Impact of the Georgia Film Tax Credit

Information reported has improved, but credit has not been capped

Greg S. Griffin | State Auditor

Lisa Kieffer | Director

FOLLOW-UP REVIEW • REPORT NUMBER 22-05B • October 2022

270 Washington Street, SW, Suite 4-101 Atlanta, Georgia 30334 | Phone 404.656.2180 | audits.ga.gov

Performance Audit Report No. 22-05B

Performance Audit Division

Greg S. Griffin, State Auditor

Lisa Kieffer, Director

October 2022

Why we did this review

This follow-up review was conducted

to determine the extent to which the

Department of Economic Development

(GDEcD) and the General Assembly

addressed the findings presented in

our January 2020 performance audit

(Report #18-03B).

The 2020 audit evaluated the

effectiveness of the credit as a tax

incentive and economic development

program, including the economic and

fiscal impact of the credit.

A companion report on the credit’s

administration was also released in

January 2020. A separate follow-up

report on the administration of the

credit was released in July.

About the Film Tax Credit

First passed in 2005, Georgia’s film

tax credit provides an income tax

credit to production companies that

spend at least $500,000 on qualified

productions. The base credit rate

was raised to 20% in 2008, with an

additional 10% for a qualified

promotion of the state (e.g., Georgia

logo). The credit is transferable, and

most credits are sold by production

companies to other taxpayers.

The value of the annual credit amount

generated grew from $669.4 million in

2016 to approximately $961.0 million

in 2019, a 44% increase.

1

This figure was provided by the Motion Picture Association.

Impact of the Georgia Film Tax Credit

Information reported has improved, but

credit has not been capped

What we found

Steps have been taken to improve the accuracy of reporting

on the film tax credit’s economic impact and evaluate the

impact of state tax benefits more broadly. However, the

credit has not been capped to control its growth, as

recommended.

Economic Impact of the Credit

Since our audit, the Department of Economic Development

(GDEcD) has focused on direct spending by production

companies, rather than reporting on the credit’s total

economic impact. Our original audit noted that GDEcD’s

economic impact calculations used an inflated multiplier,

which nearly doubled the credit’s impact. (The multiplier

estimates the film vendors’ and employees’ additional

spending in the state, which increases economic impact

above the production companies’ direct spending. The

additional spending is known as indirect and induced.)

GDEcD has improved its reporting on film jobs but has still

misrepresented distribution jobs as resulting from

production-related spending. While the credit supports film

production in the state, GDEcD had previously included film

distribution jobs (e.g., movie theater workers) when

publicizing credit-related spending, tying the credit to

inflated job numbers. Since our original audit, GDEcD no

longer includes industry-wide job totals in its annual press

releases on film production spending. However, it has still

attributed wages that are unrelated to credit spending. For

example, GDEcD claimed that Georgia-filmed productions

“delivered” $9.2 billion in wages,

1

but this amount included

wages from distribution-related jobs (which are outside these

productions), which GDEcD did not disclose.

Additionally, the General Assembly has passed legislation to

initiate evaluations of tax provisions like the film tax credit. Our original report noted that decision

makers and the general public needed additional information to properly assess the costs and benefits

of the film tax credit. In 2021, the General Assembly passed Senate Bill 6, which provides for economic

analyses of tax benefits, such as credits, deductions, and exemptions. Benefits are evaluated upon a

request from the chairperson of the House Ways and Means Committee or the Senate Finance

Committee.

Due to the resources necessary to accurately evaluate the economic and fiscal impacts of the credit, we

did not update the analysis performed for our original report. We did, however, review federal

employment figures

2

and found approximately 16,500 jobs in film production in Georgia in 2019, an

increase of 51% over the 10,900 reported in 2016, likely due to increased production activity.

Credit Cap

Despite the growth in the film tax credit, there has been no legislation passed to cap the credit. The

Senate Finance Committee included a cap in 2022 legislation, but the cap was removed prior to final

