Employee

Benefit

Overview

E N R O L L A T

B E N E F I T S . P L A N S O U R C E . C O M

23-24 PLAN YEAR

SEPTEMBER 1, 2023 - AUGUST 31, 2024

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 2

BENEFIT HIGHLIGHTS

Flagler Schools Benets Guide

Our employees are Flagler Schools greatest resource. We truly recognize and value your outstanding

contributions. We encourage you to fully read this comprehensive guide which describes the Medical,

Dental, Vision, Life Insurance, Long Term Disability and Flexible Spending Account benefits for the

2023-2024 plan year.

T A B L E O F C O N T E N T S

Contacts

3

Plansource

4 - 6

General Informaon

7

My QHealth

8

Medical & Rx

9 - 12

Cost Savings Tools

13

Health Savings Accounts

14 - 15

Prompt Clinic

16

Flexible Spending Accounts

17

Dental Coverage

18 –19

Vision Coverage

20

Disability Coverage

21

EAP

22

Life Coverage

23-24

Qualifying Life Events

25

Salary Reducon Agreement

26-29

Addional Benets

30-31

Medical Benets - No Carrier, Plan or Rate Changes. Dependents are now eligible up to age 30.

Health Savings Account - You must submit an HSA Direct Deposit form from SCCU to the benets

department in order to begin contributions. Contributions will not automatically roll over.

Prescription Benefits - New Value Added Programs

Dental Benefits - Guardian is our new dental carrier, offering a larger provider network. Please

see page 19 for full details.

Vision - No Carrier, Plan or Rate changes

Basic Life, Voluntary Life, LTD & Flexible Spending Accounts - No Carrier, Plan or Rate Changes

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 3

BENEFIT CONTACT PHONE NUMBER WEBSITE/EMAIL

My QHealth

One stop resource to call rst when

you need help with your benets

Quantum 1-855-497-1235 Myaglerbenets.com

Health Savings Account

Space Coast Credit

Union

1-800-447-7228

Opon 9 x855

www.sccu.com

Prompt Care Clinic Prompt Care Clinic

386-586-4280

www.pickatime.com/flagler

Flexible Spending Accounts Medcom 1-800-523-7542 www.medcombenets.com

Dental Guardian 1-888-600-1600 www.guardiananyme.com

Vision Aetna 1-877-973-3238 www.aetnavision.com

Long Term Disability, Basic Life

& Voluntary Life

Symetra 1-877-377-6773 www.symetra.com

Employee Assistance Program Symetra 1-888-327-9573 www.guardianresources.com

Salary Reducon Agreement

Processing Service

TSA Consulng Group

1-888-796-3786

Opon 5

sraprocessing.tsacg.com

Florida Rerement System (FRS) 844-377-1888 www.myfrs.com

This Benets-At-A-Glance booklet is designed to provide basic informaon to employees on benet plans and

programs available September 1, 2023 – August 31, 2024. It does not detail all of the provisions, restricons and

exclusions of the various benet programs documented in the carrier contract or the Summary Plan Descripon

(SPD). This booklet does not constute an SPD or Plan Document as dened by the Employee Rerement Income

Security Act (ERISA).

I M P O R T A N T N O T I C E

CONTACT INFORMATION

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 4

PLANSOURCE

Enrollment Instructions

To enroll in benets, go to: hps://benets.plansource.com

Login Page: Enter username & password to get started.

Username: Your username is the rst inial of your rst

name, up to the rst six leers of your last name, and the

last four digits of your SSN.

For example, if your name is Taylor Williams, and the

last four digits of your SSN are 1234, your username

would be twillia1234.

Password: Your initial password is Welcome@1

The first time you log in, you will be

prompted to change your

password. Your password must be

a minimum of 8 characters, with at

least 1 upper case letter, 1 lower

case letter, 1 number and 1 special

character.

Homepage

On the Homepage, click

“Get Started” to begin.

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 5

PLANSOURCE

Prole

First, you’ll be asked to review

and update your prole and

ensure that all informaon listed

about yourself and your family

members is correct.

Shop for Benets

You can then begin shopping for

benets!

Educaonal material about the

specic plan type is available at the

top of the page.

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 6

PLANSOURCE

Plan Details

The plan detail page will give you

informaon about each plan,

including deducble, cost per pay

period and projected costs.

Select Plan

To select a plan, indicate which

family members are covered by

clicking “edit family covered”

and select the card for each

family member you’d like to be

on the plan.

Click “Update Cart” to choose

the plan.

Shopping Cart

The shopping cart displays a

running total of your

combined benets costs and

shows your progress. You will

need to select or decline a

plan in each benet type

Checkout

To nalize your choices, click

“Review and Checkout and

then “Checkout”.” You must

complete the checkout

process in order to be

enrolled in benets.

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 7

What is a “Copayment?”

• A copayment is a pre-determined amount you must pay out-of-pocket when seeing a service

provider. It is paid directly to the provider and is due at the me services are rendered.

What is a “Deductible?”

• A deducble is a pre-determined amount that is paid by you before the insurer begins to pay.

What is “Coinsurance?”

• Coinsurance is the percentage paid by the insurer and the percentage paid by you aer you have

met the deducble.

What is “Precertication?”

• Certain services, such as hospitalizaon or outpaent surgery, may require prior authorizaon with

your insurer to verify coverage for those services. When required, your parcipang physician

must obtain a precercaon for you prior to your treatment.

What is a “Primary Care Physician?” (PCP)

• A physician who is usually the rst health professional to examine a paent and who recommends

secondary care physicians, medical or surgical specialists with experse in the paent’s specic

health problem, if further treatment is needed.

Where can I nd an in-network provider?

• Directories of parcipang service providers may be found on Myaglerbenets.com. If you do not

have internet access, you may call MyQHealth at 1-855-497-1235 for assistance.

Should I use a Convenient Care Center, an Urgent Care Center, or the Emergency Room?

• Convenient Care Centers (found in many CVS and Walgreens stores) are a great way to address the

common cough, cold, and sore throat. The cost is normally the same co-payment as seeing your

doctor. Urgent Care Centers are another great alternave to the Emergency Room when your

doctor’s oce is closed. The co-payments are normally a lot less than an Emergency Room visit.

GENERAL INFORMATION

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 8

MY Q-HEALTH

When you don’t even know where to begin, start with MyQHealth.

Your healthcare-benet-navigang Care Coordinators

From replacing ID cards to more complicated maers like claim resoluons, no request is too big or small

for your MyQHealth Care Coordinators. We’re problem-solving, frustraon-ghng people on a mission

to make your healthcare simpler. And, we’re the one resource you need whenever you need help with

your medical, dental, wellness or pharmacy benets.

Think of us as your personal team of nurses, benet experts and claims specialists who will provide per-

sonalized support and guidance any me you need help with medical claims, health benets, prescrip-

ons and so much more – at no addional cost to you.

Empowered and resourceful, we’ll do things like:

Answer open-enrollment quesons

Verify coverage

Provide health-educaon resources

Advocate for your care

Conrm precercaons

Help manage chronic condions

Find in-network providers

Contact providers to discuss treatment

Answer claims, billing and benets quesons

Create health-improvement plans

Help reduce unnecessary, out-of-pocket costs

Whatever it takes to make your healthcare work to your benet

Don’t forget: we’re just a tap, click or call away.

855-497-1235 (Monday-Friday, 8:30 a.m. – 10 p.m.)

