ISSUE BRIEF

Older Immigrants

and Medicare

UPDATED AUGUST 2024

Natalie Kean, Director, Federal

Health Advocacy

Tiffany Huyenh-Cho, Director,

California Medicare and

Medicaid Advocacy

We gratefully acknowledge Georgia Burke, formerly Justice in Aging’s Director of Medicare Advocacy, for authoring the

rst edition of this issue brief in 2019. We would also like to thank Nancy Lorenz of Greater Boston Legal Services and

Vicky Pulos of Massachusetts Law Reform Institute for their insight and contributions.

INTRODUCTION

Enrolling in the Medicare program and accessing its benets can be complex and is often confusing for older adults.

e process can be even more challenging for older immigrants, some of whom do not have a signicant work

history in the United States, are not citizens, or have limited English prociency. More than 8million U.S. residents

age 65 and older are immigrants, and 4 million Medicare beneciaries have limited English prociency.

1

To assist advocates working with older immigrants who may qualify for Medicare, this issue brief discusses Medicare

policies and practices most relevant to older immigrants, including:

• Eligibility and enrollment, with particular attention to rules aecting non-citizens

• Help paying for coverage

• Post-enrollment issues

e issue brief includes numerous hypothetical examples. e names and details are created to illustrate the rules

and are not actual case reports.

PROGRAM ELIGIBILITY, ENROLLMENT AND COSTS

e Social Security Administration (SSA) determines eligibility and handles enrollment for the two core Medicare

benets: Part A, generally referred to as the hospital benet, and Part B, which covers physicians and most other

health services. People with either Part A or Part B coverage can enroll in Part D, the prescription drug benet.

JUSTICE IN AGING | ISSUE BRIEF | www.justiceinaging.org | 2

Enrollees with both Part A and Part B coverage

have the option to receive their benets through

managed care, called Medicare Advantage (MA). e

Centers for Medicare and Medicaid Services (CMS)

administers enrollment for both Part D and Medicare

Advantage.

2

Many older immigrants who immigrated

later in life have little or no work history in the United

States, which aects their Medicare costs, and, in some

cases, their eligibility.

Premium Costs for Medicare

Part A premiums, which are tied to work history,

can be a particular challenge for some immigrants.

Nearly all (99%) Medicare enrollees qualify for Part

A coverage without paying a premium (“premium-free

Part A”) based on their work credits (generally 40

quarters,approximately ten years) or on the work

credits of their spouse.

3

However, those without the

required work credits must pay high premiums for Part

A coverage, up to $505/mo. in 2024.

4

Note that work

credit requirements are dierent for people qualifying for

Medicare on the basis of disability and that there also are

unique rules for people with End Stage Renal Disease

(ESRD).

5

Regardless of work history, Medicare Part B requires a

premium payment, which for 2024 is $174.90/month.

6

To purchase Part A, an individual must also enroll in

Part B. In contrast, it is possible to enroll only in Part B

and forgo Part A coverage. Both Part A and Part B have

late enrollment penalties that may apply to individuals

who do not enroll when rst eligible.

7

Medicare Part D Prescription Drug Plans (PDPs)

also have premiums that vary depending on the

plan, as well as late enrollment penalties for delays

in enrollment.

8

Individuals can enroll in the Part D

prescription drug benet if they have either Part A or

Part B coverage.

9

ACRONYMS

A&D: Aged and Disabled Medicaid

CMS: Centers for Medicare and Medicaid

Services

COFA: Compact of Free Association

ESRD: End Stage Renal Disease

FPL: Federal Poverty Level

GEP: General Enrollment Period

IEP: Initial Enrollment Period

LEP: Limited English Prociency

LIS: Low-Income Subsidy, also known as

Extra Help

LAPR: Lawfully Admitted Permanent

Resident

LPR: Lawful Permanent Resident

MA: Medicare Advantage, also known as

Part C

MAGI: Modied Adjusted Gross Income

MSP: Medicare Savings Programs

PDP: Prescription Drug Plans

QHP: Qualied Health Plan

QI: Qualied Individual

QMB: Qualied Medicare Beneciary

SEP: Special Enrollment Period

SLMB: Specied Low-income Medicare

Beneciary

SSA: Social Security Administration

TPS: Temporary Protected Status

Immigration Status and Enrollment

To enroll in either Part A or Part B, an individual must either be a U.S. citizen or be lawfully present in the United

States. Some non-citizens have a length of U.S. residency requirement for Medicare and others do not. In most cases,

JUSTICE IN AGING | ISSUE BRIEF | www.justiceinaging.org | 3

as discussed in detail below, a non-citizen who does not qualify for premium-free Part A must be a lawful permanent

resident (LPR) with ve years of continuous residence in the U.S. immediately prior to Medicare enrollment.

Non-citizens who are not lawfully present (undocumented) are ineligible to enroll in Medicare coverage under any

circumstances.

10

People who are lawfully present and enroll in Medicare but later lose their lawful presence status are

not eligible for Medicare payment on any claims. ey may still be “enrolled” in Medicare, but Medicare will not

process payments for claims submitted by Medicare providers. is policy applies to those in Original Medicare and

those in Medicare Advantage.

MA Disenrollment Following a Change in Immigration Status

In 2021, CMS issued updated guidance clarifying that individuals without the required immigration status

for Medicare are ineligible for Part C and D enrollment.

