2023

Budget

TAX MEASURES:

SUPPLEMENTARY

INFORMATION

©His Majesty the King in Right of Canada (2023)

All rights reserved

All requests for permission to reproduce this document

or any part thereof shall be addressed to the Department of Finance Canada.

This document is available at www.Canada.ca/Budget

Cette publication est aussi disponible en français.

F1-23/3E-PDF

Cat No.: 1719-7740

In case of discrepancy between the printed version and the electronic version,

the electronic version will prevail.

Foreword v

Deputy Prime Minister’s Foreword

Canada has made a remarkable recovery from the COVID recession.

The strongest economic growth in the G7 over the last year. 830,000 more

Canadians employed than before the pandemic. Near-record low

unemployment. A record 85.7 per cent labour force participation rate for

Canadian women in their prime working years, supported by our Canada-

wide system of aordable early learning and child care. Ination has fallen for

eight months in a row, and the Bank of Canada predicts that it will fall to just

2.6 per cent by the end of the year.

With these strong economic fundamentals, Budget 2023 comes at an important

moment for our country—and at an important moment for the world.

In the near-term, we must contend with a slowing global economy, elevated

interest rates around the world, and ination that is still too high.

In the months and years to come, we must seize the remarkable opportunities

for Canada that are presented by two fundamental shifts in the global economy:

the race to build the clean economies of the 21

st

century, and our allies’

accelerating eorts to friendshore their economies by building their critical

supply chains through democracies like our own.

Budget 2023 is a direct response to these essential challenges, and it delivers:

1. New, targeted ination relief for the Canadians who need it most.

2. Stronger public health care, including dental care for millions of Canadians.

3. Signicant investments to build Canada’s clean economy, create good

middle class careers, and help usher in a new era of economic prosperity for

Canadians.

4. A responsible scal plan that will see Canada maintain the lowest decit and

the lowest net debt-to-GDP ratio in the G7.

I am proud to introduce Budget 2023: our plan to build a stronger, more

sustainable, and more secure Canadian economy—for everyone.

We have the remarkable good fortune to live in the greatest country in the world.

Canada is lled with people who can do big things, and I have never been more

optimistic about the future of our country than I am today.

At a challenging time in a challenging world, there is no better place to be

than Canada.

The Honourable Chrystia Freeland, P.C., M.P.

Deputy Prime Minister and Minister of Finance

Table of Contents

Deputy Prime Minister’s Foreword ................................................................v

Economic Overview .........................................................................................3

1. Recent Economic Developments.....................................................................................5

Canada’s Recovery Has Created the Strongest Job Market in Decades ......5

Ination Is Coming Down but Remains a Challenge for Canadians .............. 8

The Canadian Economy Has Been Resilient, but Canadian and

Global Growth Is Slowing ............................................................................................ 10

2. Canadian Economic Outlook ......................................................................................... 12

Private Sector Economists Expect a Shallow Recession ................................... 12

Budget 2023 Economic Scenario Analysis ............................................................ 14

3. Canada’s Place in a Changing Global Economy .................................................... 16

Moving to Net-Zero ..................................................................................................... 16

Reducing Supply Chain Vulnerabilities ................................................................. 17

Transforming Challenges into Opportunities ...................................................... 18

4. Investing Responsibly in Canada’s Future ................................................................ 19

A Responsible Fiscal Plan in Challenging Times ................................................. 22

International Comparisons ........................................................................................ 24

Preserving Canada’s Fiscal Advantage: Maintaining our Fiscal Anchor ... 25

Chapter 1: Making Life More Aordable and Supporting the Middle Class .. 29

1.1 Making Life More Aordable ..................................................................................... 32

A New Grocery Rebate for Canadians .................................................................... 34

Cracking Down on Junk Fees ..................................................................................... 35

Cracking Down on Predatory Lending ................................................................... 36

Lowering Credit Card Transaction Fees for Small Businesses........................ 36

Supporting Your Right to Repair .............................................................................. 37

Common Chargers for Your Devices ....................................................................... 38

Automatic Tax Filing ...................................................................................................... 38

Making Life More Aordable for Students ......................................................... 39

Improving Registered Education Savings Plans ................................................ 40

Supporting Our Seniors ............................................................................................... 41

1.2 An Aordable Place to Call Home ............................................................................ 42

Launching the New Tax-Free First Home Savings Account ........................... 44

A Code of Conduct to Protect Canadians With Existing Mortgages ......... 44

Building More Aordable Housing..........................................................................45

Investing in an Urban, Rural, and Northern Indigenous Housing Strategy 46

Chapter 2: Investing in Public Health Care and Aordable Dental Care ... 51

2.1 Investing in Public Health Care .................................................................................. 52

Working Together to Improve Health Care for Canadians ............................. 54

Health Care Results and Accountability ................................................................. 56

Investing in Better Health Care Data....................................................................... 56

Encouraging More Doctors and Nurses to Practise in Rural and

Remote Communities .................................................................................................. 57

Strengthening Retirement Saving for Personal Support Workers .............. 57

Fighting Crime and Saving Lives: Combatting the Opioid Crisis ................. 58

Implementing the 988 Suicide Prevention Line ................................................ 60

Building the Shepody Healing Centre .................................................................... 60

Safeguarding Access to Abortion and Other Sexual and

Reproductive Health Care Services ......................................................................... 60

Improving Canada’s Readiness for Health Emergencies ................................. 61

2.2 Dental Care for Canadians ........................................................................................... 61

The New Canadian Dental Care Plan ...................................................................... 62

Expanding Access to Dental Care ........................................................................... 62

Investing in Better Dental Care Data ..................................................................... 62

Chapter 3: Made-In-Canada Plan: Aordable Energy, Good Jobs,

and a Growing Clean Economy ........................................................................ 67

A Strong Foundation ............................................................................................................. 69

A Safe, Smart, and Competitive Place to Do Business.............................................. 69

The Opportunities Ahead .................................................................................................... 70

The Challenges We Face ....................................................................................................... 71

A Made-In-Canada Plan: Aordable Energy, Good Jobs, and

a Growing Clean Economy .................................................................................................. 73

3.1 Investing in Clean Electricity ...................................................................................... 76

An Investment Tax Credit for Clean Electricity .................................................... 79

A Clean Electricity Focus for the Canada Infrastructure Bank ....................... 80

Supporting Clean Electricity Projects ...................................................................... 81

The Atlantic Loop ............................................................................................................ 81

3.2 A Growing, Clean Economy ......................................................................................... 82

An Investment Tax Credit for Clean Technology Manufacturing.................. 83

Securing Major Battery Manufacturing in Canada ............................................ 84

Delivering the Canada Growth Fund ....................................................................... 85

An Investment Tax Credit for Clean Hydrogen .................................................... 88

Growing Canada’s Biofuels Sector ........................................................................... 89

Enhancing the Reduced Tax Rates for Zero-Emission Technology

Manufacturers ..................................................................................................................90

Supporting Clean Technology Projects .................................................................. 90

Expanding Eligibility for the Clean Technology Investment Tax Credit ...... 91

Getting Major Projects Done ....................................................................................................92

Enhancing the Carbon Capture, Utilization, and Storage Investment

Tax Credit ...........................................................................................................................93

3.3 Investing in Canadian Workers ................................................................................. 94

Fair Pay for Workers Who Build the Clean Economy ....................................... 96

Ensuring Fairness for Canadian Workers with Federal Reciprocal

Procurement .....................................................................................................................96

Doubling the Tradespeople’s Tool Deduction .................................................... 97

Supporting Employee Ownership Trusts .............................................................. 99

Investing in Canada’s Labour Market Transfer Agreements ......................... 99

Continuing to Support Seasonal EI Claimants ................................................... 99

Protecting Federally Regulated Gig Workers ...................................................100

Protecting Jobs with Timely Access to Work-Sharing Agreements ......... 100

Continuing Support for the Student Work Placement Program ...............101

Prohibiting the Use of Replacement Workers ...................................................101

3.4 Reliable Transportation and Resilient Infrastructure ........................................101

Strengthening Canada’s Trade Corridors ............................................................102

Delivering Canada’s Infrastructure Funding .....................................................104

Supporting Resilient Infrastructure Through Innovation ..............................106

Investing in VIA Rail Trains and Services ............................................................106

