1

Additional Actions Need to Be Taken to Identify and

Address Noncompliant Biofuel Tax Credit Claims

April 24, 2024

Report Number: 2024-300-021

This report has cleared the Treasury Inspector General for Tax Administration disclosure review process and

information determined to be restricted from public release has been redacted from this document.

TIGTACommunications@tigta.treas.gov | www.tigta.gov

TREASURY INSPECTOR GENERAL FOR TAX ADMINISTRATION

HIGHLIGHTS: Additional Actions Need to Be Taken to Identify

and Address Noncompliant Biofuel Tax Credit Claims

Final Audit Report issued on April 24, 2024 Report Number 2024-300-021

Why TIGTA Did This Audit

Since Congress enacted legislation

creating biofuel tax credits in

Calendar Year 2004, the IRS has

been susceptible to significant

fraudulent schemes that have

resulted in the payment of

erroneous refunds. The most

egregious scheme (one of the

largest fraud schemes in U.S.

history) resulted in over $500

million in erroneous refunds paid

to one entity making fraudulent

claims. With the passage of

additional and expanded clean

energy tax credits in the Inflation

Reduction Act of 2022, there is

even greater incentive to take

advantage of biofuel tax credits

and make fraudulent claims for

biofuel that does not exist or does

not qualify for the biofuel tax

credits. This audit was initiated to

assess the effectiveness of IRS

procedures to detect and prevent

questionable claims for biofuel tax

credits.

Impact on Tax Administration

The Inflation Reduction Act of

2022 extended biofuel tax credits

through December 31, 2024, to

encourage the production of

cleaner energy sources. This

includes tax credits for biodiesel,

renewable diesel, alternative fuels,

and second-generation biofuels.

The Joint Committee on Taxation

estimates that taxpayers will claim

over $5.6 billion of these tax

credits during Fiscal Years 2023

through 2025.

What TIGTA Found

The IRS is not using all of the compliance tools to encourage more

tax compliance of biofuel tax claims. Internal Revenue Code Section

4101 requires applicable taxpayers to register with the IRS before

producing or importing biofuels. Additionally, certain taxpayers

claiming biodiesel-related tax credits are not required to be

registered but must provide a Certificate of Biodiesel from the

producer showing that the biodiesel used to produce the mixture

met the Environmental Protection Agency’s (EPA) biodiesel

specification and registration requirements. TIGTA analysis found

that 42 of 124 taxpayers sampled, that claimed biofuel tax credits

totaling about

$30.3 million, did

not provide either

an approved

registration

number or a

Certificate of

Biodiesel;

therefore, these claims would not be allowable. Under current law,

the IRS could only address these claims after the returns are filed and

examined and it issues notices of deficiency to the taxpayers, as

appropriate. The IRS does not have the legal authority to deny

biofuel tax credits or otherwise enforce the registration requirements

on taxpayers who are not eligible to receive the credits at the time a

tax return is filed.

TIGTA found that the IRS’s compliance efforts are primarily focused

on biofuel tax credit claims made on the Form 8849, Schedule 3,

Certain Fuel Mixtures and the Alternative Fuel Credit

, and Form 720,

Schedule C,

Claims

, and more effective efforts could be undertaken

to evaluate claims made on the Form 4136,

Credit for Federal Tax

Paid on Fuels

.

What TIGTA Recommended

TIGTA recommended that the IRS: 1) engage with the Department of

the Treasury’s Office of Tax Policy to develop a legislative proposal to

ensure taxpayers claiming biofuel tax credits are entitled to the

biofuel credit claims and are properly registered or provide the

required Certificate of Biodiesel with income tax returns; 2) conduct

examinations of the 42 taxpayers we identified to ensure the validity

of the credits claimed; 3) examine more Forms 4136, involving biofuel

tax credit claims; and 4) partner with the EPA to use the agency’s

expertise and data involving taxpayers that claimed biofuel tax

credits.

IRS management agreed with recommendations 1, 3 and 4 and

partially agreed with recommendation 2.

U.S. DEPARTMENT OF THE TREASURY

WASHINGTON, D.C. 20024

TREASURY INSPECTOR GENERAL

FOR TAX ADMINISTRATION

April 24, 2024

MEMORANDUM FOR: COMMISSIONER OF INTERNAL REVENUE

FROM: Matthew A. Weir

Acting Deputy Inspector General for Audit

SUBJECT: Final Audit Report – Additional Actions Need to Be Taken to Identify

and Address Noncompliant Biofuel Tax Credit Claims

(Audit No. 202330023)

This report presents the results of our review to assess the effectiveness of Internal Revenue

Service (IRS) procedures to detect and prevent questionable claims for biofuel tax credits. This

review is part of our Fiscal Year 2024 Annual Audit Plan and addresses the major management

and performance challenge of

Tax Fraud and Improper Payments

.

Management’s complete response to the draft report is included as Appendix VI. If you have

any questions, please contact me or Phyllis Heald London, Acting Assistant Inspector General for

Audit (Compliance and Enforcement Operations).

Additional Actions Need to Be Taken to Identify and Address Noncompliant Biofuel Tax Credit Claims

Table of Contents

Background .....................................................................................................................................Page 1

Results of Review .......................................................................................................................Page 6

Biofuel Tax Credit Claims Were Allowed for Taxpayers That

Were Not Properly Registered or Did Not Provide Proper

Certification Documentation .......................................................................................... Page 6

Recommendation 1: ...................................................................Page 9

Recommendation 2: ...................................................................Page 10

Steps Can Be Taken to More Effectively Identify Noncompliant

Biofuel Tax Credit Claims ..................................................................................................Page 10

Recommendation 3: ...................................................................Page 13

Data Obtained From the Environmental Protection

Agency Could Help Identify Noncompliant Taxpayers and

Fraudulent Schemes ............................................................................................................Page 13

Recommendation 4: ...................................................................Page 18

Appendices

Appendix I – Detailed Objective, Scope, and Methodology ................................Page 19

Appendix II – Outcome Measure ...................................................................................Page 21

Appendix III – Internal Revenue Code Sections Related to the

Biofuel Tax Credit .................................................................................................................Page 23

Appendix IV – Tax Forms Related to the Biofuel Tax Credit ................................Page. 24

Appendix V – Current Examination Initiatives Related to the

Biofuel Tax Credit .................................................................................................................Page 25

Appendix VI – Management’s Response to the Draft Report .............................Page 27

Appendix VII – Glossary of Terms ..................................................................................Page 32

Appendix VIII – Abbreviations .........................................................................................Page. 34

Page 1

Additional Actions Need to Be Taken to Identify and Address Noncompliant Biofuel Tax Credit Claims

Background

History of biofuel tax credits

The Internal Revenue Code (I.R.C.) allows several tax credits for the production, blending, or use

of biofuels.

1

These credits impact a relatively small number of taxpayers compared to other tax

credits. For instance, individuals filed approximately 1.2 million claims for the Fuel Tax Credit on

the Form 1040,

U.S. Individual Income Tax Return

, during Processing Years 2018 through 2021.

2

During a similar period, taxpayers filed a fraction of that amount in biofuel tax credit claims.

The biodiesel tax credit (the most prevalent biofuel credit) was first established with the

American Jobs Creation Act of 2004, and the renewable diesel tax credit was established a year

later with the passage of the Energy Policy Act of 2005.

3

The alternative fuel tax credits were

first established with the passage of the Safe, Accountable, Flexible, Efficient Transportation

Equity Act in 2005.

4

Since then, these fuel tax credits have been extended through legislation

numerous times. Most recently, the Inflation Reduction Act of 2022 (IRA), signed into law on

August 16, 2022, extended these credits through December 31, 2024.

5

The Joint Committee on

Taxation estimates that for Fiscal Years 2023 through 2025, taxpayers will claim $5.6 billion in

these credits.

The second generation biofuel producer credit was first established with the Food Conservation

and Energy Act of 2008.

6

Since then, it has been extended several times, most recently, with the

IRA extending these credits through December 31, 2024.

7

The Joint Committee on Taxation

estimates that for Fiscal Years 2023 through 2025 taxpayers will claim $54 million in these

credits.

1

For purposes of this audit, the term biofuels will encompass biodiesel (one of the most common), renewable diesel,

alternative fuels, and second generation biofuels. See Appendix VI for a glossary of terms.

2

Treasury Inspector General for Tax Administration, Report No. 2023-30-053,

Actions Have Been Taken to Enhance

Fuel Tax Credit Screening and Examination Processes; However, Improvements Are Still Needed

(Sept. 2023).

3

H.R. 4520, P.L. 108-357 and H.R. 6, P.L. 109-58.

4

H.R. 3, P.L. 109-59. See Appendix IV for the various credits and forms.

5

Inflation Reduction Act (IRA), Pub. L. No. 117-169, 136 Stat. 1818

Extension of Incentives for Biodiesel, Renewable

Diesel, and Alternative Fuels

(Section 13201) (2022).

6

H.R. 6124, P.L. 110-246. This tax credit was introduced as the cellulosic biofuel producer credit but was renamed

second generation biofuel with the American Taxpayer Relief Act of 2012, H.R. 8, P.L. 112-240, 126 Stat. 2313.

7

IRA, Pub. L. No. 117-169, 136 Stat. 1818,

Extension of Second Generation Biofuel Incentives

(Section 13202) (2022)

.

