- 1 -

Last updated: September 20, 2022

Personnel and Payroll Services

Glossary of Terms

A B C D E F G H I J K L M N O P Q R S T U V W X Y Z

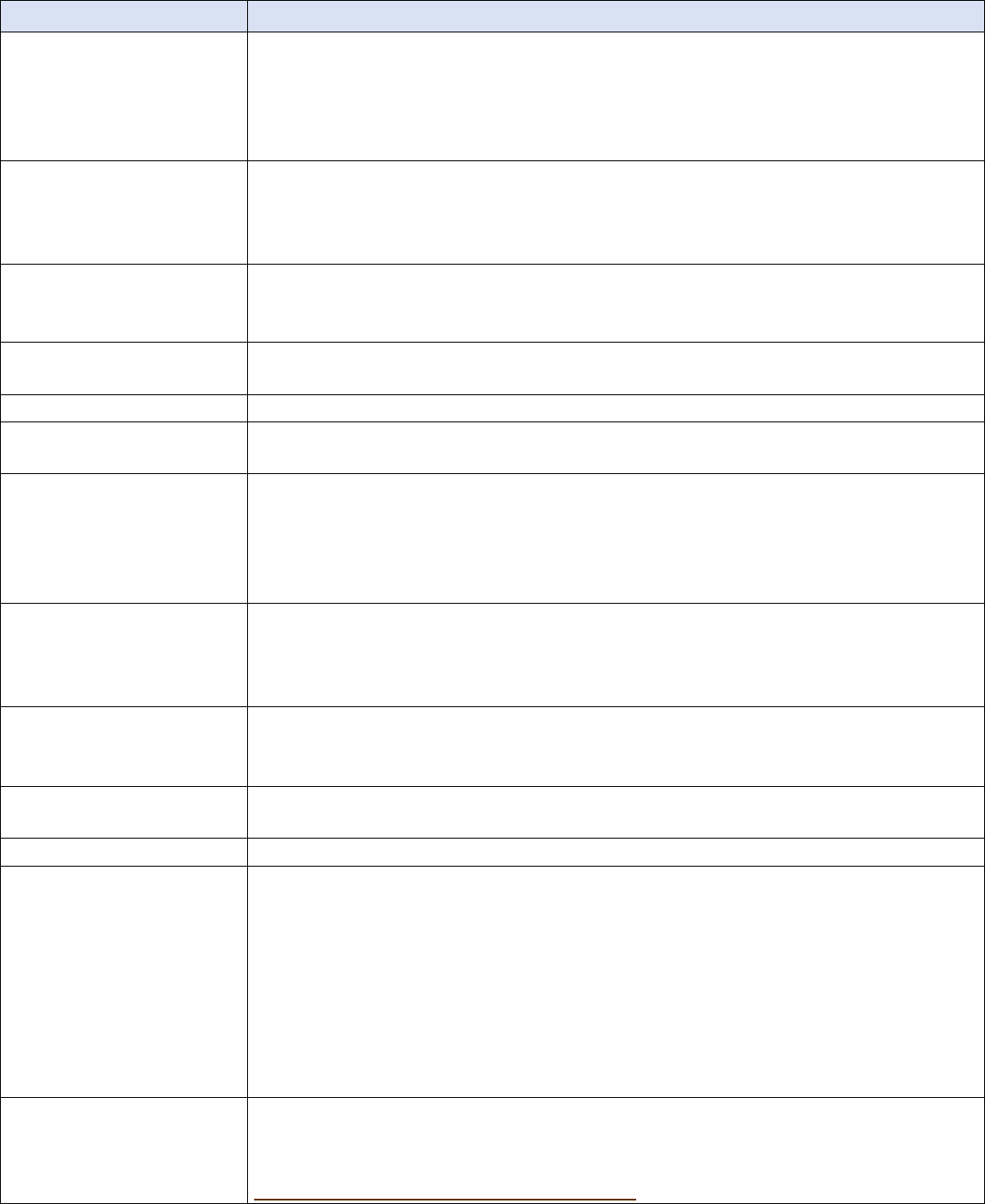

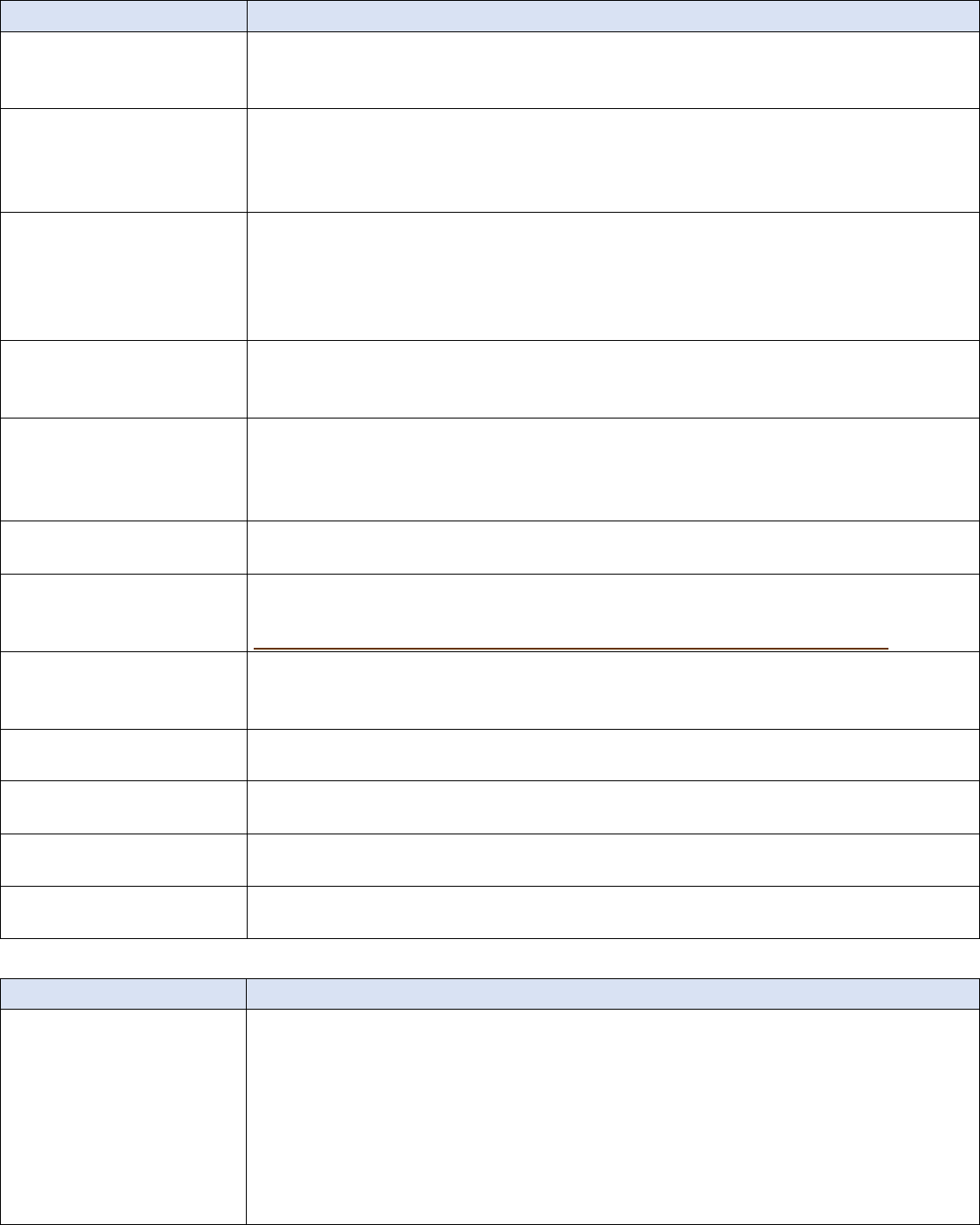

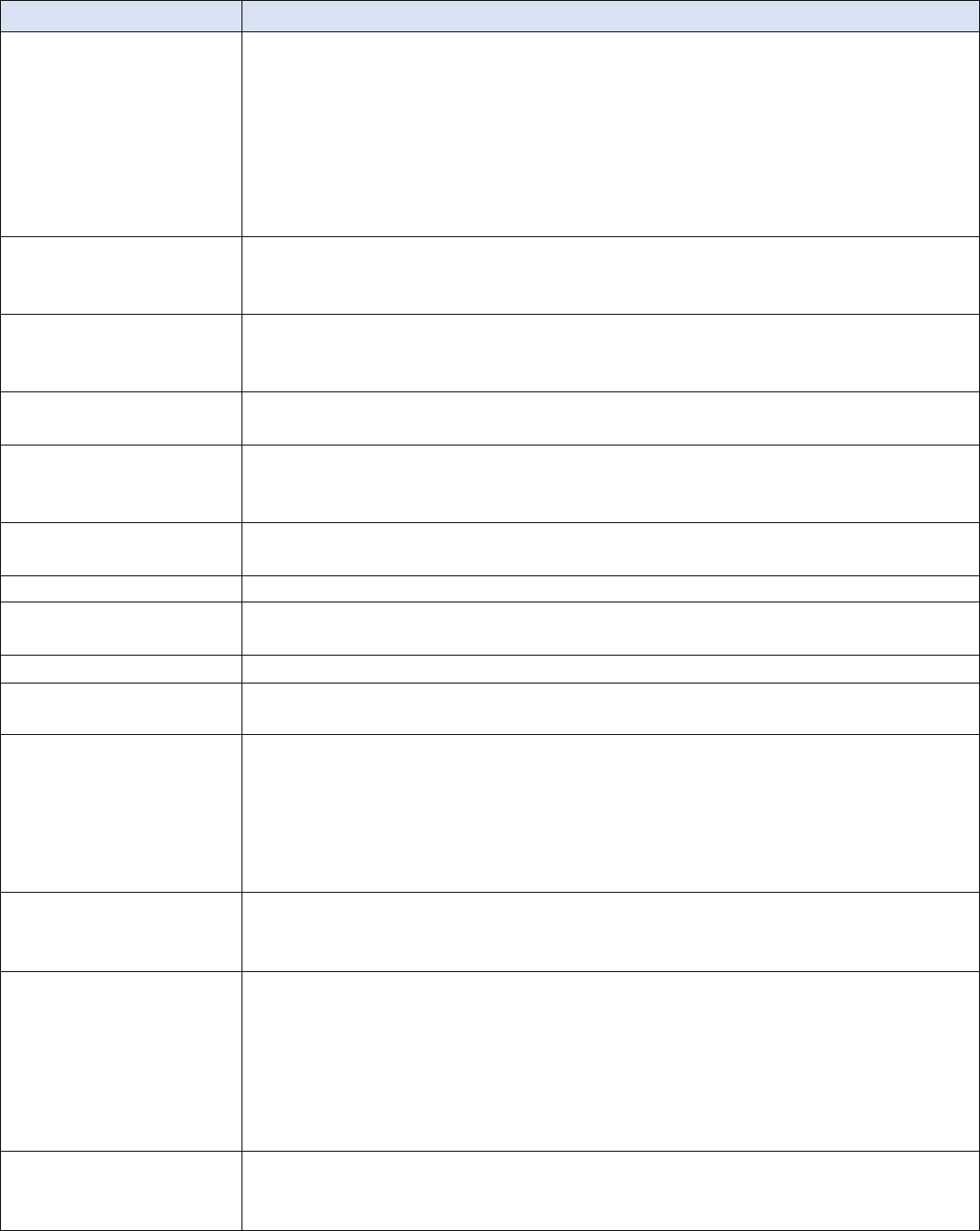

TERM

DESCRIPTION

8/12 PAY PLAN

CSU employees who work 8 months each year may receive 8 month’s salary in 12

payments.

11/12 PAY PLAN

CSU employees who work 11 months each year may receive 11 month’s salary in 12

payments.

10/12 PAY PLAN

Employees who work 10 months each year may receive 10 month's salary in 12

payments.

401(k) Plan

A retirement plan governed by Section 401(k) of the Internal Revenue Code. Also

referred to as a 401(k) Thrift Plan.

457 Plan

A retirement plan governed by Section 457(b) of the Internal Revenue Code. Also

referred to as a 457 Deferred Compensation Plan.

99

When 99 appears as the days paid on pay history, this means that a full month was

paid no matter how many days are in the specific pay period (21/22 or other if

academic). This does not mean that 99 days were paid and should not be viewed as

such. See "Full Month" definition.

A

DESCRIPTION

ABSENCE AND

ADDITIONAL TIME

WORKED REPORT - STD

634

See the "STD 634 - Absence and Additional Time Worked Report" description.

ABSENCES WITHOUT PAY -

STD 603

See the "STD 603 - Absences Without Pay Report" definition.

ABSENCE WITHOUT LEAVE

(AWOL)

An unapproved absence without pay.

ABSTRACT

To summarize payment history or employment history in order to isolate records for

a specific period of time.

ACA (AFFORDABLE CARE

ACT)

See the "Affordable Care Act (ACA)" definition.

ACADEMIC CALENDAR

Lists actual work days/holidays by month, quarter, semester, and year for academic

employees in CSU and Department of Education, Special Schools. Used in lieu of

"Nearly Equal Pay Periods."

