SUPREME COURT OF THE STATE OF NEW YORK

COUNTY OF NEW YORK

PEOPLE OF THE STATE OF NEW

YORK, by LETITIA JAMES,

Attorney General of the State of New York,

Plaintiff,

-against-

DONALD J. TRUMP

, DONALD TRUMP,

JR., ERIC TRUMP, IVANKA TRUMP,

ALLEN WEISSELBERG, JEFFREY

MCCONNEY, THE DONALD J. TRUMP

REVOCABLE TRUST, THE TRUMP

ORGANIZATION, INC.,

TRUMP

ORGANIZATION LLC, DJT HOLDINGS

LLC, DJT HOLDINGS MANAGING

MEMBER, TRUMP ENDEAVOR 12 LLC,

401 NORTH WA

BASH VENTURE LLC,

TRUMP OLD POST OFFICE LLC, 40

WALL STREET LLC

, and SEVEN

SPRINGS LLC

,

Defendants.

Index No.

SUMMONS

Date Index No. Purchased:

_____________

TO THE ABOVE-NAMED DEFENDANTS:

You are hereby summoned to answer the complaint in this action and to serve a copy of

your answer, or, if the complaint is not served with this summons, to serve a notice of appearance,

on the Plaintiff’s attorney within 20 days after service of this summons, exclusive of the day of

service (or within 30 days after the service is complete if this summons is not personally delivered

to you within the State of New York); and in case of your failure to appear or answer, judgment

will be taken against you by default for the relief demanded in the complaint.

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 09/21/2022

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

1 of 222

The basis of venue pursuant to CPLR § 503(a) is that Plaintiff is located in New York

County, with its address at 28 Liberty Street, New York, New York 10005, and because a

substantial part of the events and omissions giving to the claims occurred in New York County.

Dated: New York, New York

September 21, 2022

To:

DONALD J. TRUMP

Habba Maddaio & Associates LLP

112 West 34th Street,New York, New York 10120

Fischetti Malgieri

565 Fifth Ave., 7th Fl, New York, NY 10017

LETITIA JAMES

Attorney General of the State of New York

By: _______________________________

Kevin Wallace

Kevin Wallace

Andrew Amer

Colleen K. Faherty

Alex Finkelstein

Wil Handley

Eric R. Haren

Louis M. Solomon

Austin Thompson

Stephanie Torre

Office of the New York State

Attorney General

28 Liberty Street

New York, NY 10005

Phone: (212) 416-6376

Attorneys for the People of the

State of New York

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 09/21/2022

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

2 of 222

DONALD TRUMP, JR.

Law Offices of Alan S. Futerfas

565 Fifth Ave., 7th Fl, New York, NY 10017

ERIC TRUMP

Law Offices of Alan S. Futerfas

565 Fifth Ave., 7th Fl, New York, NY 10017

IVANKA TRUMP

Law Offices of Alan S. Futerfas

565 Fifth Ave., 7th Fl, New York, NY 10017

ALLEN WEISSELBERG

Friedman Kaplan Seiler Adelman

7 Times Sq., New York, NY 10036

JEFFREY MCCONNEY

ArentFox Schiff

1301 Avenue of the Americas, 42nd floor, New York, NY 10019

THE DONALD J. TRUMP REVOCABLE TRUST

c/o The Trump Organization – 725 Fifth Avenue, New York, NY 10022

LaRocca Hornik Rosen & Greenberg LLP

40 Wall Street, 32nd Floor, New York, NY 10005

Habba Maddaio & Associates LLP

112 West 34th Street, 17th & 18th Floors, New York, NY 10120

THE TRUMP ORGANIZATION, INC.

LaRocca Hornik Rosen & Greenberg LLP

40 Wall Street, 32nd Floor, New York, NY 10005

Habba Maddaio & Associates LLP

112 West 34th Street, 17th & 18th Floors, New York, NY 10120

TRUMP ORGANIZATION LLC

LaRocca Hornik Rosen & Greenberg LLP

40 Wall Street, 32nd Floor, New York, NY 10005

Habba Maddaio & Associates LLP

112 West 34th Street, 17th & 18th Floors, New York, NY 10120

DJT HOLDINGS LLC

LaRocca Hornik Rosen & Greenberg LLP

40 Wall Street, 32nd Floor, New York, NY 10005

Habba Maddaio & Associates LLP

112 West 34th Street, 17th & 18th Floors, New York, NY 10120

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 09/21/2022

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

3 of 222

DJT HOLDINGS MANAGING MEMBER

LaRocca Hornik Rosen & Greenberg LLP

40 Wall Street, 32nd Floor, New York, NY 10005

Habba Maddaio & Associates LLP

112 West 34th Street, 17th & 18th Floors, New York, NY 10120

TRUMP ENDEAVOR 12 LLC

c/o The Trump Organization – 725 Fifth Avenue, New York, NY 10022

LaRocca Hornik Rosen & Greenberg LLP

40 Wall Street, 32nd Floor, New York, NY 10005

Habba Maddaio & Associates LLP

112 West 34th Street, 17th & 18th Floors, New York, NY 10120

401 NORTH WABASH VENTURE LLC

c/o The Trump Organization – 725 Fifth Avenue, New York, NY 10022

LaRocca Hornik Rosen & Greenberg LLP

40 Wall Street, 32nd Floor, New York, NY 10005

Habba Maddaio & Associates LLP

112 West 34th Street, 17th & 18th Floors, New York, NY 10120

TRUMP OLD POST OFFICE LLC

c/o The Trump Organization – 725 Fifth Avenue, New York, NY 10022

LaRocca Hornik Rosen & Greenberg LLP

40 Wall Street, 32nd Floor, New York, NY 10005

Habba Maddaio & Associates LLP

112 West 34th Street, 17th & 18th Floors, New York, NY 10120

40 WALL STREET LLC

c/o The Trump Organization – 725 Fifth Avenue, New York, NY 10022

LaRocca Hornik Rosen & Greenberg LLP

40 Wall Street, 32nd Floor, New York, NY 10005

Habba Maddaio & Associates LLP

112 West 34th Street, 17th & 18th Floors, New York, NY 10120

SEVEN SPRINGS LLC

LaRocca Hornik Rosen & Greenberg LLP

40 Wall Street, 32nd Floor, New York, NY 10005

Habba Maddaio & Associates LLP

112 West 34th Street, 17th & 18th Floors, New York, NY 10120

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 09/21/2022

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

4 of 222

SUPREME COURT OF THE STATE OF NEW YORK

COUNTY OF NEW YORK

PEOPLE OF THE STATE OF NEW

YORK, by LETITIA JAMES,

Attorney General of the State of New York,

Plaintiff,

-against-

DONALD J. TRUMP

, DONALD TRUMP,

JR.

, ERIC TRUMP, IVANKA TRUMP,

ALLEN WEISSELBERG,

JEFFREY

MCCONNEY,

THE DONALD J. TRUMP

REVOCABLE TRUST,

THE TRUMP

ORGANIZATION, INC.,

TRUMP

ORGANIZATION LLC, DJT HOLDINGS

LLC, DJT HOLDINGS MANAGING

MEMBER,

TRUMP ENDEAVOR 12 LLC,

401 NORTH WABASH VENTURE LLC

,

TRUMP OLD PO

ST OFFICE LLC, 40

WALL STREET LLC

, and SEVEN

SPRINGS LLC

,

Defendants.

Index No.

VERIFIED COMPLAINT

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 09/21/2022

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

5 of 222

i

TABLE OF CONTENTS

I. NATURE OF THE ACTION .................................................................................................. 1

A.

The Fraudulent Statements of Financial Condition…………………………………………...……………….3

B.

