So Cal 9th District Sound & Comm Agreement

Monthly Payroll Report For Hours Worked Within

IBEW Local Union #441

This report may also include Health Only contributions for hours worked

within the IBEW Local #40, 413, 428, 440, 477, 639, and 952 jurisdictions.

Employer Name: Federal Registration Number:

Street Address: Are you a NECA Member?

□ YES □ NO

City, State, Zip: Is this your First or Last Report?

□ FIRST □ LAST □ NO

Phone Number: Working Month & Year Reported:

This transmittal covers all payroll weeks ending in the month shown above.

Grand Totals From ALL #441 Employee Pages

Box 1

441 Hours

Box 2

441 Earnings

Box 3

441 Health

Box 4

441 Pension

Box 5

441 Training

Box 6

441 LMCC

Box 7

441 AMF

Box 8

441 Dues

TOTAL PAYMENT DUE

Total Electrical Industry Accounts

(Sum of Boxes 3 – 8)

Total Health Only Contributions

(For hours worked outside of #441, if applicable)

National Electrical Benefit Fund (NEBF)

(Box 2 x 3.00%)

NEIF – NECA Members Only

(Box 2 x 1.00%)

Please include with Payment:

1 Copy of this #441 Cover Page

1 Copy of the #441 Employee Page(s)

Make One Check Payable to:

Orange County Electrical Industry

Employees Benefit Board #119

P.O. Box 5210, Orange, CA 92863

Total Due:

Signature & Title: ___________________________________________________________________________ Date: _________________

Report Prepared By: _________________________________________________________________________________________________

(Please Print Name Clearly)

