2018 STATE BALLOT

INFORMATION BOOKLET

and

Recommendations on Retention of Judges

http://leg.colorado.gov/bluebook

Legislative Council of the

Colorado General Assembly

Research Publication No. 702-2

STATEWIDE ELECTION DAY IS

Tuesday, November 6, 2018

Voter service and polling centers open 7 a.m. to 7 p.m. on Election Day.

Ballots are mailed to all registered voters the week of October 15, 2018.

Select voter service and polling centers are open beginning October 22, 2018.

For election information, contact your county election office.

Contact information is provided inside the back cover of this booklet.

NOTICE OF ELECTION

TO INCREASE TAXES ON

A CITIZEN PETITION

NOTICE OF ELECTION

TO INCREASE DEBT ON

A CITIZEN PETITION

A "YES/FOR" vote on any ballot issue is a vote IN

FAVOR OF changing current law or existing

circumstances, and a "NO/AGAINST" vote on any

ballot issue is a vote AGAINST changing current law or

existing circumstances.

This publication, as well as a link to the full

text of the fiscal impact statements for each measure,

can be found at:

http://leg.colorado.gov/bluebook

An audio version of the book is available through the

Colorado Talking Book Library at:

http://myctbl.cde.state.co.us/legislative-blue-book

COLORADO GENERAL ASSEMBLY

EXECUTIVE COMMITTEE

Rep. Crisanta Duran, Chair

Sen. Kevin J. Grantham, Vice Chair

Sen. Leroy Garcia

Sen. Chris Holbert

Rep. KC Becker

Rep. Patrick Neville

STAFF

Mike Mauer, Director

COMMITTEE

Sen. Kerry Donovan

Sen. Matt Jones

Sen. Andy Kerr

Sen. Vicki Marble

Sen. Ray Scott

Sen. Jerry Sonnenberg

Rep. Perry Buck

Rep. Susan Lontine

Rep. Jovan Melton

Rep. Dan Pabon

Rep. Lori Saine

Rep. Cole Wist

LEGISLATIVE COUNCIL

Room 029 State Capitol

Denver, Colorado 80203-1784

E-mail: [email protected]

303-866-4799

September 11, 2018

This booklet provides information on the 13 statewide measures on the November 6, 2018, ballot and on the

judges who are on the ballot for retention in your area. The information is presented in two sections.

Section One — Analyses and Titles and Text

Analyses. Each statewide measure receives an analysis that includes a description of the measure and

major arguments for and against. Careful consideration has been given to the arguments in an effort to fairly

represent both sides of the issue. Each analysis also includes an estimate of the fiscal impact of the measure.

More information on the fiscal impact of measures can be found at http://leg.colorado.gov/bluebook. The state

constitution requires that the nonpartisan research staff of the General Assembly prepare these analyses and

distribute them in a ballot information booklet to registered voter households.

Titles and text. Following each analysis is the title that appears on the ballot, which includes information

about whether the measure changes the constitution or statute. Following the ballot title is the legal language of

each measure, which shows new laws in capitalized letters and laws that are being eliminated in strikeout type.

Amendments and Propositions

A measure placed on the ballot by the state legislature that amends the state constitution is labeled an

"Amendment," followed by a letter. A measure placed on the ballot by the state legislature that amends the state

statutes is labeled a "Proposition," followed by a double letter.

A measure placed on the ballot through the signature-collection process that amends the state constitution is

labeled an "Amendment," followed by a number between 1 and 99. A measure placed on the ballot through the

signature-collection process that amends the state statutes is labeled a "Proposition," followed by a number

between 100 and 199.

Constitutional vs. Statutory Changes

The first line of the analysis of each measure indicates whether the measure is a change to the constitution,

statute, or both. Of the 13 measures on the ballot, 8 propose changes to the state constitution, 4 propose

changes to the state statutes, and 1 proposes changes to both the state constitution and state statutes. Voter

approval is required in the future to change any constitutional measure adopted by the voters, although the

legislature may adopt statutes that clarify or implement these constitutional measures as long as they do

not conflict with the constitution. The state legislature, with the approval of the Governor, may change

any statutory measure in the future without voter approval.

Under provisions in the state constitution, passage of a constitutional amendment requires at least

55 percent of the votes cast, except that when a constitutional amendment is limited to a repeal, it

requires a simple majority vote. In 2018, Amendments V, W, X, Y, and Z, and Amendments 73, 74, and

75 require 55 percent of the vote to pass, and Amendment A requires a simple majority vote.

Additionally, the four statutory measures, Propositions 109, 110, 111, and 112, require a simple majority

vote to pass.

Section Two — Recommendations on Retaining Judges

The second section contains information about the performances of the Colorado Supreme Court

justices, the Colorado Court of Appeals judges, and district and county court judges in your area who are

on this year’s ballot. The information was prepared by the state commission and district commissions on

judicial performance. The narrative for each judge includes a recommendation on whether a judge

“Meets Performance Standards" or "Does Not Meet Performance Standards."

Information on Local Election Officials

The booklet concludes with addresses and telephone numbers of local election officials. Your local

election official can provide you with information on voter service and polling centers, absentee ballots,

and early voting.

TABLE OF CONTENTS

Amendment V: Lower Age Requirement for Members of the State Legislature* ........................................ 1

Amendment W: Election Ballot Format for Judicial Retention Elections* .................................................... 3

Amendment X: Industrial Hemp Definition* ..................................................................................................... 6

Amendment Y: Congressional Redistricting* .................................................................................................. 8

Amendment Z: Legislative Redistricting* ...................................................................................................... 23

Amendment A: Prohibit Slavery and Involuntary Servitude in All Circumstances ................................... 39

Amendment 73: Funding for Public Schools** ............................................................................................... 41

Amendment 74: Compensation for Reduction in Fair Market Value by Government Law

or Regulation** ....................................................................................................................... 52

Amendment 75: Campaign Contributions** .................................................................................................... 54

Proposition 109: Authorize Bonds for Highway Projects ............................................................................... 56

Proposition 110: Authorize Sales Tax and Bonds for Transportation Projects ........................................... 64

Proposition 111: Limitations on Payday Loans ............................................................................................... 79

Proposition 112: Increased Setback Requirement for Oil and Natural Gas Development .......................... 82

* These referred measures are constitutional amendments requiring at least 55 percent of the vote to pass pursuant to

Article XIX, Section 2, of the Colorado Constitution.

**These initiatied measures are constitutional amendments requiring at least 55 percent of the vote to pass pursuant to

Article V, Section 1, of the Colorado Constitution.

Amendment V: Lower Age Requirement for Members of the State Legislature 1

ANALYSIS

Amendment V

Lower Age Requirement for Members of the State Legislature

(This measure requires at least 55 percent of the vote to pass.)

ANALYSIS

Amendment V proposes amending the Colorado Constitution to:

♦ lower the age requirement for serving in the state legislature from 25 to 21.

Summary and Analysis

Requirements for serving in the state legislature. The state constitution requires that a

representative or senator in the state legislature be at least 25 years old, be a U.S. citizen, and reside in the

district from which he or she is elected for at least 12 months prior to being elected. Amendment V lowers

the minimum age requirement to 21.

Comparison of state age requirements. Every state, with the exception of Vermont, has minimum

age requirements ranging from 18 to 30 years old for members of the state legislature. In Colorado, an

individual must be at least 25 years old to become a state representative or state senator. Forty-three

states set the minimum age requirement for state representatives at either 18 or 21. For state senators,

about half of the states set the minimum age requirement between 25 and 30, and the other half set it at

either age 18 or 21.

For information on those issue committees that support or oppose the measures on the ballot at the

November 6, 2018, election, go to the Colorado Secretary of State's elections center web site hyperlink for

ballot and initiative information: http://www.sos.state.co.us/pubs/elections/Initiatives/InitiativesHome.html

Argument For

1) Excluding 21- to 24-year-olds from seeking election to the state legislature is an unnecessary

restriction. A 21-year-old is considered an adult under the law. Voters can judge whether a

candidate possesses the maturity, ability, and competence to hold political office. In addition,

allowing younger candidates to run for office encourages the civic engagement of young people.

Argument Against

1) The current age requirement strikes an appropriate balance between youth and experience.

Younger candidates may lack the maturity and expertise to be effective legislators. The policy

decisions and political pressures that legislators face are best handled by people with more life

experience. Lack of experience could hinder a young legislator's ability to represent his or her

constituents effectively.

Estimate of Fiscal Impact

This measure has no impact on state or local government revenue or spending.

2 Amendment V: Lower Age Requirement for Members of the State Legislature

TITLE AND TEXT

The ballot title below is a summary drafted by the professional legal staff for the general assembly for

ballot purposes only. The ballot title will not appear in the Colorado constitution. The text of the measure

that will appear in the Colorado constitution below was referred to the voters because it passed by a

two-thirds majority vote of the state senate and the state house of representatives.

Ballot Title:

Shall there be an amendment to the Colorado constitution concerning a reduction in the age

qualification for a member of the general assembly from twenty-five years to twenty-one years?

Text of Measure:

Be It Resolved by the Senate of the Seventy-first General Assembly of the State of Colorado, the

House of Representatives concurring herein:

SECTION 1. At the election held on November 6, 2018, the secretary of state shall submit to the

registered electors of the state the ballot title set forth in section 2 for the following amendment to the state

constitution:

In the constitution of the state of Colorado, amend section 4 of article V as follows:

Section 4. Qualifications of members. No person shall be a representative or senator who shall not

have attained the age of twenty-five TWENTY-ONE years, who shall not be a citizen of the United States, and

who shall not for at least twelve months next preceding his OR HER election, have resided within the territory

included in the limits of the district in which he OR SHE shall be chosen.

SECTION 2. Each elector voting at the election may cast a vote either "Yes/For" or "No/Against" on the

following ballot title: "Shall there be an amendment to the Colorado constitution concerning a reduction in

the age qualification for a member of the general assembly from twenty-five years to twenty-one years?"

SECTION 3. Except as otherwise provided in section 1-40-123, Colorado Revised Statutes, if at least

fifty-five percent of the electors voting on the ballot title vote "Yes/For", then the amendment will become

part of the state constitution.

Amendment W: Election Ballot Format for Judicial Retention Elections 3

ANALYSIS

Amendment W

Election Ballot Format for Judicial Retention Elections

(This measure requires at least 55 percent of the vote to pass.)

ANALYSIS

Amendment W proposes amending the Colorado Constitution to:

♦ change the ballot format for judicial retention elections to remove the requirement that a

retention question be asked for each justice and judge.

Summary and Analysis

Background. In 1966, Colorado voters approved a constitutional amendment that repealed the

partisan election of justices and judges and enacted the current process. This process requires justices

and judges to be nominated by a judicial nominating commission and then appointed by the Governor.

Thereafter, justices and judges must go before voters in a retention election to maintain their seat on the

bench. Colorado justices serve on the Supreme Court, and judges serve in all other courts.

Judicial retention elections. A retention election asks voters whether incumbent justices or judges

should remain in office for another term. In Colorado, justices and judges stand for retention at the end of

their judicial terms, and elections are held during the November general election in even-numbered years.

Justices or judges do not face an opponent and retain their position if the majority of voters cast a "yes"

vote.

Colorado state court types. Colorado law requires judicial retention elections for all levels of state

courts, including the Supreme Court, district courts, county courts, City and County of Denver Probate

Court, Denver Juvenile Court, and any other state court created by the state legislature, such as the

Court of Appeals.

Current ballot format. Under current law, ballots must be formatted according to the type of office

up for election. Federal offices are required to be first on the ballot, followed by state, county, and local

offices. The judicial retention candidates are listed after the county or local officers, but before the

introduction of ballot measures.

For judicial retention elections, the Colorado Constitution requires that a separate question be placed

on the ballot for each justice or judge up for retention as follows:

"Shall Justice (Judge) ... of the Supreme (or other) Court be retained in office?" YES/NO

Judicial retention ballot format under Amendment W. Amendment W requires the county clerk

and recorder to display the retention question once for each court type followed by a list of each individual

justice or judge seeking retention on that court with the "yes" or "no" option next to each name.

