CPA Evolution

Model Curriculum

Disclaimer: The contents of this publication do not necessarily reect the position or opinion of the American Institute of

CPAs (AICPA), its divisions and its committees, and do not necessarily reect the position or opinion of the National Association

of State Boards of Accountancy (NASBA), its divisions and its committees. This publication is designed to provide accurate and

authoritative information on the subject covered. It is distributed with the understanding that the authors are not engaged in

rendering legal, accounting or other professional services. If legal advice or other expert assistance is required, the services

of a competent professional should be sought.

For more information about the procedure for requesting permission to make copies of any part of this work, please email

copyright@aicpa.org with your request. Otherwise, requests should be written and mailed to the Permissions Department,

AICPA, 220 Leigh Farm Road, Durham, NC 27707–8110.

1 CPA Evolution Model Curriculum

Contents

3 Introduction

6 Information and Instructions for Use of CPA Evolution Model Curriculum

8 Part I: CPA Evolution Core

8 Section 1: Accounting and Data Analytics Core

8 Module 1: Financial Statements

10 Module 2: Select Financial Statement Accounts

14 Module 3: Select Financial Statement Transactions and Events

16 Module 4: Financial Statement Analysis and Metrics

16 Module 5: Financial Statements and Select Transactions for Not-For-Prot (NFP) Entities

18 Module 6: Financial Statements and Select Transactions for State and Local Governments

19 Module 7: Critical Thinking

19 Module 8: Financial Data Analytics

21 Module 9: Digital Acumen

22 Section 2: Audit and Accounting Information Systems Core

22 Module 1: Audit Environment

24 Module 2: Engagement Planning and Considerations

26 Module 3: Understanding an Entity and its Environment

29 Module 4: Information Technology

30 Module 5: Risk Assessment of Fraud and Noncompliance

31 Module 6: Assessing Risk of Material Misstatement

32 Module 7: Materiality

33 Module 8: Audit Evidence

34 Module 9: Audit Procedures

35 Module 10: Special Considerations

37 Module 11: Audit Conclusion

38 Module 12: Audit Reports

39 Module 13: Other Engagements

41 Module 14: Subsequent Events and Subsequently Discovered Facts

41 Module 15: Digital Acumen

42 Section 3: Tax Core

42 Module 1: Responsibilities in Tax Practice

42 Module 2: Methods of Taxation

42 Module 3: Federal Tax Procedures

43 Module 4: Legal Duties and Responsibilities

44 Module 5: Acquisition and Disposition of Assets

45 Module 6: Federal Taxation of Individuals

47 Module 7: C Corporations

48 Module 8: S Corporations

49 Module 9: Partnerships

50 Module 10: Limited Liability Companies

50 Module 11: Tax-Exempt Organizations

51 Module 12: Technology and Digital Acumen

2 CPA Evolution Model Curriculum

52 Part II: CPA Evolution Discipline

52 Section 1: Business Analysis and Reporting (BAR) Discipline

52 Module 1: Accounting Research

52 Module 2: For-Prot Entity Financial Statements

53 Module 3: Select Financial Statement Accounts

54 Module 4: Select Transactions

56 Module 5: Cost accounting

57 Module 6: State and Local Governments

60 Module 7: Employee Benet Plan Accounting

60 Module 8: Planning Techniques

61 Module 9: Financial Statement Analysis

62 Module 10: Advanced Data Analytics

66 Section 2: Information Systems and Controls (ISC) Discipline

66 Module 1: IT Governance and Risk Assessment

69 Module 2: Performing Procedures, Tests of Internal Controls

70 Module 3: SOC Engagements

71 Module 4: Use and Management of Data

72 Module 5: Information Security and Protection of Information Assets

73 Section 3: Tax Compliance and Planning (TCP) Discipline

73 Module 1: Individual Tax Fundamentals and Tax Planning

75 Module 2: Acquisition, Use and Disposition of Assets

76 Module 3: Tax Accounting Methods

77 Module 4: Federal Taxation of Entities

78 Module 5: C Corporations

79 Module 6: S Corporations

80 Module 7: Partnerships

83 Module 8: Tax Planning for Entities

84 Module 9: Trusts

85 Module 10: Tax-Exempt Organizations

85 Module 11: Multijurisdictional Tax Basics

86 Module 12: Technology

86 Module 13: Tax Research

87 Module 14: Personal Financial Advisory Services

89 Appendix

89 Illustrative Accounting Program Structures for Future CPAs

3 CPA Evolution Model Curriculum

Introduction

Thank you for your interest in the AICPA’s and NASBA’s CPA Evolution Model Curriculum. It

was developed to assist faculty who want to prepare their students for the CPA profession.

It is materially aligned with the Uniform Accountancy Act Model Rules for education and reects

insights gathered through the 2021 CPA Exam Practice Analysis as well as the views of the

subject matter experts who served on the CPA Evolution Model Curriculum Task Forces.

The Task Forces were comprised of over 40 volunteers, including faculty from small schools and

large universities, CPAs in public practice, business and industry and representatives from state

boards of accountancy. The Task Forces met over 50 times over the course of six months. The

AICPA and NASBA would like to extend our gratitude to the Task Forces – they worked tirelessly

to produce a curriculum that is reective of the practice environment, volunteering dozens of

hours of their time.

The CPA Evolution Model Curriculum is comprised of two main components: (1) detailed content

suggestions split into two parts comprised of three sections each with multiple modules, topics,

and learning objectives and (2) examples of course structuring. This CPA-oriented curriculum

is an example, developed at the request of accounting faculty, to provide insight into how an

accounting program might transition in light of CPA Evolution.

The role of today’s CPA has evolved. Newly licensed CPAs need deeper skill sets, more

competencies and greater knowledge of emerging technologies. That’s why the CPA licensure

model is changing. The CPA Evolution initiative, a joint project between the AICPA and NASBA,

aims to transform the CPA licensure model to recognize the rapidly changing skills and

competencies the practice of accounting requires today and will require in the future. Aspiring

CPAs who are college freshmen today will be among the rst to take the updated version of the

Uniform CPA Examination when it launches in 2024.

Accounting educators will play a vital role in preparing students to pursue the CPA license under

this new model. We developed the CPA Evolution Model Curriculum as one example of how an

accounting program might transition to reect the new Core + Disciplines, CPA licensure model.

When targeting our efforts in developing the curriculum, we elected to focus on a university’s

accounting curriculum that is relevant to preparing future CPAs, except for principles of

accounting courses, which are often built into a university’s business pre-requisite curriculum.

This means that independent of the content recommended through the CPA Evolution Model

Curriculum, it is presumed that students will complete coursework in principles of nancial

accounting and principles of managerial accounting, as well as relevant business courses such

as economics, nance and business law.

Part 1 of this CPA Evolution Model Curriculum covers the content necessary for all future CPAs,

regardless of their chosen discipline and Part 2 covers the content relevant for each of the three

separate disciplines. The CPA Evolution Model Curriculum, however, does not specify whether

content should be covered at an undergraduate or graduate level, as this decision will differ

based on the circumstances of each accounting program. Leveraging feedback from the faculty

on the Task Forces, we have provided suggested courses where the content might be taught as

well as instructional time estimates for each topic, however, these are provided for reference only.

We recognize that the courses chosen and time devoted by a program to present these topics are

entirely at the program’s discretion.

4 CPA Evolution Model Curriculum

Based on these data points, we believe we have developed a curriculum that is actionable

for faculty at programs of all sizes. For universities able to devote more classroom time, like

those with master’s programs, we’ve provided sucient detail to inform a deeper dive into

each topical area.

The CPA Evolution Model Curriculum is specically designed with future CPAs in mind.

We sought to build a curriculum that provides an accounting student with the skills and

competencies required of a newly licensed CPA to meet the needs of the marketplace and

protect the public interest. It should be viewed as a roadmap for faculty seeking to prepare

future CPAs, not a one-size-ts-all approach to accounting education. Again, when reviewing

recommendations within the CPA Evolution Model Curriculum, each accounting program

should consider its unique circumstances and the needs of employers hiring its students.

We want to thank all the faculty that have provided us feedback on CPA Evolution. Your input

was invaluable as we sought to identify and meet the needs of the academy. We look forward

to continuing to work with the academic community throughout this time of transition.

