Child Care Stabilization Grants: Frequently Asked Questions

Updated September 27, 2022

Table of Contents

General Information ........................................................................................................................... 2

North Carolina Child Care Stabilization Grants Timeline ...................................................................... 3

Fixed Costs and Families Grant ........................................................................................................... 4

Optional Funding for Compensation Support Grants ........................................................................... 5

Application/Recertification Application .............................................................................................. 7

Grant Award Payments .................................................................................................................... 10

Quarterly Update ............................................................................................................................. 11

Monitoring ....................................................................................................................................... 13

Get Help ........................................................................................................................................... 13

Index ................................................................................................................................................ 14

NC Child Care Stabilization Grants FAQs | Updated 27 September 2022

Page 2

General Information

Q. What are child care stabilization grants?

A. North Carolina child care stabilization grants are non-competitive financial awards made directly to

eligible, qualified early care and learning programs across the state to sustain and stabilize

their businesses, support working families with access to high-quality, affordable care and education,

and promote equity for children, parents, and teachers.

Q: How are child care stabilization grant funds awarded?

A: Child care programs must apply for Stabilization Grants. Each approved program receives a fixed

costs and families grant, based on capacity, subsidized child care enrollment, program quality (star

rating), infant/toddler enrollment, and community context (using Social Vulnerability Index).

Programs may choose to also receive additional funding, compensation supports grants, to support

recruitment and retention. The two components are intended to grant early care and learning

programs the funds to facilitate high quality early childhood education at its true cost and attract and

retain high-quality teachers by increasing compensation.

Q. What are the options for Compensation Support Grants?

A. If a child care program decides to apply for additional funding for compensation support, it must

select only one of the two options: Option 1: Bonuses Only OR Option 2: Increase Salary and/or

Benefits.

Q. Are child care stabilization grants loans? Do the funds they have to be paid back?

A. Child care stabilization grants are not loans. Child care stabilization grants do not have to be paid

back as long as they are used for approved purposes.

Q. Are child care stabilization grants payments automatically awarded to early care and learning

programs?

A. No, child care programs must apply for these non-competitive grants.

Q. Can a new child care program apply?

A. Yes, newly licensed programs are paid at 3-star rate for 6 months. If the program has applied for its

star rating and has not been rated, the same star rating will be used until the assessment process has

been completed.

Q. Can Head Start/Early Head Start programs apply for child care stabilization grants?

Q. Can publicly funded NC Pre-K programs apply for child care stabilization grants?

A. No. Because stabilization grant funding is intended to help the child care sector, public

prekindergarten programs, Head Starts, or Early Head Starts, which typically operate under different

program rules and funding structures than child care, are not eligible for NC child care stabilization

grants. However, private-pay NC Pre-K programs may apply.

Q. Can child care programs located in public schools apply?

A. Yes, if the school-based program is funded by family fees (including child care subsidy). No, if public

funds finance the program.

NC Child Care Stabilization Grants FAQs | Updated 27 September 2022

Page 3

Q. When can child care programs expect the grant money?

A. Review the Timeline below.

North Carolina Child Care Stabilization Grants Timeline

Quarter

#

Quarter

Dates

Est.

Pay Date

Quarterly

Update

Due

Plus

Recertification

Fixed Costs

Amount

Compensation

Grants

Spend by

Date

1

Oct 1-Dec 31,

2021

Nov 2021

5-Jan-22

Original

Original

30-Sep-23

2

Jan 1-Mar 31,

2022

Jan 2022

5-Apr-22

Yes

Original

Original

30-Sep-23

3

Apr 1-Jun 30,

2022

Apr 2022

5-Jul-22

Original

Original

30-Sep-23

4

July 1-Sep 30,

2022

Jul 2022

7-Oct-22

Yes

2/3 of Original

Option 2

Quality Bonus

reduced

30-Sep-23

5

Oct 1-Dec 31,

2022

Oct 2022

Early

Jan 2023

1/3 of Original

Option 2

Quality Bonus

reduced

30-Sep-23

6

Jan 1-Mar 31,

2023

Jan 2023

Early

Apr 23

Yes

1/3 of Original

Same as

Previous

Quarter

30-Sep-23

7

Apr 1-Jun 30,

2023

Apr 2023

Early

July 2023

Discontinued

Option 2

Quality Bonus

Discontinued

30-Sep-24

8

July 1-Sep 30,

2023

Jul 2023

Early

Oct 2023

Yes

Discontinued

Option 2

Quality Bonus

Discontinued

30-Sep-24

9

Oct 1-Dec 31,

2023

Oct 2023

Early

Jan 2023

Discontinued

Option 2

Quality Bonus

Discontinued

30-Sep-24

Quarterly Updates required until all funding has been reported spent.