"Shall the following Justices (Judges) of the Supreme (or other) Court be retained in office?" YES/NO

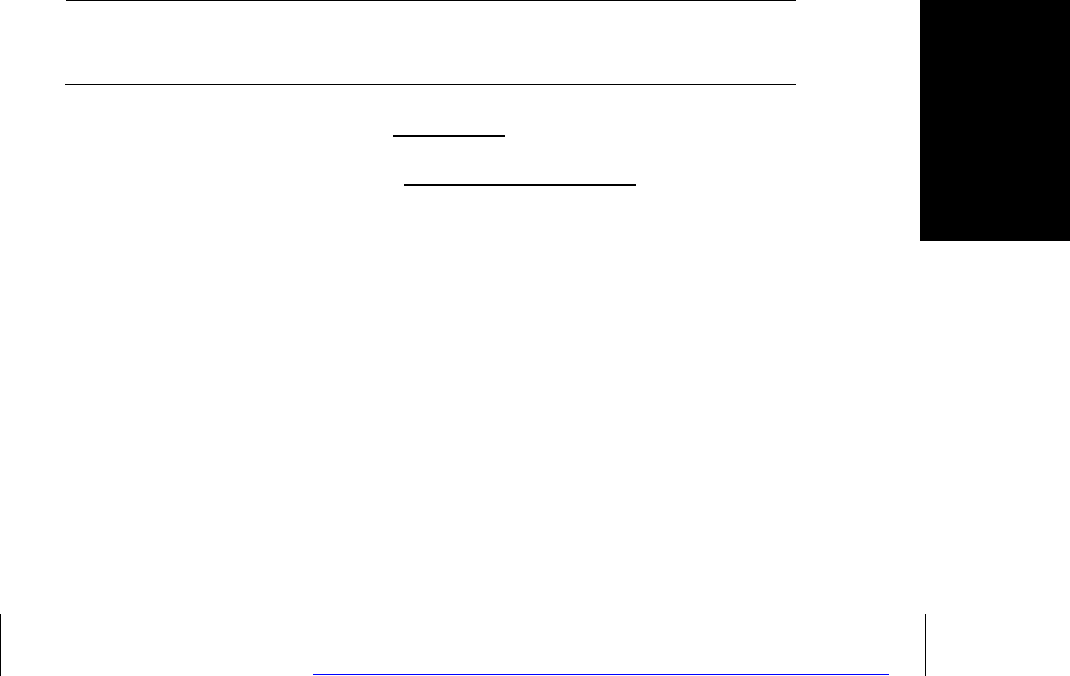

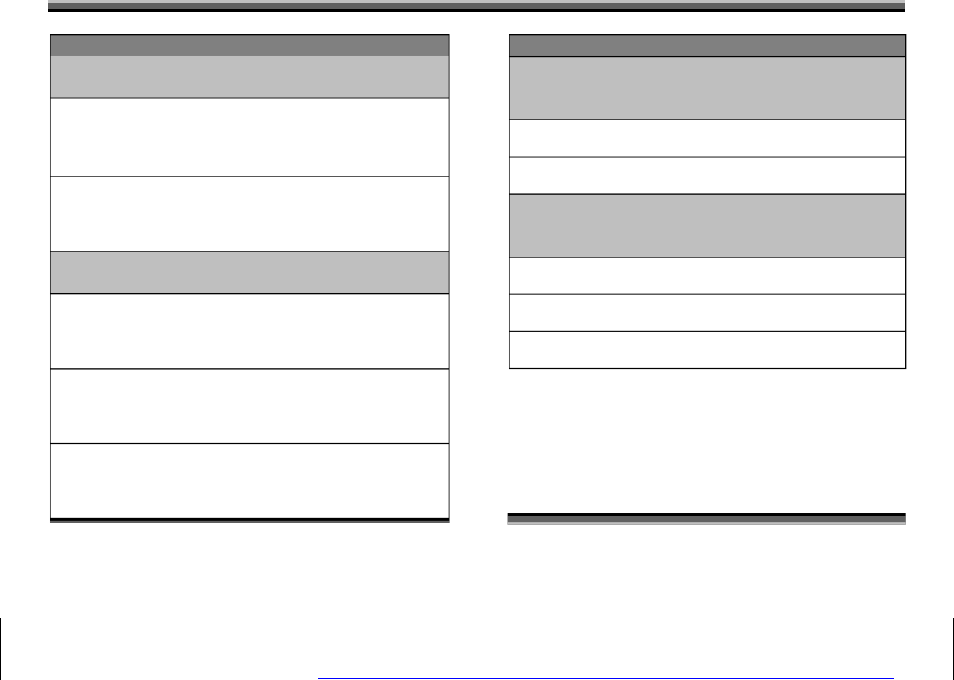

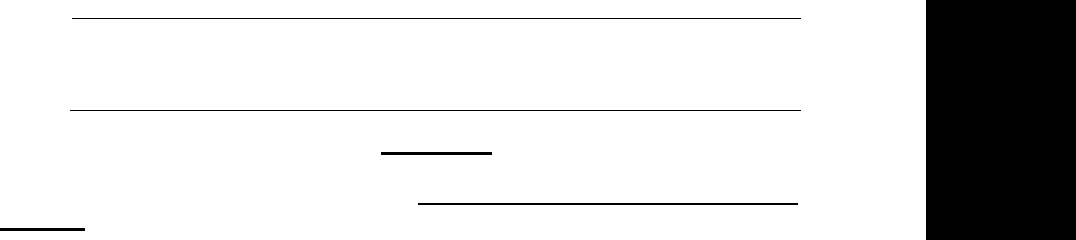

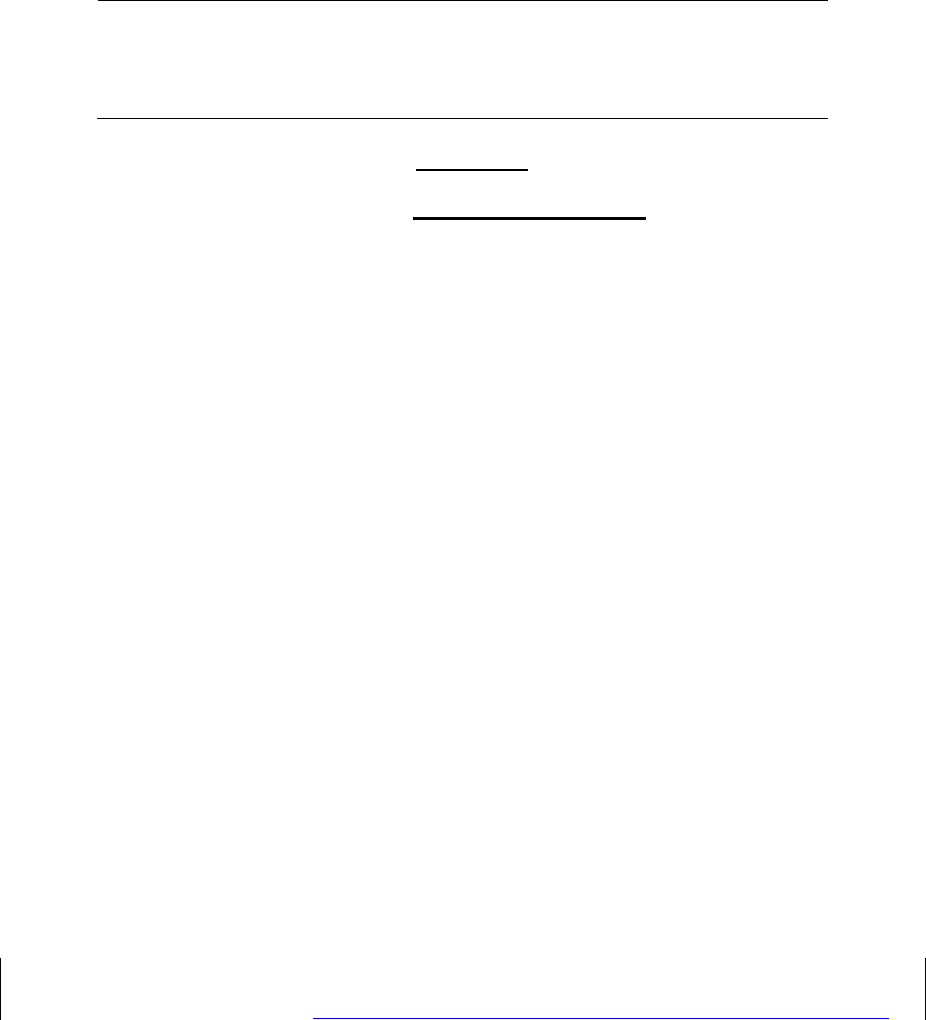

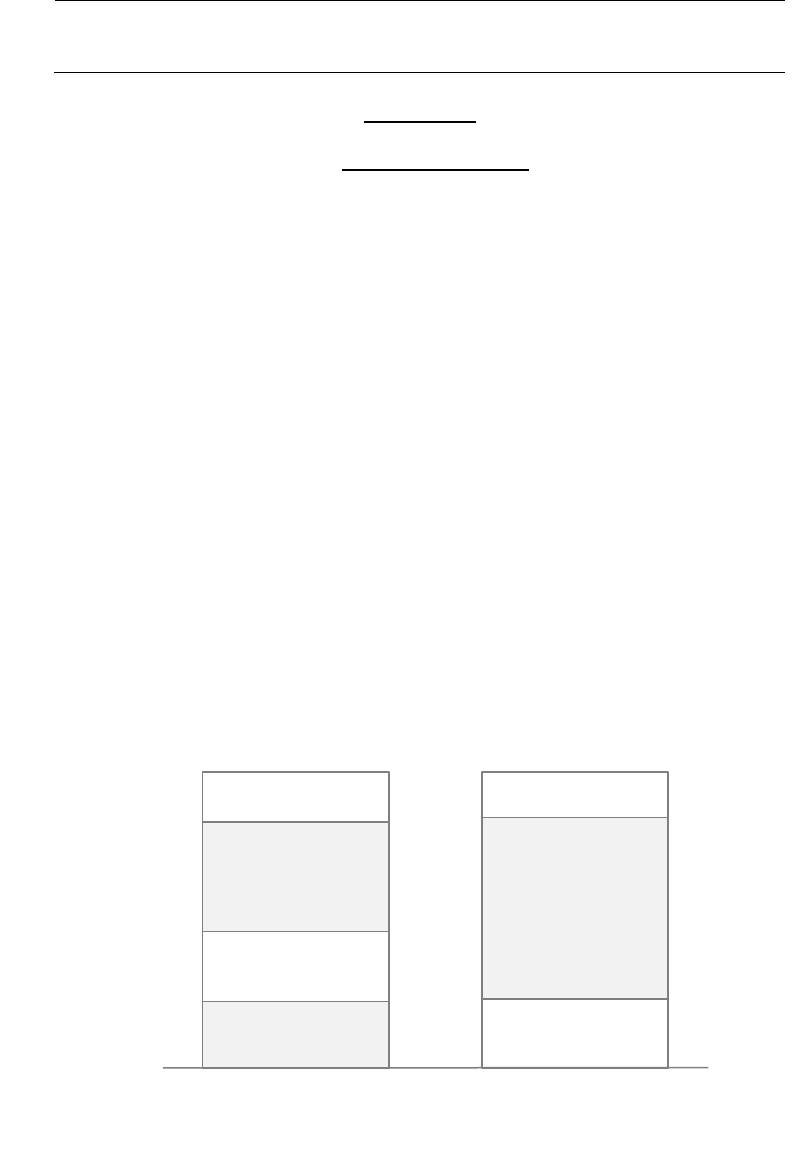

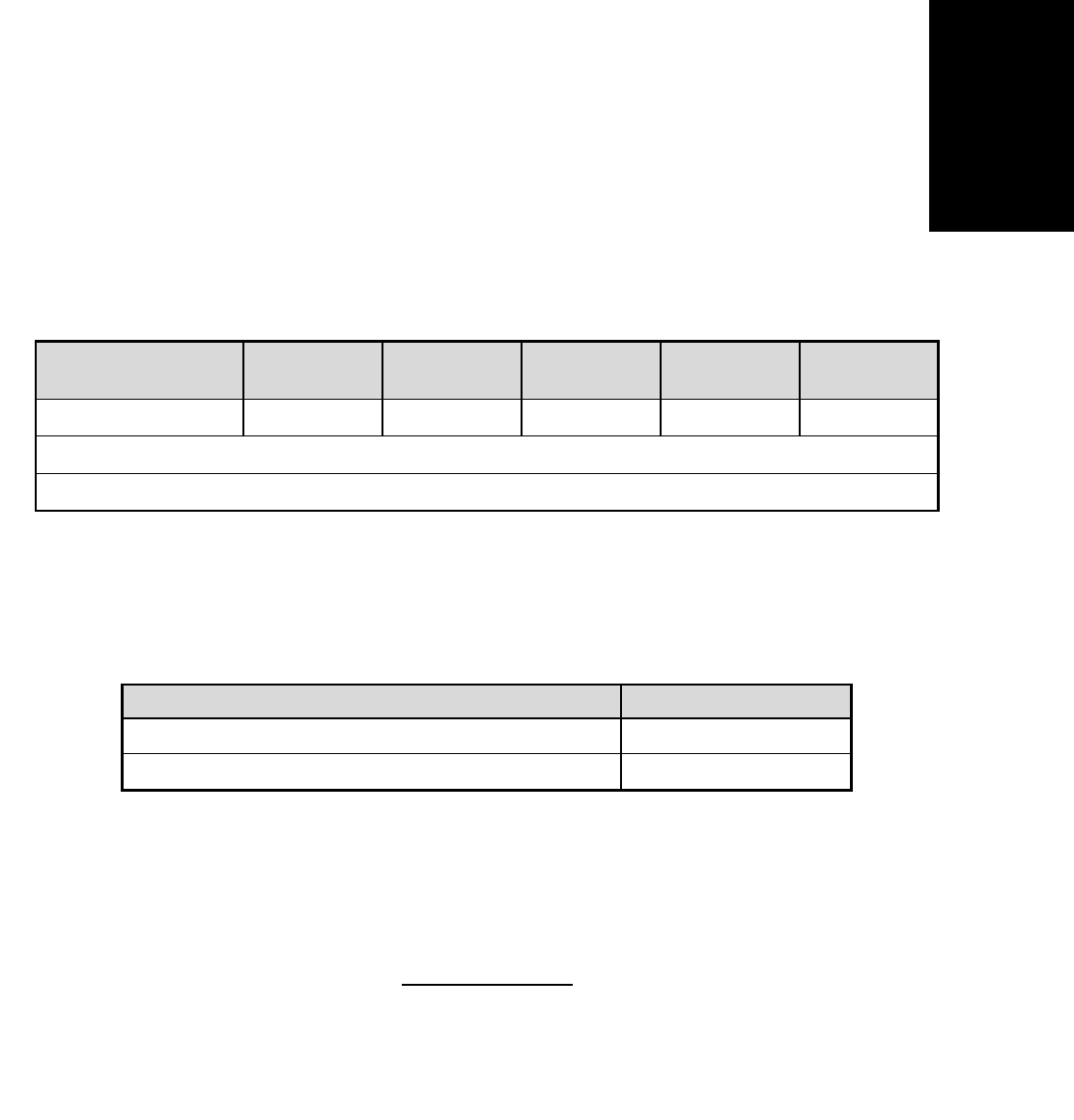

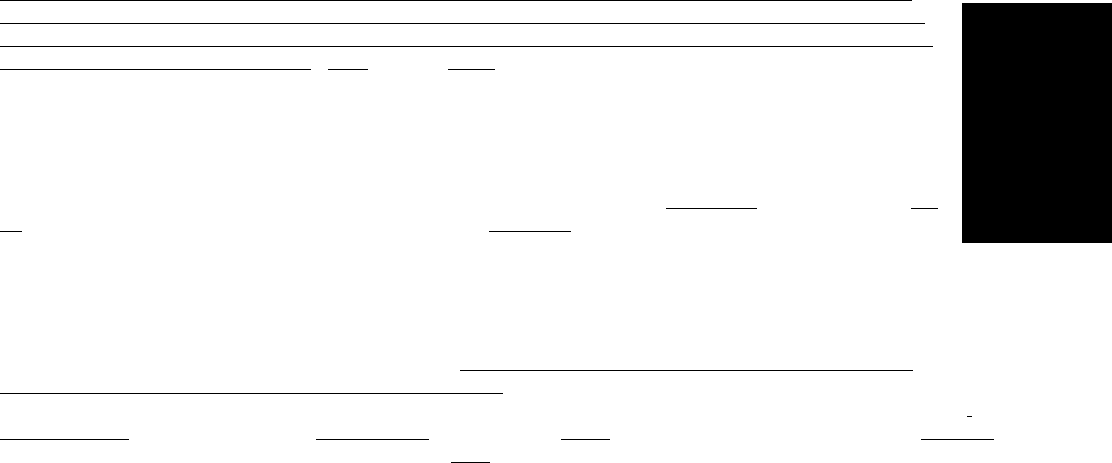

Figure 1 provides a mock-up of a judicial retention ballot both under current law and Amendment W.

4 Amendment W: Election Ballot Format for Judicial Retention Elections

Figure 1. Sample Judicial Retention Ballot*

Sample Ballot Under Current Law

Potential Ballot Under Amendment W

* These sample ballots were prepared by Legislative Council Staff. Should Amendment W be adopted by

the voters, actual ballots will vary based on county clerk and recorder ballot designs.

For information on those issue committees that support or oppose the measures on the ballot at the

November 6, 2018, election, go to the Colorado Secretary of State's elections center web site hyperlink for

ballot and initiative information: http://www.sos.state.co.us/pubs/elections/Initiatives/InitiativesHome.html

Argument For

1) Amendment W helps make the ballot more concise and reader-friendly. A well-designed and

shorter ballot will allow voters to complete it more efficiently, which may encourage voter

participation. A more compact ballot may also save counties printing and mailing costs,

particularly in more populous counties that elect multiple justices or judges and counties that are

required to print ballots in both English and Spanish.

Argument Against

1) Amendment W is unnecessary and risks confusing voters. Under the changes proposed in

Amendment W, voters may be uncertain whether they are casting votes in a multi-candidate

election or for each individual justice or judge. This potential confusion may increase the

likelihood that voters will skip judicial retention questions.

Estimate of Fiscal Impact

Local government impact. Amendment W decreases county clerk and recorder workload by a

minimal amount and may reduce ballot printing and mailing costs.

Judicial

Colorado Supreme Court

(Vote Yes or No)

Shall Justice Robert Smith of the Colorado

Supreme Court be retained in office?

Yes

O

No

O

Shall Justice Maria Rodriguez of the Colorado

Supreme Court be retained in office?

Yes

O

No

O

Colorado Court of Appeals

(Vote Yes or No)

Shall Judge James Johnson of the Colorado

Court of Appeals be retained in office?

Yes

O

No

O

Shall Judge Mary Adams of the Colorado Court

of Appeals be retained in office?

Yes

O

No

O

Shall Judge John Franklin of the Colorado

Court of Appeals be retained in office?

Yes

O

No

O

Judicial

Shall the following justices of the Colorado

Supreme Court

be retained in office?

(Vote Yes or No for each justice)

Robert Smith

Yes

O

No

O

Maria Rodriguez

Yes

O

No

O

Shall the following judges of the Colorado

Court of Appeals

be retained in office?

(Vote Yes or No for each judge)

James Johnson

Yes

O

No

O

Mary Adams

Yes

O

No

O

John Franklin

Yes

O

No

O

Amendment W: Election Ballot Format for Judicial Retention Elections 5

ANALYSIS

TITLE AND TEXT

The ballot title below is a summary drafted by the professional legal staff for the general

assembly for ballot purposes only. The ballot title will not appear in the Colorado constitution. The

text of the measure that will appear in the Colorado constitution below was referred to the voters

because it passed by a two-thirds majority vote of the state senate and the state house of

representatives.

Ballot Title:

Shall there be an amendment to the Colorado constitution concerning a change in the format of the

election ballot for judicial retention elections?

Text of Measure:

Be It Resolved by the House of Representatives of the Seventy-first General Assembly of the State of

Colorado, the Senate concurring herein:

SECTION 1. At the election held on November 6, 2018, the secretary of state shall submit to the

registered electors of the state the ballot title set forth in section 2 for the following amendment to the

state constitution:

In the constitution of the state of Colorado, amend section 25 of article VI as follows:

Section 25. Election of justices and judges. A justice of the supreme court or a judge of any other

court of record, who shall desire to retain his OR HER judicial office for another term after the expiration of

his OR HER then term of office shall file with the secretary of state, not more than six months nor less than

three months prior to the general election next prior to the expiration of his OR HER then term of office, a

declaration of his OR HER intent to run for another term. Failure to file such a declaration within the time

specified shall create a vacancy in that office at the end of his OR HER then term of office. Upon the filing

of such a declaration DECLARATIONS, a question FOR EACH TYPE OF COURT SPECIFIED IN SECTION 1 OF THIS

ARTICLE VI shall be placed on the appropriate ballot at such general election, as follows:

