rev 05/2019

PETITION for RESIDENT CLASSIFICATION

UC IRVINE UNIVERSITY REGISTRAR

www.reg.uci.edu

(949) 824 - 6124

Requirements

1. Physical Presence: Documentation that you have been physically present in California for more than 12 months (366 days)

immediately prior to the residence determination date of the quarter you wish to be classified as a resident.

2. Intent: Documentation that you established residential ties to the state of California and relinquished all out-of-state ties

shortly after your arrival in California (see other side).

3. Financial Independence ( for students under 24 years of age who are not dependent on a California resident parent):

Documentation which demonstrates that you have been self-supporting and not claimed as a dependent for income tax

purposes for the preceding calendar year (contact the Residence Officer for more information).

Deadlines

The Petition for Resident Classification must be received at the University Registrar by 5:00 PM on the

deadline date. LATE PETITIONS WILL NOT BE ACCEPTED.

Filing a Petition

Petition for Resident Classification filing periods by term:

Fall Semester 2019 Spring Semester 2020

Jun 1 - Aug 2, 2019 Jan 15 - Feb 28, 2020

Apr 12 - Jun 14, 2019 Oct 14 - Nov 18, 2019

Oct 14 - Nov 30, 2019

Undergraduate /

Graduate Students

Law Students

Spring Quarter 2020Winter Quarter 2020Fall Quarter 2019

Procedures

If you are a nonresident student for tuition purposes, and you wish to be classified as a California resident, you

must file a Petition for Resident Classification by the deadline date for the applicable quarter. You should

consult the Residence Officer for information regarding your residence status at the University Registrar, 215

Aldrich Hall, Irvine, CA 92697-4975, (949) 824-6124, or E-mail: [email protected].

Who should file

this Petition?

1. Download or open a Petition for Resident Classification from the University Registrar web site.

2. Complete the petition on line, print, sign and date. Respond to ALL questions.

3. Drop off your completed petition, or mail it to the University Registrar. Normal hours are 8am to 5pm

Monday through Friday. No appointment is required.

How do I file

a Petition?

You must provide photocopies of all documentation relevant to your demonstration of intent as indicated on

your Petition for Resident Classification. All documentation should identify you by name and be dated (see

reverse side).

IMPORTANT: Documentation will not be accepted after the last day of the term for which you are petitioning

for classification as a resident. If you fail to provide photocopies of any or all of the required documentation by

the end of the applicable term, your petition will be denied and you will remain classified as a nonresident for

that term. If you are unable to provide the required documentation by the end of the term for which you are

petitioning, and you wish to file a petition for any future quarter, you must file a new Petition for Resident

Classification by the applicable deadline.

Documentation

IS REQUIRED

Jun 1 - Aug 3, 2020

Fall Quarter 2020

Fall Semester 2020

Apr 13 - Jun 15, 2020

rev 05/2019

Required Documentation

IMPORTANT INFORMATION:

It is the responsibility of the student to provide photocopies of all documentation relevant to their demonstration of intent. The

intent to reside permanently in California must be demonstrated for the required period of physical presence (366 days) in California.

Residence classification is determined on the basis of the concurrence of physical presence and the intent to reside permanently in

California. Documentation of intent is always required of the student and is required of the California resident parent(s) upon whom

the student is financially dependent. Your petition cannot be accepted without photocopies of documentation (see list of

required documentation below). All the listed documents below are required. **

Failure to establish legal ties with the state of California shortly after your arrival in California or the maintenance of legal ties with

your previous state of residence will be viewed as inconsistent with the intent to reside permanently and could jeopardize the

success of your petition to reclassify as resident of the state of California.

Provide a photocopy of the following documents (All the listed documents below are required **):

** If you are unable to provide a photocopy of a document listed below, you must submit a written statement explaining the lack of the required document(s).