NC Child Care Stabilization Grants FAQs | Updated 27 September 2022

Page 4

Fixed Costs and Families Grant

Q: How can the Fixed Costs and Families Grant be used?

A. Fixed Costs and Families Grant Expenditures must fit into one of these categories of approved uses:

1) Rent (including rent under a lease agreement) or payment on any mortgage obligation, utilities,

facility maintenance or improvements, or insurance.

a. Examples of acceptable facility maintenance or improvements include, but are not

limited to:

i. building or upgrading playgrounds

ii. renovating bathrooms

iii. installing railing, ramps, or automatic doors to make the facility more accessible

iv. removing non-load bearing walls to create additional space for social distancing

v. maintenance and minor renovations to address COVID-19 concerns

vi. facilities improvements that make programs inclusive and accessible to children

with disabilities and family members with disabilities.

2) Personal protective equipment, cleaning and sanitization supplies and services, or training and

professional development related to health and safety practices.

3) Purchases of or updates to equipment and supplies to respond to the COVID–19 public health

emergency.

4) Goods and services necessary to maintain or resume child care services.

5) Mental health supports for children and employees.

6) Tuition assistance for families.

7) Past Expenses: reimbursement of debt or expenditures incurred after January 31, 2020, for the

cost of a good or service that falls in the categories above to respond to the COVID–19 public

health emergency.

8) Personnel costs, including payroll and salaries or similar compensation for an employee

(including any sole proprietor or independent contractor), employee benefits, costs for

employee recruitment and retention as well as ongoing professional development or training,

premium or hazard pay, staff bonuses, and employee transportation costs to or from work.

Q. What can I not use Stabilization Grants (Fixed Costs and Families Grants) for? What are uses are

prohibited?

A. This is not an exhaustive list. Stabilization Grant funds may NOT be used for new construction or

major renovation. As defined in 45 CFR 98.2, “Major renovation” means:

• structural changes to the foundation, roof, floor, exterior or load-bearing walls of a facility, or

the extension of a facility to increase its floor area; or

• extensive alteration of a facility such as to significantly change its function and purpose, even if

such renovation does not include any structural change.

Q. What is the formula for the Fixed Cost & Family Grant?

A. The Fixed Cost & Family Grant formula components:

1. Total licensed capacity and star level

2. Program indicators:

a. % of infants & toddlers enrolled when full:

i. 1-25%: Increase in funds by 5%

ii. 26-50%: Increase in funds by 10%

NC Child Care Stabilization Grants FAQs | Updated 27 September 2022

Page 5

iii. 51-75%: Increase in funds by 15%

iv. 76-100%: Increase in funds by 20%

b. Community context by County (SVI)

i. 0-25%: Increase in funds by 3%

ii. 26-50%: Increase in funds by 6%

iii. 51-75%: Increase in funds by 9%

iv. 76-100%: Increase in funds by 12%

c. % of children currently enrolled in child care subsidy:

i. 1-25%: Increase in funds by 3%

ii. 26-50%: Increase in funds by 6%

iii. 51-75%: Increase in funds by 9%

iv. 76-100%: Increase in funds by 12%

Q. How and when are Fixed Costs and Families Grant reduced? What is the Fixed Costs and Families

Grant reduction?

A. Beginning with the July 2022 quarterly payment, the Fixed Cost and Families Grant component of

the child care stabilization grants has been reduced by about one-third (1/3) for all approved child care

programs. The planned decrease was postponed from April 2022 to allow programs time to recover

from the COVID-19 omicron surge in early 2022. An additional 1/3 reduction from the April 2022 in

Fixed Cost and Families Grant will take place in October 2022. The January 2023 Fixed Cost and

Families Grant payment will be the same amount as the October 2022 amount. (Also, see Timeline.)

Optional Funding for Compensation Support Grants

Q. What are the options for Compensation Support Grants?

A. Option 1. Provide Bonuses to all staff

• Implement a bonus plan.

