Universal Music Group N.V.

(a public company (naamloze vennootschap) incorporated under the laws of the Netherlands with its statutory

seat in Amsterdam, the Netherlands and its registered address in Hilversum, the Netherlands)

Admission to listing and trading of all ordinary shares on Euronext Amsterdam

This prospectus (this Prospectus) has been prepared in connection with the Distribution (as defined

below) and the first admission to listing and trading (the Admission) of all of the ordinary shares (the Shares) in

the share capital of Universal Music Group B.V. (to be converted to a public company (naamloze vennootschap)

incorporated under the laws of the Netherlands prior to the Admission) (the Company) on Euronext Amsterdam,

a regulated market operated by Euronext Amsterdam N.V. (Euronext Amsterdam).

The shareholders of Universal Music Group, Inc. (UMGI) and Universal International Music B.V.

(UIM), Vivendi SE (Vivendi), Concerto Investment B.V. (Concerto) and Scherzo Investment B.V. (Scherzo)

(Concerto and Scherzo hereafter collectively referred to as the Tencent-led Consortium and together with

Vivendi, the Restructuring Shareholders) contributed their shares held in UMGI and UIM, representing all of

the issued capital of both UMGI and UIM, to the Company in exchange for newly issued shares in the Company,

as a consequence whereof the Company became the sole holding company of the Group (as defined below) (the

Restructure). The Restructure was completed on February 26, 2021.

Capitalized terms used but not otherwise defined in this Prospectus are defined in Section 17 (Definitions

and Glossary).

Vivendi shall make a distribution in kind of the majority of the issued and outstanding shares that it holds

in the share capital of the Company (the Distribution). On September 23, 2021 (the Distribution Date), Vivendi

shall distribute up to 60% of the Shares to the Vivendi Shareholders (as defined in this Prospectus) pursuant to

the Distribution (the Distribution Shares). Each Vivendi Shareholder will receive one (1) Share for each one (1)

share which it holds in Vivendi on September 22, 2021 (the Distribution Record Date) as part of the Distribution

(the Allocation Ratio), subject to adjustment of the Allocation Ratio (the Adjustment of the Allocation Ratio).

Approval of the Distribution by the Vivendi Shareholders was obtained at the annual general meeting of Vivendi

Shareholders held on June 22, 2021 (the Vivendi AGM).

The Distribution Shares will constitute up to 60% of the issued and outstanding Shares of the Company

upon the Distribution Date. Following the Distribution: (i) Vivendi will hold such number of Shares, representing

approximately 10% of the issued and outstanding share capital of the Company; (ii) Concerto will hold such

number of Shares, representing 10% of the issued and outstanding share capital of the Company; (iii) Scherzo will

hold such number of Shares, representing 10% of the issued and outstanding share capital of the Company; (iv)

Pershing Square Holdings, Ltd., Pershing Square L.P., Pershing Square International Ltd. and PS VII Master, L.P.

(together, the Pershing Entities) will hold such number of Shares, representing 10% of the issued and outstanding

share capital of the Company and (v) it is expected that the Bolloré Entities will hold such number of Shares,

representing 18% of the issued and outstanding share capital of the Company.

Investing in the Shares involves substantial risks and uncertainties. An investor is exposed to the risk

to lose all or part of his or her investment. Before any investment in the Shares, an investor must read

this entire document and in particular Section 1 (Risk Factors).

Prior to the Admission, there has been no public market for the Shares. Application has been made to list

all of the Shares under the symbol “UMG” on Euronext Amsterdam. Trading in the Shares on an “as-if-and-when-

delivered” basis on Euronext Amsterdam is expected to start on or about September 21, 2021 (the First Trading

Date). BNP Paribas, Crédit Agricole Corporate and Investment Bank, Morgan Stanley, Natixis and Société

Générale are acting as joint financial advisors (in such and any other capacity, the Lead Financial Advisors).

Banque Hottinguer, Messier et Associés, CIC, Rothschild, Bank of America, ING, Intesa Sanpaolo S.p.A., Lazard,

Mizuho Securities and Banco Santander are acting as financial co-advisors (in such and any other capacity, the

Financial Co-Advisors). Bank of China and Goldman Sachs Bank Europe SE are acting as other financial advisors

(in such and any other capacity, the Other Financial Advisors and, together with the Lead Financial Advisors and

the Financial Co-Advisors, the Lead Equity Capital Markets Advisors). The Lead Equity Capital Markets

Advisors and the Listing and Paying Agent (as defined herein) are acting exclusively for the Company and/or

Vivendi and no one else in connection with the Admission and Distribution. They will not regard any other person

(whether or not a recipient of this document) as their respective clients in relation to the Admission and

Distribution and will not be responsible to anyone other than the Company and Vivendi for providing the

protections afforded to their respective clients nor for giving advice in relation to the Admission and Distribution

or any transaction or arrangement referred to herein. The Lead Equity Capital Markets Advisors are acting only

in respect of the Admission and Distribution.

Allotment, delivery and settlement of the Distribution Shares (Settlement) to the Vivendi Shareholders

is expected to take place on or about September 23, 2021 through the book-entry systems of Euroclear France.

For more information on the Distribution, see Section 14 (The Distribution).

This Prospectus constitutes a prospectus for the purposes of Article 3 of Regulation (EU) 2017/1129 (the

Prospectus Regulation) and has been prepared in accordance with the Prospectus Regulation. This Prospectus

has been approved by the Netherlands Authority for the Financial Markets (Stichting Autoriteit Financiële

Markten, the AFM), as competent authority under the Prospectus Regulation. The AFM only approves this

Prospectus as meeting the standards of completeness, comprehensibility and consistency imposed by the

Prospectus Regulation. Such approval should not be considered as an endorsement of the Company that is or the

quality of the securities that are the subject of this Prospectus. Investors should make their own assessment as to

the suitability of investing in the Shares.

Prospectus dated September 14, 2021

Lead Financial Advisors

BNP Paribas Crédit Agricole CIB Morgan Stanley

Natixis

Société Générale

Financial Co-Advisors

Banque Hottinguer Messier et Associés CIC

Rothschild ING

Intesa Sanpaolo S.p.A. Bank of America Lazard

Mizuho Securities Banco Santander

Other Financial Advisors

Bank of China Goldman Sachs Bank Europe SE

-i-

CONTENTS

(A) Summary of the Prospectus ...................................................................................................... 1

1. Risk Factors ....................................................................................................................................... 8

2. Important Information ...................................................................................................................... 27

3. Forward-Looking Statements ........................................................................................................... 33

4. Reasons for the Distribution and Use of Proceeds ........................................................................... 35

5. Dividend Policy ............................................................................................................................... 36

6. Capitalisation and Indebtedness ....................................................................................................... 38

7. Selected Financial Information ........................................................................................................ 41

8. Operating and Financial Review ...................................................................................................... 49

9. UMG Profit Forecast ........................................................................................................................ 75

10. Industry Overview ......................................................................................................................... 79

11. Business Description ...................................................................................................................... 91

12. Board and Employees .................................................................................................................. 114

13. Description of Share Capital and Corporate Governance ............................................................ 143

14. The Distribution ........................................................................................................................... 159

15. Taxation ....................................................................................................................................... 163

16. General Information on the Company ......................................................................................... 167

17. Definitions and Glossary .............................................................................................................. 176

18. Historical Financial Information .................................................................................................. 183

-1-

(A) SUMMARY OF THE PROSPECTUS

INTRODUCTION AND WARNINGS

Warning. The summary has been prepared in accordance with Article 7 of Regulation (EU) 2017/1129 and should

be read as an introduction to the prospectus (the Prospectus) prepared in connection with the Distribution (as defined

below) and the first admission to listing and trading (the Admission) of all of the ordinary shares (the Shares) in the

share capital of Universal Music Group B.V. (to be converted to a public company (naamloze vennootschap)

incorporated under the laws of the Netherlands prior to the Admission) (the Company) on Euronext Amsterdam, a

regulated market operated by Euronext Amsterdam N.V. (Euronext Amsterdam).

The shareholders of Universal Music Group, Inc (UMGI) and Universal International Music B.V. (UIM), Vivendi

SE (Vivendi), Concerto Investment B.V. (Concerto) and Scherzo Investment B.V. (Scherzo) (Concerto and Scherzo

hereafter collectively referred to as the Tencent-led Consortium and together with Vivendi, the Restructuring

Shareholders) contributed their shares held in UMGI and UIM, representing all of the issued capital of both UMGI

and UIM, to the Company in exchange for newly issued shares in the Company, as a consequence whereof the

Company became the sole holding company of the Group (the Restructure). The Restructure was completed on

February 26, 2021. Vivendi shall make a distribution in kind of the majority of the issued and outstanding shares that

it holds in the share capital of the Company (the Distribution). On September 23, 2021 (the Distribution Date),

Vivendi shall distribute up to 60% of the Shares to the Vivendi Shareholders (as defined in this Prospectus) pursuant

to the Distribution (the Distribution Shares).

Any decision to invest in the Shares should be based on a consideration of the Prospectus as a whole by any potential

investor. Any potential investor could lose all or part of its invested capital. Where a claim relating to the information

contained in the Prospectus is brought before a court, the plaintiff investor might, under national law, have to bear

the costs of translating the Prospectus before the legal proceedings are initiated. Civil liability attaches only to those

persons who have tabled the summary, including any translation thereof, but only where the summary is misleading,

inaccurate or inconsistent when read together with the other parts of the Prospectus or where it does not provide,

when read together with the other parts of the Prospectus, key information in order to aid investors when considering

whether to invest in the Shares.

The Prospectus was approved on September 14, 2021 by the Netherlands Authority for the Financial Markets

(Stichting Autoriteit Financiële Markten, the AFM), as competent authority under Regulation (EU) 2017/1129, with

its head office at Vijzelgracht 50 1017 HS, Amsterdam, and telephone number: +31(0)20-797 2000.

KEY INFORMATION ON THE ISSUER

Who is the issuer of the securities?