Myaglerbenets.com

Download our app MyQHealth – Care Coordinators

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 9

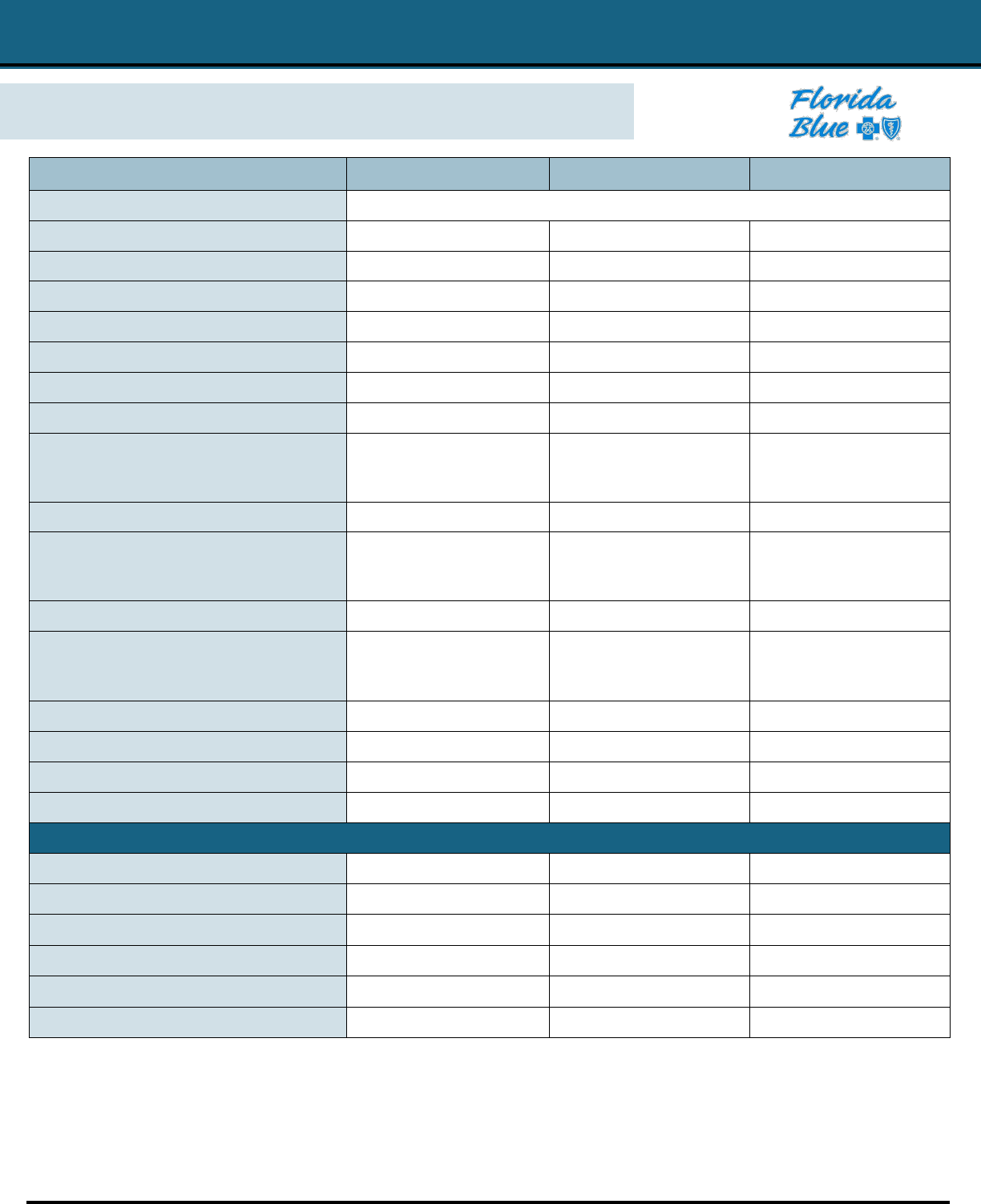

MEDICAL BENEFITS

HSA Plan (05196/97)

Standard Plan (05901) Premium Plan (03359)

Name of Network

BlueOpons

Policy Year Deducble - Individual/Family

$2,000 / $4,000* $3,000 / $9,000 $3,000 / $6,000

Annual Out-of-Pocket Max - Individual/Family $3,500 / $7,000** $7,000 / $14,000 $4,000 / $8,000

Coinsurance 20% 50% 10%

Preventave Care Covered at 100% Covered at 100% Covered at 100%

Primary Care Physician Deducble + Coinsurance $20 Copay $20 Copay

Specialist Deducble + Coinsurance $40 Copay $40 Copay

Chiropracc Deducble + Coinsurance $20 Copay $20 Copay

Independent Diagnosc Tesng Facility

Diagnosc Services (except AIS)

Advanced Imaging (MRI, MRA, CT etc)

Deducble + Coinsurance

Deducble + Coinsurance

$0 Copay

$200 Copay

$0 Copay

$300 Copay

Independent Clinical Lab (e.g. blood work)

Deducble + Coinsurance $0 Copay $0 Copay

Outpaent Hospital Facility Services

Diagnosc Services (except AIS)

Advanced Imaging (MRI, MRA, CT etc)

Deducble + Coinsurance

Deducble + Coinsurance

$0 Copay

$200 Copay

$0 Copay

$300 Copay

Ambulatory Surgical Center Facility (ASC) Deducble + Coinsurance $300 Copay + Ded. & Coins. $300 Copay

Outpaent Hospital Facility Services (per visit)

Therapy (Opon 1/2)

All Other Services (Opon 1/2)

Deducble + Coinsurance

Deducble + Coinsurance

Deducble + Coinsurance

Deducble + Coinsurance

Deducble + Coinsurance

Deducble + Coinsurance

Outpaent Hospital Facility Services (Surgical) Deducble + Coinsurance $300 Copay + Ded. & Coins. $300 Copay

Inpaent Hospital Per Admission Deducble + Coinsurance $500 Copay + Ded. & Coins. Deducble + Coinsurance

Emergency Room Deducble + Coinsurance $350 Copay $350 Copay

Urgent Care Deducble + Coinsurance $50 Copay $50 Copay

P R E S C R I P T I O N D R U G B E N E F I T S

Retail - Up to 30-day supply Plan Year Deducble then

Preventave Generic $0 Copay NA NA

Tier 1 $10 Copay $5 Copay $5 Copay

Tier 2 $30 Copay $35 Copay $35 Copay

Tier 3 $50 Copay $75 Copay $75 Copay

Mail Order - Up to 90-day supply $25 / $75 / $125 $10 / $87.50 / $187.50 $10 / $87.50 / $187.50

*If one individual on a family plan meets $2,800, their deducble will be sased and they will move to coinsurance.

** If one individual on a family meets $3,500, their out of pocket maximum will be sased.

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 10

PRESCRIPTION DRUG BENEFITS

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 11

PRUDENTRX

Only available on the

Standard & Premium

Plan

Your specialty prescripon benet plan will look a lile dierent.

Here’s what’s new

PrudentRx has collaborated with CVS Caremark® to oer a third-

party (manufacturer) copay assistance program* that may help

save you money on your specialty prescripon.

How it works

You’ll pay nothing out of pocket† – that’s right, $0! – for medica-

ons on your plan’s specialty drug list dispensed by CVS Special-

ty®, as well as select high-cost limited distribuon drugs (LDDs) as

outlined within the PrudentRx Copay Program drug list. We will

work with you to obtain third-party copay assistance for your

medicaon, if available.**

How to get started

Your enrollment in the program will be started automacally, but

you must speak with a PrudentRx advocate to nalize enroll-

ment.** You can choose to opt out at any me.