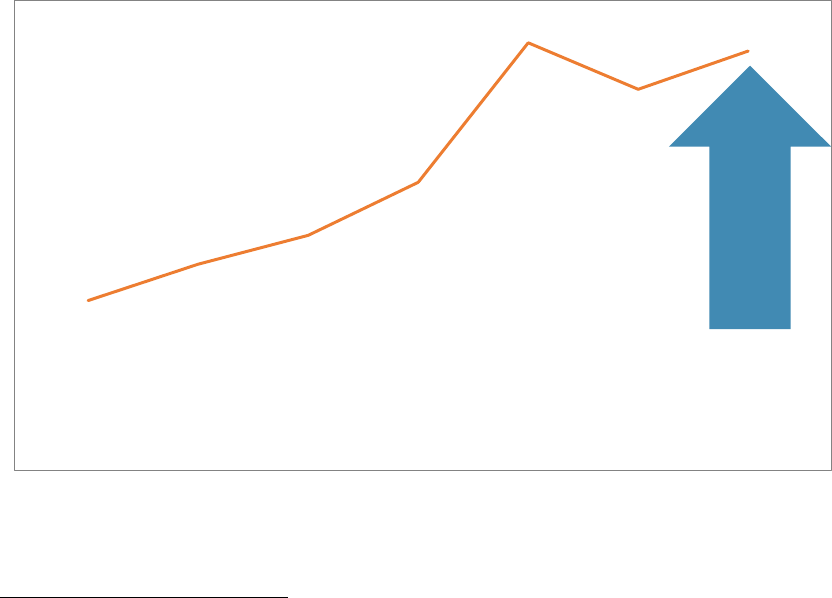

passage of the bill. As shown in Exhibit 1, the credit has more than doubled since 2013, reaching $961

million in tax year 2019. It remains the state’s largest income tax credit and the largest film incentive in

the country. Additionally, due to the carryforward period, the state has a large amount of outstanding

film tax credits. As of June 2022, the Department of Revenue (DOR) reported $1.4 billion in credits

that had been earned by production companies but had not yet been claimed (for credits earned

through tax year 2019).

Exhibit 1

Film Tax Credits

1

Increased Significantly, Tax Years 2013-2019

Production companies typically sell their film tax credits to other taxpayers because they have little to

no Georgia income tax liability.

3

Our original report presented preliminary statistics for credits

generated in tax year 2016. Updated figures indicate that approximately 97% of credits generated in tax

2

These figures are published by the U.S. Bureau of Labor Statistics in the Quarterly Census of Employment and Wages. The jobs

include temporary and part-time jobs but do not include self-employed workers.

3

The increased production activity in Georgia does not increase income taxes owed by companies because income taxes owed

are based on sales (or other receipts), not production costs.

$407 M

$487 M

$552 M

$669 M

$979 M

$876 M

$961 M

2013 2014 2015 2016 2017 2018 2019

1

Amounts for recent years could change because companies can submit amended returns for three years after

the due date, and credits may be adjusted due to DOR audit.

Source: Due to data limitations, the source varied by year: GDEcD application data, 2013-2014; DOR reporting,

2015; DOR Business Credit Manager data, 2016-2019

More than

$4.9 Billion

generated

+

136

%

since 2013

year 2016 were transferred to another taxpayer (e.g., sold), while less than 1% of credits were used by

the production companies against their own income tax liability or their employee income tax

withholding.

4

Benefits Accruing to Other States

Film tax credit provisions have not been changed to reduce economic benefits flowing to other states.

Our original audit noted that most states incentivized hiring residents over nonresidents, but Georgia

did not. As such, nonresidents and out-of-state vendors can provide services within the state, and the

expenditures qualify for the credit. Our original audit also found that while most jobs (80%) were held

by Georgia residents, most wages (53%) went to nonresidents, who typically hold the higher paying jobs

(e.g., principal actors).

However, newly required audits may reduce ineligible out-of-state expenditures. House Bill 1037,

passed in 2020, mandates audits for all film projects receiving the credit, and DOR has improved its

audit procedures. While expenditures for nonresident wages and out-of-state vendors are still eligible

for the credit, these changes should reduce ineligible expenditures for work performed outside the

state, which were unlikely to be identified prior to our original audit.

GDEcD’s Response: GDEcD generally agreed with or had no comment on the current status as

presented in the following table. Where applicable, additional GDEcD comments are included in the

table.

The following table summarizes the findings and recommendations in our 2020 report and actions

taken to address them. A copy of the 2020 performance audit report 18-03B may be accessed at Impact

of the Georgia Film Tax Credit.

4

While DOR data does not differentiate between sales, affiliate transfers, and pass-throughs to company owners, the consensus

is that most credits are sold because the companies have little Georgia income tax liability. Additionally, the remaining credits

from 2016 could still be transferred or used by the companies due to late or amended returns.

Impact of the Georgia Film Tax Credit

1

Impact of the Georgia Film Tax Credit

Follow-Up Review, October 2022

Original Findings/Recommendations

Current Status

Finding 1: Projects receiving the film tax credit in

2016 had a net impact of $2.8 billion on the state's

economy.

No recommendation

No action required

Finding 2: Tax revenue generated as a result of

the economic activity inspired by the film tax

credit offsets only a small portion of the credit.

No recommendation

No action required

Impact of the Georgia Film Tax Credit

2

Impact of the Georgia Film Tax Credit

Follow-Up Review, October 2022

Original Findings/Recommendations

Current Status

Finding 3: The impact of the film tax credit on the

state’s economy has been significantly

overstated, leaving decision makers without

accurate information necessary to assess the

credit.

