August 4, 2021

Real Estate Settlement

Procedures Act

(Regulation X) and Truth

in Lending Act

(Regulation Z) Mortgage

Servicing Rules

Small entity compliance guide

2 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

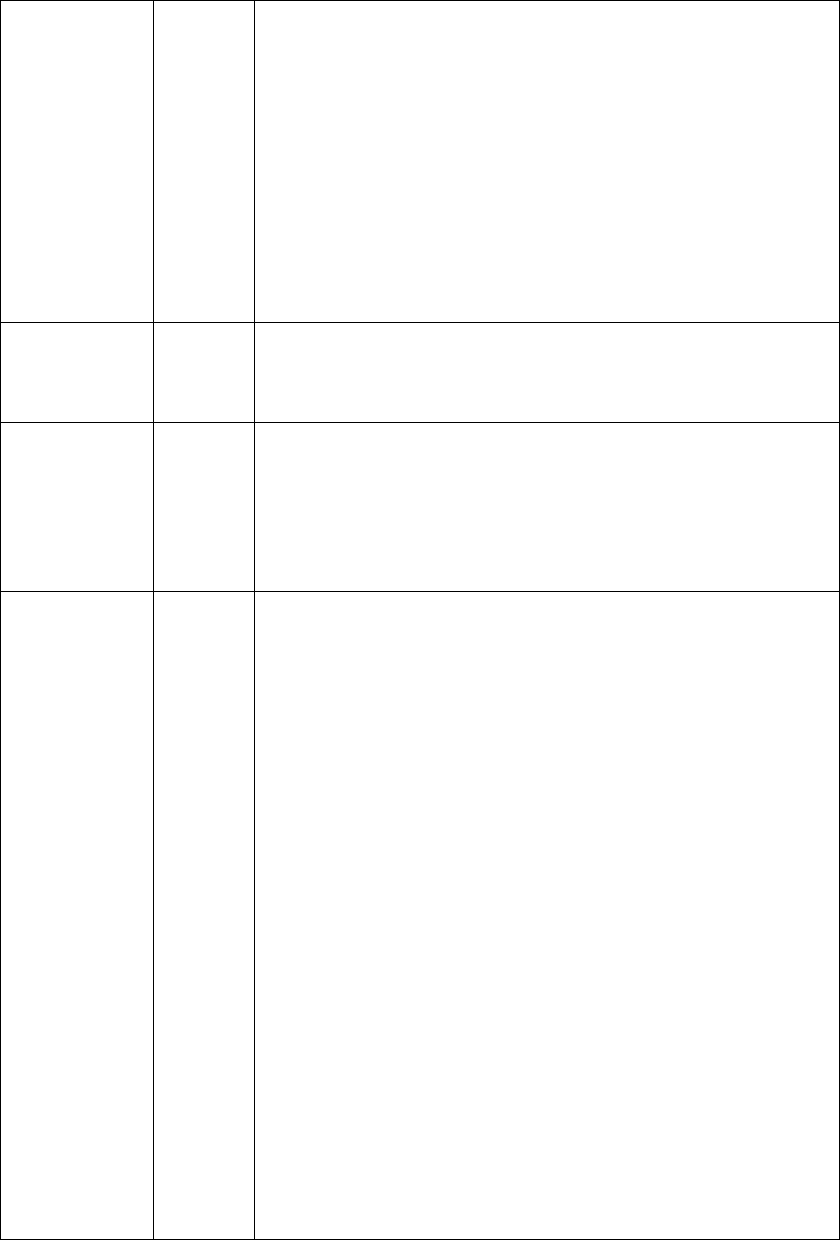

Version log

The Bureau updates this guide on a periodic basis to reflect finalized amendments and

clarifications to the rule that impacts guide content, as well as administrative updates. Below is

a version log noting the history of this document and its updates:

Date

Version

Changes

August 4,

2021

4

On June 28, 2021, the Bureau issued a final rule adding

certain provisions related to the COVID-19 pandemic.

This rule:

Loss mitigation foreclosure protections: Added

temporary procedural safeguards to the loss

mitigation requirements.

Loss mitigation incomplete application

requirements: Revised reasonable diligence

timing requirements for borrowers in a short-

term forbearance program related to COVID-19.

It also added the ability to temporarily provide

certain COVID-19-related streamlined loan

modifications to borrowers based on the

evaluation of an incomplete application.

Early intervention live contact: Added additional

information servicers must temporarily provide

certain borrowers promptly after establishing

living contact.

On June 23, 2020, the Bureau issued an interim final rule

to temporarily permit mortgage servicers to offer certain

loss mitigation options (e.g., payment deferral and partial

claim programs) to borrowers affected by the COVID-19

pandemic based on the evaluation of an incomplete loss

mitigation application.

3 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

These revisions for these two rules are generally

discussed in Appendix B.

Separately, based on frequently asked questions, this

version also clarifies certain guidance related to the

servicing file and use of multiple electronic systems. (See

“Servicing file” in Section 10.5.2.)

Miscellaneous Administrative Changes.

August 6,

2019

3.2.1

Corrected typo on header of Early Invention with

Delinquent Borrowers in Section 11.

March 22,

2019

3.2

Correction of citations in the Modified Periodic

Statement Requirements table. (See “Content and layout

requirements for modified periodic statements and

coupon books” in

Section 5.10.2)

March 29,

2018

3.1

On March 8, 2018, the Bureau issued a final rule

amending the 2016 Mortgage Servicing Rules. This rule

replaces the single-billing-cycle exemption for periodic

statements and coupon books with a single-statement

exemption when servicers transition to providing

modified or unmodified periodic statements and coupon

books to consumers entering or exiting bankruptcy. This

final rule provides a single-statement exemption for the

next periodic statement or coupon book that a servicer

would otherwise have to provide, regardless of when in

the billing cycle the triggering event occurs. (See

“

Periodic statement and coupon book exemption for

borrowers in bankruptcy (§ 1026.41(e)(5)) in Section

5.10.6)

Provisions of the mortgage servicing rules in effect prior

to April 19, 2018, which are no longer in effect on or after

April 19, 2018, have been removed.

4 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

Miscellaneous formatting changes.

October 18,

2017

3.0

In October 2017, the Bureau issued an interim final rule

amending certain mortgage servicing rules. This guide

refers to the October 2017 interim final rule as the

October 2017 Interim Final Rule.

Early intervention: The October 2017 Interim

Final Rule clarifies the obligations for servicers to

provide the early intervention written notice if the

borrower has invoked the cease communication

protection under the Fair Debt Collection

Practices Act (FDCPA). (See “How often must I

provide a written notice to a borrower who has

invoked the cease communication right under the

FDCPA? (§ 1024.39(d)(3)(iii)) in Section 11.8.8)

In July 2017, the Bureau published a final rule making

technical corrections to the 2016 Mortgage Servicing Rule

(July 2017 Final Rule). The July 2017 Final Rule clarifies

the effective date for modifications to the sample notices

provided in appendix H-30 and for commentary relating

to periodic statements for certain borrowers in

bankruptcy. (See “5.6.3 Note on modifying sample

periodic statements” in Section 5.6.3 and “When do I

have to start following these rules?” in Section 2.2)

Miscellaneous Administrative Changes.

November

30, 2016

3.0

In August 2016, the Bureau published a final rule

amending certain mortgage servicing rules. This guide

refers to the August 2016 final rule as the 2016 Mortgage

Servicing Rule.