Domicile and legal form. The Company is a private company with limited liability (besloten vennootschap met

beperkte aansprakelijkheid) with the name Universal Music Group B.V. The commercial name is “Universal Music”.

In accordance with applicable law, the Company has undertaken to convert to a public company (naamloze

vennootschap) prior to the Admission. The Company’s statutory seat is in Hilversum, the Netherlands (and will, upon

the conversion of the Company to a public company (naamloze vennootschap) be in Amsterdam, the Netherlands).

The registered office address of the Company is ‘s-Gravelandseweg 80, 1217 EW Hilversum, the Netherlands. The

telephone number of the Company is +31 (0) 88 62 61 500. The Company is registered with the trade register of the

Chamber of Commerce of the Netherlands (Kamer van Koophandel) under number 81106661. Its legal entity

identifier is 724500GJBUL3D9TW9Y18.

Principal Activities. The Company is the holding company of the Universal Music Group (together with the

Company, UMG or the Group). UMG is a driving force in the global music industry, with revenues of €7.2 billion

in the year ended December 31, 2019 and €7.4 billion in the year ended December 31, 2020. UMG, operating in more

than 60 territories, is home to the greatest local and international artists, spanning all genres and generations including

ABBA, Louis Armstrong, The Beatles, The Beach Boys, The Bee Gees, Andrea Bocelli, James Brown, Bon Jovi,

Neil Diamond, Marvin Gaye, Guns N’ Roses, Elton John, Bob Marley, Paul McCartney, Nirvana, Luciano Pavarotti,

Queen, The Rolling Stones, Frank Sinatra, U2, Amy Winehouse and Stevie Wonder, as well as many of the biggest

artists today, such as J Balvin, Justin Bieber, Luke Bryan, Lewis Capaldi, J. Cole, Daddy Yankee, Drake, Billie Eilish,

Eminem, Selena Gomez, Ariana Grande, Imagine Dragons, Lady Gaga, Kendrick Lamar, Lang Lang, Post Malone,

Shawn Mendes, Kacey Musgraves, Katy Perry, Gregory Porter, Olivia Rodrigo, Sam Smith, Taylor Swift, Carrie

Underwood, Keith Urban and The Weeknd. UMG has three main operating businesses: recorded music, music

publishing and merchandising. The recorded music business is dedicated to the discovery and development of artists,

marketing and promoting their music across a wide array of formats and platforms. UMG is also expanding into other

areas such as live events, livestreaming, sponsorship, film and television and podcasts. The music publishing business

discovers and develops songwriters and owns and administers the copyright for musical compositions used in

recordings, public performances and related uses, such as films, television programs and advertisements. The

merchandising business produces and sells artist

-

branded and other bra

nded products. These products are marketed

-2-

through multiple sales channels, including fashion retail, concert touring and retail stores and direct-to-consumer

online sales. UMG’s activities also extend to other areas, such as brand rights management.

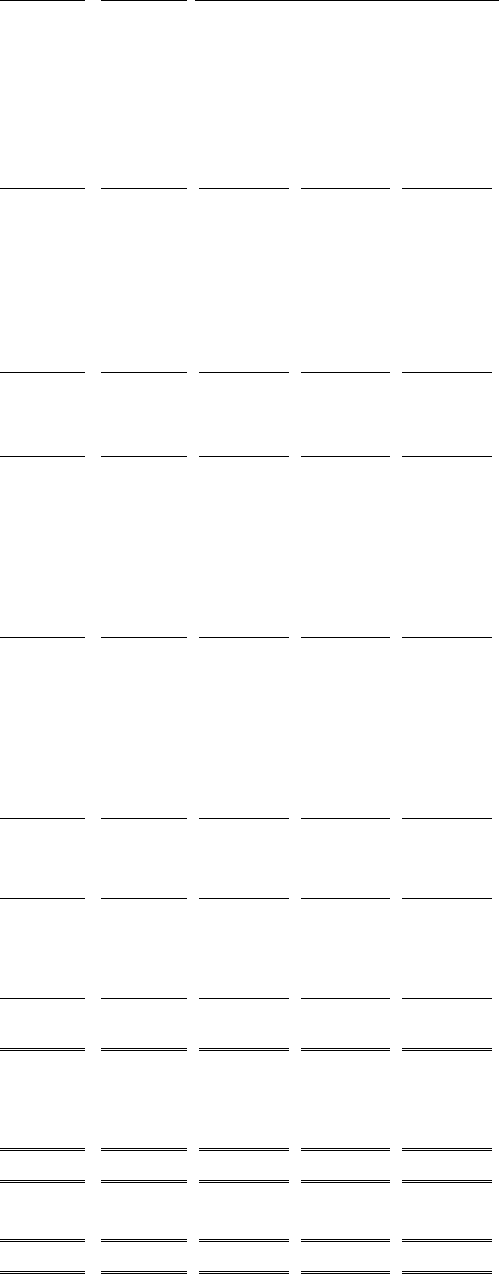

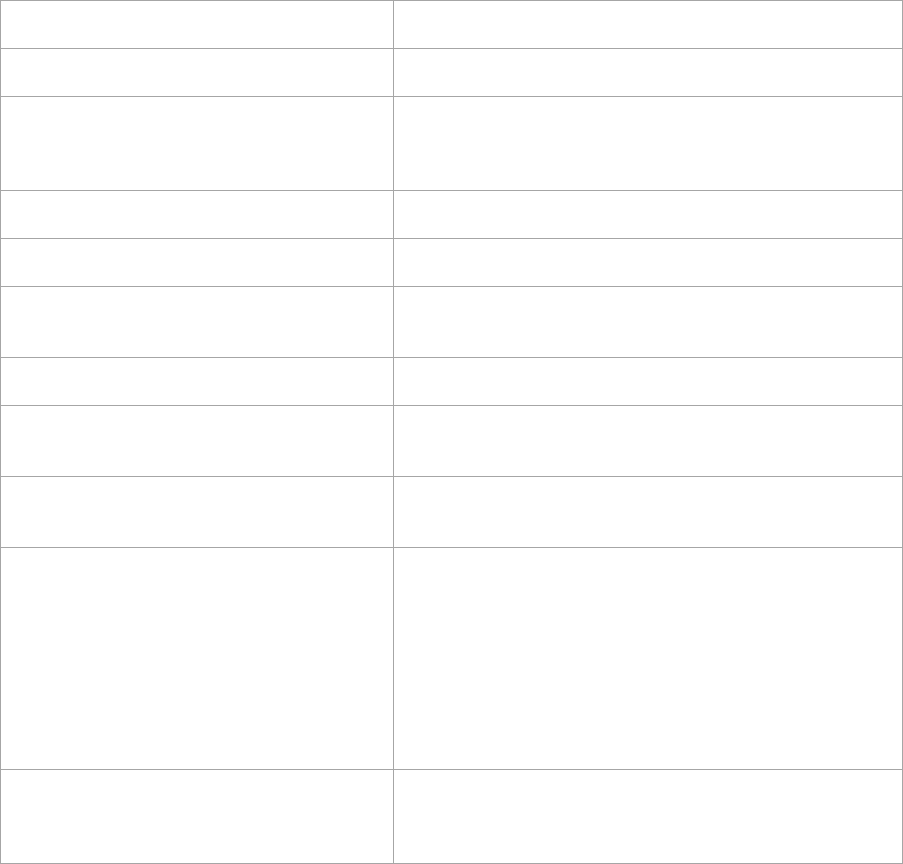

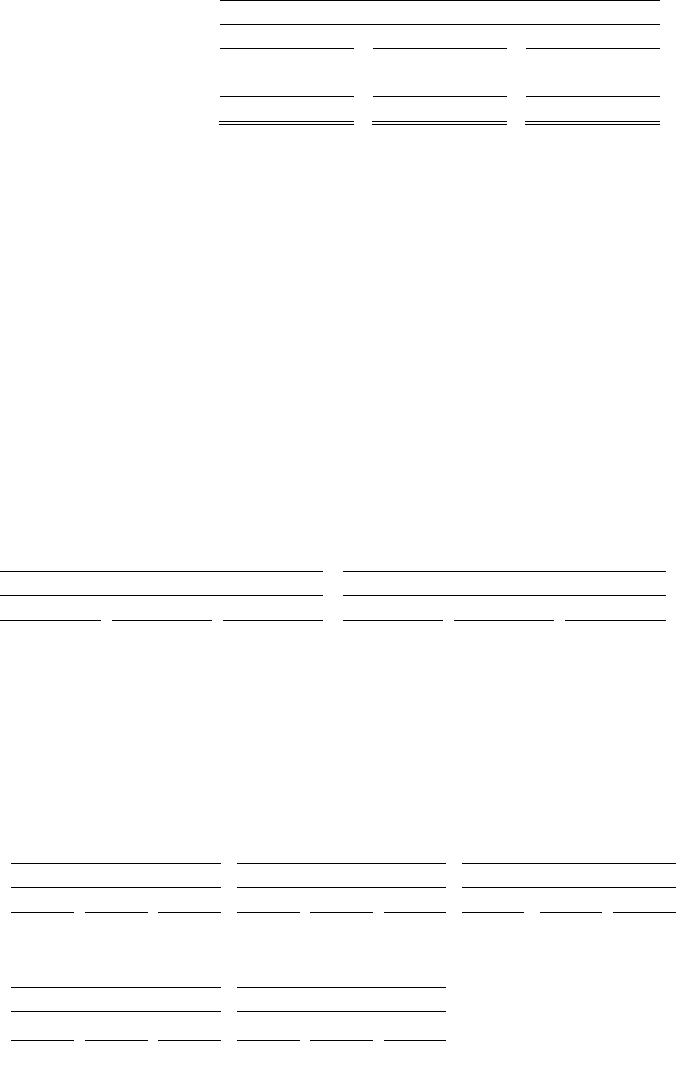

Major Shareholders. As at the date of the Prospectus, Vivendi, the Bolloré Entities, the Tencent-led Consortium and

the Pershing Entities (together, the Existing Shareholders) beneficially hold 100% of the Company’s issued ordinary

share capital. The following table sets forth the shareholders of the Company which, to the Company’s knowledge

as of September 8, 2021 and based on the number of shares and voting rights comprising the share capital of Vivendi

published on September 1, 2021, will directly or indirectly have a notifiable interest in the Company’s capital and

voting rights within the meaning of the Dutch Financial Supervision Act (Wet op het financieel toezicht) (DFSA) (i)

immediately prior to the Distribution (as defined below) and (ii) immediately following the Distribution.

