2020

School Finance

in Colorado

Research Publication No. 746

FOREWORD

The purpose of this publication is to help readers understand how Colorado finances its public

elementary and secondary schools. The major focus is an explanation of the funding formula included

in the Public School Finance Act of 1994, including amendments made to the act in 2019. Several

illustrations are provided to help readers calculate funding under the formula. The booklet also

describes several other provisions of law that relate to school district funding. These provisions

include a description of revenue that is earmarked for specific functions, other local sources of

revenue, categorical programs, and the Colorado Preschool Program. Please note that this publication

is intended to provide a summary overview of programs that affect funding for schools; state law

should be consulted for more specific details on the operation of the programs or for information on

other programs that provide money to school districts.

This publication was prepared by the Colorado Legislative Council Staff, the nonpartisan research

staff of the Colorado General Assembly. It is available online at:

http://leg.colorado.gov/agencies/legislative-council-staff/school-finance

The numbers in this handbook reflect the FY 2019-20 appropriation contained in HB 20-1260, the

midyear supplemental adjustment, and are subject to change.

This page intentionally left blank.

TABLE OF CONTENTS

Summary of School Finance Funding ........................................................................................................... 1

Per Pupil Funding by District ..................................................................................................................... 2

Who Pays for a School District’s Funding? ........................................................................................... 3

Colorado’s School Finance Act ..................................................................................................................... 5

The Funding Formula ................................................................................................................................ 5

How Are Pupils Counted? ..................................................................................................................... 5

How Is Per Pupil Funding Calculated? ................................................................................................. 7

Statewide Base is Starting Point ........................................................................................................... 7

What Is At-Risk Funding? ................................................................................................................... 10

How Are Online and ASCENT Students Funded? .............................................................................. 13

What Is the Budget Stabilization Factor? ............................................................................................ 13

Local Share and State Aid ...................................................................................................................... 14

How Is the Local Share Calculated? ................................................................................................... 14

Property Taxes Provide Most Local Revenue ..................................................................................... 14

Specific Ownership Taxes Supplement Property Taxes ..................................................................... 15

How Is State Aid Calculated? ................................................................................................................. 16

State Aid Comes Primarily From Three Sources ................................................................................ 16

Modifications to the Funding Formula ..................................................................................................... 17

Earmarked Revenue ............................................................................................................................... 19

School Districts May Raise Additional Property Taxes for Operating Purposes ................................ 19

Unequalized District Property Taxes Also Pay for Debt ..................................................................... 20

“Growth” Districts May Raise Additional Property Taxes for Capital Improvements .......................... 21

Transportation Levies Require Voter Approval ................................................................................... 21

Full-Day Kindergarten May Be Funded From Voter-Approved Property Taxes ................................. 21

Voters May Also Approve Special Building or Technology Levies ..................................................... 21

Cash Flow Loan Program ....................................................................................................................... 22

State Contingency Reserve .................................................................................................................... 22

Capital Construction ................................................................................................................................ 22

The Public School Capital Construction Assistance Fund Provides Matching Grants to School

Districts ................................................................................................................................................ 23

Charter Schools Receive Money for Capital ....................................................................................... 23

Funding Formulas ....................................................................................................................................... 25

Calculation Examples .................................................................................................................................. 27

Categorical Programs ................................................................................................................................. 33

Colorado Preschool Program ...................................................................................................................... 37

Glossary ...................................................................................................................................................... 39