1. California driver’s license or California ID card (http://www.dmv.ca.gov/)

2. California vehicle registration (http://www.dmv.ca.gov/)

3. California voter registration (Contact your county's Registrar of Voters for verification. For Orange County: (714) 567-7600)

4. Your most recent California State Income Tax Return and Federal Income Tax Return.

5. Your current and previous lease or rental agreement (pages showing duration of lease and signature only).

6. A copy of pay receipts and/or W-2 forms documenting employment held within the preceding 12 months.

7. If you are not a U.S. citizen, you must provide documentation from the Immigration and Naturalization Service which

demonstrates your legal status for a minimum of 366 days prior to the residence determination date of the term for which you

are seeking classification as a resident. If you are under 19 years of age, you must also provide documentation of your parents’

status (contact the Residence Officer if you have any questions about your legal status).

8. Proof of your physical presence during the 12 months preceding the quarter you wish to be reclassified, including the months

of June, July, August, and September, such as employment verification, summer school enrollment, and bank statements.

9. Undergraduate students under the age of 24 by December 31

st

of the academic year of the term for which classification as a

resident is requested must provide the above items for your parents as well if they claim to be CA residents.

Relevant documentation is not limited to the above items. The more indicia obtained, the stronger one's demonstration of intent.

Additional documentation may be required on or after the time you file your Petition for Resident Classification. Evidence must

consistently show that your primary residence has been established in California and relinquished outside of California. All

information supporting a claim of California residence will be considered in the reclassification determination. Students deemed to

be in the state solely for educational purposes are not eligible for resident status, regardless of their length of stay in California.

IMPORTANT NOTICE

The student is cautioned that this summation is not a complete explanation of the laws regarding residence. Applicable sections of

the Education Code and the regulations adopted by The Regents of the University of California are available for inspection at the

University Registrar. Please note that changes may be made in the residence requirements between the publication date of this

statement and the relevant determination date. Non-citizen students must consult the Residence Officer for information regarding

specific criteria for determining residence eligibility for alien students.

DETACH THIS PAGE AND KEEP FOR YOUR RECORDS

rev 05/2019

PETITION for RESIDENT CLASSIFICATION

UC IRVINE UNIVERSITY REGISTRAR

FOR REGISTRAR USE ONLY

Resident Nonresident

By: Date:

Complete this Petition for Resident Classification online, then print, sign and date. Bring your completed petition at the University

Registrar on or prior to 5 PM of the stated deadline for the quarter you wish to change your residence classification.

PLEASE NOTE: You are not eligible to change your classification for a quarter in which late registration fees are in effect.

LATE PETITIONS WILL NOT BE ACCEPTED.

Print full name (Last, First,Middle)

Student ID#

Present Mailing Address (Line 1) Age

Date of Birth

UCI Email

Present Mailing Address (Line 2) State ZIP Code

Legal Status

Proof of legal status is required

1) Are you a citizen of the United States? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2) If not, have you been awarded:

a) Permanent Residence? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b) Employment Authorization? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c) Temporary Residence? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

d) United States Visa? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Specify dates of physical presence in California:

Continuously since birth

Have you been absent from California for more than

six weeks during the past 12 months?

If yes, you must attach a written statement

explaining your absence(s) (include specific dates).

Intent

a) Did you/will you file an income tax return as a

California Resident or Part-Year Resident?. . . . . .

1) Financial Information

b)Did you/will you file an income tax return as a

Resident of another state? . . . . . . . . . . . . . . . . . . . . . .

YES

NO

YES

NO

c) Employment Status

Were you employed in California?. . . . . . . . . . . . . . . . .

Were you employed outside of California?. . . . . . . . .

YES

NO

YES

NO

YES

NO

YES

NO

If yes, specify states: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If yes, provide a written explanation.

2019 2018

d) Did you receive loans, scholarships, or benefits

That required residence outside of California?. . . . .

YES

NO

YES

NO

If yes, provide a written explanation.

e) Did you/will you live with your parents for

more six weeks in:

YES

NO

YES

NO

2019

2018

:

Date Awarded

g) Did you/will you receive more than $750

in financial Support from your parents in:

YES

NO

YES

NO

2019

2018

f) Source of your financial support in:

:

2019

:

2018

h) Did your/will your parents claim you as an

exemption on their state and federal tax returns in:

YES

NO

YES

NO

2019

2018

2) Driver License & Motor Vehicle Information

a) Do you have a driver's license?. . . .