Small servicer: The small servicer exemption

generally applies to servicers who service 5,000 or

fewer mortgage loans for all of which the servicer

5 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

is the creditor or assignee. The 2016 Mortgage

Servicing Rule excludes certain seller-financed

transactions and mortgage loans voluntarily

serviced for a non-affiliate, even if the non-

affiliate is not a creditor or assignee, from being

counted toward the 5,000-loan limit. (See “

Small

Servicer Exemption” in Section 3. )

Successors in interest: The 2016 Mortgage

Servicing Rule adds definitions of “successor in

interest” to subpart C of Regulation X and to

Regulation Z. In addition, it includes provisions

related to how a servicer confirms a successor in

interest’s identity and ownership interest in a

property. It also generally provides that the

mortgage servicing rules apply to successors in

interest once a servicer confirms the successor in

interest’s status. (See “Successors in Interest” in

Section 4. )

Periodic statements: The 2016 Mortgage

Servicing Rule clarifies certain periodic statement

disclosure requirements relating to mortgage

loans and requires servicers to provide certain

borrowers in bankruptcy a modified periodic

statement or coupon book. In addition, in certain

circumstances, servicers generally are exempt

from the periodic statement requirement for

charged-off mortgage loans. (See “Periodic

Statements” in Section 5. )

Force-placed insurance: The 2016 Mortgage

Servicing Rule amends the force-placed insurance

disclosures and model forms to account for

instances when the borrower has insufficient

coverage on the property, and it gives servicers the

6 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

option to omit a borrower’s mortgage loan

account number on certain required notices. (See

“

Force-Placed Insurance” in Section 8. )

Early intervention: The 2016 Mortgage Servicing

Rule clarifies the obligations for servicers to

establish or make good faith efforts to establish

live contact with delinquent borrowers. In

addition, the rule revises the exemption from

early intervention for borrowers who are in

bankruptcy or who have invoked cease

communication protection under the Fair Debt

Collection Practices Act (FDCPA). (See “Early

Intervention with Delinquent Borrowers” in

Section 11. )

The definition of delinquency: The 2016 Mortgage

Servicing Rule adopts a general definition of

delinquency that applies to all servicing provisions

of Regulation X and periodic statements for

mortgage loans in Regulation Z. For more

information on when a borrower is delinquent,

see the Bureau’s factsheet on Delinquency

.

Loss mitigation: The 2016 Mortgage Servicing

Rule amends and modifies several sections of the

loss mitigation rule. (See “Loss Mitigation

Procedures” in Section 13). The final rule:

Requires servicers to meet the loss mitigation

requirements more than once in the life of a

loan for borrowers who become current on

payments at any time between the borrower’s

prior complete loss mitigation application and

a subsequent loss mitigation application;

7 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

Modifies an existing exception to the 120-day

prohibition on foreclosure filing to allow a

servicer to join the foreclosure action of a

superior or subordinate lienholder;

Clarifies how servicers select the reasonable

date by which a borrower should return

documents and information to complete an

application;

Makes clear that servicers cannot move for

foreclosure judgment or order of sale, or

conduct a foreclosure sale, in certain

circumstances;

Requires that servicers provide a written

notice to a borrower within five days

(excluding Saturdays, Sundays, or legal

holidays) after they receive a complete loss

mitigation application and requires certain

information to be included in the notice;

Sets forth how servicers must attempt to

obtain information not in the borrower’s

control and evaluate a loss mitigation

application while waiting for third party

information;

Permits servicers to offer a short-term

repayment plan based upon an evaluation of

an incomplete loss mitigation application;

Eases document collection requirements in

connection with some loss mitigation

applications; and

Addresses and clarifies how loss mitigation

procedures and timelines apply when a

8 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

transferee servicer receives a mortgage loan

for which there is a loss mitigation application

pending at the time of a servicing transfer.

Other amendments and technical corrections or

clarifications to the mortgage servicing rules not

listed above.

The mortgage servicing rules address the servicing of

mortgage loans, and are implemented in both Regulation

X and Regulation Z. Regulation X uses the term

“borrower,” and Regulation Z uses the term “consumer.”

Previous versions of the Mortgage Servicing Guide used

the term “consumer” for ease of reading. This version

replaced the term “consumer” throughout the guide with

the term “borrower.”

A nonprofit servicer section was added to the Small

Servicer Exemption section.

Miscellaneous Administrative Changes.

November 3,

2014

2.2

The Bureau published a final rule amending certain

mortgage rules to:

Provide a small servicer definition for nonprofit

entities that meet certain requirements. (See

“

Small Servicer Exemption” in Section 3.)

January 7,

2014

2.1

Miscellaneous Administrative Changes.

November

27, 2013

2.0

Servicer activities prohibited during the first 120

days of delinquency: The Bureau’s servicing rule

prohibits servicers from making the “first notice

or filing” under state law during the first 120 days

of the borrower’s delinquency. The October 2013

Final Rule clarifies how the rule works across

9 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

different states with different foreclosure laws,

and adopts a narrower definition of “first notice of

filing” that closely tracks FHA’s “first legal”

standard, which is familiar to industry. Also

under the final rule, servicers will be allowed to

send early notices that may provide beneficial

information to borrowers about legal aid,

counseling, or other resources.

Procedures for obtaining follow-up information

on loss-mitigation applications: According to the

Bureau’s servicing rule, within five days of receipt

of a loss mitigation application, a servicer must

acknowledge receipt of the application and inform

the borrower whether it deems the application

complete or incomplete. If incomplete, the

servicer must identify for the borrower what is

needed to complete it. The October 2013 Final

rule makes two changes to these provisions:

First, it outlines procedures for servicers to

follow if, after conducting an initial review and

sending the notice to the borrower, they

discover that they do not have the information

needed to complete an assessment or failed to

identify needed documents or information in

the initial notice. The changes clarify that

servicers are required to seek the additional

information from the borrower if they cannot

complete the assessment without it.

Second, it provides borrowers who submit

“facially complete” applications—i.e., they

respond to the initial notice by providing all of

the documents or information identified by

the servicer at that time—with rights and

protections under the rule. This includes

10 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

prohibiting servicers form proceeding with a

foreclosure until the borrower has been

notified that additional documents or

information is needed and been given a

reasonable time to those documents or

information.

Short-term forbearance: The October 2013 Final

Rule provides servicers more flexibility in

providing short-term forbearance plans for

delinquent borrowers who need only temporary

relief without going through a full loss mitigation

evaluation process.

Interplay between the servicing rules,

bankruptcy law, and Fair Debt Collection

Practices Act (FDCPA): The October 2013 Interim

Final Rule and CFPB Bulletin 2013-12 provide

clarifications that certain notices and

communications mandated by the servicing rules

and the Dodd-Frank Wall Street Reform and

Consumer Protection Act are still required even

when delinquent borrowers have instructed

servicers who are debt collectors under the

FDCPA to cease communications. However, such

will not be required to provide early intervention

contacts or certain notices of interest rate

adjustments. The October 2013 Interim Final

Rule also exempts servicers from being required

to provide periodic statements and early

intervention contacts with borrowers in

bankruptcy.