Investing in the Canadian Coast Guard ...............................................................106

Safe and Reliable Ferry Services in Eastern Canada ........................................107

Redeveloping the Bonaventure Expressway and Supporting

Transportation Infrastructure in Montreal .........................................................107

Delivering the Lac-Mégantic Rail Bypass Project .............................................108

3.5 Investing in Tomorrow’s Technology ......................................................................108

Review of the Scientic Research and Experimental Development

Tax Incentive Program.................................................................................................109

Using College Research to Help Businesses Grow .........................................111

Supporting Canadian Leadership in Space .........................................................111

Investing in Canada’s Forest Economy ...............................................................112

Establishing the Dairy Innovation and Investment Fund .............................112

Supporting Farmers for Diversifying Away from Russian Fertilizers .........113

Providing Interest Relief for Agricultural Producers ......................................113

Maintaining Livestock Sector Exports with a Foot-and-Mouth Disease

Vaccine Bank ..................................................................................................................113

Chapter 4: Advancing Reconciliation and Building a Canada

That Works for Everyone ............................................................................ 121

Key Ongoing Actions ........................................................................................................... 121

Investments in Indigenous Priorities .............................................................................122

4.1 Self-Determination and Prosperity for Indigenous Peoples .........................125

Supporting Indigenous Governance, Capacity, and Participation

in Decision-Making ......................................................................................................125

Building an Economy That Works for Indigenous Peoples .........................127

4.2 Investing in Indigenous Communities ..................................................................129

Supporting Indigenous Health Priorities ............................................................129

Supporting Safe and Aordable Housing in Indigenous Communities..130

Implementing the National Action Plan to End the Tragedy of Missing

and Murdered Indigenous Women and Girls .................................................... 130

Supporting First Nations Children .........................................................................131

Gottfriedson Band Class Settlement Agreement ............................................132

4.3 Clean Air and Clean Water .........................................................................................132

Protecting Our Freshwater ........................................................................................134

Protecting Canada’s Whales ..................................................................................... 135

Cleaner and Healthier Ports ...................................................................................... 135

Protecting Species at Risk ........................................................................................135

Supporting Natural Disaster Resilience................................................................136

4.4 Stronger and More Inclusive Communities ........................................................137

Supporting Our Ocial Languages ......................................................................137

Investing in Employment Assistance Services for Ocial Language

Minority Communities ............................................................................................... 139

Supporting the Canadian Screen Sector ............................................................140

Supporting the Growth of Canada’s Tourism Sector ..................................... 140

Fighting Systemic Racism, Discrimination, and Hate ...................................... 141

Supporting Black Canadian Communities .........................................................142

Supporting a More Equitable, Diverse, and Inclusive Public Service ......143

Advancing Public Safety Research ........................................................................ 143

Addressing Wrongful Convictions .........................................................................144

Advancing Gender Equality in Canada ................................................................. 144

A Safe and Accountable Sport System ................................................................144

Helping Canadians Stay Active ..............................................................................145

Local Food Infrastructure Fund Top-Up ..............................................................145

Making Life More Aordable for Persons With Disabilities ........................145

Advancing Inclusion of Canadians with Disabilities ....................................... 146

Building Communities Through Arts and Heritage ......................................... 148

Creating a New Leave for Pregnancy Loss ........................................................148

Improving Access to Leave Related to the Death or Disappearance

of a Child .........................................................................................................................148

4.5 A Stronger Immigration System .............................................................................149

Safe and Ecient Citizenship Applications .......................................................149

Supporting Travel to Canada ..................................................................................150

Supporting Legal Aid for Asylum Seekers .........................................................150

Chapter 5: Canada’s Leadership in the World .......................................... 161

Key Ongoing Actions ........................................................................................................... 162

5.1 Defending Canada .........................................................................................................162

Defence Policy Update ...............................................................................................163

Establishing the NATO Climate Change and Security Centre of Excellence

in Montreal ...................................................................................................................... 164

Securing Our Economy ............................................................................................... 165

Protecting Diaspora Communities and All Canadians From

Foreign Interference, Threats, and Covert Activities .......................................165

5.2 Supporting Ukraine ....................................................................................................... 166

Financial Assistance to Ukraine in 2023 ............................................................... 168

Bolstering the Defence of Ukraine ........................................................................168

Humanitarian, Development, and Security and Stabilization Assistance

for Ukraine ....................................................................................................................... 169

A Safe Haven for Ukrainians ..................................................................................... 169

Indenite Withdrawal of Most-Favoured-Nation Status From Russia

and Belarus ...................................................................................................................... 169

5.3 Standing Up for Canadian Values ............................................................................170

Supporting the Economic Growth of Developing Countries ....................... 170

Eradicating Forced Labour from Canadian Supply Chains ...........................171

5.4 Combatting Financial Crime ......................................................................................171

Combatting Money Laundering and Terrorist Financing ..............................172

Strengthening Eorts Against Money Laundering and Terrorist Financing ....173

Implementing a Publicly Accessible Federal Benecial

Ownership Registry ...................................................................................................... 173

Modernizing Financial Sector Oversight to Address Emerging Risks ......174

Canada Financial Crimes Agency ............................................................................175

Protecting Canadians from the Risks of Crypto-Assets ................................175

Chapter 6: Eective Government and a Fair Tax System ........................ 181

Key Ongoing Actions ........................................................................................................... 182

6.1 Eective Government ................................................................................................... 183

Refocusing Government Spending to Deliver for Canadians ....................183

Realigning Previously Announced Spending ..................................................... 184

Eective Government Programs .............................................................................184

6.2 Improving Services for Canadians ........................................................................... 185

Protecting Passenger Rights .....................................................................................185

Improving Airport Operations and Passenger Screening ............................ 186

Faster Passport Processing and Improved Immigration Services ............. 186

Faster Services for Veterans ......................................................................................187

Improving Canada.ca and 1 800 O-Canada .......................................................187

Old Age Security IT Modernization .......................................................................187

Ensuring the Integrity of Emergency COVID19 Benets ..............................188

Renewing Equalization and Territorial Formula Financing ..........................188

6.3. A Fair Tax System ...........................................................................................................188

Ensuring the Wealthiest Canadians Pay Their Fair Share .............................188

International Tax Reform ...........................................................................................189

A Tax on Share Buybacks ...........................................................................................190

Fair Taxation of Dividends Received by Financial Institutions .................... 191

Strengthening the General Anti-Avoidance Rule ............................................ 191

Annex 1: Details of Economic and Fiscal Projections .............................. 197

Annex 2 : Debt Management Strategy ..................................................... 237

Annex 3: Legislative Measures................................................................... 247

2023

Budget

TAX MEASURES:

SUPPLEMENTARY

INFORMATION

Economic Overview

1. Recent Economic Developments.....................................................................................5

Canada’s Recovery Has Created the Strongest Job Market in Decades ......5

Ination Is Coming Down but Remains a Challenge for Canadians .............. 8

The Canadian Economy Has Been Resilient, but Canadian and Global

Growth Is Slowing...........................................................................................................10

2. Canadian Economic Outlook ......................................................................................... 12

Private Sector Economists Expect a Shallow Recession ................................... 12

Budget 2023 Economic Scenario Analysis ............................................................ 14

3. Canada’s Place in a Changing Global Economy .................................................... 16

Moving to Net-Zero ..................................................................................................... 16

Reducing Supply Chain Vulnerabilities ................................................................. 17

Transforming Challenges into Opportunities ...................................................... 18

4. Investing Responsibly in Canada’s Future ................................................................ 19

A Responsible Fiscal Plan in Challenging Times ................................................. 22

International Comparisons ........................................................................................ 24

Preserving Canada’s Fiscal Advantage: Maintaining our Fiscal Anchor ... 25

Economic Overview 3

Economic Overview

In many ways, the Canadian economy is doing well. Our unemployment rate is

near its record low, 830,000 more Canadians are employed compared to when

COVID-19 rst hit, and Canada’s economic growth was the strongest in the G7

over the last year.

