Cook County Treasurer

Maria Pappas

STATE OF T H E OFF I CE - 2022

CONTENTS

S T A T E O F T H E O F F I C E - 2022

INTRODUCTION

2

-6

A

WEBSITE

– COOKCOUNTYTREASURER.COM 7-

36

Website Highlights (cookcountytreasurer.com)

8

-9

Website

– Page Visits 10-

13

Mobile Website (cookcountytreasurer.com)

14-

15

Duplicate/Overpayment Refund Search

16-

17

Search for Missing Exemptions

18-

19

Electronic Tax Bill (PDF)

20-

21

Warning for Sold/Forfeited Taxes

22-

23

Message for Tax Bills Returned by USPS

24-

25

Electronic Name/Address Changes

26-

27

Refund Status

28-

29

Taxing District Debt and Pension

30-

31

Foreign Language Content

32-

33

New Informational Brochures

34-

35

B

MAJOR INITIATIVES

37-

58

Pappas Studies: 20

-Year Property Tax History 38-

39

Pappas Studies: Scavenger Sale Study

40-

41

Pappas Studies: 50 Largest Tax Increases Since 2000

42-

43

Pappas Studies: Voter Turnout 2011

-2020 44-

45

Pappas Studies: Debt Study

46-

47

Pappas Studies: Tax Bill 2020 Tax Bill Analysis

48-

49

DDO Amendment

– TIF Data

50

Property Tax Bills

51

Black and Latino Houses Matter

52-

55

Stop Taxpayer Overpayment System (STOPS)

56

Electronic Refunds

57

C

AUTOMATION PROJECTS

– PAYMENTS 59-

70

Lockbox

61

Bank Branch Payments

62

Community Bank Branch Payments

63

Third Party Agent (TPA)

– Wire Payments

64

Third Party Agent (TPA)

– ACH Payments

65

Online Payments

66

Credit Card Payments

67

Subsequent Tax Electronic Payment System (STEPS)

68

In

-Person Payments

69

Payment Source Trend by Tax Year (On

-Time Payments)

70

D

AUTOMATION PROJECTS

– SYSTEMS 71-

84

Customer Service

– Email System

72

Customer Service

– Call Center

73

Document Imaging Project

74-

75

PIN Research (Internal Portal)

76-

77

Electronic Warrant Book

78-

79

Annual Tax Sale

80-

81

Taxing Agency Extranet

82-

83

E

TRANSPARENCY PROJECTS

85-

98

Debt Disclosure Ordinance (DDO)

86-

88

Data and TIF Information on the Tax Bills

89-

91

County Property Tax Portal

92-

93

County Property Tax Portal

– Mobile 94-

95

Freedom of Information Act (FOIA) Log

96-

97

F

FOCUS ON BUDGET

99-

110

Budget Comparison

100

FY1998 Budget Comparison

101

Funding

102

Personnel Costs

103

Cost

-of-Living Adjustment (COLA) History

104

Fringe Benefit Comparison

105

Focus on Budget

106

Position Count

107

FY2022 Reduce Corporate Budget

108

Account Summary

– 060 Corporate Account

109

Account Summary

– 534 Automation Account

110

G

PROJECTS

111

-

124

FY2022

– FY2024 Future Projects

112

-

119

Top 100 Automation/Streamlining Efforts FY1998

– FY2021

120

-

124

I

APPENDIX

125

Toni Preckwinkle

President

Cook County Board of Commissioners

118 N. Clark Street, Room 500

Chicago, IL 60602

Dear President Preckwinkle:

It is with great pleasure that I submit to you the Fiscal Year 2022 budget for my office.

Year after year, I come before the Board with a budget request that meets or exceeds the proposed target. My 2022 budget marks the 21

st

consecutive year that I have met or exceeded the target. My budget for FY2022 is $54,218 less than for FY2021.

In 2021, my website had nearly TWO MILLION VISITS in a single month. Additionally, I am continuing to prioritize providing outreach to

taxpayers, helping taxpayers claim part of $72 million in duplicate and overpayment refunds and $43 million in missing senior exemptions.

Lastly, my new property tax think tank was created to foster policy proposals and work with legislators to make the property taxes less

costly, fairer and more equitable.

The following are highlights of the FY2022 Treasurer’s Office Budget:

• Our current employee count is 58, a 76.8 percent reduction from 1998 when the office had 250 employees.

• If the office maintained a staff of 250 as it had in 1998, the budget for the office would be approximately $55.5 million.

• 94 percent of the budget comes from commercial user fees. Our goal continues to be an entirely self-funded office

independent of any taxpayer-funded sources.

I am proud to request the adoption of this FY2022 budget for the Treasurer’s Office.

Sincerely,

Maria Pappas

Cook County Treasurer

Maria Pappas

Cook County Treasurer

October 25, 2021

2

INTRODUCTION

S T A T E O F T H E O F F I C E - 2022

Cook County is the second-largest collector of property taxes in the United

States and is home to City of Chicago, the country's third-largest city.

3

INTRODUCTION

S T A T E O F T H E O F F I C E - 2022

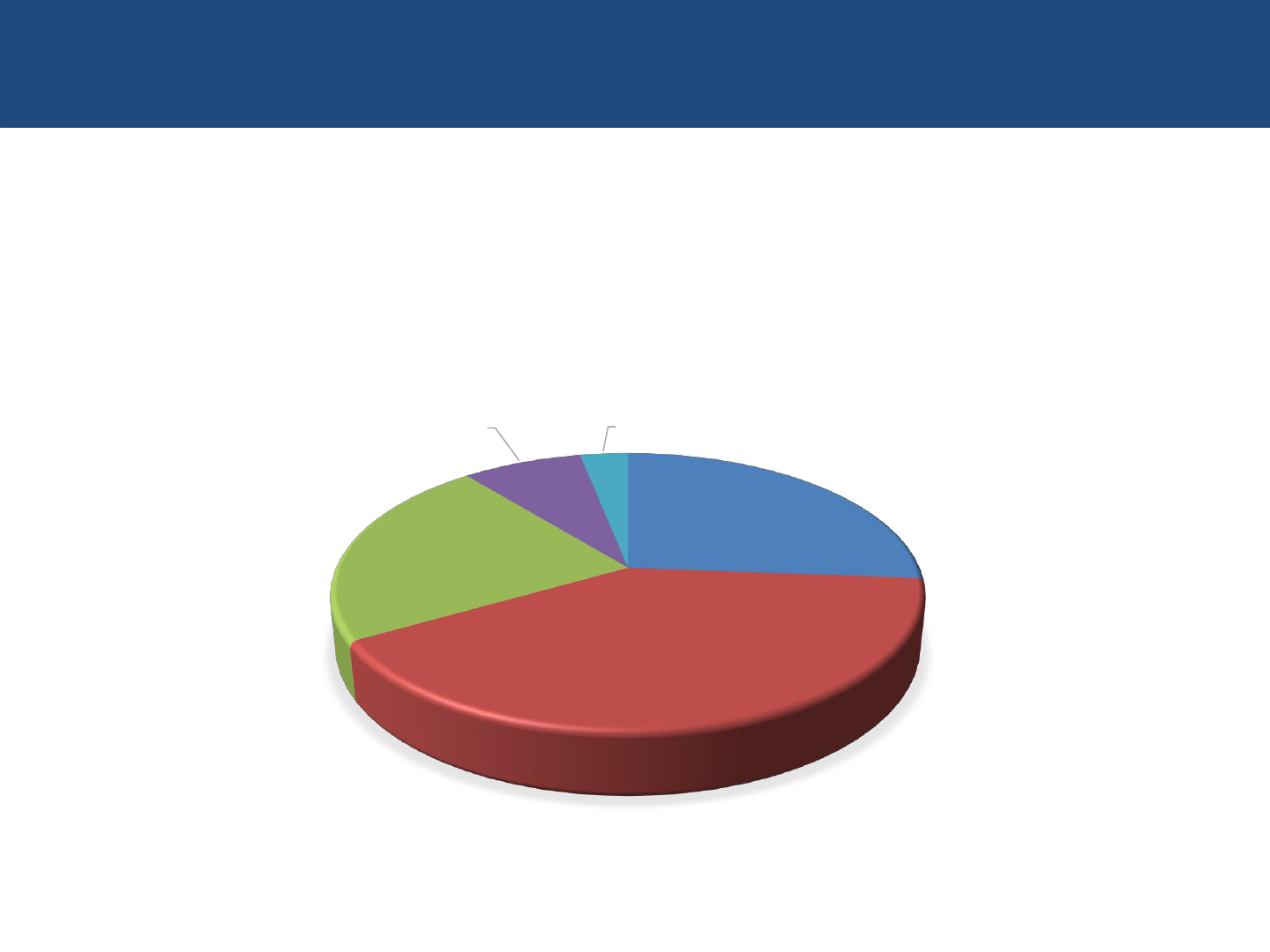

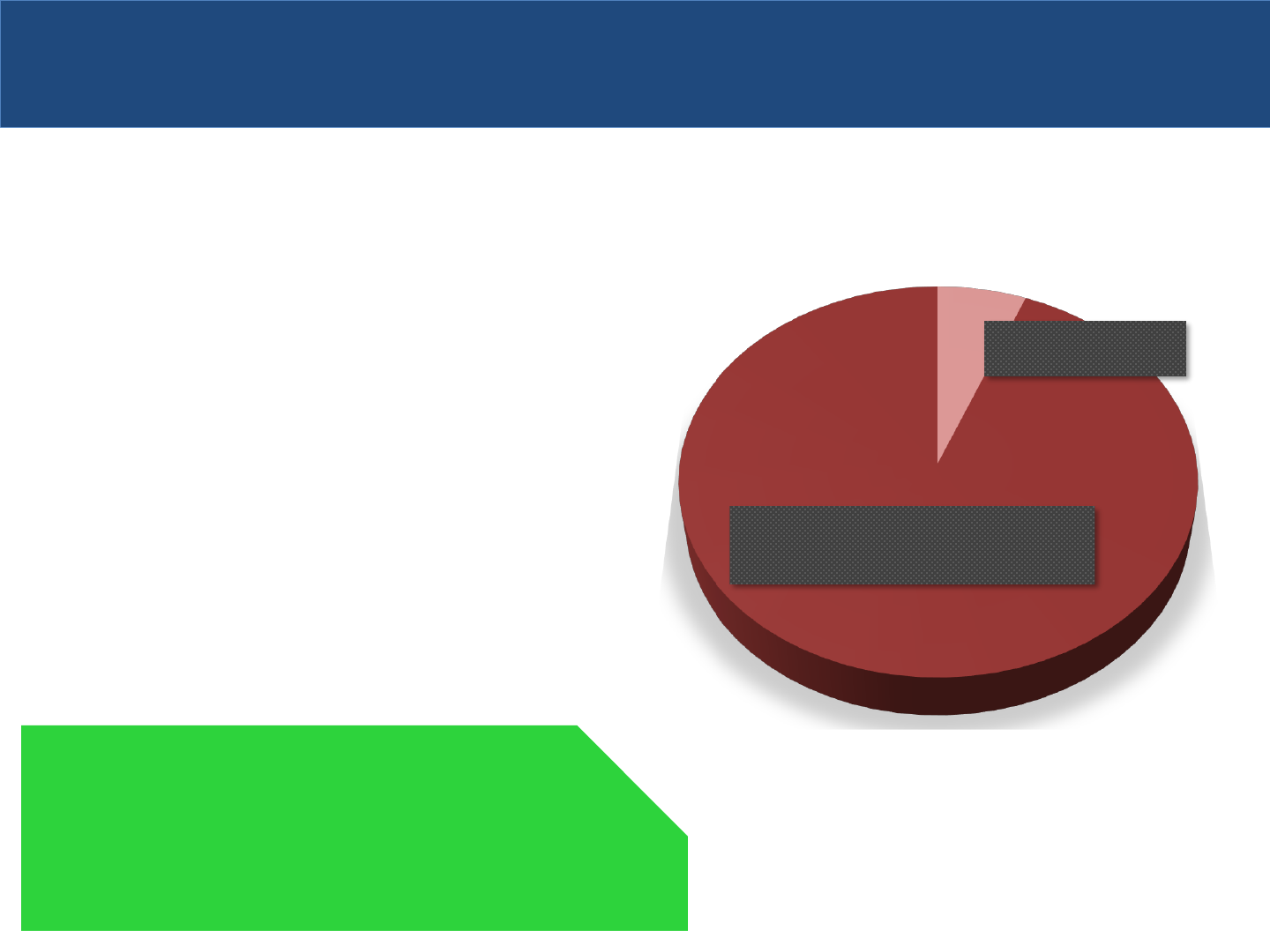

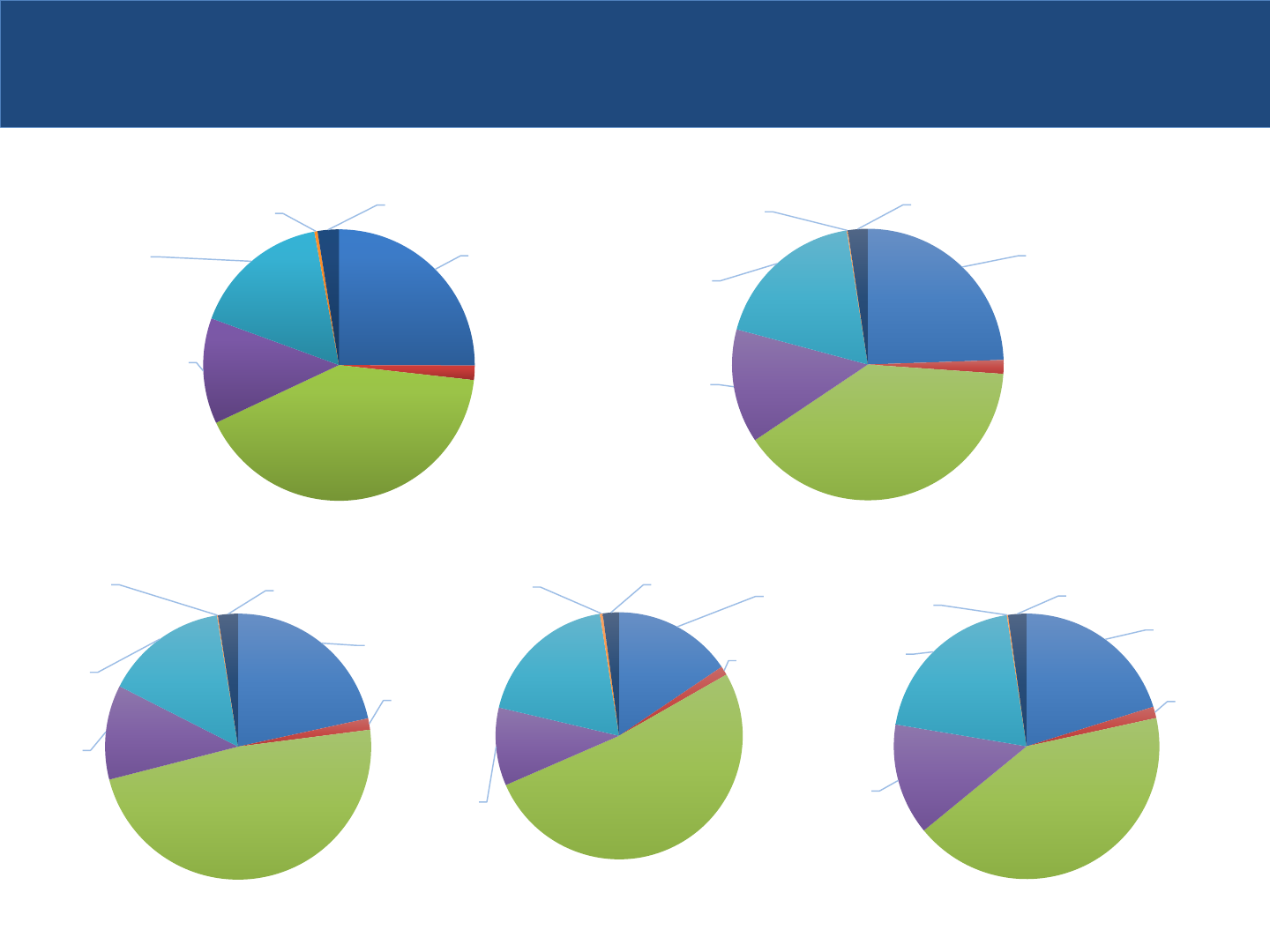

Cook County’s population is 5.28 million. In addition to the City of Chicago, 134 other municipal

governments are located in the county.

One third of the population speaks a language other than English.

The leading second languages are Spanish and Polish. city.

Latino

1,382,778

26%

White

2,135,243

41%

Black

1,185,601

22%

Asian

408,691

8%

Other

163,228

3%

4

INTRODUCTION

The Cook County Treasurer’s Office follows the laws from two primary sources, the Illinois Property

Tax Code and Cook County Municipal Code.

Treasurer Maria Pappas’ responsibilities include:

• Printing and mailing property tax bills on behalf of other local governments

• Collecting $16.1 billion in yearly taxes from the owners of 1.8 million parcels of property

• Distributing tax funds to approximately 2,200 local government units to cover operations, pay

bond debt and fund pension obligations

• Investing the revenues and other public funds of the County in conformance with federal and

state laws and local ordinances

• Conducting a tax sale of delinquent property taxes as required by state law

S T A T E O F T H E O F F I C E - 2022

5

INTRODUCTION

In FY1998 when Treasurer Pappas took office, there were a number of challenges:

• 250 employees in the office

• Only six ‘386’ personal computers

• Office was not Y2K Compliant

• No Third Party Agent (TPA) wire payment system

• No lockbox

• No bank branches accepting payments

• No financial audit

• No Information Technology (IT) department

• No website

• No email system

• No phone system

• $30 million in uncashed checks on the floor

• One mail-opening machine

The solution?

Automation, which has led to reduced headcount and greater efficiency.

S T A T E O F T H E O F F I C E - 2022

6

Website

cookcountytreasurer.com

7

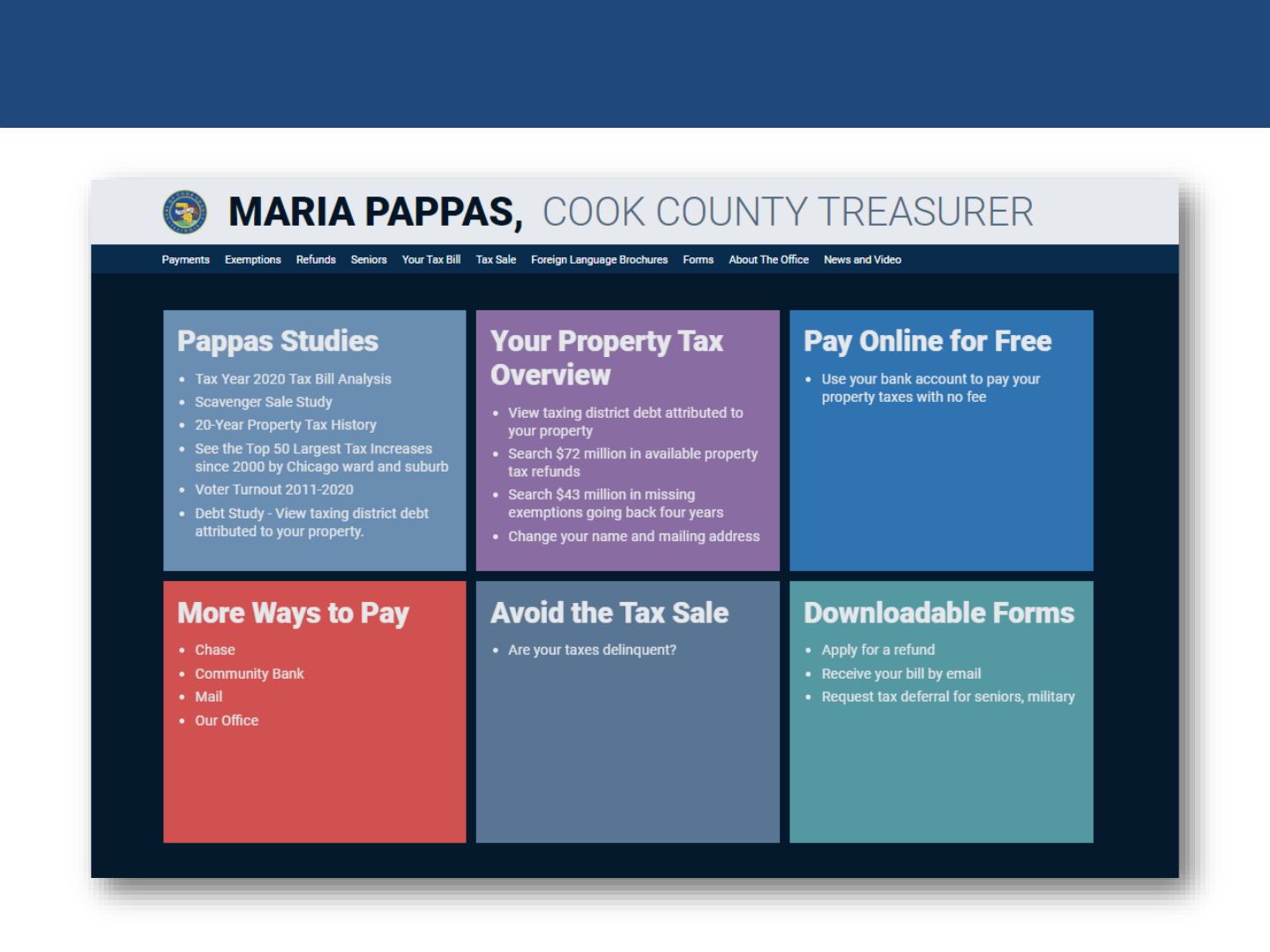

WEBSITE HIGHLIGHTS – (cookcountytreasurer.com)

S T A T E O F T H E O F F I C E - 2022

“Your Property Tax Overview”

at cookcountytreasurer.com is a one-stop shop for taxpayers

10.5 million visits

December 1, 2020 through October 1, 2021

1.96 million visitors

August 2021

86.6 million total visitors

since 2004

6.4 million visits

on mobile devices since December 2017

8

WEBSITE HIGHLIGHTS – (cookcountytreasurer.com)

S T A T E O F T H E O F F I C E - 2022

$43 Million in

Missing Exemptions

for seniors

$72 Million in Refunds

Online, electronic application

(going back 20 years)

Download/Print your

Property Tax Bill

See Important Messages

• Taxes paid or not paid

• Taxes sold or forfeited

• Mailed tax bill received or not

• Refund check status

View Taxing District

Debt Information

• Access to financial reports

• Number of retirees vs. current

employees

“Your Property Tax Overview”

at cookcountytreasurer.com is a one-stop shop for taxpayers

9

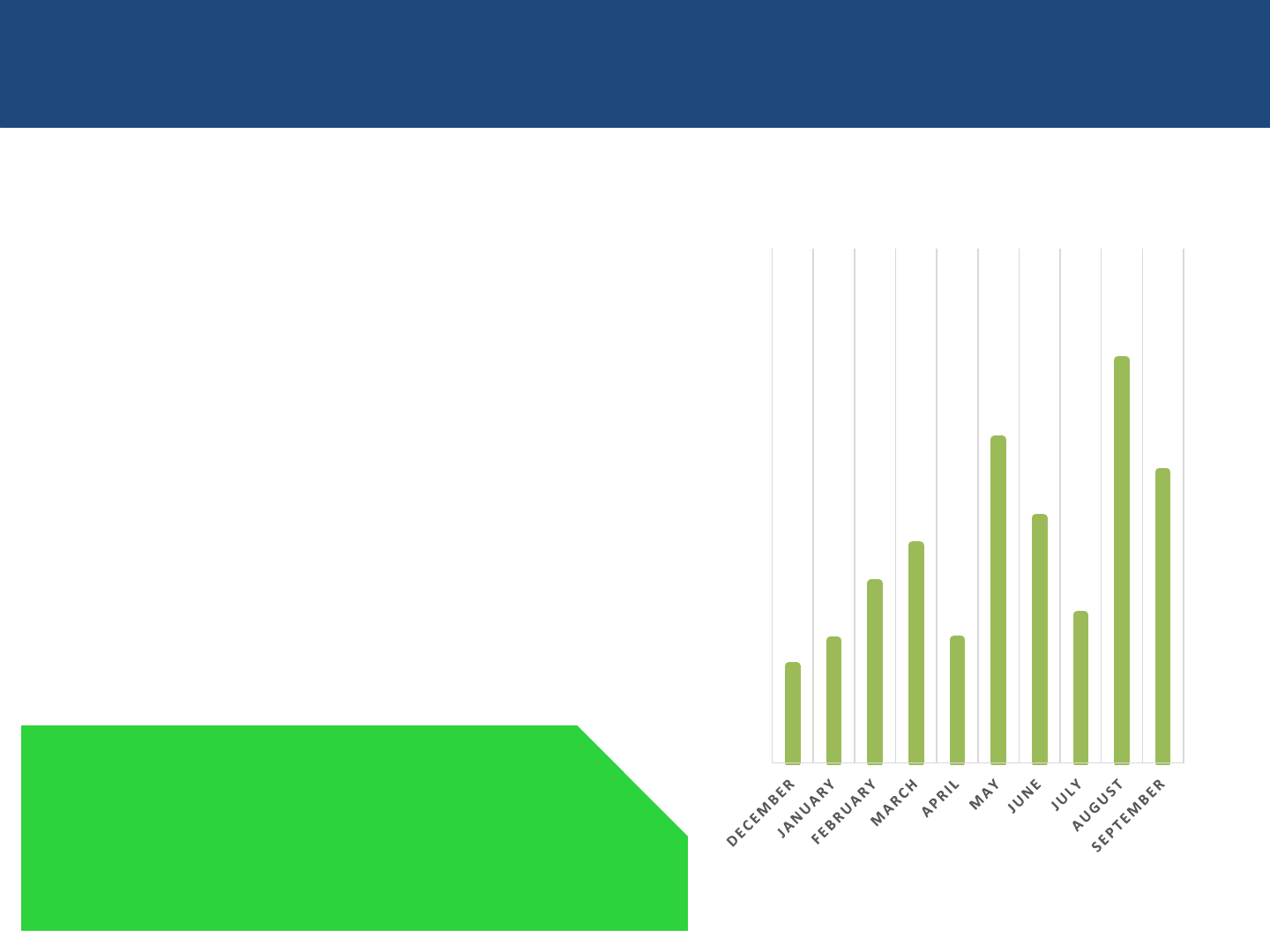

WEBSITE – PAGE VISITS

The Treasurer’s Office continues to improve

the website with new features and expanded

information.

As a result, nearly 2 million visitors accessed

the site in August 2021 when the 2020 Second

Installment tax bills were posted online and

mailed.

“Your Property Tax Overview” serves as a one-

stop shop to provide quick access to:

• Current mailing name and address

• Tax amount due

• Tax bill download

• 20 year overpayments

• Tax exemptions going back four years

S T A T E O F T H E O F F I C E - 2022

2million

website visitors between 8/1/2021 and 8/31/2021

470,591

595,809

872,982

1,057,841

599,161

1,573,165

1,191,277

719,726

1,960,533

1,416,290

VISITS IN 2021

10

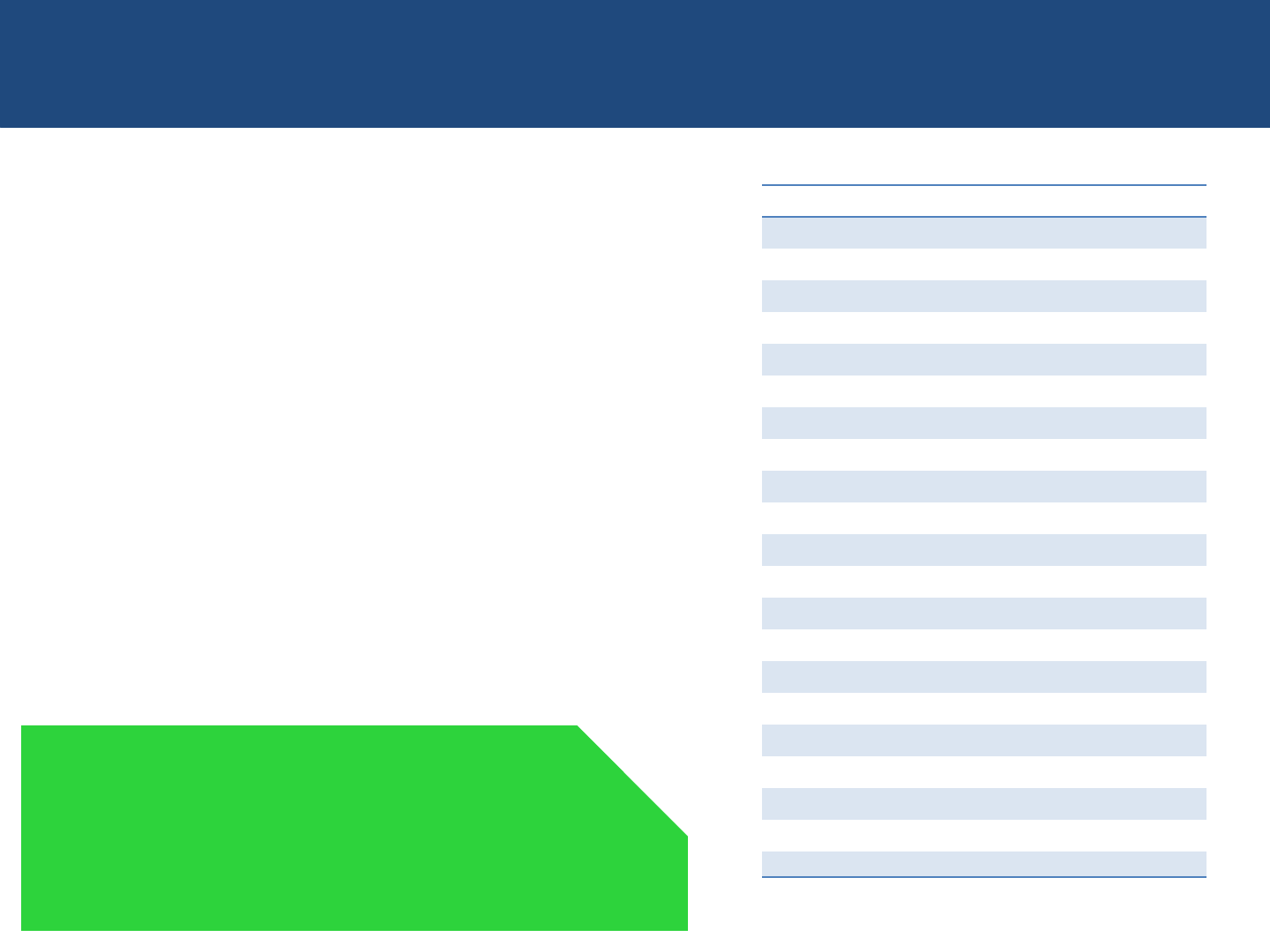

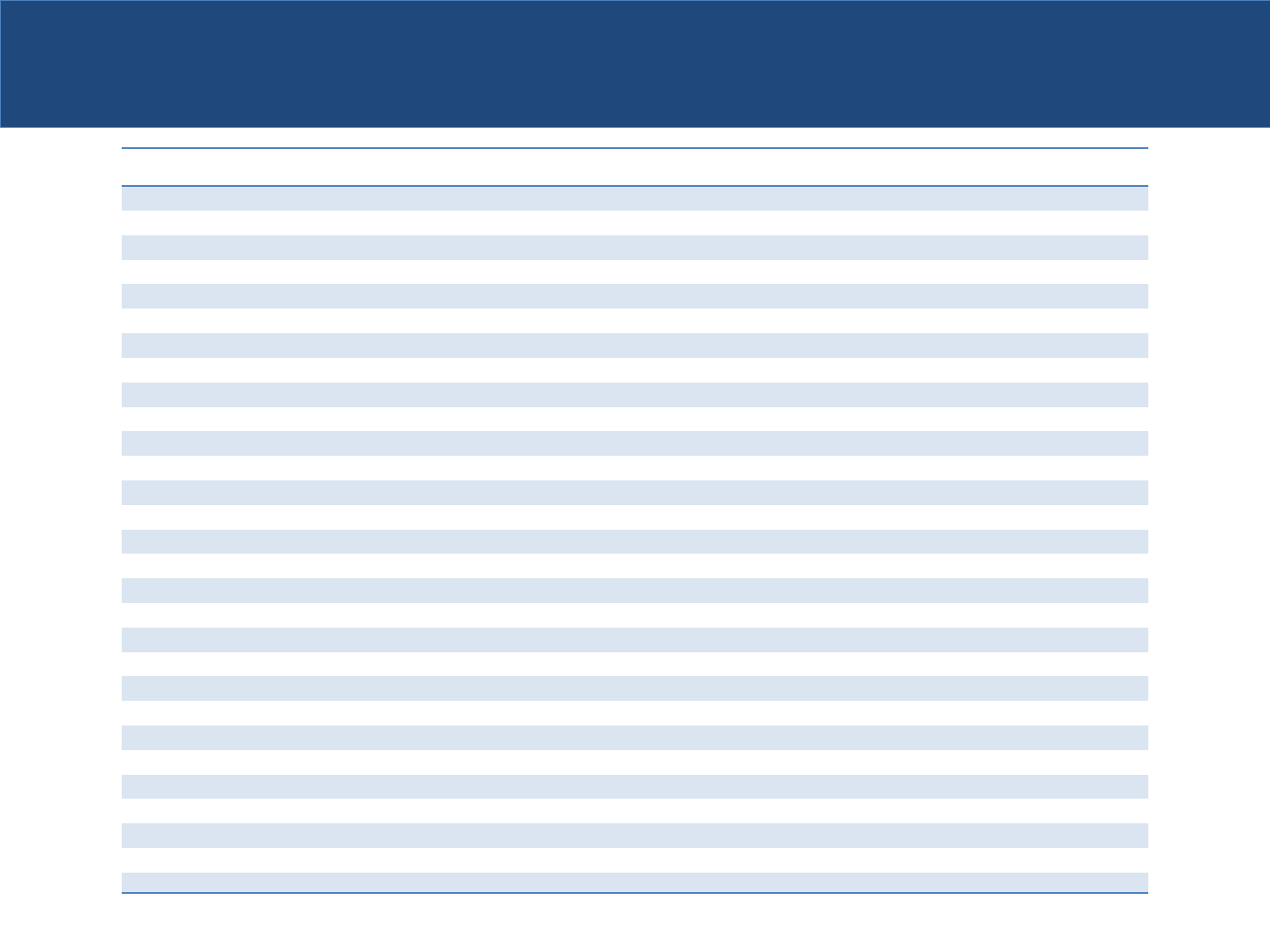

WEBSITE – PAGE VISITS

In FY2021, cookcountytreasurer.com has been visited more than 10.5 million times.