June 7, 2013

1.0

Original Document

11 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

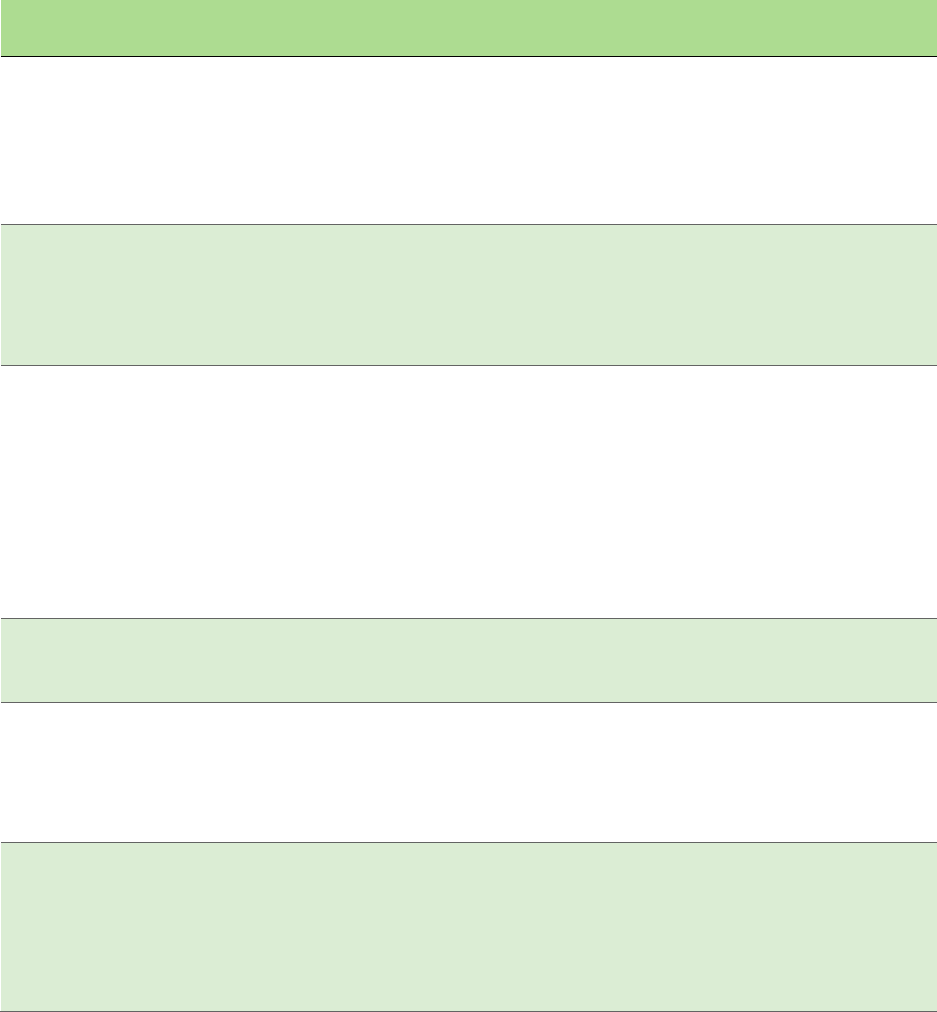

Table of contents

Version log ................................................................................................................... 2

Table of contents....................................................................................................... 11

1. Introduction ......................................................................................................... 18

1.1 What are the RESPA & TILA Mortgage Servicing Rules? .................................. 18

1.2 What is the purpose of this guide? ..................................................................... 21

1.3 Who should read this guide? ............................................................................. 22

1.4 Where can I find additional resources that will help me understand the

Mortgage Servicing Rules? ................................................................................ 22

2. Overview of the Mortgage Servicing Rules ...................................................... 24

2.1 What are the Mortgage Servicing Rules about? ................................................ 24

2.2 When do I have to start following these rules? ................................................. 25

2.3 What loans do the Mortgage Servicing Rules cover? ........................................ 26

3. Small Servicer Exemption .................................................................................. 27

3.1 Who is considered a small servicer? (§ 1026.41(e)(4)) .................................... 27

3.2 What loans should be considered? (§ 1026.41(a) and (e)) ............................... 29

3.3 From what provisions are small servicers exempt? ........................................... 31

4. Successors in Interest ....................................................................................... 33

4.1 What do the successor in interest rules require? .............................................. 33

4.2 What is the scope of the successor in interest rules? ........................................ 34

4.3 Is there a small servicer exemption from the successor in interest

requirements? .................................................................................................... 34

4.4 When do I have to start complying with the successor in interest rules? ........ 35

4.5 Who are successors in interest? (§§ 1024.31 and 1026.2(a)(27)) .................... 35

12 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

4.6 What are my responsibilities to a potential successor in interest?

(§§ 1024.36(i) and 38(b)(1)(vi)) .........................................................................37

4.7 What are my responsibilities to a confirmed successor in interest? ................ 43

4.8 Is there a private right of action for potential successors in interest under

RESPA or a privately enforceable notice of error requirement related to

successorship determinations?........................................................................... 51

5. Periodic Statements ........................................................................................... 52

5.1 What does the rule on periodic statements require? (§ 1026.41) .................... 52

5.2 What is the scope of the periodic statements rule? (§ 1026.41(a)(1)) .............. 52

5.3 Is there a small servicer exemption to the periodic statement rule? ................ 54

5.4 Who is responsible for sending a periodic statement? (§ 1026.41(a)(2) and

comment 41(a)-3) .............................................................................................. 54

5.5 How often must I send a periodic statement? (§ 1026.41(a)(2)) ..................... 54

5.6 What information must be on the periodic statement, and how must I arrange

it? ........................................................................................................................ 56

5.7 How can I use coupon books instead of periodic statements? (§ 1026.41(e)(3)

and comments 41(e)(3)-1 to -4) .......................................................................... 61

5.8 How must I deliver the information in periodic statements? ........................... 64

5.9 Must I continue to provide periodic statements or coupon books after a

mortgage loan is charged off? (§ 1026.41(e)(6)) .............................................. 66

5.10 Must I provide a borrower in bankruptcy a periodic statement or coupon

book? .................................................................................................................. 68

6. Interest Rate Adjustment Notices (§ 1026.20(c) and (d)) ................................. 79

6.1 What does the rule on interest rate adjustment notices require? (§ 1026.20(c)

and (d)) .............................................................................................................. 79

6.2 What is the scope of the interest rate adjustment notice rule?......................... 79

6.3 Is there a small servicer exemption to the interest rate adjustment notices

rule?.................................................................................................................... 80

6.4 Who is responsible for sending the ARM notices? (§ 1026.20(c) and (d))...... 80

13 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

6.5 When must I send these notices? (§ 1026.20(c)(2) and (d)(2)) ....................... 81

6.6 What information must be included in the initial and ongoing interest rate

adjustment notices? ........................................................................................... 82

7. Prompt Payment Crediting and Payoff Statements (§ 1026.36(c)) ................. 86

7.1 What do the prompt crediting and payoff statements rules require? .............. 86

7.2 What is the scope of the prompt crediting and payoff statement rules?

(§ 1026.36(c)(1) and (c)(3)) ............................................................................... 86

7.3 Is there a small servicer exemption to the prompt crediting and payoff

statement rules? ................................................................................................. 87

7.4 What is a periodic payment, and how must I handle it? (§ 1026.36(c)(1)(i)) . 87

7.5 What is a partial payment, and how must I handle it? (§ 1026.36(c)(1)(ii) and

comment 36(c)(1)(ii)-1) ..................................................................................... 88

7.6 What is a non-conforming payment, and how must I handle it?

(§ 1026.36(c)(1)(iii)) .......................................................................................... 89

7.7 How must I respond to written requests for payoff statements?

(§ 1026.36(c)(3)) ................................................................................................ 90

8. Force-Placed Insurance ..................................................................................... 91

8.1 What does the force-placed insurance rule require? (§ 1024.37) ..................... 91

8.2 What is the scope of the force-placed insurance rule? ....................................... 91

8.3 Is there a small servicer exemption to the force-placed insurance rule? ......... 92

8.4 What is force-placed insurance? ....................................................................... 92

8.5 What must I do before I charge a borrower for force-placed insurance? ......... 93

8.6 May I charge a borrower for insurance placed before the notices have been

sent? ................................................................................................................... 93

8.7 What must be in the force-placed insurance notices? ...................................... 94

8.8 What evidence may I request from borrowers showing they have had

continuous hazard insurance coverage? (Comment 37(c)(1)(iii)-2) .............. 100

8.9 What do I do when the borrower responds? .................................................... 101

14 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

8.10 What are the limitations on charges? (§ 1024.37(h)(1) and (h)(2)) ............... 101

8.11 What additional rules apply for borrowers with escrow accounts for payment

of hazard insurance? (§ 1024.17(k)(5))........................................................... 102

8.12 What is the small servicer exemption from the escrow provisions?

(§ 1024.17(k)(5)(iii)) ........................................................................................ 102

9. Error Resolution and Information Requests .................................................. 103

9.1 What do the error resolution and information request rules require? ........... 103

9.2 What is the scope of the error resolution and information request rules? ..... 104

9.3 Is there a small servicer exemption to the error resolution and information

request rules? ................................................................................................... 104

9.4 How is this different from the requirements for Qualified Written

Requests? ......................................................................................................... 104

9.5 What is a notice of error? (§ 1024.35(a))........................................................ 104

9.6 What is an information request? (§ 1024.36(a)) ............................................. 107

9.7 Are there situations that do not trigger the error resolution or information

request response procedures? (§§ 1024.35(g) and 36(f)) .............................. 108

9.8 Can I designate addresses for notices of error or requests for

information? ..................................................................................................... 110

9.9 What must I do if I receive a notice of error? ................................................... 112

9.10 What is the timeline for responding to borrowers who send notices of

errors? ............................................................................................................... 115

9.11 What must I do when I receive an information request?................................. 116

9.12 What is the timeline for responding to borrowers who request

information? ..................................................................................................... 119