• Submit the bonus plan (even if unchanged) during each quarterly update.

Option 2. Increase Base Pay and/or Benefits for all staff

• Implement a salary a/o benefits plan.

• Submit salary/benefits plan (even if unchanged) during each quarterly update.

• Use quarterly payments to maintain the increased salary/benefits.

• Use Fixed Costs or own funds for staff bonuses.

Option 3. Decline to participate in Compensation Grants. If child care programs have not applied

previously, they can apply to opt in during recertification.

Q: How can the child care stabilization grant compensative support grant option 1 be used?

A: Early care and learning programs selecting Option 1: Bonuses Only agree to use the additional

funding to provide bonuses to all staff. Programs will develop and implement a bonus plan that ideally

factors in education and length of service, as well as job responsibilities. The bonus plan must be

uploaded during each quarterly update. Programs must keep payroll records for seven years.

Q. How can the Child Care Stabilization Compensation Support Grants Option 2 be used?

A. By selecting Option 2: Increase Salary and/or Benefits, early care and learning programs agree to

increase base pay and/or benefits for any staff in a child care center or family child care home and their

employees. Once base pay and/or benefits have been increased using stabilization grant compensation

NC Child Care Stabilization Grants FAQs | Updated 27 September 2022

Page 6

funds, child care programs may use the quarterly payment to maintain the increases. Programs will

develop and implement a compensation scale that ideally factors in education and length of service, as

well as job responsibilities. Programs must keep records of payroll and premiums paid with grant funds

for seven years.

Q. What’s the difference between Compensation Support Grant Option 1 and Option 2?

Q. What is the difference between Bonuses and Increasing Salary?

A. Programs may use the Grant Payment Estimator on the DCDEE Stabilization Grants web page to see

the difference in grant award amounts between Option 1 and Option 2.

Option 1: Bonuses

Option 2: Increase Salary

and/or Benefits

Option 2: Benefits

Additional lump sum on

paycheck or separate bonus

check

Additional pay per hour

Non-monetary compensation

such as health insurance,

retirement plans, reimbursement

for professional development or

transportation, etc.

Is taxable

Is taxable

Often tax free

Counts toward income

eligibility

Counts toward income

eligibility

Typically doesn’t count toward

income eligibility

Higher grant award amounts

Q. I want to give bonuses AND increase salary/benefits. Can I choose both Option 1 and Option 2?

A. No. Programs may only choose one Compensation Supports Grant option. Programs that select

Option 2: Increase Salary and/or Benefits may use fixed costs and families’ funds to give bonuses.

Q: Can child care programs use the fixed costs for bonuses if they didn’t choose Option 2?

A: Yes, if a child care program didn’t opt-in to Option 2, it can use the fixed cost grant for bonuses.

Q. What is a salary scale? How do I make one?

A. North Carolina Early Childhood Compensation Collaborative Model Salary Scale for Early Education

Teachers is an excellent example salary scale. Child care programs do not have to copy it exactly; feel

free to adapt it to fit the facility.

Q. What counts as benefits for Compensation Support Grants Option 2?

A. Examples of benefits, includes, but is not limited to:

• Health, dental, and vision insurance

• Scholarships

• Paid time off

• Paid sick or family leave

• Retirement contributions

• Professional development or training

• Premium or hazard pay

NC Child Care Stabilization Grants FAQs | Updated 27 September 2022

Page 7

• Employee transportation costs to and/or from work.

• Funds may also be used to support staff in accessing COVID-19 vaccines, including paid time off

for vaccine appointments and to manage side effects, as well as transportation costs to vaccine

appointments.

Q. Will there a reduction in the Compensation Support Grants?

A. No. There will be no change in the formula for compensation support grants, but some grantees

may notice a decrease in the grant payment amount for Compensation Support Option 2: Increase Base

Pay/Benefits. This is not an error; included in the Option 2 formula is a quality enhancement bonus for

3, 4, and 5-star rated child care programs which adds 10% of the fixed costs and families grant amount

to the Compensation Grant payment. If the fixed costs and families grant increases, then the bonus

amount increases. Similarly, if the fixed costs and families grant goes down, then the bonus amount

goes down too. The reduction in the fixed costs and families grant doesn’t affect the amount of

Compensation Support Option 1: Bonuses.