General Statistics

December January February March April May June July August September October YTD

Number of Visits

470,591

595,809

872,982

1,057,841

599,161

1,573,165

1,191,277

719,726

1,960,533

1,416,290

58,095

10,515,470

Average Visit Length (Minutes)

2.00

2.10

1.66

1.47

1.82

1.56

1.59

1.53

4.89

1.57

1.47

1.97

Visitors that visited more than once

68,007

87,274

121,202

145,713

86,141

89,887

88,158

119,669

131,741

125,496

8,479

1,071,767

First time visitors

208,849

303,565

501,037

461,508

316,501

325,047

300,153

374,033

540,520

581,544

36,229

3,948,986

Visited Pages

December January February March April May June July August September October YTD

Property Tax Overview Results

211,142

264,798

483,148

525,476

300,606

1,033,514

875,602

334,444

1,375,905

981,661

37,943

6,424,239

Download Your Tax Bill

27,045

37,352

47,711

56,272

36,646

38,256

39,611

58,023

69,825

44,845

2,023

457,609

Payment Status Search

38,027

46,061

58,127

73,444

46,451

42,399

42,744

45,791

61,598

60,707

3,446

518,795

Apply for Refund Information

2,036

2,107

2,606

6,389

1,966

3,216

2,190

1,579

2,799

4,275

211

29,374

Overpayment Application/Status

4,076

4,718

7,098

11,002

4,526

5,996

4,870

4,594

9,811

8,063

448

65,202

Name/Address Change

9,226

10,821

20,997

21,657

12,936

12,834

18,830

18,333

21,150

16,477

1,084

164,345

If Taxes Were Sold

965

1,218

1,311

2,029

1,003

1,037

1,168

1,322

1,405

1,510

66

13,034

Annual Tax Sale Information

412

997

713

930

371

328

392

457

417

642

0

5,659

Research A Topic

572

474

481

531

331

397

376

630

601

416

11

4,820

News Article View

21,435

6,213

8,159

11,138

7,326

8,262

9,531

9,568

8,282

5,156

156

95,226

TPA Home Site (Bulk Wire Payments)

8,284

87

11,181

12,653

7,429

8,140

7,492

6,053

8,608

12,039

272

82,238

Community Bank Home (Teller View)

350

539

1,745

925

556

440

487

903

1,330

1,582

106

8,963

Payment By Electronic Check

8,707

20,945

143,147

82,384

34,720

20,578

7,347

5,132

56,278

158,651

19,060

556,949

Payment By Credit Card

2,459

3,724

16,388

15,169

6,214

5,115

2,555

1,859

7,797

19,244

2,979

83,503

Estate Search

589

703

772

1,038

489

761

715

820

1,221

1,293

39

8,440

Sign up for email notification

793

1,126

1,332

1,923

1,038

832

904

997

1,676

1,375

42

12,038

Due dates

2,250

4,251

6,815

6,019

3,175

4,116

7,670

37,960

30,395

6,560

329

109,540

Exemption Results

9,688

13,745

22,265

24,000

12,518

12,542

12,175

12,980

20,917

18,696

857

160,383

Homeowner Exemption Information

3,796

6,362

10,407

9,865

3,640

3,650

3,005

3,681

9,165

7,473

296

61,340

Senior Citizen Exemption

1,848

3,613

6,269

4,738

1,813

1,725

1,759

2,155

5,399

4,670

186

34,175

Senior Citizen Freeze Exemption

1,942

4,140

6,369

4,540

1,821

1,842

1,899

2,254

5,357

4,690

177

35,031

Contact Us Form

2,767

1,121

2,442

3,484

1,948

2,078

1,702

3,403

3,724

3,067

283

26,019

*Through October 1, 2021

S T A T E O F T H E O F F I C E - 2022

11

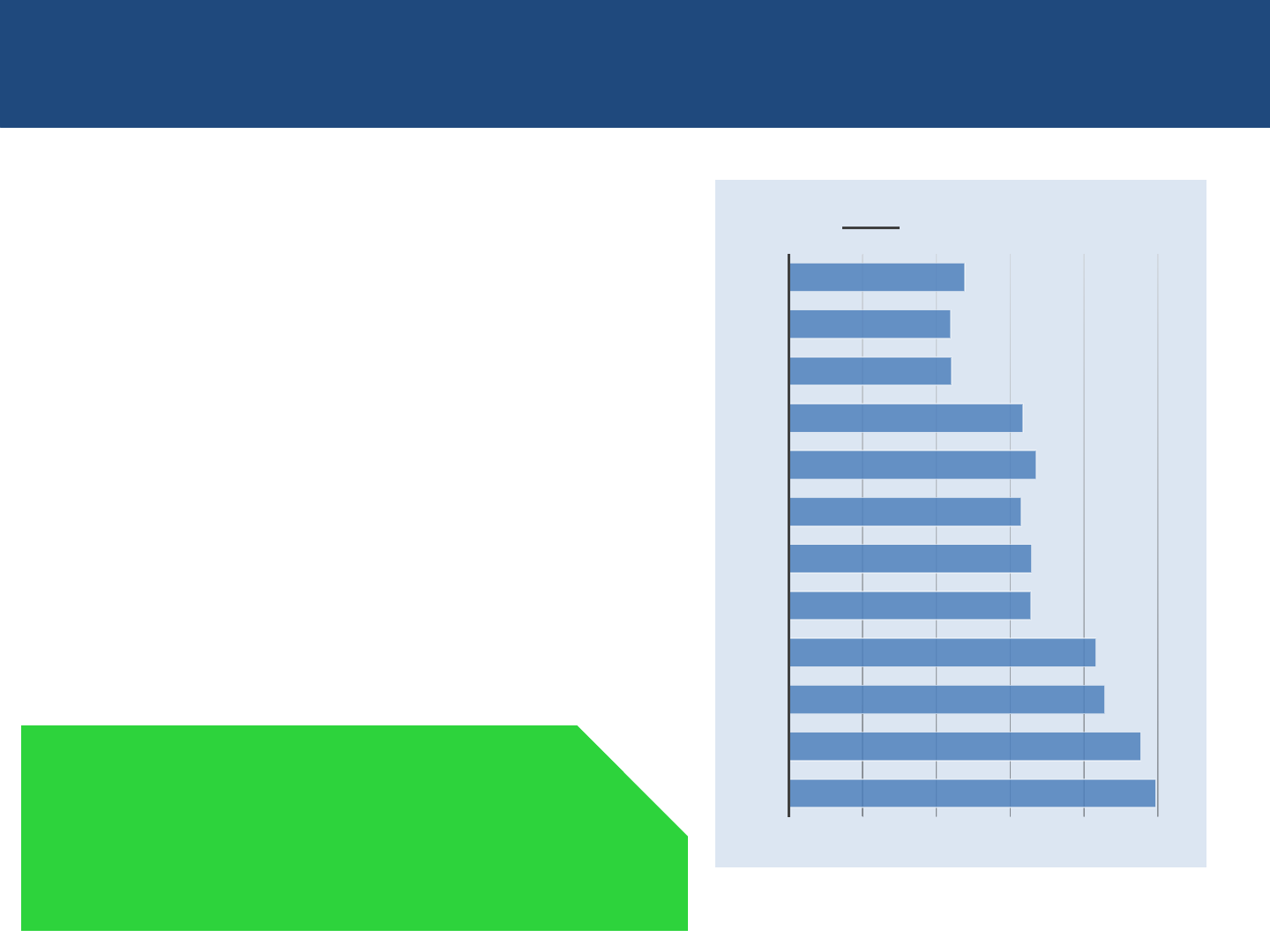

WEBSITE – PAGE VISITS

The heart of the Treasurer’s Office is

cookcountytreasurer.com. The site was created

internally and allows taxpayers to easily:

• Submit payment online

• Check payment status

• Download electronic tax bill

• Search for refunds

• Check property tax exemptions

• Obtain frequently used forms

• Contact us via email

• Download informational brochures

• Read important studies

The site has been visited nearly 86.6 million

times since 2004.

86.6million

website visitors

S T A T E O F T H E O F F I C E - 2022

Fiscal Year Site Visits

2021*

10,515,470

2020

7,277,861

2019

7,477,080

2018

6,630,301

2017

5,063,847

2016

4,554,406

2015

4,068,008

2014

3,051,125

2013

3,766,049

2012

4,367,537

2011

4,081,384

2010

3,776,292

2009

3,390,660

2008

3,412,301

2007

4,832,303

2006

3,678,393

2005

3,904,819

2004

2,738,366

Total

86,586,202

*Through October 1, 2021.

12

WEBSITE (cookcountytreasurer.com)

S T A T E O F T H E O F F I C E - 2022

13

MOBILE WEBSITE (cookcountytreasurer.com)

The site was upgraded in June 2015 to better

assist taxpayers using a mobile device.

Programming code automatically recognizes if

a visitor is using a mobile device and

conforms the layout and design to fit the

device.

Since December 1, 2017, there have been

nearly 6.4 million website visits from mobile

users.

6.4 million

mobile device visitors to cookcountytreasurer.com

S T A T E O F T H E O F F I C E - 2022

Mobile Visits

iPhone

3,889,063

Android

1,546,229

iPad

682,972

Samsung

260,401

14

MOBILE WEBSITE (cookcountytreasurer.com)

S T A T E O F T H E O F F I C E - 2022

15

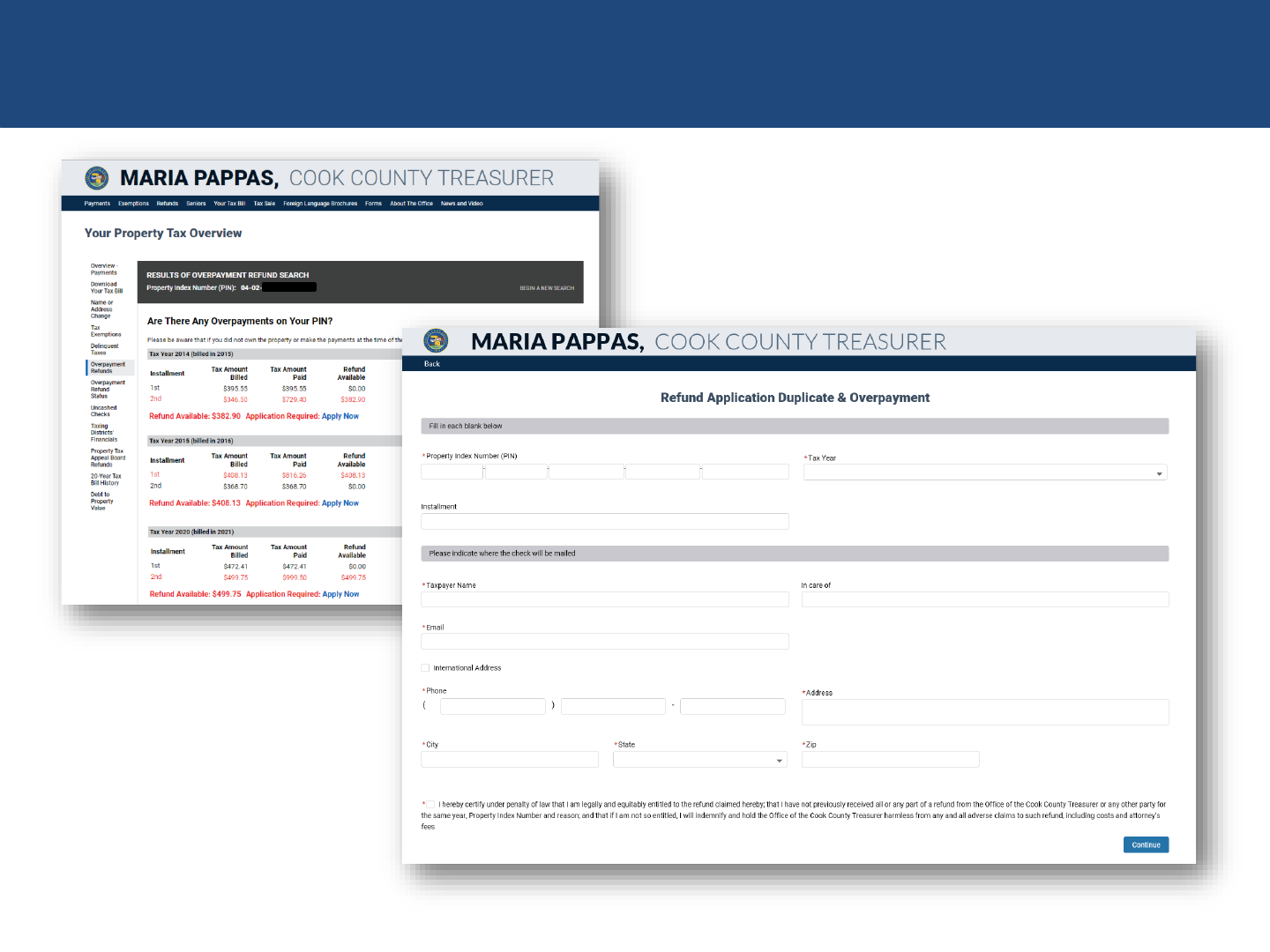

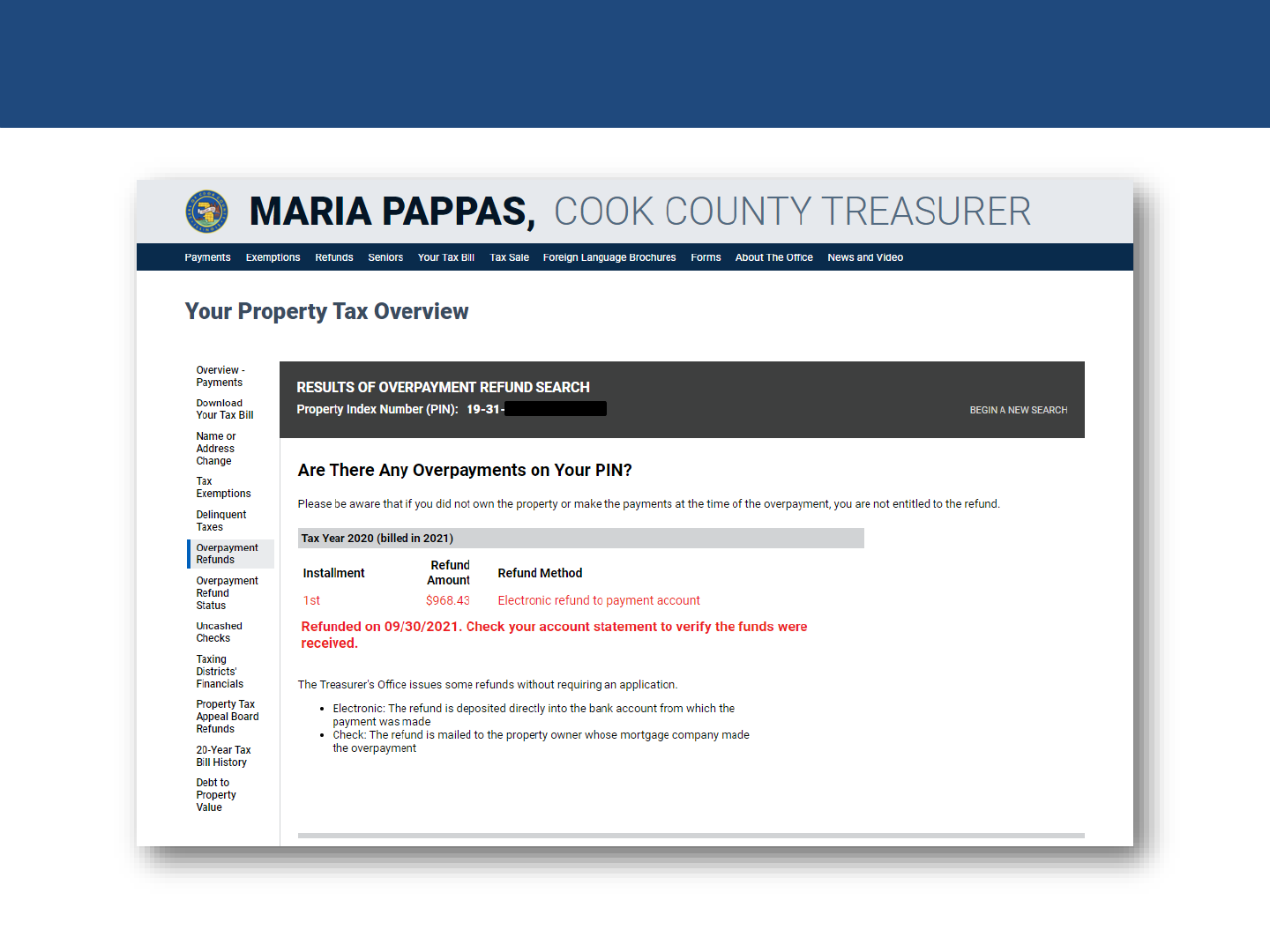

WEBSITE – DUPLICATE/OVERPAYMENT REFUND SEARCH

The website has built-in functionality to display

if a property address or property index number

(PIN) has an overpayment going back 20

years.

In May 2020, the Treasurer’s Office introduced

a new feature that allows Taxpayers to easily

complete an electronic, online refund

application to claim an overpayment of taxes.

The office streamlined the process to

eliminate paper refund applications.

Currently, there are about $72 million in

overpayments available from the Treasurer’s

Office.

$72 million

in available duplicate and overpayment refunds

S T A T E O F T H E O F F I C E - 2022

16

WEBSITE – SEARCH FOR DUPLICATE/OVERPAYMENT REFUNDS

S T A T E O F T H E O F F I C E - 2022

17

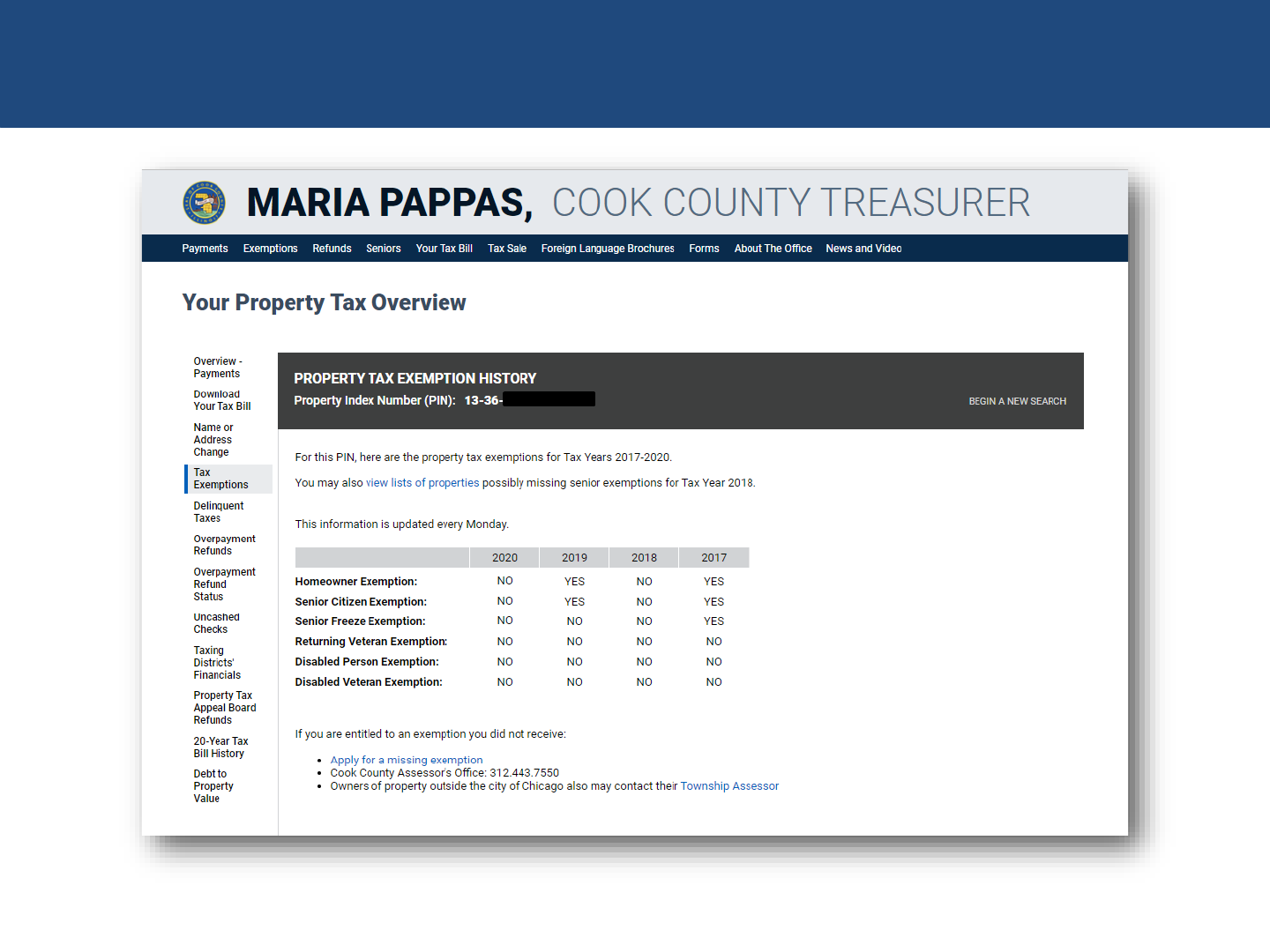

WEBSITE – SEARCH FOR MISSING EXEMPTIONS

The site details the property tax exemptions

received for the most recent four years.

About 24,000 senior citizens could save a

total of $43 million by applying for

exemptions they did not receive.

If a taxpayer needs to apply for a missing

exemption, a link takes them to the

application.

$43 million

possible total dollar amount of missing exemptions

S T A T E O F T H E O F F I C E - 2022

18

WEBSITE – SEARCH FOR MISSING EXEMPTIONS

S T A T E O F T H E O F F I C E - 2022

19

ELECTRONIC TAX BILL (PDF)

In July 2017, the Treasurer’s Office began offering

property owners the option to download or print their

tax bill in PDF format. Previously, requests for

duplicate bills were printed in hard copy form and

mailed to owners.

The website has produced more than 3 million

electronic tax bills since December 1, 2017.

20,025 electronic tax bills were generated on August

17, 2021, the highest number of bills produced on a

single day.

3,015,285

electronic tax bill requests from taxpayers

S T A T E O F T H E O F F I C E - 2022

Year Quantity

2021

838,286

2020

813,050

2019

643,877

2018

647,279

2017

(Introduced 12/1/2017)

72,793

Total

3,015,285

*Through October 1, 2021.

20

ELECTRONIC TAX BILL (PDF)

S T A T E O F T H E O F F I C E - 2022

21

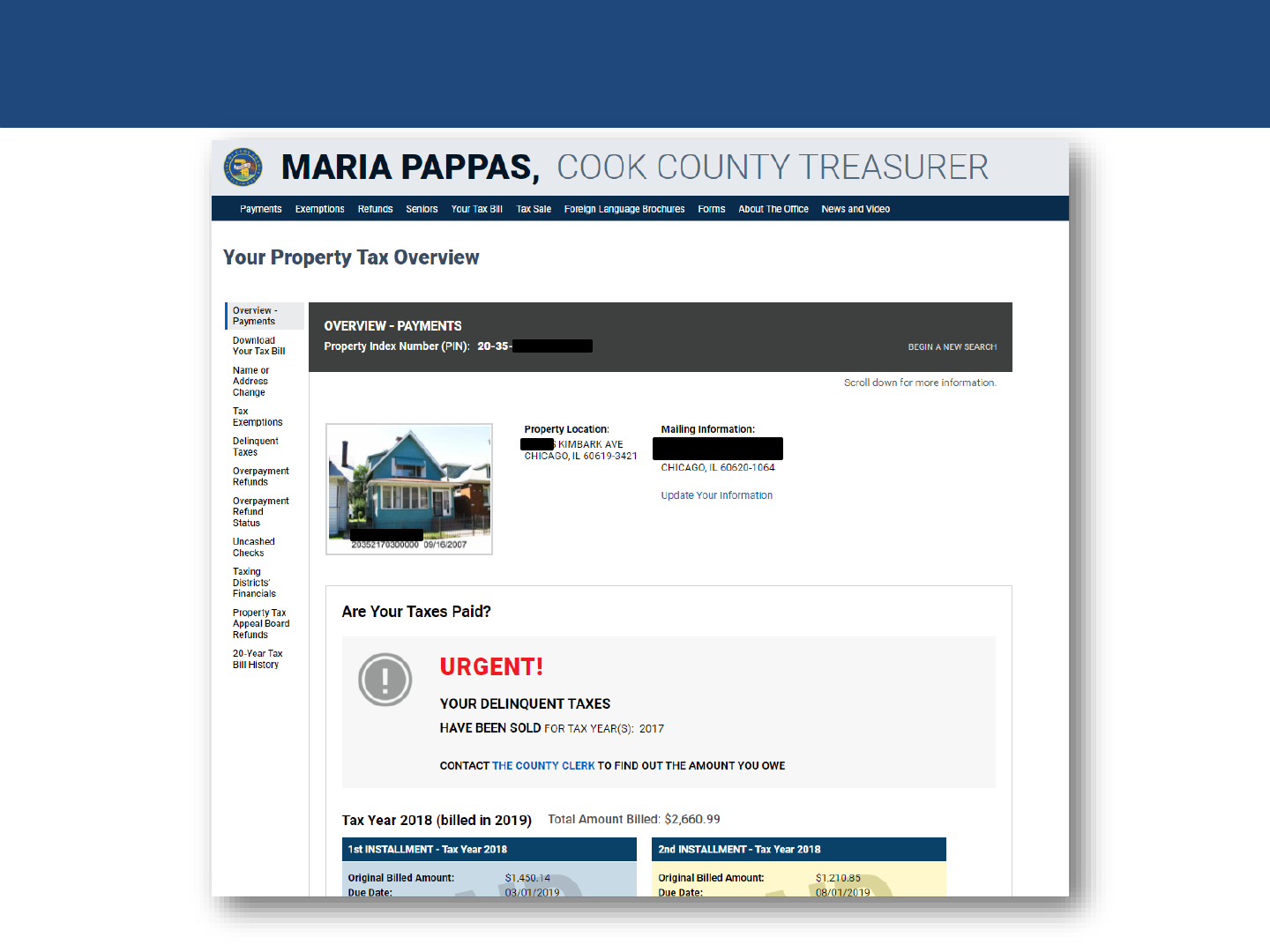

WEBSITE – WARNING FOR SOLD/FORFEITED TAXES

“Your Property Tax Overview” tells property

owners if taxes were sold or forfeited at the

Annual Tax Sale.

A message warns property owners to contact

the Cook County Clerk to redeem sold taxes.

11,920 properties were sold in the May

2019 sale.

The 2018 Annual Tax Sale scheduled for May

2020 was postponed due to the COVID-19

pandemic. It will begin on November 5, 2021.

Redeeming taxes as soon as possible is

important to avoid costly interest charges.

11,920

number of properties sold at the May 2019 tax sale

S T A T E O F T H E O F F I C E - 2022

24,860

23,848

21,399

20,814

16,419

16,442

15,757

16,773

15,865

11,031

10,970

11,920

0 5,000 10,000 15,000 20,000 25,000

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

PINs Sold in Annual Tax Sale

22

WEBSITE – WARNING FOR SOLD/FORFEITED TAXES

S T A T E O F T H E O F F I C E - 2022

23

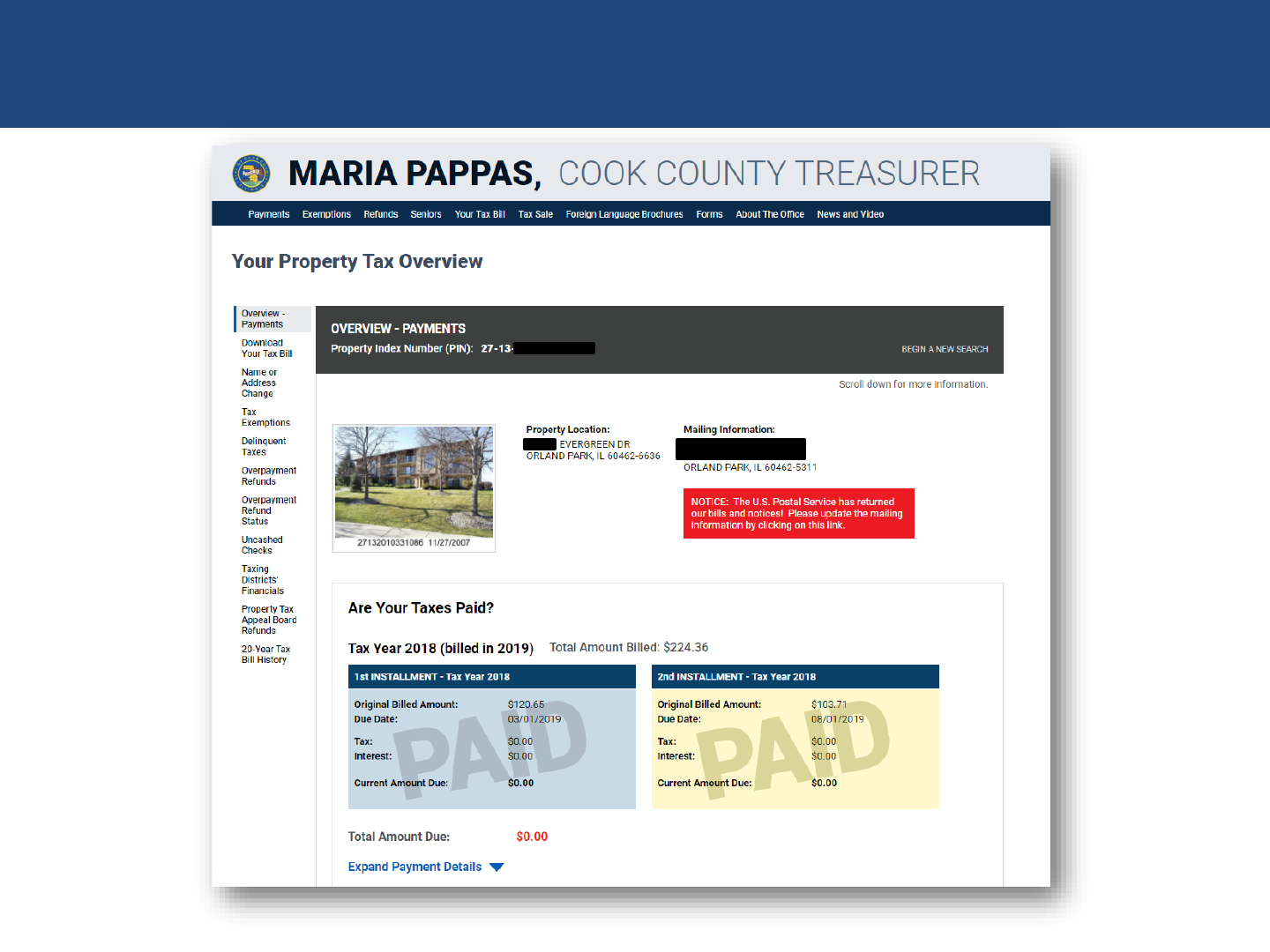

WEBSITE – MESSAGE FOR TAX BILLS RETURNED BY USPS

To help homeowners who have mail-delivery

problems, cookcountytreasurer.com now

shows when tax bills have been returned by

the U.S. Postal Service.

The Treasurer's Office has reduced the

number of properties with incorrect mailing

addresses by nearly a third, to 52,928 for the

TY2020 First Installment.