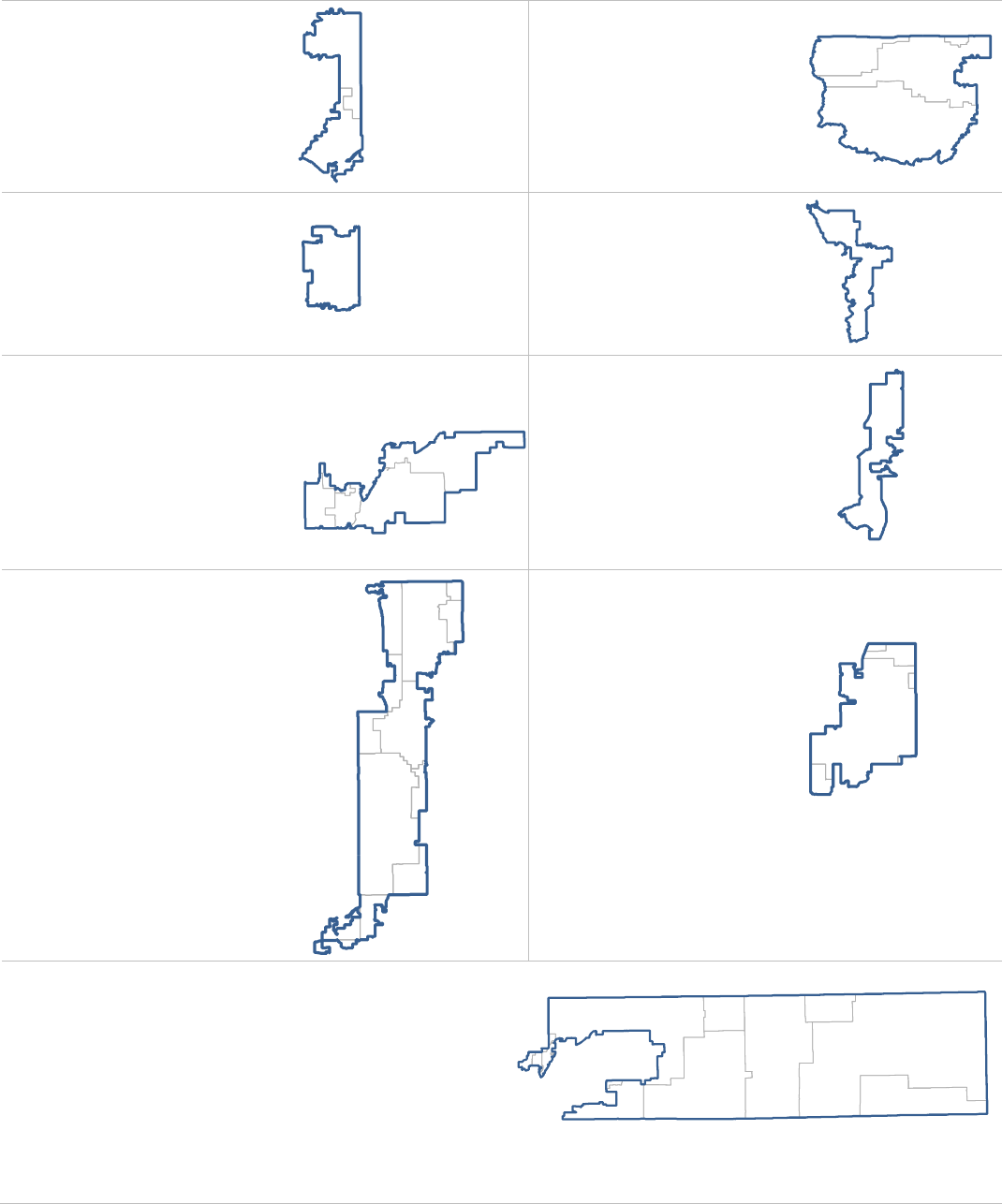

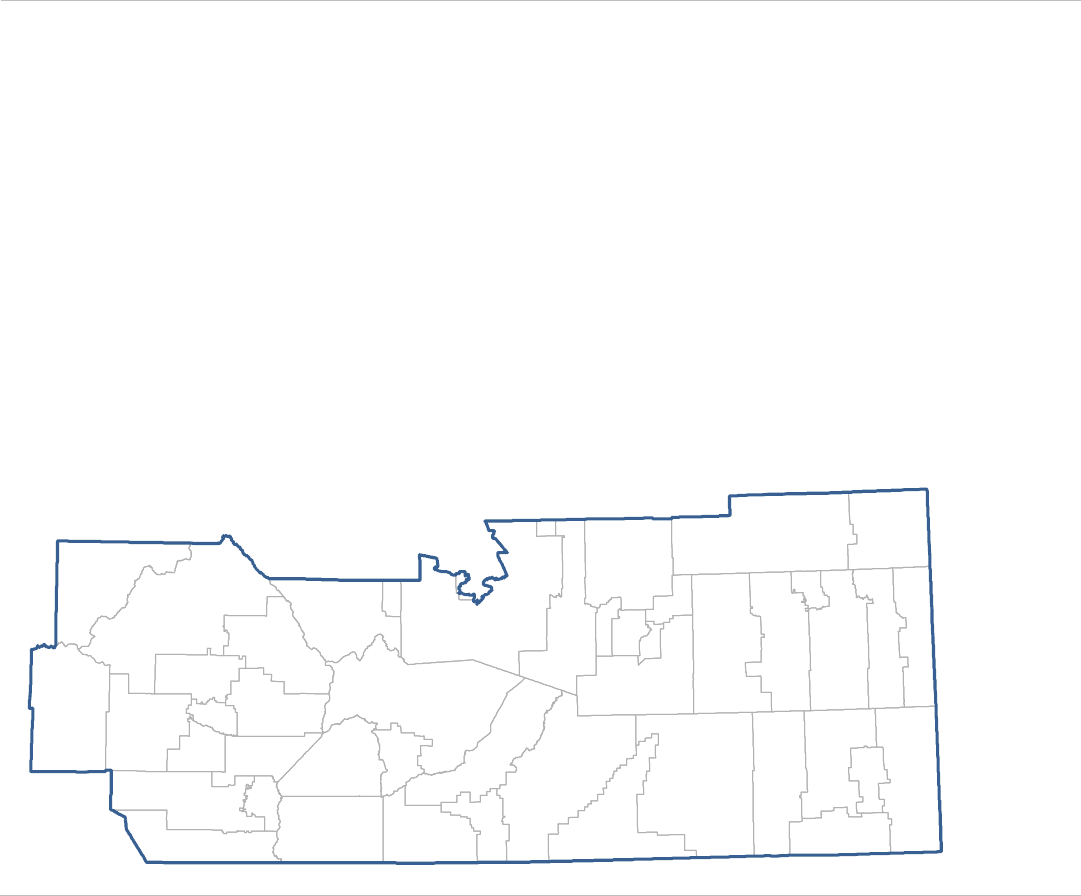

Appendix A: School District Map Key ......................................................................................................... 43

Appendix B: School Districts in Colorado House Districts .......................................................................... 45

Appendix C: School Districts in Colorado Senate Districts ......................................................................... 55

This page intentionally left blank.

School Finance in Colorado 1

SUMMARY OF SCHOOL FINANCE FUNDING

1) Calculate Per Pupil Funding for Each District

Multiply statewide base per pupil funding by district-level factors to determine per pupil funding

for each district.

2) Calculate Total Funding Required for Each District

To determine total funding for each district, multiply district per pupil funding by the number of

students in the district, then add funding for at-risk, online, and ASCENT students.

3) Determine the Local Share of Funding

The local government share of funding comes from property tax and specific owner tax

collections from property owners in the district.

4) Determine the Required Amount of State Aid

Subtract the local share of funding across all districts from the total funding required across all

districts to determine the total amount of state aid required by the school finance act.

5) Apply the Budget Stabilization Factor

The budget stabilization factor is a state budget element that proportionately reduces the amount

of total funding for each district, such that state aid is reduced.

Statewide

Base Per Pupil

Funding

$

District

Per Pupil

Funding

$1,500.01 - $3,559.24

$1,000.01 - $1,500.00

$750.01 - $1,000.00

$500.01 - $750.00

$10.13 - $500.00

Cost-of-Living Adjustment per Pupil, 2016-17

Cost-of-Living and

Personnel Cost

Adjustments

Size

Adjustment

+

=

+

$5,000.01 - $10,095.92

$2,000.01 - $5,000.00

$1,000.01 - $2,000.00

$500.01 - $1,000.00

$56.15 - $500.00

Enrollment Size Adjustment per Pupil, 2016-17

$

District

Per Pupil

Funding

×

District

Pupil Count

+

At-Risk, Online,

and/or ASCENT

Funding

Total Funding

Per District

$

=

Residential and

Nonresidential

Property Tax

$

Local Share

Per District

+

=

Specific

Ownership Tax

$

Local Share

Across Districts

$

State Aid

Across Districts

=

−

Total Funding

Across Districts

$

$

Actual Total

District Funding

Budget Stabilization

Factor

=

×

Total Funding

Per District

$

−%

2 School Finance in Colorado

Per Pupil Funding by District

Figure 1 shows total per pupil funding across the state’s 178 school districts for FY 2019-20. In

FY 2019-20, funding per pupil ranged from $8,056 in the Academy School District to $18,446 in the

Agate School District. A key for the school districts is provided in Appendix A on page 43. Per pupil

funding is highest in rural districts due primarily to the enrollment size factor adjustment in the school

finance formula. Per pupil funding is lowest in districts that qualify for little additional funding from

the size, cost-of-living, or at-risk adjustment factors. Per pupil funding amounts shown in Figure 1

are after the application of the budget stabilization factor, which reduces funding across most districts

proportionally (see page 13 for more information). A history of total school finance act funding and

average per pupil funding is provided on page 32.

Figure 1

FY 2019-20 Total Per Pupil Funding

Source: Legislative Council Staff.

Note: Numbers in parentheses indicate the number of school districts in each tier.

School Finance in Colorado 3

Who Pays for a School District’s Funding?

Most school districts rely on a combination of state and local sources of revenue to pay for school

finance, or what is also called total program funding. Normally, state aid makes up the difference

between a district’s total funding and what is provided from local tax revenue. The state’s share of

funding for districts varies based on the amount of local tax revenue generated in each district.

The following describes in greater detail how the various

elements of the school finance funding formula are

calculated. It also highlights recent changes in school

finance funding formula, such as the use of the budget

stabilization factor to achieve budget savings for the state

by reducing each district’s total funding.

In FY 2019-20, total funding for school finance was

$7.6 billion, with the state contribution at $4.6 billion, or

61 percent of the total, and the local contribution at

$3.0 billion, or 39 percent of the total. The average per

pupil funding was $8,489 for all districts. The lowest district received $8,056 per pupil, and the highest

district received $18,446 per pupil.

Over time, the state share of funding across all school districts has increased, as shown in Figure 2.

For more information on why the state share has increased, see the Legislative Council Staff memo

titled, “School Finance and the State Constitution.”

Figure 2

Statewide Average School Finance Funding Per Pupil

Source: Legislative Council Staff.

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000

$4,500

$5,000

$5,500

$6,000

$6,500

$7,000

State Aid

Per Pupil

Local Funding

Per Pupil

Local Contribution

A school district receives revenue

directly from individuals and businesses

in the form of property taxes and specific

ownership taxes.

State Aid

The state’s contribution to a district’s

funding comes mostly from state income

and sales taxes, which are primarily

deposited into the state General Fund.

This page intentionally left blank.

School Finance in Colorado 5

COLORADO’S SCHOOL FINANCE ACT

Colorado’s school finance act distributed nearly $7.6 billion in state and local dollars to the state’s

178 school districts for K-12 public education in FY 2019-20. Currently, this money is allocated under

a law called the “Public School Finance Act of 1994.” The school finance act contains a formula that

calculates a per pupil funding amount for each school district based on the individual characteristics

of the district, such as the cost to live in the district and the number of students enrolled. The act is

explained in detail on the following pages, including amendments made under the most recent school

finance bill, Senate Bill 19-246, as amended through the mid-year supplemental, House Bill 20-1260

and including additional changes resulting from House Bill 19-1262, State Funding of Full Day

Kindergarten. The numbers in this handbook are subject to change.

The Funding Formula

A district’s funding under the school finance act is the number of pupils in the district multiplied by

the district’s preliminary per pupil funding level, plus an amount of money provided to compensate

a district for at-risk pupils, online students, and pupils participating in the accelerating students

through concurrent enrollment (ASCENT) program.

The following describes elements contained in state law that determine how pupils are counted and

how a school district’s per pupil funding is adjusted by certain factors. Most recently, because of

ongoing state budget constraints, the budget stabilization factor was implemented to reduce each

school district’s funding by a fixed percentage. This reduction is made after all other adjustments in

the funding formula are calculated. The budget stabilization factor was previously known as the

negative factor. An example of this adjustment is illustrated on page 31.

How Are Pupils Counted?

Funding under the school finance act is based on the number of pupils enrolled in the school district

on October 1. Thus, the number of pupils counted on October 1, 2019, determines funding for the

budget year beginning July 1, 2019. Because the fiscal year begins before the count date, state aid is

distributed based on estimated pupil counts. State aid is adjusted to reflect the actual count, usually

starting in January of the fiscal year.

The act provides an alternative to the October 1 count date in certain instances, such as when students

in a year-round educational program will be on vacation on October 1. This alternative count date

must be within 45 calendar days of the first school day after October 1.

