SCHOOL OF DISTANCE EDUCATION

UNIVERSITY OF CALICUT

ADVANCED

CORPORATE ACCOUNTING

M.Com

II SEMESTER

SCHOOL OF DISTANCE EDUCATION

Calicut university P.O, Malappuram,

Kerala,India 673 635

2026

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 2

UNIVERSITY OF CALICUT

SCHOOL OF DISTANCE EDUCATION

STUDY MATERIAL

M.Com

II SEMESTER

Prepared By:

T.H.JAHFARALI

Assistant Professor

P.G. Department of Commerce

Government College Malappuram

Layout & Settings: Computer Section, SDE

©

Reserved

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 3

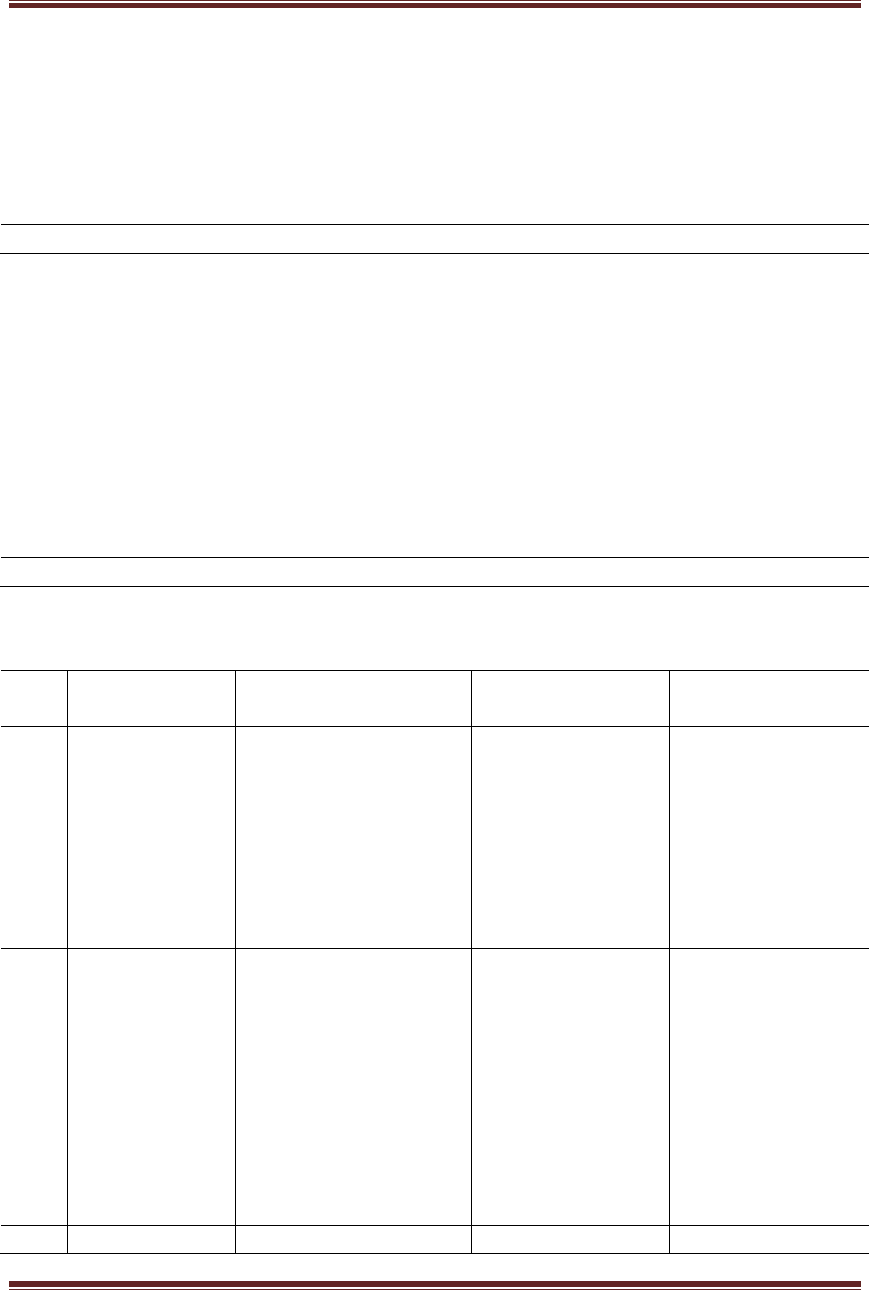

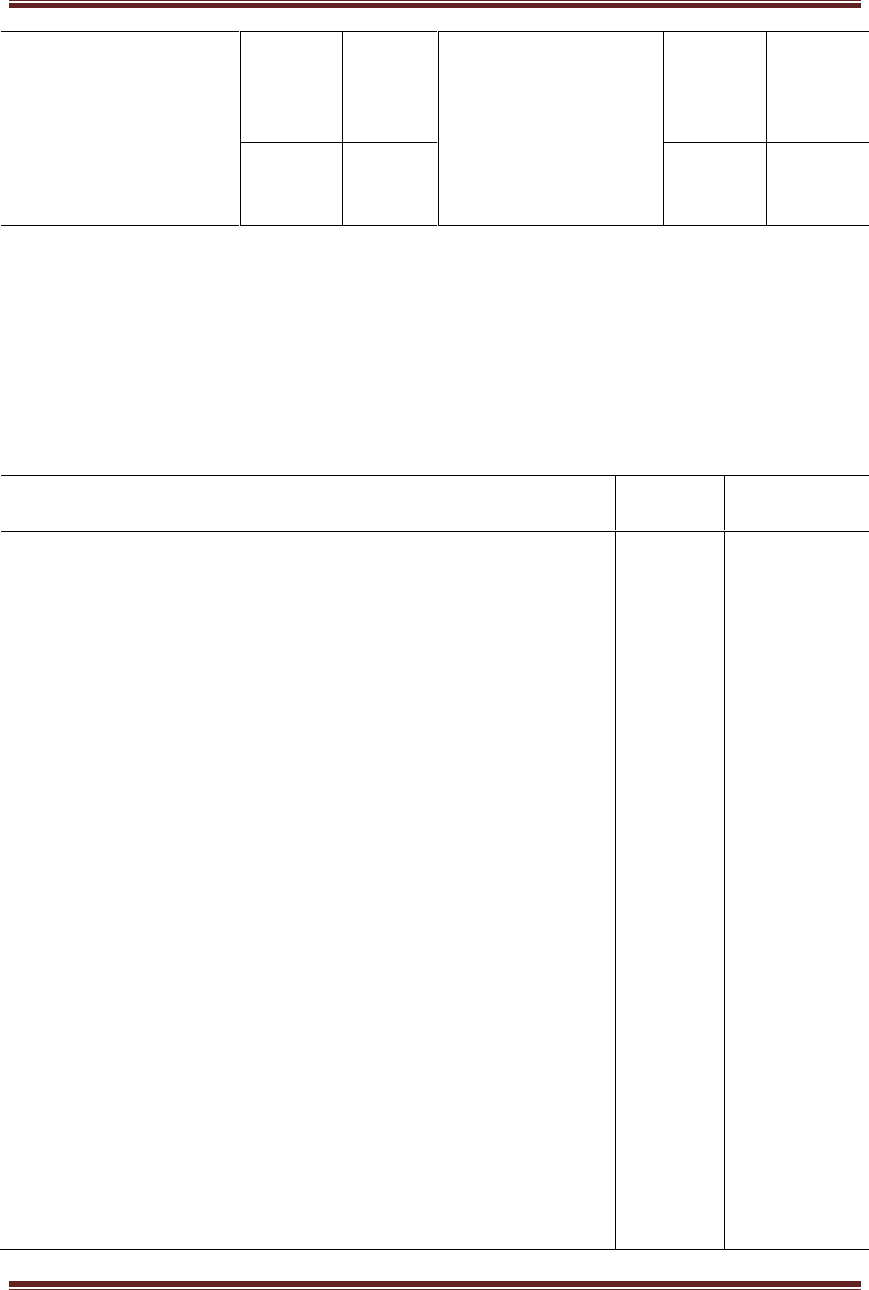

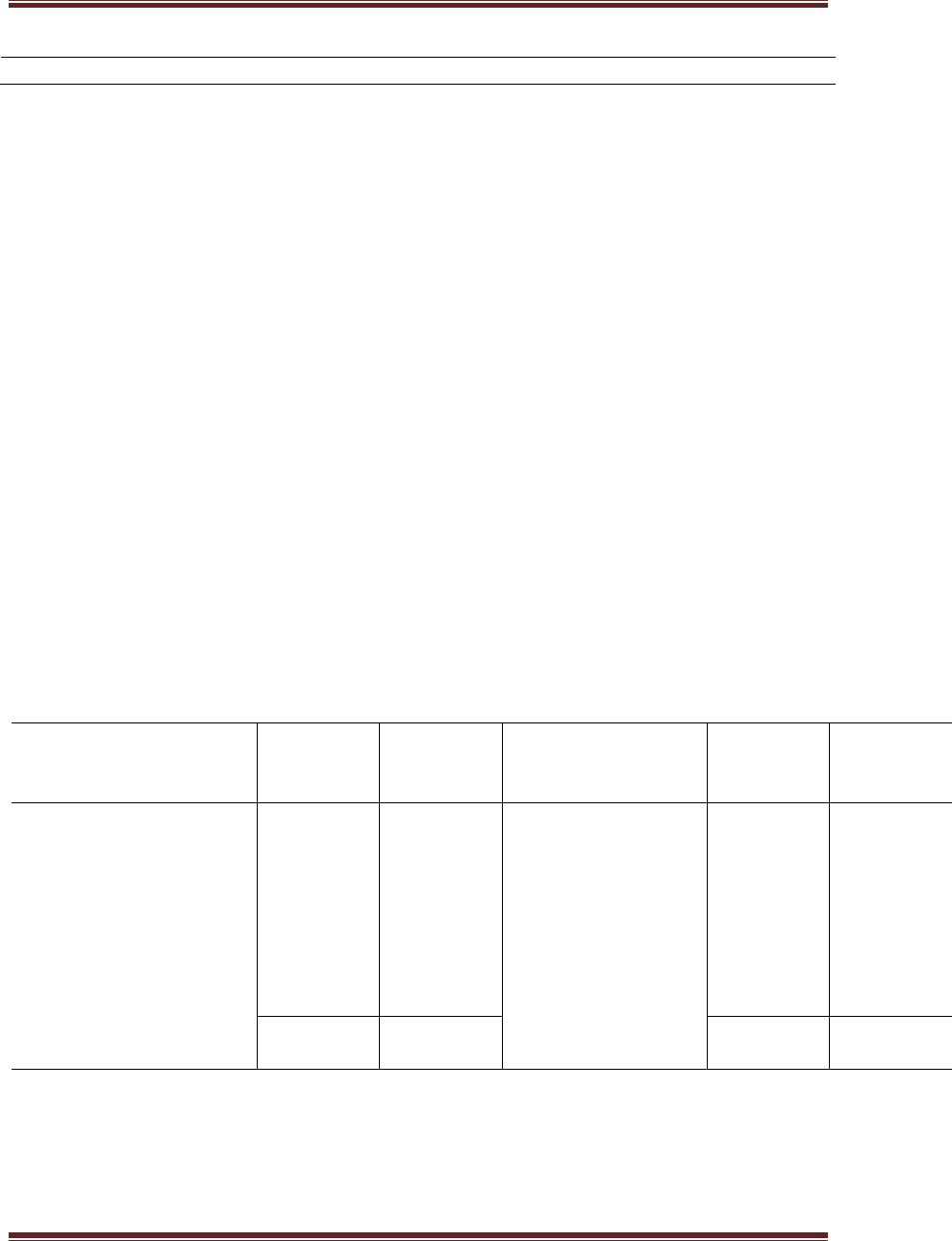

CONTENTS

Lesson

No.

Topic

Page No.