As we work through the next couple of years in dening the new Exam, developing

academic resources, and preparing students and CPA candidates, we want to hear from

you. Please continue to ask us questions and share your feedback by contacting us at

Feedback@EvolutionofCPA.org.

Sincerely,

Jan Taylor-Morris, CPA, CGMA, Ph.D. Daniel J. Dustin, CPA

Academic-in-Residence, AICPA Vice President — State Board Relations,

NASBA

5 CPA Evolution Model Curriculum

CPA Evolution Model Curriculum

FOUNDATION

Business program curriculum

including accounting principles

CORE

Business

analysis and

reporting

Information

systems and

controls

Tax compliance

and planning

Accounting and

data analytics

Auditing and AIS

Tax

CPA Evolution Model Curriculum

6 CPA Evolution Model Curriculum

Information and Instructions for Use of

CPA Evolution Model Curriculum

The CPA Evolution Model Curriculum is comprised of two parts, each with three sections. The sections are further

divided into modules, topics, and learning objectives.

The topics and learning objectives are presented in tabular format. First, a topical summary is presented with an

estimated range of instruction hours for each topic and the course(s) recommended for delivery of the topic.

Next, the learning objectives relevant to the topic are listed.

Our recommended learning objectives are based on the most recent revisions to Bloom’s Taxonomy of learning. We

recognize that some institutions and faculty may not have adopted or care to implement Bloom’s methodology. We felt

it was important to use a commonly accepted systemic approach to learning objectives, and expect that schools and

faculty may well adapt these recommendations to t their specic institutional and personal professional expectations.

Estimated Hours:

An estimated range of hours are presented, indicating the minimum and maximum hours of instruction recommended

for that topic.

Suggested Course(s):

Suggested courses for each topic are presented as a recommendation by Task Force members. Faculty and programs

should consider their own resources and student needs when choosing where each topic will t best in their programs.

Key to Course Abbreviations:

Abbrev. Course Name

ADA Advanced Data Analytics in Accounting

ADV Advanced Financial Accounting

AMA Advanced Managerial Accounting

AMDA Advanced Managerial Accounting/Data Analytics

AIS Accounting Information Systems

AUD Auditing Principles

DAA Data Analytics in Accounting

EA Emerging Attestation

ECP Entity (Tax) Compliance and Planning

GVT/NFP Government/Not-for-Prot (combined course or separate in one of the two subjects)

ICP Individual (Tax) Compliance and Planning

IMDA Intermediate Managerial Accounting/Data Analytics

INFOSEC Information Security and Forensics

INT Intermediate Accounting 1 or 2 (two courses)

ISAA Information Systems Assurance and Advisory 1 or 2 (two courses)

PFAS Personal Financial Advisory Services

TAX Introduction to Tax for Individuals and Entities

TR Tax Research

7 CPA Evolution Model Curriculum

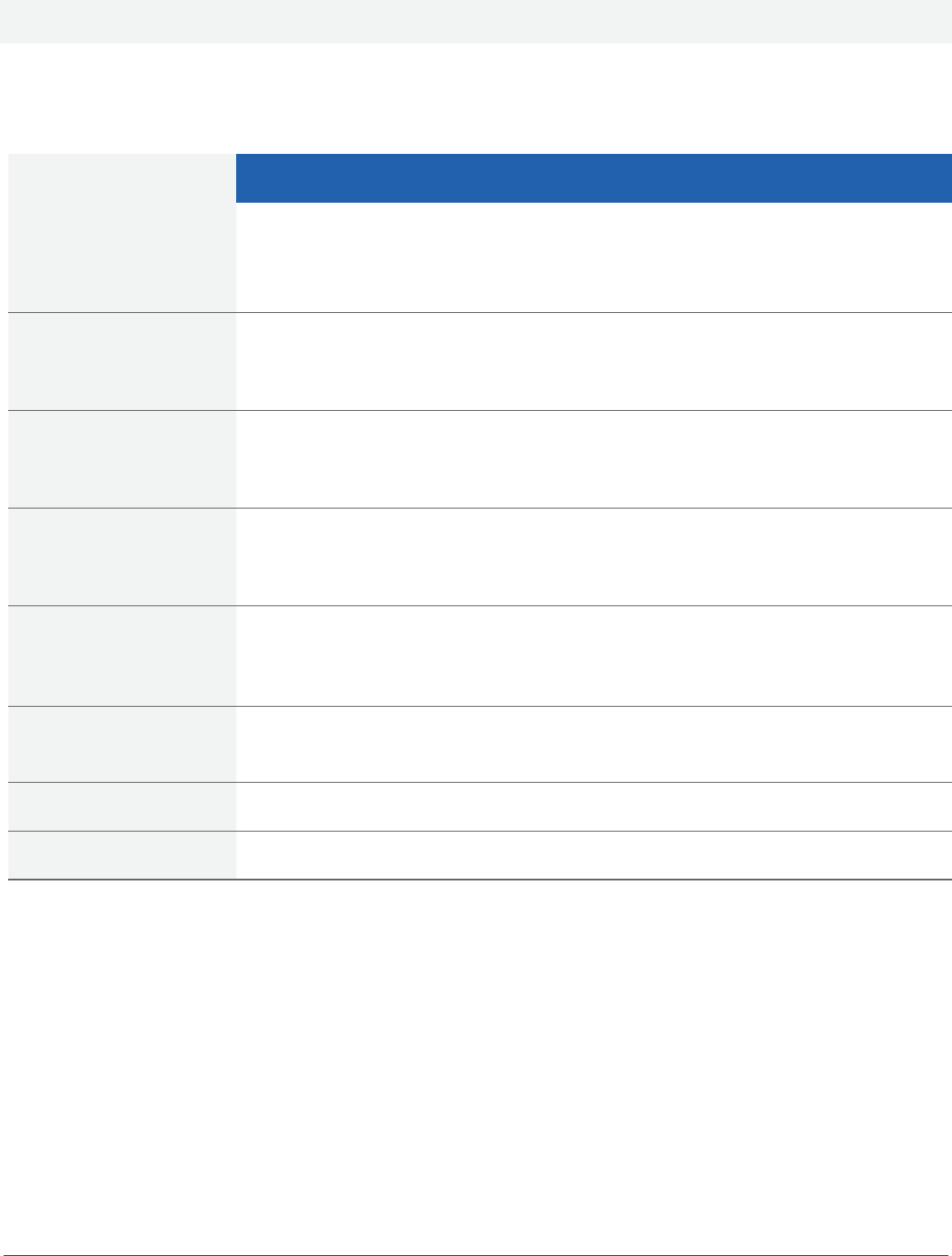

For example, in the illustration shown below, Part 1, Section 1, Module 1, Topic 1, Balance Sheet, is summarized and

an estimate of 3-5 hours is the range of time suggested for delivering this topic and INT (see key on page 6) is the

suggested course. Separate learning objectives for each topic are provided after this summary.

Part I: CPA Evolution Core

Section 1: Accounting and Data Analytics Core

Module 1: Financial statements

Topic 1: Balance sheet

Summary Estimated

Hours

Suggested

course(s)

Dene elements and prepare a for-prot entity’s balance sheet; make needed

adjustments; and perform basic nancial analysis using appropriate technology

(e.g., general ledger software, spreadsheet software/application).

3-5 INT

Learning objective(s):

1. Prepare a classied balance sheet from a trial balance and supporting documentation.

2. Adjust the balance sheet to correct identied errors.

3. Detect, investigate, and correct discrepancies while agreeing the balance sheet amounts to supporting

documentation (see Part I, Section 1, Module 3, Topic 1).

4. Calculate uctuations and ratios and interpret the results while reviewing comparative balance sheets.

Appendix and Other Resources

The Appendix provides a few simple examples of how accounting programs might structure courses to incorporate this

CPA Evolution Model Curriculum.

Many resources are provided by AICPA on the Academic Resource Hub to assist in incorporating new topics or learning

objectives into your existing curriculum.

8 CPA Evolution Model Curriculum

Part I: CPA Evolution Core

Section 1: Accounting and Data Analytics Core

Module 1: Financial statements

Topic 1: Balance sheet

Summary Estimated

Hours

Suggested

course(s)

Dene elements and prepare a for-prot entity’s balance sheet; make needed

adjustments; and perform basic nancial analysis using appropriate technology

(e.g., general ledger software, spreadsheet software/application).