School District Funding =

(Number of Pupils × Preliminary Per Pupil Funding)

+ At-Risk Funding + Online and ASCENT Funding

× Budget Stabilization

Factor

6 School Finance in Colorado

The pupil count is expressed in full-time equivalent (FTE) pupils to reflect the amount of time a

student spends in an instructional setting. Preschool students are usually counted half time. Full-day

kindergarten students are counted 1.0 FTE, and half-day kindergarten students are counted as 0.58 of

a pupil. A school district’s pupil count also includes students who are enrolled in online programs

and students who are eligible to complete a fifth year of high school while enrolled concurrently in

higher education courses. The latter is called the ASCENT program.

The formula also makes enrollment allowances for districts that lose pupils from one year to

the next, recognizing that such districts may have difficulty budgeting for fewer pupils. The

pupil count for declining enrollment districts is the greater of a two-year, three-year, four-year,

or five-year average of the October counts.

Online, ASCENT, and a portion of preschool, kindergarten, and Charter School Institute students are

not included in the averaging formula. The number of pupils for which a district receives funding is

called the funded pupil count.

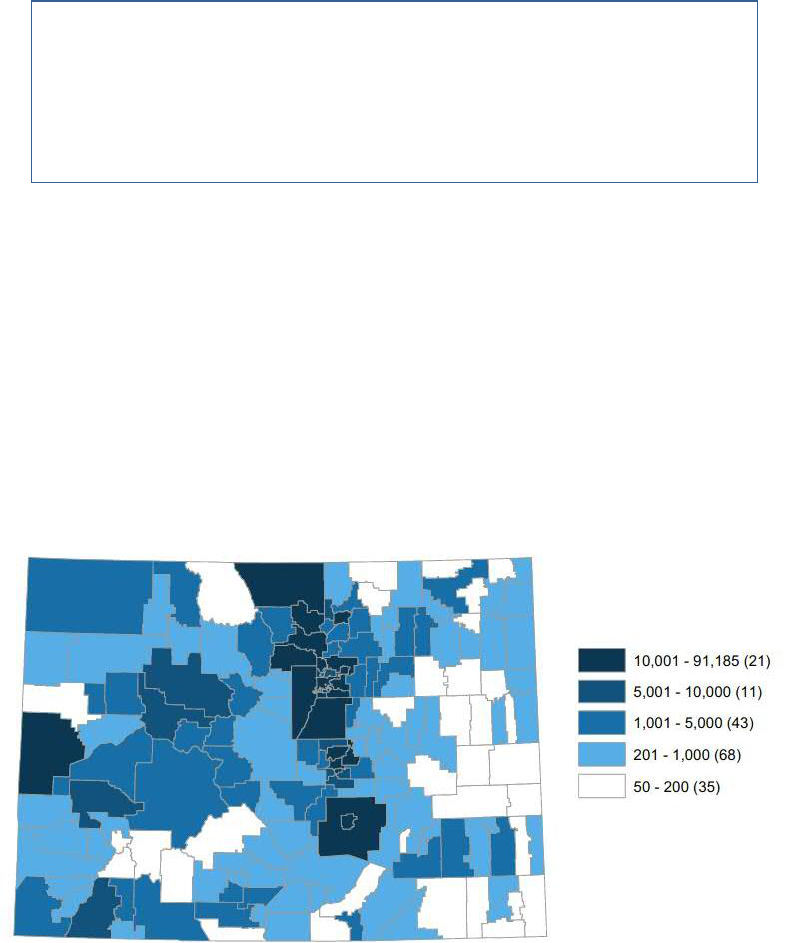

Figure 3 shows the funded pupil count for FY 2019-20, ranging from the smallest districts funded at

the minimum level of 50 FTE to Denver, funded at 91,185 FTE. The highest density of students is

along the Front Range from Pueblo north through Fort Collins. Other districts with relatively high

enrollment include those containing the cities of Grand Junction and Durango and districts located

along the western I-70 corridor between Summit County and Glenwood Springs. The smallest

districts are in the central and southern portions of the Eastern Plains and the northern portion of the

San Luis Valley.

Figure 3

FY 2019-20 Funded Pupil Count

Source: Colorado Department of Education. Map created by Legislative Council Staff.

Note: Numbers in parentheses indicate the number of school districts in each tier.

Funded Pupil Count =

0.5 x Preschool Count

+ Online and ASCENT Counts

+ .08 Half-Day Kindergarten Count

+ Greater of the current year’s K-12 count or a two-year, three-year,

four-year, or five-year average of K-12 counts

School Finance in Colorado 7

How Is Per Pupil Funding Calculated?

A district’s preliminary per pupil funding is the result of adjusting the statewide base by various

factors representing district-specific characteristics including cost-of-living, personnel and

nonpersonnel costs, and enrollment size.

Statewide Base is Starting Point

The calculation of each district’s pupil funding starts with a statewide base per pupil funding amount

which is set annually by the General Assembly. The statewide base for FY 2019-20 is $6,951.53, an

increase of 2.7 percent ($182.76) over the prior year. Base funding accounts for about $6.2 billion of

the money allocated under the formula in FY 2019-20, or about 76 percent of total funding before

application of the budget stabilization factor.

Although the General Assembly sets the base annually, Article IX, Section 17, of the Colorado

Constitution, commonly referred to as Amendment 23, requires minimum increases for the base. The

amendment required that through FY 2010-11, the General Assembly increase the base each year at

least by the rate of inflation plus 1 percent, and by inflation thereafter. Because the inflation rate for

calendar year 2019 was 1.9 percent, a 1.9 percent increase is the minimum increase for FY 2020-21

required by Amendment 23. Figure 4 provides a history of statewide base per pupil funding dating

back to FY 2001-02. The gray portion of each bar represents the previous year’s per pupil funding,

while the blue portion represents the per pupil increase required by Amendment 23.

Figure 4

Statewide Base Per Pupil Funding

Source: Legislative Council Staff.

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

Required Increases under

Amendment 23

Preliminary Per Pupil Funding =

(Statewide Base × Personnel Costs Factor × Cost of Living Factor)

+ (Statewide Base × Nonpersonnel Costs Factor)

× Size Factor

8 School Finance in Colorado

The Statewide Base Is Adjusted for Cost of Living

Each school district is assigned a factor to indicate the cost of living in the district relative to the cost

of living in other districts in the state. For FY 2019-20, the cost-of-living factors for school districts

range from about 1 percent to 65 percent. Statewide, an estimated $1.2 billion in FY 2019-20 school

finance funding is attributed to the cost-of-living factor, or 14.7 percent of total funding, before

application of the budget stabilization factor.

State law contains the method for calculating cost-of-living factors, but not the actual factors

themselves. Cost-of-living factors are certified to the Colorado Department of Education by the

Legislative Council Staff every two years following a study that measures the cost in each district of

an identical set of items, such as housing, goods and services, and transportation. The 2019 study set

factors for the 2020-21 and 2021-22 budget years. Under state law, a district’s factor from the prior

two-year cycle is increased when the cost of living in the district increases by a greater percentage

than the increase in the statewide average teacher salary used in the study. The 2019 study uses

representative purchases made by a household earning an average teacher’s salary of $56,547 per year.

This amount reflects the average salary for a teacher with a bachelor’s degree and ten or more years

of teaching experience, and represents a 6.46 percent increase over the $53,115 salary for a comparable

teacher in 2017.

In periods when average salaries increase by 1.0 percent or more, the increase in the factor is equal to

the percentage change in the district's cost of living divided by the percentage change in the salary

level divided by 1,000. The increase in the factor is rounded to three decimal places.

District “Personnel Costs Factor” Defines the Portion of the Statewide Base Adjusted for Cost of

Living

The formula recognizes that differences in the cost of living primarily affect the salaries that must be

paid to hire and retain qualified personnel. Therefore, the cost-of-living factor is applied only to the

portion of the base that relates to personnel, as defined by the personnel costs factor.

The personnel costs factor ranges from 79.9 percent to 90.5 percent and differs by district according to

enrollment. Smaller districts have smaller factors and, therefore, a smaller portion of the base is

increased for cost of living. Larger districts spend a higher proportion of their budgets on personnel

costs than smaller districts, and thus receive a larger increase to their base from the cost-of-living

factor. The formula for determining district personnel costs factors is illustrated on page 28.

Each district's "nonpersonnel costs factor" is the difference between 100 percent and the district's

personnel costs factor. It is the portion of the base that is not adjusted for cost of living and ranges

from 9.5 percent to 20.1 percent.