MODULE 1

1

INTERNATIONAL FINANCIAL

REPORTING STANDARDS (IFRS)

5 - 20

MODULE 2

2

ACCOUNTS OF HOLDING COMPANIES

21-61

MODULE 3

3

AMALGAMATION OF COMPANIES

62 -105

4

ACCOUNTING FOR INTERNAL

RECONSTRUCTION

5

LIQUIDATION OF COMPANIES

119-145

MODULE 4

6

VOYAGE ACCOUNTS

146 - 153

7

FARM ACCOUNTS

154 -163

MODULE 5

8

HUMAN RESOURCE ACCOUNTING

(HRA)

164 - 171

9

ACCOUNTING FOR PRICE LEVEL

CHANGES (INFLATION ACCOUNTING)

172-198

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 4

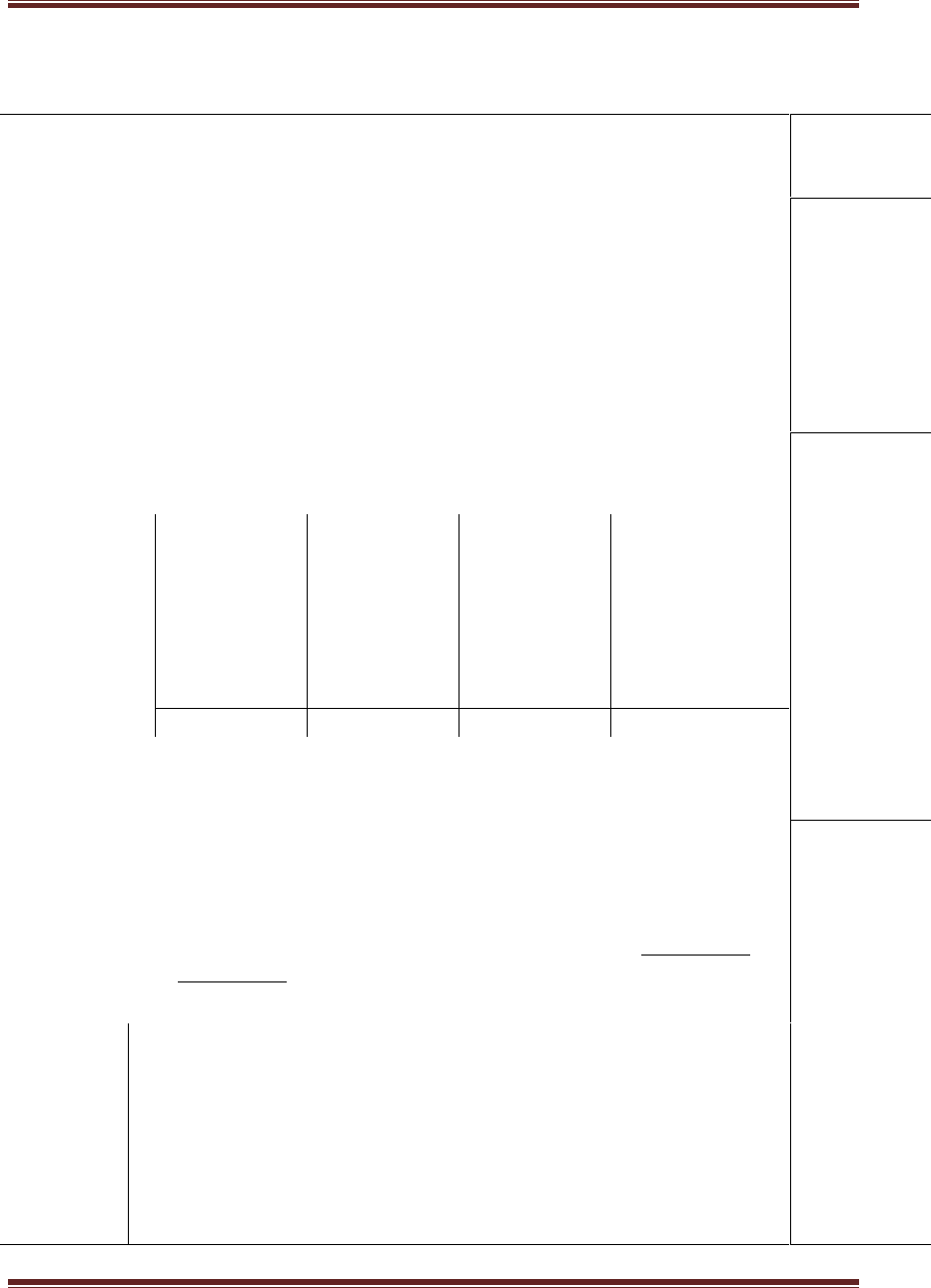

SYLLABUS

MC2C7 – ADVANCED CORPORATE ACCOUNTING

80 Hours Marks: 80

Objectives:

1. To provide theoretical knowledge of International Financial Reporting

Standards.

2. To enable the students to gain ability to solve problems relating to Holding

Company Accounts, Liquidation of Companies and various other Accounts

Module 1: International Financial Reporting Standards (IFRS): Introduction –

Meaning – Scope – An Overview of the International Financial Reporting Standards –

IFRS 1 to 13 – Role of IASB – Arguments for Global Convergence – Required

disclosure as per IFRS – Achievements of IASB and Obstacles in Convergence –

Difference between IFRS and Indian Accounting Standards – US GAAP.

15 Hours

Module 2: Accounting for Group companies – Holding Companies – Definition –

Accounts Consolidation – Preparation of Consolidated Balance Sheet – Minority

Interest – Pre-acquisition or Capital Profits – Cost of Control or Goodwill – Inter-

company Balance – Unrealised Inter-company profits – Revaluation of assets and

liabilities – Bonus Shares – Treatment of Dividend.

20 Hours

Module 3: Accounting for Corporate Restructuring - Internal –External – Merger and

acquisition – Accounting for liquidation of companies – Preparation of Statement of

Affairs – Deficiency/Surplus Account - Liquidator’s Final Statement of Account –

Receiver’s Statement of Accounts

25 Hours

Module 4: Voyage Accounts – Meaning of important terms – Voyage in Progress –

Farm Accounts – Characteristics – Advantages and Disadvantages – Final Accounts of

Farms

10 Hours

Module 5: Human Resources Accounting – Objectives – Methods of valuation -

Advantages and Disadvantages.

Accounting foe Price Level Changes – CPP – CCA and Hybrid.

10 Hours

(Theory and Problems may be in the ratio of 30% and 70% respectively)

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 5

MODULE – 1

INTERNATIONAL FINANCIAL REPORTING

STANDARDS (IFRS)

LESSON 1

INTERNATIONAL FINANCIAL REPORTING

STANDARDS (IFRS)

International Accounting Standards Board (IASB)

International Accounting Standards Board is an independent, privately – funded

accounting standard setter based in London. Contributors include major accounting

firms, private financial institutions, industrial companies throughout the world, central

and development banks, and other international and professional organisations.

In March 2001 the International Accounting Standards Committee (IASC)

Foundation was formed as a not for profit corporation incorporated in the USA. The

IASC Foundation is the parent entity of the IASB. In July 2010 it changed its name to

the International Financial Reporting Standards (IFRS) Foundation.

From April 2001the IASB assumed the accounting standard setting

responsibilities from the predecessor body, the International Accounting Standards

Committee (IASC). The 14 members of the IASB come from nine countries and have

a variety of backgrounds with a mix of auditors, preparers of financial statements,

users of financial statements and an academic.

Objectives of the IASB

The following are the formal objectives of the IASB:

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 6

1. Develop, in the public interest, a single set of high quality, understandable and

enforceable global accounting standards based on clearly articulated principles that

require high quality, transparent and comparable information in financial statements

and other financial reporting to help participants in the various capital markets of the

world and other users of the information to make economic decisions.

2. Promote the use and rigorous application of those standards.

3. Work actively with national standard-setters to bring about convergence of

national accounting standards and IFRSs to high quality solutions.

Role of the IASB

Under the IFRS Foundation Constitution, the IASB has complete responsibility

for all technical matters of the IFRS Foundation including: Full discretion in

developing and pursuing its technical agenda, subject to certain consultation

requirements with the Trustees and the public

a) The preparation and issuing of IFRSs (other than Interpretations) and exposure

drafts, following the due process stipulated in the Constitution

b) The approval and issuing of Interpretations developed by the IFRS

Interpretations Committee.

International Financial Reporting Standards (IFRS)

IFRS is a refined system of financial reporting which is going to benefit all the

stakeholders in the coming years, together with improved corporate governance and

increased free flow of capital across the globe.

International Financial Reporting Standards (IFRS) are a set of accounting

standards developed by the International Accounting Standards Board (IASB) that is

becoming the global standard for the preparation of public company financial

statements.

IFRS is sometimes confused with International Accounting Standards (IAS),

which are older standards that IFRS has now replaced. The goal of IFRS is to provide

a global framework for how public companies prepare and disclose their financial

statements. IFRS provides general guidance for the preparation of financial statements,

rather than setting rules for industry-specific reporting.

IFRS Foundation

The IFRS Foundation is the legal entity under which the International

Accounting Standards Board (IASB) operates. The Foundation is governed by a board

of 22 trustees. IFRS Foundation is the new name of International Accounting

Standards Committee (IASC), approved in January 2010.

IFRS Advisory Council

The IFRS Advisory Council is the formal advisory body to the IASB and the

Trustees of the IFRS Foundation. It consists of a wide range of representatives from

groups that are affected by and interested in the work of IASB. These include

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 7

investors, financial analysts and other users of financial statements, as well as

preparers, academics, auditors, regulators, professional accounting bodies and standard

setters. Members of the Advisory Council are appointed by the Trustees.

IFRS Interpretations Committee

The IFRS Interpretations Committee is the interpretive body of the IFRS

Foundation. Its mandate is to review on a timely basis widespread accounting issues

that have arisen within the context of current IFRSs. The work of IFRS Interpretations

Committee is aimed at reaching consensus on the appropriate accounting treatment

(IFRIC Interpretations) and providing authoritative guidance on those issues.

Importance of IFRS

The following are the major importance of International Financial Reporting

Standards:

a) A business can present its financial statements on the same basis as its foreign

competitors, making comparisons easier.

b) Companies with subsidiaries in countries that require or permit IFRS may be

able to use one accounting language company-wide.

c) Companies may need to convert to IFRS if they are a subsidiary of a foreign

company that must use IFRS, or if they have a foreign investor that must use IFRS.

d) Capital market regulators must be aware of only one set of accounting standards

and the companies will experience efficiency in raising capital and reduced

information processing cost.

e) The companies will no longer required to prepare its financial statement under

different GAAP and make the task of listing shares in foreign exchange easier.

List of the International Financial Reporting Standards (IFRSs)

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

IFRS 1

IFRS 2

IFRS 3

IFRS 4

IFRS 5

IFRS 6

IFRS 7

IFRS 8

IFRS 9

IFRS 10

IFRS 11

IFRS 12

IFRS 13

IFRS 14

IFRS 15

First-time Adoption of International Financial Reporting

Standards.

Share-based Payment.

Business Combinations.

Insurance Contracts.

Non-current Assets Held for Sale and Discontinued Operations.

Exploration for and Evaluation of Mineral Resources.

Financial Instruments: Disclosures.

Operating Segments.

Financial Instruments.

Consolidated Financial Statements.

Joint Arrangements.

Disclosure of Interest in Other Entities.

Fair Value Measurement.

Regulatory Deferral Accounts.

Revenue from Contracts with Customers.

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 8

Summary of IFRSs

The technical summary of important IFRSs is as under:

IFRS 1 - First-time Adoption of International Financial Reporting Standards

This IFRS was issued at 1 January 2013. The objective of this IFRS is to ensure

that an entity’s first IFRS financial statements, and its interim financial reports for part

of the period covered by those financial statements, contain high quality information

that: (a) is transparent for users and comparable over all periods presented; (b)

provides a suitable starting point for accounting in accordance with International

Financial Reporting Standards (IFRSs); and (c) can be generated at a cost that does not

exceed the benefits.

An entity shall prepare and present an opening IFRS statement of financial

position at the date of transition to IFRSs. This is the starting point for its accounting

in accordance with IFRSs. An entity shall use the same accounting policies in its

opening IFRS statement of financial position and throughout all periods presented in

its first IFRS financial statements. Those accounting policies shall comply with each

IFRS effective at the end of its first IFRS reporting period.