- 2 -

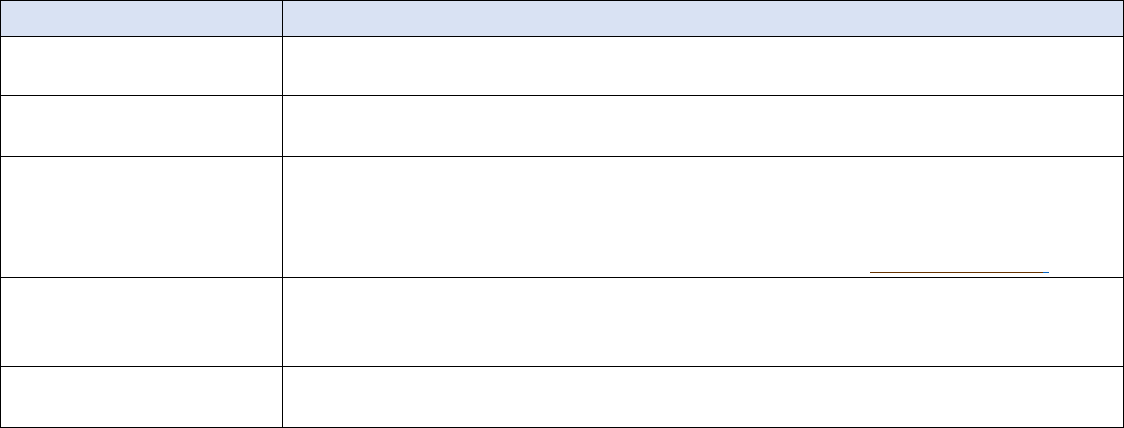

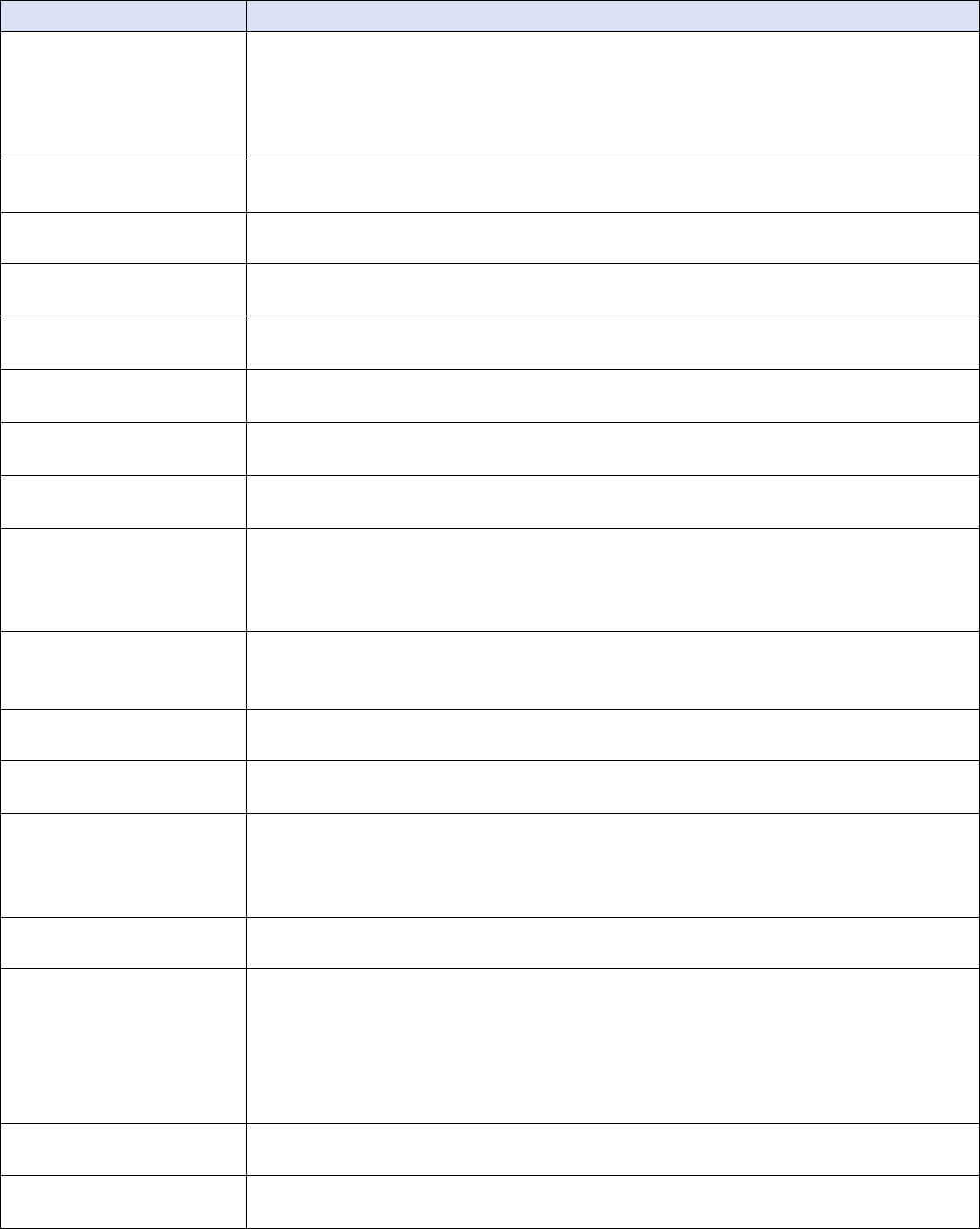

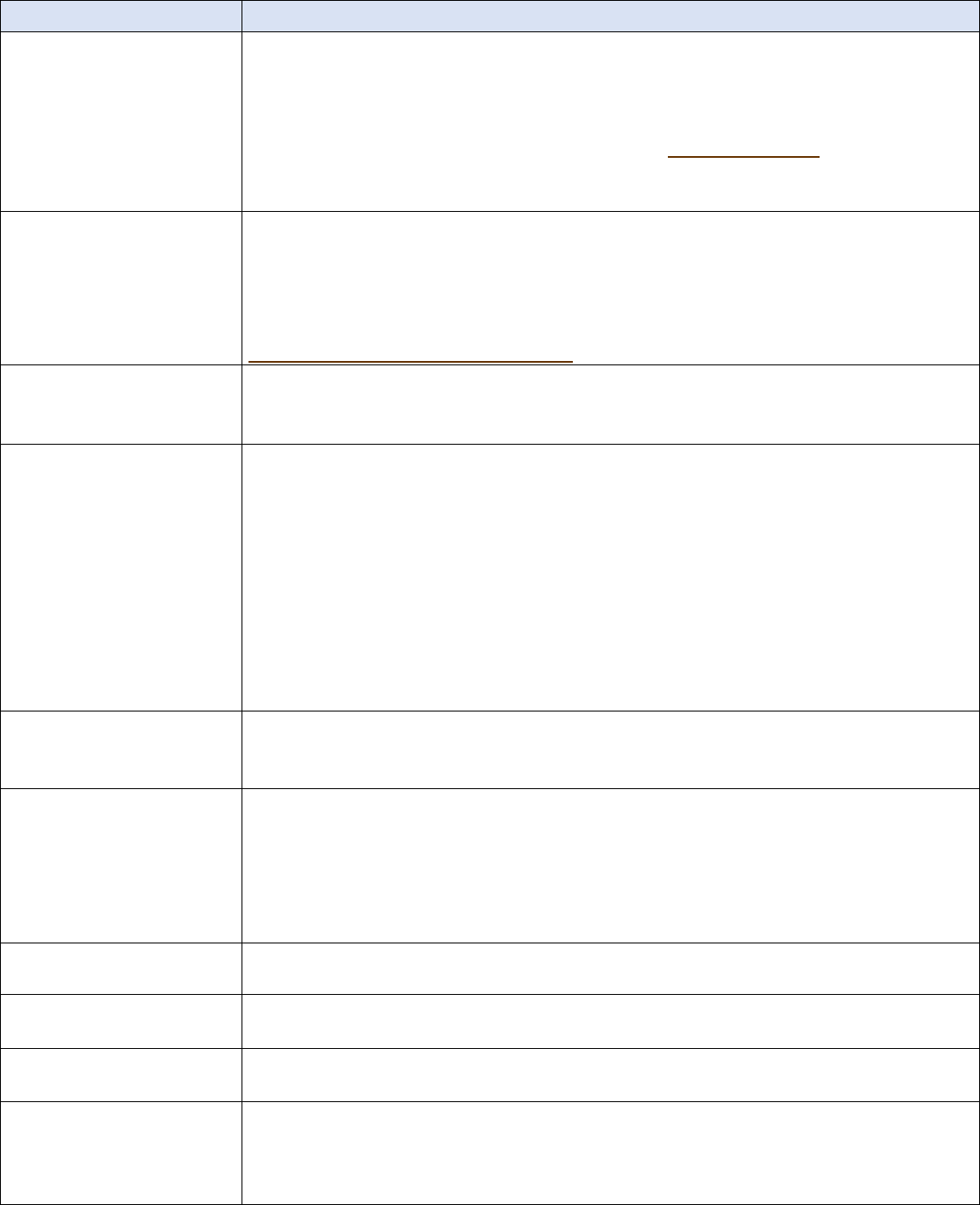

A

DESCRIPTION

ACADEMIC EMPLOYEE

Employees engaged in teaching or closely related professional activities for an

academic year. Compensation is based on class and rank. Work days are based on

the academic year calendar for each campus/special school. May be employed in

CSU or Department of Education, Special Schools. Use 1/210 or 1/1680 dock

formula.

ACCELERATED SALARY

ADJUSTMENT

Established by Resolution, the receipt of a Special In-Grade Salary Adjustment (SISA)

or Merit Salary Adjustment (MSA) prior to the normal 6 and 12 months when an

employee’s movement between classifications resulted in less than a one-step

increase.

ACCOUNT CODE

An Account Code is a one or two-character code used by the EHDB system to denote

employees’ retirement attributes. It is critical that the correct retirement account

code is assigned to ensure that payroll is accurately calculated.

ACCOUNTS RECEIVABLE

(A/R)

A balance due from a debtor on a current account.

ACTIVE BATCH

A batch (see the "Batch" definition) that is Empty, Saved or Closed.

(ACTN) NEXT ACTION

COMMAND

See the "Next Action Command (ACTN)" definition.

ACTUAL TIME WORKED

(ATW)

The counting of Temporary Authorization Appointment (TAU) and emergency

service on the basis of actual time worked as opposed to standard limitations.

Normally, a TAU employee cannot work more than 9 months in any 12 consecutive

calendar month period and an emergency employee cannot work more than 30

working days within any 12 month period.

ADDITIONAL HISTORY

Those transactions, which do not appear, summarized on the PAR in Line 12-

Employment History, because the space in Line 12 has already been filled. History

earlier than the latest 15 entries is stored on the data base, on microfilm or on

microfiche, and is available on request.

ADDITIONAL POSITION

A position in addition to employee's primary employment. Additional position may

be with the same or different appointing power. May be appointed to the same or

different tenure or time base.

(ADJ) PAY ADJUSTMENT

REQUEST

See the "Pay Adjustment Request (ADJ)" definition.

ADJUSTMENT CODE

Identifies payment as regular or adjustment involving salary rate, time, and fraction.

AFFORDABLE CARE ACT

(ACA)

The Federal Patient Protection and Affordable Care Act (ACA) was enacted in March

2010 to ensure individuals have access to quality and affordable health care. The

ACA Employer Shared Responsibility provisions, effective January 2015, mandate

that large employers file annual reports with the Internal Revenue Service (IRS). The

annual reports must identify the offer and acceptance or decline of health coverage

to full-time employees and their eligible dependents. The California Department of

Human Resources (CalHR), State Controller’s Office (SCO), and California Public

Employees’ Retirement System (CalPERS) continue to lead the effort to ensure the

State’s compliance with these provisions.

AFFORDABLE CARE ACT

(ACA) STATUS CODES

Identify the status of an employee's health benefits so the State of California can

report accurate data to the Internal Revenue Service. For a detailed list of ACA

Status Codes, including their definitions, see the ACAS User Guide

http://www.sco.ca.gov/ppsd_elearning.html beginning on page 23.