Relief Sought………………………………………………………...………………………………………………………….11

II. THE PARTIES ...................................................................................................................... 12

III. JURISDICTION, APPLICABLE LAW, AND VENUE ........................................................ 16

IV. FACTUAL ALLEGATIONS ................................................................................................ 19

A.

Overview of Trump Organization Assets…………………………………..……………………………………..20

B.

Overview of the Statements of Financial Condition……………………………………………….………..23

C.

The Asset Values and Associated Descriptions Presented in the Statements Were

Fraudulent, Misleading, and Not Presented in Accordance with GAAP……………….………...26

1. Cash and Cash Equivalents/Marketable Securities ........................................................ 26

2. Escrow and Reserve Deposits and Prepaid Expenses .................................................... 29

3. Trump Park Avenue ....................................................................................................... 31

4. 40 Wall Street ................................................................................................................. 38

5. Niketown ........................................................................................................................ 47

a. June 30, 2011 and June 30, 2012 valuations of Niketown ......................................... 48

b. Valuations of Niketown from 2013 through 2018...................................................... 50

c. June 30, 2019 valuation of Niketown ......................................................................... 55

d. June 30, 2020 valuation of Niketown ......................................................................... 56

6. Trump Tower .................................................................................................................. 58

a. Valuation of Trump Tower from 2011 to 2014 and 2016 to 2019 ............................. 59

b. 2015 valuation of Trump Tower ................................................................................. 65

7. Seven Springs ................................................................................................................. 67

8. Mr. Trump’s Triplex Apartment .................................................................................... 75

9. 1290 Avenue of the Americas and 555 California (Vornado Partnerships) .................. 84

a. The Restricted Nature of Mr. Trump’s Limited Partnership Interest ......................... 85

b. The False and Misleading Valuations of the Buildings .............................................. 87

10. Las Vegas (Ruffin Joint Venture) .................................................................................. 92

11. Club Facilities and Related Real Estate ......................................................................... 98

a. Mar-a-Lago ............................................................................................................... 101

b. Trump Aberdeen ....................................................................................................... 110

i. The Golf Course Valuations ................................................................................. 111

ii. The Undeveloped Land Valuations ...................................................................... 114

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 09/21/2022

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

6 of 222

ii

c. Trump Turnberry ...................................................................................................... 119

d. TNGC Jupiter ........................................................................................................... 120

e. TNGC Briarcliff ....................................................................................................... 122

i. The Golf Course Valuations ................................................................................. 123

ii. The Undeveloped Land Valuations ...................................................................... 125

f. TNGC LA ................................................................................................................. 126

i. The Golf Course Valuations ................................................................................. 127

ii. The Undeveloped Land Valuations ...................................................................... 128

g. TNGC Colts Neck .................................................................................................... 137

h. TNGC Philadelphia .................................................................................................. 139

i. TNGC DC ................................................................................................................. 140

j. TNGC Charlotte ....................................................................................................... 142

k. TNGC Hudson Valley .............................................................................................. 143

12. Real Estate Licensing Developments ........................................................................... 144

D.

The False and Misleading Statements of Financial Condition Were Used to Secure and

Maintain Financial Benefits, Including Financing and Insurance, on Favorable Terms..147

1. Deutsche Bank Loan Facilities ..................................................................................... 148

2. Deutsche Bank Loan Issued in Connection with Trump National Doral Golf Club

(Florida) ....................................................................................................................... 151

3. Deutsche Bank Loan Issued in Connection with Trump Chicago (2012) .................... 159

4. Deutsche Bank Loan Issued in Connection with Trump Old Post Office Hotel in

Washington, D.C. ......................................................................................................... 165

5. 40 Wall Street Loan Issued by Ladder Capital ............................................................ 171

6. Seven Springs Loan Issued by Royal Bank America / Bryn Mawr Bank .................... 174

7. Other Efforts To Use The False And Misleading Statements In Commercial

Transactions ................................................................................................................. 176

E.

Insurance-Related Benefits…………………………………………………………………...………………………..178

1. Insurance Fraud Against Surety Underwriters ............................................................. 179

2. Insurance Fraud Against Directors & Officers Liability Underwriters ........................ 183

F.

Ongoing Scheme and Conspiracy……………………………………………………………..……………………189

V. CAUSES OF ACTION ....................................................................................................... 198

VI. PRAYER FOR RELIEF ...................................................................................................... 213

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 09/21/2022

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

7 of 222

Plaintiff, the People of the State of New York, by Letitia James, Attorney General of the

State of New York, as and for their Verified Complaint, respectfully allege:

I. NATURE OF THE ACTION

1. Following a comprehensive three-year investigation by the Office of the Attorney

General (“OAG”), involving interviews with more than 65 witnesses and review of millions of

pages of documents produced by Defendants and others, OAG has determined that Defendants

Donald J. Trump (“Mr. Trump”), Trump Organization LLC and the Trump Organization, Inc.

(collectively with the other named entities, the “Trump Organization”), Allen Weisselberg, and

the other individuals and entities affiliated with Mr. Trump and his companies named as

Defendants, engaged in numerous acts of fraud and misrepresentation in the preparation of Mr.

Trump’s annual statements of financial condition (“Statements of Financial Condition” or

“Statements”) covering at least the years 2011 through 2021.

2. These acts of fraud and misrepresentation were similar in nature, were committed

by upper management at the Trump Organization as part of a common endeavor for each annual

Statement, and were approved at the highest levels of the Trump Organization—including by

Mr. Trump himself. Indeed, Mr. Trump made known through Mr. Weisselberg that he wanted

his net worth on the Statements to increase—a desire Mr. Weisselberg and others carried out

year after year in their fraudulent preparation of the Statements.

3. These acts of fraud and misrepresentation grossly inflated Mr. Trump’s personal

net worth as reported in the Statements by billions of dollars and conveyed false and misleading

impressions to financial counterparties about how the Statements were prepared. Mr. Trump and

the Trump Organization used these false and misleading Statements repeatedly and persistently

to induce banks to lend money to the Trump Organization on more favorable terms than would

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 09/21/2022

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

8 of 222

2

otherwise have been available to the company, to satisfy continuing loan covenants, and to

induce insurers to provide insurance coverage for higher limits and at lower premiums.

4. All of this conduct was in violation of New York Executive Law § 63(12)’s

prohibition of persistent and repeated business fraud, which embraces any conduct that “has the

capacity or tendency to deceive, or creates an atmosphere conductive to fraud.” People v.

Northern Leasing Systems, Inc., 193 A.D.3d 67, 75 (1st Dep’t 2021).

5. These misrepresentations also violated a host of state criminal laws, constituting

repeated and persistent illegality in violation of Executive Law § 63(12). Among other laws,

Defendants repeatedly and persistently violated the following: New York Penal Law § 175.10

(Falsifying Business Records); Penal Law § 175.45 (Issuing a False Financial Statement); and

Penal Law § 176.05 (Insurance Fraud).