Shares to be owned immediately

prior to the Distribution

Shares to be owned immediately

following the Distribution

Amount % Amount %

Vivendi

(1)

...........................

1,269,268,713 70% c. 183,582,493 c.10.12%

(7)

Concerto

(2)

..........................

181,324,116 10% 181,324,116 10%

Scherzo

(2)

...........................

181,324,116 10% 181,324,116 10%

Pershing Entities jointly

(3)

..

181,324,115 10% 181,324,115 10%

Bolloré Entities jointly

(4)(5)

.

100 0% 326,507,033 18.01%

Société Générale

(6)

0 0% 59,556,315 3.28%

(1) Vivendi’s shares have been listed on Euronext Paris since 1995. No shareholder is controlling Vivendi within the meaning of article L.233-

3 of the French commercial code. Vivendi’s major shareholder is Bolloré Group (through the Bolloré Entities, Vincent Bolloré and Cyrille

Bolloré), representing jointly 29.46% of the share capital, 29.73% of the theoretical voting rights and 30.34% of the exercisable voting rights

of Vivendi as of August 31, 2021, representing an indirect interest of 20.62% in the Shares of the Company.

(2) Concerto LLC indirectly controls Concerto and Scherzo.

(3) Pershing Entities refers collectively to entities advised by, or affiliated with, Pershing Square Capital Management, L.P. William A. Ackman

controls Pershing Square Capital Management, L.P.

(4) Bolloré Entities collectively refers to Compagnie de Cornouaille and Compagnie de l’Odet. For more information, see Section 12.11.

Compagnie de Cornouaille is controlled by Compagnie de l’Odet, itself controlled by Sofibol, which is controlled at the highest level by

Bolloré Participations SE. Bolloré Participations SE is controlled by Vincent Bolloré, who holds, directly and indirectly 92.55% of the share

capital, 72.20% of the theoretical voting rights and 93.60% of the exercisable voting rights of Compagnie de l’Odet.

(5) This percentage only reflects the shares held by the Bolloré Entities and does not take into account the Vivendi shares directly held by M.

Vincent Bolloré and M. Cyrille Bolloré, which represent together less than 0.01% of the total share capital and voting rights of Vivendi.

(6) On August 24, 2021, the French Autorité des Marchés Financiers reported that, on August 19, 2021, Société Générale had crossed the

threshold of 5% of the share capital and voting rights of Vivendi. On September 7, 2021, Vivendi was informed by Société Générale that,

on September 2 and September 6, 2021, it had crossed the statutory threshold of 5.5% of the share capital and voting rights of Vivendi and

that it held 59,556,315 shares in Vivendi, representing 5.37% of the share capital and 5.21% of the voting rights of Vivendi as of August 31,

2021, representing an indirect interest of 3.76% in the Shares of the Company .

(7) These figures include an estimate of the number of Shares to be transferred by Vivendi to the relevant Corporate Executives pursuant to an

award by Vivendi to a limited number of senior managers of UMG, including certain of the Corporate Executives. The number of Shares to

be transferred to the relevant Corporate Executive will only be determinable closer to the date of listing and may vary depending upon the

expected trading price of the Shares, and the number of shares will be reduced to cover any required local payroll and income withholding,

and market capitalization of the Company. For more information, see Section 12.6.

Key executive directors. Sir Lucian Grainge CBE is the Chairman and Chief Executive Officer of the Company, and

Vincent Vallejo is the Deputy Chief Executive Officer of the Company.

Independent auditors. Ernst & Young et Autres (EY), an independent registered public audit firm with its address at

Tour First, TSA 14444, 92037 Paris-La Défense Cedex, France. The auditors signing the auditor's reports on behalf

of Ernst & Young et Autres are members of the Compagnie régionale des Commissaires aux Comptes de Versailles

et du Centre. Deloitte & Associés (Deloitte), an independent registered public audit firm with its address at 6, place

de la Pyramide, 92908 Paris-la Défense Cedex, France. The auditors signing the auditor's reports on behalf of Deloitte

& Associés are members of the Compagnie régionale des Commissaires aux Comptes de Versailles et du Centre.

What is the key financial information regarding the issuer?

With regard to the financial information as at and for the financial years ended December 31, 2018, 2019 and 2020

presented in the Prospectus, references to Universal Music Group, UMG or the Group refer to UMGI and UIM

collectively, and each of their respective subsidiaries, unless otherwise indicated. The Prospectus includes the

combined financial statements of Universal Music Group as at and for the years ended December 31, 2018, 2019 and

2020 (together, the Combined Financial Statements) and the unaudited consolidated condensed interim financial

statements for the Company as at and for the six-month period ended June 30, 2021 (the Interim Financial

Statements and, together with the Combined Financial Statements the UMG Financial Statements). There are no

qualifications in the auditors’ report on the Combined Financial Statements, and no qualifications in the auditors’

review report on the Interim Financial Statements included in the Prospectus. The Joint Auditors’ report includes

on

-3-

the Combined Financial Statements the following emphasis of matter paragraph, titled “Emphasis of matter”: We

draw attention to the Note "Basis of preparation of the Combined Financial Statements", in Section "Accounting

conventions used when preparing the Combined Financial Statements". Our opinion is not modified in respect of this

matter. This ‘Emphasis of matter” has been noted by the Joint Auditors in view of the fact that combined financial

statements are less common than consolidated financial statements and, taking into account that they comprise

accounts of two different companies (as opposed to an aggregate consolidated position of a parent company and its

subsidiaries as is the case for consolidated accounts) are more complex than consolidated financial statements.

Therefore, the Joint Auditors deemed it necessary and helpful to include an emphasis of matter paragraph in their

Report on the Combined Financial Statements to draw readers’ attention to the basis of preparation of these accounts,

which basis is described in the relevant notes to the Combined Financials Statements.

