Page 1 of 34

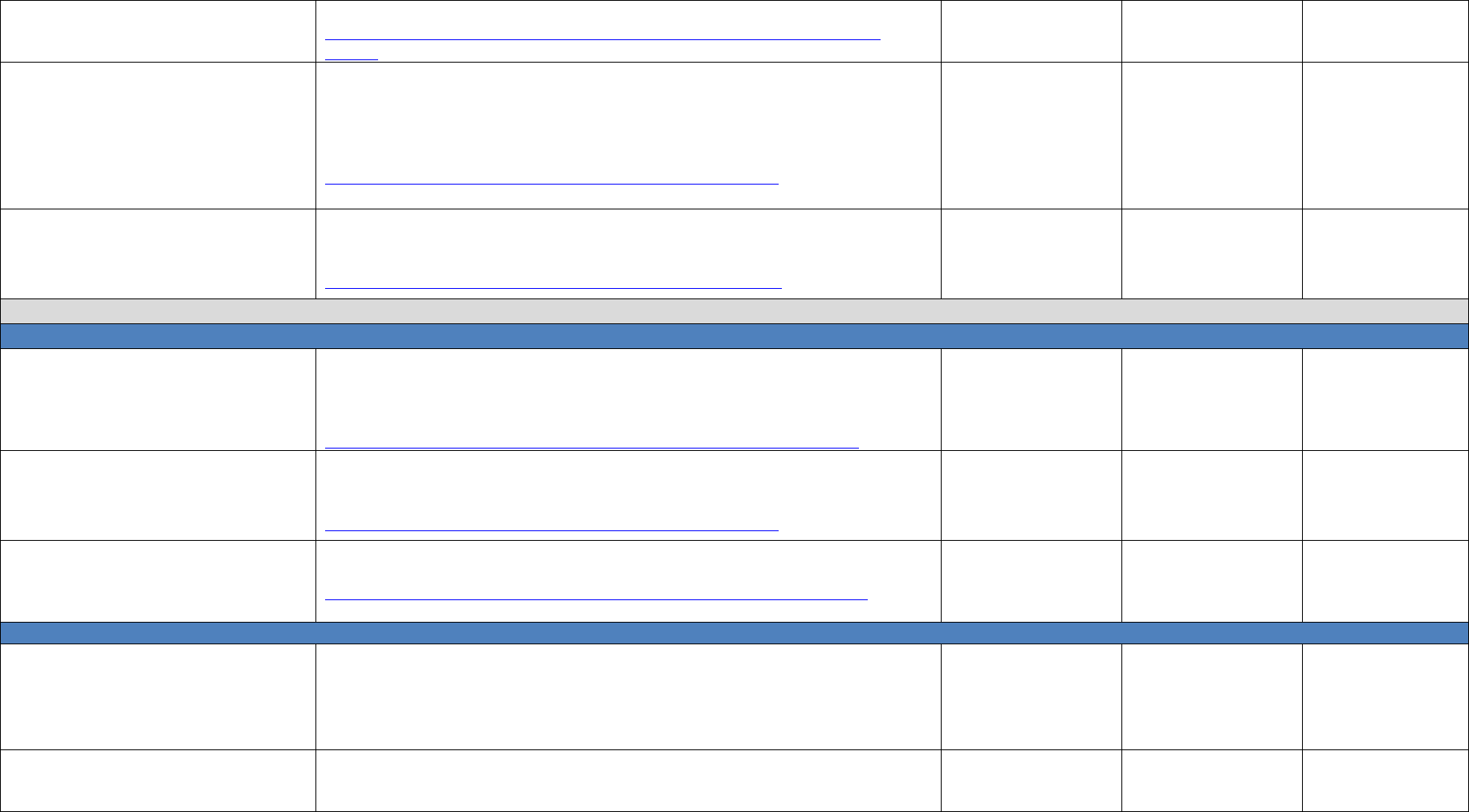

LAW ENFORCEMENT ACTIONS

FEDERAL ACTIONS

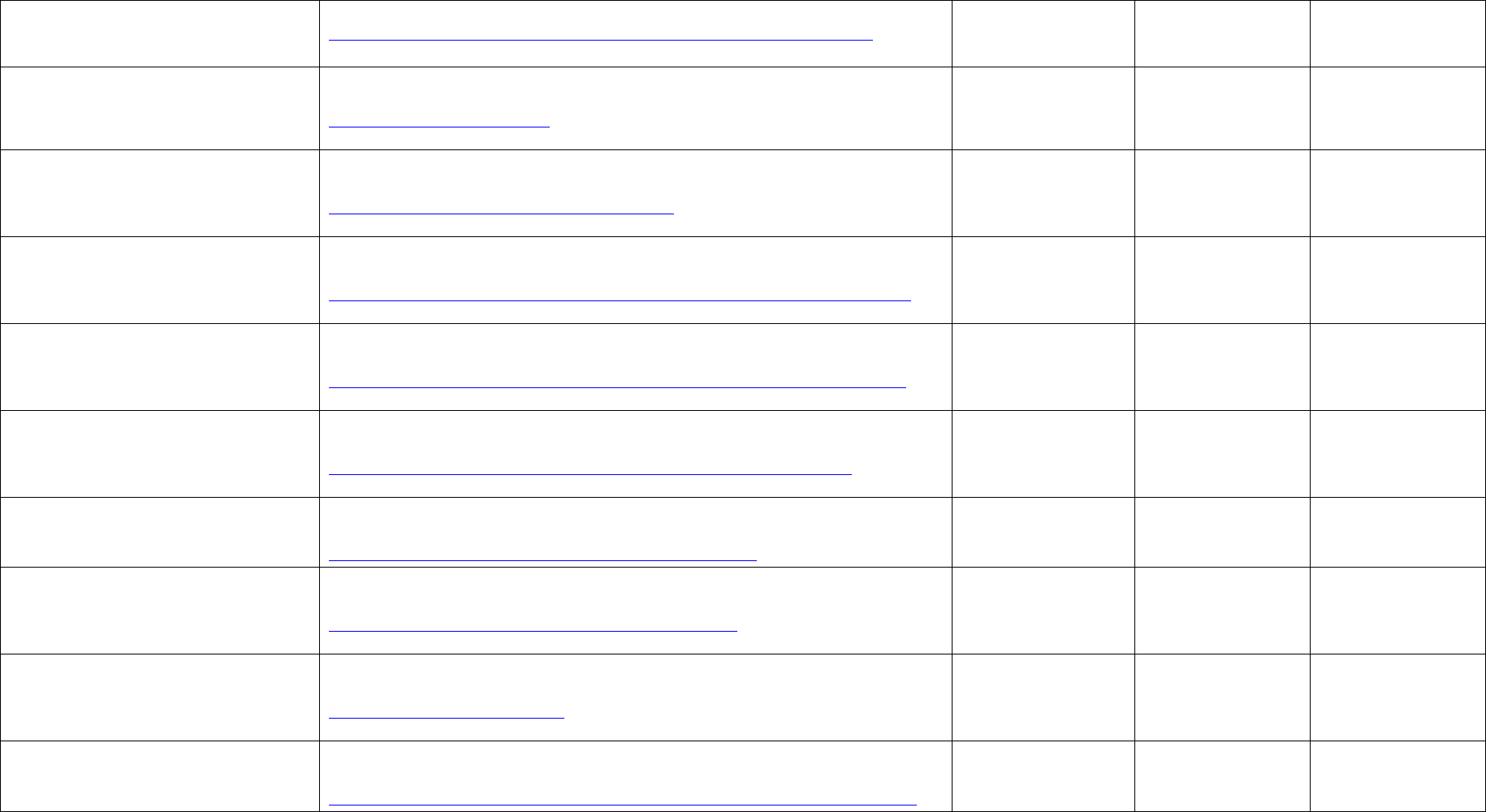

United States Federal Trade Commission – New Actions

Name

Description

Status

Staff Contact:

Press Contact:

Jim Burke Automotive, Inc., also doing

business as Jim Burke Nissan

Administrative action settling allegations of deceptive advertising in violation of

Section 5 of the FTC Act and provisions of the Truth in Lending Act and Regulation

Z.

The Commission

issued an

administrative

complaint and

accepted the proposed

consent order for

public comment.

Staff Contact:

Sana Chriss, 404-656-

1364

Press Contact:

Cheryl Warner,

202-326-2480

TT of Longwood, Inc., also doing

business as Cory Fairbanks Mazda

Administrative action settling allegations of deceptive advertising in violation of

Section 5 of the FTC Act and provisions of the Consumer Leasing Act and

Regulation M.

The Commission

issued an

administrative

complaint and

accepted the proposed

consent order for

public comment.

Staff Contact:

Sana Chriss, 404 656-

1364

Press Contact:

Cheryl Warner,

202-326-2480

City Nissan, Inc., also doing business as

Ross Nissan

Administrative action settling allegations of deceptive advertising in violation of

Section 5 of the FTC Act and provisions of the Truth in Lending Act and Regulation

Z, and the Consumer Leasing Act and Regulation M.

The Commission

issued an

administrative

complaint and

accepted the proposed

consent order for

public comment.

Staff Contact:

John Jacobs, 310-824-

4360

Press Contact:

Cheryl Warner,

202-326-2480

National Payment Network, Inc.

Administrative action settling allegations of deceptive advertising in violation of

Section 5 of the FTC Act and provisions of the Truth in Lending Act.

The Commission

issued an

Staff Contact: Daniel

Dwyer, (202) 326-

Press Contact:

Cheryl Warner,

Page 2 of 34

administrative

complaint and

accepted the proposed

consent order for

public comment.

2957

202-326-2480

Matt Blatt Dealerships

Administrative action settling allegations of deceptive advertising in violation of

Section 5 of the FTC Act and provisions of the Truth in Lending Act.

The Commission

issued an

administrative

complaint and

accepted the proposed

consent order for

public comment.

Staff Contact: Daniel

Dwyer, (202) 326-

2957

Press Contact:

Cheryl Warner,

202-326-2480

FTC v. Regency Financial Services and

Ivan Levy

Federal District Court action in the Southern District of Florida alleging that an auto

loan modification operation accepted upfront fees without performing the promised

services in violation of Section 5 of the FTC Act and the FTC’s Telemarketing Sales

Rule.

Stipulated Preliminary

Injunction entered

February 10, 2015.