Our review found that GDEcD had overstated the

economic impact of the film tax credit. For more

than 30 years, GDEcD had used a 3.57 multiplier to

estimate total impact. This multiplier was higher

than any known industry multiplier in Georgia and

nearly twice the 1.84 multiplier found in our study.

Additionally, GDEcD reported misleading jobs data

by including jobs unrelated to production (e.g.,

movie theater workers) when discussing credit-

related spending. GDEcD also included jobs held

by nonresidents in project press releases and

agency performance measures.

We recommended that GDEcD use a reasonable

multiplier to estimate economic impact, avoid

including jobs unrelated to production when

discussing the credit, and collect information on

the number of jobs held by Georgia residents,

while discussing resident and nonresident jobs

separately.

Partially Addressed – After our review, GDEcD changed how

it publicizes the credit’s impact on the state’s economy.

However, GDEcD’s reporting on film production jobs is still

misleading at times.

GDEcD no longer publicizes overall economic impact and as

such does not rely on a multiplier to estimate additional

spending by film vendors and employees (i.e., indirect and

induced spending). Instead, GDEcD has begun reporting

production companies’ direct spending, which is the amount

the companies report they plan to spend in Georgia. For

example, GDEcD reported in its annual press release that

production companies spent $4 billion in fiscal year 2021.

GDEcD reporting on job figures has been more mixed. It has

stopped publicizing the overall number of film industry jobs

in its annual press release, which had included jobs unrelated

to production. However, other reported numbers have still

tied credit-related production spending to nonproduction

jobs. For example, GDEcD reported that productions filmed in

Georgia in 2019 “delivered” $9.2 billion in total wages, but it

did not disclose that those wages also included distribution

jobs (e.g., movie theater workers) unrelated to production, as

well as the indirect and induced jobs supported by them.

Additionally, federal data showed approximately 10,700

Georgia jobs

5

in film production in 2020, while GDEcD

reported “tens of thousands of Georgians” were employed in

film production. For job numbers, GDEcD typically relies on

the Motion Picture Association, which represents film studios

that benefit from the credit.

Regarding jobs held by residents, GDEcD edited its project

expenditure form to request the number of Georgia

residents hired (in addition to all hires). This can be used to

more accurately present information on “Georgians hired” in

press releases for individual projects. However, GDEcD has

not changed its agency performance measure to exclude

nonresident workers from “work days created by film and

television production.”

GDEcD’s Response: While GDEcD agrees with the status, it

“stands by its reporting of the direct spend and job figures

related to the film industry in Georgia, as this information

comes directly from its expenditure form collected from all

applicants, as well as other reputable sources.”

5

The number of workers in film production is typically lower than the number of jobs. Workers can hold multiple jobs when

they move to a new job once a production (e.g., movie or commercial) is completed. Jobs may also be held by nonresidents.

Impact of the Georgia Film Tax Credit

3

Impact of the Georgia Film Tax Credit

Follow-Up Review, October 2022

Original Findings/Recommendations

Current Status

Finding 4: A significant portion of the credit’s

benefits accrue to other states.

Our report noted that 88% of the 2016 credit went

to production companies with no permanent

locations in Georgia, and 53% of wages used

toward the credit were paid to nonresidents.

Nonresidents typically hold higher paying jobs

such as principal actors, directors, and department

heads. Most other states (65%) with a film incentive

had provisions that required or incentivized hiring

residents over nonresidents, but Georgia’s credit

did not. Additionally, production companies could

use out-of-state vendors for on-site services. We

also noted that most projects were not audited,

and for those that were, auditors did not always

identify and disallow out-of-state expenditures.

We recommended that the General Assembly

consider changing the credit’s provisions to

reduce credits allowed for out-of-state workers

and service providers.

Partially Addressed –While the General Assembly did not

change statutory provisions that allow expenditures for out-

of-state vendors and workers, it did pass a new audit

requirement to identify ineligible expenditures. This provision

from House Bill 1037 should reduce credit amounts earned

for expenditures incurred outside the state.

No changes have been made to incentivize hiring Georgia

residents over out-of-state workers and service providers. As

a result, productions receive the same incentive (up to 30%)

for hiring nonresidents, allowing significant economic benefits

from the credit to flow to other states.

However, changes were made in response to our report on

the credit’s administration, which recommended mandatory

audits and stronger controls to prevent ineligible out-of-state

expenditures. (The follow-up report is available at:

Administration of the Georgia Film Tax Credit.) In 2020, the

General Assembly passed House Bill 1037, which clarified that

expenditures are only eligible for the credit if they occur in

Georgia. For example, nonresident wages are still eligible for

the credit, but only if the work is performed in-state. The

legislation also required audits for any film project

6

receiving

the credit, which should help to detect and disallow ineligible

out-of-state expenditures. Additionally, DOR (which oversees

the audits) implemented new standards for expenditure

eligibility that better consider economic impact, such as

requiring auditors to assess where services were performed

and disallowing most goods shipped from out-of-state by an

in-state vendor.