11

People in this group were disenrolled from

their Part C and D plans nationwide and moved to Original Medicare. This group remained ineligible

for Medicare payment on Part A, B, and D services. Many of those affected originally had the required

immigration status and lost eligibility (e.g., legal permanent residents who lost residency because they had

been out of the country for more than 6 months). There may be state-specic solutions available. If you are

seeing this issue, please contact Justice in Aging.

Citizens have no length of residency requirements

U.S. citizens face no length of residency requirement to enroll in Medicare, whether or not they have the work

credits to qualify for premium-free Part A.

12

People who do not enroll during the Initial Enrollment Period (IEP)

around their 65th birthday can face higher costs and gaps in enrollment, including citizens who are living abroad

and return to the U.S. after they reach age 65. In most cases, they do not have a Special Enrollment Period (SEP)

when they return so must wait until the General Enrollment Period (GEP), which extends from January 1 to March

31 each year, with coverage starting the rst of the month after application.

13

Case Examples: Citizens living abroad

Mr. Santos, born in the Philippines, came to the United States twenty years ago. He worked and contributed to

Social Security and Medicare since shortly after he arrived. He has been a U.S. citizen for ten years but has lived in

the Philippines for the last four years caring for relatives, who are now deceased. He returned to the United States

in the fall last year, shortly after he turned 68. Because he is a U.S. citizen, he was able to begin his Part A Medicare

immediately. e fact that he reestablished U.S. residence only months ago was irrelevant to his eligibility for Part

A or Part B. ough eligible for Part B, he did not enroll. e fact that he was living overseas and unable to use

Medicare benets did not delay his IEP and there is no SEP for returning citizens. He enrolls in Part B during the

GEP with enrollment eective the rst of the month after he signs up. Mr. Santos will also owe a late enrollment

penalty for his Part B premium because he did not enroll during his IEP.

Ms. Reyes, who will turn 65 in a few months, came to the U.S. in the same year as Mr. Santos. She also is a

citizen and also spent extended periods out of the country to care for family members. She, however, does not have

the work history needed for premium-free Part A, but she wants to enroll and pay the premiums. Because Ms.

Reyes is a citizen, she can enroll in premium Part A during her IEP and in Part B without any length of residency

requirements. e SSA will not consider her time abroad when processing her enrollment.

JUSTICE IN AGING | ISSUE BRIEF | www.justiceinaging.org | 4

Lawfully present non-citizens who qualify for premium-free Part A have no length of

residency requirement

LPRs, individuals in Temporary Protected Status (TPS), and other lawfully present individuals

14

with work credits

that qualify them for premium-free Part A also do not face any length of residency requirement.

15

Because they

qualify for premium-free Part A, these individuals can enroll in both Part A and Part B without any length of

residency requirement.

16

Although advocates for older adults report that they usually see only LPRs and TPS holders with the required work

history, it is possible that other categories of lawfully present individuals, such as Compact of Free Association

(COFA) Migrants or asylees, could accrue enough work credits to qualify for premium-free Part A. In many cases,

these would be younger individuals who qualify for disability-based Medicare with fewer years of work credits.

Case Examples: Lawfully present individuals eligible for premium-free Part A

Ms. Flores, originally from El Salvador, has lived and worked in the United States for 13 years holding Temporary

Protected Status. Her work history qualies her for premium-free Part A. She can enroll in both Part A and Part B

without any length of residency requirement.

Ms. Lopez is an LPR who came to the U.S. three years ago. She married another LPR shortly after arriving. Her

husband, a long-term U.S. resident, has enough work credits for premium-free Part A. Ms. Lopez is turning 65.

Because she can rely on her husband’s work history, she can start her Part A and Part B coverage right away, even

though she has not been a U.S. resident for ve years.

A Note about Terminology

Terminology can be confusing. For example, SSA and CMS use the term “entitled to Part A benets”

to describe someone who qualies for premium-free Part A. Another possible point of confusion is the

fact that, although “Lawful Permanent Resident” (LPR) is the term used in most immigration contexts for

green card holders (and also used in this issue brief), SSA refers to these individuals as Lawfully Admitted

Permanent Residents (LAPR).

Non-citizens without the work credits to qualify for premium-free Part A face

additional status and length of residency requirements

Many non-citizen immigrants do not qualify for premium-free Part A because they have not worked in the U.S.

for a long enough period. To be eligible to enroll in Medicare Part A or B, these individuals must 1) be lawful

permanent residents (LPR, i.e., holding a green card) and 2) have ve years of continuous residence in the United

States immediately prior to Medicare enrollment.

17

SSA determines whether an individual has met the ve-year

continuous residency requirements.

When does the ve-year period start?

e ve-year period of U.S. residency begins the day the individual arrives in the U.S. with the intention of

establishing a home. e period can start before the individual has LPR status. e ve-year clock can start, for

example, with arrival under refugee or asylee status. It cannot start with visitor status since visitors are assumed to be

retaining their foreign residence.

18

JUSTICE IN AGING | ISSUE BRIEF | www.justiceinaging.org | 5

What qualies as “continuing residence”?

SSA looks at records of entry into the U.S. compiled by the Department of Homeland Security.

