CONDOMINIUM DOCUMENTS:

DRAFTING TO COMPLY WITH HUD CONDOMINIUM

PROJECT APPROVAL REQUIREMENTS

ROBERT D. BURTON

Winstead PC

401 Congress Avenue, Suite 2100

Austin, Texas 78701

State Bar of Texas

24

th

ANNUAL

ADVANCED REAL ESTATE DRAFTING COURSE

March 7-8, 2013

Houston

CHAPTER 21

ROBERT D. BURTON

Winstead PC

401 Congress Avenue, Suite 2100

Austin, Texas 78701

512-370-2869

FAX: 512-370-2850

EDUCATION:

B.S. M.S. (Accounting), University of North Texas

J.D., Tulane University, with honors and member and editor of Tulane Law Review

PROFESSIONAL ACTIVITIES

Shareholder, Winstead PC, Real Estate Development & Investments Practice Group and Co-Chair of Planned

Community, Mixed-Use and Condominium Practice Group

Member, State Bar of Texas

Board Member, Texas Community Association Advocates

Member, Community Associations Institute

Full Member, Urban Land Institute

Board Member, Urban Land Institute – Austin, Urban Development and Mixed-Use Council

Member, Real Estate Council of Austin

Condominium Documents:

Drafting to Comply with HUD Condominium Document Approval Requirements Chapter 21

i

TABLE OF CONTENTS

I. INTRODUCTION: HUD AUTHORTY ................................................................................................................ 1

II. OVERVIEW OF HUD CONDOMINIUM PROJECT APPROVAL ..................................................................... 1

A. Two Approval Options: DELRAP and HRAP. ............................................................................................... 1

B. The Detached Exception.................................................................................................................................. 1

III. HUD CONDOMINIUM DOCUMENT PROVISIONS ......................................................................................... 2

A. Recommended Provisions. .............................................................................................................................. 2

B. Ineligible Projects. ........................................................................................................................................... 4

IV. HARMONIZING HUD, FNMA AND VA ............................................................................................................. 4

V. CONCLUSION ....................................................................................................................................................... 5

APPENDIX A ................................................................................................................................................................. 7

APPENDIX B ................................................................................................................................................................. 8

Condominium Documents:

Drafting to Comply with HUD Condominium Document Approval Requirements Chapter 21

1

CONDOMINIUM DOCUMENTS:

DRAFTING TO COMPLY WITH

HUD CONDOMINIUM DOCUMENT

APPROVAL REQUIREMENTS

I. INTRODUCTION: HUD AUTHORTY

Section 203(b) of the National Housing Act

authorizes the Department of Housing and Urban

Development (“HUD” or the “Department”) to issue,

or commit to issue, mortgage insurance on loans to

purchase or refinance one-family residential

dwellings.

1

Section 203(b) is the primary mortgage

insurance program administered by HUD. Section

234(c) of the National Housing Act authorizes the

Secretary of HUD to issue, or commit to issue,

mortgage insurance on individual condominium

units.

2

Section 234(c) further authorizes the

Secretary to adopt rules and conditions, which must

be satisfied as a precondition to issuance of mortgage

insurance on loans to purchase or refinance

condominium units.

3

The rules and conditions have

been issued and codified.

4

The periodic issuance of

HUD Mortgagee Letters has further supplemented the

codified rules.

5

II. OVERVIEW OF HUD CONDOMINIUM

PROJECT APPROVAL

A. Two Approval Options: DELRAP and

HRAP.

Since an individual condominium unit is created

and established by a governance system,

6

and since

the components and administration of that system can

have an effect on the value of the unit, HUD requires

that all attached condominium projects be pre-

approved as a condition to eligibility for mortgage

insurance. The condominium pre-approval is referred

1

12 U.S.C. §1709(b) (2006 & Supp. 2010).

2

12 U.S.C. §1715y (2006 & Supp. 2010).

3

12 U.S.C. §1715y(c) (2006 & Supp. 2010).

4

24 C.F.R. §234 (2012) and 24 C.F.R. §203 (2012).

5

For example, see Mortgagee Letters 2009-46A, 2009-

46B, 2011-03, 2011-22, and 2012-18. Though a matter of

some controversy among practitioners, HUD has taken the

position that the National Housing Act and the rule-making

authority vested in the Secretary, does not require the

traditional public comment period otherwise applicable to

the publication of new regulations.