3-5 INT

Learning objective(s):

1. Prepare a classied balance sheet from a trial balance and supporting documentation.

2. Adjust the balance sheet to correct identied errors.

3. Detect, investigate, and correct discrepancies while agreeing the balance sheet amounts to supporting

documentation (see Part I, Section 1, Module 3, Topic 1).

4. Calculate uctuations and ratios and interpret the results while reviewing comparative balance sheets.

Topic 2: Income statement

Summary Estimated

Hours

Suggested

course(s)

Dene elements and prepare a for-prot entity’s income statement; make

needed adjustments; and perform basic nancial analysis, including Earnings

Per Share (EPS), using appropriate technology (e.g., general ledger software,

spreadsheet software/application).

3-5 INT

Learning objective(s):

1. Prepare the sections of a multiple-step income statement (including operating, nonoperating, discontinued

operations) from a trial balance and supporting documentation.

2. Prepare a single-step income statement from a trial balance and supporting documentation.

3. Adjust the income statement to correct identied errors.

4. Detect, investigate, and correct discrepancies while agreeing the income statement amounts to supporting

documentation (see Part I, Section 1, Module 3, Topic 1).

5. Calculate uctuations and ratios and interpret the results while reviewing comparative income statements.

6. Calculate Earnings Per Share, both basic and fully diluted.

9 CPA Evolution Model Curriculum

Topic 3: Statements of comprehensive income and changes in equity

Summary Estimated

Hours

Suggested

course(s)

Dene elements of and prepare a statement of comprehensive income and

a statement of changes in equity using appropriate technology (e.g., general

ledger software, spreadsheet software/application).

1-3 INT

Learning objective(s):

1. Recall basic components of other comprehensive income statement.

2. Describe purpose and structure of other comprehensive income statement.

3. Prepare a statement of changes in equity from a trial balance and supporting documentation.

4. Adjust the statement of changes in equity to correct identied errors (see Part I, Section 1, Module 3, Topic 1).

5. Detect, investigate, and correct discrepancies while agreeing the statement of changes in equity amounts to

supporting documentation (see Part I, Section 1, Module 3, Topic 1).

Topic 4: Statement of cash ows

Summary Estimated

Hours

Suggested

course(s)

Prepare a Statement of cash ows under both methods allowed by Generally

Accepted Accounting Principles (GAAP) and be able to adjust the statement as

needed using appropriate technology (e.g., general ledger software, spreadsheet

software/application), and demonstrate knowledge of individual transactions on

the statement.

3-5 INT

Learning objective(s):

1. Prepare a statement of cash ows using the direct method and required disclosures from supporting documentation.

2. Prepare a statement of cash ows using the indirect method and required disclosures from supporting

documentation.

3. Adjust a statement of cash ows to correct identied errors (see Part 1, Section 1, Module 3, Topic 1).

4. Detect, investigate, and correct discrepancies while agreeing the statement of cash ows amounts to supporting

documentation (see Part I, Section 1, Module 3, Topic 1).

5. Derive the impact of transactions on the statement of cash ows.

Topic 5: Notes to the nancial statements

Summary Estimated

Hours

Suggested

course(s)

Read notes to identify inconsistencies with reported amounts in the nancial

statements and adjust as needed.

1-2 INT

Learning objective(s):

1. Compare the notes to the nancial statements and supporting documentation to identify inconsistencies

and investigate those inconsistencies.

2. Adjust the notes to the nancial statements to correct identied errors and omissions (see Part I, Section 1,

Module 3, Topic 1).

10 CPA Evolution Model Curriculum

Topic 6: Other

Summary Estimated

Hours

Suggested

course(s)

List requirements and nancial statements related to for-prot entity nancial

reporting, such as Securities and Exchange Commission (SEC) requirements,

and prepare nancial statements using appropriate technology (e.g., general

ledger software, spreadsheet software/application) in accordance with special

purpose frameworks.

5-6 INT

Learning objective(s):

1. List the basic ling requirements (type of ler, type of ling, deadlines for ling) for 10-K, 10-Q and 8-K for publicly

traded companies in the U.S.

2. Recall appropriate nancial statement titles to be used for the nancial statements prepared under a special

purpose framework.

3. Perform calculations to convert cash basis nancial statements to accrual basis nancial statements.

4. Prepare nancial statements using the cash basis of accounting.

5. Prepare nancial statements using a modied cash basis of accounting.

6. Prepare nancial statements using the income tax basis of accounting.

Module 2: Select Financial Statement Accounts

Topic 1: Cash and receivables

Summary Estimated

Hours

Suggested

course(s)

Account for cash, cash equivalents, and trade receivables and allowances

and select and use appropriate technology in calculations, journal entries,

roll-forward schedules, and reconciliations.

3-6 INT

Learning objective(s):

1. Calculate cash and cash equivalents balances to be reported in the nancial statements.

2. Reconcile the cash balance per the bank statement to the general ledger.

3. Investigate unreconciled cash balances to determine whether an adjustment to the general ledger is necessary.

4. Calculate trade receivables and allowances and prepare journal entries.

5. Prepare any required journal entries to record the transfer of trade receivables (secured borrowings, factoring,

assignment, pledging).

6. Prepare a roll-forward of the trade receivables account balance using various sources of information.

7. Reconcile and investigate differences between the subledger and general ledger for trade receivables to determine

whether an adjustment is necessary.

11 CPA Evolution Model Curriculum

Topic 2: Revenue

Summary Estimated

Hours

Suggested

course(s)

Explain basics of revenue accounting. Compute and record revenue from a

basic contract.

6-12 INT

Learning objective(s):

1. Recall concepts of accounting for revenue.

2. Determine the amount and timing of revenue to be recognized under a basic contract and prepare journal entries.

Topic 3: Inventory

Summary Estimated

Hours

Suggested

course(s)

Recall basics of inventory accounting and select and use appropriate technology

in calculations, journal entries, roll-forward schedules, and reconciliations.

6-9 INT; IMDA

Learning objective(s):

1. Calculate the carrying amount of inventory and prepare journal entries using various costing methods.

2. Measure impairment losses on inventory.

3. Prepare a roll-forward of the inventory account balance using various sources of information.

4. Reconcile and investigate differences between the subledger and general ledger for inventory to determine

whether an adjustment is necessary.

Topic 4: Property, plant, and equipment

Summary Estimated

Hours

Suggested

course(s)

Account for basic Property, Plant, and Equipment (PPE) transactions and reporting.

Select and use appropriate technology in calculations, journal entries, roll-forward

schedules, and reconciliations.

6-9 INT

Learning objective(s):

1. Calculate the gross and net property, plant, and equipment balances and prepare journal entries.

2. Calculate gains or losses on the disposal of long-lived assets to be recognized in the nancial statements.

3. Measure impairment losses on long-lived assets to be recognized in the nancial statements.

4. Calculate the amounts necessary to prepare journal entries to record a nonmonetary exchange.

5. Determine whether an asset qualies to be reported as held for sale in the nancial statements.

6. Adjust the carrying amount of assets held for sale and calculate the loss to be recognized in the nancial statements.

7. Prepare a roll-forward of the property, plant and equipment account balance using various sources of information.

8. Reconcile and investigate differences between the subledger and general ledger for property, plant, and equipment

to determine whether an adjustment is necessary.

9. Calculate the recorded assets and related liabilities resulting from asset retirement obligations and prepare

journal entries.

10. Calculate the carrying amount of donated assets (nancial assets or long-lived assets) to be reported in the

statement of nancial position.

12 CPA Evolution Model Curriculum

Topic 5: Intangible assets

Summary Estimated

Hours

Suggested

course(s)

Recall basics of accounting for intangible assets and select and use appropriate

technology in calculations, journal entries, roll-forward schedules, and

reconciliations.

3-6 INT

Learning objective(s):

1. Identify the criteria for recognizing intangible assets in the balance sheet and classify intangible assets

as either nite-lived or indenite-lived.

2. Calculate the carrying amount of nite-lived intangible assets reported in the nancial statements

(initial measurement, amortization, and impairment) and prepare journal entries.

3. Prepare a roll-forward of the nite-lived intangible asset account balance using various sources of information.

Topic 6: Investments

Summary Estimated

Hours

Suggested

course(s)

Classify, measure, account for, and report investments in nancial instruments

using appropriate technology.