- 3 -

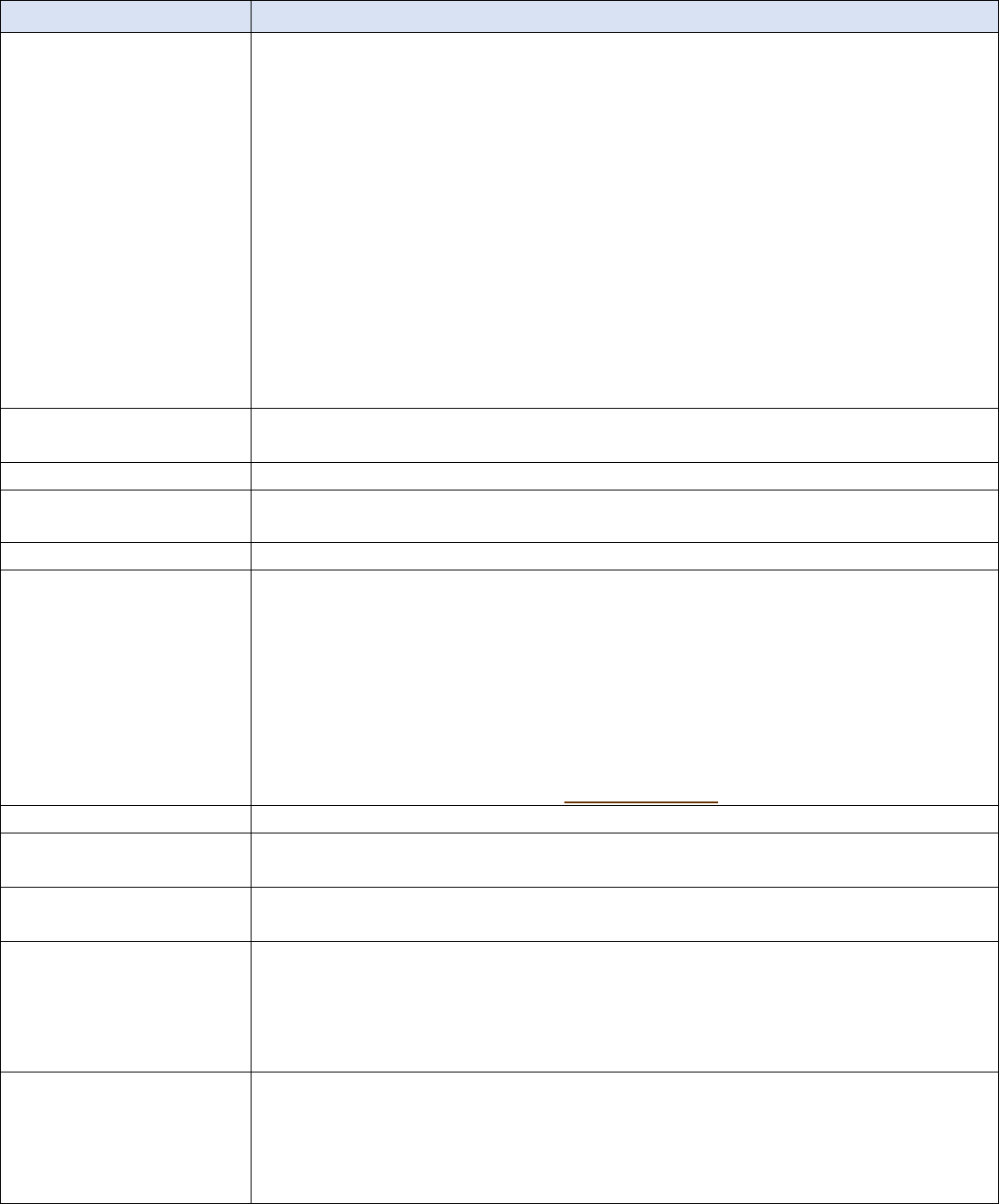

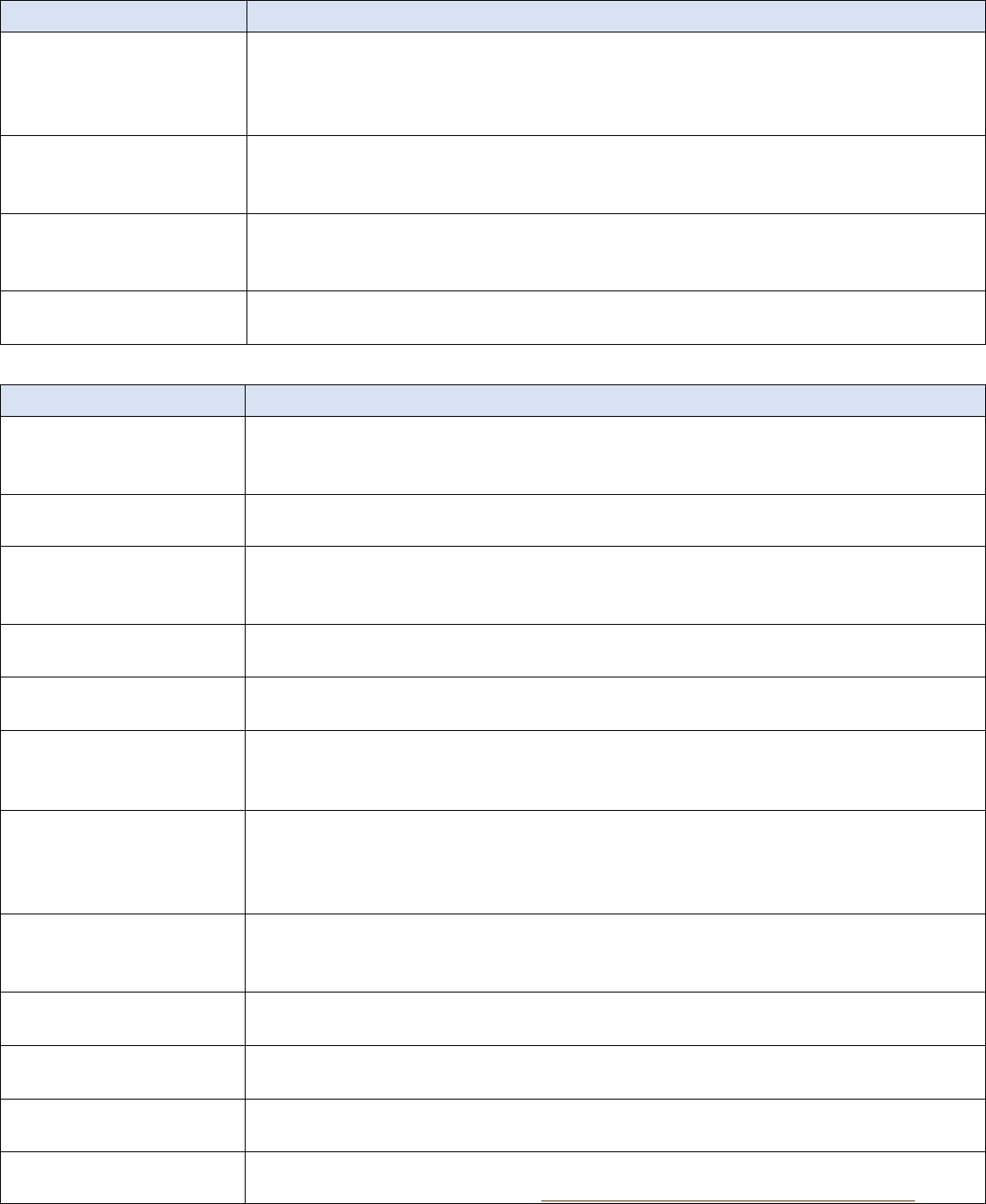

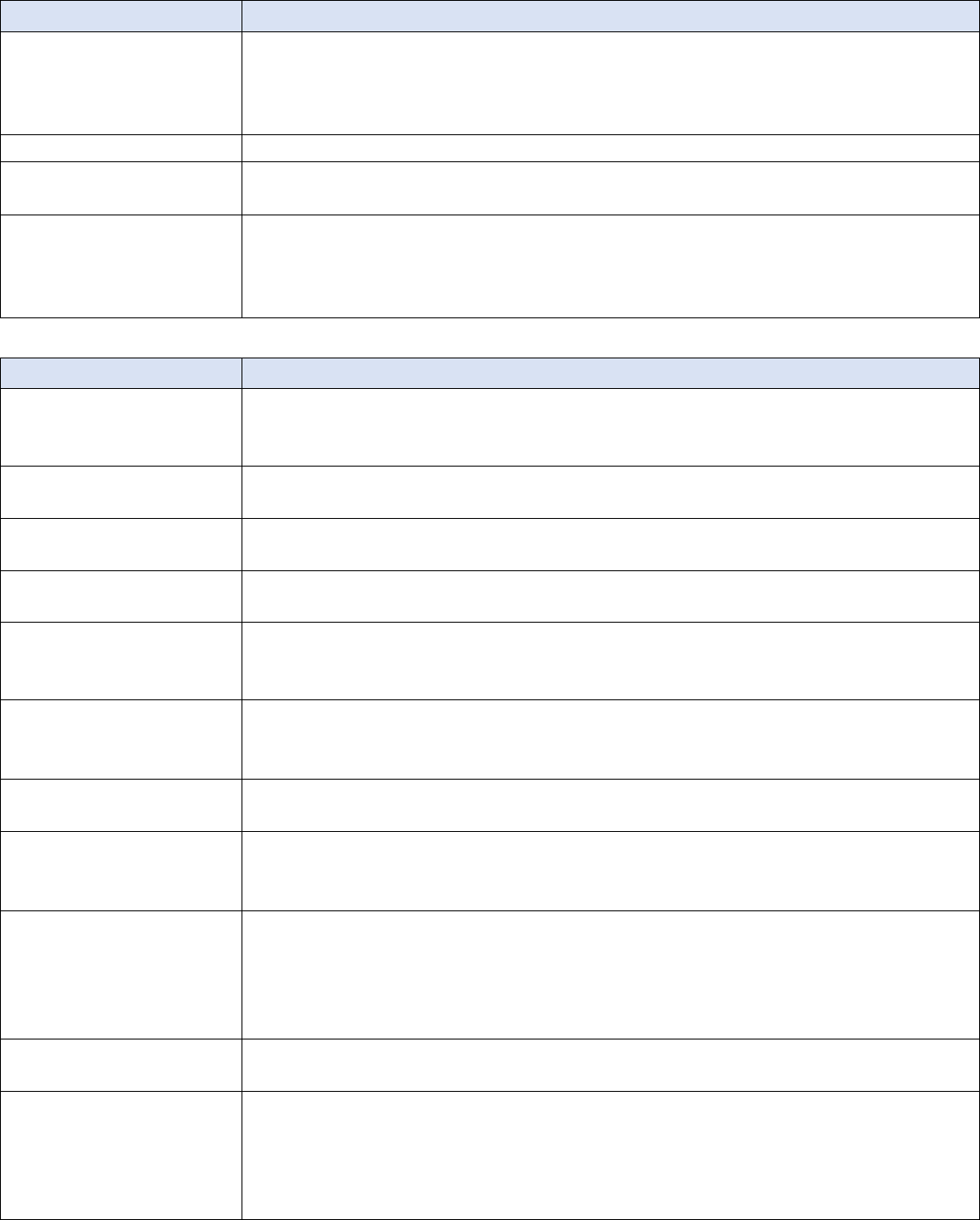

A

DESCRIPTION

AFFORDABLE CARE ACT

SYSTEM (ACAS) DATABASE

The ACAS database serves as the official tracking and reporting repository of ACA

required information for Civil Service, California State University (CSU), and Judicial

Council (JUD) employees. The system provides a single centralized source of current

and historical health benefit status data for employees. It is maintained via on-line

real-time updating of individual ACA health benefit status code transactions, as well

as batch processing, which links the ACAS to employee data in the SCO Employment

History (EH) system.

AFSCME (AMERICAN

FEDERATION OF STATE,

COUNTY, AND MUNICIPAL

EMPLOYEES)

See Also “Bargaining Unit 19”. AFSCME’s members consist of Health and Social

Services/Professionals (AFSCME – American Federation of State, County, and

Municipal Employees) (nurses, corrections officers, EMTs, sanitation workers, etc)

AGE-BASED DEFERRAL

An additional deferral amount that you can have deducted from your paycheck and

deposited in a 401(k) and/or a 457 plan account beginning in the year you reach age

50.

AGENCY CODE

A three-digit numeric code assigned to a department or an agency that identifies

that department/agency for personnel/payroll use. Agency Codes are defined in the

SCO Payroll Procedures Manual (PPM) Section B: Codes

AGGREGATION

To bring together specific payments for the purpose of computing taxes and

retirement.

ALIEN

A foreign-born resident who has not become a naturalized citizen of the country in

which they are residing.

ALLOWABLE ITEM

PAR item containing one of the symbols from the legend on a Required/Conditional

chart that may have information entered.

ALTERNATE FUNDING

Position number other than the employee's regular position number where pay is to

be issued from; (e.g. the blanket serial number for overtime pay).

ALTERNATE FUNDING

CODE

An operator assigned code (alpha or numeric) which identifies the alternate funding

position number entered on the batch entry screen.

ALTERNATE RANGE (AR)

A class having more than one salary range.

ALTERNATE RANGE

CRITERIA (ARC)

The requirements necessary for appointment or movement to an alternate range.

ALTERNATE WORK WEEK

SCHEDULE (AWWS)

An alternative to the normal 5-day, 40-hour work week. An AWWS does not change

the number of hours worked, it simply allows each individual, with supervisory

approval, the flexibility to rearrange their work schedule to better meet their

personal needs while also considering the needs of the workplace. Learn more

about Alternate Work Week Schedules at www.calhr.ca.gov.

ALTERNATE WORK WEEK

SCHEDULE (AWWS)

4/10/40

One of the two most common Alternate Work Week Schedules, the 4/10/40 is when

an employee works the required 40-hour minimum work week in four, 10-hour days

between Monday and Friday.

ALTERNATE WORK WEEK

SCHEDULE (AWWS) 9/8/80

One of the two most common Alternate Work Week Schedules, the 9/8/80 is when

an employee works eight, 9-hour days and one, 8-hour day in a two-week period

with one day off every other week that corresponds with the 8-hour day. Employees

who are approved for a 9/8/80 work week will be required to adjust their work

week to ensure that they do not work over 40 hours in any consecutive seven-day

period.