52,928

properties with returned tax bills

S T A T E O F T H E O F F I C E - 2022

To see if your bills have been returned or to

change the name and address on your bill, visit

cookcountytreasurer.com and:

• Select the purple box labeled "Your Property

Tax Overview"

• Enter your address or Property Index

Number (PIN)

• Look for a red warning box that appears if

your bills have been returned

• Select "Update Your Information" to change

the taxpayer name or mailing address

24

WEBSITE – MESSAGE FOR TAX BILLS RETURNED BY USPS

S T A T E O F T H E O F F I C E - 2022

25

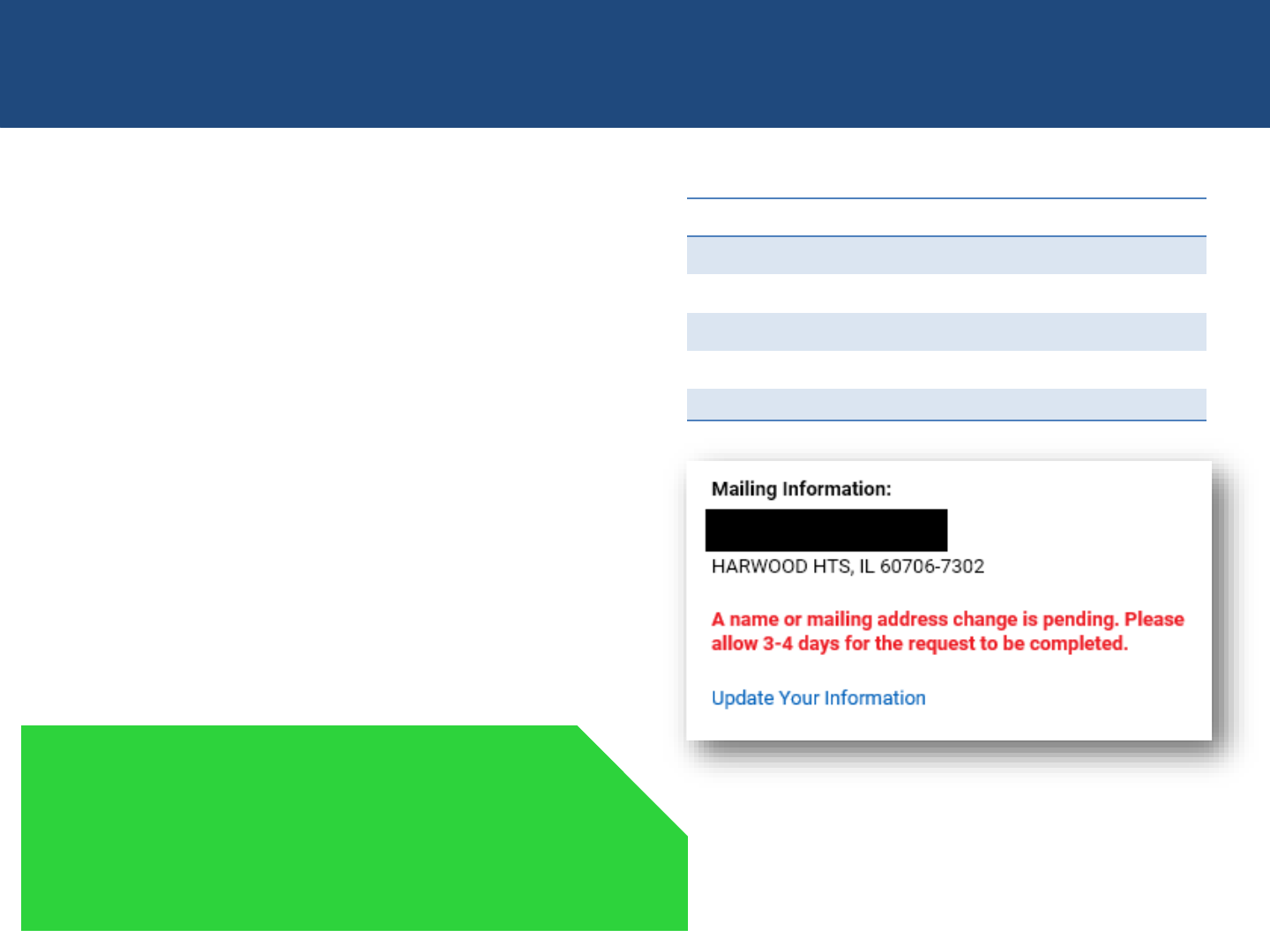

WEBSITE – ELECTRONIC NAME/ADDRESS CHANGES

The site was upgraded on June 6, 2019 to

accept electronic name and address changes.

The simple, electronic process eliminates the

need for paper applications to be sent to the

Treasurer’s Office and processed by hand.

More than 120,980 electronic name and

address updates have been made by Cook

County property owners since the process

went live.

Once a change has been initiated, a message

informs the requestor of the pending change.

120,980

electronic name and address changes made

S T A T E O F T H E O F F I C E - 2022

Year Quantity

2021

49,885

2020

36,943

2019

34,152

Total 120,980

*Through October 1, 2021.

26

WEBSITE – ELECTRONIC NAME/ADDRESS CHANGES

S T A T E O F T H E O F F I C E - 2022

27

WEBSITE – REFUND STATUS

The Treasurer’s Office automatically issued

nearly 11,500 refunds to taxpayers totaling

$25.4 million in September 2021. Since

November 2018, the Treasurer’s Office has

issued 121,00 automatic refunds totaling

about $82 million.

The site displays the status of a refund,

including the amount, expected refund date,

and then the actual refund date once issued.

The refunds were a result of property tax

exemptions applied to the second installment

tax bill. Taxpayers do not need to submit a

paper application for these refunds.

$82 million

automatic refunds issued since November 2018

S T A T E O F T H E O F F I C E - 2022

28

WEBSITE – REFUND STATUS

S T A T E O F T H E O F F I C E - 2022

29

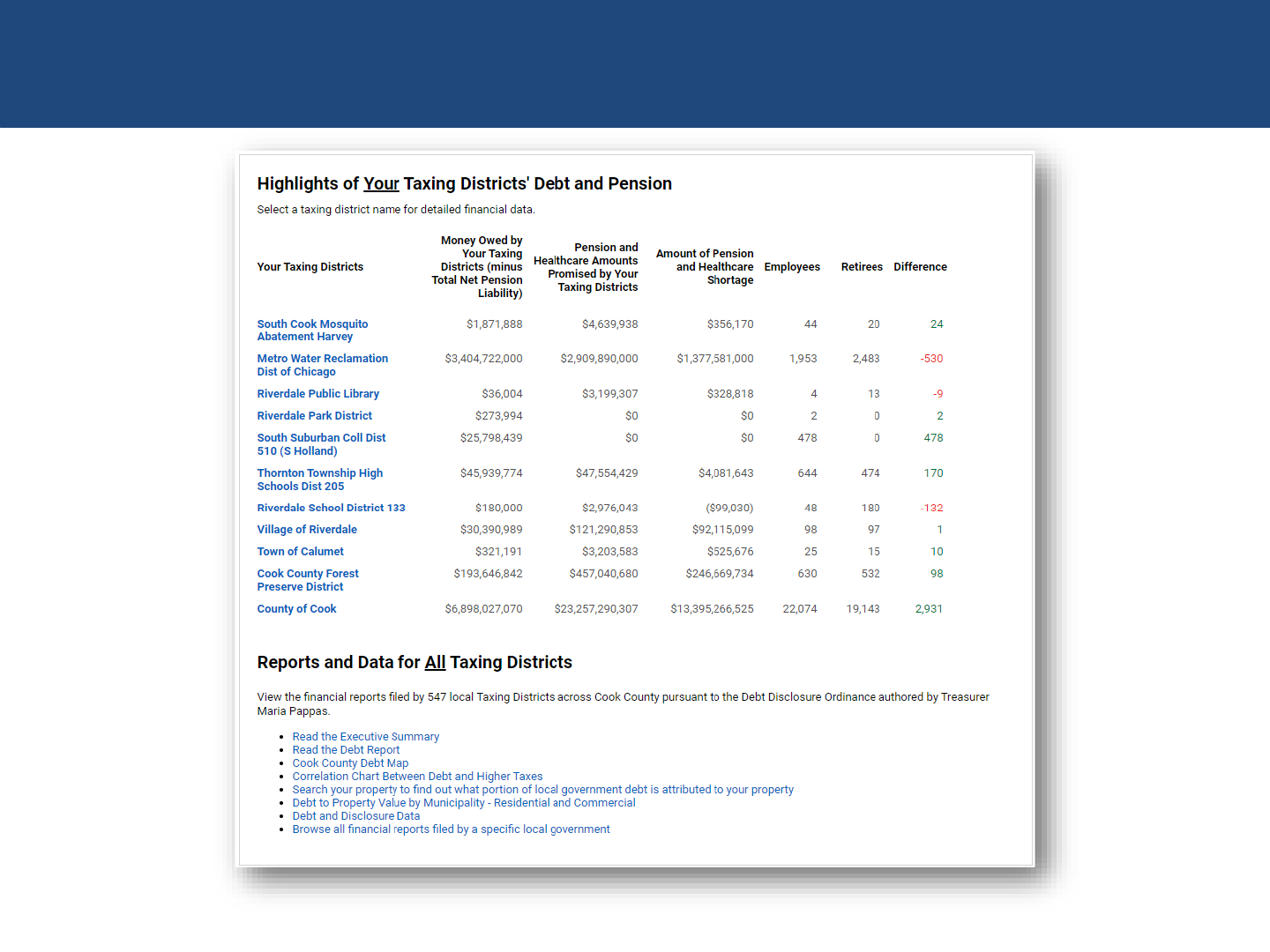

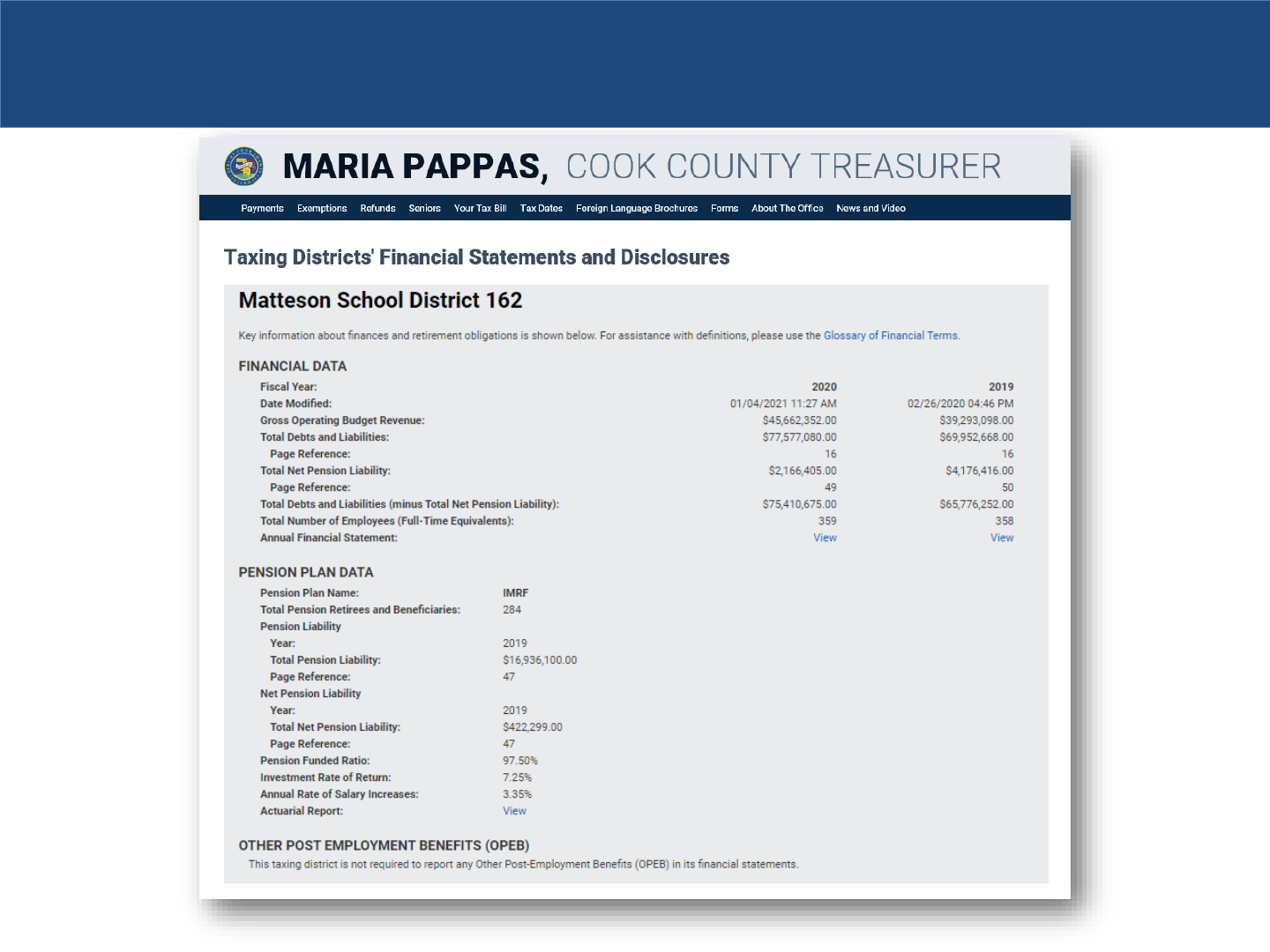

WEBSITE – TAXING DISTRICT DEBT AND PENSION

The Taxing Districts' Debt and Pension data is

easily accessible online, allowing taxpayers to

electronically obtain the financial information

they need to make informed decisions about

the local agencies that receive a share of their

property taxes.

The Treasurer’s Debt Disclosure data includes

important information like current employees

versus retirees and lists total debts ranked

worst to best.

$153.4 billion

total debt of the 547 primary taxing agencies

S T A T E O F T H E O F F I C E - 2022

30

WEBSITE – TAXING DISTRICT DEBT AND PENSION

S T A T E O F T H E O F F I C E - 2022

31

WEBSITE – FOREIGN LANGUAGE CONTENT

The Treasurer’s Office has a feature on the

website that allows property owners to use

cookcountytreasurer.com in 108 different

languages.

The Treasurer’s Office implemented

translation services directly into the code. By

simply selecting a button, the site’s content is

translated into the desired language via

Google Translate.

108 languages

available on cookcountytreasurer.com

foreign

Afrikaans

Albanian

Amharic

Arabic

Armenian

Azerbaijani

Basque

Belarusian

Bengali

Bosnian

Bulgarian

Catalan

Cebuano

Chichewa

Chinese

(Simplified)

Chinese (Traditional)

Corsican

Croatian

Czech

Danish

Dutch

Esperanto

Estonian

Filipino

Finnish

French

Frisian

Galician

Georgian

German

Greek

Gujarati

Haitian Creole

Hausa

Hawaiian

Hebrew

Hindi

Hmong

Hungarian

Icelandic

Igbo

Indonesian

Irish

Italian

Japanese

Javanese

Kannada

Kazakh

Khmer

Kinyarwanda

Korean

Kurdish (Kurmanji)

Kyrgyz

Lao

Latin

Latvian

Lithuanian

Luxembourgish

Macedonian

Malagasy

Malay

Malayalam

Maltese

Maori

Marathi

Mongolian

Myanmar (Burmese)

Nepali

Norwegian

Odia (Oriya)

Pashto

Persian

Polish

Portuguese

Punjabi

Romanian

Russian

Samoan

Scots Gaelic

Serbian

Sesotho

Shona

Sindhi

Sinhala

Slovak

Slovenian

Somali

Spanish

Sundanese

Swahili

Swedish

Tajik

Tamil

Tatar

Telugu

Thai

Turkish

Turkmen

Ukrainian

Urdu

Uyghur

Uzbek

Vietnamese

Welsh

Xhosa

Yiddish

Yoruba

Zulu

S T A T E O F T H E O F F I C E - 2022

32

WEBSITE – FOREIGN LANGUAGE CONTENT

S T A T E O F T H E O F F I C E - 2022

COOKCOUNTYTREASURER.COM – TRANSLATED TO CROATIAN

33

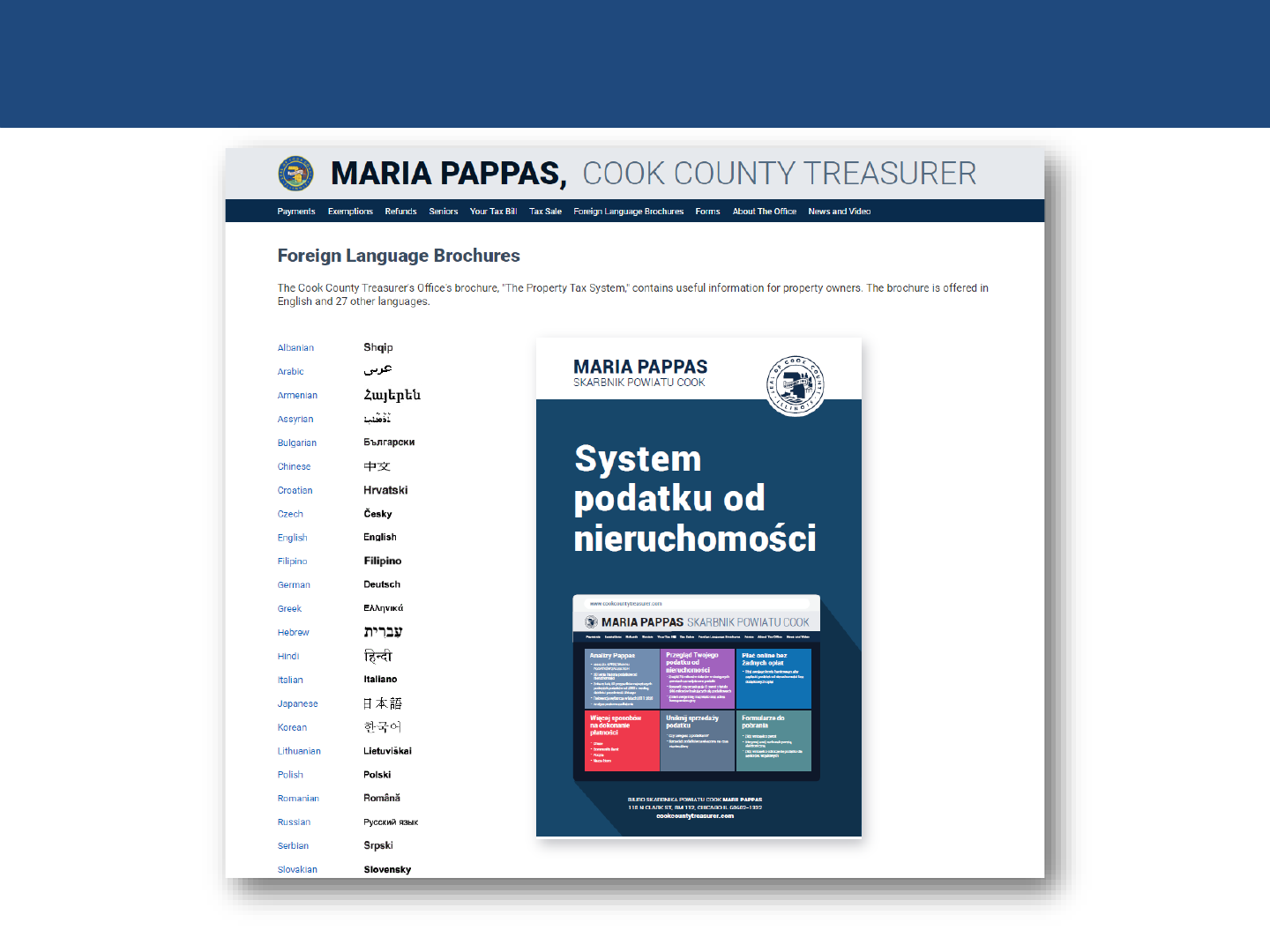

Taxpayers may view and download informational

brochures - revised in 2021 in English and 27 foreign

languages (including 4 new languages) - on

cookcountytreasurer.com:

The informational brochures have been downloaded

519,105 times (foreign brochures downloaded 423,281

times) since 2006.

The office has eliminated the need for translators since

foreign language information is readily available.

▪ Albanian

▪ Arabic

▪ Armenian

▪ Assyrian

▪ Bulgarian

▪ Chinese

▪ Croatian

▪ Czech

▪ Filipino

▪ German

▪ Greek

▪ Hebrew

▪ Hindi

▪ Italian

▪ Japanese

▪ Korean

▪ Lithuanian

▪ Polish

▪ Romanian

▪ Russian

▪ Serbian

▪ Slovakian

▪ Spanish

▪ Thai

▪ Ukrainian

▪ Urdu

▪ Vietnamese

WEBSITE – NEW INFORMATIONAL BROCHURES

519,105

brochure downloads

S T A T E O F T H E O F F I C E - 2022

Language

Total (as of 10/3/2021)

Albanian 9,049

Arabic 19,886

Armenian* 3

Assyrian 13,265

Bulgarian 13,221

Chinese 29,407

Croatian 21,398

Czech 7,539

English 95,824

Filipino* 18

German 9,858

Greek 10,337

Hebrew* 27

Hindi 969

Italian 10,374

Japanese 3,023

Korean 24,056

Lithuanian 10,026

Polish 134,956

Romanian 14,699

Russian 18,394

Serbian 14,038

Slovakian 5,601

Spanish 32,475

Thai 3,827

Ukrainian 7,974

Urdu 8,853

Vietnamese* 8

Total Downloads

519,105

* NEW LANGUAGE ADDED IN 2021

34

WEBSITE – NEW INFORMATIONAL BROCHURES

S T A T E O F T H E O F F I C E - 2022

35

36

Major Initiatives

37

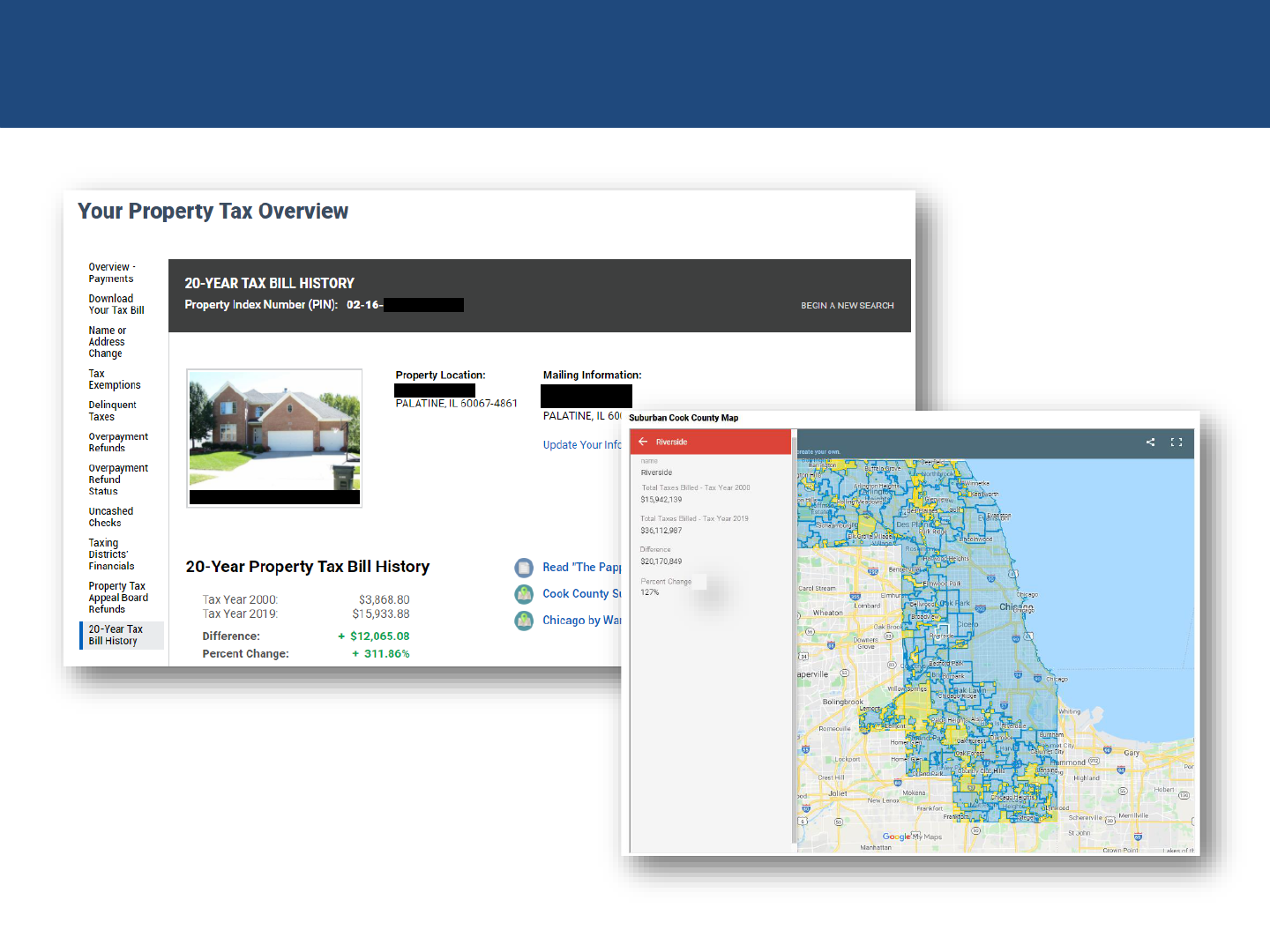

PAPPAS STUDIES: 20-YEAR TAX BILL HISTORY

Using data amassed to date, the report

documented that property taxes rose by

99%, while local wages increased only

57% and the cost of living increased by

only 36% from 2001 to 2020.

• Residential properties skyrocketed

164% in Chicago, 116% in suburbs.

• Commercial properties jumped 81%

in Chicago, 54% in suburbs.

Any taxpayer can see their own 20-year

increase on cookcountytreasurer.com.

Interactive maps on the website show

changes by suburb or Chicago ward.

S T A T E O F T H E O F F I C E - 2022

99 percent

total tax increase for all properties since 2000

38

PAPPAS STUDIES: 20-YEAR TAX BILL HISTORY

S T A T E O F T H E O F F I C E - 2022

39

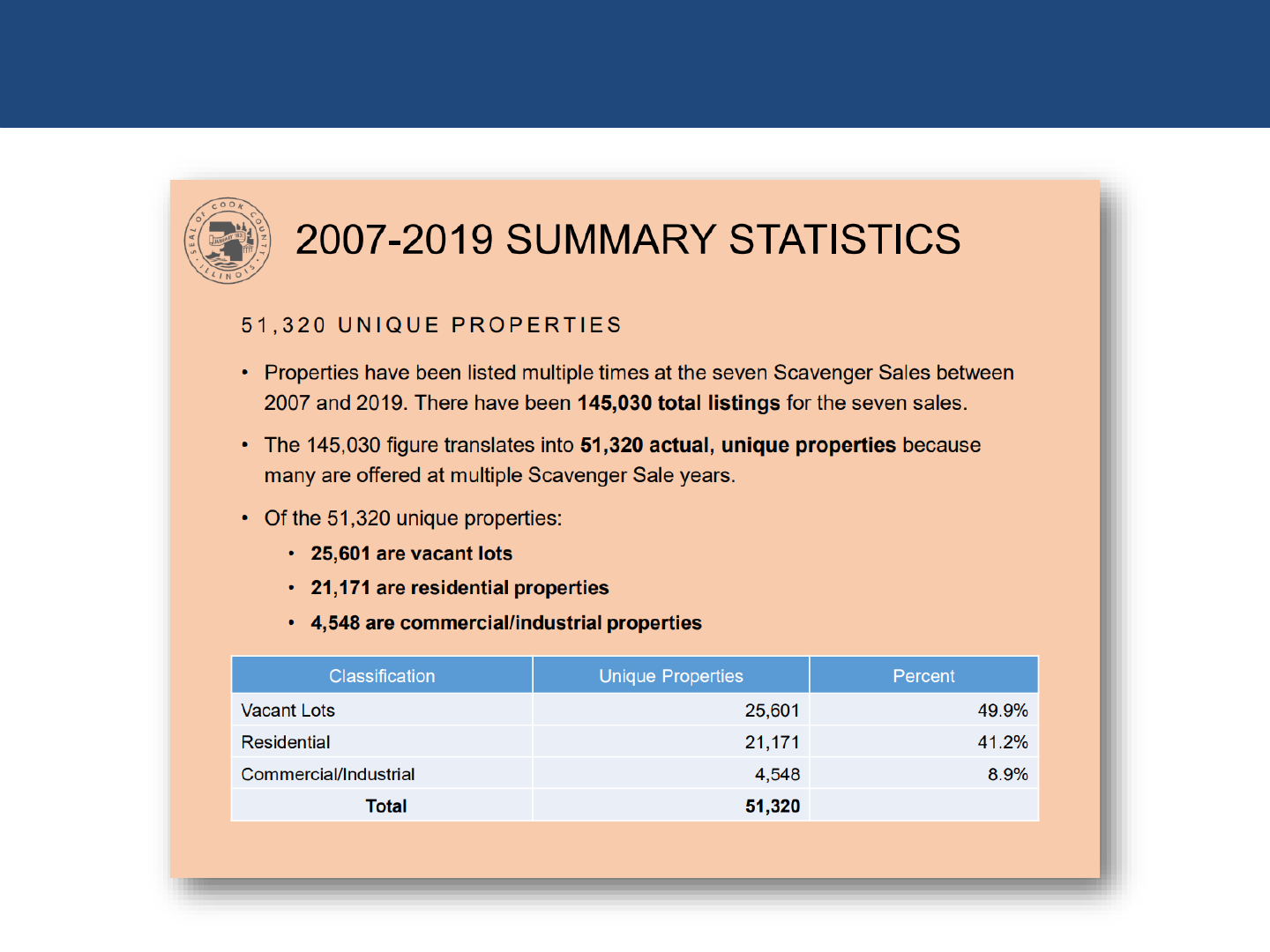

PAPPAS STUDIES: SCAVENGER SALE STUDY

A study found that the Scavenger Sale,

designed to put vacant and abandoned

properties back in productive use has

failed decade after decade to accomplish

that goal.

Of the 51,320 properties offered at the last

seven sales, 25,601 (50%) were classified

as vacant lots.

Areas in Cook County that have the most

delinquent properties also are:

• losing population

• have large property tax increases

• have the most violent crime

S T A T E O F T H E O F F I C E - 2022

50 percent

scavenger properties that are vacant lots

40

PAPPAS STUDIES: SCAVENGER SALE STUDY

S T A T E O F T H E O F F I C E - 2022

total tax increase for all properties since 2000

41

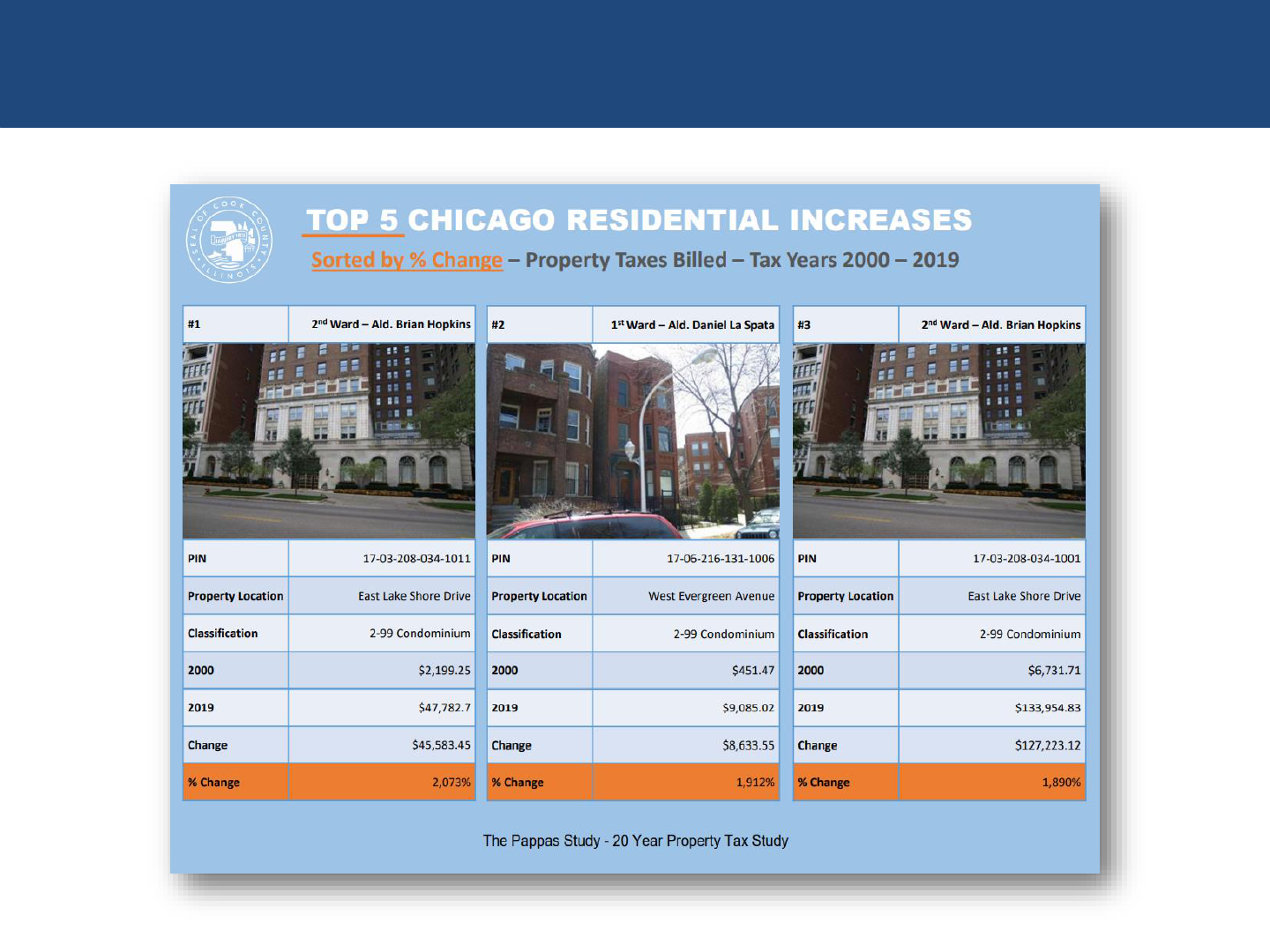

PAPPAS STUDIES: 50 LARGEST TAX INCREASES SINCE 2000

Another study in January 2021 disclosed

the Top 50 Property Index Numbers (PINs)

with the largest tax increases from 2000 to

2019 in Chicago and the suburbs, for both

residential and commercial property.