9.13 May I charge borrowers a fee for responding to notices of errors or requests for

information? .................................................................................................... 120

9.14 How do error notices and information requests affect collections and credit

reporting? (§ 1024.35(i)(1) to (2)) .................................................................. 120

10. General Servicing Policies, Procedures, and Requirements ........................ 121

15 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

10.1 What does the general servicing policies, procedures, and requirements rule

require? ............................................................................................................. 121

10.2 What is the scope of the general servicing policies, procedures, and

requirements rule? ............................................................................................ 122

10.3 Is there a small servicer exemption to the general servicing policies,

procedures, and requirements rule? ................................................................ 122

10.4 What objectives must I design my policies and procedures to achieve? ......... 123

10.5 What are the standard requirements I must meet? ......................................... 127

11. Early Intervention with Delinquent Borrowers ............................................... 129

11.1 What does the early intervention rule require? (§ 1024.39) ........................... 129

11.2 What is the scope of the early intervention rule? ............................................. 129

11.3 Is there a small servicer exemption to the early intervention rule? ............... 130

11.4 When must I establish live contact with a delinquent borrower? (§ 1024.39(a)

and comment 31(Delinquency)-1) ................................................................... 130

11.5 What Information must I share with delinquent borrowers about loss

mitigation options? (Comment 39(a)-4.i) ....................................................... 134

11.6 When must I provide a written notice about loss mitigation to delinquent

borrowers? (§ 1024.39(b) and comments 39(a)-1 and (b)(1)-2 and -5) ......... 135

11.7 What information must be in the written notice about loss mitigation options?

(§ 1024.39(b)(2) to (3)) .................................................................................... 137

11.8 Do the rules provide any exemptions to the early intervention requirements if a

borrower is in bankruptcy or invoked the cease communication protection

under the FDCPA? ............................................................................................ 138

12. Continuity of Contact with Delinquent Borrowers ......................................... 145

12.1 What does the continuity of contact rule require? ........................................... 145

12.2 What is the scope of the continuity of contact rule? ........................................ 145

12.3 Is there a small servicer exemption to the continuity of contact rule? ............ 146

12.4 What is continuity of contact? (§ 1024.40(a)) ................................................. 146

16 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

12.5 When must continuity of contact personnel be available to borrowers?

(§ 1024.40(a)(1) to (2)) ..................................................................................... 147

12.6 What must personnel be able to do? (§ 1024.40(b)(1)-(2)) ............................148

13. Loss Mitigation Procedures ............................................................................. 150

13.1 What does the loss mitigation rule require? (§ 1024.41) ................................ 150

13.2 What is the scope of the loss mitigation rule? .................................................. 151

13.3 Is there a small servicer exemption to the loss mitigation

rule? (§ 1024.41(j)) ........................................................................................... 151

13.4 What must I do when I receive a loss mitigation application? ........................ 153

13.5 What must I do when I deny a loan modification application? (§ 1024.41(d)

and comments 41(d)(1)-1 to -4) ........................................................................168

13.6 How long must I give borrowers to respond to loss mitigation offers?

(§ 1024.41(e)(1)) ................................................................................................ 169

13.7 What appeals must I allow when I offer loan

modifications? (§ 1024.41(h)) .......................................................................... 170

13.8 When am I prohibited from starting foreclosure or completing a foreclosure for

which I have already made the first notice or filing? (§§ 1024.41(f)(1)-(2) and

(g) and comments 41(f)-1 and 41(g)-1 to -5) .................................................... 171

13.9 What requirements apply to loss mitigation applications submitted 37 days or

less before a foreclosure sale?........................................................................... 174

13.10 What loss mitigation rules apply to servicing transfers? (§ 1024.41(k)) ........ 175

13.11 When must I evaluate a subsequent complete loss mitigation application?

(§ 1024.41(i)) ..................................................................................................... 183

13.12 Is there a private right of action for a borrower to enforce the loss mitigation

procedures? .......................................................................................................184

14. Practical Implementation and Compliance Considerations .......................... 185

15. Other Resources ............................................................................................... 187

15.1 Where can I find a copy of the Mortgage Servicing Rules and get more

information about them? .................................................................................. 187

17 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

Appendix A: ............................................................................................................. 188

Appendix B: ............................................................................................................. 189

Additional Provisions: 2020 and 2021 Mortgage Servicing COVID-19 Rules .........189

18 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

1. Introduction

1.1 What are the RESPA & TILA Mortgage

Servicing Rules?

In 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act (the Dodd-Frank

Act) amended the Real Estate Settlement Procedures Act (RESPA) of 1974, which is

implemented by Regulation X, and the Truth in Lending Act (TILA), which is implemented by

Regulation Z, with regard to the servicing of certain residential mortgage loans. The Consumer

Financial Protection Bureau (Bureau) issued rules in January 2013 to implement these Dodd-

Frank Act amendments to RESPA and TILA. The Bureau also issued several amendments to

these rules in 2013 and 2014. This guide refers to all of these rules collectively as the 2013

Mortgage Servicing Rules. Most of the 2013 Mortgage Servicing Rules became effective on

January 10, 2014.

In August 2016, the Bureau issued a final rule that clarified, revised, and amended several

provisions in the 2013 Mortgage Servicing Rules.

1

These provisions include requirements

regarding force-placed insurance notices, policies and procedures, early intervention, and loss

mitigation under Regulation X’s servicing provisions; and prompt crediting and periodic

statements under Regulation Z’s servicing provisions. The final rule also addressed certain

servicing requirements when a person is a potential or confirmed successor in interest, is a

debtor in bankruptcy, or has sent a cease communication request under the Fair Debt Collection

Practices Act (FDCPA). This guide refers to the August 2016 final rule as the 2016 Mortgage

Servicing Rule. Most provisions of the 2016 Mortgage Servicing Rule became effective on

October 19, 2017. The provisions relating to successors in interest and bankruptcy periodic

statements became effective on April 19, 2018.

To assist borrowers affected by the COVID-19 emergency, the Bureau issued two rules amending

Regulation X. In June 2020, the Bureau issued an interim final rule (2020 Mortgage Servicing

COVID-19 Interim Final Rule) to temporarily permit mortgage servicers to offer certain loss

1

The Bureau issued the final rule on August 4, 2016. The rule was published in the Federal Register on October 19,

2016. 81 Fed. Reg. 72160 (October 19, 2016).

19 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

mitigation options, such as certain payment deferral and partial claim programs, to borrowers

affected by the COVID-19 pandemic based on the evaluation of an incomplete loss mitigation

application. These amendments were effective on July 1, 2020. Additionally, in June 2021, the

Bureau issued a final rule that amended several provisions to assist borrowers during the

COVID-19 pandemic (2021 Mortgage Servicing COVID-19 Rule). The final rule included

provisions to establish temporary procedural safeguards that servicers must ensure are met

before you can make the first notice or filing required for foreclosure on certain mortgages. In

addition, the provisions temporarily permit mortgage servicers to offer certain COVID-19-

related streamlined loan modifications based on the evaluation of an incomplete application and

added temporary early intervention and loss mitigation reasonable diligence obligations. These

provisions are effective on August 31, 2021.

The 2013 and 2016 Mortgage Servicing Rules, the 2020 Mortgage Servicing COVID-19 Interim

Final Rule, and the 2021 Mortgage Servicing COVID-19 Rule are collectively referred to in this

guide as the “Mortgage Servicing Rules.” This guide provides a summary of those rules. The

guide highlights issues that small creditors, and those that work with them, might find helpful to

consider when implementing the rules. Appendix B

of this Guide specifies deviations from the

2013 and 2016 Mortgage Servicing Rules that are applicable in the limited and temporary

circumstances of the 2020 Mortgage Servicing COVID-19 Interim Final Rule and the 2021

Mortgage Servicing COVID-19 Rule. References to

Appendix B are placed in the applicable

sections of this Guide where relevant to compliance with the 2013 and 2016 Mortgage Servicing

Rules. The content of this guide does not include any rules, bulletins, guidance, or other

interpretations of the Mortgage Servicing Rules, Regulation X, or Regulation Z issued or

released after the date on the guide’s cover page.