ALPHA

Alphabetic letters A-Z.

ALPHANUMERIC

Letters A-Z and digits 0-9.

- 4 -

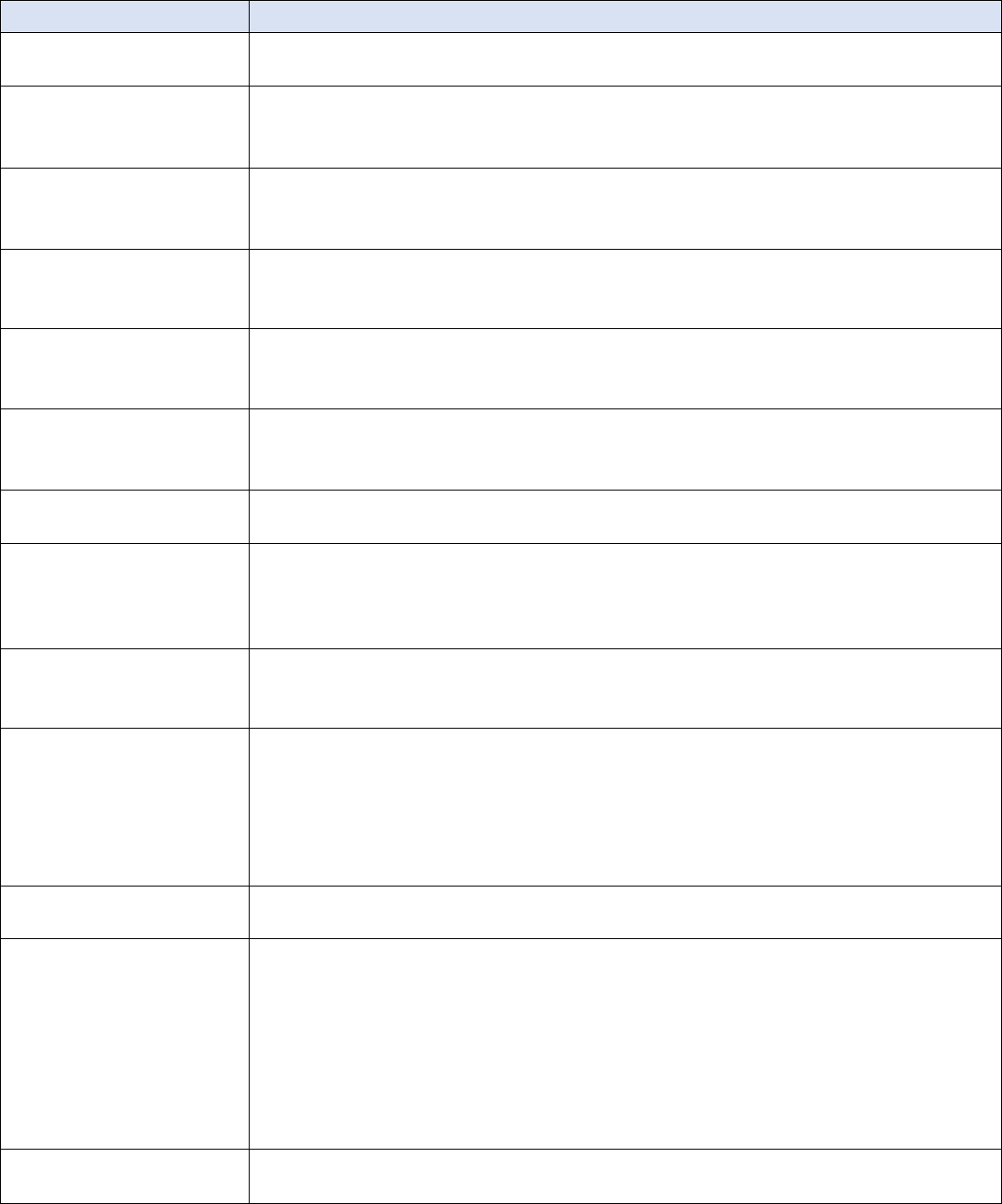

A

DESCRIPTION

ANNI DATE (ANNIVERSARY

DATE)

See the "Anniversary Date (ANNI DATE)" definition.

ANNIVERSARY DATE (ANNI

DATE)

The date on which an employee becomes eligible for a salary increase; e.g., Merit

Salary Adjustment (MSA) and Special In-grade Salary Adjustment (SISA).

ANNUAL LEAVE

Provides eligible employees a combined pool of "annual leave" credits instead of

separate vacation and sick leave credits. Annual leave covers the same kinds of

absences that otherwise would be covered by vacation or sick leave. For more

information about Annual Leave, visit the CalHR website at www.calhr.ca.gov.

ANOTHER CLASS WITH

SUBSTANTIALLY THE SAME

SALARY RANGE

A class where the maximum of the salary range is the same as or less than 2 steps

higher or lower than the other class.

APPOINTING POWER

A person or group (such as an agency/department), defined by statute, that has the

authority to make appointments.

- 5 -

A

DESCRIPTION

APPOINTMENT TYPE

A computer generated code which is stored and displayed on the PAR History Detail

screen (B segment) to indicate a specific type of appointment or separation

transaction. Miscellaneous transactions do not have their own "appointment type"

codes. (See codes/meanings below.) The "appointment type" code is reflective of

and generated each time an appointment or separation transaction is processed. It

is carried forward and displayed in subsequent miscellaneous transactions until

another appointment or separation transaction is processed and the system

generates an "appointment type" which is indicative of that transaction. When a

new appointment or separation transaction is keyed to the system, the above

process is repeated. This code (appointment type) is useful in determining if out-of-

sequence PAR transaction packages were keyed in the correct sequence to allow the

information to be carried forward properly.

A Appointment from List

B Reinstatement

C Promotion

D Demotion

E Emergency

F Transfer

G SPB or Court Action

H Exempt

I Retired Employee

J Training and Development

K TAU

L Leave of Absence without Pay

M Military Leave without Pay

N Non-Industrial Disability Leave (NDI)

P Permanent Separation without Fault

Q Disability Retirement

R Service Retirement

S Punitive Suspension

T Lay-Off

U To Accept Exempt Appointment

W Permanent Separation with Fault

X Death

AR (ALTERNATE RANGE)

See the "Alternate Range (AR)" definition.

A/R (ACCOUNTS

RECEIVABLE)

See the "Accounts Receivable (A/R)" definition.

ARC (ALTERNATE RANGE

CRITERIA)

See the "Alternate Range Criteria (ARC)" definition.

ATW (ACTUAL TIME

WORKED)

See the "Actual Time Worked (ATW)" definition.

AUDIT

The manual examination and review of incoming PARs by the Audits Section and

Production Support Section of Personnel Operations for compliance with legal and

system requirements.

- 6 -

A

DESCRIPTION

AUDIT (PAYROLL USE)

1. A manual examination/review of documents by Payroll Operations for

compliance with legal/system requirements.

2. An electronic data process with programmed audit conditions.

AUDIT OVERRIDE (AUDIT

O/R)

A field in the Civil Service/Exempt Payscale System (CSP) that displays an "A" when a

payscale audit was overridden during update processing.

AUDITS SECTION

A section in Personnel Operations which reviews incoming PARs to determine

whether or not the transaction complies with legal and Employment History System

requirements.

AUDIT TRAIL

Procedure used to trace processing of data.

AUTHORIZED SIGNATURE

(REPORTING OFFICER)

Signature of person authorized by each Appointing Power (or deputy) to sign various

types of payroll documents, certifying that the information is complete, correct, and

in accordance with all laws and regulations.

ASTERISK

This symbol (*) is entered on the PAR to delete information which has turned

around in the shaded areas. An asterisk appears on the Turnaround PAR beside

those items that changed as a result of the most recent transaction.

ATTENDANCE REPORT

Complete record of time worked, leave, and absence for each state employee by

each pay period, maintained by each agency /campus.

ATTENDANCE REPORTING

METHOD

Determined by the employee pay rate (hourly, daily, or monthly), pay frequency

(monthly, semi-monthly, or biweekly) and categorized by a Roll Code.

AWOL (ABSENCE

WITHOUT LEAVE)

See the "Absence Without Leave (AWOL)" definition.

AWWS (ALTERNATE WORK

WEEK SCHEDULE)

See the "Alternate Work Week Schedule (AWWS)" definition.

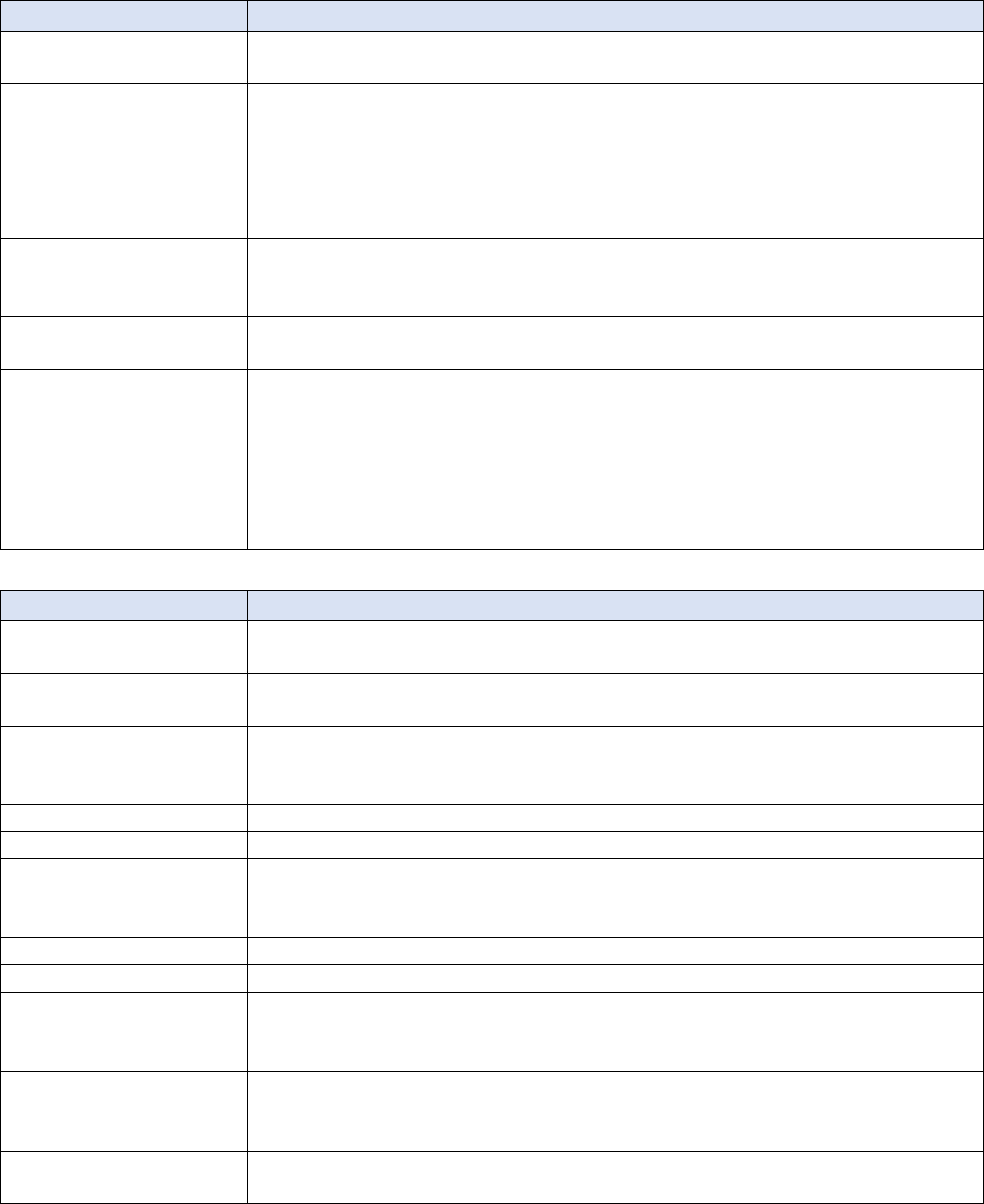

B

DESCRIPTION

BACKUP

Substantiating information which gives proof or evidence that certain conditions for

certain transactions have been met.

In the PAM, substantiation is entered on the PAR in Line 10 - Remarks, or is attached

to the PAR depending upon the condition. See Line 10 information, Section 2.200.

BAM (BENEFITS

ADMINISTRATION

MANUAL)

See the "Benefits Administration Manual (BAM)" definition.

BARGAINING UNIT (BU)

A group of Rank and File employees aligned together based on their job category

and levels of responsibility. For more information on Bargaining Units, visit the

CalHR website at www.calhr.ca.gov.