"Shall Justice (Judge) THE FOLLOWING JUSTICES (JUDGES) .... of the Supreme (or other) Court be

retained in office?" THE NAME OF EACH JUSTICE OR JUDGE STANDING FOR RETENTION MUST BE PRINTED OR

WRITTEN ON THE BALLOT UNDER THE APPROPRIATE QUESTION. OPPOSITE OR BELOW THE NAME OF EACH JUSTICE

OR JUDGE ON THE BALLOT MUST APPEAR THE WORDS: "YES/..../NO/..../." If a majority of those voting on the

question vote "Yes", the justice or judge is thereupon elected to a succeeding full term. If a majority of

those voting on the question vote "No", this will cause a vacancy to exist in that office at the end of his OR

HER then present term of office.

In the case of a justice of the supreme court or any intermediate appellate court, the electors of the

state at large; in the case of a judge of a district court, the electors of that judicial district; and in the case

of a judge of the county court or other court of record, the electors of that county; shall vote on the

question of retention in office of the justice or judge.

SECTION 2. Each elector voting at the election may cast a vote either "Yes/For" or "No/Against" on

the following ballot title: "Shall there be an amendment to the Colorado constitution concerning a change

in the format of the election ballot for judicial retention elections?"

SECTION 3. Except as otherwise provided in section 1-40-123, Colorado Revised Statutes, if at least

fifty-five percent of the electors voting on the ballot title vote "Yes/For", then the amendment will become

part of the state constitution.

6 Amendment X: Industrial Hemp Definition

Amendment X

Industrial Hemp Definition

(This measure requires at least 55 percent of the vote to pass.)

ANALYSIS

Amendment X proposes amending the Colorado Constitution to:

♦ remove the definition of "industrial hemp" from the Colorado constitution and, instead, use the

definition in federal law or state statute.

Summary and Analysis

Background. Amendment 64, which legalized the recreational use of marijuana in Colorado in 2012,

added a definition of "industrial hemp" to the Colorado Constitution. The definition states that industrial

hemp is "the plant of the genus cannabis and any part of such plant, whether growing or not, with a delta-

9 tetrahydrocannabinol [THC] concentration that does not exceed three-tenths [0.3] percent on a dry

weight basis." The definition of industrial hemp in federal law sets the same limit for THC concentration.

Impact of the measure. Amendment X removes the definition of industrial hemp from the state

constitution and gives the term the same meaning as in federal law or state statute. In the event that

federal law changes, Colorado would maintain compliance with federal regulation.

What is industrial hemp? Industrial hemp (commonly referred to as "hemp") is an agricultural

commodity that belongs to the cannabis family. Industrial hemp is not marijuana. Cultivated hemp has

trace amounts of delta-9 tetrahydrocannabinol (THC), typically around 0.3 percent. Industrial hemp’s

applications include building material, food, fuel, medicine, paper, plastic substitute, rope, and textiles.

Industrial hemp and federal law. Under current federal law, all cannabis varieties including

industrial hemp, are classified as controlled substances regulated by the federal Drug Enforcement

Agency in the U.S. Department of Justice. The U.S. Congress currently has legislation pending regarding

industrial hemp.

Industrial hemp industry in Colorado. As of June 1, 2018, there are 688 registered hemp growers

in Colorado cultivating 23,500 outdoor acres and 3.9 million indoor square feet of industrial hemp.

For information on those issue committees that support or oppose the measures on the ballot at the

November 6, 2018, election, go to the Colorado Secretary of State's elections center web site hyperlink for

ballot and initiative information: http://www.sos.state.co.us/pubs/elections/Initiatives/InitiativesHome.html

Argument For

1) Colorado is the leading producer of industrial hemp in the country and the only state with a

definition of industrial hemp in its constitution. Striking this definition will allow Colorado’s hemp

industry to remain competitive with other states as the regulatory landscape evolves for this crop.

Argument Against

1) Colorado voters added the definition of industrial hemp to the Colorado Constitution through the

initiative process. The measure may deviate from the voters' original intent.

Estimate of Fiscal Impact

Removing the definition of industrial hemp from the Colorado constitution has no impact on the

revenue or expenditures of any state or local government agencies.

Amendment X: Industrial Hemp Definition 7

ANALYSIS

TITLE AND TEXT

The ballot title below is a summary drafted by the professional legal staff for the general assembly

for ballot purposes only. The ballot title will not appear in the Colorado constitution. The text of the

measure that will appear in the Colorado constitution below was referred to the voters because it

passed by a two-thirds majority vote of the state senate and the state house of representatives.