Page 2

Additional Actions Need to Be Taken to Identify and Address Noncompliant Biofuel Tax Credit Claims

Biodiesel and renewable diesel credits

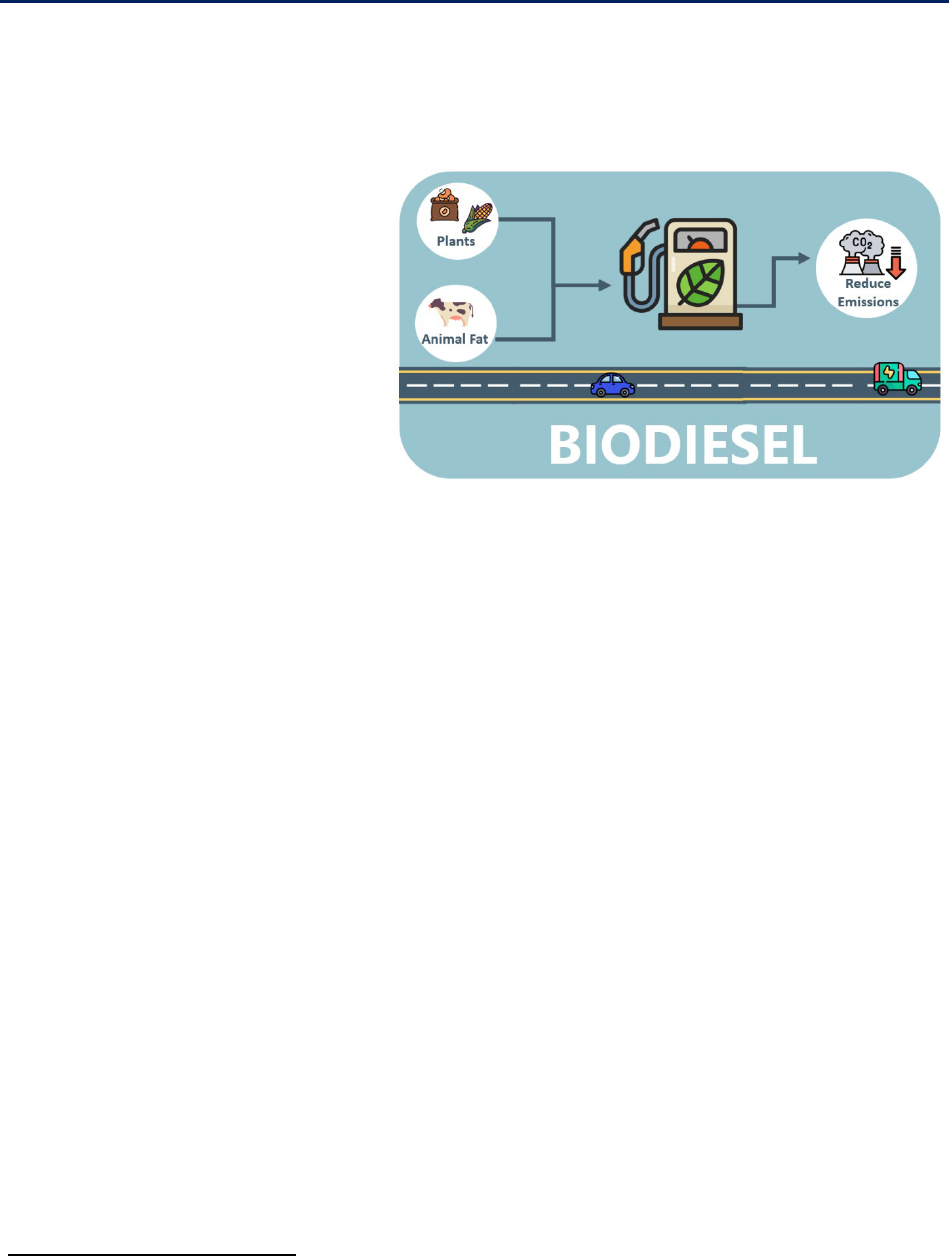

Biodiesel fuel is considered an alternative to petroleum-based transportation fuel. In the United

States, biodiesel is typically made from soybeans and other plant oils, animal fats, and recycled

cooking oils. The use of biodiesel instead of conventional diesel fuel is believed to reduce

particulate matter and hydrocarbon

emissions. Renewable diesel is a fuel

made from fats and oils, such as

soybean oil or canola oil, and is

processed to be chemically the same

as petroleum diesel.

I.R.C. § 6426(a) and (c) allows a

$1.00 per gallon credit against a

taxpayer’s excise tax liability on

taxable fuel under I.R.C. § 4081 for

blended biodiesel, renewable diesel,

and agri-biodiesel. The taxpayers that typically pay excise taxes are those blenders of biodiesel

that purchased the diesel to create the qualifying biodiesel mixtures.

Pursuant to I.R.C. § 6427(e), a payment is allowable to the blender of the mixture to the extent

the tax credits exceed the blender’s excise tax liability under I.R.C. § 4081. Under I.R.C. § 34, the

biodiesel mixture credit described in I.R.C. § 6426 exceeds a person’s I.R.C. § 4081 liability for the

quarter of a tax year, an income tax credit is allowable to the producer of the mixture.

8

I.R.C. § 40A provides a nonrefundable credit for:

• A biodiesel mixture tax credit for the production of a qualified biodiesel mixture sold for

use as a fuel or used as a fuel in the taxpayer’s trade or business.

• A biodiesel tax credit used by the taxpayer in a trade or business or sold by the taxpayer

for fuel in a buyer’s vehicle.

9

The biodiesel tax credit for any tax year is $1.00 for each gallon of biodiesel or qualified

biodiesel mixture.

Alternative fuel credit

Alternative fuels include liquefied petroleum gas, compressed or liquefied natural gas,

compressed or liquefied gas derived from biomass, and liquid fuel derived from biomass.

10

I.R.C. § 6426(d) provides an alternative fuel credit of $0.50 for each gallon of alternative fuel or

gasoline gallon equivalents of a nonliquid alternative fuel sold by the taxpayer for use as a fuel

in a motor vehicle or motorboat. Like biodiesel and agri-biodiesel mixtures, any excess over the

tax liability may be claimed as a payment under I.R.C. § 6427(e) or under I.R.C. § 34.

8

Notice 2020-8,

Biodiesel and Alternative Fuels; Claims for 2018-2019.

9

I.R.C. § 40A(b)(1) and I.R.C. § 40A(b)(2).

10

The IRA removed liquefied hydrogen from the definition of alternative fuel under I.R.C. § 6426(d)(2) for the

purposes of the alternative fuel credit and alternative fuel mixture credit for fuel sold or used after

December 31, 2022.

Page 3

Additional Actions Need to Be Taken to Identify and Address Noncompliant Biofuel Tax Credit Claims

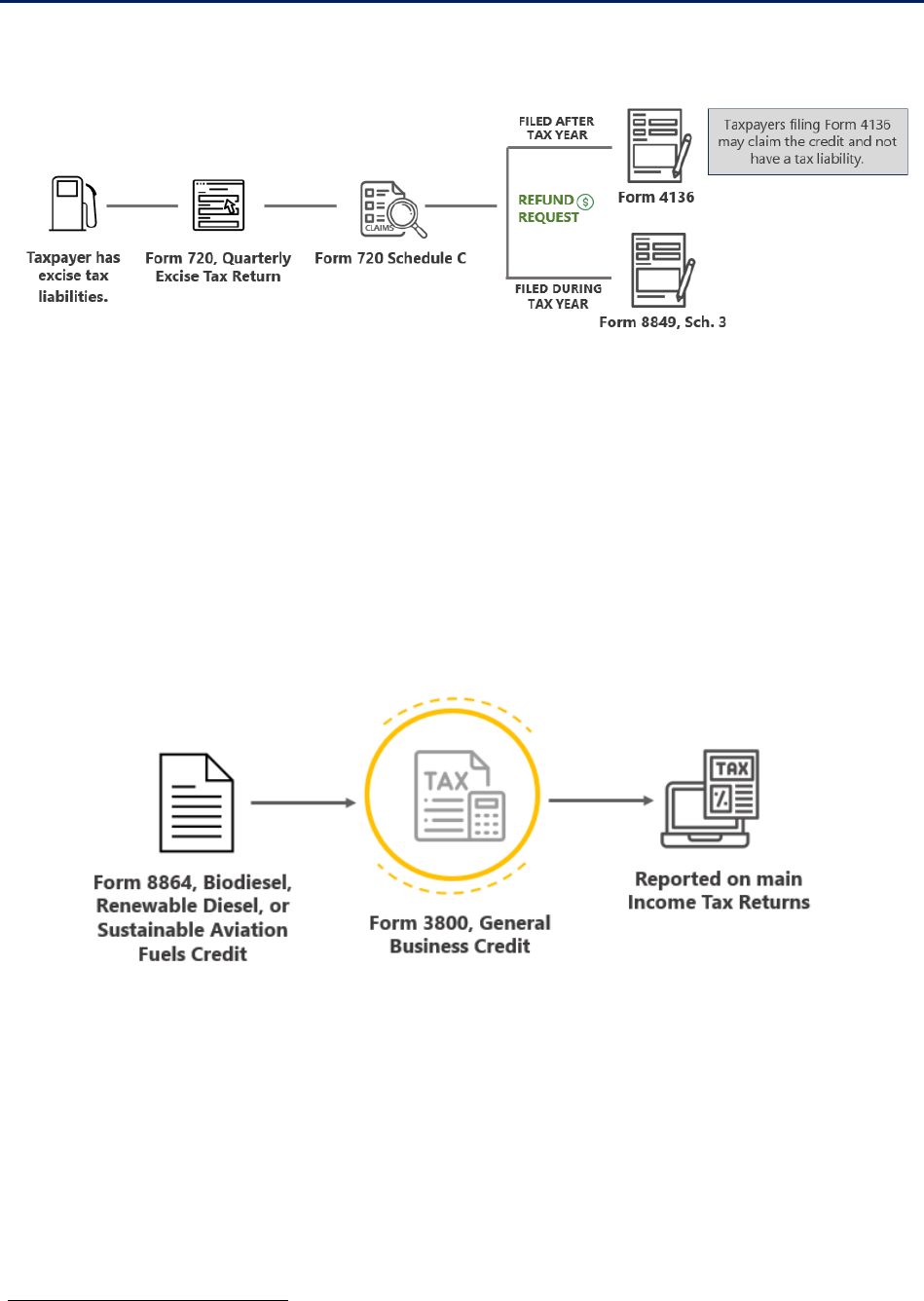

Tax forms used to claim biodiesel and alternative fuel credits

There are several different tax forms that may be used to claim the diesel-related and alternative

fuel tax credits:

1. Form 720,

Quarterly Federal Excise Tax Return

, must be filed if the taxpayer claiming the

tax credit is liable for fuel excise taxes. The blender of the biodiesel is liable for the

excise tax upon sale or removal of blended taxable fuel or the alternative fuel mixture.