Found that some properties, in gentrifying

neighborhoods, saw increases by as much

as 2,000%.

The bill for a condominium on East Lake

Shore Drive in Chicago jumped 1,890%,

from $6,700 to nearly $134,000.

A two-story house in suburban Winnetka

saw a 1,174% tax increase, from $53,000

to $675,000.

S T A T E O F T H E O F F I C E - 2022

99 percent

total tax increase for all properties since 2000

42

PAPPAS STUDIES: 50 LARGEST TAX INCREASES SINCE 2000

S T A T E O F T H E O F F I C E - 2022

total tax increase for all properties since 2000

43

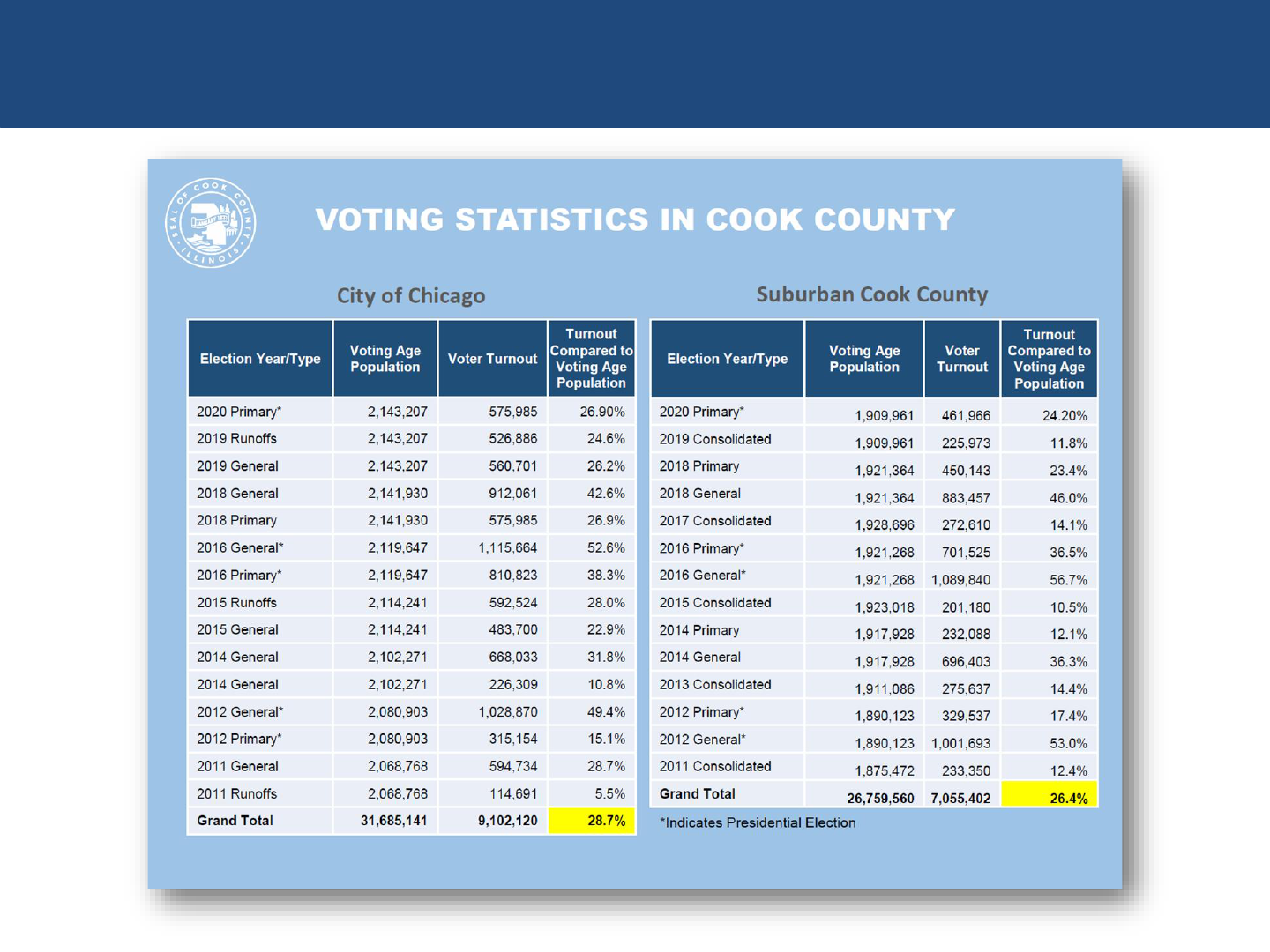

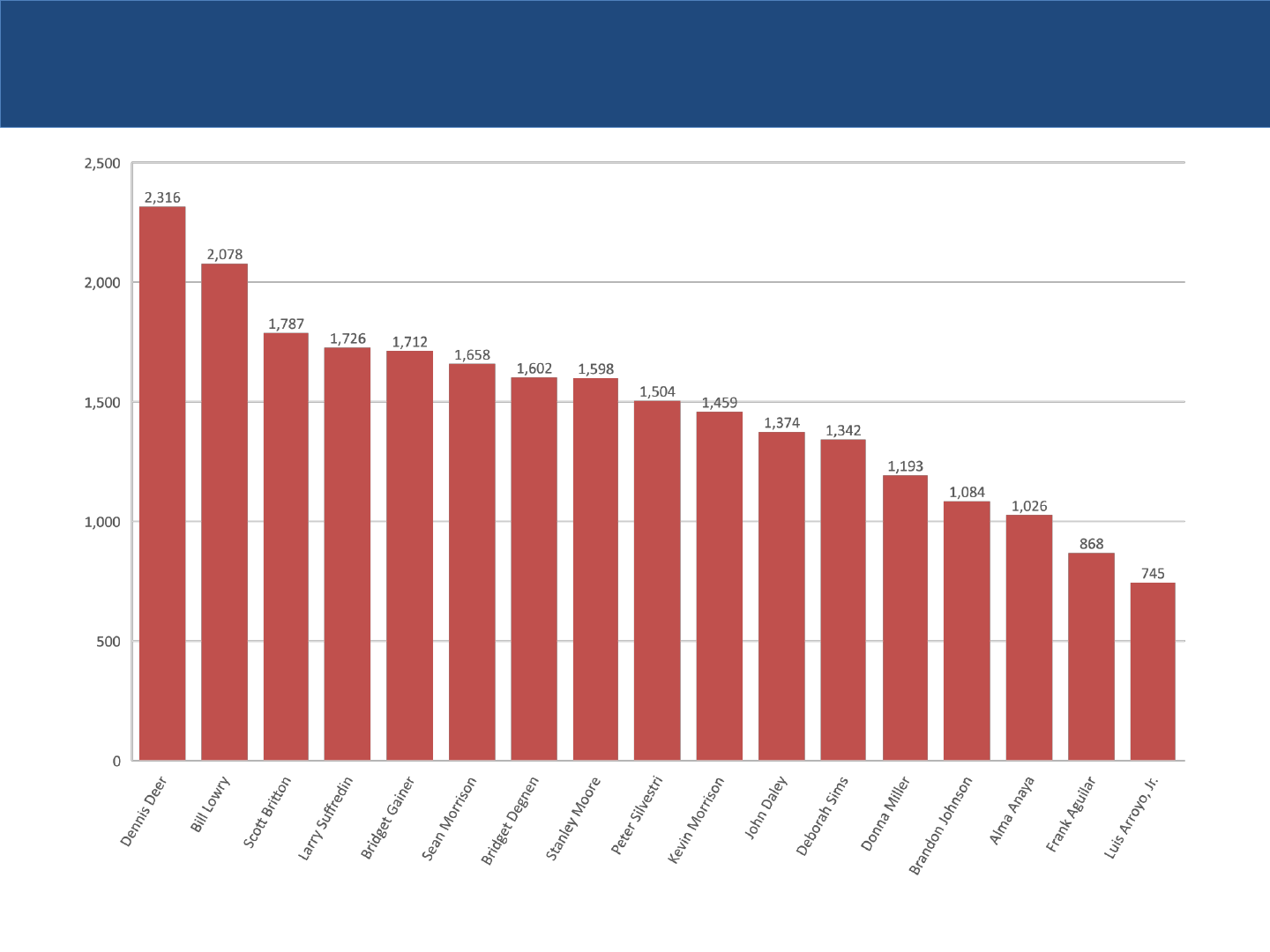

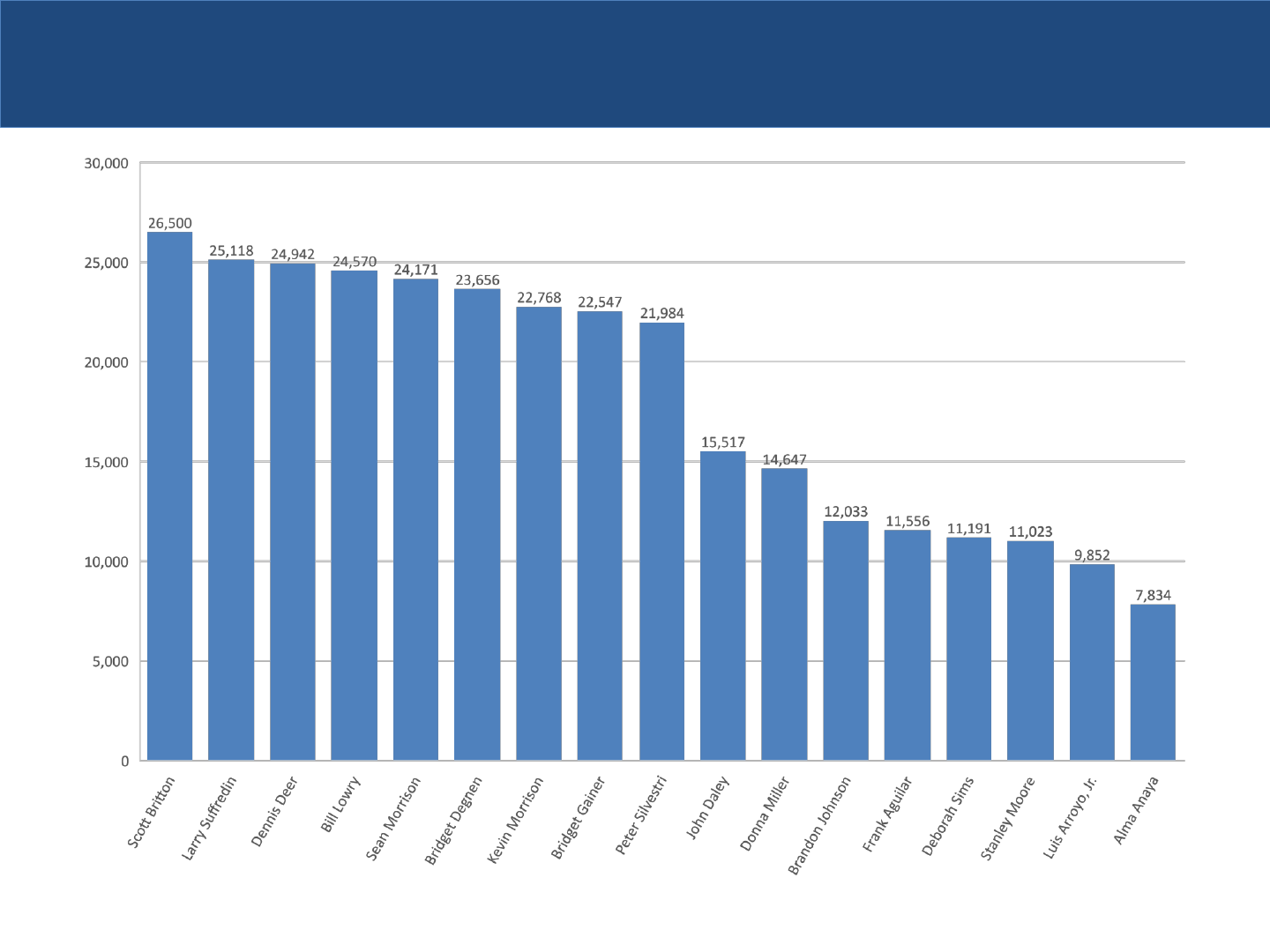

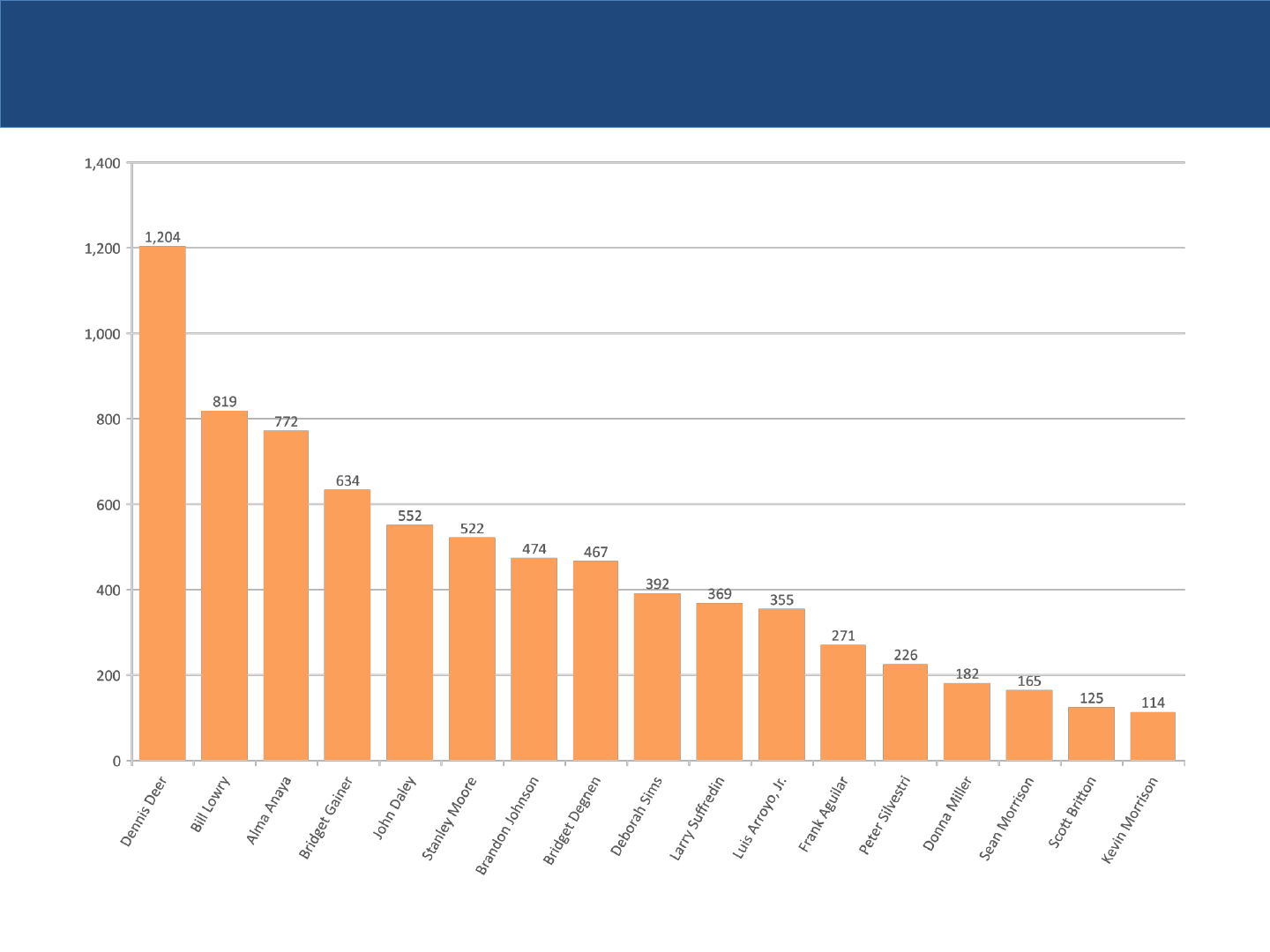

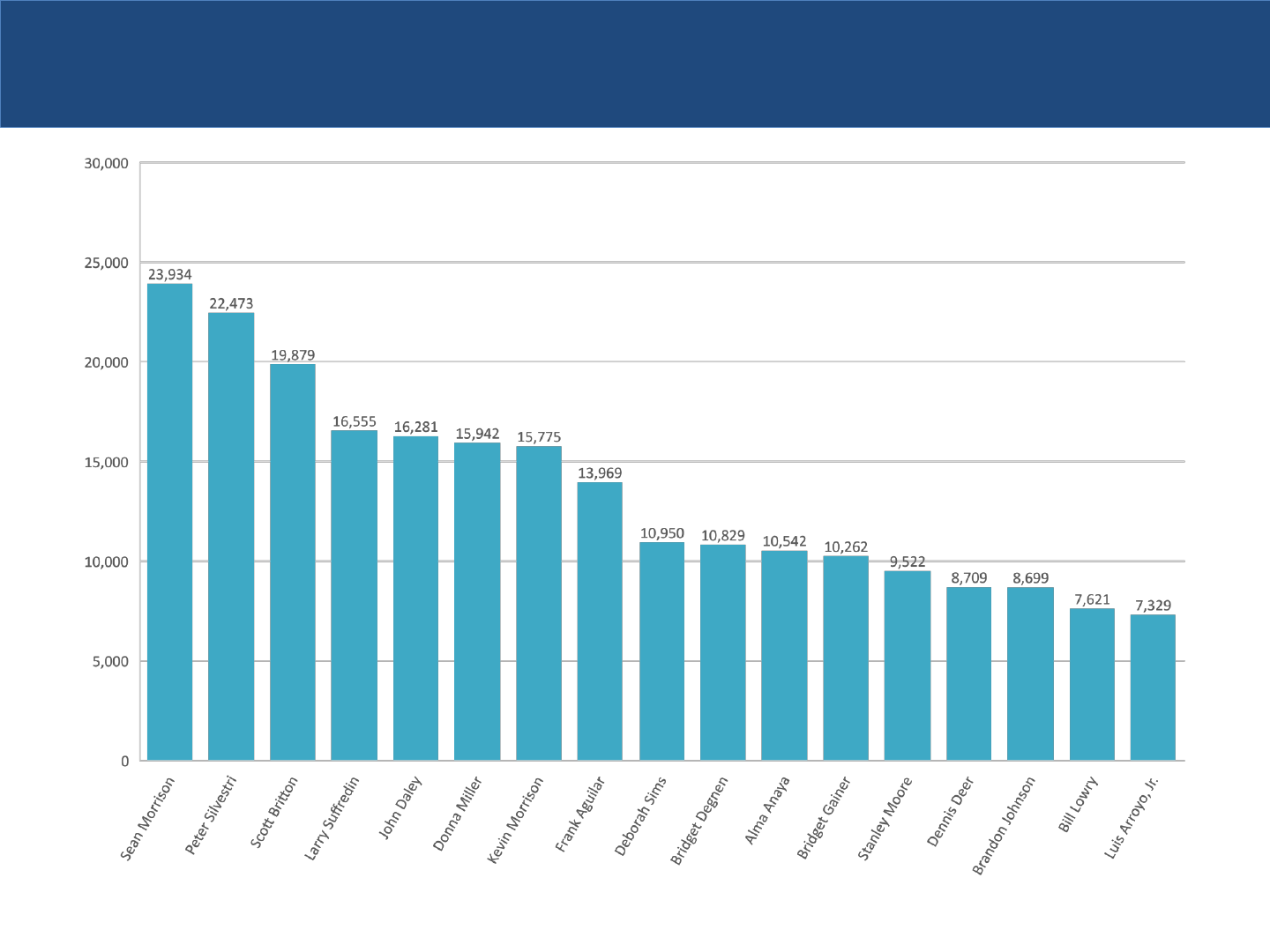

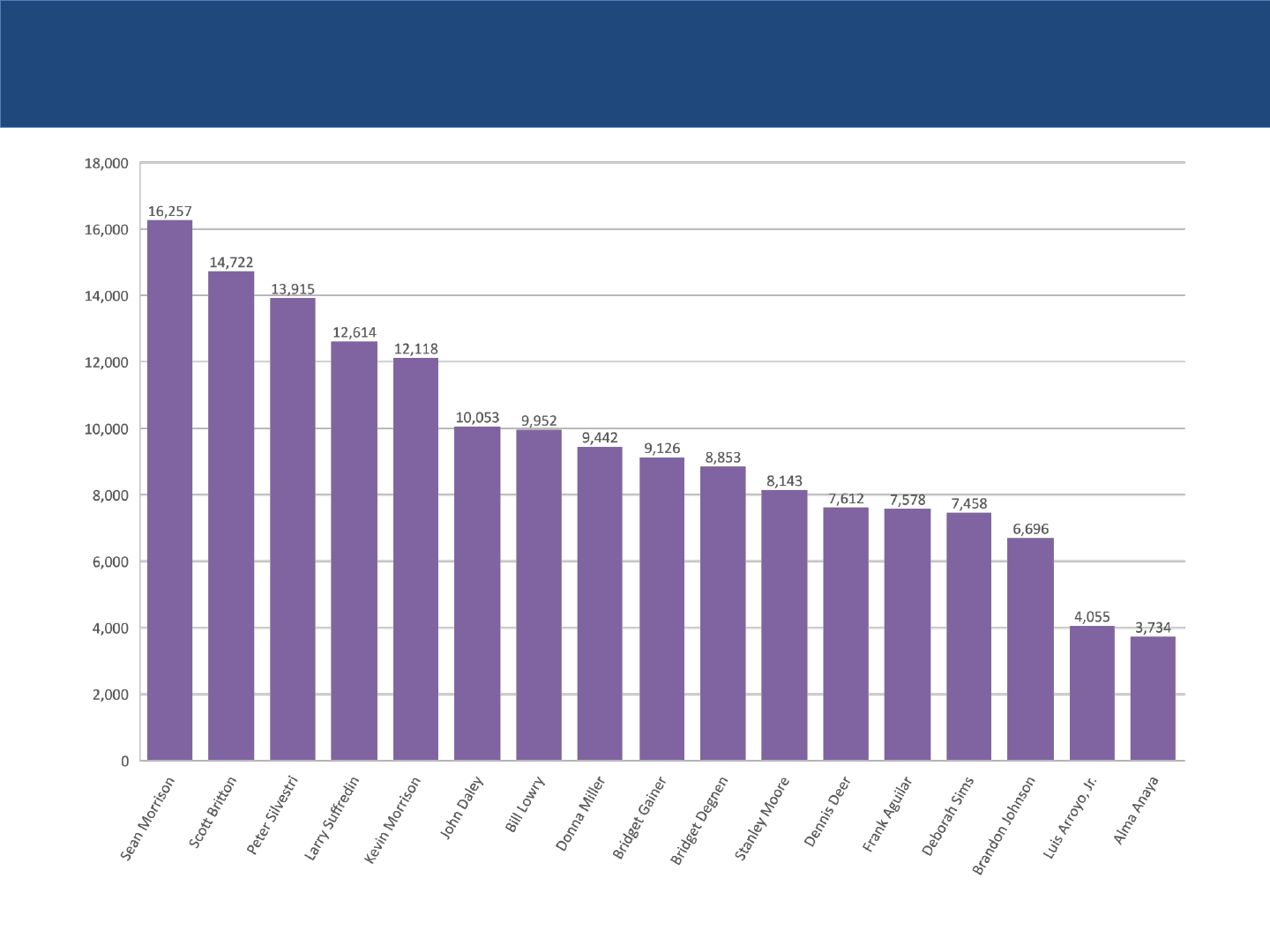

PAPPAS STUDIES: VOTER TURNOUT 2011-2020

The Voter Turnout figures show only about

one-quarter of all citizens eligible to vote

actually cast a ballot in most elections.

Since 2011:

• Only 28.7% of the City of Chicago

voting-age population has cast ballots

in elections.

• In suburban Cook County, only

26.4% of the voting-age population has

cast ballots.

S T A T E O F T H E O F F I C E - 2022

25 percent

approximate voting-age population that votes

44

PAPPAS STUDIES: VOTER TURNOUT 2011-2020

S T A T E O F T H E O F F I C E - 2022

45

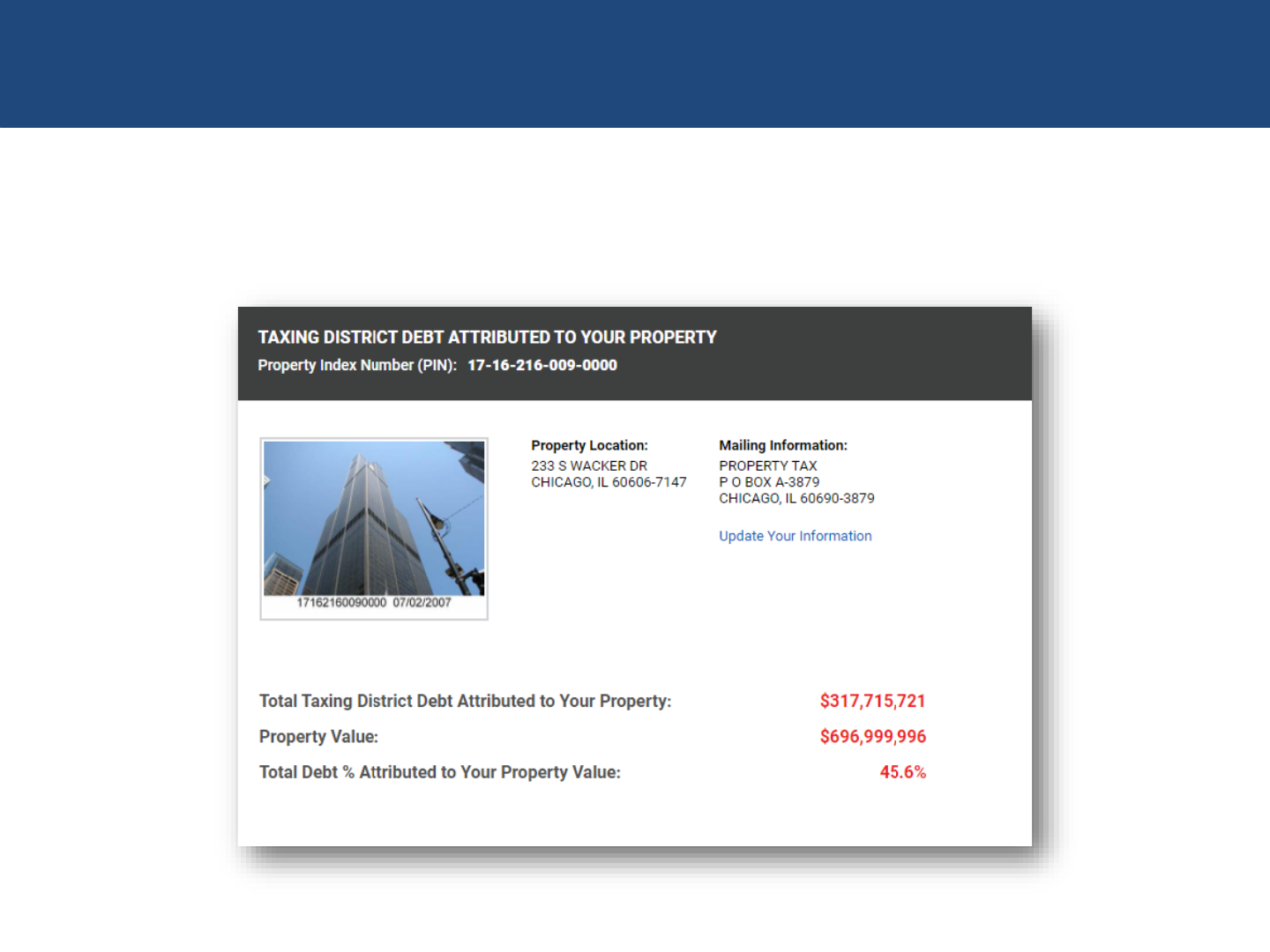

PAPPAS STUDIES: DEBT STUDY

Since 2009, the office has collected debt figures

for 547 local governments in Cook County that

set 2,200 different taxing district levies. Total

debt in Cook County is $153.4 billion.

From 2016 to early 2021, the total debt grew by

$22.8 billion (16.6%). During that same period,

the consumer price index (CPI) in the Chicago

region grew by just 8%.

Found that dozens of local governments had

pensions funded at levels well below 80%, with

some falling below 30%. Much of the debt is

rooted in unfunded pension liabilities.

Functionality now on cookcountytreasurer.com

allows owners to see the total amount of local

government debt attributed to a property.

S T A T E O F T H E O F F I C E - 2022

46

$153.4 billion

total debt of the 547 primary taxing agencies

PAPPAS STUDIES: DEBT STUDY

S T A T E O F T H E O F F I C E - 2022

Property owners can see the level of debt attributed to their property value at cookcountytreasurer.com.

At the time of the study, the Willis (Sears) Tower carried a total debt of 45.6% of its property value.

47

PAPPAS STUDIES: TAX YEAR 2020 TAX BILL ANALYSIS

In August 2021, the office released a first-

of-its-kind analysis of nearly 1.8 million

bills.

Taxes billed this year totaled $16.1

billion, an increase of $534 million, or

3.4%, from last year.

• Commercial property was billed more

than $7 billion, an increase of $410

million, or 6.2%, from last year.

• Residential property was billed $8.9

billion, an increase of $114 million, or

1.3%, from last year.

The biggest tax bill increases occurred

primarily in financially struggling Black and

Latino communities.

S T A T E O F T H E O F F I C E - 2022

$16.1 billion

total billed for tax year 2020, payable in 2021

48

PAPPAS STUDIES: TAX YEAR 2020 TAX BILL ANALYSIS

S T A T E O F T H E O F F I C E - 2022

total tax increase for all properties since 2000

15.3

15.4

15.5

15.6

15.7

15.8

15.9

16.0

16.1

Tax Year 2019 Tax Year 2020

Total Tax Billed

Tax Year 2020 increase from 2019: 3.425%

Tax Year 2020 Total Property Taxes Billed in Cook County – (Payable in 2021)

49

DDO AMENDMENT – TIF DATA

The amendment to the Debt Disclosure

Ordinance, approved by the Cook County

Board of Commissioners in February 2021,

will increase disclosure of Tax Increment

Financing districts in Cook County.

The amendment gives taxpayers the

opportunity to examine how TIF dollars

have been spent. This information will be

posted on cookcountytreasurer.com for

taxpayers to view and download at a later

date once municipalities comply with the

requirement and upload data to the

Treasurer’s Office.

S T A T E O F T H E O F F I C E - 2022

Tax Year TIF Revenue

2020 $1.5 billion

2019 $1.3 billion

2018 $1.2 billion

2017 $1.0 billion

2016 $852 million

2015 $718 million

2014 $644 million

2013 $683 million

2012 $723 million

2011 $729 million

50

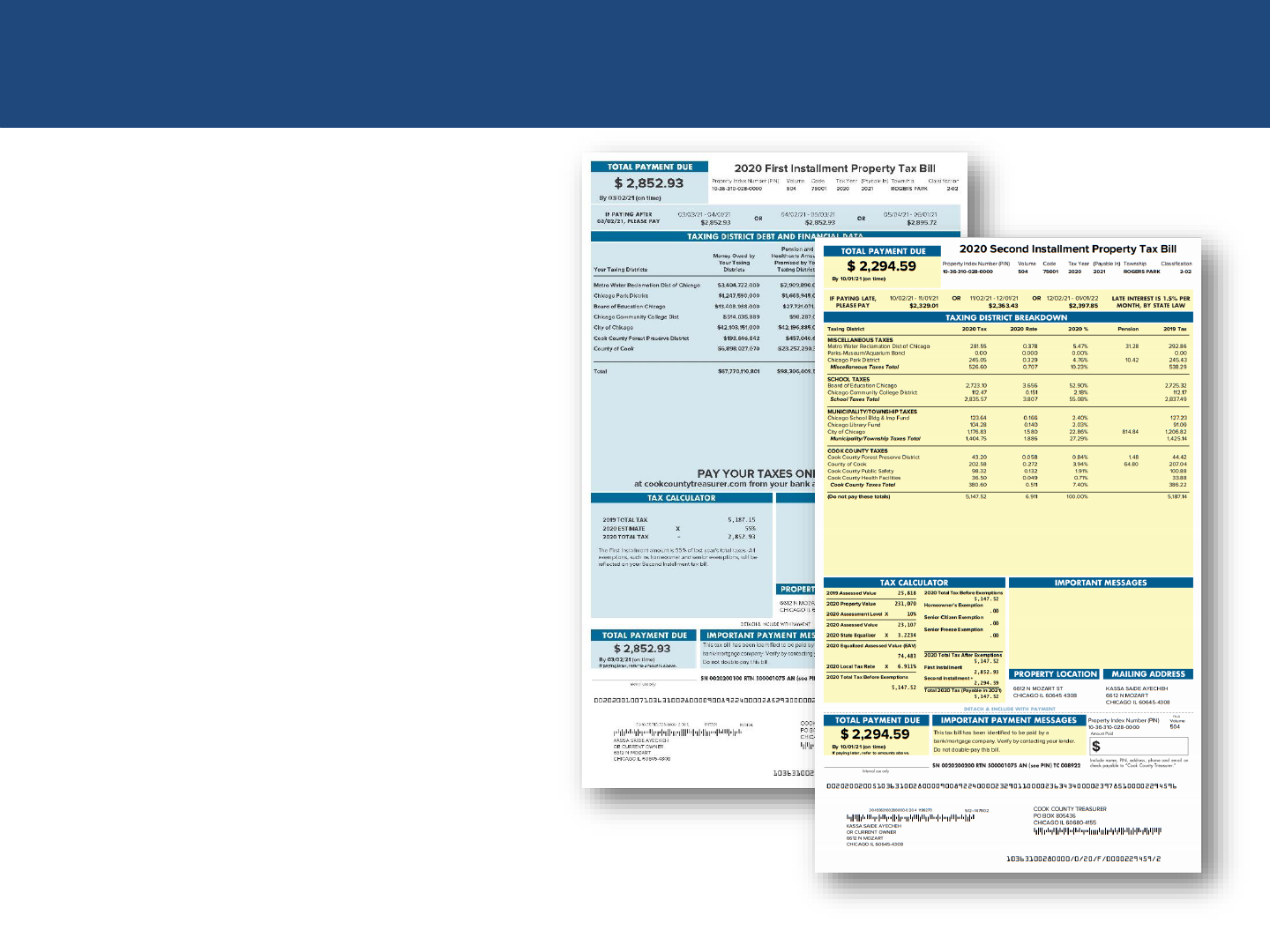

PROPERTY TAX BILLS

S T A T E O F T H E O F F I C E - 2022

total tax increase for all properties since 2000

The Treasurer’s Office contracts with

Sebis Direct Inc. to print the semi-

annual 1.8 million tax bills offsite instead

of in house.