*Not all specialty prescripons oer assistance. Eligibility for third-party copay assistance program is dependent on the applicable terms andcondions required

by that parcular program and are subject to change.

**Some manufacturers require you to sign up to take advantage of the copay assistance that they provide for their medicaons – in that case, you must call

PrudentRx to parcipate in the copay assistance for that medicaon. PrudentRx will also contact you if you are required to enroll in the copay assistance for any

medicaon that you take. If you do not return their call, choose to opt-out of the program, or if you do not armavely enroll in any copay assistance as re-

quired by a manufacturer, you will be responsible for 30 percent of the cost of your specialty medicaons.

†

Out-of-pocket maximum is the amount you must pay each policy year before the policy starts paying the full benets. This may be for the whole family and/or

one person alone.

Your privacy is important to us. Our employees are trained regarding the appropriate way to handle your private health informaon.

©2022 PrudentRx. All rights reserved. 106-56566B 010322

We’ll send more

informaon before we

make this plan change. In

the meanme, you can con-

nue to ll your prescrip-

ons as usu-

al.

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 12

PRESCRIPTION DRUG BENEFITS

An update on

your specialty

Rx benefit

Here’s what’s changing

We’re changing how we calculate your annual deducble and out-

of-pocket (OOP) maximum* if you use a third-party copay assistance

program**, commonly referred to as a “manufacturer copay card”, when

you ll your specialty medicaons. When you use a copay assistance

program, your OOP is reduced to save you money and help you get the

medicaon you need. You can sll use these programs to help save

money, but any savings or rebates you receive from the manufacturer

will no longer count toward your deducble or OOP maximum.

What this means for you

Aer you enroll in a third-party copay assistance program, the amount

you have to pay OOP for your medicaons may be reduced or stay the

same, however only what you pay OOP will apply toward your

Sam has rheumatoid

arthris and is

prescribed an

expensive medicaon

Fortunately, the

drug manufacturer

oers a copay card

to assist with the cost

Now, Sam’s

medicaon costs

$175 less. Sam only

pays $25 OOP

Sam can ll his

medicaon

with reduced

OOP costs

Only the $25 Sam

paid is counted

toward his deducble

and OOP maximum

We’ll send more

informaon

before we make

this plan change.

In the meanme,

you can connue to

ll your prescripons

as usual.

*Out-of-pocket maximum is the amount you must pay each policy year before the policy starts paying the full benets. This may be for the whole

family and/or one person alone. Some policies may also include a deducble that must be sased before copays or coinsurance applies.

**Not all specialty prescripons oer copay assistance. Eligibility for third-party copay assistance programs is dependent on the applicable terms

and condions required by that parcular program and are subject to change. This change does not aect copay assistance programs provided

by foundaons or nancial need-based copay assistance. If a copay assistance program is available for your medicaon, a specialty pharmacy

representave may be able to assist you with more informaon.

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 13

Prescription Drug Cost Comparison Tools:

Use GoodRx and SingleCare’s drug price search to compare prices (just like you do for travel or

electronics on other sites) for your prescripon at pharmacies near you. GoodRx as well as SingleCare

do not sell the medicaons, the free website and mobile app will tell you where you can get the best

deal on them. If you have insurance, your co-pay might not be the best price. Hundreds of generic

medicaons are available for $4 or even free without insurance. Every week both GoodRx and SingleCare

collect millions of prices and discounts from pharmacies, drug manufacturers and other sources. GoodRx and

SingleCare will show you prices, coupons, discounts and savings ps for your prescripons at pharmacies near

you. There is no cost or membership required to use either of these cost savings tools. Please visit the websites at

www.goodrx.com and www.singlecare.com. You can also download these apps on your smartphone. Please note: amounts paid

for prescripons using GoodRx or SingleCare’s discount programs do not apply toward your medical plan’s deducble or annual

out of pocket maximum.

Urgent Care/Walk-In-Clinics Vs. Emergency:

Do not pay more than you have to for medical care. The Emergency room is meant for true

emergencies such as life threatening illnesses and injuries. Walk-in-clinics are designed to treat

common ailments and provide basic primary health care and are typically staed by nurse

praconers and somemes a physician’s assistant. They are used for common ailments such

as: u/strep throat, allergies, cold and cough. Urgent care facilies are designed to serve

paents who are suering from acute illnesses and injuries which are beyond the capacies of

a regular walk-in-clinic, are typically open for extended hours, and are used to treat non-life

threatening injuries and illnesses. To maximize savings use in-network facilies.

Above are potenal ways to save money on the cost of medical care and prescripons. Actual results may vary.

Pharmacy Discount Programs:

Before you pay for your next prescripon, check to see if they are available for free or at a lower cost than tradional copays.

Pharmacies such as Wal-Mart, CVS/Target, and Costco oer prescripon discount programs that allow you to purchase

medicaons for as low as $4 for a 30 day Supply. If your local pharmacy is not listed please check with them to see if they oer

any discounts.

COST SAVINGS TOOLS

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 14

A health savings account (HSA) combines high deducble health insurance with a tax-favored savings account. Money in the savings

account can help pay the costs of qualied medical expenses not covered by medical insurance for you and your dependents. Money le in

the savings account earns interest and is yours to keep.

• EMPLOYEE OWNED ACCOUNT

• Pre-tax contribuons

• Pay for any qualied medical, dental & vision expenses for yourself, spouse or dependents even if they are enrolled under another

medical plan. (See IRS Publicaon 502 for a complete list of qualied medical expenses– sample list below).

To be HSA-eligible for a month, an individual must:

• Be covered by an HDHP on the rst day of the month;

• Not be covered by other health coverage that is not an HDHP (with certain excepons);

• Not be enrolled in Medicare; and

• Not be eligible to be claimed as a dependent on another person’s tax return.

Why might an HSA be the right choice for you?

• It saves you money. For individuals with few regular health expenses, paying a tradional health plan premium can feel like

throwing money out the window. HDHPs come with much lower premiums than tradional health plans, meaning less money is

deducted from your paychecks. Plus, HSAs are basically “cash” accounts, so you may be able to negoate pricing on many medical

services.

• It’s portable. Even if you change jobs, you get to keep your HSA.

• It’s a tax saver. Contribuons to your HSA are made with pre-tax dollars. Since your taxable income is decreased by your

contribuons, you pay less in taxes.

• It allows for an improved rerement account. Funds roll over at the end of each year and accumulate tax-free, as does the interest

on the account. Also, once you reach the age of 55, you are allowed to make addional “catch-up” contribuons to your HSA unl

age 65.

• It puts money in your pocket. You never lose unused HSA funds. They always roll over to the next year.