The person that sells or uses alternative fuel in a motor vehicle or motorboat is liable for

excise tax on the sale or use of the alternative fuel.

2. Form 720, Schedule C,

Claims

, is filed by the taxpayer to offset any alternative fuel credit,

alternative fuel mixture credit, biodiesel or renewable diesel mixture credit, or sustainable

aviation fuel credit against taxable liabilities reported on Form 720. The Form 720,

Schedule C, cannot be used to claim tax credits unless the buyer has an excise tax

liability.

3. Form 8849,

Claim for Refund of Excise Taxes

,

Schedule 3,

Certain Fuel Mixtures and the

Alternative Fuel Credit

, is submitted by the taxpayer to request a refund for any credits in

excess of the excise taxes paid. These claims can be filed quarterly or even weekly

during the tax year. The excess can also be claimed on Form 720, Schedule C.

4. Form 4136,

Credit for Federal Tax Paid on Fuels

,

is used to claim biodiesel, renewable

diesel, and alternative fuel credits as refundable income tax credits on the taxpayer’s

Federal income tax return when any amount of biodiesel, renewable diesel, or alternative

fuel have not been claimed on the Form 8849, Schedule 3, or Form 720, Schedule C.

In addition, the taxpayer can use Form 8864,

Biodiesel and Renewable Diesel, or Sustainable

Aviation Fuels Credit

, to offset income tax liability, but the credit is otherwise nonrefundable.

The credits claimed on Form 8864 are recorded on the Form 3800,

General Business Credit

.

Form 3800 is used to summarize all the various business credits and to calculate the total

General Business Credit amount allowed in the current tax year. The amount is also reported on

the main income tax form such as the Form 1040 or Form 1120,

U.S. Corporation Income Tax

Return

, to offset tax liability.

Only one credit may be claimed for any one gallon of biodiesel or renewable diesel. If any

amount is claimed (or will be claimed) of biodiesel or renewable diesel on Form 720, Schedule C;

Form 8849, Schedule 3; or Form 4136, a claim cannot be made on Form 8864 for that amount of

biodiesel or renewable diesel. Figure 1 illustrates the process of paying excise taxes and

claiming the credits for the excise taxes paid, including claiming refundable excise tax credits.

Page 4

Additional Actions Need to Be Taken to Identify and Address Noncompliant Biofuel Tax Credit Claims

Figure 1: The Process for Taxpayers to Claim Excise Tax Credits

Source: Treasury Inspector General for Tax Administration (TIGTA) created graphic.

While these credits can be used only to offset tax liability and are not otherwise refundable,

taxpayers can carry any unused General Business Credit back or forward on subsequently filed

returns. A TIGTA audit found that only about 23 percent of the total amount claimed by

business taxpayers on the Form 3800 was used to offset tax. The remaining unused credits were

available to carryback or carryforward.

11

Figure 2 illustrates the process for claiming the

nonrefundable biodiesel credit.

Figure 2: The Process for Claiming the Nonrefundable Biodiesel Income Tax Credit

Source: TIGTA-created graphic.

Second generation biofuel producer credit (or otherwise termed Cellulosic)

Second generation biofuel is produced from feedstocks such as wood crops, grass, or

non-edible parts of plants. As with biodiesel and renewable diesel production, second

generation biofuel is produced through specialized processes. The tax credit for production of

11

TIGTA, Report No. 2015-40-012,

Processes Do Not Ensure That Corporations Accurately Claim Carryforward General

Business Credits

(Feb. 2015).

Page 5

Additional Actions Need to Be Taken to Identify and Address Noncompliant Biofuel Tax Credit Claims

second generation biofuels allows qualified taxpayers a $1.01 per gallon tax credit.

12

The

taxpayers that claim this credit are the producers of second generation biofuels.

This nonrefundable tax credit is calculated and claimed on Form 6478,

Biofuel Producer Credit

.

Like the biodiesel tax credits, these calculated tax credits are then recorded on the Form 3800.

As stated previously, the Form 3800 is used to summarize all the various business credits and to

calculate the total General Business Credit amount allowed in the current tax year. The amount

used for the current year by the taxpayer to offset taxes owed is then reported on the parent

income tax form such as the Form 1040 or Form 1120. The amount used is generally limited to

the amount of tax owed. Taxpayers can carry any unused General Business Credit back or

forward on subsequent filed income tax returns. Figure 3 illustrates the process for claiming the

credit.

Figure 3: The Process for Claiming the Nonrefundable

Second Generation Biofuel Producer Credit

Source: TIGTA-created graphic.

Most biofuel tax credits are claimed on Form 8849, Schedule 3

To gain perspective on the number and amounts of biofuel tax credit claims, we requested

statistical information from the Internal Revenue Service (IRS) on the number claimed in recent

years, and the IRS referred us to Statistics of Income Division data. However, the Statistics of

Income data did not contain Form 8849, Schedule 3, data. We therefore relied on data from the

Modernized Tax Return Database to identify biofuel tax credit claims made during Processing

Years 2020 through 2023 (Tax Years 2019 through 2022) on the Form 8849, Schedule 3; Form

4136; Form 8864; and Form 6478. However, this only provided us with information from tax

returns that were filed electronically.

Our analysis of data from the Modernized Tax Return Database found that the highest biofuel

tax credit claims are made using the Form 8849, Schedule 3.

13

Specifically, from Tax Years 2019

through 2022 almost 1,500 claims were made for over $3.5 billion using the Form 8849,

12

I.R.C. § 40(a)(4) and (b)(6).

13

The numbers in this paragraph are approximations from our analysis.

Page 6

Additional Actions Need to Be Taken to Identify and Address Noncompliant Biofuel Tax Credit Claims

Schedule 3. Over the same period, more than 16,000 claims totaling over $600 million were

made on the Form 4136. Almost 12,000 claims were made for about $100 million on the

Form 8864 and just over 2,000 claims for about $33 million were made on the Form 6478.

The most prevalent refundable biofuel tax credits claimed on the Form 8849, Schedule 3, and

Form 4136 include agri-biodiesel mixtures, biodiesel mixtures, and renewable diesel mixtures.

Among the alternative fuel credits claimed, the liquefied petroleum gas and compressed natural

gas were claimed the most.

14

IRS biofuel tax credit responsibilities

The IRS is responsible for the administration of biofuel tax credits. While these credits might be

questioned by any revenue agent during an examination, overall responsibility for the Federal

Fuel Tax Program areas falls under the Excise Tax Program of the Small Business/Self-Employed

(SB/SE) Division. The SB/SE Division Excise Tax Program is the responsibility of the Specialty

Examination Director. This program is responsible for conducting a wide variety of fuel-related

examinations, inspections, and compliance reviews for the taxes related to biofuels.

The SB/SE Division, Excise Tax Policy, is responsible for the administration, procedures, and

updates related to the Fuel Tax Program. The SB/SE Division Excise Case Selection (ECS)

function is responsible for following policy guidance on the selection of cases and delivery of

inventory for examination, and SB/SE Division Specialty Examination – Field is responsible for

conducting those examinations. Criminal Investigation (CI) is responsible for conducting

criminal investigations involving fraudulent biofuel tax credit claims.

Results of Review

Biofuel Tax Credit Claims Were Allowed for Taxpayers That Were Not Properly

Registered or Did Not Provide Proper Certification Documentation

Our review found that the IRS does not address improper biofuel tax credit claims during filing

because it lacks legal authority to do so and can only address these claims during examinations.

I.R.C. § 4101 and Treasury Regulation § 48.4101-1 require taxpayers to register with the IRS

before engaging in certain excise tax activities, and in other situations, a taxpayer must be

registered in order to file a claim for refund or credit. These activities include producing or

importing biodiesel and renewable diesel, producing second generation biofuels, and creating a

blended taxable fuel.

According to the SB/SE Division, Specialty Examination Policy, claimants of the biodiesel and

renewable diesel tax credits are not required to be registered under I.R.C. § 4101. However,

claimants must provide a certificate from the importer or producer showing that the biodiesel or

renewable diesel used to produce the mixture met the registration requirements. Taxpayers

14

IRS management opined that our calculations of biofuel tax credit claims may be understated because we

only analyzed claims made on electronically filed tax returns and most biofuel tax credit claims made on the

Form 8849, Schedule 3, are made using paper returns. However, IRS management was unable to provide data

on the total amount of Form 8849, Schedule 3, biofuel tax credit claims made in recent years.

Page 7

Additional Actions Need to Be Taken to Identify and Address Noncompliant Biofuel Tax Credit Claims

apply for registration by filing Form 637,

Application for Registration (For Certain Excise Tax

Activities)

, with the IRS. The SB/SE Division indicated that claims for biodiesel or renewable

diesel should not be paid unless the original importer or producer had an approved Form 637.

In the case of second generation biofuel, the producer must be registered. Figure 4 provides

the registration and certification documentation requirements for those taxpayers claiming

biofuel tax credits.