At the same time, many Canadians are faced with real aordability challenges,

and are feeling the eects of higher grocery prices and housing costs. While

ination has fallen in Canada for eight straight months, it remains elevated—

both in Canada and around the world. For many advanced economies, interest

rates have risen to their highest levels in more than 15 years. This is resulting

in slowing economic growth, both in Canada and around the world. The rapid

rise in interest rates has also led to turmoil in some parts of the global banking

system and volatility in global nancial markets, highlighting the considerable

uncertainty about how economic conditions will evolve going forward.

Canada is well positioned to navigate these turbulent times. Our economy

entered 2023 on a better footing than most of our peers, and with strong

economic fundamentals, including robust population growth, a strong labour

market, and a well-regulated and well-capitalized nancial system, Canada will

be able to weather a global economic slowdown.

Canada’s strength and resilience in the face of global economic challenges has

been underpinned by steps the government has taken since 2015 to support

Canadians and build an economy that creates good jobs and opportunities:

Jobs

By helping workers acquire the skills they need, and helping our lowest-paid—

and often most essential—workers and their families achieve a good standard

of living.

People

By investing in our public health care system, making childcare more aordable,

and reinforcing Canada’s social safety net, including enhancing supports

for children and seniors.

Communities

By investing in infrastructure, more aordable housing, public transit,

and broadband.

Growth

By investing in infrastructure, supporting investment in Canada’s clean economy,

and helping Canadian businesses grow and create jobs.

4 Overview

Since 2015, close to 2.7 million fewer Canadians are living in poverty, income

inequality has continued to fall, the labour force participation rate for women

aged 15 to 64 years is at record highs, and young Canadians have access to

a greater number of good-paying jobs than before the pandemic. Signicant

investments in infrastructure and in the capacity of the Canadian economy will

continue to benet Canadians for decades.

A More Inclusive Economy: Progress Since 2015

2.7 million fewer Canadians are living in poverty, a 56 per cent decrease;

Income inequality has declined by 11 per cent;

The gender wage gap is getting smaller, having decreased by 12 per cent;

Women are closing the labour force participation gap, which has

decreased by 28 per cent; and,

More young people have good jobs, with the youth unemployment

rate down by 22 per cent.

In the face of a rapidly changing global economic landscape, there is more work

to be done to build a more sustainable and prosperous future for Canadians.

In the years to come, Canada will contend with two intertwined global

economic shifts: rst, the accelerating global race to build net-zero economies

and the industries of tomorrow; and second, a realignment of global trade

patterns as democracies move to friendshore their economies by limiting their

strategic economic dependence on countries like Russia and China.

While these two global shifts represent signicant economic opportunities for

Canadian workers and businesses, signicant investment will be required to

capitalize on them, from both the private and the public sectors. To support this,

Budget 2023 takes substantial action to mobilize private investment in building

Canada’s clean economy. The goal of these investments is to grow Canada’s

economic capacity in the industries of the future, create good careers, and usher

in a new generation of prosperity for all Canadians, while simultaneously reducing

Canada’s emissions and strengthening our essential trading relationships.

Moreover, at a time of elevated global ination, investing in Canada’s long-term

prosperity must be balanced with the need to avoid exacerbating ination.

Against this backdrop, the government is taking a responsible, balanced

approach to scal management: supporting the most vulnerable Canadians,

strengthening our public health system, and investing in Canada’s future

prosperity while preserving Canada’s long-term scal sustainability. Canada’s

enviable scal position—the lowest net debt and decit as a share of gross

domestic product (GDP) in the G7—means we can aord to make these

essential investments. Over time, the growing returns of these essential

investments will further enhance Canada’s economic prospects.

Economic Overview 5

1. Recent Economic Developments

Canada’s Recovery Has Created the Strongest Job

Market in Decades

Canada’s economy is now 103 per cent the size it was before the pandemic,

marking the fastest recovery of the last four recessions, and the second strongest

recovery in the G7 (Chart 1). Throughout 2022, our economy demonstrated

sustained strength, with Canada posting the fastest growth in the G7 over the past

year (Chart 2). Resilient household and business nances and strong population

growth, supported by the government’s COVID-19 Economic Response Plan and

Immigration Levels Plan, underpinned this strong economic performance.

Chart 1

Real GDP Recovery From the

Pandemic in G7 Economies

Chart 2

Real GDP Growth in G7 Economies,

2021Q4 to 2022Q4

75

80

85

90

95

100

105

2019

Q4

2020

Q2

2020

Q4

2021

Q2

2021

Q4

2022

Q2

2022

Q4

Range of Other G7

Canada

index, 2019Q4 = 100

0.0 0.5 1.0 1.5 2.0 2.5

U.K.

Japan

France

U.S.

Germany

Italy

Canada

per cent

Note: Last data point is 2022Q4.

Sources: Statistics Canada; Haver Analytics.

Note: The growth rate shown is the percentage change in

real GDP from 2021Q4 to 2022Q4.

Sources: Statistics Canada; Haver Analytics.

Canada’s strong recovery has supported the strongest labour market in several

decades. About 830,000 more Canadians are employed compared to the pre-

pandemic period, and at just 5 per cent, the unemployment rate is near its

record low of 4.9 per cent (Chart 3).

6 Overview

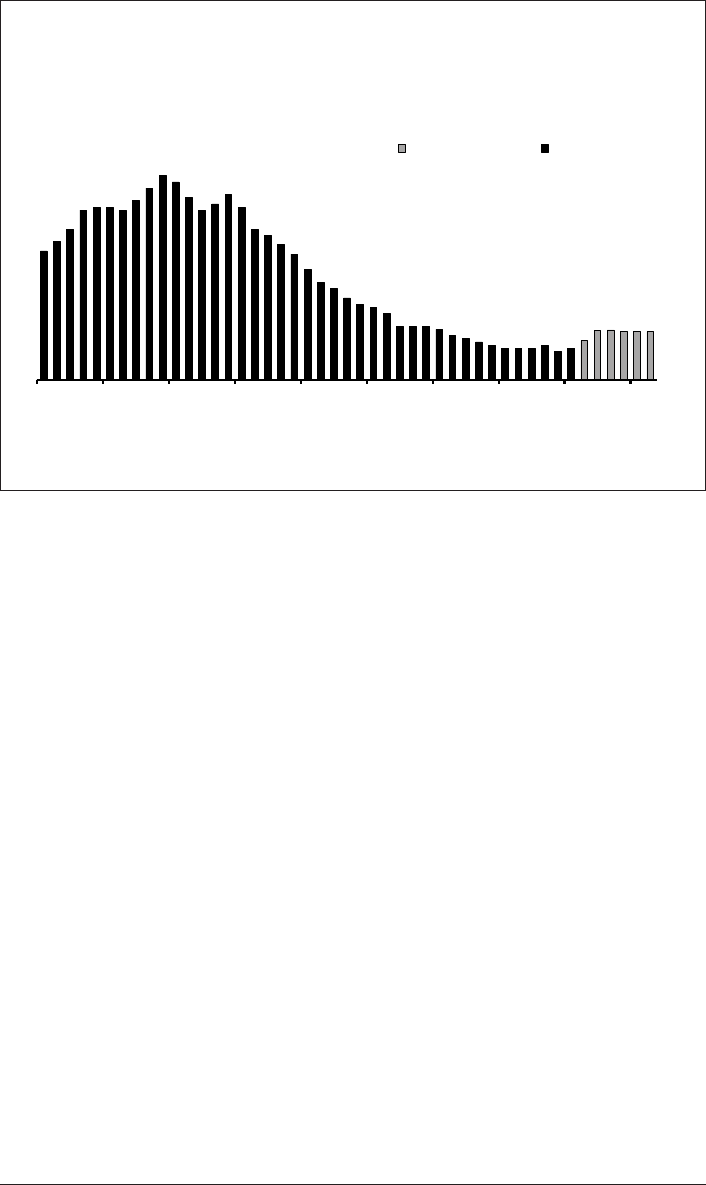

Chart 3

Unemployment Rate

Current Rate (5.0%)

4

6

8

10

12

14

1976 1981 1986 1991 1996 2001 2006 2011 2016 2021

per cent

Recessions

Note: Last data point is February 2023.

Source: Statistics Canada.

The benets of this strong labour market are being widely shared among

Canadians. More people aged 15 to 64 years are engaged in the labour market

than ever before, with meaningful increases for historically under-represented

groups, including women, newcomers, and young Canadians. Today, more

Canadians have good middle class jobs than before the pandemic, with many also

benetting from stronger wage growth, particularly among lower-wage workers.

