processing times to enter the United States by international passengers. The additional CBP

officer began in July 2018.

8

(f) In accordance with the FAA's Policy and Procedures Concerning the Use of Airport Revenue and

Board adopted policy, RTAA revenue may provide the following financial incentives:

1. Waiver or reduction of airport fee and charges, and

2. Funding for acceptable promotional costs, where the purpose is to encourage an air carrier

to bring and/or increase air service at the airport.

The FAA allows promotional incentives to air carriers for new service to (a) increase travel using

the airport and/or (b) promote competition at the airport.

Land and Facilities Development

As an integral element to all strategic priorities, RTAA must not only support but also proactively respond

to market demands. Infrastructure needs outlined in the RNO Master Plan provides a proactive response

to the projected growth of passenger traffic at RNO by nearly 60% from 2017 to 2036, which is on top of

a 10% increase from 2016.

The strategic approach to create facilities for the future is envisioned as follows:

Relieve congestion in RNO public parking and rental car facilities. RNO’s growth over the last

five years has resulted in congestion in the public parking facilities requiring RTAA to implement

overflow procedures more frequently during peak periods. Additionally, the Short-Term Parking area

on the first floor of the garage fills to capacity during peak periods multiple times per week due to

constraints caused by sharing the space with the rental car companies. Moreover, the rental car

companies have outgrown their operations on the first floor of the garage. Together, the rental car

companies hired Conrac Solutions, LLC to design, build, finance, own and operate a new Consolidated

Rental Car Facility (ConRAC) to accommodate their need for additional space. A Ground Transportation

Center (GTC) component will also be incorporated into the project at the request of the rental car

companies, creating a centralized transportation hub for the airport. This facility will free up

approximately 700 parking spaces in the garage and current Quick Turn Around (QTA) areas.

Additionally, the rental car companies will move their current ticket counter operations out of baggage

claim and into the new customer service building located within the ConRAC/GTC, freeing up space that

can be utilized by airlines, airline support, or other underserved uses.

Redevelop RNO terminal concourses which are aging and undersized. With the existing concourses

being 40 years old, RTAA needs to replace the terminal concourses with new and larger concourses

to address existing constraints, such as limited space for new amenities and concessions, and allow for

future growth and expansion for both domestic and international travel. A planning study to identify the

preferred alternative for redevelopment concludes in 2022, and design is anticipated to begin in 2023.

The preferred alternative is the 28-Gate New Build Alternative and involves the full replacement of

existing Concourses B & C with larger concourses, the partial replacement of the Connector Concourse,

new and replacement aircraft apron, a new central utility plant to be located outside the main terminal

building footprint, and adjustments to existing Taxiway Alpha to provide room to expand the concourses

east.

9

The primary improvements are described below in greater detail:

Facility/Service PrimaryRecommendedImprovements

ConcourseDimensions

Increaseoverallsquarefootagefrom155,000SFto250,000SFand

concoursewidthfrom74’to110’.

Passenger&Employee

Experience

Incorporateexperienceenhancementsincludinghigherceilings,

increasednaturallight&mountainviews,outdoorspaces,intuitive

wayfinding,minimalincreasestowalki ngdistances,andexceed

requiredADAstandards.

BuildingSystems

Constructseparatecentralutilityplant,installnewmaindistribution

framefacilityandnewcentralizedmechanical&electricalsystems.

ClimateResiliency

Installcriticalbuildingsystemsabovefloodconcernareas,incorporate

intodesignfeaturesfocusedonenergyefficiency, greenhousegas

emissionreduction,waterconservation,wastemanagement,water

quality,andindoorairquality.

AircraftGates/Parking

Positions

Replaceexisting23gateswith28newgatesofvaryingsizes,capableof

supportingsixteen(16)737Max‐10aircraftandtwelve(12)ERJaircraft

atsametime.

Allaircraftgatestoincludepassengerboardingbridges(PBB).Eleven

(11)oftheexistingPBBcanbereusedforthenewconcourses.The

remainingtwelve(12)arepasttheendofusefullifeandwillrequirefull

replacement.

Atotalofseventeen(17)newPBBwillneedtobe

acquired.

PassengerHoldrooms

Replaceexisting23holdrooms(1,450SFaverage)with28new

holdroomsofvaryingsizes(16holdroomsat2,800SFeachand12

holdroomsat1,500SFeach).

Concessions

Replaceexisting25,000SFofretail,restaurant,gamingspacewith

50,000SFofnewspaceintheconcourses.

FirstFloorOperations

(Concessions,Airport)

Replaceexisting65,000SFwith85,000SFnewspace,incorporate50’

drive‐thrutunnelswideandtallenoughforexistinggroundvehicle

fleet,addcentraldistributioncenterfordeliveryandstaging.

Anadditional40,000SFcoveredspacewillalsobeavailableforfuture

build‐outifneeded.Untilthen,thatspacecanbeusedforstorage

and/orgroundvehicleparking.

AircraftNon‐Movement

andMovementAreas

Widendistancebetweennewconcoursestoallowforcreationofadual

taxilaneinthecentral alley,expandapronsouthtoreplacesouth

remainovernight(RON)spots,relocatenorthRONsandinternational

parkingpositions,andreconfigureTaxiwayAtoallowforeastern

expansionofconcourses.