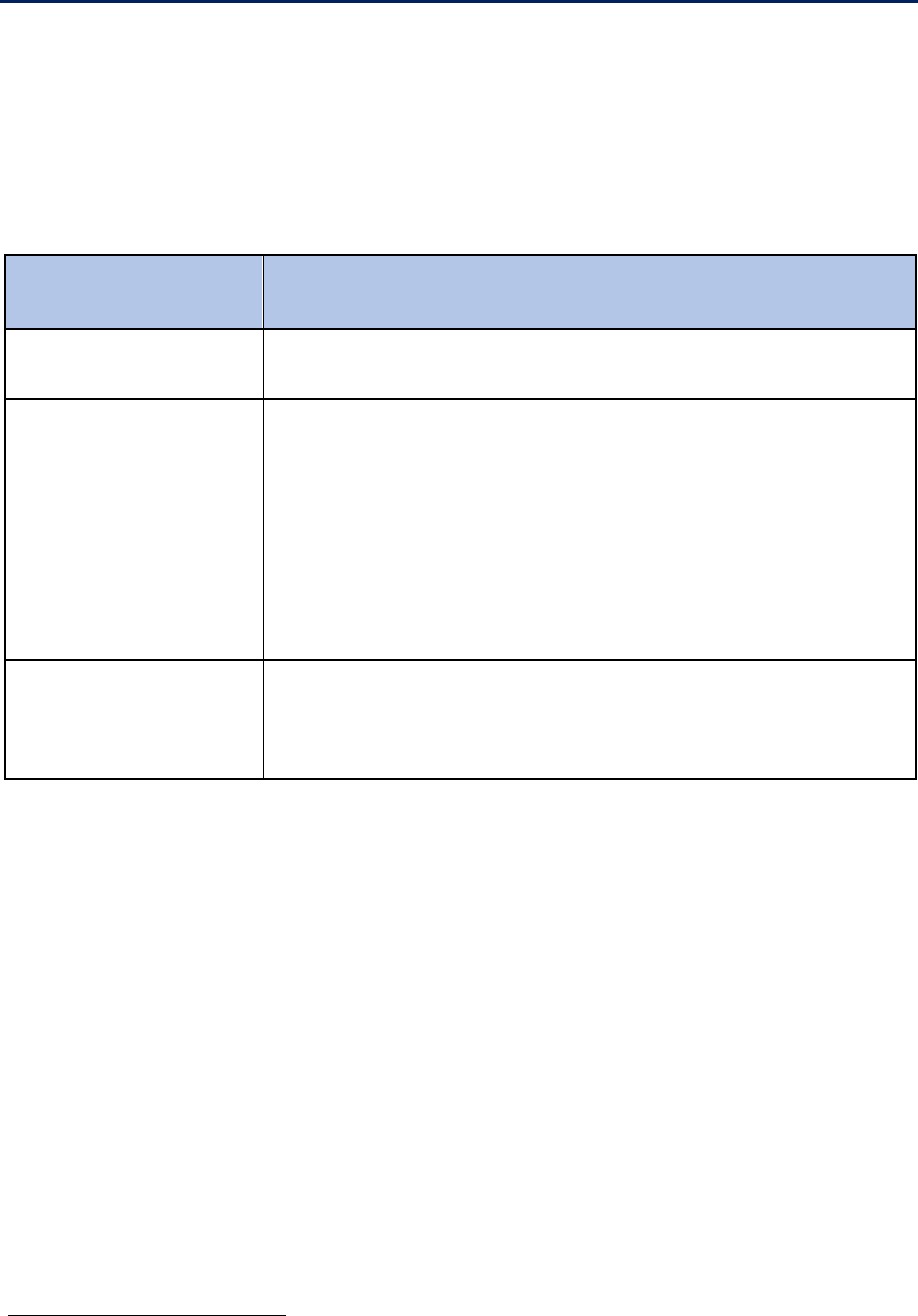

Figure 4: Biofuel Tax Credit Registration and Certification Requirements

Type of Tax

Credit Claim

Requirements

Alternative Fuel Credit

The alternative fueler (of unmixed fuel) must be registered with a Form

637 registration in order to file a claim for the alternative fuel credit.

Biodiesel and Renewable

Diesel Mixture Credit

Producers and importers of agri-biodiesel must be registered with a Form

637 registration.

Producers and importers of biodiesel (other than agri-biodiesel) are

required to be registered with a Form 637 registration.

Producers and importers of renewable diesel must be registered with a

Form 637 registration.

Blenders are required to be registered with a Form 637 registration if the

blender produces a blended taxable fuel outside the bulk

transfer/terminal system.

A certificate from the producer/importer is

required to be included with the claim for the tax credit.

Second Generation Biofuel

Tax Credit

Producers of second generation biofuel are required to register with Form

637 registration.

Registration is required to file a claim for the second generation biofuel

tax credit.

Source: SB/SE Division, Excise Revenue Agent Basic Recruit Training – Phase 2.

We selected a judgmental sample of 124 taxpayers that claimed biofuel tax credits during

Processing Year 2022 to determine if they were properly registered or if they provided the

Certificate of Biodiesel indicating that the producer of the biodiesel is registered with the IRS.

15

This included 75 business taxpayers that claimed the biodiesel or renewable diesel mixture

credits on the Form 8849, Schedule 3; Form 4136; and Form 8864, 24 business taxpayers that

claimed alternative fuel credits on the Form 4136, and 25 business taxpayers that claimed

second generation biofuel tax credits on the Form 6478.

For the 124 sample cases, we reviewed the IRS Integrated Data Retrieval System (IDRS) data and

tax return information. We found that all 25 taxpayers that made claims for biodiesel or

renewable diesel mixture credits on the Form 8849, Schedule 3, were either properly registered

with the IRS or provided the Certificate of Biodiesel. However, we found that most of the

remaining taxpayers either did not provide a valid registration number or did not provide the

Certificate of Biodiesel. Specifically, we found that taxpayers did not provide the following:

• A Certificate of Biodiesel for 10 of the 25 claims for refundable biodiesel or renewable

diesel mixture credits totaling almost $1 million made on the Form 4136. We provided

15

A judgmental sample is a nonprobability sample, the results of which cannot be used to project to the population.

Page 8

Additional Actions Need to Be Taken to Identify and Address Noncompliant Biofuel Tax Credit Claims

three of the 10 claims to the SB/SE Division for review. It responded that the claimants

should have attached the Certificate of Biodiesel from the producer showing that the

biodiesel used to produce the mixture met the Environmental Protection Agency’s (EPA)

registration requirements for fuels and fuel additives. Without the Certificate of

Biodiesel, these claims are not allowable.

• The required valid registration for 13 of the 24 claims for refundable alternative fuel

credits totaling more than $25 million made on the Form 4136.

• A Certificate of Biodiesel for 19 of the 25 claims for nonrefundable biodiesel or

renewable diesel mixture credits totaling more than $3.6 million made on the Form 8864.

****************************************1***************************************************

****************************************1****************************************************

*****************************************1***************************************************

*****************************************1***********************************.

16

******1******

*****************************************1**************

• T

he required valid registration for 22 of the 25 claims for nonrefundable second

generation biofuel credits totaling almost $1.3 million made on the Form 6478. *1*

*******************************************1********************************************

*******************************************1*****************************************

********************************************1*******************************************

********************************************1*******************************************

********************************************1*******************************************

*****1*****************. All 22 cases were flow-throughs from either partnerships,

S corporations, cooperatives, estates, or trusts claimed on Line 3 of the form.

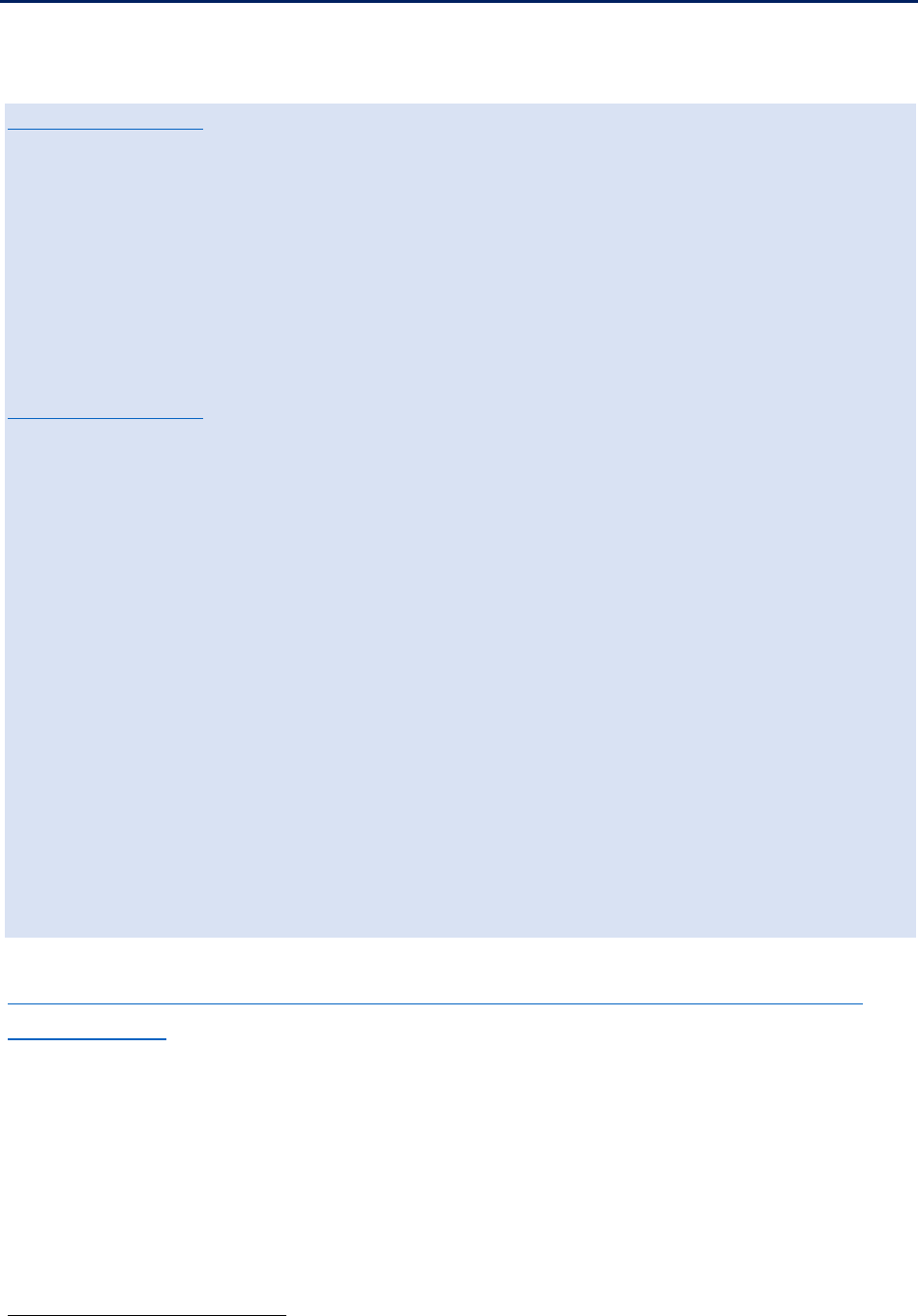

Figure 5 shows the samples selected and the results of our testing to determine if taxpayers

were properly registered or provided a valid Certificate of Biodiesel.