Staff Contact:

Anna Burns, 404-656-

1350

Press Contact:

Cheryl Warner,

202-326-2480

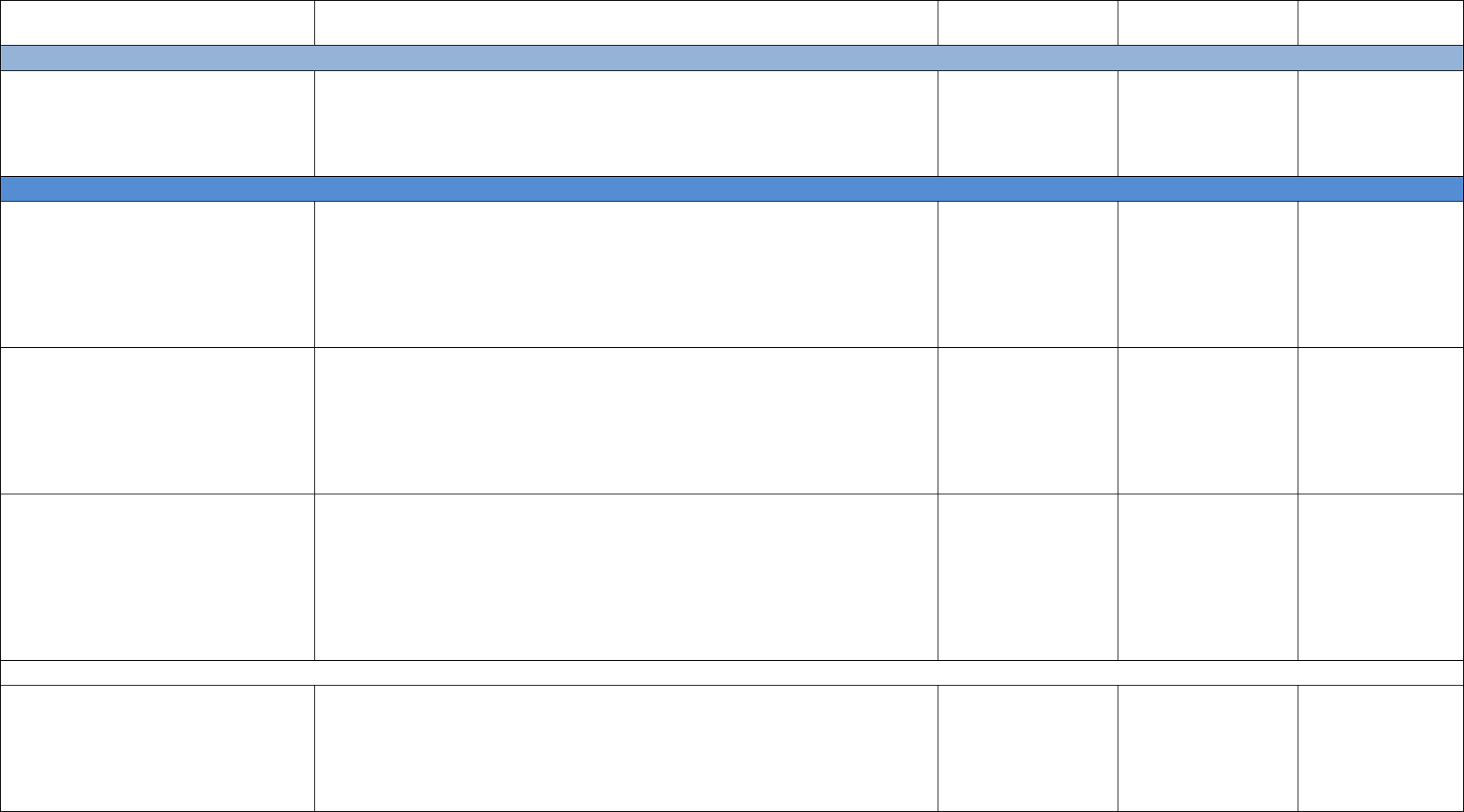

FTC Previously Announced Actions

In the Matter of First American Title

Lending of Georgia, LLC, a limited

liability company

Administrative action settling allegations of deceptive advertising for zero percent

interest rates for 30-day car title loans in violation of Section 5 of the FTC Act.

http://www.ftc.gov/news-events/press-releases/2015/01/first-ftc-cases-against-car-

title-lenders-companies-settle

The Commission

issued an

administrative

complaint and

accepted the proposed

consent order for

public comment

through March 3,

2015.

Staff Contact: Helen

Wong, 202-326-3779

Press Contact:

Cheryl Warner,

202-326-2480

In the Matter of Finance Select, Inc., a

Georgia corporation

Administrative action settling allegations of deceptive advertising for zero percent

interest rates for 30-day car title loans in violation of Section 5 of the FTC Act.

http://www.ftc.gov/news-events/press-releases/2015/01/first-ftc-cases-against-car-

title-lenders-companies-settle

The Commission

issued an

administrative

complaint and

accepted the proposed

consent order for

public comment

through March 3,

2015.

Staff Contact: Helen

Wong, 202-326-3779

Press Contact:

Cheryl Warner,

202-326-2480

Trophy Nissan

Administrative action settling allegations of deceptive advertising in violation of

The Commission

Staff Contact: Luis

Press Contact:

Page 3 of 34

Section 5 of the FTC Act and provisions of the Truth in Lending Act and Regulation

Z, and the Consumer Leasing Act and Regulation M.

http://www.ftc.gov/news-events/press-releases/2015/02/ftc-approves-final-order-

texas-auto-dealers-deceptive-ad-case

issued a final decision

and order settling the

allegations.

Gallegos, 214-979-

9383

Cheryl Warner,

202-326-2480

In the Matter of

AmeriFreight, Inc.,

a corporation

and Marius Lehmann,

individually and as an officer of

AmeriFreight, Inc.

AmeriFreight, an automobile shipment broker based in Peachtree City, Georgia, has

agreed to a settlement with the Federal Trade Commission that will halt the

company’s allegedly deceptive practice of touting online customer reviews, while

failing to disclose that the reviewers were compensated with discounts and

incentives.

https://www.ftc.gov/news-events/press-releases/2015/02/ftc-stops-automobile-

shipment-broker-misrepresenting-online

The Commission

issued an

administrative

complaint and

accepted the proposed

consent order for

public comment

through March 31,

2015.

Staff Contact: Victor

DeFrancis

Bureau of Consumer

Protection

202-326-3495

Press Contact:

Cheryl Warner,

202-326-2480

BMW of North America LLC

Administrative action publishing for public comment a proposed settlement with

BMW of North America LLC concerning allegations that the company violated the

Magnuson-Moss Warranty Act by telling consumers that BMW would void their

warranty unless they used MINI parts and MINI dealers to perform maintenance and

repair work.

https://www.ftc.gov/news-events/press-releases/2015/03/bmw-settles-ftc-charges-its-

mini-division-illegally-conditioned.

The Commission

voted to accept the

consent agreement

package containing the

proposed consent

order for public

comment.

The

agreement will be

subject to public

comment through

April 20, 2015, after

which the Commission

will decide whether to

issue the order on a

final basis.

Staff Contact:

Svetlana S. Gans,

202-326-3708

Press Contact:

Cheryl Warner,

202-326-2480

Ramey Motors, Inc.

Ramey Automotive Group, Inc.,

Ramey Automotive, Inc.,

Ramey Chevrolet, Inc.,

Federal District Court action alleging that the dealerships violated a 2012 FTC

administrative order. Among other things, Ramey Motors’ ads allegedly

misrepresented the costs of financing or leasing a vehicle by concealing important

terms of the offer, such as a requirement to make a substantial down payment.

https://www.ftc.gov/news-events/press-releases/2014/12/ftc-takes-action-against-

two-auto-dealership-chains-violating

Complaint filed

December 11, 2014.

Staff Contact: Lemuel

Dowdy

Bureau of Consumer

Protection

202-326-2981

Press Contact:

Cheryl Warner,

202-326-2480

Consumer Portfolio Services, Inc.

Settlement with a national subprime auto lender to resolve allegations that the

company used illegal tactics to service and collect consumers’ loans.

Consent decree filed

in Central District of

California on May 28,

Staff Contact: Tracy

Thorleifson

Press Contact:

Cheryl Warner,

202-326-2480

Page 4 of 34

https://www.ftc.gov/news-events/press-releases/2014/05/auto-lender-will-pay-55-

million-settle-ftc-charges-it-harassed

2014. $2,000,000

civil penalty.

$3,500,000 to adjust

consumers’ accounts.

Northwest Regional

Office 206-220-4481

United States Department of Justice

United States v. Gerald R. Shepard

(USAO NDAL)

Defendant and others conspired to boost loan approvals and car sales by fraudulent

means including, but not limited to, inflating the customer’s income and providing

false information to obtain loans to which the customer would not otherwise qualify

for.

http://www.justice.gov/usao/aln/News/March%202015/March%2011,%202015%20S

erra.html

Indicted and plead

guilty. Sentencing

between May and

July.

Staff Contact:

Contact: AUSA

Amanda Wick, 205-

244-2138

Press Contact:

Peggy Sanford, 205

244-2020

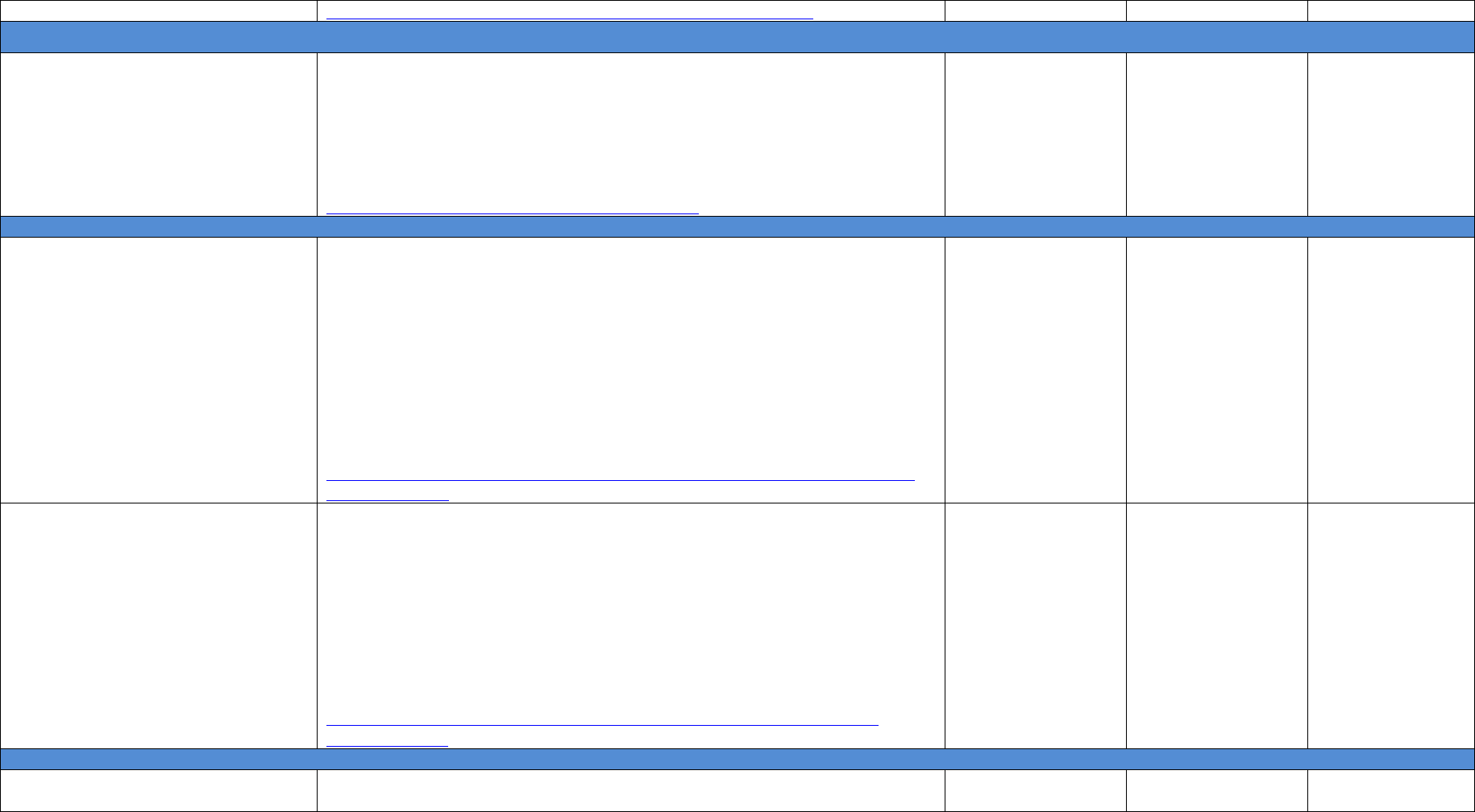

United States v. Jeffrey R. Green

(USAO NDAL)

Defendant and others conspired to boost loan approvals and car sales by fraudulent

means including, but not limited to, inflating the customer’s income and providing

false information to obtain loans to which the customer would not otherwise qualify

for.

http://www.justice.gov/usao/aln/News/March%202015/March%2011,%202015%20S

erra.html

Indicted and plead

guilty. Sentencing

between May and

July.