The IFRS requires disclosures that explain how the transition from previous

GAAP to IFRSs affected the entity’s reported financial position, financial performance

and cash flows.

IFRS 2 - Share-based Payment

IFRS 2 was issued at 1 January 2012. The objective of this IFRS is to specify

the financial reporting by an entity when it undertakes a share-based payment

transaction. The IFRS requires an entity to recognise share-based payment transactions

in its financial statements, including transactions with employees or other parties to be

settled in cash, other assets, or equity instruments of the entity. There are no

exceptions to the IFRS, other than for transactions to which other Standards apply.

This also applies to transfers of equity instruments of the entity’s parent, or

equity instruments of another entity in the same group as the entity, to parties that have

supplied goods or services to the entity.

The IFRS prescribes various disclosure requirements to enable users of financial

statements to understand: (a) the nature and extent of share-based payment

arrangements that existed during the period; (b) how the fair value of the goods or

services received, or the fair value of the equity instruments granted, during the period

was determined; and (c) the effect of share-based payment transactions on the entity’s

profit or loss for the period and on its financial position.

IFRS 3 - Business Combination

This states that all business combinations are accounted for using purchase

accounting, with limited exceptions. A business combination is to bringing together of

separate entities or business into one reporting entity. A business can be operated

managed for the purpose of providing return to investors or lower costs. An entity in

its development stage can meet the definition of a business. In some cases the legal

subsidiary is identified as the acquirer for accounting purposes (reverse

acquisition).The date of acquisition is the date on which effective control is transferred

to the acquirer. The cost of acquisition is the amount of cash equivalents paid, plus the

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 9

fair value of other purchase considerations given, plus any cost directly attributable to

the acquisition.

The fair values of securities issued by the acquirer are determined at the date of

exchange. Costs directly attributable to the acquisition may be internal costs but

cannot be general administrative costs. There is no requirement for directly

attributable cost to be incremental.

IFRS 4 - Insurance Contracts

IFRS 4 was issued at 1 January 2013. The objective of this IFRS is to specify

the financial reporting for insurance contracts by any entity that issues such contracts

(described in this IFRS as an insurer) until the Board completes the second phase of its

project on insurance contracts. In particular, this IFRS requires: (a) limited

improvements to accounting by insurers for insurance contracts. (b) Disclosure that

identifies and explains the amounts in an insurer’s financial statements arising from

insurance contracts and helps users of those financial statements understand the

amount, timing and uncertainty of future cash flows from insurance contracts.

An insurance contract is a contract under which one party (the insurer) accepts

significant insurance risk from another party (the policyholder) by agreeing to

compensate the policyholder if a specified uncertain future event (the insured event)

adversely affects the policyholder. The IFRS applies to all insurance contracts

(including reinsurance contracts) that an entity issues and to reinsurance contracts that

it holds, except for specified contracts covered by other IFRSs.

The IFRS permits an insurer to change its accounting policies for insurance

contracts only if, as a result, its financial statements present information that is more

relevant and no less reliable, or more reliable and no less relevant. In particular, an

insurer cannot introduce any of the following practices, although it may continue using

accounting policies that involve them: (a) measuring insurance liabilities on an

undiscounted basis. (b) Measuring contractual rights to future investment management

fees at an amount that exceeds their fair value as implied by a comparison with current

fees charged by other market participants for similar services. (c) Using non-uniform

accounting policies for the insurance liabilities of subsidiaries.

The IFRS requires disclosure to help users understand: (a) the amounts in the

insurer’s financial statements that arise from insurance contracts. (b) The nature and

extent of risks arising from insurance contracts.

IFRS 5 - Non-current Assets Held for Sale and Discontinued Operations

This IFRS was issued at 1 January 2013. The objective of this IFRS is to specify

the accounting for assets held for sale, and the presentation and disclosure of

discontinued operations. In particular, the IFRS requires: (a) assets that meet the

criteria to be classified as held for sale to be measured at the lower of carrying amount

and fair value less costs to sell, and depreciation on such assets to cease; (b) an asset

classified as held for sale and the assets and liabilities included within a disposal group

classified as held for sale to be presented separately in the statement of financial

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 10

position; and (c) the results of discontinued operations to be presented separately in the

statement of comprehensive income.

The IFRS: (a) adopts the classification ‘held for sale’. (b) Introduces the concept

of a disposal group, being a group of assets to be disposed of, by sale or otherwise,

together as a group in a single transaction, and liabilities directly associated with those

assets that will be transferred in the transaction. (c) Classifies an operation as

discontinued at the date the operation meets the criteria to be classified as held for sale

or when the entity has disposed of the operation.

An entity shall classify a non-current asset (or disposal group) as held for sale if

its carrying amount will be recovered principally through a sale transaction rather than

through continuing use.

A discontinued operation is a component of an entity that either has been

disposed of, or is classified as held for sale, and (a) represents a separate major line of

business or geographical area of operations, (b) is part of a single co-ordinated plan to

dispose of a separate major line of business or geographical area of operations or (c) is

a subsidiary acquired exclusively with a view to resale.

IFRS 6 - Explorations for and Evaluation of Mineral Resources

IFRS 6 was issued at 1 January 2012. The objective of this IFRS is to specify

the financial reporting for the exploration for and evaluation of mineral resources.

Exploration and evaluation expenditures are expenditures incurred by an entity in

connection with the exploration for and evaluation of mineral resources before the

technical feasibility and commercial viability of extracting a mineral resource are

demonstrable. Exploration for and evaluation of mineral resources is the search for

mineral resources, including minerals, oil, natural gas and similar non-regenerative

resources after the entity has obtained legal rights to explore in a specific area, as well

as the determination of the technical feasibility and commercial viability of extracting

the mineral resource. Exploration and evaluation assets are exploration and evaluation

expenditures recognised as assets in accordance with the entity’s accounting policy.

An entity shall determine an accounting policy for allocating exploration and

evaluation assets to cash- generating units or groups of cash-generating units for the

purpose of assessing such assets for impairment. Each cash-generating unit or group

of units to which an exploration and evaluation asset is allocated shall not be larger

than an operating segment determined in accordance with IFRS 8 Operating Segments.

An entity shall disclose information that identifies and explains the amounts

recognised in its financial statements arising from the exploration for and evaluation of

mineral resources.

IFRS 7 - Financial Instruments: Disclosures

This IFRS was issued at 1 January 2012. The objective of this IFRS is to require

entities to provide disclosures in their financial statements that enable users to

evaluate: (a) the significance of financial instruments for the entity’s financial

position and performance; and (b) the nature and extent of risks arising from financial

instruments to which the entity is exposed during the period and at the end of the

reporting period, and how the entity manages those risks. The qualitative disclosures

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 11

describe management’s objectives, policies and processes for managing those risks.

The quantitative disclosures provide information about the extent to which the entity is

exposed to risk, based on information provided internally to the entity’s key

management personnel. Together, these disclosures provide an overview of the

entity’s use of financial instruments and the exposures to risks they create.

The IFRS applies to all entities, including entities that have few financial

instruments (e.g. a manufacturer whose only financial instruments are accounts

receivable and accounts payable) and those that have many financial instruments (e.g.

a financial institution most of whose assets and liabilities are financial instruments).

When this IFRS requires disclosures by class of financial instrument, an entity

shall group financial instruments into classes that are appropriate to the nature of the

information disclosed and that take into account the characteristics of those financial

instruments. An entity shall provide sufficient information to permit reconciliation to

the line items presented in the statement of financial position.

IFRS 8 - Operating Segments

IFRS 8 was issued at 1 January 2013. An entity shall disclose information to

enable users of its financial statements to evaluate the nature and financial effects of

the business activities in which it engages and the economic environments in which it

operates.

This IFRS shall apply to: (a) the separate or individual financial statements of

an entity: (i) whose debt or equity instruments are traded in a public market (a

domestic or foreign stock exchange or an over-the-counter market, including local and

regional markets), or (ii) that files, or is in the process of filing, its financial statements

with a securities commission or other regulatory organisation for the purpose of

issuing any class of instruments in a public market; and (b) the consolidated financial

statements of a group with a parent: (i) whose debt or equity instruments are traded in

a public market (a domestic or foreign stock exchange or an over-the-counter market,

including local and regional markets), or (ii) that files, or is in the process of filing, the

consolidated financial statements with a securities commission or other regulatory

organisation for the purpose of issuing any class of instruments in a public market.

The IFRS requires an entity to report a measure of operating segment profit or

loss and of segment assets. It also requires an entity to report a measure of segment

liabilities and particular income and expense items if such measures are regularly

provided to the chief operating decision maker. It requires reconciliations of total

reportable segment revenues, total profit or loss, total assets, liabilities and other

amounts disclosed for reportable segments to corresponding amounts in the entity’s

financial statements.

IFRS 9 - Financial Instruments

IFRS 9 was issued in July 2014.IFRS 9 is built on a logical, single classi

fi

cation

and measurement approach for

fi

nancial assets that re

fl

ects the business model in

which they are managed and their cash

fl

ow characteristics.

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 12

Built upon this is a forward-looking expected credit loss model that will result

in more timely recognition of loan losses and is a single model that is applicable to all

financial instruments subject to impairment accounting. In addition, IFRS 9 addresses

the so-called ‘own credit’ issue, whereby banks and others book gains through pro

fi

t

or loss as a result of the value of their own debt falling due to a decrease in credit

worthiness when they have elected to measure that debt at fair value. The Standard

also includes an improved hedge accounting model to better link the economics of risk

management with its accounting treatment.

IFRS 10 - Consolidated Financial Statements

IFRS 10 was issued at 1 January 2013.The objective of this IFRS is to establish

principles for the presentation and preparation of consolidated financial statements

when an entity controls one or more other entities. To meet the objective, this IFRS:

(a) requires an entity (the parent) that controls one or more other entities (subsidiaries)

to present consolidated financial statements; (b) defines the principle of control, and

establishes control as the basis for consolidation; (c) sets out how to apply the

principle of control to identify whether an investor controls an investee and therefore

must consolidate the investee; and (d) sets out the accounting requirements for the

preparation of consolidated financial statements.

Consolidated financial statements are the financial statements of a group in

which the assets, liabilities, equity, income, expenses and cash flows of the parent and

its subsidiaries are presented as those of a single economic entity. The IFRS requires

an entity that is a parent to present consolidated financial statements. The IFRS

defines the principle of control and establishes control as the basis for determining

which entities are consolidated in the consolidated financial statements.

When preparing consolidated financial statements, an entity must use uniform

accounting policies for reporting like transactions and other events in similar

circumstances. Intragroup balances and transactions must be eliminated. Non-

controlling interests in subsidiaries must be presented in the consolidated statement of

financial position within equity, separately from the equity of the owners of the parent.

IFRS 11 - Joint Arrangements

IFRS 11 was issued in May 2011. It establishes principles for the financial

reporting by parties to a joint arrangement. IFRS 11 improves the accounting for joint

arrangements by introducing a principle- based approach that requires a party to a joint

arrangement to recognise its rights and obligations arising from the arrangement. Such

a principle-based approach will provide users with greater clarity about an entity’s

involvement in its joint arrangements by increasing the verifiability, comparability and

understandability of the reporting of these arrangements.

The disclosure requirements allow users to gain a better understanding of the

nature, extent and financial effects of the activities that an entity carries out through

joint arrangements. The disclosure requirements for joint arrangements have been

placed in IFRS 12 Disclosure of Interests in Other Entities.

IFRS 12 - Disclosure of Interests in Other Entities

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 13

IFRS 12 applies to entities those have an interest in subsidiaries, joint

arrangements, associates and unconsolidated structured entities.

IFRS 12 does not apply to: (a) Post-employment benefit plans or other long-

term employee benefit plans to which IAS 19 Employee Benefits applies , (b) Separate

financial statements, where IAS 27 Separate Financial Statements applies , (c) An

interest held by an entity that participates in, but does not have joint control or

significant influence over, a joint arrangement , and (d) Interests accounted for in

accordance with IFRS 9 Financial Instruments, except for interests in an associate or

joint venture measured at fair value as required by IAS 28 Investments in Associates

and Joint Ventures.