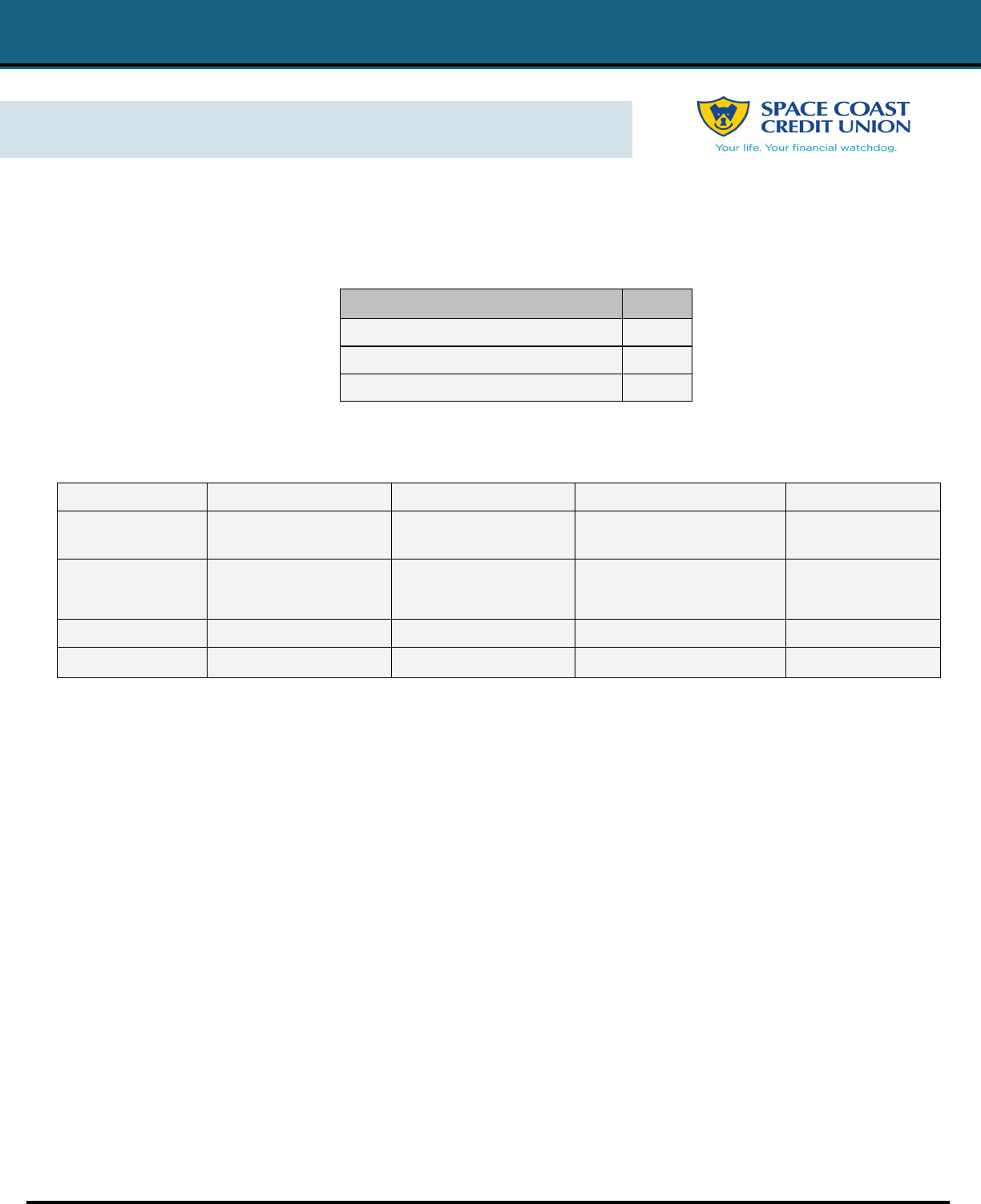

MAXIMUM ANNUAL CONTRIBUTIONS 2023

Self - Only Contribuon Limit $3,850

Family Contribuon Limit $7,750

Catch-up Contribuon (Age 55 & Older) $1,000

Acupuncture Blood pressure monitor Crutches/Wheelchair Lasik/Vision Correcon Surgery Psychologist fees

Alcohol or Drug

addicon treatment

Breast Pumps and Supplies/

Accessories

Dental Services Long-Term Care Smoking Cessaon

Ambulance Chiropractor Care

Diabec monitors, test kits,

strips & supplies

Medicines (prescripon &

over-the-counter)

Speech Therapy

Bandages Coinsurance & Copayments Ferlity Treatment Oxygen Sunscreen

Birth Control Contact Lenses & Glasses Hearing aids & baeries Psychiatric Care Vasectomy

HEALTH SAVINGS ACCOUNT

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 15

HEALTH SAVINGS ACCOUNT

YOU MUST SUBMIT AN HSA DIRECT DEPOSIT FORM FROM SPACE COAST CREDIT UNION TO THE BENEFITS

DEPARTMENT EACH YEAR (benets@aglerschools.com) IN ORDER TO BEGIN CONTRIBUTIONS.

1. With Space Coast Credit Union, you can start your Health Savings Account applicaon online or by phone at 1-800-447-

7228 (opon 9, then extension 855).

2. Go to Space Coast Credit Union. You will be required to go into a SCCU branch near you to complete the applicaon pro-

cess (with your signature) within 30 days of the start of your applicaon. There are two SCCU branches in Palm Coast and

the addresses are listed below for your convenience. You are able to go to any Space Coast Credit Union; you are not re-

quired to use a Palm Coast branch.

3. A one-me $10 deposit is required. $5 will apply to your one-me Space Coast Credit Union membership fee to prevent

your account from closing from inacvity.

4. Your Health Savings Account card will be requested on the rst-date of the account being acve. Cards are processed lo-

cally; they should arrive within 3-5 business days depending on your locaon. If you would like to request a card replace-

ment at any point please contact 1-800-447-7228 (Opon 5 to speak with Member Services).

5. If you wish to contribute to your Health Savings Account pretax, please request a “Check Ordering Instrucons Sheet” or

a “Direct Deposit Enrollment form” from SCCU. The informaon required is as follows:

• Name on Account

• Health Savings Account Checking/Savings (22/32 Code)

• Account Number

• Roung Number

• Signature of Space Coast Credit Union representave verifying account informaon

6. If you wish to contribute to your Health Savings Account, please write “I [insert rst and last name], wish to contribute $

[insert dollar amount] per pay period. Please make sure to sign and date the form at the boom.

7. Provide the form to the Benets Department in Human Resources. We encourage you not to use email for this corre-

spondence as this has sensive nancial informaon and our email system is not considered secure. Voided checks are

not an acceptable form of documentaon for enrolling in HSA contribuons.

For Your Informaon:

Health Savings Accounts are subject to closure due to inacvity.

It is the responsibility of the employee to manage processes and compliance regulaons regarding their account.

Flagler Schools has provided this form as an informaonal resource when opening up your Health Savings Account with

Space Coast Credit Union. This informaon is subject to change at the discreon of Space Coast Credit Union.

For addional quesons or concerns please contact the Flagler Schools Benets Department.

Space Coast Credit Union

10 Leanni Way

Palm Coast, FL 32137

Space Coast Credit Union

258 Palm Coast Pkway NE

Palm Coast, FL 32137

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 16

PROMPT CARE CLINIC

Why Use The Clinic?