10

Modernize the RNO Terminal Building to accommodate future technologies and enhance

customer experience and wayfinding. The terminal building consists of the functional areas in the

non-sterile zone, including the ticketing hall, main lobby, security-screening checkpoint (SSCP)

and baggage claim areas. The facility requirements analysis in the RNO Master Plan shows these

areas are sufficient in size through the projected 2036 planning period. However, RNO currently

experiences congestion, queuing, and wayfinding issues. This effort will focus on the following areas:

Ticketing Hall – Expand circulation by relocating the existing entry outside of the existing

terminal building envelope into the curbside public space to improve queuing and circulation,

build new restrooms within the ticket hall area, incorporate digital signage and common use

equipment, design improvements to make the experience in the Ticketing Hall more welcoming

and enjoyable including more natural light, higher ceilings, and art.

Intuitive Wayfinding – The basic layout at RNO allows for intuitive passenger wayfinding.

However, the current organization of concessions, art, gaming, and other amenities has relied

heavily on signs to communicate wayfinding. The execution of this signage diminishes the

intuitive nature of the airport layout. RTAA will focus on enhancing clarity by incorporating

intuitive wayfinding in future improvements projects.

Modify the RNO Airfield to FAA Compliance. The runway and taxiway system is in good condition

and meets FAA standards, except for some non-standard geometry that should be addressed as new

airfield projects are implemented. The following are identified airfield improvements:

Runway 17R CAT II Approach: Site the location of an additional Runway Visual Range (RVR)

on Runway 17R to enhance instrument approach capabilities.

Deicing Aprons: Examine dedicated deicing or anti-icing areas at ends of Runways 17R/L and

35L/R to help facilitate operations during winter storms. A north deicing pad could be constructed

after completion of the Concourse Redevelopment efforts, while a south deicing pad could be

constructed as part of future air cargo development.

Address taxiway hot spots and intersections: The FAA has designated three areas on the airfield

as being areas of high potential for incursion and improvements to these areas need to be evaluated

to enhance safety. The Juliet and Lima hotspots were successfully addressed during the Taxiway

Charlie Reconstruction project. The 17L/35R south end hotspot was initially recommended to be

addressed by correcting non-standard taxiway geometry at the south end of Taxiway Alpha. That

mitigation effort was not successful. As a result, additional analysis focused on signage and

marking adjustments is underway.

Develop airfield geometry improvements to address non-standard taxiway geometry and

intersections that do not comply with FAA taxiway design guidance.

Consider moving aircraft hold short positions to 294 feet from runway centerlines. RTAA will

coordinate with FAA Airport District Office to clarify the need for compliance with new

standards.

Run-Up Aprons: Evaluate areas to locate pavement where propeller aircraft can perform system

checks prior to departure. Construction of a run-up area at the north end of Taxiway Charlie has

been designed. Construction, pending bids and funding, is anticipated for 2023.

11

FINANCIAL INFORMATION

While RTAA is a quasi-governmental entity, the generally accepted accounting principles applicable to

an enterprise fund governmental entity apply. RTAA’s financial statements are prepared on an accrual

basis. Revenues are recognized when earned, not when received. Expenses are recognized when incurred,

not when paid. Financial policies are set to conform to generally accepted accounting principles and the

accrual basis of accounting. There were no unusual financial policies or one-time activities during the

current period.

RTAA has several funds that accumulate money for specific and discretionary purposes. These are not

the governmental purpose type funds usually seen in governmental accounting, but debt related accounts.

The RTAA’s revenue bond resolutions establish the funds and their payment priority. These funds are

common in the airport industry's revenue bond resolutions.

The revenue bond resolutions are the RTAA's contract with the purchasers of the revenue bonds. This

contract specifies how RTAA will manage its money so that it will have sufficient funds to operate the

Airport system, and to pay the interest and principal due.

RTAA prepares, approves, and revises its budget pursuant to Nevada's Local Government Budget and

Finance Act, airline agreements, and the RTAA’s revenue bond resolutions. The table below outlines the

statutory requirements:

Statutory Date Calendar Date Action

April 15

th

April 15, 2022 Tentative budget filed with the

Nevada Department of Taxation

Not more than 14 nor less than 7

days before the date set for the

hearing

May 10, 2022 Notice of Budget Public Hearing

published

Not sooner than the third

Monday in May and not later

than the last day in May

May 19, 2022 Hold Public Hearing

On or Before June 1s

t

May 19, 2022 Adopt Budget.

Pursuant to airline agreements, airlines that have signed agreements with RTAA must also review the

budget. Adoption of a resolution by the RTAA’s Board of Trustees is required for any subsequent changes

to the budget and the amendment submitted to the Nevada Department of Taxation for approval.

INTERNAL CONTROLS

The RTAA’s management is responsible for establishing and maintaining an internal control structure

designed to ensure that the assets are protected from loss, theft or misuse, and to ensure that adequate

accounting data are compiled to allow for the preparation of financial statements in conformity with

generally accepted accounting principles. The internal control structure is designed to provide reasonable,

but not absolute, assurance that these objectives are met. The concept of reasonable assurance recognizes

that: (1) the cost of a control should not exceed the benefits likely to be derived; and (2) the valuation of

costs and benefits requires estimates and judgments by management.

12

REPORTI

NG ACHIEVEMENT

The Government Finance Officers Association (“GFOA”) of the United States and Canada awarded a

Certificate of Achievement for Excellence in Financial Reporting to RTAA for its Annual Comprehensive

Financial Report for the fiscal year ended June 30, 2021. This was the 35th consecutive year that RTAA

has achieved this prestigious award. In order to be awarded a Certificate of Achievement, the Annual

Comprehensive Financial Report must be easily readable, efficiently organized, and conform to the

program standards. This report must satisfy both generally accepted accounting principles and applicable

legal requirements. A Certificate of Achievement is valid for a period of one year only. RTAA believes

this current report continues to meet the Certificate of Achievement Program’s requirements and will

submit this report to the GFOA to determine its eligibility for another certificate.