Application/Recertification Application

Q: Are all child care programs in NC required to apply for child care stabilization grants?

A: No, programs are not required to apply, but all eligible, qualified child care providers in North

Carolina are encouraged to apply for child care stabilization grants funding.

Q: What is the deadline to apply for child care stabilization grants?

A: Applications for non-competitive child care stabilization grants are still being accepted. Child care

programs may apply at any time to begin receiving the child care stabilization grants.

Q. When is the recertification application due?

A. Child care programs that receive stabilization grants funds must apply to recertify the application

every 6 months.

Q: Who is eligible and qualified to receive child care stabilization grants ?

A: North Carolina child care programs that are eligible for Stabilization Grant funding include:

1. Licensed, private (for- and not-for-profit) Child Care Centers

2. Licensed Family Child Care Homes

3. Faith-based (GS 110) Child Care Programs operating under a Notice of Compliance

Qualified North Carolina Child Care programs are open and hold one of these three:

1. a current star-rated child care license;

2. a notice of compliance and eligibility to participate in the Subsidized Child Care Assistance

Program;

3. or have had a license or been regulated under a notice of compliance by DCDEE (i.e., faith-

based GS110-) on or before March 11, 2021.

Q. Are Head Start, Early Head Start and NC Pre-K programs eligible to receive child care stabilization

grants?

A. No. Because stabilization grant funding is intended to help the child care sector, public

prekindergarten programs, Head Start, or Early Head Start, which typically operate under different

NC Child Care Stabilization Grants FAQs | Updated 27 September 2022

Page 8

program rules and funding structures than child care, are not eligible for NC child care stabilization

grants. However, private NC Pre-K programs may apply.

Q. Can child care programs located in public schools apply?

A. Yes, if the school-based program is funded by family fees (including child care subsidy). No, if public

funds finance the program.

Q: What information is needed to apply for child care stabilization grants?

A: Eligible, qualified child care programs will need to:

1. Have or create a Business NCID and link the facility name to it. (See Job Aid – Creating and

Linking your NCID)

2. Have or setup a direct deposit account (See Job Aid - Setting up your Direct Deposit (PDF))

3. Detailed list of staff, including education and pay rate (See Staff and Training Worksheet)

4. Student enrollment information by age

5. Tuition rates

6. Estimated monthly expenses (payroll, benefits, rent/mortgage, utilities, insurance, teaching

supplies, cleaning supplies, PPE, groceries, etc.)

7. Estimated monthly revenue

Q. How does a program apply for child care stabilization grants?

A. Use the Job Aid - Application Instructions (PDF) for step-by-step guidance and screenshots to

complete the online application in the American Rescue Plan Stabilization Grants for Child Care

Providers Portal.

Q: Can I complete a paper application for child care stabilization grants?

A. No, paper applications are not available and will not be accepted.

Q: If a provider owns/operates more than one child care facility, how do he/she apply?

A: Providers can receive only one stabilization grant per licensed child care program. If a provider has

multiple sites, one application will need to be submitted per site.

Q: How often do programs need to apply for a child care stabilization grant?

A: Child care programs will only apply for the stabilization grant funding once. Every 6 months,

programs must complete a recertification application to continue receiving funds.

Q. How do child care programs complete the recertification application for child care stabilization

grants?

A. Use the Job Aid - Stabilization Grant – Recertification Application (PDF) for step-by-step guidance

and screenshots. Login to the American Rescue Plan Stabilization Grants for Child Care Providers Portal

to complete the recertification application.

Q: Where in the application or recertification application are records and receipts uploaded?

A: Child care programs do not have to submit receipts in the application or recertification application.

Child care programs will document the use of funds during quarterly updates.

Q: How in the application or recertification application is the star rating entered?

NC Child Care Stabilization Grants FAQs | Updated 27 September 2022

Page 9

A: Child care programs will not need to enter the star rating. The star rating will come from the DCDEE

regulatory system.

Q: How do I answer: *Was your program licensed (OR operating under a notice of compliance) by

DCDEE on or before March 11, 2021?

A: If the child care program was licensed on or before March 11, 2021, respond “yes”. If the child care

program is a GS 110-106 operating under a notice of compliance on or before March 11, 2021, respond

“yes”. Only respond “no” if it’s a new facility that was licensed after March 11, 2021.