6

At a minimum, a condominium declaration must be filed

to establish individual units and common areas. In almost

all cases, the governance system will also include rules and

regulations applicable to the condominium project which

affect ownership and use.

to by HUD as “project approval” and presently

includes two separate approval tracks: Direct

Endorsement Lender Review and Approval Process

and HUD Review and Approval Process. Direct

Endorsement Lender Review and Approval Process,

known as “DELRAP”, is administered by a lender

with direct endorsement authority with HUD. Under

the DELRAP approval process, the lender determines

whether the condominium project complies with the

rules and conditions adopted by HUD for project

approval and certifies satisfaction of the conditions to

HUD. If the condominium project is approved by a

specific lender under the DELRAP process, that

lender’s loans will qualify for mortgage insurance

provided that the individual borrower satisfies

applicable underwriting criteria. The HUD Review

and Approval Process, known as “HRAP”, is

administered by HUD and is initiated directly by the

sponsor or condominium association’s submission of

a project approval application directly to HUD. If

HUD approves the project, the project is considered

approved for mortgage insurance and loans will

qualify for mortgage insurance provided that the

individual borrower satisfies applicable underwriting

criteria. The principal difference between DELRAP

and HRAP is that DELRAP approval is specific to the

lender who has approved the project and provided the

appropriate certifications to HUD. In most

circumstances, the sponsor and condominium

association should opt for the HRAP approval process

since HRAP provides the prospective condominium

unit purchaser with more options when selecting a

lender.

Under both approval tracks, the project must

comply with the rules and conditions for project

approval. On June 30, 2011, HUD issued Mortgagee

Letter 2011-22,

7

which adopted a consolidated

“Condominium Project Approval and Processing

Guide” (the “Guide”).

8

B. The Detached Exception.

Effective June 12, 2009, condominium project

approval is not required for detached or “site”

condominiums.

9

HUD has further defined site-based

7

At http://portal.hud.gov/hudportal/documents/huddoc?id=11-

22ml.pdf.

8

At http://portal.hud.gov/hudportal/documents/huddoc?id=1122

mlguide.pdf.

9

See HUD Mortgagee Letter 2009-46B, http://portal.hud.

gov/hudportal/documents/huddoc?id=09-46bml.pdf

Condominium Documents:

Drafting to Comply with HUD Condominium Document Approval Requirements Chapter 21

2

condominiums as a condominium that meets the

following criteria:

10

1) Single family totally detached dwellings

where no physical dwelling improvements

are shared, e.g., garages, breezeways,

archways;

2) Subject to the terms and provisions of a

condominium declaration;

3) The actual condominium unit includes the

entire structure, i.e., the unit boundaries

encapsulate the dwelling;

11

4) Insurance and maintenance costs are the

responsibility of the unit owner; and

5) Any common assessments collected will be

for amenities outside of the footprint of the

individual site.

It should be noted that if a single declaration

establishes both detached and attached condominium

units, HUD condominium project approval is

required.

III. HUD CONDOMINIUM DOCUMENT

PROVISIONS

A. Recommended Provisions.

The Guide does not include recommended text

of specific document provisions that must be included

in condominium documents. However, the Guide

does require that certain conditions be present as a

condition to approval, and that the condominium

documents comply with applicable law. In addition,

as discussed in Part IV of this article, if the

condominium project will require Fannie Mae,

Freddie Mac, or Veteran’s Administration approval

under their respective mortgage insurance programs,

certain provisions will need to be included in the

condominium documents. In addition, due to the

continued fragile state of the HUD mortgage

insurance program and the Department’s history of

modifying guidance based on changes in the political

or economic environment, there are certain customary

provisions the practitioner should consider including

despite the lack of any specific mandate.