INDEPENDENT AUDIT

Nevada Revised Statutes 354.624 requires that RTAA have its financial statements audited each year by

an Independent Certified Public Accountant. In addition, the receipt of Federal funds and Passenger

Facility Charges, to assist in funding capital improvement projects and security-related costs, requires the

audit meet federal audit standards referred to collectively as the "Single Audit Act". The reports of the

RTAA’s auditors, Crowe LLP, are included herein.

Respectfully submitted,

Daren A. Griffin, A.A.E.

President/CEO

13

RENO-TAHOE AIRPORT AUTHORITY

JUNE 30, 2022

Board of Trustees Position Term

Expires

Represents

Shaun Carey Chair June 2023 City of Sparks

Adam Kramer Vice-Chair June 2025 Washoe County

Jenifer Rose Treasurer June 2023 City of Reno

Richard Jay Secretary June 2025 City of Reno

Jessica Sferrazza Trustee June 2023 City of Reno

Jennifer Cunningham Trustee June 2025 City of Reno

Art Sperber Trustee June 2025 City of Sparks

Carol Chaplin Trustee June 2025 Reno-Sparks Convention &

Visitors Authorit

y

Lisa Gianoli Trustee June 2023 Washoe Count

y

More information on the Board of Trustees can be viewed on the RTAA website at

www.renoairport.com or by clicking RTAA Board of Trustees.

Staff Title

Daren Griffin, A.A.E. President/CEO

Cris Jenson Chief Operations & Public Safety Officer

Gary Probert Chief Infrastructure & Planning Officer

Randall Carlton Chief Finance & Administration Officer

Tina Iftiger Chief Commercial Officer

Brian Kulpin Chief Marketing & Public Affairs Officer

Larry Harvey Chief People, Culture & Equity Officer

14

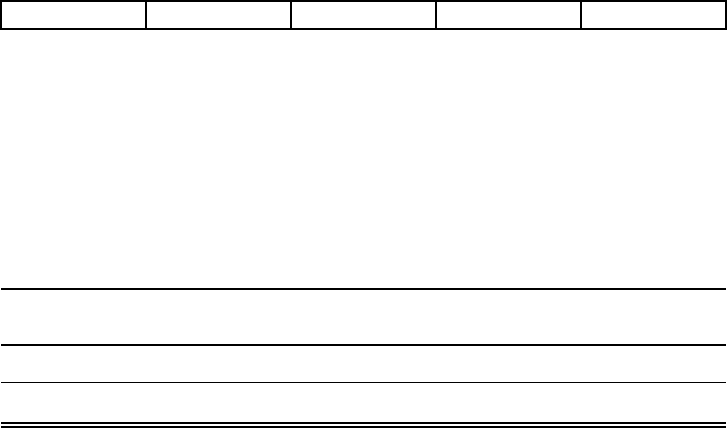

Scott Gordon

Manager of Reno-Stead

Airport

328-6573

Gary Probert

Chief Infrastructure and

Planning Officer

Randall Carlton

Chief Finance and

Administration Officer

Marty Mueller

Manager of IT Security

Alex Kovacs

Director of Finance

Tracy Caster

Manager of Accounting

Larry Harvey

Chief People, Culture and

Equity Officer

Chris Cobb

Manager of Engineering &

Construction

Art Rempp

Director of IT/ Chief Information

Officer

David Pittman

Director of Facilites &

Maintenance

George Lanyon

Facilities Superintendent

Dave Derie

Airfield Superintendent

Aurora Ritter

Manager of Airport Economic

Development

Cris Jensen

Chief Operations and Public

Safety Officer

Dale Carnes

Chief of Airport Rescue

Firefighters

Ricardo Duarte

Chief of Airport Police

Brandon Mikoleit

Manager of Landside

Operations

Carrie Guedea

Manager of Airside

Operations

Brad Erger

Manager of Properties

Reno-Tahoe Airport Authority Board of Trustees

Chief Legal Officer

Daren Griffin

President/CEO

Brian Kulpin

Chief Marketing and Public

Affairs Officer

Holly Luna

Manager of Purchasing &

Materials Management

Tina Iftiger

Chief Commercial Officer

Hasaan Azam

Manager of Ai

r Service & Cargo

B

u

si

nes

s

De

vel

o

p

m

en

t

Lissa Butterfield

Manager of Planning &

Environmental Serv

ices

Ben Carpenter

Manager of Airport

Communications

Shane Imsdahl

Manager of IT

Trish Tucker

Manager of Air Service &

Co

mmunity Engagement

Stacey Sunday

Director of Corporate

Communication

s

Janelle Conine

Customer Service Supervisor

Julie Sternberg

Manager of Labor Relations

and Benefits

Tracy Moore

Airport Emergerncy

Manager

Romona Agena

Manager of Airport

Security

Vacant

Director of Operations

15

Government Finance Officers Association

Certificate of

Achievement

for Excellence

in Financial

Reporting

Presented to

Reno-Tahoe Airport Authority

Nevada

For its Annual Comprehensive

Financial Report

For the Fiscal Year Ended

June 30, 2021

Executive Director/CEO

16

Financial Section

17

INDEPENDENT AUDITOR’S REPORT

To the Board of Trustees

Reno-Tahoe Airport Authority

Reno, Nevada

Report on the Audit of the Financial Statements

Opinion

We have audited the financial statements of the business-type activities of the Reno-Tahoe Airport Authority (the

“Authority” or “RTAA”), as of and for the year ended June 30, 2022, and the related notes to the financial

statements, which collectively comprise the Authority’s basic financial statements as listed in the table of

contents.