3-6 INT

Learning objective(s):

1. Identify investments that are eligible or required to be reported at fair value in the nancial statements.

2. Calculate the carrying amount of investments measured at fair value and prepare journal entries

(excluding impairment).

3. Calculate gains and losses to be recognized in net income or other comprehensive income for investments

measured at fair value and prepare journal entries.

4. Calculate investment income to be recognized in net income for investments measured at fair value and

prepare journal entries.

5. Measure impairment losses to be recognized on applicable investments reported at fair value in the nancial

statements.

6. Identify investments that are eligible to be reported at amortized cost in the nancial statements.

7. Calculate the carrying amount of investments measured at amortized cost and prepare journal entries

(excluding impairment).

8. Measure impairment losses to be recognized on investments reported at amortized cost in the nancial

statements.

9. Identify when the equity method of accounting can be applied to an investment.

10. Calculate the carrying amount of equity method investments and prepare journal entries (excluding impairment).

11. Measure impairment losses to be recognized in the nancial statements on equity method investments.

13 CPA Evolution Model Curriculum

Topic 7: Current liabilities and other payables

Summary Estimated

Hours

Suggested

course(s)

Compute and report current liabilities, and select and use appropriate technology

in calculations, journal entries, and reconciliations.

3-6 INT

Learning objective(s):

1. Calculate the amount of payables (including accounts payable, dividends payable) and accrued liabilities (including

accrued wages, accrued vacation, accrued bonuses) and prepare journal entries.

2. Reconcile and investigate differences between the subledger and general ledger for accounts payable and accrued

liabilities to determine whether an adjustment is necessary.

3. Identify and calculate liabilities arising from exit or disposal activities and determine the timing of recognition in the

nancial statements.

Topic 8: Long-term debt

Summary Estimated

Hours

Suggested

course(s)

Classify and account for long-term debt throughout the life cycle of the debt,

including basic classication and effects of modications to the original debt

agreement and debt extinguishment. Select and use appropriate technology in

calculations, journal entries, roll-forward schedules, and reconciliations.

3-6 INT

Learning objective(s):

1. Determine the classication of debt.

2. Classify a nancial instrument as either debt or equity, based on its characteristics.

3. Calculate the interest expense attributable to notes and bonds payable reported in the nancial statements

(including discounts, premiums, or debt issuance costs).

4. Calculate the carrying amount of notes and bonds payable and prepare journal entries.

5. Perform debt covenant calculations as stipulated in a debt agreement to ascertain compliance. Focus on using

nal nancial statements to complete calculations to determine current period debt covenant compliance.

6. Classify a change to a debt instrument as either a modication of terms or an extinguishment of debt.

7. Describe when a change to the terms of a debt instrument qualies as a troubled debt restructuring.

8. Determine the implications of a violation of a debt covenant.

Topic 9: Equity

Summary Estimated

Hours

Suggested

course(s)

Prepare journal entries to recognize equity transactions in the nancial statements. 3-4 INT

Learning objective(s):

1. Prepare journal entries to recognize sales of equity interest transactions in the nancial statements.

2. Prepare journal entries to recognize declaration of cash dividends (common and preferred) and stock splits.

3. Prepare journal entries to recognize treasury stock transactions.

4. Prepare journal entries to recognize retirement of equity interests.

14 CPA Evolution Model Curriculum

Topic 10: Current and deferred income tax expense

Summary Estimated

Hours

Suggested

course(s)

Recall basic concepts of accounting for income taxes and calculate the

amounts to be reported in related specic income tax accounts on the

income statement and balance sheet.

3-5 INT

Learning objective(s):

1. Recall concepts of accounting for income taxes (e.g., temporary differences vs. permanent differences;

valuation allowance accounts).

2. Recall the criteria for recognizing or adjusting a valuation allowance for a deferred tax asset in the nancial

statements.

3. Calculate the income tax expense, current taxes payable/receivable and deferred tax liabilities/assets to be reported

in the nancial statements.

4. Recall the accounting treatment for uncertainty in income taxes.

Module 3: Select Financial Statement Transactions and Events

Topic 1: Accounting changes and error corrections

Summary Estimated

Hours

Suggested

course(s)

To the extent the underlying subject matter is in Section 1: Accounting and Data

Analytics Core, describe underlying concepts associated with changes and error

corrections and prepare journal entries for those accounting changes in principle

or estimates, and for error corrections.

2-4 INT

Learning objective(s):

1. Describe concepts related to error corrections/prior period adjustments/change in estimates.

2. Calculate a required adjustment to the nancial statements due to an accounting change or error correction and

determine whether it requires prospective or retrospective application.

3. Prepare journal entries to record error corrections, changes in estimates, and prior period adjustments.

4. Derive the impact to the nancial statements and related note disclosures of an accounting change or an

error correction.

Topic 2: Commitments and contingencies

Summary Estimated

Hours

Suggested

course(s)

Recall basics of reporting of commitments and contingencies. 1-2 INT

Learning objective(s):

1. Recall the recognition and disclosure criteria used to identify commitments and contingencies.

2. Calculate contingencies reported and prepare journal entries as needed.

3. Review supporting documentation to determine whether a commitment or contingency requires recognition

or disclosure in the nancial statements.

15 CPA Evolution Model Curriculum

Topic 3: Lease transactions (lessee)

Summary Estimated

Hours

Suggested

course(s)

Recall criteria for lease classication by lessees, compute amounts, and prepare

journal entries for lessees at the appropriate time.

3-6 INT

Learning objective(s):

1. Recall concepts of accounting for leases including lease classication for lessee.

2. Determine the amount and timing of lease accounting to be recognized under a simple lease contract

and prepare journal entries for lessee.

Topic 4: Subsequent events

Summary Estimated

Hours

Suggested

course(s)

Identify, calculate, and determine reporting for subsequent events. 1-2 INT; AUD

Learning objective(s):

1. Identify a subsequent event and recall its appropriate accounting treatment.

2. Calculate required adjustments to nancial statements and/or note disclosures based on identied

subsequent events.

3. Derive the impact to the nancial statements and required note disclosures due to identied subsequent events.

Topic 5: Fair value measurements

Summary Estimated

Hours

Suggested

course(s)

Identify techniques to measure and use concepts and hierarchy for fair value. 1-2 DAA; INT

Learning objective(s):

1. Identify the valuation techniques used to measure fair value.

2. Use the fair value hierarchy to determine the classication of a fair value measurement.

3. Use of accounting estimates in fair value measurements and decision-making.

4. Use the fair value concepts (e.g., highest, and best use, market participant assumptions, unit of account)

to measure the fair value of assets and liabilities.

Topic 6: Foreign currency transactions

Summary Estimated

Hours

Suggested

course(s)

Dene foreign currency transaction concepts and calculate gains or losses from

transactions denominated in foreign currencies.

2-3 INT

Learning objective(s):

1. Calculate transaction gains or losses recognized from monetary transactions denominated in a foreign currency.

16 CPA Evolution Model Curriculum

Module 4: Financial Statement Analysis and Metrics

Topic 1: Capital structure and working capital

Summary Estimated

Hours

Suggested

course(s)

Compute nancial statement ratios and other metrics using appropriate

technology and interpret the effect of transactions on the metrics.

2-4 INT; IMDA

Learning objective(s):

1. Calculate debt and equity related ratios.

2. Calculate the metrics associated with the working capital components, such as current ratio, quick ratio, cash

conversion cycle, inventory turnover, and receivables turnover.

3. Interpret an effect of a proposed or past transaction on a nancial statement metric.

Topic 2: Budgeting/nancial and nonnancial measures of performance management

Summary Estimated

Hours

Suggested

course(s)

Identify, calculate, and analyze a variety of measures to assess an entity’s

nancial performance using appropriate technology.

5-7 DAA; IMDA

Learning objective(s):

1. Calculate the difference between budgeted and actual nancial data to determine variances.

2. Calculate nancial and nonnancial measures appropriate to analyze specic aspects of an entity’s performance

(e.g., economic value added, costs of quality-prevention vs. appraisal vs. failure).

3. Determine which nancial and nonnancial measures are appropriate to analyze specic aspects of an entity’s

performance and risk prole (e.g., return on equity, return on assets and contribution margin).