Staff Contact: AUSA

Amanda Wick, 205

244-2138

Press Contact:

Peggy Sanford, 205

244-2020

United States v. D. Scott Burton

(USAO NDAL)

Defendant and others conspired to boost loan approvals and car sales by fraudulent

means including, but not limited to, inflating the customer’s income and providing

false information to obtain loans to which the customer would not otherwise qualify

for.

http://www.justice.gov/usao/aln/News/March%202015/March%2011,%202015%20S

erra.html

Indicted and plead

guilty. Sentencing

between May and

July.

Staff Contact: AUSA

Amanda Wick, 205-

244-2138

Press Contact:

Peggy Sanford, 205

244-2020

United States v. Michael J. Wilkinson

(USAO NDAL)

Defendant and others conspired to boost loan approvals and car sales by fraudulent

means including, but not limited to, inflating the customer’s income and providing

false information to obtain loans to which the customer would not otherwise qualify

for.

http://www.justice.gov/usao/aln/News/March%202015/March%2011,%202015%20S

erra.html

Indicted and plead

guilty. Sentencing

between May and

July.

Staff Contact: AUSA

Amanda Wick, 205-

244-2138

Press Contact:

Peggy Sanford, 205

244-2020

United States v. Dwight Perry

(USAO NDAL)

Defendant and others conspired to boost loan approvals and car sales by fraudulent

means including, but not limited to, inflating the customer’s income and providing

false information to obtain loans to which the customer would not otherwise qualify

for.

http://www.justice.gov/usao/aln/News/March%202015/March%2011,%202015%20S

erra.html

Indicted and plead

guilty. Sentencing

between May and

July.

Staff Contact: AUSA

Amanda Wick, 205

244-2138

Press Contact:

Peggy Sanford, 205

244-2020

United States v. Terry W. Henderson, Jr.

(USAO NDAL)

Defendant and others conspired to boost loan approvals and car sales by fraudulent

means including, but not limited to, inflating the customer’s income and providing

false information to obtain loans to which the customer would not otherwise qualify

for.

Indicted and plead

guilty. Sentencing

between May and

July.

Staff Contact: AUSA

Amanda Wick, 205

244-2138

Press Contact:

Peggy Sanford, 205

244-2020

Page 5 of 34

http://www.justice.gov/usao/aln/News/March%202015/March%2011,%202015%20S

erra.html

United States v. Roland W. Riley

(USAO NDAL)

Defendant and others conspired to boost loan approvals and car sales by fraudulent

means including, but not limited to, inflating the customer’s income and providing

false information to obtain loans to which the customer would not otherwise qualify

for.

http://www.justice.gov/usao/aln/News/March%202015/March%2011,%202015%20S

erra.html

Indicted and plead

guilty. Sentencing

between May and

July.

Staff Contact: AUSA

Amanda Wick, 205

244-2138

Press Contact:

Peggy Sanford, 205

244-2020

United States v. Abdul Islam Mughal

(USAO NDAL)

Defendant and others conspired to boost loan approvals and car sales by fraudulent

means including, but not limited to, inflating the customer’s income and providing

false information to obtain loans to which the customer would not otherwise qualify

for.

http://www.justice.gov/usao/aln/News/March%202015/March%2011,%202015%20S

erra.html

Indicted and plead

guilty. Sentencing

between May and

July.

Staff Contact: AUSA

Amanda Wick, 205

244-2138

Press Contact:

Peggy Sanford, 205

244-2020

United States v. Shamai Salpeter

(DOJ Civil, Consumer Protection Branch,

and USAO CDCA)

Odometer Tampering and Fraud.

http://www.justice.gov/opa/pr/two-men-including-former-car-salesman-prominent-

los-angeles-dealership-charged-conspiring

Indictment

Staff Contact: Jill

Furman, 202-307-

0090

Press Contact:

Nicole Navas, 202-

514-2007

United States v. Billion Auto Inc. et al.

(USAO NDIA)

Federal District Court action settling allegations that the dealerships violated a 2012

FTC administrative order. The dealerships and advertising company violated the

2012 FTC administrative order by frequently focusing on only a few attractive terms

in their ads while hiding others in fine print, through distracting visuals, or with

rapid-fire audio delivery.

http://www.justice.gov/usao-ndia/pr/court-enters-360000-consent-judgment-against-

auto-dealership-and-advertising-company

$360,000 civil

penalties.

Staff Contact:

Michael J. Davis

FTC, Bureau of

Consumer Protection

202-326-2458

Press Contact:

FTC, Cheryl

Warner, 202-326-

2480

United States v. Precious W. House, et al.

(USAO NDIL)

Defendants are Precious W. House, Brian Hughes, Keith B. Foster, and Crystal D.

Williams of Georgia. Superseding indictment was filed in April 2014. Total amount

of auto loans was 51, seeking more than $1.6 million. Approximately 36 loans were

approved for $1.12 million. The credit unions lost more than $850,000 as a result of

the scheme. Defendants never sold a single car despite making it appear they were

selling luxury, used-end automobiles through Rolling Auto, Inc., Express

Automotives, and WLA Motors of Indiana and Chicago.

Case was investigated by

FBI Chicago-South RA.

http://www.justice.gov/usao/iln/pr/chicago/2015/pr0320_02.html

Williams and Foster

pled guilty. Foster

sentenced to a year

and a day. Williams

cooperating and will

be sentenced at a later

time. March 19, 2015,

House and Hughes

convicted of bank

fraud and will be

sentenced June 2015.

Staff Contact: AUSA

Christopher

McFadden

phone 312

353-1931;

AUSA

Sunil Harjani

Press Contact:

Public Information

Office

Direct: 312 353-

5318

United States vs. Duane Akuffo

(USAO MD)

U.S. District Judge Catherine C. Blake sentenced Duane Akuffo to two years in

prison for bank fraud in connection with a scheme to obtain more than $500,000 in

Sentenced to two

years in prison and

Staff Contact: U.S.

Attorney David

Press Contact:

Vickie LeDuc

Page 6 of 34

fraudulent car loans from credit unions.

http://www.justice.gov/usao-md/pr/bowie-man-sentenced-attempting-obtain-over-

500000-fraudulent-car-loans-credit-unions

forfeit $357,356.

Sharfstein

Public Information

Officer (410) 209-

4912

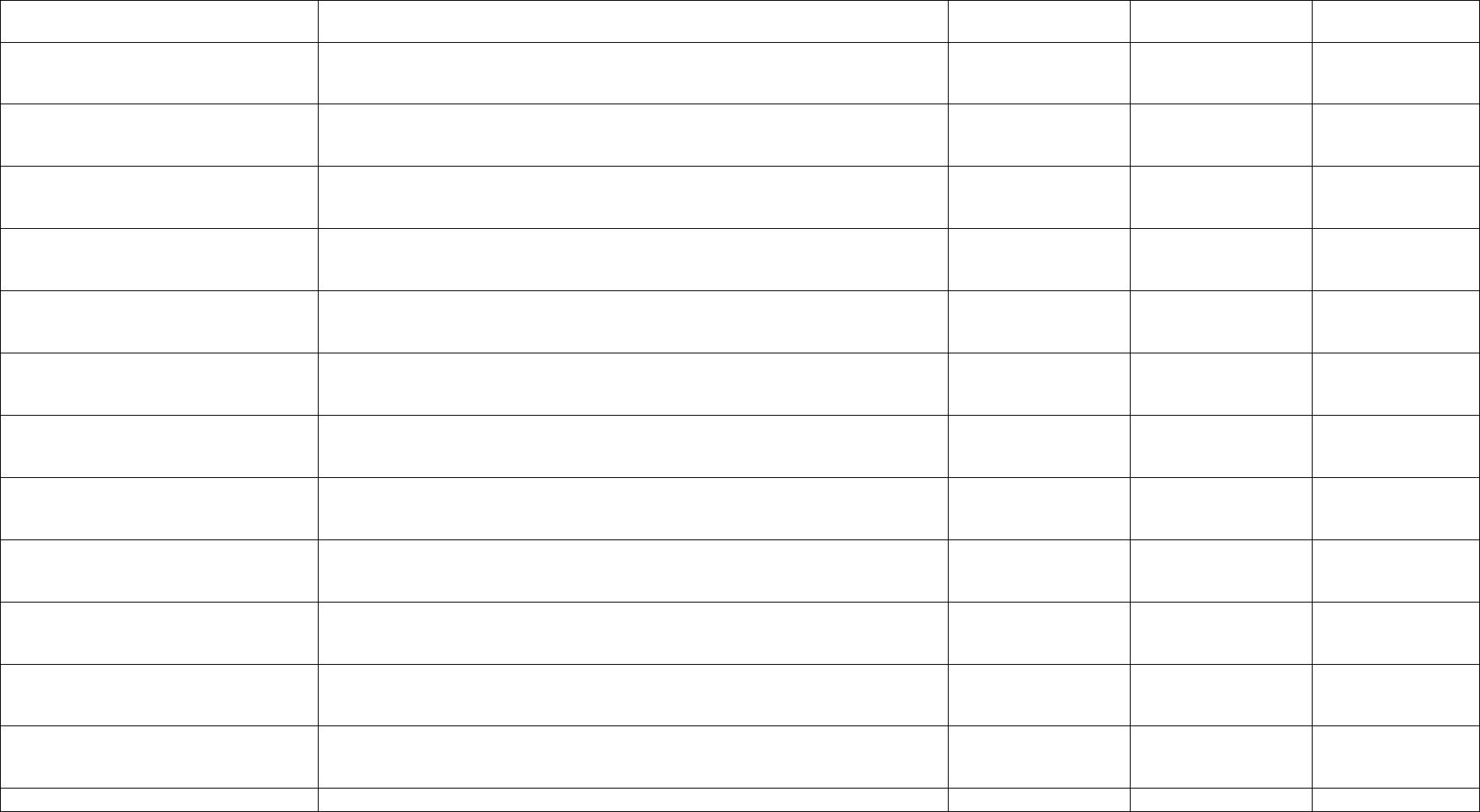

United States v. Makushamari Gozo

(USAO MD)

Convicted of filing claims for more than $23 million in fraudulent alternative fuel tax

credits and refunds and personal tax refunds, as well as engaging in schemes to

fraudulently obtain more than $3 million in loans from credit unions.