10

Condominium Project Approval and Processing Guide,

at http://portal.hud.gov/hudportal/documents/huddoc?id=

11-22mlguide.pdf, p. 19.

11

There remains the question of whether yard area can be

included as limited common element and still be

considered “detached” for the purpose of project approval.

The Guide requires the unit to include the “entire structure

as well as the site and air space and are not considered to

be common areas or limited common areas.” Guide, p.19.

Do the terms “site and air space” pertain to the area and air

space enveloping only the structure?

(i) Mortgagee Protection. The mortgagee

protection clause requires that certain

material modifications to the condominium

declaration be approved by 51% of all

mortgagees. A sample mortgagee protection

clause is attached as Exhibit A to this article.

While this provision is not expressly

required by the Guide, it is required by

Fannie Mae guidelines,

12

and is so

frequently seen in condominium documents

recorded over the past decade that exclusion

is not recommended.

13

Note that the sample

mortgagee protection clause includes

express carve-outs for amendments

prosecuted by the sponsor to add additional

units or modify the project when exercising

special declarant rights.

14

The exclusions

are permissible FNMA exceptions to the

mortgagee amendment approval requirement

and HUD has also accepted these

exclusions.

(ii) Board Amendment for Changes in

Underwriting Guidelines. Section 82.067 of

the Texas Property Code permits the sponsor

to include a provision in the declaration

which allows the board of directors of the

condominium association to amend the

declaration without owner consent provided

that the amendment is necessary “to meet

the requirements of the Federal National

Mortgage Association, the Federal Home

Loan Mortgage Corporation, the Federal

Housing Administration, or the Veterans

Administration.”

15

A sample underwriting

12

Though beyond the scope of this article, most projects

will utilize HUD and Fannie Mae condominium project

approval for sales. This is due to different loan limits

between the two agencies and HUD’s requirements that it

will issue mortgage insurance on no more than 50% of units

within the project.

13

It should be noted that prior to 2010, Fannie Mae, HUD

and VA honored reciprocity with respect to project

approvals. In other words, Fannie Mae project approval

resulted in HUD project approval and vice versa. Since

Fannie Mae included specific guidelines on mandatory

condominium document provisions, practitioners would

draft to the Fannie Mae standard. These Fannie Mae

provisions have become customary and accepted by the

market. As a result, there is justifiable reluctance about

removing Fannie Mae provisions from condominium

documents even if the project will only seek HUD approval.

14

Special declarant rights are defined in §82.003(22) of the

Texas Property Code.

15

Tex. Prop. Code. Ann. §82.067(f) (West 2012).

Condominium Documents:

Drafting to Comply with HUD Condominium Document Approval Requirements Chapter 21

3

amendment provision is attached as Exhibit

A to this article. As previously noted, HUD

and staff have had frequent occasion to

modify and supplement the rules and

procedures attributable to condominium

project review and approval based on

political and economic considerations.

16

Including the amendment right afforded by

Section 82.067 is a means to respond to

changes and preserve mortgage insurance

eligibility.

(iii) Leasing. The Guide provisions on

minimum lease terms have created some

confusion.

17

The confusion stems from the

Guide’s example of a 6-month minimum

lease term as beneficial for project stability

coupled with a statement that leasing

restrictions are permissible if such

restrictions meet one or more of Guide’s

seven stated criteria. Our experience is that

HUD is interpreting the seven criteria as a

list of permissible and impermissible

conditions associated with leasing

restrictions. The seven criteria are as

follows:

18

1) All leases must be in writing and subject

to the declaration and by-laws of the

condominium project.

2) The condominium association may

request and receive a copy of the

sublease or rental agreement.

3) The condominium association may

request the name(s) of all tenants

including the tenants’ family members

who will occupy the unit.