• During the hours listed below clinic services are FREE to all individuals

enrolled in one of the three Flagler Schools Medical Plans

• No Copayments

• Shorter wait mes

• Physicians on site

• Walk-Ins during non-scheduled mes will be charged according to your plan’s benets for PCP

• Appointments needed during scheduled hours below:

EMPLOYEE CLINIC HOURS

FS Clinic Hours

Monday: 3:00pm - 6:00pm

Tuesday: 7:30am - 8:30am; 3:00pm - 6:00pm

Wednesday: 11:00am - 1:00pm; 3:00pm - 6:00pm

Thursday: 3:00pm - 6:00pm

Friday: 3:00pm - 6:00pm

Saturday: 8:30am, 8:45am, 9:15am, 9:30am,

10:15am, 12:15pm, 1:15pm

*Appointments Are Required

Walk-ins (even during clinic hours) will be processed

as a Primary Care Visit

1200 Cypress Edge Drive

(386) 586-4280

pickatime.com/flagler

CLINIC SERVICES AT NO COST WITH AN APPOINTMENT

DURING HOURS LISTED

• Treatment of chronic illnesses such as: Diabetes,

Hypertension, and High Cholesterol

• Treatment for acute illnesses such as flu, cold, sinus

or urinary tract infections

• EKG’s

• Annual Physicals

• Laboratory Tests (must be ordered by Prompt Care

Provider) such as:

Panels: Metabolic, Comprehensive Metabolic,

Electrolytes, Hepac Funcon, Lipid/Cardiac

Risk, Renal Failure

Rapid Lab Test - strep, mono, pregnancy

• Minor Procedures: minor laceraons, suturing

• Basic X-Rays including the radiologist

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 17

WHAT IS A MEDICAL FLEXIBLE SPENDING ACCOUNT: An Medical FSA is a pre-tax benet account that is used to pay for

eligible medical, dental, and vision care expenses that are not covered by your health care plan. With an FSA you use pre-tax

dollars to pay for qualied out-of-pocket health care expenses. Please note, if you elect the Health Savings Account, you can

not enroll in the Medical FSA.

WHAT ARE THE BENEFITS OF A FLEXIBLE SPENDING ACCOUNT (FSA):

There are a variety of dierent benets of using a Flexible Spending Account (FSA), including the following:

• It saves you money. Allows you to put aside money tax-free that can be used for qualified medical expenses.

• It’s a tax saver. Since your taxable income is decreased by your contributions, you’ll pay less in taxes

• You can use it for a variety of expenses. Use your FSA for qualified medical, dental, or vision expenses.

(Remember to keep your receipts for audit purposes).

You cannot stockpile your money in your FSA. You can le for reimbursement of eligible expenses incurred during the 2023-

2024 plan year (September 1, 2023-August 31, 2024). You do have an addional 2 1/2 month grace period unl November

15, 2024 to use your benets and unl November 30, 2024 to submit for reimbursement for claims incurred during the plan

year or applicable grace period or you will lose any unused balance. You should only contribute the amount of money you

expect to pay out of pocket that year. The maximum you can contribute each year is $3,050 (Minimum $300).

WHAT IS A DEPENDENT CARE FSA: Dependent care FSAs allow you to contribute pre-tax dollars to pay for qualied

dependent care. The maximum amount you may contribute each year is $5,000 (or $2,500 if married and ling separately).

The dependent care FSA is a use it or lose it. Eligible expenses include expenses from a qualied dependent day care facility,

daycare for children under the age of 13, disabled spouses, and dependent parent.

FSA CASE STUDY: Because FSAs provide you with an important tax advantage that can help you pay for health care

expenses on a pre-tax basis, due to the personal tax savings you incur, your spendable income will increase. The example

that follows illustrates how an FSA can save you money.

Without FSA With FSA

Gross income $45,000 $45,000

FSA contribuons $0 (-$2,850)

Gross income $45,000 $42,150

Esmated taxes (-$5,532)* (-$4,999)*

Aer-tax earnings $39,468 $37,151

Eligible out-of-pocket expenses (-$3,000) (-$300)

Remaining spendable income $36,468 $36,851

Spendable income increase -- $383

*Assumes standard deducons, amounts can vary and are for illustrave purposes only.

Please note, the above example is for illustrave purposes only. Each situaon varies and it is recommended you consult a tax

advisor for all tax advice

FLEXIBLE SPENDING ACCOUNT

www.medcombenets.com

800-523-7542

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 18

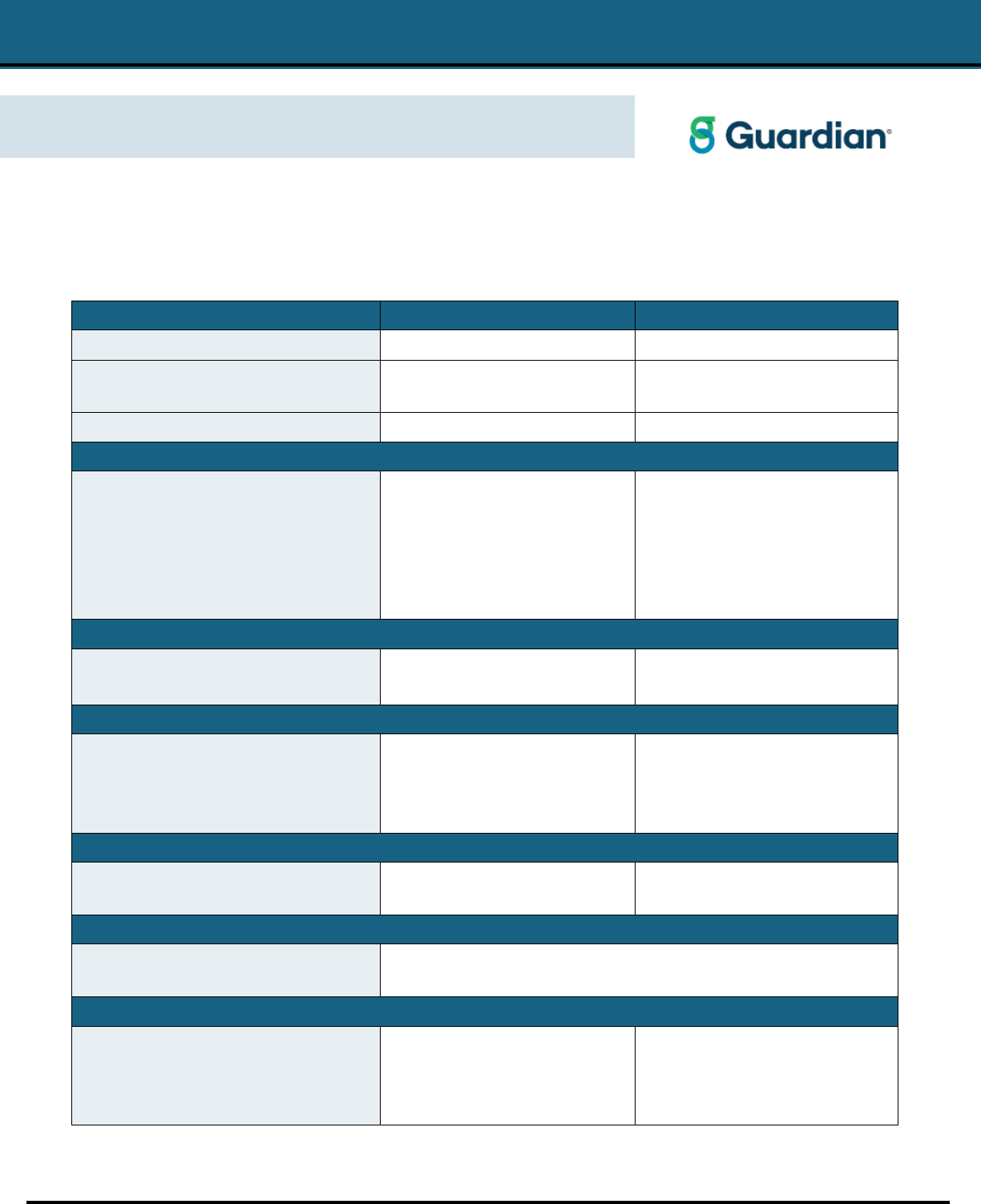

Below are your PPO dental plans which gives you freedom to use in-network or out-of-network densts. Since network providers

oer reduced contracted rates, you save money by using network providers for all your dental needs. All benets received from out-

of-network densts are subject to “reasonable and customary/maximum allowable” fees. Any amount that exceeds the dental

carrier’s “reasonable and customary/maximum allowable” amounts is the paent’s responsibility.