16

ASTM D6751 is the U.S. specification that defines biodiesel as mono-alkyl esters of long chain fatty acids derived

from vegetable oils and animal fats.

Page 9

Additional Actions Need to Be Taken to Identify and Address Noncompliant Biofuel Tax Credit Claims

Figure 5: Biofuel Tax Credit Registration and Certification Testing

Tax

Form

Type of Credits

Tested

Sample

Tested

Sample

Amount of

Biofuel Tax

Credits

Claimed

No Proper

Registration

or

Certification

Provided

Claims

Amount of

Erroneous Biofuel

Tax Credits

Claimed

8849,

Sch. 3

Biodiesel or

Renewable Diesel

Mixture Credits

25 $180,071,190 0 $0

4136

Biodiesel or

Renewable Diesel

Mixture Credits

25 $11,520,489 10 $908,126

4136

Alternative Fuel

Credits

24 $44,134,575 13 $25,750,247

8864

Biodiesel or

Renewable Diesel

Mixture Credits

25 $8,251,942 19 $3,611,883

6478

Second Generation

Biofuel Credit

25 $8,645,919 0 $0

Totals

124

$252,624,115

42

$30,270,256

Source: TIGTA analysis of the Modernized Tax Return Database, the IDRS, and the Employee User

Portal.

We discussed with the Wage and Investment Division, Submission Processing, conducting

compliance checks when the tax returns are received and processed to ensure that applicable

taxpayers are properly registered, are attaching the required certificates, and that any attached

certificates contain a valid registration number. These checks could have prevented the IRS

from allowing the 42 biofuel tax credit claims totaling $30,270,256 that were made on the Forms

4136 and 8864.

However, IRS management stated that the IRS cannot deny biofuel tax credits when income tax

returns are filed without an examination subject to deficiency procedures.

17

IRS management

stated they are unable to use so-called “math error authority” to deny biofuel tax credits even

though the taxpayers may have failed to obtain the certifications and registrations required by

law.

18

The IRS’s math error authority is limited to specific categories of mathematical or clerical

errors, and while the omission of information from a form or schedule can constitute a math

error under the law, it is the IRS’s position that the law must require the inclusion of that

information on a taxpayer’s return for math error authority to be applicable. Accordingly, the

ability to address these claims when they are filed would require a change to the biofuel tax

credit provision discussed in this report to require that registration and certification be

evidenced on the tax return. Under current law, the IRS could only address these claims after

the returns are filed and examined and it issues notices of deficiency to the taxpayers, as

appropriate. The IRS would need to engage with the Department of the Treasury’s Office of Tax

17

I.R.C. §§ 6211 through 6215.

18

I.R.C. § 6213(g)(2)(D) defines math error authority to include “an omission of information which is required to be

supplied on the return to substantiate an entry on the return.” However, IRS management states that the certification

and registration information referenced in this report is not currently required to be provided on the tax return.

Page 10

Additional Actions Need to Be Taken to Identify and Address Noncompliant Biofuel Tax Credit Claims

Policy to proceed with a legislative proposal to obtain the legal authority to ensure that

taxpayers meet the requirements.

Recommendation 1: The Commissioner, Wage and Investment Division, should engage with

the Department of the Treasury’s Office of Tax Policy to develop a legislative proposal to require

that taxpayers claiming biofuel tax credits provide information that they are properly registered

(if applicable) or that they provided the required Certificate of Biodiesel when income tax returns

are filed.

Management’s Response: IRS management agreed with this recommendation and will

share this report with the Department of the Treasury’s Office of Tax Policy, explain the

current law and compliance constraints during filing, and support the Department of the

Treasury if it determines to proceed with a legislative proposal to address this issue.

Recommendation 2: The Commissioner, SB/SE Division, should establish a Compliance

Initiative Project to conduct examinations of the 42 taxpayers reported in Figure 5 to ensure the

validity of the biofuel tax credits that were claimed and that these taxpayers are properly

registered and have the required certificates (that contain a valid registration number).

Management’s Response: IRS management partially agreed with this recommendation

stating it will review the 42 tax returns identified by TIGTA and determine if compliance

activity is warranted.

Office of Audit Comment: We disagree with IRS management’s proposed

alternate corrective action. We believe that compliance activity is warranted

given these 42 taxpayers were allowed over $30 million in biofuel tax credits

while not providing a valid registration number or not providing the Certificate of

Biodiesel. Compliance Initiative Projects involve contact with specific taxpayers to

identify potential areas of noncompliance for the purpose of correcting the

noncompliance. For these 42 cases, the Compliance Initiative Project approach is

ideal in that the results of the examinations will be closely tracked with project

codes and provide IRS management with additional support in discussions with

the Department of the Treasury’s Office of Tax Policy (recommendation 1).

Steps Can Be Taken to More Effectively Identify Noncompliant Biofuel Tax

Credit Claims

The IRS’s compliance efforts are primarily focused on excise tax-related biofuel tax credit claims

made on the Form 8849, Schedule 3, and the Form 720, Schedule C.

19

All Form 8849, Schedule

3, biofuel tax credit claims are received and processed by its Centralized Specialty Tax

Operations at the Cincinnati Campus. Claims exceeding a certain dollar threshold are classified

by a revenue agent, and all remaining claims are screened by a tax specialist to determine if the

claim is allowable or should be referred for examination. If large, unusual, or questionable

19

Specifically, the biofuel tax credit claims are made on the Form 8849, Schedule 3.

Page 11

Additional Actions Need to Be Taken to Identify and Address Noncompliant Biofuel Tax Credit Claims

issues are identified during processing of the unpaid claims, they are referred to Field

Examination.

20

SB/SE Division management stated that after the refund has been issued, all claims made on the

Form 8849, Schedule 3, and the Form 720, Schedule C, are screened for examination using filters

designed by various examination initiatives to identify claims that require further review. The

SB/SE Division reviews the claims for certain attributes or indicators and will consider sending

them to the field for examination if the claims contain some of these attributes,

e.g.

, if the

taxpayer making the claim did not file a related income tax return.

The Form 720, Schedule C, is received and processed by the Wage and Investment Division’s

Submission Processing function at the Ogden Campus. A tax compliance officer reviews the

forms to determine if the claim is allowable or if additional review is required. If further

scrutinization is warranted, the forms are referred and reviewed by a revenue agent in the Excise

Tax function. If large, unusual, or questionable issues exist, they are referred to Field

Examination.

The SB/SE Division has 14 ongoing examination initiatives related to biofuel tax credit claims.

These initiatives tend to be related to excise tax claims and focus on those claims made on the

Form 8849, Schedule 3, and the Form 720, Schedule C. Only one of these initiatives appears to

address biofuel-related claims made by businesses on the Form 4136, and none appear to

address those nonrefundable credit claims made on the Forms 8864 or 6478. Appendix V

contains a more detailed description of each initiative along with initiation dates and tracking

codes.

Some of the initiatives dedicated solely to biofuel tax credits tend to have relatively high

no-change rates. This may indicate that the taxpayers claiming these credits are largely

compliant or that the methods to identify or conduct these examinations can be improved. The

IRS’s primary objective in selecting returns for examination is to promote the highest degree of

voluntary compliance on the part of taxpayers while making the most efficient use of finite

examination staffing and other resources.

21

Having a higher no-change rate for examinations

means that more compliant taxpayers are being subject to examinations and noncompliant

taxpayers are not being identified, thereby negatively impacting taxpayer compliance. For some

of these examination initiatives, it may be too early to form conclusions about the no-change

rates.

The SB/SE Division recently started two of the initiatives. One is designed to compare biofuel

claims to the data received from the EPA Renewable Identification Numbers (RIN) data. The

other is designed to analyze biodiesel mixture and renewable diesel mixture claims made on the

Form 720, Schedule C, and the Form 8849, Schedule 3, using various filters. The SB/SE Division

has completed only a small number of examinations for these initiatives, if any, and it is too

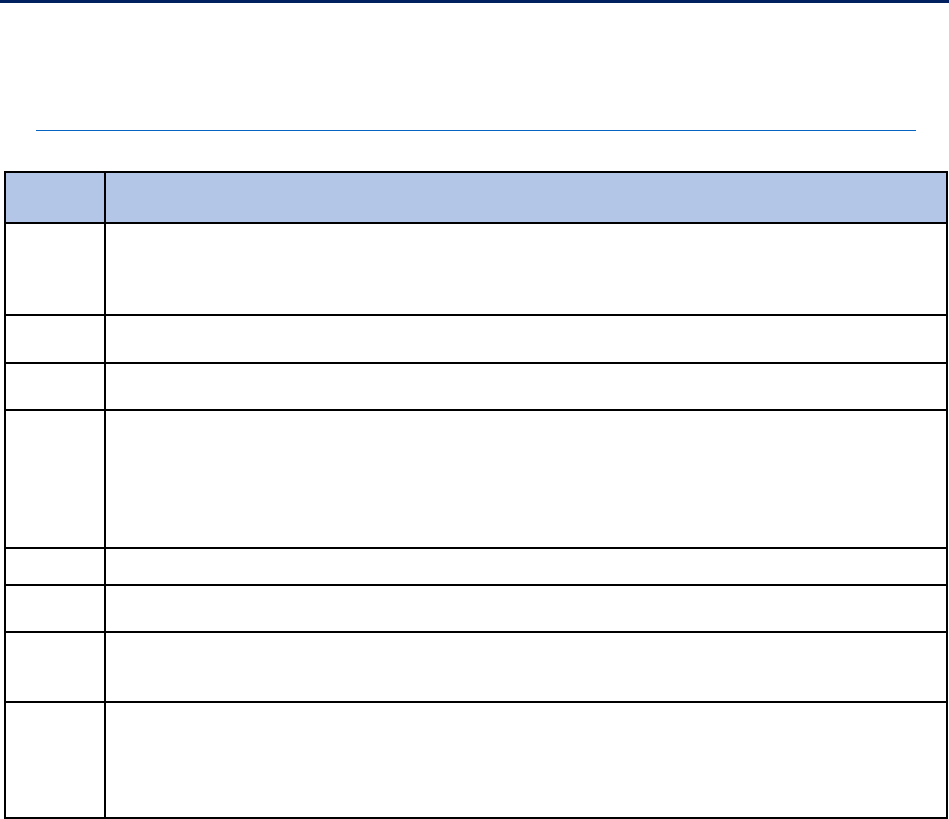

soon to evaluate their effectiveness. Figure 6 lists the 14 ongoing SB/SE Division examination

20

On February 21, 2020, the Director, SB/SE Division, Examination, Specialty Policy, issued a memorandum to the

Director, Examination, Cincinnati Campus, providing guidance regarding criteria for the disallowance, examination

selection, and payment of biofuel tax credit claims that were retroactively reinstated for Tax Years 2018 and 2019 as

part of the budget agreement.