4) Unit owners are prohibited from leasing

their units for an initial term of less

than 30 days.

16

42 U.S.C. 3535(d) (2006 & Supp. 2010) authorizes the

Secretary of HUD to “delegate any of his functions,

powers, and duties to such officers and employees of the

Department as he may designate, may authorize such

successive redelegations of such functions, powers, and

duties as he may deem desirable, and may make such rules

and regulations as may be necessary to carry out his

functions, powers, and duties.” The Federal Housing

Administration Commissioner/Assistant Secretary for

Housing and FHA staff presently issues rules and

procedures associated with condominium project approval.

17

See Condominium Project Approval and Processing

Guide, at http://portal.hud.gov/hudportal/documents/

huddoc?id=11-22mlguide.pdf, p. 26.

18

Id.

5) The condominium association may

establish a maximum allowable lease

term, e.g. six months, twelve months,

etc.

6) The condominium association may

establish a maximum number of rental

units within the project; however, the

percentage of rental units may not

exceed the current FHA condominium

project owner-occupancy

requirement.

19

7) The condominium association may not

require that a prospective tenant be

approved by the condominium

association and/or its agent(s),

including but not limited to meeting

creditworthiness standards.

Based on HUD application of the leasing rules, we

believe that Items 1 through 3, 5 and 6 are restrictions,

which may be included in the condominium project

documents. HUD is presently applying Item 5 to

require a minimum lease term of no more than 30

days. Item 7 is a condition that must not be included

in the condominium documents.

(iv) Insurance. The Guide requires that the

condominium association procure property

insurance covering 100% of the current

replacement cost of the condominium,

which for purpose of HUD project approval

may require that the association procure

insurance for the common elements and the

units despite the fact that the Association,

under the Texas Uniform Condominium

Act, need not insure units. Specifically,

Section 82.111(b) of the Texas Property

Code requires that the association procure

insurance for the units, in addition to the

common elements, if the units include

horizontal boundaries.

20

As a result, it is

permissible under Texas law for a project

without horizontal boundaries, e.g., a

townhome product, to obtain property

insurance for the common elements and not

the units. However, the Guide: (i) prohibits

a unit owner from obtaining gap coverage if

the association has not procured 100%

19

The FHA condominium project owner occupancy

requirement is 50% for existing projects and 30% for

projects until 1 year after the first conveyance of a unit.

Guide, p. 43-44.

20

Horizontal boundaries, in effect, means that some portion

on one unit is above another unit.

Condominium Documents:

Drafting to Comply with HUD Condominium Document Approval Requirements Chapter 21

4

replacement value insurance; and (ii)

requires that each unit owner obtain HO-6,

or “walls-in” coverage.

21

Consequently,

dependent upon how unit boundaries are

established under the condominium

declaration there may be a “gap” between

the insurance policy on the common

elements procured by the association and

the HO-6 policy obtained by each unit

owner, i.e., the unit may be defined to

include an area not covered by the HO-6

policy. HO-6 insurance differs slightly

from one insurance company to the next

and the prospective unit owner will not

procure such insurance until shortly before

or at unit closing. Confirmation of HO-6

insurance and the insurance procured by the

association will be confirmed as part of the

purchaser’s loan level underwriting.

22

Questions may then arise regarding whether

the project insurance meets FHA

requirements. For those projects where

FHA project approval is important, we

recommend that the condominium

association procure 100% replacement

value insurance for common elements and

units excluding improvements and

betterments installed by unit owners.

(v) Development Period. Development rights

are rights reserved in the condominium

declaration to enable the sponsor to create

units, common elements, and add and

withdraw land from the project.

23

The

ability to create units and common elements

is critical to managing the presale

requirements imposed by HUD as a

precondition to issuance of mortgage

insurance.

24

Section 82.055(14) of the

21

An HO-6 policy usually covers damage to personal

property, interior walls and floor coverings, and

improvements and betterments installed by the unit owner.