GDEcD’s Response: “GDEcD contends that the legislature

addressed this finding in HB 1037, by requiring mandatory

audits on all productions. Further, GDOR has addressed this

finding through its related audit procedures. It is within the

legislature’s purview to decide whether to take additional

action related to this finding.”

6

Projects from qualified interactive entertainment production companies are exempt from the audit requirement.

Impact of the Georgia Film Tax Credit

4

Impact of the Georgia Film Tax Credit

Follow-Up Review, October 2022

Original Findings/Recommendations

Current Status

Finding 5: Most states with a film incentive have

program caps to limit the fiscal risk to the state.

Most other states (87%) with a film incentive have

a cap to limit the total incentive amount (a

program cap) and/or a cap for individual projects.

However, Georgia did not cap its credit (with the

exception of qualified interactive entertainment

companies). As a result, film tax credits had grown

to $915 million in 2017 (as of March 2019) and

represented an increasing percentage of state

income tax receipts each year. During our review,

Georgia had the largest film incentive of any state.

We recommended that the General Assembly

consider options for capping the film tax credit to

reduce the fiscal risk to the state. Alternatively, the

General Assembly could consider other provisions

to reduce the cost of the credit, such as excluding

above-the-line (e.g., principal actors, directors) or

nonresident wages.

Partially Addressed – Though considered during the 2022

legislative session, no cap on the film tax incentive has been

implemented.

In 2022, the Senate Finance Committee passed a version of

House Bill 1437 that would have capped the film tax credit at

$900 million per year. However, this provision was removed

prior to final passage of the bill.

The annual credit amount has grown since our audit. As

shown in Exhibit 1, the credit reached approximately $961

million in 2019. Though actual credit amounts cannot yet be

determined for more recent years, GDEcD estimates for fiscal

years 2021 and 2022 exceed $1 billion, making Georgia’s the

largest film incentive of any state. New York and California

7

have the next largest incentive amounts, which are capped

at $420 million per year.

As a percentage of state income tax receipts, the credit has

grown in a pattern similar to Exhibit 1. The credit reached

8.2% of income tax collections in 2017, before falling to 6.9%

in 2018 and rising again to 7.1% in 2019.

In addition, our original report noted that outstanding film tax

credits had reached $1.7 billion as of March 2019. These were

credits already earned by production companies (through tax

year 2017) but not yet claimed against taxes. DOR indicated

this amount had fallen to $1.4 billion in outstanding credits

(through tax year 2019), as of June 2022. The decrease is

likely due to production shutdowns during the COVID-19

pandemic (resulting in fewer credits earned) and delays in

earning the credit due to the new audit requirement from

House Bill 1037.

7

California’s credit is typically capped at $330 million. However, the cap was increased to $420 million in 2021 for a period

of two years.

Impact of the Georgia Film Tax Credit

5

Impact of the Georgia Film Tax Credit

Follow-Up Review, October 2022

Original Findings/Recommendations

Current Status

Finding 6: Limited information has been available

to decision makers and the general public

regarding the film tax credit.

Our report noted that Georgia had no process in

place for evaluating the film tax credit or other

incentives. We also found that Georgia did not

permit disclosure of individual companies or

projects receiving the credit, unlike most other

states (74%) with a film incentive.

We recommended that the General Assembly

consider requiring periodic, objective evaluations

of the film tax credit program and amending state

law to require DOR to disclose the production

company, production name, and credit amount for

each project receiving the credit.

Partially Addressed – The General Assembly passed

legislation to provide for economic evaluations of tax

benefits. However, no changes were made to require or

allow the disclosure of projects receiving the film tax credit.

In 2021, the General Assembly passed Senate Bill 6, known as

the “Tax Credit Return on Investment Act of 2021.” Effective

July 2021, the legislation allows the General Assembly to

request economic analyses of tax benefits, such as credits,

deductions, and exemptions. The chairpersons of the House

Ways and Means Committee and the Senate Finance

Committee may each request analyses of up to five specific

provisions per year. The Department of Audits and Accounts

contracts with economists to conduct the analyses, which

must include net change in state revenue, net change in

state expenditures, net change in economic activity, and net

change in public benefit (if applicable). Under Senate Bill 6,

analyses on two tax credits, Georgia Agribusiness and Rural

Jobs Act and low-income housing, have already been

published.

The General Assembly has not passed legislation requiring

the disclosure of projects or companies receiving the film tax

credit.

6 Findings

0 Fully Addressed

4 Partially Addressed

0 Not Addressed

2 No Recommendations

This page intentionally left blank