For FY 2019-20, Figure 5 shows the adjustments made for cost of living and personnel costs across

school districts. Adjustments range from $14 to $3,886 per pupil. As the figure demonstrates, the

highest cost-of-living adjustments come in districts associated with the resort communities of Aspen

and Telluride. Districts along the Front Range and in other areas of the mountain region also receive

relatively high cost-of-living adjustments. Rural districts in the central and southern portions of the

Eastern Plains receive the lowest adjustments for this factor.

School Finance in Colorado 9

Figure 5

Per Pupil Funding Increase from

Cost-of-Living and Personnel Cost Factor Adjustments, FY 2019-20

Source: Legislative Council Staff.

Note: Numbers in parentheses indicate the number of school districts in each tier.

Size Factor Adjusts for Economies of Scale

The act includes a size factor that provides additional money to all school districts, but particularly

small school districts unable to take advantage of economies of scale. In FY 2019-20, approximately

$343.3 million is allocated through the size factor, or about 4.2 percent of total funding, before

application of the budget stabilization factor.

Like the personnel costs factor, a size factor is calculated under a formula using district

enrollment. The smallest districts — districts with enrollments of fewer than 5,000 students — receive

the largest size factors and, therefore, more funding per pupil. All other districts receive a size factor,

which provides an increase in per pupil funding of about 3 percent. The formula for calculating a

school district's size factor appears on page 29.

Since the formula for determining the size factor is based on a district's enrollment, the act

acknowledges that the formula inherently provides incentives and disincentives for districts to

reorganize and take advantage of the formula. For example, when a reorganization results in a lower

size factor, and less funding per pupil, the lower size factor is phased in over six years. When a

reorganization results in a higher size factor, and more funding per pupil, the district or districts

involved in the reorganization receive the lower size factor of the original district. Thus, the act lessens

the negative fiscal impact of reorganization, while prohibiting a district from taking advantage of a

higher size factor following reorganization.

10 School Finance in Colorado

The act also attempts to minimize the effect that charter schools may have on the size factor of small

school districts. The size factor for districts with fewer than 500 pupils is calculated using the district's

enrollment minus 65 percent of the pupils enrolled in charter schools.

For FY 2019-20, Figure 6 shows the adjustment made for the enrollment size factor across school

districts. Adjustments range from $83 to $11,029 per pupil. Districts that receive the largest funding

adjustment from this factor are the small rural districts concentrated on the Eastern Plains and the

northern and southern portions of the San Luis Valley. The largest enrollment districts receiving the

smallest funding adjustment from this factor are clustered along the Front Range and the western I-70

corridor.

Figure 6

Per Pupil Funding Increase from the

Size Factor Adjustment, FY 2019-20

Source: Legislative Council Staff.

Note: Numbers in parentheses indicate the number of school districts in each tier.

What Is At-Risk Funding?

Colorado's school finance act provides additional funding for school districts that serve students who

are at risk of failing or dropping out of school. The additional funding depends on the district's

preliminary per pupil funding, the number of at-risk students, and the proportion of at-risk students

in the district. In FY 2019-20, the act provides $360.3 million in at-risk funding statewide, or 4.4 percent

of total funding, before application of the budget stabilization factor. At-risk funding is determined

according to the following formula.

At-Risk Funding =

(At-Risk Pupils × 12% × Preliminary Per Pupil Funding) + At-Risk Funding Premium

School Finance in Colorado 11

Definition of At-Risk Pupils Follows the Federal Free Lunch Program and Includes Some Students

with Limited English Skills

Under the act, at-risk pupils are defined as students from low-income families, as measured by

eligibility for free lunches under the National School Lunch Act. The definition of at-risk pupils also

includes a limited number of non-English-speaking students.

Students qualify for free meals at school based on their family's income. The act defines at-risk

pupils as those who are eligible for free lunches so districts can receive funding for students who do

not actually participate in the federal program. As an alternative, the act allows districts to use the

proportion of free-lunch students in grades one through eight multiplied by the district's enrollment

if it produces a larger number than the actual count. This alternative count is provided because some

high schools do not offer free lunches, and some students choose not to participate in the free lunch

program, especially at the high school level.

A student with limited English skills, as defined by the English Language Proficiency Act, can be

included in the at-risk count if the student meets one of two criteria. First, a student can be counted

if he or she took the statewide assessment in a language other than English in the preceding year.

Second, a student can be counted if the student’s assessment scores were not included in calculating

school academic performance. In either case, a student can be counted as at-risk only once; therefore,

a student who is counted under the income guidelines of the free lunch program cannot be counted

because of limited proficiency in English.

Preschool students are not included in a district's at-risk count. The official date for counting at-risk

pupils is October 1.

Proportion of At-Risk Students Determines At-Risk Funding

The proportion of at-risk students in a district determines the amount of funding a district receives

for its at-risk pupils. Every district receives at least 12 percent of its preliminary per pupil funding for

each at-risk pupil.

Districts with higher-than-average proportions of at-risk students receive a premium above this initial

amount for those at-risk pupils. The amount of this premium depends upon enrollment in the district

and the degree to which the district's share of at-risk students exceeds the statewide average. For

districts with enrollments between 459 and 50,000, the premium is equal to 12 percent plus 0.30 of a

percentage point for each percentage point that the district's at-risk percentage exceeds the

statewide average. Thus, if the statewide average is 30 percent, and 41 percent of a particular

district's students qualify for at-risk funding, the district would receive a premium of 15.3 percent

(12.0 + (0.3 × 11) = 15.3) for qualifying students. For districts with enrollments greater than 50,000, the

premium is equal to 12 percent plus 0.36 of a percentage point for each percentage point that the

district's at-risk percentage exceeds the statewide average. The premium is capped at 30 percent, so

18 percentage points is the maximum that can be added to the existing 12 percent of per pupil

funding provided for each at-risk student.

12 School Finance in Colorado

The at-risk funding premium is provided only for pupils over the statewide average percentage of

at-risk pupils. So, the district described above with 41 percent at-risk students would receive

12 percent more in per pupil funding for 30 percent of its students and 15.3 percent more in per pupil

funding for the other 11 percent of its students who are at risk. In addition, only districts with more

than 459 pupils qualify for the at-risk funding premium.

Figure 7 shows the share of total pupils that are classified as at-risk in each district for FY 2019-20. The

highest concentrations of at-risk students are in the urban districts in the Denver and Pueblo metro

areas, and scattered rural districts throughout the state. The lowest concentrations are in Boulder and

Douglas counties, and districts containing the resort communities of Aspen, Steamboat Springs, and

Telluride.

Figure 7

Share of At-Risk Students, FY 2019-20

Source: Legislative Council Staff.

Note: Numbers in parentheses indicate the number of school districts in each tier.

How Are Online and ASCENT Students Funded?

Students who participate in public, multi-district online education programs or the ASCENT program

are funded through the school finance act. Online students participate either in programs that serve

students from multiple districts (multi-district programs) or in a program offered by the student's

home district (single-district program). The vast majority of online students participate in

multi-district programs. Both multi-district online and ASCENT students were funded at a uniform

$8,382 in FY 2019-20, accounting for about $29.3 million in school finance funding, before application

of the budget stabilization factor. After the budget stabilization factor, this amount was reduced to

$7,793, which compares with statewide average per pupil funding of $8,489.

School Finance in Colorado 13

What Is the Budget Stabilization Factor?

In an effort to generate budget savings for the state, House Bill 10-1369 included a new factor called

the budget stabilization factor for FY 2010-11 and FY 2011-12. For most districts, after all the funding

adjustments required by the school finance act are calculated, this factor reduces total funding

proportionately across districts.

Senate Bill 11-230 changed the name of this factor to the negative factor and extended its applicability

indefinitely; Senate Bill 17-296 changed the name back to budget stabilization factor. In FY 2019-20,

for most districts, the budget stabilization factor reduced total funding by approximately 7.0 percent,

or a total of $572.4 million compared to what would have been funded without the factor. Per pupil

funding fell by a similar percentage, although certain districts with limited state aid did not lose as

much funding. Districts with limited state aid were instead required to contribute through a buyout

of state spending on categorical programs, described on page 18.