Tax Year 2020 installment tax bills were

produced with Sebis in January 2021

and August 2021.

Sebis receives the property tax data

from electronic files and prints each

bill’s data at the same time as the form

layout, thereby combining processes

that had been separate in prior years.

Printing, folding, inserting and mailing

are now all handled as a single process.

51

BLACK AND LATINO HOUSES MATTER

Treasurer Maria Pappas launched the

“Black Houses Matter” initiative in March

2020 to directly reach and assist

homeowners in Cook County.

The initiative includes a weekly 30-minute

radio show on WVON/1690-AM. During the

show, Treasurer Pappas discusses the

program and takes calls from taxpayers

owed a tax refund or missing a property tax

exemption.

The office continues to work with

community leaders, ethnic groups,

aldermen and other elected officials to help

preserve homeownership and create

opportunities for generational wealth-

building.

S T A T E O F T H E O F F I C E - 2022

52

BLACK AND LATINO HOUSES MATTER – PHONE BANKS

Treasurer Maria Pappas teamed with ABC 7

Chicago to host a series of phone banks.

The four “Black and Latino Houses Matter”

phone banks sought to help Cook County

homeowners find refunds, apply for property

tax exemptions and avoid the Tax Sale.

S T A T E O F T H E O F F I C E - 2022

Phone Bank Date

Total Refunds

March 11

-17 $12.5 million

May 12

$2.7 million

June 16

$1.7 million

September 21

$2.2 million

Total

$19.1 million

$19.1 million

total refunds from Treasurer’s Office phone banks

53

BLACK HOUSES MATTER

S T A T E O F T H E O F F I C E - 2022

Black Communities – Refunds Issued (Overpayments and Exemptions)

Municipality

Total Refunded

3/13/2020 -10/8/2021

# of Refunds Issued $ Value of Refunds Issued

Bellwood 1,147 $2,500,493

Burnham 224 $649,133

Calumet City 1,911 $5,673,131

Calumet Park 492 $715,395

Chicago (Majority Black Wards) 29,633 $40,268,488

Country Club Hills 1,118 $1,929,617

Dolton 1,457 $2,150,047

East Hazel Crest 136 $216,550

Flossmoor 485 $2,397,308

Ford Heights 58 $130,873

Glenwood 527 $882,235

Harvey 1,481 $2,104,623

Hazel Crest 797 $1,468,776

Lynwood 380 $624,308

Markham 1,084 $1,855,441

Matteson 979 $2,576,461

Maywood 977 $2,154,883

Olympia Fields 357 $977,378

Park Forest 1,409 $3,378,295

Phoenix 170 $112,979

Richton Park 711 $1,027,794

Riverdale 779 $1,198,631

Robbins 206 $246,907

Sauk Village 663 $672,089

South Holland 1,340 $3,501,994

TOTAL 48,521 $79,413,828

54

LATINO HOUSES MATTER

S T A T E O F T H E O F F I C E - 2022

Latino Communities –

Refunds Issued (Overpayments and Exemptions)

Municipality

Total Refunded

3/13/2020 -10/8/2021

# of Refunds Issued $ Value of Refunds Issued

Berwyn 1,729 $5,191,453

Cicero 1,612 $3,342,338

Chicago (Majority Latino Wards) 13,237 $20,740,985

Forest View 52 $400,566

Hodgkins 128 $1,948,222

Lyons 440 $811,669

Melrose Park 787 $2,268,618

Northlake 426 $2,303,559

Posen 255 $372,844

Stickney 203 $321,477

Stone Park 175 $297,939

Summit 411 $1,145,306

TOTAL 19,455

$39,144,976

55

STOP TAXPAYER OVER PAYMENT SYSTEM (STOPS)

STOPS was created by the Treasurer’s Office to

prevent the double payment of taxes and automatically

return the second (duplicate) payment to the taxpayer.

If a payment is stopped, the payer is notified. The

payer is given the opportunity to resubmit payment

only if legally responsible. When this occurs, the first

payee is authorized to receive a refund.

Nearly 114,000 payments (nearly $533 million) that

would have been issued as refunds have been

stopped and returned since November 2010. Before

STOPS, those payments would have been accepted

and the payer required to request a refund.

Additional website enhancements were introduced in

July 2019 to display pending payment information, an

additional safeguard against overpayments.

$533million

duplicate payments stopped from taxpayers

Tax Year Quantity Dollar Amount

2020 10,370 $60,789,652

2019

18,268

$89,216,133

2018

5,403

$28,145,398

2017

7,050

$45,746,948

2016

6,946

$34,948,957

2015

7,001

$29,911,317

2014

10,401

$45,920,361

2013

7,039

$30,626,258

2012

13,123

$54,940,477

2011

6,941

$32,937,220

2010

12,019

$51,541,178

2009

9,430

$28,024,221

Total

113,991

$532,748,120

*Through October 1, 2021.

S T A T E O F T H E O F F I C E - 2022

56

ELECTRONIC REFUNDS – ELIMINATING PAPER APPLICATIONS

The Treasurer’s Office introduced online

electronic refund applications in May 2020.

The process eliminates the need to download,

print and mail a request for an overpayment

refund.

48,807 electronic refund applications have

been received since May 19, 2020.

Eliminating paper applications reduces the

time it takes the office to issue refunds due to

overpayments by one week.

Taxpayers can search for refunds by property

address at cookcountytreasurer.com and

select the “Apply Now” button to submit their

claim.

S T A T E O F T H E O F F I C E - 2022

48,807

electronic refund application from taxpayers

57

58

Automation

Projects

Payments

59

AUTOMATION PROJECTS – PAYMENTS

In 1998, there were two payment options: mail and in-person at one of six office locations.

Now, there are nine payment options.

1998

2 PAYMENT METHODS:

• Mail to Treasurer’s Office

• In-Person at Treasurer’s Office (6 Offices)

2022

9 PAYMENT METHODS:

• Mail to Lockbox

• In-Person at Chase (Nearly 400 Locations)

• In-Person at Community Banks (164 Locations)

• In-Person at Treasurer’s Office (1 Office)

• Wire Payments by Third Party Agents

• ACH Payments by Third Party Agents

• Online (Internet)

• Credit Card (Internet)

• Subsequent Taxes by Tax Buyers (Internet)

S T A T E O F T H E O F F I C E - 2022

60

Lockbox

In 1999, the Treasurer’s Office incorporated a

lockbox system for collecting and processing

taxes. This has meant same-day deposits,

immediate interest earnings and quicker

distributions to taxing agencies.

The lockbox system eliminated the need for

daily mail payments to be opened and

processed individually by Treasurer’s staff.

Since 1999, more than 12.2 million

payments have been processed by lockbox.

AUTOMATION PROJECTS – PAYMENTS

12.2million

payments processed by lockbox

S T A T E O F T H E O F F I C E - 2022

Tax Year Quantity

2020 344,090

2019 376,224

2018 375,609

2017 378,926

2016 469,095

2015 459,502

2014 483,973

2013 493,316

2012 495,577

2011 504,629

2010 481,173

2009 527,264

2008 493,194

2007 583,267

2006 640,139

2005 652,493

2004 704,773

2003 736,396

2002 855,683

2001 788,621

2000 752,702

1999 624,703

Total 12,221,349

*On-Time Payments through October 1, 2021.

61

AUTOMATION PROJECTS – PAYMENTS

Bank Branch Payments

Cook County property tax payments are

accepted at hundreds of local banks, making it

convenient for taxpayers to pay.

Today, there are nearly 400 Chase banking

locations in Cook County and throughout the

state that accept property tax payments.

More than 15.7 million payments have been

accepted at bank branches since calendar

year 1999.

As a result of bank branches accepting Cook

County property tax payments, the Treasurer’s

Office closed its five satellite offices.

15.7million

payments accepted at bank branches

S T A T E O F T H E O F F I C E - 2022

Tax Year

On-Time

Payments

Late

Payments

Total

Payments

2020

465,949

15,307

481,256

2019

505,466

37,841

543,307

2018

543,576

68,064

611,640

2017

576,236

71,112

647,348

2016

637,102

83,451

720,053

2015

738,050

91,729

829,779

2014

746,972

86,334

833,306

2013

747,895

92,575

840,470

2012

738,841

96,680

835,521

2011

745,788

96,866

842,654

2010

751,521

73,513

825,034

2009

733,239

127,947

861,186

2008

713,827

76,254

790,081

2007

727,451

85,079

812,530

2006

707,983

74,587

782,570

2005

707,640

84,223

791,863

2004

695,093

68,685

763,778

2003

668,896

60,094

728,990

2002

634,727

55,467

690,194

2001

558,546

49,828

608,374

2000

435,777

30,643

466,420

1999

302,723

19,455

322,178

1998

109,877

109,877

Total

13,722,229

1,550,731

15,738,909

*Through October 1, 2021.

Payments may include prior tax years.

62

AUTOMATION PROJECTS – PAYMENTS

Community Bank Branch Payments

Cook County taxpayers may visit one of the

participating local community banks to pay

taxes by direct debit (electronically).

164 banking locations throughout the area

accept property tax payments.

Nearly 105,000 payments have been

accepted at these locations since 2004.

since August 2003

105,000

payments at community banks

S T A T E O F T H E O F F I C E - 2022

Tax Year

# of Community Bank

Branches

# of

Payments

2020 164 4,292

2019 152 4,930

2018 106 5,140

2017 116 5,316

2016 120 5,967

2015 178 6,865

2014 194 5,484

2013 208 7,110

2012 194 7,140

2011 209 6,991

2010 209 7,222

2009 226 6,843

2008 223 6,084

2007 220 5,611

2006 216 5,342

2005 214 5,507

2004 215 4,794

2003 219 4,080

Total 104,718

*Through October 1, 2021.

63

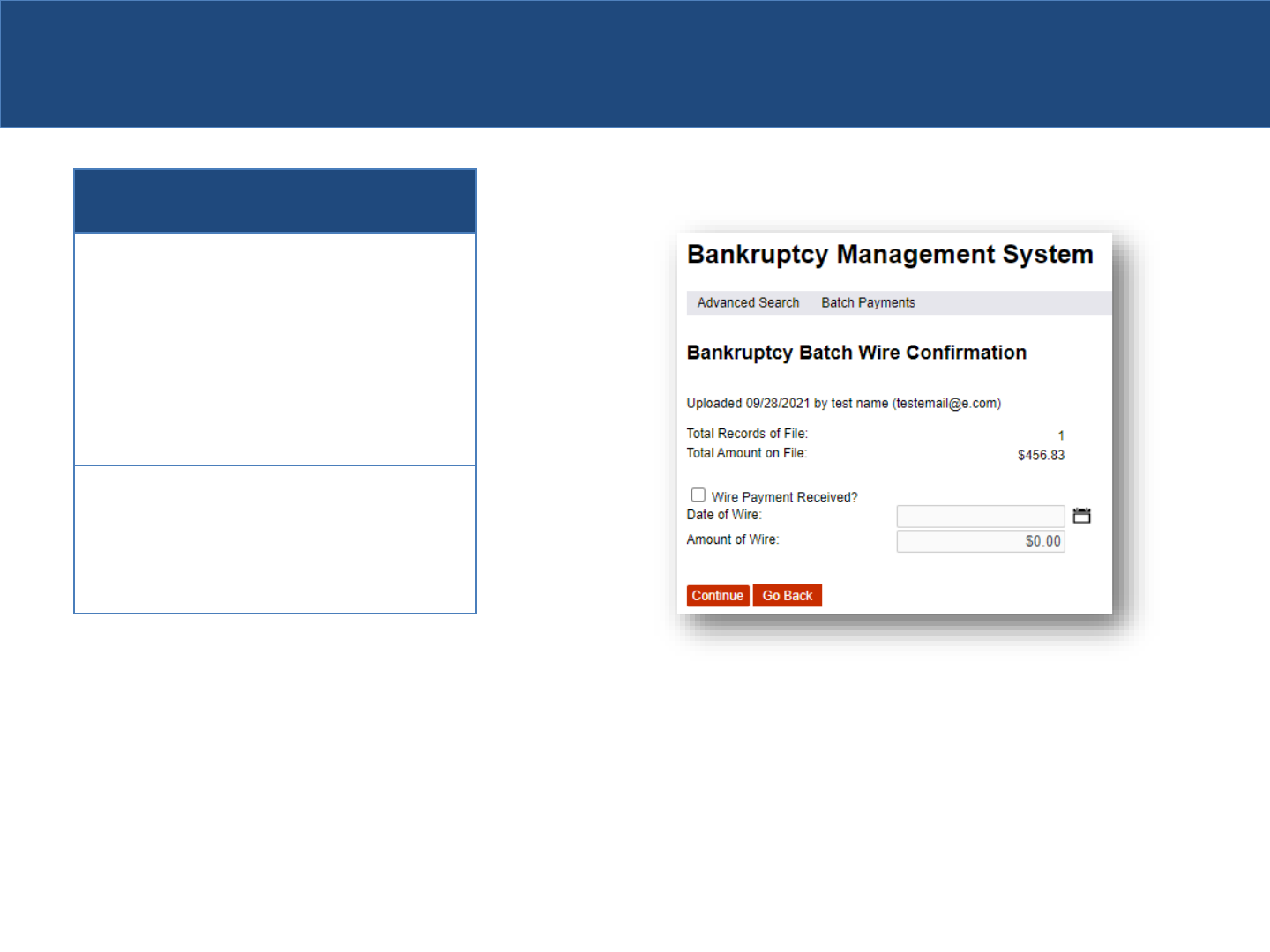

AUTOMATION PROJECTS – PAYMENTS

Third Party Agent (TPA) – Wire Payments

The Treasurer’s Office established a

commercial wire payment system used by

banks, mortgage and title companies to pay

taxes instead of submitting individual checks

to the office.

The prior process in the office required

manual handling and deposit of individual

checks.

Wire payments from Third Party Agents have

totaled more than 26 million payments

(nearly $77 billion) since August 2003.

26.2million

commercial user wire payments

S T A T E O F T H E O F F I C E - 2022

Tax Year Quantity Dollar Amount

2020

1,477,070

$5,673,304,194

2019

1,493,768

$5,496,221,680

2018 1,485,660

$5,335,195,002

2017 1,453,482

$4,949,322,628

2016 1,477,447 $4,796,620,456

2015

1,457,321 $4,501,362,291

2014

1,447,536 $4,230,786,339

2013

1,458,832

$4,214,041,154

2012 1,469,742

$4,294,860,099

2011 1,491,680

$4,205,521,196

2010 1,496,930

$4,245,980,447

2009

1,478,790

$4,092,128,626

2008

1,451,042

$3,947,466,410

2007

1,403,129

$3,731,088,684

2006 1,349,619

$3,459,730,206

2005 1,291,410 $3,106,617,529

2004 1,253,555 $2,873,612,587

2003

1,238,729

$2,621,405,164

2002

587,796

$1,209,770,282

Total

26,263,538

$76,985,034,973

*Through October 1, 2021.

64

AUTOMATION PROJECTS – PAYMENTS

Third Party Agent (TPA) – ACH Payments

The Treasurer’s Office instituted a system for

commercial users (banks, mortgage and title

companies) to pay via ACH direct debit

transactions from an online site instead of

submitting individual checks to the office.

Commercial users have submitted more than

1 million payments (more than $4.3 billion)

since 2007.

1 million

commercial user ACH direct debit payments

S T A T E O F T H E O F F I C E - 2022

Tax Year Quantity Dollar Amount

2020

71,113

$393,651,037

2019

62,770

$379,658,583

2018

58,144

$330,964,658

2017

56,321

$312,225,976

2016 55,555

$292,408,474

2015 60,281

$312,461,721

2014

73,251

$327,658,628

2013

70,195

$331,899,450

2012

84,071

$356,061,761

2011

81,184

$343,046,357

2010

76,612

$279,687,650

2009

82,904

$265,681,436

2008

87,699

$232,692,641

2007

70,455

$167,931,735

2006

24,182

$55,091,532

Total 1,014,737

$4,381,121,638

*Through October 1, 2021.

65

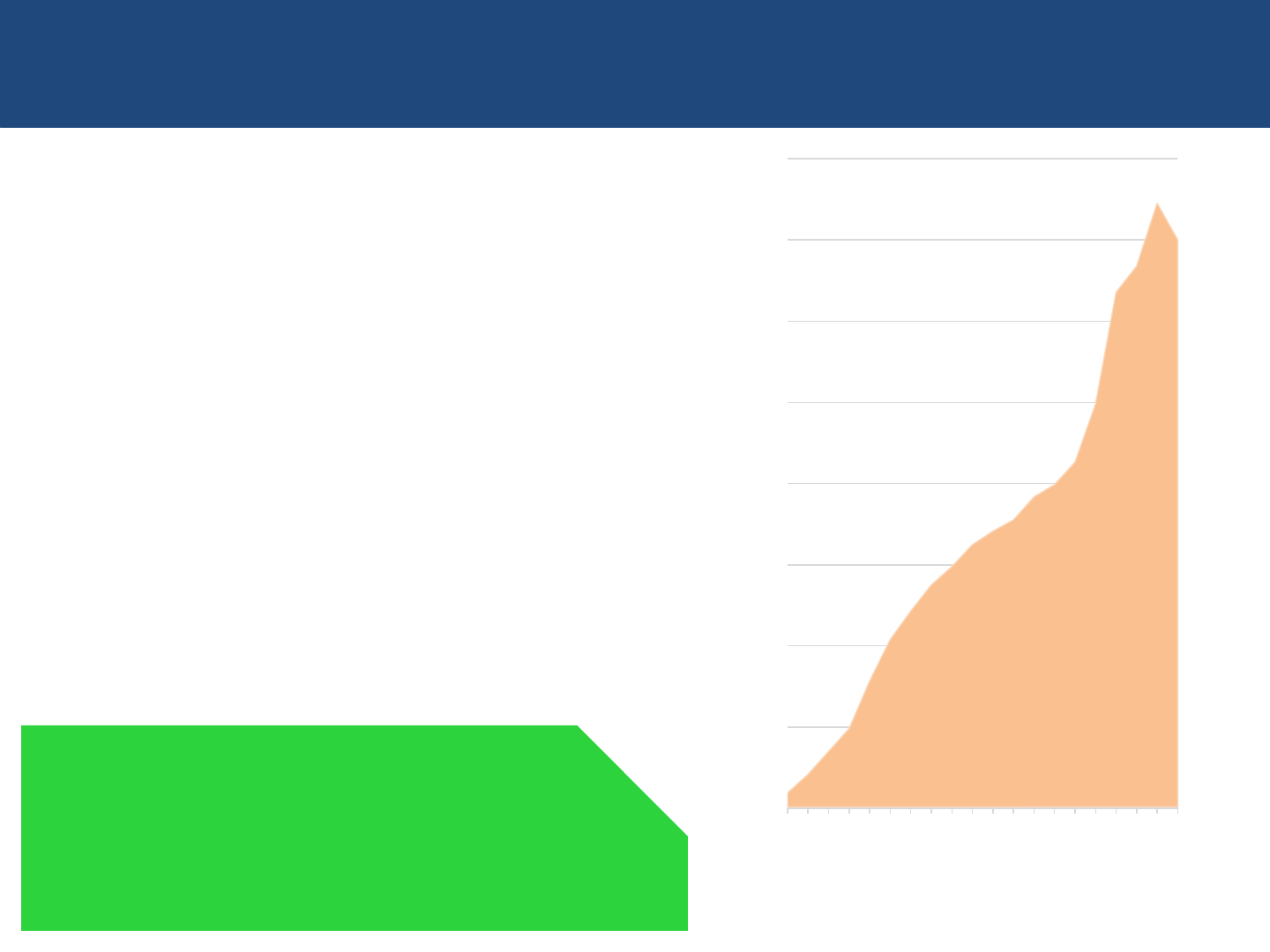

AUTOMATION PROJECTS – PAYMENTS

Online Payments

In March 2002, the Treasurer’s Office

introduced online payments for on-time

payments. The office has collected nearly 7

million online payments through October 1,

2021.

Since January 2018, there is no fee for

taxpayers to make an online payment.

Online payments continue to increase year

after year, especially as more taxpayers

choose to stay home during the COVID-19

pandemic.

700,000

online tax payments to date for TY2020

S T A T E O F T H E O F F I C E - 2022

*Through October 1, 2021 (please note taxpayers may continue

to pay Tax Years 2018, 2019 and 2020 online).

0

100,000

200,000

300,000

400,000

500,000

600,000

700,000

800,000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

16,738

698,114*

66

AUTOMATION PROJECTS – PAYMENTS

Credit Card Payments

In July 2012, the office added the option for

taxpayers to pay property taxes with a credit

card.

Property owners may make delinquent

payments via credit card year-round through

the online payment channel.

A total of 461,854 credit card payments have

been made totaling nearly $1.1 billion.

462,000

credit card payments

S T A T E O F T H E O F F I C E - 2022

Tax Year Quantity Dollar Amount

2020

62,685

$151,275,809

2019

81,727

$188,081,110

2018

81,680

$195,484,582

2017

80,628

$212,328,627

2016

64,052

$143,672,948

2015

35,288

$71,712,548

2014

18,404

$40,478,645

2013

15,920

$34,911,745

2012

13,802

$29,732,837

2011

7,668

$15,360,212

Total 461,854 $1,083,039,063

*Through October 1, 2021.

67

AUTOMATION PROJECTS – PAYMENTS

Subsequent Tax Electronic Payment System

(STEPS)

The Treasurer’s Office created an online

payment method for tax buyers to make tax

payments on properties after the initial

purchase at the Annual Tax Sale.

Since 2007, tax buyers have submitted nearly

528,000 (almost $1.4 billion) subsequent tax

payments.

IMPORTANT NOTE:

Property owners should redeem their sold taxes as quickly as

possible to avoid additional costs accruing from unpaid

subsequent taxes.

Tax buyers can pay delinquent subsequent taxes following the

Annual Tax Sale. Taxpayers are assessed 12 percent interest

per installment per year on each tax amount paid by a buyer.

528,000

subsequent taxes paid online by tax buyers

S T A T E O F T H E O F F I C E - 2022

Tax Year Quantity Dollar Amount

2020

3,233

$8,953,192

2019

15,477

$42,324,395

2018

31,059

$87,700,288

2017

32,433

$85,077,044

2016

37,005

$98,738,268

2015

47,936

$120,812,504

2014

40,025

$93,867,028

2013

40,584

$99,123,888

2012

39,298

$95,799,877

2011

46,068

$124,413,038

2010

46,589

$132,676,578

2009

44,977

$136,854,229

2008

42,528

$118,181,052

2007

45,984

$106,138,464

2006

14,617

$29,455,268

Total

527,813

$1,380,115,113

*Through October 1, 2021.

68

AUTOMATION PROJECTS – PAYMENTS

S T A T E O F T H E O F F I C E - 2022

In-Person Payments

Because of the many payment options available to taxpayers, the Treasurer’s Office, at the end of 2005,

closed the five satellite offices. The six satellite offices processed more than 384,000 in-person payments in

2000.

For Tax Year 2020, in-person, on-time payments totaled fewer than 20,000 at the Clark Street location –

accounting for just 0.62 percent of nearly 3.1 million total on-time payments.

On-Time In-Person Payments (Satellite and Downtown Totals)

Payments

Tax Year

384,597

312,062

265,557

114,800

105,108

105,855

70,865

51,585

26,765

25,204

21,445

26,695

21,080

21,365

19,926

19,612

25,381

26,051

25,026

28,416

27,568

19,185

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

0

50,000

100,000

150,000

200,000

250,000

300,000

350,000

400,000

69

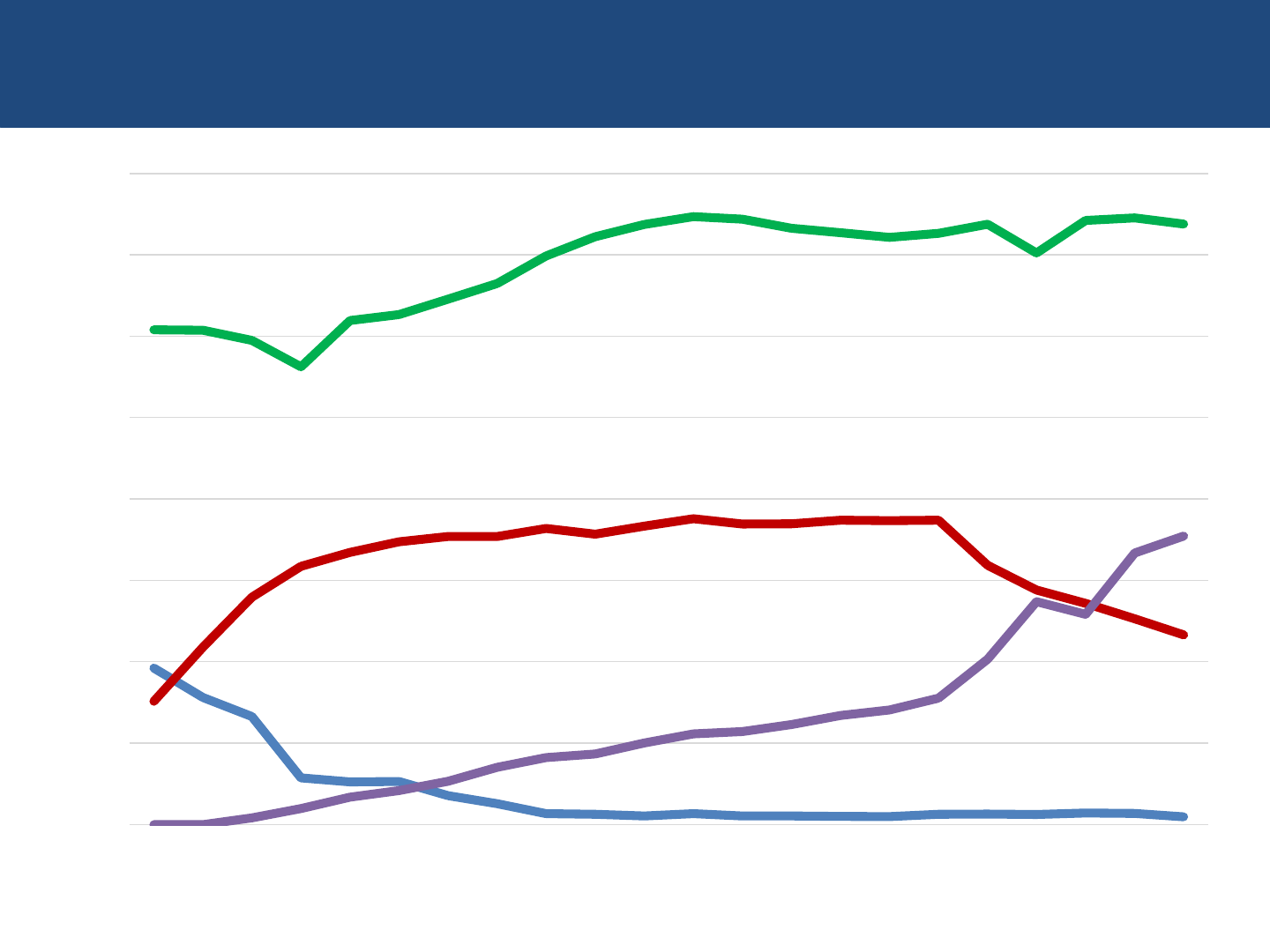

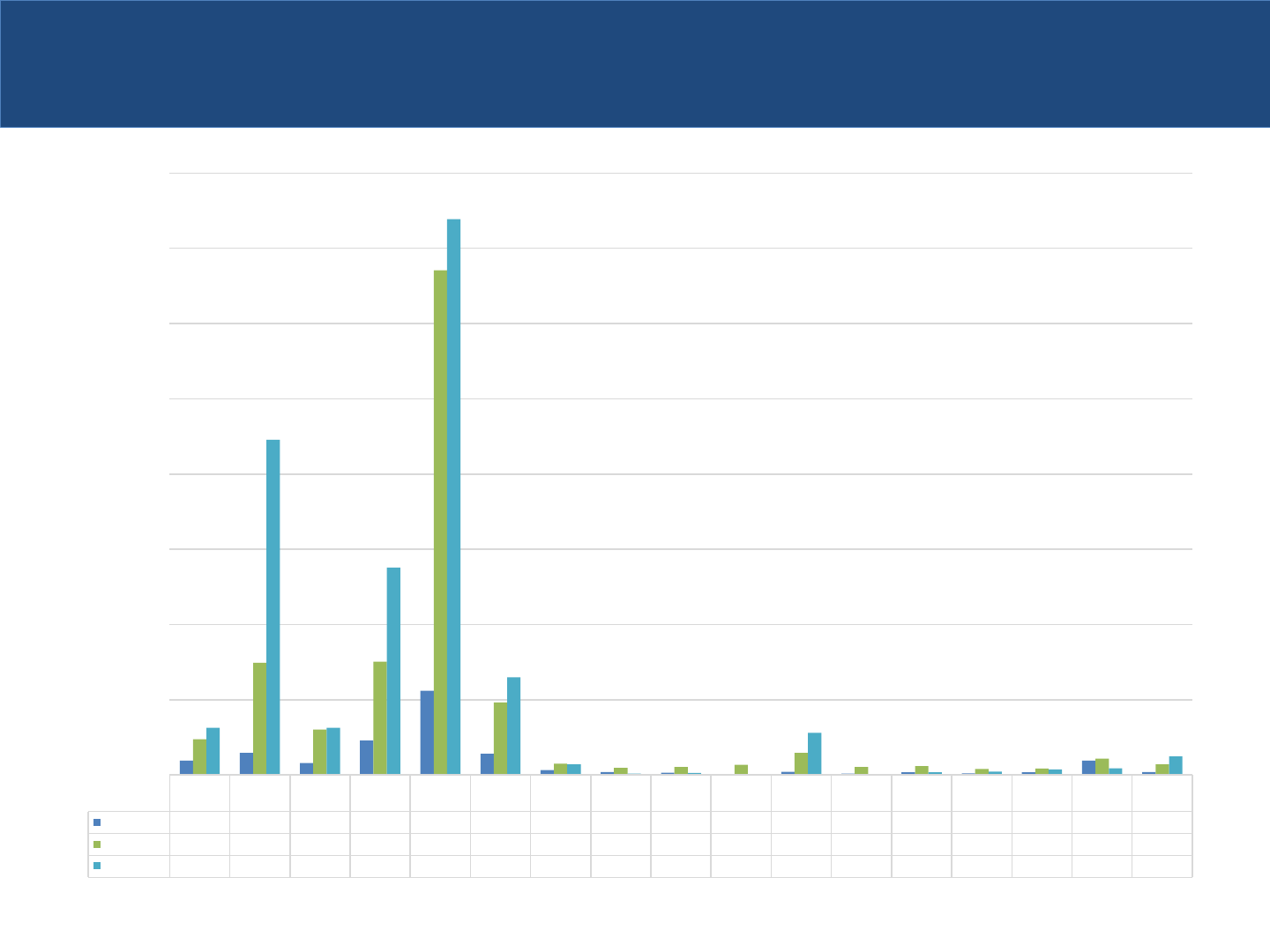

PAYMENT SOURCE TREND BY TAX YEAR (ON-TIME PAYMENTS)

S T A T E O F T H E O F F I C E - 2022

-

200,000

400,000

600,000

800,000

1,000,000

1,200,000

1,400,000

1,600,000

Tax Year

1999

Tax Year

2000

Tax Year

2001

Tax Year

2002

Tax Year

2003

Tax Year

2004

Tax Year

2005

Tax Year

2006

Tax Year

2007

Tax Year

2008

Tax Year

2009

Tax Year

2010

Tax Year

2011

Tax Year

2012

Tax Year

2013

Tax Year

2014

Tax Year

2015

Tax Year

2016

Tax Year

2017

Tax Year

2018

Tax Year

2019

Tax Year

2020

Bank Branch (In-Person)

TPA (Third-Party Web System)

CCTO (In-Person, 118 N. Clark)

Internet (Web System)

On-time payments only.