BARGAINING UNIT 1

Administrative, Financial, and Staff Services: Employees performing administrative,

fiscal, and analytical functions such as accounting, planning, personnel, data

processing, research, and analysis. (SEIU – Service Employees International Union)

BARGAINING UNIT 2

Attorneys and Hearing Officers: Employees practicing law for the State or exercising

quasi-judicial job duties within administrative hearings. (CASE – California Attorneys,

Administrative Law Judges, and Hearing Officers in State Employment)

BARGAINING UNIT 3

Professional Educators and Librarians (SEIU – Service Employees International

Union)

- 7 -

B

DESCRIPTION

BARGAINING UNIT 4

Office and Allied: Employees providing vital support to the primary professional,

technical, or administrative objectives of each State department or agency. (SEIU –

Service Employees International Union)

BARGAINING UNIT 5

Highway Patrol (CAHP – California Association of Highway Patrolmen)

BARGAINING UNIT 6

Corrections (CCPOA – California Correctional Peace Officer Association)

BARGAINING UNIT 7

Protective Services and Public Safety (CSLEA – California Statewide Law Enforcement

Association)

BARGAINING UNIT 8

Firefighters (CDFF – California Department of Firefighters)

BARGAINING UNIT 9

Professional Engineers (PECG – Professional Engineers in California Government)

BARGAINING UNIT 10

Professional Scientific (CAPS – California Association of Professional Scientists)

BARGAINING UNIT 11

Engineering and Scientific Technicians (SEIU – Service Employees International

Union)

BARGAINING UNIT 12

Craft and Maintenance: Employees operating and maintaining State equipment,

facilities, buildings, grounds, and roads. (IUOE – International Union of Operating

Engineers)

BARGAINING UNIT 13

Stationary Engineer (IUOE – International Union of Operating Engineers)

BARGAINING UNIT 14

Printing and Allied Trades: Employees preparing, composing, and printing material

for State agencies. (SEIU – Service Employees International Union)

BARGAINING UNIT 15

Allied Services (SEIU – Service Employees International Union)

BARGAINING UNIT 16

Physicians, Dentists, and Podiatrists (UAPD – Union of American Physicians and

Dentists)

BARGAINING UNIT 17

Registered Nurses: Employees involved in educational, preventive and treatment

programs associated with State health care. (SEIU – Service Employees International

Union)

BARGAINING UNIT 18

Psychiatric Technicians (CAPT – California Association of Psychiatric Technicians)

BARGAINING UNIT 19

Health and Social Services/Professional (AFSCME – American Federation of State,

County, and Municipal Employees)

BARGAINING UNIT 20

Medical and Social Services/Support: Employees providing direct and indirect health

care and social service support to inmates and other recipients of State social

service programs. (SEIU – Service Employees International Union)

BARGAINING UNIT 21

Educational Consultants and Library (SEIU – Service Employees International Union)

BATCH

A system name for one or more documents keyed into the Payroll Input Process

(PIP) system. Data processing approach in which items to be processed are

accumulated into groups prior to processing. A group of documents/transactions

processed in the same payroll cycle and usually retained in the same file folder after

processing.

BATCH BALANCE STATUS

Identifies if a batch is in balance (IN) or out of balance (OUT) on the BATCH

ENTRY/BATCH INQUIRY screen.

BATCH CREATION

METHOD (BCH CREATE

MTHD)

Identifies whether a batch is scratch (S) or preloaded (P) from the BATCH DIRECTORY

or BATCH SELECTION screens.

BATCH DIRECTORY (DIR)

Provides a list of closed, saved, empty, deleted and processed batches that may be

selected for detail inquiry.

BATCH ENTRY

The screen used to enter the batch totals and any Alternate Funding information if

applicable on this screen.

- 8 -

B

DESCRIPTION

BATCH ENTRY (ENT)

Selection on the T/A Menu screen which allows the operator to enter or re-enter a

batch.

BATCH IDENTIFIER (BATCH

ID)

Assigned number to identify a batch.

BATCH INQUIRY (BCH)

The Inquiry screen containing the same information as the BATCH ENTRY screen.

BATCH LOAD

The process of using off-line data to create formats (screens) for current month data

entry for decentralization.

BATCH SELECTION (SEL)

Provides a list of closed, saved and empty batches that may be selected for detail

update, will only display deleted and processed batches when requested in Batch

Status field.

BATCH STATUS

Identifies the status of a batch as closed (CLS), saved (SAV), empty (EMP), deleted

(DEL), or processed (PRC).

BEGINNING PAY PERIOD

First day of the pay period.

BENEFITS

ADMINISTRATION

MANUAL (BAM)

Maintained by CalHR and is designed to provide decentralized departmental staff

the most current information they need to interpret and input employee benefit

information.

BEREAVEMENT LEAVE

State employees are entitled paid time off if a member of your family dies. For

represented employees the most recent Memorandum of Understanding sets forth

the provisions of use. It identifies relatives and frequency of use thereof. Typically,

an employee may receive up to three (3) days off with pay (additional days may be

allowed if travel over a certain distance is required and leave may be deducted from

an employee’s own leave for the additional time, see the bargaining unit contracts

for more details). Moreover, Supervisors may request verification of usage by

instructing employees to provide evidence of death. Such information can come in

the form of an obituary, funeral order of services, or similar documents. For more

information about Bereavement Leave, visit the CalHR website at www.calhr.ca.gov.

BIWEEKLY

Refers to a pay plan of two-week increments paid on positive pay. Currently only for

Department of Water Resources hydroelectric plant employees.

BLANKET

A blanket position is designated by a position serial number in the 900 series. The

blanket is established for one fiscal year.

BONA FIDE ASSOCIATION

Groups of state employees or former state employees whose primary purpose is not

to represent employees in employer/employee relations with the state.

BU (BARGAINING UNIT)

See the "Bargaining Unit (BU)" definition.

BUDGETARY, STATUTORY,

OR ADMINISTRATIVE

REORGANIZATION

A reorganization that is based on a change in budget, law, or function as opposed to

reorganization based on an internal change within the department.

BUDGET FUNCTION CODE

A three-digit code used in lieu of reporting unit code. Identifies a group of

employees reporting under a single budgetary control.

BUFF MEMORANDUM

A memorandum is NO longer on buff colored paper. The memos are issued on white

paper to all PAM holders as cover transmittals for PAM revisions to communicate

special processing or clarifying information.

BUSINESS MONTH

Accounting period used by the State Controller's Office. It includes all payroll

warrants and adjustments issued from the second of one month through the first of

the following month.

- 9 -

B

DESCRIPTION

BUSINESS SYSTEMS

BUREAU (BSB) OF SCO

Provides application development services to the SCO’s program divisions and

external users of SCO’s web services and legacy mainframe systems and collaborates

with SCO business users to implement legislation, union agreements and other

business and program changes by implementing new systems, enhancing existing

systems, and maintaining these systems. BSB supports the state payroll and fiscal

systems along with applications for unclaimed property, local government claims

processing, and business intelligent (BI) solutions.

BSB (BUSINESS SYSTEMS

BUREAU)

See the "Business Systems Bureau (BSB) of SCO" definition.

C

DESCRIPTION

CALATERS (CALIFORNIA

AUTOMATED TRAVEL

EXPENSE

REIMBURSEMENT

SYSTEM)

See the "California Automated Travel Expense Reimbursement System (CalATERS)"

definition.

CALENDAR YEAR

The twelve-month period of time beginning January 1

st

and ending the following

December 31

st

.

CAHP (CALIFORNIA

ASSOCIATION OF

HIGHWAY PATROLMEN)

See also “Bargaining Unit 5”. Members consist of California Highway Patrol (CHP)

officers, both active and retired members of the CHP family.

CALHR (CALIFORNIA

DEPARTMENT OF HUMAN

RESOURCES)

See the "California Department of Human Resources (CalHR)" definition.

CALIFORNIA AUTOMATED

TRAVEL EXPENSE

REIMBURSEMENT SYSTEM

(CalATERS)

A web-based solution for travel advance and expense reimbursement processing

that includes automated audits of statewide travel rules, form tracking,

management reporting capabilities, and much more.

CALIFORNIA CODE OF

REGULATIONS (CCR)

Formerly referred to as DPA Rules and Regulations the official compilation and

publication of the regulations adopted, amended or repealed by state agencies

pursuant to the Administrative Procedure Act (APA).

CALIFORNIA DEPARTMENT

OF HUMAN RESOURCES

(CALHR)

A control agency responsible for all issues related to employee salaries, benefits, job

classifications, position allocations, civil rights, training, exams, recruitment, and

retention. For most employees, many of these matters are determined through the

collective bargaining process managed by CalHR.

CALIFORNIA DEPARTMENT

OF HUMAN RESOURCES

LAWS AND RULES

California Department of Human Resources (CalHR) [formerly known as the

Department of Personnel Administration (DPA)] administers the laws and rules

governing the employees of the State of California. To review a particular rule, see

CalHR website at www.calhr.ca.gov.

CALIFORNIA DEPARTMENT

OF HUMAN RESOURCES

(CALHR) POLICY MEMOS

Informs State departments and agencies about new or changes to policies,

procedures, and to provide other important information.

CALIFORNIA LEAVE

ACCOUNTING SYSTEM

(CLAS or LAS)

Provides online capabilities for tracking and recording leave accounting records and

data.

- 10 -

C

DESCRIPTION

CALIFORNIA PUBLIC

EMPLOYEES' RETIREMENT

SYSTEM (CALPERS or PERS)

The California Public Employees Retirement System is a control agency responsible

for the investment and regulation of retirement contributions and benefits and the

administration of health benefits and long-term care programs and for the

production of circular letters.

CALIFORNIA PUBLIC

EMPLOYEES' RETIREMENT

SYSTEM (CALPERS or PERS)

STATE REFERENCE GUIDE

Designed to assist in business transactions with CalPERS. It is useful to specialists

who enroll employees into CalPERS membership or who convey benefit information

to staff.

CALIFORNIA FAMILY

RIGHTS ACT (CFRA)

The California Family Rights Act (CFRA) (Gov. Code, § 12945.2) was established to

ensure secure leave rights for the birth of a child for purposes of bonding;

placement of a child in the employee's family for adoption or foster care; serious

health condition of the employee's child, parent or spouse; and the employee's own

serious health condition.

CALIFORNIA STATE CIVIL

SERVICE PAY SCALES

MANUAL

Contains information such as Class Code, Schematic code, Salary Range, trade rate,

and compressed salary ranges.

CALIFORNIA STATE

UNIVERSITY (CSU)

California State University

CALPERS (CALIFORNIA

PUBLIC EMPLOYEES'

RETIREMENT SYSTEM)

See the "California Public Employees' Retirement System (CalPERS)" definition.

CAPS (CALIFORNIA

ASSOCIATION OF

PROFESSIONAL

SCIENTISTS)

See also “Bargaining Unit 10”. Members include scientists working for the State of

California.

CAPT (CALIFORNIA

ASSOCIATION OF

PSYCHIATRIC

TECHNICIANS)

See also “Bargaining Unit 18”. Members include state-licensed Psychiatric

Technicians.

CAREER EXECUTIVE

ASSIGNMENT (CEA)

A type of appointment made for some top-level managerial personnel.

CASE (CALIFORNIA

ATTORNEYS,

ADMINSTRATIVE LAW

JUDGES, AND HEARING

OFFICERS IN STATE

EMPLOYMENT)

See also “Bargaining Unit 2”. Members include attorneys, administrative law judges

and other legal professionals.

CASH OPTION

A flexible benefit option which gives the employee additional money in each

month's paycheck in exchange for not enrolling in a state sponsored health and or

dental plan.

CASUAL EMPLOYMENT

Those classes that are paid a prevailing union or trade rate; e.g., carpenters,

painters, electricians, laborers. Employees may elect union or civil service benefits

under certain conditions.

CAT LEAVE

(CATASTROPHIC LEAVE)

See the "Catastrophic Leave (Cat Leave)" definition.

- 11 -

C

DESCRIPTION

CATASTROPHIC LEAVE

(CAT LEAVE)

Catastrophic Leave (Cat Leave) is a program that enables employees to assist other

fellow employees in time of financial hardship due to a prolonged illness, injury, an

incapacitated family member, or a natural disaster. For more information about

Catastrophic Leave, visit the CalHR website at www.calhr.ca.gov.

CATCH-UP DEFERRAL

Additional amounts that you may defer to a 457 plan to make up for previous years

when you didn't defer the maximum allowable amount under the same employer.

You're only eligible to participate in catch-up during the three years prior to your

Normal Retirement Age. Savings Plus defines Normal Retirement Age as a range

between ages 50–70½. It's up to you to decide your Normal Retirement Age.

CATHODE RAY TUBE (CRT)

A Device equipped with a keyboard and display screen used at PPSD to update and

request information about an employee's record. The CRT (Cathode Ray Tube) is

also referred to as a terminal or video display unit (VDU).

CBID (COLLECTIVE

BARGAINING

IDENTIFICATION

DESIGNATION)

See "Collective Bargaining Identification Designation" definition.

CC (CIVIL CODE)

See the "Civil Code (CC)" definition.

CCP (CIVIL CODE

PROCEDURES)

See the "Civil Code Procedures (CCP)" definition.

CCPOA (CALIFORNIA

CORRECTIONAL PEACE

OFFICER ASSOCIATION)

See also “Bargaining Unit 6”. Members include correctional peace officers and the

state’s parole agents.

CCR (CALIFORNIA CODE OF

REGULATIONS)

See the "California Code of Regulations (CCR)" definition.

CDFF (CALIFORNIA

DEPARTMENT OF

FIREFIGHTERS)

See also “Bargaining Unit 8”. Members consist of current and retired Firefighters,

Fire Apparatus Engineers, Fire Captains, Battalion Chiefs, Foresters, Pilots,

Supervisors, Forestry Logistics Officers, Fire Prevention Specialists and other

classifications.