Ballot Title:

Shall there be an amendment to the Colorado constitution concerning changing the industrial

hemp definition from a constitutional definition to a statutory definition?

Text of Measure:

Be It Resolved by the Senate of the Seventy-first General Assembly of the State of Colorado, the

House of Representatives concurring herein:

SECTION 1. At the election held on November 6, 2018, the secretary of state shall submit to the

registered electors of the state the ballot title set forth in section 2 for the following amendment to the

state constitution:

In the constitution of the state of Colorado, section 16 of article XVIII, amend (2)(d) as follows:

Section 16. Personal use and regulation of marijuana. (2) Definitions. As used in this section,

unless the context otherwise requires,

(d) "Industrial hemp" means the plant of the genus cannabis and any part of such plant, whether

growing or not, with a delta-9 tetrahydrocannabinol concentration that does not exceed three-tenths

percent on a dry weight basis HAS THE SAME MEANING AS IT IS DEFINED IN FEDERAL LAW OR AS THE TERM IS

DEFINED IN COLORADO STATUTE.

SECTION 2. Each elector voting at the election may cast a vote either "Yes/For" or "No/Against" on

the following ballot title: "Shall there be an amendment to the Colorado constitution concerning changing

the industrial hemp definition from a constitutional definition to a statutory definition?"

SECTION 3. Except as otherwise provided in section 1-40-123, Colorado Revised Statutes, if at least

fifty-five percent of the electors voting on the ballot title vote "Yes/For", then the amendment will become

part of the state constitution.

8 Amendment Y: Congressional Redistricting

Amendment Y

Congressional Redistricting

(This measure requires at least 55 percent of the vote to pass.)

ANALYSIS

Amendment Y proposes amending the Colorado Constitution to:

♦ create the Independent Congressional Redistricting Commission, consisting of an equal number

of members from each of the state's two largest political parties and unaffiliated voters, to amend

and approve congressional district maps drawn by nonpartisan legislative staff;

♦ establish a process for selecting commissioners, new requirements for transparency and ethics,

and a procedure for judicial review of commission maps; and

♦ establish and prioritize the criteria the commission must use for adopting the state’s

U.S. congressional district map.

Summary and Analysis

Amendment Y establishes a new process for congressional redistricting. Amendment Z, which is also

on the 2018 ballot, proposes a similar but separate process for state legislative redistricting.

Reapportionment and redistricting. The U.S. Census Bureau counts the U.S. population every ten

years. After this, the congressional reapportionment process occurs, by which each state is granted

seats in the U.S. House of Representatives based on its share of the total U.S. population. The states

must then redraw their districts so that the number of people in each district is equal.

Congressional redistricting process in Colorado. Colorado currently has seven seats in the

U.S. House of Representatives. Under the state constitution, the state legislature is responsible for

dividing the state into these congressional districts. If the state legislature fails to complete a new map of

congressional districts during the legislative session after the census, legal challenges may result in state

courts drawing the map. The process has resulted in court action the last four times congressional

redistricting has occurred. Current law lists factors that the courts consider when evaluating maps, but

does not direct how the courts should prioritize these factors.

Amendment Y transfers the authority to draw congressional district maps from the state legislature to

a newly created Independent Congressional Redistricting Commission (commission). The commission

must have 12 members, 4 from the state's largest political party, which is currently the Democratic Party,

4 from the state's second largest political party, which is currently the Republican Party, and 4 who are

not affiliated with any political party. These members are appointed from a pool of applicants as

described below.

Application and appointment process. Amendment Y sets minimum qualifications for

commissioners. An applicant must be registered to vote and have voted in the previous two general

elections in Colorado, and have been either affiliated with the same party or unaffiliated with any party for

the last five consecutive years. An applicant may not be appointed to the commission if he or she has

been a candidate for federal office within the last five years, or within the last three years been: a

professional registered lobbyist; an elected public official; an elected political party official above the

precinct level; or paid by a member of or candidate for Congress. Commissioners may not also serve on

the Independent Legislative Redistricting Commission proposed in Amendment Z.

Amendment Y: Congressional Redistricting 9

ANALYSIS

The measure requires nonpartisan legislative staff to prepare an application form for

commissioners after receiving public input on the application at one or more public hearings. All

applications submitted must be posted on a public website. Nonpartisan legislative staff must review

commission applications to ensure applicants meet the minimum qualifications.

The Chief Justice of the Colorado Supreme Court designates a panel of three of the most recently

retired judges from the Colorado Supreme Court or Colorado Court of Appeals to facilitate the

selection of commissioners. No more than one of the three judges may be registered with any one

political party, and the panel's decisions must be unanimous. Selected judges may not also serve on

the panel that facilitates the selection of the proposed Independent Legislative Redistricting

Commission. From all of the qualified applicants, the panel of retired judges randomly selects a pool

of 1,050 applicants. The panel then narrows the applicant pool to 150 applicants using criteria related to

applicants’ experience, analytical skills, and ability to be impartial and promote consensus.

From the 150-person applicant pool, the panel randomly chooses 2 commissioners affiliated with the

state’s largest political party, 2 commissioners affiliated with the state’s second largest political party, and

2 commissioners who are not affiliated with a political party. For the remaining 6 commissioners, the

panel selects 2 additional unaffiliated commissioners from the pool of 1,050 applicants, and

4 commissioners from applicant pools determined by legislative leaders. The final 12-member

commission will have 4 Democrats, 4 Republicans, and 4 unaffiliated members, unless another political

party becomes the largest or second largest political party in the state. The final composition of the

commission should reflect Colorado’s racial, ethnic, gender, and geographic diversity, and must include

members from each congressional district, including at least one member from the Western Slope.

Commission operations. Under the measure, the commission is responsible for adopting rules to

govern its administration and operation, and the commissioners are subject to open meeting laws. Staff

for the commission must be assigned from nonpartisan legislative staff agencies. Commissioners are

prohibited from communicating with nonpartisan legislative staff about any maps outside of a public

meeting or hearing, and staff are prohibited from communicating with outside parties concerning the

development of a redistricting map. Any commissioner who participates in prohibited communication

must be removed from the commission. Any person who receives compensation for advocating to the

commission, one or more commissioners, or staff is considered a lobbyist and must disclose his or her

compensation and its source to the Secretary of State for publication.

Criteria for drawing a congressional district map. The U.S. Constitution requires that all

congressional districts within a state have equal populations. Under the federal Voting Rights Act of

1965, the state cannot change voting standards, practices, or procedures in a way that denies or limits

the right to vote based on race or color or membership in a language minority group. In particular, the act

requires that a minority group’s voting strength not be diluted under a redistricting map. Amendment Y

incorporates principles of the Voting Rights Act into state law and prohibits the approval of a map that

violates these principles.

Amendment Y also adds criteria for the commission to follow when adopting a map. After achieving

population equality and complying with the Voting Rights Act, the commission must preserve whole

political subdivisions and communities of interest as much as possible, and districts must be as compact

as possible. After the consideration of these criteria, Amendment Y requires the commission to maximize

the number of politically competitive districts, which are defined as having the reasonable potential for the

party affiliation of the district's representative to change at least once over the decade, to the extent

possible. Maps cannot be drawn for the purpose of protecting incumbents, candidates, or political

parties.

Map consideration and public involvement. The measure directs nonpartisan commission staff to

create a preliminary redistricting map, and requires them to consider public comments while developing

the map. Members of the public may also present proposed redistricting maps and written comments for

the commission's consideration. The commission must hold at least three public hearings in each

congressional district to receive public input before approving a redistricting map. At least ten

commissioners must attend each hearing, either in person or electronically. These hearings must be

broadcast online, and the commission must maintain a website through which Colorado residents may

10 Amendment Y: Congressional Redistricting

submit maps or written comments. All written comments pertaining to redistricting must be published on

the website. After the commission holds its hearings on the preliminary map, staff must prepare

additional maps. The commission can adopt standards and guidelines for staff to follow when developing

staff maps. Any commissioner can request at a public hearing that staff prepare additional maps or

amendments to maps. The commission can adopt a final map at any time after the presentation of the

first staff map.

Final map. Under the measure, the commission must adopt a final map and submit it to the

Colorado Supreme Court for review. At least 8 of the 12 commissioners, including at least 2 unaffiliated

commissioners, must approve the final map, and the map must be made public before the commission

votes on it. If the commission fails to submit a final map, a staff map must be submitted, without

amendments, to the Colorado Supreme Court for judicial review.

The Colorado Supreme Court must approve the final map unless the court finds that the commission

abused its discretion in applying or failing to apply required criteria, in which case the court must return it

to the commission. If returned, the commission has 12 days to hold a hearing and submit a revised map

to the Colorado Supreme Court. If the commission fails to submit a revised map, nonpartisan staff have

an additional three days to submit a revised map. The Colorado Supreme Court must approve a

congressional redistricting map by December 15 of the redistricting year.

For information on those issue committees that support or oppose the measures on the ballot at the

November 6, 2018, election, go to the Colorado Secretary of State's elections center web site hyperlink for

ballot and initiative information: http://www.sos.state.co.us/pubs/elections/Initiatives/InitiativesHome.html

Arguments For

1) Amendment Y limits the role of partisan politics in the congressional redistricting process by

transferring the legislature’s role to an independent commission. The measure creates a system

of checks and balances to ensure that no one political party controls the commission.

Republicans, Democrats, and unaffiliated voters must be appointed to the commission in equal

numbers. Lobbyists and politicians are prohibited from serving on the new commission.

Additionally, nonpartisan legislative staff draw the district maps, and a map's approval requires a

supermajority vote of the commission, including at least two unaffiliated commissioners. These

provisions encourage political compromise by keeping political parties and politicians with a

vested interest in the outcome from controlling the redistricting process.

2) The measure makes the redistricting process more transparent and provides greater opportunity

for public participation. Congressional redistricting is conducted by an independent commission

in public meetings, with safeguards against undue influence in the preparation and adoption of

maps. All Coloradans will have the opportunity to engage in the process because the

commission will conduct meetings throughout the state rather than only at the State Capitol. The

commission is subject to state open records and open meetings laws, and anyone paid to lobby

the commission has 72 hours to disclose their lobbying activities. By requiring that map-related

communications occur in public, Coloradans will be able to see exactly how the districts are

drawn.

3) The measure brings structure to the redistricting process by using clear, ordered, and fair criteria

in the drawing of districts. By prioritizing factors such as communities of interest, city and county

lines, and political competitiveness, it provides specific direction to the commission about how it

should evaluate proposed maps. It also prevents the adoption of a map that protects incumbents,

candidates, or political parties, or a map that dilutes the electoral influence of racial or ethnic

minorities. Along with these prioritized criteria, the measure prescribes a structured court review

process and provides more guidance regarding the court’s role than has existed in prior

redistricting cycles.

Amendment Y: Congressional Redistricting 11

ANALYSIS

Arguments Against

1) Amendment Y takes accountability out of the redistricting process. Unlike state legislators

who are subject to election and campaign finance requirements, unelected commissioners are

not accountable to the voters of Colorado. The selection process relies on unelected retired

judges to screen applicants and select half of the commissioners. Further, the commission is

staffed by government employees who are not accountable to the voters, and they may end

up drawing the final map if the commission cannot reach an agreement.

2) The commissioner selection process outlined in the measure is complex, and half of the

members are determined by random chance. This complicated and random selection process

may prevent individuals with important experience and knowledge from becoming

commissioners. While the goal of the random selection may be to remove politics from

redistricting, unaffiliated commissioners with partisan views could still be selected, and the

selection process may not result in a commission that can be impartial and promote consensus.

3) The measure outlines criteria that may be difficult to apply in an objective manner. For example,

the broad definition of communities of interest is vague and open to interpretation. The measure

also leaves the commission to determine what a competitive district is without specifying what

factors to consider. Additionally, the four unaffiliated commissioners will have political leanings

that may be difficult to discern, but that could sway how they apply the criteria and influence the

final map, since many critical votes require their support. The resulting map may serve to protect

certain segments of the population at the expense of others and could result in districts that make

no sense to voters.

Estimate of Fiscal Impact

State revenue. Beginning in FY 2020-21, Amendment Y may minimally increase Secretary of State

cash fund revenue from fines collected from lobbyists who fail to disclose the required information.

State expenditures. Overall, Amendment Y increases state expenditures to fund the commission by

$31,479 in FY 2020-21 and $642,745 in FY 2021-22 as compared with the expenses for the current

process.