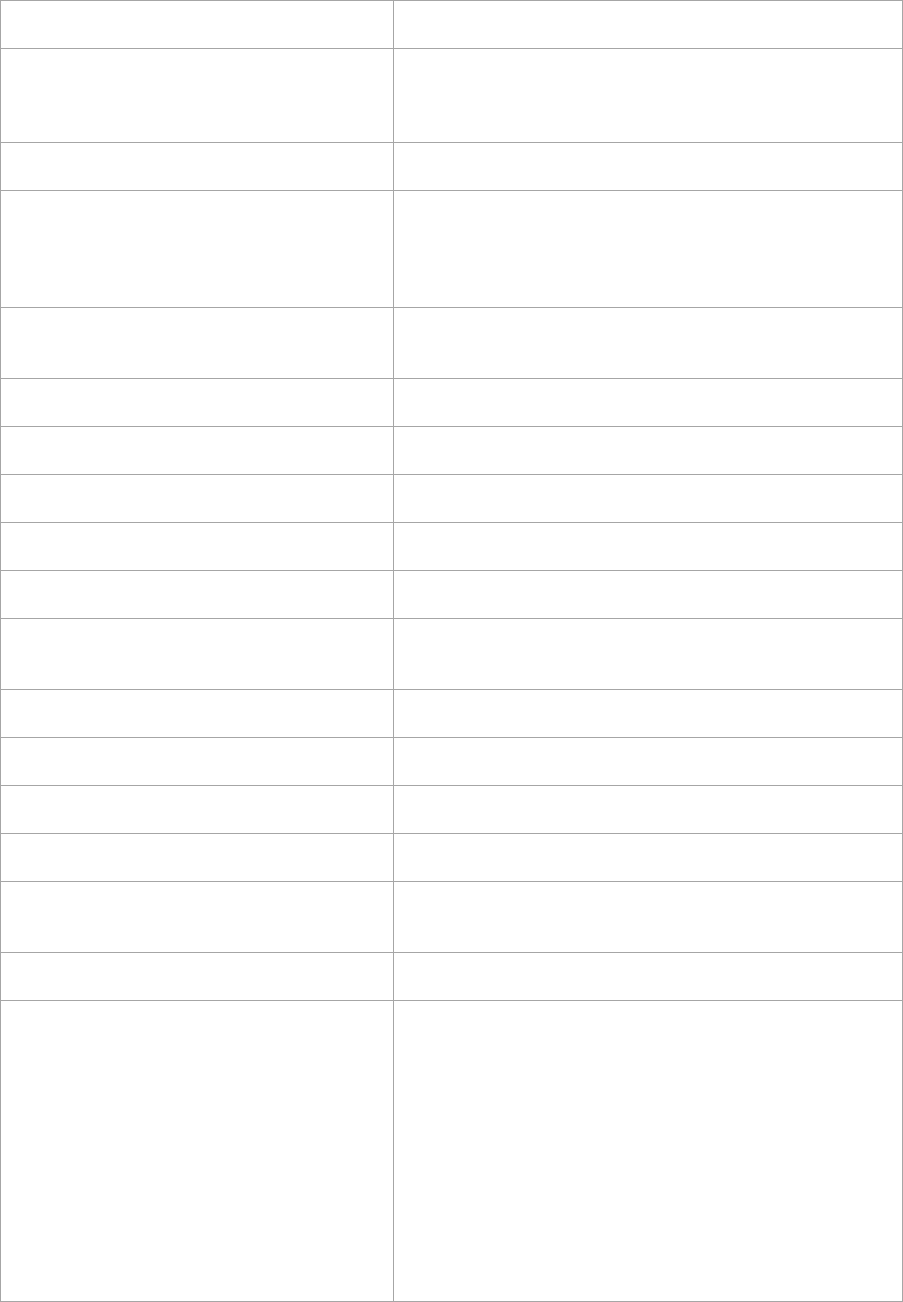

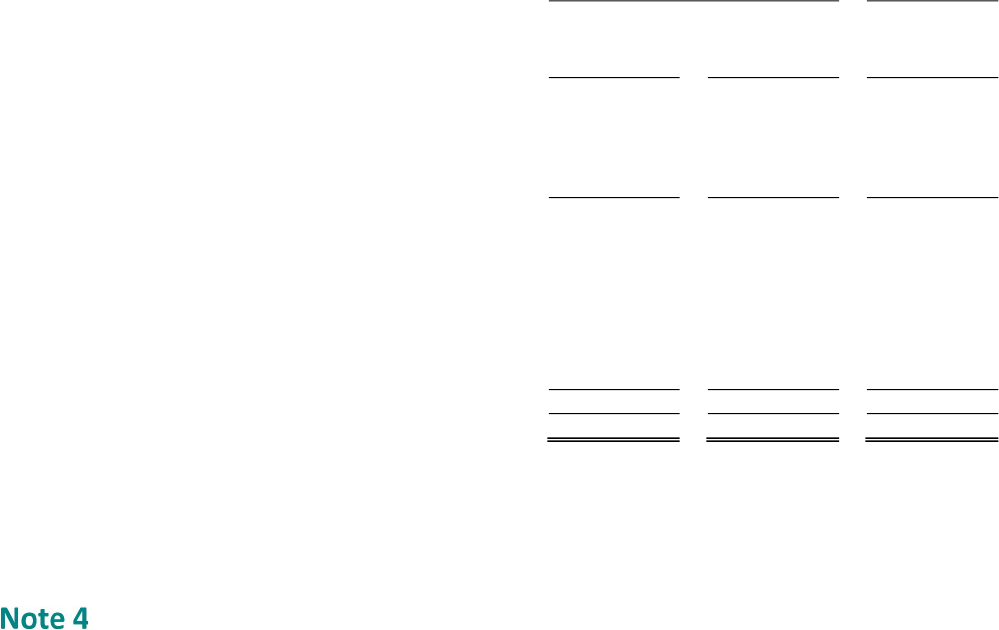

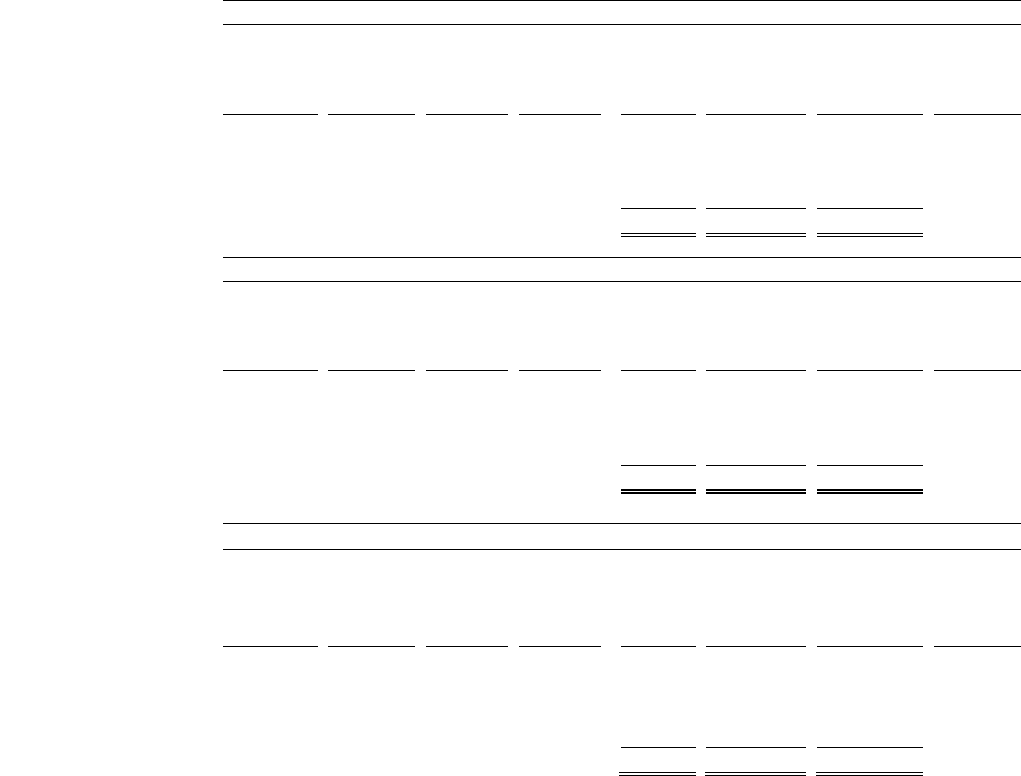

Summary combined / consolidated statements of profit or loss

Year ended December 31

6 months ended June

30

2020 2019

2018

2021 2020

Audited Unaudited

(€ millions)

Revenues ........................................................................ 7,432 7,159 6,023 3,831 3,459

Cost of revenues .............................................................. (3,917) (3,818) (3,110) (2,047) (1,820)

Selling, general and administrative expenses .................. (2,265) (2,276) (2,062) (1,090) (1,104)

Restructuring charges ...................................................... (20) (24) (29) (9) (8)

Impairment losses on intangible assets acquired through

business combinations .....................................................

- - - - -

Income from equity affiliates - operational ..................... (9) (2) (1) (1) (11)

Earnings before interest and income taxes (EBIT) .....

1,221 1,039 821 684 516

Interest ............................................................................. (15) 14 27 (9) (6)

Income from investments ................................................ - - 1 - -

Other financial income .................................................... 603 174 333 105 453

Other financial charges .................................................... (28) (57) (29) (183) (13)

560 131 332 (87) 434

Earnings before provision for income taxes ................ 1,781 1,170 1,153 597 950

Provision for income taxes ..............................................

(412) (195) (251) (144) (214)

Earnings from continuing operations ..........................

1,369 975 902 453 736

Earnings from discontinued operations ........................... - - - - -

Earnings .........................................................................

1,369 975 902 453 736

of which

Earnings attributable to shareowners ......................... 1,366 972 897 452 735

Non-controlling interests .................................................

3 3 5 1 1

Summary combined / consolidated statements of financial position

As at December 31 As at June 30

2020 2019 2018 2021 2020

Audited Unaudited

(€ millions)

Non-current assets ...................... 8,000 6,055 4,749 7,808 6,849

Current assets ............................. 2,987 2,775 3,248 2,865 2,748

Total assets ................................

10,987 8,830 7,997 10,673 9,597

Total equity ...............................

1,432 2,984 3,077 1,487 1,253

Non-current liabilities ................ 4,830 1,713 1,138 2,308 4,114

Current liabilities........................ 4,725 4,133 3,782 6,878 4,230

Total liabilities ..........................

9,555 5,846 4,920

9,186

8,344

TOTAL EQUITY AND

LIABILITIES ...........................

10,987 8,830 7,997 10,673 9,597

-4-

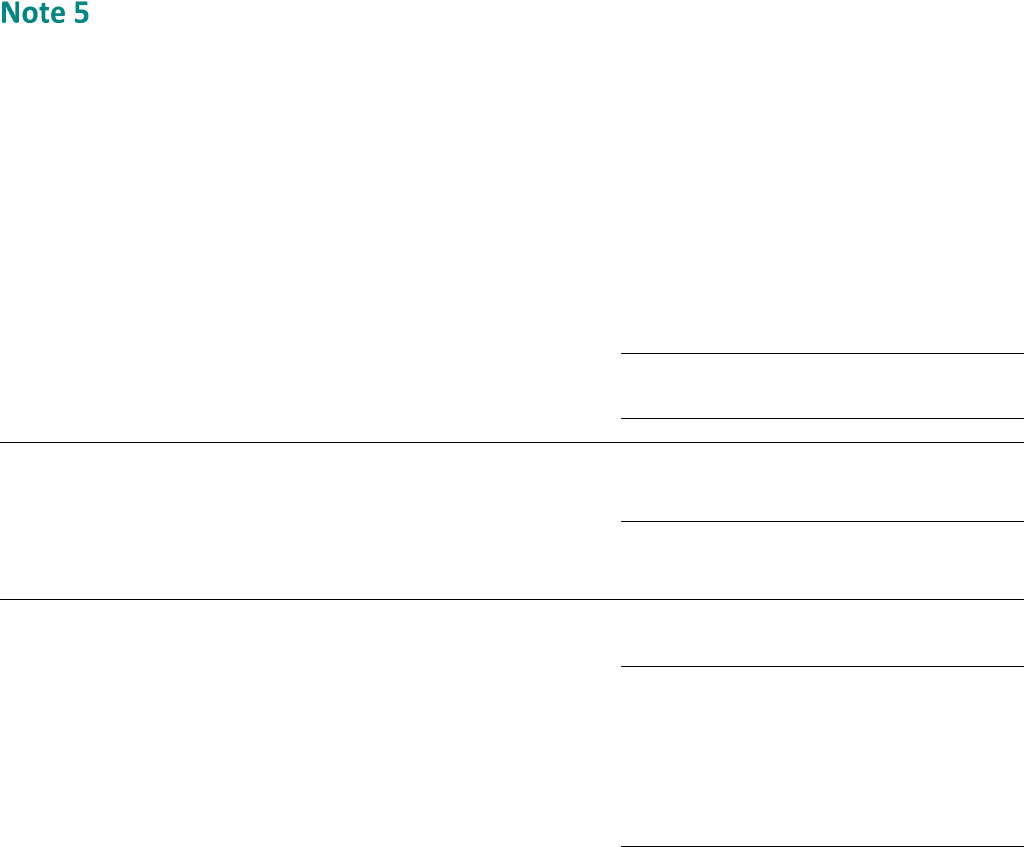

Summary combined / consolidated statements of cash flows

Year ended December 31 6 months ended June 30

2020 2019 2018 2021 2020

Audited Unaudited

(€ millions)

Net cash provided by operating activities .......... (3) 685 747 309 76

Net cash provided by/(used for) investing

activities ............................................................ (46) (129) (111) 29 (37)

Net cash provided by/(used for) financing

activities ............................................................ 217 (1,076) (2,387) (584) 85

Foreign currency translation adjustments of

continuing operations ........................................ (35) (8) (19) 6 (20)

Change in cash and cash equivalents and

shareowners loans ...........................................

