This PDF is a selection from an out-of-print volume from the National

Bureau of Economic Research

Volume Title: Home Mortgage Delinquency and Foreclosure

Volume Author/Editor: John P. Herzog and James S. Earley

Volume Publisher: NBER

Volume ISBN: 0-87014-206-2

Volume URL: http://www.nber.org/books/herz70-1

Publication Date: 1970

Chapter Title: Appendix A: Sampling Techniques, Questionnaires,

and Worksheets

Chapter Author: John P. Herzog, James S. Earley

Chapter URL: http://www.nber.org/chapters/c3297

Chapter pages in book: (p. 87 - 104)

Appendix A

Sampling Techniques, Questionnaires,

and Worksheets

United States Savings and Loan League Data

PARTICIPATING INSTITUTIONS

In selecting a sample of savings associations for the delinquency study

the League aimed at a cross section of the business that would reflect

primarily geographic patterns of delinquency. No attempt was made to

include size or other institutional differences except within the geo-

graphic framework. The basis for the regional distribution of delin-

quencies was reports from associations to the League's Data Exchange

Group (now called the MIRRORS group).

Originally 100 institutions were invited to participate in the study.

Of that group fifty responded favorably, but attrition and difficulties

with the schedule as set up reduced the final group to thirty-eight. In

making up the original list, only associations which were large enough

to have at least 100 delinquency accounts were included.

INSTRUCTION SHEETS: DELINQUENCIES ON SINGLE-FAMILY

CONVENTIONAL LOANS AT SAVINGS AND LOAN ASSOCIATIONS

Note. This study is restricted to conventional single-family home

loans. FHA and VA loans and loans on multiple-family properties are

not to be included in the sample.

We recognize that variations exist in loan procedures from one

association to another. Because of this fact, it is difficult to establish

rigid guidelines for this study. Therefore, we will cite the principles we

wish to hold to in the study and follow with a recommended, but

88

Mortgage Delinquency and Foreclosure

illustrative, method of proceeding. The officers supervising the local

work can then determine the most efficient method of getting the job

done in their own shop. We ask only that the person assigned to extract

the information from the loan files have working familiarity with the

loan records and procedures and not be simply a clerk. He, or she,

should review thoroughly the information in these instructions.

I. Defining a Delinquent Loan

A delinquent loan is defined as a loan in arrearage sixty days or

more. The loan is sixty days or more delinquent if the borrower

owes the equivalent of two monthly payments in the last twelve

months. You may follow the local practice regarding partial loan

payments. What we wish to guard against is including thirty day-

past due loans in our sample.

II. Drawing the Sample

A. Select at random 100 loans from the delinquent loan file. To

insure randomness, each eligible loan must have an equal chance

of being included in the study. Determine first the number of loans

eligible for the study. Remember to exclude the ineligible FHA,

VA and multi-unit property loans. If the number is 100 or less,

include every loan. If the number exceeds 100, you must sample

systematically. If the number of loans is 150, e.g., include two loans

and skip each third loan. If your association has 300 delinquent

loans, select one out of every three loans from a register or a

listing of such loans, or use the assembled ledger cards and select

every third card. If the association had 350 delinquent loans, you

would select two loans and skip five loans, etc. It may be that this

sampling could best be done in the Collections Department.

B. Select at random 100 loans from the current loan file. If you

have 7,000 loans on the books, then the sampling ratio would be

100/7000, or one out of 70. Typically, you would work through a

loan register, a similar listing, or the loan file itself and select every

nth loan, record the number of that account and include it in the

study. The account numbers of the loans included in the survey

may be recorded on a separate sheet, or directly on Worksheet A.

Remember, however, to keep the delinquent loans and the current

loans separate, because Worksheet B applies only to delinquent

loans.

III. Definitions—Worksheet A

Worksheet A is to be prepared from materials in the loan file for

all loans included in the survey—current and delinquent. All replies

TABLE A 1

WORKSHEET A:

DELINQUENCY STUDY—CONVENTIONAL SINGLE-FAMILY MORTGAGES

Name of Assn.