YES

NO

b) Do you have a motor vehicle? . . . .

/ /:

Date Issued

/ /:

Last Renewed

Which State

If you do not drive, do you have

a California identification card?. . . .

YES

NO

/ /:

Date Issued

YES

NO

Which state is it registered with?

/ /:

Date of Registration

3) Voter Registration Information

a) Are you registered to vote? . . . . . . .

YES

NO

Which state are you registered with?

/ /:

Date of Registration

b) Have you voted within the

the last fifteen months? . . . . . . . . . . .

YES

NO

Which state did you vote?

NOYES

NOYES

NOYES

NOYES

//

Date Awarded

: //

Date Awarded

: //

:

Visa Type Valid From

: //

to

//

A#

:

NOYES

Physical Presence

From

: / /

to

/ /

or

NOYES

4) Bank Information

a) Checking Account:

:

Bank Name

:

Acct Mailing Address (state only)

b) Savings Account:

:

Bank Name

Date established

: / /

Date established

: / /

:

Acct Mailing Address (state only)

i) Marital Status

Married or Registered Domestic Partner

Divorced or Partnership Terminated

Single

//:

Date

//:

Date

:

State married in

:

State divorced in

5)

What state do you regard as your permanent home?

How long has it been your home?

Do you plan to remain in California

after you complete your education?

NOYES

YES

NO

YES

NO

Specify Term:

rev 05/2019

If you are under 24 years of age, please complete the remainder of this page. If not, continue to the next page.

Are you or is your spouse currently on active duty in the U.S. military?

If yes, where are you stationed at? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If you were stationed OUTSIDE of California, what is your

State of Legal Residence (not "home of record") on military Records?. . . .

Student (yourself) Spouse

YES

NO

YES

NO

From To

From To

Parent Information

1) Are your parents divorced or permanently separated?

YES

NO

If yes, with whom did you live with last?

Father Other

Mother

Dates of Residence with parent: . . . . . . . . . . . . . . . . . . . . . .

From To

From To

2) If your parent(s) are deceased, please provide the date and place of death, Otherwise provide all information required below.

(Place)

Father: (Date)

(Place)

Mother: (Date)

Is your father a citizen of the United States?

Has your father been awarded:

-- Permanent Residence?. . . . . . . . . . . . . . . . .

-- Employment Authorization?. . . . . . . . . . . .

-- Temporary Residence? . . . . . . . . . . . . . . . . .

-- United States Visa?. . . . . . . . . . . . . . . . . . . . .

First Awarded

First Awarded

First Awarded

First Awarded

Last Renewed

Last Renewed

Expiration Date

Visa Type

I94 Entry Date

If NO, complete the following questions regarding your legal status in the U.S.

3) Information on Student's Father:

Print full name (Last, First,Middle)

Present Mailing Address (Number,Street,Apt#)

State

ZIP Code

b) Legal Status

Date California became your father's permanent home . . . . . . . .

Have your father been absent from California for

more than six weeks during the past 12 months? . . . . . . . . . . .

Important: If yes, attach a written statement explaining his absence(s) (include specific dates).

YES NO

a) Physical Presence

Does your father claim to be a Resident of California?

f) Military Information

Is your father currently on active duty in the U.S. military?

If yes, where is your father station at? . . . . . . . .. . . . . . . . . . . . . .

If your father was stationed OUTSIDE of California, what is your

father's State of Legal Residence (not "home of record") on

military Records?. . . .

YES

NO

From

To

Does your father have a driver's license?

Date Issued

Last Renewed

Which State

c) Driver License & Motor Vehicle Information

Does your father have a motor vehicle?. . . .

If your father does not drive, does he

have a California identification card?

Date Issued

Which state is it registered with?