133 (528) (1,770) (240) 104

Cash and cash equivalents and shareowners

loans ..................................................................

At beginning of the period................................. 1,008 1,536 3,306 1,141 1,008

At end of the period ........................................... 1,141 1,008 1,536 901 1,112

of which Shareowners loans

At beginning of the period................................. 672 1,260 3,059 815 672

At end of the period ...........................................

815 672 1,260 146 695

of which Cash and cash equivalent

At beginning of the period................................. 336 276 247 326 336

At end of the period ...........................................

326 336 276 755 417

Other Key Financial Information

KPIs. The table below sets out the Group’s key performance indicators (KPIs), which the Group monitors

to track the financial and operating performance of its business. Certain of these KPIs are not defined in the

International Financial Reporting Standards issued by the International Accounting Standards Board and as endorsed

by the EU (IFRS).

Year ended December 31

6 months ended

June 30

2020 2019 2018

2021 2020

Audited Unaudited

(€ millions, unless otherwise indicated)

EBITA

(1)

....................................

1,329 1,124 902 753 567

EBITA margin

(2)

.......................

17.9% 15.7% 15.0% 19.7% 16.4%

EBITDA

(3)

................................. 1,487 1,267 979 822 649

EBITDA margin

(4)

....................

20.0% 17.7% 16.3% 21.5% 18.8%

(1) To calculate EBITA, the accounting impact of the following items is excluded from the income from EBIT: (i) the amortization of intangible

assets acquired through business combinations as well as other rights catalogs acquired; (ii) impairment losses on goodwill, other intangibles

acquired through business combinations and other rights catalogs acquired; and (iii) other income and charges related to transactions with

shareowners (except when directly recognized in equity).

(2) EBITA margin represents EBITA as a percentage of revenues. EBITA margin is unaudited.

(3) To calculate EBITDA, the accounting impact of the following items is excluded from the income from EBIT: (i) the depreciation of tangible,

intangible and right of use assets; (ii) gains/(losses) on the sale of tangible, intangible and right of use assets; (iii) the amortization of

intangible assets acquired through business combinations as well as other rights catalogs acquired; (iv) impairment losses on goodwill, other

intangibles acquired through business combinations and other rights catalogs acquired; (v) income from equity affiliates having similar

operating activities; and (vi) restructuring charges, and other non-recurring items.

(4) EBITDA margin represents EBITDA as a percentage of revenues. EBITDA margin is unaudited.

-5-

What are the key risks that are specific to the issuer?

Any investment in the Shares is associated with risks. Prior to any investment decision, it is important to carefully

analyse the risk factors considered relevant to the future development of the Group and the Shares. The below are

the key risks relating to the Company that, alone or in combination with other events or circumstances, could have a

material adverse effect on the Group’s business, financial condition, results of operations and prospects. In making

the selection, the Group has considered circumstances such as the probability of the risk materialising on the basis of

the current state of affairs, the potential impact which the materialisation of the risk could have on the Group’s

business, financial condition, results of operations and prospects, and the attention that management would, on the

basis of current expectations, have to devote to these risks if they were to materialise:

UMG may be unable to compete successfully in the highly competitive industry and markets in which it

operates and UMG’s business may be adversely affected if UMG fails to identify, attract, sign and retain

successful recording artists and songwriters or by the absence of superstar releases.

If streaming and subscription adoption or revenue fail to grow or grow less rapidly than UMG anticipates,

UMG’s business may be adversely affected.

UMG relies on digital service providers for the online distribution and marketing of its music on the basis

of contractual terms that are subject to change.

UMG’s results of operations may be adversely affected if it is unable to compete successfully in the evolving

markets in which it operates or is unable to execute its business strategy.

Technological advancements are rapidly changing the marketplace in which UMG competes and the nature

of UMG’s competition.

UMG operates in many jurisdictions around the world and therefore, is subject to a variety of trends,

developments and limitations in those jurisdictions, which could affect it adversely.

UMG’s ability to operate effectively could be impaired if it fails to attract and retain its executive officers

and other key personnel.

The success of UMG’s business is dependent on the existence and maintenance of its intellectual property

rights and challenges in obtaining, maintaining, protecting and enforcing UMG’s intellectual property rights

and involvement in intellectual property litigation could adversely affect its business, operating results and

financial condition.

Piracy continues to adversely impact UMG’s business and content protection is a key focus of UMG’s

business.

UMG’s business is subject to a variety of European, US and other supranational or domestic laws, rules,

policies and other obligations regarding data protection.

A significant portion of UMG’s revenues are subject to regulation either by government entities or by local

third-party collecting societies throughout the world and rates on other income streams may be set by

governmental proceedings or be subject to legislative intervention, which may limit its profitability.

Changes in laws and regulations, including those relating to intellectual property rights, may have an adverse

effect on UMG’s business.

KEY INFORMATION ON THE SECURITIES

What are the main features of the securities?

Type, class and ISIN. The Shares are ordinary shares, created under and in accordance with the laws of the

Netherlands, with a nominal value of €10.00 each in the share capital of the Company. Application has been made to

list all of the Shares under the ticker symbol “UMG” on Euronext Amsterdam under ISIN Code NL0015000IY2.

Currency, denomination, par value and number of securities. The Shares are denominated in and will trade in euro.

Immediately prior to the Distribution, the authorized share capital of the Company shall amount to €27,000,000,000,

divided into 2,700,000,000 Shares with a nominal value of €10.00 each. The issued share capital of the Company

immediately prior to the Distribution is expected to amount to €18,132,411,600, divided into 1,813,241,160 Shares

with a nominal value of €10.00 each.

Rights attached to the Shares. Shortly prior to Admission, the articles of association of the Company will be amended

and fully restated. Reference to the Articles of Association hereafter will be to the Company’s articles of association

as they will read after such amendment and restatement. Each Share confers its holder the right to cast one vote at

the Company’s general meeting, being the corporate body or, where the context so requires, the physical meeting

(the General Meeting). There are no restrictions on voting rights. The Shares carry dividend rights.

Rank of securities in the issuer’s capital structure in the event of insolvency. The Shares do not carry any rights in

respect to capital to participate in a distribution (including on a winding-up) other than those that exist as a matter of

law. The Shares, which includes the Distribution Shares, will rank pari passu in all respects.

Restrictions on the free transferability of the securities. There are no restrictions on the transferability of the Shares

in the Articles of Association or under Dutch law. However, the offering of Shares to persons located or resident in,

-6-

or who are citizens of, or who have a registered address in certain countries, and the transfer of Shares into certain

jurisdictions, may be subject to specific regulations or restrictions.

Dividend or pay-out policy. The Company plans, as from the Admission, to annually declare and pay dividends to

all holders of the Shares on a pro rata basis in two semi-annual instalments, in the aggregate amount of no less than

50% of the Company’s net profits realized during the relevant financial year, subject to agreed non-cash items. The

Company intends to pay an interim dividend in the fourth quarter of each financial year, after the publication of the

half-year figures of the Company, and a final dividend in the second quarter of the following financial year, to be

paid following approval of the Company’s financial statements at its annual General Meeting.

On July 28, 2021, the Board resolved to make a distribution for an amount in cash of €362,648,232 to all Shareholders

by way of an interim dividend distribution at the charge of the Company’s current profits in the current financial year

that started on January 1, 2021, provided that in the event that after adoption of the annual accounts for the financial

year of the Company that started on January 1, 2021, the Company’s profits shall appear to be less than the amount

of such interim dividend distribution, the balance shall be deemed to have been a distribution from the Company’s

freely distributable reserves. With regard to such distribution: (i) the ex-dividend date will be October 25, 2021; (ii)

the record date will be October 26, 2021; and (iii) the payment date will be October 28, 2021.

Where will the securities be traded?

Application has been made for the admission to listing and trading of all of the Shares (Admission) under the symbol

“UMG” on Euronext Amsterdam. Trading on an “as-if-and-when-delivered” basis in the Shares on Euronext

Amsterdam is expected to commence at 9.00 (Central European Time (CET)) on or around September 21, 2021 (the

First Trading Date). Prior to being admitted to trading on Euronext Amsterdam, there has been no public trading

market for the Shares.

What are the key risks that are specific to the securities?

The key risks relating to the Distribution and the Shares are:

The Existing Shareholders will continue to hold a significant minority stake in the Company and may have

conflicts of interest with other Shareholders.

An active trading market on Euronext Amsterdam may not develop.

The Company may issue additional Shares or other equity securities without Shareholder approval, which

would dilute Shareholder ownership interests and may depress the market price of the Shares.

KEY INFORMATION ON THE ADMISSION TO TRADING ON A REGULATED MARKET

Under which conditions and timetable can I invest in this security?