You can access the dental provider’s network and nd a denst near you at www.guardiananyme.com.

Please see carrier benet summary for addional plan details

DENTAL COVERAGE - PPO

PPO Dental Services Low Dental Plan High Dental Plan

Name of Network DentalGuard Preferred DentalGuard Preferred

Annual Deducble $50 per person

$150 per family

$50 per person

$150 per family

Annual Maximum $1,000 $1,500

PREVENTATIVE PROCEDURES: Deducble Waived

Roune Exams

Teeth Cleaning

Bitewing X-Rays

Full Mouth X-Rays

Fluoride Treatments

Sealants

Plan Pays 100% Plan Pays 100%

BASIC PROCEDURES: Deducble Applies

Fillings

Oral Surgery—Simple/Complex

Plan Pays 70% Plan Pays 80%

MAJOR PROCEDURES: Deducble Applies

Crowns

Bridges

Dentures

Implants

Plan Pays 50% Plan Pays 50%

ORTHODONTIC PROCEDURES:

Deducble Waived

Lifeme Maximum Benet

(Children& Adult)

$1,000

Plan Pays 50%

$1,500

Plan Pays 50%

OUT-OF-NETWORK BENEFITS:

Low Plan (Preventave/Basic/Major/Ortho)

High Plan (Preventave/Basic/Major/Ortho)

80%/60%/40%/50%

100%/80%/50%/50%

Maximum Rollover

Threshold

Rollover Amount

Rollover Bonus Amount

Account Limit

$ 700

$ 350

$ 500

$1,250

$ 500

$ 250

$ 350

$1,000

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 19

DENTAL –MAX REWARDS

Oral Health

Rewards

Regular visits to the denst can help prevent

and detect the early signs of serious diseases.

That’s why Guardian’s Maximum Rollover Oral Health Rewards

Program encourages and rewards members who visit the

denst, by rolling over part of your unused annual maximum

into a Maximum Rollover Account (MRA). This can be used in

future years if your plan’s annual maximum is reached.

How maximum rollover works*

Depending on a plan’s annual maximum, if claims made for a

certain year don’t reach a specied threshold, then the set

$1,500

Maximum claims

reimbursement

$700

Claims amount that

determines rollover

eligibility

$350

Addional dollars

added to a plan’s

annual maximum

$500

Addional dollars

added if only in-network

providers were used

during the benet year

$1,250

The limit that cannot

be exceeded within

the maximum rollover

account

* This example has been created for illustrave purposes only.

** If a plan has a dierent annual maximum for PPObenets vs. non-PPObenets, ($1500 PPO/$1000 non-PPOfor example) the non-PPOmaximum

determines the Maximum Rollover plan. May not be available in all states.

Guardian’s Dental Insurance is underwrien and issued by The Guardian Life Insurance Company of America, New York, NY. Products are not available in all

states. Policy limitaons and exclusions apply. Oponal riders and/or features may incur addional costs. Plan documents are the nal arbiter of coverage.

Informaon provided in this communicaon is for informaonal purposes only. Dental Policy Form No. GP-1-DEN-16. GUARDIAN® is a registered service mark

of The Guardian Life Insurance Company of America ®©Copyright 2019 The Guardian Life Insurance Company of America.

Automac rollover

Submit a claim (without

exceeding the paid claims

threshold of a benet year),

and Guardian will roll over

a poron of your unused

annual dental maximum.

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 20

This plan covers eye exams, prescripon lenses and frames, or contact lenses for you and your dependents

when you receive services from in-network or out-of-network providers. As you can see from the table

below, staying in-network cuts costs down and gives you more of a benet.

To nd a parcipang provider log on to www.aetnavision.com.

VISION COVERAGE

In-Network Out-of-Network

Eye Exam (Once every 12 months) $0 Copay Reimbursed up to $35

Lenses (Once every 12 months)

Single Vision

Bifocal

Trifocal

Standard Progressive

$10 Copay

$10 Copay

$10 Copay

$75 Copay

Reimbursed up to $25

Reimbursed up to $40

Reimbursed up to $60

Reimbursed up to $40

Frames (Once every 2 calendar years) $125 Allowance (20% o balance) Reimbursed up to $50

Contact Lenses (Once every 12 Months)

Standard Fit / Follow up

Elecve

Medically Necessary

Member pays discounted fee up to $40 copay

$135 Allowance (15% o balance)

Paid in Full

Not covered

Reimbursed up to $135

Reimbursed up to $210

*Contacts and eyeglasses cannot be purchased in the same year

Helpful Tip:

Please note that the provider network for the Flagler

Schools Aetna vision insurance is the “EyeMed

Network.” The provider search is located at

www.aetnavision.com. Please note that some providers

list their corporate name, e.g. Eyecare Express is under

Palm Coast Opcal in the provider search.

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 21

LONG-TERM DISABILITY COVERAGE

You count on your income to provide the things you need today and to achieve the dreams you have for

tomorrow. But, what would happen if you were suddenly unable to earn a living because of an unexpected

accident or illness?

Long Term Disability Insurance provides income protecon if you are unable to work

for long periods of me. LTD benet will pay you a percentage of your income for the

amount of me that you are unable to work. Flagler County School Board oers all full

me employees LTD through Symetra. This benet is provided to you at no

addional cost as Flagler County School Board pays for the enre premium.

Your income replacement benet would equal 66 2/3% of your pre-disability earnings

reduced by any deducble income. The maximum monthly benet you can receive is

$6,000.

Benets will begin aer you have been unable to work for 90 days due to a covered

injury or illness and will connue to pay unl your Normal Social Security Rerement

Age (if you are disabled in any occupaon). Benets are not payable during the

benet wait period.

Please contact the Benets Department for more informaon.

Interested in a Short-Term Disability Policy?

Supplemental Short-Term Disability Policies are available

Please contact the Benets Department for more informaon

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 22

EMPLOYEE ASSISTANCE PROGRAM

Helping you cope with the present and plan for the future

When life gets tough, it’s helpful to have someone in your corner to listen. That’s what you get from Disa-

bilityGuidance—an Employee Assistance Program that oers condenal counseling for individuals cov-

ered under a Symetra group disability policy.

Program highlights

Up to ve1 face-to-face condenal sessions with a counse-

lor, nancial planner or aorney are available to you and

your

eligible family members each calendar year. An addional

ve sessions are available if you have a covered disability

claim.

Sessions are per household and may be divided among the

three types of professionals. These services are included in

the overall premium, so no addional payment is required to

use the program.

Condenal counseling

Trained counselors with a master’s or doctorate degree are

just a phone call away to provide you the right resources for

stress, anxiety, job pressures, substance abuse, and grief and

loss.

Legal support

Talk to an aorney about legal concerns such as divorce, real

estate transacons, debt and bankruptcy, and more.

Need legal representaon?

A general guidance consultant will refer you to a qualied

aorney in your area for a free 30-minute consultaon. Any

customary legal fees aer that are reduced by 25%.

Financial informaon and resources

A cered public accountant or nancial planner can provide

nancial informaon and guidance on topics like debt, taxes,

rerement planning, credit card or loan problems, and more.