Date of Registration

d) Banking Information e) Tax Information

Did your father file a California

income tax return for:

NO

YES

NO

YES

Last Year

This Year

Military Information

City

//:

//:

//:

//:

//:

//:

//:

//:

//:

:

:

A#

: / /

//:

YES NO

: / /

YES NO

YES NO

: / /

a) Checking Account:

:

Bank Name

:

Acct Mailing Address (state only)

b) Savings Account:

:

Bank Name

Date established

: / /

Date established

: / /

:

Acct Mailing Address (state only)

4) Information on Student's Mother:

Print full name (Last, First,Middle)

Present Mailing Address (Number,Street,Apt#)

State

ZIP Code

Date California became your mother's permanent home . . . . . . . .

Have your mother been absent from California for

more than six weeks during the past 12 months? . . . . . . . . . . .

Important: If yes, attach a written statement explaining her absence(s) (include specific dates).

YES NO

a) Physical Presence

Does your mother claim to be a Resident of California?

f) Military Information

Is your mother currently on active duty in the U.S. military?

If yes, where is your mother station at? . . . . . . . .. . . . . . . . . . . . . .

If your mother was stationed OUTSIDE of California, what is your

mother's State of Legal Residence (not "home of record") on

military Records?. . . .

YES

NO

From

To

Does your mother have a driver's license?

Date Issued

Last Renewed

Which State

c) Driver License & Motor Vehicle Information

Does your mother have a motor vehicle?. . . .

If your mother does not drive, does he

have a California identification card?

Date Issued

Which state is it registered with?

Date of Registration

d) Banking Information e) Tax Information

Did your mother file a California

income tax return for:

NO

YES

NO

YES

Last Year

This Year

City

//:

: / /

//:

YES NO

: / /

YES NO

YES NO

: / /

a) Checking Account:

:

Bank Name

:

Acct Mailing Address (state only)

b) Savings Account:

:

Bank Name

Date established

: / /

Date established

: / /

:

Acct Mailing Address (state only)

NOYES

NOYES

NOYES

NOYES

NOYES

Is your mother a citizen of the United States?

Has your mother been awarded:

-- Permanent Residence?. . . . . . . . . . . . . . . . .

-- Employment Authorization?. . . . . . . . . . . .

-- Temporary Residence? . . . . . . . . . . . . . . . . .

-- United States Visa?. . . . . . . . . . . . . . . . . . . . .

First Awarded

First Awarded

First Awarded

First Awarded

Last Renewed

Last Renewed

Expiration Date

Visa Type

I94 Entry Date

If NO, complete the following questions regarding your legal status in the U.S.

b) Legal Status

//:

//:

//:

//:

//:

//:

//:

//:

:

:

A#

NOYES

NOYES

NOYES

NOYES

NOYES

YES NO

If no, skip to section #4

YES NO

If no, skip to the next page.

rev 05/2019

Summer Physical Presence

Briefly explain your physical presence during the summer months of June, July, August and September immediately preceding the

quarter you wish to be classified as a resident for tuition purposes. If you will remain physically present in California during the

summer months, please indicate this fact. You must include all dates of departure and return for any absence from California

during the 366 day period immediately preceding the beginning of the term for which classification as a resident is requested.

I declare under penalty of perjury under the laws of the State of California that the statements on this page and any attachments

submitted by me in connection with the determination of my residence are, and each of them is, true and correct.

Student Signature:

Date:Signed in (city/county):

If you intend to leave the state of California during the summer months immediately preceding

the term for which you wish to be classified as a resident, complete the remainder of this form.

If you will remain physically present in the state of California, please sign and date below.

With whom will you live while outside of California (e.g. with your parents, in an apartment, etc.)?

Where will you keep your personal belongings while outside of California?

Are you leaving California for employment purposes?

YES NO

If yes, did you attempt to find employment in the state of California prior to accepting employment outside of California?

NOYES

If you did attempt to find employment in California, please submit verification of your search for employment in California.

rev 05/2019

RECLASSIFICATION PROCEDURE

FINANCIAL INDEPENDENCE INFORMATION

(for continuing students who wish to be reclassified as California Residents)

University residence regulations require that a student who will not reach the age of 24 by December 31

st

of the

academic year of the term for which classification as a resident is requested, and who is not the dependent of a

California resident parent, demonstrate financial independence in addition to meeting the 366 day physical

presence and intent requirements when seeking classification as a resident for tuition purposes (see Financial

Independence Overview on the next page).