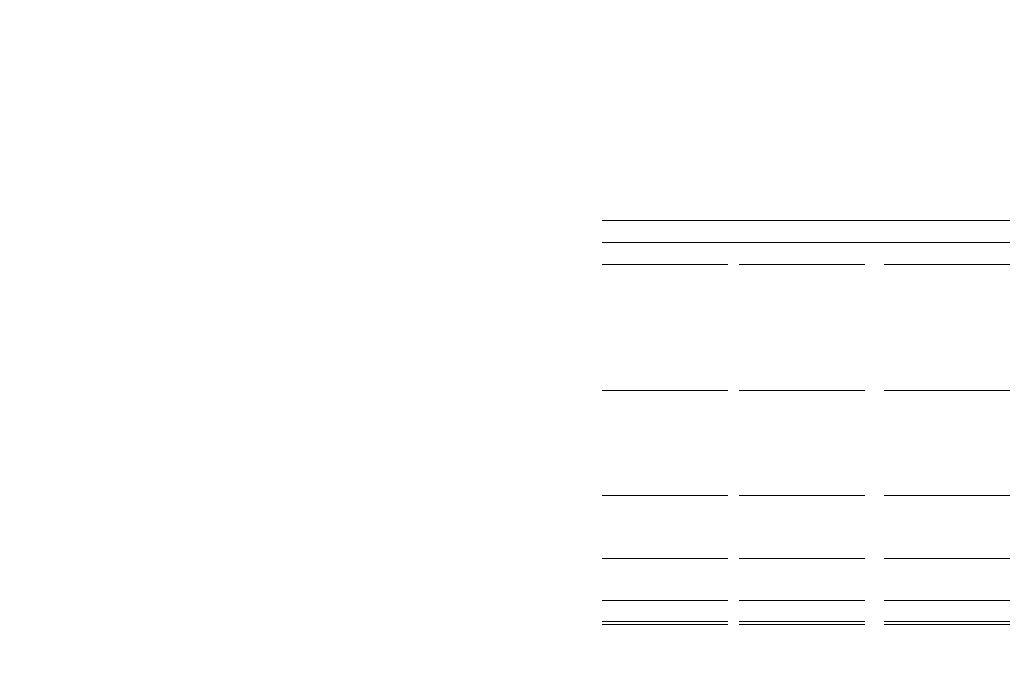

Timetable. Subject to acceleration or extension of the timetable by the Company and Vivendi for, or withdrawal of,

the Admission and the Distribution, the timetable below lists the expected key days for the Admission and the

Distribution:

Event Time (CET) and date

Distribution

Resolution of Vivendi’s management board to distribute an exceptional interim

dividend in kind

September 14, 2021

Euronext Amsterdam notice announcing the Reference Price for the Shares September 20, 2021

Distribution ex-Date in respect of Distribution of Distribution Shares September 21, 2021

Admission September 21, 2021

Commencement of trading under the ticker symbol "UMG" on an "if-and-when-

delivered" (conditional upon delivery) basis

September 21, 2021

Distribution Record Date in respect of Distribution of Distribution Shares September 22, 2021

Payment of the Distribution (delivery and book-entry of the Distribution Shares

allocated pursuant to the Distribution)

September 23, 2021

Distribution Settlement September 23, 2021

The Company and Vivendi reserve the right to adjust the dates, times and periods given in the timetable and throughout the

Prospectus.

Lead Equity Capital Markets Advisors. BNP Paribas, Crédit Agricole Corporate and Investment Bank, Morgan

Stanley, Natixis and Société Générale are acting as lead financial advisors (in such and any other capacity, the Lead

Financial Advisors). Banque Hottinguer, Messier et Associés, CIC, Rothschild, Bank of America, ING, Intesa

Sanpaolo S.p.A., Lazard, Mizuho Securities and Banco Santander are acting as financial co-advisors (in such and

any other capacity, the Financial Co-Advisors). Bank of China and Goldman Sachs Bank Europe SE are acting as

other financial advisors (in such and any other capacity,

the

Other Financial Advisors

and, together with the Lead

-7-

Financial Advisors and the Financial Co-Advisors, the Lead Equity Capital Markets Advisors). The Lead Equity

Capital Markets Advisors are acting only in respect of the Admission and Distribution.

Distribution Allocation Ratio. Subject to adjustment of the Allocation Ratio (the Adjustment of the Allocation

Ratio), each Vivendi Shareholder will receive one (1) Share for each one (1) share which it holds in Vivendi on

September 22, 2021 (the Distribution Record Date) as part of the Distribution (the Allocation Ratio).

Distribution Delivery. Subject to acceleration or extension of the timetable for the Distribution, the Distribution is

expected to be implemented and settled on September 23, 2021 (the Distribution Date) through the book entry

facilities of Euroclear France in accordance with Euroclear France’s normal procedures applicable to equity securities

(the Distribution Settlement).

Listing and Paying Agent. BNP Paribas is the Listing Agent and BNP Paribas Securities Services is the Paying and

Settlement Agent with respect to the Shares on Euronext.

Dilution. There shall be no dilution of the shareholdings of the Existing Shareholders pursuant to the Distribution,

however, the shareholding of Vivendi will be reduced from 70% to approximately 10% as a result of the Distribution.

Estimated expenses related to the Admission: The maximum amount of expenses to be paid in relation to the

Admission and Distribution cannot precisely be estimated as of the date of this Prospectus, however, the maximum

amount expenses will in any case remain limited to a maximum of 0.5% of the total amount of the Distribution.

Estimated expenses charged to the investors. No expenses or fees will be charged by the Company or Vivendi to

Vivendi Shareholders in relation to the Admission and the Distribution. However, the beneficiaries of the Distribution

would be required to pay, as appropriate, to their authorized financial intermediary or to Vivendi, through the Listing

and Paying Agent, the social withholdings and/or the non-final withholding tax or the withholding tax payable in

respect of the Distribution.

Why is this prospectus being produced?

Reasons for the Admission. Prior to the date of the Prospectus, financial analysts highlighted that Vivendi’s stock

market price per share was approximately 10% to 30% lower than the sum of all of Vivendi’s businesses divided by

its number of shares. For a number of years, Vivendi’s leading institutional shareholders have been seeking a spin-

off from or a distribution of UMG by Vivendi to reduce such conglomerate discount and to allow for a valuation of

UMG, and for UMG to further develop, on a stand-alone basis. The transactions resulting in 20% of the share capital

of UMG now being held by the Tencent-led Consortium led Vivendi’s management board to conclude that the time

was ripe for a distribution of up to 60% of UMG’s share capital to the Vivendi Shareholders, which resulted in

Vivendi’s pursuance of the Distribution. Whilst the Company will not receive any proceeds from the Admission, it

believes that the Admission is well aligned to the Company’s continued growth ambitions and will help to maximise

shareholder value over time, including by addressing the conglomerate discount highlighted by financial analysts in

relation to Vivendi’s stock market price per share. In addition, the Company and Vivendi believe that the Admission

is also a significant step and presents a new opportunity to the Company which will allow it to broaden artist

opportunities and enrich experiences for music fans, further promoting a thriving music and entertainment industry

and further solidifying UMG’s position as an industry leader. The Admission is expected to further increase the

Company’s profile with the music and entertainment industry, investors, business partners and customers, brand

recognition and credibility. The Admission is also expected to provide additional financial flexibility and diversity

through access to capital markets.

Net proceeds. No proceeds shall be raised pursuant to Admission and the Distribution.

Most material conflicts of interest pertaining to the Admission and the Distribution. Certain of the Lead Equity

Capital Markets Advisors and/or their affiliates are, or have been, engaged and may in the future engage in

commercial banking, investment banking and financial advisory (including in the context of the Admission and

Distribution) and ancillary activities in the ordinary course of their business with the Group and/or Vivendi, other

Existing Shareholders or any parties related to or competing with any of them, in respect of which they have received,

and may in the future receive, customary fees and commissions. In particular, some of the Lead Equity Capital

Markets Advisors and/or their affiliates have taken an active part or takes an active part to Vivendi and UMG’s

financing (see for example a description of the syndicated bank credit facility mentioned in Section 16.5.3 (Facilities

Agreement)) and are long-standing partners to Vivendi. Additionally, the Lead Equity Capital Markets Advisors

may, in the ordinary course of their business, and in the future, effect transactions for their own account or the account

of customers, and make or hold a broad array of investments and actively trade debt and equity securities (or related

derivative securities) and financial instruments on behalf of themselves or their customers. Such investments and

securities activities may involve long or short positions in the Company’s and/or Vivendi’s securities. As a result of

acting in the capacities described above, the Lead Equity Capital Markets Advisors and their affiliates may have

interests that may not be aligned, or could potentially conflict, with the interests of investors in the Shares or with the

interests of the Company or the Group.

-8-

1. RISK FACTORS

Any investment in the Shares is subject to a number of risks. Investors should carefully consider the risk

factors included below, UMG’s business and the industry in which it operates, together with all other information

contained in this Prospectus.

The occurrence of any of the events or circumstances described in these risk factors, individually or

together with other circumstances, may have a significant negative impact on the Group’s business, financial

condition, results of operations and prospects. The price of the Shares could decline and an investor might lose

part or all of its investment upon the occurrence of any such event.

All of these risk factors and events are contingencies that may or may not occur. The Group may face a

number of these risks described below simultaneously and some risks described below may be interdependent

where indicated with a cross-reference. Although the most material risk factors have been presented first within

each category, the order in which the remaining risks are presented is not necessarily an indication of the

likelihood of the risks actually materializing, of the potential significance of the risks or of the scope of any

potential negative impact to the Group’s business, financial condition, results of operations and prospects. While

the risk factors below have been divided into categories, some risk factors could belong in more than one category

and prospective investors should carefully consider all of the risk factors set out in this section.

The below is what the Company believes are the material risks and uncertainties concerning the Group’s

business and industry, and the Shares that, alone or in combination with other events or circumstances, could

have a material adverse effect on the Group’s business, financial condition, results of operations and prospects.

In making the selection, the Group has considered circumstances such as the probability of the risk materializing

on the basis of the current state of affairs, the potential impact which the materialization of the risk could have

on the Group’s business, financial condition, results of operations and prospects, and the attention that

management would, on the basis of current expectations, have to devote to these risks if they were to materialize:

Although the Company believes that the risks and uncertainties described below are the material risks and

uncertainties concerning the Group’s business and industry, and the Shares, they are not the only risks and

uncertainties relating to the Group and the Shares. Other risks, events, facts or circumstances not presently known

to the Group, or that the Group currently deems to be immaterial could, individually or cumulatively, prove to be

important and may have a significant negative impact on the Group’s business, financial condition, results of

operations and prospects and the price of the Shares may decline and investors could lose all or part of their

investment.