1

6. Each Statement from 2011 to 2021 provides Mr. Trump’s personal net worth as of

June 30 of the year it covers, was compiled by Trump Organization executives, and was issued

as a compilation report by Mr. Trump’s accounting firm. Each Statement provides on its face

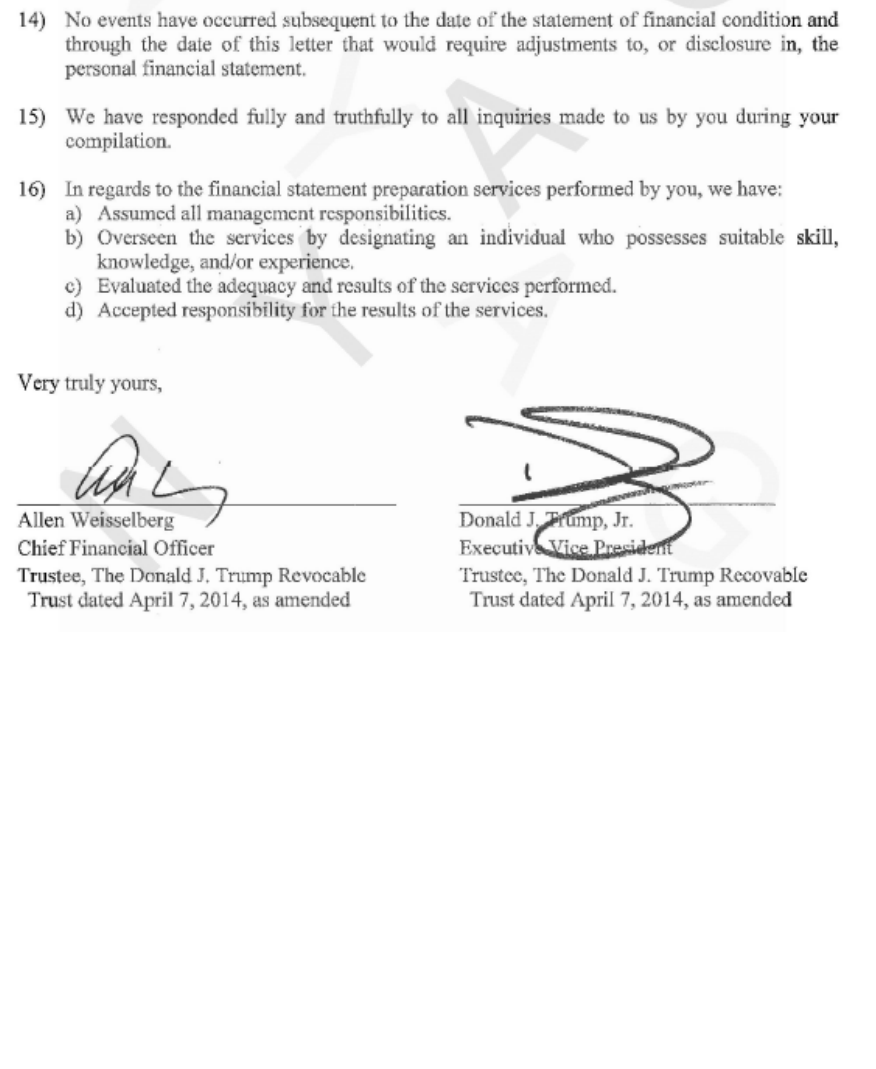

that its preparation was the responsibility of Mr. Trump, or starting in 2016, the trustees of his

revocable trust, Donald Trump, Jr. and Allen Weisselberg.

2

Each Statement was personally

1

While not a basis for recovery in this action, the conduct alleged in this action also plausibly

violates federal criminal law, including 18 U.S.C. § 1014 (False Statements to Financial

Institutions) and 18 U.S.C. § 1344 (Bank Fraud). Under those provisions, a defendant violates

federal law by knowingly submitting a false document or statement in order to influence the

decision of a federally-insured bank or to obtain money from a bank by means of false

representations or pretenses. There is no requirement of loss or reliance. OAG is making a

referral of its factual findings to the Office of the United States Attorney for the Southern District

of New York.

2

Mr. Weisselberg was removed as a trustee as of July 2021, after having been indicted by the

New York District Attorney on charges of tax fraud. Mr. Weisselberg pleaded guilty to those

charges on August 18, 2022.

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 09/21/2022

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

9 of 222

3

certified as accurate by Mr. Trump, by one of his trustees, or in 2021 by Eric Trump, when

submitting the Statement to financial institutions with the purpose and intent that the information

contained in the Statement would be relied upon by those institutions.

7. Each year from 2011 to 2016, Mr. Trump and Mr. Weisselberg would meet to

review and approve the final Statement. When asked questions about those meetings under oath,

both men invoked their Fifth Amendment privilege against self-incrimination and refused to

answer. When asked under oath if he continued to review and approve the Statements after

becoming President of the United States in 2017, Mr. Trump invoked his Fifth Amendment

privilege and refused to answer.

8. As further evidence of their scheme to inflate the value of Mr. Trump’s assets

when beneficial to his financial interests, Mr. Trump and the Trump Organization procured

inflated appraisals through fraud and misrepresentations in 2014 and 2015 for the purpose of

granting conservation easements over two of Mr. Trump’s properties. Through these

conservation easements, Mr. Trump and the Trump Organization agreed to forgo their purported

rights to develop areas of the two properties that are the subjects of the easements, which enabled

them to treat as a charitable donation the difference in the value of each property with and

without the relinquished development rights as determined in the appraisals. In the same way

that Mr. Trump and the Trump Organization inflated the valuations of Mr. Trump’s assets for the

Statements, they manipulated the appraisals to inflate the value of the donated development

rights with respect to both conservation easements.

A.

The Fraudulent Statements of Financial Condition

9. Each Statement of Financial Condition lists Mr. Trump’s assets and liabilities,

and then presents his “net worth” as the difference between the two. On the asset side, each

Statement includes five basic categories: (i) “cash and cash equivalents;” (ii) monies held in

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 09/21/2022

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

10 of 222

4

“escrow” and “reserve deposits;” (iii) interests in “partnerships and joint ventures;” (iv) real

estate licensing fees; and (v) by far the largest category – real estate holdings. On the liability

side, each Statement lists “accounts payable and accrued expenses,” loans on “real and operating

properties,” and other mortgages and loans.

10. Mr. Trump’s Statements of Financial Condition for the period 2011 through 2021

were fraudulent and misleading in both their composition and presentation. The number of

grossly inflated asset values is staggering, affecting most if not all of the real estate holdings in

any given year. All told, Mr. Trump, the Trump Organization, and the other Defendants, as part

of a repeated pattern and common scheme, derived more than 200 false and misleading

valuations of assets included in the 11 Statements covering 2011 through 2021.

11. Nearly every one of the Statements represented that the values were prepared by

Mr. Trump and others at the Trump Organization in “evaluation[s]” done with “outside

professionals,” but that was false and misleading; no outside professionals were retained to

prepare any of the asset valuations presented in the Statements. To the extent Mr. Trump and the

Trump Organization received any advice from outside professionals that had any bearing on how

to approach valuing the assets, they routinely ignored or contradicted such advice. For example,

they received a series of bank-ordered appraisals for the commercial property at 40 Wall Street

that calculated a value for the property at $200 million as of August 1, 2010 and $220 million as

of November 1, 2012. Yet in the 2011 Statement, they listed 40 Wall Street with a value $524

million and increased the valuation to $527 million in the 2012 Statement, and to $530 million in

2013—more than twice the value calculated by the “professionals.” Even more egregiously the

valuation of more than $500 million was attributed to information obtained from the same

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 09/21/2022

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

11 of 222

5

professional appraiser who prepared both valuations putting the building’s value at or just over

$200 million.

12. The inflated asset valuations in the Statements cannot be brushed aside or excused

as merely the result of exaggeration or good faith estimation about which reasonable real estate

professionals may differ. Rather, they are the result of the Defendants utilizing objectively false

assumptions and blatantly improper methodologies with the intent and purpose of falsely and

fraudulently inflating Mr. Trump’s net worth to obtain beneficial financial terms from lenders

and insurers.

13. Nor can the false and fraudulent asset values in the Statements be defended based

on boilerplate disclaimers in the accountant’s compilation report accompanying each Statement.