For FY 2019-20, Figure 8 shows the adjustment made for the budget stabilization factor across school

districts, ranging from $0 to $1,394 per pupil. While the budget stabilization factor imposes the same

percentage reduction on total and per pupil funding for all districts not fully paid with local sources,

the per pupil reduction can vary widely on a level basis. Front Range districts incur a smaller funding

reduction because they have lower per pupil funding levels. In contrast, small rural districts on the

Eastern Plains and in the northern San Luis Valley incur a larger reduction on a per pupil basis due to

their higher per pupil funding levels. In FY 2019-20, the funding reduction for Jefferson County

School District was $627 per pupil, while the funding reduction for the Karval School District was

$1,304 per pupil. In general, the per pupil reduction is inversely related to the degree to which the

district is locally funded, and the funded pupil count.

Figure 8

Budget Stabilization Factor Per Pupil Funding Decrease, FY 2019-20

Source: Legislative Council Staff.

Note: Numbers in parentheses indicate the number of school districts in each tier.

14 School Finance in Colorado

Local Share and State Aid

The money to fund the school finance act comes from a combination of local and state sources. In

FY 2019-20, local taxes contributed 39 percent of total funding, or $3.0 billion, while state sources

accounted for the remaining 61 percent, or $4.6 billion. These percentages vary widely among

individual school districts, however, because districts have different amounts of property wealth and

different property tax rates. Under the act, each district's local share is calculated first, and state aid

makes up the difference between the local portion and the total funding need identified through the

formula. The principle of using state aid to make up for differences in local property wealth is called

"equalization."

How Is the Local Share Calculated?

A district's local share comes from two sources — property taxes and specific ownership taxes.

Property taxes are paid on real estate and business equipment; specific ownership taxes are paid on

motor vehicles. Of the two taxes, property taxes produce the vast majority of the local contribution,

roughly 93 percent of the total. Both of these taxes are described in greater detail below.

Property Taxes Provide Most Local Revenue

Statewide, property taxes contributed nearly $2.8 billion in funding for

school finance in FY 2019-20, or 37 percent of total school finance act

funding. A school district's property taxes are the result of multiplying a

district's taxable property value (assessed value) by its property tax rate

(mill levy). The assessed value of a district is determined each year, and it

includes all taxable property in the district.

Based on the Colorado Supreme Court decision on Senate Bill 07-199, commonly referred to as the

mill levy freeze or stabilization bill, state law requires most districts to impose the school finance mill

levy from the prior budget year. In cases where a school district has not obtained voter approval to

retain and spend revenues in excess of the property tax revenue limit, a modified mill levy formula

applies: the change in a school district's property tax revenue is limited to the sum of the

Denver-Aurora-Lakewood inflation rate and the percentage change in the district's enrollment. If a

district's property tax revenue exceeds that amount with the prior year's levy, the district must reduce

its mill levy so that property tax revenue does not grow more than the maximum allowed.

The law also includes a ceiling on school finance mill levies. For all districts, the maximum mill levy

for school finance is 27 mills. In addition, a district's levy cannot be higher than the levy required to

cover the district's total funding less specific ownership tax revenue.

For FY 2019-20, Figure 9 shows mill levies for school finance across districts, ranging from a low of

1.7 mills to the cap of 27 mills. The 64 districts at or near the cap include most districts in the Denver

and Pueblo metro areas, a cluster of rural districts in the northern portion of the Eastern Plains, and

another cluster at the southern end of the San Luis Valley. The 18 districts in the lowest mill levy

Local Share = Current Year Property Taxes + Prior Year Specific Ownership Taxes

15 School Finance in Colorado

category include high property wealth districts either in the resort communities such as Aspen and

Telluride or districts in the oil and gas producing areas of Weld County, the Piceance Basin in

northwest Colorado, and the San Juan Basin in southwest Colorado. Because the state does not allow

districts to collect more revenue than the amount required to fund statutory school finance obligations,

mill levies in these districts have been reduced over time as property values have increased. For a

more detailed discussion of why school finance mill levies have decreased, see the Legislative Council

Staff memo titled, “School Finance and the State Constitution.”

Figure 9

District Mill Levies for the School Finance Act, FY 2019-20

Source: Legislative Council Staff.

Note: Numbers in parentheses indicate the number of school districts in each tier.

Specific Ownership Taxes Supplement Property Taxes

Specific ownership taxes provided about $201.1 million for school

finance in FY 2019-20, bringing the local share to 39 percent of total

school finance act funding. Specific ownership taxes are paid annually

on motor vehicles. Counties collect specific ownership taxes and

distribute them to all governments in the county that collect property taxes, such as school

districts, cities, special districts, and the county itself. By law, counties distribute specific ownership

tax revenue to these governments in proportion to the amount of property taxes collected by each.

Thus, a school district that receives 50 percent of all the property taxes collected in a county would

receive 50 percent of the specific ownership taxes collected in the county.

The funding formula does not count all specific ownership tax revenue against the district's local

share, however. Some districts collect more specific ownership taxes than others because the voters

in those districts have approved additional property taxes. The formula specifically does not count

any specific ownership taxes attributable to a bond redemption (debt) or override (operating) mill

levy, if the mill levy was approved by the district's voters.

16 School Finance in Colorado

The formula uses specific ownership taxes collected in the previous fiscal year because they are the

most recent actual figures. Thus, the local share in FY 2019-20 reflects the FY 2018-19 specific

ownership tax revenue.

How Is State Aid Calculated?

State aid provides the difference between a district's total school finance act funding and the district's

local share. In school finance, this concept of state assistance supplementing local resources is called

"equalization." An equalized school finance system allows similar districts to spend similar amounts

regardless of property wealth. For FY 2019-20, the school finance act drives state aid of $4.6 billion, or

61 percent of total funding.

The state distributes money to school districts in 12 approximately equal monthly payments. In the

first half of the fiscal year, the payments are based upon projected pupil count and assessed value

estimates, because the state does not know exact pupil counts or district assessed values during that

time period. The payments are later adjusted to reflect actual pupil counts and assessed values. These

approximately equal monthly payments may cause some districts to experience cash flow problems

at certain times of the year, so the state offers a loan program to qualifying school districts. This loan

program is discussed in further detail on page 22.

State Aid Comes Primarily From Three Sources

Three sources of revenue provide money for the state aid appropriation for school finance. The

FY 2019-20 fund sources are based on HB 20-1260, the mid-year supplemental adjustment, and are

subject to change. The state General Fund provides the vast majority of money: in FY 2019-20,

90 percent of the appropriation, or $4.2 billion, was provided by the General Fund.

The State Education Fund also contributes to the state aid appropriation. The State Education Fund,

created by Article IX, Section 17, of the Colorado Constitution (Amendment 23), receives revenue

equal to a tax of one-third of 1 percent on federal taxable income. Its contribution to the state aid

appropriation was about $393.6 million in FY 2019-20, or 8.5 percent of the state aid package. In most

years, the balance comes from the State Public School Fund, which consists primarily of federal

mineral lease revenue and a portion of rent and royalties from state school lands. In FY 2019-20, the

State Public School Fund contributed 1.5 percent, or $68.8 million, to the state share of school finance.

State Aid = Total Funding – Local Share

School Finance in Colorado 17

Figure 10 shows the state share of total funding across school districts for FY 2019-20, ranging from a

low of 0 percent to a high of 94.4 percent. Seven districts, Cripple Creek, Estes Park, Fort Lupton,

North Park, Pawnee, Platte Valley, and Prairie, were fully locally funded in FY 2019-20. As discussed

on page 18, these districts had to buy back some of their state funding for categorical programs, as

they could not fully implement the required budget stabilization factor reduction. Districts receiving

a relatively high state share include districts in the Las Animas, Piceance, and San Juan basins where

oil and natural gas production has declined. As a result, because district mill levies were previously

reduced, the decline in the property tax base required additional state funding for school finance.

Figure 10

State Share of Total Funding After Application of the Budget Stabilization Factor,

FY 2019-20

Source: Legislative Council Staff.

Note: Numbers in parentheses indicate the number of school districts in each tier.

Modifications to the Funding Formula

The state's basic funding formula applies to nearly all districts. However, the act makes modifications

to the formula to account for unusual situations or to achieve policy objectives. These modifications

may cause a district's total funding to be computed differently than the formula described in the

preceding pages. In addition, the act contains modifications that may alter the share of a district's

funding that comes from state or local sources. These modifications include the following.

18 School Finance in Colorado

The law guarantees that all districts receive a minimum level of per pupil funding. Minimum per

pupil funding applies to any school district that would have a lesser per pupil funding amount

under the formula described on the preceding pages. The minimum per pupil funding level is

benchmarked to the state average per pupil funding, excluding online funding. In FY 2019-20,

state law set minimum per pupil funding at 95 percent of the state average, or $8,674, before

application of the budget stabilization factor. Eleven districts benefitted from minimum per pupil

funding, totaling about $12.9 million.