The Mortgage Servicing Rules can be found in the Federal Register:

Regulation X at 78 FR 10695 (February 14, 2013), as amended by 78 FR 44685 (July 24,

2013), 78 FR 60381 (October 1, 2013), 78 FR 62993 (October 23, 2013) (Interim Final

Rule), 81 FR 72160 (October 19, 2016), 85 FR 39055 (June 30, 2020) (Interim Final

Rule), and 86 FR 34848 (June 30, 2021).

Regulation Z at 78 FR 10901 (February 14, 2013), as amended by 78 FR 44685 (July 24,

2013), 78 FR 60381 (October 1, 2013), 78 FR 62993 (October 23, 2013) (Interim Final

Rule), 79 FR 65299 (November 3, 2014), and 81 FR 72160 (October 19, 2016).

The Bureau has also issued several other rules and documents related to the Mortgage Servicing

Rules. These documents include:

20 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

A supervisory bulletin CFPB Bulletin 2013-12;

Two interpretive rules relating to the Mortgage Servicing Rules: 79 FR 41631 (July 17,

2014) and 81 FR 71977 (October 19, 2016);

Policy guidance on supervisory and enforcement priorities for early compliance with the

2016 Mortgage Servicing Rules, 82 FR 29713 (June 30, 2017) (June 2017 Policy

Guidance);

A final rule making technical corrections to the 2016 Mortgage Servicing Final Rule, 82

FR 30947 (July 5, 2017) (July 2017 Final Rule);

An interim final rule, 82 FR 47953 (October 16, 2017) (October 2017 Interim Final Rule);

and

A final rule which revised the timing requirements adopted in the 2016 Mortgage

Servicing Final Rule for servicers transitioning between modified or unmodified periodic

statements and coupon books when consumers enter or exit bankruptcy, 83 FR 1053

(March 12, 2018).

The Dodd-Frank Act required disclosures for certain adjustable-rate mortgages (ARMs) and

force-placed insurance as well as periodic statements for consumers’ mortgage loans. It also

required prompt crediting of mortgage payments and providing payoff statements to

consumers. The Dodd-Frank Act further required servicers to take action to correct certain

errors asserted by consumers regarding their mortgages and to respond to requests for certain

information from consumers regarding their mortgages. The Dodd-Frank Act, TILA, and

RESPA authorized the Bureau to implement these requirements and to issue additional

consumer protection regulations. The Mortgage Servicing Rules issued by the Bureau under this

(and other) authority require servicers to establish certain policies, procedures, and

requirements—including regarding the designation of personnel to assist consumers who fall

behind in their mortgage payments—and to contact consumers soon after delinquency and work

with them to be considered for applicable loss mitigation options.

The Mortgage Servicing Rules set forth minimum requirements for compliance. The

Mortgage Servicing Rules do not foreclose other entities, such as owners and assignees of

mortgage loans, from setting higher servicing standards that are not in conflict with the

requirements set forth in the Mortgage Servicing Rules. An applicable servicing requirement is

not in conflict with the Mortgage Servicing Rules solely because it imposes additional

requirements. For example, if owner or assignee guidelines prescribe exactly how frequently

21 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

servicers must call borrowers until right party contact is made, those requirements may exceed

the general requirement of good faith efforts under the Mortgage Servicing Rules so long as the

guidelines are not in conflict with the requirements of the Mortgage Servicing Rules.

Note that, subsequent to the publication of this guide, the Bureau may update or amend

provisions of the Mortgage Servicing Rules and intends to provide guidance updates to reflect

any such future changes. Changes to this Small Entity Compliance Guide are noted in the

guide’s Version Log.

1.2 What is the purpose of this guide?

This guide provides a summary of the Mortgage Servicing Rules. This guide also highlights

issues that small creditors, and those that work with them, might find helpful to consider when

implementing the Mortgage Servicing Rules.

This guide also meets the requirements of Section 212 of the Small Business Regulatory

Enforcement Fairness Act of 1996, which requires the Bureau to issue a small entity compliance

guide to help small businesses comply with the regulations, and is a Compliance Aid issued by

the Consumer Financial Protection Bureau. The Bureau published a Policy Statement on

Compliance Aids, available at

www.consumerfinance.gov/policy-

compliance/rulemaking/finalrules/policy-statement-compliance-aids/, that explains the

Bureau’s approach to Compliance Aids.

Users of this guide should review the Mortgage Servicing Rules as well. The Mortgage Servicing

Rules are available at

www.consumerfinance.gov/rules-policy/final-rules/mortgage-servicing-

rules-under-real-estate-settlement-procedures-act-and-truth-lending-act/.

Servicers may want to review their policies, processes, software, contracts, or other aspects of

their business operations in order to identify any changes needed to comply with the Mortgage

Servicing Rules. Changes related to the Mortgage Servicing Rules may take careful planning,

time, or resources to implement. This guide will help you identify and plan for any necessary

changes.

Except when specifically needed to explain the Rule, this guide does not discuss other laws,

regulations, or regulatory guidance that may apply. The content of this guide does not include

22 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

any rules, bulletins, guidance, or other interpretations issued or released after the date on the

guide’s cover page.

At the end of this guide, there is more information about where to find some additional

resources.

1.3 Who should read this guide?

Creditors, assignees, and servicers of mortgage loans may find this guide useful. This guide may

also be helpful to companies that serve as business partners to creditors, assignees, and

servicers.

This guide may be useful in helping you determine whether these rules regulate the loans you

service, and, if so, what your compliance obligations are under the rules.

1.4 Where can I find additional resources that

will help me understand the Mortgage

Servicing Rules?

Resources to help you understand and comply with the Dodd-Frank Act mortgage reforms and

the Bureau’s regulations, including downloadable compliance guides, are available through the

Bureau’s website at

www.consumerfinance.gov/compliance/compliance-resources/mortgage-

resources/mortserv/. On this website, we also offer the ability to sign up for an email

distribution list through which we announce additional resources and tools as they become

available. The Bureau’s website also provides a link to our interactive regulations tool, which is

available at

www.consumerfinance.gov/rules-policy/regulations/. The interactive regulations

tool includes an unofficial version of Regulation X (12 CFR Part 1024) and Regulation Z (12 CFR

part 1026), in which the Mortgage Servicing Rules are codified. The tool provides versions of

the regulatory text and commentary that are currently in effect in a single location.

If after reviewing these materials, as well as the regulation and official commentary, you have a

specific regulatory interpretation question about the Mortgage Servicing Rules, you can submit

it to us on our website at https://reginquiries.consumerfinance.gov/

. Please understand that

23 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

the responses we provide are not official interpretations of the Bureau and are not a substitute

for formal legal counsel or other compliance advice.

Email comments about this guide to CFPB_RegulatoryImplementat[email protected]

. Your

feedback is crucial to making this guide as helpful as possible. The Bureau welcomes your

suggestions for improvements and your thoughts on its usefulness and readability.

The Bureau is particularly interested in feedback relating to:

How useful you found this guide for understanding the rules

How useful you found this guide for implementing the rules at your business

Suggestions you have for improving the guide, such as additional implementation tips

24 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

2. Overview of the Mortgage

Servicing Rules

2.1 What are the Mortgage Servicing Rules

about?

The Mortgage Servicing Rules address the servicing of mortgage loans and are set forth in both

Regulation X and Regulation Z. Regulation X uses the term “borrower,” and Regulation Z uses

the term “consumer.” Unless otherwise noted, this guide uses the term “borrower” throughout.

The Regulation X rule addresses:

Successors in interest (§ 1024.17 and Subpart C of Regulation X)

Error resolution and information requests (§§ 1024.35 and 1024.36)

Force-placed insurance (§§ 1024.17 and 1024.37)

General servicing policies, procedures, and requirements (§ 1024.38)

Early intervention with delinquent borrowers (§ 1024.39)

Continuity of contact with delinquent borrowers (§ 1024.40)

Loss mitigation (§ 1024.41)

The Regulation Z rule addresses:

Successors in interest (§§ 1026.2(a)(11) and (a)(27), 1026.20(c) through (e), 1026.36(c),

1026.39(f), and 1026.41(g))

Interest rate adjustment notices for ARMs (§ 1026.20)

Prompt crediting of mortgage payments and responses to requests for payoff amounts

(§ 1026.36(c))

Periodic statements for mortgage loans (§ 1026.41)

25 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

Small servicers (§ 1026.41(e)(4))

2.2 When do I have to start following these

rules?