Module 5: Financial Statements and Select Transactions for Not-For-Prot (NFP) Entities

Topic 1: Statement of nancial position

Summary Estimated

Hours

Suggested

course(s)**

Recall purpose and objectives and prepare a statement of nancial position for

nongovernmental, NFP, and be able to make necessary adjustments.

2-4 INT; GVT/NFP

Learning objective(s):

1. Recall the purpose and objectives of the statement of nancial position for a nongovernmental, not-for-prot entity.

2. Prepare a statement of nancial position for a nongovernmental, not-for-prot entity from a trial balance and

supporting documentation.

3. Calculate net asset balances for a nongovernmental, not-for-prot entity and prepare journal entries.

4. Adjust the statement of nancial position for a nongovernmental, not-for-prot entity to correct identied errors.

17 CPA Evolution Model Curriculum

Topic 2: Statement of activities

Summary Estimated

Hours

Suggested

course(s)**

Recall purpose and objectives and prepare a statement of activities

for nongovernmental, NFP, and be able to make necessary adjustments.

2-4 INT; GVT/NFP

Learning objective(s):

1. Recall the purpose and objectives of the statement of activities for a nongovernmental, not-for-prot entity.

2. Prepare a statement of activities for a nongovernmental, not-for-prot entity from a trial balance and

supporting documentation.

3. Adjust the statement of activities for a nongovernmental, not-for-prot entity to correct identied errors.

Topic 3: Statement of cash ows

Summary Estimated

Hours

Suggested

course(s)**

Recall purpose and objectives and prepare a statement of cash ows

for nongovernmental, NFP, and be able to make necessary adjustments.

2-4 INT; GVT/NFP

Learning objective(s):

1. Recall the purpose and objectives of the statement of cash ows for a nongovernmental, not-for-prot entity.

2. Prepare a statement of cash ows and required disclosures using the indirect method for a nongovernmental,

not-for-prot entity.

3. Adjust the statement of cash ows for a nongovernmental, not-for-prot entity to correct identied errors.

Topic 4: Notes to NFP nancial statements

Summary Estimated

Hours

Suggested

course(s)**

Prepare and adjust, as needed, notes to the nancial statements

for nongovernmental, NFP organizations.

0.5-1 INT; GVT/NFP

Learning objective(s):

1. Prepare the notes to the nancial statements of a nongovernmental, not-for-prot entity using

supporting documentation.

2. Adjust the notes to the nancial statements of a nongovernmental, not-for-prot entity to correct identied

errors and omissions.

18 CPA Evolution Model Curriculum

Topic 5: Select transactions: nonreciprocal transfers

Summary Estimated

Hours

Suggested

course(s)**

Recall and identify transfers and promises to give to a nongovernmental,

not-for-prot and be able to calculate effect on net assets.

0.5-1 INT; GVT/NFP

Learning objective(s):

1. Recall the recognition requirements associated with conditional and unconditional promises to give (pledges)

for a nongovernmental, not-for-prot entity.

2. Identify transfers to a nongovernmental, not-for-prot entity acting as an agent or intermediary that are not

recognized as contributions in the statement of activities.

3. Calculate increases in net assets attributable to contributions for a nongovernmental, not-for-prot entity.

** For programs with a GVT/NFP or similar course, these topics would likely be taught in this course. For programs without the GVT/NFP course, depending

on the programs’ objectives, they could elect to add some level of this topic into INT or could decide that this topic could be developed in an internship or other

post-graduation studies/experiences.

Module 6: Financial Statements and Select Transactions for State and Local Governments

Topic 1: State and local government concepts

Summary Estimated

Hours

Suggested

course(s)

Recall the measurement focus and basis of accounting used by state and local

governments for fund and government-wide nancial reporting.

3-4 INT; GVT/NFP

Learning objective(s):

1. Recall authoritative guidance setting body for governmental accounting standards.

2. Recall the types of governmental entities and differentiate the regulation and reporting for each.

3. Recall the measurement focus and basis of accounting used by state and local governments for fund and

government-wide nancial reporting.

4. Determine the appropriate fund(s) that a state or local government should use to record its activities.

19 CPA Evolution Model Curriculum

Module 7: Critical Thinking

Topic 1: Critical thinking

Summary Estimated

Hours

Suggested

course(s)

Identify nancial data risks and opportunities using relevant facts to make

appropriate nancial decisions.

2-4 DAA; IMDA

Learning objective(s):

1. Identify how nancial data and nonnancial metrics are linked to the nancial performance and forecasting.

2. Identify nancial opportunities and risks using relevant nancial data and nonnancial metrics.

3. Identify internal and external stakeholders in nancial related decision processes.

4. Identify outcome probabilities and weightings in nancial related decision processes.

5. Recognize potential decision-making biases in nancial related decision processes.

6. Describe alternative questions and answers in nancial related decision processes.

Module 8: Financial Data Analytics

Topic 1: Logical thinking

Summary Estimated

Hours

Suggested

course(s)

Dene main logical thinking concepts related to nancial data analytics. 2-4 DAA; IMDA

Learning objective(s):

1. Dene conditional thinking in nancial data analytics.

2. Identify appropriate conditional logic statements in nancial analysis.

3. Identify what conditions are met in a conditional statement related to nancial analysis.

4. Explain relational concepts (e.g., normalization, integrity, cell referencing) in nancial data.

5. Explain the different types of codes (e.g., relational, functional, object-oriented) related to nancial data.

6. Identify universal code concepts (e.g., loop) in nancial data.

Topic 2: Financial data

Summary Estimated

Hours

Suggested

course(s)

Explain main components of nancial data and extract-transform-load (ETL)

processes.

5-7 DAA; IMDA

Learning objective(s):

1. Identify basic concepts of nancial data analytics.

2. Explain the dimensions or characteristics of nancial data.

3. Dene the ETL process and principles of ETL as related to nancial data.

4. Dene the goals of the ETL process related to nancial data.

5. Identify methods to cleanse, prepare, and transform structured nancial raw data.

20 CPA Evolution Model Curriculum

Topic 3: Data mining of structured nancial data

Summary Estimated

Hours

Suggested

course(s)

Explain main concepts of data mining related to nancial data. 3-6 DAA; IMDA

Learning objective(s):

1. Dene data mining of structured nancial data.

2. Describe correlations, patterns, and anomalies in structured nancial data.

Topic 4: Analysis of nancial data

Summary Estimated

Hours

Suggested

course(s)

Describe data analysis concepts and models. 6-9 DAA; IMDA

Learning objective(s):

1. Describe the analytical maturity model (descriptive, diagnostic, predictive, and prescriptive).

2. Determine and interpret appropriate descriptive analysis, mins, max, means, median, standard deviation, and

distribution shapes.

3. Determine and interpret appropriate diagnostic data analysis, correlations, patterns, and anomalies.

Topic 5: Visualization

Summary Estimated

Hours

Suggested

course(s)

Describe data visualization techniques. 6-9 DAA; IMDA

Learning objective(s):

1. Describe the various types of data relationships.

2. Describe the data visualization techniques used to identify patterns, trends, and correlations.

3. Match the appropriate data visualization method to specic data sets and circumstances.

21 CPA Evolution Model Curriculum

Topic 6: Communicating accounting data results

Summary Estimated

Hours

Suggested

course(s)

Demonstrate ability to communicate accounting data analysis results. 6-12 DAA; IMDA

Learning objective(s):

1. Demonstrate written communication skills (i.e., memos, emails, social media, reports, disclosures).

2. Demonstrate oral communication skills (i.e., mock interviews, role-playing, presentations).

3. Demonstrate visual communication skills (i.e., interpretation, mind maps, infographics, choosing appropriate

visualizations, design best practices).

4. Demonstrate interpersonal communication skills (i.e., listening, situational awareness, emotional intelligence).

5. Explain key performance indicators (KPIs) on a dashboard.

6. List assumptions used in analysis of data for nancial decisions.

7. Identify targeted audience and scope of analysis.

Topic 7: Data ethics

Summary Estimated

Hours

Suggested

course(s)

Demonstrate awareness of data ethics issues. 3-9 DAA; IMDA

Learning objective(s):

1. Summarize data ownership concepts.

2. Demonstrate awareness of common issues associated with data ownership.

3. Summarize required informed consent, local regulations, and jurisdictions as related to data privacy.

4. Describe various regulatory data privacy frameworks.

5. Identify common pitfalls in data visualization.

6. Dene common data and analysis biases.

7. Dene Articial Intelligence (AI).

8. Describe the role of AI in data analysis and processing.

Module 9: Digital Acumen

Topic 1: Digital acumen

Summary Estimated

Hours

Suggested

course(s)

Demonstrate knowledge of, and the essential ability to respond to change in,

the world of digital tools and technologies.