Gozo

submitted four loan applications to credit unions in which he misrepresented his

income and employment in order to buy luxury automobiles that Gozo never actually

purchased.

http://www.justice.gov/usao-md/pr/repeat-fraudster-sentenced-falsely-claiming-over-

23-million-tax-refunds-and-scheming

Sentence: 11 years in

prison, pay restitution

totaling $202,667.23.

Staff Contact: U.S.

Attorney David

Sharfstein

Press Contact:

Vickie LeDuc,

Public Information

Officer (410) 209-

4912

United States v. Sanden Corporation

(DOJ Antitrust Division)

Sanden Corporation, an automotive parts manufacturer based in Gunma, Japan, has

agreed to plead guilty and to pay a $3.2 million criminal fine for its role in a

conspiracy to suppress and eliminate competition for the purchase of compressors

used in air conditioning systems sold to Nissan North America Inc.

http://www.justice.gov/opa/pr/sanden-corp-agrees-plead-guilty-price-fixing-

automobile-parts-installed-us-cars

Agreed to plead guilty

and to pay a $3.2

million criminal fine.

Sanden’s plea

hearing/sentencing is

currently scheduled

for March 30, 2015 in

the Eastern District of

Michigan.

Staff Contact: AUSA

Brian Bughman

Press Contact:

Office of Public

Affairs (202) 514-

2007/TDD

(202)514-1888

United States v. Francis Marimo

(DOJ Civil, Consumer Protection Branch)

Marimo purchased used vehicles from 2008 through 2012 primarily through online

advertisements, and then replaced the existing odometers with odometers showing

lower mileages. Marimo sold these vehicles to consumers in the Raleigh, N.C. area.

http://www.justice.gov/opa/pr/north-carolina-man-sentenced-odometer-tampering-

charges

Sentence: 18 months

imprisonment

$190,845 restitution.

Staff Contact: Jill

Furman, 202 307-0066

Press Contact:

Nicole Navas, 202-

514-2007

United States v. Edward Capicchioni

(DOJ Civil, Consumer Protection Branch)

In March 2014, Capicchioni pled guilty to one count of conspiracy to tamper with

odometers.

http://www.justice.gov/opa/pr/new-york-man-sentenced-24-months-prison-odometer-

fraud-scheme

Sentence: 24 months

in prison. Ordered to

pay $412,880 in

restitution to victims.

Staff Contact: Jill

Furman, 202-307-

0090

Press Contact:

Nicole Navas, 202-

514-2007

United States v. Gali et al.

(DOJ Civil, Consumer Protection

Branch, and USAO EDNY)

Charged in a 15-count indictment in the Eastern District of Pennsylvania (EDPA)

with conspiracy, securities fraud and false odometer statements. The defendants are

also charged in a related two-count indictment in the Eastern District of New York

(EDNY) with mail and wire fraud conspiracy, and money laundering conspiracy.

http://www.justice.gov/opa/pr/used-motor-vehicle-dealers-indicted-odometer-

tampering-and-money-laundering

Indictment

Staff Contact: Jill

Furman, 202-307-

0090

Press Contact:

Nicole Navas, 202-

514-2007

United States v. Jeffrey Levy

Odometer Tampering and Fraud

Sentenced to one year

Staff Contact: Jill

Press Contact:

Page 7 of 34

(DOJ Civil, Consumer Protection Branch)

http://www.justice.gov/opa/pr/car-salesman-sentenced-prison-odometer-fraud-

scheme

and one day.

Furman, 202-307-

0090

Nicole Navas, 202-

514-2007

United States v. Kyle Novitsky and Judith

Aloe

(DOJ Civil, Consumer Protection Branch)

In April, 2014, the defendant pled guilty to one count of conspiracy to tamper with

odometers, make false odometer certifications, and commit securities fraud, and two

counts each of securities fraud and making false odometer certifications. On October

9, 2014, Kyle Novitsky was sentenced in U.S. District Court in Philadelphia.

http://www.justice.gov/civil/cpb/cpb_currentcases.html#_Odom

Novitsky sentenced to

serve 60 months’

imprisonment. He

was also ordered to

pay restitution of

$1,482,000 to victims.

Aloe – fugitive.

Staff Contact: Jill

Furman, 202-307-

0090

Press Contact:

Nicole Navas, 202-

514-2007

United States v. Erick Sanchez-Pulido

and Israel Sanchez-Pulido

(DOJ Civil, Consumer Protection Branch,

and USAO EDWI)

Erick Sanchez-Pulido and his brother, Israel Sanchez-Pulido, were charged with one

count of conspiracy, 15 counts of odometer tampering, four counts of making false

odometer statements and other charges.

http://www.justice.gov/opa/pr/two-men-charged-odometer-fraud

Indictment

Staff Contact: Jill

Furman, 202-307-

0090

Press Contact:

Nicole Navas, 202-

514-2007

STATE ACTIONS

State of California - Department of Motor Vehicles

George Guevara

California Car Sales owner George Guevara was charged with 79 criminal counts

including conspiracy to commit grand theft, odometer tampering, and theft by false

pretenses.

DMV Investigation Leads to Criminal Charges Against Antioch Car Dealer

Arrested

Staff Contact: DMV

Office of Public

Affairs

Press Contact:

(916) 657–6437 |

dmvpublicaffairs@d

mv.ca.gov

California Department of Motor Vehicles

Undercover Sting

California Department of Motor Vehicles investigators cited unlicensed car dealers

posing as private sellers.

DMV Targets Unlicensed Car Dealers Posing As Private Sellers

Citations

Staff Contact: DMV

Office of Public

Affairs

Press Contact:

(916) 657–6437 |

dmvpublicaffairs@d

mv.ca.gov

Alberto Navarro Zapata

Odometer tampering, theft by false pretenses, and acting as an unlicensed car dealer.

https://www.dmv.ca.gov/portal/dmv/detail/pubs/newsrel/newsrel14/2014_13

Arrested

Staff Contact: DMV

Office of Public

Affairs

Press Contact:

(916) 657–6437 |

dmvpublicaffairs@d

mv.ca.gov

State of Florida - Office of the Attorney General

Napleton Enterprises, LLC.

(“NAPLETON”)

NAPLETON possible violations include failure to clearly and conspicuously disclose

required equity or down payments, additional charges and other material restrictions

or conditions; and failure to comply with Reg Z regulations governing credit

advertising. Napleton voluntarily agreed to enter into an Assurance of Voluntary

Compliance (AVC).

AVC/Settlement

Signed, Case Closed.

Staff Contact: Kristen

K. Johnson, Assistant

Attorney General;

407-316-4840

Press Contact:

Gerald Whitney

Ray, Press

Secretary; 850-245-

0150

Gator Motors, Inc. d/b/a Fiat of

Melbourne. (“FIAT”)

FIAT failed to disclose all material terms, such as additional fees and costs, in its

advertisements of the sale and lease of motor vehicles to consumers. FIAT

voluntarily agreed to enter into an Assurance of Voluntary Compliance (AVC).

AVC/Settlement

Signed, Case Closed.

Staff Contact: Kristen

K. Johnson, Assistant

Attorney General;

Press Contact:

Gerald Whitney

Ray, Press

Page 8 of 34

407-316-4840

Secretary; 850-245-

0150

Arrigo Automotive Group, Inc.

(“ARRIGO”)

ARRIGO failed to disclose all material terms, such as additional fees and costs, in its

advertisements of the sale and lease of motor vehicles to consumers. ARRIGO

voluntarily agreed to enter into an Assurance of Voluntary Compliance (AVC).

AVC/Settlement

Signed, Case Closed.

Staff Contact: Kristen

K. Johnson, Assistant

Attorney General;

407-316-4840

Press Contact:

Gerald Whitney

Ray, Press

Secretary; 850-245-

0150

Greenway Ford, Inc. (“GREENWAY”)

GREENWAY failed to disclose all material terms, such as additional fees and costs,

in its advertisements of the sale and lease of motor vehicles to consumers.

GREENWAY voluntarily agreed to enter into an Assurance of Voluntary

Compliance (AVC).

AVC/Settlement

Signed, Case Closed.

Staff Contact: Press

Contact: Kristen K.

Johnson, Assistant

Attorney General;

407-316-4840

Press Contact:

Gerald Whitney

Ray, Press

Secretary; 850-245-

0150

Maher Chevrolet, Inc. (“MAHER”)

MAHER failed to disclose all material terms, such as additional fees and costs, in its

advertisements of the sale and lease of motor vehicles to consumers. MAHER

voluntarily agreed to enter into an Assurance of Voluntary Compliance (AVC).

AVC/Settlement

Signed, Case Closed.

Staff Contact: Kristen

K. Johnson, Assistant

Attorney General;

407-316-4840

Press Contact:

Gerald Whitney

Ray, Press

Secretary; 850-245-

0150

Gatorland Toyota. (“GATORLAND”)

GATORLAND failed to disclose all material terms, such as additional fees and costs,

in its advertisements of the sale and lease of motor vehicles to consumers.

GATORLAND voluntarily agreed to enter into an Assurance of Voluntary

Compliance (AVC).

AVC/Settlement

Signed, Case Closed.

Staff Contact: Kristen

K. Johnson, Assistant

Attorney General;

407-316-4840

Press Contact:

Gerald Whitney

Ray, Press

Secretary; 850-245-

0150

State of Georgia

Governor’s Office of Consumer Protection

Golden Motors, Inc.

Alleged unfair and deceptive vehicle advertising and sales practices.

Assurance of

Voluntary Compliance

Staff Contact: Lauren

Villnow,

a.gov, 404-656-3790

Press Contact:

Shawn Conroy,

shawn.conroy@ocp.

ga.gov , 404-656-

2867

F Todd Conner Auto Sales

Alleged unfair and deceptive vehicle advertising and sales practices.

Assurance of

Voluntary Compliance

Staff Contact: Lauren

Villnow,

a.gov, 404-656-3790

Press Contact:

Shawn Conroy,

shawn.conroy@ocp.

ga.gov , 404-656-

2867

Auto Loan Finders, Inc.

Alleged unfair and deceptive vehicle advertising and sales practices.

Assurance of

Voluntary Compliance

Staff Contact: Lauren

Villnow,

Press Contact:

Shawn Conroy,

shawn.conroy@ocp.