Online resources and tools

Get trusted, professional informaon about relaonships, work,

school, children, wellness, legal or nancial issues, and more.

Turn to GuidanceResources® online for:

• Timely arcles, tutorials, videos and self-assessments.

• “Ask the Expert” personal responses to your quesons.

• Searches for child or elder care, aorneys and nancial

planners.

Planning for the future

A will is one of the most important legal documents you can

have. It ensures that you’ll control who gets your property, who

will be your children’s guardian, and who manages your estate

when you die.

EstateGuidance® makes it easy to create a simple,

customized, legally binding will by oering:

• Convenient online access to will documentaon tools.

• Simple-to-follow instrucons guiding you through the

will-generaon process.

• Online support from licensed aorneys, if needed.

• The ability to make revisions at no cost.

A simple will costs just $14.99. Prinng and mailing services

are available for an addional fee. Prices may be subject to

change—contact ComPsych for addional informaon.

First-me users, follow these simple steps:

(1) Go to www.guidanceresources.com and click “Register.”

(2) Provide your organizaon web ID: SYMETRA

(3) Create a user name and password

If you have problems registering or logging in, send an email to

memberservices@compsych.com or call 1-888-327-9573.

Contact ComPsych

Phone: 1-888-327-9573

TDD: 1-800-697-0353

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 23

Life and AD&D insurance protects your family or other beneciaries in the event of your death. The death

benet helps replace the income you would have provided and can help meet important nancial needs. It can

help pay your mortgage, rent, run your household, send your children to college and pay o debts.

LIFE AND AD&D COVERAGE

BASIC TERM LIFE AND AD&D INSURANCE

Life and AD&D insurance protects your family or other beneciaries in the event of your death. The death benet helps

replace the income you would have provided and can help meet important nancial needs. It can help pay your mort-

gage, rent, run your household, send your children to college, pay o debts, etc. Flagler County School Board provides

eligible employees $25,000 for Administrators and $20,000 for all other employees of Basic Life and AD&D insurance with

Symetra at no cost. You will also have the opportunity to purchase addional Voluntary Life and AD&D insurance at a

group rate (located on the next page).

The following are aached to this group term life insurance policy:

• Waiver of premium

• Accelerated life benet

• Portability

• Conversion

To nd more informaon about the aachments above, refer to your Cercate of Benets.

VOLUNTARY LIFE AND AD&D INSURANCE

If you choose to enroll in Voluntary Life and AD&D insurance, you may also insure your spouse and eligible

dependent children up to the age of 26. A summary of your Life and AD&D insurance coverage is listed in the

table below. If you should have quesons on this policy, see your Symetra Cercate of Benets.

Summary of Insurance

Guaranteed Issue

Minimum Benet Amount

Maximum Benet Amount

Increments of...

$100,000

$10,000

$300,000

$10,000

Dependent Life Insurance Opons (No more than 50% of the combined amounts of employee basic and life insurance) AD&D not in-

cluded with dependent coverage

Opon 1 Spouse: $10,000, Child(ren): $5,000 Cost = $1.49/month

Opon 2 Spouse: $20,000, Child(ren): $5,000 Cost = $2.52/month

Opon 3

Spouse: $50,000, Child(ren): $10,000 Cost = $5.67/month

Note: You cannot receive coverage under this Plan as:

Both an employee and a dependent; or

A dependent of more than one employee

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 24

Employee Cost

If your age is... Rates/$1,000 (Monthly)

29 & under $0.085

30-34

$0.090

35-39

$0.110

40-44

$0.160

45-49

$0.260

50-54

$0.390

55-59

$0.630

60-64

$0.710

65-69

$1.300

70-74

$2.120

75+

$8.710

VOLUNTARY LIFE AND AD&D COSTS

Addional Informaon

• Age reducon scale:

35% of original amount at age 65

50% of original amount at age 70

65% of original amount at age 75

• Age-bracketed premiums: Premiums increase

end of birthday month aer you enter next 5

year age group.

• Annual Enrollment: any new elecons or

increases will require an Evidence of

Insurability form (EOI form).

• You do not have to must purchase Voluntary

Life Insurance for yourself in order to

purchase Voluntary Life Insurance for your

eligible dependents. Benet is limited to 50%

of your combined Basic Life & Voluntary Life

amount

• If husband and wife work for FCSB, dependent

life on your spouse is not available.

• Evidence of Insurability will be required if

changes are made.

• New hires are guaranteed up to $100,000

during the new hire enrollment window.

• Exact premiums are calculated by Symetra

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 25

If you experience any of the below qualifying life events, you must contact Human Resources within 30 days of

the event to be able to make changes to your benets. Proof of the event is required in order to successfully

make the requested changes to your plans.

• Marriage • Divorce or legal separaon (subject to State

regulaons)

• Death of spouse, child or other qualied

dependent

• Birth or adopon of child

• Loss of other group coverage • Change in employment status for employee,

spouse or dependent

• Change in residence due to an employment

transfer

• Change of dependent status

Eligible Dependents

Spouse under a legally valid exisng marriage

Natural, newborn, adopted, Foster or step child(ren) or a child for whom you have been appointed

legal guardian or custodian.

Medical, Dental & Vision - Eligible dependent children can be covered unl the end of the calendar year in

which they turn 30.

Voluntary Child Life - Eligible dependent children can be covered unl their 26 birthday.