22

FHA project approval is obtained for the entire project.

However, at each closing, the purchaser’s lender will

confirm that certain FHA requirements have been satisfied.

This confirmation usually takes the form on a

Condominium Questionnaire completed by the sponsor or

manager of the condominium association.

23

Tex. Prop. Code Ann. §82.003(12) (West 2012).

24

Strategies associated with legal phasing are beyond the

scope of this article. However, for new projects, HUD

requires that at least 30% of all units established by the

declaration be conveyed or under contract to owner-

occupants. For a large project, units will be created in

phases by amendment to the condominium declaration to

ensure that the presale requirement is satisfied as the

Texas Property Code requires that the

condominium declaration specify the time

period during which the sponsor may

exercise such rights. Though the Guide

provides no express limit on the duration of

these rights, Fannie Mae guidelines limit

this period to seven (7) years. We

recommend that but for unusual

circumstances, the 7 year period be utilized

for HUD projects for the same reasons

expressed in Section III.A(i) of this article.

(vi) Transition of Association Control. The

Guide includes requirements on the

transition of control from the sponsor to unit

owners, which requirements are the same as

those set from in the Texas Uniform

Condominium Act.

25

However, for

purposes of HUD project approval it is

recommended that the transition

requirements be expressly and

conspicuously set forth in the condominium

declaration rather than incorporated by

reference to Texas law. A sample transition

clause is attached as Exhibit A to this article.

B. Ineligible Projects.

Projects ineligible for HUD project approval

include projects with a mandatory rental pool, projects

which have more than 25% of total space used for

nonresidential purposes, live/work projects with more

than 25% of project area or unit area dedicated to non-

residential purposes, and projects where purchasers

must be approved by the board or the consent of a

third-party.

IV. HARMONIZING HUD, FANNIE MAE AND

VA

Prior to February 1, 2010, HUD, Fannie Mae and

the Veteran’s Administration honored reciprocity with

respect to condominium project approvals.

26

In other

project is developed. Note that phasing is also a means to

limit a sponsor’s exposure to assessments payable on

unbuilt units. Section 82.112(c) of the Texas Property

Code requires that the sponsor commence payment of

assessments no later than three years after the first

conveyance of a unit.

25

Section 82.103(c) of the Texas Property Code provides

that the sponsor must relinquish control of the

condominium association on or before 120 days after 75%

of the units that may be created under the condominium

declaration have been conveyed to third parties.

26

Project Review Information and Frequently Asked

Questions, Fannie Mae, February, 28, 2012, p. 9, See

https://www.fanniemae.com/content/faq/project-review-

summary-faqs.pdf,

Condominium Documents:

Drafting to Comply with HUD Condominium Document Approval Requirements Chapter 21

5

words, a condominium project approved by Fannie

Mae would be considered approved by HUD, and

vice versa. Reciprocity was the result of

harmonization of approval criteria and cooperation

between the agencies over the years. The

harmonization of rules and cooperation between the

agencies ended as a result of the real estate downturn

in 2008, when Fannie Mae revised its approval

guidelines and HUD began the process to rewrite the

HUD condominium project approval guidelines. In

addition, the Veteran’s Administration presently

requires that a condominium project be separately

submitted for approval without regard to whether the

project has been approved by HUD or Fannie Mae.

Termination of reciprocity between the agencies

requires that the condominium documents be

prepared in accordance with the requirements of each

agency. As noted in this article, HUD does not

currently have mandatory provisions that must be

included in the documents. However, Fannie Mae

and VA do have such document requirements.