19

Temporary

absences do not aect “continuous” residence as long as the individual intends to maintain U.S. residence, but if

absences are frequent or of long duration, the agency may inquire to determine whether continued U.S. residency

was intended. Examples of evidence of intent could include continuing to pay U.S. income taxes, or maintaining a

house or apartment with the individual’s furnishings and belongings. If an absence is over six months, SSA requires

a “strong showing” of intent to retain U.S. residence.

20

If SSA determines that continuous residence has been

broken, the new ve-year period begins on the date that the individual has returned to the United States.

21

Case Examples: LPRs without work credits

Mr. Rao, an LPR, came to the United States at age 62 to live with his son, a U.S. citizen. He has taken on a little

part-time work but mostly helps care for his grandchildren. Because he does not have enough work history in the

U.S. to qualify for premium-free Part A, Mr. Rao must wait for ve years from his date of entry to the U.S. to

qualify for Medicare Part A or B. When he meets the ve-year residency point, he can enroll in premium Medicare

Part A and Part B, or can decide to enroll only in Part B.

Mr. Lee just turned 65. He has been an LPR since his arrival in the U.S. eight years ago but does not have sucient

work history to qualify for premium-free Part A. Most years, he takes a trip back to Korea to visit family, usually

for about six weeks. Mr. Lee applied for Part B Medicare coverage during his IEP. e SSAapproved his application

because he is an LPR and, despite several short absences, has met the ve-year continuous residency requirement.

What happens to the waiting period if a person marries someone with premium-free Part A?

If an LPR subject to the ve-year continuous residency requirement marries someone entitled to premium-free

Part A (and who is over age 62), the LPR, after a year of marriage, will also have Part A entitlement based on their

spouse’s work history.

22

e continuous residency requirement will no longer apply.

23

Case Example: LPRs with work credits by marriage

Mr. Williams, a 65-year-old LPR, came to the U.S. from Jamaica last year when he was 64. Because he is subject

to the ve-year continuous residency period, he cannot enroll in Medicare until he is 69. However, next month he

plans to marry Ms. Allen, also an LPR and age 63. She has been in the U.S. over 15 years and, because of her work

history, qualies for premium-free Part A. Once they are married for a year, Mr. Williams will be entitled to Part A

based on Ms. Allen’s record. He won’t have to wait for ve years to enroll or pay a premium for Part A.

What about Medicare Part D and Medicare Advantage?

Part D and MA do not have separate citizenship or length of residency requirements. Plans are prohibited from

requesting any documentation of citizenship or immigration status. CMS provides the ocial status to the plan.

If CMS records show that a plan member is not lawfully present, the plan is required to disenroll the member.

24

Individuals with either PartA or Part B can join a Part D plan. To join an MA plan, a beneciary must have both

Medicare Part A and Part B.

JUSTICE IN AGING | ISSUE BRIEF | www.justiceinaging.org | 6

Advocacy Tip

Enrollment denials or disenrollments arising from errors in SSA and/or CMS records will need to be

corrected with those agencies. Such denials are not subject to Medicare plan appeal processes. Justice in

Aging can assist advocates with resolving these types of records issues.

AFFORDING COVERAGE

Even when an immigrant qualies for Medicare coverage, aording that coverage can be a challenge. is is

particularly true for immigrants who must pay premiums to enroll in Part A. e steep Part A premium is

simply out of reach for many. Premiums for Part B and Part D coverage also add nancial burden forlow-income

immigrants.

State Medicaid Programs Can Assist With Medicare Premiums

ere are two ways that state Medicaid programs can assist eligible low-income immigrants with Medicare costs.

First, every state’s Aged and Disabled (A&D) Medicaid benet includes payment of the Part B premium for

Medicare beneciaries.

25

e income and asset limits for A&D Medicaid are low, though they vary by state.

Medicare Savings Programs (MSPs), which state Medicaid agencies administer, also oer premium relief and

typically have higher eligibility limits than A&D Medicaid. MSPs do not provide full Medicaid coverage; instead,

they are specically designed to assist with Medicare costs. Federal law sets minimum countable income and asset

limits for MSPs, and several states have set more generous limits or eliminated the asset test altogether.

26

e MSP with the most robust benets, the Qualied Medicare Beneciary (QMB) program, can be particularly

helpful to low-income immigrants who must pay a premium for Part A. e QMB program pays both Part A and

Part B premiums. In most states, income must be at or below 100% of the federal poverty level (FPL) and countable

resources may not exceed (for 2024) $9,430 for an individual and$14,130 for a couple.

27

QMB also protects

enrollees from paying Part A or B Medicare deductibles, co-pays, and co-insurance. Note that many QMBs also

qualify for full A&D Medicaid and are referred to as QMB-plus.

Two other MSP programs, the Specied Low-income Medicare Beneciary (SLMB) program and the Qualied

Individual (QI) program, only pay Part B premiums. e federal minimum income requirements for these programs

are 135% and 150% of FPL, respectively. Federal minimum asset limits for both programs are the same as for QMB.

Most state Medicaid programs serving older adults, including MSPs, have immigration status requirements and

waiting periods.

28

In almost all states, non-citizens must be “qualied” (a designation that is narrower than lawfully

present) to be eligible for A&D Medicaid or MSPs. us, a Medicare-eligible individual who is not “qualied,”

such as an individual with TPS, cannot get help from Medicaid with Medicare costs. In addition, some qualied

immigrants, including many LPRs,

29

are subject to the ve-year bar, meaning they must wait ve years after

attaining a qualied status before they are eligible for Medicaid, including MSPs.