Increases in total program for districts are capped at a district's constitutional spending limit

percentage (inflation plus the percentage change in district enrollment). The law allows a district

to receive the total amount of funding from the school finance act if it receives voter approval to

exceed its constitutional spending limit. Most districts have held such elections, and 174 of 178

have received voter approval. Cherry Creek, Colorado Springs, Harrison, and Steamboat Springs

have not received voter approval.

The categorical buyout provisions of the school finance act require certain districts to offset or

"buy out" state aid for categorical programs with local property tax revenue. This requirement

applies when a district can raise enough money from local property taxes to cover its total formula

funding, less specific ownership taxes, with a levy less than the prior year’s levy. Depending on

the level of increase in the district’s property tax base, the district may maintain its mill at the prior

year’s level and use the revenue to cover both its school finance funding and “buy out” a portion

of its state aid for categorical programs. Alternatively, if the increase in the property tax base is

sufficient to cover both school finance funding and state categorical funding at a lower mill levy,

the mill levy will be reduced. Four districts, Cripple Creek, Pawnee, Platte Valley, and Prairie,

had a categorical buyout of $796,983 in FY 2019-20.

A school district may have to buy out additional state support for categorical program funding

if it does not have enough state aid to rescind the full amount of the budget stabilization factor,

specified in Senate Bill 17-296. Seven districts, Cripple Creek, Estes Park, Fort Lupton, North Park,

Pawnee, Platte Valley, and Prairie, are in this position in FY 2019-20, refunding a total of $715,564

as a further offset against categorical program funding.

State aid to school districts may be reduced if the General Assembly's appropriation is not

sufficient to pay for its share of the cost of the school finance act. In these instances, state aid is

reduced by the same percentage of total funding in all districts, but no district loses more state aid

than it actually receives.

A district's enrollment is modified to prevent a school district from using enrollment averaging

to increase its funded pupil count when a charter school originally authorized by the district is

subsequently converted to an institute charter school.

School Finance in Colorado 19

Earmarked Revenue

School districts are no longer required to earmark revenue for instructional supplies, materials, capital

outlay, capital reserve, and risk management. However, districts are still required to allocate a

portion of the at-risk moneys they receive for specific purposes. Seventy-five percent of at-risk

moneys must be allocated for instructional programs or staff development efforts that relate directly

to at-risk pupils. All other money distributed to school districts under the school finance act can be

spent at the discretion of districts.

Unequalized Local Revenue

Many school district revenues are equalized, meaning that the state provides funding to equalize

property wealth. However, the school finance act also allows local school districts some discretion to

raise additional local revenue, for which the state provides no equalization. A description of these

unequalized local revenue sources follows.

School Districts May Raise Additional Property Taxes for Operating Purposes

With voter approval, the act allows districts to raise and spend property taxes over and above those

that support the school finance act. These additional property taxes are called mill levy overrides.

The act limits override revenue to 25 percent (30 percent for small rural districts) of a district's total

funding, prior to application of the budget stabilization factor, or $200,000, whichever is greater, plus

the FY 2001-02 supplemental cost-of-living adjustments. (The FY 2001-02 supplemental cost-of-living

adjustment is a flat dollar amount in 104 districts that resulted from a calculation required by law

based on the results of the 1999 cost-of-living study.)

The school finance act counts other revenue sources against a district's override limit. These other

sources of revenue may limit a district's ability to request voter approval for a property tax increase

equal to the full amount of the limit. For example, in FY 2019-20, the override for 27 districts includes

approximately $4.7 million in property taxes relating to hold harmless provisions that used to be in

the law. This funding was designed to hold districts harmless from any decrease in per pupil funding

resulting from the passage of the 1994 act.

In FY 2019-20, 125 school districts authorized $1.4 billion in override property taxes. Since some

districts are phasing in overrides, the amount of taxes collected may be somewhat less than the

amount authorized by voters.

For FY 2019-20, Figure 11 shows per pupil mill levy override funding across districts. In FY 2019-20,

125 districts received mill levy override revenue, and 53 districts did not. Districts without overrides

are concentrated on the Eastern Plains and the southern end of the San Luis Valley. Pueblo is the only

Front Range metropolitan district without an override. Most of the other metropolitan districts have

overrides, but the funding per pupil is relatively low because enrollment is comparatively high. The

highest override per pupil funding levels occur in resort communities and a handful of districts on

the Eastern Plains with low enrollment.

20 School Finance in Colorado

Figure 11

Mill Levy Override Funding Per Pupil, FY 2019-20

Source: Legislative Council Staff.

Note: Numbers in parentheses indicate the number of school districts in each tier.

House Bill 17-1375 required that all school districts with mill levy overrides implement a plan to

distribute mill levy override revenue to charter and innovation schools, or distribute to those schools

95% of mill levy override per pupil revenue, beginning in FY 2019-20. The bill also created the Mill

Levy Equalization Fund to provide an annual appropriation for state Charter School Institute schools

that are in school districts that have passed mill levy overrides. Any moneys in the fund must be

distributed on a per pupil basis. In FY 2019-20, $7.0 million was distributed to charter schools.

Unequalized District Property Taxes Also Pay for Debt

Independent of the school finance act, state law permits school districts to request voter approval to

incur debt by issuing bonds. This is known as bonded debt. Districts repay the debt with a dedicated

mill levy. Bonded debt is generally used by school districts for major capital construction projects.

Revenue collected from a bonded debt mill levy must be credited to the district's bond redemption

fund and used to repay the bondholders. In FY 2019-20, 131 school districts collected about

$355.5 million from bonded debt mill levies.

State law imposes a limit on the amount of bonded debt a school district may incur. Districts are

prohibited from issuing bonded debt in excess of 20 percent of the district's assessed valuation or

6 percent of market value, whichever is greater. For districts that meet specified enrollment growth

criteria, the limit is the greater of 25 percent of assessed value or 6 percent of market value.

School Finance in Colorado 21

“Growth” Districts May Raise Additional Property Taxes for Capital Improvements

Growth districts may request voter approval to levy additional property taxes for capital projects. The

money must be deposited into the district's capital reserve fund and can be used to pay for capital

projects outright or to repay loans from the Public School Fund or the Colorado Educational and

Cultural Facilities Authority. Growth districts are districts in which the supplemental enrollment

count grows by at least 1 percent or 50 students, whichever is less, over the October count.

The number of mills a growth district may levy is based on a district's property wealth relative to the

statewide average. A district with an assessed value per pupil that exceeds the statewide average may

impose an additional levy of up to one mill. The number of mills a district may levy increases as

district property wealth decreases below the state average, up to a maximum of five mills. For

instance, a district with an assessed value per pupil of $20,000 could impose five mills, if the statewide

average assessed value per pupil was $100,000.

Transportation Levies Require Voter Approval

State law permits school districts to request voter approval to impose a levy to pay for transportation

costs not reimbursed by the state. The proceeds from this levy must be deposited in the district's

transportation fund.

Full-Day Kindergarten May Be Funded From Voter-Approved Property Taxes

State law requires school districts to offer kindergarten to children who are eligible for first grade the

next year. The school finance act counts full-day kindergarten students at 1.0 FTE, and half-day

kindergarten students at 0.58 FTE. With voter approval, school districts may raise additional

property taxes to pay for full-day kindergarten programs and the associated capital costs. For the

operational costs of full-day kindergarten programs, property taxes may not exceed the cost of the

program less one-half of the district's per pupil funding multiplied by the number of students

enrolled. Property taxes must be deposited in a full-day kindergarten fund and, if an election includes

a levy for capital purposes, the proceeds of such a levy must be deposited in the capital construction

account of the fund.

Voters May Also Approve Special Building or Technology Levies

School districts may also request voter approval to levy up to ten mills for up to three years to maintain

and construct schools or to purchase and install instructional technology. The proceeds from such a

levy are deposited in the district's special building and technology fund.

22 School Finance in Colorado

Cash Flow Loan Program

School districts may participate in an interest-free cash flow loan program sponsored by the state.

Under this program, the state borrows money on behalf of school districts and pays the interest costs

of the loan. In some circumstances, the state may lend money directly to school districts, charging the

district interest. Participating school districts are required to pledge their property taxes toward the

loan's repayment. The loan program was created to help districts deal with the fact that property tax

collections occur late in the budget year. A school district applies to the State Treasurer for a loan. A

district is eligible for a loan from the state in any month in which the district can demonstrate that a

cash deficit will exist in its general fund and that it has the capacity to repay the loan by June 25 of the

state fiscal year in which the loan was made. A loan may not be made to provide assistance for matters

eligible for payment from the contingency reserve or to cover a foreseeable level of uncollectible

property taxes, nor may a loan be used by a district for arbitrage.

