Attention:

Copy A of this form is provided for informational purposes only. Copy A appears in red,

similar to the official IRS form. The official printed version of Copy A of this IRS form is

scannable, but the online version of it, printed from this website, is not. Do not print and file

copy A downloaded from this website; a penalty may be imposed for filing with the IRS

information return forms that can’t be scanned. See part O in the current General

Instructions for Certain Information Returns, available at IRS.gov/Form1099, for more

information about penalties.

Please note that Copy B and other copies of this form, which appear in black, may be

downloaded and printed and used to satisfy the requirement to provide the information to

the recipient.

If you have 10 or more information returns to file, you may be required to file e-file. Go to

IRS.gov/InfoReturn for e-file options.

If you have fewer than 10 information returns to file, we strongly encourage you to e-file. If

you want to file them on paper, you can place an order for the official IRS information

returns, which include a scannable Copy A for filing with the IRS and all other applicable

copies of the form, at IRS.gov/EmployerForms. We’ll mail you the forms you request and

their instructions, as well as any publications you may order.

See Publications 1141, 1167, and 1179 for more information about printing these forms.

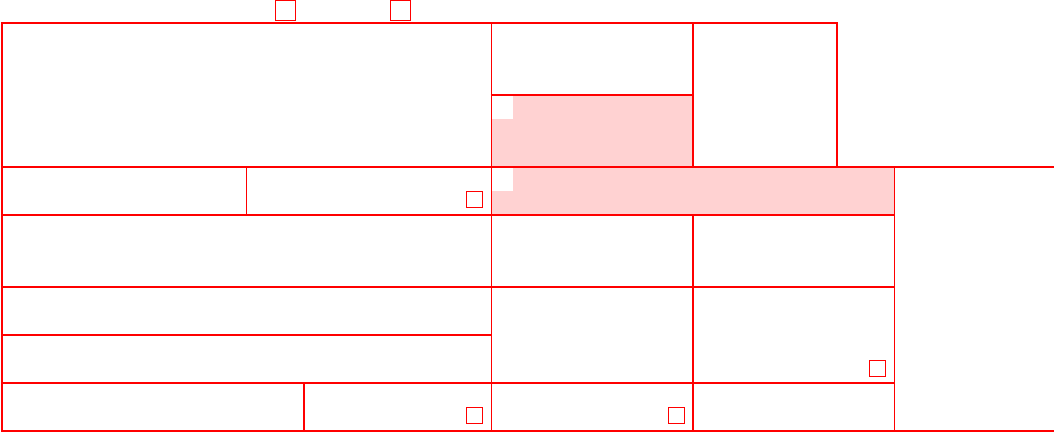

Form 1098-T

2024

Cat. No. 25087J

Tuition

Statement

Department of the Treasury - Internal Revenue Service

Copy A

For

Internal Revenue

Service Center

File with Form 1096.

OMB No. 1545-1574

For Privacy Act and

Paperwork Reduction

Act Notice, see the

2024 General

Instructions for

Certain Information

Returns.

8383

VOID CORRECTED

FILER’S name, street address, city or town, state or province, country, ZIP or

foreign postal code, and telephone number

FILER’S employer identification no. STUDENT’S TIN

STUDENT’S name

Street address (including apt. no.)

City or town, state or province, country, and ZIP or foreign postal code

Service Provider/Acct. No. (see instr.)

1 Payments received for

qualified tuition and related

expenses

$

2

3

4 Adjustments made for a

prior year

$

5 Scholarships or grants

$

6 Adjustments to

scholarships or grants

for a prior year

$

7 Checked if the amount

in box 1 includes

amounts for an

academic period

beginning January–

March 2025

8 Checked if at least

half-time student

9 Checked if a graduate

student

10 Ins. contract reimb./refund

$

Form 1098-T

www.irs.gov/Form1098T

Do Not Cut or Separate Forms on This Page — Do Not Cut or Separate Forms on This Page

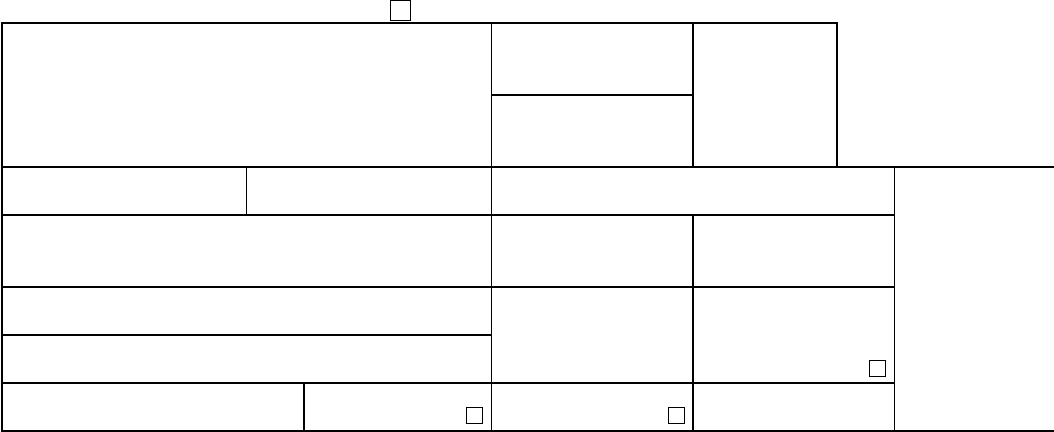

Form 1098-T

2024

Tuition

Statement

Department of the Treasury - Internal Revenue Service

Copy B

For Student

This is important

tax information

and is being

furnished to the

IRS. This form

must be used to

complete Form 8863

to claim education

credits. Give it to the

tax preparer or use it to

prepare the tax return.