In our opinion, the accompanying financial statements referred to above present fairly, in all material respects,

the respective financial position of the business-type activities of the Authority, as of June 30, 2022, and the

respective changes in financial position and, where applicable, cash flows thereof for the year then ended in

accordance with accounting principles generally accepted in the United States of America.

Basis for Opinions

We conducted our audit in accordance with auditing standards generally accepted in the United States of America

(GAAS) and the standards applicable to financial audits contained in Government Auditing Standards

(Government Auditing Standards), issued by the Comptroller General of the United States. Our responsibilities

under those standards are further described in the Auditor's Responsibilities for the Audit of the Financial

Statements section of our report. We are required to be independent of the Authority, and to meet our other

ethical responsibilities, in accordance with the relevant ethical requirements relating to our audits. We believe

that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinions.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance

with accounting principles generally accepted in the United States of America, and for the design,

implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial

statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, management is required to evaluate whether there are conditions or events,

considered in the aggregate, that raise substantial doubt about the Authority’s ability to continue as a going

concern for twelve months beyond the financial statement date, including any currently known information that

may raise substantial doubt shortly thereafter.

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free

from material misstatement, whether due to fraud or error, and to issue an auditor's report that includes our

opinions. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not

a guarantee that an audit conducted in accordance with GAAS and Government Auditing Standards will always

detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from

fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions,

misrepresentations, or the override of internal control. Misstatements are considered material if there is a

substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a

reasonable user based on the financial statements.

18

In performing an audit in accordance with GAAS and Government Auditing Standards, we:

x Exercise professional judgment and maintain professional skepticism throughout the audit.

x Identify and assess the risks of material misstatement of the financial statements, whether due

to fraud or error, and design and perform audit procedures responsive to those risks. Such

procedures include examining, on a test basis, evidence regarding the amounts and

disclosures in the financial statements.

x Obtain an understanding of internal control relevant to the audit in order to design audit

procedures that are appropriate in the circumstances, but not for the purpose of expressing an

opinion on the effectiveness of the Authority’s internal control. Accordingly, no such opinion is

expressed.

x Evaluate the appropriateness of accounting policies used and the reasonableness of

significant accounting estimates made by management, as well as evaluate the overall

presentation of the financial statements.

x Conclude whether, in our judgment, there are conditions or events, considered in the

aggregate, that raise substantial doubt about the Authority’s ability to continue as a going

concern for a reasonable period of time.

We are required to communicate with those charged with governance regarding, among other matters, the

planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that

we identified during the audit.

Required Supplementary Information

Accounting principles generally accepted in the United States of America require that the Management’s

Discussion and Analysis, the Schedule of RTAA’s Proportionate Share of the Net Pension Liability, the Schedule

of Pension Plan Contributions, and the Schedule of Changes in RTAA’s Total OPEB Liability and Related Ratios

as listed in the Table of Contents, be presented to supplement the basic financial statements. Such information,

although not a part of the basic financial statements, is required by the Governmental Accounting Standards

Board who considers it to be an essential part of the financial reporting for placing the financial statements in an

appropriate operational, economic or historical context. We have applied certain limited procedures to the

required supplementary information in accordance with auditing standards generally accepted in the United

States of America, which consisted of inquiries of management about the methods of preparing the information

and comparing the information for consistency with management’s responses to our inquiries, the basic financial

statements, and other knowledge we obtained during our audit of the basic financial statements. We do not

express an opinion or provide any assurance on the information because the limited procedures do not provide

us with sufficient evidence to express an opinion or provide any assurance.

Supplementary Information

Our audit was conducted for the purpose of forming an opinion on the financial statements that collectively

comprise the Authority’s basic financial statements. The Introductory Section, Statistical Section, the Schedule

of Revenues and Expenses, Comparison of Budget to Actual, the Schedule of Debt Service Requirements on

Bonds and Notes, and the Schedule of Expenditures of Federal Awards (SEFA) as required by Title 2 U.S. Code

of Federal Regulations (CFR) Part 200, Uniform Administrative Requirements, Cost Principles, and Audit

Requirements for Federal Awards, as listed in the Table of Contents, are presented for purposes of additional

analysis and are not a required part of the basic financial statements.

The Schedule of Revenues and Expenses, Comparison of Budget to Actual, Schedule of Debt Service

Requirements on Bonds and Notes, and SEFA the responsibility of management and were derived from and

relates directly to the underlying accounting and other records used to prepare the basic financial statements.

Such information (except for the cumulative thru June 30, 2021 amounts on the SEFA) has been subjected to

the auditing procedures applied in the audit of the basic financial statements and certain additional procedures,

including comparing and reconciling such information directly to the underlying accounting and other records

used to prepare the basic financial statements or to the basic financial statements themselves, and other

additional procedures in accordance with auditing standards generally accepted in the United States of America.

In our opinion, the Schedule of Revenues and Expenses, Comparison of Budget to Actual, Schedule of Debt

Service Requirements on Bonds and Notes, and SEFA (except for the Cumulative thru June 30, 2022 amounts)

are fairly stated, in all material respects, in relation to the basic financial statements as a whole.