If you will not reach the age of 24 by December 31

st

of the academic year you are requesting residency for, and are

not dependent upon a California resident parent, you must complete the attached Verification of Self-Sufficiency

form and submit the attached Parent Statement form, completed and signed by your parent(s). You must

demonstrate that you were not claimed as a dependent for tax purposes by your parent(s) or any other adult for the

year immediately prior to the term for which you are seeking classification as a California resident. You must also

provide objective documentation demonstrating that you have sufficient financial resources, earned through your

own employment and/or credit, to cover all of your living and educational expenses for the current calendar year,

and for the last 12 months immediately prior to the term for which classification as a resident is requested.

If all or a portion of the current and/or previous 12 months occurred during your minority (under the age of 18), you

must clearly demonstrate that you lived separate and apart from your parents or other family members, and were

managing your own financial affairs as a minor. In most cases, an individual is not eligible to begin their first calendar

year of self-sufficiency until reaching the age of majority (18 years or older).

If you feel that you qualify for one of the recognized exemptions from the University's financial independence

requirement, you must provide documentation verifying this fact (see Financial Independence Summary for possible

exemptions). If you reached the age of majority while one or both parents were residents of California and your

parent(s) thereafter left California to establish a residence elsewhere, and you remained a resident of California

following your parent(s) departure, you must include a written statement from your parent(s) indicating the dates

that they resided in California and the date of their departure. In addition, you must provide documentation

demonstrating that one or both parents remained residents of California until you reached 18 years of age.

NOTE TO GRADUATE STUDENTS: Graduate students, regardless of age, are considered independent.

Please read the financial independence information provided in this packet carefully. You are strongly encouraged

to contact the campus Residence Officer at the earliest possible date if you have questions. You may reach the

campus Residence Officer at (949) 824-6124 or e-mail [email protected]

.

rev 05/2019

FINANCIAL INDEPENDENCE OVERVIEW

University residence regulations require that a student who will not reach the age of 24 by December 31

st

of the

academic year of the term for which classification as a resident is requested, and who is not dependent upon a

parent

1

who meet the requirements for establishing residence for tuition purposes, demonstrate financial

independence in addition to meeting the 366 day physical presence and intent requirements when seeking

classification as a resident for tuition purposes. It should be noted that this requirement makes it extremely difficult for

most undergraduates who do not have a parent living in California, including transfer students from community colleges

and other post-secondary institutions within California, to qualify for classification as a resident at a University of California

campus.

If you will not reach the age of 24 by December 31

st

of the academic year of the term which classification as a resident

is requested, and are not dependent upon a California resident parent, you must demonstrate that you were/will not

be claimed as a dependent for tax purposes by your parent(s) or any other adult for the 12 months immediately prior

to the term for which you are seeking classification as a resident. You must also provide objective documentation

demonstrating that you have sufficient financial resources, earned through your own employment and/or credit

2

, to

cover all of your living and educational expenses for each of the two calendar years immediately prior to the term for

which classification as a resident is requested.

You must submit an estimated budget for the last 12 months preceding the start of the term residency is requested

for demonstrating your ability to support yourself with the funds you claim. Along with your estimated budget, you

must provide objective documentation that demonstrates your total income for each calendar year (e.g., tax forms,

W-2 forms, financial aid award statements, trust instruments, inheritance documents, etc.). In addition, you must

submit a written statement summarizing your living arrangement(s). You must indicate the specific date you left your

parents' home, and whether you have lived with other family members, with friends, with roommates, or alone

during each of the calendar years for which you claim financial independence.

If your claim of self-sufficiency is derived in whole or in part from any form of savings or trust, you must provide

objective documentation that demonstrates (1) when the funds were established, (2) that the funds are sufficient to

meet your living and school expenses, (3) that the funds are under your administrative control, and (4) that the funds

you claim are being withdrawn by you from your financial account(s) and used by you as a means of support during

the calendar year for which self-sufficiency is asserted. Please be advised that the University makes a clear distinction

between merely having access to financial resources, and the actual use of those resources for self-support. Loans or gifts

from parents, regardless of the terms, during any period for which a claim of self-sufficiency is made are considered

financial assistance and cannot be considered as student income. Non-institutional loans or gifts from a friend or

family member other than a parent, made at or near the time of enrollment in a post-secondary institution, will also

be considered financial assistance.