___________________________________________________________#

6f Loan

Delinquent

Location of Property

Current ___________________

(In City

;

Built-Up Suburb

; New Surburban Development

Check Appropriate Boxes or Fill in Blanks:

00

1.

Loan Terms:

Date Loan Closed*

Original Balance

$

Interest Rate

Service Charge*

$

Monthly Payment (Pl)*

$

2. Type of Loon:*

Original Borrower—Walk-in

Original Borrower—Brought in by Broker

Builder loan—assumed

Builder loan—substitued

Ordinary assumption

Ordinary substitution

-

3.

Loan and Property Characteristics:

Purchase Price of Home

$

Age of Home:*

Appraisal

$ New____________

Downpayment*

$

Used: 0 to

5 yrs. —

Maturity of Loan

5 to 10 yrs. —

Any Junior Financing?* Yes No

10 to 15 yrs._

Pledged Saving Acct.

16 and Over_

Other (Describe)

4

Age of Head of Household:

21 to 29

45 to 49

30 to 34

50 to 54

35 to 39

55 to 59

40 to 44 60 & over

5.

Marital Status:

Married

Widowed

Divorced

Single

6. Number of Dependents:

Number of Jobs*

Length of Time on

Main Job

TABLE Al (continued)

7.

Annual Income:

Husband $

Wages and Salary

Own Business

Other

Wife

$

/year

Wages and Salary

j Other

Other

$

/year

From

Other

$

/year From

8. Occupation:

Self-employed

Executive or Manager

Salesman

White-collar

Skilled Labor

Unskilled Labor

Other (Farmer, Military, etc.)

9. Purpose of Loan:*

Purchase

Repair and Improvement

Refinancing

Other (Specify)

10.

Credit Information:

Balance Sheet Info:

Yes

No

No Credit Report

Court Items:

Yes

No

Credit Info. by Bureau

Collections: Yes

No

Credit Info. by Assn.

Rating Given Borrower by Loan Interviewer:*

No. Jobs past 5 yrs. Excellent

Fair

Length of Time in State

Satisfactory

Poor

None

11.

Reference Information (Check applicable items):

No References Given

— Private Party

Trade-Retailers & Merchants

Complete:

Auto Finance Company

of References Given

Small Loan Company

..Number Checked

Bank and Mortgage Items

Other Comments:

*Instructions Define These Terms

March 1963

'0

Techniques, Questionnaires, Worksheets 91

must be facts available to loan officer at time of loan application,

approval, or closing. Remember to indicate whether each loan is

current or delinquent in the upper right-hand corner of the work-

sheet.

Location of Property. Place here the address of the property. This

item is important for identification purposes. We ask, if possible,

that a loan officer classify the loans as "In City," "Built-up Suburb,"

or "New Suburban Development."

Item 1. Date loan closed. Refers to date borrower incurred con-

tractual liability to association—the date of loan closing

for construction loans.

Service charge. Includes total of fees and charges, paid by

borrower, whether itemized or not. Credit report, appraisal,

and title fees are included. Enter dollar amount.

Monthly payment. Includes principal and interest. Escrow

payments are not included in this item.

Item 2. Type of loan:

Original borrower—brought in by broker. Borrower re-

ferred to association by real estate agent or builder.

Builder loan—assumed. Borrower assumed loan made

originally to homebuilder.

Builder loan—substituted. Borrower's loan, although a new

contract, was closely tied to (substituted for) the builder's

original loan on the same property.

Ordinary assumption. Borrower assumed loan made origi-

nally to another borrower.

Ordinary substitution. Borrower's loan, although a new

contract, was tied closely to (substituted for) an earlier

loan made by association to another borrower on the same

property.

Item 3. Down payment. The earnest money payment and other cash

transferred from buyer to seller. Item should appear on

settlement statement.

Any junior financing? Any additional borrowing to get the

downpayment or any additional collateral offered to make

the first mortgage possible. This can be by builder or other

third party as well as borrower. Includes pledged savings

account, notes, or agreements of builders, or any outside

party. Answer "yes" or "no." Where loan file provides

evidence that junior financing existed, indicate type of

secon4ary financing involved.