30

JUSTICE IN AGING | ISSUE BRIEF | www.justiceinaging.org | 7

States Expanding Medicaid Access for Older Immigrants

Some states waive the ve-year waiting period for Medicaid benets, such as California. Immigrants

otherwise eligible for Medicaid if not for the ve year waiting period, can access Medicaid in California

and the state pays for their care using state funds only.

31

California also expanded its Medicaid program

to include older adults regardless of immigration status, specically individuals who are undocumented

or who do not otherwise meet the “qualied” immigrant status.

32

New York recently expanded Medicaid

coverage to undocumented older adults age 65 and older as of January 2024.

33

States nance these efforts

using state funds only and do not receive a federal match.

Case Examples: Medicare Savings Programs

Ms. Flores, a TPS holder, has premium-free Medicare Part A coverage because of her long work history in the U.S.

Her income is below 100% of FPL, but she cannot qualify for QMB assistance with her Part B premiums because

TPS is not a “qualied” status.

Ms. Gonzales, an LPR, has premium-free Part A based on her husband’s work history. Her income and assets

qualify her for the SLMB benet, but she only has three years of continuous residence in the U.S. Due to the 5-year

bar, she will have to wait another two years before she can enroll in SLMB to get help with her Part B premiums.

Advocacy Tip

Advocates report that many immigrant families are reluctant to apply for any needed Medicaid benet for

older family members because of fears of estate recovery. It is important to inform them and their families

that the QMB benet and other MSPs are exempt from estate recovery.

34

Enrolling in the QMB Program Can Be Challenging

As discussed above, the QMB benet can be particularly helpful to low-income immigrants who must pay a

premium for Part A. e mechanics and timing of enrolling in the QMB program, however, can be complex for

both citizens and non-citizens. Enrollment procedures depend on the state and on whether the individual already

is enrolled in Part B. For those who are not enrolled in Part B and/or who are in “group payer states” as discussed

below, enrollment may require visits to both the Social Security oce to apply for “conditional” Part A enrollment,

and to the state Medicaid agency to apply for QMB enrollment.

In the majority of states (identied as “Part A buy-in states”), individuals can apply for QMB coverage at any time

of the year and coverage begins in the month following approval. In 14 states (identied as “group payer states”),

however, people without premium-free Part A may only apply at SSA for conditional Part A enrollment during the

General Enrollment Period (January 1-March 31) each year,

35

with QMB and Part A enrollment beginning the rst

of the month following approval.

A Justice in Aging fact sheet

36

and clarifying guidance from SSA detail the specic steps needed to apply in each set

of states.

37

JUSTICE IN AGING | ISSUE BRIEF | www.justiceinaging.org | 8

Advocacy Tip

Advocates should give their clients step-by-step guidance so that they follow through with all needed

procedures.In all states, advocates often report delays in Medicaid ofces verifying Part A applications, a

lack of awareness of the Conditional Part A application, and inaccurate information given by both SSA and

Medicaid ofces. Particularly in group payer states, calendared reminders and follow-up may be needed to

ensure that clients successfully navigate the enrollment process due to the limited application window.

Case Example: Enrolling in QMB

Mrs. Chen is 66 and lives in Arizona, a group payer state. She came to the U.S. seven years ago and has met the

status and residency requirements to qualify for Medicare. Since she has no work history, she has not enrolled in

Medicare because she cannot pay the premiums, especially the Part A premium. In June, Mrs. Chen meets with an

advocate who tells her that, with her income and assets, she qualies for the QMB program, which will pay both

her Part A and Part B premiums. e advocate tells Mrs. Chen, however, that she must wait until January to go to

SSA and apply for conditional Part A enrollment and for Part B. With Mrs. Chen’s consent, the advocate also tells

her daughter and urges both of them to put the date on their calendars. In December, the advocate contacts both

Mrs. Chen and her daughter to remind them to make an appointment with SSA in January and, after applying for

conditional enrollment at SSA, to go directly to the state Medicaid oce to apply for QMB. e advocate follows up

in late January to make sure that Mrs. Chen took the required steps. She did, and nally on February 1, to her great

relief, Mrs. Chen gets both Part A and Part B coverage without having to pay premiums. Mrs. Chen, because of her

QMB status, is also protected from payment of Medicare related cost sharing, including co-pays, co-insurance, and

deductibles. Her QMB enrollment also automatically qualies her for the Part D Low-income Subsidy (discussed

below) to help her with prescription drug co-insurance.

Marketplace Enrollment Offers an Alternate Coverage Option

Immigrants who do not qualify for premium-free Part A or QMB can also consider enrolling in a Qualied Health

Plan (QHP) in the Marketplace and applying for nancial assistance in the form of premium tax credits and cost-

sharing reductions.

Non-citizens who are “lawfully present” are eligible to enroll in QHPs. is includes LPRs as well as individuals on

non-immigrant visas, and many temporary status categories such as TPS.

38

Immigrants who are eligible to enroll in

QHPs may also qualify for premium tax credits and cost-sharing reductions to help them aord coverage.

39

(Note

that individuals who have premium-free Part A generally cannot enroll in the Marketplace and are not eligible for

premium or cost-sharing assistance.

40

)

ere are no length of residency requirements for QHPs or for premium tax credits and cost-sharing reductions.