If all or a portion of the current and/or 12 previous months occurred during your minority (under age 18), you must

clearly demonstrate that you lived separate and apart from your parents or other family members, and were

managing your own financial affairs as a minor. In most cases, an individual is not eligible to begin their first calendar

year of self-sufficiency until reaching the age of majority (18 years or older).

Notice: This information is intended to assist students and their family members in understanding University

requirements for financial independence, and is not a complete explanation of the laws regarding residency.

Additional information is available from the University Registrar . You are strongly encouraged to contact the campus

Residence Officer at the earliest possible date if you have questions at [email protected].

1

“Parent”- the natural or adoptive parent(s) upon whom the student is financially dependent.

The term“parent” does not include step-parent(s) or guardian(s).

2

With the exception of co-signed loans (e.g., parent PLUS loans).

rev 05/2019

FINANCIAL INDEPENDENCE SUMMARY

In order to be classified as a resident for tuition purposes, a student must satisfy the University's financial independence

requirement in addition to requirements for physical presence and intent.

A student who is deemed to be an Independent Student based on satisfaction of one of the below listed requirements may

satisfy the Residency Requirements without regard to a parents:

A. A student is considered to be financially independent if they meet all of the following criteria:

1. Is single;

AND

2. Was not claimed as a dependent for income tax purposes by their parents

1

or any other individual for the previous

tax year immediately preceding the term for which classification as a resident is requested;

AND

3. Can demonstrate self-sufficiency for the past 12 months prior to the start of term. Self-sufficiency is defined as the

ability to support oneself financially without the help of others. When determining self-sufficiency, money earned

by the student through their own employment, financial aid and other loans

2

obtained on their own credit, without

a co-signer, will be considered acceptable student income. Loans or gifts from relatives, associates, or friends,

regardless of the terms, are considered financial assistance and cannot be included as student income when

determining self-sufficiency; non-institutional loans or gifts made at or near

3

the time the student is enrolled in an

institution will also be considered financial assistance. Funds that are “gifted” to the student by a relative, associate,

or friend, through a “college fund,” savings, trust, or other financial vehicle, will not be considered if the funds were

established after the student's 14

th

birthday. “Bartering” for free room and board, or other services or necessities is

considered financial assistance. A student who receives free room and board from a relative, associate, or friend is

not deemed totally self-sufficient.

B. The financial independence requirement will not be a factor in residence determination

if the student meets one of the following criteria:

1. The student's parents

1

meet the University of California requirements for residence for tuition purposes; OR

2. The student is at least 24 years of age by December 31

st

of the academic year in which classification as a resident is

requested; OR

3. Married or Registered Domestic Partner as of the RDD, regardless of age; OR

4. Serving in the U.S. Armed Forces; OR

5. Veteran of the U.S. Armed Forces; OR

6. Has a legal dependent other than a spouse or registered domestic partner; OR

7. Is or was a ward of the court, foster youth, or both Parents are deceased; OR

8. Declared by a court to be an Emancipated Minor; OR

9. Has been determined to be an unaccompanied youth who was homeless pursuant to federal financial aid rules; OR

10. Has demonstrated fulfillments of the UC-Self-Supporting Financial Independence criteria during the one-year

period ending on the relevant to RDD; OR

11. Student was a Minor who reached the age of majority while in CA, while Parents were Residents for UC tuition

purposes, and the Parents left the state to establish residence elsewhere, and the Student continued to reside in CA

after the Parents departure. Student is require to have fulfilled the applicable Residency Requirement

independently of the Parents upon reaching the age of majority.

NOTICE: The student is cautioned that this summation is not a complete explanation of the laws regarding

residence. Additional information is available from the University Registrar. Changes may be made in the residence

requirements between the publication date of this statement and the relevant residence determination date.