Page 9 of 34

a.gov, 404-656-3790

ga.gov , 404-656-

2867

Chamblee Georgia Police Department

Capital Auto and Trucks

Daniel Begolla Garcia was arrested for alleged odometer fraud.

Arrested

Staff Contact:

Captain Ernesto Ford,

eford@chambleega.go

v

Press Contact:

Captain Ernesto

Ford,

eford@chambleega.

gov

State of Indiana – Office of the Attorney General

In Re: Tom Roush, Inc.

Dealer was charging consumers $129.00 for “etch insurance” and putting the charge

into the dealer’s document preparation fee, obscuring the amount the dealer was

charging consumers for “etch insurance,” if the consumer was aware they were

purchasing etch at all. Consumers were also provided an “etch insurance” contract

which listed the price of the “etch insurance” as $0.00.

The matter was settled

through entry of an

AVC whereby the

dealer agreed to

refund consumers in

the total amount of

$140,737.00.

Staff Contact: Mark

Snodgrass, Deputy

Attorney General,

(317) 234-6784

Press Contact:

Molly Johnson,

Public Information

Officer, (317) 232-

0168

In Re: Custom Car Care Inc.

Dealer was charging consumers $199.00 for “etch insurance” and putting the fee into

the dealer’s document preparation fee, obscuring the amount the dealer was charging

consumers for “etch insurance” if the consumer was aware they were purchasing etch

at all. Consumers were also provided an “etch insurance” contract which listed the

price of the “etch Insurance” as $0.00.

The matter was settled

through entry of an

AVC whereby the

dealer agreed to

refund consumers in

the total amount of

$159,840.00.

Staff Contact: Mark

Snodgrass, Deputy

Attorney General,

(317) 234-6784

Press Contact:

Molly Johnson,

Public Information

Officer, (317) 232-

0168

State of Indiana v. Robledo Auto Sales

LLC and Noe Jairo Mandujano-Robledo

The Defendants sold a vehicle and represented the vehicle as having 108,000 miles

on its odometer. Prior to the sale, the Defendants had the vehicle’s title in their

possession and the title stated the vehicle had 178,000 miles. The Defendants altered

the physical title to read 108,000 miles rather than 178,000.

A Judgment was

entered against the

Defendants in the

amount of $16,487.00

for consumer

restitution, treble

damages, full civil

penalties and costs.

Staff Contact: Mark

Snodgrass, Deputy

Attorney General,

(317) 234-6784

Press Contact:

Molly Johnson,

Public Information

Officer, (317) 232-

0168

Failure to Deliver Title Cases Resulting in a total of 57 court-ordered titles for consumers’ vehicles

State of Indiana v. Curtis Flowers d/b/a

Capital Auto Advantage

Action against a dealer who failed to provide consumers with valid titles to the

vehicles purchased by the consumers.

Judgments obtained

that included costs,

civil penalties, and

numerous court-

ordered titles for

consumers’ vehicles.

Staff Contact: Mark

Snodgrass, Deputy

Attorney General,

(317) 234-6784

Press Contact:

Molly Johnson,

Public Information

Officer, (317) 232-

0168

Page 10 of 34

State of Indiana v. Muensterman Motors,

Inc.

Action against a dealer who failed to provide consumers with valid titles to the

vehicles purchased by the consumers.

Judgments obtained

that included costs,

civil penalties, and

numerous court-

ordered titles for

consumers’ vehicles.

Staff Contact: Mark

Snodgrass, Deputy

Attorney General,

(317) 234-6784

Press Contact:

Molly Johnson,

Public Information

Officer, (317) 232-

0168

State of Indiana v. Lori Bunch d/b/a

Franklin Auto Sales

Action against a dealer who failed to provide consumers with valid titles to the

vehicles purchased by the consumers.

Judgments obtained

that included costs,

civil penalties, and

numerous court-

ordered titles for

consumers’ vehicles.

Staff Contact: Mark

Snodgrass, Deputy

Attorney General,

(317) 234-6784

Press Contact:

Molly Johnson,

Public Information

Officer, (317) 232-

0168

State of Indiana v. Indiana Cars and

Trucks, Inc.

Action against a dealer who failed to provide consumers with valid titles to the

vehicles purchased by the consumers.

Judgments obtained

that included costs,

civil penalties, and

numerous court-

ordered titles for

consumers’ vehicles.

Staff Contact: Mark

Snodgrass, Deputy

Attorney General,

(317) 234-6784

Press Contact:

Molly Johnson,

Public Information

Officer, (317) 232-

0168

State of Indiana v. Five Star Car Sales,

Inc.

Action against a dealer who failed to provide consumers with valid titles to the

vehicles purchased by the consumers.

Judgments obtained

that included costs,

civil penalties, and

numerous court-

ordered titles for

consumers’ vehicles.

Staff Contact: Mark

Snodgrass, Deputy

Attorney General,

(317) 234-6784

Press Contact:

Molly Johnson,

Public Information

Officer, (317) 232-

0168

State of Indiana v. Continental Autohaus,

Inc.

Action against a dealer who failed to provide consumers with valid titles to the

vehicles purchased by the consumers.

Judgments obtained

that included costs,

civil penalties, and

numerous court-

ordered titles for

consumers’ vehicles.

Staff Contact: Mark

Snodgrass, Deputy

Attorney General,

(317) 234-6784

Press Contact:

Molly Johnson,

Public Information

Officer, (317) 232-

0168

Improper Document Fee Charges Resulting in Entry of AVCs or Judgments that Provided Consumer Restitution in the Total Amount of $216,271 paid to approximately 5,588 affected consumers

In Re: Bart’s Car Store, Inc.

Actions against a dealer who charged consumers a document preparation fee that

contained expenses not actually incurred in the preparation of documents and/or

contained expenses related to the extension of credit, in violation of Indiana’s statute

governing document preparation fees, Ind. Code § 9-32-13-7.

Settlement obtained

that provided

consumer restitution.

Staff Contact: Mark

Snodgrass, Deputy

Attorney General,

(317) 234-6784

Press Contact:

Molly Johnson,

Public Information

Officer, (317) 232-

0168

State of Indiana v. Auto Liquidation

Center, Inc.

Actions against a dealer who charged consumers a document preparation fee that

contained expenses not actually incurred in the preparation of documents and/or

Settlement obtained

that provided

Staff Contact: Mark

Snodgrass, Deputy

Press Contact:

Molly Johnson,

Page 11 of 34

contained expenses related to the extension of credit, in violation of Indiana’s statute

governing document preparation fees, Ind. Code § 9-32-13-7.

consumer restitution.

Attorney General,

(317) 234-6784

Public Information

Officer, (317) 232-

0168

In Re: Bobb Auto Group, LLC

Actions against a dealer who charged consumers a document preparation fee that

contained expenses not actually incurred in the preparation of documents and/or

contained expenses related to the extension of credit, in violation of Indiana’s statute

governing document preparation fees, Ind. Code § 9-32-13-7.

Settlement obtained

that provided

consumer restitution.

Staff Contact: Mark

Snodgrass, Deputy

Attorney General,

(317) 234-6784

Press Contact:

Molly Johnson,

Public Information

Officer, (317) 232-

0168

In Re: KMK, LLC d/b/a Southwest Auto

Sales

Actions against a dealer who charged consumers a document preparation fee that

contained expenses not actually incurred in the preparation of documents and/or

contained expenses related to the extension of credit, in violation of Indiana’s statute

governing document preparation fees, Ind. Code § 9-32-13-7.

Settlement obtained

that provided

consumer restitution.

Staff Contact: Mark

Snodgrass, Deputy

Attorney General,

(317) 234-6784

Press Contact:

Molly Johnson,

Public Information

Officer, (317) 232-

0168

State of Louisiana - Used Motor Vehicle Commission

Larry Brown, Individually and Lauco,

LLC DBA Lauco Auto Sales

Administrative hearing concerning fraudulent acts in selling, purchasing, or dealing

in used motor vehicles or misrepresenting the terms and conditions of a sale,

purchase, or contract for sale or purchase of a used motor vehicle or any interest

including an option to purchase.

JUDGEMENT:

$6,000.00 FINE

Staff Contact: Derrick

Parnell

Louisiana Used Motor

Vehicle Commission

(225) 925-3874

Shawn Calvit, Individually and Lauco,

LLC DBA Lauco Auto Sales

Administrative hearing concerning fraudulent acts in selling, purchasing, or dealing

in used motor vehicles or misrepresenting the terms and conditions of a sale,

purchase, or contract for sale or purchase of a used motor vehicle or any interest

including an option to purchase.

JUDGEMENT:

$72,000.00 FINE

Staff Contact: Derrick

Parnell

Louisiana Used Motor

Vehicle Commission

(225) 925-3874

Michael Laue, Individually and Lauco,

LLC DBA Lauco Auto Sales

Administrative hearing concerning fraudulent act in selling, purchasing, or dealing in

used motor vehicles or misrepresenting the terms and conditions of a sale, purchase,

or contract for sale or purchase of a used motor vehicle or any interest including an

option to purchase; employing unlicensed salespersons or other unlicensed persons in

connection with the sale of used motor vehicles; engaging in a practice failing to

deliver certificates of title to a consumer within a lawful amount of time; engaging in

the practice of failing to remit sales tax where the tax has been collected by the

dealer; and accepting a deposit of down payment for a purchase agreement

conditioned upon the consumer’s ability to obtain financing of the remainder of the

purchase price without returning the deposit or down payment upon a determination

that the consumer does not qualify for financing.

JUDGEMENT:

$298,000.00 FINE

Staff Contact: Derrick

Parnell

Louisiana Used Motor

Vehicle Commission

(225) 925-3874

State of Maine - Office of the Attorney General

State of Maine v. Glenn A. Geiser Jr.;

Bumper to Bumper, Inc.; and My Main

Alleged unfair and deceptive acts and practices in the sale of used cars.

Consent Judgment

entered August 26,

Staff Contact:

Carolyn A. Silsby,

Press Contact: Tim

Feeley, 207-626-

Page 12 of 34

Ride

State of Maine v. Geiser et al. Press Release

2014.

207-626-8829

8887

State of Maine v. Bangor Car Care, Inc.

Alleged unfair and deceptive acts and practices in the sale of used cars.

Staff Contact:

Carolyn A. Silsby,

207-626-8829

Press Contact: Tim

Feeley, 207-626-

8887

In the Matter of Consumer Portfolio

Services, Inc.

Finance company agreed to stop collection actions for consumers whose vehicles

were repossessed – essentially erasing the debt – and to remove all negative

information relating to these loans from consumers’ credit reports.

http://www.maine.gov/tools/whatsnew/attach.php?id=624468&an=3

Assurance of

Discontinuance, May

12, 2014.

Staff Contact:

Carolyn A. Silsby,

207-626-8829

Press Contact: Tim

Feeley, 207-626-

8887

In the Matter of Credit Acceptance

Corporation

Finance company agreed to stop collection actions for consumers whose vehicles

were repossessed – essentially erasing the debt – and to remove all negative

information relating to these loans from consumers’ credit reports.

http://www.maine.gov/tools/whatsnew/attach.php?id=624468&an=3

Assurance of

Discontinuance, April

1, 2014.