Further, lawfully present individuals, unlike citizens, can receive premium tax credits and costsharing reductions,

even if their income is below 100% of FPL if they are ineligible for Medicaid because of their immigration status.

41

In contrast to QMB and Medicaid A&D eligibility, eligibility for QHP premium tax credits and cost-sharing

reductions is based on Modied Adjusted Gross Income (MAGI) rules, which do not include asset tests.

42

Depending on an individual’s income and circumstances, getting coverage through the Marketplace may be less

expensive than paying for Part A. ose who choose Marketplace coverage rather than Medicare need to be aware

that, if they later decide to switch to Medicare, they can face late enrollment penalties for both Part A and Part B.

43

JUSTICE IN AGING | ISSUE BRIEF | www.justiceinaging.org | 9

ey also may face gaps in coverage because they may only be able to enroll in Medicare during the annual General

Enrollment Period.

44

Because Marketplace enrollment is permitted under a range of immigration statuses and does not have a length of

residency requirement, QHPs are also an option for older adults who are not currently eligible for Medicare. For

example, LPRs who are still in their ve-year waiting period and people under age 65 may want to enroll in a QHP.

Advocacy Tip

Advocates should remind clients choosing Marketplace coverage that, even if their income is below tax

ling requirements, they need to le income tax returns in order to get MAGI-based subsidies.

Case Examples: Marketplace and Medicare

Ms. Park is an LPR who is eligible for Medicare but does not qualify for premium-free Part A. Her income is at

200% FPL, which is too high to qualify for the QMB program in her state. Because her income is low enough to

qualify her for premium tax credits and cost-sharing reductions in the Marketplace, she decides to enroll in a QHP.

Note she will face both Part A and Part B enrollment penalties if she later decides to enroll in Medicare and will

only be able to do so during certain times of year.

Mr. Jones is an LPR who arrived in the U.S. when he was 62. He is now 66 and enrolled in a QHP with premium

tax credits and cost-sharing reductions. Next year he will have been in the U.S. for ve years. At that time he will

become eligible for Medicare and, because of his low income, he will also qualify for his state’s Medicaid program.

He will lose his eligibility for Marketplace subsidies so he will switch from the Marketplace to Medicare. His

Medicaid coverage will assist with his Medicare costs.

Some People Choose To Enroll Only in Part B

Enrolling only in Medicare Part B and not in Part A is an available option for people who face steep Part A

premiums but don’t qualify for either QMB or Marketplace subsidies. Part B enrollment allows them to also enroll

in Part D and, if they qualify, to get the Low-Income Subsidy (LIS) to help pay for Part D costs (see below). is

course is far from ideal because it leaves an individual without coverage for hospital costs. However, it is an available

option. If these individuals later decide to enroll in Part A, they can face late enrollment penalties and also may be

limited to enrolling during the General Enrollment Period. If they enroll in Part B and not in Part D, they could

also face Part D late enrollment penalties if they do not have creditable drug coverage through another source.

Case Example: Declining Part A coverage

Mr. Singh came to the U.S. eight years ago. He is now 65, an LPR and eligible for Medicare but not for premium-

free Part A. From his career in India, he has a pension and a small nest egg, disqualifying him for Medicaid,

including the Medicare Savings Programs, or Marketplace subsidies. He decides to conserve resources and only

enroll in Part B and not in Part A. By doing so, he will have coverage for doctor visits but risks wiping out his nest

egg if he needs hospital care. ough he currently only takes one inexpensive generic drug, he enrolls in a Part D

plan so that he will not face late enrollment penalties if he later nds that his drug coverage needs increase.

JUSTICE IN AGING | ISSUE BRIEF | www.justiceinaging.org | 10

The Part D Low Income Subsidy (“Extra Help”) Can Reduce

Prescription Drug Costs

Immigrants who are eligible for Part D, i.e., those who are enrolled in either Part A or Part B, also may be eligible

for the Part D Low Income Subsidy (LIS or “Extra Help”).

45

LIS provides help with Part D premiums, deductibles,

and co-pays, for prescription drugs, and can waive Part D late enrollment penalties. Because LIS asset and income

limits are higher than those for QMB and other Medicare Savings Programs, some individuals with higher incomes

may qualify for this benet.

46

e Social Security Administration determines LIS eligibility based on income and assets. Individuals may apply

with SSA in-person, on-line or by phone.

47

ere are no additional immigration status or length of U.S. residency

requirements for LIS beyond what is needed for Part A and Part B eligibility. LIS enrollment is automatic for

Medicare beneciaries receiving SSI and for those enrolled in any Medicaid program, including Medicare Savings

Programs such as QMB.

48

Case Example: Extra Help v. QMB

Ms. Flores, a low-income TPS holder with premium-free Part A, successfully applied for the Part D Low Income

Subsidy. Although she had been unable to enroll in the QMB program because she was not a “qualied” immigrant,

that was not a factor in evaluation her LIS application. Having LIS gives her signicant relief from prescription drug

costs.