Please refer any questions to the Residence Officer at (949) 824-6124 or e-mail [email protected].

1

“Parent”- The natural or adoptive father or mother upon whom the student is financially dependent; or, if both parents are deceased,

their legal guardian. The term “parent” does not include step-parents or guardians.

2

With the exception of co-signed loans (e.g., parent PLUS loans).

3

The University considers “at or near” the time of enrollment in an institution to be after the student's 14

th

birthday.

rev 05/2019

UNIVERSITY OF CALIFORNIA, IRVINE

VERIFICATION OF SELF-SUFFICIENCY

In order to qualify for classification as a resident for tuition purposes, a student under the age of 24, who is not dependent

upon a California resident parent, must demonstrate self-sufficiency as part of the financial independence requirement.

The following types of funding will support a claim of self-sufficiency under University of California residence regulations:

• Money earned through your own employment;

• Loans obtained from a lending institution without a co-signer;

• Financial aid loans, scholarships and grants obtained without a co-signer.

If your claim of self-sufficiency is derived from any form of savings or trust, you must provide objective documentation

that demonstrates when the funds were established, that the funds are sufficient to meet your living and school

expenses, that the funds are under your administrative control, and that the funds you claim are being withdrawn by you

from your account(s) and are being used by you as a means of support during the calendar year for which self-sufficiency

is asserted.

You must submit an estimated budget for the calendar year directly prior to the term for which you are seeking

classification as a California resident, demonstrating your ability to support yourself with the funds you claim. Below is a

chart to assist you in providing the required information. Along with your estimated budget, you must also provide

objective documentation that demonstrates your total income for each calendar year (ALL - tax forms, W-2 forms,

financial aid award statements, bank statements from accounts you used to support yourself).* In addition, please

provide a written statement describing your housing arrangement during each of the calendar years for which self-

sufficiency is asserted. Please indicate the specific date you left your parents' home, and whether you have lived with

other family members, with friends, with

roommates, or alone during each of the calendar years for which you claim

financial independence.

NOTE: Because determining a student’s ability to meet their own living and educational expenses involves subjective

decisions which must be made by the campus Residence Officer, it is to the student’s advantage to submit a clearly

legible and complete profile of their financial resources and expenses for each of the calendar years for which self-

sufficiency is asserted. Following a final decision by the campus Residence Officer, any student who is classified as a

nonresident will be given the opportunity to appeal.

*DOCUMENTATION OF INCOME AND EXPENSES MUST BE PROVIDED AND SHOULD BE ORGANIZED BY CALENDAR YEAR.