State Contingency Reserve

State law requires the General Assembly to annually determine the amount to appropriate to a

contingency reserve fund to provide supplemental assistance to school districts. Money in the fund

can be allocated by the State Board of Education to school districts for certain types of financial

emergencies. Money may also be allocated in the following situations: if a district's abatement levy

is insufficient to refund property taxes; if children placed in the district by a court create an unusual

financial burden; to offset the impact of a decline in enrollment resulting from a detachment and

annexation; or to offset the cost of pupils moving to a district after the count date. This last option is

only available for districts with fewer than 2,000 pupils and only for the cost of the additional pupils.

In cases of extreme emergency, the state board may consider factors that are not specifically delineated

in law and may provide financial aid from the contingency reserve to districts that could not maintain

their schools without such additional assistance. In determining which districts receive payments

from the contingency reserve and the amount of the payment, the state board must consider the

amount of assistance requested as a percentage of each district's total funding.

In some situations, such as when disputed property taxes are eventually paid to a district,

districts reimburse the state, thereby providing a source of revenue for the fund. For FY 2019-20, the

General Assembly appropriated $1.0 million to the fund.

Capital Construction

The state offers several programs to assist with school district capital construction projects.

Depending on the program, the state provides assistance as a grant or a matching grant.

School Finance in Colorado 23

The Public School Capital Construction Assistance Fund Provides Matching Grants to

School Districts

Through the Building Excellent Schools Today (BEST) Act, the Public School Capital Construction

Assistance Fund provides matching grant money to school districts, charter schools, and boards of

cooperative services to ensure that the condition and capacity of public school facilities are sufficient

to provide a safe and uncrowded environment that is conducive to learning. The State Treasurer is

authorized to enter into lease-purchase agreements and to sell certificates of participation to raise

money to finance public school capital construction projects.

Under the law, a board within the Colorado Department of Education is responsible for establishing

construction guidelines. These guidelines, which are used to assess and prioritize capital construction

needs and evaluate requests for assistance, are required to identify construction, renovation, and

equipment standards that meet educational and safety needs at a reasonable cost. In addition, the

board is responsible for the conduct of a financial assistance priority assessment. For purposes of

awarding assistance, the law prioritizes projects as follows:

projects that address safety hazards and health or security concerns at existing public school

facilities;

projects that relieve overcrowding;

projects that will provide career and technical education capital construction; and

projects that are designed to incorporate technology into the educational environment.

Recipients of assistance from the BEST program are expected to pay a portion of the cost of the project

unless a waiver is granted. Among the criteria taken into account in determining the local portion of

a project's cost are the property and income wealth of a district and current efforts of districts and

schools to finance capital improvements.

The Public School Capital Construction Assistance Fund is capitalized from a variety of revenue

sources: state public school lands income; the proceeds from the sale of certificates of

participation; some lottery money; and local matching money. In addition, starting in FY 2019-20, the

fund will receive all revenue from the 15 percent excise tax on retail marijuana. The fund is used to

provide financial assistance for projects, pay the administrative costs of the program, and to make

lease payments. The amount of the annual lease payments is limited by law to $105 million in

FY 2019-20.

Charter Schools Receive Money for Capital

The General Assembly appropriated $28.0 million from the State Education Fund and the Public

School Capital Construction Assistance Fund for charter school capital construction in FY 2019-20. A

charter school qualifies for money if it has costs associated with constructing, demolishing,

remodeling, financing, purchasing or leasing land, buildings, or facilities. Each charter school receives

its proportionate share of the appropriation based on the number of pupils enrolled in the charter

school.

This page intentionally left blank.

School Finance in Colorado 25

FUNDING FORMULAS

Type of Funding

Formula Used

School District Funding

(Total Funding)

(Pupils × Preliminary Per Pupil Funding)

+ At-Risk Funding + Online and ASCENT Funding

Funded Pupil Count

0.5 x Preschool Count + Online/ASCENT Counts + .08 x Half

Day Kindergarten Count + the Greater of:

The Current Year’s K-12 Count or a Two-year, Three-year,

Four-year, or Five-year average of the October Counts

Preliminary Per Pupil Funding

[(Statewide Base × Personnel Costs Factor × Cost of Living

Factor) + (Statewide Base × Nonpersonnel Costs Factor)] ×

Size Factor

At-Risk Funding

At-Risk Pupils × 12% × Preliminary Per Pupil Funding +

At-Risk Funding Premium

Online + ASCENT Funding

(Online + ASCENT Pupil Count) × Per Pupil Funding for

Online and ASCENT Students

Local Share

Current Year Property Taxes + Prior Year Specific Ownership

Taxes

State Aid

Total Funding – Local Share

This page intentionally left blank.

School Finance in Colorado 27

CALCULATION EXAMPLES

The following tables are provided for two purposes: first, to help illustrate the calculations included

in the formula; and second, to provide data on how to determine the factors used in the formula. The

two hypothetical districts used in these illustrations represent (A) a large district with a relatively high

percentage of at-risk students; and (B) a small district with a relatively low percentage of at-risk

students. Both districts are assumed to have the same cost-of-living factor.

Illustration 1 shows how base per pupil funding is multiplied by the cost-of-living, personnel and

nonpersonnel costs, and size factors to determine preliminary per pupil funding (last row). District A

(larger district) benefits more from the cost-of-living factor because of its higher personnel costs factor,

but District B (smaller district) benefits more from the size factor. As a result, the smaller district's

preliminary per pupil funding is $1,560.53 higher than the larger district ($10,033.55 versus $8,473.02).

Illustration 2 multiplies preliminary per pupil funding by pupil count and adds the amount of at-risk

funding and online/ASCENT funding to determine total funding. The larger district benefits more

from the at-risk funding element because it has more at-risk students. This calculation narrows the

per pupil funding difference to $1,372.51.

ILLUSTRATION 1: CALCULATING PRELIMINARY PER PUPIL FUNDING

Preliminary Per Pupil Funding = [(Base × Personnel Costs Factor × Cost-of-Living Factor) +

(Base × Nonpersonnel Costs Factor)] × District Size Factor

District A

District B

Base Per Pupil

$6,951.53

$6,951.53

× Cost-of-Living Factor

× 1.203

× 1.203

× Personnel Costs Factor

× 0.9050

× 0.8255

$7,568.23

$6,903.40

Base Per Pupil

$6,951.53

$6,951.53

× Nonpersonnel Costs Factor

× .095

× .1745

$660.40

$1,213.04

Total Adjustment Per Pupil

$7,568.23

$6,903.40

+ $660.40

+ $1,213.04

$8,228.63

$8,116.44

Total Adjustment Per Pupil

$8,228.63

$8,116.44

× Size Factor

× 1.0297

× 1.2362

= Preliminary Per Pupil Funding

$8,473.02

$10,033.55

28 School Finance in Colorado

ILLUSTRATION 2: CALCULATING TOTAL AND PER PUPIL FUNDING

Total Funding = (Preliminary Per Pupil × Funded Pupil Count) + At-Risk Funding + Online and

ASCENT Funding

District A

District B

Preliminary Per Pupil Funding (see Illustration 1)

× Pupils*

$8,473.02

× 30,000

$254,190,620

$10,033.55

× 450

$4,515,096

+ At-Risk Funding (see Illustrations 5 and 6)

+ $11,252,129

+ $120,403

+ Online/ASCENT Funding (see Illustration 7)

+ $628.650

+ $167,640

Total Funding

$266,071,399

$4,803,139

Funded Pupil Count**

30,075

470

Per Pupil Funding

$8,846.93

$10,219.44

*Excludes Online and ASCENT pupils.

**Includes Online and ASCENT pupils.

Illustrations 3 and 4 show how the personnel costs and size factors are set in state law, based on a

district's pupil count.