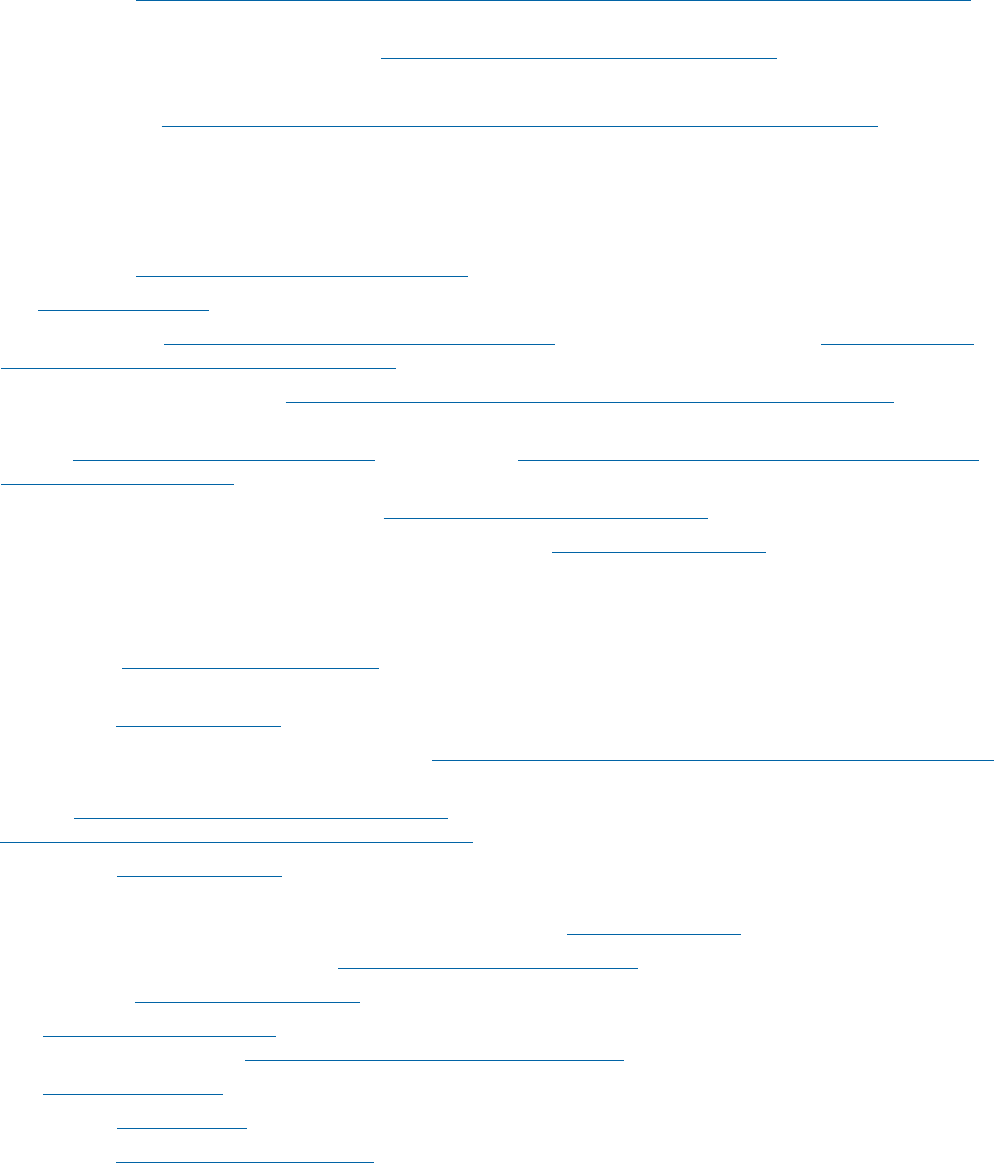

Summary of Eligibility and Premium Assistance Options—

Lawful Permanent Resident (LPR) and Temporary Protected

Status (TPS)

MEDICARE

ELIGIBILITY

AVAILABLE PROGRAMS TO HELP WITH COSTS

Does 5 Year Residence

Apply?

Medicaid and

Medicare Savings

Programs (MSPs)

Part D Low

Income

Subsidy (LIS or

“Extra Help”)

Marketplace

Subsidies

LPR—

qualifying

work record

No

Yes after 5 years w/

qualied status

Yes No

LPR—without

qualifying

work record

Yes but w/ Part A premium

Yes after 5 years w/

qualied status

Yes if enroll in

either A or B

Yes*

TPS—

qualifying

work record

No No Yes No

TPS—without

qualifying

work record

N/A**

N/A**

N/A**

Yes

* For those with income below 100% FPL, subsidies are available only if they are ineligible for Medicaid because of their immigration status.

** Not Applicable because ineligible for Medicare or Medicaid.

JUSTICE IN AGING | ISSUE BRIEF | www.justiceinaging.org | 11

POST ENROLLMENT ISSUES

Medicare Does Not Pay for Services Outside the U.S.

Many immigrants, particularly those who are citizens, may spend signicant time overseas during their retirement.

Medicare does not cover health care provided outside the United States.

49

Medicare Premium Payment Liabilities Continue Even When an

Enrollee Is Abroad

To maintain enrollment, individuals must continue paying Medicare premiums while abroad. If an enrollee stops

paying Part A or Part B premiums, SSA may disenroll them and they will likely have to wait until the next Medicare

General Enrollment Period to reenroll, which may cause coverage gaps and late enrollment penalties.

50

Note that

going abroad for a longer period of time may also trigger questions about satisfying Medicaid residency requirements

and risk disenrollment from QMB or Medicaid and impact Part D or MA enrollment.