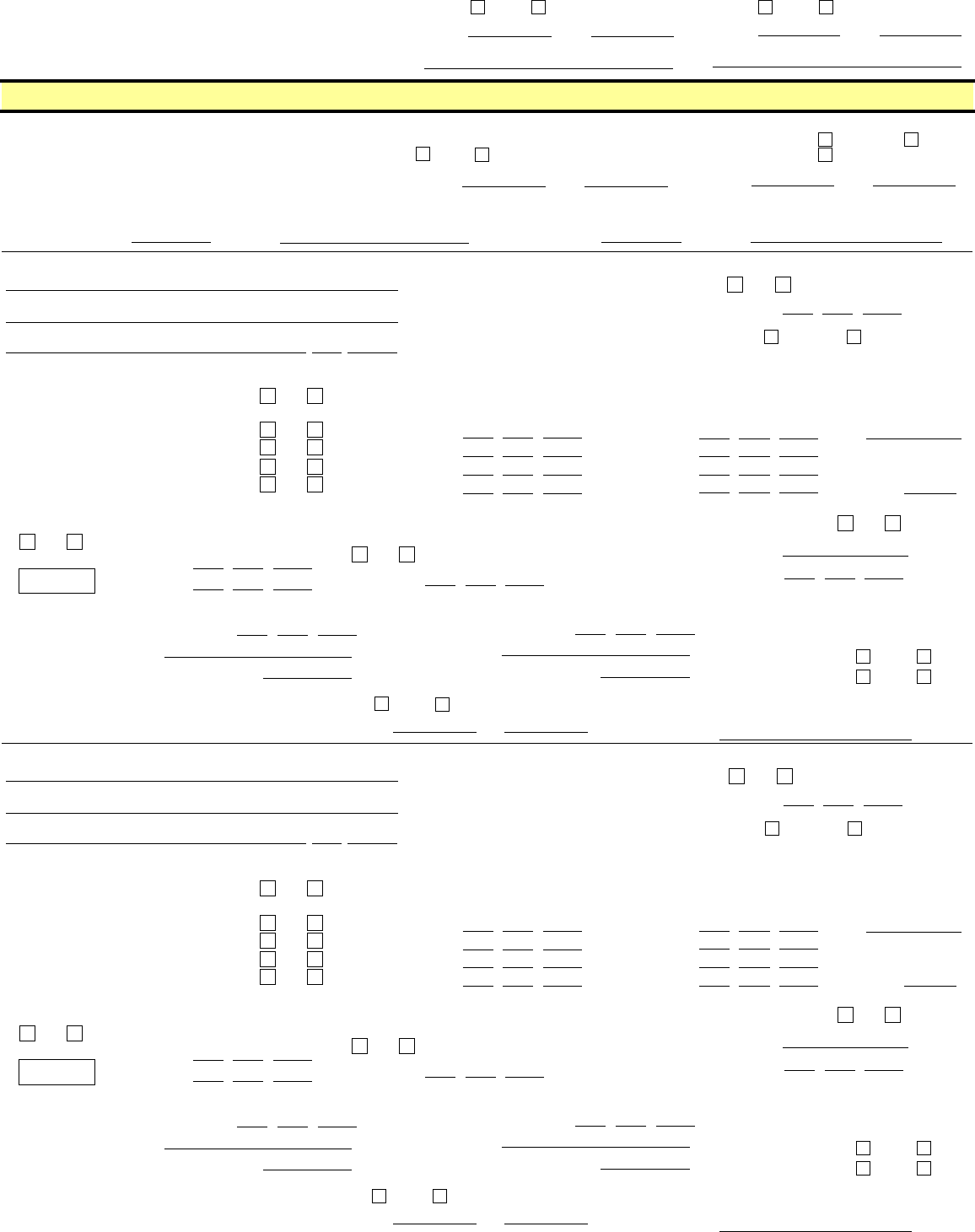

EXPENSES

School Fees

Books and Supplies

Housing

Food and Personal Expenses

TOTAL EXPENSES

2019 2018

SOURCE(s) OF INCOME

1)

2)

3)

4)

TOTAL INCOME

20182019

rev 05/2019

UNIVERSITY OF CALIFORNIA, IRVINE

PARENT STATEMENT

I am the parent of (student name), ,

a student at the University of California, Irvine.

I am not financially supporting

1

my child at the present time. The last date I supported my child was

(date: month/year) .

I will not claim my child as my dependent for income tax purposes for this tax year, and I did not claim my child as a

dependent for the past two tax years. Attached are copies of my state and federal income tax returns for the current tax

year (if filed) and two previous tax years as verification of the statements made above. This statement is incomplete and

unacceptable without copies of tax forms.

NOTICE: If you did not file a state and/or federal income tax return for the current and/or any one of the two previous tax years,

please provide a written explanation indicating your reason(s) for not doing so. In addition, if you filed an amended tax return

for the current and/or any one of the two previous tax years, you must provide both the amended tax return(s) and the original

tax return(s) for the applicable year(s) along with a written explanation regarding your reason(s) for filing an amended return.

I declare under penalty of perjury under the laws of the State of California that the information provided in this

Parental Statement and on any attachments hereto is true and correct.

1

Financial support is interpreted at the Irvine campus to mean a consistent and/or significant contribution given near or during the calendar year(s)

for which self-sufficiency is asserted. Parents paying school fees or contributing to student living expenses are considered to be providing

student support.

father signature mother signature

print mother's nameprint father's name

Print FormMake Sure All Fields are Completed Before Printing.