92

Mortgage Delinquency and Foreclosure

New home. Refers to home not previously occupied.

Used home. Previously occupied property.

Items 4, 5, 6 and 8. Refer to Head of Household.

Number of jobs. Refers to "moonlighting" by borrower.

Item 7. Annual income. Indicate dollar amount and whether total

comes from wages and salary, own business, or other

sources. If income of persons other than husband or wife

were noted, indicate source of such income.

Item 9. Purpose of loan:

Construction. Refers to long-term construction loan to

borrower.

Purchase. Home purchase. Also includes builder loans that

have been assumed or substituted by the home owner.

Repair and improvement. Loan where indicated purpose

is major alteration or improvement of property.

Refinancing. Loan written to repay or recast an existing

home mortgage debt, even if additional funds are granted

for other purposes.

Items 10 & 11. Credit information. Practice here will vary, depend-

ing on degree of reliance on outside credit agency. Recom-

mend that loan application and credit report be used

together in completing sections 10 and 11.

Rating by loan interviewer. Where a rating appears in loan

file

in writing, indicate evaluation. Where it does not,

check "None."

Number of references given and number checked. Item

refers to credit work done by association. Reply requires a

counting of references and a counting of the number

checked.

IV. Definitions—Worksheet B. (For delinquent loans only).

Present loan balance. As of March 1, 1963. Taken from loan ledger

card.

Number of payments in arrears. As of March 1, 1963. See definition

of delinquent loan at beginning of instructions. Partial payments

are to be handled according to association practice. If more than

50 per cent of a payment is overdue, most associations count this

as a missed payment.

Reason for delinquency. As ascertained in Collections Department.

Attitude of borrower. Indicate in capsule fashion essence of any

report or reports noted on records by collections personnel regard-

ing contact with borrower.

TABLE A2

WORKSHEET B:

DELINQUENCY STUDY—CONVENTIONAL SINGLE-FAMILY IYIORTGAGES

(To be Prepared by Collections Dept.)

Name of Assn.

of Loan

Present Loan Balance $

No. Payments in Arrears

Payment Experience:

Problems throughout loan life

Intermittent trouble

Good until recently, then

no payment

Other (

Reason for Delinquency:

lmpropei regard for obligations

Curtailment of income

Excessive obligations

Death or illness

Marital difficulties

Other reasons:

Attitude of borrower when contacted:

Other

94 Mortgage Delinquency and Foreclosure

Other comments. Might include notation regarding previous collec-

tion problems and how resolved; comments regarding changes in

borrower's situation since date of original loan.

V. Other Instructions

A. Time schedule. If workload permits, records research should be

conducted prior to March 15.

B. Completed worksheets. Hold for visit of League Field Service

Representative. He will review procedures followed and pick up the

worksheets.

C. Special procedures. If any are employed, please note these for

us. Such notations will be of great help in the editing which will

precede electronic processing.

Mortgage Bankers Association Data

PARTICIPATING INSTITUTIONS

The universe from which the sample was drawn consisted of the

regular reporters in the MBA's quarterly delinquency survey. As of

June 30, 1962, a year earlier than the actual survey date, there were

38 mutual savings banks, 102 commercial banks, and 256 mortgage

companies so reporting. For each institution, a ratio was computed of

the number of loans delinquent ninety days or more plus number of

loans in foreclosure to the total number of loans serviced. This ratio

was then used to compute variances and to estimate the required sample

size for each of the three types of institution. The ratio was also used

along with the number of loans in default to determine the within-

institution sampling rate. The schedule was:

Loans in Default

Sample Rate

0—25 1—1

26—60 1—2

61—100

1—3

100—150 1—4

150+

1—10

The

results of the sample determination process indicated that

it would be necessary to obtain a sample of 50 per cent of the reporters

in the mortgage company and commercial bank groups. Mutual savings

banks were selected on a one for one basis. These reporters, however

were merged with the National Association of Mutual Savings Banks

sample which will be discussed later.