While the accountants gave notice in the reports that they did not audit or review the Statements

to verify the accuracy or completeness of the information provided by Mr. Trump or the Trump

Organization, they confirmed that their clients were responsible for preparing the Statements in

accordance with generally accepted accounting principles in the United States (“GAAP”). The

disclaimers may relieve the accountants of certain obligations that would otherwise adhere to

their work on a more rigorous audit engagement, but they do not give license to Mr. Trump or

the Trump Organization to submit to their accountants fraudulent and misleading asset valuations

for inclusion in the Statements.

14. Moreover, Mr. Trump and the Trump Organization have no excuse for issuing

Statements of Financial Condition that repeatedly violated GAAP rules in multiple ways despite

expressly representing in the Statements that they were prepared in accordance with GAAP.

Among the many GAAP rules they violated are: (i) including as “cash” funds that Mr. Trump

could not immediately liquidate because they did not belong to him and may never be distributed

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 09/21/2022

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

12 of 222

6

to him; (ii) failing to determine the present value of projected future income when including the

income as part of an asset valuation; (iii) failing to disclose a substantial change in methodology

from the prior year’s statement for how an asset value was derived; (iv) failing to value the

entirety of Mr. Trump’s interest in a partnership, including all limitations and restrictions on his

interest; and (v) including intangibles such as internally-generated brand premiums when

calculating an asset’s value.

15. As discussed in greater detail in the sections that follow, Mr. Trump and others

affiliated with the Trump Organization who are named as Defendants employed a number of

deceptive strategies as part of the overall scheme to fraudulently and falsely inflate Mr. Trump’s

assets in order to comply with Mr. Trump’s instruction to increase his net worth. A chart

showing many of the deceptive strategies employed by Mr. Trump and other Defendants by asset

and year is attached as Exhibit 1, and includes the following, to list just a few:

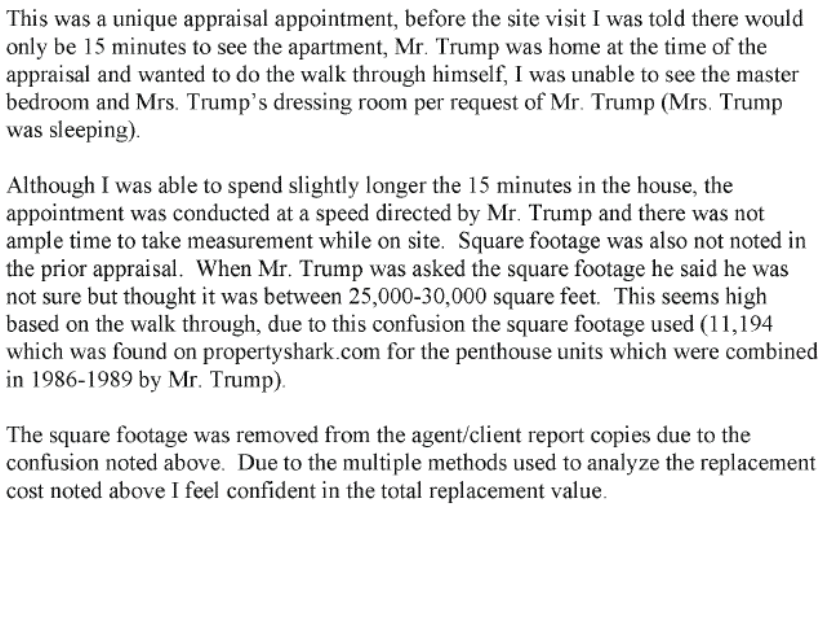

a. Relying on objectively false numbers to calculate property values. For example,

Mr. Trump’s own triplex apartment in Trump Tower was valued as being 30,000

square feet when it was 10,996 square feet. As a result, in 2015 the apartment

was valued at $327 million in total, or $29,738 per square foot. That price was

absurd given the fact that at that point only one apartment in New York City had

ever sold for even $100 million, at a price per square foot of less than $10,000.

And that sale was in a newly built, ultra-tall tower. In 30 year-old Trump Tower,

the record sale as of 2015 was a mere $16.5 million at a price of less than $4,500

per square foot.

b. Ignoring legal restrictions on development rights and marketability that would

materially decrease property values. For example:

i. In the 2012 Statement, rent stabilized apartments at Trump Park Avenue

were valued as if they were unrestricted, leading to a nearly $50 million

valuation for those units—but an appraisal accounting for those units’

stabilized status valued them collectively at just $750,000;

ii. The Mar-a-Lago club was valued as high as $739 million based on the false

premise that it was unrestricted property and could be developed and sold

for residential use, even though Mr. Trump himself signed deeds donating

his residential development rights and sharply restricting changes to the

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 09/21/2022

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

13 of 222

7

property – in reality, the club generated annual revenues of less than $25

million and should have been valued at closer to $75 million; and

iii. For his golf course in Aberdeen, Scotland, the valuation assumed 2,500

homes could be developed when the Trump Organization had obtained

zoning approval to develop less than 1,500 cottages and apartments, many

of which were expressly identified as being only for short-term rental. The

$267 million value attributed to those 2,500 homes accounted for more than

80% of the total $327 million valuation for the Aberdeen property on the

2014 Statement.

c. Failing to use basic rules of valuation to ensure reliable and accurate results—

such as discounting revenue or cash flow that might be obtained from a

speculative development far into the future to its present value. For example, a

series of high-value properties estimated the profits from developing and selling

homes without accounting for the years it would take to plan, build, and sell the

homes and instead operated under the impossible and thus false premise that the

homes could be planned, built, and sold instantaneously.

d. Using an inappropriate valuation method for a given category of assets. For

example, for the period 2013 to 2020, Mr. Trump’s golf course in Jupiter, Florida

was valued using a fixed-asset approach even though that was not an acceptable

method for valuing an operating golf course. And the bulk of the value in that

fixed-asset approach was based on the use of an inflated purchase price from the

purported assumption of “refundable” membership liabilities. Mr. Trump

claimed to have paid $46 million for the club, consisting of $5 million in cash he

actually paid and $41 million in assumed membership liabilities. In the

Statement Mr. Trump did not disclose the inclusion of those inflated liabilities in

the price of the club and in fact took the opposite position, stating that his

potential liability for those membership deposits was zero.

e. Increasing the value of golf clubs to incorporate a “brand premium” despite

expressly advising in the Statements that brand value was not included in the

figures and despite GAAP rules prohibiting inclusion of internally-generated

intangible brand premiums. For example, in the 2013 Statement, the value of Mr.

Trump’s golf course in Jupiter, Florida was further inflated by fraudulently

adding 30% for the Trump “brand.” Combining the inflation from using the

fixed-asset approach with the 30% brand premium, Mr. Trump claimed that a

club he purchased for $5 million in 2012 was worth more than $62 million in

2013. The 2013 Statement included the same fraudulent 30% brand premium for

six other golf clubs.

f. Using inflated net operating income (“NOI”) figures and arbitrarily low

capitalization rates to calculate valuations using the income capitalization

method, where value is derived by dividing NOI by a capitalization rate. For

example, in some instances the NOI for Trump Tower relied on favorable

numbers by mixing time periods, using future income that exceeded the Trump

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 09/21/2022

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

14 of 222

8

Organization’s internal budget projections while also using expense figures that

were lower than past expenses in audited financials. Capitalization rates were

derived by cherry-picking an unsupported figure from, or averaging the lowest

two or three capitalization rates listed in, generic marketing reports and ignoring

rates in those same reports for buildings that were closer and more comparable to

Trump Tower.

g. Claiming as Mr. Trump’s own “cash” monies belonging not to Mr. Trump but to

partnerships in which Mr. Trump had only a limited partnership interest with no

control over making disbursements. For example, one-third of the amount under

“cash and cash equivalents” listed in the 2018 Statement belonged to Vornado

Partnerships, not Mr. Trump. Those are partnerships in which he owns a minority

30% stake with no right to control distributions. Mr. Trump did the same thing in

counting funds held in escrow. For example, one-half of the amount under

“escrow” in the 2014 Statement belonged to the Vornado Partnership.

h. Including in the value of golf clubs anticipated income from inflated membership

initiation fees. For example, at Mr. Trump’s golf course in Westchester, the

valuation for 2011 assumed new members would pay an initiation fee of nearly

$200,000 for each of the 67 unsold memberships, even though many new

members in that year paid no initiation fee at all. In some instances, Mr. Trump

specifically directed club employees to reduce or eliminate the initiation fees to

boost membership numbers.