Staff Contact:

Carolyn A. Silsby,

207-626-8829

Press Contact: Tim

Feeley, 207-626-

8887

In the Matter of Mid-Atlantic Finance

Company

Finance company agreed to stop collection actions for consumers whose vehicles

were repossessed – essentially erasing the debt – and to remove all negative

information relating to these loans from consumers’ credit reports.

http://www.maine.gov/tools/whatsnew/attach.php?id=624468&an=3

Assurance of

Discontinuance, June

17, 2014.

Staff Contact:

Carolyn A. Silsby,

207-626-8829

Press Contact: Tim

Feeley, 207-626-

8887

In the Matter of Persian Acceptance

Corporation

Finance company agreed to stop collection actions for consumers whose vehicles

were repossessed – essentially erasing the debt – and to remove all negative

information relating to these loans from consumers’ credit reports.

http://www.maine.gov/tools/whatsnew/attach.php?id=624468&an=3

Assurance of

Discontinuance, May

28, 2014.

Staff Contact:

Carolyn A. Silsby,

207-626-8829

Press Contact: Tim

Feeley, 207-626-

8887

In the Matter of Source One Financial

Corporation

Finance company agreed to stop collection actions for consumers whose vehicles

were repossessed – essentially erasing the debt – and to remove all negative

information relating to these loans from consumers’ credit reports.

http://www.maine.gov/tools/whatsnew/attach.php?id=624468&an=3

Assurance of

Discontinuance,

March 27, 2014.

Staff Contact:

Carolyn A. Silsby,

207-626-8829

Press Contact: Tim

Feeley, 207-626-

8887

In the Matter of United Auto Credit

Corporation

Finance company agreed to stop collection actions for consumers whose vehicles

were repossessed – essentially erasing the debt – and to remove all negative

information relating to these loans from consumers’ credit reports.

http://www.maine.gov/tools/whatsnew/attach.php?id=624468&an=3

Assurance of

Discontinuance, May

22, 2014.

Staff Contact:

Carolyn A. Silsby,

207-626-8829

Tim Feeley, 207-

626-8887

In the Matter of Westlake Services, LLC

Finance company agreed to stop collection actions for consumers whose vehicles

were repossessed – essentially erasing the debt – and to remove all negative

information relating to these loans from consumers’ credit reports.

Assurance of

Discontinuance, May

21, 2014.

Staff Contact:

Carolyn A. Silsby,

207-626-8829

Tim Feeley, 207-

626-8887

Page 13 of 34

http://www.maine.gov/tools/whatsnew/attach.php?id=624468&an=3

State of Maryland – Office of the Attorney General

Jones Junction Auto Group

Alleged unfair or deceptive trade practices regarding use of a contract that contains a

confessed judgment clause waiving a consumer's right to assert a legal defense to an

action. The dealer also was accused of repossessing consumers’ vehicles without

providing statutory notices and without giving the consumers an opportunity to

redeem the vehicles or any liability that still might be owed before the repossessed

vehicles were resold at auction.

http://www.oag.state.md.us/Press/2014/061614.html

Settlement: Pay

restitution to

consumers equal to

amounts that they

were illegally forced

to pay. Pay $115,000

in penalties and costs

to the State.

Staff Contact: Philip

Ziperman, Deputy

Chief, Consumer

Protection Division,

410-576-6374

Press Contact:

David Nitkin 410-

576-6357; Alan

Brody, 410-576-

6956

Commonwealth of Massachusetts – Office of the Attorney General

Commonwealth of Massachusetts v. Auto

Number One et al.

On January 14, 2015, the Massachusetts Attorney General’s Office filed an action

against an eastern Massachusetts car dealership, Auto Number One, Inc. (“Auto

Number One”) and its owner and sole proprietor, Mark Hanna (“Hanna”), alleging

the defendants violated the Massachusetts Consumer Protection Act, G.L. c. 93A, in

the sale of used motor vehicles. The alleged violations include: failing to make

repairs to vehicles as promised or required under express or implied warranties;

selling vehicles that were substantially impaired, or completely inoperable, leaving

financially vulnerable consumers with vehicles they could not operate, and could not

afford to repair; requiring consumers to execute incomplete purchase agreements,

increasing the purchasing price from what consumers had agreed to pay, sometimes

two or three times more than the actual agreed-upon price.

http://www.mass.gov/ago/news-and-updates/press-releases/2015/2015-03-03-auto-

number-one.html

The Attorney General

obtained a preliminary

injunction, and

attachments of real

and personal property

against Auto Number

One and Hanna. The

case is in active

litigation.

Staff Contact:

Jennifer David

Special Assistant

Attorney General

(617) 963-2068

Press Contact:

Jillian Fennimore

(617) 727-2543

Commonwealth of Massachusetts v.

Northampton Volkswagen et al.

On June 11, 2014, the Massachusetts Attorney General’s Office obtained an

Assurance of Discontinuance from four related automobile dealerships in western

Massachusetts: Northampton Volkswagen, County Hyundai, Country Nissan, and

Patriot Buick GMC. Following an extensive investigation, the Attorney General

alleged that, among other unfair practices, these dealerships violated the

Massachusetts Consumer Protection Act, G.L. c. 93A, by refusing to honor

advertised sales, failing to make necessary disclosures in advertisements, failing to

clearly and conspicuously disclose conditions related to advertised sales and

promotions, and failing to pay the specific price they offered in advertisements for

trade-in vehicles.

http://www.mass.gov/ago/news-and-updates/press-releases/2014/2014-06-18-

cosenzi-aod.html

Assurance of

Discontinuance. In

addition to agreeing to

particular advertising

restrictions, the

dealerships paid the

Commonwealth

$175,000.

Staff Contact: Ann

Lynch, Assistant

Attorney General

(617) 963-2068 x7710

Press Contact:

Jillian Fennimore

(617) 727-2543

State of Minnesota – Office of the Attorney General

State of Minnesota v. Enterprise Financial

Group, Inc.

Civil lawsuit, filed in Minnesota state court in September 2014, alleging that EFG

engaged in deceptive trade practices, consumer fraud, and violated Minnesota law

Order issued in

December 2014,

Staff Contact: David

Cullen Assistant

Press Contact:

Benjamin Wogsland

Page 14 of 34

regulating service contracts by failing to issue timely refunds owed to Minnesota

consumers for extended auto warranties and by failing to pay consumers a 10%

penalty payment per month for refunds made after 45 days of the consumer’s

cancellation as required by Minnesota law.

http://www.ag.state.mn.us/Office/PressRelease/20140923AutoWarranty2.asp

requiring EFG to

change certain of its

practices, and pay

restitution to

Minnesota consumers

in the form of refunds

and 10% penalty

payments.

Attorney General

(651) 757-1221

Director of

Communications

Minnesota Attorney

General’s Office

(651) 296-2069

State of New Jersey – Office of the Attorney General – Division of Consumer Affairs

State of New Jersey v. 21

st

Century Auto

Group, Inc. et. al.

In December 2013, the State filed suit against 21st Century Auto Group alleging that

the dealership committed multiple violations of the Consumer Fraud Act, motor

vehicle advertising regulations, automotive sales regulations and used car lemon law

regulations.

http://nj.gov/oag/newsreleases14/pr20141007a.html

Settlement: $100,513

in civil penalties and

will reimburse the

State $29,487 for its

attorneys’ fees and

investigative costs.

Staff Contact: Jeffrey

Koziar, Deputy

Attorney General

Kelly Fennell,

Investigator

Press Contact: Jeff

Lamm or

Neal Buccino

973-504-6327

Route 22 Toyota, Route 22 Honda, Route

22 Nissan and Route 22 Kia, all of

Hillside, Hackettstown Honda, Hudson

Honda of West New York, Freehold

Hyundai, and Freehold Chrysler Jeep.

The settlement resolves allegations of deceptive sales tactics including failure to

disclose existing mechanical defects or past damage to used cars, charging for

supplemental warranties and other costly “after-sale” items without customer

consent, and failure to honor negotiated or advertised vehicle prices.

http://www.njconsumeraffairs.gov/press/07142014.htm

Consent Order: $1.8

million which includes

$1,733,059 in civil

penalties and $66,941

to reimburse the

State's investigative

costs and attorneys'

fees.

Staff Contact: Deputy

Attorney General

Jeffrey Koziar

Kelly Fennell,

Investigator

Press Contact: Jeff

Lamm or

Neal Buccino

973-504-6327

State of New Jersey v. Direct Buy

Associates Inc. D/B/A Direct Buy Auto

Warranty, et al.

The State filed a lawsuit against Direct Buy Auto Warranty in February 2014,

alleging that DBAW had violated the New Jersey Consumer Fraud Act, the

Regulations Governing General Advertising, the Plain Language Act and the

Business Corporations Act through its advertising, offering for sale and sale of motor

vehicle service contracts.

http://nj.gov/oag/newsreleases15/pr20150129a.html

Consent Judgment:

$500,000 civil

penalty; $199,559

restitution; and

$111,009

reimbursement to the

State for attorney’s

fees and investigative

costs.

Staff Contact: Deputy

Attorney General

David Reap

Aziza Salikhov,

Investigator

Press Contact: Jeff

Lamm or

Neal Buccino

973-504-6327

State of New York - Office of the Attorney General

Adee Motors, LLC. (d/b/a Middletown

Honda)

The State alleged that Middletown Honda charged customers who bought vehicles at

the end of their lease an undisclosed $500.00 “Processing Fee.”

http://www.ag.ny.gov/press-release/ag-schneiderman-announces-settlement-

middletown-auto-dealer-over-bogus-fee-customers

Settlement: Repay

$87,000 to 174

customers who were

charged the processing

fee and $48,000 in

penalties to the State.

Staff Contact: Case

handled by Assistant

Attorney General Amy

Schallop

New York City

Press Office: (212)

416-8060;

Albany Press Office:

(518) 776-2427

nyag.pressoffice@a

Page 15 of 34

g.ny.gov

Albany Dodge;

DeNooyer Chevrolet;

DePaula Chevrolet;

Goldstein Auto Group, Inc.;

Lia Nissan;

Zappone Chrysler Jeep Dodge Ram

Six auto dealers were found to have advertising practices that were deceptive and

misleading.

http://www.ag.ny.gov/press-release/ag-schneiderman-announces-crackdown-

deceptive-auto-dealer-advertising

Settlements.

Agreements to reform

advertising practices

and pay fines ranging

from $7,500 to

$15,000.

Staff Contact: Case

handled by Assistant

Attorney General Amy

Schallop

New York City

Press Office: (212)

416-8060;

Albany Press Office:

(518) 776-2427

nyag.pressoffice@a

g.ny.gov

Bay Ridge Nissan

The State alleged that Bay Ridge Nissan engaged in a pattern of fraudulent and

deceptive practices in the sale of automobiles and aftermarket warranties.