Generally, the provisions recommended in Section

III. A above will satisfy the Fannie Mae guidelines.

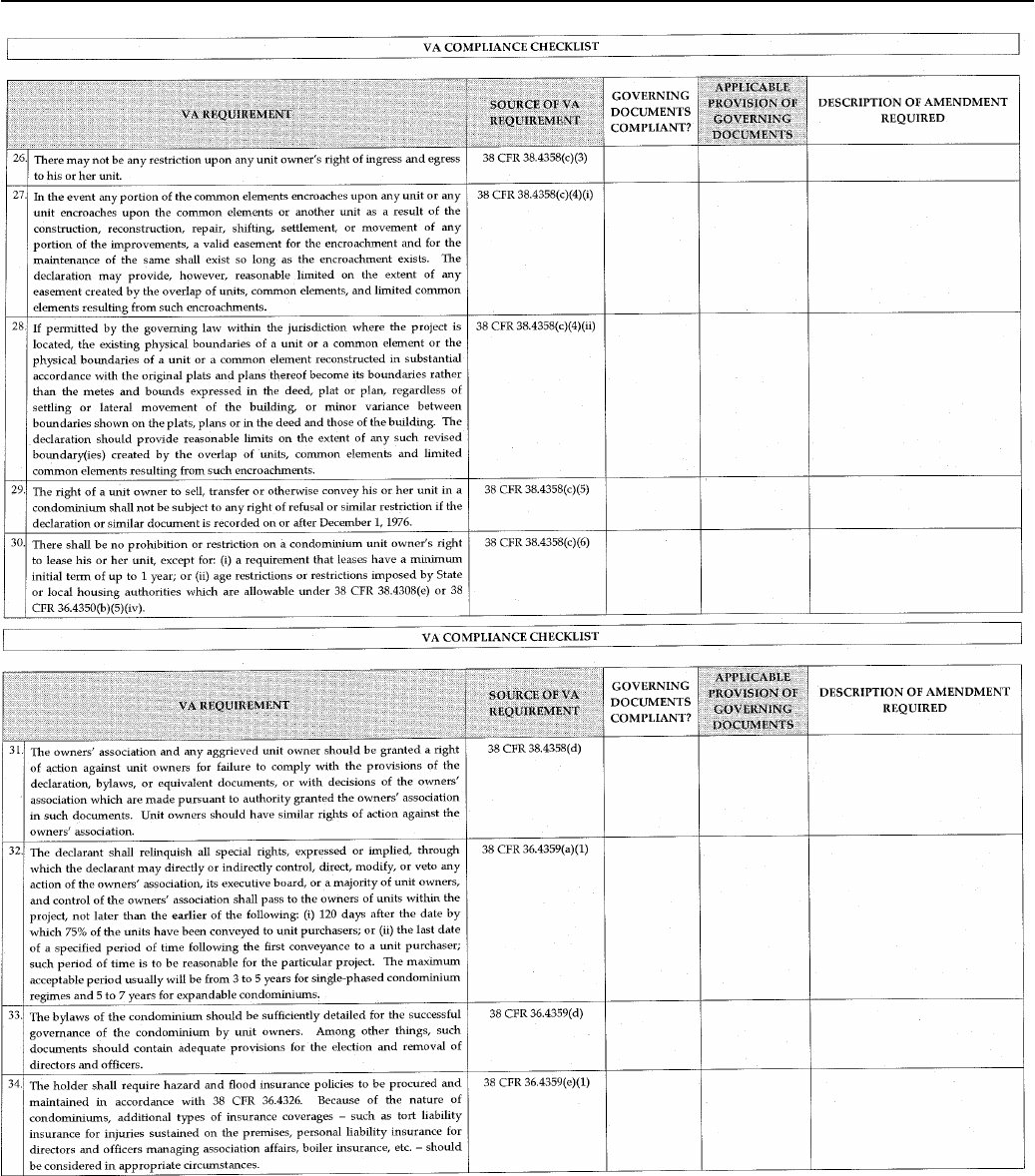

However, the VA guidelines include specific

requirements over and above the requirements

imposed by Fannie Mae. Exhibit B attached to this

article includes a worksheet which may be used to

draft the condominium documents in a manner that

complies with the VA requirements, or to evaluate

whether existing condominium documents comply

with the VA requirements.