The actual firms chosen were selected at random and responses

Techniques, Questionnaires, Worksheets

95

were excellent. Usable data were obtained from 36 of 38 savings

banks, 41 of 51 commercial banks, and 105 of 129 mortgage com-

panies. Because later checks revealed that mortgage companies had

been under-sampled, the blow-up factor for that group had to be

adjusted from 2.0 to 2.64.

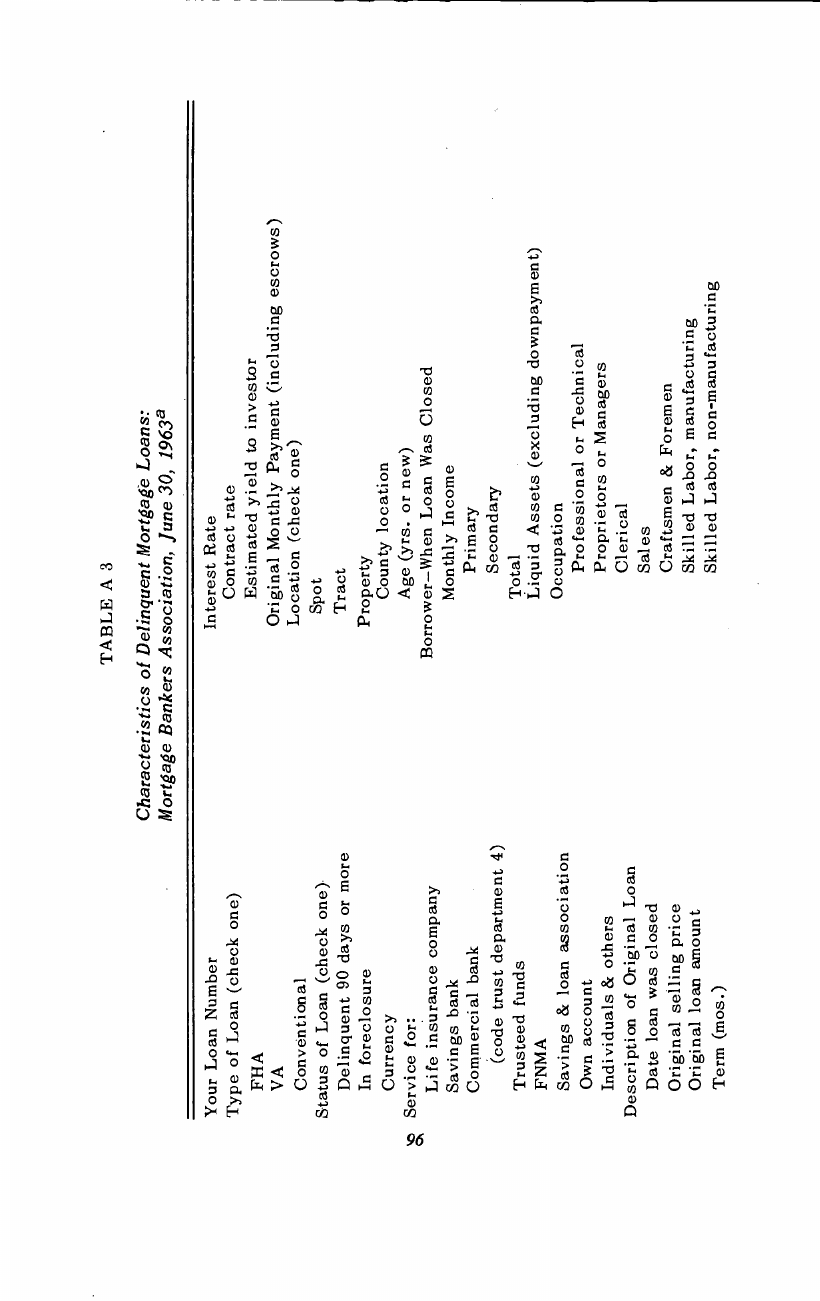

QUESTIONNAIRE AND CODING INSTRUCTIONS

The Mortgage Bankers Association, of America conducted a survey of

the characteristics of delinquent mortgage loans, using data as of June

30, 1963. Table A3 lists the categories as they appeared on the ques-

tionnaire. Table A4 shows the format used in putting the data on punch

cards.