Case Example: Time abroad

Ms. Adebayo, originally from Nigeria, is a U.S. citizen with premium-free Medicare Part A and Part B coverage. She

rushed back to Nigeria after a niece died suddenly to care for her niece’s children. She now realizes that she needs to

stay an indenite time. ough she has the option of stopping her Part B premiums, she decides that she will let SSA

continue to deduct the premium from her monthly Social Security benet. She does not want to face late enrollment

penalties when she returns or have a gap in coverage while she waits for the General Enrollment Period to re-enroll.

Language Access and Medicare

Older immigrants with limited English prociency (LEP) need language assistance to understand their benets,

address their health care needs, and exercise their rights under Medicare.Federal laws, including the Health Care

Rights Law (Section 1557 of the Aordable Care Act) and Title VI of the Civil Rights Act of 1964, provide language

access rights to people with Medicare. ese laws and their implementing regulations also prohibit discrimination on

the basis of primary language or LEP and obligate the Medicare program, insurers, and providers to take reasonable

steps to provide meaningful access to each individual with LEP, including free and timely language assistance

services. Visit Justice in Aging’s Health Care Rights Law webpage to learn more.

51

e 1-800-Medicare help line provides free interpretation services in all languages. Call centers for Medicare Part D

plans and Medicare Advantage plans are required to do so as well. SSA provides free interpreter services for Medicare

and LIS enrollment.

52

e SSA website and Medicare and LIS applications are also available in Spanish.

53

CMS provides some Medicare resources in other languages. e Medicare consumer website, Medicare.gov, is

available in Spanish. e Medicare & You Handbook is also published and available online and to order in print in

Spanish, Chinese, Vietnamese and Korean.

54

CMS’s “Information in Other Languages” page lists all non-English

language forms andpublications available and is searchable by 27 languages.

55

JUSTICE IN AGING | ISSUE BRIEF | www.justiceinaging.org | 12

Advocacy Tip

Both 1-800-MEDICARE and all Medicare Advantage and Part D prescription drug plans offer interpreter

services in virtually all non-English languages. In most cases, there is a special prompt for Spanish. For

other languages, the best approach may be to say “agent” repeatedly until reaching a representative. After

reaching the representative, identifying the language needed, without additional explanation, should get

an interpreter on the line.

We know these systems don’t always work and can cause frustration. At the same time, use of interpreter

services and uptake of translated materials are well below what should be expected given the number of

Medicare enrollees with LEP. Advocates should encourage their clients with LEP to use available language

services when they have questions or when they are confused about mail regarding their Medicare

benets. If adequate language services are not provided or are delayed, contact Justice in Aging. We can

help hold Medicare and providers accountable.

CONCLUSION

Advocates can assist their older immigrant clients to navigate Medicare enrollment, costs, and language hurdles.

Justice in Aging is available to support advocates as they encounter Medicare issues for their immigrant clients.

Contact info@justiceinaging.org.

JUSTICE IN AGING | ISSUE BRIEF | www.justiceinaging.org | 13

ENDNOTES

1 Migration Policy Institute, State Immigration Data Proles, United States (2022); CMS Oce of Minority Health, Understanding

Communication and Language Needs of Medicare Beneciaries, at 8, 10 (Apr 2017).

2 For a description of the parts of Medicare and services covered, see CMS “Medicare & You” (2023).

3 CMS, 2024 Medicare Parts A & B Premiums and Deductibles (Oct. 12, 2023). e regulations regarding Part A entitlement are

found at 42 C.F.R. § 406.10. e POMS provisions concerning Part A entitlement are found at subchapter HI 00801. See also CMS,

Original Medicare (Part A and B) Eligibility and Enrollment.

4 CMS, 2024 Medicare Parts A & B Premiums and Deductibles.

5 42 C.F.R. § 406.12 (individuals who qualify for premium-free Part A based on disability determination by the Social Security

Administration) and 42 C.F.R. § 406.13 (individuals with End Stage Renal Disease (“ESRD”)). Note that SSA requires fewer work

credits for individuals under 65 who qualify for Medicare on the basis of disability, using a formula based on the applicant’s age when

becoming disabled. For a chart of credits needed based on age, see SSA, “How You Earn Credits”,p. 3 (2024).

6 CMS, What does Medicare cost?.

7 For a summary of late enrollment penalties see NCOA, Understanding Medicare's Late Enrollment Penalties (Oct. 2020).

8 CMS, What does Medicare cost?.

9 42 C.F.R. §§ 423.30.

10 e SSA POMS GN 00303.800 has created some confusion about whether this prohibition applies to undocumented persons with

ESRD. e POMS provision notes that there are no residency, citizenship or alien status requirements for Medicare entitlement

based on ESRD. Entitlement, however, must be distinguished from actual access to the benet. Pursuant to the Personal

Responsibility and Work Opportunity Reconciliation Act of 1996 (PRWORA), no Medicare payments can be made for an

undocumented beneciary. See SSA POMS RS 00204.010(B). us, as with other Medicare benets, ESRD-based Medicare is only

available to those non-citizens who are lawfully present.

11 CMS, Disenrollment for Individuals Who Are Not Lawfully Present in the United States (Nov. 2021).

12 42 C.F.R. § 406.20.