A Growing Workforce Benets All Canadians

A strong and inclusive labour market has been a key driver of Canada’s economic

resilience over the past year.

Canada’s job gains compared to when COVID-19 rst hit have outperformed almost

all of our G7 peers, supported by a rapidly expanding workforce (Chart 4). Notably,

the government’s historic investment in early learning and child care is helping

more women fully participate in the workforce. The labour force participation rate

for women aged 25 to 54 years has reached a record high of nearly 86 per cent,

compared to just 77 per cent in the U.S. At the same time, a record high of 80

per cent of Canadians aged 15 to 64 years are now participating in the workforce,

reecting broad-based gains in employment opportunities across demographic

groups (Chart 5). Making full use of the skills and talents of Canadians is a key driver

of a stronger economy, helps to address labour market shortages, and increases the

rate at which the economy can grow without generating inationary pressures.

Immigration is a signicant driver of economic growth and helps to build a

stronger economy for everyone. Canada continues to post the fastest population

growth in the G7, with strong immigration levels pushing population growth to

its fastest pace since the 1950s (Chart 6).

Economic Overview 7

A Growing Workforce Benets All Canadians

Together, higher immigration and higher labour force participation are

expanding the pool of available workers, and osetting population aging more

than in other G7 economies. The resulting boost to employment has helped

maintain real household disposable income per capita, even as it declined in

peer economies (Chart 7). This is expected to continue to support the Canadian

economy throughout 2023.

Chart 4

Employment Recovery From the

Pandemic in G7 Economies

Chart 5

Change in Employment Rates From

the Pre-Pandemic Period

-1 0 1 2 3 4 5

U.K.

Japan

Italy

U.S.

Germany

Canada

France

change from pre-pandemic peak, per cent

0 2 4 6 8

Youth

All Canadians

Women

Women, youngest

child under 6

Off-reserve Indigenous

Recent Immigrants

change from 2019 to 2022, percentage points

Note: Last data points: February 2023 (Canada, U.S.),

January 2023 (Germany, Italy, Japan), December 2022

(U.K.), and 2022Q4 (France).

Source: Haver Analytics.

Note: The age of each group is 25 to 54 years, except

youth which is 15 to 24 years.

Source: Statistics Canada.

Chart 6

Population Growth in Selected

Economies

Chart 7

Real Household Disposable Income

Per Capita in G7 Economies

-0.5

0.0

0.5

1.0

1.5

2.0

2000 2004 2008 2012 2016 2020

United States

European Union

Canada

per cent

Note: Last data point is 2022.

Sources: Statistics Canada, Haver Analytics.

Note: Japan is not included. Last data point is 2022Q3.

Source: Organisation for Economic Co-operation and

Development (OECD).

95

100

105

110

115

120

2019

Q4

2020

Q2

2020

Q4

2021

Q2

2021

Q4

2022

Q2

Range of Other G7

Canada

index, 2019Q4 = 100

8 Overview

With strong labour markets supporting household income, Canadians have

also built up signicant savings since the beginning of the pandemic (Chart 8).

Notably, many people have continued to add to their pool of savings despite

the elevated cost of living (Chart 9).

Chart 8

Change in Household Gross Savings

Rates in G7 Economies

Chart 9

Household Savings Rate and Build-

Up in Deposits

- 10

- 5

0

5

10

15

20

25

2019

Q4

2020

Q2

2020

Q4

2021

Q2

2021

Q4

2022

Q2

Range of Other G7

Canada

change from 2019Q4, percentage points

0

50

100

150

200

0

10

20

30

40

2019

Q4

2020

Q2

2020

Q4

2021

Q2

2021

Q4

2022

Q2

2022

Q4

Built-Up Deposits (right axis)

Savings Rate (left axis)

per cent

$billions (annualized

)

Note: Japan is not included. Last data point is 2022Q3.

Source: Organisation for Economic Co-operation and

Development (OECD).

Note: Built-up deposits are calculated as actual relative to

pre-pandemic trend.

Sources: Statistics Canada; Department of Finance Canada

calculations.

A strong economic recovery has also resulted in labour shortages, as evidenced

by Canada’s near record-low unemployment rate combined with many unlled

job openings. These ongoing labour shortages are a challenge for many

employers. Many businesses continue to face diculties hiring workers, with

the number of vacant job positions for every unemployed person currently

about 75 per cent above the pre-pandemic norm. Canada’s immigration system

will continue to play an important role in helping our businesses grow.

Ination Is Coming Down but Remains a Challenge

for Canadians

As the global economy recovered from the pandemic, ination emerged as a

major global economic challenge. Ination was already rising when Russia’s full-

scale illegal invasion of Ukraine drove up commodity prices, pushing consumer

price ination globally to multi-decade highs (Chart 10). In Canada, consumer

price ination reached a peak of 8.1 per cent in June 2022, putting pressure on

many household budgets.

In addition to the eect on commodity prices of Russia’s full-scale invasion,

rising global ination was driven by supply-chain disruptions, strong

consumption of goods, and rebounding global demand. A shortage of workers

combined with higher demand for services have also contributed to upward

pressure on services prices in many countries.

Economic Overview 9

Chart 10

Consumer Price Ination in G7

Economies

Chart 11

Change in Consumer Price Ination

Since the Peak of June 2022 for

Selected Items in Canada

0

2

4

6

8

10

12

14

year-over-year, per cent

Latest Most recent peak

-39.4

-19.9

-2.9

-1.2

0.1

0.1

1.1

-20 -15 -10 -5 0 5

Energy

Child care services

All-items

Goods, excluding groceries and

energy

Services, excluding shelter

services

Shelter services

Groceries

change in inflation rate from June 2022, percentage points

-50

-30

Note: Last data point is February 2023, except for Japan

which is January 2023. Canadian CPI ination peaked at 8.1

per cent in June 2022.

Sources: Statistics Canada; Haver Analytics.

Note: Last data point is February 2023.

Sources: Statistics Canada; Department of Finance Canada

calculations.

In recent months, some of these pressures have started to ease, with

commodity prices falling, supply-chain bottlenecks easing, and the demand for

goods normalizing (Chart 11). At 5.2 per cent in February, Canadian consumer

price ination has fallen meaningfully since its June 2022 peak and is below the

rates seen in many peer economies. Services price ination in Canada—a gauge

of underlying inationary pressures—has also plateaued in recent months, while

it has continued to rise in some other countries.

Ination is still too high. To bring ination down, central banks around the

world have sharply raised interest rates in what has been one of the fastest and

most synchronised monetary policy tightening cycles since the 1980s. As the

government continues to make targeted investments to support Canadians and

grow the Canadian economy, it is important that governments remain mindful

of not fuelling ination. Measures in Budget 2023 to provide ination relief to

the most vulnerable are thus carefully targeted, while investments in jobs and

economic growth will play a meaningful role in Canada’s continued prosperity.

Continued progress on reducing ination will be needed over the coming year

to ensure that this period of elevated ination is only temporary. As a result,

there remains uncertainty about how long interest rates around the world will

need to remain elevated.

10 Overview

The Canadian Economy Has Been Resilient,

but Canadian and Global Growth Is Slowing

While the Canadian economy has remained solid, higher interest rates are

beginning to work their way through both the global and Canadian economies.

This is resulting in weaker economic activity.

After growth of around 3 per cent annualized over the rst three quarters of

2022, economic activity in Canada was unchanged in the nal quarter. Despite

slowing economic growth, nal domestic demand—a measure of underlying

economic strength—has shown resilience, and data so far suggest modest

growth in the rst quarter of 2023. So far, the consequences of moderating

growth have been concentrated in housing markets, with higher mortgage rates

pushing resales down 40 per cent, and prices down 16 per cent from their peaks

in February 2022 (Chart 12). New construction is also slowing.

Ination, elevated interest rates, and the higher costs, driven by global factors

such as Russia’s illegal invasion of Ukraine, are also creating aordability

pressures for many Canadians. This is reected in lower consumer condence

(Chart 13).

While business activity is at a healthy level and most businesses continue to

report strong sales, many are also under nancial pressure as the signicant rise

in interest rates boosts borrowing costs. A growing proportion of businesses

expect activity to weaken in the coming year as the lagged impact of higher

interest rates continues to feed into weaker consumer spending. As a result,

many businesses have started to dial back their investment plans in recent

months.