OMB No. 1545-1574

CORRECTED

FILER’S name, street address, city or town, state or province, country, ZIP or

foreign postal code, and telephone number

FILER’S employer identification no. STUDENT’S TIN

STUDENT’S name

Street address (including apt. no.)

City or town, state or province, country, and ZIP or foreign postal code

Service Provider/Acct. No. (see instr.)

1 Payments received for

qualified tuition and related

expenses

$

2

3

4 Adjustments made for a

prior year

$

5 Scholarships or grants

$

6 Adjustments to

scholarships or grants

for a prior year

$

7 Checked if the amount

in box 1 includes

amounts for an

academic period

beginning January–

March 2025

8 Checked if at least

half-time student

9 Checked if a graduate

student

10 Ins. contract reimb./refund

$

Form 1098-T

(keep for your records) www.irs.gov/Form1098T

Instructions for Student

You, or the person who can claim you as a dependent, may be able to claim an

education credit on Form 1040 or 1040-SR. This statement has been furnished

to you by an eligible educational institution in which you are enrolled, or by an

insurer who makes reimbursements or refunds of qualified tuition and related

expenses to you. This statement is required to support any claim for an

education credit. Retain this statement for your records. To see if you qualify for

a credit, and for help in calculating the amount of your credit, see Pub. 970,

Form 8863, and the Instructions for Form 1040. Also, for more information, go to

www.irs.gov/Credits-Deductions/Individuals/Qualified-Ed-Expenses and

www.irs.gov/Education.

Your institution must include its name, address, and information contact telephone

number on this statement. It may also include contact information for a service provider.

Although the filer or the service provider may be able to answer certain questions about

the statement, do not contact the filer or the service provider for explanations of the

requirements for (and how to figure) any education credit that you may claim.

Student’s taxpayer identification number (TIN). For your protection, this form may

show only the last four digits of your TIN (SSN, ITIN, ATIN, or EIN). However, the issuer

has reported your complete TIN to the IRS. Caution: If your TIN is not shown in this box,

your school was not able to provide it. Contact your school if you have questions.

Account number. May show an account or other unique number the filer

assigned to distinguish your account.

Box 1. Shows the total payments received by an eligible educational institution in 2024

from any source for qualified tuition and related expenses less any reimbursements or

refunds made during 2024 that relate to those payments received during 2024.

Box 2. Reserved for future use.

Box 3. Reserved for future use.

Box 4. Shows any adjustment made by an eligible educational institution for a

prior year for qualified tuition and related expenses that were reported on a

prior year Form 1098-T. This amount may reduce any allowable education credit

that you claimed for the prior year (may result in an increase in tax liability for the

year of the refund). See “recapture” in the index to Pub. 970 to report a

reduction in your education credit or tuition and fees deduction.

Box 5. Shows the total of all scholarships or grants administered and processed

by the eligible educational institution. The amount of scholarships or grants for

the calendar year (including those not reported by the institution) may reduce

the amount of the education credit you claim for the year.

TIP: You may be able to increase the combined value of an education credit and certain

educational assistance (including Pell Grants) if the student includes some or all of the

educational assistance in income in the year it is received. For details, see Pub. 970.

Box 6. Shows adjustments to scholarships or grants for a prior year. This

amount may affect the amount of any allowable tuition and fees deduction or

education credit that you claimed for the prior year. You may have to file an

amended income tax return (Form 1040-X) for the prior year.

Box 7. Shows whether the amount in box 1 includes amounts for an academic period

beginning January–March 2025. See Pub. 970 for how to report these amounts.

Box 8. Shows whether you are considered to be carrying at least one-half the

normal full-time workload for your course of study at the reporting institution.

Box 9. Shows whether you are considered to be enrolled in a program leading

to a graduate degree, graduate-level certificate, or other recognized graduate-

level educational credential.

Box 10. Shows the total amount of reimbursements or refunds of qualified tuition

and related expenses made by an insurer. The amount of reimbursements or refunds

for the calendar year may reduce the amount of any education credit you can claim

for the year (may result in an increase in tax liability for the year of the refund).

Future developments. For the latest information about developments related to

Form 1098-T and its instructions, such as legislation enacted after they were

published, go to www.irs.gov/Form1098T.

Free File Program. Go to www.irs.gov/FreeFile to see if you qualify for no-cost

online federal tax preparation, e-filing, and direct deposit or payment options.