IFRS 13 - Fair Value Measurement

IFRS 13 was issued at 1 January 2013. This IFRS (a) defines fair value; (b) sets

out in a single IFRS a framework for measuring fair value; and (c) requires disclosures

about fair value measurements.

The IFRS applies to IFRSs that require or permit fair value measurements or

disclosures about fair value measurements (and measurements, such as fair value less

costs to sell, based on fair value or disclosures about those measurements), except in

specified circumstances.

A fair value measurement assumes that a financial or non-financial liability or

an entity’s own equity instrument (e.g. equity interests issued as consideration in a

business combination) is transferred to a market participant at the measurement date.

The transfer of a liability or an entity’s own equity instrument assumes the

following: (a) A liability would remain outstanding and the market participant

transferee would be required to fulfil the obligation. The liability would not be settled

with the counterparty or otherwise extinguished on the measurement date. (b) An

entity’s own equity instrument would remain outstanding and the market participant

transferee would take on the rights and responsibilities associated with the instrument.

The instrument would not be cancelled or otherwise extinguished on the measurement

date.

An entity shall disclose information that helps users of its financial statements

assess both of the following: (a) for assets and liabilities that are measured at fair

value on a recurring or non-recurring basis in the statement of financial position after

initial recognition, the valuation techniques and inputs used to develop those

measurements. (b) for recurring fair value measurements using significant

unobservable inputs (Level 3), the effect of the measurements on profit or loss or other

comprehensive income for the period.

Scope of the International Financial Reporting Standards

a) IFRSs are not intended to be applied to immaterial items and they are not

retrospective.

b) Within each individual country local regulations govern, to a greater or lesser

degree, the issue of financial statements.

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 14

c) IFRSs concentrate on essentials and are designed not to be too complex;

otherwise they would be impossible to apply on a worldwide basis.

d) IFRSs do not override local regulations on financial statements.

Advantages of the IFRS

a) The world's economies are becoming more integrated and having one

accounting system will make life a little less complicated for both the companies and

the investors.

b) As multinational businesses continue to grow and expand, a thorough

knowledge of IFRS is now essential for internationally active, growing businesses.

c) There seems to be worldwide consensus surrounding the need for one global set

of high-quality accounting standards and that IFRS is currently best positioned to fulfil

that need.

d) In today's global economy the consistency of one reporting standard will make

it more efficient for investors to research and compare financial statements globally

and more effectively.

e) IFRS adoption leads to higher market liquidity, more investment flows through

foreign mutual funds, and more favourable terms in private debt contracting, greater

analyst coverage, and lower stock return synchronicity.

Disadvantages of the IFRS

a) Even if the IFRS is implemented, there would still be differences in financial

reporting, and financial statements would not be “identical” because of the differences

in national laws, economic conditions, and objectives.

b) The environmental factors such as culture, language, and legal system affect

how IFRS is applied.

c) The differing backgrounds of the people in numerous countries applying IFRS

means that interpretative differences will arise because of different historical practices.

d) If some countries interpret the IFRS differently than other countries, the

financial statements between those countries would not be comparable.

e) The audit fees of public accounting firms increase after the transition to IFRS.

f) The costs of application by companies, such as changing the internal systems to

make it compatible with the new reporting standards, training costs and etc., are

increased.

g) It will take a substantial amount of time to convert to IFRS completely,

depending on the size of the company.

Requirements of the IFRS

A complete set of financial statements, includes the following components, is

required under IFRS:

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 15

a) A Statement of Financial Position as at the end of the reporting period.

b) A Statement of Profit or Loss and Other Comprehensive Income for the

reporting period.

c) A Statement of Changes in Equity (SOCE) for the reporting period.

d) A Cash Flow Statement or Statement of Cash Flows for the reporting period.

e) Notes comprising a summary of significant accounting policies and other

explanatory information.

f) A Statement of financial position at the beginning of the earliest comparative

period when an entity applies an accounting policy retrospectively or makes a

retrospective restatement of items in its financial statements, or when it reclassifies

items in its financial statements.

Convergence between IFRSs and US GAAP

The IASB and the US Financial Accounting Standards Board (FASB) have been

working together since 2002 to achieve convergence of IFRSs and US Generally

Accepted Accounting Principles (GAAP). A common set of high quality global

standards remains a priority of both the IASB and the FASB.

In September 2002 the IASB and the FASB agreed to work together, in

consultation with other national and regional bodies, to remove the differences

between international standards and US GAAP. This decision was embodied in a

Memorandum of Understanding (MoU) between the boards known as the Norwalk

Agreement. The boards’ commitment was further strengthened in 2006 when the

IASB and FASB set specific milestones to be reached by 2008.

In the light of progress achieved by the boards and other factors, the US

Securities and Exchange Commission (SEC) removed in 2007 the requirement for

non-US companies registered in the US to reconcile their financial reports with US

GAAP if their accounts complied with IFRSs as issued by a proposed road map on

adoption of IFRSs for domestic US companies.

In 2008 the two boards issued an update to the MoU, which identified a series

of priorities and milestones, emphasising the goal of joint projects to produce

common, principle based standards.

The Group of 20 Leaders (G20) called for standard setters to re-double their

efforts to complete convergence in global accounting standards. Following this

request, in November 2009the IASB and FASB published a progress report describing

and intensification of their work programme, including the hosting of monthly joint

board meetings and to provide quarterly updates on their progress on convergence

projects.

In April 2012 the IASB and FASB published a joint progress report in which

they describe the progress made on financial instruments, including a joint expected

loss impairment (‘provisioning’) approach and a more converged approach to

classification and measurement.

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 16

In February 2013 the IASB and FASB published a high level update on the

status and timeline of the remaining convergence projects. The report includes an

update on the impairment phase of the joint project on financial instruments.

The listed companies of European Union State including UK, France and

Germany, have adopted IFRS since 2005. The process of converging towards IFRS is

still going on in India.

IFRS in India

IFRS convergence, in recent years, had gained momentum in this world. As the

capital markets become increasingly global in nature, more and more investors see the

need for a common set of accounting standards.

India being one of the global players, migration to IFRS will enable Indian

entities to have access to international capital markets without having to go through

the cumbersome conversion and filing process. It will lower the cost of raising funds,

reduce accountants’’ fees and enable faster access to all major capital markets.

Furthermore it will facilitate companies to set targets and milestones based on a global

business environment rather than an inward perspective.

Furthermore, convergence to IFRS, by various group entities, will enable

management to bring all components of the group into a single financial reporting

platform. This will eliminate the need for multiple reports and significant adjustment

for preparing consolidated financial statements or filing financial statements in

different stock exchanges.

Benefits of IFRS over the Indian GAAP

The following are the reasons for adoption of IFRS inspite of Indian GAAP:

1. Improve transparency in accounting system.

2. Globally accepted.

3. New opportunity.

4. Allows exercise of professional judgement.

5. IFRS are increasingly being recognised as Global Reporting Standards for

financial statements.

6. Indian GAAP is becoming rare because it has some limitations in comparison

with IFRS.

7. As global capital markets become increasingly integrated, many countries are

adopting IFRs.

8. More than 100 countries already permit the use of IFRS in their countries.

Benefits of IFRS in India

The following are the benefits to India by the implementation of IFRS:

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 17

1. It would benefit the economy by increasing the growth of international business.

2. It would encourage foreign investment which results in foreign capital inflows

into the country.

3. It would reduce the cost of compliance.

4. IFRS would open many opportunities for the professionals to serve the

international clients.

Challenges in implementation of IFRS in India

There are certain challenges in implementation of IFRS in India. They include:

1. Increase in cost initially due to dual reporting requirement, which entity might

have to meet till the full convergence is achieved.

2. Current accounting framework in India is deeply affected by laws and

regulations. It is required to make amendments in various laws and regulations.

3. All stakeholders, employees, auditors, regulators, tax authorities etc. would

need to aware about IFRS. They need to be trained.

4. Organisations would incur additional costs for modifying their current

accounting procedures for meeting the new disclosures and reporting requirements.