Chart 12

Home Sales, House Prices and

Housing Starts, Canada

Chart 13

Measures of Consumer and Business

Condence, Canada

25

50

75

100

125

150

Jan

2020

Jul

2020

Jan

2021

Jul

2021

Jan

2022

Jul

2022

Jan

2023

Home Sales

Housing Starts (6-month moving average)

House Prices

index, 100 = 2019 average

Index of Consumer

Confidence (left axis)

Business Barometer, 12-month

index (right axis)

30

40

50

60

70

80

25

50

75

100

125

150

2007 2009 2011 2013 2015 2017 2019 2021 2023

index, 100 = 2014 index, >50 = stronger

Note: Last data point is February 2023.

Sources: Canadian Real Estate Association; Canada

Mortgage and Housing Corporation; Haver Analytics.

Note: Last data point is February 2023.

Sources: Conference Board of Canada; Canadian Federation

of Independent Business.

Economic Overview 11

Outside of Canada, the rapid tightening in monetary policy has revealed

pockets of vulnerabilities in the global banking system. Since March 8, three

medium-sized regional U.S. banks—Silicon Valley Bank, Signature Bank, and

Silvergate Bank—have failed. In Europe, one large and systemically important

bank, Credit Suisse, was also nearing failure before UBS agreed to acquire it.

While the global banking system remains well capitalized, uncertainty over the

extent and magnitude of additional credit-related losses that could accrue as

economies slow remains elevated. In response, nancial authorities have taken

a series of steps to stabilize the nancial system, maintain condence in the

banking system, and limit further negative feedback into the global economy.

These events sent tremors across global markets, which saw an abrupt rise in

risk aversion, a sudden tightening in global nancial conditions, and a sharp

decline in global crude oil prices (Chart 14). While the responses by U.S. and

Swiss authorities have calmed markets, uncertainty remains, and a handful

of smaller U.S. banks are under review for potential downgrades. On March

19, ve central banks, including the Federal Reserve and the Bank of Canada,

announced coordinated action to enhance the provision of liquidity in the

nancial system to ease strains in global funding markets.

Globally, most central banks are set to maintain their policy rates at elevated

levels or raise them further, with some continuing to shrink their balance sheets.

This could keep broad liquidity conditions tighter than they have been in recent

years. While the ramications of banking sector stresses for the global economy

are not yet clear, were the crisis to broaden, it could result in higher funding

costs, restricted credit, and the amplication of the global economic slowdown.

These developments also complicate the ght against global ination, and

markets now expect some pullback in policy rates as early as the second half

of the year (Chart 15), suggesting the perceived likelihood of a soft landing

has decreased.

The Canadian nancial system is well-equipped to cope with the challenging

global nancial situation, and the Canadian banking sector is well-known for

its stability and resilience, having fared better than many peers through the

global nancial crisis in 2008. Despite the healthy position of Canadian nancial

institutions, intensication of global nancial stresses could have negative

eects on the Canadian economy through tighter nancial conditions and lower

global economic activity.

12 Overview

Chart 14

Expected Future WTI Crude Oil Prices

Chart 15

Canada and United States Policy Rate

Expectations

Futures as of

Feb 15, 2023

Futures as of

Mar 20, 2023

0

20

40

60

80

100

120

2019 2020 2021 2022 2023 2024 2025

$US per barrel

United

States

Canada

0

1

2

3

4

5

6

2017 2019 2021 2023 2025

per cent

Forecast (market

expectations

as of Mar 22)

Note: Last data point is March 2025.

Sources: Bloomberg; Haver Analytics.

Note: Last data point is December 2024. Futures

pricing converted into market-based odds of future

announcements of the target interest rate.

Sources: Bloomberg; Haver Analytics.

2. Canadian Economic Outlook

Private Sector Economists Expect a Shallow Recession

The Department of Finance surveyed a group of private sector economists in

February 2023. The average of private sector forecasts has been used as the

basis for economic and scal planning since 1994, helping to ensure objectivity

and transparency, and introducing an element of independence into the

government’s economic and scal forecast.

With higher interest rates, as well as slower economic growth in the U.S. and

around the world, private sector economists expect Canada’s economy to slow

more than was projected in the 2022 Fall Economic Statement (Chart 16). Private

sector economists expect the Canadian economy to enter a shallow recession

in 2023. With a peak-to-trough decline of just 0.4 per cent, the contraction in

real GDP is signicantly smaller than during the 2008-09 recession (-4.4 per

cent) and is less severe than the 1.6 per cent decline considered in the 2022 Fall

Economic Statement downside scenario.

On an annual basis, real GDP growth is projected to decelerate from a strong

3.4 per cent in 2022 (slightly better than the 3.2 per cent projected in the 2022

Fall Economic Statement) to 0.3 per cent in 2023, before rebounding to 1.5 per

cent in 2024 (previously 0.7 per cent and 1.9 per cent, respectively).

As the economy slows, Canada’s near record-low unemployment rate is

expected to rise to a peak of 6.3 per cent by the end of 2023. However, driven

by Canada’s strong labour market, unemployment is expected to remain low by

historical standards, and far below the peaks of past recessions (Chart 17).

Economic Overview 13

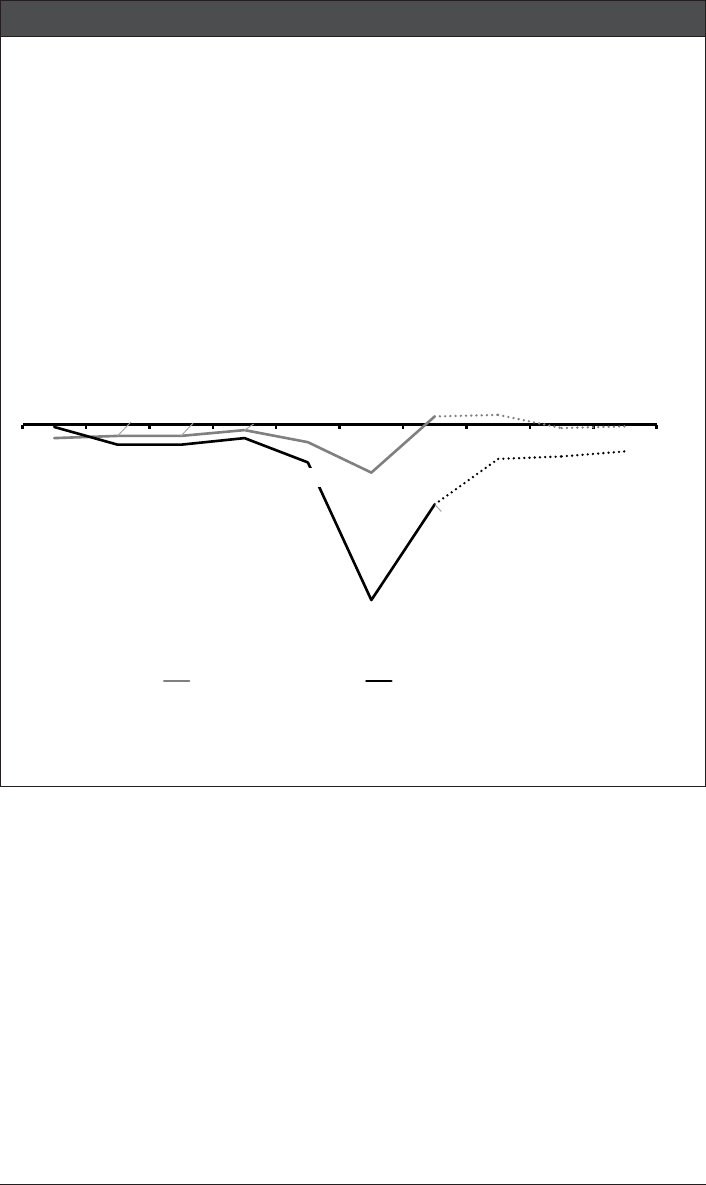

Chart 16

Real GDP Growth Projections

Chart 17

Peak Unemployment Rates in Past

Recessions

Actual

(0.0)

Actual

-1

0

1

2

3

4

2022

Q4

2023

Q1

2023

Q2

2023

Q3

2023

Q4

2022 2023 2024

February 2023 Survey

FES 2022 (September

2022 Survey)

per cent, period-to-period at annual rates

Quarterly

Annual

13.0

11.7

8.7

13.4

6.3

0

2

4

6

8

10

12

14

16

1982

Q4

1992

Q4

2009

Q3

2020

Q2

2023

Q4

per cent

Current Rate

(5.0%)

Sources: Statistics Canada; Department of Finance Canada

September 2022 and February 2023 surveys of private

sector economists.