16. Mr. Trump and the other Defendants also engaged in conduct intended to mislead

Mazars in connection with its work compiling the Statements, including by concealing important

information. Because Mazars was not conducting any review or audit procedures, but rather

issuing a compilation in which Mr. Trump’s and the Trustees’ assertions were being compiled

into financial-statement format, many of their fraudulent statements and strategies remained

concealed from, or undetected by, Mazars.

17. As a result, shortly after some of the findings uncovered by OAG’s investigation

came to light in public filings to enforce OAG’s investigative subpoenas, Mazars concluded that

it had to end its long-term business relationship with Mr. Trump and the Trump Organization and

withdraw the Statements it had compiled from 2011 to 2020. In a letter to the Trump

Organization dated February 9, 2022, Mazars explained that it had “come to this conclusion

based, in part, upon the filings made by the New York Attorney General on January 18, 2022,

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 09/21/2022

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

15 of 222

9

our own investigation, and information received from internal and external sources,” and advised

“that the Statements of Financial Condition for Donald J. Trump for the years ending June 30,

2011—June 30, 2020, should no longer be relied upon.” Mazars further instructed the Trump

Organization to “inform any recipients thereof who are currently relying upon one or more of

those documents that those documents should not be relied upon.”

18. Mr. Trump’s Statements of Financial Condition were repeatedly and persistently

submitted to banks insured by the Federal Deposit Insurance Corporation for the purpose of

influencing the actions of those institutions. The Statements were used to obtain and maintain

favorable loans over at least an eleven-year period, including: (a) Deutsche Bank’s extension of a

$125 million loan (or combination of loans) in connection with the Trump Organization’s

purchase of the property known as Trump National Doral; (b) Deutsche Bank’s financing of up

to $107 million in debt in connection with the Trump International Hotel and Tower, Chicago, in

2012, as well as a $54 million expansion of that loan in 2014; and (c) Deutsche Bank’s financing

of up to $170 million in funds in connection with the Trump Organization’s purchase and

renovation of the Old Post Office property in Washington, DC.

19. As to each of those loans, the truthfulness and accuracy of the pertinent

Statement, as certified by Mr. Trump, was a precondition to lending. Moreover, pursuant to the

covenants of those loans, each year Mr. Trump or the trustees would submit a new Statement and

certify its accuracy. Material misrepresentations on any loan document, including the Statements

or the certifications as to their accuracy, would constitute an event of default under the terms of

the loan agreements.

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 09/21/2022

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

16 of 222

10

20. The Statements, along with other false representations, were also used repeatedly

and persistently to obtain beneficial terms on insurance policies from insurers participating on

the Trump Organization’s surety program and directors and officers liability policies.

3

21. The magnitude of financial benefit derived by Mr. Trump and the Trump

Organization by means of these fraudulent and misleading submissions was considerable.

Following the initiation of subpoena-enforcement litigation against Mr. Trump, and Mazars’s

withdrawal of ten years’ worth of Mr. Trump’s Statements of Financial Condition, Mr. Trump

and the Trump Organization decided to repay hundreds of millions of dollars in debt early. But

even that step, the equivalent of partial disgorgement, fails to account for substantial additional

financial benefit obtained by Mr. Trump and the Trump Organization by means of the false and

fraudulent Statements of Financial Condition. Mr. Trump and his operating companies obtained

additional benefits from banks other than loan proceeds in the form of favorable interest rates

that likely saved them more than $150 million over the prior ten-year period.

3

Under the surety program, insurers underwrote surety bonds on behalf of the Trump

Organization required for the company’s business activities, primarily to secure judgments and

mechanics liens and as needed on construction projects and for liquor licenses. Ordinarily, a

surety underwriter requires the insured to put up collateral to secure the obligations assumed

under the bonds, but here the underwriters waived the collateral requirements and accepted

instead a personal indemnity from Mr. Trump coupled with the opportunity to review his

Statement of Financial Condition. Under the directors and officers liability program,

underwriters agreed to defend and indemnify the officers and directors of the Trump

Organization in connection with any claims and investigations asserted against them arising out

of their work for the company. As part of the underwriting negotiations, the insurers reviewed

Mr. Trump’s Statement of Financial Condition and questioned company executives about any

pending or threatened claims and investigations.

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 09/21/2022

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

17 of 222

11

22. The Statements were also critical to the overall success of the investment in the

Old Post Office property in Washington, D.C. Based on its own statement, the Trump

Organization won the bidding as part of “one of the most competitive selection processes in the

history of” the General Services Administration. Critical to the success of that bid was a

demonstration of the “financial wherewithal” of the Trump Organization through the submission

of his Statement of Financial Condition. The favorable interest rates obtained from Deutsche

Bank were instrumental in the financial performance of the investment, which ultimately led to

“the record breaking sale of the Trump International Hotel, Washington, D.C.,” and a financial

benefit to the Trump Organization of more than $100 million in May 2022.

23. All of those benefits were derived from the improper, repeated, and persistent use

of fraudulent and misleading financial statements and are, therefore, subject to disgorgement in

this action under Executive Law § 63(12).

24. It is no defense to claims for disgorgement under § 63(12) that the Trump

Organization may have made all payments due under the loans and insurance policies. The

remedy of disgorgement is available to deprive a wrongdoer of illegal benefit regardless of

whether any entity suffered a financial loss.

B.

Relief Sought

25. In this proceeding, the People seek an order and judgment granting the following

relief to remedy the substantial, persistent, and repeated fraudulent and misleading conduct

occurring since 2011:

a. Cancelling any certificate filed under and by virtue of the provisions of section

one hundred thirty of the New York General Business Law for the corporate

entities named as defendants and any other entity controlled by or beneficially

owned by Donald J. Trump which participated in or benefitted from the foregoing

fraudulent scheme;

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 09/21/2022

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

18 of 222

12

b. Appointing an independent monitor to oversee compliance, financial reporting,

valuations, and disclosures to lenders, insurers, and governmental authorities, at

the Trump Organization, for a period of no less than five years;

c. Replacing the current trustees of the Donald J. Trump Revocable Trust with new

independent trustees, and requiring similar independent governance in any newly-

formed trust should the Revocable Trust be revoked and replaced with another

trust structure;

d. Requiring the Trump Organization to prepare a GAAP-compliant, audited

statement of financial condition audited by an independent auditing firm

empowered to retain independent valuation personnel showing Mr. Trump’s net

worth, to be distributed to all recipients of his prior Statements of Financial

Condition, with any statements of financial condition prepared for the next five

years to also be subject to a GAAP-compliant audit;

e. Barring Mr. Trump and the Trump Organization from entering into any New

York State commercial real estate acquisitions for a period of five years;

f. Barring Mr. Trump and the Trump Organization from applying for loans from any

financial institution chartered by or registered with the New York Department of

Financial Services for a period of five years;

g. Permanently barring Mr. Trump, Donald Trump, Jr., Ivanka Trump, and Eric

Trump from serving as an officer or director in any New York corporation or

similar business entity registered and/or licensed in New York State;

h. Permanently barring Allen Weisselberg and Jeffrey McConney from serving in

the financial control function of any New York corporation or similar business

entity registered and/or licensed in New York State;

i. Awarding disgorgement of all financial benefits obtained by each Defendant from

the fraudulent scheme, including all financial benefits from lenders and insurers

through repeated and persistent fraudulent practices of an amount to be

determined at trial but estimated to be $250,000,000, plus prejudgment interest;

and

j. Granting any additional relief the Court deems appropriate.