1-2 DAA; IMDA; INT

Learning objective(s):

1. Recall how to identify prevailing technological trends and anticipate their impact on accounting and

nancial reporting.

2. Recall existing technological trends that are impacting accounting and nancial reporting.

3. Identify common technological applications and their uses when delivering services relative to accounting

and nancial reporting.

22 CPA Evolution Model Curriculum

Part I: CPA Evolution Core

Section 2: Audit and Accounting Information Systems Core

Module 1: Audit Environment

Topic 1: Nature and scope: audit and other engagements

Summary Estimated

Hours

Suggested

course(s)

Identify the nature, scope, and objectives of the different types of audit

engagements and identify the factors for consideration in engagements in

another country or within special-purpose framework.

2-4 AUD

Learning objective(s):

1. Identify the nature, scope, and objectives of the different types of audit engagements, including issuer and

nonissuer audits.

2. Identify the nature, scope, and objectives of engagements performed in accordance with Government

Accountability Oce Government Auditing Standards (GAGAS).

3. Identify the requirements under GAGAS related to reporting on internal controls over nancial reporting (ICOFR)

and compliance with provisions of the law, regulations, contracts, and grant agreements that have a material effect

on the nancial statements.

4. Identify the factors an auditor should consider when reporting on the audit of nancial statements prepared in

accordance with a special-purpose framework, including cash basis, tax basis, regulatory basis, contractual basis,

or other basis.

Topic 2: Audit-related research

Summary Estimated

Hours

Suggested

course(s)

Explain basics of audit-related research and identify appropriate

authoritative guidance.

1-3 AUD

Learning objective(s):

1. Explain the importance of audit-related research and appropriate techniques for conducting it.

2. Identify the appropriate authoritative guidance (e.g., PCAOB AS, AICPA AU-C) and resources for audit research.

23 CPA Evolution Model Curriculum

Topic 3: AICPA Code of Professional Conduct

Summary Estimated

Hours

Suggested

course(s)

Describe, recognize threat to, and apply the principles, rules, and interpretations

included in the AICPA Code of Professional Conduct.

2-3 AUD

Learning objective(s):

1. Describe the principles, rules, and interpretations included in the AICPA Code of Professional Conduct.

2. Recognize situations that present threats to compliance with the AICPA Code of Professional Conduct, including

threats to independence.

3. Apply the principles, rules, and interpretations included in the AICPA Code of Professional Conduct to given

situations.

4. Apply the Conceptual Framework for both members in public practice or in business included in the AICPA Code

of Professional Conduct to situations that could present threats to compliance with the rules included in the Code.

5. Apply the Conceptual Framework for Independence included in the AICPA Code of Professional Conduct to

situations that could present threats to compliance with the rules included in the Code.

Topic 4: Other ethical frameworks

Summary Estimated

Hours

Suggested

course(s)

Describe other ethical frameworks which auditors are required to comply with

beyond the AICPA Code of Professional Conduct and apply as needed.

0.5-1 AUD

Learning objective(s):

1. Describe other ethical frameworks which auditors are required to comply with beyond the Code

(e.g., SEC, GAO, DOL).

2. Recognize threats to compliance with other frameworks.

3. Apply requirements and independence rules of other ethical frameworks to situations that present

threats to compliance.

Topic 5: Licensing

Summary Estimated

Hours

Suggested

course(s)

Explain the role and authority of state boards of accountancy. 0.5-1 AUD

Learning objective(s):

1. Explain the role and authority of state boards of accountancy in licensing CPAs.

2. Explain state reciprocity and cross-border practice considerations.

24 CPA Evolution Model Curriculum

Topic 6: Professional skepticism and professional judgment

Summary Estimated

Hours

Suggested

course(s)

Describe concepts of professional skepticism and professional judgment

and the impediments to exercising both.

1-1.5 AUD

Learning objective(s):

1. Describe the concepts of professional skepticism and professional judgment.

2. Describe personal bias and other impediments to acting with professional skepticism, such as threats, incentives,

and judgment-making shortcuts.

Module 2: Engagement Planning and Considerations

Topic 1: Pre-engagement activities

Summary Estimated

Hours

Suggested

course(s)

Identify the preconditions necessary for accepting or retaining a client,

and other engagement terms, conditions, and requirements.

0.5-1 AUD

Learning objective(s):

1. Identify the preconditions needed for accepting or continuing an engagement.

2. Identify the factors affecting the acceptance or continuance of an engagement.

3. Perform procedures to conrm that a common understanding of the terms of an engagement exist with

management and those charged with governance.

4. Document the terms of an engagement in a written engagement letter or other suitable form of written agreement.

Topic 2: Requirements for engagement documentation

Summary Estimated

Hours

Suggested

course(s)

Explain the elements of and requirements for sucient and appropriate

engagement documentation.

0.5-2 AUD

Learning objective(s):

1. Identify the elements that comprise sucient appropriate documentation for an engagement.

2. Identify the requirements for the assembly and retention of documentation for an engagement.

3. Prepare documentation that is sucient to enable an experienced auditor having no previous connection with an

engagement to understand and describe the nature, timing, extent, and results of procedures performed and the

signicant ndings and conclusions reached.

25 CPA Evolution Model Curriculum

Topic 3: Firm quality control system

Summary Estimated

Hours

Suggested

course(s)

Recognize and apply a rm’s internal system of quality control. 0.5-1 AUD

Learning objective(s):

1. Recognize a CPA rm’s responsibilities for its accounting and auditing practice’s system of quality control.

2. Apply quality control procedures on an engagement.

Topic 4: Sarbanes-Oxley Act of 2002

Summary Estimated

Hours

Suggested

course(s)

Identify key provisions of the Sarbanes-Oxley Act of 2002 related to the

engagement.

1-3 AUD; AIS

Learning objective(s):

1. Identify and dene key corporate governance provisions of the Sarbanes-Oxley Act of 2002 related to an audit.

2. Identify regulatory deciencies within a client entity by using the requirements associated with the Sarbanes-Oxley

Act of 2002.

Topic 5: Planning the engagement

Summary Estimated

Hours

Suggested

course(s)

Explain the purpose of an engagement strategy and prepare a plan. 1-2 AUD

Learning objective(s):

1. Explain the purpose and signicance of the overall engagement strategy for an engagement.

2. Identify additional consideration for an initial audit (predecessor auditor inquiries, opening balances).

3. Prepare a plan for an engagement starting with the prior-year engagement plan or with a template incorporating

known business, economic, standard changes for the current year.

4. Prepare supporting planning related materials (e.g., client assistance request listings, time budgets) for an

engagement plan starting with the prior-year engagement plan or with a template.

26 CPA Evolution Model Curriculum

Topic 6: Planning for and using the work of others

Summary Estimated

Hours

Suggested

course(s)

Identify considerations when using the work of others. 0.5-1 AUD

Learning objective(s):

1. Identify the factors to consider in determining the extent to which an engagement team can use the work of the

internal audit function, IT auditor, auditor’s specialist, or a component auditor.

Topic 7: Planning communications with the client

Summary Estimated

Hours

Suggested

course(s)

Identify matters and types of communication needed during planning. 0.5-1 AUD

Learning objective(s):

1. Identify the matters related to the planned scope and timing of an engagement that should be communicated to

management and those charged with governance.

2. Identify the types of the presentation materials and supporting schedules for use in communicating the planned

scope and timing of an engagement to management and those charged with governance.

Module 3: Understanding an Entity and its Environment

Topic 1: Understanding an entity and its environment: external factors

Summary Estimated

Hours

Suggested

course(s)

Identify relevant external factors and explain their impact on the entity’s business. 2-4 AUD; AIS; IMDA

Learning objective(s):

1. Identify the relevant external factors (e.g., industry, regulation, applicable nancial reporting framework and

technology) that impact an entity and/or the inherent risk of material misstatement, and document the procedures

performed to obtain that understanding.