Q: I am receiving error message “invalid date” when adding my license date. What do I do?

A: Make sure you answered the 2

nd

question in this section correctly. *See previous Q&A above.

Q: In Section 3, how do I calculate my facility’s “maximum enrollment?”

A: Maximum enrollment means the total number of children attending if the facility has full

enrollment. For example: If a facility serves three shifts of 8 children in each shift, the maximum

enrollment in that facility would be 24 children. If you serve children part-time, count shared slots as

‘one’ slot. For instance, if your enrollment is 4 full time and 4 part time, your enrollment is 6.

Q. How do I opt in to receive additional child care stabilization grants funding for compensation

support, i.e., compensation support grants?

A. In Section VI Certifications, Question 2 asks, “Would you like to receive funds for Compensation

Support (Bonuses, Salaries and/or Benefits)?” Answer “Yes”. Then select either “Option 1: Bonuses” or

“Option 2: Increase Base pay and/or Benefits”. You may only make one selection.

Q. How can I change my compensation support option or opt out of that funding?

A. During recertification application period, you may opt out, opt in, or switch options for

compensation support. Just be sure to spend the funds according to how they were awarded. For

example, if you’ve been paid option 1 funds and wish to change during the recertification period to

option 2, you must still spend any option 1 funds you received to award bonuses.

Q: What must child care providers attest to in order to qualify for a stabilization grant?

A: Applicants must certify that, if awarded grant funds, they will:

1. Follow local, state, and federal health and safety requirements.

2. Maintain full compensation for staff.

3. To the extent possible, provide relief from copayments and tuition for parents struggling to

afford child care.

4. Meet CCDF requirements (e.g., background checks, participate in health and safety

trainings).

Q. What does “Status” mean in the child care stabilization grants portal?

A. Status definitions for application or recertification application:

• Draft – Indicates that a recertification has been started, but not submitted. Action is required.

Programs must submit recertification by the applicable deadline.

• Pending Signature – Child care program has accepted the Terms and Conditions but has not

submitted the recertification. Action is required. Program staff log back in, sign and submit the

recertification to be considered for grant funds.

NC Child Care Stabilization Grants FAQs | Updated 27 September 2022

Page 10

• Approved – The recertification has been accepted and will be funded on the next grant

payment date.

• Pending – Program has submitted the recertification; but the electronic review has found one

or more items that need to be reviewed by an appropriate DCDEE staff member who will

address the issue or contact the child care program to resolve. These reviews can take 5-7

business days, occasionally longer, so please be patient.

• Denied – The child care program, as assessed from recertification, does not qualify to receive

child care stabilization grant funds.

Q: When will my application be approved? How long does DCDEE take to review a child care

stabilization grant application?

A. Applications are electronically reviewed immediately upon submission and assigned an application

status of approved, denied, pending signature, or pending, which will display on the screen.

Q: Once I submit my online child care stabilization grants application, how can I edit my

information?

A: You can’t. Once approved, the submitted application becomes a legally binding agreement between

the applicant and the Division of Child Development and Early Education. You may review the Terms

and Conditions of that agreement. Please take your time and make certain that all information is

accurate before signing and submitting.

Q: Should child care programs include contracted workers (accountants, sub- teachers, HR

consultants, etc.) in the payroll or fixed cost?

A: Use fixed costs and families grant funds to pay for these services.

Q: Are all program staff required to be vaccinated against COVID-19 to get stabilization grant funds?

A: There is no COVID-19 vaccine requirement for child care stabilization grant recipients. However,

grantees are required to follow local, state, and federal public health requirements in the fight against

COVID-19. NC DHHS remains committed to providing the most effective and appropriate public

health guidance for the current phase of the pandemic. The best tools right now

are getting vaccinated, getting boosted when eligible, testing after exposure, and staying home when

sick. NC DHHS COVID-19 guidance for child care programs can be found in the Managing COVID-19

Cases in Child Care Facilities .

Grant Award Payments

Q: How much money will each program get?

A: Grant award amounts depend on several factors. Use the grant payment estimator on the DCDEE

Stabilization Grants web page for a close estimate.

Q: When are child care stabilization grant awards paid?