II. THE PARTIES

26. The Attorney General is responsible for overseeing the activities of New York

businesses and the conduct of their officers and directors, in accordance with the New York

Executive Law and other applicable laws. She is expressly tasked by the Legislature with

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 09/21/2022

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

19 of 222

13

policing any persistent or repeated fraud and illegal conduct in business. See, e.g., Executive

Law § 63(12).

27. Defendant Donald J. Trump is the beneficial owner of the collection of entities he

styles the “Trump Organization.” Approximately 500 separate entities collectively do business as

the Trump Organization and operate for the benefit, and under the control, of Donald J. Trump.

Among the entities that comprise the Trump Organization are:

a. Defendant Trump Organization, Inc. From May 1, 1981 to January 19, 2017, Mr.

Trump was Director, President, and Chairman of the Trump Organization, Inc. From

at least July 15, 2015 until May 16, 2016, Mr. Trump was the sole owner of the

Trump Organization, Inc.

b. Defendant Trump Organization LLC, a limited liability company doing business in

the State of New York with a principal place of business in New York, NY.

c. Defendant DJT Holdings LLC, a Delaware limited liability company with a principal

place of business in New York, NY.

d. Defendant DJT Holdings Managing Member, a Delaware limited liability company

registered to do business in New York, NY.

28. In addition, the Trump Organization incorporates a host of entities that either own

property at issue in this action or received loans at issue in this action. Included among those

entities are:

a. Defendant Trump Endeavor 12 LLC, a Delaware limited liability company registered to

do business in New York, NY. Trump Endeavor 12 LLC owns the resort property doing

business as Trump National Doral.

b. Defendant 401 North Wabash Venture LLC, a Delaware limited liability company that

operates out of the Trump Organization offices in New York, NY. 401 North Wabash

Venture LLC owns the building doing business as Trump International Hotel & Tower,

Chicago.

c. Defendant Trump Old Post Office LLC, a Delaware limited liability company with its

principal place of business in New York, NY. Trump Old Post Office LLC held a ground

lease from the federal government to operate the property doing business as the Trump

International Hotel, Washington, DC.

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 09/21/2022

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

20 of 222

14

d. Defendant 40 Wall Street LLC, a New York Limited Liability Corporation, which holds a

ground lease for an office building located at 40 Wall Street, New York, NY.

e. Respondent Seven Springs LLC is a New York limited liability company that owns the

Seven Springs estate, consisting of 212 acres of property within the towns of Bedford,

New Castle, and North Castle in Westchester County, NY.

29. Donald J. Trump served as the President and Chairman of the Trump

Organization from May 1, 1981 to January 19, 2017. While serving as President of the United

States, Mr. Trump remained the inactive president of the Trump Organization. After leaving

office, Mr. Trump resumed his position as the president of the Trump Organization.

30. Defendant Donald J. Trump Revocable Trust is a trust created under the laws of

New York that is the legal owner of the entities constituting the Trump Organization. The

Donald J. Trump Revocable Trust was created on April 7, 2014 and amended by Second

Amendment to the Trust dated January 17, 2017. The purpose of the trust is to hold assets for the

exclusive benefit of Donald J. Trump. Mr. Trump is the sole beneficiary of The Donald J. Trump

Revocable Trust.

31. A complete organizational chart of the entities held by the Donald J. Trump

Revocable Trust, that was prepared by the Trump Organization in 2017 for the purposes of

obtaining insurance coverage, is attached as Exhibit 2.

32. Defendant Donald Trump, Jr. is an Executive Vice President of the Trump

Organization. He maintains a business office at 725 Fifth Avenue, New York, NY. Donald

Trump, Jr. oversees the Trump Organization’s property portfolio and is involved in all aspects of

the company’s property development, from deal evaluation, analysis and pre-development

planning to construction, branding, marketing, operations, sales and leasing. Donald Trump Jr. is

also responsible for all of the commercial leasing for the Trump Organization which includes

Trump Tower and 40 Wall Street.

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 09/21/2022

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

21 of 222

15

33. Defendant Ivanka Trump was an Executive Vice President for Development and

Acquisitions of the Trump Organization through early January 2017. Among other

responsibilities, Ms. Trump negotiated and secured financing for Trump Organization properties.

While at the Trump Organization she directed all areas of the company’s real estate and hotel

management platforms. This included active participation in all aspects of projects, including

deal evaluation, pre-development planning, financing, design, construction, sales and marketing,

as well as involvement in all decisions relating to those activities—large and small. Among other

duties, she negotiated the lease with the government and a loan related to the Old Post Office

property. Ms. Trump also negotiated loans on Trump Organization properties at Doral and

Chicago. On each of those transactions with Deutsche Bank, Ms. Trump was aware that the

transactions included a personal guaranty from Mr. Trump that required him to provide annual

Statements of Financial Condition and certifications.

34. After leaving the Trump Organization, Ms. Trump retained a financial interest in

the operations of the Trump Organization through a number of vehicles, including an interest in

the Old Post Office property through Ivanka OPO LLC. In a 2021 federal filing, Ms. Trump

reported total income from Trump Organization entities of $2,588,449, including income from

Ivanka OPO LLC, TTT Consulting, LLC, TTTT Venture LLC and Trump International Realty.

35. Defendant Eric Trump is an Executive Vice President of the Trump Organization,

and Chairman of the Advisory Board of the Donald J. Trump Revocable Trust. He maintains a

business office at 725 Fifth Avenue, New York, NY. Eric Trump is responsible for all aspects of

management and operation of the Trump Organization including new project acquisition,

development and construction. Eric Trump actively spearheaded the growth of Trump Golf

including the addition of 13 golf properties since 2006.

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 09/21/2022

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

22 of 222

16

36. Defendants Donald Trump, Jr. and Eric Trump took over management of the

Trump Organization from Mr. Trump in 2017.

37. Defendant Allen Weisselberg was the Chief Financial Officer of the Trump

Organization from 2003 until July 2021. During that time he maintained a business office at 725

Fifth Avenue, New York, NY. Among his responsibilities as CFO, from at least 2011 until 2020,

Mr. Weisselberg supervised and approved the preparation of the valuations contained in the

Statements of Financial Condition.

38. Defendants Donald Trump, Jr. and Allen Weisselberg were trustees of the Donald

J. Trump Revocable Trust until Mr. Weisselberg resigned in June 2021. On information and

belief, Donald Trump, Jr. is now the sole Trustee of the Donald J. Trump Revocable Trust.

Donald Trump Jr. is named in both his personal capacity and as the Trustee of the Donald J.

Trump Revocable Trust.

39. Defendant Jeffrey McConney is the Controller of the Trump Organization. He

maintains a business office at 725 Fifth Avenue, New York, NY. Among his responsibilities as

Controller, from 2011 to 2016, Mr. McConney prepared the valuations contained in the

Statements of Financial Condition. From 2016 to the present, Mr. McConney supervised and

approved the preparation of the valuations contained in the Statements of Financial Condition.