ILLUSTRATION 3: DETERMINING THE PERSONNEL COSTS FACTOR

For a pupil count of:

The district’s personnel cost factor is:

Less than 453.5

0.8250 – (0.0000639 × the difference between the pupil count and 453.5)

453.5 or more

but less than 1,568

0.8595 – (0.0000310 × the difference between the pupil count and 1,567.5)

1,567.5 or more

but less than 6,682

0.8850 – (0.0000050 × the difference between the pupil count and 6,682)

6,682 or more

but less than 30,000

0.905 – (0.0000009 × the difference between the pupil count and 30,000)

30,000 or more

0.905

School Finance in Colorado 29

ILLUSTRATION 4: DETERMINING THE SIZE FACTOR

For a pupil count of:

The district’s size factor is:

Less than 276

1.5457 + (0.00376159 × the difference between the district’s pupil count and 276)

276 or more

but less than 459

1.2385 + (0.00167869 × the difference between the district’s pupil count and 459)

459 or more

but less than 1,027

1.1215 + (0.00020599 × the difference between the district’s pupil count and 1,027)

1,027 or more

but less than 2,293

1.0533 + (0.00005387 × the difference between the district’ pupil count and 2,293)

2,293 or more

but less than 3,500

1.0368 + (0.00001367 × the difference between the district’s pupil count and 3,500)

3,500 or more

but less than 5,000

1.0297 + (0.00000473 × the difference between the district’s pupil count and 5,000)

5,000 or more

1.0297

Note: The size factor for districts with fewer than 500 pupils is calculated using the district’s enrollment minus

65 percent of the district’s pupils in charter schools.

Illustration 5 shows how the at-risk factor is determined, with District A getting additional funding

for at-risk students that exceed the statewide average. In this example, District A's percentage of

at-risk students exceeds the statewide average by 5.9 percentage points. As a result, District A's at-risk

funding for students above the statewide average is equal to 13.8 percent of its preliminary per pupil

funding (last row).

Illustration 6 shows how the at-risk factor is applied to these two school districts, with District A

receiving additional funding for the number of at-risk students exceeding the statewide average

(last row).

ILLUSTRATION 5: DETERMINING THE AT-RISK FACTOR

At-Risk Factor = 12.0% of preliminary per pupil funding for pupils below the statewide average;

12.0% plus 0.3 (0.36 for districts with pupil counts greater than 50,000) for each percentage

point over the statewide average

District A

District B

At-Risk Pupils Divided by Total Pupils

10,800 ÷ 30,075

100 ÷ 470

= 35.9%

= 21.3%

State Average At-Risk Percent

30.0%

30.0%

Does District Percentage Exceed Statewide

Average

Yes:

No:

35.9% - 30.0% =

21.3% - 30.0% =

(5.9% pts. Over)

(8.7% pts. under)

District Receives 0.3 Percentage Points for

Each Percentage Point Over Statewide

Average

5.9% × 0.3

0.0% × 0.3

= 1.8%

= 0.0%

At-Risk Factor for Pupils > State Average

12.0% + 1.8%

12.0% + 0.0%

= 13.80%

= 12.0%

30 School Finance in Colorado

ILLUSTRATION 6: CALCULATING AT-RISK FUNDING

District A

District B

At-Risk Pupils Divided by Total Pupils

10,800 ÷ 30,075

100 ÷ 470

= 36.0%

= 21.3%

State Average At-Risk Percent

30%

30%

(9,023 pupils)

(141 pupils)

Funding for Students Below State Average

(12% × Per Pupil Funding × Pupils Below

Average)*

12.0%

12.0%

× $8,473.02

× $10,033.55

× 9,023

× 100

$9,173,739

$120,403

Funding for Students Above State Average

(At-Risk Factor × Per Pupil Funding × Pupils

Above Average)

13.8%

12.0%

× $8,473.02

× $10,033.55

× 1,778

× 0

$2,078,390

$0

Below Average

+ Above Average

= Total At-Risk Funding

$9,173,739

$120,403

+ $2,078,390

+ $0

$11,252,129

$120,403

* Excludes online and ASCENT students.

Illustration 7 shows how a district's funding for online and ASCENT students is determined, before

application of the budget stabilization factor.

ILLUSTRATION 7: DETERMINING ONLINE AND ASCENT STUDENT FUNDING

District A

District B

Online/ASCENT Per Pupil Funding

× Online and ASCENT Pupils

$8,382

$8,382

× 75

× 20

$628,650

$167,640

Illustration 8 shows how the budget stabilization factor is applied to each school district. For most

districts, total program funding is reduced proportionately, or by 7.02 percent in this example. The

reduction in total program funding for a district decreases its amount of state aid by the same dollar

amount. This results in the same proportional cut in per pupil funding for each district. A small

number of districts with limited state aid are unable to realize the full proportional reduction

(see pages 13 and 18).

School Finance in Colorado 31

ILLUSTRATION 8: DETERMINING TOTAL PROGRAM WITH

BUDGET STABILIZATION FACTOR*

District A

District B

Before Budget Stabilization Factor

Total Program Funding from Illustration 2

$266,071,399

$4,803,139

Funded Pupil Count (includes Online and ASCENT pupils)

30,075

470

Final Per Pupil Funding

$8,847

$10,219

After Budget Stabilization Factor

Assuming a 7.02% factor applied to a district’s total program

($18,678,212)

($337,180)

Total Program with Budget Stabilization Factor

% Change

$247,393,187

(7.02%)

$4,465,958

(7.02%)

Total Per Pupil Funding with Budget Stabilization Factor

% Change

$8,225.87

(7.02%)

$9,085.07

(7.02%)

*Assumes enough state aid to enact full 7.02 percent rescission.

32 School Finance in Colorado

School Finance in Colorado 33

CATEGORICAL PROGRAMS

School districts in Colorado receive state revenue through a variety of programs designed to serve

special groups of students or student needs. The state constitution designates a specific group of these

programs as "categorical programs." Article IX, Section 17, of the Colorado Constitution, commonly

referred to as Amendment 23, defines categorical programs as programs for transportation, English

language proficiency, expelled and at-risk students, children with disabilities and gifted children,

suspended students, vocational education, small attendance centers, comprehensive health education,

and any other accountable program specifically identified in law as a categorical program. The

General Assembly is required to increase the sum of funding for all of these programs by the rate of

inflation. The General Assembly may use money in the State Education Fund to provide the increased

funding. The state appropriation figures and the descriptive paragraphs below are limited to the

appropriations that are regulated by Amendment 23, which are primarily paid from the General Fund

and State Education Fund. However, federal and local funds are also used to pay for these services.

Table 1 summarizes state funding for these categorical programs.

Table 1

State Funding for Categorical Programs

Millions of Dollars

Categorical Program

FY 2018-19

FY 2019-20

% Change

Special Education

$176.1

$202.7

15.1%

Gifted and Talented Children

$12.5

$12.7

1.6%

Public School Transportation

$59.1

$60.5

2.4%

Vocational Education

$26.7

$27.2

1.9%

English Language Proficiency

$21.6

$23.0

6.5%

Small Attendance Centers

$1.1

$1.3

18.2%

Comprehensive Health Education

$1.1

$1.1

0.0%

Expelled and At-Risk Student Services

$9.5

$9.5

0.0%

TOTAL

$307.7

$338.0

9.8%

Special Education

The state provides special education funding for disabled students, as well as for gifted and talented

students. The Exceptional Children's Educational Act (ECEA) dictates how funding is distributed.

The State Provides Funding for Students with Disabilities

State funding for the education of students with disabilities totals $202.7 million in FY 2019-20.

This money is used to provide special services to about 106,000 Colorado public school students with

disabilities, or roughly 12.0 percent of total pupil membership.

34 School Finance in Colorado

Funding to provide educational services to students with disabilities is distributed to administrative

units. An administrative unit could be a school district, a board of cooperative services, or a

combination of school districts. Under the law, an administrative unit receives $1,250 for each student

with a disability. Administrative units also receive an additional distribution based on each unit's

proportion of students with specific disabilities compared to the number of students statewide with

these disabilities. These specific disabilities include vision or hearing disabilities, autism, a significant

identifiable emotional disability, a traumatic brain injury, multiple disabilities, or significant limited

intellectual capacity. These distribution mechanisms account for about $195.4 million of the special

education appropriation.

A relatively small portion of the appropriation ($7.3 million) is set aside for three specific purposes.

Administrative units that pay tuition to facilities to provide special education services to students

whose parents cannot be located or are incarcerated or whose parents' rights have been relinquished

or terminated receive $500,000 of the appropriation for services for children with disabilities. Four

million dollars is distributed in grants to administrative units for "high cost" students. Administrative

units also receive funding — about $2.8 million in FY 2019-20 — to identify children who may benefit

from early intervention services.

The State Provides Funding for Programs to Serve Gifted and Talented Students

For FY 2019-20, the General Assembly appropriated about $12.7 million for district gifted and talented