1,215,597

1,475,912

302,723

465,949

384,597

19,185

709,011

16,429

70

Automation

Projects

Systems

71

CUSTOMER SERVICE – EMAIL SYSTEM

The Treasurer’s Office created online functionality so

taxpayers can contact us via email.

In May 2020, the Treasurer’s Office overhauled the

taxpayer email system by leveraging the Salesforce

platform. A number of enhancements and efficiencies

were built into this updated email system.

Emails are routed to employees throughout the office

to respond within 48 hours.

The office has received and responded to nearly

185,000 emails since 2003.

184,691

emails from taxpayers

S T A T E O F T H E O F F I C E - 2022

Calendar Year Quantity

2021 8,433

2020 12,354

2019 11,925

2018 8,347

2017^ 10,575

2016 3,830

2015 3,622

2014 4,372

2013 4,731

2012 6,686

2011 7,471

2010 9,658

2009 14,951

2008 16,093

2007 13,145

2006 11,681

2005 13,706

2004 15,430

2003 (Began May 2003) 7,681

Total

184,691

*Through October 1, 2021.

^NOTE: The spike in 2017 can be attributed to

5,796 emails received in December 2017 with

questions about the prepayment program and

changes to federal tax laws.

72

CUSTOMER SERVICE – CALL CENTER

The Treasurer’s Customer Service Call Center

has handled 188,430 phone calls through

September 30, 2021.

76.9% of the calls have been handled

automatically by the system. 23.1% have been

answered by a Call Center employee.

In 2019, the Treasurer’s Office introduced a

feature that gives callers the option to leave a

message and receive a returned phone call

with 24 hours.

Callers can select from English, Polish or

Spanish and follow prompts to obtain specific

PIN information such as amount due or refund

amount available.

S T A T E O F T H E O F F I C E - 2020

188,430

phone calls received in FY2021

144,971

Phone calls to the Treasurer’s Office

answered automatically by the

system.

43,459

Phone calls to the Treasurer’s Office

answered by a Call Center employee.

BY THE NUMBERS

73

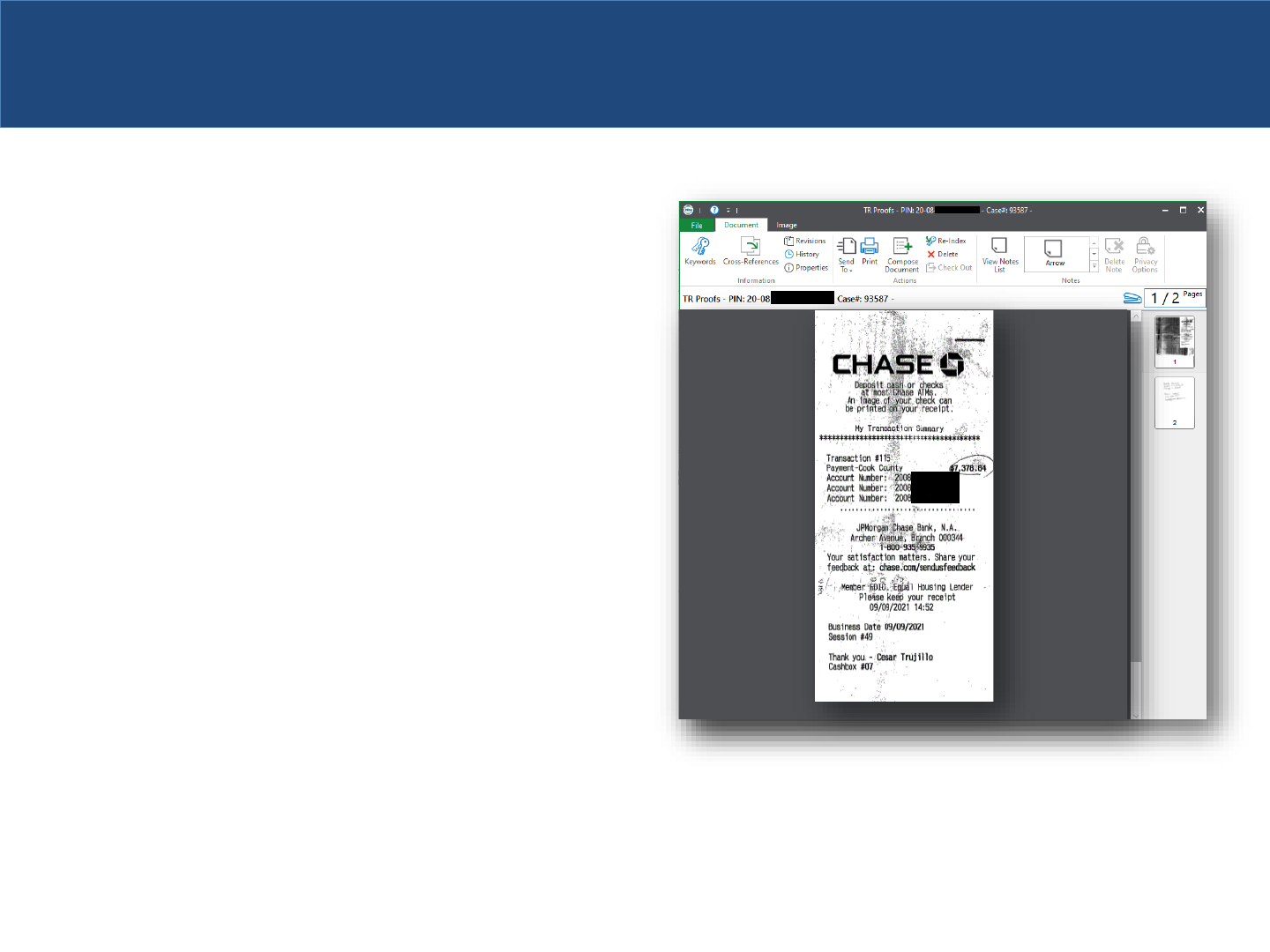

DOCUMENT IMAGING PROJECT

In 2016, the Treasurer’s Office implemented the

Paperless Customer Service System.

The system provides:

• Scanning, imaging, and storing of electronic

documents, files and data. As a result, the

office significantly reduces the need to retain

hard-copy paper documents.

• Tracking of documents by Property Index

Number (PIN) for quick access to information.

Treasurer’s Office employees provide

seamless customer services.

• Notification – All requested information is

emailed to the taxpayer.

S T A T E O F T H E O F F I C E - 2022

74

DOCUMENT IMAGING PROJECT

S T A T E O F T H E O F F I C E - 2022

75

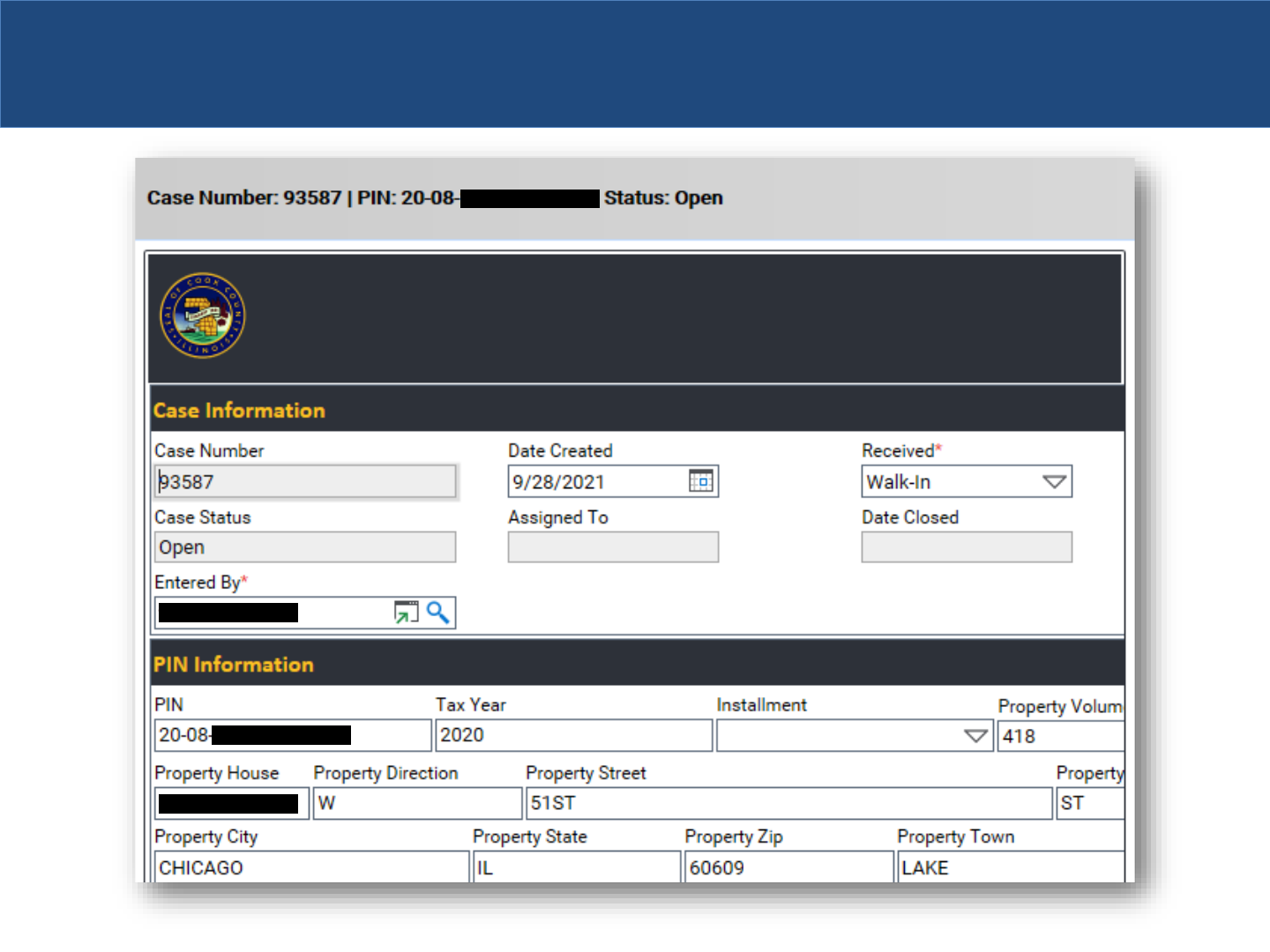

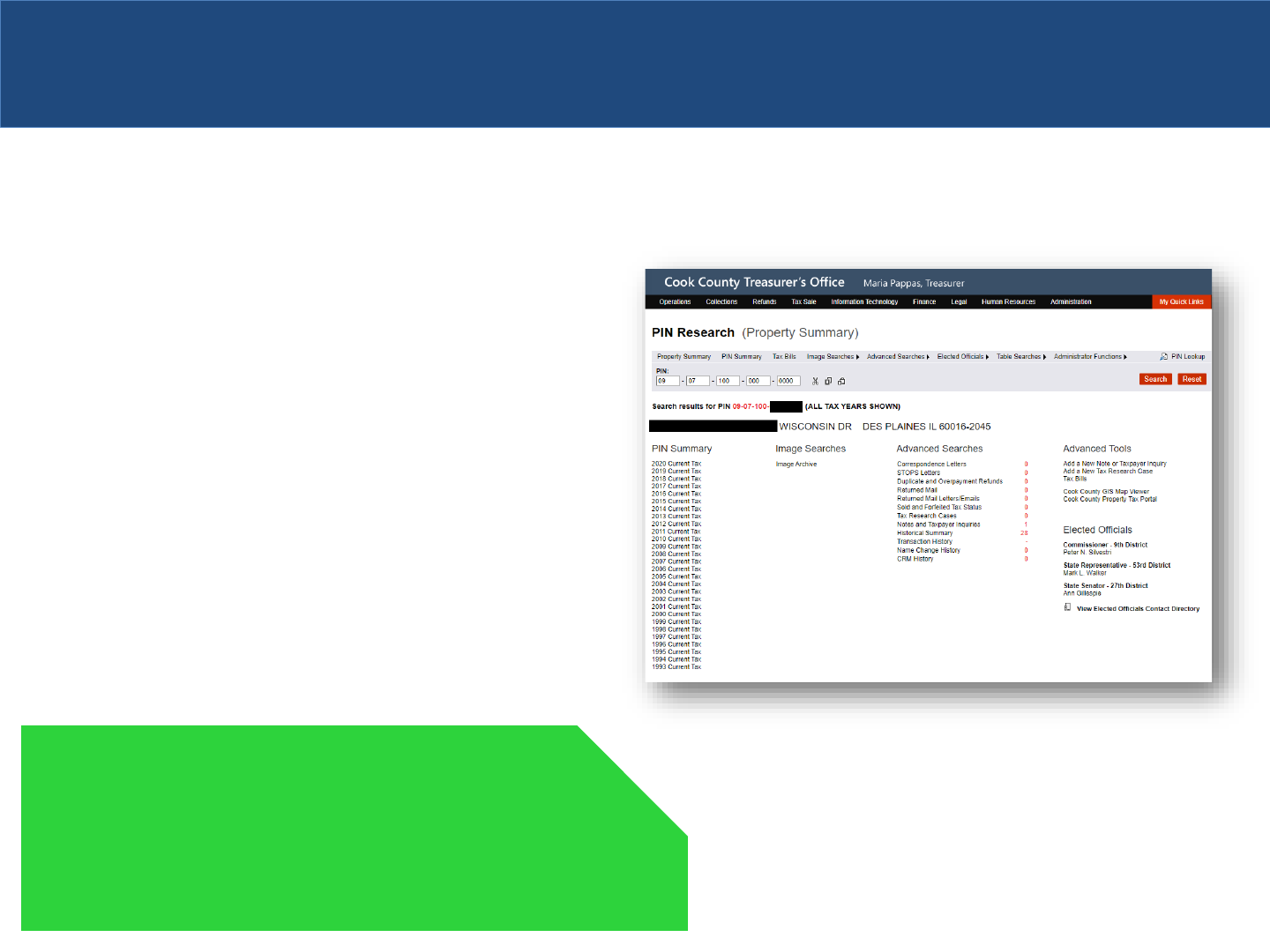

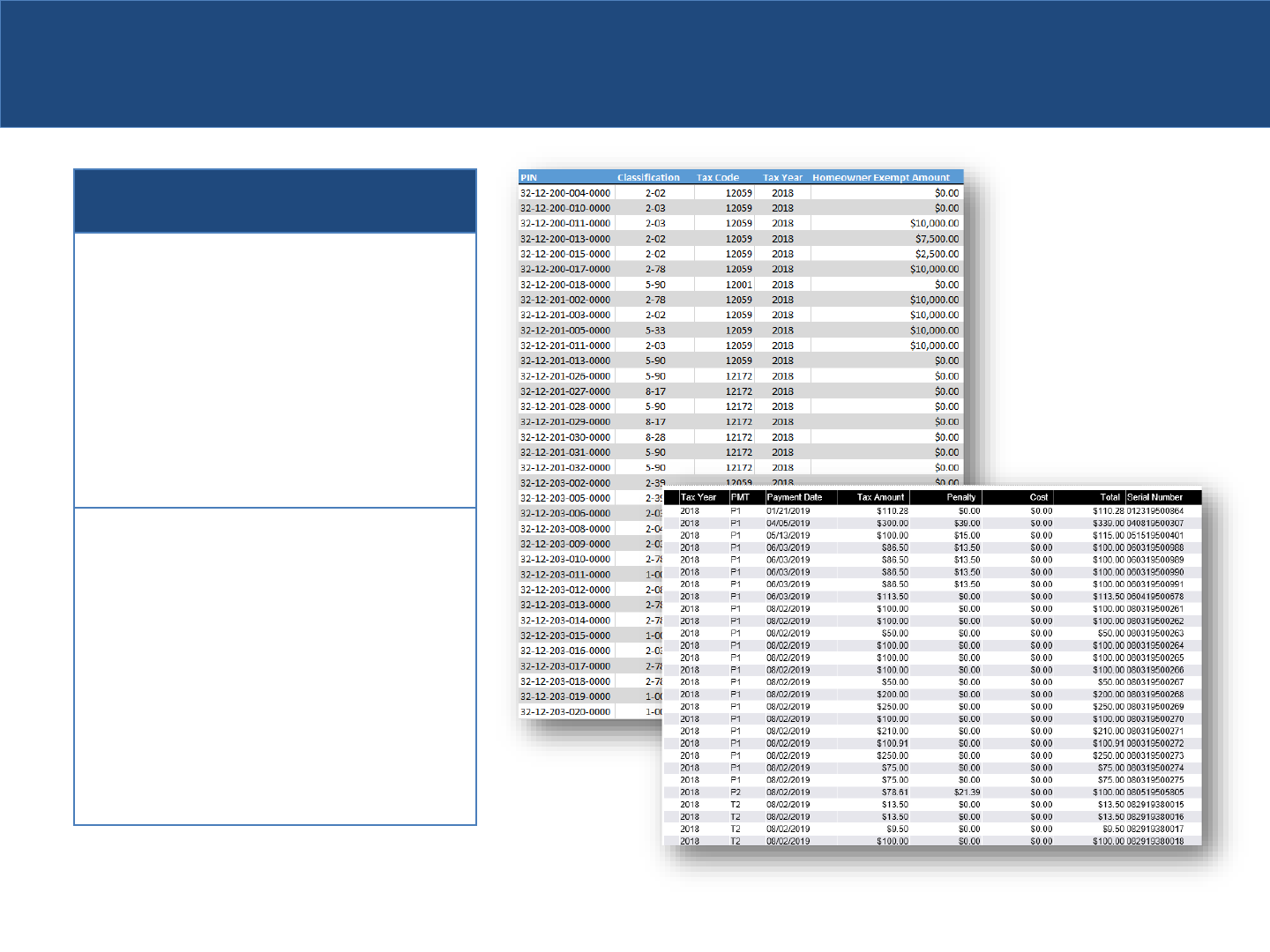

CUSTOMER SERVICE SYSTEM

The PIN Research System is an internal

system used by office staff that centralizes

PIN data that previously was accessible

only via cumbersome stand-alone modules.

The system contains 20 years of PIN data

including entire PIN Summary, mailing

address, property address, exemptions,

payment overview, Tax Research Cases

and scanned images, such as payment

coupons and checks, name/address change

applications and returned certified mail

images.

PIN RESEARCH (INTERNAL PORTAL)

2,115,035

total number of unique PIN records available

S T A T E O F T H E O F F I C E - 2022

76

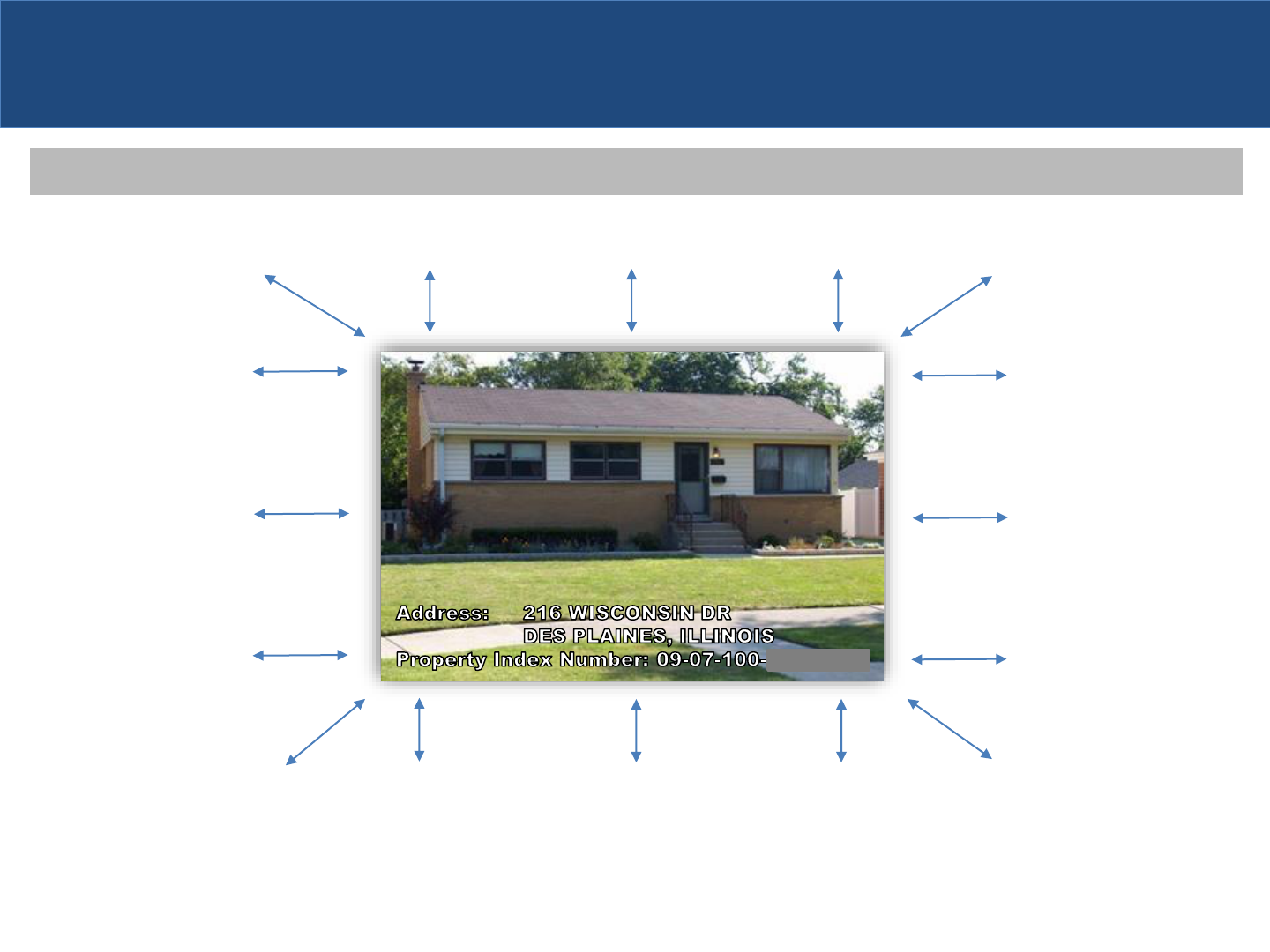

S T A T E O F T H E O F F I C E - 2022

PIN RESEARCH (INTERNAL PORTAL)

Property Location

Mailing Name/

Address

Property

Market Value

Tax Bill History

Payments

Check/Coupon

Images*

Document

Images*

Property Photos

Tax Exemptions

Available

Overpayments

(Refunds)

Email Addresses

Correspondence

History

Ownership Records

Property Type

Classification

(Residential,

Commercial, etc)

Tax Appeal History Overpayments

(Refunds)

History

* All physical documents are electronically imaged, added to property portal and physical document then discarded.

Comprehensive Data/Information Retained Internally for Every Property

77

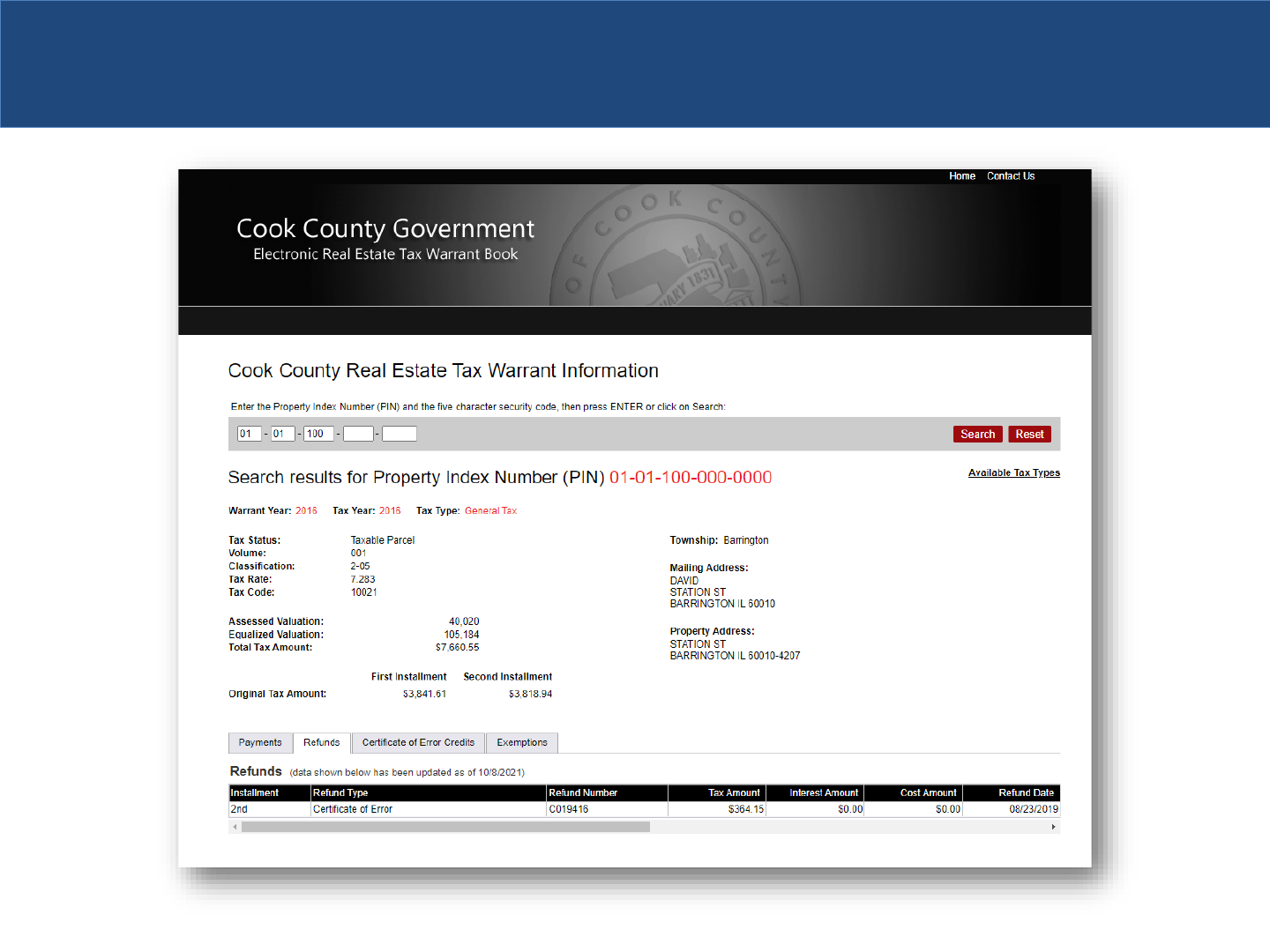

ELECTRONIC WARRANT BOOK

The Electronic Property Tax Warrant Book system

replaced the physical Warrant Books, which serve as

the official property tax records for the county.

In April 2016, the Treasurer’s Office incorporated

4,765,458 individual pages from 12,011 books into the

system.

The system eliminates manual posting of records

because all transactions and new tax year data sets

are automatically added electronically.

4,765,458

total number of pages scanned

S T A T E O F T H E O F F I C E - 2022

78

ELECTRONIC WARRANT BOOK

S T A T E O F T H E O F F I C E - 2022

79

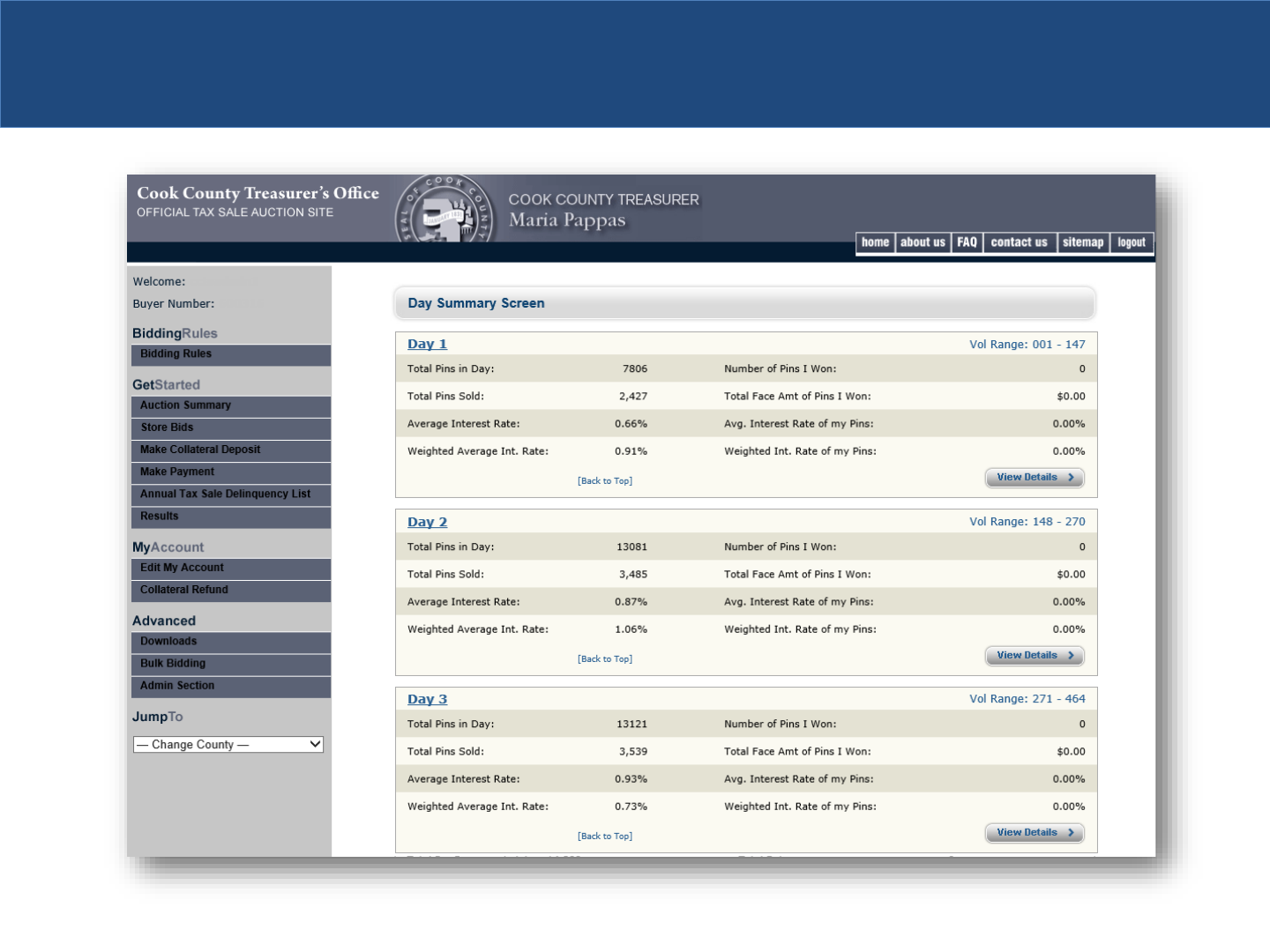

ANNUAL TAX SALE

The Treasurer’s Office replaced the traditional

outcry Annual Tax Sale auction with an

automated, online auction in 2008. Tax buyer

registration, collateral deposits, bidding and

payments went from manually intensive

processes to an online system.

Prior to this automation project, the outcry

auction would take 20 days to conduct and

require a staff of eight people to manage.

Now, the sale lasts just four days and takes

two employees; a computer algorithm awards

PINs.

More than 206,000 PINs have been sold

through the automated sale system since

2008.