21

Internal Revenue Manual, 4.1.26.2.2(1),

SB/SE Campus Examination Guidance for Fairness in Case Selection

(Aug. 29, 2017).

Page 12

Additional Actions Need to Be Taken to Identify and Address Noncompliant Biofuel Tax Credit Claims

initiatives along with the no-change percentages for the number of examinations closed during

Fiscal Years 2018 through 2023 (as of March 31, 2023).

Figure 6: Ongoing Examination Initiatives Related to Biofuel Tax

Credits and No-Change Rates for Closed Examinations

Title of Initiative

Biofuel

Specific

Number

Closed

22

No-Change

Percentage

23

Total

Adjustment

Amount

Adjustments

Per Hour

24

Biofuel Claims for Credit Reference

Numbers 307, 388, and 390

X 0

Not

Applicable

$0

Not

Applicable

Biodiesel Blenders Below the Rack X 44 77 $83,165 $78

Workload Return System 2,803 63 $70,691,222 $929

Form 637, M Registrant Nonfilers 60 78 $19,723 $13

Nontaxable Use Claims for Alternative

Fuels

X 13 38 $28,859 $385

Alternative Fuel Mixture Credits for

Butane and Gasoline Blends

25

X 52 89 ($472,609) ($1,136)

Alternative Fuels and Alternative

Fuels Mixture Credits

X 130 55 $1,981,136 $519

Propane and Butane Mixture

Claims

26

X 12 42 ($79,757,718) ($839,555)

Tax Year 2018 Form 1040 Excise

Referral Returns Compliance

Initiative Project

471 1 $16,708,359 $3,254

Volume Comparison 720TO vs. 720

27

203 48 $16,132,470 $3,043

Biodiesel Blenders Below the Rack -

Claims

X 35 77 $68,208 $67

Biofuel Claims vs EPA RIN Data X 3 33 $2,691 $14

2018 – 2019 Retroactive Biofuel

Credits

X 307 51 $59,818,724 $3,997

Fuel Summit Project 100 76 $122,485 $34

Source: TIGTA analysis of Data Center Warehouse Audit Information Management System data. The

initiative title was provided by the SB/SE Division.

22

Total number of tax returns examined and closed. A taxpayer may have more than one tax return examined.

23

When an examination results in no adjustment, it will be disposed of as no-change and closed.

24

The total adjustments made on the tax returns examined divided by the total time spent by examiners on all tax

returns examined.

25

Per the SB/SE Division, alternative fuel mixture credits for the butane and gasoline blends initiative are unpaid claim

examinations. A no-change on an unpaid claim examination reflects that the claim was disallowed in full; therefore,

this would be revenue protection. The negative adjustment amounts in these columns show the amount of

disallowed unpaid claims, revenue protected, and not a no-change examination as traditionally viewed.

26

Per the SB/SE Division, the propane and butane mixture claims are unpaid claim examinations. See the prior

footnote for an explanation of a no-change on an unpaid claim examination.

27

Form 720-TO,

Terminal Operator Report

.

Page 13

Additional Actions Need to Be Taken to Identify and Address Noncompliant Biofuel Tax Credit Claims

ECS personnel stated that adding additional reporting requirements for taxpayers making

biodiesel and renewable diesel mixtures, alternative fuel, and alternative fuel mixture tax credit

claims could help the IRS identify noncompliance. Additional reporting requirements that would

helpful include: a list of sales to include the customer’s name, Employer Identification Number,

and summary of gallons sold to each customer. Taxpayers could enter that information into the

Excise Summary Terminal Activity Reporting System, commonly referred to as ExSTARS.

28

SB/SE

Division Excise Tax Policy indicated that this would require a legislative change to classify

biodiesel as a taxable fuel and has been pursuing that change but has thus far been

unsuccessful.

Recommendation 3: The Commissioner, SB/SE Division, should evaluate if there are

opportunities to include biofuel tax credit claims made on the Form 4136 into ongoing

examination initiatives involving biofuel.

Management’s Response: IRS management agreed with this recommendation and will

evaluate its biofuel initiatives and determine if Form 4136 data will add value to case

selection.

Data Obtained From the Environmental Protection Agency Could Help Identify

Noncompliant Taxpayers and Fraudulent Schemes

Congress adopted the Renewable Fuel Standard (RFS) program to reduce the Nation’s

dependence on foreign oil, help grow the U.S. renewable energy industry, and achieve

significant greenhouse emissions reductions. The EPA is responsible for implementing the RFS

program and enforcing its requirements. The RFS program requires a certain amount of

renewable fuel to replace or reduce the quantity of petroleum-based transportation fuel,

heating oil, or jet fuel. Congress set targets for the total amount of renewable fuel to replace

petroleum-based fuels each year through Calendar Year 2022. The EPA translates these targets

into individual compliance obligations that each blender or importer must meet every year.

These blenders and importers generate RINs to meet their renewable fuel obligations.

29

RINs are self-generated by producers of a renewable fuel pursuant to EPA guidelines and

registered in the EPA’s Moderated Transaction System. To be eligible to generate RINs, the

producers of renewable fuel must register and receive approval from the EPA and show annual

compliance and obey mandated recordkeeping requirements. The RIN code structure makes it

possible to tie a RIN to both a specific company and a specific facility. This information is part of

the EPA’s Moderated Transaction System in which the business activities at each facility location

are also tracked. Each batch of fuel produced each year has a unique batch number.

30

The

number of RINs generated can be voluminous. For instance, during Calendar Year 2021 alone,

nearly 20 billion RINs were generated.

31

28

This system requires a monthly information document from fuel terminal operators and carriers detailing the

receipts and disbursements of liquid products passing through a taxable fuel storage and distribution facility.

29

U.S. EPA, Office of Inspector General, Report No. 23-P-0032,

The EPA Must Improve Controls and Integrate Its

Information System to Manage Fraud Potential in the Renewable Fuel Standard Program

(Sept. 2023).

30

The International Council on Clean Transportation

, A Conversational Guide to…Renewable Identification Numbers

(RINs) in the U.S. Renewable Fuel Standard

(May 2014).

31

EPA: 19.86 billion RINs generated under the RFS in 2021

, https://biomassmagazine.com, January 21, 2022.

Page 14

Additional Actions Need to Be Taken to Identify and Address Noncompliant Biofuel Tax Credit Claims

The EPA pursues enforcement actions (both civil and criminal) against renewable fuel producers

and importers that generated invalid RINs to protect the program’s integrity and maintain a

level playing field for regulated companies. The fraudulent generation of RINs for fuel that was

not produced can be used to claim fraudulent biofuel tax credits from the IRS.

In July 2019, the IRS signed a Memorandum of Understanding (MOU) with the EPA to share

information about fuel production facilities and fuel program compliance. The purpose of the

MOU was to facilitate policy development, market understanding, verify data for renewable fuel

credits, identify and reduce RIN fraud in support of RFS program administration, and identify

and reduce fuel tax credit fraud in support of Federal tax administration.

32

According to the

MOU, there is a residual compliance effect that occurs when entities considering dishonest or

illegal practices realize the IRS is involved with joint enforcement efforts with the EPA. In

addition, the IRS can make requests for information on a case-by-case basis.

During Fiscal Year 2021, the SB/SE Division obtained data files which included aggregate RIN

data such as buy and sell transaction data. The SB/SE

Division’s Excise Tax Program personnel analyzed this data by

comparing biodiesel tax credit claims made on the Form 8849,

Schedule 3, and identified companies that claimed biofuel tax

credits that may not have been justified based on taxpayer

behavior in the industry. The resulting SB/SE Division internal

report concluded that some entities filed claims on the Form

8849, Schedule 3, that did not have any corresponding RIN

data, which may be indicative of noncompliance with the tax

laws.

33

The internal IRS report also indicated that the analysis found

the data to be complex and transactionally rich and could be

useful in identifying noncompliance. The report recommended

that the SB/SE Division conduct examinations on those entities

that had Form 8849, Schedule 3, claims but did not have any

related activity transaction data according to EPA information.

The SB/SE Division began an initiative during Calendar

Year 2022 to conduct examinations with this information to

identify noncompliance with credits and payments allowable

for biodiesel mixtures and renewable diesel mixtures. The IRS

assigned tracking codes to monitor the results, but it does not

have a planned number of examinations and explained that

plans are not built for specific tracking codes. ECS personnel stated there are significant

challenges to comparing EPA RIN data to biofuel tax credits claimed to identify noncompliance,

including:

• Buying and selling RINs like a commodity without the biofuel ever changing hands.

32

Memorandum of Understanding Between the Internal Revenue Service and the United States Environmental

Protection Agency

, July 30, 2019.

33

Environmental Protection Agency and IRS Data Analysis to Identify Potentially Inflated Form 8849 Claims.

Joint

Operations Center, Excise Tax, Internal Revenue Service, December 16, 2021.

Page 15

Additional Actions Need to Be Taken to Identify and Address Noncompliant Biofuel Tax Credit Claims

• Being eligible to claim the tax credit but not processing the RIN. For example, a RIN is

created when the pure biodiesel is created by a producer and a third party blends the

pure biodiesel with diesel to create a new blend. The third-party blender would be

eligible for the tax credit.