The Introductory Section, Statistical Section, and Cumulative thru June 30, 2022 amounts on the SEFA have not

been subjected to the auditing procedures applied in the audit of the basic financial statements and accordingly,

we do not express an opinion or provide any assurance on them.

19

Other Reporting Required by Government Auditing Standards

In accordance with Government Auditing Standards, we have also issued our report dated November 30, 2022

on our consideration of the Authority’s internal control over ¿nancial reporting and on our tests of its compliance

with certain provisions of laws, regulations, contracts, and grant agreements and other matters. The purpose of

that report is solely to describe the scope of our testing of internal control over ¿nancial reporting and compliance

and the results of that testing, and not to provide an opinion on the eႇectiveness of the Authority’s internal control

over ¿nancial reporting or on compliance. That report is an integral part of an audit performed in accordance with

Government Auditing Standards in considering the Authority’s internal control over ¿nancial reporting and

compliance.

Crowe LLP

Indianapolis, Indiana

November 30, 2022

MANAGEMENT’S DISCUSSION

AND ANALYSIS

RENO-TAHOE AIRPORT AUTHORITY

MANAGEMENT’S DISCUSSION AND ANALYSIS

JUNE 30, 2022

This Management Discussion and Analysis (MD&A) of Reno-Tahoe Airport Authority (“RTAA” or “the

Authority”) provides an introduction and overview of the major activities affecting the operations and the

financial performance of RTAA for the fiscal year (FY) ended June 30, 2022. The information contained

in this MD&A should be considered in conjunction with the information contained in RTAA’s financial

statements.

FINANCIAL HIGHLIGHTS

The Authority’s assets and deferred outflows exceeded liabilities and deferred inflows, or Net

Position, by $459.125 million at June 30, 2022.

The number of enplaned passengers at the Reno-Tahoe International Airport (RNO) increased 69%

to 2.080 million and landing fees increased 18% to $10.585 million from the prior year.

At June 30, 2022 the Authority had no debt. As of June 30, 2021, RTAA had $12.290 million of

outstanding airport revenue bonds related to the construction of the public parking garage. On

December 9, 2021, the Board of Trustees approved the prepayment of the 2015 Bonds. RTAA

received federal stimulus funds as reimbursement of the debt payoff amount in January 2022.

RTAA’s operating revenues increased $14.402 million (33%) from the prior fiscal year.

The Authority recognized $41.522 million in lease receivables, $41.265 million in deferred inflow

of resources, and $592 thousand in lease interest income as on June 30, 2022, and for the year then

ended, related to the implementation of Governmental Accounting Standards Board (GASB)

Statement No. 87, Leases.

Federal stimulus grant revenue increased 59% over prior year to $14.483 million for the year ended

June 30, 2022. Funding sources include award amounts from the Coronavirus Aid, Relief and

Economic Security (CARES) Act, American Rescue Plan Act (ARPA), and Coronavirus Response

and Relief Supplemental Appropriations (CRRSA) Act funding.

OVERVIEW OF THE FINANCIAL STATEMENTS

RTAA’s financial statements are prepared on the accrual basis in accordance with accounting principles

generally accepted in the United States of America (GAAP) promulgated by GASB. RTAA has a single

enterprise fund, and as such separate government-wide financial statements are not prepared. Revenues are

recognized when earned, not when received, and expenses are recognized when incurred, not when paid.

Capital assets are capitalized and depreciated over their useful lives. See the notes to RTAA’s financial

statements for a summary of the significant accounting policies.

This discussion and analysis is intended to serve as an introduction to RTAA’s basic financial statements.

The basic financial statements consist of three components: 1) fund financial statements, 2) notes to the

financial statements, and 3) required supplementary information other than the MD&A.

Fund financial statements – RTAA maintains its accounting records in a single enterprise fund. An

enterprise fund is a type of proprietary fund used to report business-type activities.

The statement of net position presents information on RTAA’s assets, deferred outflows of resources,

liabilities, and deferred inflows of resources, with the difference shown as net position.

20

MANAGEMENT’S DISCUSSION AND ANALYSIS

The statement of revenues, expenses and change in net position presents information on how RTAA’s net

position changed during the fiscal year. All changes in net position are reported as soon as the underlying

events giving rise to the changes occur, regardless of the timing of the related cash flows.

The statement of cash flows presents RTAA’s cash flow (sources and uses) related to operating activities,

non-capital financing activities, capital financing activities, and investing activities during the year.

Notes to Financial Statements - The notes to the basic financial statements provide additional information

that is essential to a full understanding of the data provided in the fund financial statements.

Required Supplementary Information other than MD&A - In addition to the basic financial statements

and accompanying notes, this report also presents certain required supplementary information related to

RTAA’s pension plan as required by the GASB to supplement information found in the notes to the basic

financial statements.

FINANCIAL ANALYSIS

Statement of Net Position

Net position may serve over time as a useful indicator of an organization’s financial position. The

Authority’s assets and deferred outflows exceeded liabilities and deferred inflows by $459.125 million at

June 30, 2022.