A. Child care stabilization award payments are issued once a quarter, usually later in the month. One

total payment will be issued with an amount for fixed costs and families grant, and if opted in, an

additional amount for compensation support grant. When a payment is issued, check the portal to see

how the payment is allocated. The final fixed costs and families portion of the grant will be paid in

NC Child Care Stabilization Grants FAQs | Updated 27 September 2022

Page 11

January 2023. Grant support to boost compensation for North Carolina’s early care and learning

teachers and staff will continue through December 2023. (See Timeline.)

Q: Are the stabilization grants considered taxable income?

A: The ARP Act does not exempt stabilization grant funding from taxation. Therefore, this funding is

subject to the same tax rules as regular CCDF funding. Child care programs may use Fixed Cost grant

funds to pay taxes.

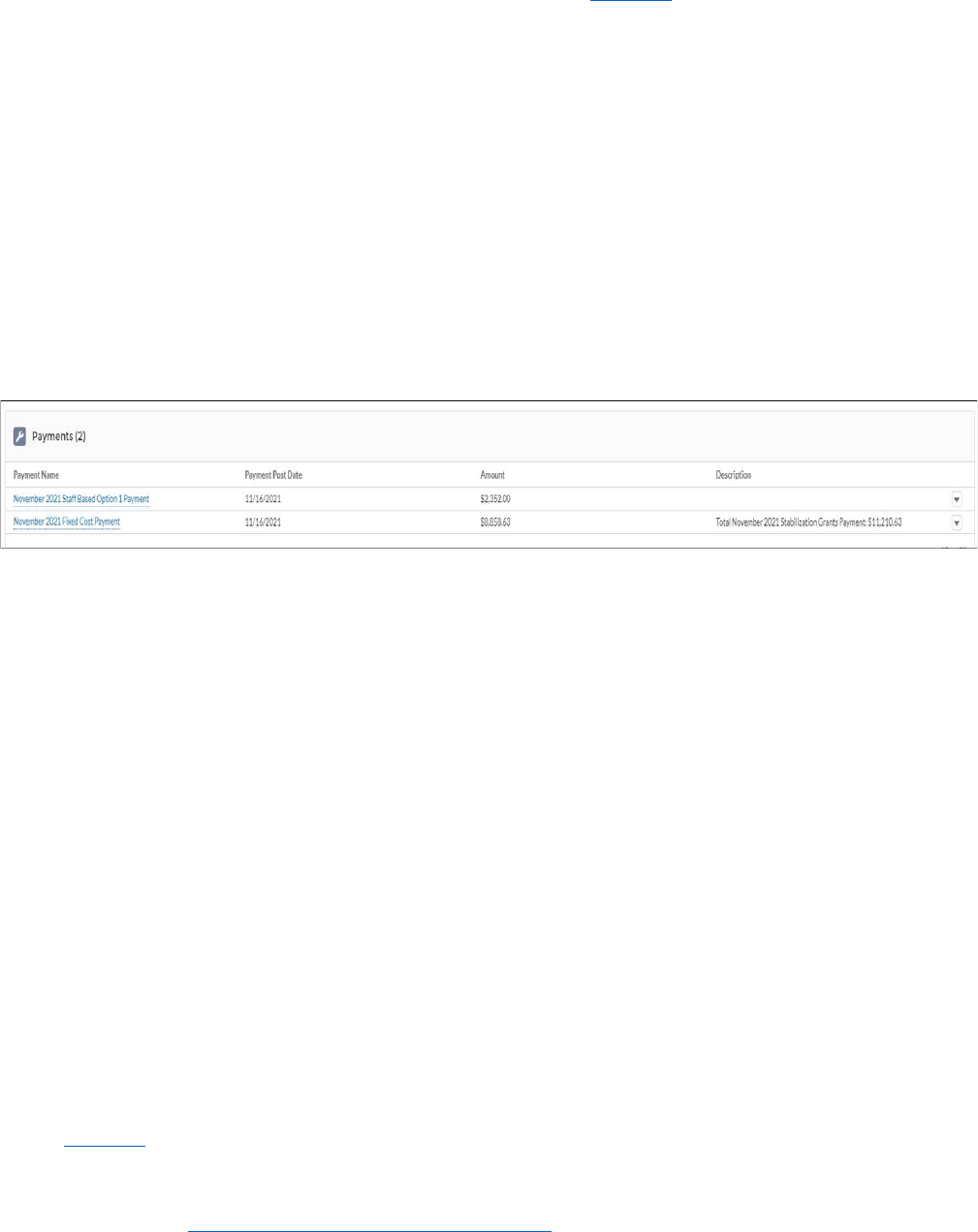

Q. How much of the grant payment is for fixed costs and families and how much is for compensation

support? Where can I see the payments made to my child care program?