TITLE AND TEXT

The ballot title below is a summary drafted by the professional legal staff for the general assembly for

ballot purposes only. The ballot title will not appear in the Colorado constitution. The text of the measure

that will appear in the Colorado constitution below was referred to the voters because it passed by a

two-thirds majority vote of the state senate and the state house of representatives.

Ballot Title:

Shall there be an amendment to the Colorado constitution concerning a change to the way that

congressional districts are drawn, and, in connection therewith, taking the duty to draw congressional

districts away from the state legislature and giving it to an independent commission, composed of

twelve citizens who possess specified qualifications; prohibiting any one political party's control of the

commission by requiring that one-third of commissioners will not be affiliated with any political party,

one-third of the commissioners will be affiliated with the state's largest political party, and one-third of the

commissioners will be affiliated with the state's second largest political party; prohibiting certain persons,

including professional lobbyists, federal campaign committee employees, and federal, state, and local

elected officials, from serving on the commission; limiting judicial review of a map to a determination by

12 Amendment Y: Congressional Redistricting

the supreme court of whether the commission or its nonpartisan staff committed an abuse of discretion;

requiring the commission to draw districts with a focus on communities of interest and political

subdivisions, such as cities and counties, and then to maximize the number of competitive congressional

seats to the extent possible; and prohibiting maps from being drawn to dilute the electoral influence of any

racial or ethnic group or to protect any incumbent, any political candidate, or any political party?

Text of Measure:

Be It Resolved by the Senate of the Seventy-first General Assembly of the State of Colorado, the

House of Representatives concurring herein:

SECTION 1. At the election held on November 6, 2018, the secretary of state shall submit to the

registered electors of the state the ballot title set forth in section 2 for the following amendment to the

state constitution:

In the constitution of the state of Colorado, amend section 44 of article V as follows:

Section 44. Representatives in congress - congressional districts - commission

created. (1) Declaration of the people. THE PEOPLE OF THE STATE OF COLORADO FIND AND DECLARE THAT:

(a) THE PRACTICE OF POLITICAL GERRYMANDERING, WHEREBY CONGRESSIONAL DISTRICTS ARE

PURPOSEFULLY DRAWN TO FAVOR ONE POLITICAL PARTY OR INCUMBENT POLITICIAN OVER ANOTHER, MUST END;

(b) THE PUBLIC'S INTEREST IN PROHIBITING POLITICAL GERRYMANDERING IS BEST ACHIEVED BY CREATING A

NEW AND INDEPENDENT COMMISSION THAT IS POLITICALLY BALANCED, PROVIDES REPRESENTATION TO VOTERS

NOT AFFILIATED WITH EITHER OF THE STATE'S TWO LARGEST PARTIES, AND UTILIZES NONPARTISAN LEGISLATIVE

STAFF TO DRAW MAPS;

(c) THE REDISTRICTING COMMISSION SHOULD SET DISTRICT LINES BY ENSURING CONSTITUTIONALLY

GUARANTEED VOTING RIGHTS, INCLUDING THE PROTECTION OF MINORITY GROUP VOTING, AS WELL AS FAIR AND

EFFECTIVE REPRESENTATION OF CONSTITUENTS USING POLITICALLY NEUTRAL CRITERIA;

(d) COMPETITIVE ELECTIONS FOR MEMBERS OF THE UNITED STATES HOUSE OF REPRESENTATIVES PROVIDE

VOTERS WITH A MEANINGFUL CHOICE AMONG CANDIDATES, PROMOTE A HEALTHY DEMOCRACY, HELP ENSURE

THAT CONSTITUENTS RECEIVE FAIR AND EFFECTIVE REPRESENTATION, AND CONTRIBUTE TO THE POLITICAL

WELL-BEING OF KEY COMMUNITIES OF INTEREST AND POLITICAL SUBDIVISIONS;

(e) FOR YEARS CERTAIN POLITICAL INTERESTS OPPOSED COMPETITIVE DISTRICTS IN COLORADO BECAUSE

THEY ARE PRIMARILY CONCERNED ABOUT MAINTAINING THEIR OWN POLITICAL POWER AT THE EXPENSE OF FAIR

AND EFFECTIVE REPRESENTATION; AND

(f) CITIZENS WANT AND DESERVE AN INCLUSIVE AND MEANINGFUL CONGRESSIONAL REDISTRICTING PROCESS

THAT PROVIDES THE PUBLIC WITH THE ABILITY TO BE HEARD AS REDISTRICTING MAPS ARE DRAWN, TO BE ABLE TO

WATCH THE WITNESSES WHO DELIVER TESTIMONY AND THE REDISTRICTING COMMISSION'S DELIBERATIONS, AND

TO HAVE THEIR WRITTEN COMMENTS CONSIDERED BEFORE ANY PROPOSED MAP IS VOTED UPON BY THE

COMMISSION AS THE FINAL MAP.

(2) Congressional districts - commission created. THERE IS HEREBY CREATED THE INDEPENDENT

CONGRESSIONAL REDISTRICTING COMMISSION. The general assembly COMMISSION shall divide the state into

as many congressional districts as there are representatives in congress apportioned to this state by the

congress of the United States for the election of one representative to congress from each district. When

a new apportionment shall be IS made by congress, the general assembly COMMISSION shall divide the

state into congressional districts accordingly.

(3) Definitions. AS USED IN THIS SECTION AND IN SECTIONS 44.1 THROUGH 44.6 OF THIS ARTICLE V,

UNLESS THE CONTEXT OTHERWISE REQUIRES:

Amendment Y: Congressional Redistricting 13

ANALYSIS

(a) "COMMISSION" MEANS THE INDEPENDENT CONGRESSIONAL REDISTRICTING COMMISSION CREATED IN

SUBSECTION (2) OF THIS SECTION.

(b) (I) "COMMUNITY OF INTEREST" MEANS ANY GROUP IN COLORADO THAT SHARES ONE OR MORE

SUBSTANTIAL INTERESTS THAT MAY BE THE SUBJECT OF FEDERAL LEGISLATIVE ACTION, IS COMPOSED OF A

REASONABLY PROXIMATE POPULATION, AND THUS SHOULD BE CONSIDERED FOR INCLUSION WITHIN A SINGLE

DISTRICT FOR PURPOSES OF ENSURING ITS FAIR AND EFFECTIVE REPRESENTATION.

(II) SUCH INTERESTS INCLUDE BUT ARE NOT LIMITED TO MATTERS REFLECTING:

(A) SHARED PUBLIC POLICY CONCERNS OF URBAN, RURAL, AGRICULTURAL, INDUSTRIAL, OR TRADE AREAS;

AND

(B) SHARED PUBLIC POLICY CONCERNS SUCH AS EDUCATION, EMPLOYMENT, ENVIRONMENT, PUBLIC HEALTH,

TRANSPORTATION, WATER NEEDS AND SUPPLIES, AND ISSUES OF DEMONSTRABLE REGIONAL SIGNIFICANCE.

(III) GROUPS THAT MAY COMPRISE A COMMUNITY OF INTEREST INCLUDE RACIAL, ETHNIC, AND LANGUAGE

MINORITY GROUPS, SUBJECT TO COMPLIANCE WITH SUBSECTIONS (1)(b) AND (4)(b) OF SECTION 44.3 OF THIS

ARTICLE V, WHICH SUBSECTIONS PROTECT AGAINST THE DENIAL OR ABRIDGEMENT OF THE RIGHT TO VOTE DUE TO

A PERSON'S RACE OR LANGUAGE MINORITY GROUP.

(IV) "COMMUNITY OF INTEREST" DOES NOT INCLUDE RELATIONSHIPS WITH POLITICAL PARTIES, INCUMBENTS,

OR POLITICAL CANDIDATES.

(c) "RACE" OR "RACIAL" MEANS A CATEGORY OF RACE OR ETHNIC ORIGIN DOCUMENTED IN THE FEDERAL

DECENNIAL CENSUS.

(d) "REDISTRICTING YEAR" MEANS THE YEAR FOLLOWING THE YEAR IN WHICH THE FEDERAL DECENNIAL

CENSUS IS TAKEN.

(e) "STAFF" OR "NONPARTISAN STAFF" MEANS THE STAFF OF THE GENERAL ASSEMBLY'S LEGISLATIVE

COUNCIL AND OFFICE OF LEGISLATIVE LEGAL SERVICES, OR THEIR SUCCESSOR OFFICES, WHO ARE ASSIGNED TO

ASSIST THE COMMISSION BY THE DIRECTORS OF THOSE OFFICES IN ACCORDANCE WITH SECTION 44.2 OF THIS

ARTICLE V.

(4) Adjustment of dates. IF ANY DATE PRESCRIBED IN SECTIONS 44.1 THROUGH 44.5 OF THIS ARTICLE V

FALLS ON A SATURDAY, SUNDAY, OR LEGAL HOLIDAY, THEN THE DATE IS EXTENDED TO THE NEXT DAY THAT IS NOT

A SATURDAY, SUNDAY, OR LEGAL HOLIDAY.

In the constitution of the state of Colorado, add sections 44.1, 44.2, 44.3, 44.4, 44.5, and 44.6 to

article V as follows:

Section 44.1. Commission composition and appointment - vacancies. (1) AFTER EACH FEDERAL

DECENNIAL CENSUS OF THE UNITED STATES, THE MEMBERS OF THE COMMISSION SHALL BE APPOINTED AND

CONVENED AS PRESCRIBED IN THIS SECTION.

(2) THE COMMISSION CONSISTS OF TWELVE MEMBERS WHO HAVE THE FOLLOWING QUALIFICATIONS:

(a) COMMISSIONERS MUST BE REGISTERED ELECTORS WHO VOTED IN BOTH OF THE PREVIOUS TWO GENERAL

ELECTIONS IN COLORADO;

(b) COMMISSIONERS MUST EITHER HAVE BEEN UNAFFILIATED WITH ANY POLITICAL PARTY OR HAVE BEEN

AFFILIATED WITH THE SAME POLITICAL PARTY FOR A CONSECUTIVE PERIOD OF NO LESS THAN FIVE YEARS AT THE

TIME OF THE APPLICATION; AND

14 Amendment Y: Congressional Redistricting

(c) NO PERSON MAY BE APPOINTED TO OR SERVE ON THE COMMISSION IF HE OR SHE:

(I) IS OR HAS BEEN A CANDIDATE FOR FEDERAL ELECTIVE OFFICE WITHIN THE LAST FIVE YEARS PRECEDING

THE DATE ON WHICH APPLICATIONS FOR APPOINTMENT TO THE COMMISSION ARE DUE UNDER SUBSECTION (4) OF

THIS SECTION;

(II) IS OR HAS BEEN, WITHIN THE LAST THREE YEARS PRECEDING THE DATE ON WHICH APPLICATIONS FOR

APPOINTMENT TO THE COMMISSION ARE DUE UNDER SUBSECTION (4) OF THIS SECTION, COMPENSATED BY A

MEMBER OF, OR A CAMPAIGN COMMITTEE ADVOCATING THE ELECTION OF A CANDIDATE TO, THE UNITED STATES

HOUSE OF REPRESENTATIVES OR THE UNITED STATES SENATE;

(III) IS OR HAS BEEN, WITHIN THE LAST THREE YEARS PRECEDING THE DATE ON WHICH APPLICATIONS FOR

APPOINTMENT TO THE COMMISSION ARE DUE UNDER SUBSECTION (4) OF THIS SECTION, AN ELECTED PUBLIC

OFFICIAL AT THE FEDERAL, STATE, COUNTY, OR MUNICIPAL LEVEL IN COLORADO;

(IV) IS OR HAS BEEN, WITHIN THE LAST THREE YEARS PRECEDING THE DATE ON WHICH APPLICATIONS FOR

APPOINTMENT TO THE COMMISSION ARE DUE UNDER SUBSECTION (4) OF THIS SECTION, AN ELECTED POLITICAL

PARTY OFFICIAL ABOVE THE PRECINCT LEVEL IN COLORADO OR AN EMPLOYEE OF A POLITICAL PARTY;

(V) IS A MEMBER OF THE COMMISSION RESPONSIBLE FOR DIVIDING THE STATE INTO SENATORIAL AND

REPRESENTATIVE DISTRICTS OF THE GENERAL ASSEMBLY; OR

(VI) IS OR HAS BEEN A PROFESSIONAL LOBBYIST REGISTERED TO LOBBY WITH THE STATE OF COLORADO,

WITH ANY MUNICIPALITY IN COLORADO, OR AT THE FEDERAL LEVEL WITHIN THE LAST THREE YEARS PRECEDING

THE DATE ON WHICH APPLICATIONS FOR APPOINTMENT TO THE COMMISSION ARE DUE UNDER SUBSECTION (4) OF

THIS SECTION.