Sources: Statistics Canada; Department of Finance Canada

February 2023 survey of private sector economists.

Private sector economists expect Consumer Price Index (CPI) ination to continue

to ease. Ination is expected to fall below 3 per cent in the third quarter of 2023

and to reach about 2 per cent, the Bank of Canada’s target, in the second quarter

of 2024, little changed from 2022 Fall Economic Statement projections.

After surging following Russia’s full-scale invasion of Ukraine, commodity prices

fell sharply in the second half of 2022, helping to reduce CPI ination—largely

through lower energy prices. This had a negative impact on GDP ination

(a measure of the selling price of goods and services that are produced in

Canada, including our exports), which in the last two quarters of 2022 was much

lower than expected by private sector economists in the 2022 Fall Economic

Statement. As a result, GDP ination in 2022 was lower than projected and is

revised down signicantly in 2023.

Together, the downward revisions to GDP ination and, to a lesser extent, real

GDP have weighed considerably on nominal GDP projections. On an annual

basis, nominal GDP increased by 11.0 per cent in 2022 (below the 11.6 per cent

projected in the 2022 Fall Economic Statement) and is projected to slow to

0.9 per cent in 2023 (previously 2.6 per cent). As a result, nominal GDP is now

expected to be $60 billion lower, on average per year, compared to the private

sector economists’ projections in the 2022 Fall Economic Statement. It is also

$16 billion lower, on average per year, compared to the downside scenario

considered in the 2022 Fall Economic Statement. As the broadest measure of

the tax base, the downward revision to nominal GDP is having an impact on tax

receipts and the government revenue outlook. Slowing growth in nominal GDP in

2023 will push up the debt-to-GDP ratio in 2023-24 before it continues trending

down (see Annex 1 for further details on the economic and scal outlook).

14 Overview

Budget 2023 Economic Scenario Analysis

Canada’s near-term economic outlook remains uncertain. While the February

2023 survey suggests a shallow recession in 2023, the wide range of views

among forecasters highlights many plausible outcomes, ranging from a soft

landing to a more pronounced downturn.

In January 2023, the IMF upgraded its global growth forecast for 2023 to

2.9 per cent (previously 2.7 per cent in its October outlook). China’s reopening

is expected to provide a boost to global growth. In other major economies,

including the U.S. and Europe, easing supply-chain bottlenecks and lower

commodity prices have reduced inationary pressures, while economic activity

has been more resilient than expected. Likewise, Canada has continued to show

progress on lowering ination while the economy has remained solid, especially

in the labour market.

The risks underpinning the downside scenario considered in the 2022 Fall

Economic Statement remain areas of concern. Should elevated global ination

persist, central banks could take their policy rates higher or keep them elevated

for longer. This could occur, for example, if labour markets remain constrained,

or if there is a resurgence in global commodity prices related to a faster

rebound in China’s economy or further supply shocks related to Russia’s illegal

invasion of Ukraine.

In addition to the path of ination, there is also uncertainty about the impact

of higher interest rates on the global economy. With the rapid tightening in

monetary policy across the world, further disruptions in the global nancial

system could emerge. Some funding markets have become more strained due

to lower levels of liquidity, as has been seen recently with the failure of three

medium-sized regional U.S. banks and challenges for Credit Suisse, and an

abrupt repricing of risk could trigger a broader tightening of lending standards.

Overall, the economic outlook in the February 2023 survey continues to provide

a reasonable basis for scal planning, and outcomes that are better or worse

than the survey are both plausible. Still, the latest developments in nancial

markets have raised the odds of a more pronounced slowdown. To facilitate

prudent economic and scal planning, and in light of elevated global uncertainty

and recent developments in nancial markets, the Department of Finance has

developed two scenarios that consider faster or slower growth tracks relative to

the February survey (see Annex 1 for further details on the scenarios).

The downside scenario considers a more pronounced recession in Canada amid

persistent elevated ination, stresses in the global nancial system associated

with the sharp rise in interest rates, and a steeper housing correction. Real GDP

contracts by 1.9 per cent from peak to trough compared to only 0.4 per cent in

the survey, leading to slower growth in 2023 and 2024 (Chart 18). At the same

time, weaker global demand weighs on commodity prices, with crude oil prices

US$13 per barrel below the survey in 2023 and remaining US$3 per barrel

below the survey over the rest of the forecast horizon.

Economic Overview 15

In contrast, the upside scenario sees the Canadian economy avoid a recession as

easing of supply challenges, both in Canada and globally, helps to bring down

ination even as economies remain stronger than anticipated. In Canada, this

improved global economic backdrop is also supported by a larger boost from

our rapidly growing population, expanding Canada’s growth potential. A faster

rebound in China’s economy provides a boost to global growth and commodity

prices, with crude oil prices US$4 per barrel above the survey in 2023 and

US$8 per barrel higher for the rest of the forecast horizon. At the same time,

an accelerated easing of global supply chain frictions, supported by China’s

reopening, results in lower ination and interest rates compared to the survey.

Overall, nominal GDP is $41 billion above the survey, on average per year, in the

upside scenario, while it is $41 billion lower in the downside scenario (Chart 19).

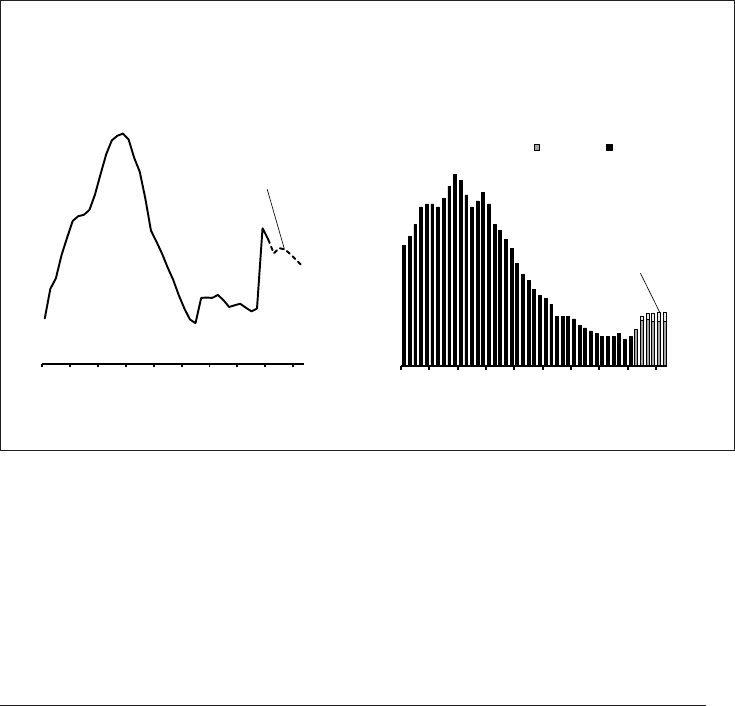

Chart 18

Real GDP Growth

Chart 19

Nominal GDP Level Dierence With

February 2023 Survey Outlook

-1

0

1

2

3

2023 2024 2025 2026 2027

Downside Scenario

Upside Scenario

February 2023 Survey

per cent

-60

-40

-20

0

20

40

60

2023 2024 2025 2026 2027

Downside Scenario Upside Scenario

$ billions

Sources: Department of Finance Canada February 2023

survey of private sector economists; Department of Finance

Canada calculations.

Sources: Department of Finance Canada February 2023

survey of private sector economists; Department of Finance

Canada calculations.

16 Overview

3. Canada’s Place in a Changing Global Economy

The government is navigating the near-term economic challenges of ination,

higher interest rates, and supporting vulnerable Canadians with the rising cost

of living, while also ensuring that Canada is well-placed to thrive in a rapidly

changing global economy.