A. Each child care program grantee receives a payment deposit composed of a fixed cost and families

payment and, if opted in, a staff-based payment. After logging in to the portal and clicking on the

facility name, locate the section labeled “Payments” (below the section labeled “Benefit Program”).

Stabilization grants payments made to your facility are listed with the Payment Name, Payment Post

Date, Amount, and Description. See the screenshot below for an example.

Q: How will I report this on my taxes?

A: Child care facilities will receive a Form 1099 documenting the grant income. If you do not receive

the 1099, please contact FIS at +1(800) 894-0050.

Q: Will I need to maintain documentation and/or receipts detailing how the stabilization grants were

used?

A: Yes. Grant expenditures must be reported and documentation must be uploaded during a quarterly

update. Child care programs receiving stabilization grant funds will need to maintain documentation of

grant fund spending. Get receipts for cash payments. Keep all records for 7 years.

Quarterly Update

Q. What is a quarterly update?

A. During the quarterly updates, child care programs report their grant expenditures and upload

documentation of those expenses in the stabilization grant portal. They can also update their

workforce records to show new hires, staff changes, pay raises, teacher educational achievement, or

student enrollment to show how grants are helping their business.

Q. When are quarterly updates due?

A. See Timeline.

Q. How do child care programs complete the quarterly update?

A. Use the Job Aid - Stabilization Grant – Quarterly Update (PDF) for step-by-step guidance and

screenshots.

NC Child Care Stabilization Grants FAQs | Updated 27 September 2022

Page 12

Q. How do I log in to the Stabilization Grant Application Portal?

Go to the American Rescue Plan Stabilization Grants for Child Care Providers Portal to complete the

Quarterly Update.

Q. How do I know what category to put my fixed costs and families grants expenses in?

A. Use this table to help decide what category each expenditure will go in.

Fixed Cost/Family Grant Types

Category

Goods and services necessary to maintain or resume child

care services.

Goods and services

Copayments and tuition payments for families with children

enrolled in the program

Goods and services

Repayment of costs incurred after the declaration of the

public health emergency on January 31, 2020, for any of the

categories listed above

Goods and services

Mental health supports for children and employees

Mental health supports

PPE, cleaning and sanitation supplies and services, or training

and professional development related to health and safety

practices

Personal protective equipment

Teacher and staff recruitment

Personnel Costs

Teacher and staff compensation

Personnel Costs

Purchases of or updates to equipment and supplies to

respond to COVID-19

Purchases of or updates to

equipment and supplies

Rent or mortgage payments, utilities, facilities maintenance

and improvements, or insurance

Rent/Mortgage/Utilities

Q: What do child care programs need to upload? What kind of documentation is acceptable?

A: Child care programs can use a variety of documents to show how the stabilization grant funds were

used. For fixed costs and families grants, acceptable documentation includes, but is not limited to:

• Invoices, receipts, and bills

• Bank account or credit card statements

• Cancelled checks

• Loan statements or documents

• Payroll records

• P&L Statements from accounting software

• For tuition assistance to families, invoice marked “paid” or something on letterhead showing

the amount given and to whom.

If you received compensation supports grants, you’ll need to upload two items:

• A bonus plan, or a salary/benefits plan establishing the method the child care program is using

to distribute compensation grant funds to staff.

o The plan must include all employees.

NC Child Care Stabilization Grants FAQs | Updated 27 September 2022

Page 13

o This can be a narrative description, a table, spreadsheet or matrix for larger

programs. Show your work! Tell us what’s different. Plan should indicate changes you’ve

made or are planning to make.

• Proof of payments you’ve made or benefits you’ve provided

o Payroll records

o Cancelled checks

o Receipts or invoices from benefit vendors

Q. In the quarterly update, I get an error message “A home facility should have at least one active

administrator.” What does that mean?