(3) (a) BY AUGUST 10 OF THE YEAR PRIOR TO THE REDISTRICTING YEAR, NONPARTISAN STAFF SHALL, AFTER

HOLDING ONE OR MORE PUBLIC HEARINGS, PREPARE AN APPLICATION FORM THAT WILL ALLOW APPOINTING

AUTHORITIES TO EVALUATE A PERSON'S EXPERIENCE AND QUALIFICATIONS AND MAKE SUCH APPLICATION

AVAILABLE ON THE GENERAL ASSEMBLY'S WEBSITE OR COMPARABLE MEANS OF COMMUNICATING WITH THE

PUBLIC.

(b) THE APPLICATION FORM MUST CLEARLY STATE THE LEGAL OBLIGATIONS AND EXPECTATIONS OF

POTENTIAL APPOINTEES. INFORMATION REQUIRED OF APPLICANTS MUST INCLUDE, BUT IS NOT NECESSARILY

LIMITED TO, PROFESSIONAL BACKGROUND, PARTY AFFILIATION, A DESCRIPTION OF PAST POLITICAL ACTIVITY, A

LIST OF ALL POLITICAL AND CIVIC ORGANIZATIONS TO WHICH THE APPLICANT HAS BELONGED WITHIN THE PREVIOUS

FIVE YEARS, AND WHETHER THE APPLICANT MEETS THE QUALIFICATIONS STATED IN SUBSECTION (2) OF THIS

SECTION. IN ADDITION, THE APPLICATION FORM MUST REQUIRE THE APPLICANT TO EXPLAIN WHY THEY WANT TO

SERVE ON THE COMMISSION AND AFFORD THE APPLICANT AN OPPORTUNITY TO MAKE A STATEMENT ABOUT HOW

THEY WILL PROMOTE CONSENSUS AMONG COMMISSIONERS IF APPOINTED TO THE COMMISSION. APPLICANTS MAY

ALSO CHOOSE TO INCLUDE UP TO FOUR LETTERS OF RECOMMENDATION WITH THEIR APPLICATION.

(4) BY NOVEMBER 10 OF THE YEAR PRIOR TO THE REDISTRICTING YEAR, ANY PERSON WHO SEEKS TO SERVE

ON THE COMMISSION MUST SUBMIT A COMPLETED APPLICATION TO NONPARTISAN STAFF. ALL APPLICATIONS ARE

PUBLIC RECORDS AND MUST BE POSTED PROMPTLY AFTER RECEIPT ON THE GENERAL ASSEMBLY'S WEBSITE OR

COMPARABLE MEANS OF COMMUNICATING WITH THE PUBLIC.

(5) (a) NO LATER THAN JANUARY 5 OF THE REDISTRICTING YEAR, THE CHIEF JUSTICE OF THE COLORADO

SUPREME COURT SHALL DESIGNATE A PANEL TO REVIEW THE APPLICATIONS. THE PANEL MUST CONSIST OF THE

THREE JUSTICES OR JUDGES WHO MOST RECENTLY RETIRED FROM THE COLORADO SUPREME COURT OR THE

COLORADO COURT OF APPEALS, APPOINTED SEQUENTIALLY STARTING WITH THE MOST RECENT JUSTICE OR JUDGE

TO RETIRE WHO HAS BEEN AFFILIATED WITH THE SAME POLITICAL PARTY OR UNAFFILIATED WITH ANY POLITICAL

PARTY FOR THE TWO YEARS PRIOR TO APPOINTMENT; EXCEPT THAT NO APPOINTEE, WITHIN TWO YEARS PRIOR TO

APPOINTMENT, SHALL HAVE BEEN AFFILIATED WITH THE SAME POLITICAL PARTY AS A JUSTICE OR JUDGE ALREADY

APPOINTED TO THE PANEL. IF ANY OF THE THREE JUSTICES OR JUDGES WHO MOST RECENTLY RETIRED FROM THE

COLORADO SUPREME COURT OR THE COLORADO COURT OF APPEALS IS UNABLE OR UNWILLING TO SERVE ON THE

Amendment Y: Congressional Redistricting 15

ANALYSIS

PANEL OR HAS BEEN AFFILIATED WITHIN TWO YEARS PRIOR TO APPOINTMENT WITH A POLITICAL PARTY ALREADY

REPRESENTED ON THE PANEL, THEN THE CHIEF JUSTICE SHALL APPOINT THE NEXT JUSTICE OR JUDGE WHO

MOST RECENTLY RETIRED FROM THE COLORADO SUPREME COURT OR THE COLORADO COURT OF APPEALS

AND WHO HAS NOT BEEN AFFILIATED WITHIN TWO YEARS PRIOR TO APPOINTMENT WITH THE SAME POLITICAL

PARTY AS ANY JUSTICE OR JUDGE ALREADY APPOINTED TO THE PANEL. IF, AFTER CONSIDERING ALL JUSTICES

AND JUDGES WHO HAVE RETIRED FROM THE COLORADO SUPREME COURT AND THE COLORADO COURT OF

APPEALS, FEWER THAN THREE ELIGIBLE PARTICIPANTS FOR THE PANEL HAVE BEEN IDENTIFIED WHO ARE ABLE

AND WILLING TO SERVE, THE CHIEF JUSTICE SHALL APPOINT THE MOST RECENTLY RETIRED DISTRICT COURT

JUDGE WHO HAS NOT BEEN AFFILIATED WITHIN TWO YEARS PRIOR TO APPOINTMENT WITH THE SAME POLITICAL

PARTY AS ANY PREVIOUS APPOINTEE TO THE PANEL AND WHO ACCEPTS SUCH APPOINTMENT. NO JUSTICE OR

JUDGE SHALL SERVE BOTH ON THIS PANEL AND THE PANEL ASSISTING IN THE PROCESS OF CHOOSING MEMBERS OF

THE COMMISSION RESPONSIBLE FOR DIVIDING THE STATE INTO STATE SENATE AND STATE HOUSE OF

REPRESENTATIVES DISTRICTS.

(b) ALL DECISIONS OF THE PANEL REGARDING THE SELECTION OF APPLICANTS PURSUANT TO THIS SECTION

REQUIRE THE AFFIRMATIVE APPROVAL OF ALL THREE MEMBERS OF THE PANEL.

(c) THE GENERAL ASSEMBLY SHALL PRESCRIBE BY LAW THE COMPENSATION OF MEMBERS OF THE PANEL.

NONPARTISAN STAFF SHALL ASSIST THE PANEL IN CARRYING OUT ITS DUTIES.

(6) AFTER APPLICATIONS ARE SUBMITTED, NONPARTISAN STAFF, WITH THE COOPERATION AND ASSISTANCE

OF THE SECRETARY OF STATE, SHALL MAKE AN OBJECTIVE AND FACTUAL FINDING BASED ON, TO THE EXTENT

POSSIBLE, PUBLICLY AVAILABLE INFORMATION, INCLUDING INFORMATION CONTAINED IN THE APPLICATION AND

INFORMATION CONTAINED WITHIN THE RECORDS MAINTAINED BY THE SECRETARY OF STATE, WHETHER EACH

APPLICANT MEETS THE QUALIFICATIONS SPECIFIED IN SUBSECTION (2) OF THIS SECTION. NO LATER THAN

JANUARY 11 OF THE REDISTRICTING YEAR, NONPARTISAN STAFF SHALL MAKE ITS FINDINGS PUBLICLY AVAILABLE

AND NOTIFY THE APPLICANTS OF THE STAFF'S FINDING. IF THE STAFF FINDS THAT AN APPLICANT IS NOT ELIGIBLE,

THEN THE STAFF SHALL INCLUDE THE REASONS IN ITS FINDING.

(7) BY JANUARY 18 OF THE REDISTRICTING YEAR, THE PANEL, IN A PUBLIC MEETING, SHALL RANDOMLY

SELECT BY LOT FROM ALL OF THE APPLICANTS WHO WERE FOUND TO MEET THE QUALIFICATIONS SPECIFIED IN

SUBSECTION (2) OF THIS SECTION THE NAMES OF THREE HUNDRED APPLICANTS WHO ARE AFFILIATED WITH THE

STATE'S LARGEST POLITICAL PARTY, THREE HUNDRED APPLICANTS WHO ARE AFFILIATED WITH THE STATE'S

SECOND LARGEST POLITICAL PARTY, AND FOUR HUNDRED FIFTY APPLICANTS WHO ARE NOT AFFILIATED WITH ANY

POLITICAL PARTY, OR SUCH LESSER NUMBER AS THERE ARE TOTAL APPLICANTS WHO MEET THE QUALIFICATIONS

SPECIFIED IN SUBSECTION (2) OF THIS SECTION FOR EACH OF THOSE GROUPS.

(8) (a) IN ONE OR MORE PUBLIC HEARINGS CONDUCTED ON OR BEFORE FEBRUARY 1 OF THE REDISTRICTING

YEAR, AFTER REVIEWING THE APPLICATIONS OF THE APPLICANTS SELECTED IN ACCORDANCE WITH SUBSECTION

(7) OF THIS SECTION, THE PANEL SHALL IDENTIFY FIFTY APPLICANTS WHO ARE AFFILIATED WITH THE STATE'S

LARGEST POLITICAL PARTY, FIFTY APPLICANTS WHO ARE AFFILIATED WITH THE STATE'S SECOND LARGEST

POLITICAL PARTY, AND FIFTY APPLICANTS WHO ARE UNAFFILIATED WITH ANY POLITICAL PARTY AND WHO BEST

DEMONSTRATE:

(I) EXPERIENCE IN ORGANIZING, REPRESENTING, ADVOCATING FOR, ADJUDICATING THE INTERESTS OF, OR

ACTIVELY PARTICIPATING IN GROUPS, ORGANIZATIONS, OR ASSOCIATIONS IN COLORADO; AND

(II) RELEVANT ANALYTICAL SKILLS, THE ABILITY TO BE IMPARTIAL, AND THE ABILITY TO PROMOTE CONSENSUS

ON THE COMMISSION.

(b) NO LATER THAN FEBRUARY 1 OF THE REDISTRICTING YEAR, FROM THE APPLICANTS IDENTIFIED IN

SUBSECTION (8)(a) OF THIS SECTION, THE PANEL SHALL CHOOSE BY LOT SIX APPLICANTS TO SERVE ON THE

COMMISSION AS FOLLOWS:

(I) TWO COMMISSIONERS WHO ARE NOT AFFILIATED WITH ANY POLITICAL PARTY;

(II) TWO COMMISSIONERS WHO ARE AFFILIATED WITH THE STATE'S LARGEST POLITICAL PARTY; AND

16 Amendment Y: Congressional Redistricting

(III) TWO COMMISSIONERS WHO ARE AFFILIATED WITH THE STATE'S SECOND LARGEST POLITICAL PARTY.

(c) IN THE PROCESS OF CHOOSING APPLICANTS BY LOT FOR APPOINTMENT TO THE COMMISSION, NO

APPLICANT WHOSE NAME IS CHOSEN MAY BE APPOINTED IF HE OR SHE IS REGISTERED TO VOTE IN A

CONGRESSIONAL DISTRICT THAT IS ALREADY REPRESENTED ON THE COMMISSION; EXCEPT THAT, WHEN ALL

THEN-EXISTING CONGRESSIONAL DISTRICTS IN COLORADO ARE REPRESENTED ON THE COMMISSION, A

CONGRESSIONAL DISTRICT MAY BE REPRESENTED BY A SECOND COMMISSIONER. NO CONGRESSIONAL DISTRICT

MAY BE REPRESENTED BY MORE THAN TWO COMMISSIONERS. ANY PERSONS WHOSE NAMES ARE CHOSEN BUT

DUPLICATE A CONGRESSIONAL DISTRICT'S REPRESENTATION ON THE COMMISSION AND ARE NOT APPOINTED TO

THE COMMISSION SHALL BE ELIGIBLE FOR APPOINTMENT PURSUANT TO SUBSECTIONS (9) AND (10) OF THIS

SECTION.

(9) (a) BY FEBRUARY 16 OF THE REDISTRICTING YEAR, THE MAJORITY LEADER OF THE STATE SENATE, THE

MINORITY LEADER OF THE STATE SENATE, THE MAJORITY LEADER OF THE STATE HOUSE OF REPRESENTATIVES,

AND THE MINORITY LEADER OF THE STATE HOUSE OF REPRESENTATIVES SHALL EACH SELECT A POOL OF TEN

APPLICANTS WHO ARE AFFILIATED WITH ONE OF THE STATE'S TWO LARGEST POLITICAL PARTIES FROM ALL

APPLICATIONS SUBMITTED TO NONPARTISAN STAFF AND NOTIFY THE PANEL OF THEIR SELECTIONS.