The accelerating work to build a net-zero global economy has sparked a global

race to attract investment in clean economies and the growing industries of

tomorrow. In the aftermath of Russia’s illegal invasion of Ukraine, which exposed

strategic economic vulnerabilities among many of the world’s democracies,

Canada’s allies are also moving at speed to limit their dependence on

dictatorships, and to friendshore their economies by building their critical supply

chains through democracies like our own. In Budget 2023, the government makes

transformative investments to ensure Canada does not fall behind at a time of

signicant opportunity for Canadians and Canadian businesses.

Moving to Net-Zero

As a major energy producer, the global shift to net-zero presents both a

challenge and a great opportunity for Canada (Chart 20). Analysis conducted

by the Bank of Canada and the Oce of the Superintendent of Financial

Institutions suggests that decisive action is required to ensure Canada

remains competitive during the global shift to net-zero. Inaction could, in

some scenarios, leave Canada’s GDP approximately 10 per cent lower than it

otherwise would be by 2050. Canada’s future economic prosperity depends on

the speed and scale of our response.

Chart 20

Aggregate Historical and Future Trajectory of GHG Emissions, 2000-2030

0

100

200

300

400

500

600

700

800

2000 2005 2010 2015 2020 2025 2030

megaton (Mt) C02 equivalent

Historical

emissions

Future

emissions

trajectory

Note: Historical data excludes eects from land use, land use change and forestry sector (LULUCF) while future emissions

include these eects.

Source: Environment and Climate Change Canada (2022), National Inventory Report 1990-2020 and 2030 Emissions

Reduction Plan.

Economic Overview 17

Having invested heavily in our clean economy since 2015, along with our

highly skilled workforce and abundance of natural resources, Canada is well-

positioned to succeed in the growing global clean economy if we continue to

make smart long-term investments today. The scale of investments that Canada

requires to reach net-zero by 2050 is signicant, with estimates ranging from

$60 billion to $140 billion per year on average. It will be up to the private sector

to make the majority of these investments, but to avoid the consequences of

underinvestment, it is critical that governments invest in policy frameworks

capable of mobilizing private capital. Supporting the private sector to make the

investments needed to thrive and create good middle class jobs in the clean

economy is a joint responsibility. The federal government cannot do this alone,

and provinces and territories must similarly invest heavily if Canada is to avoid

the consequences of being underprepared for the global shift to net-zero.

Reducing Supply Chain Vulnerabilities

Simultaneously, Canada must navigate a fundamental shift in the patterns of

global trade. For much of the past three decades, the global economy has

become increasingly interconnected. While economic integration lowered costs

for many goods, it also built a system of global trade that was vulnerable to the

disruption of critical supply chains.

For Canada and our democratic partners, the vulnerability created by

dependence on authoritarian regimes for critical goods is no longer tenable.

Russia’s weaponization of energy exports has forced the world’s democracies

to fundamentally rethink their supply chain vulnerabilities. China currently

dominates key portions of supply chains for clean technologies, including

batteries (Chart 21).

The mitigating of these vulnerabilities by the world’s democracies will require a

realignment of global trade, and the shifting of critical supply chains away from

dictatorships and towards democracies like our own.

This process, which has been referred to as “friendshoring,” represents a

signicant economic opportunity for Canada and for Canadian workers. As a

stable democracy with a skilled workforce and a rich endowment of natural

resources, Canada has a strong foundation from which to become a supplier

of critical goods for our allies. Building upon this foundation will require

investments in Canada’s economic capacity, both now and into the future.

18 Overview

Chart 21

China’s Comparative Concentration in the Global Electric Vehicle (EV)

Battery Supply Chain, 2022

0

25

50

75

100

Lithium Nickel Cobalt Graphite Cathode Anode Production Assembly

Material processing Cell Components Battery cells EVs

China USA Europe Other

per cent

Source: International Energy Agency.

Transforming Challenges into Opportunities

The need for investment to manage these structural challenges will not be

limited to one sector or one aspect of the economy. Broad-based investment

will be required to grow our economy and create good middle class jobs in the

years to come. The scale of required investments is massive and the private

sector alone is unlikely to mobilize the level of capital required in Canada at

sucient speed.

Many of the investments that need to be made will stretch over decades and

involve high up-front costs. Moreover, key sectors and technologies will have

signicant spillover eects by driving development of related industries. For

example, fundamental inputs to clean production and the production of clean

technologies, such as electricity, critical minerals, and carbon capture, utilization

and storage (CCUS), will provide foundations for an expanding clean economy.

For related sectors, such as hydrogen and clean manufacturing, this will boost

their productivity and support their resilience, and help to generate new middle

class jobs. Private investment decisions may not take full account of these

spillovers, which increases the risk of underinvestment.

Without the right policy framework, Canada could see underinvestment in

critical areas and a slow pace of innovation in new clean technology. Together,

these would result in Canada falling behind the United States and other

countries that are moving forward aggressively to build their clean economies,

create middle class jobs, and ensure more prosperous futures for their people.

Canada must act decisively to ensure it remains the location of choice for new

investment in these sectors, particularly in the face of recent passage of U.S.

Ination Reduction Act (IRA).

Economic Overview 19

Budget 2023 proposes substantial measures as the next steps in the

government's plan to “crowd-in” new private investment by leveraging

public investment and government policy. The goal of this approach is not

to substitute government for the private sector, nor supplant market-based

decision making. It is to leverage the tools of government to mobilize the

private sector.

This approach is not about the government picking individual corporate

winners in an eort to engineer a preferred vision of the economy in 2050.

That approach did not work in the past, and is even less likely to work in today’s

environment of rapid technological change. The tax incentives and investment

supports proposed in Budget 2023 are designed to set a framework for

boosting overall investment, while leaving the private sector to determine how

to invest based on market signals.

At the same time, the government has an indispensable role in ensuring that

investment happens where it will have the greatest long-term impact for

Canadians’ standard of living and the reduction of our emissions. This means

focusing on areas where Canada has a comparative advantage, and making

investments that will have the greatest impact on Canada’s productive capacity

and ability to create good middle class jobs. It will also mean looking to

industries that will grow in a changing global economy, and seeking out areas

where Canada can both benet at home and contribute to the economic

resilience of our friends and allies.

Budget 2023 takes a strategic approach to supporting Canada’s long-term

economic competitiveness and prosperity by investing in securing Canada’s

clean technology advantage, our future as a global leader in clean fuels, and our

natural advantage as a producer of clean electricity. In doing so, we can help to

usher in a new era of prosperity for Canadians.

4. Investing Responsibly in Canada’s Future

Budget 2023 lays out a responsible plan to grow Canada’s economy and create good

middle class jobs for Canadians; to strengthen Canada’s universal public health care

system and provide dental care for Canadians; to protect our environment; and to

support a range of other key priorities that matter to Canadians.

Years of responsible scal stewardship have left Canada in an enviable scal

position relative to our global peers. This responsible stewardship also allows

the government to act proactively, with support for those who need it most

and critical investments in the long-term prosperity of Canadians. At the same

time, the government recognizes there is an opportunity to refocus existing

spending, following the pandemic, on priorities that matter most to Canadians.

20 Overview

Table 1

Economic and Fiscal Developments, Policy Actions and Measures

billions of dollars

Projection

2022– 2023– 2024– 2025– 2026– 2027–

2023 2024 2025 2026 2027 2028

Budgetary balance – 2022 Fall

Economic Statement (FES 2022)

-36.4 -30.6 -25.4 -14.5 -3.4 4.5

Economic and scal developments

since FES 2022

6.4 -4.7 -4.9 -5.1 -7.5 -10.3

Budgetary balance before policy

actions and measures

-30.0 -35.3 -30.3 -19.5 -10.9 -5.8

Policy actions since FES 2022 -5.4 0.7 3.2 2.6 1.7 0.1

Budget 2023 measures (by

chapter)

1. Making Life More Aordable and

Supporting the Middle Class

-2.5 -0.8 -0.3 -0.5 -0.5 -0.6

2. Investing in Public Health Care

and Aordable Dental Care

-2.0 -3.6 -4.6 -6.4 -6.8 -7.9

3. A Made in Canada Plan:

Aordable Energy, Good Jobs, and a

Growing Clean Economy

0.0 -1.2 -3.1 -4.4 -5.9 -6.3

4. Advancing Reconciliation and

Building a Canada That Works for

Everyone

-3.1 -2.5 -1.3 -1.0 -0.6 -0.6

5. Canada’s Leadership in the World -0.1 -0.2 -0.1 -0.1 -0.1 -0.1

6a. Eective Government and

Improving Services to Canadians

0.1 2.8 0.1 0.8 2.9 3.2

6b. A Fair Tax System 0.0 0.2 1.5 1.6 4.4 4.0

Total – Actions Since FES 2022 and

Budget 2023 Measures

-13.0 -4.8 -4.7 -7.3 -4.9 -8.3

Budgetary Balance -43.0 -40.1 -35.0 -26.8 -15.8 -14.0

Budgetary Balance (per cent of GDP) -1.5 -1.4 -1.2 -0.9 -0.5 -0.4

Federal debt (per cent of GDP) 42.4 43.5 43.2 42.2 41.1 39.9

A negative number implies a deterioration in the budgetary balance (lower revenue or higher expenses). A positive

number implies an improvement in the budgetary balance (higher revenue or lower expenses).