A. To align with recently released federal reporting requirements, the Division of Child Development

and Early Education has changed a required response in Section VI: Workforce Updates. Every grantee

must designate one employee’s position as “administrator”. Many family child care homes may need

to change their position from “owner” to “administrator”. To do so, select “Yes” when asked “Have

there been any changes to your workforce during the past quarter?” Then follow instructions for

updating an employee on page 25 of the Recertification Job Aid Quarterly Update Job Aid.

Q. I received payments for Option 2: Increase Base pay and/or Benefits. How do I “identify the way

in which the funds were used for personnel cost” in Section III Compensation Supports of the

Quarterly Update?

A. Enter a value between 0 to 100 to indicate the percentage of your compensation support grant

funds you used to increase base pay and the percentage you used for benefits. Values should add up to

100 percent of Option 2 funds received.

Q: If we have recently made a part-time teacher full time, would that be considered workforce

update?

A: Yes, please update that information in the Workforce Section.

Q: How do I upload paper receipts to my computer?

A: The Job Aid-Stabilization Grants – Quarterly Update has upload and download instructions.

Monitoring

DCDEE monitors the stabilization grants program on an ongoing basis to ensure child care program

grantees use funds for allowed uses only and in compliance with the Terms and Conditions. If an audit

finds no problems, the child care program will receive a letter notifying them of the audit result. If an

audit reveals any issues, the auditor will contact the child care program with any questions or to

request documentation. Grantees must cooperate and respond to any instructions from DCDEE

auditors. Not all application will be reviewed; goal is approximately 1/3 to ½ of all applications.

Get Help

Q: Where can I get more information about child care stabilization grants?

A. The Division of Child Development and Early Education maintains a child care stabilization grants

webpage at https://ncchildcare.ncdhhs.gov/Stabilization-Grants.

NC Child Care Stabilization Grants FAQs | Updated 27 September 2022

Page 14

Q. How do I ask a question or report a problem?

A. Assistance is available Monday-Friday from 8:30 AM-4:30 PM. Ask questions using the Stabilization

Grant Customer Support Form or call Stabilization Grants Customer Service Team at (919) 814-6300,

press 2.

Q. If I am experiencing a technical problem, how do I contact NC FAST?

A. Child care providers who need assistance from the NC FAST Help Desk may call (919) 813-5460.

Index

A

Administrator · 14

Application · 7, 8, 9, 10, 12

Status · 10

Application Instructions · 8

approved uses · 4

B

benefits · 4, 5, 6, 7, 8, 13, 14

Business NCID · 8

C

Child Care Stabilization Grants · 1, 2, 7, 8, 9, 10, 11, 14

Child Care Stabilization Grants Option 1

Bonuses Only · 6

Compensation Support

Option 2

Increase Salary and/or Benefits · 6

Compensation Support Grant · 6, 11, 14

Compensation Support Grants · 2, 5, 6, 7, 10

Compensation Supports

Option 1: Bonuses Only · 2

Compensation Supports Grants · 1, 13

construction · 4

COVID-19 vaccine · 11

Customer Service · See Customer Support

D

direct deposit account · 8

documentation · See receipts

E

Edit Application · 11

F

FIS · 12

Fixed Cost & Family Grant formula · 5

Fixed Costs and Families Grant · 1, 4, 11

G

grant award payments · 11

grant payment · 7, 10, 11, 12

Grant Payment Estimator · 6

H

Head Start

Early Head Start · 2

M

major renovation · 4

maximum enrollment · 9

monitor · See audit

Monitoring · 14

N

NC Pre-K · 2, 8

new child care program · 2

O

Option 1. Provide Bonuses to all staff · 5

Option 2: Increase Salary and/or Benefits · 2

Option 2. Increase Base Pay and/or Benefits for all staff · 5

Optional Additional Funding · Compensation Support Grants

NC Child Care Stabilization Grants FAQs | Updated 27 September 2022

Page 15

P

Past Expenses · 4

public schools · 2, 8

Q

Quarterly Update · 6, 12, 14

R

receipts · 9, 12, 13, 14

recertification application · 7, 9, 10

reduction · 5

S

salary scale · 6

Status

Pending · 10

Pending Signature · 10

T

tax · 6, 11

taxable · 11

taxes · 11, 12

Timeline · 3, 5, 11, See Dates

U

Uses, Allowable

Mortgage/Rent · 4