(b) AS DETERMINED BY THE LEGISLATIVE LEADERS IN SELECTING THEIR RESPECTIVE POOLS, THE APPLICANTS

SELECTED FOR EACH POOL MUST MEET THE QUALIFICATIONS SET FORTH IN SUBSECTION (2) OF THIS SECTION AND

DEMONSTRATE THE QUALITIES LISTED IN SUBSECTION (8)(a) OF THIS SECTION.

(c) FOR EACH CONGRESSIONAL DISTRICT NOT REPRESENTED BY A COMMISSIONER APPOINTED PURSUANT TO

SUBSECTIONS (8)(b) AND (8)(c) OF THIS SECTION, EACH POOL MUST CONSIST OF AT LEAST ONE APPLICANT WHO

IS REGISTERED TO VOTE IN THAT CONGRESSIONAL DISTRICT.

(d) IF THERE IS AN INSUFFICIENT NUMBER OF AVAILABLE APPLICANTS THAT MEET THE REQUIREMENTS OF

SUBSECTION (9)(b) OF THIS SECTION TO SELECT ANY COMPLETE POOL, THEN THE POOL MUST CONSIST OF ONLY

THOSE APPLICANTS WHO MEET THOSE REQUIREMENTS.

(10) BY MARCH 1 OF THE REDISTRICTING YEAR, THE PANEL OF JUDGES SHALL SELECT, IN SUCH ORDER AS

THE PANEL DETERMINES, ONE COMMISSIONER FROM EACH LEGISLATIVE LEADER'S POOL OF APPLICANTS AND TWO

COMMISSIONERS FROM THOSE APPLICANTS WHO ARE NOT AFFILIATED WITH ANY POLITICAL PARTY AND WHOSE

NAMES WERE RANDOMLY SELECTED BY LOT PURSUANT TO SUBSECTION (7) OF THIS SECTION. THE PANEL OF

JUDGES MUST ENSURE THAT THE COMMISSION INCLUDES FOUR COMMISSIONERS WHO ARE NOT AFFILIATED WITH

ANY POLITICAL PARTY, FOUR COMMISSIONERS WHO ARE AFFILIATED WITH THE STATE'S LARGEST POLITICAL PARTY,

AND FOUR COMMISSIONERS WHO ARE AFFILIATED WITH THE STATE'S SECOND LARGEST POLITICAL PARTY. THE

PANEL OF JUDGES MAY INTERVIEW APPLICANTS BEFORE MAKING THE APPOINTMENTS. IN SELECTING APPLICANTS,

THE PANEL SHALL, IN ADDITION TO CONSIDERING APPLICANTS' OTHER QUALIFICATIONS:

(a) TO THE EXTENT POSSIBLE, ENSURE THAT THE COMMISSION REFLECTS COLORADO'S RACIAL, ETHNIC,

GENDER, AND GEOGRAPHIC DIVERSITY;

(b) ENSURE THAT AT LEAST ONE COMMISSIONER IS REGISTERED TO VOTE IN EACH CONGRESSIONAL DISTRICT

BUT NO MORE THAN TWO COMMISSIONERS ARE REGISTERED TO VOTE IN ANY SINGLE CONGRESSIONAL DISTRICT;

(c) ENSURE THAT AT LEAST ONE COMMISSIONER RESIDES WEST OF THE CONTINENTAL DIVIDE; AND

(d) ENSURE THAT ALL COMMISSIONERS MEET THE QUALIFICATIONS SET FORTH IN SUBSECTION (2) OF THIS

SECTION AND DEMONSTRATE THE QUALITIES LISTED IN SUBSECTION (8)(a) OF THIS SECTION.

(11) (a) A COMMISSIONER'S POSITION ON THE COMMISSION WILL BE DEEMED VACANT IF HE OR SHE, HAVING

BEEN APPOINTED AS A REGISTERED ELECTOR WHO IS NOT AFFILIATED WITH A POLITICAL PARTY, AFFILIATES WITH A

POLITICAL PARTY BEFORE THE SUPREME COURT HAS APPROVED A PLAN PURSUANT TO SECTION 44.5 OF THIS

ARTICLE V. A COMMISSIONER'S POSITION ON THE COMMISSION WILL ALSO BE DEEMED VACANT IF HE OR SHE,

HAVING BEEN AFFILIATED WITH ONE OF THE STATE'S TWO LARGEST POLITICAL PARTIES AT THE TIME OF

APPOINTMENT, AFFILIATES WITH A DIFFERENT POLITICAL PARTY OR BECOMES UNAFFILIATED WITH ANY POLITICAL

PARTY BEFORE THE SUPREME COURT HAS APPROVED A PLAN PURSUANT TO SECTION 44.5 OF THIS ARTICLE V.

Amendment Y: Congressional Redistricting 17

ANALYSIS

(b) ANY VACANCY ON THE COMMISSION, INCLUDING ONE THAT OCCURS DUE TO DEATH, RESIGNATION,

REMOVAL, FAILURE TO MEET THE QUALIFICATIONS OF APPOINTMENT, REFUSAL OR INABILITY TO ACCEPT AN

APPOINTMENT, OR OTHERWISE, MUST BE FILLED AS SOON AS POSSIBLE BY THE DESIGNATED APPOINTING

AUTHORITY FROM THE DESIGNATED POOL OF ELIGIBLE APPLICANTS FOR THAT COMMISSIONER'S POSITION AND

IN THE SAME MANNER AS THE ORIGINALLY CHOSEN COMMISSIONER; EXCEPT THAT NO COMMISSIONER CHOSEN

TO FILL A VACANCY WILL BE BYPASSED FOR APPOINTMENT IF ALL CONGRESSIONAL DISTRICTS ARE ALREADY

REPRESENTED ON THE COMMISSION.

(12) FOR PURPOSES OF THIS SECTION, THE STATE'S TWO LARGEST POLITICAL PARTIES SHALL BE

DETERMINED BY THE NUMBER OF REGISTERED ELECTORS AFFILIATED WITH EACH POLITICAL PARTY IN THE

STATE ACCORDING TO VOTER REGISTRATION DATA PUBLISHED BY THE SECRETARY OF STATE FOR THE EARLIEST

DAY IN JANUARY OF THE REDISTRICTING YEAR FOR WHICH SUCH DATA IS PUBLISHED.

Section 44.2. Commission organization - procedures - transparency - voting requirements.

(1) Initial organization, officers, procedures, rules, and transparency. (a) THE GOVERNOR SHALL

CONVENE THE COMMISSION NO LATER THAN MARCH 15 OF THE REDISTRICTING YEAR AND APPOINT A TEMPORARY

CHAIRPERSON FROM THE COMMISSION'S MEMBERS. UPON CONVENING, THE COMMISSION SHALL ELECT A CHAIR

AND A VICE-CHAIR, WHO ARE NOT MEMBERS OF THE SAME POLITICAL PARTY, AND OTHER SUCH OFFICERS AS IT

DETERMINES.

(b) THE DIRECTOR OF RESEARCH OF THE LEGISLATIVE COUNCIL AND THE DIRECTOR OF THE OFFICE OF

LEGISLATIVE LEGAL SERVICES, OR THE DIRECTORS OF SUCCESSOR NONPARTISAN OFFICES OF THE GENERAL

ASSEMBLY, SHALL APPOINT NONPARTISAN STAFF FROM THEIR RESPECTIVE OFFICES AS NEEDED TO ASSIST THE

COMMISSION AND THE PANEL OF JUDGES AS DESCRIBED IN SECTION 44.1 OF THIS ARTICLE V. NONPARTISAN

STAFF SHALL ACQUIRE AND PREPARE ALL NECESSARY RESOURCES, INCLUDING COMPUTER HARDWARE,

SOFTWARE, AND DEMOGRAPHIC, GEOGRAPHIC, AND POLITICAL DATABASES, AS FAR IN ADVANCE AS NECESSARY TO

ENABLE THE COMMISSION TO BEGIN ITS WORK IMMEDIATELY UPON CONVENING.

(c) THE COMMISSION MAY RETAIN LEGAL COUNSEL IN ALL ACTIONS AND PROCEEDINGS IN CONNECTION WITH

THE PERFORMANCE OF ITS POWERS, DUTIES, AND FUNCTIONS, INCLUDING REPRESENTATION OF THE COMMISSION

BEFORE ANY COURT.

(d) THE GENERAL ASSEMBLY SHALL APPROPRIATE SUFFICIENT FUNDS FOR THE PAYMENT OF THE EXPENSES

OF THE COMMISSION, THE COMPENSATION AND EXPENSES OF NONPARTISAN STAFF, AND THE COMPENSATION AND

EXPENSES OF THE PANEL OF JUDGES AS DESCRIBED IN SECTION 44.1 OF THIS ARTICLE V. MEMBERS OF THE

COMMISSION SHALL BE REIMBURSED FOR THEIR REASONABLE AND NECESSARY EXPENSES AND MAY ALSO RECEIVE

SUCH PER DIEM ALLOWANCE AS MAY BE ESTABLISHED BY THE GENERAL ASSEMBLY. SUBJECT TO AVAILABLE

APPROPRIATIONS, HARDWARE AND SOFTWARE NECESSARY FOR THE DEVELOPMENT OF PLANS MAY, AT THE

REQUEST OF ANY COMMISSIONER, BE PROVIDED TO THE COMMISSIONER. THE COMMISSION AND ITS STAFF MUST

HAVE ACCESS TO STATISTICAL INFORMATION COMPILED BY THE STATE AND ITS POLITICAL SUBDIVISIONS AS

NECESSARY FOR ITS DUTIES. STATE AGENCIES AND POLITICAL SUBDIVISIONS SHALL COMPLY WITH REQUESTS

FROM THE COMMISSION AND ITS STAFF FOR SUCH STATISTICAL INFORMATION.

(e) THE COMMISSION SHALL ADOPT RULES TO GOVERN ITS ADMINISTRATION AND OPERATION. THE

COMMISSION MUST PROVIDE AT LEAST SEVENTY-TWO HOURS OF ADVANCE PUBLIC NOTICE OF ALL PROPOSED

RULES PRIOR TO CONSIDERATION FOR ADOPTION; EXCEPT THAT PROPOSED RULES MAY BE AMENDED DURING

COMMISSION DELIBERATIONS WITHOUT SUCH ADVANCE NOTICE OF SPECIFIC, RELATED AMENDMENTS. NEITHER

THE COMMISSION'S PROCEDURAL RULES NOR ITS MAPPING DECISIONS ARE SUBJECT TO THE "STATE

ADMINISTRATIVE PROCEDURE ACT", ARTICLE 4 OF TITLE 24, C.R.S., OR ANY SUCCESSOR STATUTE. RULES MUST

INCLUDE BUT NEED NOT BE LIMITED TO THE FOLLOWING:

(I) THE HEARING PROCESS AND REVIEW OF MAPS SUBMITTED FOR ITS CONSIDERATION;

(II) MAINTENANCE OF A RECORD OF THE COMMISSION'S ACTIVITIES AND PROCEEDINGS, INCLUDING A RECORD

OF WRITTEN AND ORAL TESTIMONY RECEIVED, AND OF THE COMMISSION'S DIRECTIONS TO NONPARTISAN STAFF ON

PROPOSED CHANGES TO ANY PLAN AND THE COMMISSION'S RATIONALE FOR SUCH CHANGES;

18 Amendment Y: Congressional Redistricting

(III) THE PROCESS FOR REMOVING COMMISSIONERS FOR PARTICIPATING IN COMMUNICATIONS PROHIBITED

UNDER THIS SECTION;

(IV) THE PROCESS FOR RECOMMENDING CHANGES TO PLANS SUBMITTED TO THE COMMISSION BY

NONPARTISAN STAFF; AND

(V) THE ADOPTION OF A STATEWIDE MEETING AND HEARING SCHEDULE, INCLUDING THE NECESSARY

ELEMENTS OF ELECTRONIC ATTENDANCE AT A COMMISSION HEARING.