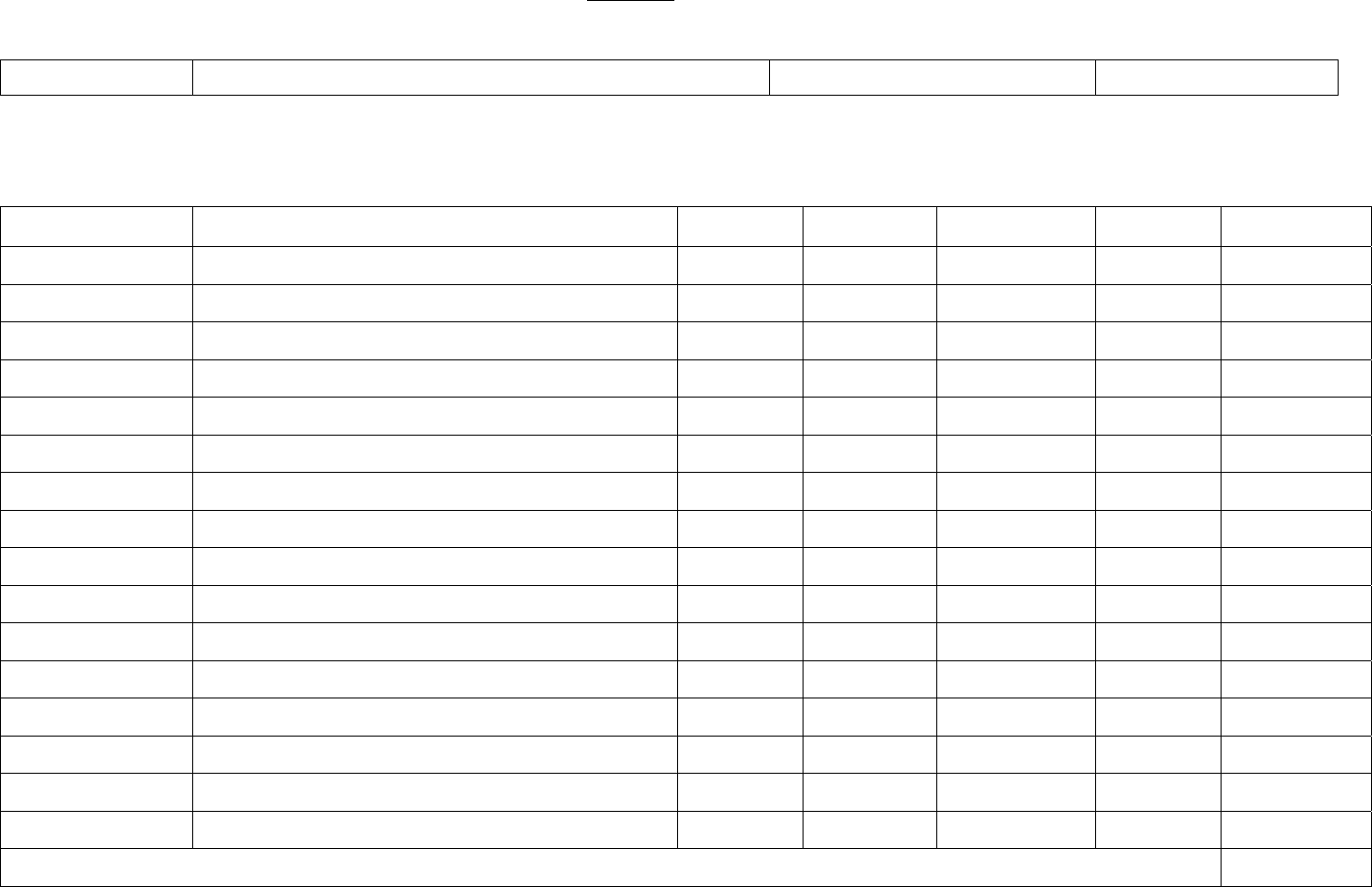

So Cal 9th District Sound & Comm Agreement

Monthly Payroll Report For Hours Worked Within

IBEW Local Union #441

Employer Name: Working Month & Year Reported:

This transmittal covers all payroll weeks ending in the month shown above.

#441 Employees Hours and Earnings Details

Installers - INST Technicians - TECH Foreman - FM Unindentured - UNID Indentured Prior to 11/29/2004 - APR* Indentured On or After 11/29/2004 - Use Appropriate % Rate

Social Security

Number

Employee Name

Class

Level

Total Hours

Total Gross

Earnings

Total Health

Total

Pension

Total LMCC Total AMF Total Dues

#441 Grand Totals:

Page ____ of ____

So Cal 9th District Sound & Comm Agreement

IBEW Local Union #441

This report contains Health Only contributions for hours worked

within the IBEW Local #40, 413, 428, 440, 477, 639, and 952 jurisdictions.

Employer Name: Working Month & Year Reported:

This transmittal covers all payroll weeks ending in the month shown above.

#441 Health Only Contributions

Installers - INST Technicians - TECH Foreman - FM Unindentured - UNID Indentured Prior to 11/29/2004 - APR* Indentured On or After 11/29/2004 - Use Appropriate % Rate

Social Security Number Employee Name Class Level Local Union # Total Hours Health Rate Total Health

Total Health Only Contributions:

Page ____ of ____

Report Cover Page Instructions

REPORT COVER PAGE - The Report Cover Page summarizes the entire report. This Page must be filled out after all Employee Transmittal Pages have been

completed. Benefit values from all subsequent sections, for all classifications, shall be included in the Grand Totals on this page.

EMPLOYER NAME AND ADDRESS, Clearly print your firm's name, office address, city, state, complete post office zip code, and phone number.

FEDERAL ID NUMBER, Clearly print your Employer Federal Tax Identification Number.

NECA MEMBERSHIP STATUS, If you are a NECA Member in any jurisdiction, check the YES box. Otherwise, check the NO box.

FIRST/LAST REPORT, Indicate if this is your First or Last report in the jurisdiction by checking the appropriate box.

REPORTING MONTH & YEAR, Enter the proper month and year in which the employees' hours are worked.

GRAND TOTALS FROM ALL #441 EMPLOYEE PAGES, Combine all of the hours, earnings, and fund contribution totals from all employee pages and enter

the result in the appropriate Grand Totals box.

TOTAL ELECTRICAL INDUSTRY ACCOUNTS (EIA), Add Grand Total boxes 3 through 8 and enter the result here.

TOTAL HEALTH ONLY CONTRIBUTIONS, If applicable, enter the sum of all Health Only contributions here.

NATIONAL ELECTRICAL BENEFIT FUND (NEBF), Multiply the Total Gross Earnings (Grand Total boxes 2) by 3.00% and enter the results here.

NECA MEMBERS ONLY (NEIF), Multiply the Total Gross Earnings (Grand Total boxes 2) by 1.00% and enter the results here.