Economic Overview 21

Investing in Canada’s Future is a Joint Responsibility

Driven by the federal government providing eight out of every ten dollars

in emergency pandemic spending, provincial and territorial governments

continue to signicantly outperform scal projections. Fiscal results to date

show that the aggregate provincial-territorial budgetary balance moved into

a surplus position in 2021-22, with an expectation that it will remain broadly

balanced thereafter. This stands in contrast to the decit of 1 per cent of GDP

in 2021-22 that had been expected through provincial and territorial 2022

budgets (Chart 22).

The solid provincial-territorial scal position means that, together, provinces

and territories have the ability to take proactive action to help build Canada’s

clean economy.

Chart 22

Federal and Provincial Budgetary Balances

-0.6

-0.5

-0.5

-0.2

-0.8

-2.2

0.4

0.4

-0.2

-0.1

-0.1

-0.9

-0.9

-0.6

-1.7

-14.9

-3.6

-1.5

-1.4

-1.2

2015-16 2016-17 2017-18 2018-19 2019-20 2020-21 2021-22 2022-23 2023-24 2024-25

Total Provincial-Territorial Federal Government

Per cent of GDP

Note: Actual data up to 2021-22. The provincial-territorial aggregate for years 2022-23 reect 2022

fall updates and 2023 budgets; for 2023-24 and 2024-25, the balance reects 2022 budgets, 2022 fall

updates, and 2023 budgets.

22 Overview

A Responsible Fiscal Plan in Challenging Times

The scal outlook presented in Budget 2023 continues to place the government’s

scal stance well within key scal sustainability indicators, including:

While rising slightly in 2023-24 due to the global economic slowdown

and lower forecasted GDP, the federal debt-to-GDP ratio continues on a

declining path from 2024-25 onward (Chart 23).

The decit is projected to decline in every year of the forecast and return

to 1 per cent of GDP or lower in 2025-26 and ongoing, ensuring Canada’s

longer-term scal sustainability by keeping the debt-to-GDP ratio on a

downward path.

Even with higher borrowing costs, public debt charges as a share of the

economy are projected to remain at historically low levels (Chart 24).

This would also be the case under even higher interest rates.

These indicators underscore the government’s continued commitment to its

scal anchor of reducing federal debt as a share of the economy over the

medium-term, even as the government invests in Canadians.

Chart 23

Federal Debt

Chart 24

Public Debt Charges

20

30

40

50

60

70

1981 19861991 1996 2001 2006 201120162021 2026

per cent of GDP

Budget 2023

Forecast

0

2

4

6

8

1981 1986 1991 1996 2001 2006 2011 2016 2021 2026

Forecast Historical

per cent of GDP

With 100 basis-

point increase in

interest rates

Source: Department of Finance Canada. Source: Department of Finance Canada.

Economic Overview 23

Scenario Analysis

As discussed in section 2, while the latest developments in nancial markets have

raised the odds of a more pronounced slowdown, outcomes that are better or

worse than the February survey of private sector economists are both plausible.

To facilitate prudent economic and scal planning, and in light of elevated global

uncertainty and recent developments in nancial markets, the Department of

Finance has developed two scenarios that consider faster or slower growth tracks

relative to the February survey.

In the upside scenario, the budgetary balance would improve by an average of

approximately $6.5 billion per year (Chart 25) and remove 1.3 percentage points

from the federal debt-to-GDP ratio by 2027-28 (Chart 26).

In the downside scenario, the budgetary balance would deteriorate by an average

of approximately $7.2 billion per year and add 1.6 percentage points to the

federal debt-to-GDP ratio by 2027-28. That said, even under the downside

scenario, the decit would remain below 1 per cent of GDP by the end of

the forecast horizon, and the federal debt-to-GDP ratio would still be lower

in 2027-28 than it is today.

Details of the government’s scal outlook and the scal impact of the scenarios

can be found in Annex 1.

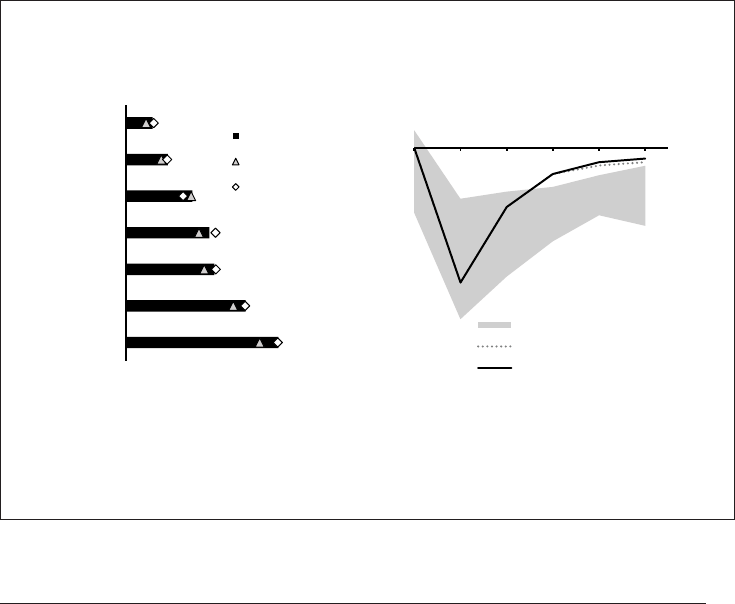

Chart 25

Federal Budgetary Balance under

Economic Scenarios

Chart 26

Federal Debt-to-GDP under

Economic Scenarios

-43.0

-40.1

-35.0

-26.8

-15.8

-14.0

-43.0

-47.0

-42.1

-34.2

-23.3

-21.4

-42.2

-32.3

-28.6

-20.2

-10.3

-7.8

-50

-40

-30

-20

-10

0

2022-23 2023-24 2024-25 2025-26 2026-27 2027-28

Budget 2023

Downside

Upside

billions of dollars

43.5

43.2

42.2

41.1

39.9

42.4

41.9

41.0

39.8

38.6

42.4

44.3

44.4

43.5

42.5

41.5

38

40

42

44

46

2022-23 2023-24 2024-25 2025-26 2026-27 2027-28

per cent of GDP

Budget 2023

Downside

Upside

Sources: Department of Finance Canada February 2023 survey of private sector economists; Department

of Finance Canada calculations.

24 Overview

International Comparisons

Including new measures in Budget 2023, Canada’s net debt as a share of

the economy is still lower today than in any other G7 country prior to the

pandemic—an advantage that Canada is forecasted to maintain (Chart 27).

Canada is also forecasted to post one of the largest improvements in its scal

balance among G7 countries since the beginning of the COVID-19 pandemic,

resulting in Canada having the smallest decit in the G7, both this year and next

(Chart 28).

Canada maintains a long tradition of responsible scal management along with

several other strengths, such as sound macroeconomic policy frameworks, a

large and diverse economy, and strong governing institutions which continue

to shape Canada’s excellent credit ratings from Moody’s (Aaa), S&P (AAA),

and Fitch (AA+). Canada is the third-largest economy in the world to have a

AAA rating from at least two of the three major global credit rating agencies,

together with only the United States and Germany.

Combined with the signicant investments made since 2015 in the long-term