(2) Voting requirements. A SIMPLE MAJORITY OF THE APPOINTED COMMISSIONERS MAY APPROVE RULES

AND PROCEDURAL DECISIONS. THE ELECTION OF THE COMMISSION'S CHAIR AND VICE-CHAIR REQUIRES THE

AFFIRMATIVE VOTE OF AT LEAST EIGHT COMMISSIONERS, INCLUDING THE AFFIRMATIVE VOTE OF AT LEAST ONE

COMMISSIONER WHO IS UNAFFILIATED WITH ANY POLITICAL PARTY. REMOVAL OF ANY COMMISSIONER AS

PROVIDED IN THIS SECTION REQUIRES THE AFFIRMATIVE VOTE OF AT LEAST EIGHT COMMISSIONERS, INCLUDING

THE AFFIRMATIVE VOTE OF AT LEAST TWO COMMISSIONERS WHO ARE UNAFFILIATED WITH ANY POLITICAL PARTY.

ADOPTION OF THE FINAL PLAN FOR SUBMISSION TO THE SUPREME COURT AND THE ADOPTION OF A REVISED PLAN

AFTER A PLAN IS RETURNED TO THE COMMISSION FROM THE SUPREME COURT REQUIRES THE AFFIRMATIVE VOTE

OF AT LEAST EIGHT COMMISSIONERS, INCLUDING THE AFFIRMATIVE VOTE OF AT LEAST TWO COMMISSIONERS WHO

ARE UNAFFILIATED WITH ANY POLITICAL PARTY. THE COMMISSION SHALL NOT VOTE UPON A FINAL PLAN UNTIL AT

LEAST SEVENTY-TWO HOURS AFTER IT HAS BEEN PROPOSED TO THE COMMISSION IN A PUBLIC MEETING OR AT

LEAST SEVENTY-TWO HOURS AFTER IT HAS BEEN AMENDED BY THE COMMISSION IN A PUBLIC MEETING, WHICHEVER

OCCURS LATER; EXCEPT THAT COMMISSIONERS MAY UNANIMOUSLY WAIVE THE SEVENTY-TWO HOUR

REQUIREMENT.

(3) Public involvement - hearing process. (a) ALL COLORADO RESIDENTS, INCLUDING INDIVIDUAL

COMMISSIONERS, MAY PRESENT PROPOSED REDISTRICTING MAPS OR WRITTEN COMMENTS, OR BOTH, FOR THE

COMMISSION'S CONSIDERATION.

(b) THE COMMISSION MUST, TO THE MAXIMUM EXTENT PRACTICABLE, PROVIDE OPPORTUNITIES FOR

COLORADO RESIDENTS TO PRESENT TESTIMONY AT HEARINGS HELD THROUGHOUT THE STATE. THE COMMISSION

SHALL NOT APPROVE A REDISTRICTING MAP UNTIL AT LEAST THREE HEARINGS HAVE BEEN HELD IN EACH

CONGRESSIONAL DISTRICT, INCLUDING AT LEAST ONE HEARING THAT IS HELD IN A LOCATION WEST OF THE

CONTINENTAL DIVIDE AND AT LEAST ONE HEARING THAT IS HELD IN A LOCATION EAST OF THE CONTINENTAL DIVIDE

AND EITHER SOUTH OF EL PASO COUNTY'S SOUTHERN BOUNDARY OR EAST OF ARAPAHOE COUNTY'S EASTERN

BOUNDARY. NO GATHERING OF COMMISSIONERS CAN BE CONSIDERED A HEARING FOR THIS PURPOSE UNLESS IT

IS ATTENDED, IN PERSON OR ELECTRONICALLY, BY AT LEAST TEN COMMISSIONERS. THE COMMISSION SHALL

ESTABLISH BY RULE THE NECESSARY ELEMENTS OF ELECTRONIC ATTENDANCE AT A COMMISSION HEARING.

(c) THE COMMISSION SHALL MAINTAIN A WEBSITE OR COMPARABLE MEANS OF COMMUNICATING WITH THE

PUBLIC THROUGH WHICH ANY COLORADO RESIDENT MAY SUBMIT PROPOSED MAPS OR WRITTEN COMMENTS, OR

BOTH, WITHOUT ATTENDING A HEARING OF THE COMMISSION.

(d) THE COMMISSION SHALL PUBLISH ALL WRITTEN COMMENTS PERTAINING TO REDISTRICTING ON ITS

WEBSITE OR COMPARABLE MEANS OF COMMUNICATING WITH THE PUBLIC AS WELL AS THE NAME OF THE

COLORADO RESIDENT SUBMITTING SUCH COMMENTS. IF THE COMMISSION OR NONPARTISAN STAFF HAVE A

SUBSTANTIAL BASIS TO BELIEVE THAT THE PERSON SUBMITTING SUCH COMMENTS HAS NOT TRUTHFULLY OR

ACCURATELY IDENTIFIED HIMSELF OR HERSELF, THE COMMISSION NEED NOT CONSIDER AND NEED NOT PUBLISH

SUCH COMMENTS BUT MUST NOTIFY THE COMMENTER IN WRITING OF THIS FACT. THE COMMISSION MAY WITHHOLD

COMMENTS, IN WHOLE OR IN PART, FROM THE WEBSITE OR COMPARABLE MEANS OF COMMUNICATING WITH THE

PUBLIC THAT DO NOT RELATE TO REDISTRICTING MAPS, POLICIES, OR COMMUNITIES OF INTEREST.

(e) THE COMMISSION SHALL PROVIDE SIMULTANEOUS ACCESS TO THE REGIONAL HEARINGS BY

BROADCASTING THEM VIA ITS WEBSITE OR COMPARABLE MEANS OF COMMUNICATING WITH THE PUBLIC AND

MAINTAIN AN ARCHIVE OF SUCH HEARINGS FOR ONLINE PUBLIC REVIEW.

Amendment Y: Congressional Redistricting 19

ANALYSIS

(4) Ethical obligations - transparency - lobbyist reporting. (a) COMMISSIONERS ARE

GUARDIANS OF THE PUBLIC TRUST AND ARE SUBJECT TO ANTIBRIBERY AND ABUSE OF PUBLIC OFFICE

REQUIREMENTS AS PROVIDED IN PARTS 3 AND 4 OF ARTICLE 8 OF TITLE 18, C.R.S., AS AMENDED, OR ANY

SUCCESSOR STATUTE.

(b) TO ENSURE TRANSPARENCY IN THE REDISTRICTING PROCESS:

(I) (A) THE COMMISSION AND THE COMMISSIONERS ARE SUBJECT TO OPEN MEETINGS REQUIREMENTS AS

PROVIDED IN PART 4 OF ARTICLE 6 OF TITLE 24, C.R.S., AS AMENDED, OR ANY SUCCESSOR STATUTE.

(B) EXCEPT AS PROVIDED IN SUBSECTION (4)(b)(I)(D) OF THIS SECTION, A COMMISSIONER SHALL NOT

COMMUNICATE WITH NONPARTISAN STAFF ON THE MAPPING OF CONGRESSIONAL DISTRICTS UNLESS THE

COMMUNICATION IS DURING A PUBLIC MEETING OR HEARING OF THE COMMISSION.

(C) EXCEPT FOR PUBLIC INPUT AND COMMENT, NONPARTISAN STAFF SHALL NOT HAVE ANY COMMUNICATIONS

ABOUT THE CONTENT OR DEVELOPMENT OF ANY PLAN OUTSIDE OF PUBLIC HEARINGS WITH ANYONE EXCEPT

OTHER STAFF MEMBERS. NONPARTISAN STAFF SHALL REPORT TO THE COMMISSION ANY ATTEMPT BY ANYONE TO

EXERT INFLUENCE OVER THE STAFF'S ROLE IN THE DRAFTING OF PLANS.

(D) ONE OR MORE NONPARTISAN STAFF MAY BE DESIGNATED TO COMMUNICATE WITH COMMISSIONERS

REGARDING ADMINISTRATIVE MATTERS, THE DEFINITION AND SCOPE OF WHICH SHALL BE DETERMINED BY THE

COMMISSION.

(E) ANY COMMISSIONER WHO PARTICIPATES IN A COMMUNICATION PROHIBITED IN THIS SECTION MUST BE

REMOVED FROM THE COMMISSION, AND SUCH VACANCY MUST BE FILLED WITHIN SEVEN DAYS.

(II) THE COMMISSION, EACH COMMISSIONER, AND NONPARTISAN STAFF ARE SUBJECT TO OPEN RECORDS

REQUIREMENTS AS PROVIDED IN PART 1 OF ARTICLE 72 OF TITLE 24, C.R.S., AS AMENDED, OR ANY SUCCESSOR

STATUTE; EXCEPT THAT MAPS IN DRAFT FORM AND NOT SUBMITTED TO THE COMMISSION ARE NOT PUBLIC

RECORDS SUBJECT TO DISCLOSURE. WORK PRODUCT AND COMMUNICATIONS AMONG NONPARTISAN STAFF ARE

SUBJECT TO DISCLOSURE ONCE A PLAN IS SUBMITTED TO THE SUPREME COURT.

(III) PERSONS WHO CONTRACT FOR OR RECEIVE COMPENSATION FOR ADVOCATING TO THE COMMISSION, TO

ONE OR MORE COMMISSIONERS, OR TO THE NONPARTISAN STAFF FOR THE ADOPTION OR REJECTION OF ANY MAP,

AMENDMENT TO A MAP, MAPPING APPROACH, OR MANNER OF COMPLIANCE WITH ANY OF THE MAPPING CRITERIA

SPECIFIED IN SECTION 44.3 OF THIS ARTICLE V ARE LOBBYISTS WHO MUST DISCLOSE TO THE SECRETARY OF

STATE ANY COMPENSATION CONTRACTED FOR, COMPENSATION RECEIVED, AND THE PERSON OR ENTITY

CONTRACTING OR PAYING FOR THEIR LOBBYING SERVICES. SUCH DISCLOSURE MUST BE MADE NO LATER THAN

SEVENTY-TWO HOURS AFTER THE EARLIER OF EACH INSTANCE OF SUCH LOBBYING OR ANY PAYMENT OF SUCH

COMPENSATION. THE SECRETARY OF STATE SHALL PUBLISH ON THE SECRETARY OF STATE'S WEBSITE OR

COMPARABLE MEANS OF COMMUNICATING WITH THE PUBLIC THE NAMES OF SUCH LOBBYISTS AS WELL AS THE

COMPENSATION RECEIVED AND THE PERSONS OR ENTITIES FOR WHOM THEY WORK WITHIN TWENTY-FOUR HOURS

OF RECEIVING SUCH INFORMATION. THE SECRETARY OF STATE SHALL ADOPT RULES TO FACILITATE THE

COMPLETE AND PROMPT REPORTING REQUIRED BY THIS SUBSECTION (4)(b)(III) AS WELL AS A COMPLAINT

PROCESS TO ADDRESS ANY LOBBYIST'S FAILURE TO REPORT A FULL AND ACCURATE DISCLOSURE, WHICH

COMPLAINT MUST BE HEARD BY AN ADMINISTRATIVE LAW JUDGE, WHOSE DECISION MAY BE APPEALED TO THE

COURT OF APPEALS.

Section 44.3. Criteria for determinations of congressional districts - definition. (1) IN ADOPTING

A CONGRESSIONAL REDISTRICTING PLAN, THE COMMISSION SHALL:

(a) MAKE A GOOD-FAITH EFFORT TO ACHIEVE PRECISE MATHEMATICAL POPULATION EQUALITY BETWEEN

DISTRICTS, JUSTIFYING EACH VARIANCE, NO MATTER HOW SMALL, AS REQUIRED BY THE CONSTITUTION OF THE

UNITED STATES. DISTRICTS MUST BE COMPOSED OF CONTIGUOUS GEOGRAPHIC AREAS;

20 Amendment Y: Congressional Redistricting

(b) COMPLY WITH THE FEDERAL "VOTING RIGHTS ACT OF 1965", 52 U.S.C. SEC. 50301, AS AMENDED.

(2) (a) AS MUCH AS IS REASONABLY POSSIBLE, THE COMMISSION'S PLAN MUST PRESERVE WHOLE

COMMUNITIES OF INTEREST AND WHOLE POLITICAL SUBDIVISIONS, SUCH AS COUNTIES, CITIES, AND TOWNS.

(b) DISTRICTS MUST BE AS COMPACT AS IS REASONABLY POSSIBLE.

(3) (a) THEREAFTER, THE COMMISSION SHALL, TO THE EXTENT POSSIBLE, MAXIMIZE THE NUMBER OF

POLITICALLY COMPETITIVE DISTRICTS.

(b) IN ITS HEARINGS IN VARIOUS LOCATIONS IN THE STATE, THE COMMISSION SHALL SOLICIT EVIDENCE

RELEVANT TO COMPETITIVENESS OF ELECTIONS IN COLORADO AND SHALL ASSESS SUCH EVIDENCE IN EVALUATING

PROPOSED MAPS.