2. Describe the business cycle (trough, expansion, peak, recession) and leading, coincident, and lagging indicators of

economic activity (e.g., bond yields, new housing starts, personal income, and unemployment).

3. Recall the characteristics of market types (e.g., perfect competition, monopolistic competition, oligopoly, monopoly)

as well as the common competitive strategies in each type.

4. Explain the impact on an entity’s industry and operations due to changes in government scal policies, monetary

policies, regulations, and trade controls.

5. Recognize the impact of market inuences on an entity’s business strategy, operations, and risk (e.g., increasing

investment and nancial leverage, innovating to develop new product offerings, seeking new foreign and domestic

markets, and undertaking productivity or cost-cutting initiatives).

6. Determine the impact of signicant transactions (e.g., business combinations and divestitures, product line

diversication, production sourcing and public and private offerings of securities) on the engagement.

27 CPA Evolution Model Curriculum

Topic 2: Understanding an entity and its environment: internal factors

Summary Estimated

Hours

Suggested

course(s)

Identify relevant internal factors and explain their impact on the entity’s risk of

material misstatement.

2-3 AUD; AIS

Learning objective(s):

1. Identify the relevant internal factors that dene the nature of an entity, including the impact on the risk of material

misstatement (e.g., its operations, ownership and governance structure, investment and nancing plans, selection

of accounting policies, objectives, and strategies).

2. Describe the corporate governance structure within an organization (e.g., tone at the top, policies, steering

committees, oversight, and ethics).

Topic 3: Business processes and controls

Summary Estimated

Hours

Suggested

course(s)

Identify major business processes and related controls. 4-6 AUD; AIS; IMDA

Learning objective(s):

1. Describe the types and purposes of accounting and nancial reporting systems along with the related tools and

software, and the benets they provide to an entity’s business processes.

2. Classify business process controls by type (e.g., preventive vs. detective, automated vs. manual).

3. Identify the sequence of steps and the information, documents, tools, and technology commonly used in key

business processes (e.g., sales, cash collections, purchasing, disbursements, human resources, payroll, production,

treasury, xed assets, general ledger, and reporting).

4. Identify an appropriate mix of business process controls (e.g., segregation of duties, input edit checks, authorization

and approval, verications, physical controls, controls over standing data, spreadsheet controls, reconciliations, and

supervisory controls) to prevent or detect errors in transactions.

5. Identify the structured and unstructured data needed to perform data analytics related to a key business process

and identify the appropriate analytic technique for a given purpose.

6. Perform a walkthrough of a signicant business process and document (e.g., ow charts, process diagrams,

narratives, including interfaces) the ow of relevant transactions and data from initiation through nancial

statement reporting and disclosure.

28 CPA Evolution Model Curriculum

Topic 4: Enterprise risk management (ERM)

Summary Estimated

Hours

Suggested

course(s)

Dene and apply enterprise risk management (ERM) within the context of the

COSO ERM framework.

2-3 AIS

Learning objective(s):

1. Dene ERM within the context of the COSO ERM framework, including the purpose and objectives of the

framework.

2. Use the COSO ERM framework to identify risk/opportunity scenarios in an entity.

3. Describe the relationship among risk, business strategy and performance within the context of the

COSO ERM framework.

Topic 5: Limitations of controls and risk of management override

Summary Estimated

Hours

Suggested

course(s)

Describe the limitations of internal controls. 1-3 AUD; AIS

Learning objective(s):

1. Describe the limitations of internal controls and the potential impact on the risk of material misstatement of an

entity’s nancial statements.

2. Identify and document the risks associated with management override of internal controls and the potential impact

on the risk of material misstatement of an entity’s nancial statements.

Topic 6: COSO internal control framework

Summary Estimated

Hours

Suggested

course(s)

Dene internal control and apply COSO internal control framework to identify

risks and controls.

3-5 AUD; AIS

Learning objective(s):

1. Dene internal control within the context of the COSO internal control framework, including the purpose, objectives,

and limitations of the framework.

2. Identify and dene the components, principles, and underlying structure of the COSO internal control framework.

3. Apply the COSO internal control framework to identify entity-level risks (inherent and residual) related to an

organization’s compliance, operations, and reporting (internal and external, nancial, and nonnancial) objectives.

4. Apply the COSO internal control framework to identify risks related to fraudulent nancial and nonnancial

reporting, misappropriation of assets and illegal acts, including the risk of management override of controls.

5. Apply the COSO internal control framework to identify controls to meet an entity’s compliance, operations, and

reporting (internal and external, nancial, and nonnancial) objectives at the entity and sub-unit level.

29 CPA Evolution Model Curriculum

Topic 7: Understanding Systems and Organization Controls (SOC) Reports

Summary Estimated

Hours

Suggested

course(s)

Explain implications of an entity using a service organization. 3-4 AUD; AIS

Learning objective(s):

1. Explain the differences between SOC 1® and SOC 2® engagements and how SOC engagements are different from

other attestation engagements.

2. Recognize the type and relevance of the report of the examination of controls at a service organization, starting

with a report example.

3. Identify the factors that a user entity and user auditor should consider when evaluating the controls at a service

organization.

Module 4: Information Technology

Topic 1: Understanding of information technology (IT)

Summary Estimated

Hours

Suggested

course(s)

Explain the role of IT within the organization. 1-3 AUD; AIS

Learning objective(s):

1. Explain the role that IT personnel, processes and strategies play in IT governance and in supporting an entity’s

overall vision, strategy, and business objectives.

2. Identify hardware, software, databases, networks, mobile technology, etc. used by an entity.

3. Describe the advantages, disadvantages, risks, and other considerations associated with cloud computing and IT

outsourcing arrangements, including the use of System and Organization Controls (SOC) for service organizations

reports from third parties.

4. Identify the role and benets of information systems (e.g., enterprise resource planning, e-commerce, and supply

chain management systems).

Topic 2: Understanding an entity’s IT environment

Summary Estimated

Hours

Suggested

course(s)

Describe an entity’s IT environment and its impact on the nancial reporting. 1-3 AUD; AIS

Learning objective(s):

1. Describe an entity’s IT environment (application systems and IT infrastructure database,

operating system, network).

2. Identify implications to risk of outsourced IT environment components.

3. Identify the IT-related signicant business processes and data ows that directly or indirectly impact

an entity’s nancial statements.

30 CPA Evolution Model Curriculum

Topic 3: Control environment, IT general controls and entity-level controls

Summary Estimated

Hours

Suggested

course(s)

Identify and document signicant components of entity-level controls, including IT. 1-3 AUD; AIS

Learning objective(s):

1. Identify and document the signicant components of an entity’s control environment (entity-level), including

its IT general controls and application controls.

2. Identify the categories of IT general controls and pervasive impact on nancial reporting.

3. Identify the types of IT application controls and impact on nancial reporting.

4. Describe the testing strategies used in selecting, developing, and implementing new information systems.

5. Recognize effective IT control activities, including manual, IT dependent and automated controls, as well as

preventive, detective, and corrective controls.

Module 5: Risk Assessment of Fraud and Noncompliance

Topic 1: Assessing risks due to fraud and noncompliance

Summary Estimated

Hours

Suggested

course(s)

Assess risks due to fraud, including discussions among the engagement team

about the risk of material misstatement due to fraud or error, and describe the

accountant’s responsibilities with respect to laws and regulations and perform

tests of compliance.

1-3 AUD

Learning objective(s):

1. Assess risks of material misstatement of an entity’s nancial statements due to fraud or error (e.g., during a

brainstorming session), leveraging the combined knowledge and understanding of the engagement team.

2. Describe the accountant’s responsibilities with respect to laws and regulations that have a direct effect on the

determination of material amounts or disclosures in an entity’s nancial statements for an engagement.

3. Describe the accountant’s responsibilities with respect to laws and regulations that are fundamental to an entity’s

business but do not have a direct effect on the entity’s nancial statements in an engagement.

4. Perform tests of compliance with laws and regulations that have a direct effect on material amounts or disclosures

in an entity’s nancial statements in an engagement.

5. Perform tests of compliance with laws and regulations that are fundamental to an entity’s business, but do not have

a direct effect on the entity’s nancial statements for an engagement.