13 See CMS, When does Medicare coverage start? (explains the enrollment periods and coverage start dates).

14 For the denition of lawfully present for purposes of SSA benets as well as Medicare determinations, see 8 C.F.R. § 1.3 and SSA

POMS RS 00204.00.

15 42 U.S.C § 1395o; 42 C.F.R. § 406.10(a)(1).

16 42 U.S.C. § 1395o; 42 C.F.R §§406.10 and 407.10(a)(1).

17 For Part A, these requirements are found at 42 U.S.C. § 1395i-2(a)(3) and 42 C.F.R. § 406.20. e requirements for Part B are

found at 42 U.S.C. § 1395o(2) and 42 C.F.R § 407.10(a)(2).

18 SSA POMS GN 00303.800(B)(4).

19 Id.

20 Id. See also SSA POMS GN 00303.740 describing SSA procedures to determine residence.

21 Id.

22 SSA POMS HI 00801.008 - HI Entitlement for Aged Spouse of Age 62 Worker.

23 SSA POMS GN 00303.800(A)(2).

24 CMS, Medicare Advantage and Part D Enrollment and Disenrollment Guidance, at § 20.4 (updated Aug. 2024).

25 CMS, Medicare Managed Care Manual, Ch. 2, at § 50.2.7 (updated Aug. 15, 2023). CMS updated the Medicare Advantage and

Part D Enrollment and Disenrollment Guidance for plan year 2025 and this provision is now codied at § 60.2.6.

26 e National Council on Aging (NCOA) has a chart showing each state’s MSP eligibility limits: Medicare Savings Programs

Eligibility and Coverage (updated Feb. 27, 2024).

27 Id.

28 See CMS, “Eligibility for Non-Citizens in Medicaid and CHIP” (Nov. 2014).

29 National Health Law Program, Medicaid Coverage for Immigrants(May 17, 2021).

JUSTICE IN AGING | ISSUE BRIEF | www.justiceinaging.org | 14

30 Justice in Aging, e Five-Year Bar Prevents Older Immigrants from Accessing Programs that Help em Meet Basic Needs (Sept.

2021).

31 California Department of Health Care Services, ALL COUNTY WELFARE DIRECTORS 18-09, (May 2018), at p. 5.

32 California Welfare and Institutions Code § 14007.8(a)(2)(A).

33 NY State of Health, New Health Insurance Option for Undocumented Immigrants Age 65 and Over Fact Sheet (Dec. 18, 2023).

34 42 U.S.C. § 1396p(b)(1)(B)(ii); see Coordination of Benets and ird Party Liability (COB/TPL) In Medicaid: 2020, at 61, 80.

Note that § 1396p(b)(1)(B)(ii) also prohibits estate recovery for payment of Medicare cost-sharing for A&D enrollees as well.

35 ese states, called “Group Payer” states, are: AL, AZ, CA, CO, IL, KS, KY, MO, NE, NJ, NM, SC, UT, and VA. California is

converting to a Part A Buy-in state in 2025.

36 Justice in Aging, Medicare Part A Conditional Applications (updated Jan. 2023).

37 SSA POMS HI 00801.140.

38 See Healthcare.gov, Immigration status to qualify for the Marketplace. For additional detail, see NILC, “Lawfully Present”

Individuals Eligible under the Aordable Care Act (updated Oct. 2022).

39 Ctr. on Budget & Policy Priorities, “Key Facts: Immigrant Eligibility for Health Insurance Aordability Programs,” (updated June

2024).

40 See IRS, Eligibility for the Premium Tax Credit; HealthCare.gov, Medicare and the Marketplace: Can I choose Marketplace

coverage instead of Medicare?.

41 26 U.S.C. § 36B(c)(B). See also HealthCare.gov, Coverage for lawfully present immigrants.

42 For a primer of MAGI counting rules, see Nat’l Health Law Program, Advocate’s Guide to MAGI (updated 2018).

43 If they don’t enroll in either Part A or Part B, they would not face Part D late enrollment penalties. Late enrollment calculations are

only triggered after the individual becomes eligible for Part D. Part D requires either Part A or Part B coverage. See 42 C.F.R. §§

423.30, 423.38 and 423.46.

44 CMS created a Medicare-Medicaid Master FAQ that discusses the details of interaction between Medicare and Marketplace

coverage. Questions A.6, A.8 and A.9 may be especially helpful. Note that some of the information in the FAQ may be outdated.

45 Medicare.gov: Help with drug costs.

46 For details of eligibility and benet levels, see NCOA, Part D Low Income Subsidy/Extra Help Eligibility and Coverage Chart

(updated 2024).

47 See SSA, Apply for Medicare Part D Extra Help program. e LIS application can be completed in English or Spanish. SSA has

sample LIS applications and instructions for other languages.

48 Medicare.gov: Help with drug costs.

49 ere are minor exceptions for people in transit between the continental U.S. and Alaska and for emergency use of a hospital across

the border that is closer than the nearest U.S. facility. See Medicare.gov, Travel outside the U.S.

50 See Medicare Rights Medicare Interactive, Medicare coverage when living abroad.

51 Justice in Aging, e Health Care Rights Law.

52 SSA, How to request an Interpreter. SSA also provides some information about Medicare and instructions for the Part D LIS

application in other languages: Social Security Information in Other Languages.

53 SSA: Inscríbase en Medicare.

54 Medicare.gov: Medicare & You.

55 Medicare.gov: Publications in Other Languages.