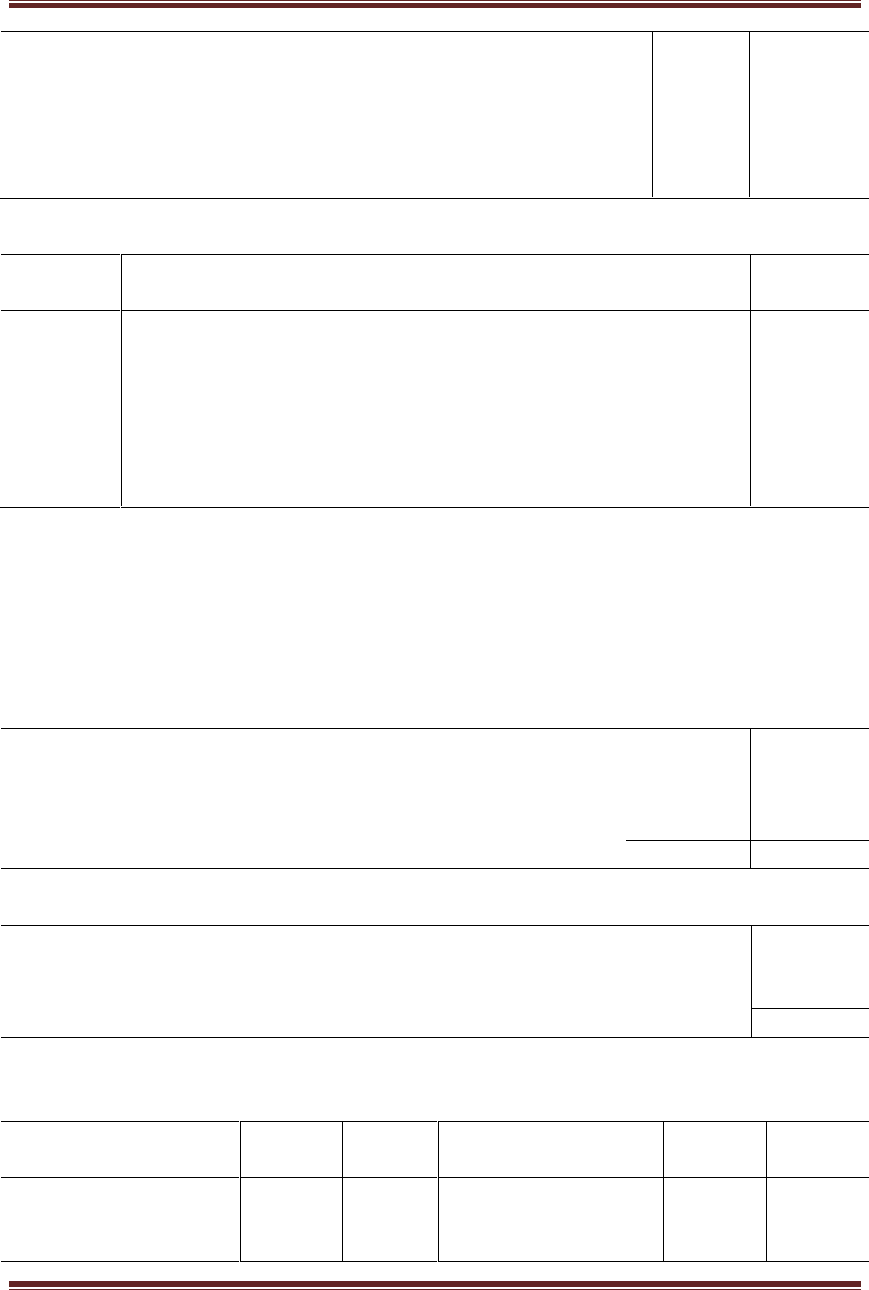

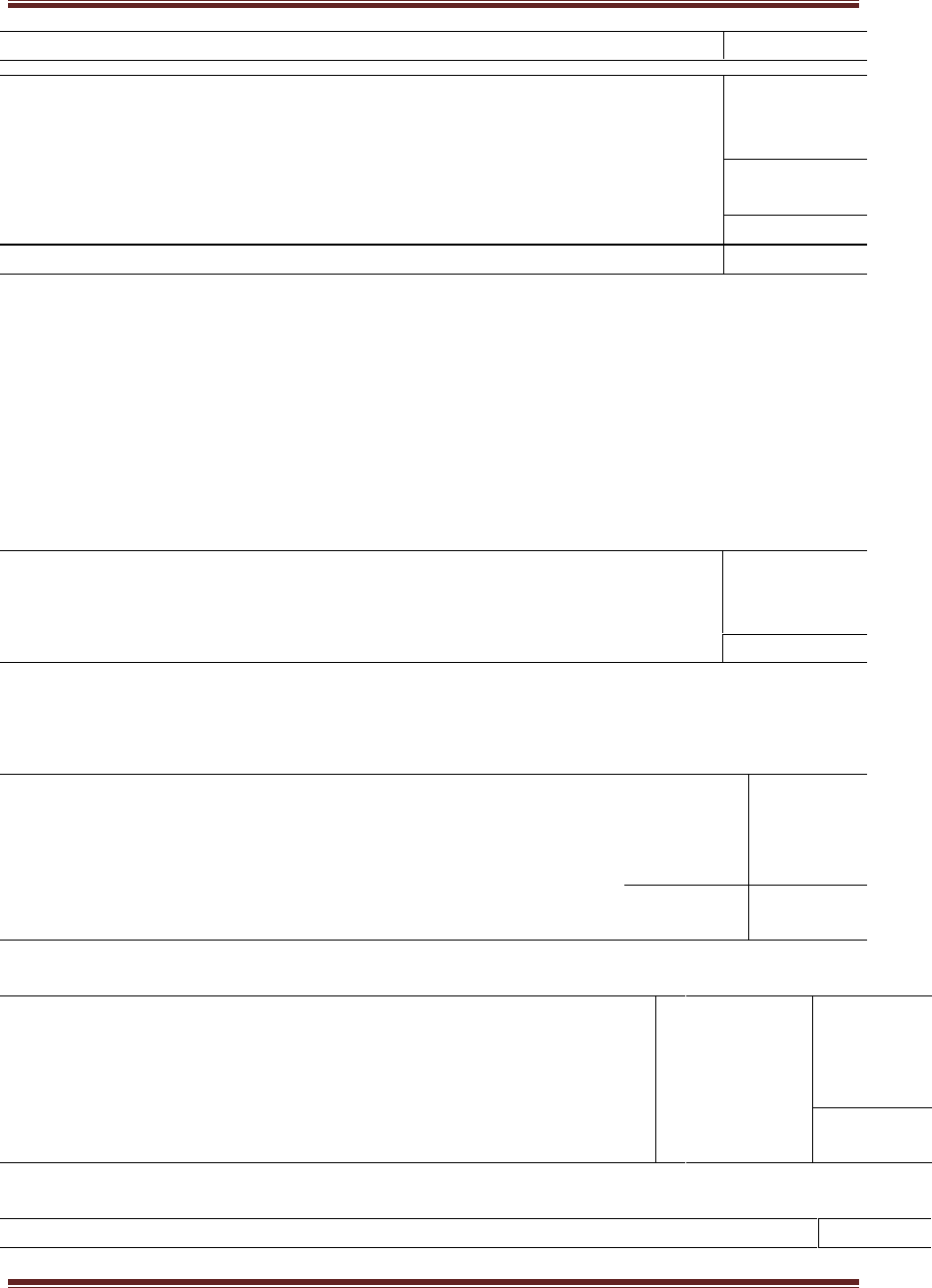

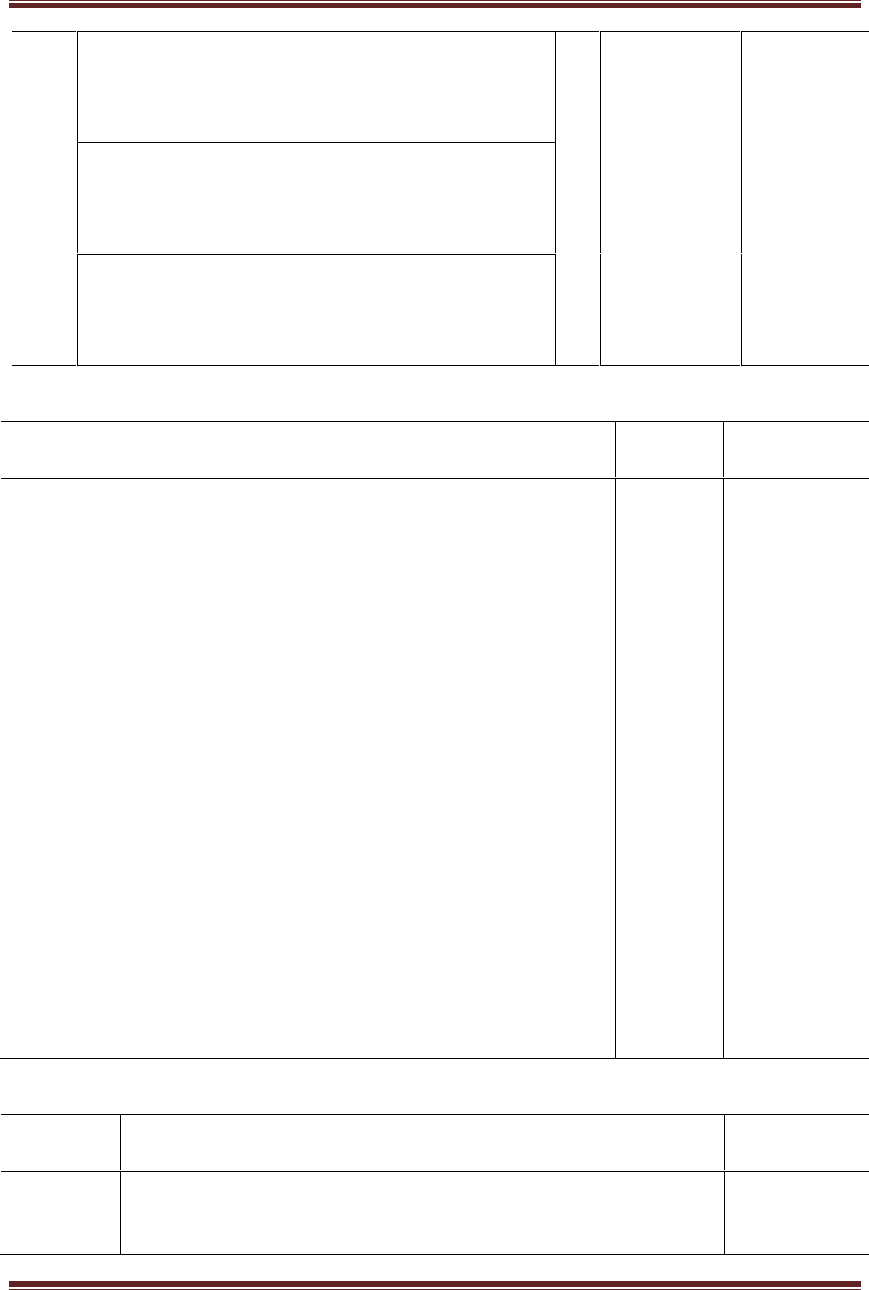

Comparison of IFRS with US GAAP and Indian GAAP

The following are the important similarities and differences between IFRS, US

GAAP and Indian GAAP:

Sl.

No.

Subject

IFRS

US GAAP

Indian GAAP

1.

Historical

Cost

Generally uses

historical cost, but

intangible assets,

property, plant and

equipment (PPE) and

investment property

may be revalued to

fair value.

No revaluation

except for

certain types of

financial

instruments.

Uses historical

cost, but

property, plant

and equipment

(PPE) may be

revalued to fair

value.

2.

First-time

adoption of

accounting

frameworks

Full retrospective

application of all

IFRSs effective at

the reporting date for

an entity’s first IFRS

financial statements,

with some optional

exemptions and

limited mandatory

exceptions.

First-time

adoption of US

GAAP requires

retrospective

application.

Similar to US

GAAP.

3.

Components

Two years’

Similar to IFRS,

Single-entity

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 18

of Financial

Statements

consolidated balance

sheets, income

statements, cash

flow statements,

changes in equity

and accounting

policies and notes.

except three

years required

for SEC

registrants

(public

companies) for

all statements

except balance

sheet

parent company

(standalone) two

years’ balance

sheets, income

statements, cash

flow statements

and accounting

policies and

notes.

4.

Balance Sheet

Does not prescribe a

particular format. A

liquidity presentation

of assets and

liabilities used

instead of a current

or non-current

presentation, only

when a liquidity

presentation

provides more

relevant and reliable

information.

Entities may

present either a

classified or non-

classified

balance sheet.

Items on the face

of balance sheet

are generally

presented in

decreasing order

of liquidity.

Accounting

standards do not

prescribe a

particular format;

certain items

must be

presented on the

face of the

balance sheet.

5.

Income

Statement

Does not prescribe a

standard format,

although expenditure

is presented in one of

two formats

(function or nature).

Present as either

a single step or

multiple step

format.

Expenditures are

presented by

function.

Does not

prescribe a

standard format;

but certain

income and

expenditure

items are

disclosed in

accordance with

accounting

standards and the

Companies Act.

6.

Cash Flow

Statements –

Format and

Method

Standard headings,

but limited guidance

on contents. Direct

or indirect method is

used.

Similar headings

to IFRS, but

more specific

guidance for

items included in

each category.

Direct or indirect

method is used.

Similar to IFRS.

However,

indirect method

is required for

listed companies

and direct

method or

insurance

companies.

7.

Cash Flow

Cash includes cash

Similar to IFRS,

Similar to US

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 19

Statements –

Definition of

Cash and cash

equivalents

equivalents with

maturities of three

months or less from

the date of

acquisition and may

include bank

overdrafts.

except that bank

overdrafts are

excluded.

GAAP.

8.

Revenue

Recognition

Based on several

criteria, which

require the

recognition of

revenue when risks

and rewards and

control have been

transferred and the

revenue can be

measured reliably.

Similar to IFRS

in principle,

based on four

key criteria.

Extensive

detailed

guidance exists

for specific types

of transactions.

Similar to IFRS

conceptually,

although several

differences in

detail.

9.

Depreciation

Associated on

systematic basis to

each accounting

period over the

useful life of the

asset.

Similar to IFRS.

Similar to IFRS,

except where the

useful life is

shorter as

envisaged under

the Companies

Act or the

relevant statute,

the depreciation

is computed by

applying a higher

rate.

10.

Property ,

Plant and

Equipment

(PPE)

Historical cost or

revalued amounts are

used. Regular

valuations of entire

classes of assets are

required when

revaluation option is

chosen.

Historical cost is

used;

revaluations are

not permitted.

Historical cost is

used.

Revaluations are

permitted.

However, no

requirement on

frequency of

revaluation.

11.

Inventories

Carried at lower of

cost and net

realisable value.

FIFO or weighted

average method is

used to determine

cost. LIFO is

Similar to IFRS;

However, use of

LIFO is

permitted.

Similar to IFRS.

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 20

prohibited.

12.

Contingencies

Disclose

unrecognised

possible losses and

probable gains.

Similar to IFRS.

Similar to IFRS,

except that

contingent gains

are neither

recognised nor

disclosed.

REVIEW QUESTIONS

A. Short Answer Type questions

1. What do you mean by IFRS?

2. Write a note on IFRS Advisory Council.

3. What do you understand by IFRS Interpretations Committee?

4. Write a note on IFRS Foundation.

5. List any four IFRSs.

B. Essay Type Questions

1. Discuss the objectives and roles of IASB.

2. Write a note on scope, merits and demerits of IFRS.

3. Briefly explain any five IFRSs.

4. How can you distinguish the IFRS and US GAAP?

5. Give a note on IFRS in India.

6. Write an essay on convergence between IFRSs and US GAAP.

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 21

MODULE – 2

ACCOUNTING FOR GROUP

COMPANIES

(ACCOUNTS OF HOLDING

COMPANIES)

LESSON 2

ACCOUNTS OF HOLDING COMPANIES

Holding Companies

A holding company is the company that holds either the whole of the share

capital or a majority of the shares in one or more companies so as to have a controlling

interest in such companies. Such other companies are known as subsidiary companies.