QUALIFYING LIFE EVENTS

DEPENDENT ELIGIBILITY RULES

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 26

Salary Reduction Agreement Processing Service

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 27

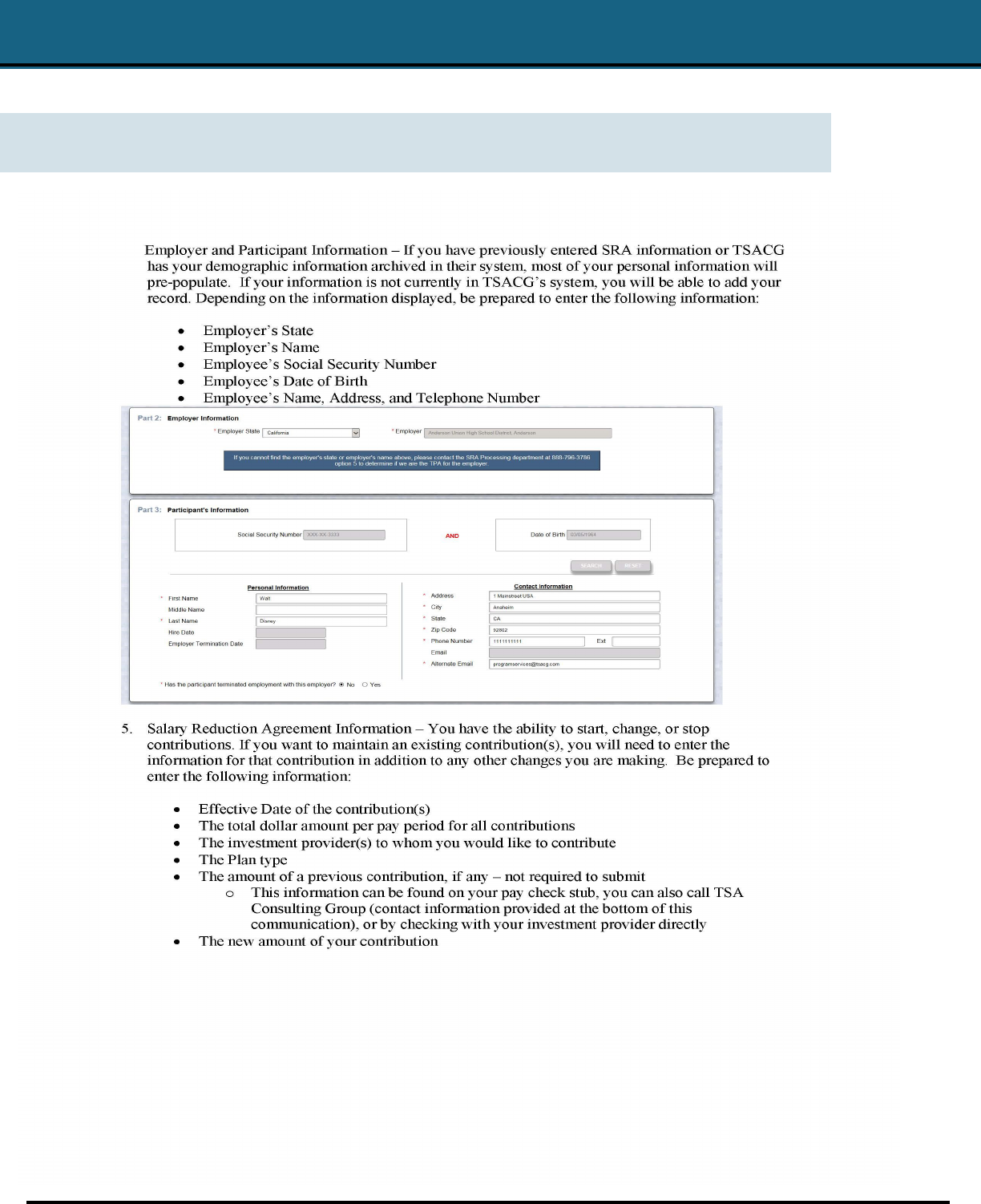

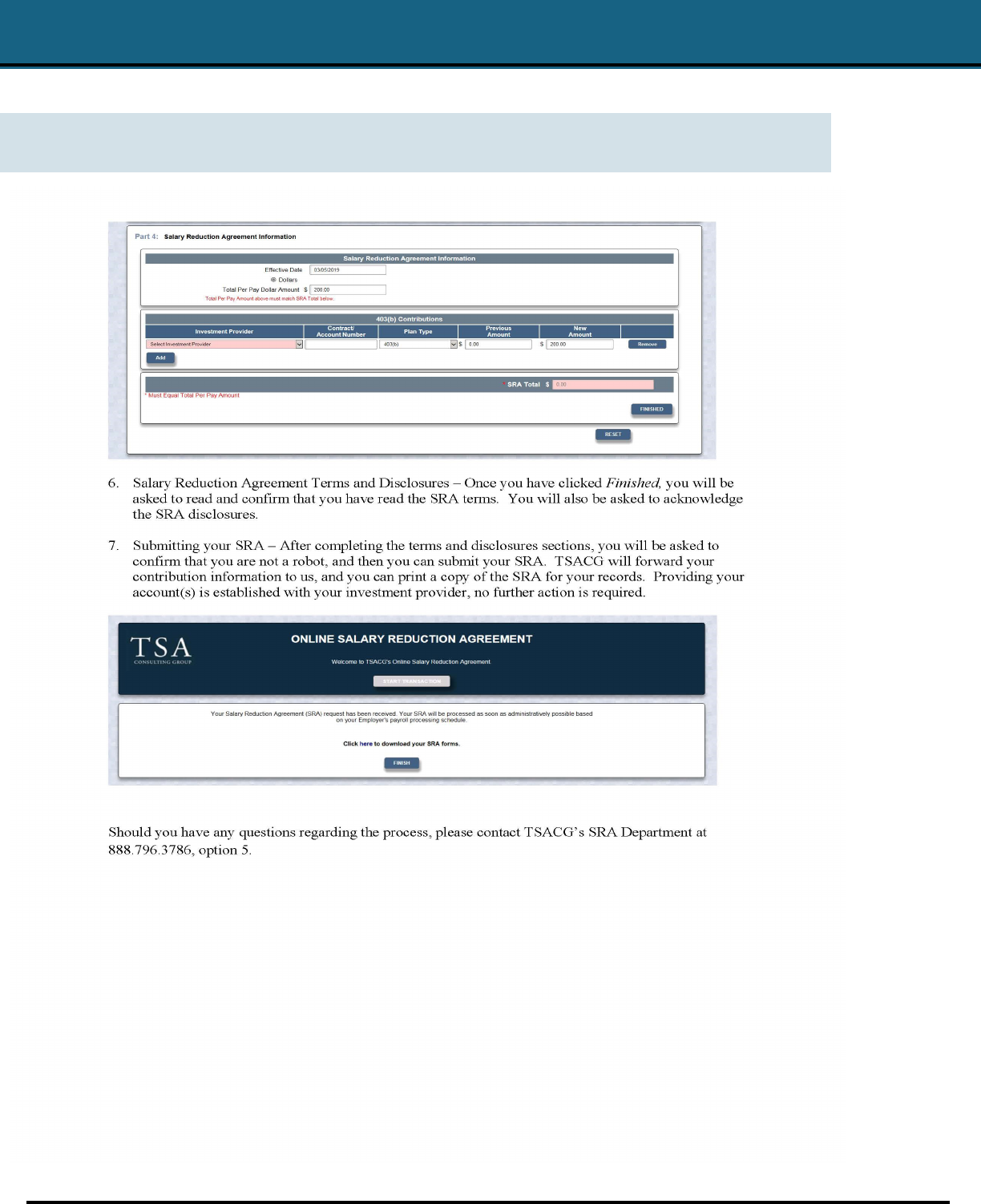

Note: Addional

Salary Reduction Agreement Processing Service

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 28

Note: Addi-

Salary Reduction Agreement Processing Service

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 29

Salary Reduction Agreement Processing Service

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 30

ADDITIONAL BENEFITS

FRS

The Florida Rerement System (FRS) is Flagler County School District’s rerement program. The contact informaon is:

Toll Free Number: 844-377-1888 Website: www.myfrs.com

FSRBC

School districts join the Florida School Reree Benets Consorum (FSRBC) to take advantage of expanded benet

opons and lower rates. The FSRBC provides rerees with access to high-quality insurance and benets, tailored

especially for rerees age 65 or older, who have rered from the Florida Public School System. Visit www.myfsrbc.com

for more informaon.

Flagler Schools Rerement Academy

To provide you with an opportunity to learn about planning and invesng for your rerement, we oer the Flagler

Rerement Academy, an online nancial educaon program. This online curriculum is easy to use and can help you plan

for your nancial future. Visit agler.retacademy.com to complete the three courses. Each course will take only 15-20

minute to complete, and includes videos and acons steps which can help you make informed decisions about your

nancial future.

BMG Loans

The LoansAtWork employee emergency loan program is available to benets-eligible employees of Flagler Schools.

Please visit www.LoansAtWork.com - enrolling is easy, fast and condenal. You can receive your loan proceeds in about

two business days aer approval.

• $500-$5,000 loans available to benets-eligible employees with at least one year on the job

• Repayments over 12,24,36, or 48 payroll deducons (6-29 months, depending upon loan execuon date and payroll

deducon schedule)

• Fixed annual interest rate 23.99% (see BMG Money materials for details on interest rate)

• Semi-monthly payments as low as $15

• Automated payroll deducons

FLAGLER SCHOOLS EMPLOYEE BENEFITS GUIDE | 31

ADDITIONAL BENEFITS