The following summarizes RTAA’s financial position as of June 30, 2022, and 2021:

2022 2021

$ Change % Change

Assets

Current assets 96,078,982$ 75,560,311$ 20,518,671$ 27%

Current assets-restricted 29,978,053 26,517,614 3,460,439 13%

Capital assets, net of depreciation 388,632,933 375,980,175 12,652,758 3%

Lease receivable, long term 33,195,211 - 33,195,211 100%

Other assets 1,383,599 1,383,599 - 0%

Total assets 549,268,778 479,441,699 69,827,079 15%

Deferred outflows of resources 14,125,539 5,771,560 8,353,979$ 145%

Liabilitie s

Current liabilities 11,951,622 8,551,985 3,399,637 40%

Payable from restricted assets 101,202 3,649,496 (3,548,294) -97%

Non-current liabilities 29,239,410 52,996,819 (23,757,409) -45%

Total liabilities 41,292,234 65,198,300 (23,906,066)$ -37%

Deferred Inflow of Resources 62,977,306 2,977,221 60,000,085$ 2015%

Net Position

Net Investment in Capital Assets 388,632,933 361,855,033 26,777,900 7%

Restricted Net Position 28,495,282 25,980,476 2,514,806 10%

Unrestricted Net Position 41,996,562 29,202,230 12,794,332 44%

Total Net Position 459,124,777$ 417,037,739$ 42,087,038$ 10%

21

MANAGEMENT’S DISCUSSION AND ANALYSIS

Total assets of $549.269 million reflect an increase of $69.827 million or 15% as compared to 2021. A

significant portion of the increase relates to the creation of a lease receivable balance from GASB 87 and

capital asset activity.

Unrestricted current assets increased by $20.519 million or 27%. This is mainly due to the increase of cash

and investments of $12.752 million and the recognition of $8.242 million in lease receivables as a result of

the implementation of GASB Statement No. 87. These increases are partially offset by reductions in

accounts receivable of $196 thousand and other current assets of $251 thousand.

Restricted current assets increased by $3.460 million or 13%, due to higher balances in restricted

investments of $4.645 million or 20%. This increase is partially offset by the $2.281 million or 99%

decrease in cash and cash equivalents.

Capital assets of $388.633 million increased by $12.653 million or 3% as compared to the prior year. The

increase is primarily due to $28.754 or 4% increase in new capital assets and $8.838 million or 22% increase

in construction in progress. These increases are partially offset by the $24.939 million or 4% increase in

accumulated depreciation and amortization.

Other assets are comprised of regional road impact credits with the Regional Transportation Commission

(RTC) of Washoe County valued at $1.384 million. The regional road impact fee is a one-time assessment

to pay for new roads or improvements to existing roads necessary to serve traffic from a new development.

The fee is paid at the time a building permit is issued. RTAA owned credits are currently set to expire on

June 26, 2033 and can be used as an offset to the road impact fee as needed or sold to others.

Total liabilities of $41.292 million decreased $23.906 million or 37% for the fiscal year ended June 30,

2022. The significant factors for the decline are the retirement of $12.290 million in outstanding revenue

bonds, and a reduction in net pension liability of $14.017 million.

The largest portion (85%) of RTAA’s total net position represents the investment in capital assets, less the

related indebtedness outstanding used to acquire those capital assets. On June 30, 2022, RTAA had

$388.633 million of net investment in capital assets, an increase of $26.778 million or 7% from the prior

fiscal year. RTAA uses these capital assets to provide services to airlines, passengers, visitors, and service

providers at the Airport. Consequently, these assets are not available for future spending.

An additional portion (6%) of RTAA’s net position represents restricted resources of $28.495 million, a

$2.515 million or 10% increase from FY 2021. The restricted net position is not available for spending due

to the following commitments:

As of June 30, 2022, the remaining unrestricted net position of $41.997 million, or 9% of total net position

represents liquidity available to meet any of RTAA’s on-going obligations.

2022 2021

Revenue bond operations and maintenance 7,532,989 7,724,482

Renewal and replacement 770,498 786,759

Passenger facility charge projects 20,160,846 15,516,627

Debt service - 1,909,953

Other reserve purposes 30,949 42,655

28,495,282 25,980,476

22

MANAGEMENT’S DISCUSSION AND ANALYSIS

The following presents RTAA’s deferred outflows and inflows as of June 30, 2022, and 2021:

A deferred outflow of resources is the recognition of “consumed” net assets that is applicable to a future

reporting period. This recognition includes: (1) pension contributions of $2.819 million to the Public

Employees Retirement System (PERS) of the State of Nevada after the measurement date of June 30, 2021;

(2) the pension value changes in actuarial assumptions of $8.156 million; differences identified on the

Schedule of Employer Allocations, Schedule of Pension Amounts by Employer and Related Notes by

PERS; (3) pension differences between expected and actual pension experience of $2.721 million; and (5)

contributions related to Other Postemployment Benefits (OPEB) liability of $127 thousand.

Conversely a deferred inflow of resources is the recognition of “acquired” resources of net assets applicable

to a future reporting period. This recognition includes: (1) pension difference between actual and projected

earnings on plan investments of $20.044 million (2) the differences in economic and demographic factors

used in the projected actuarial assumptions and actual experiences of $173 thousand; (3) the difference

between the actual and proportionate share of contribution of $1.580 million; and (4) the value of lease

receivables of $41.180 million.

The deferred outflows and inflows related to RTAA’s pension plan and OPEB are further explained in Note

9 - Pension Plan and Note 13 - Other Postemployment Benefits (OPEB) in the notes to the financial

statements. Deferred inflows related to leases are discussed in detail in Note 8 – Leases.

Statement of Changes in Net Position

During the current fiscal year, the Authority’s net position increased by approximately $42.087 million.