National Association of Mutual Savings Banks Data

PARTICIPATING INSTITUTIONS

The savings banks included in the NAMSB survey were selected basic-

ally on a random basis. The original list was then modified in order

to integrate it with that of the MBA so that the combined list would

reflect more accurately the distribution of savings banks with respect

to (1) geographical location (2) size (3) mortgage portfolio compo-

sition (FHA, VA, and conventional loans) and (4) the proportion of

delinquent loans to total loans.

Each institution in the NAMSB survey was sent instruction sheet

(1), (2), or (3), depending on the within-institution sampling rate

requested. This provided for a 1-2, 1-3, or a 1-7 loan sample of de-

linquent loans. In each case the banks were asked to select a number

of current loans equal to the number of delinquents reported on. The

purpose of using different sampling ratios was to minimize the report-

ing burdens' on the banks. Those having a larger number of delinquents

selected a smaller proportion.

Altogether data were secured on about 1250 delinquent loans

and an equal number of currents. This represents about 10 per cent

of the total population of delinquents as of the survey date. In all, 73

banks participated in the survey (combined MBA and NAMSB).

INSTRUCTION SHEET: CHARACTERISTICS OF DELINQUENT

MORTGAGE LOANS

Types of Loans Included. Report only on current and delin-

quent loans in the 1- to 4-family property classification or the most

closely corresponding property classification used by your institution.

Include only loans on property located in your own state.

TABLE A 3

Characteristics of Delinquent Mortgage Loans:

Mortgage Bankers Association, June 30, 1963a

Your Loan Number

Interest Rate

Type of Loan (check one)

Contract rate

FHA

Estimated yield to investor

VA

Original Monthly Payment (including escrows)

Conventional

Location (check one)

Status of Loan (check one).

Spot

Delinquent 90 days or more

Tract

In foreclosure

Property

Currency

County location

Service for:

Age (yrs. or new)

Life insurance company

Borrower—When Loan Was Closed

Savings bank

Monthly Income

Commercial bank

Primary

(code trust department 4)

Secondary

Trusteed funds

Total

FNMA

Liquid Assets (excluding downpayment)

Savings & loan association

Occupation

Own account

Professional or Technical

Individuals & others

Proprietors or Managers

Description of Original Loan

Clerical

Date loan was closed

Sales

Original selling price

Craftsmen & Foremen

Original loan

Skilled Labor, manufacturing

Term (mos.)

Skilled Labor, non-manufacturing

Services

Laborer

Number of Dependents (Including wife)

Age of Family Head

Monthly Payments (including escrows)

Principal Balance (4-30-63)

Est. Current Value of Property

Marital Status (check one)

Married

Single

Current Value-to-Selling-Price ratio

Number of Prior Delinquencies That Were Cured

History of Loan

Apply to Current Delinquent Problem Only

'o

Date of

First Unpaid Installment

First Contact

Number of Contacts

Letter

Phone

Personal

Reason For Delinquency

Death or illness in family

Family or marital problems

aThe questionnaire used by the National Associa-

tion of Mutual Savings Banks, dated December 31,

1963,

is almost identical

to

this questionnaire. It

differs

in only three respects: (1) The question re-

garding the institution for which the loan was serviced

Over-obligated, same income

Reduction in secondary income

Cost of home ownership increased

Increases in other living costs

Property unsatisfactory

Increase in dependents

Entered military service

Unable to sell or rent

Improper regard for obligations

Property abandoned

Describe Nature and Term of Forbearance, if any (if

necessary, explain on separate sheet and identify

by loan number)

Date Placed in Foreclosure

was dropped; (2) The question regarding the nature

and term of forebearance was dropped; and (3) Two

additional

employment categories were

added —

military

and retired.