TOTAL PAYMENT DUE, Add the total EIA + Health Only + NEBF + NEIF and enter the result here.

SIGNATURE, This report must be signed by (1) the individual, if the employer is a sole proprietor; (2) the president, treasurer or other officer if the employer is

a corporation; or (3) a responsible and duly authorized member having knowledge of the firm's affairs if the employer is a partnership or other unincorporated

organization.

Employee Page Instructions for Hours Worked Within Local #441

#441 EMPLOYEES HOURS AND EARNINGS DETAILS PAGE(S) - The following information shall be set forth in separate columns for each of your employees. If

an employee has worked under multiple Classifications during the report period, then you must report each employee Classification on separate lines.

EMPLOYEE'S SOCIAL SECURITY NUMBER, Clearly print the employee's SSN: "xxx-xx-xxxx".

NAME OF EMPLOYEE, Clearly print the employee's Last, First name.

CLASS LEVEL, Enter one of the following Classification Levels for each employee line in Column #3:

INST For ALL Installers, including Stepped Installers.

TECH For ALL Technicians

FM For ALL Foreman

UNID For ALL Unindentured Apprentices

APR For ALL Apprentices Indentured Prior to 11/29/2004

xx% For ALL Apprentices Indentured On or After 11/29/2004, Use Appropriate % Rate (i.e. - 45%, 50%, ...90%)

CLOCK HOURS, Enter the total clock hours for the employee in column 4.

GROSS EARNINGS, Enter the actual Gross Earnings subject to withholding taxes for the employee in column 5.

TOTAL HEALTH, Multiply the Employee’s Clock Hours by the appropriate H&W rate as indicated on the current benefit rate sheet and enter the result in column 6.

Enter $0.00 for any employee who is not eligible to participate.

TOTAL PENSION Multiply the Employee’s Clock Hours by the appropriate Pension rate as indicated on the current benefit rate sheet and enter the result in

column 7. Enter $0.00 for any employee who is not eligible to participate.

TOTAL LMCC, Multiply the Employee’s Clock Hours by the appropriate LMCC rate as indicated on the current benefit rate sheet and enter the result in column 8.

TOTAL AMF, Multiply the Employee’s Clock Hours by the appropriate AMF rate as indicated on the current benefit rate sheet and enter the result in column 9.

UNION DUES, Enter the Employee’s total Union Dues withholding result in column 11. Enter $0.00 for those who do not participate.

GRAND TOTALS THIS PAGE, Total each benefit column on all pages. The Grand Totals for all pages will be included on the Report Cover Page.

Employee Page Instructions for Health Only Contributions

(For hours worked within the IBEW Local #40, 413, 428, 440, 477, 639, and 952 jurisdictions)

#441 HEALTH ONLY CONTRIBUTIONS PAGE(S) - The following information shall be set forth in separate columns for each of your employees. If an employee

has worked under multiple Classifications during the report period, then you must report each employee Classification on separate lines.

EMPLOYEE'S SOCIAL SECURITY NUMBER, Clearly print the employee's SSN: "xxx-xx-xxxx".

NAME OF EMPLOYEE, Clearly print the employee's Last, First name.

CLASS LEVEL, Enter one of the following Classification Levels for each employee line in Column #3:

INST For ALL Installers, including Stepped Installers.

TECH For ALL Technicians

FM For ALL Foreman

UNID For ALL Unindentured Apprentices

APR For ALL Apprentices Indentured Prior to 11/29/2004

xx% For ALL Apprentices Indentured On or After 11/29/2004, Use Appropriate % Rate (i.e. - 45%, 50%, ...90%)

LOCAL UNION, Enter the Local Union number where work was performed in column 4.

CLOCK HOURS, Enter the total clock hours for the employee in column 5.

HEALTH RATE, Enter the appropriate hourly Health Contribution Rate for the Employee as indicated on the current benefit rate sheet in column 6.

TOTAL HEALTH, Multiply the Employee’s Clock Hours by the appropriate hourly Health Contribution Rate and enter the result in column 7. Enter $0.00 for any

employee who is not eligible to participate.

GRAND TOTALS THIS PAGE, Total all Health Only Contributions from all pages. Provide the Total Health Only Contributions for all pages on the Report Cover

Page as directed in the Report Cover Page Instructions.