Bay Ridge Nissan

$48,341 restitution to

consumers and

$50,000 civil penalties

to the State.

Staff Contact: Case

Handled By Assistant

Attorney General

Matthew Eubank

New York City

Press Office: (212)

416-8060 ;

Albany Press Office:

(518) 776-2427

Frontier Autohaus

The State alleged that Frontier Autohaus misled customers and failed to pay off liens

on used vehicles and failed to pay off loan balances on trade-in vehicles.

The Court ordered the

dealership

permanently closed.

The owner will pay

$289,000 in restitution

to 46 consumers, and

$50,000 in fines and

other costs to New

York State.

Staff Contact: Debra

Martin, Assistant

Attorney general in

Charge

Albany Press Office:

(518) 776-2427

State of North Carolina – Office of the Attorney General

State of NC v. Mooser Moto, LLC, d/b/a

Riders Wholesale; and Barry T. Moose,

Jr.

The State of North Carolina’s Complaint alleged that Riders Wholesale offered all-

terrain vehicles (ATV’s), utility vehicles, scooters, go-carts and mopeds for sale

online. Moose and his company collected money upfront—either the full purchase

price or a substantial deposit—and then promised delivery of the vehicle by a certain

date. Riders Wholesale routinely failed to deliver ATVs and other vehicles as

promised in violation of the NC Unfair and Deceptive Trade Practices Act.

http://www.ncdoj.gov/News-and-Alerts/News-Releases-and-Advisories/Press-

Releases/Off-road-vehicle-seller-banned-from-business-in-NC.aspx

Judgment by Default

entered January 26,

2015. Consumer

restitution

$438,022.06.

$435,000 civil penalty.

Staff Contact:

Assistant Attorney

General Torrey Dixon

Press Contact:

Noelle Talley,

(919)716-6413

United States Department of Justice and State of North Carolina

United States and State of NC v. Auto

Fare, Inc; Southeastern Auto Corp.; and

Zuhdi A. Saadeh

A lawsuit was filed in January 2014 by the Department of Justice and the State of

North Carolina, alleging that Auto Fare Inc. and Southeastern Auto Corp., two “buy

here, pay here” used-car dealerships in Charlotte, North Carolina, and their owner –

violated the federal Equal Credit Opportunity Act by engaging in a pattern or practice

of “reverse redlining” by intentionally targeting African-American customers for

Settlement. Change

lending practices and

pay $225,000 for a

settlement fund to pay

Staff Contact:

Assistant Attorney

General Torrey Dixon.

DOJ, Housing and

NC Press Contact:

Noelle Talley, (919)

716-6413

Page 16 of 34

unfair and predatory credit practices in the financing of used car purchases. The state

of North Carolina also alleged that the dealerships’ actions violated the state’s Unfair

and Deceptive Trade Practices Act.

http://www.justice.gov/opa/pr/us-justice-department-and-north-carolina-attorney-

general-reach-settlement-resolve

injured consumers.

Civil Enforcement

Section

Civil Rights Division

(202) 514-4713

State of Oklahoma – Motor Vehicle Commission

David Stanley Dodge, LLC dba David

Stanley Chrysler Jeep Dodge

Complaint alleging advertising violations.

Consent Agreement

and Order, $350,000

fine.

Roy Dockum,

Executive Director

OMVC, (405) 607-

8227 ext. 102

Roy Dockum,

Executive Director

OMVC, (405) 607-

8227 ext. 102

David Stanley Chrysler Jeep Dodge,

Norman

Spot Delivery Agreement Violation, Jan

$1000

Roy Dockum,

Executive Director

OMVC, (405) 607-

8227 ext. 102

Roy Dockum,

Executive Director

OMVC, (405) 607-

8227 ext. 102

Jim Norton Toyota of OKC

Advertising Violation, Jun

$2,000

Roy Dockum,

Executive Director

OMVC, (405) 607-

8227 ext. 102

Roy Dockum,

Executive Director

OMVC, (405) 607-

8227 ext. 102

Big Red Sports/Imports, Norman

Advertising Violations Jan, Jun, Oct

Total fines $2,000

Roy Dockum,

Executive Director

OMVC, (405) 607-

8227 ext. 102

Roy Dockum,

Executive Director

OMVC, (405) 607-

8227 ext. 102

Bob Howard Hyundai

Violation of Motor Vehicle Delivery Agreement, May

$1000

Roy Dockum,

Executive Director

OMVC, (405) 607-

8227 ext. 102

Roy Dockum,

Executive Director

OMVC, (405) 607-

8227 ext. 102

Bob Moore Nissan of Norman

Advertising Violation, May

$500

Roy Dockum,

Executive Director

OMVC, (405) 607-

8227 ext. 102

Roy Dockum,

Executive Director

OMVC, (405) 607-

8227 ext. 102

Jamatt RV Sales, Poteau

Advertising Violation, May

$500

Roy Dockum,

Executive Director

OMVC, (405) 607-

8227 ext. 102

Roy Dockum,

Executive Director

OMVC, (405) 607-

8227 ext. 102

Jim Glover Chevrolet of Lawton

Advertising Violation, Feb, Apr

$2,500

Roy Dockum,

Executive Director

OMVC, (405) 607-

8227 ext. 102

Roy Dockum,

Executive Director

OMVC, (405) 607-

8227 ext. 102

Lake Country Chevrolet Cadillac,

Advertising Violation, Nov

$1,500

Roy Dockum,

Roy Dockum,

Page 17 of 34

Muskogee

Executive Director

OMVC, (405) 607-

8227 ext. 102

Executive Director

OMVC, (405) 607-

8227 ext. 102

State of Pennsylvania - Office of Attorney General, Bureau of Consumer Protection

Commonwealth of Pennsylvania v.

Drivehere.com, Inc. d/b/a Drivehere.com

and DTC Corp. d/b/a Carvision.com and

Peoples Commerce, Inc. and Dean

Cafiero, individually and as President of

Drivehere.com, Inc., and as President of

DTC Corp., and as President of Peoples

Commerce, Inc.

A legal action was brought by the Commonwealth of Pennsylvania Office of

Attorney General Bureau of Consumer Protection following the receipt of consumer

complaints regarding the business practices of Defendants who sold and/or leased

older, high mileage automobiles to consumers at inflated prices. Defendants’

advertisements were directed toward consumers with bad or no credit. Consumers

complained about issues, including but not limited to, the condition of the vehicles

sold/leased, credit or billing disputes, refund practices, contract disputes,

guarantee/warranty issues, and repair issues. Consumers also complained that

Defendants made false or misleading representations and failed to disclose several

pertinent details regarding contract terms, vehicle roadworthiness, payments, repairs,

pricing, financing, warranties, vehicle availability, refunds and cancellations. The

Complaint alleges various violations of Pennsylvania’s Unfair Trade Practices and

Consumer Protection Law, and Automotive Industry Trade Practices Regulations.

Pending

Staff Contact: Senior

Deputy Attorney

General Julia N.

Nastasi, 215-560-2436

Press Contact:

Carolyn E. Myers,

717-787-5205,

cmyers@attorneyge

neral.gov

Commonwealth of Pennsylvania v.

Donald J. Martino, Jr., Individually, and

Martino Motors, Inc. d/b/a Martino

Motors, Docket No. GD-14-015176

An investigation was initiated by the Commonwealth of Pennsylvania Office of

Attorney General Bureau of Consumer Protection regarding a used motor vehicle

dealer alleged misrepresentations about the condition of vehicles at the time of sale,

failure to make repairs as promised, retention of funds designated for aftermarket

warranty companies, and other violations of various provisions of Pennsylvania’s

Unfair Trade Practices and Consumer Protection Law, and Automotive Industry

Trade Practices Regulations. As a result of the investigation a settlement in the form

of an Assurance of Voluntary Compliance (AVC) was entered into between the

parties.

Closed: AVC

provided for civil

penalties totaling

$10,500.00, restitution

totaling $10,114.02, as

well as injunctive

relief.

Staff Contact: Deputy

Attorney General

Susan M. Ruffner,

412-565-5134,

sruffner@attorneygen

eral.gov

Press Contact:

Carolyn E. Myers,

717-787-5205,

cmyers@attorneyge

neral.gov

State of South Carolina – Department of Consumer Affairs

Automobile Dealer Outreach

In February 2014, SCDCA sent a mailer detailing the dos and don’ts of auto

advertising in South Carolina to the more than 2,500 automobile dealers in an

increased effort to bring about awareness and compliance to the industry.

Staff Contact: Kelly

Rainsford, Director of

Regulatory

Enforcement, 803-

734-4200

Press Contact:

Juliana Harris,

Communications

Coordinator, 803-

734-4296

Consumer Outreach

Placed classified advertisements in automobile section of classifieds in newspapers

across South Carolina directing consumers to SCDCA for information pertinent to

purchasing a vehicle.

Staff Contact: Kelly

Rainsford, Director of

Regulatory

Enforcement, 803-

734-4200

Press Contact:

Juliana Harris,

Communications

Coordinator, 803-

734-4296

Warning Letters

Issued 78 automobile advertising warning letters identifying 105 violations of

pertinent state and federal laws to South Carolina dealers. Violations included failure

to disclose terms as required by the Truth in Lending and Consumer Leasing Acts,

Staff Contact: Kelly

Rainsford, Director of

Regulatory

Press Contact:

Juliana Harris,

Communications

Page 18 of 34

and use of deceptive or misleading language, such as “free.”

Enforcement, 803-

734-4200

Coordinator, 803-

734-4296

Burns Automotive, 101 Peachoid Road,

Gaffney, SC 29341

TILA- Downpayment trigger term/ Missing Terms of Repayment & APR

Fine

Staff Contact: Kelly

Rainsford, Director of

Regulatory

Enforcement, 803-

734-4200

Press Contact:

Juliana Harris,

Communications

Coordinator, 803-

734-4296

USA Auto Sales, 2504 Broad River Road,

Columbia, SC 29210

TILA- Downpayment trigger term/ Missing Terms of Repayment & APR

Fine

Staff Contact: Kelly

Rainsford, Director of

Regulatory

Enforcement, 803-

734-4200

Press Contact:

Juliana Harris,

Communications

Coordinator, 803-

734-4296

Benson Chrysler Jeep Dodge, 400 W.

Wade Hampton Blvd., Greer, SC 29650

Consumer Leasing Act- Monthly payment trigger term/ Missing security deposit

disclosure

Fine

Staff Contact: Kelly

Rainsford, Director of

Regulatory

Enforcement, 803-

734-4200

Press Contact:

Juliana Harris,

Communications

Coordinator, 803-

734-4296

Ko Enterprises, 3820 River Drive,

Columbia, SC 29201

Unfair and/or Misleading- Excluding Dealer Fees

Fine

Staff Contact: Kelly

Rainsford, Director of

Regulatory

Enforcement, 803-

734-4200

Press Contact:

Juliana Harris,

Communications

Coordinator, 803-

734-4296

State of South Dakota – Office of the Attorney General

Joseph Matthew Stanford

The indictment charges that in late 2013, Stanford, owner and principal of Moto Joes,

engaged in deceptive business transactions surrounding the selling and buying of a

vehicle.