Any investment in the Shares is associated with risks. Prior to any investment decision, it is important to

carefully analyze the risk factors considered relevant to the future development of the Group and the Shares.

Prospective investors should carefully read and review the entire Prospectus and should form their own views

before making an investment decision with respect to any Shares. Furthermore, before making an investment

decision with respect to any Shares, prospective investors should consult their own professional adviser and

carefully review the risks associated with an investment in the Shares and consider such an investment decision

in light of their personal circumstances.

1.1 Risks Related to UMG’s Business and Industry

1.1.1 UMG may be unable to compete successfully in the highly competitive industry and markets in which

it operates and UMG’s business may be adversely affected if UMG fails to identify, attract, sign and

retain successful recording artists and songwriters or by the absence of superstar releases.

The industry in which UMG operates is highly competitive, influenced by consumer preferences and

rapidly evolving. UMG’s competitive position is dependent on identifying, attracting, signing and retaining

recording artists who are or will become commercially successful, who have long-term potential, whose music is

well received, whose subsequent music is demanded by consumers and whose music will continue to generate

sales as part of its catalog for years to come. Competition among record companies for such talent is intense.

UMG is also dependent on signing and retaining songwriters who are capable of writing songs that will be the

popular hits of today and the classics of tomorrow. For example, in 2020, UMG’s artists took four of the year’s

top five spots in the Spotify global charts (Drake, J. Balvin, Juice WRLD and The Weeknd), released the number

one song of the year (Blinding Lights by The Weeknd) and took two spots in the top three album rankings (After

Hours by The Weeknd and Hollywood’s Bleeding by Post Malone). UMG’s competitive position is dependent on

its continuing ability to attract and develop such recording artists and songwriters whose work can achieve a high

degree of popularity and thereafter, continue to create music and songs to retain, engage and expand their fan

base. With regard to development of recording artists and songwriters, UMG believes that traditional, high-touch,

-9-

full-service label deals with its portfolio of world-renowned labels, provide the most long-term value to an artist

and greatly increase the commercial success, consumer base and longevity potential for artists at every stage of

their careers. These deals provide for the full suite of professional expertise and global resources of a major label,

including a comprehensive approach to content creation, organic artist development, timing, marketing,

promotion, financial investment, and forward planning.

UMG’s recorded music business is to a large extent dependent on technological developments in order

to remain competitive, including access to, selection and viability of new technologies, and UMG’s recorded

music business is subject to potential pressure from competitors as a result of technological developments

modifying the nature of UMG’s competition. If UMG is unable to remain competitive as a result of technological

developments, this could have a material adverse effect on UMG’s business, prospects, financial condition and

results of operations. See Section 1.1.5 (Technological advancements are rapidly changing the marketplace in

which UMG competes and the nature of UMG’s competition).

UMG’s business may be adversely affected if it is unable to sign successful recording artists or

songwriters. Signing, retaining and successfully developing artists is highly competitive, requires substantial

human and capital resources, and can be dependent on consumer preferences that are rapidly and continuously

changing. UMG uses external sources of data provided by streaming platforms or other external providers.

Limitations to access of such data could adversely impact UMG’s capability of identifying future talents and

therefore negatively affect its business. While UMG is required to devote significant time and investment to these

activities, the returns on these activities are influenced by a number of factors, including factors outside of the

control of UMG, and are uncertain at the time of investment. To the extent that the expected returns from these

activities fail to materialize or are not in line with expectations, this may negatively impact UMG’s operating and

financial performance and prospects.

UMG’s competitors may become more successful at signing, marketing and promoting recording artists,

for example if UMG’s competitors increase the amounts they spend to discover, or to market and promote,

recording artists and songwriters or reduce the prices of their music in an effort to expand market share, which

may adversely impact UMG’s business, financial condition, results of operations and prospects.

UMG’s business, prospects, financial condition and results of operations may be adversely affected if it

is unable to identify, attract, sign and retain such recording artists and songwriters on terms that are economically

viable to it. UMG’s financial results may also be affected by the absence of superstar recording artist releases

during a particular period via a negative impact on physical sales, download volumes and UMG’s share of digital

platform subscription streaming revenues, which may result in a decrease in UMG’s revenues from these income

streams and an adverse impact on UMG’s business, financial condition, results of operations and prospects.

1.1.2 If streaming and subscription adoption or revenue fail to grow or grow less rapidly than UMG

anticipates, UMG’s business may be adversely affected.

Revenues from subscription music services are important to UMG because they offset declines in

downloads and physical sales and represent a growing area of UMG’s recorded music business. According to the

IFPI Global Music Report 2021 issued by the International Federation of the Phonographic Industry (IFPI), an

organization that represents the interests of the recording industry worldwide, subscription music services and ad-

supported streaming revenues accounted for approximately 62.1% of global recorded music revenues in 2020,

approximately a 19.9% increase as compared to 2019. In 2020, UMG generated €3,833 million of revenue from

subscription music services and ad-supported streaming, as compared to €3,325 million in 2019. There can be no

assurance that this growth pattern will persist or that digital revenue will continue to grow at a rate sufficient to

offset and exceed declines in downloads and physical sales. Consumption formats in the music industry are

susceptible to technological advancements and changing consumer preferences around how music is accessed, as

illustrated in recent years by the global decline in revenue derived from downloads and CD sales. See Section

1.1.5 (Technological advancements are rapidly changing the marketplace in which UMG competes and the nature

of UMG’s competition). These, and other factors, may in the future negatively impact subscription and ad-

supported streaming, for example where newer formats become more popular with consumers. Additionally,

technology around streaming manipulation, fraud and hacking is becoming increasingly refined and subscription

streaming services are particularly vulnerable which could undermine consumer confidence and cause revenue

loss.

If UMG’s subscription or streaming revenue fails to grow, grows less rapidly than it has over the past

several years or declines, UMG’s recorded music business may experience reduced levels of revenue and

operating income. Additionally, slower growth in streaming adoption or revenue is also likely to have a negative

impact on UMG’s music publishing business, which generates a significant portion of its revenue from sales and

-10-

other uses of recorded music. Both of these may adversely impact UMG’s business, prospects, financial condition

and results of operations.

1.1.3 UMG relies on digital service providers for the online distribution and marketing of its music on the

basis of contractual terms that are subject to change.

UMG derives an increasing portion of its revenues from the distribution of music through digital

distribution channels and partners with several hundred music services around the world and, in 2020, the top 50

music services accounted for 95% of UMG’s digital revenue for 2020. In 2020, 65% of UMG’s overall revenue

was derived from digital channels.

UMG currently enters into relatively short-term agreements with digital music streaming services. There

can be no assurance that UMG will be able to renew or enter into new agreements with any digital music service.

The terms of these agreements, including the rates that UMG receives pursuant to them and the basis for

calculation of those rates, may change as a result of changes in the industry or changes in the law, or for other

reasons. Decreases in rates or changes to other terms of agreements with digital music streaming services could

adversely impact UMG’s business, prospects, financial condition and results of operations.

UMG’s music is also promoted by the digital music services on playlists curated by such services or

generated from their algorithms (or a combination of both). Any unfavorable changes made by such service

providers to their algorithms or to the terms on which they market or promote UMG’s music could adversely

affect UMG’s business, prospects, financial condition and results of operations.

1.1.4 UMG’s results of operations may be adversely affected if it is unable to compete successfully in the

evolving markets in which it operates or is unable to execute its business strategy.

UMG expects to increase revenues and cash flow through a business strategy which requires it to, among

other things, continue to maximize the long-term value of its music by expanding the licensing partners with

which UMG works and diversifying its revenue streams by partnering with an increasing array of new businesses

that benefit from the use of music content to engage consumers. UMG’s strategy includes efforts to grow revenues

from new digital platforms, including fitness and video games, and through business arrangements with non-

traditional partners, including social media platforms. For example, in 2017, UMG became the first major music

company to sign a deal with Facebook. UMG has the largest portfolio of fitness technology agreements of any

music company, including with Peloton and Apple’s Fitness+, and in 2021, licensed its catalog to Equinox Media,

LLC’s Variis digital fitness app. The success of these initiatives relies on adequate third-party support and requires

UMG to accurately forecast and keep up with technological developments and consumer preferences relating to

platforms and may require UMG to implement new business models or adapt to new distribution platforms. If

UMG is unable to implement its strategy successfully or properly react to changes in consumer preference, its

financial condition, results of operations and cash flows could be adversely affected.

1.1.5 Technological advancements are rapidly changing the marketplace in which UMG competes and the

nature of UMG’s competition.

The industries in which UMG operates are subject to rapid and significant changes in technology and are

characterized by the frequent introduction of new products and services and use of technology in new ways, as

demonstrated by the resulting global increase in streaming revenues over the past five years, coupled with a

converse decline in downloads and CD sales. Technological advancements are also modifying the nature of

UMG’s competition and bringing new challenges. The uses of technology are constantly evolving, and it may not

be possible to foresee the ways in which technology could be used in, and to disrupt, the music industry, for

example through the use of artificial intelligence and non-fungible tokens. Technological advancements may also

be used to manipulate and adversely impact the reach of UMG’s digital content to its consumers and, as mentioned

above, technology around streaming manipulation, fraud and hacking is becoming increasingly advanced.

Adapting to, and competing with, rapid technological advancements requires substantial investment of

time and resources; however, such investment does not guarantee UMG’s success in developing, implementing,

transitioning to, competing with, utilizing or defending against new technology. Any failure by UMG to accurately

anticipate customers’ changing needs and emerging technological trends could significantly harm UMG’s

competitive positioning and results of operations. If UMG is not successful in adapting to or competing and

keeping up with new technology, UMG’s business, prospects, financial condition and results of operations could

be adversely affected.