TABLE A 4

Punch Card

Format,

Characteristics of Delinquent Mortgage Loansa

Respondent identification

Not reported

Region

Description of Loan (compute age of

State

mortgage as of 6/30/63

City

June 30, 1958 and earlier

Type of business

July—December 1958

Loan number

January—June 1959

Loan Identification

July—December 1959

Page

January—June 1960

Line

July—December 1960

Type of Loan

January—June 1961

FHA, 203

July—December 1961

FHA, 221

January—June 1962

FHA, other

July—December 1962

VA

January—June 1963

Conventional

Not reported

Combination

Original Selling Price

Not reported

Under $10,000

Status of Loan

$10,000—11,000

90-day delinquent

$11,000—12,000

In foreclosure

$12,000—13,000

Current

$13,000—14,Q00

Not reported

$14,000—15,000

Serviced for:

$15,000—16,000

Codes on form RD-3

$16,000—17,000

$ 17,000—18,000

$ 18,000—19,000

$19 ,000—20 ,000

$20,000 and over

Not reported

Original Loan Amount (compute loan to selling

price ratio and code; compute principal balance

to selling price ratio and code; compute

principal balance to market value ratio and code)

Less than 75 per cent

75—80 per cent

80—85 per cent

8 5—90 per cent

90—95 per cent

95 per cent and over

Not reported

Terms (months) (coiivert to years and code)

Less than 240 months

240—3 00 months

300—360 months

360 months or more

Not reported

Contract Interest Rate (round to nearest

.25 per cent)

4.00 per cent or less

4.25 per cent

4.50 per cent

4.75 per cent

5.00 per cent

5.25 per cent

5.50 per cent

5.75 per cent

6.00 per cent

6.25 per cent

6.50 per cent

7.00 per cent

More than 7.00 per cent

Not reported

Yield to Investor (same as contract interest

rate; round to nearest .25 per cent)

Original Monthly Payment (include escrow)

Current Monthly Payment (include escrow)

Less than $70

$70—80

$80—90

$90—100

$ 100—110

$1 10—120

$120—140

$140— 150

$150

and above

Type

of Transaction

Spot

Tract

Not reported

County (alphabetical within alphabetical

listing of states, see Rand McNally)

Age

New

Less than 1 year

1—2

years

2—5

years

5—10 years

10

years and older

Existing

Not reported

Monthly Income

Primary, original

Primary, current

Total, original

Total, current

Not reported

(compute ratio of monthly income to

monthly payment and code)

Less than 5 per cent

5—10 per cent

10—15 pet cent

15—20 per cent

20—25 per cent

25—30 per cent

30—35 per cent

35 per cent or more

Not reported

Liquid Assets, Original

Liquid Assets, Current

(compute ratio of liquid asset to monthly payment)

Less than 1 (or modest) (or small)

1—2

2—3

3—4

4—5

5—10

10 or more

Not reported

Occupation, Original Borrower

Occupation, New Borrower

Marital Status, Original Borrower

Marital Status, New Borrower

Married

Single

Divorced

Widowed

Separated

Not reported

Number of Dependents (include wife)

Original borrower

New borrower

Not reported

Age of Head of Family, Original Borrower

Age of Head of Family, New Borrower

Less than 25 years

25—SO years

30-45 years

35—40 years

40—45 years

45—50 years

50—60 years

60 years or more

Not reported

Borrower

Same

New

Not re parted

Estimated Current Value of Property (compute ratio

of current value to original selling price and code)

100 per cent or more

95—100 per cent

90—95 per cent

85—90 per cent

80—85 per cent

75—80 per cent

Less than 75 rer cent

Not reported

Number of Prior Delinquencies

Many, numerous or several

Chronic

Not reported

Date of First Default (compute period from

June 30,

1963)

May and June 1963

April 1963

March 1963

February 1963

July 1962 through January 1963

12—18 months

18 months Or more

Not reported

Date of First Contact With Borrower (compute

per.iod from date of first default)

Less than 1 week

1—2 weeks

2—3 weeks

3—4 weeks

4—8 weeks

8—12 weeks

12 weeks or more

Not reported

Number of Contacts Made By Letter

Number of Contacts Made By Phone

Number of Personal Contacts

Constant

Several

Numerous

Many

Not reported

Reason for Delinquency of Forbearance (code

on RD-3 form)