South Dakota Attorney General Indictment

Indicted February 10,

2015

Staff Contact: Sara

Rabern, (605) 773-

3215; Phil

Carlson@state.sd.us

State of Texas – Department of Motor Vehicles

Warning Letters

244 warning letters issued for alleged violations of the Texas Administrative Code in

connection with the advertising and sale of motor vehicles.

Staff Contact: Corrie

Alvarado (512)

465.1205

Press Contact:

Adam Shaivitz,

512.465.4210

Car Stop Inc.

Alleged violation of the Texas Administrative Code in connection with the

advertising and sale of motor vehicles.

$1,000 penalty

Staff Contact: Corrie

Alvarado (512)

465.1205

Press Contact:

Adam Shaivitz,

512.465.4210

Finn's Discount Auto, Inc.

Alleged violation of the Texas Administrative Code in connection with the

advertising and sale of motor vehicles.

$4,000 penalty

Staff Contact: Corrie

Alvarado (512)

465.1205

Press Contact:

Adam Shaivitz,

512.465.4210

West Auto Sales

Alleged violation of the Texas Administrative Code in connection with the

$2,000 penalty

Staff Contact: Corrie

Press Contact:

Page 19 of 34

advertising and sale of motor vehicles.

Alvarado (512)

465.1205

Adam Shaivitz,

512.465.4210

South Point Hyundai

Alleged violation of the Texas Administrative Code in connection with the

advertising and sale of motor vehicles.

$1,000 penalty

Staff Contact: Corrie

Alvarado (512)

465.1205

Press Contact:

Adam Shaivitz,

512.465.4210

Vandergriff Chevrolet

Alleged violation of the Texas Administrative Code in connection with the

advertising and sale of motor vehicles.

$1,000 penalty

Staff Contact: Corrie

Alvarado (512)

465.1205

Press Contact:

Adam Shaivitz,

512.465.4210

Friendly Chevrolet, Ltd.

Alleged violation of the Texas Administrative Code in connection with the

advertising and sale of motor vehicles.

$3,000 penalty

Staff Contact: Corrie

Alvarado (512)

465.1205

Press Contact:

Adam Shaivitz,

512.465.4210

Westway Ford

Alleged violation of the Texas Administrative Code in connection with the

advertising and sale of motor vehicles.

$2,000 penalty

Staff Contact: Corrie

Alvarado (512)

465.1205

Press Contact:

Adam Shaivitz,

512.465.4210

Jeno Autoplex, LLC

Alleged violation of the Texas Administrative Code in connection with the

advertising and sale of motor vehicles.

$2,000 penalty

Staff Contact: Corrie

Alvarado (512)

465.1205

Press Contact:

Adam Shaivitz,

512.465.4210

Benny Boyd Used Superstore

Alleged violation of the Texas Administrative Code in connection with the

advertising and sale of motor vehicles.

$6,000 penalty

Staff Contact: Corrie

Alvarado (512)

465.1205

Press Contact:

Adam Shaivitz,

512.465.4210

North Central Ford

Alleged violation of the Texas Administrative Code in connection with the

advertising and sale of motor vehicles.

$2,000 penalty

Staff Contact: Corrie

Alvarado (512)

465.1205

Press Contact:

Adam Shaivitz,

512.465.4210

Rockwall Ford-Mercury

Alleged violation of the Texas Administrative Code in connection with the

advertising and sale of motor vehicles.

$2,000 penalty

Staff Contact: Corrie

Alvarado (512)

465.1205

Press Contact:

Adam Shaivitz,

512.465.4210

Allen Samuels Dodge, Allen Samuels

Dodge Chrysler Jeep, Allen Samuels

Gym, Allen Samuels Hyundai

Alleged violation of the Texas Administrative Code in connection with the

advertising and sale of motor vehicles.

$2,000 penalty

Staff Contact: Corrie

Alvarado (512)

465.1205

Press Contact:

Adam Shaivitz,

512.465.4210

Amarillo Hyundai, Tri State Ford

Alleged violation of the Texas Administrative Code in connection with the

advertising and sale of motor vehicles.

$4,000 penalty

Staff Contact: Corrie

Alvarado (512)

465.1205

Press Contact:

Adam Shaivitz,

512.465.4210

Henna Chevrolet LP

Alleged violation of the Texas Administrative Code in connection with the

advertising and sale of motor vehicles.

$2,000 penalty

Staff Contact: Corrie

Alvarado (512)

465.1205

Press Contact:

Adam Shaivitz,

512.465.4210

Clay Cooley Real Estate Holdings 1 LLC

Alleged violation of the Texas Administrative Code in connection with the

advertising and sale of motor vehicles.

$4,000 penalty

Staff Contact: Corrie

Alvarado (512)

465.1205

Press Contact:

Adam Shaivitz,

512.465.4210

Southwest Kia

Alleged violation of the Texas Administrative Code in connection with the

$2,000 penalty

Staff Contact: Corrie

Press Contact:

Page 20 of 34

advertising and sale of motor vehicles.

Alvarado (512)

465.1205

Adam Shaivitz,

512.465.4210

North Central Ford

Alleged violation of the Texas Administrative Code in connection with the

advertising and sale of motor vehicles.

$2,000 penalty

Staff Contact: Corrie

Alvarado (512)

465.1205

Press Contact:

Adam Shaivitz,

512.465.4210

Absolute Hyundai Of Mesquite

Alleged violation of the Texas Administrative Code in connection with the

advertising and sale of motor vehicles.

$3,000 penalty

Staff Contact: Corrie

Alvarado (512)

465.1205

Press Contact:

Adam Shaivitz,

512.465.4210

Desoto Mac Haik Ford Ltd

Alleged violation of the Texas Administrative Code in connection with the

advertising and sale of motor vehicles.

$2,000 penalty

Staff Contact: Corrie

Alvarado (512)

465.1205

Press Contact:

Adam Shaivitz,

512.465.4210

Randall Noe Chrysler Dodge Jeep

Alleged violation of the Texas Administrative Code in connection with the

advertising and sale of motor vehicles.

$8,000 penalty

Staff Contact: Corrie

Alvarado (512)

465.1205

Press Contact:

Adam Shaivitz,

512.465.4210

Midway Autos LLC

Alleged violation of the Texas Administrative Code in connection with the

advertising and sale of motor vehicles.

$2,000 penalty

Staff Contact: Corrie

Alvarado (512)

465.1205

Press Contact:

Adam Shaivitz,

512.465.4210

Mac Haik Chrysler Dodge Jeep Ram,

Mac Haik Dodge Chrysler Jeep

Alleged violation of the Texas Administrative Code in connection with the

advertising and sale of motor vehicles.

$2,000 penalty

Staff Contact: Corrie

Alvarado (512)

465.1205

Press Contact:

Adam Shaivitz,

512.465.4210

Holiday Ford

Alleged violation of the Texas Administrative Code in connection with the

advertising and sale of motor vehicles.

$2,000 penalty

Staff Contact: Corrie

Alvarado (512)

465.1205

Press Contact:

Adam Shaivitz,

512.465.4210

State of Virginia – Motor Vehicle Dealer Board

D & S Imports, LLC and Diego S.

Canzobre

An informal fact-finding conference was conducted to address the alleged violations

of dealer records, buyer’s guide, buyer’s order, business hours, temporary

registration, D-tag insurance required, material misstatement or omission on an

application, and failure to comply with a written warning or willful failure to comply.

$5,000 civil penalty,

require a satisfactory

inspection, and pass

the dealer-operator

course.

Staff Contact: Bruce

Gould,

bruce.gould@mvdb.vi

rginia.gov

General Imports of Salem and

Christopher Bower

An informal fact-finding conference was conducted to address the alleged violations

related to dealer records, unlicensed salesperson, use of D-tags, leasing, renting,

lending, or otherwise allowing the use of a dealer’s license plate by persons not

specifically authorized to use dealer tags and advertising practices.

$1,000 civil penalty,

require a satisfactory

inspection, and pass

the dealer-operator

course.

Staff Contact: Bruce

Gould,

bruce.gould@mvdb.vi

rginia.gov

Connection Auto Sales, Inc. of

Spotsylvania, and Liliana D. Garcia

Mejia

An informal fact-finding conference was conducted to address the alleged violations

of license required, display of salesperson’ licenses, dealer records, odometer

disclosure, business hours, failure to comply with a written warning, and deceptive

acts or practices.

$1,500 civil penalty,

require a satisfactory

inspection, and pass

the dealer-operator

course.

Staff Contact: Bruce

Gould,

bruce.gould@mvdb.vi

rginia.gov

Page 21 of 34

Bordens Auto Sales, Inc. and Gerald L.

Borden

An informal fact-finding conference was conducted to address the alleged violations

of use of temporary transport plates, and having been convicted of any criminal act

involving the business of selling vehicles.

$250 civil penalty,

require a satisfactory

inspection, and pass

the dealer-operator

course.

Staff Contact: Bruce

Gould,

bruce.gould@mvdb.vi

rginia.gov

Curtis Automotive, Inc. and Robert J.

Curtis

An informal fact-finding conference was conducted to address the alleged violations

of failure to comply with a written warning, defrauding or damaging a retail buyer;

deceptive acts or practices, and failure to submit fees to DMV within 30 days.

Board revoked Mr.

Curtis’s Independent

Dealer-Operator

Qualification, but took

no action against the

dealership, due to the

Dealer closing the

dealership in October

of 2014.

Staff Contact: Bruce

Gould,

bruce.gould@mvdb.vi

rginia.gov

Auto Madi, LLC and Mohammad Y.

Ghatri.

An informal fact-finding conference was conducted to address the alleged violations

of display of salesperson’ licenses, dealer records, buyer’s guide, buyer’s orders,

business hours, signs, proof of inspection, temporary registration, use of dealer tags

and material misstatement, failure to comply with a written warning, deceptive acts

or practices, convicted of any criminal act while in the business of selling motor

vehicles, possessing titles which have not been completely and legally assigned to

him, and failure to submit fees to DMV within 30 days.

$14,500 civil penalty

and revocation of all

licenses and

certificates associated

with Auto Madi and

Mohammad Yousef

Ghatri.

Staff Contact: Bruce

Gould,

bruce.gould@mvdb.vi

rginia.gov

Today’s Auto and Eldon L. Smith.

A formal hearing was conducted to address the alleged violations of license required;

failure to comply with written warning or willful failure to comply; and having used

deceptive acts or practices.

$14,000 civil penalty,

revocation of the

dealership certificate,

and Mr. Smith’s

Independent Dealer-

Operator qualification.

Staff Contact: Bruce

Gould,

bruce.gould@mvdb.vi

rginia.gov

City Import Gallery, LLC, and

Mohammed Basheer, and Haider

Ramadhan,

Unlicensed Salesperson

$500 civil penalty

Staff Contact: Bruce

Gould,

bruce.gould@mvdb.vi

rginia.gov