V. CONCLUSION

Though HUD does not provide specific

provisions that must be included in the condominium

documents, the practitioner should include certain

customary provisions based on HUD’s historical

document review and approval practices. In addition,

due to the termination of reciprocity between

condominium project approval agencies, the

condominium documents should be drafted in a

manner that complies with each agencies guidelines

and requirements. Finally, the practitioner is advised

to keep abreast of changes in project approval

guidelines. HUD guidelines will change based on a

variety of factors, including agency leadership, HUD

fiscal directives, politics, and the economy.

Condominium Documents:

Drafting to Comply with HUD Condominium Document Approval Requirements Chapter 21

7

EXHIBIT A

A. Sample Mortgagee Protection Provision:

Amendments of a Material Nature. A document amendment of a material nature must

be approved by owners representing at least sixty-seven percent (67%) of the votes in the

Association and by at least fifty-one percent (51%) of Eligible Mortgagees. THIS

APPROVAL REQUIREMENT DOES NOT APPLY TO AMENDMENTS

EFFECTED BY THE EXERCISE OF A DEVELOPMENT RIGHT PROVIDED

IN APPENDIX “A” ATTACHED HERETO. A change to any of the provisions

governing the following would be considered material:

• Voting rights.

• Assessment liens or the priority of assessment liens.

• Reductions in reserves for maintenance, repair, and replacement of Common

Elements.

• Responsibility for maintenance and repairs.

• Reallocation of interests in the General Common Elements or Limited

Common Elements, or rights to their use; except that when Limited Common

Elements are reallocated by Declarant pursuant to any rights reserved by

Declarant pursuant to Appendix “A”, by agreement between Owners (only

those Owners and only the Eligible Mortgagees holding mortgages against

those Units need approve the action).

• Redefinitions of boundaries of Units, except pursuant to any rights reserved

by Declarant pursuant to Appendix “A”.

• Convertibility of Units into Common Elements or Common Elements into

Units.

• Expansion or contraction of the Regime, or the addition, annexation, or

withdrawal of property to or from the Regime.

• Property or fidelity insurance requirements.

• Imposition of any restrictions on the leasing of Units.

• Imposition of any restrictions on Owners’ right to sell or transfer their Units.

• Restoration or repair of the Regime, in a manner other than that specified in

the Documents, after hazard damage or partial condemnation.

• Any provision that expressly benefits mortgage holders, insurers, or

guarantors.

B. Sample Underwriting Amendment Provision

During the Development Period, Declarant may amend this Declaration and the other

Documents, without consent of other Owners or any mortgagee, for the following limited

purposes: (i) to meet the requirements, standards, or recommended guidelines of an

Underwriting Lender to enable an institutional or governmental lender to make or

purchase mortgage loans on the Units.

C. Sample Transition Clause

Declarant may appoint, remove, and replace any officer or director of the Association,

none of whom need be Members or Owners, and each of whom is indemnified by the

Association as a “Leader,” subject to the following limitations: (i) within one hundred

and twenty (120) days after fifty percent (50%) of the total number of Units that may be

created have been conveyed to Owners other than Declarant, at least one-third of the

Board must be elected by the Owners other than Declarant; and (ii) within one hundred

and twenty (120) days after seventy-five percent (75%) of the total number of Units that

may be created have been conveyed to Owners other than Declarant, all Board members

must be elected by all Owners, including the Declarant.

Condominium Documents:

Drafting to Comply with HUD Condominium Document Approval Requirements Chapter 21

8

EXHIBIT B

Condominium Documents:

Drafting to Comply with HUD Condominium Document Approval Requirements Chapter 21

9

Condominium Documents:

Drafting to Comply with HUD Condominium Document Approval Requirements Chapter 21

10

Condominium Documents:

Drafting to Comply with HUD Condominium Document Approval Requirements Chapter 21

11

AUSTIN_1\689192v3

999995-1846 02/16/2013