The following summarizes the changes in RTAA’s net position for June 30, 2022, and 2021:

2022 2021 $ Change % Change

Deferred outflows of resources 14,125,539$ 5,771,560$ 8,353,979$ 145%

Deferred inflows of resources 62,977,306 2,977,221 60,000,085 2015%

2022 2021 $ Change % Change

Operating revenues 58,065,181$ 43,662,916$ 14,402,265$ 33%

Operating expenses 46,340,021 42,612,297 3,727,724 9%

Operating income before depreciation

and amortization 11,725,160 1,050,619 10,674,541 1016%

Depreciation and amortization expense 25,079,112 26,827,690 (1,748,578) -7%

Operating income/(loss) (13,353,952) (25,777,071) 12,423,119 48%

Non-operating revenues/(expenses) 27,754,958 16,386,414 11,368,544 69%

Income/(loss) before capital contributions 14,401,006 (9,390,657) 23,791,663 253%

Capital contributions 27,686,032 25,193,485 2,492,547 10%

Change in net position 42,087,038$ 15,802,828$ 22,043,085$ 139%

23

MANAGEMENT’S DISCUSSION AND ANALYSIS

Significant Changes in Net Position for Fiscal Year 2022 versus 2021

Total operating revenues increased by $14.402 million or 33% and total operating expenses increased by

$3.728 million or 9%. A review of these two categories is detailed below.

Depreciation and amortization expense of $25.079 million was $1.749 million or 7% lower than the prior

year due the full depreciation of certain assets in the prior year.

Non-operating income of $27.755 million increased by $11.369 million or 69% over prior year. This is

primarily due to the increase of federal stimulus grant revenues (CARES, ARPA, and CRRSA).

Capital contributions of $27.686 million, primarily comprised of grants from the Federal Aviation

Administration (FAA), increased by $2.493 million or 10% in FY 2022 as compared to FY 2021. The grant

contributions include reimbursements for runways, taxiways, and apron rehabilitation.

Operating Revenues

Revenues are defined as “operating” for those revenue categories used to finance RTAA’s operation and

maintenance of RNO and Reno-Stead Airport (RTS). Included are landing fees, concession revenues,

parking, and other charges. The table below represents operating revenues by source for the fiscal years

ended June 30, 2022, and 2021:

Significant Changes in Operating Revenues for Fiscal Year 2022 versus 2021

A key metric associated with RTAA’s operating revenues is the number of enplaned passengers at RNO.

The COVID-19 pandemic caused unprecedented disruption of the passenger airline traffic worldwide.

Governments issued travel restrictions, mask mandates, and other restrictive measures in an effort to

manage the pandemic. The number of enplaned passengers recorded at RNO declined significantly during

FY 2021, ending the year with 1.232 million enplanements. With the rollout of vaccines, lifting travel

restrictions, and the transition back to business as usual in FY 2022, passenger traffic has increased to pre-

pandemic levels in some months, ending the year with 2.080 million enplanements.

Landing fee revenues of $10.585 million increased $1.636 million or 18% from the prior year mainly due

to the recovery of airline activity at RNO. Cargo airlines benefited from the boom of ecommerce during the

pandemic and recorded higher landed weights than pre-pandemic. Landing fees represent approximately

18% of RTAA’s total operating revenues.

2022 2021

$ Change % Change

Landing fees 10,584,517$ 8,948,847$ 1,635,670$ 18%

Concession revenue 15,257,011 9,628,195 5,628,816 58%

Parking and ground transportation 14,004,587 7,361,177 6,643,410 90%

Rentals 15,073,833 15,715,644 (641,811) -4%

Reimbursements for services 3,000,059 1,823,280 1,176,779 65%

Other revenue 145,174 185,773 (40,599) -22%

Total operating revenue 58,065,181$ 43,662,916$ 14,402,265$ 33%

24

MANAGEMENT’S DISCUSSION AND ANALYSIS

Concession revenues of $15.257 million were generated from auto rental, gaming, food and beverage,

merchandising, advertising, and other concessions. They represent 26% of the total operating revenues and

58% higher than FY 2021. Concession revenues recorded in FY 2021 were $1.674 million, which was 15%

below FY 20 results due to the impacts of the COVID 19 pandemic. In August 2021 the Board authorized

the President/CEO to provide temporary financial relief to in-terminal concessionaires: The Paradies Shops,

LLC, SSP America, Inc., MAG US Lounge Management, Traveler Gifts, LLC, and Tahoe Douglas Visitors

Authority through the waiver of monthly minimum annual guarantee (MAG) payments, rents, or reduction

of concession fees through June 30, 2022.

Parking and Ground Transportation revenues of $14.005 million accounted for 23% of total operating

revenues. Parking revenues increased by $6.643 million or 90% above the prior year results. Current

parking rates are $1.00 for the first 30 minutes, $2.00 for the first hour, and an additional $1.00 per hour,

with maximum amounts of $24.00 per day for short-term, $14.00 per day for the long-term garage, and

$10.00 per day for long-term surface lot parking.

Rental revenues of $15.074 million decreased $642 thousand or 4%. The decrease is the result of the year

end airline fee settlement calculation with revenues higher than budget and expenses lower than the budget

estimate.

Reimbursements for services and the other revenue category generated $3.145 million or 5% of total

operating revenues. Reimbursements for services increased $1.177 million or 65% from fiscal year 2021.

Revenues in this category include airline charges to use RTAA’s baggage handling system (BHS). The

BHS fee reflects 100% cost recovery of the direct operating and maintenance costs of the system less any

reimbursement from the Transportation Security Administration (TSA) for direct costs associated with their

screening equipment. Other revenues of $145 thousand include miscellaneous revenues, such as late fees

collected by RTAA, and rebates received.