31 CPA Evolution Model Curriculum

Module 6: Assessing Risk of Material Misstatement

Topic 1: Impact of risks at the nancial statement level

Summary Estimated

Hours

Suggested

course(s)

Identify, document, and analyze the impact of risks of material misstatement. 1-2 AUD

Learning objective(s):

1. Identify and document the assessed impact of risks of material misstatement at the nancial statement level,

taking into account the effect of relevant controls.

2. Analyze identied risks to detect those that relate to an entity’s nancial statements as a whole (as contrasted to

the relevant assertion level).

Topic 2: Impact of risks for each relevant assertion at the class of transaction, account balance

and disclosure levels

Summary Estimated

Hours

Suggested

course(s)

Identify, document, and analyze risks and related controls at the relevant

assertion level.

2-4 AUD

Learning objective(s):

1. Identify and document risks and related controls at the relevant assertion level for signicant classes of

transactions, account balances, and disclosures in an entity’s nancial statements.

2. Analyze the potential impact of identied risks at the relevant assertion level for signicant classes of transactions,

account balances, and disclosures in an entity’s nancial statements, taking account of the controls the auditor

intends to test.

3. Recognize the potential impact of lower complexity and higher complexity signicant accounting estimates

on the risk of material misstatement, including the indicators of management bias.

Topic 3: Risk associated with IT

Summary Estimated

Hours

Suggested

course(s)

Describe IT-related risks. 1-2 AUD; AIS

Learning objective(s):

1. Identify IT-related risks, including cybersecurity risks, and describe mitigating strategies given risk severity,

probability, and costs.

2. Describe the risks associated with an inadequate change control and change management process for an entity’s

information systems and processes, including acquisition, integration, and outsourcing.

32 CPA Evolution Model Curriculum

Topic 4: Response to identied risks

Summary Estimated

Hours

Suggested

course(s)

Analyze risk of material misstatement, analyze transactions, and use audit data

analytics outputs to develop audit procedures in response to identied risks.

1-3 AUD

Learning objective(s):

1. Develop planned audit procedures that are responsive to identied risks of material misstatement due to fraud or

error at the relevant assertion level for signicant classes of transactions and account balances.

2. Analyze the risk of material misstatement, including the potential impact of individual and cumulative

misstatements, to provide a basis for developing planned audit procedures.

3. Analyze transactions that may have a higher risk of material misstatement from audit data analytic outputs (e.g.,

reports and visualizations) by determining relationships among variables and interpreting results to provide a basis

for developing planned audit procedures.

Module 7: Materiality

Topic 1: Materiality for the nancial statements as a whole

Summary Estimated

Hours

Suggested

course(s)

Describe and calculate materiality as it relates to the nancial statements

as a whole.

1-2 AUD

Learning objective(s):

1. Describe materiality as it relates to the nancial statements as a whole.

2. Calculate materiality for an entity’s nancial statements as a whole.

3. Calculate the materiality level (or levels) to be applied to classes of transactions, account balances, and disclosures

in an audit of an issuer or nonissuer.

Topic 2: Materiality for tolerable misstatement and performance materiality

Summary Estimated

Hours

Suggested

course(s)

Describe and calculate tolerable misstatement. 1-2 AUD

Learning objective(s):

1. Describe the use of tolerable misstatement or performance materiality in an audit of an issuer or nonissuer.

2. Calculate tolerable misstatement or performance materiality for the purposes of assessing the risk of material

misstatement and determining the nature, timing, and extent of further audit procedures in an audit of an

issuer or nonissuer.

33 CPA Evolution Model Curriculum

Module 8: Audit Evidence

Topic 1: Tests of controls

Summary Estimated

Hours

Suggested

course(s)

Determine the need for tests of controls on an engagement. 0.5-1 AUD

Learning objective(s):

1. Based on the nature of the engagement, determine the need for tests of controls in an audit engagement.

Topic 2: Sucient appropriate evidence

Summary Estimated

Hours

Suggested

course(s)

Determine the sources and evaluate whether evidence is sucient and

appropriate given the nature of the audit engagement.

2-4 AUD

Learning objective(s):

1. Determine the sources of sucient appropriate evidence (e.g., generated from management’s nancial reporting

system, obtained from management specialists, obtained from external sources, or developed by the audit team

from internal or external sources).

2. Identify procedures to validate the completeness and accuracy of data and information obtained from management

(e.g., tying information back to original sources such as general ledger, subledger or external information sources,

validate search or query criteria used to obtain data, etc.).

3. Exercise professional skepticism and professional judgment while analyzing the data and information to be used

as evidence to determine whether it is suciently reliable and corroborates or contradicts the assertions in the

nancial statements and the objectives of the engagement and modify planned procedures accordingly.

4. Evaluate whether sucient appropriate evidence has been obtained to achieve the objectives of the

planned procedures.

34 CPA Evolution Model Curriculum

Module 9: Audit Procedures

Topic 1: General procedures to obtain sucient appropriate evidence

Summary Estimated

Hours

Suggested

course(s)

Describe and perform general procedures to test controls and to obtain sucient

and appropriate audit evidence to support the auditor’s conclusion.

3-6 AUD

Learning objective(s):

1. Describe the purpose and application of sampling techniques including the use of automated tools and audit data

analytic techniques to identify signicant events or transactions that may impact the nancial statements.

2. Use sampling techniques to extrapolate the characteristics of a population from a sample of items.

3. Use observation and inspection to obtain evidence.

4. Use recalculation (e.g., manually or using automated tools and techniques) to test the mathematical accuracy of

information to obtain evidence.

5. Use reperformance to independently execute procedures or controls to obtain evidence.

6. Inquire of management and others to gather evidence and document the results.

7. Analyze responses obtained during structured interviews or informal conversations with management and others,

including those in nonnancial roles, and ask relevant and effective follow-up questions to understand their

perspectives and motivations.

Topic 2: Analytical procedures

Summary Estimated

Hours

Suggested

course(s)

Perform analytical procedures. 1-3 AUD

Learning objective(s):

1. Determine the suitability of substantive analytical procedures to provide evidence to support an identied assertion.

2. Develop an expectation of recorded amounts or ratios when performing analytical procedures and determine

whether the expectation is suciently precise to identify a misstatement in the entity’s nancial statements

or disclosures.

3. Perform analytical procedures during engagement planning.

4. Perform analytical procedures near the end of an audit engagement that assist the auditor when forming an overall

conclusion about whether the nancial statements are consistent with the auditor’s understanding of the entity.

5. Evaluate the reliability of data from which an expectation of recorded amounts or ratios is developed when

performing analytical procedures.

6. Evaluate the signicance of the differences of recorded amounts from expected values when performing

analytical procedures.

35 CPA Evolution Model Curriculum

Topic 3: External conrmations

Summary Estimated

Hours

Suggested

course(s)

Conduct external conrmations and analyze responses. 1-2 AUD

Learning objective(s):

1. Conrm signicant account balances and transactions using appropriate tools and techniques (e.g., conrmation

services, electronic conrmations, manual conrmations) to obtain relevant and reliable evidence.

2. Analyze external conrmation responses in the audit of an issuer or nonissuer to determine the need for follow-up

or further investigation.

Topic 4: Audit data analytics

Summary Estimated

Hours

Suggested

course(s)

Describe the use of audit data analytics. 4-6 AUD; AIS

Learning objective(s):

1. Verify the accuracy and completeness of data sets that are used in an engagement to complete planned

procedures.

2. Determine the attributes, structure and sources of data needed to complete audit data analytic procedures.

3. Identify procedures using outputs (e.g., reports and visualizations) from audit data analytic techniques to determine

relationships among variables.

4. Summarize the capabilities needed in tools that support data modeling and analysis.

Module 10: Special Considerations

Topic 1: Accounting estimates

Summary Estimated

Hours

Suggested

course(s)

Perform audit procedures related to accounting estimates. 0.5-1 AUD

Learning objective(s):

1. Recalculate and reperform procedures to validate the inputs and assumptions of an entity’s signicant accounting

estimates with a higher risk of material misstatement or complexity, such as fair value estimates.

2. Perform procedures (e.g., reviewing the work of a specialist and procedures performed by the engagement team) to

validate an entity’s calculations and detailed support for signicant accounting estimates in an audit of an issuer or