The 2013 Mortgage Servicing Rules generally took effect on January 10, 2014. The 2016

Mortgage Servicing Rule took effect on October 19, 2017 for all provisions, except as noted

below.

2

Bankruptcy periodic statement exemption and bankruptcy modified periodic statements

took effect on April 19, 2018. The relevant provisions are §§ 1026.41(e)(5) and (f) and

related commentary.

Successor in interest provisions took effect on April 19, 2018. The relevant provisions

are in both Regulation X and Regulation Z.

Under Regulation X, these provisions are § 1024.30(d) and related comments 30(d)-

1 through -3; the definitions of successor in interest and confirmed successor in

interest under § 1024.31 and related comments 31 (Successor in interest)-1 and -2;

§ 1024.32(c) and related comments 32(c)(1)-1, 32(c)(2)-1 and -2, and 32(c)(4)-1;

§ 1024.35(e)(5); § 1024.36(d)(3) and (i) and related comments 36(i)-1 through -3;

§ 1024.38(b)(1)(vi) and related comments 38(b)(1)(vi)-1 through -5; comment 41(b)-

1; and comment appendix MS to part 1024-2.

Under Regulation Z, these provisions are § 1026.2(a)(11) and (a)(27) and related

comments 2(a)(11)-4 and 2(a)(27)(i)-1 and -2; comment 20(e)(4)-3; § 1026.20(f);

comment 36(c)(1)(iii)-2; § 1026.39(f); comment 41(c)-5; and § 1026.41(g).

The 2020 Mortgage Servicing COVID-19 Interim Final Rule took effective on July 1, 2020. The

2021 Mortgage Servicing COVID-19 Rule took effect on August 31, 2021.

2

In June 2017, the Bureau issued policy guidance on its supervisory and enforcement priorities regarding early

compliance with the 2016 Mortgage Servicing Rule.

81 FR 7260, 72350 (Oct. 19, 2016); 82 FR 29713 (June 30,

2017). The Bureau indicated in the guidance that it does not intend to take supervisory or enforcement action for

violations of Regulation X or Regulation Z resulting from a servicer’s compliance with the 2016 Mortgage Servicing

Rule occurring up to three days before the applicable effective dates. 82 FR 29713.

26 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

The Bureau may—from time to time—issue rule updates that have different effective dates.

2.3 What loans do the Mortgage Servicing

Rules cover?

These rules generally apply to consumer mortgage loans and entities that service these loans.

Servicers should note that certain aspects of the rules exempt particular types of consumer

mortgage loans. For example, reverse mortgages transactions and timeshare plans are exempt

from the periodic statement requirements. In addition, not all servicers are required to comply

with all rules. For example, small servicers are exempt from the majority of the loss mitigation

requirements. To help readers, this guide includes a scope and small servicer exemption

discussion for each section of the rules.

27 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

3. Small Servicer Exemption

3.1 Who is considered a small servicer?

(§ 1026.41(e)(4))

Servicers that qualify as small servicers are exempt from certain parts of the Mortgage Servicing

Rules. You are a small servicer if you meet one of these criteria:

You, together with any affiliates, service 5,000 or fewer mortgage loans, and you (or an

affiliate) are the creditor or assignee for all of them. See “What loans should be

considered?” in Section 3.2 for more information about what loans count toward the

5,000 mortgage loan threshold.

You are a nonprofit small servicer, meaning you are designated as a nonprofit

organization under section 501(c)(3) of the Internal Revenue Code of 1986, you service

5,000 or fewer mortgage loans (including any mortgage loans serviced on behalf of

associated nonprofit entities), and you (or an associated nonprofit entity) are the creditor

for all of those loans. See § 1026.41(e)(4)(ii)(C)(2) for a definition of “associated

nonprofit entities” and “What loans should be considered?” in Section 3.2 for more

information.

You are a Housing Finance Agency, as defined in 24 CFR § 266.5.

(§ 1026.41(e)(4)(ii))

3.1.1 Servicers that service 5,000 or fewer mortgage loans

(§ 1026.41(e)(4)(ii)(A))

To qualify for the small servicer exemption under § 1026.41(e)(4)(ii)(A), you must meet a two-

part test. First, you must (together with any affiliates) service 5,000 or less mortgage loans per

year. Second, you must service only mortgage loans for which you (or your affiliate) are the

creditor or assignee. (Comment 41(e)(4)(ii)-2)

For example, if you service 3,000 loans—2,900 of which you own or originated and 100 of which

neither you nor any affiliate own or originated—you do not qualify as a small servicer because

28 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

you service loans for which you (or an affiliate) are not the creditor or assignee, notwithstanding

that you service fewer than 5,000 loans. (Comment 41(e)(4)(ii)-2.ii)

3.1.2 Nonprofit servicer (§ 1026.41(e)(4)(ii)(C))

To qualify for the nonprofit small servicer exemption pursuant to § 1026.41(e)(4)(ii)(B), you

must be designated a “nonprofit entity.” A “nonprofit entity” is defined as an entity having a tax

exemption ruling or determination letter from the Internal Revenue Service under section

501(c)(3) of the Internal Revenue Code. (§ 1026.41(e)(4)(ii)(C))

In addition to meeting the definition of a nonprofit entity, you must meet a two-part test. First,

you must service 5,000 or fewer mortgages loans, including those serviced on behalf of

associated nonprofit entities. The term “associated nonprofit entities” is defined as nonprofit

entities that by agreement operate using a common name, trademark, or servicemark to further

and support a common charitable mission or purpose. Second, you must service only mortgage

loans that you or an associated nonprofit entity originated. (Comment 41(e)(4)(ii)-4)

For example, if you service 4,400 loans—3,400 of which you originated and 1000 of which your

associated nonprofit originated, and 500 loans neither you nor your associated nonprofit entity

originated, you do not qualify as a small servicer because you service loans that you or your

associated nonprofit entity did not originate. (Comment 41(e)(4)(ii)-4.ii)

3.1.3 Note on loans acquired through merger or acquisition

Any mortgage loan you or your affiliates obtain as part of a merger or acquisition, or as part of

the acquisition of all of the assets or liabilities of a branch office of a creditor counts as a loan for

which you (or an affiliate) are the creditor or assignee.

A branch office means either an office of a depository institution that is approved as a branch by

a federal or state supervisory agency or an office of a for-profit mortgage lending institution

(other than a depository institution) that takes applications from the public for mortgage loans.

(Comment 41(e)(4)(iii)-1)

3.1.4 Note on master/subservicer

Where a loan is subserviced, the master servicer does not lose its small servicer status if it

retains a subservicer (see § 1024.31 for the definition of those terms). The subservicer can gain

29 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

the benefit of the small servicer exemption only if both the master servicer and the subservicer

are small servicers. The subservicer generally will not be a small servicer because it does not

own and did not originate the loans it subservices—unless it is an affiliate of a master servicer

that qualifies as a small servicer. (Comment 41(e)(4)(ii)-3)

3.2 What loans should be considered?

(§ 1026.41(a) and (e))

Only consider mortgage loans that you service. “Mortgage loan” is defined in § 1026.41(a)(1) to

mean a closed-end consumer credit transaction secured by a dwelling. Use this definition to

identify the pool of loans from which to determine your small servicer status. Do not include

mortgage loans that are:

Voluntarily serviced by you for a non-affiliate and for which the you do not receive any

compensation or fees;

Reverse mortgages;

Timeshare plans in the pool of loans; or

Transactions serviced by you for a “seller financer” that meet all of the criteria identified

in § 1026.36(a)(5). See “Who is considered a ‘seller financer’?” in Section 3.2.1 for more

information.

This same pool of loans determines your status as a small servicer whether you are looking at

the small servicer exemption with regard to provisions in Regulation X or Z.

3.2.1 Who is considered a “seller financer”?

(§ 1026.36(a)(5))

To be considered a “seller financer,” you must meet three criteria. First, a “seller financer” must

be a natural person, estate, or trust that provides seller financing for the sale of only one

property in any 12-month period to purchasers of such property, which is owned by the natural

person, estate, or trust and serves as security for the financing. (§ 1026.36(a)(5)(i))

30 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

Second, the “seller financer” cannot have constructed, or acted as a contractor for the

construction of, a residence on the property in its ordinary course of business.