CEA (CAREER EXECUTIVE

ASSIGNMENT)

See the "Career Executive Assignment (CEA)" definition.

CEM (SET FLAG

COMPOSITE)

Personnel Action Request (PAR), Employee Action Request (EAR), and Retirement

System Transaction (RST) transactions keyed under CEM will not interface to PERS,

SCO, or SPB and will not create a Notice of Personnel Action (NOPA) or Retirement

System Transaction (RST). This flag is used for applying an employee's record to the

database who was not converted due to a conversion error.

CERBT (CALIFORNIA

EMPLOYERS’ RETIREE

BENEFIT TRUST)

The California Employers’ Retiree Benefit Trust (CERBT) Fund is an IRS Section 115

trust fund dedicated to prefunding Other Post Employment Benefits (OPEB) for all

eligible California public agencies. CalPERS maintains the CERBT fund for State

employee OPEB contributions.

CERTIFICATION

The process used to make appointments from an employment list; includes the

referral of eligibles to the appointing power and the reporting of subsequent actions

to CalHR. Employment lists are established by competitive examinations also

administered by CalHR or delegated to departments.

CIRCULAR LETTERS

Used to keep HR shops informed of changes in policies and procedures when

working on CalPERS-related issues.

- 12 -

C

DESCRIPTION

CIVIL CODE (CC)

A collection of statutes for the State of California. The code is made up of statutes

which govern the general obligations and rights of persons within the jurisdiction of

California.

CIVIL CODE PROCEDURES

(CCP)

The Civil Code of California is a collection of statutes for the State of California. The

code is made up of statutes which govern the general obligations and rights of

persons within the jurisdiction of California.

CIVIL SERVICE

A system of employment used in state service by which appointments are usually

determined through competitive examinations.

CIVIL SERVICE BENEFITS

CUT-OFF CALENDAR

The Civil Service Benefits Cut-Off Calendar is a document that provides the business

month dates that departments need to have their documentation submitted and/or

keyed

CIVIL SERVICE/EXEMPT

PAYSCALES (CSP)

An online system that maintains all current and historic classification and salary

information for Civil Service/Exempt classifications.

CLAS (CALIFORNIA LEAVE

ACCOUNTING SYSTEM)

See the "California Leave Accounting System (CLAS or LAS)" definition.

CLASS (CLASSIFICATION)

See the "Classification (CLASS)" definition.

CLASSIFICATION (CLASS)

A group of positions (jobs) with duties and responsibilities sufficient in similarity to

warrant the same title and salary range.

CLASSIFICATION (CLASS)

CODE

An assigned four-digit number that is used for all payroll and transaction purposes.

CLASSIFICATION (CLASS)

STATUS

A field in the Civil Service/Exempt Payscale System (CSP) that indicates if the class is

active or abolished.

CLASS TYPE

Identifies whether a particular class and corresponding salary schedule are Exempt

or Civil Service in the Pay Scales Table. This item is system generated and is stored

on the PAR History Detail screen.

CLEARANCE NUMBER

Five digits assigned by the State Controller's Office, Division of Disbursements, to

identify/control payments/ adjustments and A/Rs on warrant registers.

CLEARANCE TYPE

A one-digit code that identifies type of payroll transaction on payroll warrant

register.

CLEARANCE TYPE 1 -

PAYROLL WARRANT

REGISTER

A record of Payroll Warrants issued. There are two categories for payroll warrant

registers; Monthly Payroll and Supplemental Payroll.

CLEARANCE TYPE 4 -

REDEPOSIT WARRANT

REGISTER

The record of payroll warrants that are redeposited back into the departments’

funds. The warrants are either withheld by the State Controller’s Office prior to

being sent to the departments, or returned by the departments. The CSP system is

used by the Employment History, Leave Accounting, Payroll, Payroll Input Process,

and Position Control systems to validate classification and salary data entered on

transactions, obtain classification and salary data for data generation and pay

calculation, and display and print classification and salary data on reports and

inquiry screens. It also provides the ability to view current and historic pay scale

data online.

CLEARANCE TYPE 5 -

ACCOUNTS RECEIVABLE

WARRANT REGISTER

The record of an

overpayment. It shows how much an employee must reimburse the

department.

- 13 -

C

DESCRIPTION

CLEARANCE TYPES 6 & 7 -

TRANSFER OF FUNDS

WARRANT REGISTER

The records of adjustments necessary to correct position and/or appropriation

originally charged in error due to retroactivity and/or incorrect PARs.

CLEARANCE TYPE 9 -

REVERSE ACCOUNTS

RECEIVABLE WARRANT

REGISTER

The record of the reversals of a previously established A/R.

CLEAR FLAG (CLF)

An Employment History (EH) transaction used to clear an EH record back in-service

following STFC, STFP, or STFS transactions. See "STFC", "STFP", and "STFS" for

further definitions.

CLEAR KEY

Used to cancel the request and return the operator to the Time and Attendance

Menu screen. Also used to signoff the Time and Attendance System.

CLF (CLEAR FLAG)

See the "Clear Flag (CLF)" definition.

CLS (CLOSE COMMAND)

See the "Close Command (CLS)" definition.

CLOSE COMMAND (CLS)

A data entry command; used to close a batch for processing.

COBEN (CONSOLIDATED

BENEFITS)

See the "Consolidated Benefits (CoBEN)" definition.

CODES

For a list of various codes used in Payroll processing, see the Payroll Procedures

Manual (PPM) - Section B, Codes Index

COLLECTIVE BARGAINING

A process for negotiating wages, hours, terms, and/or conditions of employment.

COLLECTIVE

BARGAINING/DATA

MANAGEMENT SECTION

OF SCO

This section is responsible for the collective bargaining support for the State,

produces management reports for the SCO and outside customers, provides system

support services and training to other state departments' staff for using the

Management Information Retrieval System (MIRS), and is responsible for generating

statewide reports in accordance with the annual IRS reporting requirements for

compliance with the Affordable Care Act as well as reports required to ensure

departmental compliance with ACA requirements.

COLLECTIVE BARGAINING

IDENTIFICATION

DESIGNATION (CBID)

A code that identifies the group representing each employee for

employee/employer relations with the state.

COMPENSABLE OVERTIME

Overtime which is compensable by cash or time off.

COMPENSATION (SALARY

RANGE)

The minimum and maximum salary for a classification (see Salary Range).

COMPOSITE RECORD

An employee's employment history record at the time of the individual's conversion

to the Employment History Data Base.

COMPUTER-GENERATED

Information produced automatically by the computer from the Employment History

or Payroll files.

CONDITIONAL

This symbol "O" in a PAR item on a Required/Conditional chart denotes items which

must be completed under certain conditions. These conditions are identified in the

item definition.

- 14 -

C

DESCRIPTION

CONSOLIDATED BENEFITS

(COBEN)

Rather than receiving three (3) separate State contributions for health, dental, and

vision benefits, employees eligible for "Consolidated Benefits" receive a single

monthly contribution from the State that covers all three (3) benefits. If this "CoBen"

allowance exceeds the total cost of the health, dental, and vision plans an eligible

employee has chosen, the employee receives the excess CoBen amount as

additional taxable income each month. If the CoBen allowance is less than the total

cost of the benefit plans the employee has chosen, the employee pays the

difference via pre-tax payroll deductions. All employees excluded from collective

bargaining (those employees classified as managerial, supervisory, confidential, or

otherwise excluded) are covered by CoBen. For rank-and-file employees, CoBen

eligibility is determined through the collective bargaining process. Ask Human

Resources or check your bargaining unit contract if you are unsure of your eligibility

for CoBen.

CONTROL AGENCY

Term used to refer to those state agencies that by law, regulation, or policy exercise

control over other agencies; e.g., Department of Finance (DOF), California

Department of Human Resources (CalHR), State Personnel Board (SPB), State

Controller's Office (SCO).

CONTROL KEYS

Pre-programmed keys which perform specific functions.

CONVERSION

The process of transferring information from one form to another as when the

employee files previously maintained at SPB, SCO, and PERS were merged to

establish one centralized file to be maintained by PPSD for the three control

agencies.

For more information, refer to the PAM, User's Conversion Dates, Section 1.2 - 1.4.

CONVERSION DATE

The date on which maintenance of employment history records were converted to

the Employment History Data Base.

CONVERSION RECORD

That part of an employee's personnel record that was put on the Employment

History Data Base at the time of the employee's department's conversion. The

information was taken from the employee' files at SPB, SCO, and PERS.

CONVERSION TABLE

That portion of the pay scales used to tabulate hourly and time-and-one-half salary

rates.

COPY COMMAND (CPY)

A data entry command; used to create a duplicate copy of any existing batch.

CORRECTION

An adjustment to a transaction or PAR item(s). This adjustment may be a change, a

deletion, or an addition to a transaction already processed in Line 12 of the

Personnel Action Request (PAR).

CORRECTIVE ACTION

A method to adjust an employee's employment history record. This adjustment may

be current or O/S correction, void or addition to PAR item(s) or transaction already

processed in Line 12 of the Personnel Action Request (PAR).

CREATE DATE

The date the batch was created.

CREDIT

For payroll to return a sum, as in a deduction amount, to an employee.

CRITIQUE SHEET

A green form (PSD 15) provided for use by any PAM User to submit a problem or

suggestion for the PAR, EAR, NOPA, PAM, or Personnel Operations.

CRT (CATHODE RAY TUBE)

See the "Cathode Ray Tube (CRT)" definition.

CPY (COPY)

See the "Copy (CPY)" definition.

CFRA (CALIFORNIA FAMILY

RIGHTS ACT)

See the "California Family Rights Act (CFRA)" definition.

- 15 -

C

DESCRIPTION

CSLEA (CALIFORNIA

STATEWIDE LAW

ENFORCEMENT

ASSOCIATION)

CSLEA's 7,000 members can be found in 180 different job classifications in state

government. The California Union of Safety Employees (CAUSE) was the former

name of the California Statewide Law Enforcement Association (CSLEA). When the

Dills Act put all state employees into various bargaining units, CAUSE was elected in

1981 to represent the Unit 7 state employees of what is now CSLEA.

CSP (CIVIL

SERVICE/EXEMPT

PAYSCALES)

See the "Civil Service/Exempt Payscales (CSP)" definition.

CSU (CALIFORNIA STATE

UNIVERSITY)

See the "California State University" definition.

CURRENT EMPLOYEE

A term used to determine which appointment Required/Conditional chart to use. A

current (as opposed to new or returning) employee is one who is on the data base in

an active status.

CURRENT STATUS RECORD

The first line of history in Line 12 on the PAR that always reflects the employee's

current status record on the data base.

CUSTOMER SUPPORT

SECTION OF SCO

The Customer Support Section provides system support services and training to

other state departments' staff for the California Leave Accounting System (CLAS),

provides instructor-led and eLearning personnel and payroll-related training classes

to HR personnel in various State departments/agencies, and provides support for

the State's Travel Expense Reporting System (CalATERS) and the procedures

associated with the system.

CUTOFF DATE

Final day each pay period for submitting/processing documents affecting payroll for

monthly/semimonthly employees. For Payroll, the cutoff date is approximately the

22nd of each month, if paid monthly, and the 8th and 22nd of the month, if paid

semimonthly. For Personnel, the cutoff date is two work days before the Payroll

Operations cutoff date.

- 16 -

D

DESCRIPTION

DATABASE

Collection of data organized for rapid search and retrieval by computer. In our case,

it is the computerized central information file or memory bank of Employment

History records for employees under the Uniform State Payroll System.

DATE OF CONVERTED

RECORD

The date an agency or department changed its employee's personnel records from a

previous system to the Employment History System.

For more information, see PAM, sections 1.4 - 1.7 for User's Conversion Dates and

page 9.1 for an illustration of this date on the PAR.

DATE OF ENTITLEMENT

The Date of Entitlement is the date, on which the employee becomes entitled to a

particular payment (i.e., date of hire, SPB/DPA action, date of settlement or lawsuit,

etc.). A court decision is regarded as a Date of Entitlement and does not require SPB

or DPA approval. (Exception: Adverse Action - 5.70-5.71) Departments are now

delegated the authority to backdate transactions to their date of entitlement

without prior review/approval by PSB. Departments must document the basis for

each date of entitlement request, and retain the documentation for review. SCO

cannot legally adjust an employee's funds for transactions effective more than three

years prior to the current (key) date with-out the PML 2007-026 or approval entered

in Item 215 and X on file in line 10. (See PML 2007-026, Personnel Letter 06-017,

PAM 2.203, and PAM item 215).

DCK (DOCK)

See the "Dock (DCK)" definition.

DD (DIRECT DEPOSIT)

See the "Direct Deposit (DD)" definition.

DEBIT

For payroll to charge a sum, as a deduction amount, to an employee.

DECENTRALIZED

Process whereby agency/campus may enter personnel/payroll information on-line.

DECENTRALIZED PAYROLL

CALENDARS

Used to determine when the system is available for inquiry and updating. Normally,

inquiry and updates are accepted between the hours of 7am and 6pm, Monday

through Friday. They display system availability, Julian date for each calendar day,

date of the MSA Mass update, cutoff dates, Employment History Database Restore

process (EHRESTORE), California Leave Accounting System (CLAS) accruals, and

Leave Activity Balance (LAB) report run date. These are maintained by the State

Controller's Office and provide valuable payday, cutoff, leave accrual, and green and

no cycle dates information.