III. JURISDICTION, APPLICABLE LAW, AND VENUE

40. This enforcement action is brought on behalf of the People of the State of New

York pursuant to the New York Executive Law.

41. Executive Law § 63(12) allows the Attorney General to bring a proceeding

“[w]henever any person shall engage in repeated fraudulent or illegal acts or otherwise

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 09/21/2022

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

23 of 222

17

demonstrate persistent fraud or illegality in the carrying on, conducting or transaction of

business.”

42. Fraudulent conduct as used in § 63(12) includes acts that have the “capacity or

tendency to deceive, or creates an atmosphere conducive to fraud.” People v. Applied Card Sys.,

Inc., 27 A.D.3d 104, 107 (3d Dep’t 2005), aff’d on other grounds, 11 N.Y.3d 105 (2008); see

also People v. Northern Leasing Systems, Inc., 193 A.D.3d 67, 75 (1st Dep’t 2021). The terms

“fraud” and “fraudulent” are “given a wide meaning so as to embrace all deceitful practices

contrary to the plain rules of common honesty, including all acts, even though not originating in

any actual evil design to perpetrate fraud or injury upon others, which do tend to deceive or

mislead.” People ex rel. Cuomo v. Greenberg, 95 A.D.3d 474, 483 (1st Dep’t 2012). By its plain

terms, Executive Law § 63(12) covers frauds committed by overtly false or fraudulent

statements, by omission, or as part of a scheme to defraud. See Executive Law § 63(12) (defining

the words “fraud” and “fraudulent” to include “any . . . misrepresentation, concealment, [or]

suppression . . . .”).

43. A violation of any federal, state, or local law or regulation constitutes “illegality”

within the meaning of Executive Law § 63(12). See, e.g., Applied Card Sys., 27 A.D.3d at 106,

109; Oncor Commc’ns, Inc. v. State, 165 Misc. 2d 262, 267 (Sup. Ct. Albany Cty. 1995), aff’d,

218 A.D.2d 60 (3d Dep’t 1996); People v. Am. Motor Club, Inc., 179 A.D.2d 277 (1st Dep’t

1992), appeal dismissed, 80 N.Y.2d 893; State v. Winter, 121 A.D.2d 287 (1st Dep’t 1986). “It

long has been recognized that the statute affords the Attorney General broad authority to enforce

federal as well as state law, unless state action in the area of federal concern has been precluded

utterly or federal courts have exclusive jurisdiction of the matter.” Oncor Commc’ns, Inc. v.

State, 165 Misc. 2d 262, 267 (Sup. Ct. Albany Cty. 1995), aff’d, 218 A.D.2d 60 (3d Dep’t 1996).

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 09/21/2022

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

24 of 222

18

Thus, if conduct violates a provision of New York’s Penal Law . . . it may be the subject of an

action for equitable relief on the basis of “illegality” under Executive Law § 63(12).

44. State laws other than Executive Law § 63(12) render unlawful certain fraudulent

actions with respect to financial statements and their use. Falsification of business records is

unlawful under the Penal Law—and is a felony when committed to aid or conceal the

commission of another offense. See, e.g., Penal Law § 175.10. The issuance of a false financial

statement is likewise an offense under the Penal Law. See, e.g., Penal Law § 175.45. A

conspiracy—essentially, an agreement to commit an offense by a group of persons, and one overt

act by one of the conspirators—is unlawful under the Penal Law as well. See generally Penal

Law § 105.

45. Fraud or illegality, within the meaning of Executive Law § 63(12), may be the

subject of an enforcement action if it is either “repeated” or “persistent.” Such conduct is

“repeated,” § 63(12) instructs, if it involves either “any separate and distinct fraudulent or illegal

act, or conduct which affects more than one person.” Executive Law § 63(12). Thus, under the

statute, “the Attorney-General [may] bring a proceeding when the respondent was guilty of only

one act of alleged misconduct, providing it affected more than one person.” State of New York v.

Wolowitz, 96 A.D.2d 47, 61 (2d Dep’t 1983).

46. The statute instructs that the term “persistent” includes the “continuance or

carrying on of any fraudulent or illegal act or conduct.” Executive Law § 63(12).

47. Among the equitable remedies available to the Attorney General under Executive

Law § 63(12) is disgorgement, which is designed to deprive the wrongdoer of illegal benefit

regardless of whether any entity suffered a financial loss. See People v. Ernst & Young, LLP, 114

A.D.3d 569, 569-70 (1st Dep’t 2014) (“Thus, disgorgement aims to deter wrongdoing by

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 09/21/2022

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

25 of 222

19

preventing the wrongdoer from retaining ill-gotten gains from fraudulent conduct. Accordingly,

the remedy of disgorgement does not require a showing or allegation of direct losses to

consumers or the public; the source of the ill-gotten gains is ‘immaterial’”). Multiple defendants

may be jointly and severally liable for disgorgement under § 63(12) when they have participated

in a common scheme. See Fed. Trade Comm’n v. Shkreli, No. 20 Civ. 706, 2022 WL 135026

(S.D.N.Y. Jan. 14, 2022). Disgorgement can also include salary and bonuses that are a result of

fraudulent activity. See, e.g., SEC v. Razmilovic, 738 F.3d 14, 32 (2d Cir. 2013).

48. This Court has jurisdiction over the subject matter of this action, personal

jurisdiction over the Defendants, and authority to grant the relief requested pursuant to Executive

Law § 63(12).

49. Pursuant to C.P.L.R. § 503, venue is proper in New York County, because

Plaintiff resides in that county, and because a substantial part of the events and omissions giving

rise to the claims occurred in that county.

IV. FACTUAL ALLEGATIONS

50. The breadth of material presented here is considerable, necessitating a roadmap

for the Court. This complaint presents verified allegations regarding scores of fraudulent, false,

and misleading representations by Mr. Trump, the Trump Organization, and the other

Defendants. The financial statements in question were issued annually; each contained a

significant number of fraudulent, false, and misleading representations about a great many of the

Trump Organization’s assets; and most played a role in particular transactions with financial

institutions. The substantial information presented in the complaint is organized in the following

manner:

a. an overview of the relevant assets of Mr. Trump presented in the

Statement (¶¶ 51(a) – 51(n));

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 09/21/2022

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

26 of 222

20

b. a general description of the Statements for the relevant years, 2011

through 2021 (¶¶ 52 – 65);

c. a detailed discussion of the inflated valuations contained in the Statements

for each relevant asset (¶¶ 66 – 558);

d. a detailed discussion of the loans procured and maintained by Mr. Trump

and the Trump Organization using the false and misleading Statements

((¶¶ 559 – 675);

e. a detailed discussion of the insurance procured by Mr. Trump and the

Trump Organization procured through the use of the false and misleading

Statements and other material misrepresentations and omissions (¶¶ 676 –

714); and

f. a detailed discussion of the ongoing nature of the fraudulent scheme and

conspiracy among the defendants (¶¶ 715 – 747).

A.