Unlike in amalgamation or absorption, the subsidiary companies retain their identities

because they do businesses in their own names.

Group of Companies

A Holding company together with its Subsidiaries can be called as the Group of

companies.

Need for Group of Companies

The following are the advantages for a company to operate as a group:

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 22

1. Decentralisation of financial risk: If one entity fails, it does not affect the other

companies in the group. The other companies can continue even if one or two

companies in the group fail.

2. Lawful obligation: In some cases, the formation of a subsidiary company is a

legal requirement.

3. Diversification possible at lower cost: One company acquires controlling

interest of another company. It helps the company to diversify its business activities at

least cost.

4.

Legal Definition

Subsidiary Company– Sec 2(87) of the Companies Act 2013 defines a company. As

per this section,a company shall be deemed to be a subsidiary company of another if

and only if:

(a) that other company controls the composition of its board of directors ; or

(b) when the first mentioned company is another company, holds more than half in

nominal value of its equity share capital; or

(c) the company is a subsidiary of any company which is that other company’s

subsidiary.

A Subsidiary company may be either Wholly Owned Subsidiary or Partly

Owned Subsidiary.

Accounts

The following documents in respect of a subsidiary or subsidiaries should be

attached with the balance sheet of a holding company:

(a) A copy of Balance Sheet of Subsidiary.

(b) A copy of its Statement of Profit and Loss.

(c) A copy of Report of its Board of Directors.

(d) A copy of Report of its Auditors.

(e) A Statement of Holding Company’s interest in Subsidiary.

According to section 129(3) of the Companies Act 2013, a holding company

shall prepare a consolidated financial statement of the company and of all the

subsidiaries in the same form and manner as that of its own, which shall also be laid

before the annual general meeting of the company along with the laying of its financial

statements.

Consolidated Balance Sheet

In addition to the legal balance sheet as prescribed in Schedule III, the holding

company may also publish a Consolidated Balance Sheet in which the assets and

liabilities of all the subsidiaries are shown along with its own assets and liabilities as

the Balance Sheet of a head office incorporates the assets and liabilities of its

branches. By way of Consolidated Balance Sheet, the investments of the holding

company in the subsidiary company are replaced by net assets.

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 23

Minority Interest

When some of the shares of the subsidiary company are held by outsiders (other

than the holding company), their interest in the subsidiary company is called as

Minority Interest in subsidiary company. The minority interest is shown on the

liabilities side of the Balance Sheet of the holding company under the head ‘Share

Capital’. The minority interest can be calculated as follows:

Paid up value of shares held by outsiders xxx

Add: Proportionate share of capital/ revenue profit and/or reserves xxx

xxx

Less: Proportionate share of capital/ revenue losses xxx

Value of Minority Interest xxx

If the preference shares are held by outsiders, paid up value of such shares

together with dividend thereon(if there is profit)is added to the value of minority

interest.

Cost of Control (Goodwill) or Capital Reserve

If the holding company purchases the shares of the subsidiary company at a

price more than their paid up value, the excess is cost of control or goodwill, if there is

no reserve or profit or loss balance in the subsidiary company on date of acquisition of

shares of the subsidiary company.

If the shares are purchased at a price which is less than the paid up value of the

shares, the difference is taken as capital reserve or profit.

The goodwill or cost of control is shown on the assets sideand the capital

reserve or profit is shown on the liabilities sidein the Consolidated Balance Sheet.

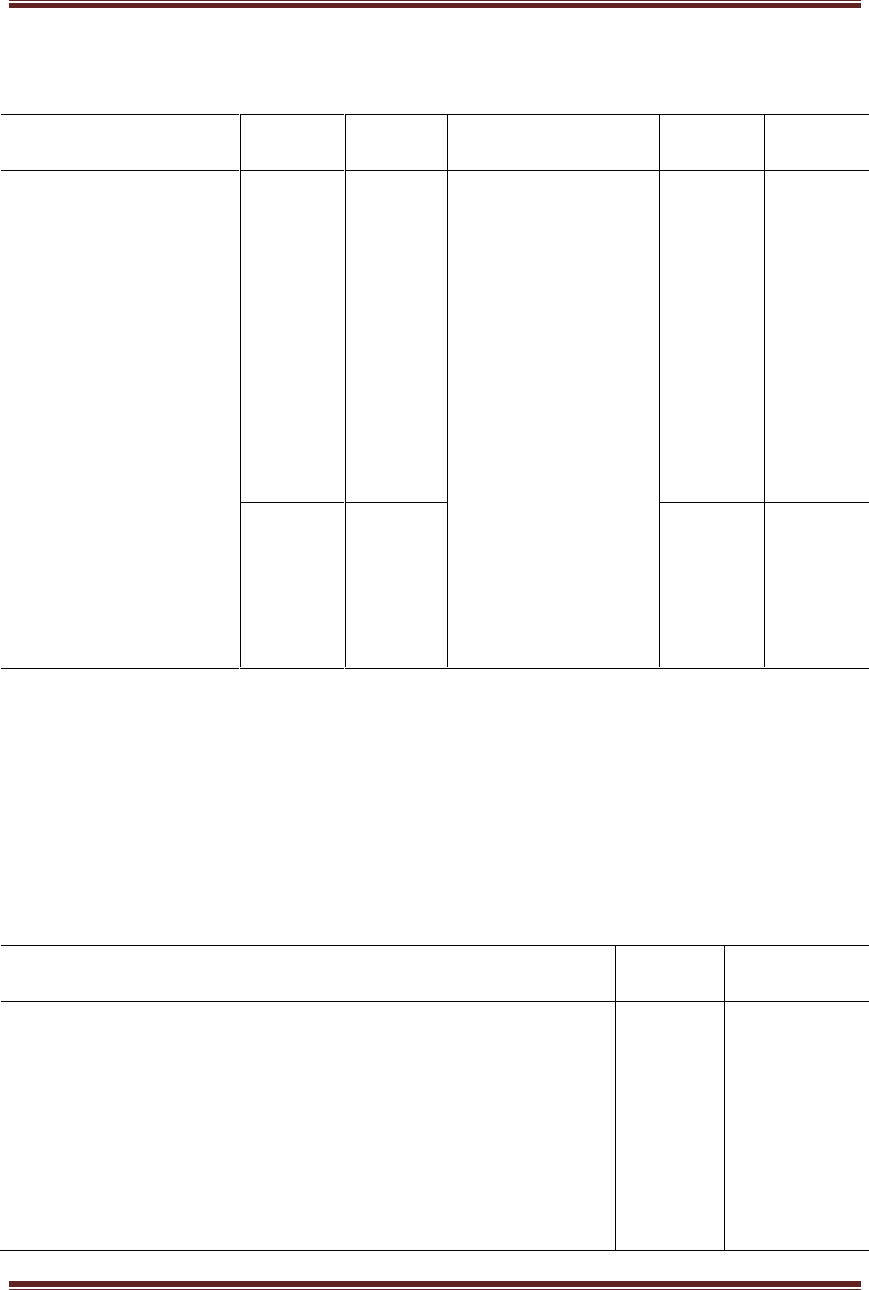

Illustration 1: The following are the liabilities and assets of the holding company H

Ltd. and its subsidiary S Ltd. as on 31

st

December 2014:

Liabilities

H Ltd.

Rs.

S Ltd.

Rs.

Assets

H Ltd.

Rs.

S Ltd.

Rs.

Share Capital:

Shares of Rs. 10

each

Profit and Loss

Account

General Reserve

Current Liabilities

400000

80000

40000

40000

200000

20000

16000

4000

Sundry Assets

Investments:

20000 shares in S

Ltd.

260000

300000

240000

560000

240000

560000

240000

H Ltd. acquired the shares of S Ltd. on 31

st

December 2014. Prepare the

Consolidated Balance Sheet.

Solution:

Consolidated Balance Sheet of H Ltd. and its Subsidiary S Ltd.

as on 31

st

December 2014

Particulars

Note

No.

Amount

(Rs.)

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 24

A. Equity and Liabilities

Shareholders’ Fund

a. Share Capital

b. Reserves and Surplus

Current Liabilities

H Ltd. 40000

S Ltd. 4000

Total

B. Assets

Non-current Assets

Fixed Assets

Tangible Assets – Sundry Assets

H Ltd. 260000

S Ltd. 240000

Intangible Assets – Goodwill

Current Assets

Total

1

2

400000

120000

44000

564000

500000

64000

Nil

564000

Notes to Accounts

Note No.

Particulars

Amount

(Rs.)

1.

2.

Share Capital

Issued and Subscribed

40000 Equity shares of Rs. 10 each

Reserves and Surplus

General Reserve

P & L A/c

400000

40000

80000

120000

Working Note:

Calculation of Goodwill or Cost of Control:

Cost of Shares in S Ltd.

Less: Face value of shares in S Ltd.

Profit and Loss Account

General Reserve

Goodwill or Cost of Control

Rs.

200000

20000

16000

Rs.

300000

236000

64000

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 25

Illustration 2: The liabilities and assets of the holding company A Ltd. and its

subsidiary B Ltd. as on 31

st

December 2014 are as follows:

Liabilities

A Ltd.

Rs.

B Ltd.

Rs.

Assets

A Ltd.

Rs.

B Ltd.

Rs.

Share Capital:

Shares of Re. 1

each

Profit and Loss

Account

General Reserve

Current Liabilities

72000

18000

12000

63000

36000

12000

6000

18000

Sundry Assets

Investments:

36000 shares in B

Ltd.

120000

45000

72000

165000

72000

165000

72000

A Ltd. acquired the shares in B Ltd. on 31

st

December 2014. Prepare the

Consolidated Balance Sheet.

Solution:

Consolidated Balance Sheet of A Ltd. and its Subsidiary B Ltd.

as on 31

st

December 2014

Particulars

Note

No.

Amount

(Rs.)

A. Equity and Liabilities

Shareholders’ Fund

a. Share Capital

b. Reserves and Surplus

Current Liabilities

A Ltd. 63000

B Ltd. 18000

Total

B. Assets

Non-current Assets

Fixed Assets

Tangible Assets – Sundry Assets

A Ltd. 120000

B Ltd. 72000

Intangible Assets

Current Assets

Total

1

2

72000

39000

81000

192000

192000

Nil

Nil

192000

Notes to Accounts

Note No.

Particulars

Amount

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 26

(Rs.)

1.

2.

Share Capital

Issued and Subscribed

72000 Equity shares of Re. 1 each

Reserves and Surplus

Capital Reserve

General Reserve

P & L A/c

72000

9000

18000

12000

39000

Working Note:

Calculation of Capital Reserve:

Cost of Shares in B Ltd.

Less: Face value of shares in B Ltd.

Profit and Loss Account

General Reserve

Capital Reserve

Rs.

36000

12000

6000

Rs.

45000

54000

9000

Illustration 3: The following are the liabilities and assets of the holding company P

Ltd. and its subsidiary Q Ltd. as on 31

st

December 2014. P Ltd. acquired 12000 shares

in Q Ltd on 31

st

December 2014. Prepare the Consolidated Balance Sheet.

Liabilities

P Ltd.

Rs.

Q Ltd.

Rs.

Assets

P Ltd.

Rs.

Q Ltd.

Rs.

Share Capital:

Shares of Re. 1

each

Sundry Liabilities

36000

24000

15000

9000

Sundry Assets

Investments:

12000 shares in Q

Ltd.

48000

12000

24000

60000

24000

60000

24000

Solution:

Share of holdings by P Ltd.in Q Ltd. = 12000 shares out of 15000 shares = 80%

Share of holdings by Outsiders in Q Ltd. = 3000 shares out of 15000 shares = 20%

Consolidated Balance Sheet of P Ltd. and its Subsidiary Q Ltd.

as on 31

st

December 2014

Particulars

Note

No.

Amount

(Rs.)

A. Equity and Liabilities

Shareholders’ Fund

a. Share Capital

b. Reserves and Surplus

Minority Interest

Current Liabilities

P Ltd. 24000

1

36000

Nil

3000

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 27

Q Ltd. 9000

Total

B. Assets

Non-current Assets

Fixed Assets

Tangible Assets – Sundry Assets

P Ltd. 48000

Q Ltd. 24000

Intangible Assets

Current Assets

Total

33000

72000

72000

Nil

Nil

72000

Notes to Accounts

Note No.