Not reported

Forbearance, Type or Nature of:

Satisfied or about to be; removed from

foreclosure

Pending sale

Pending recovery from illness, imminent

death, death

Pending receipt of other sources of income

Practiced forbearance, type undefined

Impossible to forbear

Repayment program

None

Not reported

Foreclosures (compute months

Not in foreclosure

June 1963

May 1963

April 1963

March 1963

February 1963

January

1963

Not reported

in foreclosure status)

aCoded for a survey conducted by Mortgage Bankers Association of America, June30, 1963.

Techniques, Questionnaires, Worksheets

103

Delinquent Loans.

A sample of the delinquent loans reported

by the bank as of December 31, 1963, in the NAMSB Quarterly Mort-

gage Delinquency Survey. This includes loans which are three or more

payments overdue on a monthly program or one or more payments

overdue on a quarterly program. Includes also all loans in the process

of foreclosure as of December 31, 1963.

Current Loans. A sample of current loans held on December

31, 1963 equal to the number of delinquent loans, selected according

to the procedures outlined below.

Selecting Samples of Current and Delinquent Loans

Note: To reduce the reporting burden, the following procedures

were designed to select a sample of loans. To assure reliability, it is

important that this procedure be followed without deviation.

1. On a separate worksheet, simply list the number and type of

each 1- to 4-family loan that was reported as delinquent in

the Mortgage Delinquency Survey on December 31,

1963

(FHA, VA, and conventional).

2. On this worksheet, place a check beside the first, fourth, and

seventh loan, continuing to the end of the list, checking every

third loan.1

3. Alongside each loan checked on the worksheet, enter the next

consecutive number of a loan that is current and of the same

type (see example below, as to breakdown by type of loan)

as the delinquent loan or loan in foreclosure.

Loans Delinquent 90 Days

or More or in Foreclosure Current Loans

Loan Number Type of Loan Loan Number Type of Loan

8,543 V

FHA, 203b 8,544

FHA, 203b

10,782

VA

9,543

Conventional

12,492V

VA

12,4952

VA

6,781

FHA, 203i

392 FHA, 203b

4,00li- FHA, 203b

4,002

FHA, 203b

1

The

other two worksheets differ only in the sampling techniques (one

asks that every other delinquent loan be checked; the other calls for every

seventh delinquent loan).

2

Intervening

loans 12,493 and 12,494 are not VA.

104

Mortgage Delinquency and Foreclosure

4. Post the loan numbers of the delinquent loans and the loans

in foreclosure that were checked, as well as all current loans

listed to the first column of the reporting form provided.

Selected Definitions

1. Type of Loan.

Consider a combination FHA-VA loan as

one loan and report as FHA.

2. Borrower—When Present Delinquency Developed.

Regard-

less of legal arrangement and liability under the mortgage contract,

if a new borrower has, in effect, assumed responsibility for the mort-

gage prior to present delinquency, check "new" and supply as much

of the indicated information as is available in your collection depart-

ment.

3. Primary and Secondary Income. Primary income is

the

total income of the head of the household as shown in your records.

Secondary income is total income of other members of the household.

4. Liquid Assets. Generally speaking, total amount of liquid

assets (such as bank deposits, savings and loan share accounts, U.S.

Savings Bonds) held by borrower, as shown in your records.

5. County Location of Property. For areas where primary

political subdivision is not a county, then enter designation of the

equivalent political subdivision, such as a township.

Notes

1. Please answer all questions from current records. Do not seek

additional information beyond that already in your files.

2. Answer each question; if data are not available, enter N.A.

3. Enter all information directly on the questionnaire and sepa-

rate worksheet used to select sample of loans. Information may be

written by hand.

Kindly send one copy of the completed forms and the worksheet

list prepared to select the loans by Friday, February 21, 1964,

if

possible to: Research Department; National Association of Mutual

Savings Banks; 200 Park Avenue, New York, N.Y. 10017.