Since the initiative began, only three examinations have been conducted and *********1******

***************************************************1***********************************************

****************************1*************************

Significant fraudulent schemes targeting biofuel tax credits have resulted in the

payment of erroneous refunds

This audit was initiated due to concerns of fraud raised to TIGTA regarding the IRS’s efforts to

ensure the compliance of those taxpayers claiming biofuel tax credits. In March 2023, the IRS

included fuel tax credit scams on its annual list of “Dirty Dozen” tax scams warning taxpayers to

watch out for promotors pushing improper fuel tax credit claims that taxpayers are not qualified

to receive.

34

There have also been a number of high-profile fraudulent schemes involving biofuel tax credits

in which the IRS did not disallow the fraudulent claims until after millions in erroneous refunds

were paid.

35

For instance, in one scheme, individuals from multiple companies conspired to

claim and receive over $15 million in fraudulent biofuel tax credits from 2010 through 2014. The

conspirators fraudulently generated RINs but did not produce renewable fuel in accordance with

specifications. Most of the biofuel claimed was either never produced or was reprocessed.

36

In another scheme, a taxpayer received over $7 million in fraudulent biofuel tax credits claimed

on the Form 8849, Schedule 3, and the Form 4136 with some claims being made after the

company was evicted from the facility and for renewable fuel that was never produced. There

was also no indication from our review of the court documents that the RINs had been falsely

generated. In addition, the taxpayer did not file corporate tax returns during the period of the

fraudulent claims.

37

SB/SE Division personnel indicated that they now include the nonfiling of

tax returns as a filter when identifying taxpayers claiming biofuel tax credits for possible

examination.

One of the most egregious biofuel tax credit frauds discovered to date involved the entity

Washakie Renewable Energy (hereafter referred to as “Washakie”) when the IRS paid over

$500 million in fraudulent biofuel tax credit claims over several years. The fraud occurred during

Calendar Years 2010 through 2016 using the Form 8849, Schedule 3, and involved the

fraudulent generation of RINs. The Washakie case study provides useful insight into the

challenges and opportunities of biofuel tax credit compliance.

34

This warning did not specifically reference biofuel tax credits.

35

IRS Criminal Investigation (CI) special agents indicated that several of these frauds may have been connected but

were treated as separate conspiracies.

36

U.S. v. Bernard

, Case No. 2:17-cr-00061-SPC-KCD (D. FL 2019), Plea Agreement.

37

U.S. v. Glover

, Criminal Action No. 18-cr-346-RM (D. UT 2019), Plea Agreement.

Page 16

Additional Actions Need to Be Taken to Identify and Address Noncompliant Biofuel Tax Credit Claims

IRS CI and Department of Justice prosecution of Washakie

As one of the ringleader’s plea agreements reflects, the Washakie case involved a complex fuel

tax credit scheme in which the defendants sought to obtain over $1 billion in fraudulent biofuel

credits from the IRS.

38

The fraud was primarily accomplished through the filing of false

Forms 8849, Schedule 3, with the IRS. The defendants claimed RINs for fuel that they did not

produce or sell. False highway toll processing agreements and fake paperwork were established

to create a false paper trail to make it appear that fuel had been produced, sold, and

transported. The fraud began with Tax Year 2010 and defendants continued to claim biofuel tax

credits for larger and larger amounts as the IRS continued to issue refunds based on the false

claims. As the IRS continued to issue more refunds, the defendant’s scheme became more

elaborate by entering into rental agreements for large storage tanks for fuel which would be

rotated back and forth, imported, and then reimported all to support double filing of false

claims on both the import and export of the same product.

According to IRS CI special agents involved with the criminal investigation, the EPA suspected

that Washakie was not in compliance with the RFS program in Calendar Year 2011. Specifically,

the fuel being produced did not meet the specifications for qualifying biodiesel under EPA

standards. EPA expertise was an important factor towards CI’s investigation of the scheme. The

EPA notified CI of its concerns, and CI initiated an investigation on March 19, 2012.

Approximately $37 million of the fraudulent claims had been paid through Calendar Year 2012.

39

CI special agents requested a search warrant be issued by the U.S. Attorney’s Office for the

District of Utah.

40

However, the Assistant U.S. Attorney from the Criminal Division would not

issue the search warrant, and the initial investigation was closed. The investigation of Washakie

was then reopened in Calendar Year 2015 based on additional information received from an

informant. The conspirators eventually pled guilty or were found guilty in this biofuel tax

conspiracy. By the time the conspiracy ended, the IRS had paid out more than $500 million in

fraudulent refund claims and is one of the largest fraud schemes in U.S. history.

In response to the Washakie fraud, CI’s Nationally Coordinated Investigation Unit developed

data analytic models in 2018 to identify similar cases. CI’s Nationally Coordinated Investigation

Unit personnel stated that these data analytic models focused on Form 8849, Schedule 3, claims

and identified six potential criminal cases. However, none of the six resulted in a prosecution

recommendation or an indictment. Because these cases did not result in viable prosecutions, CI

has not conducted additional analysis, although the biofuels project is not considered to be

discontinued. CI is not confident that a similar fraud could be identified systemically because it

is not actively engaged in identifying these fraudulent claims and has redirected its resources to

focus on other criminal investigations. However, CI management stated that special agents will

always investigate if a fraudulent claim is identified through other sources.

38

U.S. v. Kingston

, Case No. 2:18-CR-365-JNP-CMR (D. UT 2019), Plea Agreement.

39

U.S. v. Kingston,

Case No. 2:18-CR-365-JNP-BCW (D. UT 2019), Indictment.

40

The Offices of the U.S. Attorneys are part of the U.S. Department of Justice. They are charged with ensuring “that

the laws be faithfully executed.” The 93 U.S. Attorneys work to enforce Federal laws throughout the country. The U.S.

Attorney is the chief Federal law enforcement office in its district.

Page 17

Additional Actions Need to Be Taken to Identify and Address Noncompliant Biofuel Tax Credit Claims

IRS civil actions related to Washakie

The SB/SE Division, ECS function, noted that it initially identified the Washakie false claims

through one of its examination initiatives and selected for field examination the claims made

during TYs 2010 and 2011 **********2***********. These examinations were initiated in

September 2012 and were later expanded to include subsequent claims. According to SB/SE

Division Specialty Examination, the revenue agent conducting the examinations encountered

obstacles such *****************************2****************************************************

*********************************************2*****************************************************

*********************************************2*****************************************************

**********2********** The Examination function made fraud referrals to CI on related tax returns

in October 2012, but the referrals did not result in new investigations.

We also inquired as to whether the SB/SE Division can systemically identify this type of fraud

and were informed that the ECS will continue to run data analytics on paid claims to identify

potentially noncompliant taxpayers, which could include potentially fraudulent claims. SB/SE

Division management added that the Office of Fraud Enforcement is devoting resources to

identifying ways to proactively deter and detect fraud related to the “green credits” established

within the IRA.

41

Coordination with the EPA could help identify fraud

The technical complexity in the biofuel tax credit area warrants coordination with the EPA. We

concluded from discussions with CI special agents involved with biofuel fraud criminal

investigations that the IRS should coordinate with EPA personnel on examinations and

investigations because they have the expertise that is more likely to identify noncompliant

taxpayers. For instance, EPA engineers can help determine if the fuel produced meets

specifications. CI special agents believed the EPA was stronger in its enforcement of

biofuel-related fraud because of its expertise.

The EPA Office of Inspector General recently issued a report on its review of the EPA’s

enforcement of the RFS program finding that the EPA has strengthened controls over the RFS

program since its inception, primarily in response to several instances of companies generating

or selling fraudulent RINs. For instance, the EPA established a quality assurance program to

mitigate fraud that was primarily occurring at small biodiesel facilities and to provide renewable

fuel producers with the way to demonstrate the validity of their RINs.

42

During our audit, the SB/SE Division stated that it has an interagency agreement with the Pacific

Northwest National Laboratory for its scientists to determine if fuel produced meets

specifications as well as to assist with tax credit claim issues and registrations involving biofuels.

According to the Internal Revenue Manual, during the course of an IRS inspection of a fuel

distribution system, fuel compliance officers conduct interviews and tours, review records, and

obtain fuel samples. The fuel samples are shipped to and tested by the Pacific Northwest

41

The mission of the Office of Fraud Enforcement is to promote compliance by strengthening the IRS’s response to

fraud and mitigating emerging threats. This includes improving fraud detection and development to address areas of

high fraud/risk noncompliance and cultivating internal and external partnerships to identify new treatment streams to

enhance enforcement.

42

U.S. EPA, Office of Inspector General, Report No. 23-P-0032,

The EPA Must Improve Controls and Integrate Its

Information System to Manage Fraud Potential in the Renewable Fuel Standard Program

(Sept. 2023).

Page 18

Additional Actions Need to Be Taken to Identify and Address Noncompliant Biofuel Tax Credit Claims

National Laboratory.

43

Fuel compliance officers also conduct inspections in support of excise tax

examinations and registration reviews. However, we believe that the IRS should evaluate if there

are opportunities to use the EPA’s expertise when conducting examinations and investigations

relating to biofuels, including taxpayers that claimed alternative fuel tax credits such as credits

for liquefied petroleum gas. This could be useful because several examination initiatives

involving biofuel tax credits have higher no-change rates (as noted previously) and this could

help identify noncompliance.

From our analysis of the IRS’s fraud detection efforts, including methodologies to identify

questionable biofuel credit claims and our review of specific fraud cases, including the Washakie

case, it is clear that the IRS’s procedures for identifying and stopping fraudulent claims can be

improved. With the passage of additional and expanded clean energy tax credits in the IRA,

there is even greater incentive to take advantage of biofuel tax credits and make fraudulent

claims for biofuel that does not exist or does not qualify for the biofuel tax credits. We believe

that by implementing the recommendations in this report, the IRS can take steps to better

ensure that fraudulent claims for biofuel tax credits are identified and stopped prior to the

issuance of erroneous refunds.

Recommendation 4: The Commissioner, SB/SE Division, and Chief, Criminal Investigation,

should identify opportunities to partner with the EPA to use the agency’s expertise and data

when selecting, conducting examinations and investigations involving taxpayers that claimed

biofuel tax credits and revise the MOU as needed.

Management’s Response: IRS management agreed with this recommendation and is

working with the EPA to identify opportunities to use the agency’s expertise and data

when selecting, conducting examinations and investigations involving taxpayers that

claimed biofuel tax credits. If it identifies additional opportunities, it will notify the EPA

that it would like to update the MOU.