-11-

In addition, UMG’s competitors may in the future be able to innovate or adjust faster than UMG can,

and new technologies may increase competitive pressure by enabling UMG’s competitors to offer superior

services or be more attractive to artists and songwriters. Such developments could make UMG’s value proposition

less compelling, which could have a material adverse effect on UMG’s business, prospects, financial condition

and results of operations.

1.1.6 UMG operates in many jurisdictions around the world and therefore is subject to a variety of trends,

developments and limitations in those jurisdictions, which could affect it adversely.

UMG has offices engaged in recorded music, music publishing, merchandising and audiovisual content

in more than 60 territories around the world. UMG’s local presences have become increasingly important as the

popularity of music originating from a country’s own language and culture is very significant, and more countries

around the world have developed legitimate business models to monetize music. In addition, UMG’s business

model is increasingly focused on developing business in new high-growth music markets. For example, in 2020,

UMG strengthened its global presence through new activities and key partnerships in Israel, Morocco, Vietnam,

Senegal, Cameroon, Nigeria, Italy, India, Indonesia, Thailand and South Korea. However, if UMG’s music does

not continue to have appeal in various countries, UMG’s results of operations could be adversely impacted and

its investments in new jurisdictions could fail to generate returns for UMG in line with expectations. Additionally,

UMG may not be successful in identifying and signing the most promising artists in these markets, which may

negatively impact UMG’s competitive position in these geographies, its prospects and its ability to generate

returns in these markets.

In countries in which the Group currently conducts, or may in the future conduct, its businesses, the

Group’s operations, growth strategy and development may be negatively impacted as a result of less developed

digital, internet and mobile network infrastructure. The Group’s success, particularly streaming revenues, depend

on the continued development and use of internet by consumers to access music as well as increasing high-speed

internet and smart-phone penetration. If internet access or smart phone penetration in these markets develops

slower than expected, or is stalled, the Group’s growth strategy could be adversely affected.

Further, depending on the customs and norms in various markets, UMG’s presence in and generation of

revenues from other countries may require UMG to accept longer accounts receivable settlement cycles and may

subject UMG to difficulties in collecting its accounts receivables. UMG is also subject to restrictions on

repatriation of capital in several jurisdictions in which it operates. For more information, see Section 1.3.6 (Export

and import control laws and regulations, tariffs and trade barriers could have an adverse effect on UMG’s

business) below. Additionally, as a result of its global presence, UMG is subject to challenges in the global

economic environment, as a result of political instability in jurisdictions where it is present as well as recessionary

trends, inflation and instability in the financial markets in jurisdictions where it is present.

Any failure of UMG to adequately respond to the needs of its operations in various jurisdictions, its

inability to appeal to consumers in various countries or the restrictions on UMG’s business due to customs, norms

and policies in various jurisdictions may adversely impact UMG’s business, prospects, financial condition and

results of operations.

1.1.7 UMG faces competition for the attention of its consumers given the constantly evolving entertainment

options that are available.

A significant portion of UMG’s revenue comes from the production and distribution of audio and

audiovisual recordings. The success of UMG’s content depends primarily upon its acceptance by the public and

on consumer tastes and preferences, which change over time and are difficult to predict. The market for these

products is highly competitive and competing products are often released into the marketplace at the same time.

To remain competitive, UMG constantly seeks new platforms to engage different demographics of consumers

around the world. The commercial success of audio and audiovisual recordings depends on several variable

factors, including the quality and acceptance of competing offerings released into the marketplace at or near the

same time, the availability of alternative forms of entertainment and leisure time activities and general economic

conditions and other tangible and intangible factors, all of which can change quickly and in unforeseeable ways.

The recorded music business faces competition for consumer attention from other forms of entertainment

and leisure activities, such as cable and satellite television, on-demand television, motion pictures, podcasts and

video games and user-generated content in physical and digital formats. UMG may face competition in the future

from the development of any number of new forms of entertainment and leisure activities. Although new platforms

and means of entertainment provide opportunities for UMG to engage its customers, such initiatives may not be

-12-

successful or offset constantly changing consumer preferences or cycling preferences between different forms of

entertainment.

If UMG’s recorded music business unsuccessfully competes against other existing or new forms of

entertainment and leisure activities, or produces and distributes audio and audiovisual recordings without broad

consumer appeal, that may adversely impact UMG’s business, prospects, financial condition and results of

operations.

1.1.8 In addition to competition from traditional music industry players, new entrants into the music

industry, artists choosing not to sign with labels and the evolving role of intermediaries may increase

competition and impact UMG’s ability to sign artists.

UMG faces competition from traditional music industry players as well as new entrants, including

investment funds whose investment thesis includes making acquisitions of collections of musical compositions,

or “catalog acquisitions”. UMG’s competitors may launch aggressive promotional campaigns and other marketing

activities, or they may pay higher than market rates to attract new talent and increase their market share. In

response, in order to stay competitive, UMG may be required to make additional investments and incur significant

additional expenditures. If UMG is unable to compete successfully in the changing competitive landscape, UMG

may lose market share, worsen its business prospects and financial condition and its results of operations may be

materially and adversely affected.

In addition, changing business practices, particularly due to the emergence of new technologies and

access to a global network of consumers, has and could further result in artists choosing to make content available

to consumers directly without being affiliated with a label or an intermediary, or could result in music services

playing some of the roles that UMG has traditionally played. In this regard, UMG also competes with certain of

the music distribution platforms who distribute the works of artists and songwriters without the involvement of

labels or intermediaries.

These and other changes in the market could also result in modifications to the ways in which UMG

contracts with its artists and to the revenue generated from those relationships. It is not possible to predict all the

ways in which the music industry could change, and UMG may not be able to effectively adapt to all of these

changes and become less competitive. As a result, changing business practices and disintermediation could have

an adverse impact on UMG’s business, prospects, financial condition and results of operations.

1.1.9 UMG’s ability to operate effectively could be impaired if it fails to attract and retain its executive

officers and other key personnel.

UMG’s success depends, in part, upon the continuing contributions of its executive officers and key

operational and creative personnel, led by its Chairman and Chief Executive Officer, Sir Lucian Grainge. These

executive officers and key personnel possess significant experience within the music industry and their established

personal connections and relationships in the music industry are important to the Group’s operations. UMG

competes with other music and entertainment companies, record labels, digital service providers, technology

companies and other companies for top talent, including executive officers and other key personnel.

If the Group were to unexpectedly lose a member of the Group’s key management, its business, financial

condition, results of operations and prospects could be materially adversely affected. Although all of UMG’s

executive officers have employment agreements with UMG, UMG cannot guarantee that key personnel, including

executive officers, will remain in UMG’s employment or that it will be able to attract and retain qualified

personnel in the future, at a reasonable cost, to replace any departing key personnel, which may disrupt its business

and operations and could adversely impact UMG’s business, prospects, financial condition and results of

operations.

1.1.10 Where UMG acquires, combines with or invests in other businesses or joint ventures, UMG will face

risks inherent in such transactions.

UMG has in the past completed and, as part of its business strategy, will continue, from time to time, to

consider strategic transactions, which could involve acquisitions, combinations or dispositions of businesses or

assets, or strategic alliances or joint ventures with companies engaged in music entertainment, entertainment,

investing or other businesses. For example, in March 2019, UMG acquired the remaining rights in Ingrooves

Music Group (Ingrooves), a global music distribution company that provides marketing and rights management

services for independent labels and artists. Ingrooves subsequently acquired a leading South African independent

distributor, based on chart performance, Electromode, allowing UMG to enhance its digital, distribution and

-13-

marketing services footprint across the continent and in December 2018, UMG acquired 100% of the share capital

in Epic Rights, thereby further expanding UMG’s merchandising business. However, there can be no assurance

that UMG will continue to be able to identify and invest in suitable operations or assets. In addition, any such

investment could be material, be difficult to implement, disrupt its business or change its business profile, focus

or strategy significantly.

UMG may not be successful in addressing any risks or problems encountered in connection with any

strategic transactions. UMG cannot assure that if it makes any future acquisitions, investments, strategic alliances

or joint ventures or enters into any business combination that they will be completed in a timely manner, or at all,

that they will be structured or financed in a way that will enhance its creditworthiness or that they will meet its

strategic objectives or otherwise be successful. In addition, if any new business in which UMG invests or which

it attempts to develop does not progress as planned, it may not recover the funds and resources it has expended,

and this could have a negative impact on its business, prospects, financial condition and results of operations.

Additionally, UMG has made investments into joint ventures with third parties in certain jurisdictions

and it may in the future enter into additional such joint ventures as a means of conducting its business in various

jurisdictions.

While UMG seeks to ensure that it has appropriate control when entering into joint ventures, in the future

UMG may not be able to fully control the operations and the assets of its joint ventures as other investors in the

joint venture may have or require certain rights under the terms of the joint venture, and therefore, UMG may not

be able to unilaterally make significant decisions or take timely actions with respect to its joint ventures. UMG’s

inability to take decisive unilateral action in respect to its joint ventures could have a material adverse impact on

its business, prospects, financial condition and results of operations.

1.1.11 UMG has engaged in substantial restructuring and re-organization activities in the past and may need

to implement further restructurings and re-organizations in the future and its restructuring and re-

organization efforts may not be successful or generate expected cost savings.

UMG’s business has been, and may continue to be, impacted by significant ongoing changes in the

entertainment industry. In response, it has sought, and will continue to actively seek, to adapt its operations and

cost structure to the changing economics of the industry. For example, while physical sales are still significant in

some markets, music consumption has shifted from an ownership model, whereby consumers purchase vinyl or

CDs, to an access model that includes subscription and ad-supported streaming formats. UMG has shifted and

continues to shift resources from its physical sales channels to efforts focused on digital channels, emerging

technologies and other new revenue streams, and it continues its efforts to reduce overhead and manage its variable

and fixed-cost structure. UMG now has entered into agreements and partnerships with every major digital music

service launched in the last decade, including Amazon, Apple, Spotify, YouTube and many others and was one