206,000

PINs sold at automated Tax Sale

S T A T E O F T H E O F F I C E - 2022

Tax Year

(Year Sale

Held)

PINs

Published/Sent

Certified Notice

PINs

Offered

PINs Sold

2018 (2021) Scheduled to begin November 5, 2021

2017 (2019) 63,385 40,440 11,920

2016 (2018) 52,637 33,332 10,970

2015 (2017) 68,199 38,283 11,031

2014 (2016) 70,789 46,655 15,865

2013 (2015) 75,668 53,553 16,773

2012 (2014) 69,288 50,036 15,757

2011 (2013) 73,418 51,289 16,442

2010 (2012) 78,418 49,462 16,419

2009 (2011) 69,484 37,827 20,814

2008 (2010) 57,181 33,114 21,399

2007 (2009) 62,728 29,787 23,848

2006 (2008) 53,347 26,846 24,860

Total 794,542 490,624 206,098

80

ANNUAL TAX SALE

S T A T E O F T H E O F F I C E - 2022

81

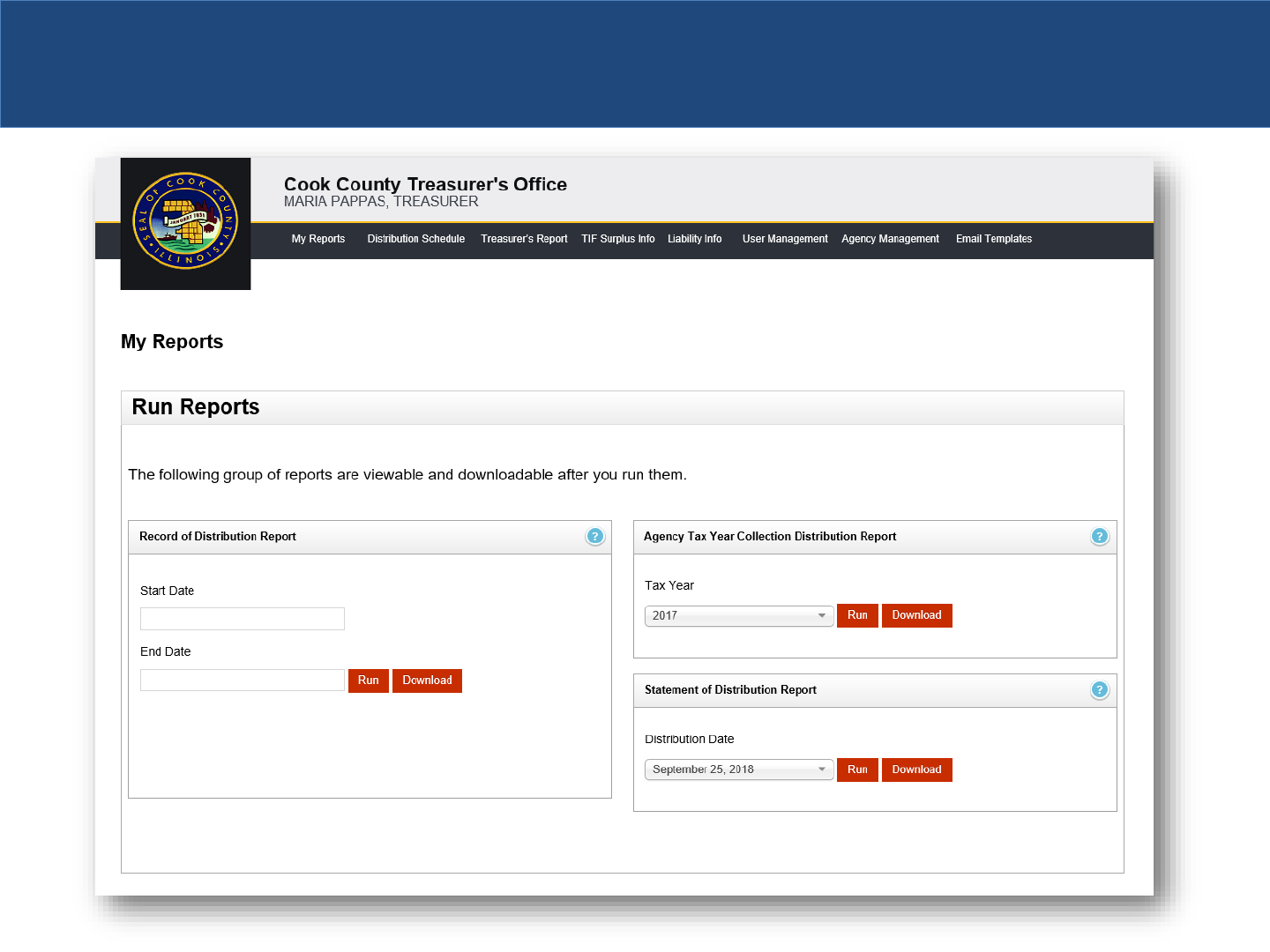

TAXING AGENCY EXTRANET

The Treasurer’s Office distributes $16 billion every

year to some 2,200 taxing agencies throughout Cook

County. The office developed the Taxing Agency

Extranet to provide taxing agencies direct access to

view data and access reports that used to be

individually printed and mailed at the Treasurer’s

expense.

The site allows authorized users 24-hour, online

retrieval of useful information and reports:

• Record of Distribution Report

• Agency Distribution Collection Summary

• Statement of Distribution

• PIN Detail of Funds Recouped

Through October 1, 2021, there have been 138,779

visits to the site.

138,779

visits to the Taxing Agency Extranet in FY2021

The purpose of the Taxing Agency

Extranet site is to provide a

transparent method for local

government taxing agencies to

access reports, data and other useful

information within the Treasurer’s

Office.

S T A T E O F T H E O F F I C E - 2022

82

TAXING AGENCY EXTRANET

S T A T E O F T H E O F F I C E - 2022

83

84

Transparency

Projects

85

DEBT DISCLOSURE ORDINANCE (DDO)

Approved by the County Board of Commissioners in

September 2009, the Taxing District Debt Disclosure

Ordinance, provides extraordinary transparency in

government.

The ordinance requires the county’s 547 primary local

governments to provide their financial data and annual

financial reports to the Treasurer’s Office each year

including:

• Audited financial statements from their most

recent audit

• Money owed (or total debts and liabilities)

• Pension and retiree health care information

(including the amount promised to retirees

and the amount promised that local

governments do not have)

$153.4billion

total debt of the 547 primary taxing agencies

S T A T E O F T H E O F F I C E - 2022

86

DEBT DISCLOSURE ORDINANCE (DDO)

S T A T E O F T H E O F F I C E - 2022

87

DEBT DISCLOSURE ORDINANCE (DDO)

S T A T E O F T H E O F F I C E - 2022

88

DEBT DISCLOSURE ORDINANCE (DDO)

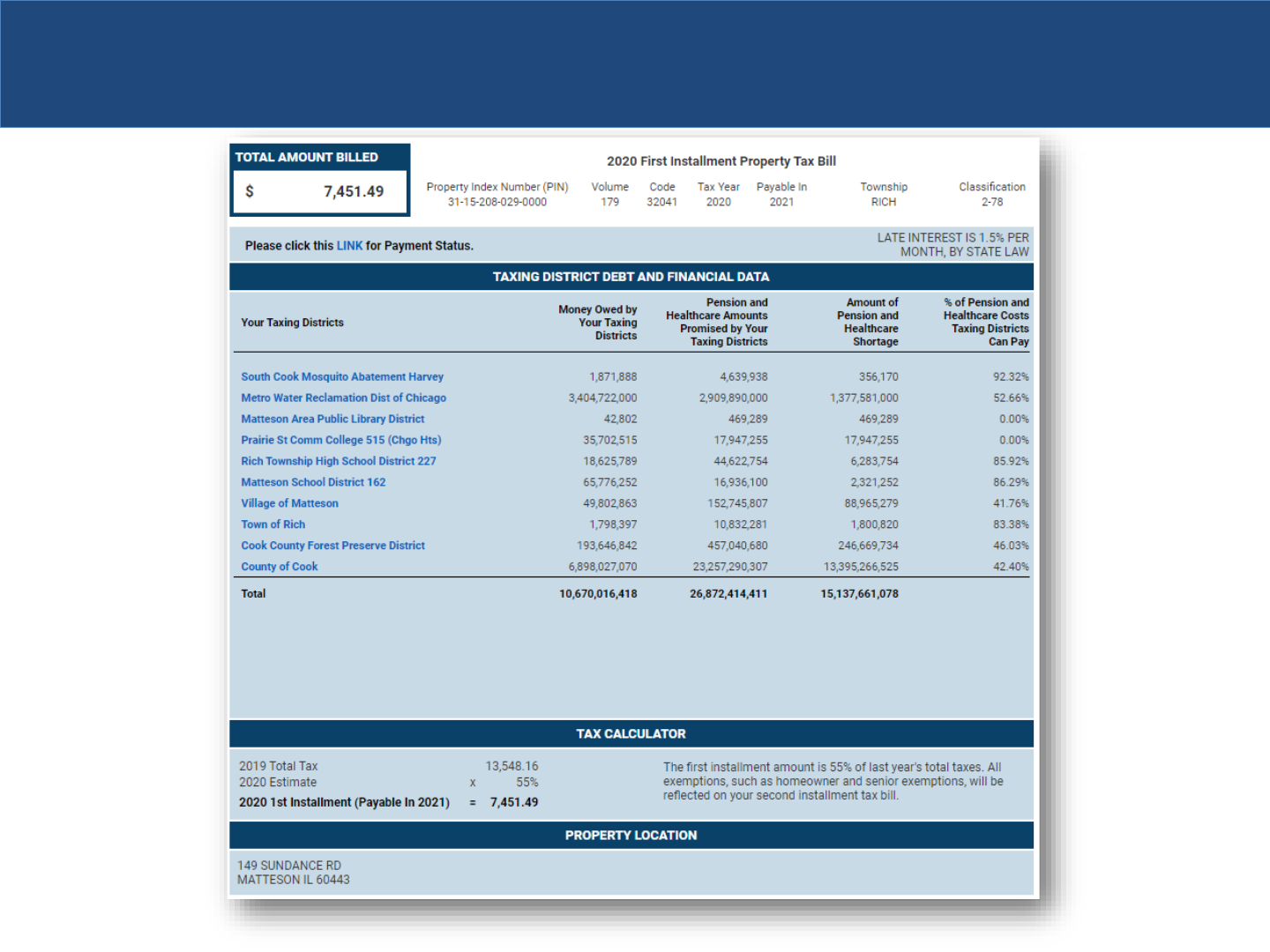

DATA AND TIF INFORMATION ON THE TAX BILLS

The Treasurer’s Office designed the property tax bill to contain useful information for property owners.

In January 2013, the Treasurer’s Office began including on the First Installment Property Tax Bill the

Debt Disclosure Ordinance (DDO) data pertaining to each parcel’s taxing districts.

The figures give taxpayers full information about each local government’s financial data including:

• Money owed (or debt)

• Pension and Healthcare Amounts Promised by Local Governments

• Amount of Pension and Healthcare Shortage

• Percentage of Pension and Healthcare Costs They Can Pay

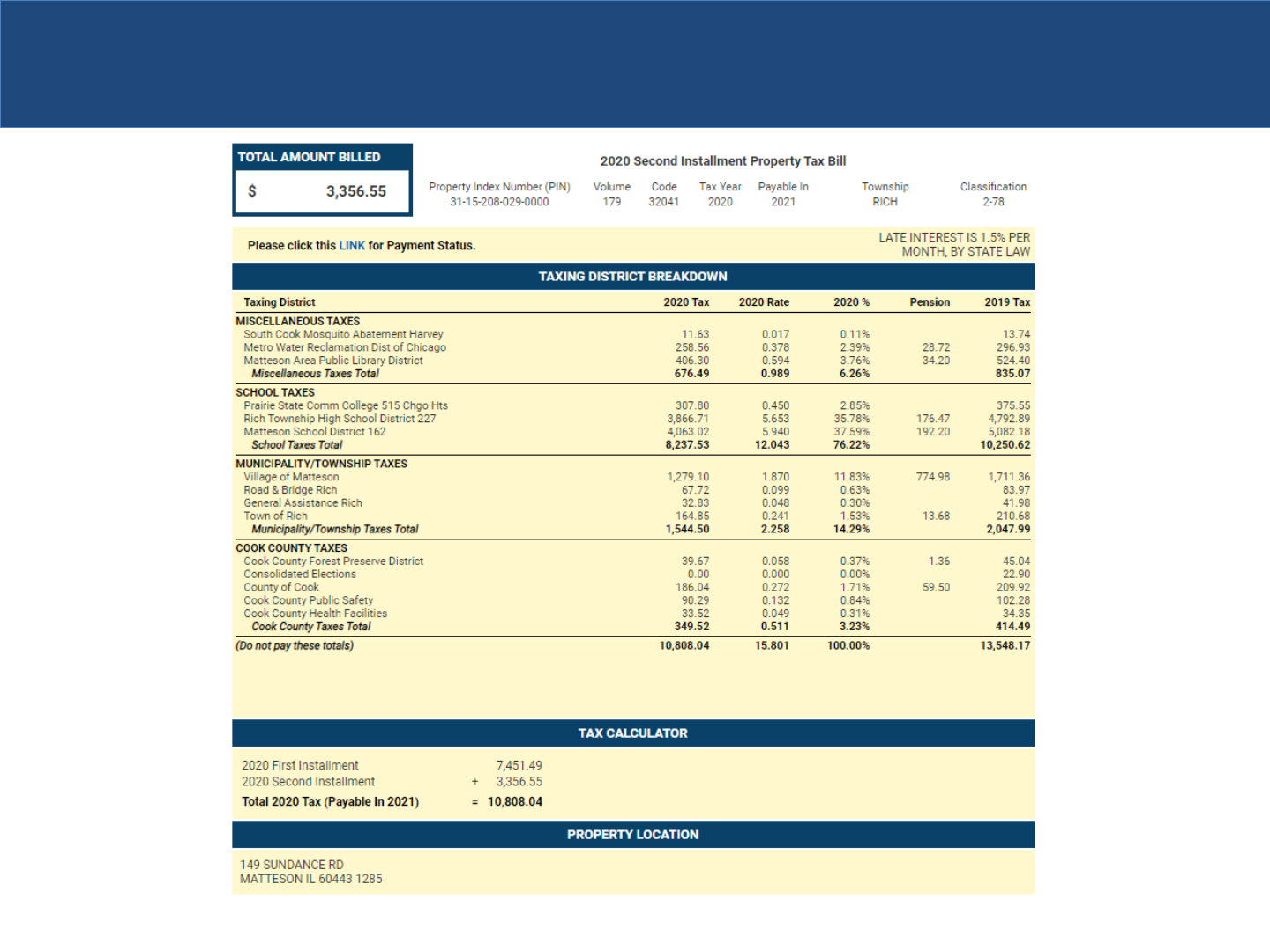

The Second Installment Property Tax Bill, since July 2014, displays to taxpayers how much each Tax

Incremental Financing (TIF) District -- in addition to their local governments -- receives from their tax

bill payments.

89

DEBT DISCLOSURE ORDINANCE (DDO) DATA – FIRST INSTALLMENT

S T A T E O F T H E O F F I C E - 2022

90

TIF INFORMATION ON TAX BILLS – SECOND INSTALLMENT

S T A T E O F T H E O F F I C E - 2022

91

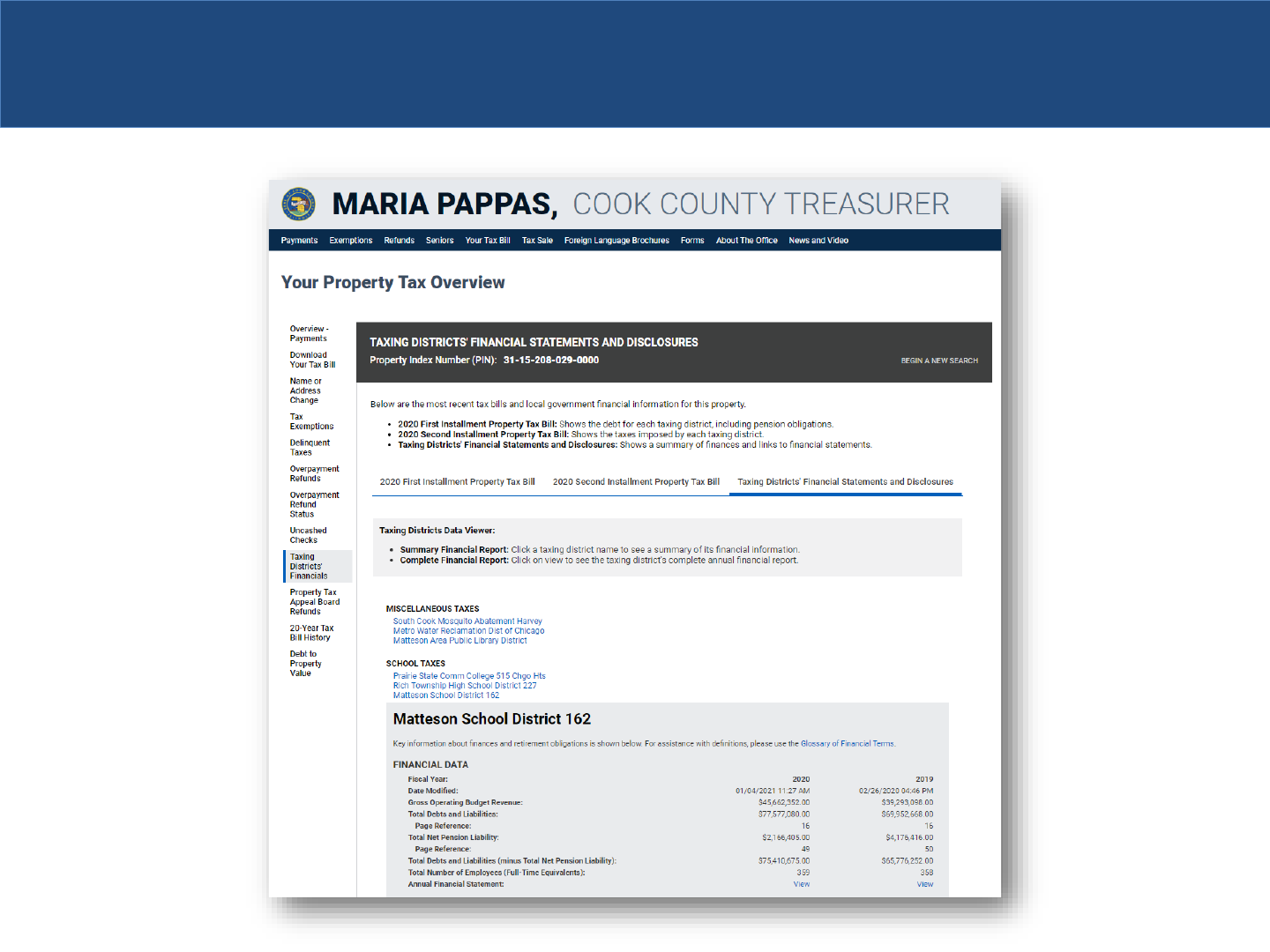

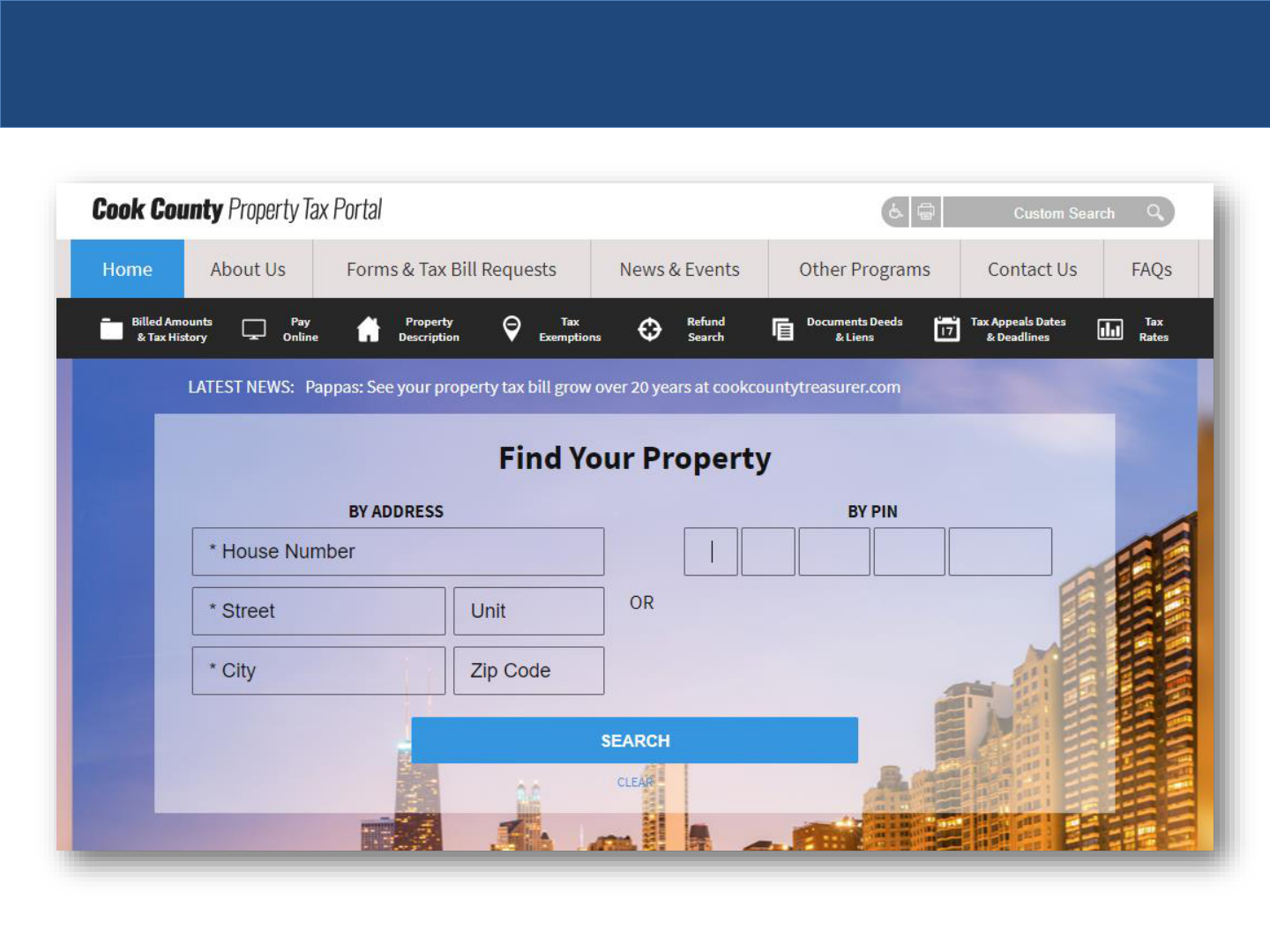

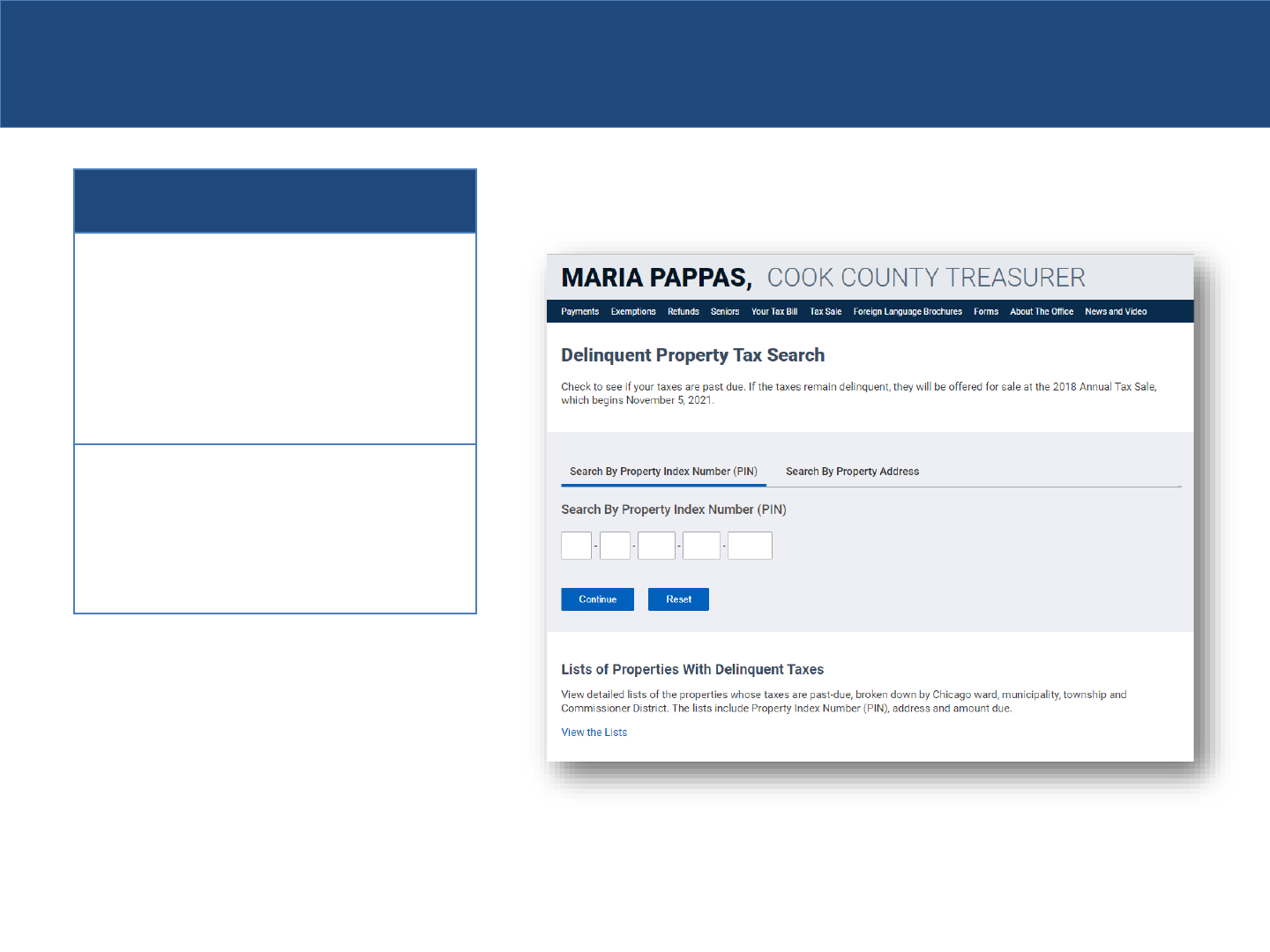

COUNTY PROPERTY TAX PORTAL

The Treasurer’s Office developed and manages the Property Tax Portal that combines data and

information from five different property-tax related offices into one single site:

• Ownership and liens – from the Recorder of Deeds

• Tax payments and refunds – from the Treasurer

• Valuations, exemptions and appeals – provided by the Assessor

• Prior year tax statuses, delinquencies and TIF information – from the Clerk

• Appeals – from the Board of Review

Since property owners have direct access to vital data, it reduces the number of questions posed

to Treasurer’s Office staff.

The portal has been visited nearly 32.9 million times since April 1, 2012. In 2021, visitor traffic

has averaged 15,252 visitors per day.

32.9million

visitors to the Property Tax Portal

S T A T E O F T H E O F F I C E - 2022

92

COUNTY PROPERTY TAX PORTAL

S T A T E O F T H E O F F I C E - 2022

93

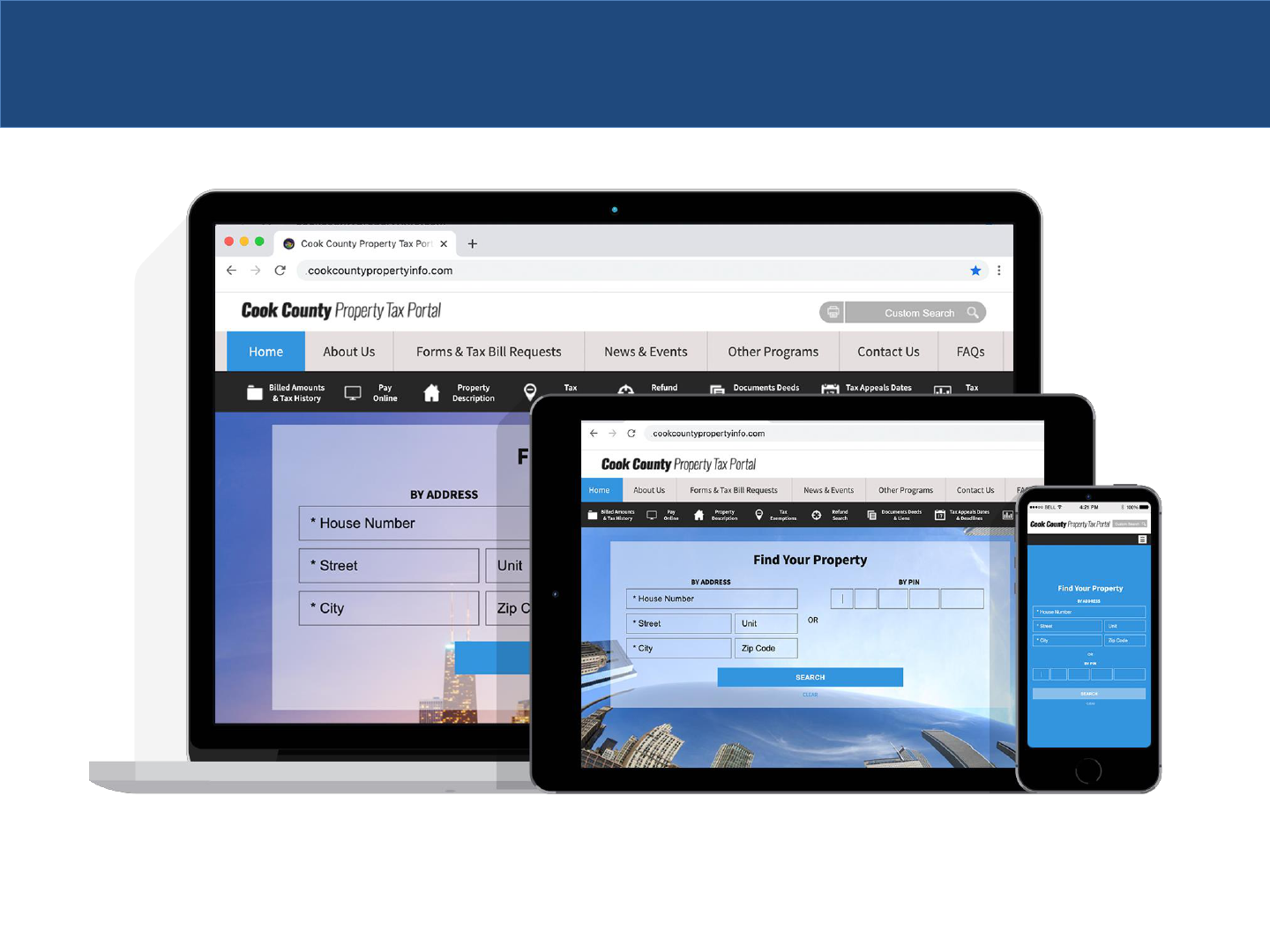

COUNTY PROPERTY TAX PORTAL – MOBILE

The Treasurer’s Office overhauled the

Property Tax Portal in 2016 to make it mobile-

friendly and added functionality. The

programming code recognizes a visitor using

the site from a mobile device and

automatically modifies the layout and design

to fit the device.

Since December 1, 2017, there have been

nearly 2.2 million visits from mobile users.

In FY2021, there have been 792,205 visits

from mobile users. An average of 2,597

mobile users access the site each day.