Particulars

Amount

(Rs.)

1.

Share Capital

Issued and Subscribed

36000 Equity shares of Re. 1 each

36000

Working Note:

Calculation of Minority Interest = 3000 shares of Re. 1 each

= Rs. 3000

Pre-Acquisition Profits or Capital Profits

Any profit or reserve standing in the Balance Sheet of subsidiary company on

the date of purchase of shares by holding company is called pre-acquisition profit or

capital profit. The outsiders’ share of such capital profit is added to the minority

interest and the balance (to holding company) are shown as Capital Reserve or

adjusted in Cost of Control or Goodwill and shown in the Consolidated Balance Sheet.

Any losses, share of loss of outsiders is deducted from the minority interest and

the share of loss to the holding company is added to the Cost of Control or Goodwill

or deducted from the Capital Reserve, and shown in the Consolidated Balance Sheet.

Post-Acquisition Profits or Revenue Profits

Profits of the subsidiary company made after the date of purchase of shares in

the subsidiary company by the holding company are called as post-acquisition profits

or revenue profits. The share of revenue profit of the holding company is added to the

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 28

profit of the holding company. The share of profit due to the outsiders in the

subsidiary company is added to the minority interest and shown in the Consolidated

Balance Sheet.

• The date of purchase of shares in the subsidiary company by the holding

company is the basis for determination of profit, whether it is Capital Profit or

Revenue Profit.

Illustration 4: The following are the liabilities and assets of the holding company H

Ltd. and its subsidiary S Ltd. as on 31

st

December 2014:

Liabilities

H Ltd.

Rs.

S Ltd.

Rs.

Assets

H Ltd.

Rs.

S Ltd.

Rs.

Share Capital:

Shares of Rs. 10

each

Profit and Loss

Account

Current Liabilities

800000

80000

80000

400000

40000

40000

Sundry Assets

Investments:

32000 shares in S

Ltd.

@ Rs. 10 each

640000

320000

480000

960000

480000

960000

480000

H Ltd. acquired the shares in S Ltd. on 31

st

December 2014. Prepare the

Consolidated Balance Sheet.

Solution:

Share of holdings by H Ltd.in S Ltd. = 32000 shares out of 40000 shares = 80%

Share of holdings by Outsiders in S Ltd. = 8000 shares out of 40000 shares = 20%

Consolidated Balance Sheet of H Ltd. and its Subsidiary S Ltd.

as on 31

st

December 2014

Particulars

Note

No.

Amount

(Rs.)

A. Equity and Liabilities

Shareholders’ Fund

a. Share Capital

b. Reserves and Surplus

Minority Interest

Current Liabilities

H Ltd. 80000

S Ltd. 40000

Total

B. Assets

Non-current Assets

Fixed Assets

Tangible Assets – Sundry Assets

H Ltd. 640000

S Ltd. 480000

1

2

800000

112000

88000

120000

1120000

1120000

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 29

Intangible Assets

Current Assets

Total

Nil

Nil

1120000

Notes to Accounts

Note No.

Particulars

Amount

(Rs.)

1.

2.

Share Capital

Issued and Subscribed

80000 Equity shares of Rs. 10 each

Reserves and Surplus

Capital Reserve

P & L A/c

800000

32000

80000

112000

Working Notes:

Calculation of Capital Profit:

Profit and Loss Account balance in S Ltd. = Rs. 40000

Share of capital profit due to H Ltd. = 40000x80% = Rs. 32000

Share of capital profit due to Outsiders in S Ltd. = 40000x20% = Rs. 8000

Calculation of Capital Reserve:

Cost of Shares in S Ltd.

Less: Face value of shares in S Ltd.

Capital Profit

Capital Reserve

Rs.

320000

32000

Rs.

320000

352000

32000

Calculation of Minority Interest:

Paid up value of Shares held by outsiders in S Ltd. (8000 x10)

Add: Share of capital profit due to Outsiders in S Ltd.

Minority Interest

Rs.

80000

8000

88000

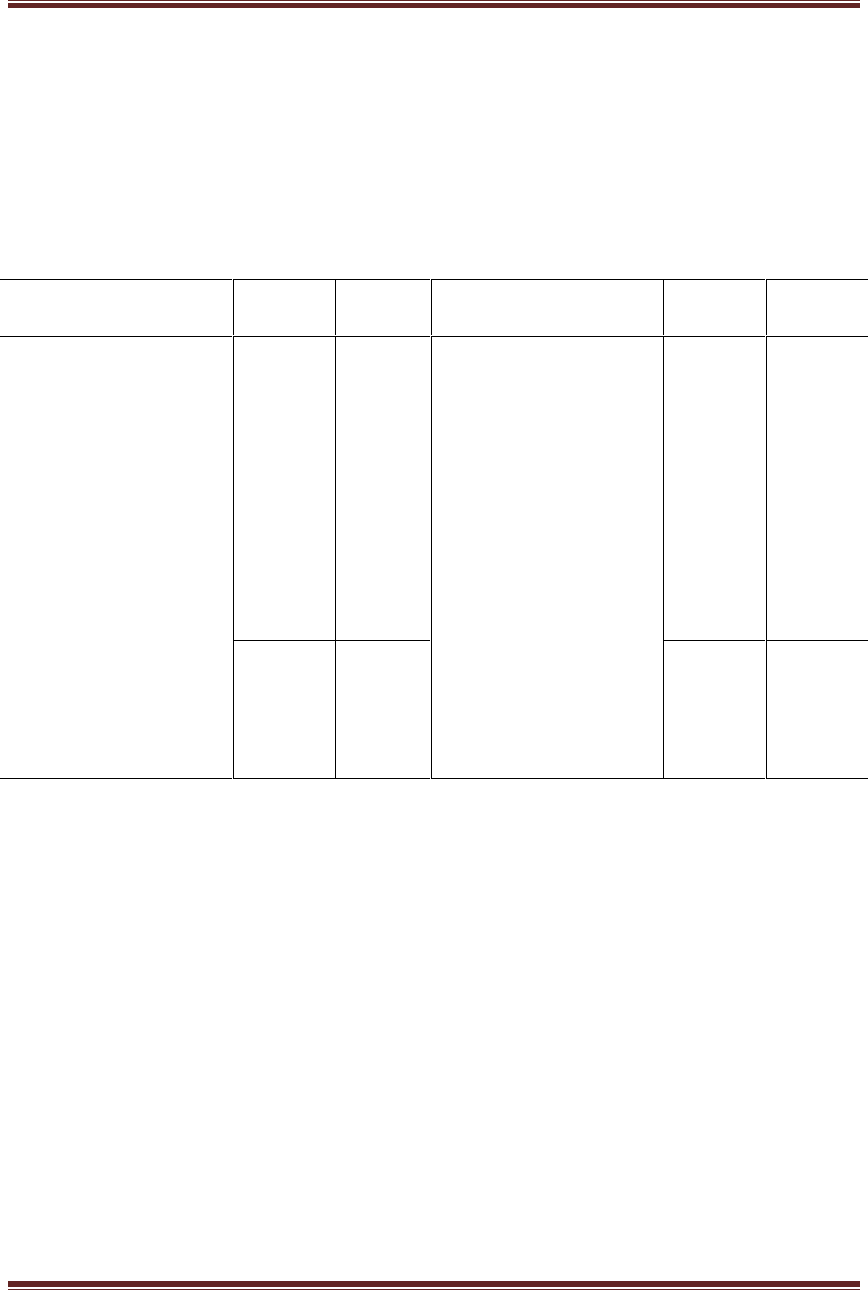

Illustration 5: The following are the liabilities and assets of the holding company H

Ltd. and its subsidiary S Ltd. as on 31

st

December 2014:

Liabilities

H Ltd.

Rs.

S Ltd.

Rs.

Assets

H Ltd.

Rs.

S Ltd.

Rs.

Share Capital:

Equity Shares of

Rs.10

120000

50000

Fixed Assets

Current Assets

Cash and Bank

100000

115000

70000

60000

20000

10000

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 30

Each

8% Preference

Shares

of Rs. 10 each

Profit and Loss

Account

Sundry Creditors

40000

25000

100000

10000

10000

20000

285000

90000

285000

90000

H Ltd. acquired 90% of the equity shares of S Ltd. at Rs. 15 per share on 1

st

January 2015. Prepare the Consolidated Balance Sheet as on 1

st

January 2015.

Solution:

Share of holdings by H Ltd.in S Ltd. = 90%

Share of holdings by Outsiders in S Ltd. = 10%

Consolidated Balance Sheet of H Ltd. and its Subsidiary S Ltd.

as on 1

st

January 2015

Particulars

Note

No.

Amount

(Rs.)

A. Equity and Liabilities

Shareholders’ Fund

a. Share Capital

b. Reserves and Surplus

Minority Interest

Current Liabilities – Sundry Creditors

H Ltd. 100000

S Ltd. 20000

Total

B. Assets

Non-current Assets

Fixed Assets

Tangible Assets – Fixed Assets

H Ltd. 100000

S Ltd. 60000

Intangible Assets - Goodwill

Current Assets

Cash & Bank

H Ltd. (70000 – 67500) 2500

S Ltd. 10000

Other Current Assets

H Ltd. 115000

1

2

160000

25000

16000

120000

321000

160000

13500

12500

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 31

S Ltd. 20000

Total

135000

321000

Notes to Accounts

Note No.

Particulars

Amount

(Rs.)

1.

2.

Share Capital

Issued and Subscribed

12000 Equity shares of Rs. 10 each

4000, 8% Preference Shares

of Rs. 10 each

Reserves and Surplus

Profit and Loss Account

120000

40000

160000

25000

Working Notes:

Calculation of Capital Profit:

Profit and Loss Account balance in S Ltd. = Rs. 10000

Share of capital profit due to H Ltd. = 10000x90% = Rs. 9000

Share of capital profit due to Outsiders in S Ltd. = 10000x10% = Rs. 1000

Calculation of Goodwill:

Cost of Shares in S Ltd. (5000x90%x15)

Less: Face value of shares in S Ltd.

Capital Profit

Goodwill

Rs.

45000

9000

Rs.

67500

54000

13500

Calculation of Minority Interest:

Paid up value of Shares held by outsiders in S Ltd.

(5000x10%x10)

Add: Share of capital profit due to Outsiders in S Ltd.

8% Preference Share Capital in S Ltd

Minority Interest

Rs.

1000

10000

Rs.

5000

11000

16000

Illustration 6: The liabilities and assets of the holding company H Ltd. and its

subsidiary S Ltd. as on 31

st

December 2014 are as follows:

Liabilities

H Ltd.

Rs.

S Ltd.

Rs.

Assets

H Ltd.

Rs.

S Ltd.

Rs.

Share Capital:

Shares of Rs. 10

1200000

600000

Sundry Assets

Investments:

720000

756000

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 32

each

Profit and Loss

Account

General Reserve

Current Liabilities

120000

120000

60000

48000

60000

48000

48000 shares in S

Ltd.

780000

1500000

756000

1500000

756000

H Ltd. acquired shares in S Ltd. on 1

st

January 2014. On that date the Profit and

Loss Account had a credit balance of Rs. 12000 and in Reserve Rs. 36000. Prepare the

Consolidated Balance Sheet.

Solution:

Share of holdings by H Ltd.in S Ltd. = 48000 shares out of 60000 shares = 80%

Share of holdings by Outsiders in S Ltd. = 12000 shares out of 60000 shares = 20%

Consolidated Balance Sheet of H Ltd. and its Subsidiary S Ltd.

as on 31

st

December 2014

Particulars

Note

No.

Amount

(Rs.)

A. Equity and Liabilities

Shareholders’ Fund

a. Share Capital

b. Reserves and Surplus

Minority Interest

Current Liabilities

H Ltd. 60000

S Ltd. 48000

Total

B. Assets

Non-current Assets

Fixed Assets

Tangible Assets – Sundry Assets

H Ltd. 720000

S Ltd. 756000

Intangible Assets - Goodwill

Current Assets

Total

1

2

1200000

288000

141600

108000

1737600

1476000

261600

Nil

1737600

Notes to Accounts

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 33

Note No.