(§ 1026.36(a)(5)(ii))

Third, the financing must have a repayment schedule that does not result in negative

amortization and must have a fixed rate or an adjustable rate subject to certain limitations. If

the financing has an adjustable rate, it must not adjust until after five or more years (i.e., 5/1 or

7/7 ARMs); the rate must be determined by the addition of a margin to an index rate, based on a

widely available index such as indices for U.S. Treasury securities or the London Interbank

Offered Rate; and the rate must be subject to reasonable annual and lifetime rate adjustment

limitations. (§ 1026.36(a)(5)(iii))

3.2.2 What happens if I no longer qualify for the small

servicer exemption? (§ 1026.41(e)(4)(iii))

The small servicer exemption is determined each calendar year based on the loans you and your

affiliates service as of January 1 of that calendar year.

If you cease to qualify for the exemption, you have 6 months or until the next January 1

(whichever is later) to comply with any requirements that you were previously exempt from

because you qualified as a small servicer.

The following examples demonstrate when a servicer either is considered, or is no longer

considered, a small servicer:

A servicer that begins servicing more than 5,000 mortgage loans on October 1, and

services more than 5,000 mortgage loans as of January 1 of the following year, would no

longer be considered a small servicer on April 1 (six months after the previous October)

of that following year.

A servicer that begins servicing more than 5,000 mortgage loans on February 1, and

services more than 5,000 mortgage loans as of the following January 1 of the following

year, would no longer be considered a small servicer as of that January 1.

A servicer that begins servicing more than 5,000 mortgage loans on February 1, but

services less than 5,000 mortgage loans as of the following January 1, is considered a

small servicer for that following year. (Comment 41(e)(4)(iii)-2)

31 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

3.3 From what provisions are small servicers

exempt?

Small servicers are exempt from the following provisions of the Mortgage Servicing Rules:

The periodic statement provisions. (§ 1026.41) (See Section 5 for more on periodic

statements.)

The prohibition on purchasing force-placed insurance where a servicer could continue

the borrower’s existing hazard insurance coverage by advancing funds to escrow under

certain circumstances (when the cost of force-placed insurance is less than the cost of

advancing for hazard insurance). (§ 1024.17(k)(5)) (See Section 8 for more on force-

placed insurance.)

The general servicing policies, procedures, and requirements provisions. (§ 1024.38)

(See Section 10

for general servicing policies, procedures, and requirements.)

The early intervention provisions. (§ 1024.39) (See Section 11 for more on early

intervention.)

The continuity of contact provisions. (§ 1024.40) (See Section 12 for more on continuity

of contact.)

Some of the loss mitigation provisions. (§ 1024.41) (See Section 13 for more on loss

mitigation.)

Small servicers must comply with certain provisions of the Mortgage Servicing Rules regardless

of servicers’ status as small servicers, including for example:

The provision relating to written requests from a person that indicate that the person

may be a successor in interest. (§ 1024.36(i)) (See Section 4.6

for more information.)

The ARM disclosure provisions. (§ 1026.20(c) and (d)) (See Section 6 for more on

interest rate adjustment notices.)

The prompt crediting and payoff statement provisions. (§ 1026.36(c)) (See Section 7 for

more on prompt crediting and payoff statements.)

The force-placed insurance provisions. (§ 1024.37) (See Section 8 for more on force-

placed insurance.)

32 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

The error resolution and information request provisions. (§§ 1024.35 and 1024.36) (See

Section 9

for more on error resolution and information requests.)

Some of the loss mitigation provisions. (§ 1024.41(j)) (See Section 13 for more on loss

mitigation.)

33 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

4. Successors in Interest

4.1 What do the successor in interest rules

require?

Successors in interest under the Mortgage Servicing Rules are certain persons who receive an

ownership interest in a property from a borrower by means of one of five types of transfers. See

“Who are successors in interest? (§§ 1024.31 and 1026.2(a)(27))” in Section 4.5.

Unless an exemption applies, the rule requires you to maintain policies and procedures

reasonably designed to ensure that you can:

1. Promptly facilitate communication with any potential or confirmed successors in interest

regarding a property securing a mortgage loan upon receiving notice of the death of a

borrower or of any transfer of the property;

2. Promptly determine what documents you reasonably require to confirm the person’s identity

and ownership interest in the property, and promptly provide the person with a description

of those documents and how to submit a written request for information regarding the

documents required for confirmation; and

3. Promptly notify the person, upon the receipt of such documents, that you have

a. confirmed the person’s status as a successor in interest, or

b. determined that additional documents are required (and what those documents

are), or

c. determined that the person is not a successor in interest. (See “Do I need to adopt

policies and procedures for communicating with potential successors in interest?

(§ 1024.38(b)(1)(vi)) in Section 4.6.1.)

The rule also requires you to respond to certain written requests indicating a person may be a

successor in interest by providing that person with a written description of the documents that

are required to confirm the person’s identity and ownership interest in the property. This

requirement includes responding to a written request from an agent of a successor in interest.

34 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

See “What are my responsibilities to a potential successor in interest? (§§ 1024.36(i) and

38(b)(1)(vi))” in Section 4.6 for more information.

You are required to treat a confirmed successor in interest as a borrower for the purposes of

Regulation X’s Mortgage Servicing Rules and a consumer for the purposes of Regulation Z’s

Mortgage Servicing Rules. These provisions generally apply to confirmed successors in interest

in the same way that they would apply to another borrower or consumer. If a servicer, such as a

small servicer, is otherwise exempt from a requirement, such as the early intervention

requirement, it does not need to comply with that requirement with regard to a confirmed

successor in interest.

4.2 What is the scope of the successor in

interest rules?

The successor in interest rules in Regulation X generally apply to federally related mortgage

loans (as defined in § 1024.2 subject to the exemptions in § 1024.5(b), but not including open-

end lines of credit). The successor in interest rules in Regulation Z generally apply to closed-end

consumer credit transactions secured by a dwelling (as defined in § 1026.2(a)(19)).

4.3 Is there a small servicer exemption from

the successor in interest requirements?

There is no general exemption from the successor in interest requirements for small servicers,

but small servicers have the same exemptions with respect to confirmed successors in interest

that they have with respect to other borrowers and consumers. For example, small servicers are

exempt from § 1024.38, which generally requires servicers to adopt servicing policies,

procedures, and requirements. (§ 1024.30(b)). However, small servicers are required to

respond to certain written requests from potential successors in interest pursuant to

§ 1024.36(i), as there is no small servicer exemption for information requests.

35 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

4.4 When do I have to start complying with

the successor in interest rules?

The successor in interest provisions of the 2016 Mortgage Servicing Rule became effective April

19, 2018. For example, as of the April 19, 2018, effective date servicers must:

Maintain policies and procedures with respect to potential successors in interest as

defined in the 2016 Mortgage Servicing Rules;

Provide a written response in accordance with § 1024.36(i) to certain written requests

received on or after the effective date from a person indicating that a person may be a

successor in interest as defined in the 2016 Mortgage Servicing Rules; and

Generally treat confirmed successors in interest as defined in the 2016 Mortgage

Servicing Rules as borrowers for the purposes of Regulation X’s mortgage servicing rules

and consumers for the purposes of Regulation Z’s mortgage servicing rules.

For more information on the requirements of the successor in interest provisions of the 2016

Mortgage Servicing Rules, see What are my responsibilities to a potential successor in interest?

in Section 4.6 and What are my responsibilities to a confirmed successor in interest? in Section

4.7.

For more information on effective dates, see “When do I have to start following these rules?” in

Section 2.2.

4.5 Who are successors in interest?

(§§ 1024.31 and 1026.2(a)(27))

Successors in interest are certain persons who inherit or otherwise receive an ownership interest

in property, from a spouse, parent, or other relative, or upon the death of a joint tenant, when

there is an outstanding mortgage loan on the property. Successors in interest can include

persons who acquire their interest in the property upon death of a borrower or in a divorce, as

well as transfers from a spouse or from a parent to a child.