2.2 million

visits to the Property Tax Portal from a mobile device

S T A T E O F T H E O F F I C E - 2022

Portal – Mobile Visits

iPhone

1,371,264

Android

552,225

iPad

167,850

Samsung

80,928

94

COUNTY PROPERTY TAX PORTAL – MOBILE

S T A T E O F T H E O F F I C E - 2022

95

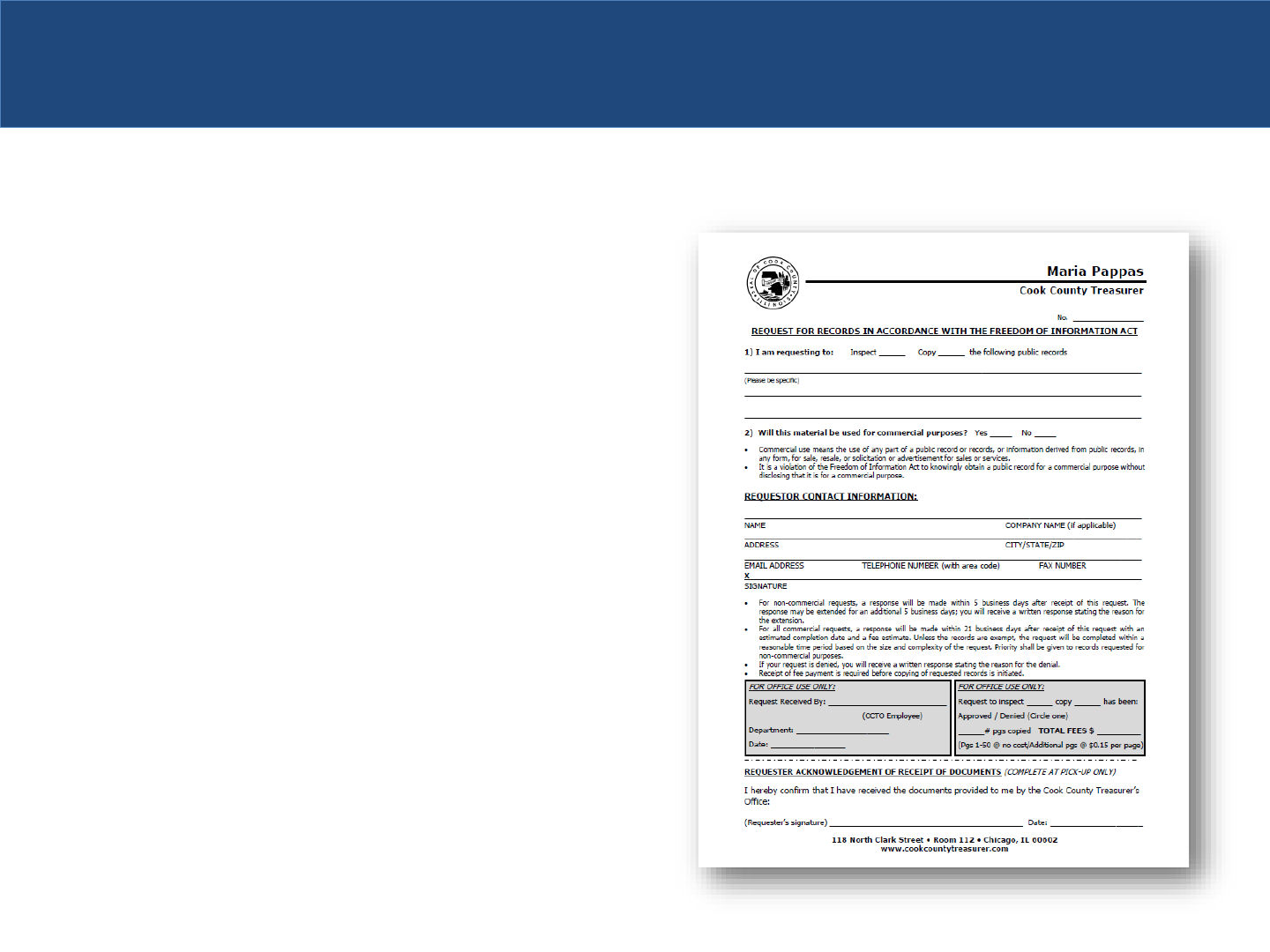

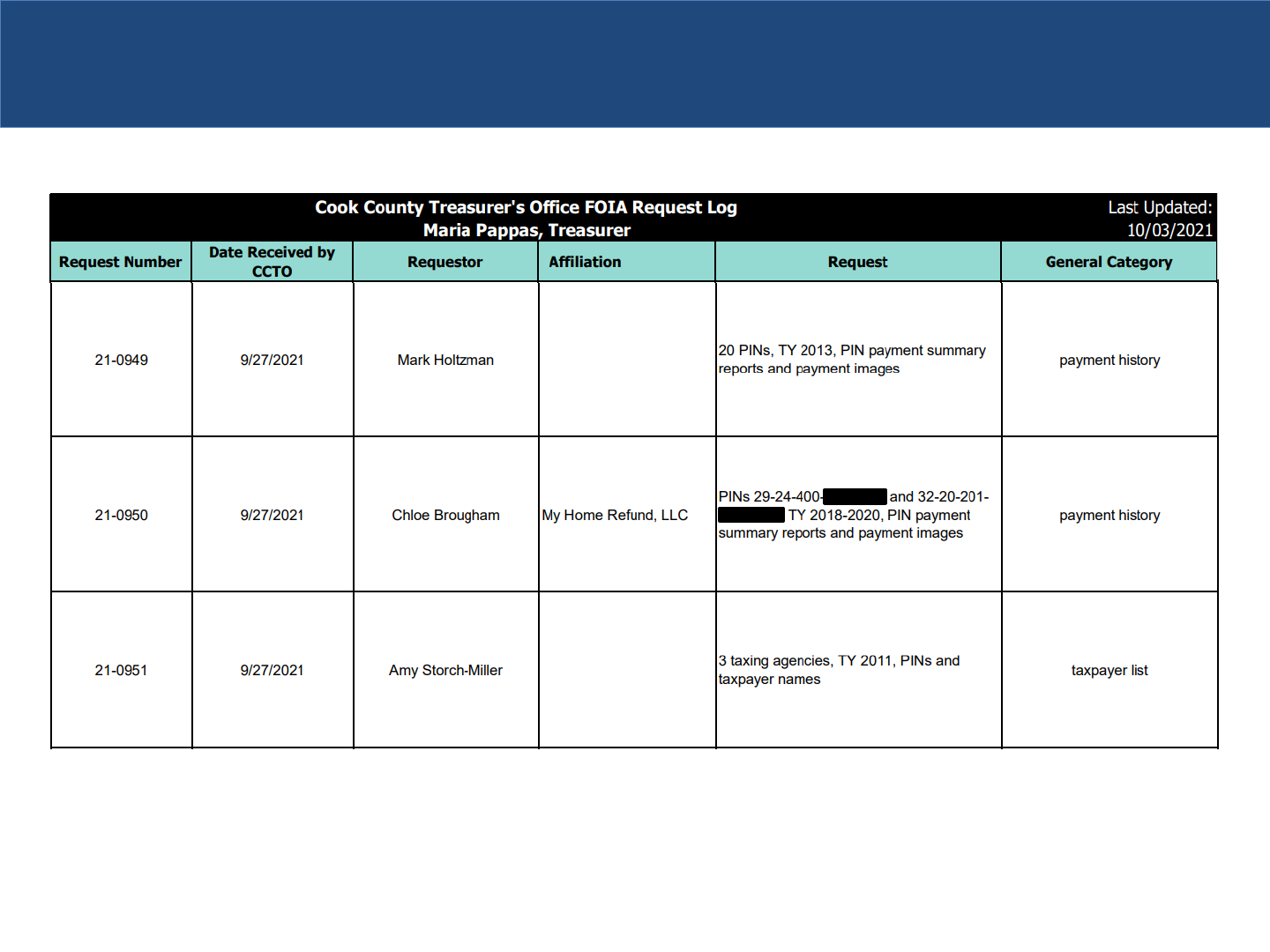

FREEDOM OF INFORMATION ACT (FOIA) LOG

A log of all Freedom of Information Act (FOIA)

requests received by the Treasurer’s Office since

January 1, 2013 is published on the website.

The additional level of transparency allows the

public to view who is requesting information and

what type of information they are requesting.

The log is updated daily in PDF format.

S T A T E O F T H E O F F I C E - 2022

96

FREEDOM OF INFORMATION ACT (FOIA) LOG

S T A T E O F T H E O F F I C E - 2022

97

98

Focus On Budget

99

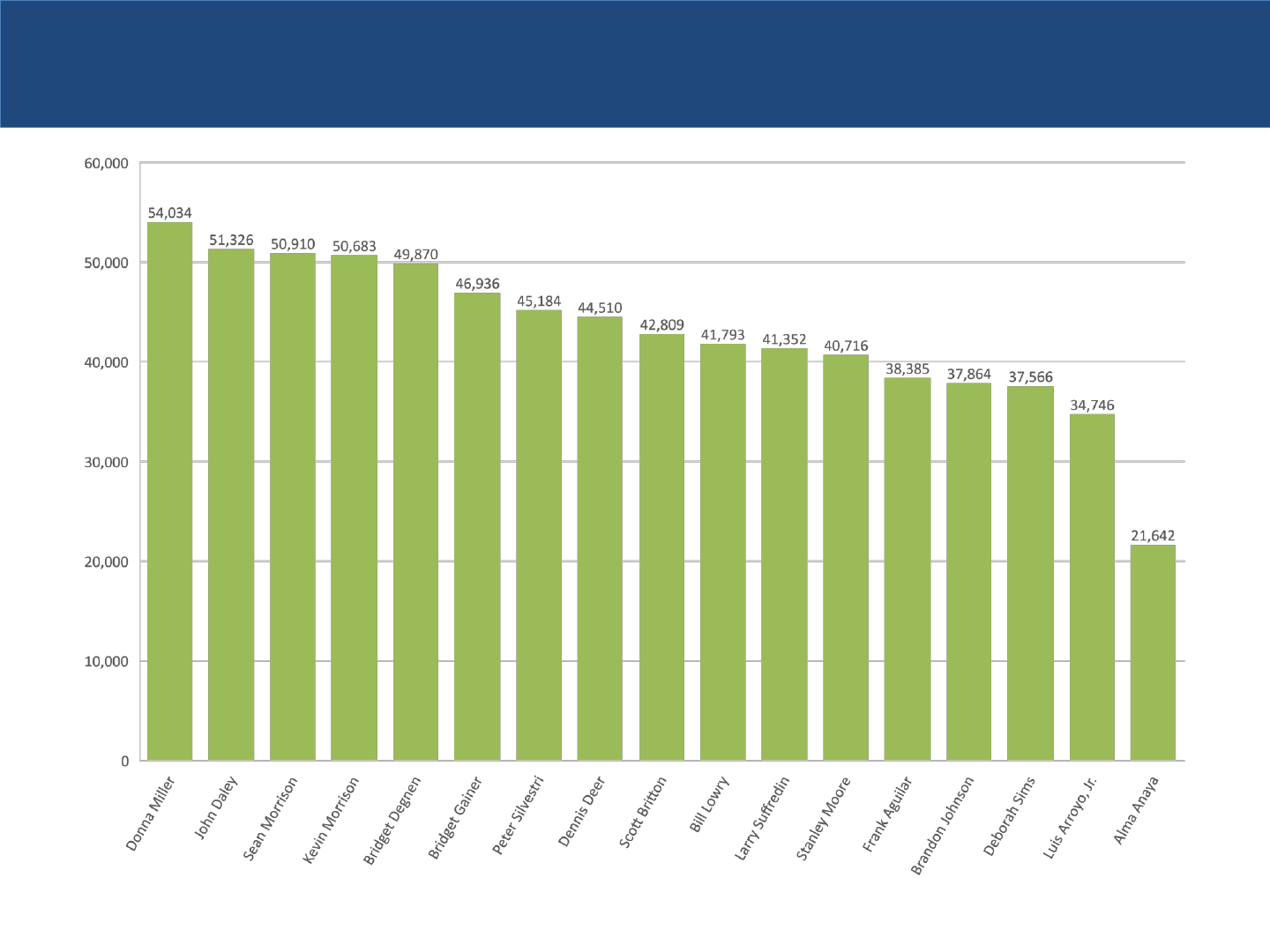

BUDGET COMPARISON

The overall FY2022 budget for the Treasurer’s Office has

been reduced compared with the FY2021 budget.

The combined budget for FY2021 was $12.8 million.

The combined budget for FY2022 is $12.7 million.

S T A T E O F T H E O F F I C E - 2022

Positions

Corporate Automation

Entire Budget

2021

7

70.5

77.5

2022

7

65.5

72.5

CHANGE

0.0%

-

7.1%

-

6.5%

Amounts

Corporate Automation

Entire Budget

FY2021

$769,732

$11,987,501

$12,757,233

FY2022

$751,431

$11,951,584

$12,703,015

CHANGE

-

2.4%

-

0.3%

-

0.4%

The overall FY2022 FTE for the Treasurer’s Office has

been reduced compared with the FY2020 budget.

FTE for FY2021 was 77.5.

FTE for FY2022 is 72.5.

100

FY1998 BUDGET COMPARISON

The Office had 250 employees in FY1998.

If the office maintained its staff of 250, the FY2022 budget

would be $55.5 million.

Instead, the office has 58 filled positions and a budget of

$12.7 million in FY2022.

• $750,000 from taxpayer revenues (Corporate

Account)

• $12 million from commercial user fees (Automation

Account)

If the Treasurer’s Office had the 250

employees that it had in FY1998, the

FY2022 budget WOULD HAVE BEEN:

$55.5 million

Instead, the office has 58 filled positions

and the FY2022 real budget IS:

$12.7 million

$55.5million

would be the budget with 1998’s employment

S T A T E O F T H E O F F I C E - 2022

101

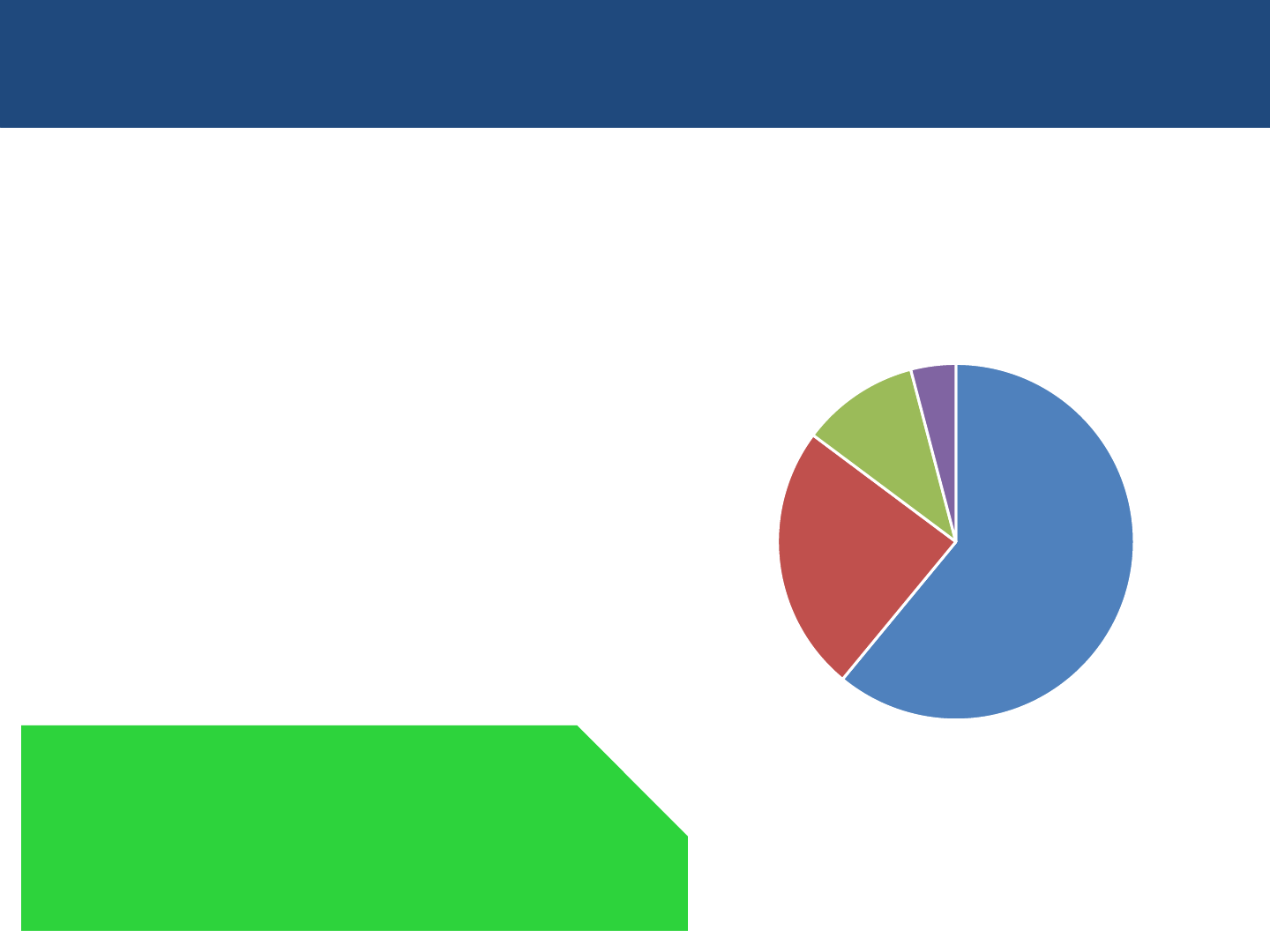

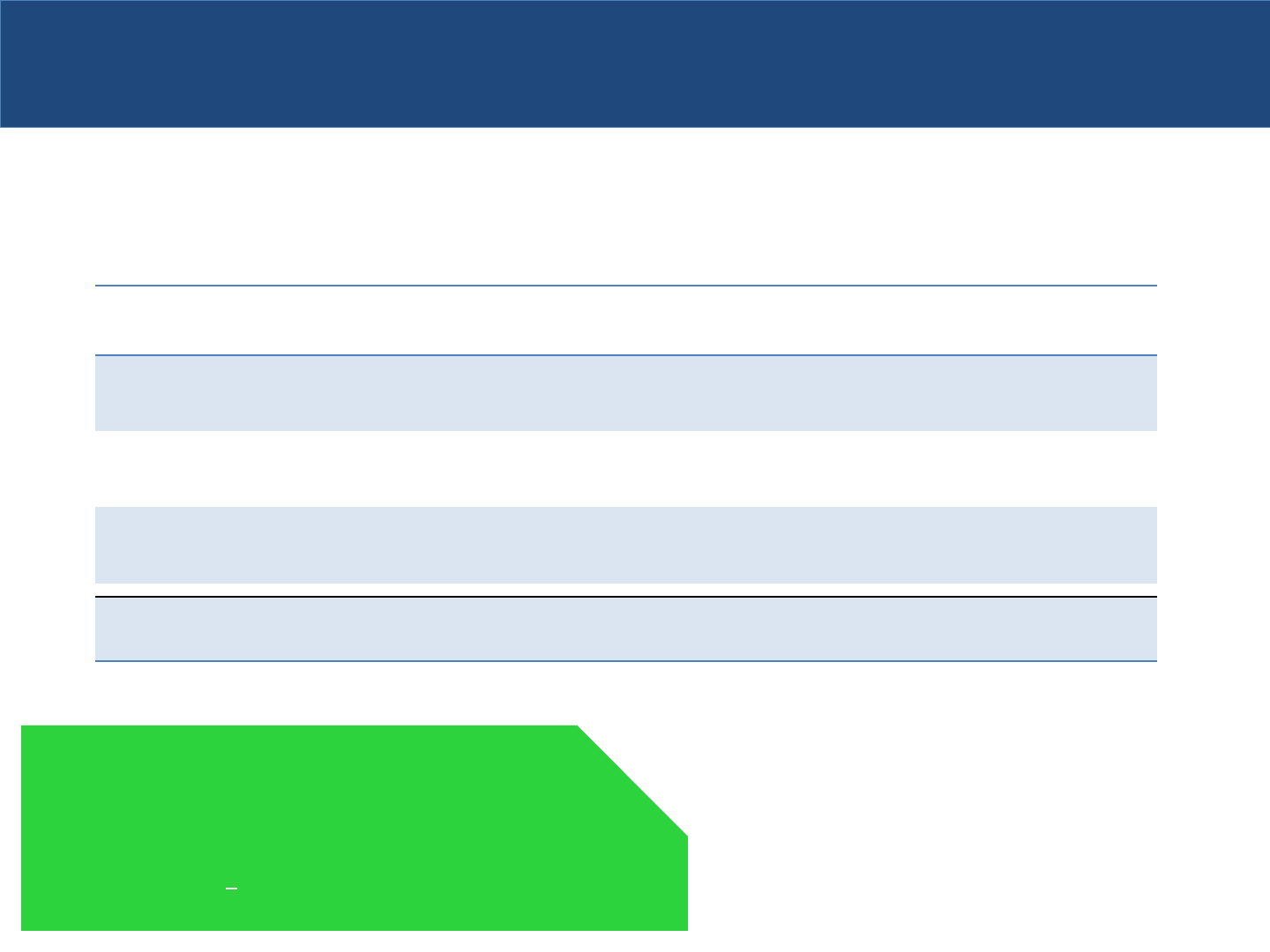

FUNDING

Only 6% of the budget is funded by

taxpayers because the office collects

convenience fees from commercial users who

pay in bulk.

Since 2008, the Treasurer’s Office has used

bank/financial institution fees to fund itself

and automation efforts.

The office is 94 percent self-funded and the

goal continues to be an entirely self-

funded office that is independent of any

taxpayer-funded sources.

94 percent

office funded from commercial user fees

S T A T E O F T H E O F F I C E - 2022

Taxpayer Sources

6%

Fees from Banks/Financial Institutions

94%

($7 per transaction)

102

PERSONNEL COSTS

The biggest portion of the Treasurer’s Office FY2022

budget comes from personnel costs – salaries and fringe

benefits, such as health, vision, dental and life insurance.

These personnel costs comprise 71 percent of the

FY2022 budget.

County employees are automatically awarded longevity

increases, or STEPS, based on years of service.

Employee salaries also increase as a result of Cost-Of-

Living Adjustments (COLAs) that are approved by the

County Board. Additionally, fringe benefit costs continue to

increase.

The following three charts illustrate the budgetary

challenges posed by salary increases, COLAs and fringe

benefits.

71percent

of the Treasurer’s budget is personnel costs

S T A T E O F T H E O F F I C E - 2022

103

COST-OF-LIVING ADJUSTMENT (COLA) HISTORY

Implemented COLA Note

FY1999 June 1, 1999 4.0%

FY2000 December 1, 1999 3.0%

FY2001 December 1, 2000 3.0% Plus $.10/hour increase

FY2002 June 1, 2002 2.5%

FY2003 December 1, 2002 2.0%

FY2003 June 1, 2003 1.0%

FY2004 December 1, 2003 3.0%

FY2005 December 1, 2004* 1.0%

FY2006 December 1, 2005* 1.0%

FY2006 June 1, 2006* 2.0% Plus $500 Bonus

FY2007 December 1, 2006* 1.5%

FY2007 June 1, 2007 2.5% 3% for Non-Union Employees and $1,000 Bonus

FY2008 December 1, 2007 2.0%

FY2008 June 1, 2008 2.75%

FY2011 January 1, 2011* 2.25%

FY2012 December 1, 2011** 2.25%

FY2012 June 1, 2012 3.75%

FY2013 June 1, 2013* 1.0%

FY2014 June 1, 2014* 1.5%

FY2015 June 1, 2015* 2.0%

FY2015 October 1, 2015** 4.5%

FY2016 December 1, 2015 2.0%

FY2017 December 1, 2016* 2.25%

FY2017 December 1, 2016** 1.5%

FY2017 June 1, 2017* 2.0%

FY2019 June 1, 2019 2.0% Plus $1,200 Bonus (December 2018)

FY2020 June 1, 2020* 2.0%

FY2021 June 1, 2021*** 1.5% Plus $3,000 Bonus (Date TBD)***

*COLA awarded to Union employees only. **COLA awarded to Non

-Union employees only. ***Awarded to Non-Union employees, Union employees TBD.

S T A T E O F T H E O F F I C E - 2020

104

FRINGE BENEFIT COMPARISON

Benefit

FY1998 Average Cost Per

Employee

FY2022 Average Cost Per

Employee

Increase ($) Increase (%)

Medicare

$290 $1,448 $1,158 499%

Pension

$3,977 $10,012 $6,035 252%

Insurance

(Health, Life, Pharmacy, Vision, Dental)

$3,689 $14,761

$11,072

400%

Total

$7,956 $26,221

$18,265

330%

$6.5million

cost of benefits if the office had 250 employees in FY2022

If the Treasurer’s Office maintained 250 employees, the fringe benefit obligations would be

approximately $6.5 million in FY2022. Instead, the benefits in the budget for FY2022 are $1.8

million, of which $1.7 million is paid out of the Treasurer’s Automation Budget.

S T A T E O F T H E O F F I C E - 2022

105

FOCUS ON BUDGET

The budget of the Treasurer’s Office operates with two separate and distinct accounts, one funded by

tax money and the other by commercial user fees. These accounts are:

County Treasurer Corporate Account (formerly 060 Account)

• Funded primarily by taxpayer sources

• FY2022 Budget: $751,431 (2 percent reduction compared with FY2021)

County Treasurer Tax Sale Automation Account (formerly 534 Account)

• Funded by commercial user fees paid by banking and mortgage firms

• Established by County ordinance on April 6, 1999

• FY2021 Budget: $11,951,584 (0.3 percent reduction compared with FY2021)

Since FY2008, the Treasurer’s Office has continually reduced the Corporate Account by shifting costs to

the Automation Account. The goal continues to be an entirely self-funded office that is independent

of any taxpayers-funded sources. Many governmental entities simply raise property taxes instead of

creating alternative funding sources and reducing their budgets.

S T A T E O F T H E O F F I C E - 2022

1

2

106

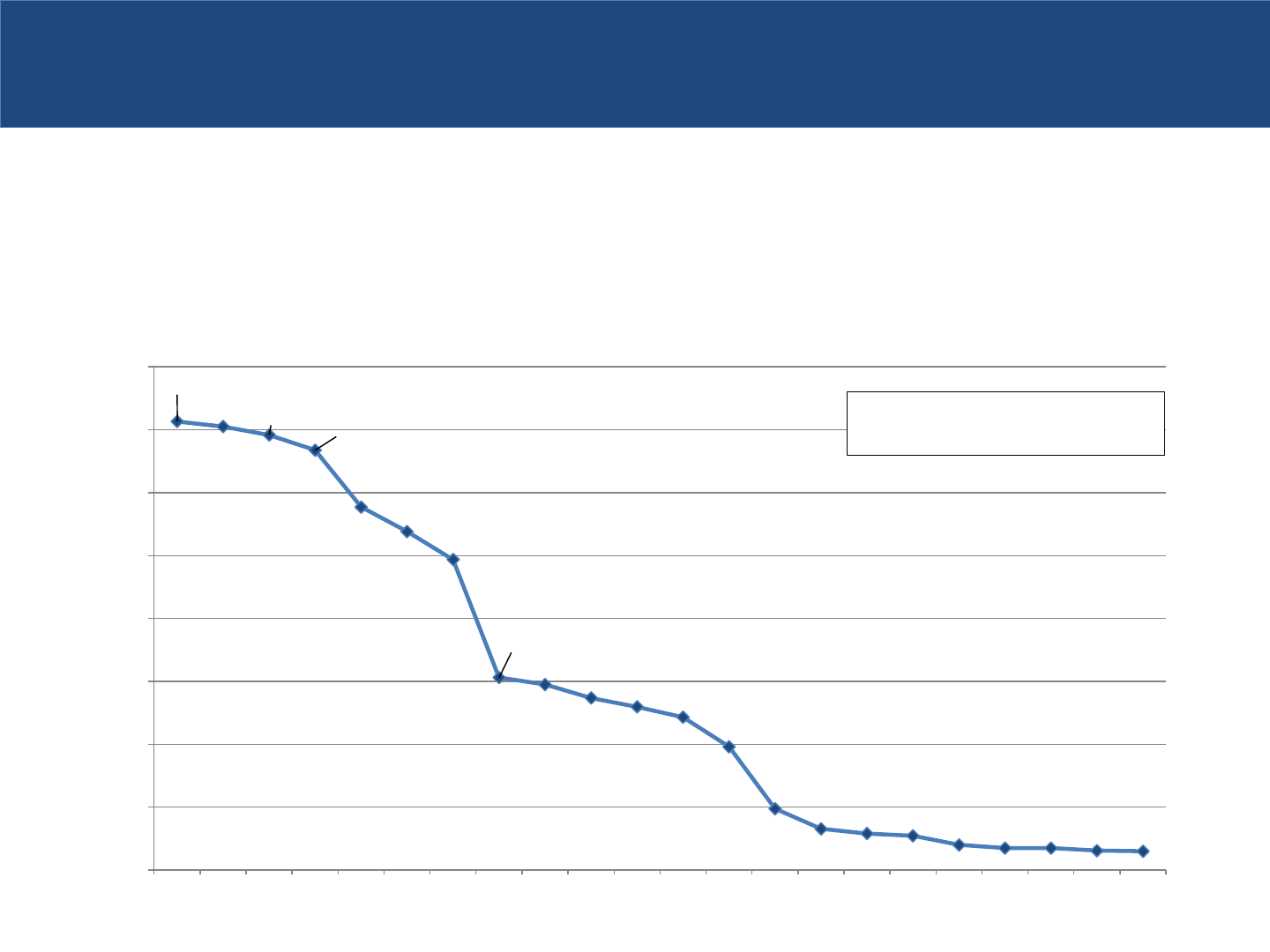

POSITION COUNT

The Automation Projects of the Treasurer’s Office have resulted in a decrease in headcount from 250

in FY1998 to 58 in FY2022, a reduction of 76.8 percent.

FY1998 – 250 EMPLOYEES

FY2022 – 58 EMPLOYEES

S T A T E O F T H E O F F I C E - 2022

Although there are 72.5 FTE in the FY2022 budget,

the Treasurer’s Office is operating with a staff of 58

as the remaining are open positions.

107

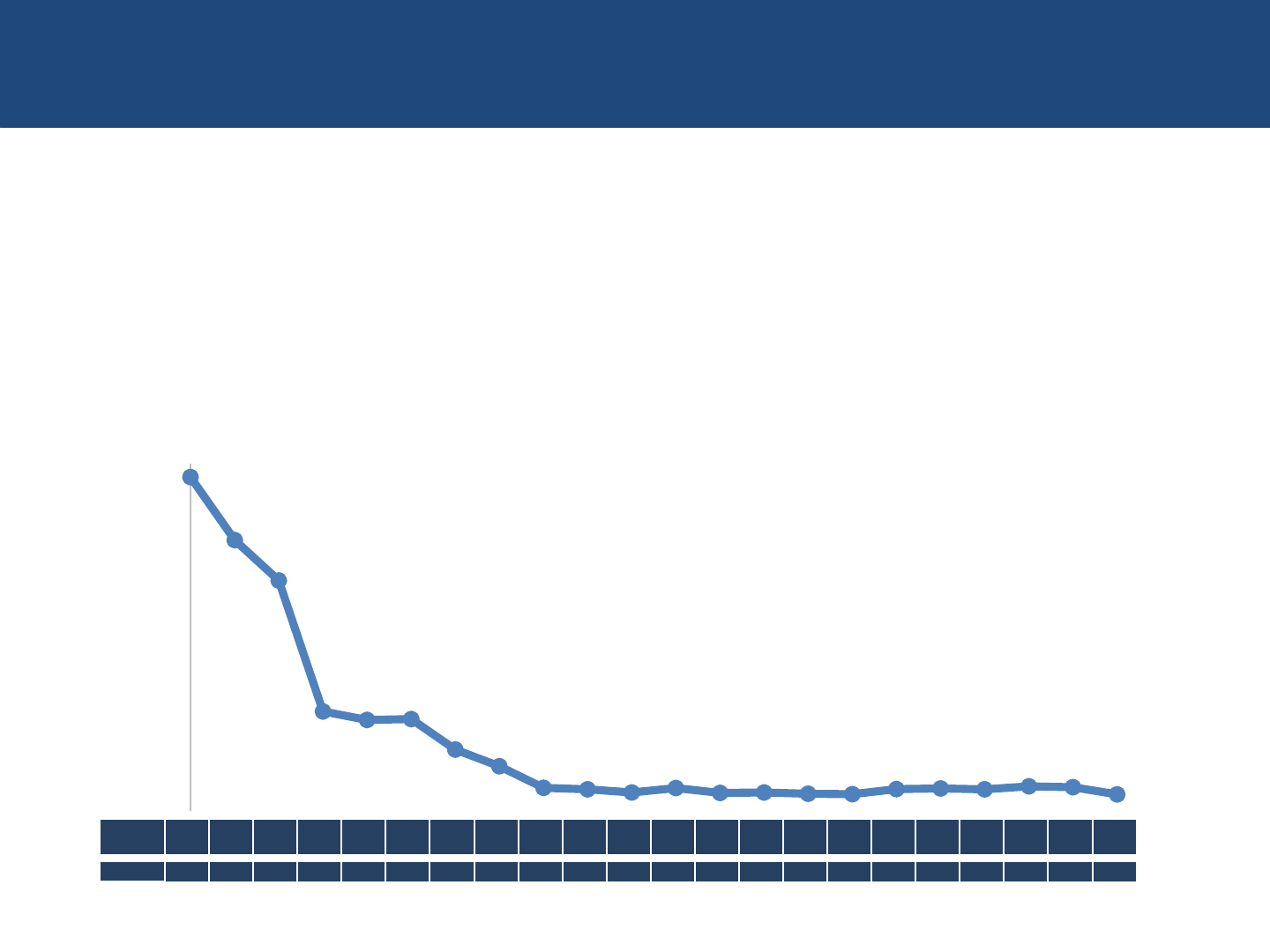

$14.26

$14.10

$13.83

$13.35

$11.54

$10.76

$9.87

$6.12

$5.90

$5.47

$5.19

$4.86

$3.92

$1.95

$1.31

$1.16

$1.09

$0.80

$0.70 $0.70

$0.62

$0.60

$0

$2

$4

$6

$8

$10

$12

$14

$16

FY2001 FY2002 FY2003 FY2004 FY2005 FY2006 FY2007 FY2008 FY2009 FY2010 FY2011 FY2012 FY2013 FY2014 FY2015 FY2016 FY2017 FY2018 FY2019 FY2020 FY2021 FY2022

Corporate Account

Budget Requests (since FY2001)

FY2022 marks the 21

st

consecutive year that the Corporate Account budget, excluding fringe

benefits, has been reduced, from $620,514 in FY2021 to $602,602 in FY2022.

(Figures In Millions)

FY2022 REDUCE CORPORATE BUDGET

S T A T E O F T H E O F F I C E - 2022

From $14.26 million in FY2001 to

$602,602 in FY2022

108

ACCOUNT SUMMARY – CORPORATE ACCOUNT

FY2022 Department Account Summary Including Fringe Benefits Corporate Account

OA Description 2021 Approved & Adopted 2022 Request Difference

501005

Salaries and Wages of Employees With Benefits

$545,674

$520,257

($25,417)

501165

Planned Salary Adjustment

$0

$4,498

$4,498

501510

Mandatory Medicare Cost

$8,164

$7,777

($387)

501585

Insurance Benefits

$141,054

$141,052

($2)

501765

Professional Develop/Fees

$3,669

$3,772

$103

520029

Armored Car Service

$36,284

$37,397

$1,113

520485

Graphics and Reproduction Services

$10,081

$10,283

$202

520725

Loss and Valuation

$11,335

$11,442

$107

530635

Books, Periodicals and Publish

$3,375

$3,444

$69

530700

Multimedia Supplies

$212

$216

$4

540129

Maintenance and Subscription Services

$9,884

$2,653

($7,231)

550129

Facility and Office Space Rental

$0

$8,640

$8,640

Total on Department:

$769,732

$751,431

($18,301)

Decrease: 2.38%

S T A T E O F T H E O F F I C E - 2022

109

ACCOUNT SUMMARY – AUTOMATION ACCOUNT

FY2022 Department Account Summary Automation

Account

OA Description 2021 Approved & Adopted 2022 Request Difference

501005

Salaries and Wages of Employees With Benefits

$6,661,952

$6,623,172

($38,780)

501165

Planned Salary Adjustment

$17,400

$7,900

($9,500)

501210

Planned Overtime Compensation

$10,000

$10,000

$0

501225

Planned Benefit Adjustment

$608,546

$655,776

$47,230

501510

Mandatory Medicare Cost

$99,545

$97,189

($2,356)

501585

Insurance Benefits

$949,407

$929,118

($20,289)