43

Internal Revenue Manual 4.24.13, Excise Tax, Overview of Excise Fuel Compliance Program. (Feb. 11, 2021).

Page 19

Additional Actions Need to Be Taken to Identify and Address Noncompliant Biofuel Tax Credit Claims

Appendix I

Detailed Objective, Scope, and Methodology

The overall objective of this audit was to assess the effectiveness of IRS procedures to detect

and prevent questionable claims for biofuel tax credits. To accomplish our objective, we:

• Evaluated the status of the MOU with the EPA by interviewing applicable SB/SE Division

personnel and reviewing SB/SE Division analysis of the data provided by the EPA.

• Determined the current procedures used for screening tax returns claiming biofuel tax

credits and identifying questionable claims for examination. We interviewed personnel

from the SB/SE and Wage and Investment Divisions and obtained information on the

current examination initiatives related to biofuel tax credits. We also analyzed Audit

Information Management System data identified from TIGTA’s Data Center Warehouse

related to the examination initiatives related to biofuel tax credits.

• Assessed CI’s efforts to identify and conduct criminal investigations involving fraudulent

claims for biofuel tax credits. We (1) obtained and analyzed information from the CI

Management Information System on criminal investigations closed from October 2017,

through March 2023 that involved biofuels; (2) interviewed two special agents who

participated in the Washakie Renewable Energy criminal investigations; and

(3) interviewed CI personnel from the Nationally Coordinated Investigations Unit on their

efforts to identify biofuel tax credit fraud using data analytics.

• Determined the number and amount of biofuel tax credits claimed by obtaining data

extracts containing Form 4136; Form 6478; Form 8849, Schedule 3; and Form 8864 data

from the Modernized Tax Return Database

.

This identified returns that were filed

electronically.

• Analyzed IDRS and tax return information on the Employee User Portal for a judgmental

sample of 124 taxpayers from a population of 6,597 that made biofuel tax credit claims

on either the Form 4136; Form 6478; Form 8849, Schedule 3; or Form 8864 filed during

Processing Year 2022 to determine if they were properly registered or provided a

Certificate of Biodiesel.

1

Performance of This Review

This review was performed with information obtained from the Criminal Investigation

Headquarters in Washington, DC; the SB/SE Division Headquarters in Lanham, Maryland; and the

Wage and Investment Division Headquarters in Atlanta, Georgia during the period August 2022

through November 2023. We conducted this performance audit in accordance with generally

accepted government auditing standards. Those standards require that we plan and perform

the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our

findings and conclusions based on our audit objective. We believe that the evidence obtained

provides a reasonable basis for our findings and conclusions based on our audit objective.

1

A judgmental sample is a nonprobability sample, the results of which cannot be used to project to the population.

Page 20

Additional Actions Need to Be Taken to Identify and Address Noncompliant Biofuel Tax Credit Claims

Major contributors to the report were Matthew A. Weir, Acting Deputy Inspector General for

Audit; Phyllis Heald London, Acting Assistant Inspector General for Audit (Compliance and

Enforcement Operations); Tim Greiner, Director; Eugenia Smoak, Audit Manager; Jeff K. Jones,

Lead Auditor; Victor Taylor, Senior Auditor; Ismael Hernandez-Rosario, Information Technology

Specialist; and Laura Christoffersen, Data Analyst, Applied Research and Technology Division.

Data Validation Methodology

During this review, we relied on Form 4136; Form 6478; Form 8849, Schedule 3; and Form 8864

data from the Modernized Tax Return Database

.

We compared the amount of biofuel tax credit

claimed according to the data extract to the amount claimed on the tax return found on the

Employee User Portal and determined that the data were sufficiently reliable for purposes of this

audit.

We also relied on Audit Information Management System data obtained from TIGTA’s Data

Center Warehouse. We compared the accuracy of 10 taxpayer records to information on the

IDRS and determined that the data were sufficiently reliable for purposes of this audit.

Internal Controls Methodology

Internal controls relate to management’s plans, methods, and procedures used to meet their

mission, goals, and objectives. Internal controls include the processes and procedures for

planning, organizing, directing, and controlling program operations. They include the systems

for measuring, reporting, and monitoring program performance. We determined that the

following internal controls were relevant to our audit objective: controls that identify taxpayers

(tax returns) claiming questionable biofuel tax credits for examination. We evaluated these

controls by interviewing and corresponding with key personnel and analyzing Audit Information

Management System data obtained from TIGTA’s Data Center Warehouse.

Page 21

Additional Actions Need to Be Taken to Identify and Address Noncompliant Biofuel Tax Credit Claims

Appendix II

Outcome Measure

This appendix presents detailed information on the measurable impact that our recommended

corrective actions will have on tax administration. This benefit will be incorporated into our

Semiannual Report to Congress.

Type and Value of Outcome Measure:

• Revenue Protection – Potential; 42 biofuel tax credit claims totaling $30,270,256 in which

the taxpayers did not provide a valid registration number or did not provide the

Certificate of Biodiesel (see Recommendation 2).

Methodology Used to Measure the Reported Benefit:

We selected a judgmental sample of 124 taxpayers that claimed biofuel tax credits during

Processing Year 2022 to determine if they were properly registered or if they provided the

Certificate of Biodiesel indicating that the producer of the biodiesel is registered with the IRS.

1

This included 75 business taxpayers that claimed the biodiesel or renewable diesel mixture

Credits on the Form 8849, Schedule 3; Form 4136; and Form 8864, 24 business taxpayers that

claimed alternative fuel credits on the Form 4136, and 25 business taxpayers that claimed

second generation biofuel tax credits on the Form 6478.

For the 124 sample cases, we reviewed IDRS data and tax return information on the Employee

User Portal. We found that all 25 taxpayers that made claims for biodiesel or renewable diesel

mixture credits on the Form 8849, Schedule 3, were either properly registered with the IRS or

provided the Certificate of Biodiesel. However, we found that most of the remaining taxpayers

either did not provide a valid registration number or did not provide the Certificate of Biodiesel.

Without the proper registration or the Certificate of Biodiesel, these claims would not be

allowable. Specifically, we found that taxpayers did not provide:

• The required valid registration for 13 of the 24 claims for refundable alternative fuel

credits totaling $25,750,247 made on the Form 4136.

• A Certificate of Biodiesel for 10 of the 25 claims for refundable biodiesel or renewable

diesel mixture credits totaling $908,126 made on the Form 4136.

• A Certificate of Biodiesel for 19 of the 25 claims for nonrefundable biodiesel or

renewable diesel mixture credits totaling $3,611,883 made on the Form 8864.

Overall, a total of 42 (13 + 10 + 19) biofuel tax credit claims totaling $30,270,256 ($25,750,247 +

$908,126 + $3,611,883) involved taxpayers not providing a valid registration number or a

Certificate of Biodiesel.

Management’s Response: IRS management disagreed with this outcome measure,

stating it lacks the legal authority to deny or otherwise effectively enforce the

registration and certificate requirements at the time of filing. To measure the outcome,

1

A judgmental sample is a nonprobability sample, the results of which cannot be used to project to the population.

Page 22

Additional Actions Need to Be Taken to Identify and Address Noncompliant Biofuel Tax Credit Claims

the IRS would have to conduct a full examination of these returns to potentially disallow

these claims.

Office of Audit Comment: In recommendation 2, we ask the IRS to establish a

Compliance Initiative Project of the 42 taxpayers in order to conduct an

examination of these returns to potentially disallow these claims. While IRS

management partially agreed to recommendation 2, we disagree with IRS

management’s proposed alternate corrective action. We believe that compliance

activity is warranted given these 42 taxpayers were allowed over $30 million in

biofuel tax credits while not providing a valid registration number or not

providing the Certificate of Biodiesel. Compliance Initiative Projects involve

contact with specific taxpayers to identify potential areas of noncompliance for

the purpose of correcting the noncompliance. For these 42 cases, the

Compliance Initiative Project approach is ideal in that the results of the

examinations will be closely tracked with project codes and provide IRS

management with additional support in discussions with the Department of

Treasury’s Office of Tax Policy (recommendation 1).

Page 23

Additional Actions Need to Be Taken to Identify and Address Noncompliant Biofuel Tax Credit Claims

Appendix III

Internal Revenue Code Sections Related to the Biofuel Tax Credit

I.R.C. §

Description

34

Provides a refundable income tax credit for the alternative fuel credit, biodiesel and renewable

diesel mixture credit, and sustainable aviation fuel credit in an amount equal to the sum of the

credit under I.R.C. § 6427(e). Credit is not allowed for any amount that was paid under I.R.C. §

6427.

40

Provides that a nonrefundable credit is claimed on the Form 6478, Biofuel Producer Credit, and

consists of the second generation biofuel producer credit.

40A

Provides a nonrefundable credit for biodiesel or renewable diesel that is sold for use as a fuel or

used as a fuel in the taxpayer’s trade or business.

4041

Imposes tax on any liquid other than gasoline that is sold by any person to an owner, lessee, or

other operator of a diesel-powered highway vehicle or train or used by any such person as a fuel

in a diesel-powered train. It also imposes tax on any liquid (other than gasoline) and compressed

natural gas that is sold by any person to an owner, lessee, or other operator of a motor vehicle or

motorboat for use as a fuel in such motor vehicle or motorboat or used by any person as a fuel in

a motor vehicle or motorboat.

4081

Tax is imposed on the sale or removal of blended taxable fuel by the blender thereof.

4101

Provides the IRS with the authority to require businesses to register with the IRS before engaging

in certain excise activities.

6426

Provides a credit against tax imposed by I.R.C. § 4081 for the alternative fuel mixture credit,

biodiesel and renewable diesel mixture credit, and sustainable aviation fuel credit. It also

provides a credit against tax imposed by I.R.C. § 4041 for the alternative fuel credit.

6427(e)

To the extent that the biodiesel or renewable diesel mixture credit or sustainable aviation fuel

mixture credit described in I.R.C. § 6426(c) and (k) exceeds a person’s I.R.C. § 4081 liability,