The Decentralized Payroll Calendars are located on the State Controller’s website at:

http://www.sco.ca.gov/ppsd_state_hr.html.

DEFERRED

COMPENSATION

An arrangement in which a portion of an employee's income is paid out at a date

after which that income is actually earned deferring the tax to the date(s) at which

the employee actually receives the income.

- 17 -

D

DESCRIPTION

DEFINED PAR ITEMS

When any of these items are incorrect for a transaction in history, they are NOT

corrected by documenting a correct (See PAM, sections 9.3 and 9.4).

The following PAR items are considered to be “defined items”:

105 Social Security Number

110, 111 Employee’s Name

140 Birthdate

205 Transaction Code

210 Effective Date and Hours

440 Sex

445 Ethnic Origin

455 Disability Code

705 Total State Service

877 Lump Sum Payment Deferral

999 Deduction Information

DELETED BATCH (DEL)

A batch that is deleted/inactive. Inactive batches cannot be updated. Information

can be accessed from the PIP Inquiry System.

DELETE COMMAND (DEL)

A data entry command; used to delete a batch from processing.

DELETE ONLY

A term to denote an item on the Required/Conditional chart that is allowable for

deletion only.

DELETION

A method to cancel incorrect item(s) on a transaction.

DENTAL BENEFITS

An employee and their eligible dependents may be eligible for State-sponsored

dental insurance, available from one of several dental plans. Eligible employees may

enroll in a dental plan within the first sixty (60) days of employment or eligibility, or

during the annual open enrollment period. Changes in coverage are also permitted

during open enrollment. The cash option is also available in lieu of dental benefits.

Collective bargaining designation determines which plans are available to State

employees. The State will pay all or part of the premium, depending on the plan

selected and the number of dependents to cover. For more information on Dental

Benefits, visit the CalHR website at www.calhr.ca.gov.

DETAIL TRANSACTIONS

Refers to the Time and Attendance, Dock or Miscellaneous screens.

DEPARTMENTAL POLICY

The internal decisions and procedures formulated by departments to administer

personnel matters within the boundaries of the law.

DEPARTMENT OF

EDUCATION (DOE)

Serves the State of California by innovating and collaborating with educators,

schools, parents, and community partners.

DEPARTMENT OF FINANCE

(DOF)

A control agency responsible for funding state positions. Interacts with other State

departments on a daily basis in terms of preparing, enacting, and administering the

budget; reviewing fiscal proposals; analyzing legislation; establishing accounting

systems; auditing department expenditures; and communicating the Governor's

fiscal policy.

DEPARTMENT OF

GENERAL SERVICES (DGS)

A control agency that serves as the business manager for the State of California;

approves and publishes the State Administrative Manual (SAM); provides the State

Forms Management Program to ensure consistency, uniformity, and economy of

operations for all state agencies; and stores and maintains the Standard forms

repository used statewide for various program purposes.

- 18 -

D

DESCRIPTION

DEPARTMENT OF

GENERAL SERVICES (DGS) -

OFFICE OF STATE

PUBLISHING (OSP)

DGS is the forms repository for all standard (STD) forms. These forms are available

on the DGS website at www.dgs.ca.gov.

DEPARTMENT OF

PERSONNEL

ADMINISTRATION (DPA)

Former control agency that interpreted and administered the statutes, rules, and

procedures pertaining to salaries and benefits for civil service, Finance exempt, and

statutory employees. In the 2012 California State Government Reorganization, the

DPA became the California Department of Human Resources (CalHR). The

reorganization plan consolidated the State of California's two personnel

departments, combining the Department of Personnel Administration with certain

programs of the State Personnel Board.

DGS (DEPARTMENT OF

GENERAL SERVICES)

See the "Department of General Services (DGS)" definition.

DGS - OSP (DEPARTMENT

OF GENERAL SERVICES -

OFFICE OF STATE

PUBLISHING

See the "Department of General Services (DGS) - Office of State Publishing (OSP)"

definition.

DIRECT DEPOSIT (DD)

Method by which the State Controller's Office automatically deposits employee's

payments into their designated bank accounts.

DIVISION PC/LAN

SUPPORT SECTION

A part of the Personnel/Payroll Operations Branch (PPOB) within the

Personnel/Payroll Services Division (PPSD) of the State Controller's Office. This

section is responsible for developing and supporting personal computer (PC)

applications for operations staff; providing PC hardware/software and LAN support

for Division users. This group also provides application support for special projects

as required across the Division.

DOC NUMBER

Found in the PIMS Position (PSN) Inquiry - Conveys the document processing

number that identifies the number of personnel actions that have been processed

for the employee.

DOCK (DCK)

Approved time off without pay. Cannot exceed 10 days in a 21 day pay period or 11

days in a 22 day pay period. Usually used because employee does not have enough

leave credits to cover an absence. See also DOCK REPORT (ABSENCES WITHOUT

PAY) - STD 603

DOCK REPORT (ABSENCES

WITHOUT PAY) - STD 603

See also "STD 603 - Absences Without Pay"

Used to document approved absences, known as Informal Leave (Dock) or Leave

Without Pay, or Absence Without Leave (AWOL). Standard Form 603 is used only for

NEGATIVE Attendance Roll Codes 1 (monthly) and 2 (semi-monthly) employees to

change the amount of regular time to be paid. It is also used to reduce pay due to

dock for Negative Attendance employees for whom regular (monthly and semi-

monthly) payrolls are prepared prior to the close of the pay period.

DOCK UPDATE (DCK)

Used to access a detail screen within a batch to key dock requests.

DOCUMENT REQUEST

When a PAR or NOPA has been lost or destroyed, a duplicate document may be

requested from Personnel Operations by calling the Liaison Unit. Decentralized

agencies can request a duplicate PAR for their employees from their site.

DOE (DEPARTMENT OF

EDUCATION)

See the "Department of Education (DOE)" definition.

- 19 -

D

DESCRIPTION

DOF (DEPARTMENT OF

FINANCE)

See the "Department of Finance (DOF)" definition.

DOMESTIC PARTNERSHIP

COVERAGE

Effective January 1, 2005, new provisions of the California Domestic Partner Rights

and Responsibilities Act of 2003 became operative. The law gives domestic partners

the same rights, protections, and benefits as spouses. Domestic partner coverage is

available to same sex partners (registered with the Secretary of State) or opposite

sex partners if the State employee and/or his/her partner are age sixty-two (62) or

over and eligible for Social Security.

DPA (DEPARTMENT OF

PERSONNEL

ADMINISTRATION)

See the "Department of Personnel Administration (DPA)" definition.

DUP KEY

Duplication of data. Duplicates information that is the same from the corresponding

line on the previous record.

DUMMY

Not conforming to documentation or to standard coding/format/ computation.

Examples:

1. "Dummy'' payments are devices used to circumvent system limitations. They are

not payments intended for release to employees.

2. "Dummy'' gross does not equal time worked multiplied by salary rate.

3. "Dummy'' warrant register does not have headings, preprinted lines, or other

features of regular register.

E

DESCRIPTION

EAR (EMPLOYEE ACTION

REQUEST)

See the "Employee Action Request (EAR)" definition.

EARNINGS ID

A unique number or letter or set on numbers(s) and/or letter(s) up to 4 characters

that identifies a specific type of pay.

EDA (EMPLOYEE

DEVELOPMENT

APPRAISAL)

See the "Employee Development Appraisal (EDA)" definition.

EE

Employee

EFFECTIVE DATE

The date upon which something is considered to take effect.

EH

See the "Employment History (EH)" definition.

EHDB (EMPLOYMENT

HISTORY DATABASE)

See the "Employment History Database (EHDB)" definition.

EH RESTORE

See the “Employment History (EH) Restore” definition.

EI (EMPLOYEE INQUIRY)

See the "Employee Inquiry (EI)" definition.

EMPLOYEE ACTION

REQUEST (EAR)

Employee Action Request (STD 686) form is used by employees to report employee

information necessary for employment such as name, address and tax allowances to

Personnel Payroll Operations Branch.

EMPLOYEE ACTION

REQUEST (EAR) INQUIRY

One of the five types of Employment History inquiries made through the PIMS

prompt screen. The EAR Inquiry displays current information and is formatted in the

same order as the EAR form.

EMPLOYEE ACTION

REQUEST (EAR) - STD 686

See the "STD 686 - Employee Action Request" definition.

- 20 -

E

DESCRIPTION

EMPLOYEE ASSISTANCE

PROGRAM (EAP)

State of California employees and their eligible dependents have access to a

statewide Employee Assistance Program (EAP). This program is provided by the

State of California as part of the State’s commitment to promoting employee health

and wellbeing at no charge to the employee. This program provides a valuable

resource for support and information during difficult times and consultation on day-

to-day concerns. For more information about the Employee Assistance Program,

visit the CalHR website at www.calhr.ca.gov.

EMP (EMPTY BATCH)

See the "Empty Batch (EMP)" definition.

EMPLOYEE INQUIRY (EI)

Used to inquire pay requests for a specific employee.

EMPLOYEE TIME

CERTIFICATION (ETC)

Used to access a detail screen within a PIP batch to key employee time certifications

(RETROACTIVE).

EMPLOYEE TIME

CERTIFICATION - STD 966

See the "STD 966 - Employee Time Certification" definition.

EMPLOYER PAID

MEMBERSHIP

CONTRIBUTION (EPMC)

A retirement plan where the gross amount that is subject to retirement, is reduced

for tax computations by the amount equal to the retirement contribution.

EMPLOYMENT HISTORY

(EH)

Personnel records of employees paid under the Uniform State Payroll System (USPS)

maintained by PPSD, Personnel Operations, on a centralized computer data base.

EMPLOYMENT HISTORY

AND SYSTEMS ACTIVITIES

COORDINATION AND

SUPPORT SECTION OF SCO

This section provides the business analysis and performs the functions necessary to

support the Division's automated systems. The section ensures the integrity of the

data, defines requirements for modifying the system in response to mandates and

customer needs, conducts acceptance testing for system releases, and implements

pay increases resulting from collective bargaining agreements.

EMPLOYMENT HISTORY

DATABASE (EHDB)

A centralized computer database that contains personnel records of employees. This

database is maintained by the State Controller's Office, Personnel/Payroll Services

Division, Personnel Operations Unit and contains the "official" file of personnel

related information for all Civil Service/Exempt, California State University

employees, elected officials, judges, and legislators employed by over 150 State

departments and campuses.

EMPLOYMENT HISTORY

(HIST) INQUIRY

One of the five types of Employment History inquiries made through the PIMS

prompt screen. The HIST Inquiry is used to inquire on employment history records to

verify transactions posted correctly.

EMPLOYMENT HISTORY

(EH) RESTORE

A process normally run each Wednesday to move records from the INACTIVE

Employment History Data Base to the ACTIVE Employment History Data Base. (See

PAM Sections 10.25 and 10.25.1).

EMPLOYMENT HISTORY

TRANSACTIONS CODES

A three digit alpha/numeric codes assigned to various types of personnel

transactions by Personnel Services for programming purposes. The proper code

MUST be used on each PAR.

EMPLOYMENT LIST

A list of persons eligible for employment as a result of an examination or

reemployment eligibility after a layoff.

EMPTY BATCH (EMP)

The status of a batch when no detail transactions were keyed or selected.

ENHANCED NDI

CALCULATOR

Computes the NDI pay and leave supplementation requirements based solely on the

data entered by the user. The calculator does not use employment history and

payment history information. http://www.sco.ca.gov/ppsd_state_hr.html.

END OF FIELD (EOF)

Indicates erase to end of field.

- 21 -

E

DESCRIPTION

ENDING PAY PERIOD

Last day of the pay period.

ENTRY DATE

The date an entry or transaction was made into an SCO Production system.

EOF (END OF FIELD)

See the "End of Field (EOF)" definition.

EPMC (EMPLOYER PAID

MEMBERSHIP

CONTRIBUTION)

See the "Employer Paid Membership Contribution (EPMC)" definition.

ERASE EOF KEY

Used to erase information within a field.

ESTABLISHED POSITION

A specific staff assignment defined and funded in the State budget.

ETC (EMPLOYEE TIME

CERTIFICATION)

See the "Employee Time Certification (ETC)" definition.

EXAMINATION

A competitive oral, written, or performance test or any combination. Tests are given

on an open or promotional basis or combinations thereof (promotional only,

combined open and promotional, and open non-promotional). A competitor need

not be a state employee to compete in an open examination. A competitor must

have permanent or probationary status to compete in a promotional examination.

EXCEPTION

A Transaction that is not included in the Monthly Payroll and/or Personnel

processing. As used in the Monthly Payroll Certification (MPC) process,

exceptions are Monthly payroll warrants that are in need of further action

(i.e., redeposit and reissue).

EXCESS HOURS

1. Hours worked in excess of 160 hours per pay period by intermittent employees.

These hours CANNOT be carried over for the purpose of earning sick leave,

vacation, salary increases and State service. However, hours earned UNDER 160

hours per pay period are accumulated for purposes of earning sick leave,

vacation, salary increases and State service.

2. Hours worked in excess of the normal number of working days in a pay period

when an employee has a shift assignment other than Monday through Friday.

These are recorded by the department.