Particulars

Amount

(Rs.)

1.

2.

Share Capital

Issued and Subscribed

120000 Equity shares of Rs. 10 each

Reserves and Surplus

Profit and Loss Account:

H Ltd. 120000

S Ltd. 28800

General Reserve:

H Ltd. 120000

S Ltd. 19200

1200000

148800

139200

288000

Working Notes:

Calculation of Capital Profit in S Ltd.:

Profit and Loss Account balance on 01/01/2014

General Reserve

Capital Profit

Rs.

12000

36000

48000

Share of capital profit due to H Ltd. = 48000x80% = Rs. 38400

Share of capital profit due to Outsiders in S Ltd. = 48000x20% = Rs. 9600

Calculation of Revenue Profit:

(a) Profit and Loss Account (48000-32000) = Rs. 36000

H Ltd. = 36000x80% = Rs. 28800

Outsiders in S Ltd. = 36000x20% = Rs. 7200

(b) General Reserve (60000-36000) = 24000

H Ltd. = 24000x80% = Rs. 19200

Outsiders in S Ltd. = 24000x20% = Rs. 4800

Calculation of Goodwill:

Cost of Shares in S Ltd.

Less: Face value of shares in S Ltd.

Capital Profit

Goodwill

Rs.

480000

38400

Rs.

780000

518400

261600

Calculation of Minority Interest:

Paid up value of Shares held by outsiders in S Ltd.

Add: Share of capital profit due to Outsiders in S Ltd.

Share of revenue profit due to Outsiders in S Ltd

(7200+4800)

Minority Interest

Rs.

9600

12000

Rs.

120000

21600

141600

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 34

Illustration 7: The liabilities and assets of the holding company H Ltd. and its

subsidiary S Ltd. as on 31

st

December 2014 are as follows:

Liabilities

H Ltd.

Rs.

S Ltd.

Rs.

Assets

H Ltd.

Rs.

S Ltd.

Rs.

Share Capital:

Shares of Re. 1

each

Profit and Loss

Account

General Reserve

Current Liabilities

30000

12000

15000

9000

15000

5400

-----

9600

Sundry Assets

Investments:

15000 shares in S

Ltd.

48000

18000

30000

66000

30000

66000

30000

H Ltd. acquired the shares in S Ltd. on 30

th

June 2014. On 1

st

January 2014 the

Balance Sheet of S Ltd. showed a loss of Rs. 9000, which was written off out of profit

earned during the year 2014. Profits are assumed to accrue evenly throughout the year.

Prepare the Consolidated Balance Sheet.

Solution:

Consolidated Balance Sheet of H Ltd. and its Subsidiary S Ltd.

as on 31

st

December 2014

Particulars

Note

No.

Amount

(Rs.)

A. Equity and Liabilities

Shareholders’ Fund

a. Share Capital

b. Reserves and Surplus

Current Liabilities

H Ltd. 9000

S Ltd. 9600

Total

B. Assets

Non-current Assets

Fixed Assets

Tangible Assets – Sundry Assets

H Ltd. 48000

S Ltd. 30000

Intangible Assets - Goodwill

Current Assets

1

2

30000

34200

18600

82800

78000

4800

Nil

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 35

Total

82800

Notes to Accounts

Note No.

Particulars

Amount

(Rs.)

1.

2.

Share Capital

Issued and Subscribed

30000 Equity shares of Re. 1 each

Reserves and Surplus

Profit and Loss Account:

H Ltd. 12000

S Ltd. 7200

General Reserve

30000

19200

15000

34200

Working Notes:

Calculation of Revenue Profit in S Ltd.:

Profit and Loss Account balance on 31

st

Dec 2014

Add: Loss written off during the year 2014

Total Profit in 2014

Rs.

5400

9000

14400

Profit before 30

th

June 2014 (Capital Profit) = 14400x1/2 = Rs. 7200

Profit after 30

th

June 2014 (Revenue Profit) = 14400x1/2 = Rs. 7200

Calculation of Capital Profit:

Profit upto 30

th

June 2014

Less: Capital Loss on 1

st

Jan 2014

Net (Capital) Loss

Rs.

7200

9000

1800

Calculation of Goodwill:

Cost of Shares in S Ltd.

Less: Face value of shares in S Ltd.

Add: Capital Loss

Goodwill

Rs.

18000

15000

3000

1800

4800

Elimination of Inter-company Transactions

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 36

While preparing Consolidated Balance Sheet, the inter-company transactions between

the holding company and the subsidiary company should be eliminated. Such

transactions may be as follows:

1. Debtors and Creditors - Goods sold on credit by the holding company to the

subsidiary company or vice versa will appear as debtors in the balance sheet of the

company selling goods and creditors in the balance sheet of the company purchasing

goods.

2. Bills of Exchange - Bills drawn by one company and accepted by the other

company are eliminated while preparing Consolidated Balance Sheet but bills

discounted and endorsed will continue to appear as liability because the company,

which has accepted such bills, will have to make the payment to an outsider (i.e. bank)

on the due date.

3. Loans and Advances - Loans advanced by the holding company to the

subsidiary company or vice versa appears as an asset in the balance sheet of the

company which gives such loans and as a liability in the balance sheet of the company

that takes these loans.

4. Debentures - Debentures issued by one company and held by the other

company.

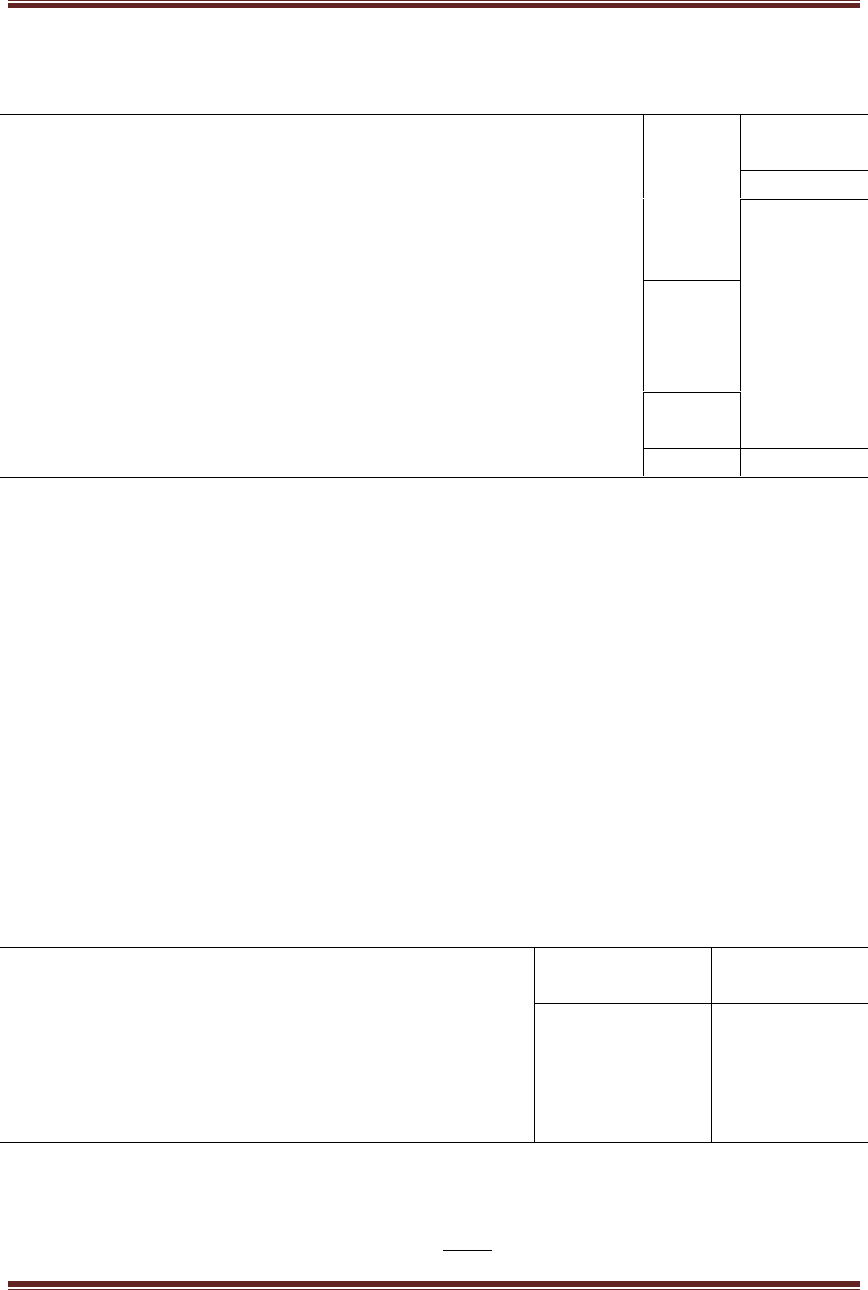

Illustration 8: The liabilities and assets of the holding company H Ltd. and its

subsidiary S Ltd. as on 31

st

March 2014 are as follows:

Liabilities

H Ltd.

Rs.

S Ltd.

Rs.

Assets

H Ltd.

Rs.

S Ltd.

Rs.

Share Capital:

Shares of Rs. 10 each

General Reserve

Profit and Loss

500000

75000

125000

25000

Land and Building

Plant and Machinery

lessdepreciation

Furniture

150000

500000

22500

…….

…….

25000

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 37

H Ltd. acquired 7500 shares in S Ltd. on 1

st

October 2013. Bills Receivables

held by S Ltd. are all accepted by H Ltd. A sum of Rs. 15000 owning by H Ltd. in

respect of goods supplied by S Ltd. Prepare the Consolidated Balance Sheet.

Solution:

Share of holdings by H Ltd.in S Ltd. = 7500 shares out of 12500 shares = 60%

Share of holdings by Outsiders in S Ltd. = 5000 shares out of 12500 shares = 40%

Consolidated Balance Sheet of H Ltd. and its Subsidiary S Ltd.

as on 31

st

March 2014

Particulars

Note

No.

Amount

(Rs.)

A. Equity and Liabilities

Shareholders’ Fund

a. Share Capital

b. Reserves and Surplus

Minority Interest

Current Liabilities

a. Trade Payables

b. Bank Overdraft

Total

B. Assets

Non-current Assets

Fixed Assets

a. Tangible

b. Intangible - Goodwill

Current Assets

Stock:

H Ltd. 100000

S Ltd. 187500

Sundry Debtors:

H Ltd. 25000

1

2

3

4

500000

318750

105000

147500

50000

1121250

697500

23750

287500

Account

(01/04/2013)

Profit and Loss

Account

(31/03/2014)

Sundry Creditors

Bills Payables

Bank Overdraft

100000

125000

75000

37500

50000

50000

62500

75000

……

……

Investments:

7500 shares in S Ltd.

Stock

Sundry Debtors

Bills Receivables

Bank Balance

Cash in Hand

162500

100000

25000

……

…….

2500

…….

18750

0

70000

25000

26250

3750

962500

337500

962500

33750

0

SCHOOL OF DISTANCE EDUCATION

Advanced Corporate Accounting Page 38

S Ltd. 70000

95000

Less: Inter-company debt 15000

Bills Receivables (25000 – 25000)

Cash and Cash Equivalents

Total

5

80000

Nil

32500

1121250

Notes to Accounts

Note No.

Particulars

Amount

(Rs.)

1.

2.

3.

4.

5.

Share Capital

Issued and Subscribed

50000 Shares of Rs. 10 each

Reserves and Surplus

General Reserve

P & L A/c

Trade Payables

Sundry Creditors:

H Ltd. 75000

S Ltd. 75000

150000

Less: Inter-company debt 15000

Bills Payables:

H Ltd. 37500

Less: Inter-company acceptance 25000

Fixed Assets – Tangible

Land & Building

Plant & Machinery less depreciation

Furniture:

H Ltd. 22500

S Ltd. 25000

Cash and Cash Equivalents

Cash in Hand

H Ltd. 2500

S Ltd. 3750

Bank Balance

500000

75000

243750

318750