Operating Expenses

The RTAA’s total operating expenses totaled $46.340 million in FY 2022, an increase of $3.728 million or

9% above the prior year results. The increase is primarily due to the increase of funding allocated to

operating activities after the budget reductions due to the COVID-19 pandemic, as well as contracted

services related to capital projects. Of the total operating expenses, 65% were costs associated with

employee wages and benefits of a workforce of 279 employees as of June 30, 2022. The following is a

summary of expenses (excluding depreciation and amortization) by source for the years ended June 30,

2022, and 2021:

2022 2021

$ Change % Change

Employee wages and benefits 30,348,607$ 30,923,994$ (575,387)$ -2%

Utilities and communications 3,156,581 2,454,099 702,482 29%

Purchase of services 7,405,170 4,887,352 2,517,818 52%

Materials and supplies 2,575,145 2,259,926 315,219 14%

Administrative expenses 2,854,518 2,086,926 767,592 37%

Total Operating Expenses 46,340,021$ 42,612,297$ 3,727,724$ 9%

25

MANAGEMENT’S DISCUSSION AND ANALYSIS

Significant Changes in Operating Expenses for Fiscal Year 2022 versus 2021

Employee salaries, wages, and benefits of $30.349 million decreased $575 thousand or 2% in fiscal year

2022. Personnel related expenses represent approximately 65% of total operating expenses. The following

table outlines the major expense categories within employee salaries, wages, and benefits for the years

ending June 30, 2022, and 2021:

2022 2021 $ Change % Change

Sala

r

ies $21,724,003 $19,400,633 $2,323,370 12%

Overtime, Standby, Holiday Worked 1,645,304 1,162,234 483,070 42%

Employee Benefits 6,979,281 10,361,127 (3,381,846) -33%

Total Employee Wages and Benefits

$30,923,994 $32,120,112 ($1,196,118) -2%

Employee salaries have increased by $2.323 million or 12% from FY 2021. This increase reflects a return

to pre-pandemic operation levels with filling existing open positions. Overtime also increased by $483

thousand. Employee benefits decreased approximately $3.382 million or 33% due largely to decreases of

RTAA’s share of the net pension liability based on the actual results of investments. The net pension

liability and related inflows and outflows of deferred revenue are based on actuarial assumptions at June

30, 2021. During FY 2021 actual results of earnings on investments was significantly larger than

expectations, resulting in a decrease of the net pension liability and RTAA’s related expense. These

expenses are further explained in Note 9 – Pension Plan and Note 11 – Other Post-Employment Benefits

(OPEB).

Utilities and communications expenses of $3.157 million increased $702 thousand or 29% from the prior

year and represents 7% of total operating expenses. This category includes electricity, natural gas, water,

sewer service, telephone, and other utility services.

Purchase of services expense includes professional and technical services and totaled $7.405 million, an

increase of $2.518 million or 52% from the prior year. The increase was primarily due to higher costs

associated with consultant services and contracted services related to capital projects and financial software

conversion and implementation. Purchase of services expense represents 52% of total operating expenses.

Expenses for materials and supplies totaled $2.575 million, an increase of $315 thousand or 14% from the

prior year. Materials and supplies represent 14% of total operating expenses.

The administrative expense category includes travel, training, air service development, insurance, and other

general expenses. In total, the category incurred $2.855 million in cost, an increase of approximately $768

thousand or 37% from the prior fiscal year. This increase reflects increased costs associated with training,

conference sponsorship, insurance premiums, and community outreach.

Non-Operating Revenues and Expenses

The category of non-operating revenues and expenses contains sources and uses of RTAA funding not

directly associated with supporting the operations of the airports or funding intended or restricted for

specific uses. Included in this group are the items following: interest income, Passenger Facility Charges

(PFCs), Customer Facility Charges (CFCs), jet fuel taxes, federal stimulus grants, and interest expense on

RTAA revenue bonds.

26

MANAGEMENT’S DISCUSSION AND ANALYSIS

The following is a summary of non-operating revenues and expenses for the years ended June 30, 2022,

and 2021:

Significant Changes in Non-Operating Revenues and Expenses for Fiscal Year 2022 versus 2021

Interest income consists of interest from leases under GASB 87 of $591 thousand and interest earned on

cash and investments of $655 thousand. Interest income from cash and investments decreased 35% and

loss on the value of investments increased 66% this past fiscal year. Interest rate changes impact RTAA’s

financial position in two ways: 1) revenues will change based on lower or higher interest rates and 2)

investment market values will change positively if rates decline and negatively if rates rise. The impact is

dependent on the overall maturity structure of the investment portfolio. Overall interest rates were low most

of the fiscal year, increasing slightly in the fourth quarter. Reduced rates during the year resulted in lower

investment revenue, due to the reinvestment of maturities at lower replacement yields.

Jet fuel tax revenues are derived from a one cent per gallon of fuel for jet or turbine aircraft sold, distributed,

or used. The tax is collected by Washoe County and remitted to RTAA as outlined in Nevada Revised

Statute (NRS) 365.170. These revenues are used by RTAA to support air service development objectives

and other discretionary expenses. The increase in revenues is due to higher volume of aircraft operations at

RNO.

Federal stimulus grant revenues of $14.483 million increased by $7.424 million in FY 2022. This includes

eligible cost reimbursement from the CARES, CRRSA, and ARPA Acts of $13.887 million. This funding

is permissible for any eligible use of airport revenues. CARES Act reimbursement in fiscal year 2022

included debt service, contracted services, salaries, and wages. RTAA also received funding for concession