EXCLUSIVE

REPRESENTATIVE

An organization that is responsible for negotiating a contract and representing

employees within their respective bargaining unit(s) on all matters covered under

the collective bargaining agreement.

EXECUTIVE OFFICER

The Executive Officer of the State Personnel Board of the State of California.

EXEMPT

Employees who are appointed or elected to .state government positions without

competing in competitive examinations.

EXEMPT APPOINTEES

A group of State employees who are appointed or elected to State government

positions without competing in an examination. These employees are not bound by

the same rules and regulations as civil service employees.

EXEMPT AUTHORITY

Salary setting bodies and/or appointing powers for exempt positions. Includes: DPA

Exempts, Judicial Council, CSU, Conservation (CCC).

EXISTING BATCH

A Batch that is created and maintained on the PIP system. The Batch Status can be

Empty (EMP), Saved (SAV), Closed (CLS), Deleted (DEL) or Processed (PRC).

EXPIRATION DATES

The dates on which an appointment or temporary separation expires.

EXTRACT

The method of pulling batches off of the system to process the data.

- 22 -

E

DESCRIPTION

EXTRA HOURS

1. Compensable time worked over the minimum amount of hours for the work

week group (official overtime).

2. Used by some departments to indicate overtime which is compensable at time

and one-half (premium) rather than straight time.

F

DESCRIPTION

FAMILY CODE (FC)

Statutes, court decisions, and provisions of the federal and state constitutions that

relate to family relationships, rights, duties, and finances.

FAMILY MEDICAL LEAVE

ACT (FMLA)

Entitles eligible employees of covered employers to take unpaid, job-protected

leave for specified family and medical reasons with continuation of group health

insurance coverage under the same terms and conditions as if the employee had not

taken leave. Eligible employees are entitled to twelve workweeks of leave in a 12-

month period for the birth of a child and to care for the newborn child within one

year of birth; the placement with the employee of a child for adoption or foster care

and to care for the newly placed child within one year of placement; to care for the

employee’s spouse, child, or parent who has a serious health condition; a serious

health condition that makes the employee unable to perform the essential functions

of his or her job; and any qualifying exigency arising out of the fact that the

employee’s spouse, son, daughter, or parent is a covered military member on

“covered active duty.” The FMLA also allows for twenty-six workweeks of leave

during a single 12-month period to care for a covered service member with a serious

injury or illness if the eligible employee is the service member’s spouse, son,

daughter, parent, or next of kin (military caregiver leave). For more information

about FMLA, visit the U.S. Dept. of Labor's FMLA webpage at

http://www.dol.gov/dol/topic/benefits-leave/fmla.htm.

FC (FAMILY CODE)

See the "Family Code (FC)" definition.

FIELD

Specified area (columns in coding) for one subject.

FIRST TIER

First tier retirement benefit formulas require you to make employee contributions

to CalPERS and provide the highest level of benefit in retirement.

FISCAL YEAR (FY)

The twelve-month period of time beginning July 1

st

and ending the following June

30

th

.

FLEX

Abbreviation for the CalHR-sponsored flexible benefits program, FlexElect.

FLEXELECT

The State of California’s FlexElect program offers two types of employee benefits:

pre-tax reimbursement accounts for out-of-pocket medical and dependent care

expenses, and Cash Options in lieu of your state-sponsored health and/or dental

benefits.

- 23 -

F

DESCRIPTION

FLEXELECT

REIMBURSEMENT

ACCOUNTS

Employees who expect to pay out-of-pocket medical or dependent care expenses

during the coming year may benefit from a FlexElect Reimbursement Account. Most

State employees are eligible. With a FlexElect Medical Reimbursement Account, an

employee can use payroll deductions to pay for medical expenses that are not

covered by their health, dental, or vision plan. A FlexElect Dependent Care

Reimbursement Account lets the employee use payroll deductions to pay for day

care expenses for a child or parent.When an employee enrolls in a reimbursement

account, they specify an amount to be deducted from their pay warrants for the

year. These deductions are not counted as taxable income. Funds are held in a

special account used by the employee to reimburse themselves for covered

expenses they and their eligible dependents incur during the year. To ensure the

employee gets back all the funds in their account, they need to submit eligible

reimbursement claims by a specified deadline. For more information about FlexElect

Reimbursement Accounts, visit the CalHR website at www.calhr.ca.gov.

FMLA (FAMILY MEDICAL

LEAVE ACT)

See the "Family Leave and Medical Act (FMLA)" definition.

FOCUS

A fourth generation software computer language used to create and access the

Management Information Retrieval System (MIRS).

FOOTNOTES

As used in the Civil Service PayScale-a 2 digit code data element detailing additional

provisions of a class code

FORMAT TYPE

Refers to the Time and Attendance, Dock and Miscellaneous Payroll formats.

FRACTIONAL TIME BASE

Six digits identifying the employee's time base if other than full-time, intermittent,

or indeterminate. First three digits are the numerator; the last three digits the

denominator; e.g., one half time = 001/002.

FULL MONTH

A full month is equal to the maximum number of days possible in a specific pay

period as related to the specific calendar. For civil service, pay periods have either

21 or 22 days for a full month. Academic calendars may have a different number of

days for a full month depending on the specific pay period and the related

employing campus of department. Pay history (HIST) may reflect 99 in time which

denotes a full month. This does not mean that 99 days were paid and should not be

viewed as such.

FY (FISCAL YEAR)

See the "Fiscal Year (FY)" definition.

G

DESCRIPTION

GARNISHMENT

The process of deducting money from an employee's monetary compensation

(including salary), sometimes as a result of a court order. Wage garnishments

continue until the entire debt is paid or arrangements are made to pay off the debt.

Garnishments can be taken for any type of debt but common examples of debt that

result in garnishments include: child support, defaulted student loans, taxes, and

unpaid Court costs.

GC (GOVERNMENT CODE)

See the "Government Code (GC)" definition.

GEN or GSI (GENERAL

SALARY INCREASE)

See the "General Salary Increase (GSI or GEN)" definition.

GENERALIST

Person and/or unit responsible for performing a variety of personnel/payroll

activities.

- 24 -

G

DESCRIPTION

GENERAL SALARY

INCREASE (GSI or GEN)

See the "General Salary Increase (GSI or GEN)" definition.

GOVERNMENT CODE (GC)

One of 29 sets of legal code groups enacted by the California State Legislature that

together, form the general statutory law of California. To learn about specific

government codes, visit the Office of Administrative Law website at:

www.oal.ca.gov.

GRAY PERIOD

A period of time for academic employees that is not covered by the academic

calendar.

GREEN CYCLE

A daily cycle that falls between monthly payroll cutoff and the end of the pay

period. Includes daily payroll and supplemental monthly payroll.

GRIEVANCE PROCEDURE

The legal procedure used to grieve a term or condition of employment.

GROSS PAY

Amount earned prior to the payroll deductions being subtracted.

GROSS TYPE

Method by which gross is computed.

GROUP LEGAL SERVICES

PLAN

The Group Legal Services Plan is a voluntary, employee-paid benefit that can

provide you with legal consultation and representation. Employees designated as

excluded and certain represented employees are eligible to enroll. New employees,

if eligible, may enroll within the first 60 days of employment or during the annual

open enrollment. A variety of legal services are available such as will preparation,

legal consultation and representation for domestic matters, defense of civil actions,

criminal misdemeanors and traffic charges, bankruptcy proceedings, and review and

preparation of documents. For more information about the Group Legal Services

Plan, visit the CalHR website at www.calhr.ca.gov.

GSI or GEN (GENERAL

SALARY INCREASE)

See the "General Salary Increase (GSI or GEN)" definition.

H

DESCRIPTION

HAM (HIRING ABOVE

MINIMUM)

See the "Hiring Above Minimum (HAM)" definition.

HARD COPY

A printed paper copy of computer output in readable form such as documents,

summaries, reports, or listings.

HEADER (PAYROLL)

Indicates the name of the agency/campus, reporting unit, name of fund,

identification of appropriation, (chapter, item number, etc.) and fiscal year. Always

printed on warrant registers and attendance reports.

HEAL

This is an outdated term referring to a system application that provided on-line

access to health benefit deduction information. This system has been replaced by

the My|CalPERS System.

HEALTH (MEDICAL)

BENEFITS

See the "Medical (Health) Benefits" definition.

HIRING ABOVE MINIMUM

(HAM)

Appointing new State employees above the entrance rate of the class based upon

extraordinary qualifications of the person being appointed.

HIST

See the "Employment History (EH)" definition.

HISTORY TYPES

History Types are the options available on Employment History (PIMS) screen.

History Type screens display specific PAR items for each transaction selected.

- 25 -

H

DESCRIPTION

HOLIDAYS

State employees observe the following paid holidays: New Year's Day, Martin Luther

King

Jr. Day, Presidents Day, Cesar Chavez Day, Memorial Day, Independence Day, Labor

Day, Veteran's Day, Thanksgiving Day, Day after Thanksgiving, and Christmas Day. If

a State employee is required to work on a holiday, they will be compensated in

accordance with your collective bargaining agreement and/or State regulations. For

more information about Holidays, visit the CalHR website at www.calhr.ca.gov.

- 26 -

I

DESCRIPTION

IDL (INDUSTRIAL

DISABILITY LEAVE)

See the "Industrial Disability Leave (IDL)" definition.

INACTIVE BATCH

A batch that has been processed (PRC) or deleted (DEL). Inactive batches cannot be

updated. Information can be accessed from the PIP Inquiry System.

INDUSTRIAL DISABILITY

LEAVE (IDL)

Absence of an employee due to a job-related illness or injury. A work-related benefit

paid in lieu of TO for members of Public Employees' Retirement System (PERS) and

State Teachers' Retirement System (STRS).

INDUSTRIAL DISABILITY

LEAVE SUPPLEMENTATION

CALCULATOR

The on-line calculator is to be used to calculate IDL supplementation information

only. It is not be used to calculate any other types of pay, such as IDL Full, IDL 2/3,

and regular pay.

This calculator can be found at http://www.sco.ca.gov/ppsd_state_hr.html.

See also the entry for INDUSTRIAL DISABILITY LEAVE SUPPLEMENTATION (IDL/S)

CALCULATOR

INDUSTRIAL DISABILITY

LEAVE SUPPLEMENTATION

(IDL/S) CALCULATOR

The on-line calculator is to be used to calculate IDL supplementation information

only. It is not be used to calculate any other types of pay, such as IDL Full, IDL 2/3,

and regular pay.

The calculator computes the gross pay and the number of leave credit hours needed

for full IDL supplementation. Calculations are based solely on the data entered on

the calculator's screen. Employment History and Payment History information is not

used by the calculator. For more information, including Exception Conditions, refer

to the Payroll Procedures Manual (PPM), Section L, located at:

http://www.sco.ca.gov/ppsd_state_hr.html.

INDUSTRIAL RETIREMENT

CATEGORY

Includes all State employees who are not State Safety members, State

Miscellaneous members, or State Peace Officer/Fire Fighter members. (See GC

Section 20382)

INFORMATIONAL LIST

An informational copy of examination results sent to departments from CalHR.

IN-GRADE

Occurring within a specified labor grade or rate range or occupational classification,

as in in-grade wage increase, and is referenced in the term SISA or Special In-Grade

Salary Adjustment.

INTERCHANGEABLE CLASS

Used for specific classes to promote the policy of recruiting employees at entry level

and promoting later to a journeyman level without additional budgetary action.

INTERMITTENT

An hourly time base. Employee’s tenure may be Temporary Authorization

Appointment (TAU), Limited Term (LT), or permanent. May occasionally be a daily

time base.

INTERFACE

The transfer of data/information between computer systems such as between

Employment History and the Uniform State Payroll System.

IUOE (INTERNATIONAL

UNION OF OPERATING

ENGINEERS)

See also “Bargaining Unit 12” and “Bargaining Unit 13”. Members consist of

operating engineers, stationary engineers, nurses and other health industry

workers, public employees engaged in a wide variety of occupations, as well as a

number of job classifications in the petrochemical industry.

ISSUE DATE

The date a warrant/payment is redeemable.

- 27 -

J

DESCRIPTION

JRS (JUDGES' RETIREMENT

SYSTEM)

See the "Judges' Retirement System (JRS)" definition.

JUDGES' RETIREMENT

SYSTEM (JRS)

Retirement coverage for employees appointed to Statutory Exempt Class Codes

5987, 5977, 5991, and 9999. (GC Sections 75000-75613)

JURY DUTY

If called for jury duty, State employees serve with no loss in pay as long as they

remit to the State a jury duty slip. An employee does not have to remit any payment

received for travel expenses. However, any jury duty fees received must be remitted

to the State. The employee's supervisory must be notified and the work schedule

discussed when called for jury duty. To view more information about Jury Duty, visit

the CalHR website at www.calhr.ca.gov.

JUSTIFICATION

(RIGHT/LEFT)

Information placed in proper spaces; i.e., all information entered starting at left

margin (left justification) or ending all information at same field on right margin

(right justification).

K

DESCRIPTION

[No data]

[No data]

L

DESCRIPTION

LAB (LEAVE ACTIVITY AND

BALANCES) REPORT

See the "Leave Activity and Balances (LAB) Report" definition.

LABOR CODE (LC)

A collection of civil law statutes for the State of California. The code is made up of

statutes which govern the general obligations and rights of persons within the