Overview of Trump Organization Assets

51. In an effort to familiarize the Court with the pertinent assets reflected in the

Statements of Financial Condition, OAG provides the following brief descriptions below:

a. Cash, marketable securities, and cash equivalents. This category of asset

reflects cash controlled by Mr. Trump, or securities (such as publicly traded

stocks) that are readily convertible to cash. Under GAAP, cash equivalents

constitute short-term, highly liquid investments that are readily convertible to

known amounts of cash and that are so near their maturity that they present

insignificant risk of changes in value because of changes in interest rates (such

as a money market fund).

b. Escrow and Reserve Deposits and Prepaid Expenses. This category purports

to include funds that belong to Mr. Trump but have been escrowed or subjected

to some other restriction pursuant to a legal document such as a loan agreement.

c. Trump Tower (commercial space) (“Trump Tower”). Mr. Trump owns

commercial space (office and retail) in a building at 725 Fifth Avenue in

midtown Manhattan.

d. Mr. Trump’s triplex apartment (“Triplex”). Separately Mr. Trump owns an

apartment in Trump Tower. This apartment is grouped with other assets in a

category entitled “other assets” on the Statements of Financial Condition.

e. 4-6 East 57th Street (“Niketown”). Mr. Trump owns two ground leases that

comprise a space adjoining Trump Tower. Mr. Trump pays rent on those

ground leases to the landowners, and those ground leases are subject to long-

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 09/21/2022

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

27 of 222

21

term rent schedules and adjustments. The retail space for many years was leased

to Nike and is known as “Niketown.”

f. 40 Wall Street (“40 Wall Street”). 40 Wall Street is a building located in

lower Manhattan. Mr. Trump purchased a ground lease pertaining to the

building in 1995 for $1.3 million. The building was completed in 1930 and

contains a mix of office and retail space.

g. Trump Park Avenue (“Trump Park Avenue”). This building, located at 502

Park Avenue in midtown Manhattan is a condominium that contains residential

and retail units owned by Mr. Trump.

h. Seven Springs (“Seven Springs”). Mr. Trump purchased this estate traversing

the towns of Bedford, North Castle, and New Castle in Westchester County,

New York in 1995 for $7.5 million. The estate consists of two large homes,

undeveloped land, and a few other buildings.

i. Trump International Hotel & Tower, Chicago (“Trump Chicago”). This

condominium-hotel building is, or has been, comprised of a residential

component and a hotel component. The building is located in Chicago, Illinois.

Since 2009, its value has been excluded from the Statements of Financial

Condition because, according to sworn testimony, Mr. Trump did not want to

take a position on the Statements that would conflict with a position about the

property’s value he has represented to tax authorities. Investigation revealed

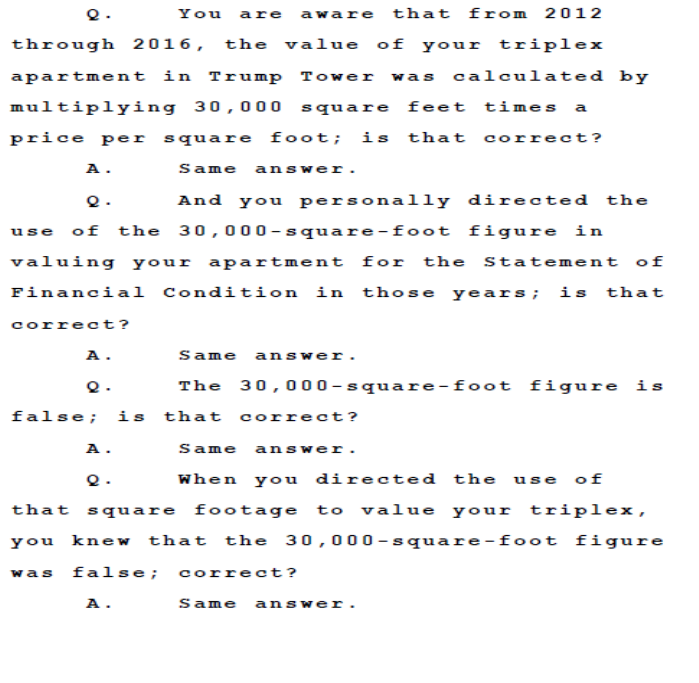

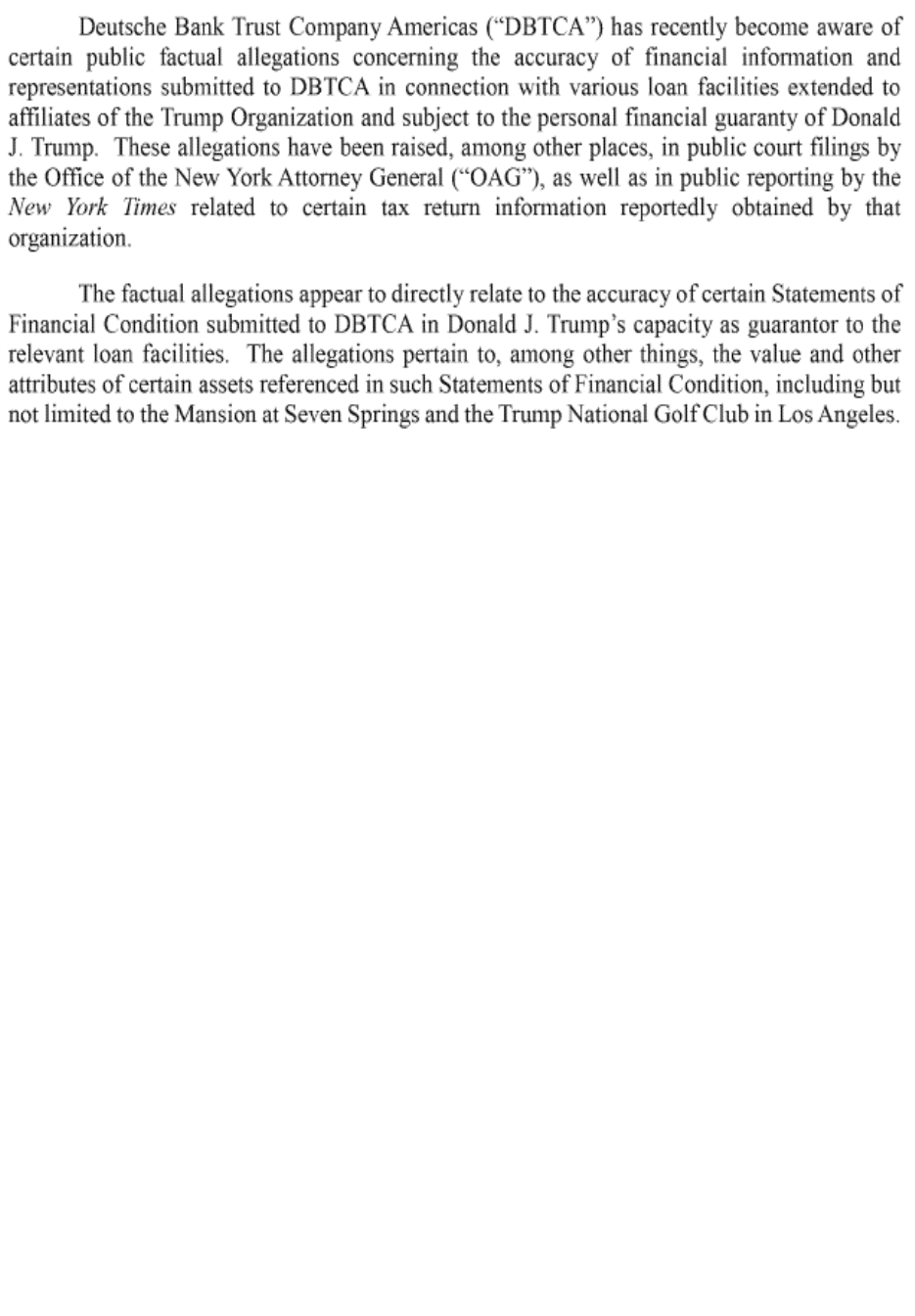

that the tax position taken was that the property had become worthless