36 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

Regulations X and Z contain similar definitions of “successor in interest.” The two definitions

vary slightly to account for the different terms and scope restrictions of the two regulations. For

example, Regulation X uses the term “borrower,” and Regulation Z uses the term “consumer.”

Under Regulation X, a person is a successor in interest if a borrower transfers an ownership

interest in a property securing a mortgage loan to the person by means of one of the five

categories of transfers listed below:

1. A transfer by devise, descent, or operation of law on the death of a joint tenant or tenant

by the entirety;

2. A transfer to a relative resulting from the death of a borrower;

3. A transfer where the spouse or children of the borrower become an owner of the

property;

4. A transfer resulting from a decree of a dissolution of marriage, legal separation

agreement, or from an incidental property settlement agreement, by which the spouse of

the borrower becomes an owner of the property; or

5. A transfer into an inter vivos trust in which the borrower is and remains a beneficiary

and which does not relate to a transfer of rights of occupancy in the property.

For example, assume that Person A, the borrower on a mortgage loan, dies and that a relative

Person B becomes the sole owner as a result of Person A’s death. Person B is a successor in

interest on Person A’s mortgage loan under the Regulation X definition. Once you confirm

Person B’s identity and ownership interest in the property, using documents appropriate under

state law for the specific type of transfer, Person B would be considered a “confirmed successor

in interest.” (§ 1024.31)

A “confirmed successor in interest” must be treated as a borrower for purposes of the Mortgage

Servicing Rules in Regulation X and a consumer for purposes of the Mortgage Servicing Rules in

Regulation Z. (§§ 1024.30(d); 1026.2(a)(11)). For example, if you receive a loss mitigation

application from a confirmed successor in interest, you must review and evaluate the application

and notify the confirmed successor in interest in accordance with the procedures set forth in

§ 1024.41 if the property is the confirmed successor in interest’s principal residence and the

procedures set forth in § 1024.41 are otherwise applicable. (Comment 30(d)-1 of Regulation X)

37 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

4.6 What are my responsibilities to a

potential successor in interest?

(§§ 1024.36(i) and 38(b)(1)(vi))

Unless you are exempt from the requirements of § 1024.38, you must develop policies and

procedures relating to potential successors in interest. See “Do I need to adopt policies and

procedures for communicating with potential successors in interest?” in Section 4.6.1. You

must respond to requests from a person indicating that a person may be a successor in interest.

See “If I receive an oral request indicating a person may be a successor in interest, how must I

respond?” in Section 4.6.3 and “If I receive a written request indicating a person may be a

successor in interest, how do I respond?” in Section 4.6.4. This includes situations where the

potential successor in interest contacts you without using the term “successor in interest,” as the

potential successor in interest does not need to use a particular phrase to alert you of their

status. (See Comments 36(i)-1 and 38(b)(1)(vi)-1)

For example, you may be notified of the existence of a potential successor in interest when:

You receive notice that a transfer of ownership or of an ownership interest in the

property has taken place;

A person notifies you that a borrower has been divorced, legally separated, or died; or

A person other than a borrower submits a loss mitigation application.

4.6.1 Do I need to adopt policies and procedures for

communicating with potential successors in interest?

(§ 1024.38(b)(1)(vi))

Servicers that are not exempt from the requirements of § 1024.38 must develop policies and

procedures relating to potential successors in interest. Specifically, these servicers must

maintain policies and procedures reasonably designed to ensure that the servicer can:

Promptly facilitate communication with any potential successors in interest regarding

the property upon receiving notice of the death of a borrower or of any transfer of the

property securing a mortgage loan;

38 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

Promptly determine what documents the servicer reasonably requires to confirm the

person’s identity and ownership interest in the property, and promptly provide a

description of those documents to the person and how the person may submit a written

request for a description of the documents required for confirmation (including the

appropriate address); and

Upon the receipt of such documents, promptly make a confirmation determination and

notify the person that the servicer has:

Confirmed the person’s status;

Determined that additional documents are required (and what those documents are);

or

Determined that the person is not a successor in interest.

The Mortgage Servicing Rules do not specifically define the term “prompt” for purposes of

§ 1024.38(b)(1)(vi). Generally, whether an action is prompt will depend on the facts and

circumstances of the potential successor in interest’s request. Notification that a potential

successor in interest has been confirmed is not prompt if it unreasonably interferes with a

successor in interest’s ability to apply for loss mitigation options according to the procedures

provided in § 1024.41. (Comment 38(b)(1)(vi)-5)

In many circumstances, providing information promptly may require a servicer to respond more

quickly than the time limits established in § 1024.36(d)(2) for responding to a request for

information under § 1024.36(i). For example, if a non-borrowing spouse indicates that the

borrowing spouse has died and that the borrowing spouse and non-borrowing spouse owned the

property jointly as tenants by the entirety, the Bureau expects that a prompt response to the

non-borrowing spouse would occur within a significantly shorter period than 30 days.

4.6.2 What documents may I require to confirm a potential

successor in interest’s identity and ownership interest?

(Comments 38(b)(1)(vi)-2 and -3)

The documents you require to confirm a potential successor in interest’s identity and ownership

interest must be reasonable in light of the laws of the relevant jurisdiction, the specific situation

of the potential successor in interest, and the documents already in your possession. For

example, assume that a potential successor in interest indicates that an ownership interest in the

39 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

property transferred to the potential successor in interest from a spouse who is a borrower as a

result of a property agreement incident to a divorce proceeding. Assume further that the

applicable law of the relevant jurisdiction does not require a deed conveying the interest in the

property, but accepts a final divorce decree and accompanying separation agreement executed

by both spouses to evidence transfer of title. Under these circumstances, it would be reasonable

for you to require the potential successor in interest to provide documentation of the final

divorce decree and an executed separation agreement. Because the applicable law of the

relevant jurisdiction does not require a deed, it generally would not be reasonable for you to

require a deed. (Comment 38(b)(1)(vi)-3.iii)

Where appropriate, the documents you require from a potential successor in interest may

include, for example, a death certificate, an executed will, or a court order. You may also require

any documents that you reasonably believe are necessary to prevent fraud (for example, if you

have reason to believe a document presented is forged). (Comment 38(b)(1)(vi)-2)

4.6.3 If I receive an oral request indicating a person may be a

successor in interest, how must I respond?

(§ 1024.38(b)(1)(vi))

Servicers subject to § 1024.38(b)(1)(vi) must maintain policies and procedures reasonably

designed to ensure that the servicer can promptly facilitate communication with any potential

successors in interest regarding the property upon receiving notice of the death of a borrower or

any transfer of the property. They must also promptly determine the documents they

reasonably require to confirm that person’s identity and ownership interest in the property and

promptly provide to the potential successor in interest a description of those documents and

how the person may submit a written request under § 1024.36(i) (including the appropriate

address). This includes situations when a servicer receives actual notice of the existence of a

successor in interest through oral notification. (§ 1024.38(b)(1)(vi) and comment 38(b)(1)(iv)-1)

4.6.4 If I receive a written request indicating a person may be

a successor in interest, how do I respond?

(§§ 1024.36(i) and 38)

Servicers subject to § 1024.38(b)(1)(vi) must maintain policies and procedures reasonably

designed to ensure that the servicer can promptly facilitate communication with any potential

successors in interest regarding the property upon receiving notice of the death of a borrower or

40 SMALL ENTITY COMPLIANCE GUIDE: MORTGAGE SERVICING RULES v4.0

any transfer of the property. They must also promptly determine the documents they

reasonably require to confirm that person’s identity and ownership interest in the property and

promptly provide to the potential successor in interest a description of those documents and

how the person may submit a written request under § 1024.36(i) (including the appropriate

address).

In addition, all servicers must provide a written response in accordance with § 1024.36(i) to

certain written requests from a person indicating that a person may be a successor in interest.

Specifically, when you receive a written request from a person that (1) indicates they may be a

successor in interest, (2) includes the name of the borrower from whom the person received an

ownership interest, and (3) provides information that enables you to identify the mortgage loan

account, you must generally do the following:

Within five days (excluding legal public holidays, Saturdays, and Sundays) of receiving

the request, provide a written acknowledgment that you have received the request.